| GENERAL ELECTRIC COMPANY | | | | | | | | | | | | | | | | | | | | | |

| CONDENSED STATEMENT OF EARNINGS (LOSS) (UNAUDITED) | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Consolidated | | | GE(a) | | | | Financial Services (GECC) |

| Three months ended September 30 | 2015 | 2014 | | V% | | | 2015 | 2014 | | V% | | 2015 | 2014 | | V% |

| | | | | | | | | | | | | | | | | | | | | | |

| Revenues and other income | | | | | | | | | | | | | | | | | | | | | |

| Sales of goods and services | $ | 25,527 | $ | 25,890 | | (1)% | | | $ | 25,612 | $ | 26,025 | | (2)% | | $ | 21 | $ | 28 | | (25)% |

| Other income | | 169 | | 258 | | | | | | 201 | | 236 | | | | | - | | - | | |

| GECC earnings from continuing operations | | - | | - | | | | | | 734 | | 843 | | | | | - | | - | | |

| GECC revenues from services | | 5,984 | | 5,959 | | | | | | - | | - | | | | | 6,290 | | 6,356 | | |

| Total revenues and other income | | 31,680 | | 32,107 | | (1)% | | | | 26,547 | | 27,104 | | (2)% | | | 6,312 | | 6,384 | | (1)% |

| Costs and expenses | | | | | | | | | | | | | | | | | | | | | |

| Cost of sales | | 19,249 | | 19,740 | | | | | | 19,336 | | 19,877 | | | | | 18 | | 25 | | |

| Interest and other financial charges | | 1,462 | | 1,325 | | | | | | 440 | | 377 | | | | | 1,151 | | 1,061 | | |

| Investment contracts, insurance losses and | | | | | | | | | | | | | | | | | | | | | |

| insurance annuity benefits | | 676 | | 662 | | | | | | - | | - | | | | | 717 | | 700 | | |

| Provision for losses on financing receivables | | 738 | | 858 | | | | | | - | | - | | | | | 738 | | 858 | | |

| Other costs and expenses | | 6,298 | | 6,318 | | | | | | 3,549 | | 3,686 | | | | | 2,918 | | 2,857 | | |

| Total costs and expenses | | 28,423 | | 28,903 | | (2)% | | | | 23,325 | | 23,940 | | (3)% | | | 5,542 | | 5,501 | | 1% |

| Earnings from continuing operations | | | | | | | | | | | | | | | | | | | | | |

| before income taxes | | 3,257 | | 3,204 | | 2% | | | | 3,222 | | 3,164 | | 2% | | | 769 | | 883 | | (13)% |

| Benefit (provision) for income taxes | | (365) | | (401) | | | | | | (413) | | (416) | | | | | 48 | | 15 | | |

| Earnings from continuing operations | | 2,892 | | 2,803 | | 3 % | | | | 2,809 | | 2,748 | | 2% | | | 817 | | 898 | | (9)% |

| Earnings (loss) from discontinued | | | | | | | | | | | | | | | | | | | | | |

| operations, net of taxes | | (347) | | 706 | | | | | | (347) | | 706 | | | | | (347) | | 706 | | |

| Net earnings | | 2,545 | | 3,509 | | (27)% | | | | 2,462 | | 3,454 | | (29)% | | | 470 | | 1,604 | | (71)% |

| Less net earnings (loss) attributable to | | | | | | | | | | | | | | | | | | | | | |

| noncontrolling interests | | 39 | | (28) | | | | | | (43) | | (83) | | | | | 83 | | 55 | | |

| Net earnings attributable | | | | | | | | | | | | | | | | | | | | | |

| to the Company | | 2,506 | | 3,537 | | (29)% | | | | 2,506 | | 3,537 | | (29)% | | | 387 | | 1,549 | | (75)% |

| Preferred stock dividends declared | | - | | - | | | | | | - | | - | | | | | - | | - | | |

| Net earnings attributable to | | | | | | | | | | | | | | | | | | | | | |

| GE common shareowners | $ | 2,506 | $ | 3,537 | | (29)% | | | $ | 2,506 | $ | 3,537 | | (29)% | | $ | 387 | $ | 1,549 | | (75)% |

| Amounts attributable to GE common | | | | | | | | | | | | | | | | | | | | | |

| shareowners: | | | | | | | | | | | | | | | | | | | | | |

| Earnings from continuing operations | $ | 2,892 | $ | 2,803 | | 3 % | | | $ | 2,809 | $ | 2,748 | | 2% | | $ | 817 | $ | 898 | | (9)% |

| Less net earnings (loss) attributable | | | | | | | | | | | | | | | | | | | | | |

| to noncontrolling interests | | 39 | | (28) | | | | | | (43) | | (83) | | | | | 83 | | 55 | | |

| Earnings from continuing operations | | | | | | | | | | | | | | | | | | | | | |

| attributable to the Company | | 2,853 | | 2,831 | | 1 % | | | | 2,853 | | 2,831 | | 1% | | | 734 | | 843 | | (13)% |

| GECC preferred stock dividends declared | | - | | - | | | | | | - | | - | | | | | - | | - | | |

| Earnings from continuing operations | | | | | | | | | | | | | | | | | | | | | |

| attributable to GE common shareowners | | 2,853 | | 2,831 | | 1 % | | | | 2,853 | | 2,831 | | 1% | | | 734 | | 843 | | (13)% |

| Earnings (loss) from discontinued | | | | | | | | | | | | | | | | | | | | | |

| operations, net of taxes | | (347) | | 706 | | | | | | (347) | | 706 | | | | | (347) | | 706 | | |

| Net earnings attributable to GE | | | | | | | | | | | | | | | | | | | | | |

| common shareowners | $ | 2,506 | $ | 3,537 | | (29)% | | | $ | 2,506 | $ | 3,537 | | (29)% | | $ | 387 | $ | 1,549 | | (75)% |

| Per-share amounts - earnings from | | | | | | | | | | | | | | | | | | | | | |

| continuing operations | | | | | | | | | | | | | | | | | | | | | |

| Diluted earnings per share | $ | 0.28 | $ | 0.28 | | -% | | | | | | | | | | | | | | | |

| Basic earnings per share | $ | 0.28 | $ | 0.28 | | -% | | | | | | | | | | | | | | | |

| Per-share amounts - net earnings | | | | | | | | | | | | | | | | | | | | | |

| Diluted earnings per share | $ | 0.25 | $ | 0.35 | | (29)% | | | | | | | | | | | | | | | |

| Basic earnings per share | $ | 0.25 | $ | 0.35 | | (29)% | | | | | | | | | | | | | | | |

| Total average equivalent shares | | | | | | | | | | | | | | | | | | | | | |

| Diluted earnings | | 10,173 | | 10,119 | | 1% | | | | | | | | | | | | | | | |

| Basic earnings | | 10,103 | | 10,039 | | 1% | | | | | | | | | | | | | | | |

| Dividends declared per common share | $ | 0.23 | $ | 0.22 | | 5% | | | | | | | | | | | | | | | |

| Amounts attributable to GE | | | | | | | | | | | | | | | | | | | | | |

| common shareowners: | | | | | | | | | | | | | | | | | | | | | |

| Earnings from continuing operations | $ | 2,853 | $ | 2,831 | | 1% | | | | | | | | | | | | | | | |

| Adjustment (net of tax): non-operating | | | | | | | | | | | | | | | | | | | | | |

| pension costs | | 450 | | 349 | | | | | | | | | | | | | | | | | |

| Operating earnings (non-GAAP measure) | $ | 3,303 | $ | 3,180 | | 4% | | | | | | | | | | | | | | | |

| Operating earnings - diluted | | | | | | | | | | | | | | | | | | | | | |

| earnings per share (non-GAAP measure) | $ | 0.32 | $ | 0.31 | | 3% | | | | | | | | | | | | | | | |

| (a) | Refers to the Industrial businesses of the Company including GECC on an equity basis. |

Amounts may not add due to rounding.

Dollar amounts and share amounts in millions; per-share amounts in dollars. Supplemental data are shown for "GE" and "GECC." Transactions between GE and GECC have been eliminated from the "Consolidated" columns. See Note 1 to the 2014 consolidated financial statements at www.ge.com/ar2014 and our Form 8-K filed on August 7, 2015 for further information about consolidation matters.

| GENERAL ELECTRIC COMPANY |

| CONDENSED STATEMENT OF EARNINGS (LOSS) (UNAUDITED) |

| |

| | Consolidated | | | GE(a) | | Financial Services (GECC) |

| Nine months ended September 30 | 2015 | 2014 | V% | | | 2015 | 2014 | | V% | 2015 | 2014 | V% |

| | | | | | | | | | | | | | | | | | | | | | |

| Revenues and other income | | | | | | | | | | | | | | | | | | | | | |

| Sales of goods and services | $ | 75,266 | $ | 75,839 | | (1)% | | | $ | 75,592 | $ | 76,262 | | (1)% | | $ | 64 | $ | 89 | | (28)% |

| Other income | | 1,092 | | 792 | | | | | | 1,023 | | 689 | | | | | - | | - | | |

| GECC earnings (loss) from continuing operations | | - | | - | | | | | | (7,394) | | 3,252 | | | | | - | | - | | |

| GECC revenues from services | | 16,373 | | 17,964 | | | | | | - | | - | | | | | 17,388 | | 19,134 | | |

| Total revenues and other income | | 92,731 | | 94,595 | | (2)% | | | | 69,221 | | 80,203 | | (14)% | | | 17,452 | | 19,223 | | (9)% |

| | | | | - | | | | | | | | - | | | | | | | - | | |

| Costs and expenses | | | | | | | | | | | | | | | | | | | | | |

| Cost of sales | | 57,438 | | 58,268 | | | | | | 57,769 | | 58,698 | | | | | 58 | | 81 | | |

| Interest and other financial charges | | 3,976 | | 3,975 | | | | | | 1,243 | | 1,142 | | | | | 3,096 | | 3,184 | | |

| Investment contracts, insurance losses and | | | | | | | | | | | | | | | | | | | | | |

| insurance annuity benefits | | 1,952 | | 1,940 | | | | | | - | | - | | | | | 2,070 | | 2,041 | | |

| Provision for losses on financing receivables | | 4,636 | | 2,693 | | | | | | - | | - | | | | | 4,636 | | 2,693 | | |

| Other costs and expenses | | 19,125 | | 18,744 | | | | | | 11,035 | | 11,355 | | | | | 8,555 | | 8,005 | | |

| Total costs and expenses | | 87,127 | | 85,620 | | 2% | | | | 70,048 | | 71,195 | | (2)% | | | 18,415 | | 16,004 | | 15% |

| Earnings (loss) from continuing operations | | | | | | | | | | | | | | | | | | | | | |

| before income taxes | | 5,604 | | 8,975 | | (38)% | | | | (827) | | 9,008 | | U | | | (963) | | 3,219 | | U |

| Benefit (provision) for income taxes | | (7,466) | | (1,034) | | | | | | (1,302) | | (1,143) | | | | | (6,164) | | 109 | | |

| Earnings (loss) from continuing operations | | (1,862) | | 7,941 | | U | | | | (2,129) | | 7,865 | | U | | | (7,127) | | 3,328 | | U |

| Earnings (loss) from discontinued | | | | | | | | | | | | | | | | | | | | | |

| operations, net of taxes | | (10,336) | | 2,065 | | | | | | (10,336) | | 2,065 | | | | | (10,332) | | 2,070 | | |

| Net earnings (loss) | | (12,198) | | 10,006 | | U | | | | (12,465) | | 9,930 | | U | | | (17,459) | | 5,398 | | U |

| Less net earnings (loss) attributable to | | | | | | | | | | | | | | | | | | | | | |

| noncontrolling interests | | 229 | | (75) | | | | | | (38) | | (151) | | | | | 267 | | 76 | | |

| Net earnings (loss) attributable to | | | | | | | | | | | | | | | | | | | | | |

| the Company | | (12,427) | | 10,081 | | U | | | | (12,427) | | 10,081 | | U | | | (17,726) | | 5,322 | | U |

| Preferred stock dividends declared | | - | | - | | | | | | - | | - | | | | | (161) | | (161) | | |

| Net earnings (loss) attributable to | | | | | | | | | | | | | | | | | | | | | |

| GE common shareowners | $ | (12,427) | $ | 10,081 | | U | | | $ | (12,427) | $ | 10,081 | | U | | $ | (17,887) | $ | 5,161 | | U |

| Amounts attributable to GE common | | | | | | | | | | | | | | | | | | | | | |

| shareowners: | | | | | | | | | | | | | | | | | | | | | |

| Earnings (loss) from continuing operations | $ | (1,862) | $ | 7,941 | | U | | | $ | (2,129) | $ | 7,865 | | U | | $ | (7,127) | $ | 3,328 | | U |

| Less net earnings (loss) attributable | | | | | | | | | | | | - | | | | | | | | | |

| to noncontrolling interests | | 229 | | (75) | | | | | | (38) | | (151) | | | | | 267 | | 76 | | |

| Earnings (loss) from continuing operations | | | | | | | | | | | | | | | | | | | | | |

| attributable to the Company | | (2,091) | | 8,016 | | U | | | | (2,091) | | 8,016 | | U | | | (7,394) | | 3,252 | | U |

| GECC preferred stock dividends declared | | - | | - | | | | | | - | | - | | | | | (161) | | (161) | | |

| Earnings (loss) from continuing operations | | | | | | | | | | | | | | | | | | | | | |

| attributable to GE common shareowners | | (2,091) | | 8,016 | | U | | | | (2,091) | | 8,016 | | U | | | (7,555) | | 3,091 | | U |

| Earnings (loss) from discontinued | | | | | | | | | | | | | | | | | | | | | |

| operations, net of taxes | | (10,336) | | 2,065 | | | | | | (10,336) | | 2,065 | | | | | (10,332) | | 2,070 | | |

| Net earnings (loss) attributable to GE | | | | | | | | | | | | | | | | | | | | | |

| common shareowners | $ | (12,427) | $ | 10,081 | | U | | | $ | (12,427) | $ | 10,081 | | U | | $ | (17,887) | $ | 5,161 | | U |

| | | | | | | | | | | | | | | | | | | | | | |

| Per-share amounts - earnings (loss) from | | | | | | | | | | | | | | | | | | | | | |

| continuing operations | | | | | | | | | | | | | | | | | | | | | |

| Diluted earnings (loss) per share | $ | (0.21) | $ | 0.79 | | U | | | | | | | | | | | | | | | |

| Basic earnings (loss) per share | $ | (0.21) | $ | 0.80 | | U | | | | | | | | | | | | | | | |

| Per-share amounts - net earnings (loss) | | | | | | | | | | | | | | | | | | | | | |

| Diluted earnings (loss) per share | $ | (1.23) | $ | 0.99 | | U | | | | | | | | | | | | | | | |

| Basic earnings (loss) per share | $ | (1.23) | $ | 1.00 | | U | | | | | | | | | | | | | | | |

| Total average equivalent shares | | | | | | | | | | | | | | | | | | | | | |

| Diluted earnings | | 10,085 | | 10,121 | | - % | | | | | | | | | | | | | | | |

| Basic earnings | | 10,085 | | 10,042 | | - % | | | | | | | | | | | | | | | |

| Dividends declared per common share | $ | 0.69 | $ | 0.66 | | 5% | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Amounts attributable to GE | | | | | | | | | | | | | | | | | | | | | |

| common shareowners: | | | | | | | | | | | | | | | | | | | | | |

| Earnings (loss) from continuing operations | $ | (2,091) | $ | 8,016 | | U | | | | | | | | | | | | | | | |

| Adjustment (net of tax): non-operating | | | | | | | | | | | | | | | | | | | | | |

| pension costs | | 1,350 | | 1,035 | | | | | | | | | | | | | | | | | |

| Operating earnings (loss) (non-GAAP measure) | $ | (741) | $ | 9,051 | | U | | | | | | | | | | | | | | | |

| Operating earnings (loss) - diluted | | | | | | | | | | | | | | | | | | | | | |

| earnings (loss) per share (non-GAAP measure) | $ | (0.07) | $ | 0.89 | | U | | | | | | | | | | | | | | | |

| (a) | Refers to the Industrial businesses of the Company including GECC on an equity basis. |

Amounts may not add due to rounding.

Dollar amounts and share amounts in millions; per-share amounts in dollars. Supplemental data are shown for "GE" and "GECC." Transactions between GE and GECC have been eliminated from the "Consolidated" columns. See Note 1 to the 2014 consolidated financial statements at www.ge.com/ar2014 and our Form 8-K filed on August 7, 2015 for further information about consolidation matters.

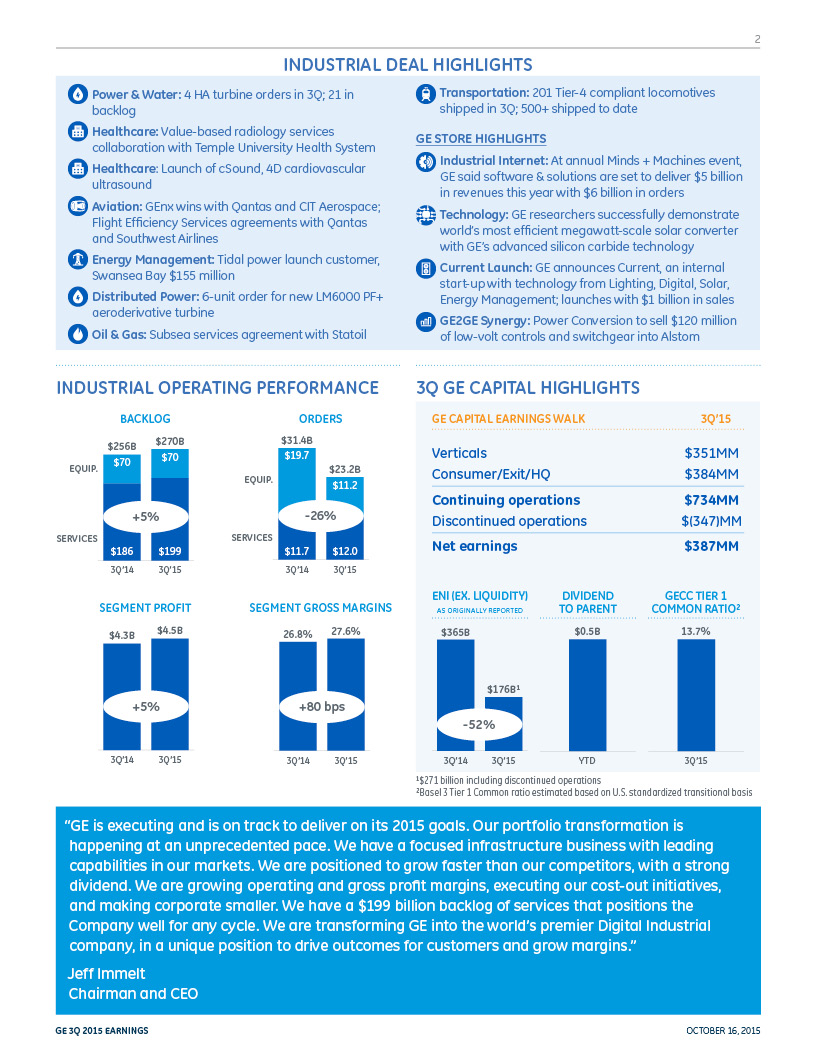

| GENERAL ELECTRIC COMPANY | | | | | | | | | | | | | | | |

| SUMMARY OF OPERATING SEGMENTS (UNAUDITED) | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | Three months ended September 30 | | Nine months ended September 30 |

| (Dollars in millions) | 2015 | | 2014 | | V% | | 2015 | | 2014 | | V% |

| | | | | | | | | | | | | | | | |

| Revenues(a) | | | | | | | | | | | | | | | |

| Power & Water | $ | 6,461 | | $ | 6,375 | | 1 % | | $ | 18,978 | | $ | 18,176 | | 4 % |

| Oil & Gas | | 3,868 | | | 4,597 | | (16)% | | | 11,891 | | | 13,666 | | (13)% |

| Energy Management | | 1,773 | | | 1,813 | | (2)% | | | 5,226 | | | 5,341 | | (2)% |

| Aviation | | 6,001 | | | 5,698 | | 5 % | | | 17,927 | | | 17,566 | | 2 % |

| Healthcare | | 4,255 | | | 4,485 | | (5)% | | | 12,666 | | | 13,166 | | (4)% |

| Transportation | | 1,593 | | | 1,540 | | 3 % | | | 4,322 | | | 4,073 | | 6 % |

| Appliances & Lighting | | 2,293 | | | 2,117 | | 8 % | | | 6,469 | | | 6,094 | | 6 % |

| Total industrial segment revenues | | 26,243 | | | 26,625 | | (1)% | | | 77,479 | | | 78,082 | | (1)% |

| GE Capital | | 6,312 | | | 6,384 | | (1)% | | | 17,452 | | | 19,223 | | (9)% |

| Total segment revenues | | 32,555 | | | 33,009 | | (1)% | | | 94,931 | | | 97,305 | | (2)% |

| Corporate items and eliminations(a) | | (875) | | | (902) | | (3)% | | | (2,201) | | | (2,710) | | (19)% |

| Consolidated revenues and other income | | | | | | | | | | | | | | | |

| from continuing operations | $ | 31,680 | | $ | 32,107 | | (1)% | | $ | 92,731 | | $ | 94,595 | | (2)% |

| | | | | | | | | | | | | | | | |

| Segment profit (loss)(a) | | | | | | | | | | | | | | | |

| Power & Water | $ | 1,270 | | $ | 1,191 | | 7 % | | $ | 3,362 | | $ | 3,212 | | 5 % |

| Oil & Gas | | 584 | | | 660 | | (12)% | | | 1,599 | | | 1,771 | | (10)% |

| Energy Management | | 127 | | | 59 | | F | | | 237 | | | 133 | | 78 % |

| Aviation | | 1,353 | | | 1,264 | | 7 % | | | 3,936 | | | 3,576 | | 10 % |

| Healthcare | | 652 | | | 727 | | (10)% | | | 1,944 | | | 2,027 | | (4)% |

| Transportation | | 379 | | | 342 | | 11 % | | | 934 | | | 814 | | 15 % |

| Appliances & Lighting | | 165 | | | 88 | | 88 % | | | 432 | | | 243 | | 78 % |

| Total industrial segment profit | | 4,530 | | | 4,331 | | 5 % | | | 12,445 | | | 11,776 | | 6 % |

| GE Capital | | 734 | | | 843 | | (13)% | | | (7,555) | | | 3,091 | | U |

| Total segment profit (loss) | | 5,264 | | | 5,174 | | 2 % | | | 4,890 | | | 14,867 | | (67)% |

| Corporate items and eliminations(a) | | (1,559) | | | (1,550) | | 1 % | | | (4,436) | | | (4,566) | | (3)% |

| GE interest and other financial charges | | (440) | | | (377) | | 17 % | | | (1,243) | | | (1,142) | | 9 % |

| GE provision for income taxes | | (413) | | | (416) | | (1)% | | | (1,302) | | | (1,143) | | 14 % |

| Earnings (loss) from continuing operations | | | | | | | | | | | | | | | |

| attributable to the Company | | 2,853 | | | 2,831 | | 1 % | | | (2,091) | | | 8,016 | | U |

| Earnings (loss) from discontinued operations, | | | | | | | | | | | | | | | |

| net of taxes | | (347) | | | 706 | | U | | | (10,336) | | | 2,065 | | U |

| Consolidated net earnings (loss) | | | | | | | | | | | | | | | |

| attributable to the Company | $ | 2,506 | | $ | 3,537 | | (29)% | | $ | (12,427) | | $ | 10,081 | | U |

| | | | | | | | | | | | | | | | |

| (a) | Segment revenues includes both revenues and other income related to the segment. Segment profit excludes results reported as discontinued operations, the portion of earnings attributable to noncontrolling interests of consolidated subsidiaries, and accounting changes. Segment profit excludes or includes interest and other financial charges and income taxes according to how a particular segment's management is measured – excluded in determining segment profit, which we sometimes refer to as "operating profit," for Power & Water, Oil & Gas, Energy Management, Aviation, Healthcare, Transportation and Appliances & Lighting; included in determining segment profit, which we sometimes refer to as "net earnings," for GE Capital. Certain corporate costs, such as shared services, employee benefits and information technology are allocated to our segments based on usage. A portion of the remaining corporate costs are allocated based on each segment's relative net cost of operations. Total industrial segment revenues and profit include the sum of our seven industrial reporting segments without giving effect to the elimination of transactions among such segments. Total segment revenues and profit include the sum of our seven industrial segments and one financial services segment, without giving effect to the elimination of transactions among such segments. We believe that this provides investors with a view as to the results of all of our segments, without inter-segment eliminations and corporate items. |

Amounts may not add due to rounding

| GENERAL ELECTRIC COMPANY |

| SUMMARY OF OPERATING SEGMENTS |

| ADDITIONAL INFORMATION (UNAUDITED) |

| | | | | | | | | | | | | | | | |

| | Three months ended September 30 | | Nine months ended September 30 |

| (Dollars in millions) | 2015 | | 2014 | | V% | | 2015 | | 2014 | | V% |

| | | | | | | | | | | | | | | | |

| GE Capital | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Revenues | | | | | | | | | | | | | | | |

| Commercial Lending and Leasing (CLL) | $ | 285 | | $ | 251 | | 14 % | | $ | 790 | | $ | 743 | | 6 % |

| Consumer | | 3,652 | | | 3,622 | | 1 % | | | 9,237 | | | 10,822 | | (15)% |

| Energy Financial Services | | 225 | | | 344 | | (35)% | | | 906 | | | 1,120 | | (19)% |

| GE Capital Aviation Services (GECAS) | | 1,307 | | | 1,262 | | 4 % | | | 3,935 | | | 3,952 | | - % |

| | | 5,468 | | | 5,479 | | - % | | | 14,867 | | | 16,637 | | (11)% |

| GECC corporate items and eliminations | | 843 | | | 905 | | (7)% | | | 2,585 | | | 2,586 | | - % |

| Total revenues | $ | 6,312 | | $ | 6,384 | | (1)% | | $ | 17,452 | | $ | 19,223 | | (9)% |

| | | | | | | | | | | | | | | | |

| Segment profit (loss) | | | | | | | | | | | | | | | |

| CLL | $ | 111 | | $ | 90 | | 23 % | | $ | 286 | | $ | 252 | | 13 % |

| Consumer | | 795 | | | 621 | | 28 % | | | (1,521) | | | 1,879 | | U |

| Energy Financial Services | | (38) | | | 61 | | U | | | 106 | | | 290 | | (63)% |

| GECAS | | 313 | | | 133 | | F | | | 981 | | | 828 | | 18 % |

| | | 1,180 | | | 905 | | 30 % | | | (149) | | | 3,249 | | U |

| GECC corporate items and eliminations | | (445) | | | (62) | | U | | | (7,245) | | | 3 | | U |

| Preferred stock dividends declared | | - | | | - | | - % | | | (161) | | | (161) | | - % |

| Total segment profit (loss) | $ | 734 | | $ | 843 | | (13)% | | $ | (7,555) | | $ | 3,091 | | U |

| | | | | | | | | | | | | | | | |

Amounts may not add due to rounding

| GENERAL ELECTRIC COMPANY | | | | | | | | | | | | | | | | | | |

| CONDENSED STATEMENT OF FINANCIAL POSITION (UNAUDITED) |

| |

| | | | | | | | | | | | | | | | | | | |

| | Consolidated | | | GE(a) | | Financial Services (GECC) |

| | September 30, | | December 31, | | | September 30, | | December 31, | | September 30, | | December 31, |

| (Dollars in billions) | 2015 | | 2014 | | | 2015 | | 2014 | | 2015 | | 2014 |

| | | | | | | | | | | | | |

| Assets | | | | | | | | | | | | | | | | | | |

| Cash & marketable securities | $ | 136.0 | | $ | 123.3 | | | $ | 16.9 | | $ | 16.0 | | $ | 119.1 | | $ | 107.3 |

| Receivables | | 22.3 | | | 23.2 | | | | 10.8 | | | 11.5 | | | - | | | - |

| Inventories | | 19.3 | | | 17.7 | | | | 19.2 | | | 17.6 | | | 0.1 | | | 0.1 |

| GECC financing receivables - net | | 72.4 | | | 110.3 | | | | - | | | - | | | 83.7 | | | 122.5 |

| Property, plant & equipment - net | | 50.7 | | | 48.3 | | | | 16.7 | | | 17.2 | | | 34.5 | | | 31.5 |

| Investment in GECC | | - | | | - | | | | 63.2 | | | 82.5 | | | - | | | - |

| Goodwill & intangible assets | | 75.3 | | | 76.8 | | | | 62.6 | | | 64.5 | | | 12.6 | | | 12.3 |

| Other assets | | 52.2 | | | 60.2 | | | | 33.3 | | | 33.5 | | | 26.7 | | | 34.3 |

| Financing receivables held for sale | | 22.8 | | | 0.4 | | | | - | | | - | | | 23.7 | | | 0.8 |

| Assets of businesses held for sale | | 8.3 | | | 6.3 | | | | 3.4 | | | 2.8 | | | 4.9 | | | 3.5 |

| Assets of discontinued operations | | 121.9 | | | 186.9 | | | | - | | | - | | | 121.9 | | | 186.9 |

| Total assets | $ | 581.3 | | $ | 653.5 | | | $ | 226.1 | | $ | 245.7 | | $ | 427.4 | | $ | 499.2 |

| | | | | | | | | | | | | | | | | | | |

| Liabilities and equity | | | | | | | | | | | | | | | | | | |

| Borrowings and bank deposits | $ | 275.2 | | $ | 313.7 | | | $ | 20.7 | | $ | 16.3 | | $ | 255.7 | | $ | 298.3 |

| Investment contracts, insurance liabilities and | | | | | | | | | | | | | | | | | | |

| insurance annuity benefits | | 26.1 | | | 27.6 | | | | - | | | - | | | 26.6 | | | 28.0 |

| Other liabilities | | 114.9 | | | 123.2 | | | | 91.7 | | | 98.7 | | | 29.8 | | | 31.3 |

| Liabilities of businesses held for sale | | 1.4 | | | 3.4 | | | | 1.8 | | | 1.5 | | | 0.3 | | | 2.4 |

| Liabilities of discontinued operations | | 43.8 | | | 48.8 | | | | 0.1 | | | 0.1 | | | 43.6 | | | 48.7 |

| GE Shareowners' equity | | 111.2 | | | 128.2 | | | | 111.2 | | | 128.2 | | | 68.2 | | | 87.5 |

| Noncontrolling interests | | 8.8 | | | 8.7 | | | | 0.7 | | | 0.8 | | | 3.2 | | | 2.9 |

| Total liabilities and equity | $ | 581.3 | | $ | 653.5 | | | $ | 226.1 | | $ | 245.7 | | $ | 427.4 | | $ | 499.2 |

| | | | | | | | | | | | | | | | | | | |

| (a) | Refers to the Industrial businesses of the Company including GECC on an equity basis. |

Amounts may not add due to rounding

Supplemental data are shown for "GE" and "GECC." Transactions between GE and GECC have been eliminated from the "Consolidated" columns. See Note 1 to the 2014 consolidated financial statements at www.ge.com/ar2014 and our Form 8-K filed on August 7, 2015 for further information about consolidation matters.

GENERAL ELECTRIC COMPANY

Financial Measures That Supplement GAAP

We sometimes use information derived from consolidated financial information but not presented in our financial statements prepared in accordance with U.S. generally accepted accounting principles (GAAP). Certain of these data are considered "non-GAAP financial measures" under the U.S. Securities and Exchange Commission rules. These non-GAAP financial measures supplement our GAAP disclosures and should not be considered an alternative to the GAAP measure. We have referred to:

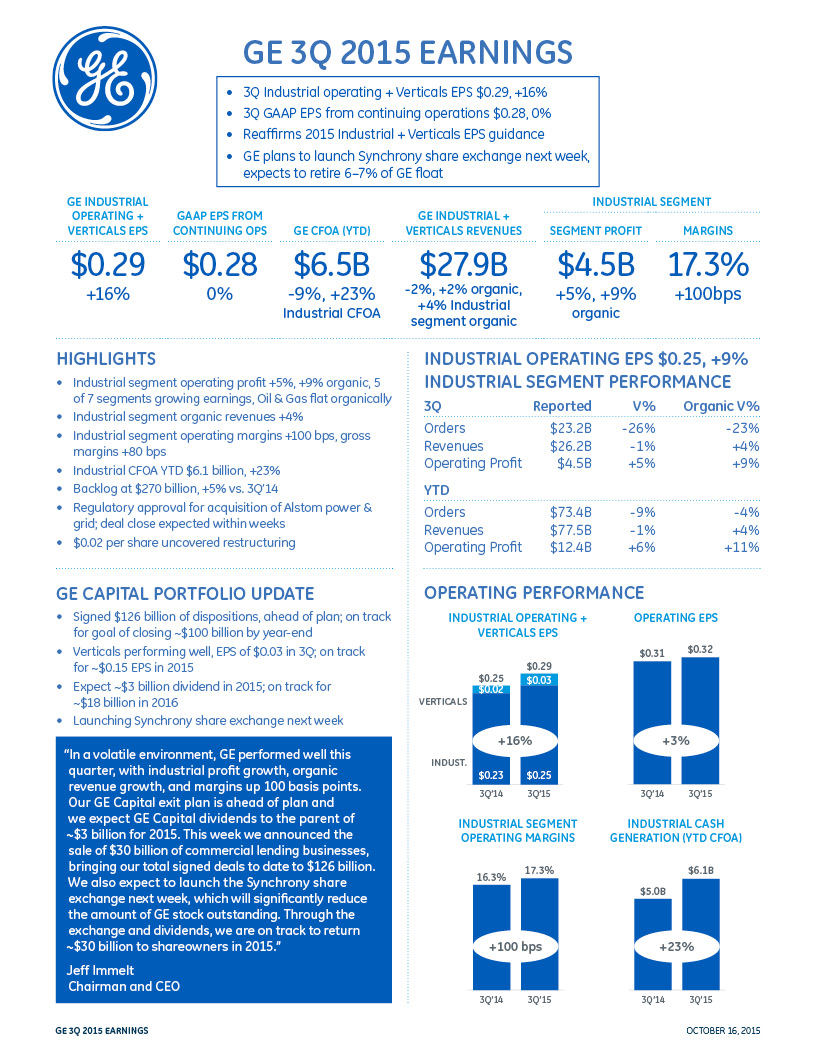

| · | Industrial operating earnings and EPS and GE Capital operating earnings (loss) and EPS |

| · | GE Industrial operating + Verticals EPS |

| · | GE Industrial + Verticals revenues |

| · | Industrial segment organic revenue growth |

| · | Industrial segment organic operating profit growth |

| · | Oil & Gas organic operating profit growth |

| · | Industrial cash flows from operating activities (Industrial CFOA) |

| · | GE Capital ending net investment (ENI), excluding liquidity |

| · | GECC Tier 1 common ratio estimate |

The reconciliations of these measures to the most comparable GAAP measures follow. Effective September 30, 2015, certain columns and rows may not add due to the use of rounded numbers. Percentages presented are calculated from the underlying numbers in millions.

| |

| INDUSTRIAL OPERATING EARNINGS AND EPS AND GE CAPITAL OPERATING EARNINGS (LOSS) AND EPS | | |

| | | | | | | | | | | | | | | | |

| | | Three months ended September 30 | | | Nine months ended September 30 |

| (Dollars in millions; except per share amounts) | | 2015 | | | 2014 | | V% | | | 2015 | | | 2014 | | V% |

| | | | | | | | | | | | | | | | |

| Earnings (loss) from continuing operations attributable to GE | $ | 2,853 | | $ | 2,831 | | | | $ | (2,091) | | $ | 8,016 | | |

| Adjustment (net of tax): non-operating pension costs | | 450 | | | 349 | | | | | 1,350 | | | 1,035 | | |

| Operating earnings (loss) | | 3,303 | | | 3,180 | | 4% | | | (741) | | | 9,051 | | U |

| | | | | | | | | | | | | | | | |

| Less GECC earnings (loss) from continuing operations | | | | | | | | | | | | | | | |

| attributable to GE common shareowners | | 734 | | | 843 | | | | | (7,555) | | | 3,091 | | |

| Operating earnings excluding GECC earnings from continuing | | | | | | | | | | | | | | | |

| operations attributable to GE | | | | | | | | | | | | | | | |

| (Industrial operating earnings) | $ | 2,569 | | $ | 2,337 | | 10% | | $ | 6,814 | | $ | 5,960 | | 14% |

| Operating earnings (loss) less Industrial operating | | | | | | | | | | | | | | | |

| earnings (GE Capital operating earnings (loss)) | | 734 | | | 843 | | (13)% | | | (7,555) | | | 3,091 | | U |

| Operating earnings (loss) | | 3,303 | | | 3,180 | | 4% | | | (741) | | | 9,051 | | U |

| | | | | | | | | | | | | | | | |

Earnings (loss) per share - diluted(a) | | | | | | | | | | | | | | | |

| Operating earnings per share attributable | | | | | | | | | | | | | | | |

| to Industrial (Industrial operating EPS) | $ | 0.25 | | $ | 0.23 | | 9% | | $ | 0.68 | | $ | 0.59 | | 15% |

| Operating earnings (loss) per share attributable | | | | | | | | | | | | | | | |

| to GE Capital (GE Capital operating EPS) | | 0.07 | | | 0.08 | | (13)% | | | (0.75) | | | 0.31 | | U |

| Total operating earnings (loss) per share | $ | 0.32 | | $ | 0.31 | | 3% | | $ | (0.07) | | $ | 0.89 | | U |

| | | | | | | | | | | | | | | | |

| (a) | Earnings (loss)-per-share amounts are computed independently. As a result, the sum of per-share amounts may not equal the total. |

Operating earnings (loss) excludes non-service related pension costs of our principal pension plans comprising interest cost, expected return on plan assets and amortization of actuarial gains/losses. The service cost, prior service cost and curtailment loss components of our principal pension plans are included in operating earnings. We believe that these components of pension cost better reflect the ongoing service-related costs of providing pension benefits to our employees. As such, we believe that our measure of operating earnings (loss) provides management and investors with a useful measure of the operational results of our business. Other components of GAAP pension cost are mainly driven by capital allocation decisions and market performance, and we manage these separately from the operational performance of our businesses. Neither GAAP nor operating pension costs are necessarily indicative of the current or future cash flow requirements related to our pension plan. We also believe that this measure, considered along with the corresponding GAAP measure, provides management and investors with additional information for comparison of our operating results to the operating results of other companies.

We believe that presenting operating earnings and operating EPS separately for our industrial and financial services businesses also provides management and investors with useful information about the relative size of our industrial and financial services businesses in relation to the total company.

| |

| GE INDUSTRIAL OPERATING + VERTICALS EPS | | |

| | | | | | | | | | | | | | | | |

| | | Three months ended September 30 | | | Nine months ended September 30 |

| (Dollars in millions; except per share amounts) | | 2015 | | | 2014 | | V% | | | 2015 | | | 2014 | | V% |

| | | | | | | | | | | | | | | | |

| GE Capital operating earnings (loss) | $ | 734 | | $ | 843 | | (13)% | | | (7,555) | | | 3,091 | | U |

| Less: Verticals earnings(a) | | 351 | | | 226 | | | | | 1,228 | | | 1,199 | | |

| GE Capital operating earnings less Verticals earnings(b) | $ | 384 | | $ | 617 | | (38)% | | | (8,783) | | | 1,892 | | U |

| | | | | | | | | | | | | | | | |

| Industrial operating earnings | $ | 2,569 | | $ | 2,337 | | 10% | | $ | 6,814 | | $ | 5,960 | | 14% |

| Verticals earnings(a) | | 351 | | | 226 | | | | | 1,228 | | | 1,199 | | |

| Industrial operating earnings + Verticals earnings | $ | 2,920 | | $ | 2,563 | | 14% | | | 8,042 | | | 7,159 | | 12% |

| | | | | | | | | | | | | | | | |

Earnings (loss) per share - diluted(c) | | | | | | | | | | | | | | | |

| Industrial operating earnings-per-share | $ | 0.25 | | $ | 0.23 | | 9% | | $ | 0.68 | | $ | 0.59 | | 15% |

| Verticals earnings-per-share | | 0.03 | | | 0.02 | | 50% | | | 0.12 | | | 0.12 | | -% |

| Industrial operating + Verticals earnings-per-share | $ | 0.29 | | $ | 0.25 | | 16% | | $ | 0.80 | | $ | 0.71 | | 13% |

| | | | | | | | | | | | | | | | |

| (a) | Verticals include businesses expected to be retained (GECAS, EFS, Healthcare Equipment Finance, Working Capital Solutions, and run-off Insurance), including allocated corporate costs of $25 million and $58 million after tax in the three months ended September 30, 2015 and 2014, respectively. |

| (b) | Includes $795 million and $621 million of Consumer after-tax operating earnings for the three months ended September 30, 2015 and 2014, respectively. |

| (c) | Earnings-per-share amounts are computed independently. As a result, the sum of per-share amounts may not equal the total. |

As described above, Verticals represents the GECC businesses that we expect to retain. We believe that presenting Industrial operating + Vertical earnings-per-share amounts provides management and investors with a useful measure to evaluate the performance of the businesses we expect to retain after the disposition of most of our financial services business.

| |

| GE INDUSTRIAL + VERTICALS REVENUES |

| | | | | | | | | |

| | | Three months ended September 30 | |

| (Dollars in millions) | | 2015 | | | 2014 | | V% | |

| | | | | | | | | |

| GE Capital revenues | $ | 6,312 | | $ | 6,384 | | (1)% | |

| Less: Verticals revenues(a) | | 2,577 | | | 2,655 | | (3)% | |

| GE Capital revenues less Verticals revenues | $ | 3,735 | | $ | 3,729 | | -% | |

| | | | | | | | | |

| Industrial segment revenues | $ | 26,243 | | $ | 26,625 | | (1)% | |

| Verticals revenues(a) | | 2,577 | | | 2,655 | | (3)% | |

| Corporate items and eliminations | | (875) | | | (902) | | (3)% | |

| GE Industrial + Verticals revenues | $ | 27,945 | | $ | 28,378 | | (2)% | |

| Less the effects of: | | | | | | | | |

| Acquisitions, business dispositions (other than | | | | | | | | |

| dispositions of businesses acquired for investment) | | | | | | | | |

| and currency exchange rates | | (932) | | | 111 | | | |

| GE Industrial + Verticals revenues excluding effects of acquisitions, | | | | | | | | |

| business dispositions (other than dispositions of | | | | | | | | |

| businesses acquired for investment) and currency | | | | | | | | |

| exchange rates (GE Industrial + Verticals revenues) | $ | 28,877 | | $ | 28,267 | | 2% | |

| | | | | | | | | |

| (a) | Verticals include businesses expected to be retained (GECAS, EFS, Healthcare Equipment Finance, Working Capital Solutions, and run-off Insurance). |

As described above, Verticals represents the GECC businesses that we expect to retain. We believe that presenting Industrial + Verticals revenues amounts provides management and investors with a useful measure to evaluate the performance of the businesses we expect to retain after the disposition of most of our financial services business.

| INDUSTRIAL SEGMENT ORGANIC REVENUE GROWTH |

| | | | | | | | | | | | | | | | |

| | Three months ended September 30 | | Nine months ended September 30 |

| (Dollars in millions) | | 2015 | | | 2014 | | V% | | | 2015 | | | 2014 | | V% |

| | | | | | | | | | | | | | | | |

| Segment revenues: | | | | | | | | | | | | | | | |

| Power & Water | $ | 6,461 | | $ | 6,375 | | | | $ | 18,978 | | $ | 18,176 | | |

| Oil & Gas | | 3,868 | | | 4,597 | | | | | 11,891 | | | 13,666 | | |

| Energy Management | | 1,773 | | | 1,813 | | | | | 5,226 | | | 5,341 | | |

| Aviation | | 6,001 | | | 5,698 | | | | | 17,927 | | | 17,566 | | |

| Healthcare | | 4,255 | | | 4,485 | | | | | 12,666 | | | 13,166 | | |

| Transportation | | 1,593 | | | 1,540 | | | | | 4,322 | | | 4,073 | | |

| Appliances & Lighting | | 2,293 | | | 2,117 | | | | | 6,469 | | | 6,094 | | |

| Industrial segment revenues | | 26,243 | | | 26,625 | | (1)% | | | 77,479 | | | 78,082 | | (1)% |

| Less the effects of: | | | | | | | | | | | | | | | |

| Acquisitions, business dispositions (other than | | | | | | | | | | | | | | | |

| dispositions of businesses acquired for investment) | | | | | | | | | | | | | | | |

| and currency exchange rates | | (1,238) | | | 76 | | | | | (3,217) | | | 563 | | |

| Industrial segment revenues excluding effects of acquisitions, | | | | | | | | | | | | | | | |

| business dispositions (other than dispositions of | | | | | | | | | | | | | | | |

| businesses acquired for investment) and currency | | | | | | | | | | | | | | | |

| exchange rates (Industrial segment organic revenues) | $ | 27,481 | | $ | 26,549 | | 4% | | $ | 80,696 | | $ | 77,519 | | 4% |

| | | | | | | | | | | | | | | | |

Organic revenue growth measures revenue excluding the effects of acquisitions, business dispositions and currency exchange rates. We believe that this measure provides management and investors with a more complete understanding of underlying operating results and trends of established, ongoing operations by excluding the effect of acquisitions, dispositions and currency exchange, which activities are subject to volatility and can obscure underlying trends. We also believe that presenting organic revenue growth separately for our industrial businesses provides management and investors with useful information about the trends of our industrial businesses and enables a more direct comparison to other non-financial businesses and companies. Management recognizes that the term "organic revenue growth" may be interpreted differently by other companies and under different circumstances. Although this may have an effect on comparability of absolute percentage growth from company to company, we believe that these measures are useful in assessing trends of the respective businesses or companies and may therefore be a useful tool in assessing period-to-period performance trends.

| INDUSTRIAL SEGMENT ORGANIC OPERATING PROFIT GROWTH |

| | | | | | | | | | | | | | | | |

| | Three months ended September 30 | | Nine months ended September 30 |

| (Dollars in millions) | | 2015 | | | 2014 | | V% | | | 2015 | | | 2014 | | V% |

| | | | | | | | | | | | | | | | |

| Industrial segment profit | $ | 4,530 | | $ | 4,331 | | 5% | | $ | 12,445 | | $ | 11,776 | | 6% |

| Less the effects of: | | | | | | | | | | | | | | | |

| Acquisitions, business dispositions (other than | | | | | | | | | | | | | | | |

| dispositions of businesses acquired for | | | | | | | | | | | | | | | |

| investment) and currency exchange rates | | (168) | | | 29 | | | | | (483) | | | 89 | | |

| Industrial segment profit excluding effects of acquisitions, | | | | | | | | | | | | | | | |

| business dispositions (other than dispositions of | | | | | | | | | | | | | | | |

| businesses acquired for investment) and currency | | | | | | | | | | | | | | | |

| exchange rates (Industrial segment organic operating profit) | $ | 4,698 | | $ | 4,302 | | 9% | | $ | 12,928 | | $ | 11,687 | | 11% |

| | | | | | | | | | | | | | | | |

Operating profit growth measures profit excluding the effects of acquisitions, business dispositions and currency exchange rates. We believe that this measure provides management and investors with a more complete understanding of underlying operating results and trends of established, ongoing operations by excluding the effect of acquisitions, dispositions and currency exchange, which activities are subject to volatility and can obscure underlying trends. Management recognizes that the term "organic operating profit growth" may be interpreted differently by other companies and under different circumstances. Although this may have an effect on comparability of absolute percentage growth from company to company, we believe that these measures are useful in assessing trends of the respective businesses or companies and may therefore be a useful tool in assessing period-to-period performance trends.

| OIL & GAS ORGANIC OPERATING PROFIT GROWTH |

| | | | | | | | | |

| | Three months ended September 30 |

| (Dollars in millions) | | 2015 | | | 2014 | | V% | |

| | | | | | | | | |

| Oil & Gas segment profit | $ | 584 | | $ | 660 | | (12)% | |

| Less the effects of: | | | | | | | | |

| Acquisitions, business dispositions (other than | | | | | | | | |

| dispositions of businesses acquired for investment) | | | | | | | | |

| and currency exchange rates | | (75) | | | 2 | | | |

| Oil & Gas segment profit excluding effects of acquisitions, | | | | | | | | |

| business dispositions (other than dispositions of | | | | | | | | |

| businesses acquired for investment) and currency | | | | | | | | |

| exchange rates (Oil & Gas organic operating profit) | $ | 659 | | $ | 658 | | -% | |

| | | | | | | | | |

INDUSTRIAL CASH FLOWS FROM OPERATING ACTIVITIES (INDUSTRIAL CFOA) | |

| | | | | | | | | |

| | Nine months ended September 30 | |

| (Dollars in millions) | | 2015 | | | 2014 | | V% | |

| | | | | | | | | |

| Cash from GE's operating activities (continuing operations), as reported | $ | 6,526 | | $ | 7,175 | | (9)% | |

| Less dividends from GECC | | 450 | | | 2,221 | | | |

| Cash from GE's operating activities (continuing operations), | | | | | | | | |

| excluding dividends from GECC (Industrial CFOA) | $ | 6,076 | | $ | 4,954 | | 23% | |

| | | | | | | | | |

We define "Industrial CFOA" as GE's cash from operating activities (continuing operations) less the amount of dividends received by GE from GECC. This includes the effects of intercompany transactions, including GE customer receivables sold to GECC; GECC services for trade receivables management and material procurement; buildings and equipment leased by GE from GECC; information technology (IT) and other services sold to GECC by GE; aircraft engines manufactured by GE that are installed on aircraft purchased by GECC from third-party producers for lease to others; and various investments, loans and allocations of GE corporate overhead costs. We believe that investors may find it useful to compare GE's operating cash flows without the effect of GECC dividends, since these dividends are not representative of the operating cash flows of our industrial businesses and can vary from period to period based upon the results of the financial services businesses. Management recognizes that this measure may not be comparable to cash flow results of companies which contain both industrial and financial services businesses, but believes that this comparison is aided by the provision of additional information about the amounts of dividends paid by our financial services business and the separate presentation in our financial statements of the GECC cash flows. We believe that our measure of Industrial CFOA provides management and investors with a useful measure to compare the capacity of our industrial operations to generate operating cash flow with the operating cash flow of other non-financial businesses and companies and as such provides a useful measure to supplement the reported GAAP CFOA measure.

| GE CAPITAL ENDING NET INVESTMENT (ENI), EXCLUDING LIQUIDITY |

| | | |

| (Dollars in billions) | September 30, 2015 | | September 30, 2014(b) |

| | | | | | |

| Financial Services (GECC) total assets | $ | 427.4 | | $ | 506.9 |

| Adjustment deferred Income taxes | | 6.4 | | | - |

| GECC total assets | | 433.8 | | | 506.9 |

| Less assets of discontinued operations | | 121.9 | | | 1.3 |

| Less non-interest bearing liabilities | | 50.3 | | | 60.9 |

| GE Capital ENI | | 261.6 | | | 444.7 |

| Less liquidity(a) | | 85.5 | | | 79.9 |

| GE Capital ENI, excluding liquidity | $ | 176.1 | | $ | 364.8 |

| Discontinued operations, excluding liquidity | | 94.5 | | | |

| GECC ENI, excluding liquidity | $ | 270.6 | | | |

| | | | | | |

| GE Capital ENI percentage variance to September 30, 2014 | | (52)% | | | |

| | | | | | |

| (a) | Liquidity includes cash and equivalents and $3.2 billion of debt obligations of the U.S. Treasury at September 30, 2015. |

| (b) | As originally reported. |

We use ENI to measure the size of our GE Capital segment. We believe that this measure is a useful indicator of the capital (debt or equity) required to fund a business as it adjusts for non-interest bearing current liabilities generated in the normal course of business that do not require a capital outlay. We also believe that by excluding liquidity, we provide a meaningful measure of assets requiring capital to fund our GE Capital segment as a substantial amount of liquidity resulted from debt issuances to pre-fund future debt maturities and will not be used to fund additional assets. Liquidity consists of cash and equivalents and certain debt obligations of the U.S. Treasury. As a general matter, investments included in liquidity are expected to be highly liquid, giving us the ability to readily convert them to cash. Providing this measure will help investors measure how we are performing against our previously communicated goal to reduce the size of our financial services segment.

| GECC TIER 1 COMMON RATIO ESTIMATE(a) |

| | | | |

| (Dollars in billions) | September 30, 2015 |

| | | | | | |

| Shareowners' equity(b) | | | | $ | 68.2 |

| Adjustments: | | | | | |

| Preferred equity | | | | | (4.9) |

| Goodwill and other intangible assets | | | | | (15.5) |

| Other additions (deductions) | | | | | 1.1 |

| GECC Tier 1 common | | | | | 48.9 |

| Estimated risk-weighted assets(c) | | | | | 356.7 |

| GECC Tier 1 common ratio estimate | | | | | 13.7% |

| | | | | | |

| (a) | Includes discontinued operations. |

| (b) | Total equity excluding noncontrolling interests. |

| (c) | Based on Basel 3 risk-weighted assets estimates. |

The GECC Tier 1 common ratio estimate is the ratio of Tier 1 common equity to total risk-weighted assets as calculated based on our interpretation of the standardized U.S. Basel 3 capital rules on a transitional basis, which is subject to review and consultation with our regulators. As such, the methodology of calculating this ratio may be refined over time as we discuss its interpretation and application with our regulators. We are not required by our regulators to disclose this estimated capital ratio, and therefore this capital ratio is considered a non-GAAP financial measure. We believe that this capital ratio is a useful measure to investors because it is widely used by analysts and regulators to assess the capital position of financial services companies.