- GE Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

General Electric (GE) DEF 14ADefinitive proxy

Filed: 12 Mar 20, 4:30pm

| Filed by the Registrant [X] | ||

| Filed by a Party other than the Registrant [ ] | ||

| Check the appropriate box: | ||

| [ ] | Preliminary Proxy Statement | |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| [X] | Definitive Proxy Statement | |

| [ ] | Definitive Additional Materials | |

| [ ] | Soliciting Material Pursuant to §240.14a-12 | |

| General Electric Company | ||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): | ||||

| [X] | No fee required. | |||

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies: | |||

| 2) | Aggregate number of securities to which transaction applies: | |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) | Proposed maximum aggregate value of transaction: | |||

| 5) | Total fee paid: | |||

| [ ] | Fee paid previously with preliminary materials. | |||

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid: | |||

| 2) | Form, Schedule or Registration Statement No.: | |||

| 3) | Filing Party: | |||

| 4) | Date Filed: | |||

| 17 | Board Leadership |

| 10 | Director Biographies |

| 20 | Risk Oversight |

| 22 | Investor Outreach |

| 24 | Board Meeting Attendance |

| 16 | Director Independence |

| 14 | Director Qualifications |

| 14 | Director Term Limits |

| 24 | Overboarding Policy |

| 24 | Political Spending Oversight |

| 25 | Related Person Transactions |

| 26 | Share Ownership for Executives & Directors |

| 32 | Peer Group and Benchmarking |

| 35 | CEO Performance Evaluation |

| 48 | Employment and Separation Agreements |

| 49 | Severance Benefits |

| 50 | Death Benefits |

| 52 | Succession Planning |

| 52 | Pay For Performance |

| 52 | Compensation Consultants |

| 52 | Share Ownership Requirements |

| 53 | Hedging Policy |

| 53 | Pledging Policy |

| 54 | Dividend Equivalents Policy |

| 56 | Management Proposal No. 2 Ratification of KPMG as Independent Auditor for 2020 |

| 56 | Independent Auditor Engagement |

| 57 | Independent Auditor Information |

| 58 | Audit Committee Report |

| 57 | Auditor Fees |

| 58 | Auditor Tenure |

| 61 | Deadlines for 2021 |

| 61 | Proxy Access |

| 62 | Proxy Solicitation & Document Request Information |

| 63 | Voting Information |

| 64 | Attending the Meeting |

| 65 | Helpful Resources |

General Electric

Company

Executive Offices

5 Necco Street

Boston, MA 02210

Fellow Shareholders,

It is a privilege to continue serving as your lead director during this important time for GE. I want to take this opportunity to share how the Board has been working on your behalf over the last year. Executing on GE’s Strategy At the beginning of the year, the Board identified two strategic priorities for GE: (1) improving the company’s financial position, and (2) strengthening the businesses. The leadership team, led by our new Chairman | Talent and Culture As we work to ensure that GE is best positioned to face its operational and strategic challenges, it is vital that our leadership has the right mix of fresh views and deep experience within the company. Following Larry’s appointment as Chairman and CEO late in 2018, we also looked outside GE to recruit several other senior leaders. In early March 2020, we welcomed our new CFO, Carolina Dybeck Happe, a proven global CFO with a track record of delivering | Larry to enable real-time dialogue on GE operations. We recognize the importance of working constructively with leadership, while vigorously questioning assumptions and offering alternative—and sometimes differing—points of view. We continue to meet with our teams at sites around the world to ensure we have an unfiltered view of company operations and culture.As a Board, we actively engage with our shareholders, gaining critical firsthand insight into the subjects that matter most to them, including not just strategy, but other issues such as executive compensation and the appointment of our auditor. Board Composition 2019 marked our first full year working together as a Board after significant refreshment in 2018. We have found that a smaller Board is conducive to a higher degree of engagement and exchange, with increased accountability for each director. However, we will continue to recruit new directors selectively where it makes sense based on GE’s strategic priorities and to ensure we have the right diversity of skills and experience on the Board. This year we have one new director nominee—Ashton Carter. Ash served as the 25th U.S. Secretary of Defense and is currently the Director of the Belfer Center for Science & International Affairs at the Harvard Kennedy School. Ash brings unrivaled expertise in international affairs, technology, security, and government to the Board. He led significant operational reforms at the Department of Defense—the largest employer in the world. He will be a tremendous addition to the Board as we serve customers across the globe. On behalf of our Board, I thank you for your investment and support of GE as we continue to create a stronger, simpler, more focused company, for you and all of GE’s stakeholders. | |||||

Your Board is focused on engaging with leadership and employees to drive positive change at GE. | |||||||

and CEO, Larry Culp, decisively executed on these priorities this past year. During 2019, we announced an agreement to sell GE Healthcare’s BioPharma business for proceeds of $20 billion, completed the merger of our Transportation business with Wabtec, sold our remaining interest in the business for proceeds of $6 billion, and raised $3 billion by further reducing our stake in Baker Hughes. We reduced GE’s leverage by tendering for $5 billion of debt. In terms of operations, Aviation performed strongly despite challenges from the grounding of the 737 MAX, and Power made significant strides in improving its operations and exercising greater commercial discipline. This is significant progress, but we have more work to do on many fronts. Much of our time as a Board this past year has been dedicated to discussing the longer-term strategy for the company and how we build sustainable shareholder value. We have also implemented a new approach to assessing and identifying risk, focusing on prioritizing and mitigating those risks that have the most significant potential impact on the company. | superior results and creating value. We are grateful to Jamie Miller, our outgoing CFO, for her significant contributions in executing on our strategic plan during a challenging period. Our new head of human resources, Kevin Cox, who joined GE in February 2019, has reenergized our focus on human capital management and has provided a fresh perspective on our culture, development, and compensation programs. At this critical juncture, we recognize the necessity of aligning culture with strategy to achieve long-term success. GE’s cultural transformation starts with promoting greater candor, transparency, and humility, with the Board and leadership setting the tone at the top. A strong culture provides the necessary framework for Larry’s vision of getting “back to basics” on operations—putting customers first and implementing lean management principles across the enterprise. Engagement and Oversight Your Board is focused on engaging with leadership and employees to drive positive change at GE. In addition to our in-person meetings, we have periodic calls with | ||||||

| THOMAS W. | ||||||

GE 2020 PROXY STATEMENT 1

About GE

| Our Strategy | |||||||

GE’s vast and valuable installed base spans power, renewable energy, aviation and healthcare. We have built a local presence, a strong brand, and deep customer relationships in more than 170 countries. GE is proud to serve as a true partner in growth and development — offering resources and experience, investing in local talent and supply chains, and bringing other partners along with us. | 1 | Improving our financial position | 2 | Strengthening our businesses |  | ||

2019 PROGRESS ✓Reduced GE Industrial leverage: $7 billion net debt* reduction, ending 2019 with 4.2x net debt* to EBITDA ratio versus 4.8x in 2018. ✓Reduced GE Capital leverage: $7 billion debt reduction, ending 2019 with 3.9x debt to equity versus 5.7x in 2018. ✓Agreed to sell BioPharma, part of GE Healthcare, to Danaher for ~$21 billion. ✓Completed spin-off and subsequent merger of GE Transportation with Wabtec and exited stake for ~$6 billion of total proceeds. ✓Executed U.S. market’s largest follow-on offering in 2019 to reduce Baker Hughes ownership and collected ~$3 billion of net proceeds. ✓Completed ~$5 billion debt tender. ✓Announced multiple changes related to U.S. pension benefits that are expected to reduce Industrial net debt* by $4-6 billion. ✓Completed majority of sale of GECAS’ PK AirFinance aviation lending platform and $3.6 billion in receivables to Apollo and Athene. ✓Completed $27 billion total asset reduction in GE Capital for 2018 and 2019, exceeding $25 billion target. * Metrics denoted with an * are non-GAAP financial measures. For information on how we calculate the performance metrics, see“Explanation of Non-GAAP Financial Measures and Performance Metrics” on page 53. |  | By driving sustainable operational and cultural change |  | ||||

LEAN PRINCIPLES MANAGEMENT TEAM Ensuring we have the right leadership in place, with two-thirds of CEO’s direct reports new to GE or in their roles since Larry Culp began as CEO in 2018. New CFO, Carolina Dybeck Happe, began in March 2020, and new head of human resources, Kevin Cox, began in February 2019. Separated Power into Gas Power and Power Portfolio businesses, with separate leadership, to improve visibility and accountability. CULTURE Defining our future by our culture and how we run the businesses. CANDOREncouraging employees to be candid and to provide honest opinions on what they observe and think, not just to tell their stakeholders what they think they want to hear. TRANSPARENCYPutting both the good and the bad on the table and in equal measure, particularly when assessing our strengths and weaknesses, so we can better prioritize our work and focus to reach the right path forward for our stakeholders. HUMILITYAcknowledging what we do not know and where we have room for improvement, and responding appropriately through our actions. | |||||||

2 GE 2020 PROXY STATEMENT

| 2019 Progress |

POWER  | MISSIONPowering lives and making electricity more affordable, reliable, accessible, and sustainable | UNITSGas Power, Power Portfolio INSTALLED BASE~7,700 gas turbines CEOsGas Power: Scott Strazik; Power Portfolio: Russell Stokes EMPLOYEES~38,000 | PROGRESS ●Separated Gas Power from Power Portfolio, which includes Steam, Power Conversion, and GE Hitachi Nuclear, to improve visibility and accountability. ●Booked 13.6 GW in gas turbine orders in 2019; launched new 7HA.03 gas turbine. ●Improved commercial discipline and cost structure in both Gas Power and Power Portfolio. | |

RENEWABLE  | MISSIONMaking renewable power sources more affordable, accessible, and reliable for the benefit of people everywhere | UNITSOnshore Wind, Offshore Wind, Grid Solutions Equipment and Services, Hydro INSTALLED BASE~45,000 onshore wind turbines CEOJérôme Pécresse EMPLOYEES~43,000 | PROGRESS ●Brought all of GE’s renewable and grid assets into this business, creating a differentiated offering that can both produce renewable energy and reliably and safely integrate it into electrical grids. ●Achieved record unit volume for onshore wind turbines. ●Secured nearly 5 GW of commitments for new offshore wind turbine, the HaliadeTM-X. | |

| AVIATION  | MISSIONProviding customers with engines, components, avionics and systems for commercial, military and business and general aviation aircraft and a global service network to support these offerings | UNITSCommercial, Military, Systems and Other INSTALLED BASE~37,800 commercial aircraft engines1and ~26,600 military aircraft engines CEODavid Joyce EMPLOYEES~52,000 | PROGRESS ●Closed Aviation’s 100th year of operation with over $270 billion in backlog and an installed base of more than 64,0001 commercial and military engines. ●Worked diligently to support our customers following the grounding of the Boeing 737 MAX, never wavering in commitment to safety while navigating near-term industry disruption. Delivered 1,736 LEAP engines to Airbus & Boeing platforms. ●Aviation’s T901 selected for the U.S. Army’s Improved Turbine Engine Program to power its next-generation Apache & Black Hawk helicopters. |

HEALTHCARE  | MISSIONOperating at the center of an ecosystem working toward precision health – digitizing healthcare, helping drive productivity and improving outcomes across the health system | UNITSHealthcare Systems, Life Sciences INSTALLED BASE4M+ healthcare installations CEOKieran Murphy EMPLOYEES~56,000 | PROGRESS ●Grew backlog to $18.5 billion and segment profit margins to 19.5%. ●Launched seven new “mission control” Command Centers with customers, which use predictive analytics and Artificial Intelligence (AI) to help hospitals coordinate patient care more efficiently. ●Introduced on-device AI on equipment like our RevolutionTMMaxima CT, where AI helps position the patient more precisely to improve efficiency, accuracy, and patient comfort. | |

CAPITAL

| MISSIONDesigning and delivering innovative financial solutions for GE industrial customers in markets around the world | UNITSGE Capital Aviation Services (GECAS), Energy Financial Services (EFS), Industrial Finance (IF) and Working Capital Solutions (WCS), Insurance CEOAlec Burger EMPLOYEES~2,000 | PROGRESS ●Enabled more than $6 billion in Industrial orders through GE’s financing capabilities, including at GECAS and EFS. |

| 1 | Including GE and its joint venture partners |

GE 2020 PROXY STATEMENT 3

| Your vote is needed on Director Elections: Election of the 11 nominees named in the proxy for the coming year |  | YOUR BOARD RECOMMENDS A VOTE FOR EACH NOMINEE |

| TENURE | AGE | |||||||

| Newer (<3 years): 8 |  | 3.2 yearsaverage tenure Our Board term limit is 15 years | <60 years: 6 |  | Our Board age limit is 75 years | |||

| Medium-tenured (4-6 years): 1 |  | 60-70 years: 5 |  | |||||

| Longer-tenured (>6 years): 2 |  | >70 years: 0 |  |

|

| INDEPENDENCE | DIVERSITY OF GENDER AND BACKGROUND | |||||||

| All director nominees except our CEO are independent and meet heightened independence standards for our audit, compensation and governance committees | Our policy is to build a cognitively diverse board representing a range of backgrounds | |||||||

| Female: 4 (36%) |  | 2 of 4 Board leadership positions are held by women | ||||||

| Independent: 10 |  | Our Board is91% independent | Ethnically diverse: 2 (18%) |  | ||||

| Not Independent: 1 |  | Born outside U.S.: 3 (27%) |  | |||||

4 GE 2020 PROXY STATEMENT

Board Nominees

The committee memberships indicate the composition of the committees of the Board as of the date of this proxy. Our director nominees’ primary qualifications and attributes are highlighted in the following matrix. The matrix is intended as a high-level summary and not an exhaustive list of each director’s skills or contributions to the Board.

| PRIMARY QUALIFICATIONS AND ATTRIBUTES | |||||||||||

|  |  |  |  |  |  |  | GE COMMITTEES | |||

| NAME | A | C | G | ||||||||

| Sébastien Bazin |  |  |  |  |  |  |  | ||||

| Ashton Carter |  |  |  |  |  | ||||||

| H. Lawrence Culp, Jr. |  |  |  |  |  | ||||||

| Francisco D’Souza |  |  |  |  |  |  |  | ||||

| Edward Garden |  |  |  |  | |||||||

| Thomas Horton |  |  |  |  |  |  |  | ||||

| Risa Lavizzo-Mourey |  |  |  |  |  | ||||||

| Catherine Lesjak |  |  |  |  |  |  |  |  | |||

| Paula Rosput Reynolds |  |  |  |  |  |  |  | ||||

| Leslie Seidman |  |  |  |  |  |  | |||||

| James Tisch |  |  |  |  |  |  | |||||

| ATTENDANCE | QUALIFICATIONS AND ATTRIBUTES | |||||

| All director nominees attended at least 75% of the meetings of the Board and committees on which they served in 2019, and on average we had a 94% attendance rate in 2019. |  | Industry & Operations |  | Risk Management | ||

| Finance & Accounting |  | Government & Regulatory | |||

| Investor |  | Global | |||

| Technology |  | Gender/Ethnic Diversity | |||

| A | Audit Committee |

| C | Compensation Committee |

| G | Governance Committee |

| Member |

| Chair |

| Financial Expert & Member |

| FULL BOARD | ||||||||||||

| Board Rhythm | ||||||||||||

Chair Larry Culp |  Lead Director Tom Horton | 6/year | 1/year | 1/year | 2019 MEETINGS 14,including 3 meetings of the independent directors | |||||||

| Regular meetings | Strategy session | Board self-evaluation | ||||||||||

| 2+/year | 2+/year | Calls | ||||||||||

| Business visits for each director | Governance & investor feedback reviews | Between meetings | ||||||||||

| Recent Focus Areas | ||||

●Reviewing GE’s portfolio and future strategy ●Capital structure and liquidity, including reducing leverage and de-risking the balance sheet ●Business performance and strategy reviews ●Talent and leadership, including hiring of new CFO and Chief Human Resources Officer | ●Sale of BioPharma business ●Impact of Boeing 737 MAX grounding ●Enterprise Risk Management ●GE Capital and Insurance ●Cybersecurity | |||

| Key Corporate Governance Practices | ||||

●10 out of 11 director nominees are independent ●Annual election of all directors by majority voting ●No supermajority provisions in governing documents ●Annual review of Board leadership structure ●Annual Board and committee self-evaluations ●Strong lead director with clearly delineated duties ●Regular executive sessions of independent directors ●Board and committees may hire outside advisors independently of management ●Proxy access by-law provisions on market terms | ●Proactive year-round shareholder engagement program ●Clawback policy that applies to all cash and incentive awards ●Anti-hedging and anti-pledging provisions ●Strong stock ownership guidelines and retention provisions ●“Overboarding” limits ●No poison pill or dual-class shares ●Encourage all directors to make at least two business visits per year without senior management present ●Shareholder right to call special meetings (at 10%) | |||

GE 2020 PROXY STATEMENT 5

Compensation

| Your vote is needed on Management Proposal #1: Advisory approval of our named executives’ compensation for 2019 |  | YOUR BOARD RECOMMENDS A VOTE FOR THIS PROPOSAL |

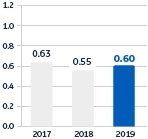

Overview of Company Performance

GE 2019 PERFORMANCE VS. KEY OUTLOOK/EXECUTIVE COMPENSATION METRICS

| GE Industrial Free Cash Flow* |

$2.3B March 2019 Outlook: $(2)B-$0B Performance:Exceeded |

| Adjusted EPS* |

$0.65 March 2019 Outlook: $0.45-$0.55 (ex. Baker Hughes) Performance: Exceeded |

2019 TOTAL SHAREHOLDER RETURN**

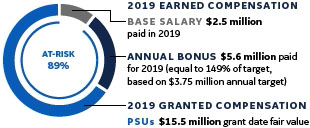

Overview of CEO Pay

| * | Metrics denoted with an * are non-GAAP financial measures. For information on how we calculate the performance metrics, see“Explanation of Non-GAAP Financial Measures and Performance Metrics” on page 53. |

| ** | Closing stock price as of December 31, 2019 was $11.16. Price shown as of December 31, 2018 reflects dividend adjustment and distribution of Wabtec shares. Data source: Bloomberg |

FURTHER PROGRESS ON OUR 2019 PRIORITIES

1 Improve our financial position

2Strengthening our businesses

| ● | Power improving: better project discipline & execution; Gas Power lower risk backlog, more conservative underwriting framework & lower fixed costs |

| ● | Healthcare Systems growth: targeted increases in R&D and prioritizing programs to highest returning product lines and projects |

| ● | Restructuring in process: cost savings on track despite lower restructuring cash & expense due to timing, attrition, lower cost to execute |

Running GE differently

| ● | Lean transformation gaining traction: focus on safety, quality, delivery & cost; lean action workouts |

| ● | Culture changing: employees exemplifying candor, transparency, humility; focus on customer, operations, prioritization |

| WHAT’S MEASURED | TARGET | TARGET NO. SHARES | PERFORMANCE PERIOD | |||||

| 2019 PSUs | TSR v. S&P 500 | 55th percentile | 1.5M | 3/19/19- 12/31/21 | ||||

| 2018 Inducement PSUs | 30-day average closing stock price | $24.80 | 5.0M | 10/1/18- 9/30/22 |

6 GE 2020 PROXY STATEMENT

Say-on-Pay Engagement and Response

| 2019 INVESTOR ENGAGEMENT AND OUR SAY- ON-PAY VOTE |

At our 2019 annual meeting, 70% of shareholders expressed support for the compensation of our named executives.

In advance of the 2019 annual meeting, and as part of our fall outreach after the meeting, we made significant efforts to engage with our institutional shareholders to better understand their concerns related to our executive compensation programs and to the factors impacting their say-on-pay vote.

This outreach also involvedtwo independent directorswho are members of our Compensation Committee,Tom Horton(the Committee Chair) andEd Garden.

| COMMITTEE RESPONSE TO INVESTOR FEEDBACK |

As part of its assessment of GE’s executive compensation programs, the Compensation Committee reviewed the voting results, evaluated investor feedback and considered other factors discussed in this proxy statement, including the alignment of our compensation program with the long-term interests of our shareholders and the relationship between risk-taking and the incentive compensation we provide to our named executives.

After considering these factors, and based on additional feedback from our investors, the committee decided to take the following actions to increase management accountability and more closely align management’s interests with shareowners.

| ● | Committing to provide no further single-trigger change of control provisions in employment agreements for new outside hires; |

| ● | Continuing to shift executive compensation away from cash-based programs and to equity; |

| ● | Adopting a formal peer group for the purposes of assessing executive compensation; |

| ● | Granting Performance Share Units (PSUs) to a broader swath of our executive officers; and |

| ● | Changing the performance metrics for the 2020 PSUs to the S&P 500 Industrial Index, which represents a more tailored group of industrial peers, compared to the S&P 500. |

GE 2020 PROXY STATEMENT 7

Audit

Your vote is needed on Management Proposal #2: Ratification of our selection of KPMG as independent auditor for 2020. See“Audit” on page 56 for more information. |  | YOUR BOARD RECOMMENDS A VOTE FOR THIS PROPOSAL |

Audit Tender Process Under Way

As previously reported, the Audit Committee has been taking a number of steps in consideration of a potential audit firm rotation. Key actions overseen and directed by the Audit Committee over the past year have included:

| 1. | WORKING TOWARD COMPLETION OF THE AUDIT TENDER PROCESS THAT BEGAN IN 2019.Audit firms have submitted initial proposals that are under consideration, and the firms have been engaged in an extensive process of reviewing information about GE and its businesses. The Audit Committee is evaluating each firm’s capabilities and global reach to take on the scope and complexity of the GE audit, audit quality, industry knowledge and expertise, independence, proposed engagement team, approach to audit innovation and technology and other factors, as we work toward completion of the tender process in the middle of 2020. | ||

| 2. | CONTINUING TO ENGAGE WITH GE’S SHAREHOLDER BASE ON THIS TOPIC.Shareholders have expressed a range of views about the tender process, the continued engagement of KPMG as our independent auditor and related considerations, which the Audit Committee has considered. | ||

| 3. | PREPARING FOR A POTENTIAL AUDITOR ROTATION.As a global, multi-business company, we currently engage audit firms other than KPMG for a variety of non-audit services, and we are continuing to analyze the non-audit services provided by firms participating in the audit tender process with a view toward concluding and transitioning those engagements, as appropriate. | ||

IN ENGAGING KPMG FOR 2020, WE ALSO CONSIDERED:

KPMG PERFORMANCE, AUDIT QUALITY, RISKS AND FEES:

| ● | KPMG’s performance on GE audit, reflecting input from a broad array of internal stakeholders, including local teams and senior management |

| ● | KPMG’s capability & expertisein handling the breadth and complexity of our worldwide operations |

| ● | External data on audit quality & performance,including the number of audit restatements compared to other Big 4 firms |

| ● | KPMG’s known legal & regulatory risks,including interviews with KPMG’s chairman and review of the most recent PCAOB oversight matters |

| ● | Appropriateness of KPMG’s feeson an absolute basis and relative to peer firms |

KPMG’S INDEPENDENCE, INCLUDING THE FOLLOWING CONTROLS:

| ● | Thorough Audit Committee oversight… regular private meetings with KPMG, committee evaluation of lead audit partner performance and selection of new lead partner for 2020 |

| ● | Limits on non-audit services… Audit Committee pre-approval required, certain types of services prohibited |

| ● | Strong internal KPMG independence processes… internal quality reviews, large number of KPMG partners |

| ● | Robust regulatory framework… KPMG subject to PCAOB inspections, Big 4 peer reviews and PCAOB/SEC oversight |

KPMG FEES(1)

| (IN MILLIONS) | AUDIT(2) | AUDIT-RELATED(3) | TAX(4) | ALL OTHER | TOTAL | |||||

| 2019 | $61.1 | $13.9 | $4.1 | $0.0 | $79.1 | |||||

| 2018 | $63.7 | $40.2 | $0.7 | $0.0 | $104.6 |

| (1) | Amounts do not include fees billed by KPMG for services to Baker Hughes Company, which GE consolidated during 2018 and until September 16, 2019. Previously, when Baker Hughes Company was consolidated as part of GE’s financial statements and covered by the GE audit, we had reported fees billed by KPMG for services to Baker Hughes Company as part of the 2018 amounts above. |

| (2) | Audit and review of financial statements for GE 10-Ks/10-Qs, internal control over financial reporting audit, statutory audits; a majority of these audit fees related to KPMG’s conduct of approximately 1,000 statutory audits in more than 100 countries. |

| (3) | Assurance services, M&A due diligence and audit services; year-over-year decrease was primarily driven by lower costs for carve-out audits in 2019, which included the BioPharma business within GE Healthcare ($7.0 million), compared to the costs for carve-out audits in 2018, which included GE Healthcare ($16.0 million) and GE Transportation ($8.6 million). |

| (4) | Tax compliance & tax advice/planning. |

2020 Shareholder Proposal

Your vote is needed on one proposal requesting an independent chair |  | YOUR BOARD RECOMMENDS A VOTE See page 59 for further information |

8 GE 2020 PROXY STATEMENT

| ||

Logistics DATE AND TIME WEBCAST LOCATION ATTENDING IN PERSON | ||

| Check out our annual reportwww.ge.com/annualreport | |

You are invited to participate in GE’s 2020 Annual Meeting. If you were a GE shareholder at the close of business on March 9, 2020, you are entitled to vote at the Annual Meeting. Even if you plan to attend, we encourage you to submit your vote as soon as possible through one of the methods below. Cordially, | |||||

Agenda | |||||

| BOARD RECOMMENDATION | READ MORE | ||||

| 1 | Elect the 11 director nominees named in the proxy for the coming year |  | FOReach director nominee | Page 10 | |

| 2 | Approve our named executives’ compensation in advisory vote |  | FOR | Page 30 | |

| 3 | Ratify the selection of KPMG as independent auditor for 2020 |  | FOR | Page 56 | |

| 4 | Vote on the shareholder proposal included in the proxy, if properly presented at the meeting |  | AGAINSTthe proposal | Page 59 | |

Shareholders also will transact any other business that properly comes before the meeting | |||||

| |||||

Voting Q&A | |||||

Who can vote? How many shares are entitled to vote? How many votes do I get? Do you have an independent inspector of elections? Can I change my vote? | Is my vote confidential? How many votes are needed to approve a proposal? Where can I find out more information? | ||||

How You Can Vote | |||||

Do you hold shares directly with GE or | Do you hold shares | ||||

| Use the Internet at |  | Use the Internet at | ||

| Call toll-free (US/Canada) |  | Call toll-free (US/Canada) | ||

| Mail your signed proxy form |  | Mail your signed | ||

GE 2020 PROXY STATEMENT 9

What are you voting on? All nominees are current GE Board members who were elected by shareholders at the 2019 annual meeting, except for Mr. Carter who is being nominated for election for the first time at the 2020 annual meeting. |  | YOUR BOARD RECOMMENDS A VOTE FOR EACH NOMINEE |

| Sébastien Bazin |  | Ashton Carter |  | ||

DIRECTOR SINCE:2016 | DIRECTOR SINCE:NEW NOMINEE | ||||

| Qualifications | Qualifications | ||||

| Chairman and CEO, AccorHotels, a global hotel company, Paris, France (since 2013) |  | Director, Belfer Center for Science and International Affairs, Harvard Kennedy School (since 2017) |  | ||

PRIOR BUSINESS EXPERIENCE ●CEO, Europe Colony Capital,a private investment firm (1997–2013)  ●Group Managing Director, CEO and General Manager, Immobilière Hôtelière (1992–1997) ●Began career in 1985 in U.S. finance sector, becomingVice President, M&A, PaineWebber  ●General Electric ●AccorHotels ●Huazhu Group* PAST PUBLIC COMPANY BOARDS●Vice Chairman, Carrefour, a multinational French retailer OTHER POSITIONS●Vice Chairman, Supervisory Board, Gustave Roussy Foundation, cancer research funding ●Chairman, Théâtre du Châtelet ●Chairman, Strategic Partnerships Committee, Safar Ventures EDUCATION●Sorbonne University ●MA (Economics), Sorbonne University *Directorship held in his capacity as CEO of AccorHotels. See“Limits on Director Service on Other Public Boards” on page 24 for more information. | PRIOR GOVERNMENT EXPERIENCE ●Secretary, U.S. Department of Defense(2015-2017)  ●Deputy Secretary and Chief Operating Officer, U.S. Department of Defense, responsible for oversight of personnel and management (2011-2013) ●Under Secretary of Defense for Acquisition, Technology and Logistics, U.S. Department of Defense, responsible for global logistics and procurement (2009-2011) ●Assistant Secretary of Defense for International Security Policy U.S. Department of Defense (1993-1996) ●Began career with U.S. Department of Defense in 1981 as a program analyst PRIOR ACADEMIC EXPERIENCE●Prior teaching positions: Stanford University (2014-2015); Harvard Kennedy School (1984-1993; 1997-2009); and Massachusetts Institute of Technology (1982-1984) PRIOR BUSINESS EXPERIENCE●Senior Partner, Global Technology Partners (1998-2009) CURRENT PUBLIC COMPANY BOARDS●Delta Air Lines  ●Fellow, American Academy of Arts & Sciences ●Director,Council on Foreign Relations  ●Yale University ●PhD (Theoretical physics), Oxford University | ||||

|

10 GE 2020 PROXY STATEMENT

H. Lawrence Culp, Jr. |  | Francisco D’Souza |  | Edward Garden |  | |||

DIRECTOR SINCE:2018 | DIRECTOR SINCE:2013 | DIRECTOR SINCE:2017 | ||||||

Qualifications | Qualifications | Qualifications | ||||||

CEO and Chairman, General Electric, Boston, MA (since September 2018) |  | Vice Chairman, Cognizant Technology Solutions Corporation, a multinational IT company, Teaneck, NJ (since 2019)* |  | Chief Investment Officer and Founding Partner, Trian Fund Management, L.P., an investment management firm, New York, NY (since 2005) |  | |||

PRIOR BUSINESS EXPERIENCE ●Senior Advisor, Bain Capital Private Equity, a global private equity firm (2017–2018)  ●Senior Lecturer, Harvard Business School (2015–2018) ●Former CEO and President, Danaher (2001–2014), a global science and technology company operating in the healthcare, environmental and applied-end markets; joined Danaher subsidiary Veeder-Root in 1990, serving in a number of leadership positions within Danaher, including COO and, following his retirement. Senior Advisor (2014–2016)   CURRENT PUBLIC COMPANY BOARDS ●General Electric PAST PUBLIC COMPANY BOARDS ●GlaxoSmithKline ●Danaher ●T. Rowe Price Group OTHER POSITIONS ●Member and former Chairman, Board of Visitors & Governors, Washington College ●Member, Board of Trustees, Wake Forest University EDUCATION ●Washington College ●MBA, Harvard Business School | PRIOR BUSINESS EXPERIENCE ●CEO, Cognizant (2007–2019) ●President, Cognizant (2007–2012) ●COO, Cognizant (2003–2006) ●Co-founded Cognizant (1994) ●Previously held various roles at Dun & Bradstreet CURRENT PUBLIC COMPANY BOARDS ●General Electric ●Cognizant* ●MongoDB OTHER POSITIONS ●Chairman, IT and Electronics Governors community, World Economic Forum ●Board Co-Chair, New York Hall of Science ●Trustee, Carnegie Mellon University ●International Advisory Panel Member, Banco Santander EDUCATION ●University of Macau ●MBA, Carnegie Mellon University *Mr. D’Souza will step down from the Cognizant board, effective March 31, 2020. | PRIOR BUSINESS EXPERIENCE ●Vice Chairman and Director, Triarc Companies(subsequently The Wendy’s Company and previously Wendy’s/Arby’s Group) (2004–2007) and Executive Vice President (2003–2004)  ●Managing Director, Credit Suisse First Boston(1999–2003)  ●Managing Director, BT Alex Brown(1994–1999)  CURRENT PUBLIC COMPANY BOARDS ●General Electric ●Legg Mason PAST PUBLIC COMPANY BOARDS ●The Bank of New York Mellon  ●The Wendy’s Company ●Family Dollar Stores ●Pentair EDUCATION ●Harvard College | ||||||

|

GE 2020 PROXY STATEMENT 11

Thomas Horton |  | Risa Lavizzo-Mourey |  | Catherine Lesjak |  | |||

DIRECTOR SINCE:2018 | DIRECTOR SINCE:2017 | DIRECTOR SINCE:2019 | ||||||

Qualifications | Qualifications | Qualifications | ||||||

Partner, Global Infrastructure Partners, New York, NY (since 2019) |  | Professor, University of Pennsylvania, Philadelphia, PA (since 2018) and Former President and CEO, Robert Wood Johnson Foundation, Princeton, NJ (2003–2017) |  | Former Chief Financial Officer, HP, a global technology company, and its predecessor, Hewlett-Packard, Palo Alto, CA (2007-2018) |  | |||

PRIOR BUSINESS EXPERIENCE ●Senior Advisor, Warburg Pincus LLC, a private equity firm focused on growth investing (2015–2019)  ●Chairman, American Airlines Group, one of the largest global airlines (formed following the merger of AMR Corp and US Airways) (2013–2014)  ●Chairman and CEO, American Airlines (2011–2014)  ●Chairman and CEO, AMR (parent company of American Airlines) (2010–2013)  ●EVP and CFO, AMR (2006–2010)  ●Vice Chairman and CFO, AT&T (2002–2006) ●SVP and CFO, AMR (2000–2002); joined AMR in 1985, serving in various finance and management roles CURRENT PUBLIC COMPANY BOARDS ●General Electric ●EnLink Midstream ●Walmart (lead director) PAST PUBLIC COMPANY BOARDS ●Qualcomm OTHER POSITIONS ●Executive Board Member, Cox School of Business, Southern Methodist University ●Board Member, National Air and Space Museum EDUCATION ●Baylor University ●MBA, Southern Methodist University | PRIOR BUSINESS EXPERIENCE ●SVP, Robert Wood Johnson Foundation, largest U.S. philanthropic organization dedicated to healthcare (2001–2003) PRIOR ACADEMIC EXPERIENCE ●Sylvan Eisman Professor of Medicine and Health Care Systems (1995–2001), Director, Institute on Aging (1994–2002), Chief of Geriatric Medicine (1986–1992), University of Pennsylvania Medical School  PRIOR GOVERNMENT EXPERIENCE ●Advisory Committee Member, President’s Advisory Commission on Consumer Protection and Quality in the Health Care Industry (1997–1998)  ●Deputy Administrator, Agency for Health Care Research and Quality(1992–1994)  ●Co-Chair, White House Health Care Reform Task Force, Working Group on Quality of Care (1993–1994) ●Advisory Committee Member, Task Force on Aging Research (1985–1992) ●Advisory Committee Member, National Committee for Vital and Health Statistics (1988–1992) CURRENT PUBLIC COMPANY BOARDS ●General Electric ●Hess  ●Intel  PAST PUBLIC COMPANY BOARDS ●Genworth Financial  ●Beckman Coulter OTHER POSITIONS ●Trustee, Smithsonian Institution Board of Regents ●Board of Fellows, Harvard Medical School ●Member, National Academy of Medicine EDUCATION ●U. of Washington & SUNY Stony Brook ●MD, Harvard Medical School ●MBA, University of Pennsylvania | PRIOR BUSINESS EXPERIENCE ●Interim Chief Operating Officer, HP (2018–2019)  ●Interim CEO, Hewlett Packard (2010)  ●Senior Vice President and Treasurer, HP(2003–2007)  ●Previously served in various leadership positions within the financial organization at HP and Hewlett Packard, including as Global Controller, Software Solutions; Controller and Credit Manager for Commercial Customers; and as Manager, Financial Operations, Enterprise Marketing and Solutions (joined Hewlett Packard in 1986) CURRENT PUBLIC COMPANY BOARDS ●General Electric ●SunPower  OTHER POSITIONS ●Board, Haas School of Business, University of California, Berkeley ●Board of Advisors, Resource Area for Teaching (RAFT) EDUCATION ●Stanford University ●MBA, University of California, Berkeley | ||||||

|

12 GE 2020 PROXY STATEMENT

| Paula Rosput Reynolds |  | Leslie Seidman |  | James Tisch |  | |||

DIRECTOR SINCE:2018 | DIRECTOR SINCE:2018 | DIRECTOR SINCE:2010 | ||||||

Qualifications | Qualifications | Qualifications | ||||||

President and CEO, PreferWest LLC, a business advisory firm (since 2009) | Former Chairman, Financial Accounting Standards Board (FASB), independent organization responsible for financial accounting and reporting standards, Norwalk, CT (2010–2013) |  | President and CEO, Loews Corp., a diversified holding company with subsidiaries involved in energy, insurance, packaging and hospitality, New York, NY (since 1998) |  | ||||

PRIOR BUSINESS EXPERIENCE ●Vice Chairman and Chief Restructuring Officer, American International Group (2008–2009)  ●Chairman, President and CEO, Safeco Insurance Company of America (2005–2008)  ●Chairman and CEO, AGL Resources (1998–2005)  ●CEO, Duke Energy Power Services, Duke Energy (1995–1998)  ●Previously served in various leadership positions at Associated Power Services, Pacific Gas Transmission Co. and Pacific Gas and Electric Company  CURRENT PUBLIC COMPANY BOARDS ●General Electric ●BAE Systems  ●BP  PAST PUBLIC COMPANY BOARDS ●Air Products & Chemicals ●Anadarko Petroleum ●CBRE Group ●Circuit City Stores ●Coca-Cola Enterprises ●Delta Air Lines ●TransCanada OTHER POSITIONS ●Trustee, Seattle Cancer Care Alliance EDUCATION ●Wellesley College | PRIOR BUSINESS EXPERIENCE ●Board Member, FASB (2003–2013) ●Financial reporting consultant (1999–2003) ●Staff Member, FASB (1994–1999) ●Vice President, Accounting Policy, JP Morgan (1987–1994)  ●Auditor, Arthur Young (1984–1987)  CURRENT PUBLIC COMPANY BOARDS ●General Electric ●Moody’s, provider of credit ratings, research and analytical tools (chairman, Audit Committee)  OTHER POSITIONS ●Advisor, Idaciti  ●Founding Director, Pace University Center for Excellence in Financial Reporting (2014–2018)  ●Board of Governors, Financial Industry Regulatory Authority (FINRA) (2014–2019)  ●Certified Public Accountant (Inactive)  EDUCATION ●Colgate University ●MS (Accounting), New York University | CURRENT PUBLIC COMPANY BOARDS ●General Electric ●Loews and two of its subsidiaries, CNA Financial, a property and casualty insurance company, and Diamond Offshore Drilling (chairman), an offshore drilling contractor*  OTHER POSITIONS ●Co-Chairman, Mount Sinai Medical Center ●Former director, Federal Reserve Bank of New York ●Director, WNET (nonprofit) ●Director, New York Public Library ●Director, Partnership for New York City ●Member, Council on Foreign Relations ●Member, American Academy of Arts & Sciences EDUCATION ●Cornell University ●MBA, University of Pennsylvania *Directorships held in his capacity as President and CEO of Loews. See“Limits on Director Service on Other Public Boards” on page 24 for more information. | ||||||

|

GE 2020 PROXY STATEMENT 13

The Governance & Public Affairs Committee (the Governance Committee) is charged with reviewing the composition of the Board and refreshing it as appropriate. With this in mind, the committee continuously reviews potential candidates and recommends nominees to the Board for approval.

Over the past three years, the Board has undertaken significant refreshment efforts to better align the Board to the businesses on which we expect to focus going forward and to bring new perspectives to the Board. As a result, of the eleven nominees proposed for election, eight are new to the Board in the last three years. We expect to continue to seek director candidates whose experiences support the company’s future strategy and industry focus.

DIRECTOR RECRUITMENT PROCESS | DIRECTOR “MUST-HAVES” ●Leadership experience ●Highest personal & professional ethics ●Integrity & values ●A passion for learning ●Inquisitive & objective perspective ●A sense of priorities & balance ●Talent development experience RECRUITMENT PRIORITIES GOING FORWARD ▲Industry expertise ▲Operations expertise ▲Technology/cyber expertise ▲International experience ▲Cognitive diversity | HOW YOU CAN RECOMMEND A CANDIDATE Write to the Governance Committee, c/o Corporate Secretary, GE, at the address listed on the inside front cover of this proxy statement, and include all information that our by-laws require for director nominations. HOW WE REFRESH THE BOARD ●Board evaluation. Each year, the Board assesses its effectiveness through a process led by its lead director. See“How We Evaluate the Board’s Effectiveness” on page 21. ●Term limits. The Board has a 15-year term limit for independent directors. ●Age limits. With limited exceptions, directors may not be renominated to the Board after their 75th birthday. See the Board’s Governance Principles (see“Helpful Resources” on page 65) for more information on these policies. |

CANDIDATE RECOMMENDATIONS From shareholders, management, directors & search firms  | ||

GOVERNANCE COMMITTEE ●Reviews qualifications & expertise, tenure, regulatory requirements & cognitive diversity ●Reviews independence & potential conflicts ●Discusses & together with other directors such as the Lead Director, interviews candidates ●Recommends nominees to the Board  | ||

BOARD OF DIRECTORS Discusses, analyzes independence & selects nominees  | ||

SHAREHOLDERS Vote on nominees at annual meeting |

Important Factors in Assessing Board Composition

The Governance Committee strives to maintain an independent board with broad and diverse experience and judgment that is committed to representing the long-term interests of our shareholders. The committee considers a wide range of factors when selecting and recruiting director candidates, including:

a range of experiences and viewpoints. Specifically, under the Board’s diversity policy, the Governance Committee considers attributes such as race, ethnicity, gender, cultural background and professional experience when reviewing candidates for the Board and in assessing the Board’s overall composition. The Board is committed to using refreshment opportunities to strengthen its cognitive diversity. To accomplish this, the Governance Committee will continue to require that search firms engaged by GE include a robust selection of women and ethnically diverse candidates in all prospective director candidate pools. In addition, the Governance Committee is committed to considering the candidacy of women and ethnically diverse candidates for all future vacancies on the Board. The committee reviews its effectiveness in balancing these considerations when assessing the composition of the Board.

14 GE 2020 PROXY STATEMENT

BOARD SKILLS AND EXPERIENCE

| Industry & Operations Experience |

| Finance & Accounting Experience |

| Investor Experience |

| Technology Experience |

| Risk Management Experience |

| Government & Regulatory Experience |

| Global Experience |

DIRECTOR RECRUITMENT PROCESS.Our Governance Committee, together with the full Board, is responsible for establishing criteria, screening candidates and evaluating the qualifications of persons who may be considered for service on our Board. The Governance Committee considers all shareholder recommendations for director candidates.

We evaluate them in the same manner as candidates suggested by other sources.

The following describes the Board’s selection process:

During 2019, the Governance Committee engaged a third-party search firm to identify qualified director candidates. In light of the broader GE transformation and board self-evaluation, the Governance Committee asked the search firm to focus on candidates with relevant industry and operations experience. Mr. Carter was recommended for the Board by a third-party search firm.

How We Assess Board Size

The Governance Committee takes a fresh look at Board size each year, consistent with the Board’s Governance Principles (see“Helpful Resources” on page 65). Based on the Board’s recent self-evaluations, assessment of trends with peer companies, and taking into account investor feedback, we anticipate that we will continue to maintain the Board’s current size, though the number of directors may fluctuate from time to time during director transitions and as we continue to assess the company’s strategic priorities.

GE 2020 PROXY STATEMENT 15

How We Assess Director Independence

BOARD MEMBERS.The Board’s Governance Principles require all non-management directors to be independent. All of our director nominees (listed under“Election of Directors” on page 10) other than Mr. Culp are independent. Former directors Messrs. Beattie and Mulva were independent throughout the period they served on our Board.

| ● | The Board’s guidelines.For a director to be considered independent, the Board must determine that he or she does not have any material relationship with GE. The Board’s guidelines for director independence conform to the independence requirements in the New York Stock Exchange’s (NYSE) listing standards. In addition to applying these guidelines, which you can find in the Board’s Governance Principles (see“Helpful Resources” on page 65), the Board considers all relevant facts and circumstances when making an independence determination. |

| ● | Applying the guidelines in 2019.In assessing director independence for 2019, the Board considered relevant transactions, relationships and arrangements, including relationships among Board members, their family members and the company, as described below. |

COMMITTEE MEMBERS.All members of the Audit Committee, Management Development and Compensation Committee (the Compensation Committee), and Governance Committee must be independent, as defined by the Board’s Governance Principles. Committee members must also meet additional committee-specific standards:

| ● | Heightened standards for Audit Committee members.Under a separate SEC independence requirement, Audit Committee members may not accept any consulting, advisory or other fees from GE or any of its subsidiaries, except compensation for Board service. |

| ● | Heightened standards for members of the Compensation and Governance Committees.As a policy matter, the Board also applies a separate, heightened independence standard to members of the Compensation and Governance Committees: no member of either committee may be a partner, member or principal of a law firm, accounting firm or investment banking firm that accepts consulting or advisory fees from GE or a subsidiary. In addition, in determining that Compensation Committee members are independent, NYSE rules require the Board to consider their sources of compensation, including any consulting, advisory or other compensation paid by GE or a subsidiary. |

The Board has determined that all members of the Audit, Compensation and Governance Committees are independent and also satisfy applicable committee-specific independence requirements.

RELATIONSHIPS AND TRANSACTIONS CONSIDERED FOR DIRECTOR INDEPENDENCE

The Board considered the following relationships and transactions in making its determination that all director nominees, other than Mr. Culp, are independent.

GE TRANSACTION & 2019 MAGNITUDE | ||||||||||

| DIRECTOR/NOMINEE | ORGANIZATION | RELATIONSHIP | SALES TO GE | PURCHASES | INDEBTEDNESS | |||||

| Bazin | AccorHotels | Chair & CEO |  | N/A | N/A | |||||

| D’Souza | Cognizant | Former CEO & Director |  | N/A | N/A | |||||

| Horton | Global Infrastructure Partners | Partner |  | N/A | N/A | |||||

| Tisch | Loews (and its consolidated subsidiaries) | President & CEO |  |  |  | |||||

| All directors | Various charitable organizations | Executive, director or trustee | Charitable contributions from GE | |||||||

16 GE 2020 PROXY STATEMENT

GE believes that independent board oversight is an essential component of strong corporate performance. We also believe that the decision as to whether the positions of Chairman and CEO should be combined or separated, and whether an executive or an independent director should serve as the Chairman should be based upon the circumstances facing the company. Maintaining flexibility on this policy allows the Board to choose the leadership structure that will best serve the interests of the company and its shareholders at any particular time.

WHY OUR BOARD LEADERSHIP STRUCTURE IS APPROPRIATE FOR GE AT THIS TIME.The Board continues to believe that its current leadership structure, which has a combined role of Chairman and CEO, counterbalanced by a strong independent Board led by a lead director and independent directors chairing each of the Board Committees, is in the best interests of GE and its shareholders. In the Board’s view, this structure allows Mr. Culp, as Chairman and CEO, to drive strategy and agenda setting at the Board level, while maintaining responsibility for executing on that strategy as CEO. At the same time, our lead director, Tom Horton, works with Mr. Culp to set the agenda for the Board and also exercises additional oversight on behalf of the independent directors. The Board will continue to review the appropriateness of this structure.

HOW WE SELECT THE LEAD DIRECTOR.The Governance Committee considers feedback from the current lead director, our other Board members and the chairman, and then makes a recommendation to the Board’s independent directors. The independent directors elect the lead director, taking into account the recommendation of the committee. Tom Horton, former chairman and CEO of American Airlines, was elected as the lead director in September 2018. Under the Board’s Governance Principles, Mr. Horton also serves as chair of the Compensation Committee. In the event of Mr. Horton’s incapacity, the chair of the Governance Committee would serve as the lead director until the independent directors selected a new lead director.

The Lead Director’s Role

The lead director focuses on overseeing the Board’s processes and prioritizing the right matters. Specifically, the lead director has the following responsibilities (and may also perform other functions at the Board’s request), as detailed in the Board’s Governance Principles:

| ● | Board leadership— provides leadership to the Board in any situation where the Chairman’s role may be perceived to be in conflict, and chairs Board meetings in the absence of the Chairman |

| ● | Board agenda, schedule & information— approves the agenda (with the ability to add agenda items), schedule and information sent to directors and calls additional meetings as needed |

| ● | Leadership of independent director meetings— calls and leads independent director meetings, which are scheduled at least three times per year (in addition to the numerous informal sessions that occur throughout the year) without any management directors or GE employees present |

| ● | Chairman-independent director liaison— regularly meets with the Chairman and serves as liaison between the Chairman and the independent directors (although every director has direct access to the Chairman) |

| ● | Shareholder communications— makes himself/herself available as the primary Board contact for direct communication with our significant shareholders |

| ● | Board governance processes— works with the Governance Committee to guide the Board’s governance processes, including succession planning, the annual Board self-evaluation and the annual Chairman’s evaluation |

| ● | Board leadership structure review— oversees the Board’s periodic review and evaluation of its leadership structure |

| ● | Committee chair selection— advises the Governance Committee in choosing committee chairs |

| Chairman of the Board & CEO |

Lead Directorelected solely by Independent Directors | |

|  |

| Lead Director also serves as: Compensation Committee Chair | The chairs of our Audit and Governance Committees are also independent |

CONSIDERATIONS IN SELECTING CURRENT LEAD DIRECTOR  Tom Horton Mr. Horton was first elected to our Board at the 2018 annual meeting. During his tenure on our Board, he has established strong working relationships with his fellow directors and garnered their trust and respect. As a relatively new director, he brings a fresh perspective to the Board. Furthermore, he has demonstrated strong leadership skills, independent thinking and a deep understanding of our businesses and their industries. The Board’s decision to select Mr. Horton as lead director took into account the tenures and capabilities of each independent director along with a potential candidate’s willingness and ability to serve as lead director, understanding that the position entails significant responsibility and time commitment. The Board considered that Mr. Horton also serves as lead independent director for Walmart. However, the fact that Walmart also has a separate board chairman mitigated concerns about Mr. Horton’s ability to dedicate sufficient time to the role as GE’s lead director. |

GE 2020 PROXY STATEMENT 17

FULL BOARD | ||||||||||

| Chairman | Members | Lavizzo-Mourey Lesjak Reynolds Seidman Tisch | 2019 Areas of Focus | ||||||

| Lead | ●Reviewing GE’s portfolio and future company strategy ●Capital structure and liquidity, particularly reducing leverage and de-risking the balance sheet ●Business performance and long-term strategy reviews | ●Leadership transitions, particularly for the CFO ●Separation of BioPharma ●Impact of Boeing 737 MAX grounding ●Enterprise Risk Management ●GE Capital and Insurance ●Cybersecurity | |||||||

| 14 meetings in 2019(including 3 independent director meetings) | ||||||||||

* Nominated for election at the 2020 annual meeting. | ||||||||||

A TYPICAL GE BOARD MEETING | ||||||||||

During 2019, the Board held 6 regularly scheduled, in-person meetings, plus 8 special meetings. | Before the Meeting |  | Thursday (Day 1) |  | Friday (Day 2) |  | After the Meeting | |||

Independent Director Meetings

The independent directors meet in executive session during at least 3 of the regularly scheduled, in-person Board meetings. They may have other special meetings throughout the year. These executive sessions promote candor and discussion of matters in a setting that is independent of the Chairman and CEO. The lead director chairs each of these executive sessions.

Board Committees

COMMITTEE COMPOSITION Listed below are the current members of each committee. | COMMITTEE OPERATIONS Each committee meets periodically throughout the year, reports its actions to the Board, receives reports from senior management, annually evaluates its performance and can retain outside advisors. Formal meetings are typically supplemented with additional calls and sessions. | COMMITTEE RESPONSIBILITIES The primary responsibilities of each committee are listed below. For more detail, see the Governance Principles and committee charters (see“Helpful Resources” on page 65). |

AUDIT | ||||||||

| Chair | Key Responsibilities and Areas of Risk Oversight ●Oversees GE’s independent auditor, including the audit plan and budget, and monitors independence and performance ●Oversees the effectiveness of GE’s financial reporting processes and systems ●Discusses with auditor and management key reporting practices (including non-GAAP), critical audit matters and new accounting standards ●Monitors the effectiveness of GE’s internal controls ●Reviews and evaluates the scope and performance of the internal audit staff and compliance program ●Oversees the company’s enterprise risk management and cybersecurity programs ●Monitors GE’s significant litigation and investigations | Recent Activities and Key Focus Areas ●Reviewing and recommending financial statement and disclosure enhancements ●Conducting the process to select an independent auditor for the fiscal year ending December 31, 2021, reviewing written and oral proposals and interviewing potential audit firms ●Overseeing the detailed audit plan and independent audit budget ●Conducting cross-functional reviews with corporate audit staff, tax, IT, controllership and legal teams ●Visiting businesses as a committee, to review compliance and audit programs on site at businesses ●Overseeing material litigation strategy and changes to the compliance and cybersecurity programs ●Overseeing assessment of and response to a report claiming accounting improprieties in August 2019 | |||||

Other Members D’Souza, Lesjak & Reynolds 9 meetings in 2019 | ||||||||

GOVERNANCE & PUBLIC AFFAIRS | ||||||||

| Chair | Key Responsibilities and Areas of Risk Oversight ●Reviews the Board’s governance processes, including all significant governance policies and procedures ●Oversees company policies and strategies related to climate change management, political spending & lobbying, human rights, and environment, health & safety ●Reviews Board composition in connection with long-term strategy and identifies new directors for GE ●Oversees Board and committee self-evaluations ●Reviews any Board conflicts of interest, as applicable | Recent Activities and Key Focus Areas ●Reviewing the Board’s agenda for oversight of environmental, social and governance matters ●Reviewing political spending and lobbying disclosure ●Overseeing management of environmental remediation efforts ●Identifying and recruiting new directors | |||||

Other Members Bazin, Horton, Lesjak & Tisch 7 meetings in 2019 | ||||||||

MANAGEMENT DEVELOPMENT & COMPENSATION | ||||||||

| Chair | Key Responsibilities and Areas of Risk Oversight ●Oversees GE’s executive compensation policies, practices and programs ●Reviews and approves goals and objectives for performance-based equity awards and evaluates performance against those goals ●Reviews and approves compensation of the CEO ●Oversees compensation policies and practices to ensure that they do not encourage unnecessary risks ●Oversees recruitment and retention efforts for all employees | Recent Activities and Key Focus Areas ●Overseeing cultural shift for GE, prioritizing values of candor, humility and transparency ●Meeting with shareholders and responding to shareholder feedback on executive compensation practices, ensuring the design of compensation programs supports the talent needs of GE ●Overseeing GE compensation and benefit programs with a focus on external benchmarking for executive compensation practices ●Reviewed options for retirement plan changes in conjunction with deleveraging activities ●Assisting with interviewing and recruiting new CFO for GE ●Reviewing succession plans for critical talent | |||||

Other Members Bazin, D’Souza, Garden & Reynolds 8 meetings in 2019 | ||||||||

Independence.All committee members satisfy the NYSE’s and GE’s definitions of independence.

Financial acumen.Mses. Lesjak, Reynolds and Seidman and Mr. D’Souza are “audit committee financial experts” (per SEC rules), and each of these directors are “financially literate” (per NYSE rules).

18 GE 2020 PROXY STATEMENT

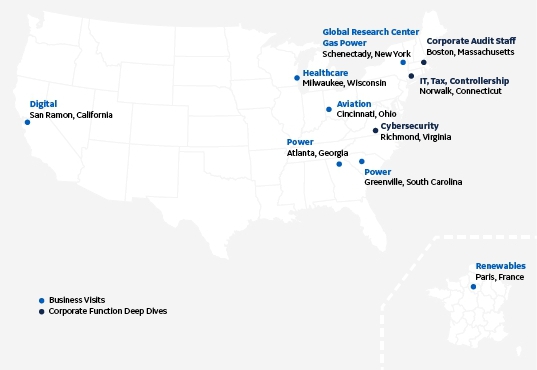

The GE Board in Action: 2019 Highlights

Our Board recognizes that its oversight of our strategic priorities and responsibility to GE shareholders requires a personal and professional commitment that extends well beyond regularly scheduled Board meetings. Ongoing and meaningful engagement with the business is critical to staying informed and provides the type of insight that allows our directors to provide effective guidance to our leadership team and to engage in constructive dialogue with each other.

DIRECTOR VISITS.Site visits are a valued Board activity, providing first-hand exposure to our operations as well as opportunities to interact with employees at all levels of the company. Perhaps most importantly, on-site and other engagement beyond the boardroom gives our directors an understanding of our culture, which we consider an essential component of our transformation strategy.

| �� | ||||||||

Director | New Director Orientation | Committee Orientation |

| |||||

Engagement | Periodic Board Calls | |||||||

Annual Senior Leadership Meeting | Business Summits/ | |||||||

Business Visits and Functional Deep Dives | ||||||||

| ||||||||

| ||||||||

Engagement | “Say-on-Pay” Engagement Engagement with shareholders included Tom Horton (Lead Director & Compensation Committee Chair) and Ed Garden | Televised Interview Leslie Seidman (Chair of Audit Committee), appearance on CNBC in response to accounting fraud allegations against GE | ||||||

| Succession Planning | New CFO and CHRO Recruitment | |||||||

GE 2020 PROXY STATEMENT 19

Strategy

The Board has oversight responsibility for management’s establishment and execution of corporate strategy. Elements of strategy are discussed at every regularly scheduled Board meeting, guided by the current company-level priorities of solidifying GE’s financial position, continuing to strengthen our businesses and driving long-term profitable growth. The Board also engages directly with the leaders of GE’s businesses and regularly reviews the businesses’ strategic and operational priorities, the competitive environment, market challenges, economic trends and regulatory developments. In late 2019 and early 2020, the Board conducted a strategy review of several topics that cut across GE’s businesses, such as climate change, the prospects for greater decoupling in US/China relations, and digital product and service offerings. At meetings occurring throughout the year, the Board also assesses capital allocation plans, the company’s performance against the annual budget and potential mergers, acquisitions and dispositions for alignment with our strategic priorities.

Risk Management

Risk assessment and risk management are the responsibility of the company’s management, and the Board has oversight responsibility for those processes. The Audit Committee assists with the oversight of the company’s enterprise risk management framework, and the Board has also delegated specific risk oversight responsibility to committees of the Board based on the expertise of those committees. Our Governance Principles and committee charters define the risk areas for which each committee has ongoing oversight responsibility, while the Board as a whole focuses on the most significant risks facing the company. Throughout the year, the Board and the committees to which it has delegated responsibility dedicate a portion of their meetings to review and discuss specific risk topics in greater detail.

The GE Board’s risk oversight builds upon management’s risk assessment and mitigation processes. Those processes include regular discussions during operational and strategic reviews with the businesses, as well as the programs, policies, processes and controls related to the company’s financial planning and analysis; controllership and financial reporting; executive development and evaluation; compliance under the company’s code of conduct (The Spirit & The Letter); integrity programs and applicable laws and regulations; environmental, health, safety compliance; information technology and cybersecurity programs; and internal audits. During 2019, we also appointed a Chief Risk Officer, Chris Pereira, at the corporate level to assist with coordinating the company’s enterprise risk management framework, and who reports periodically to the Audit Committee and the full Board on risk topics. These have included discussions with the Audit Committee or Board about top enterprise risks, liquidity risk management and stress testing, delegations of authority for significant transactions and expenditures and risks related to the company’s strategic planning and priorities.

We typically organize enterprise risks into the broad categories of strategic, operational, financial, legal and compliance or reputational risk. Risks identified through our risk management processes are prioritized and, depending on the probability and severity of the risk, escalated as appropriate. Senior management discusses these risks periodically and assigns responsibility for them to owners within the businesses or at the corporate level. Risk leaders within the businesses and corporate functions are responsible to present risk assessments and key risks to senior management and, when appropriate, to the Board or the relevant committee of the Board. Refer to the Risk Factors section of our Annual Report on Form 10-K for the year ended December 31, 2019 for a discussion of key risks that could have a material adverse effect on our business, reputation, financial position and results of operations.

Environmental, Social and Governance (ESG) Matters

The Board and its committees oversee the execution of GE’s environmental, social and governance strategies and initiatives as an integrated part of their oversight of the company’s overall strategy and risk management. For example, as noted above, the Board in late 2019 reviewed climate change-related opportunities and risks across GE’s businesses as part of its strategy review. The Board is actively engaged with management on related topics such as the competitive landscape for our businesses amidst climate-related shifts in technology, product and service demand; scenario analysis of potential pathways; customer, investor and other stakeholder expectations; and the environmental impact of GE’s own operations. In addition, the Governance Committee assists the Board in its oversight of corporate social responsibilities, significant public policy issues, protection of human rights, environmental, health & safety (EHS) matters, political contributions and lobbying activities.

Human Capital Management and Succession Planning

The Board believes that human capital management and succession planning, including diversity and inclusion initiatives, are critical to the company’s success. Our Board’s involvement in leadership development and succession planning is ongoing throughout the year, and the Board provides input on important decisions in each of these areas. The Board has primary responsibility for succession planning for the CEO and oversight of other senior management positions. The Compensation Committee oversees the development of the process, and the Board meets regularly with high-potential executives at many levels across the company through formal presentations and informal events throughout the year. The Compensation Committee is also regularly updated on key talent indicators for the overall workforce, including recruiting and attrition, diversity and inclusion, and development programs.

20 GE 2020 PROXY STATEMENT

Our Board seeks to operate with the highest degree of effectiveness, supporting a dynamic boardroom culture of independent thought and intelligent debate on critical matters. We take a comprehensive, year-round view of corporate governance and our adoption of best practices impacts our leadership structure, Board composition and recruitment, director engagement, and accountability to shareholders. Our Board and committee evaluation process allows for annual assessment of our Board practices and the opportunity to identify areas for improvement.

GE 2020 PROXY STATEMENT 21

How We Get Feedback from Investors

Our Investor Engagement Program

We conduct extensive governance reviews and investor outreach throughout the year involving our directors, senior management, investor relations, legal and human resources departments. This helps management and the Board understand and focus on the issues that matter most to our shareholders so GE can address them effectively.

| GE Participants | How the Board Receives Direct Feedback from Major Institutional Investors | ||||

●Directors ●Senior management ●Investor relations department ●Legal department ●Human resources department | STRATEGY AND BUSINESS MATTERS. From time to time, GE’s independent directors meet with representatives of our shareholders. This complements management’s investor outreach program and allows directors to directly solicit and receive investors’ views on GE’s strategy and performance. | GOVERNANCE AND COMPENSATION MATTERS. Our lead director regularly accompanies management on its governance-focused roadshow with a number of significant investors, and other directors join these outreach discussions from time to time. In 2019, our lead director participated in discussions with a number of our largest investors to discuss the recent CEO transition and to solicit feedback on executive compensation programs, Board engagement and the Board’s role in overseeing the company’s strategy and portfolio transformation. | |||

Our Investor |  |

| Investor Feedback | Committee Response | |

– | Investors had the most significant concerns about the following actions by the Compensation Committee: ●Applying positive discretion to grant bonuses to certain Corporate executive officers, notwithstanding the failure to meet formulaic targets for the 2018 performance period; and ●Providing for single-trigger change of control provisions in the employment agreements for outside executive hires. | As part of its assessment of GE’s executive compensation programs, the Compensation Committee reviewed these voting results, evaluated investor feedback and considered other factors discussed in this proxy statement, including the alignment of our compensation program with the long-term interests of our shareholders and the relationship between risk-taking and the incentive compensation we provide to our named executives. After considering these factors, and based on additional feedback from our investors, the committee decided to take the following actions to increase management accountability and more closely align management’s interests with shareholders: ●Committing to provide no further single-trigger change of control provisions in employment agreements for new outside hires; ●Continuing to shift executive compensation away from cash-based programs and to equity; ●Adopting a formal peer group for the purposes of assessing executive compensation; ●Granting PSUs to a broader swath of our executive officers; and ●Changing the performance metrics for the 2020 PSUs to the S&P 500 Industrial Index, which represents a more tailored group of industrial peers, compared to the S&P 500. |

| + | Notwithstanding these concerns, the vast majority of investors with whom we engaged indicated that they were supportive of the Compensation Committee’s actions overall. In particular, investors indicated that they were supportive of: ●Taking action to attract and retain key talent during a period of uncertainty for the company; ●Ongoing focus on tailoring incentives to the business units for the bonus program; ●Ongoing efforts to align executive pay with results for shareholders through equity; and ●Simplifying the performance metrics used across our compensation programs. |

22 GE 2020 PROXY STATEMENT

| Recent Investor Discussion Topics and Board Response | |

| GE Strategy and Portfolio | Critically review the company’s strategy and portfolio, narrowing our focus to strengthen our businesses to improve top-line and bottom-line performance |

| Debt Strategies | Take action to reduce the company’s leverage and debt outstanding |

| Board Composition | Continue our ongoing Board refreshment, adding directors with relevant industry experience and skill sets |

| Executive Compensation | Simplify our executive compensation programs to increase focus on key performance metrics |

| Audit Matters | Lay the groundwork for going to bid for our independent auditor |

Investor Outreach and Our 2019 Say-On-Pay Vote | |

At our 2019 annual meeting, 70% of shareholders expressed support for the compensation of our named executives. In advance of the 2019 annual meeting, and as part of our fall outreach after the meeting, we made significant efforts to engage with our institutional shareholders to better understand their concerns related to our executive compensation programs and to the factors impacting their say-on-pay vote. This outreach also involved two independent directors who are members of our Compensation Committee, Tom Horton (the Committee Chair) and Ed Garden. During 2019, we solicited feedback from shareholders representing 48% of our shares outstanding as of December 31, 2019, and we spoke with 25 shareholders (some on multiple occasions) representing 44% of our shares outstanding as of that date to collect their feedback on our executive compensation programs. This was in addition to the engagement by our investor relations department as well as the engagement we do with retail investors. |  |

HOW YOU CAN COMMUNICATE WITH YOUR BOARD |

GE 2020 PROXY STATEMENT 23

Director Attendance at Meetings

The Board expects directors to attend all meetings of the Board and the committees on which the director serves as well as the annual shareholders meeting.

BOARD/COMMITTEE MEETINGS.In 2019, each of our current directors attended at least 75% of the meetings held by the Board and committees on which the member served during the period the member was on the Board or committee. Average attendance by our current directors for these meetings was 94% during 2019.

ANNUAL SHAREHOLDERS MEETING.9 of our 10 director nominees for 2019 attended the 2019 annual meeting.

Board Integrity Policies

CODE OF CONDUCT.All directors, officers and employees of GE must act ethically at all times and in accordance with GE’s code of conduct (contained in the company’s integrity policy, The Spirit & The Letter). Under the Board’s Governance Principles, the Board does not permit any waiver of any ethics policy for any director or executive officer. The Spirit & The Letter, and any amendments to the code that we are required to disclose under SEC rules, are posted on GE’s website (see“Helpful Resources” on page 65).

CONFLICTS OF INTEREST.All directors are required to recuse themselves from any discussion or decision affecting their personal, business or professional interests. If an actual or potential conflict of interest arises, the director is required to promptly inform the CEO and the lead director. The Governance Committee reviews any such conflict of interest. If any significant conflict cannot be resolved, the director involved is expected to resign.

Limits on Director Service on Other Public Boards

GE POLICY.As discussed in detail in the Board’s governance documents, and summarized in the table below, the Board has adopted policies to ensure that all of our directors have sufficient time to devote to GE matters. In 2019, the Governance Committee decided to further reduce the number of public company boards permitted for GE directors, as disclosed below.

| PERMITTED # OF PUBLIC COMPANY BOARDS (INCLUDING GE) | |

| Public company executives | 2* |

| Other directors | 4 |

| PERMITTED # OF PUBLIC COMPANY AUDIT COMMITTEES (INCLUDING GE) | |

| Audit Committee Chair | 2 |

| Audit Committee member | 3 |

| OTHER RESTRICTIONS | |

| Lead Director | Absent special circumstances should not serve as lead director, chairman or CEO of another public company |

| * | Service on the board of a public company for which a director serves as an executive, together with service on the board of any public company subsidiary or public affiliates as part of the director’s executive responsibilities shall count as one board for purposes of this limit. |