Filed by General Electric Company

Pursuant to Rule 425 under the Securities Act of 1933, as amended

Subject Company: General Electric Company

Commission File No.: 001-00035

|

Imagination at work.

October – November 2015

GE/Synchrony Financial Exchange Supplement

|

2

IMPORTANT NOTICE

Additional Information and Where to Find It

This document is for informational purposes only and is neither an offer to sell or the solicitation of an offer to buy any securities nor a recommendation as to whether investors should participate in the exchange offer. Synchrony has filed with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that includes the Prospectus and GE has filed with the SEC a Schedule TO, which more fully describes the terms and conditions of the exchange offer. The Prospectus contains important information about the exchange offer, GE, Synchrony and related matters, and GE has delivered the Prospectus to holders of GE common stock. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROSPECTUS, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, WHEN THEY BECOME AVAILABLE AND BEFORE MAKING ANY INVESTMENT DECISION, BECAUSE THEY CONTAIN IMPORTANT INFORMATION. None of GE, Synchrony or any of their respective directors or officers or the dealer managers appointed with respect to the exchange offer makes any recommendation as to whether you should participate in the exchange offer. The offer will be made solely by the Prospectus.

Holders of GE common may obtain copies of the Prospectus, other related documents, and any other information that GE and Synchrony file electronically with the SEC free of charge at the SEC’s website at http://www.sec.gov. Holders of GE common stock will also be able to obtain a copy of the Prospectus by clicking on the appropriate link on this website. Alternatively, Georgeson Inc., the information agent for the exchange offer, will, upon request, arrange to send the Prospectus to holders of GE common stock who call (866) 300-8594 (toll-free in the United States) or (781) 575-2173 (international).

|

3

What Is the Exchange Offer, And What Does It Mean for GE and Synchrony?

The exchange allows GE to execute on its strategy of reducing the size of GE’s financial businesses and focusing on its core industrial businesses. The exchange offer presents an opportunity for GE to repurchase outstanding shares of GE common stock in exchange for Synchrony stock, without reducing overall cash and financial flexibility. Completion of the separation is also a necessary step in GE terminating its status as a savings and loan holding company.

What is the Exchange Offer?

What It Means for GE

GE is offering its holders of common stock the opportunity to exchange shares of Synchrony Financial for their shares of GE. Details are included in the Prospectus provided to shareholders.

The completion of the exchange offer and separation will allow Synchrony Financial to operate as a standalone company and pursue a long-term strategy that is focused only on its own business objectives.

What It Means for Synchrony Financial

|

4

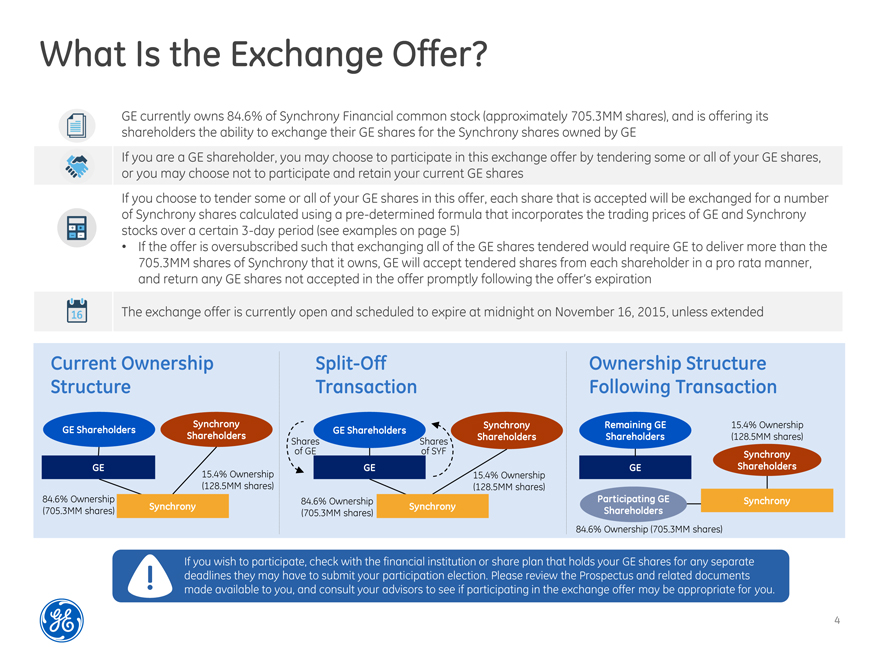

What Is the Exchange Offer?

GE currently owns 84.6% of Synchrony Financial common stock (approximately 705.3MM shares), and is offering its shareholders the ability to exchange their GE shares for the Synchrony shares owned by GE

If you are a GE shareholder, you may choose to participate in this exchange offer by tendering some or all of your GE shares, or you may choose not to participate and retain your current GE shares

If you choose to tender some or all of your GE shares in this offer, each share that is accepted will be exchanged for a number of Synchrony shares calculated using a pre-determined formula that incorporates the trading prices of GE and Synchrony stocks over a certain 3-day period (see examples on page 5) If the offer is oversubscribed such that exchanging all of the GE shares tendered would require GE to deliver more than the 705.3MM shares of Synchrony that it owns, GE will accept tendered shares from each shareholder in a pro rata manner, and return any GE shares not accepted in the offer promptly following the offer’s expiration

The exchange offer is currently open and scheduled to expire at midnight on November 16, 2015, unless extended

If you wish to participate, check with the financial institution or share plan that holds your GE shares for any separate deadlines they may have to submit your participation election. Please review the Prospectus and related documents made available to you, and consult your advisors to see if participating in the exchange offer may be appropriate for you.

Current Ownership Structure

Split-Off Transaction

Ownership Structure Following Transaction

GE Shareholders

Synchrony Shareholders

15.4% Ownership

(128.5MM shares)

84.6% Ownership

(705.3MM shares)

15.4% Ownership

(128.5MM shares)

Shares of GE

Shares

of SYF

GE

Remaining GE Shareholders

84.6% Ownership (705.3MM shares)

Synchrony

Synchrony

15.4% Ownership (128.5MM shares)

GE

84.6% Ownership

(705.3MM shares)

GE

GE Shareholders

Synchrony Shareholders

Synchrony Shareholders

Synchrony

Participating GE Shareholders

|

5

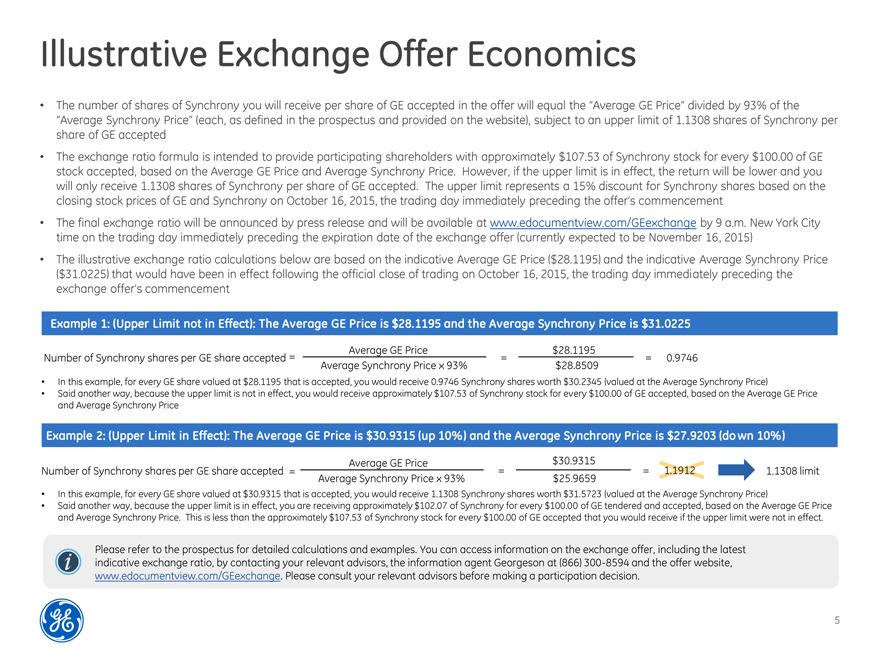

The number of shares of Synchrony you will receive per share of GE accepted in the offer will equal the “Average GE Price” divided by 93% of the “Average Synchrony Price” (each, as defined in the prospectus and provided on the website), subject to an upper limit of 1.1308 shares of Synchrony per share of GE accepted

The exchange ratio formula is intended to provide participating shareholders with approximately $107.53 of Synchrony stock for every $100.00 of GE stock accepted, based on the Average GE Price and Average Synchrony Price. However, if the upper limit is in effect, the return will be lower and you will only receive 1.1308 shares of Synchrony per share of GE accepted. The upper limit represents a 15% discount for Synchrony shares based on the closing stock prices of GE and Synchrony on October 16, 2015, the trading day immediately preceding the offer’s commencement

The final exchange ratio will be announced by press release and will be available at www.edocumentview.com/GEexchange by 9 a.m. New York City time on the trading day immediately preceding the expiration date of the exchange offer (currently expected to be November 16, 2015)

The illustrative exchange ratio calculations below are based on the indicative Average GE Price ($28.1195) and the indicative Average Synchrony Price ($31.0225) that would have been in effect following the official close of trading on October 16, 2015, the trading day immediately preceding the exchange offer’s commencement

Illustrative Exchange Offer Economics

Example 1: (Upper Limit not in Effect): The Average GE Price is $28.1195 and the Average Synchrony Price is $31.0225

Number of Synchrony shares per GE share accepted

Average GE Price

Average Synchrony Price x 93%

=

=

$28.1195

$28.8509

=

0.9746

In this example, for every GE share valued at $28.1195 that is accepted, you would receive 0.9746 Synchrony shares worth $30.2345 (valued at the Average Synchrony Price)

Said another way, because the upper limit is not in effect, you would receive approximately $107.53 of Synchrony stock for every $100.00 of GE accepted, based on the Average GE Price and Average Synchrony Price

Example 2: (Upper Limit in Effect): The Average GE Price is $30.9315 (up 10%) and the Average Synchrony Price is $27.9203 (down 10%)

Number of Synchrony shares per GE share accepted

Average GE Price

Average Synchrony Price x 93%

=

=

$30.9315

$25.9659

=

1.1912

In this example, for every GE share valued at $30.9315 that is accepted, you would receive 1.1308 Synchrony shares worth $31.5723 (valued at the Average Synchrony Price)

Said another way, because the upper limit is in effect, you are receiving approximately $102.07 of Synchrony for every $100.00 of GE tendered and accepted, based on the Average GE Price and Average Synchrony Price. This is less than the approximately $107.53 of Synchrony stock for every $100.00 of GE accepted that you would receive if the upper limit were not in effect.

1.1308 limit

Please refer to the prospectus for detailed calculations and examples. You can access information on the exchange offer, including the latest

indicative exchange ratio, by contacting your relevant advisors, the information agent Georgeson at (866) 300-8594 and the offer website, www.edocumentview.com/GEexchange. Please consult your relevant advisors before making a participation decision.

Additional Information and Where to Find It

This document is for informational purposes only and is neither an offer to sell or the solicitation of an offer to buy any securities nor a recommendation as to whether investors should participate in the exchange offer. Synchrony has filed with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that includes the Prospectus and GE has filed with the SEC a Schedule TO, which more fully describes the terms and conditions of the exchange offer. The exchange offer will be made solely by the Prospectus. The Prospectus contains important information about the exchange offer, GE, Synchrony and related matters, and GE will deliver the Prospectus to holders of GE common stock. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROSPECTUS, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, WHEN THEY BECOME AVAILABLE AND BEFORE MAKING ANY INVESTMENT DECISION, BECAUSE THEY CONTAIN IMPORTANT INFORMATION. None of GE, Synchrony or any of their respective directors or officers or the dealer managers appointed with respect to the exchange offer makes any recommendation as to whether you should participate in the exchange offer.

Holders of GE common stock may obtain the Prospectus, and other related documents filed with the SEC, at the SEC’s Public Reference Room, located at 100 F Street, N.E., Washington, D.C. 20549, and will be able to obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Holders of GE common stock will also be able to obtain copies of the Prospectus, and other documents filed with the SEC, by mail from the SEC at the above address, at prescribed rates. The SEC also maintains a website that contains reports, proxy statements and other information that GE and Synchrony file electronically with the SEC and that may be obtained for free. The address of that website ishttp://www.sec.gov. Holders of GE common stock will also be able to obtain a copy of the Prospectus by clicking on the appropriate link on this website. Alternatively, Georgeson Inc., the information agent for the exchange offer, will, upon request, arrange to send the Prospectus to holders of GE common stock who call (866) 300-8594 (toll-free in the United States) or (781) 575-2173 (internationally).

Forward-Looking Statements

This document contains “forward-looking statements” – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” or “target.”

Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about our announced plan to reduce the size of our financial services businesses, including expected cash and non-cash charges associated with this plan; expected income; earnings per share; revenues; organic growth; margins; cost structure; restructuring charges; cash flows; return on capital; capital expenditures, capital allocation or capital structure; dividends; and the split between Industrial and GE Capital earnings.

For us, particular uncertainties that could cause our actual results to be materially different than those expressed in our forward-looking statements include:

| • | failure to consummate the exchange offer; |

| • | obtaining (or the timing of obtaining) any required regulatory reviews or approvals or any other consents or approvals associated with our announced plan to reduce the size of our financial services businesses; |

| • | our ability to complete incremental asset sales as part of that plan in a timely manner (or at all) and at the prices we have assumed; |

| • | changes in law, economic and financial conditions, including interest and exchange rate volatility, commodity and equity prices and the value of financial assets, including the impact of these conditions on our ability to sell or the value of incremental assets to be sold as part of our announced plan to reduce the size of our financial services businesses as well as other aspects of that plan; |

| • | the impact of conditions in the financial and credit markets on the availability and cost of GECC’s funding, and GECC’s exposure to counterparties; |

| • | the impact of conditions in the housing market and unemployment rates on the level of commercial and consumer credit defaults; |

| • | pending and future mortgage loan repurchase claims and other litigation claims in connection with WMC, which may affect our estimates of liability, including possible loss estimates; |

| • | our ability to maintain our current credit rating and the impact on our funding costs and competitive position if we do not do so; |

| • | the adequacy of our cash flows and earnings and other conditions, which may affect our ability to pay our quarterly dividend at the planned level or to repurchase shares at planned levels; |

| • | GECC’s ability to pay dividends to GE at the planned level, which may be affected by GECC’s cash flows and earnings, financial services regulation and oversight, and other factors; |

| • | our ability to convert pre-order commitments/wins into orders; |

| • | the price we realize on orders since commitments/wins are stated at list prices; |

| • | customer actions or developments such as early aircraft retirements or reduced energy demand and other factors that may affect the level of demand and financial performance of the major industries and customers we serve; |

| • | the effectiveness of our risk management framework; |

| • | the impact of regulation and regulatory, investigative and legal proceedings and legal compliance risks, including the impact of financial services regulation and litigation; |

| • | adverse market conditions, timing of and ability to obtain required bank regulatory approvals, or other factors relating to us or Synchrony Financial that could prevent us from completing the Synchrony Financial split-off as planned; |

| • | our capital allocation plans, as such plans may change including with respect to the timing and size of share repurchases, acquisitions, joint ventures, dispositions and other strategic actions; |

| • | our success in completing, including obtaining regulatory approvals for, announced transactions, such as the proposed transactions and alliances with Alstom, Appliances and our announced plan to reduce the size of our financial services businesses, and our ability to realize anticipated earnings and savings; |

| • | our success in integrating acquired businesses and operating joint ventures; |

| • | the impact of potential information technology or data security breaches; and |

| • | the other factors that are described in “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2014. |

These or other uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements