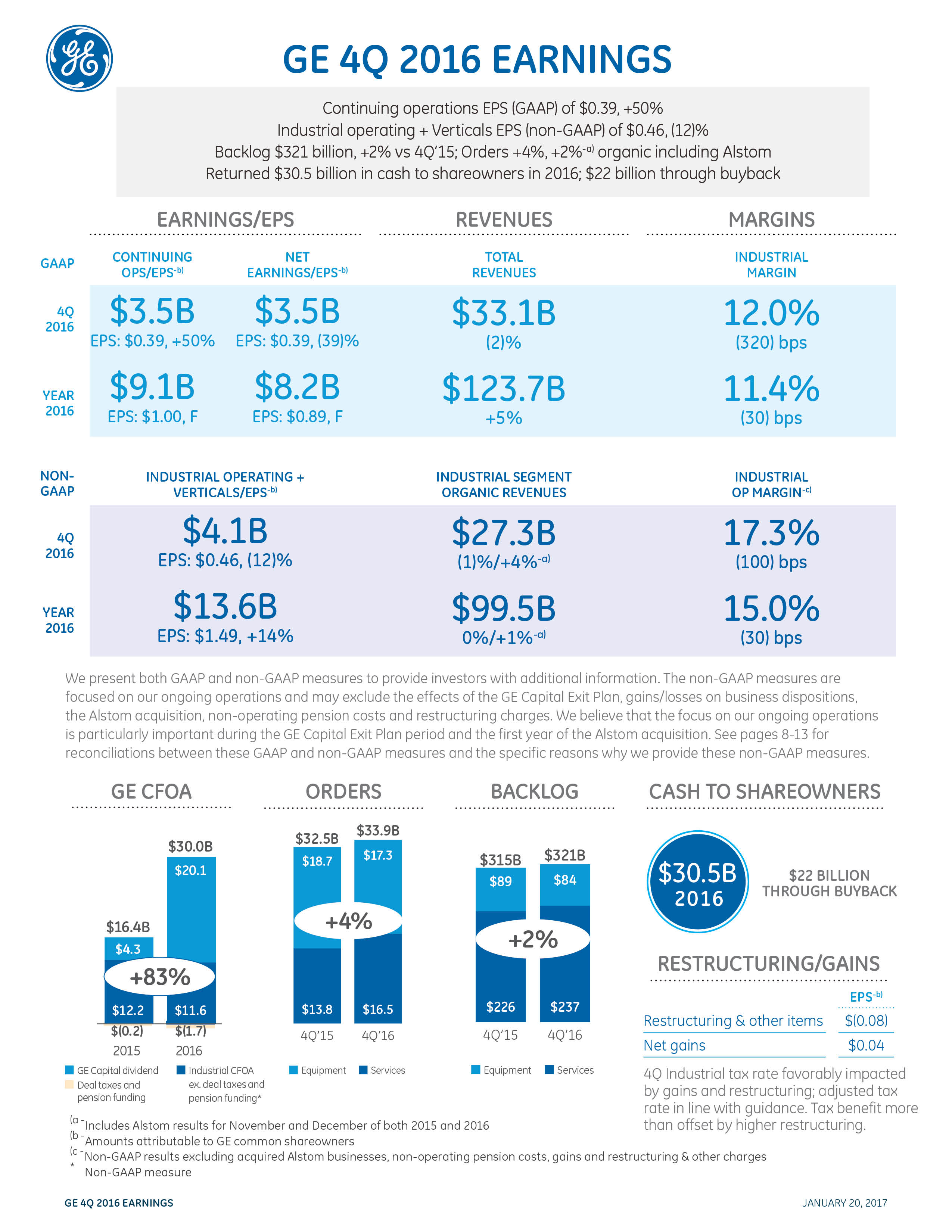

| GENERAL ELECTRIC COMPANY | | | | | | | | | | | | | | | | | | | | |

| CONDENSED STATEMENT OF EARNINGS (LOSS) (UNAUDITED) | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | Consolidated | | | GE(a) | | | Financial Services (GE Capital) |

| Three months ended December 31 | 2016 | 2015 | | V% | | | 2016 | 2015 | | V% | 2016 | 2015 | | V% |

| | | | | | | | | | | | | | | | | | | | | |

| Revenues and other income | | | | | | | | | | | | | | | | | | | | |

| Sales of goods and services | $ | 30,234 | $ | 30,543 | | (1)% | | | $ | 30,345 | $ | 30,614 | | (1)% | $ | 27 | $ | 15 | | 80% |

| Other income | | 619 | | 1,135 | | | | | | 733 | | 1,143 | | | | - | | - | | |

| GE Capital earnings (loss) from continuing operations | | - | | - | | | | | | 215 | | (1,465) | | | | - | | - | | |

| GE Capital revenues from services | | 2,235 | | 2,214 | | | | | | - | | - | | | | 2,622 | | 2,570 | | |

| Total revenues and other income | | 33,088 | | 33,892 | | (2)% | | | | 31,294 | | 30,292 | | 3% | | 2,649 | | 2,585 | | 2% |

| Costs and expenses | | | | | | | | | | | | | | | | | | | | |

| Cost of sales | | 23,773 | | 23,584 | | | | | | 23,318 | | 23,058 | | | | 593 | | 612 | | |

| Selling, general and administrative expenses | | 4,543 | | 4,772 | | | | | | 4,029 | | 3,878 | | | | 709 | | 1,053 | | |

| Interest and other financial charges | | 1,002 | | 1,235 | | | | | | 536 | | 463 | | | | 784 | | 953 | | |

| Investment contracts, insurance losses and | | | | | | | | | | | | | | | | | | | | |

| insurance annuity benefits | | 696 | | 663 | | | | | | - | | - | | | | 674 | | 676 | | |

| Other costs and expenses | | 182 | | 1,735 | | | | | | - | | - | | | | 191 | | 1,744 | | |

| Total costs and expenses | | 30,196 | | 31,989 | | (6)% | | | | 27,883 | | 27,399 | | 2% | | 2,952 | | 5,039 | | (41)% |

| Earnings (loss) from continuing operations | | | | | | | | | | | | | | | | | | | | |

| before income taxes | | 2,893 | | 1,903 | | 52% | | | | 3,411 | | 2,892 | | 18% | | (303) | | (2,454) | | 88% |

| Benefit (provision) for income taxes | | 766 | | 742 | | | | | | 67 | | (204) | | | | 699 | | 946 | | |

| Earnings (loss) from continuing operations | | 3,659 | | 2,645 | | 38% | | | | 3,478 | | 2,688 | | 29% | | 396 | | (1,508) | | F |

| Earnings (loss) from discontinued | | | | | | | | | | | | | | | | | | | | |

| operations, net of taxes | | - | | 3,758 | | | | | | 4 | | 3,716 | | | | (1) | | 3,764 | | |

| Net earnings (loss) | | 3,659 | | 6,403 | | (43)% | | | | 3,482 | | 6,404 | | (46)% | | 396 | | 2,257 | | (82)% |

| Less net earnings (loss) attributable to | | | | | | | | | | | | | | | | | | | | |

| noncontrolling interests | | (8) | | 103 | | | | | | (4) | | 121 | | | | (4) | | (19) | | |

| Net earnings (loss) attributable to the Company | | 3,667 | | 6,301 | | (42)% | | | | 3,486 | | 6,283 | | (45)% | | 399 | | 2,275 | | (82)% |

| Preferred stock dividends | | (181) | | (18) | | | | | | - | | - | | | | (181) | | (169) | | |

| Net earnings (loss) attributable to | | | | | | | | | | | | | | | | | | | | |

| GE common shareowners | $ | 3,486 | $ | 6,283 | | (45)% | | | $ | 3,486 | $ | 6,283 | | (45)% | $ | 218 | $ | 2,107 | | (90)% |

| Amounts attributable to GE common | | | | | | | | | | | | | | | | | | | | |

| shareowners: | | | | | | | | | | | | | | | | | | | | |

| Earnings (loss) from continuing operations | $ | 3,659 | $ | 2,645 | | 38% | | | $ | 3,478 | $ | 2,688 | | 29% | $ | 396 | $ | (1,508) | | F |

| Less net earnings (loss) attributable | | | | | | | | | | | | | | | | | | | | |

| to noncontrolling interests, continuing operations | | (5) | | 60 | | | | | | (4) | | 121 | | | | (1) | | (61) | | |

| Earnings (loss) from continuing operations | | | | | | | | | | | | | | | | | | | | |

| attributable to the Company | | 3,664 | | 2,585 | | 42% | | | | 3,483 | | 2,567 | | 36% | | 397 | | (1,447) | | F |

| Preferred stock dividends | | (181) | | (18) | | | | | | - | | - | | | | (181) | | (169) | | |

| Earnings (loss) from continuing operations | | | | | | | | | | | | | | | | | | | | |

| attributable to GE common shareowners | | 3,483 | | 2,567 | | 36% | | | | 3,483 | | 2,567 | | 36% | | 215 | | (1,615) | | F |

| Earnings (loss) from discontinued | | | | | | | | | | | | | | | | | | | | |

| operations, net of taxes | | - | | 3,758 | | | | | | 4 | | 3,716 | | | | (1) | | 3,764 | | |

| Less net earnings (loss) attributable to | | | | | | | | | | | | | | | | | | | | |

| noncontrolling interests, discontinued operations | | (3) | | 43 | | | | | | - | | - | | | | (3) | | 43 | | |

| Net earnings (loss) attributable to GE | | | | | | | | | | | | | | | | | | | | |

| common shareowners | $ | 3,486 | $ | 6,283 | | (45)% | | | $ | 3,486 | $ | 6,283 | | (45)% | $ | 218 | $ | 2,107 | | (90)% |

| | | | | – | | | | | | | | #REF! | | | | | | #REF! | | |

| Per-share amounts - earnings (loss) from | | | | | | | | | | | | | | | | | | | | |

| continuing operations | | | | | | | | | | | | | | | | | | | | |

| Diluted earnings (loss) per share | $ | 0.39 | $ | 0.26 | | 50% | | | | | | | | | | | | | | |

| Basic earnings (loss) per share | $ | 0.40 | $ | 0.26 | | 54% | | | | | | | | | | | | | | |

| Per-share amounts - net earnings (loss) | | | | | | | | | | | | | | | | | | | | |

| Diluted earnings (loss) per share | $ | 0.39 | $ | 0.64 | | (39)% | | | | | | | | | | | | | | |

| Basic earnings (loss) per share | $ | 0.40 | $ | 0.64 | | (38)% | | | | | | | | | | | | | | |

| Total average equivalent shares | | | | | | | | | | | | | | | | | | | | |

| Diluted | | 8,901 | | 9,821 | | (9)% | | | | | | | | | | | | | | |

| Basic | | 8,795 | | 9,745 | | (10)% | | | | | | | | | | | | | | |

| Dividends declared per common share | $ | 0.24 | $ | 0.23 | | 4% | | | | | | | | | | | | | | |

| (a) | Represents the adding together of all affiliated companies except GE Capital, which is presented on a one-line basis. |

Amounts may not add due to rounding. Dollar amounts and share amounts in millions; per-share amounts in dollars.

"GE Capital" means GE Capital Global Holdings, LLC (GECGH) and its predecessor General Electric Capital Corporation (GECC) and all of their affiliates and associated companies. Separate information is shown for "GE" and "Financial Services (GE Capital)." Transactions between GE and GE Capital have been eliminated from the "Consolidated" column. See Note 1 to the 2015 consolidated financial statements at www.ge.com/ar2015 for further information about consolidation matters.

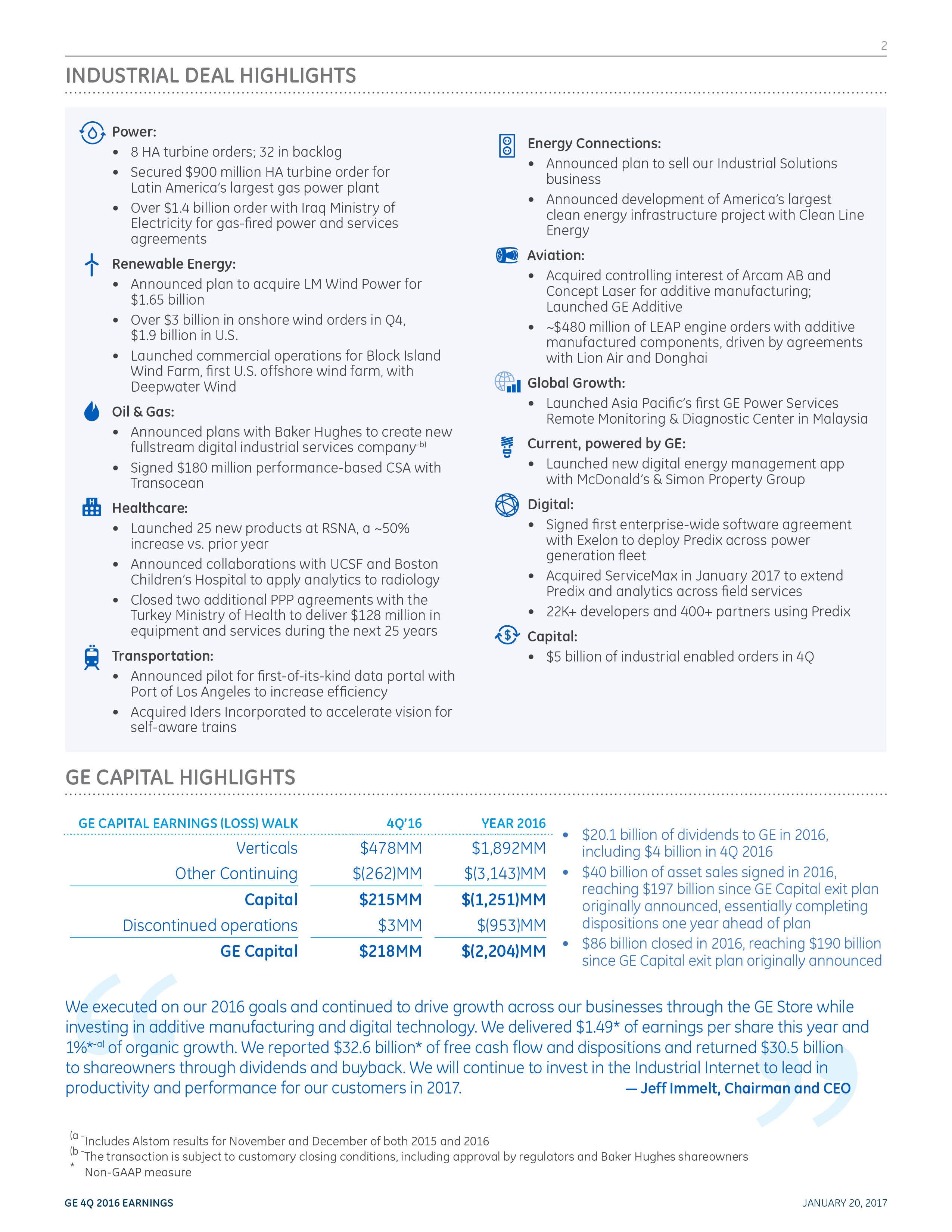

| GENERAL ELECTRIC COMPANY |

| CONDENSED STATEMENT OF EARNINGS (LOSS) (UNAUDITED) |

| |

| | Consolidated | | | GE(a) | Financial Services (GE Capital) |

| Twelve months ended December 31 | 2016 | 2015 | | V% | | | 2016 | 2015 | | V% | 2016 | 2015 | | V% |

| | | | | | | | | | | | | | | | | | | | | |

| Revenues and other income | | | | | | | | | | | | | | | | | | | | |

| Sales of goods and services | $ | 110,391 | $ | 105,808 | | 4% | | | $ | 110,835 | $ | 106,206 | | 4% | $ | 115 | $ | 79 | | 46% |

| Other income | | 4,005 | | 2,227 | | | | | | 4,092 | | 2,165 | | | | - | | - | | |

| GE Capital earnings (loss) from continuing operations | - | | - | | | | | | (1,251) | | (7,672) | | | | - | | - | | |

| GE Capital revenues from services | | 9,297 | | 9,350 | | | | | | - | | - | | | | 10,790 | | 10,722 | | |

| Total revenues and other income | | 123,693 | | 117,386 | | 5% | | | | 113,676 | | 100,700 | | 13% | | 10,905 | | 10,801 | | 1% |

| | | | | | | | | | | | | | | | | | | | | |

| Costs and expenses | | | | | | | | | | | | | | | | | | | | |

| Cost of sales | | 87,483 | | 82,693 | | | | | | 85,712 | | 80,828 | | | | 2,331 | | 2,343 | | |

| Selling, general and administrative expenses | | 18,377 | | 17,831 | | | | | | 16,123 | | 14,914 | | | | 2,947 | | 3,512 | | |

| Interest and other financial charges | | 5,025 | | 3,463 | | | | | | 2,026 | | 1,706 | | | | 3,790 | | 2,301 | | |

| Investment contracts, insurance losses and | | | | | | | | | | | | | | | | | | | | |

| insurance annuity benefits | | 2,797 | | 2,605 | | | | | | - | | - | | | | 2,861 | | 2,737 | | |

| Other costs and expenses | | 982 | | 2,608 | | | | | | - | | - | | | | 1,013 | | 2,647 | | |

| Total costs and expenses | | 114,663 | | 109,200 | | 5% | | | | 103,860 | | 97,447 | | 7% | | 12,942 | | 13,539 | | (4)% |

| Earnings (loss) from continuing operations | | | | | | | | | | | | | | | | | | | | |

| before income taxes | | 9,030 | | 8,186 | | 10% | | | | 9,815 | | 3,252 | | F | | (2,037) | | (2,739) | | (26)% |

| Benefit (provision) for income taxes | | 464 | | (6,485) | | | | | | (967) | | (1,506) | | | | 1,431 | | (4,979) | | |

| Earnings (loss) from continuing operations | | 9,494 | | 1,700 | | F | | | | 8,849 | | 1,746 | | F | | (606) | | (7,718) | | (92)% |

| Earnings (loss) from discontinued | | | | | | | | | | | | | | | | | | | | |

| operations, net of taxes | | (954) | | (7,495) | | | | | | (952) | | (7,807) | | | | (954) | | (7,485) | | |

| Net earnings (loss) | | 8,540 | | (5,795) | | F | | | | 7,896 | | (6,061) | | F | | (1,560) | | (15,202) | | 90% |

| Less net earnings (loss) attributable to | | | | | | | | | | | | | | | | | | | | |

| noncontrolling interests | | (291) | | 332 | | | | | | (279) | | 83 | | | | (12) | | 248 | | |

| Net earnings (loss) attributable to the Company | | 8,831 | | (6,126) | | F | | | | 8,176 | | (6,145) | | F | | (1,548) | | (15,450) | | 90% |

| Preferred stock dividends | | (656) | | (18) | | | | | | - | | - | | | | (656) | | (330) | | |

| Net earnings (loss) attributable to | | | | | | | | | | | | | | | | | | | | |

| GE common shareowners | $ | 8,176 | $ | (6,145) | | F | | | $ | 8,176 | $ | (6,145) | | F | $ | (2,204) | $ | (15,780) | | 86% |

| Amounts attributable to GE common | | | | | | | | | | | | | | | | | | | | |

| shareowners: | | | | | | | | | | | | | | | | | | | | |

| Earnings (loss) from continuing operations | $ | 9,494 | $ | 1,700 | | F | | | $ | 8,849 | $ | 1,746 | | F | $ | (606) | $ | (7,718) | | 92% |

| Less net earnings (loss) attributable | | | | | | | | | | | | | | | | | | | | |

| to noncontrolling interests, continuing operations | | (290) | | 19 | | | | | | (279) | | 83 | | | | (10) | | (64) | | |

| Earnings (loss) from continuing operations | | | | | | | | | | | | | | | | | | | | |

| attributable to the Company | | 9,784 | | 1,681 | | F | | | | 9,128 | | 1,663 | | F | | (595) | | (7,654) | | 92% |

| Preferred stock dividends | | (656) | | (18) | | | | | | - | | - | | | | (656) | | (330) | | |

| Earnings (loss) from continuing operations | | | | | | | | | | | | | | | | | | | | |

| attributable to GE common shareowners | | 9,128 | | 1,663 | | F | | | | 9,128 | | 1,663 | | F | | (1,251) | | (7,983) | | 84% |

| Earnings (loss) from discontinued | | | | | | | | | | | | | | | | | | | | |

| operations, net of taxes | | (954) | | (7,495) | | | | | | (952) | | (7,807) | | | | (954) | | (7,485) | | |

| Less net earnings (loss) attributable to | | | | | | | | | | | | | | | | | | | | |

| noncontrolling interests, discontinued operations | | (1) | | 312 | | | | | | - | | - | | | | (1) | | 312 | | |

| Net earnings (loss) attributable to GE | | | | | | | | | | | | | | | | | | | | |

| common shareowners | $ | 8,176 | $ | (6,145) | | F | | | $ | 8,176 | $ | (6,145) | | F | $ | (2,204) | $ | (15,780) | | 86% |

| | | | | | | | | | | | | | | | | | | | | |

| Per-share amounts - earnings (loss) from | | | | | | | | | | | | | | | | | | | | |

| continuing operations | | | | | | | | | | | | | | | | | | | | |

| Diluted earnings (loss) per share | $ | 1.00 | $ | 0.17 | | F | | | | | | | | | | | | | | |

| Basic earnings (loss) per share | $ | 1.01 | $ | 0.17 | | F | | | | | | | | | | | | | | |

| Per-share amounts - net earnings (loss) | | | | | | | | | | | | | | | | | | | | |

| Diluted earnings (loss) per share | $ | 0.89 | $ | (0.61) | | F | | | | | | | | | | | | | | |

| Basic earnings (loss) per share | $ | 0.90 | $ | (0.62) | | F | | | | | | | | | | | | | | |

| Total average equivalent shares | | | | | | | | | | | | | | | | | | | | |

| Diluted | | 9,130 | | 10,016 | | (9)% | | | | | | | | | | | | | | |

| Basic | | 9,025 | | 9,944 | | (9)% | | | | | | | | | | | | | | |

| Dividends declared per common share | $ | 0.93 | $ | 0.92 | | 1% | | | | | | | | | | | | | | |

| (a) | Represents the adding together of all affiliated companies except GE Capital, which is presented on a one-line basis. |

Amounts may not add due to rounding. Dollar amounts and share amounts in millions; per-share amounts in dollars.

"GE Capital" means GE Capital Global Holdings, LLC (GECGH) and its predecessor General Electric Capital Corporation (GECC) and all of their affiliates and associated companies. Separate information is shown for "GE" and "Financial Services (GE Capital)." Transactions between GE and GE Capital have been eliminated from the "Consolidated" column. See Note 1 to the 2015 consolidated financial statements at www.ge.com/ar2015 for further information about consolidation matters.

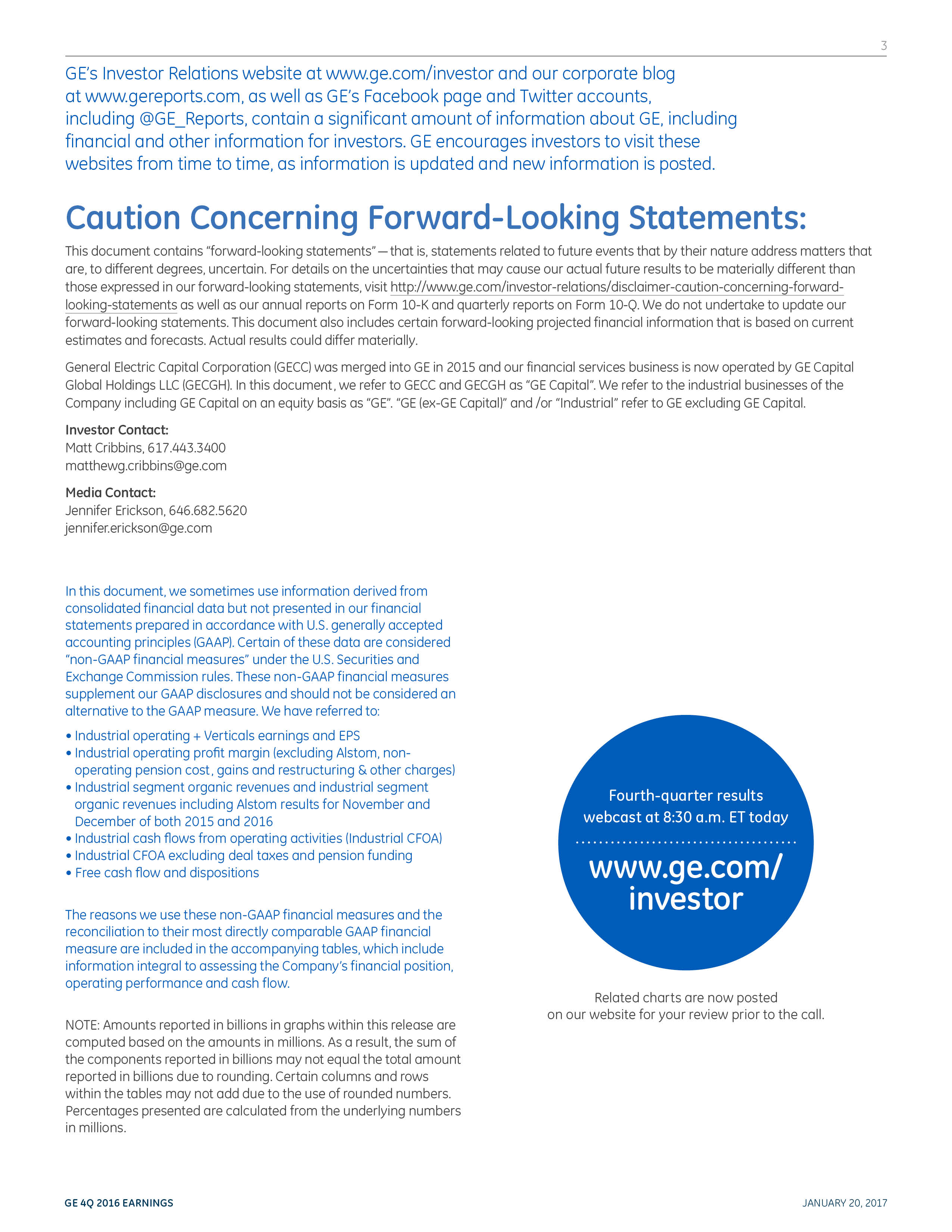

| GENERAL ELECTRIC COMPANY | | | | | | | | | | | | | | | |

| SUMMARY OF OPERATING SEGMENTS (UNAUDITED) | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | Three months ended December 31 | | Twelve months ended December 31 |

| (Dollars in millions) | 2016 | | 2015 | | V% | | 2016 | | 2015 | | V% |

| | | | | | | | | | | | | | | | |

| Revenues(a) | | | | | | | | | | | | | | | |

| Power | $ | 8,479 | | $ | 7,085 | | 20 % | | $ | 26,827 | | $ | 21,490 | | 25 % |

| Renewable Energy | | 2,500 | | | 1,938 | | 29 % | | | 9,033 | | | 6,273 | | 44 % |

| Oil & Gas | | 3,402 | | | 4,355 | | (22)% | | | 12,898 | | | 16,450 | | (22)% |

| Aviation | | 7,187 | | | 6,734 | | 7 % | | | 26,261 | | | 24,660 | | 6 % |

| Healthcare | | 5,101 | | | 4,973 | | 3 % | | | 18,291 | | | 17,639 | | 4 % |

| Transportation | | 1,243 | | | 1,612 | | (23)% | | | 4,713 | | | 5,933 | | (21)% |

| Energy Connections & Lighting(b) | | 3,325 | | | 4,657 | | (29)% | | | 15,133 | | | 16,351 | | (7)% |

| Total industrial segment revenues | | 31,236 | | | 31,352 | | - % | | | 113,156 | | | 108,796 | | 4 % |

| Capital | | 2,649 | | | 2,585 | | 2 % | | | 10,905 | | | 10,801 | | 1 % |

| Total segment revenues | | 33,885 | | | 33,937 | | - % | | | 124,061 | | | 119,597 | | 4 % |

| Corporate items and eliminations(a) | | (796) | | | (46) | | | | | (368) | | | (2,211) | | |

| Consolidated revenues and other income | | | | | | | | | | | | | | | |

| from continuing operations | $ | 33,088 | | $ | 33,892 | | (2)% | | $ | 123,693 | | $ | 117,386 | | 5 % |

| | | | | | | | | | | | | | | | |

| Segment profit (loss)(a) | | | | | | | | | | | | | | | |

| Power | $ | 2,069 | | $ | 1,628 | | 27 % | | $ | 4,979 | | $ | 4,502 | | 11 % |

| Renewable Energy | | 163 | | | 56 | | F | | | 576 | | | 431 | | 34 % |

| Oil & Gas | | 411 | | | 715 | | (43)% | | | 1,392 | | | 2,427 | | (43)% |

| Aviation | | 1,749 | | | 1,571 | | 11 % | | | 6,115 | | | 5,507 | | 11 % |

| Healthcare | | 1,030 | | | 938 | | 10 % | | | 3,161 | | | 2,882 | | 10 % |

| Transportation | | 317 | | | 339 | | (6)% | | | 1,064 | | | 1,273 | | (16)% |

| Energy Connections & Lighting(b) | | 102 | | | 274 | | (63)% | | | 311 | | | 944 | | (67)% |

| Total industrial segment profit | | 5,842 | | | 5,522 | | 6 % | | | 17,598 | | | 17,966 | | (2)% |

| Capital | | 215 | | | (1,615) | | F | | | (1,251) | | | (7,983) | | 84 % |

| Total segment profit (loss) | | 6,057 | | | 3,907 | | 55 % | | | 16,347 | | | 9,983 | | 64 % |

| Corporate items and eliminations(a) | | (2,106) | | | (673) | | | | | (4,226) | | | (5,108) | | |

| GE interest and other financial charges | | (536) | | | (463) | | | | | (2,026) | | | (1,706) | | |

| GE provision for income taxes | | 67 | | | (204) | | | | | (967) | | | (1,506) | | |

| Earnings (loss) from continuing operations | | | | | | | | | | | | | | | |

| attributable to GE common shareowners | | 3,483 | | | 2,567 | | 36 % | | | 9,128 | | | 1,663 | | F |

| Earnings (loss) from discontinued operations, | | | | | | | | | | | | | | | |

| net of taxes | | - | | | 3,758 | | U | | | (954) | | | (7,495) | | 87 % |

| Less net earnings attributable to | | | | | | | | | | | | | | | |

| noncontrolling interests, discontinued operations | | (3) | | | 43 | | U | | | (1) | | | 312 | | U |

| Earnings (loss) from discontinued operations, | | | | | | | | | | | | | | | |

| net of tax and noncontrolling interest | | 4 | | | 3,716 | | U | | | (952) | | | (7,807) | | 88 % |

| Consolidated net earnings (loss) | | | | | | | | | | | | | | | |

| attributable to GE common shareowners | $ | 3,486 | | $ | 6,283 | | (45)% | | $ | 8,176 | | $ | (6,145) | | F |

| | | | | | | | | | | | | | | | |

| (a) | Segment revenues include revenues and other income related to the segment. Segment profit excludes results reported as discontinued operations and material accounting changes, the portion of earnings or loss attributable to noncontrolling interests of consolidated subsidiaries, and as such only includes the portion of earnings or loss attributable to our share of the consolidated earnings or loss of consolidated subsidiaries. Segment profit excludes or includes interest and other financial charges and income taxes according to how a particular segment's management is measured – excluded in determining segment profit, which we sometimes refer to as "operating profit," for Power, Renewable Energy, Oil & Gas, Aviation, Healthcare, Transportation and Energy Connections & Lighting; included in determining segment profit, which we sometimes refer to as "net earnings," for Capital. Certain corporate costs, such as shared services, employee benefits and information technology are allocated to our segments based on usage. A portion of the remaining corporate costs are allocated based on each segment's relative net cost of operations. Total industrial segment revenues and profit include the sum of our seven industrial reporting segments without giving effect to the elimination of transactions among such segments. Total segment revenues and profit include the sum of our seven industrial segments and one financial services segment, without giving effect to the elimination of transactions among such segments. We believe that this provides investors with a view as to the results of all of our segments, without inter-segment eliminations and corporate items. |

| (b) | Beginning in the third quarter of 2016, the former Energy Connections and Appliances & Lighting segments are presented as one reporting segment called Energy Connections & Lighting. This segment includes the historical results of the Appliances business prior to its sale in June 2016. |

Amounts may not add due to rounding

| GENERAL ELECTRIC COMPANY | | | | | | | | | | | | | | | | | | |

| CONDENSED STATEMENT OF FINANCIAL POSITION (UNAUDITED) |

| |

| | | | | | | | | | | | | | | | | | | |

| | Consolidated | | | GE(a) | | Financial Services (GE Capital) |

| | December 31, | | December 31, | | | December 31, | | December 31, | | December 31, | | December 31, |

| (Dollars in billions) | 2016 | | 2015 | | | 2016 | | 2015 | | 2016 | | 2015 |

| | | | | | | | | | | | | |

| Assets | | | | | | | | | | | | | | | | | | |

| Cash and marketable securities | $ | 92.4 | | $ | 102.5 | | | $ | 10.7 | | $ | 10.5 | | $ | 81.8 | | $ | 91.9 |

| Receivables | | 24.1 | | | 27.0 | | | | 12.7 | | | 14.7 | | | - | | | - |

| Inventories | | 22.4 | | | 22.5 | | | | 22.3 | | | 22.4 | | | 0.1 | | | 0.1 |

| GE Capital financing receivables - net | | 12.2 | | | 12.1 | | | | - | | | - | | | 26.0 | | | 25.0 |

| Property, plant & equipment - net | | 50.5 | | | 54.1 | | | | 19.1 | | | 20.1 | | | 32.2 | | | 34.8 |

| Receivable from GE Capital (debt assumption) | | - | | | - | | | | 58.8 | | | 84.7 | | | - | | | - |

| Investment in GE Capital | | - | | | - | | | | 24.7 | | | 46.2 | | | - | | | - |

| Goodwill & intangible assets | | 86.9 | | | 83.3 | | | | 84.2 | | | 80.5 | | | 2.7 | | | 2.8 |

| Contract assets | | 25.2 | | | 21.2 | | | | 25.2 | | | 21.2 | | | - | | | - |

| Other assets | | 35.0 | | | 46.7 | | | | 18.7 | | | 20.5 | | | 25.4 | | | 36.0 |

| Assets of businesses held for sale | | 1.7 | | | 2.8 | | | | 1.6 | | | 2.8 | | | - | | | - |

| Assets of discontinued operations | | 14.8 | | | 121.0 | | | | - | | | - | | | 14.8 | | | 120.9 |

| Total assets | $ | 365.2 | | $ | 493.1 | | | $ | 277.9 | | $ | 323.7 | | $ | 183.0 | | $ | 311.5 |

| | | | | | | | | | | | | | | | | | | |

| Liabilities and equity | | | | | | | | | | | | | | | | | | |

| Borrowings | $ | 136.2 | | $ | 197.6 | | | $ | 79.3 | | $ | 103.1 | | $ | 117.3 | | $ | 180.2 |

| Investment contracts, insurance liabilities and | | | | | | | | | | | | | | | | | | |

| insurance annuity benefits | | 26.1 | | | 25.7 | | | | - | | | - | | | 26.5 | | | 26.2 |

| Non-current compensation and benefits | | 43.8 | | | 40.5 | | | | 42.8 | | | 39.5 | | | 1.0 | | | 1.0 |

| Other liabilities | | 73.8 | | | 78.8 | | | | 74.9 | | | 77.0 | | | 9.0 | | | 11.1 |

| Liabilities of businesses held for sale | | 0.7 | | | 0.9 | | | | 0.7 | | | 1.4 | | | - | | | - |

| Liabilities of discontinued operations | | 4.2 | | | 46.5 | | | | - | | | 0.1 | | | 4.1 | | | 46.4 |

| Redeemable noncontrolling interest | | 3.0 | | | 3.0 | | | | 3.0 | | | 3.0 | | | - | | | - |

| GE shareowners' equity | | 75.8 | | | 98.3 | | | | 75.8 | | | 98.3 | | | 24.7 | | | 46.2 |

| Noncontrolling interests | | 1.7 | | | 1.9 | | | | 1.4 | | | 1.4 | | | 0.3 | | | 0.5 |

| Total liabilities and equity | $ | 365.2 | | $ | 493.1 | | | $ | 277.9 | | $ | 323.7 | | $ | 183.0 | | $ | 311.5 |

| | | | | | | | | | | | | | | | | | | |

| (a) | Represents the adding together of all affiliated companies except GE Capital, which is presented on a one-line basis. |

Amounts may not add due to rounding

"GE Capital" means GE Capital Global Holdings, LLC (GECGH) and its predecessor General Electric Capital Corporation (GECC) and all of their affiliates and associated companies. Separate information is shown for "GE" and "Financial Services (GE Capital)." Transactions between GE and GE Capital have been eliminated from the "Consolidated" column. See Note 1 to the 2015 consolidated financial statements at www.ge.com/ar2015 for further information about consolidation matters.

GENERAL ELECTRIC COMPANY

Financial Measures That Supplement GAAP

We sometimes use financial measures derived from consolidated financial information but not presented in our financial statements prepared in accordance with U.S. generally accepted accounting principles (GAAP). Certain of these are considered "non-GAAP financial measures" under the U.S. Securities and Exchange Commission rules. The following non-GAAP financial measures supplement our GAAP disclosures and should not be considered an alternative to the GAAP measure.

| | Industrial operating and GE Capital earnings (loss) from continuing operations and EPS |

| | Industrial operating + Verticals earnings and EPS |

| | Industrial operating profit and operating profit margin (excluding certain items) |

| | Industrial segment organic revenues and industrial segment organic revenues including Alstom results for November and December of both 2015 and 2016 |

| | Industrial cash flows from operating activities (Industrial CFOA) and Industrial CFOA excluding deal taxes and pension funding |

| | Free cash flow plus dispositions |

The reasons we use these non-GAAP financial measures and the reconciliations to their most directly comparable GAAP financial measures follow. Certain columns, rows or percentages within these reconciliations may not add or recalculate due to the use of rounded numbers. Totals and percentages presented are calculated from the underlying numbers in millions.

| |

| INDUSTRIAL OPERATING AND GE CAPITAL EARNINGS (LOSS) FROM CONTINUING OPERATIONS AND EPS | | |

| | | | | | | | | | | | | | | | |

| | | Three months ended December 31 | | | Twelve months ended December 31 |

| (Dollars in millions; except per share amounts) | | 2016 | | | 2015 | | V% | | | 2016 | | | 2015 | | V% |

| | | | | | | | | | | | | | | | |

| Earnings (loss) from continuing operations attributable to GE | | | | | | | | | | | | | | | |

| common shareowners (GAAP) | $ | 3,483 | | $ | 2,567 | | | | $ | 9,128 | | $ | 1,663 | | |

| Non-operating pension costs (pre-tax) | | 517 | | | 687 | | | | | 2,052 | | | 2,764 | | |

| Tax effect on non-operating pension costs(a) | | (181) | | | (240) | | | | | (718) | | | (967) | | |

| Adjustment: non-operating pension costs (net of tax) | | 336 | | | 447 | | | | | 1,334 | | | 1,797 | | |

| Operating earnings (loss) (Non-GAAP) | | 3,819 | | | 3,014 | | 27% | | | 10,462 | | | 3,460 | | F |

| | | | | | | | | | | | | | | | |

| Adjustment: GE Capital earnings (loss) from continuing operations | | | | | | | | | | | | | | | |

| attributable to GE common shareowners | | 215 | | | (1,615) | | | | | (1,251) | | | (7,983) | | |

| Industrial operating earnings (Non-GAAP) | $ | 3,603 | | $ | 4,629 | | (22)% | | $ | 11,713 | | $ | 11,443 | | 2% |

| | | | | | | | | | | | | | | | |

Earnings (loss) per share - diluted(a) | | | | | | | | | | | | | | | |

| Continuing EPS from continuing operations | | | | | | | | | | | | | | | |

| attributable to GE common shareowners (GAAP) | | 0.39 | | | 0.26 | | 50% | | | 1.00 | | | 0.17 | | F |

| Adjustment: non-operating pension costs (net of tax) | | 0.04 | | | 0.05 | | | | | 0.15 | | | 0.18 | | |

| Operating EPS (Non-GAAP) | | 0.43 | | | 0.31 | | 39% | | | 1.14 | | | 0.35 | | F |

| GE Capital EPS from continuing operations | | | | | | | | | | | | | | | |

| attributable to GE common shareowners (GAAP) | | 0.02 | | | (0.16) | | F | | | (0.14) | | | (0.80) | | 83% |

| Industrial operating EPS (Non-GAAP) | $ | 0.40 | | $ | 0.47 | | (15)% | | $ | 1.28 | | $ | 1.14 | | 12% |

| | | | | | | | | | | | | | | | |

| (a) | The tax effect on non-operating pension costs was calculated using a 35% U.S. federal statutory tax rate, based on its applicability to such cost. |

| (b) | Earnings (loss) per-share amounts are computed independently. As a result, the sum of per-share amounts may not equal the total. |

Operating earnings (loss) excludes non-service related pension costs of our principal pension plans comprising interest cost, expected return on plan assets and amortization of actuarial gains/losses. The service cost, prior service cost and any curtailment gain or loss components of our principal pension plans are included in operating earnings. We believe that these components of pension cost better reflect the ongoing service-related costs of providing pension benefits to our employees. As such, we believe that our measure of operating earnings (loss) provides management and investors with a useful measure of the operational results of our business. Other components of GAAP pension cost are mainly driven by capital allocation decisions and market performance, and we manage these separately from the operational performance of our businesses. Non-operating pension costs are not necessarily indicative of the current or future cash flow requirements related to our pension plan. We also believe that this measure, considered along with the corresponding GAAP measure, provides management and investors with additional information for comparison of our operating results to the operating results of other companies.

| INDUSTRIAL OPERATING + VERTICALS EARNINGS AND EPS | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Three months ended December 31 | | | Twelve months ended December 31 |

| (Dollars in millions; except per share amounts) | | 2016 | | | 2015 | | V% | | | 2016 | | | 2015 | | V% |

| | | | | | | | | | | | | | | | |

| GE Capital earnings (loss) from continuing operations | | | | | | | | | | | | | | | |

| attributable to GE common shareowners (GAAP) | $ | 215 | | $ | (1,615) | | F | | $ | (1,251) | | $ | (7,983) | | 84% |

| Adjustment: GE Capital other continuing | | | | | | | | | | | | | | | |

| earnings (loss) (Other Capital) | | (262) | | | (2,053) | | | | | (3,143) | | | (9,649) | | |

| Verticals earnings(a) | $ | 478 | | $ | 438 | | 9% | | $ | 1,892 | | $ | 1,666 | | 14% |

| | | | | | | | | | | | | | | | |

| Industrial operating earnings (Non-GAAP) | $ | 3,603 | | $ | 4,629 | | (22)% | | $ | 11,713 | | $ | 11,443 | | 2% |

| Verticals earnings(a) | | 478 | | | 438 | | | | | 1,892 | | | 1,666 | | |

| Industrial operating earnings + Verticals earnings (Non-GAAP) | $ | 4,081 | | $ | 5,067 | | (19)% | | $ | 13,605 | | $ | 13,109 | | 4% |

| Adjustment: Non-operating pension costs and Other Capital | | (598) | | | (2,500) | | | | | (4,477) | | | (11,446) | | |

| Earnings (loss) from continuing operations | | | | | | | | | | | | | | | |

| attributable to GE common shareowners (GAAP) | $ | 3,483 | | | 2,567 | | 36% | | $ | 9,128 | | | 1,663 | | F |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Earnings (loss) per share - diluted(b) | | | | | | | | | | | | | | | |

| Industrial operating EPS (Non-GAAP) | $ | 0.40 | | $ | 0.47 | | (15)% | | $ | 1.28 | | $ | 1.14 | | 12% |

| Verticals EPS | | 0.05 | | | 0.04 | | 25% | | | 0.21 | | | 0.17 | | 24% |

| Industrial operating + Verticals EPS (Non-GAAP) | $ | 0.46 | | $ | 0.52 | | (12)% | | $ | 1.49 | | $ | 1.31 | | 14% |

| Adjustment: Non-operating pension costs and Other Capital | | (0.07) | | | (0.25) | | | | | (0.49) | | | (1.14) | | |

| EPS from continuing operations (GAAP) | $ | 0.39 | | | 0.26 | | 50% | | $ | 1.00 | | | 0.17 | | F |

| | | | | | | | | | | | | | | | |

| (a) | Verticals include businesses expected to be retained (GECAS, EFS, Industrial Finance, and run-off Insurance), including allocated corporate after tax costs of $25 million in both the three months ended December 31, 2016 and 2015 and $100 million and $133 million in the twelve months ended December 31, 2016 and 2015, respectively. |

| (b) | Earnings-per-share amounts are computed independently. As a result, the sum of per-share amounts may not equal the total. |

As described above, Verticals represents the GE Capital businesses that we expect to retain. We believe that presenting Industrial operating + Verticals earnings-per-share amounts provides management and investors with a useful measure to evaluate the performance of the businesses we expect to retain after the disposition of most of our financial services business.

| INDUSTRIAL OPERATING PROFIT AND OPERATING PROFIT MARGIN (EXCLUDING CERTAIN ITEMS) |

| | | | | | | | | | | | |

| | Three months ended December 31 | | Twelve months ended December 31 |

| (Dollars in millions) | | 2016 | | | 2015 | | | 2016 | | | 2015 |

| | | | | | | | | | | | |

| Revenues | | | | | | | | | | | |

| GE total revenues and other income | $ | 31,294 | | $ | 30,292 | | $ | 113,676 | | $ | 100,700 |

| Less: GE Capital earnings (loss) from continuing operations | | 215 | | | (1,465) | | | (1,251) | | | (7,672) |

| GE revenues and other income excluding GE Capital | | | | | | | | | | | |

| earnings (loss) (Industrial revenues) (GAAP) | $ | 31,079 | | $ | 31,757 | | $ | 114,927 | | $ | 108,371 |

| | | | | | | | | | | | |

| Less: gains | | 49 | | | 998 | | | 3,444 | | | 1,497 |

| Less: Alstom revenues | | 3,805 | | | 1,956 | | | 13,015 | | | 1,956 |

| Adjusted Industrial revenues (Non-GAAP) | $ | 27,225 | | $ | 28,803 | | $ | 98,468 | | $ | 104,918 |

| | | | | | | | | | | | |

| Costs | | | | | | | | | | | |

| GE total costs and expenses | $ | 27,883 | | $ | 27,399 | | $ | 103,860 | | $ | 97,447 |

| Less: GE interest and other financial charges | | 536 | | | 463 | | | 2,026 | | | 1,706 |

| Industrial costs excluding interest and other financial charges (GAAP) | $ | 27,347 | | $ | 26,936 | | $ | 101,834 | | $ | 95,741 |

| | | | | | | | | | | | |

| Less: Alstom costs and expenses | | 3,295 | | | 2,110 | | | 12,243 | | | 2,110 |

| Less: non-operating pension costs (pre-tax) | | 517 | | | 687 | | | 2,052 | | | 2,764 |

| Less: restructuring and other | | 1,022 | | | 567 | | | 3,578 | | | 1,734 |

| Less: noncontrolling interests and 2015 GE preferred stock dividend | | 4 | | | 30 | | | 279 | | | 229 |

| Adjusted Industrial costs (Non-GAAP) | $ | 22,509 | | $ | 23,542 | | $ | 83,682 | | $ | 88,905 |

| | | | | | | | | | | | |

| Industrial profit (GAAP) | $ | 3,732 | | $ | 4,820 | | $ | 13,093 | | $ | 12,630 |

| Industrial margins (GAAP) | | 12.0% | | | 15.2% | | | 11.4% | | | 11.7% |

| | | | | | | | | | | | |

| Industrial operating profit (Non-GAAP) | $ | 4,716 | | $ | 5,259 | | $ | 14,786 | | $ | 16,013 |

| Industrial operating profit margins (Non-GAAP) | | 17.3% | | | 18.3% | | | 15.0% | | | 15.3% |

| | | | | | | | | | | | |

We have presented our Industrial operating profit and operating profit margin excluding gains, non-operating pension costs (pre-tax) restructuring and other, noncontrolling interests, GE Capital preferred stock dividends, as well as the results of Alstom. We believe that Industrial operating profit and operating profit margin adjusted for these items are meaningful measures because they increase the comparability of period-to-period results.

| INDUSTRIAL SEGMENT ORGANIC REVENUES GROWTH AND INDUSTRIAL SEGMENT ORGANIC REVENUES |

| INCLUDING ALSTOM RESULTS FOR NOVEMBER AND DECEMBER OF BOTH 2015 AND 2016 |

| | | | | | | | | | | | | | | | |

| | Three months ended December 31 | | Twelve months ended December 31 |

| (Dollars in millions) | | 2016 | | | 2015 | | V% | | | 2016 | | | 2015 | | V% |

| | | | | | | | | | | | | | | | |

| Industrial segment revenues (GAAP) | $ | 31,236 | | $ | 31,352 | | - % | | $ | 113,156 | | $ | 108,796 | | 4 % |

| Adjustments: | | | | | | | | | | | | | | | |

| Acquisitions | | 3,916 | | | 1,961 | | | | | 13,207 | | | 1,961 | | |

| Business dispositions (other than dispositions of businesses | | | | | | | | | | | | | | | |

| acquired for investment | | 104 | | | 1,833 | | | | | 1,256 | | | 6,838 | | |

| Currency exchange rates | | (79) | | | - | | | | | (808) | | | - | | |

| Industrial segment organic revenues (Non-GAAP) | | 27,295 | | | 27,559 | | (1)% | | | 99,501 | | | 99,997 | | - % |

| Adjustments: Plus Alstom November and December(a) | | 3,202 | | | 1,812 | | | | | 3,202 | | | 1,812 | | |

| Industrial segment organic revenues including November | | | | | | | | | | | | | | | |

| and December of both 2015 and 2016 (Non-GAAP) | $ | 30,497 | | $ | 29,371 | | 4 % | | $ | 102,703 | | $ | 101,809 | | 1 % |

| | | | | | | | | | | | | | | | |

| (a) | Alstom was acquired in November 2015. This adjustment results in the inclusion of Alstom revenues from November and December 2015 and 2016 in the adjusted organic revenue growth measure as described below. |

Organic revenue growth measures revenue excluding the effects of acquisitions, business dispositions and currency exchange rates. We believe that this measure provides management and investors with a more complete understanding of underlying operating results and trends of established, ongoing operations by excluding the effect of acquisitions, dispositions and currency exchange, which activities are subject to volatility and can obscure underlying trends. We also believe that presenting organic revenue growth separately for our industrial businesses provides management and investors with useful information about the trends of our industrial businesses and enables a more direct comparison to other non-financial businesses and companies. Management recognizes that the term "organic revenue growth" may be interpreted differently by other companies and under different circumstances. Although this may have an effect on comparability of absolute percentage growth from company to company, we believe that these measures are useful in assessing trends of the respective businesses or companies and may therefore be a useful tool in assessing period-to-period performance trends.

We integrate acquisitions as soon as possible. Revenues from the date we complete the acquisition through the end of the fourth quarter following the acquisition are considered the acquisition effect of such business for purposes of calculating organic revenue. As such, organic revenue excludes Alstom revenues from November 3, 2015 through December 31, 2016. However, because of the significance of Alstom to our results and the exclusion of Alstom revenues for more than 12 months in calculating organic revenue growth, we believe investors would also find it helpful to see the revenue growth of the industrial segments adjusted to include Alstom's November and December revenues in an organic measure. As a result, we have also presented an adjusted organic revenue growth measure on that basis.

| INDUSTRIAL CASH FLOWS FROM OPERATING ACTIVITIES (INDUSTRIAL CFOA) | | | | | | | |

| AND INDUSTRIAL CFOA EXCLUDING DEAL TAXES AND PENSION FUNDING |

| | | | | | | | |

| | Twelve months ended December 31 |

| (Dollars in millions) | | 2016 | | | 2015 | | V% |

| | | | | | | | |

| Cash from GE's operating activities (continuing operations), as reported (GAAP) | $ | 29,960 | | $ | 16,354 | | 83% |

| Adjustment: dividends from GE Capital | | 20,095 | | | 4,300 | | |

| Industrial CFOA (Non-GAAP) | $ | 9,865 | | $ | 12,054 | | (18)% |

| Adjustment: deal taxes related to the Appliances business sale & pension funding | | 1,745 | | | 184 | | |

| Industrial CFOA excluding deal taxes and pension funding (Non-GAAP) | $ | 11,611 | | $ | 12,238 | | (5)% |

| | | | | | | | |

We define "Industrial CFOA" as GE's cash from operating activities (continuing operations) less the amount of dividends received by GE from GE Capital. This includes the effects of intercompany transactions, including GE customer receivables sold to GE Capital; GE Capital services for trade receivables management and material procurement; buildings and equipment leased by GE from GE Capital; information technology (IT) and other services sold to GE Capital by GE; aircraft engines manufactured by GE that are installed on aircraft purchased by GE Capital from third-party producers for lease to others; and various investments, loans and allocations of GE corporate overhead costs. We believe that investors may find it useful to compare GE's operating cash flows without the effect of GE Capital dividends, since these dividends are not representative of the operating cash flows of our industrial businesses and can vary from period to period based upon the results of the financial services businesses. We also believe that investors may find it useful to compare Industrial CFOA excluding the effects of deal taxes paid related to the Appliances business sale and the amount of pension funding. Management recognizes that these measures may not be comparable to cash flow results of companies which contain both industrial and financial services businesses, but believes that this comparison is aided by the provision of additional information about the amounts of dividends paid by our financial services business and the separate presentation in our financial statements of the GE Capital cash flows. We believe that our measure of Industrial CFOA and Industrial CFOA excluding Appliances deal-related taxes and pension funding provides management and investors with useful measures to compare the capacity of our industrial operations to generate operating cash flow with the operating cash flow of other non-financial businesses and companies and as such provides useful measures to supplement the reported GAAP CFOA measure.

| FREE CASH FLOW PLUS DISPOSITIONS |

| | | | | | | | | | | |

| | | | | | | | | | Twelve months ended |

| (Dollars in millions) | | | | | | | | | December 31, 2016 |

| | | | | | | | | | | |

| Cash from GE's operating activities (continuing operations) (GAAP) | | | | | | | | | $ | 29,960 |

| Less GE additions to property, plant and equipment | | | | | | | | | | 3,758 |

| Plus GE dispositions of property, plant and equipment | | | | | | | | | | 1,080 |

| Free cash flow (FCF) (Non-GAAP) | | | | | | | | | | 27,282 |

| | | | | | | | | | | |

| Plus GE proceeds from principal business dispositions | | | | | | | | | | 5,357 |

| FCF plus dispositions (Non-GAAP) | | | 32,639 |

We define free cash flow as GE's cash from operating activities (continuing operations) less GE additions to property, plant and equipment and plus GE dispositions of property, plant and equipment, which are included in cash flows from investing activities. We believe that free cash flow is a useful financial metric to assess our ability to pursue opportunities to enhance our growth. We also believe that presenting free cash flow plus proceeds from business dispositions provides investors with useful information about the company's actual performance against performance targets. Management recognizes that the term free cash flow may be interpreted differently by other companies and under different circumstances. Although this may have an effect on comparability of absolute percentage growth from company to company, we believe that these measures are useful in assessing trends of the respective businesses or companies and may therefore be a useful tool in assessing period-to-period performance trends.