- GIS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

General Mills (GIS) DEF 14ADefinitive proxy

Filed: 12 Aug 24, 3:00pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

| Filed by the Registrant |  | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under §240.14a-12 |

General Mills, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

| No fee required. |

| Fee paid previously with preliminary materials. |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Accelerate | ||

Strategy |

We are executing our Accelerate strategy to drive sustainable, profitable growth and top-tier shareholder returns over the long term. The Accelerate strategy focuses on four pillars to create competitive advantages and win: boldly building brands, relentlessly innovating, unleashing scale and standing for good. We are prioritizing our core markets, global platforms and local gem brands that have the best prospects for profitable growth and we are committed to reshaping our portfolio with strategic acquisitions and divestitures to further enhance our growth profile.

Our Purpose

Making Food the World Loves

Where to Play | ||

CORE MARKETS | GLOBAL PLATFORMS | LOCAL GEMS | PORTFOLIO |

How to Win | ||

BOLDLY BUILDING | RELENTLESSLY | UNLEASHING | STANDING FOR |

Drive Long-Term Shareholder Value | ||

ORGANIC NET SALES* | ADJUSTED | ADJUSTED DILUTED | MAINTAIN CAPITAL |

| * | Non-GAAP measure. |

| (1) | Mid-single-digit constant currency growth rate. |

| (2) | High-single-digit constant currency growth rate. |

|  | |

A Letter from Our |

In fiscal 2024, we continued to execute on our Accelerate strategy and navigated a more challenging category and competitive backdrop than we expected at the beginning of the year. Our fiscal 2024 performance was impacted by an uncertain macroeconomic environment, which resulted in greater-than-expected value-seeking behaviors by consumers and our organic net sales declining one percent for the year. While our fiscal 2024 results were mixed, we invested in brand building and innovation, advanced our digital capabilities and improved our supply chain efficiency, including generating industry-leading Holistic Margin Management (“HMM”) cost savings.

STRONG INNOVATION, DIGITAL MARKETING, AND PORTFOLIO SHAPING POSITION US FOR GROWTH AND STRONG SHAREHOLDER RETURNS.

We increased our focus on new product innovation in fiscal 2024, which resulted in General Mills launching each of the five largest new products in the U.S. Cereal category and the rollout of successful new varieties in Pet. We advanced our digital capabilities, doubling down on investments in data-driven marketing, including digital rewards and couponing, that will be critical for driving future growth. We also continued to reshape our portfolio, including acquiring premium European pet food brand Edgard & Cooper. In fiscal 2024, we were able to return more than $3 billion to shareholders through dividends and share repurchases, which brings our total cash returns to shareholders to nearly $10 billion since fiscal 2021.

PREPARED TO WIN IN FISCAL 2025.

We enter fiscal 2025 ready to compete and invest behind our brands in an operating environment that we know will continue to evolve in the face of ongoing economic uncertainty for consumers. In fiscal 2025, we will continue to execute our Accelerate strategy and are focused on achieving three priorities that will be critical to our success. First, we will accelerate our organic sales by improving our competitiveness through our remarkable experiences framework. Second, we will create fuel for investment by generating HMM cost savings to offset inflation and accelerate brand investment. Finally, we will continue our robust cash conversion and capital allocation discipline to drive strong cash generation.

GENERAL MILLS WILL ALWAYS STAND FOR GOOD.

In addition to the business results achieved by our teams in fiscal 2024, our employees continued to live out our purpose of making food the world loves. Recognizing that everything we do touches the lives of families and communities – now, and for years to come – we are more determined than ever to ensure the G in General Mills stands for Good. Our focus on putting people first extends beyond our consumers to our entire value chain, including the farmers who grow our ingredients, our employees who are the heartbeat of General Mills and, of course, the communities we are proud to be a part of and serve. We also continue to advance and make progress against our priority planetary commitments, including climate change, regenerative agriculture and packaging.

As I reflect on the past year, I have tremendous pride in what our people have accomplished and confidence that they will return us to growth in the year ahead. With new senior leaders for our four business segments, our teams are energized by our plans and by multiple areas of innovation designed to drive our fiscal 2025 business results.

I want to close by thanking you, our shareholders, for your investment in General Mills. On behalf of our more than 34,000 talented employees around the world, I want you to know that as we continue to navigate an evolving operating environment, we are in a strong position to deliver consistent, profitable growth and top-tier shareholder returns over the long term.

Sincerely,

JEFFREY L. HARMENING

Chairman and Chief Executive Officer

August 12, 2024

| Notice of 2024 Annual Meeting of Shareholders | 1 |

|  | |

A Letter from Your |

This is my first letter to you as Independent Lead Director of General Mills, having been appointed to my new role by the board in September 2023. I want to begin by recognizing Steve Odland, who preceded me, for his many significant contributions to building the effective, engaged and collaborative board we have today.

Guiding the development and execution of the company’s long-term Accelerate strategy remains the board’s top priority. At each meeting, the board receives updates from company leaders on how they are advancing the Accelerate strategy, including regular discussions on portfolio shaping. The board is confident that the Accelerate strategy will benefit shareholders by providing a strategic foundation for long-term value creation.

One of the board’s key roles is working with management to set ambitious business plans for each fiscal year. The board then closely monitors the company’s performance throughout the year, with ongoing assessments against those business plans at each board meeting. The board is also actively engaged in overseeing the company’s risk management. To ensure that the board fulfills its oversight role in a comprehensive and coordinated manner, the responsibility for overseeing specific aspects of the company’s risk management program is purposefully allocated among the full board and board committees.

To ensure the company continues to advance its sustainability and global impact commitments, the board is actively engaged in overseeing the company’s efforts that are focused on addressing climate change, advancing regenerative agriculture, increasing the recyclability of our packaging, and strengthening the communities in which the company operates. The board’s oversight is informed by feedback and engagements with stakeholders, including our shareholders.

The board is also actively involved in overseeing the company’s strategies to recruit, develop and safeguard the well-being of our talented and dedicated team. The full board regularly discusses matters of corporate culture and employee engagement to ensure that our teams embody the attributes, behaviors and commitment necessary to advance our strategies. An essential part of our culture is our commitment to operating with integrity and acting with the highest ethical standards. This starts with the clear expectation set by the board and is reinforced by the audit committee and board’s regular reviews of our ethics and compliance reports.

You are represented by an accomplished, ethical and diverse board of directors with significant experience in the consumer packaged goods and retail industries, global business operations, new product launches and innovation, finance, portfolio shaping, technology, and consumer health and wellness. Our board succession work, including the additions of Benno O. Dorer and John G. Morikis this year, has built a best-in-class board with strong industry experience that is capable, diverse, engaged and focused on long-term value creation for shareholders. We also want to thank R. Kerry Clark, who will be retiring at this year’s annual meeting, for his valuable contributions and longstanding service as a board member. I encourage you to vote for each of the board’s nominees.

On behalf of the board, thank you for the confidence you’ve placed in us and for your continued investment in General Mills.

Sincerely,

MARIA HENRY

Independent Lead Director

August 12, 2024

| 2 | General Mills, Inc. |

Background |

|

| ||

Date and Time Tuesday, September 24, 2024, at | Location Online only at www.virtualshareholder meeting.com/GIS2024 | Who Can Vote The record date for the Annual Meeting is July 26, 2024. If you held General Mills stock at the close of business on that date, you are entitled to vote at the Annual Meeting. | ||

Voting Items |

|

|

PROPOSAL | BOARD VOTING | |||

| ||||

1 | ELECT AS DIRECTORS THE 12 NOMINEES NAMED IN THE ATTACHED PROXY STATEMENT |  | FOR each director nominee | |

2 | APPROVE ADVISORY VOTE ON EXECUTIVE COMPENSATION |  | FOR | |

3 | RATIFY THE APPOINTMENT OF KPMG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR OUR FISCAL YEAR ENDING MAY 25, 2025 |  | FOR | |

4-5 | VOTE ON TWO SHAREHOLDER PROPOSALS, IF PROPERLY PRESENTED AT THE MEETING |  | AGAINST |

Shareholders will also transact any other business that properly comes before the meeting.

Your vote is important. We encourage you to vote by proxy, even if you plan to attend the virtual meeting.

|  |  |  |  | ||||

| INTERNET www.proxyvote.com | TABLET OR SMARTPHONE | TELEPHONE Toll-free (U.S. and Canada) 1-800-690-6903 | MAIL Mail in your signed proxy card or voting instruction form (if you received one) | ONLINE AT ANNUAL MEETING www.virtualshareholder meeting.com/GIS2024 |

Sincerely,

Karen Wilson Thissen Secretary

August 12, 2024

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON SEPTEMBER 24, 2024

Our Notice of 2024 Annual Meeting of Shareholders, Proxy Statement and Annual Report to Shareholders are available on the General Mills website at www.generalmills.com in the Investors section. We first mailed or made available the proxy materials to our shareholders on or about August 12, 2024. |

| Notice of 2024 Annual Meeting of Shareholders | 3 |

Table of Contents

| 4 | General Mills, Inc. |

Proxy | Guided by our purpose of making food the world loves, General Mills is executing our Accelerate strategy to drive sustainable, profitable growth and top-tier shareholder returns over the long-term. While facing a more challenging operating environment, we were able to deliver on our updated guidance in fiscal 2024. We drove improved volume performance in the second half of the year and generated industry-leading levels of HMM cost savings, allowing us to protect our brand investment while still delivering our profit and cash commitments. In fiscal 2025, our top priority is to accelerate our organic net sales growth, and specifically our volume growth, by delivering remarkable experiences across our portfolio of leading brands. We also plan to drive another strong year of HMM cost savings, allowing us to reinvest in exciting growth opportunities to meet evolving consumer needs.

General Mills remains committed and continues to stand for good by focusing on our robust regenerative agriculture, climate change, and recyclability and packaging commitments. We also continue to give back to and strengthen the communities in which we operate.

|

Driving Long-Term Shareholder Value

In fiscal 2024, we executed well in a challenging operating environment, highlighted by generating industry-leading HMM cost savings and removing significant disruption-related costs from the supply chain.

We delivered strong total shareholder returns (“TSR”), including 52% TSR performance over the past 5-years, outperforming our compensation peer group by 36%.(1)

In fiscal 2024, we returned more than $3 billion to shareholders through dividends and share repurchases, and our board recently approved a 2% increase to our dividend, underlining our commitment to driving strong returns for our shareholders over the long term.

Committed to Standing for Good

We continued to work towards our goals of reducing our absolute greenhouse gas (“GHG”) emissions by 30% by 2030 and achieving net zero GHG emissions across our full value chain by 2050.

As an industry leader in regenerative agriculture, we are committed to advancing 1 million acres of regenerative agriculture in our supply chain by 2030 and have currently enrolled more than 500,000 acres into our program.

We are deeply committed to the communities where we live and operate and from which we source our ingredients. Our philanthropic partnerships and employee engagement aim to build strong, equitable and resilient communities.

|

(1) 5-Year TSR data as of May 26, 2024; Source: FactSet.

| Notice of 2024 Annual Meeting of Shareholders | 5 |

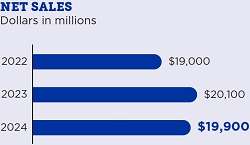

Proxy Summary: Fiscal Year Financial Highlights |

|

In fiscal 2024, we continued to take strategic actions to adapt to the changing marketplace and improve our profitability. While facing a more challenging operating environment, we were able to deliver on our updated guidance in fiscal 2024.

We continued to compete effectively and increased our product innovation and offerings. Our efforts to strengthen our brand building, innovation and in-store execution helped drive improved volume and market share trends in the second half of fiscal 2024. We introduced roughly 40 percent more “big bet” launches into market versus fiscal 2023, launching each of the five largest new products in the U.S. Cereal category. We are also accelerating our product innovation with remarkable new product and package offerings for pet parents, including new varieties of Tasteful Purees and seasonal gifting packs.

We improved our supply chain efficiency. We accelerated our HMM cost savings to nearly six percent of cost of goods sold, which was higher than our initial estimate and higher than historical levels. We aggressively removed disruption-related costs in our supply chain by internalizing manufacturing, readjusting formulas, and optimizing logistics.

We maintained our capital allocation discipline. We continued our longstanding track record of industry-leading cash conversion, generating more than $2.5 billion of free cash flow at a 96 percent conversion rate. We continued to reshape our portfolio in fiscal 2024, including acquiring the premium European pet food brand Edgard & Cooper. Finally, we were able to return more than $3 billion to shareholders through dividends and share repurchases, which brings our total returns to shareholders to nearly $10 billion since fiscal 2021.

| Delivering on our Financial Targets | |

Net sales totaled

$19.9 billion and organic net sales decreased 1% compared to year-ago levels*.

|  |

Operating profit

$3.4 billion and adjusted operating profit of $3.6 billion increased 4% on a constant-currency basis*.

|  |

Diluted EPS totaled

$4.31 and adjusted diluted EPS of $4.52 increased 6% on a constant-currency basis*.

|  |

Net cash provided by

$3.3 billion This cash generation supported capital investments totaling $774 million and our resulting free cash flow was $2.5 billion*.

|  |

| * | Organic net sales, adjusted operating profit (on a constant-currency basis), adjusted diluted EPS (on a constant-currency basis) and free cash flow are non-GAAP measures. For more information on the use of non-GAAP measures in the Proxy Statement, and a reconciliation of non-GAAP measures to the most directly comparable GAAP measures, see Appendix A. |

| 6 | General Mills, Inc. |

| Proxy Summary: People and Inclusion Highlights |

| 38% of our officers are women | |

| Diversity, Inclusion & Belonging | 28% of our officers are racially or ethnically diverse |

We believe that fostering a culture of inclusion and belonging strengthens our business performance and execution, improves our ability to recruit and develop talent and provides for a rewarding workplace experience that allows all of our employees to thrive and succeed. We actively cultivate a culture that acknowledges, respects and values all dimensions of diversity – including gender, race, sexual orientation, ability, backgrounds and beliefs.(1) Ensuring diversity of input and perspectives is core to our business strategy, and we are committed to recruiting, retaining, developing and advancing a workforce that reflects the diversity of the consumers we serve.

| Our Inclusion Goal | Our Inclusion Strategy |

| Is to foster a culture of inclusion and belonging that allows all of our employees to thrive. Ensuring diversity of input and perspectives is core to our business strategy. | Is to use our inclusion framework to advance engagement around the world, leveraging data to assess progress and holding ourselves accountable as we continue to foster a culture of inclusion and belonging. |

| 85% of salaried employees are proud of General Mills(2) | |

| Employee Engagement | 90% of salaried employees say General Mills is a great place to work(2) |

The efficient production of high-quality products and successful execution of our strategy requires a talented, skilled, dedicated and engaged team of employees. We work to equip our employees with critical skills and expand their contributions over time by providing a range of training and career development opportunities, including hands-on experiences through challenging work assignments and job rotations, coaching and mentoring opportunities and training programs. To foster employee engagement and commitment, we follow a robust process to listen to employees, take action and measure our progress with ongoing employee conversations, transparent communications and employee engagement surveys.

We are committed to maintaining a safe and secure workplace for our employees. We set specific safety standards to identify and manage critical risks. We use global safety management systems and employee training to ensure consistent implementation of safety protocols and accurate measurement and tracking of incidents. To provide a safe and secure working environment for our employees, we prohibit workplace discrimination, and we do not tolerate abusive conduct or harassment. Our attention to the health and safety of our workforce extends to the workers and communities in our supply chain.

We have a history of strong safety performance. We recently took bold steps forward by implementing new injury and illness reporting criteria and metrics to improve our safety culture and focus more intently on eliminating incidents and situations with the greatest potential to significantly harm our people. The new safety metric criteria are based on current best practices and globally recognized principles for recording occupational injuries and illnesses.

| (1) | Additional data on the diversity breakdown of our U.S. salaried employee base can be found in our annual Global Responsibility Report (available on our website at www.generalmills.com under the Global inclusion & diversity section), including a link to employment data from our EEO-1 report. |

| (2) | Global survey of salaried employees, September 2023. |

| Notice of 2024 Annual Meeting of Shareholders | 7 |

Proxy Summary: Sustainability and Climate Highlights |

|

For more than 155 years, General Mills has been making food the world loves while creating long-term value for society and our shareholders. Feeding a growing global population and the success of our business depend on a healthy planet.

As we look to the challenges ahead, we begin with the firm belief that a global food company can stand for good. We are investing in the potential of agriculture to ensure a thriving future for both people and planet. To that end, we are working to drive meaningful change through regenerative agriculture, a holistic approach to farming that improves environmental, social and economic resilience.

As a global food company, our business is rooted in agriculture. Over time, the quality and availability of the earth’s natural resources have declined, while the need to provide for a growing population has increased. Simply sustaining the current state of ecosystems and communities is not enough. We must instead invest in the potential of agriculture to ensure a thriving future for both people and planet. To that end, we are on a journey to make a meaningful difference through our commitment of advancing regenerative agriculture on one million acres of farmland by 2030. Through regenerative agriculture, farmers can regenerate the soil they work on, reduce the number of inputs and amount of water used and lower GHG emissions through carbon sequestration. This year our board of directors visited a regenerative farm to see the benefits of and better understand the regenerative practices and results firsthand.

In fiscal 2024, we continued our commitment to transparency through our disclosures based on the Task Force on Climate-related Financial Disclosure principles and the Sustainability Accounting Standards Board standards for our industry. We also published our first Climate Transition Action Plan to further enhance our climate reporting.

While the company is focused on regeneration efforts across our full value chain, our current key priorities include climate change, regenerative agriculture and packaging. As highlighted below, the company has set ambitious goals in these areas, and continues to focus our efforts to achieve them.

An overview of our initiatives may be found in our annual Global Responsibility Report (available on our website at www.generalmills.com under the “How we make it” section). | Climate Change | Regenerative Agriculture | ||||

| GOAL Net Zero GHG emissions across our full value chain by 2050 |  | GOAL 1M acres of farmland advancing regenerative agriculture | |||

| Our goals are to reduce absolute GHG emissions across our full value chain (Scopes, 1, 2 and 3) by 30% by 2030 (compared to 2020). By 2050, we expect to achieve net zero GHG emissions across our full value chain. | We are committed to being a leader in regenerative agriculture, which we define as a holistic, principles-based approach to farming and ranching that seeks to build and strengthen ecosystem and community resilience. We have set a goal to advance regenerative agriculture practices on 1 million acres of farmland by 2030. To date, we are helping to advance regenerative management on more than 70 farms and have more than 500,000 acres enrolled in our program. | |||||

| Packaging | ||||||

| GOAL 100% of packaging designed to be reusable or recyclable by 2030 | |||||

| To reduce the environmental impact of packaging, we are working to ensure that General Mills brands will design 100% of packaging to be recyclable or reusable by 2030 (by weight). | ||||||

| 8 | General Mills, Inc. |

At General Mills, we work to create holistic value throughout our supply chain, from agriculture and operations to our consumers and communities. Our sustainability and corporate social responsibility achievements, some of which are highlighted below, help us strengthen our business, brands and the communities we serve.

|  |  |  |

| FOOD | PLANET | PEOPLE | COMMUNITY |

| 100% | 500,000+ | 90% | $112.5 million |

| of our company-owned production facilities are Global Food Safety Initiative (GFSI) certified. | acres enrolled in programs designed to advance regenerative management.(1) | of our salaried employees say that General Mills is a great place to work. | given to charitable causes, including General Mills Foundation grants, corporate contributions and food donations. |

| 41% | 97% | 38% | 48 million |

| of General Mills global volume met the company’s criteria as Nutrition- Forward Foods.(1)(2) | renewable electricity sourced for our global operations. | of our officers are women and 28% are racially or ethnically diverse. | Our product donations to food banks enabled 48 million meals around the world. |

| #1 | 93% | $521 million | 6 continents |

| General Mills is the largest provider of natural and organic packaged food in the U.S.(3) | of General Mills packaging is recyclable or reusable (by weight).(4)(1) | spent with minority-owned suppliers. | Our strategic philanthropy and our community giving in General Mills hometown communities spanned 6 continents. |

| |

Human Rights | |

As one of the world’s leading food companies, we believe we have a responsibility to respect human rights throughout our business and value chain. By standing for good, we are accelerating our actions to respect human rights and positively impact the people we depend on – and who depend on us. We follow a strategic framework to assess, address and prevent potential human rights impacts across our value chain. We also regularly assess our human rights risks and strategy to ensure alignment with the United Nations Guiding Principles on Business and Human Rights. (1) Data as of the last day of fiscal 2023. (2) Global Health Reporting excludes our Pet segment. (3) Includes food for both humans and pets. Source: SPINS Nat/Org Multi Channel, 52 weeks ended 1/28/2024. (4) Progress reflects approximately 90% of total General Mills packaging spend; excludes Asia & Latin America, External Supply Chain and Pet treat businesses. | |

| Notice of 2024 Annual Meeting of Shareholders | 9 |

Board Independence and Composition

|  Independent and diverse board of directors Independent and diverse board of directors Strong Independent Lead Director with authority to approve board meeting agendas Strong Independent Lead Director with authority to approve board meeting agendas Comprehensive director nomination and board refreshment process Comprehensive director nomination and board refreshment process Executive sessions for independent directors at each board meeting Executive sessions for independent directors at each board meeting | |

| Active and Engaged Board |  Thoughtful management development and succession plans for the CEO and his direct reports Thoughtful management development and succession plans for the CEO and his direct reports Strong oversight of culture, human capital management and leadership development programs and strategies Strong oversight of culture, human capital management and leadership development programs and strategies Active shareholder engagement program with regular updates to the board Active shareholder engagement program with regular updates to the board Substantive annual board and committee evaluations Substantive annual board and committee evaluations Board and committee agendas developed annually to address core responsibilities Board and committee agendas developed annually to address core responsibilities Enterprise risk management processes at board and committee levels Enterprise risk management processes at board and committee levels Extensive oversight of sustainability and public policy issues impacting our business Extensive oversight of sustainability and public policy issues impacting our business | |

| Shareholder Rights |  Annual director elections based on a majority vote Annual director elections based on a majority vote Right of shareholders to request a special meeting Right of shareholders to request a special meeting Proxy access by-law Proxy access by-law Board service policies limiting the number of public company boards on which our directors may serve Board service policies limiting the number of public company boards on which our directors may serve |

| 10 | General Mills, Inc. |

| PROPOSAL NUMBER 1: | ||||

| Election of Directors | The board of directors recommends the election of each of the highly experienced director nominees presented in this proxy statement to our independent and diverse board. | ||

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR EACH DIRECTOR NOMINEE.

| INDEPENDENCE |  | |||

| GENDER |  | ||||

| ETHNIC DIVERSITY |  | ||||

| AGE |  | ||||

| TENURE (AVERAGE TENURE: 6 YEARS) |  | ||||

| Our Directors’ Skills and Experiences Support Our Long-term Strategy | |||||

| Additional information about each director, including our two new directors Benno O. Dorer and John G. Morikis, and his or her qualifications may be found beginning on page 20. | |||||

| Notice of 2024 Annual Meeting of Shareholders | 11 |

| PROPOSAL NUMBER 2: | ||||

| Advisory Approval of Executive Compensation | The compensation program for our executive team recognizes and rewards the achievement of annual and sustained competitive performance. Each element of compensation is tied to performance. Incentive measures are closely linked to our strategy, long-term growth model, financial objectives and ultimately TSR. | ||

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE RESOLUTION. | Percentage Of CEO Target Compensation | Total Direct Compensation Element | Pay Element | Performance Measure | |||||

| BASE SALARY | Cash | • Individual performance and contributions based on scope and complexity of role | ||||||

| ANNUAL INCENTIVE | Cash-based award | Company Performance (80%) • Organic net sales growth* • Adjusted operating profit growth* Individual Performance (20%)

| ||||||

| LONG-TERM INCENTIVE | ||||||||

| Performance Share Units (“PSUs”) | Three-year cliff vesting and Three-year measurement period • Organic net sales growth (Compound Annual Growth Rate (“CAGR”))* • Cumulative operating cash flow* • +/- 25% Relative TSR Modifier

| |||||||

| Stock Options | Four-year graded vesting | |||||||

| Restricted Stock Units | Four-year graded vesting | |||||||

| Additional information about executive compensation may be found beginning on page 46. | |||||||||

| PROPOSAL NUMBER 3: | ||||

Ratify Appointment of the Independent Registered Public Accounting Firm

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE PROPOSAL.

| Our audit committee is responsible for the selection and engagement of our independent auditor. The audit committee annually reviews qualifications, performance, independence and fees of KPMG, our current registered public accounting firm. The focus of the process is to select and retain the most qualified firm to perform the annual audit. Based on its annual review, the audit committee believes that the retention of KPMG as our independent auditor is in the best interests of the company and its shareholders. We are asking shareholders to ratify the appointment of KPMG for fiscal 2025. Additional information about the independent registered public accounting firm may be found beginning on page 74.

| ||

| * Non-GAAP measure. For more information on the use of non-GAAP measures in the Proxy Statement, and a reconciliation of non-GAAP measures to the most directly comparable GAAP measures, see Appendix A. |

| 12 | General Mills, Inc. |

| PROPOSAL NUMBERS 4 and 5: | ||||

Shareholder Proposals

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE AGAINST THESE PROPOSALS.

| We received two shareholder proposals to be voted on at this year’s annual meeting, if properly presented. Shareholders are asked to vote against each of the shareholder proposals.

Information on the shareholder proposals and our statements in opposition of the proposals may be found beginning on page 77.

|

| Notice of 2024 Annual Meeting of Shareholders | 13 |

PROPOSAL NUMBER 1:

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE ELECTION OF EACH OF THE DIRECTOR NOMINEES. | Upon the recommendation of the corporate governance committee, the board has nominated all of the current directors to stand for reelection, except for R. Kerry Clark, who has decided not to stand for reelection at the end of his term. All of the nominees are independent under New York Stock Exchange (“NYSE”) corporate governance rules, except Chairman and Chief Executive Officer Jeffrey L. Harmening. See Board Independence and Related Person Transactions on page 41.

Our directors are elected annually by a majority of votes cast to enhance their accountability to shareholders. If an incumbent director is not reelected, the director must promptly offer his or her resignation to the board. The corporate governance committee will recommend to the board whether to accept or reject the resignation, and the board will disclose its decision and the rationale behind it within 90 days from the certification of the election results. If there are more director nominees than the number of directors to be elected, the directors will be elected by a plurality of the votes cast.

Each of the director nominees currently serves on the board and was elected by our shareholders at the 2023 Annual Meeting, except for Benno O. Dorer and John G. Morikis who were identified by a search firm as new director candidates and elected as directors by the board in January 2024.

If elected, each director will hold office until the 2025 Annual Meeting and until his or her successor is elected and qualified. We have no reason to believe that any of the nominees will be unable or unwilling to serve if elected. However, if any nominee should become unable for any reason or unwilling for good cause to serve, proxies may be voted for another person nominated as a substitute by the board, or the board may reduce the number of directors.

Included in each director nominee’s biography is a description of the top five key qualifications and experiences of such nominee based on the skills and qualifications described on page 18. The board and the corporate governance committee believe that the combination of the various qualifications and experiences of the director nominees will contribute to an effective and well-functioning board and that the director nominees possess the necessary qualifications and capacity to provide effective oversight of the business and counsel to the company’s management to advance our long-term strategy and oversee the interests of our shareholders. | ||

| 14 | General Mills, Inc. |

2024 Director Nominees |  |

| Notice of 2024 Annual Meeting of Shareholders | 15 |

Our board follows an annual director nomination process that promotes thoughtful and in-depth review of overall board composition and director nominees throughout the year. At the beginning of the process, the corporate governance committee reviews current board composition and considers search priorities for any new director candidates. The skills and experiences of our directors are reviewed annually to confirm that our board possesses the traits, attributes and qualifications to successfully guide and oversee the company’s long-term strategy and priorities and continue to promote effective board performance. The corporate governance committee reviews incumbent director candidates, evaluates any changes in circumstances that may impact their candidacy and considers information from the board evaluation process to ensure the board continues to operate effectively. Upon a recommendation from the corporate governance committee, the board of directors approves the nomination of director candidates for election at the Annual Meeting.

The corporate governance committee identifies potential new director candidates using a search firm that is paid a fee for its services, together with referrals and suggestions from board members and shareholders. The corporate governance committee interviews potential director candidates to confirm their qualifications, interest and availability for board service. This year, after a thorough search process, Benno O. Dorer and John G. Morikis were appointed by the board to serve as directors effective January 29, 2024. As recently retired Chairman and CEOs, both Mr. Dorer and Mr. Morikis bring significant board and executive experience, industry expertise, and proven track records of leading companies that produce strong results through organic growth and portfolio shaping.

We plan thoughtfully for director succession and board refreshment. By developing and following a long-term succession plan, the board has an ongoing opportunity to:

| • | Evaluate the depth and diversity of experience of our board; |

| • | Expand and replace key skills and experience that support our strategies; |

| • | Continue our record of gender and ethnic diversity; and |

| • | Maintain a balanced mix of tenures. |

In selecting directors, the board evaluates characteristics such as independence, integrity, experience and sound judgment in areas relevant to our businesses, a proven record of accomplishment, willingness to speak one’s mind and commit sufficient time to the board, appreciation for the long-term interests of shareholders and the ability to challenge and stimulate management and to work well with fellow directors.

Each newly appointed director follows a well-developed and comprehensive onboarding program, which, among other things, includes meetings with board members and senior company leaders. This helps ensure directors become well-acclimated to the board in a timely manner.

The corporate governance committee also plans for the orderly succession of the Independent Lead Director and the chairs for the board’s five committees, providing for their identification, development and transition of responsibilities.

| 16 | General Mills, Inc. |

Board members are expected to devote sufficient time and attention to carrying out their director duties and responsibilities and ensure that their other responsibilities, including service on other boards, do not materially interfere with their responsibilities as directors of the company. The board will take into account the nature and extent of a director’s other commitments when determining whether it is appropriate to nominate that individual for re-election.

In no event shall a director serve on more than four total public company boards (including the company’s board). A director who is an active public company CEO or executive officer shall not serve on more than two total public company boards (including their own board and the company’s board). Subject to a determination by the board that additional service will not impair the ability of a director to serve effectively on the company’s audit committee, a member of the audit committee may not serve on more than three total audit committees for public companies.

A director must inform the chair of the corporate governance committee in advance of becoming a director and/or member of the audit committee of any other public company.

The board reviewed the nominees for the 2024 Annual Meeting and has determined that all directors have the willingness and capacity to serve effectively on the company’s board.

Bringing together informed directors with different perspectives, in a well-managed, transparent and constructive environment, fosters thoughtful and innovative decision making. We have a policy of encouraging a range of tenures on the board, to ensure both continuity and fresh perspectives among our director nominees. It is also our policy as described in our corporate governance principles to include racial, ethnic and gender diversity on the board. Diversity has been a core value of our board and the company for many years. We have had at least one female director and one ethnically diverse director on our board for each fiscal year since 1975. We are committed to maintaining the current diversity of the board and will look for opportunities to increase the diversity of the board where appropriate to enhance the overall skills, experiences and profile of the board.

Our current director nominees possess a broad range of backgrounds and experiences and a balanced mix of diversity that enriches board discussions and deliberations:

| • | Four of our eleven independent director nominees are ethnically diverse; |

| • | The majority of our independent director nominees are female; and |

| • | The board exhibits a balanced mix of tenure, with an average director tenure of six years. |

| Notice of 2024 Annual Meeting of Shareholders | 17 |

The director nominees possess the qualifications, skills and experiences necessary to successfully guide and oversee the company’s long-term strategy and priorities. All of our directors have senior executive leadership experience leading large, complex organizations. These experiences are particularly important in evaluating key strategic decisions, including portfolio shaping, setting priorities and critically evaluating performance to drive sustainable, long-term shareholder value. Importantly, many of our directors have backgrounds in consumer packaged goods, retail and other consumer-facing businesses that enable the board to guide management in a rapidly changing business, marketing and product innovation environment. The board also possesses significant financial and accounting expertise that ensures the critical evaluation of strategic actions, strong oversight of performance and shareholder value creation and careful attention to financial disclosures. Additionally, many directors have held international executive positions leading global businesses or segments. These directors provide helpful insights to board discussions as we continue to grow and expand our global operations. Board experience, governance and public policy skills are also key strengths of several of our directors and are important for the effective operation of the board and oversight of the company. While we consider deep and diverse experience to be a strength of the board, we consider the following skills and experiences to be particularly valuable in supporting the company’s strategies and fulfilling the board’s responsibilities:

SENIOR EXECUTIVE LEADERSHIP

We believe that directors who have served as CEOs or senior executives are in a position to challenge management and contribute practical insight into business strategy, operations and human capital management. Our directors provide sources of market intelligence, analysis and relationships that benefit the company.

|

A significant portion of the company’s growth depends on its success in markets outside the U.S. Directors with a global perspective help us make key strategic decisions in international markets.

|

Innovation is a core focus for the company and is critical in helping us continue to develop and deploy successful products to meet the demands and preferences of our consumers.

| ||

As a company that relies on the strengths of our branded products, we seek directors who are familiar with the consumer packaged goods and retail industries. These directors help guide the company in assessing trends and external forces in these industries.

|

A deep understanding of the board’s duties and responsibilities enhances board effectiveness and ensures independent oversight that is aligned with shareholder interests.

|

A thorough understanding of the health and wellness trends among our consumers provides management and the board with insights into potential product enhancements and offerings.

| ||

A strong understanding of accounting and finance is important for ensuring the integrity of our financial reporting and critically evaluating our performance. Our directors have significant accounting experience, corporate finance expertise and financial reporting backgrounds.

|

Organic sales growth is one of our key financial metrics and directors with marketing expertise provide important perspectives on developing new markets and growing current markets. Sales and marketing expertise in E-commerce and mobile platforms is also vital to our growth and success in these channels. |

Directors with governmental and policymaking experience play an increasingly important role on our board as our business becomes more heavily regulated and as our engagement with stakeholders continues to expand.

|

| 18 | General Mills, Inc. |

The chart below identifies the balance of skills and qualifications each director nominee brings to the board. The fact that a particular skill or qualification is not designated does not mean the director nominee does not possess that particular attribute. Rather, the skills and qualifications noted below are those reviewed by the corporate governance committee as part of the board succession planning process. We believe the combination of skills and qualifications shown below demonstrate how our board is well positioned to provide strategic advice and effective oversight to our management.

|

|

|  Global Experience |

|

|

|

|

| |

| Benno O. Dorer | • | • | • | • | • | • | • | • | • |

| C. Kim Goodwin | • | • | • | • | • | ||||

| Jeffrey L. Harmening | • | • | • | • | • | • | • | • | |

| Maria G. Henry | • | • | • | • | • | • | • | ||

| Jo Ann Jenkins | • | • | • | • | • | • | • | ||

| Elizabeth C. Lempres | • | • | • | • | • | • | • | • | |

| John G. Morikis | • | • | • | • | • | • | • | ||

| Diane L. Neal | • | • | • | • | • | • | • | • | |

| Steve Odland | • | • | • | • | • | • | • | • | • |

| Maria A. Sastre | • | • | • | • | • | • | • | • | |

| Eric D. Sprunk | • | • | • | • | • | • | • | • | • |

| Jorge A. Uribe | • | • | • | • | • | • | |||

| Total |  |  |  |  |  |  |  |  |  |

| Notice of 2024 Annual Meeting of Shareholders | 19 |

Benno O. Dorer

Age 60 Independent Director Since 2024

Committees AUDIT, CORPORATE GOVERNANCE

Other Public Directorships VF CORPORATION (2017-2024) ORIGIN MATERIALS (2021-2023)

|

C. Kim Goodwin

Age 65 Independent Director Since 2022

Committees COMPENSATION, FINANCE

Other Public Directorships TJX COMPANIES, INC. POPULAR, INC.

| ||

Benno O. Dorer served as Chairman and Chief Executive Officer of The Clorox Company from 2014 to September 2020, Chairman from 2016 to September 2020 and Executive Chairman from September 2020 to February 2021. Prior to his role as Chief Executive Officer, he served as Chief Operating Officer from 2013 to 2014. Before joining Clorox, Dorer worked for The Procter & Gamble Company in various marketing and sales roles in the U.S. and Europe. Following his retirement from Clorox, Dorer served as Executive Advisor at KKR & Co. Inc. from 2021 to July 2022 and on the board of Origin Materials from 2021 to May 2023. Dorer served on the board of VF Corporation, where he also served as Interim President and Chief Executive Officer from December 2022 to July 2023 and Lead Independent Director from 2021 to 2022.

Contributions to the Board

• As the former Chief Executive Officer and Chairman of The Clorox Company, Mr. Dorer brings business leadership and strategic planning skills, governance expertise and a strong operating and portfolio shaping background to the board.

• Mr. Dorer’s international leadership experience at Clorox and The Procter & Gamble Company provides valuable global business perspectives.

• With a strong background in consumer packaged goods and retail, Mr. Dorer brings to the board extensive experience in launching new products, brand building, marketing and partnering with customers across sales channels.

Top Five Key Skills

|

C. Kim Goodwin is an experienced financial services professional. Ms. Goodwin served as Managing Director and Head of Equities (Global) for the Asset Management Division of Credit Suisse Group AG from 2006 to 2008, and as Chief Investment Officer – Equities at State Street Research & Management Co., a money management firm, from 2002 to 2005. Since 2008, Ms. Goodwin has been a private investor, sitting on a number of public and private company boards.

Contributions to the Board

• As a former investment executive at two global investment institutions, Ms. Goodwin provides valuable investor perspective on matters of company strategy, portfolio shaping, performance and corporate governance.

• Ms. Goodwin also brings significant financial and capital markets expertise to the board.

• Her significant public and private board service, including at the TJX Companies, Inc., strengthens the board’s overall experience in areas of risk oversight and marketing and consumer insights.

Top Five Key Skills

|

| 20 | General Mills, Inc. |

Jeffrey L. Harmening

Age 57 Director Since 2017

Other Public Directorships THE TORO COMPANY

|

Maria G. Henry,

Age 58 Independent Director Since 2016

Committees FINANCE, PUBLIC RESPONSIBILITY | ||

| Jeffrey L. Harmening is Chairman and Chief Executive Officer of General Mills, Inc. Mr. Harmening joined General Mills in 1994 and served in a variety of positions before becoming Vice President of Marketing for Cereal Partners Worldwide (“CPW”), the company’s joint venture with Nestlé based in Switzerland, in 2003. Mr. Harmening served as Vice President and Senior Vice President of the Big G cereal division from 2007 to 2012, and Senior Vice President, Chief Executive Officer of CPW from 2012 to 2014. From 2014 to June 2016, he served as Executive Vice President, Chief Operating Officer, U.S. Retail. Mr. Harmening was appointed President and Chief Operating Officer of General Mills in July of 2016, Chief Executive Officer in June of 2017 and Chairman in January of 2018.

Contributions to the Board

• With more than 25 years of service at General Mills in a variety of senior leadership roles across several business categories, Mr. Harmening’s deep knowledge of the company’s business and the markets in which we operate position him well to serve as our Chairman and Chief Executive Officer.

• Prior to his appointment as Chief Executive Officer, Mr. Harmening served in a number of key management and operational roles in the company’s North America Retail division.

• He also spent six years abroad focusing on our international operations, including two years as Chief Executive Officer of CPW.

Top Five Key Skills

|

Other Public Directorships NIKE, INC. NEXTERA ENERGY, INC.

| ||

| Maria G. Henry served as Executive Vice President and Senior Advisor of Kimberly-Clark Corporation until her retirement in 2022. She served as Chief Financial Officer of Kimberly-Clark Corporation from 2015 to April 2022. Prior to that, she was Executive Vice President and Chief Financial Officer of Hillshire Brands, formerly known as Sara Lee Corporation, from 2012 to 2014. Ms. Henry was the Chief Financial Officer of Sara Lee’s North American Retail and Foodservice business from 2011 to 2012. Prior to Sara Lee, she held various senior leadership positions in finance and strategy in three portfolio companies of Clayton, Dubilier, and Rice, most recently as Executive Vice President and Chief Financial Officer of Culligan International. Ms. Henry also held senior finance roles in several technology companies, and she began her career at General Electric.

Contributions to the Board

• As our Independent Lead Director, Ms. Henry draws on her business leadership, corporate strategy and board experience to provide strong, independent board leadership and to ensure board effectiveness by fostering active discussion and collaboration among the independent directors and serving as an effective liaison with management.

• As the former Chief Financial Officer of a global company, Ms. Henry offers capital markets expertise and current insights on public company financial, governance and leadership matters.

• Ms. Henry’s consumer products background and experience make her well-positioned to critically and thoughtfully review and guide company strategy.

Top Five Key Skills

|

| Notice of 2024 Annual Meeting of Shareholders | 21 |

Jo Ann Jenkins

Age 66 Independent Director Since 2020

Committees CORPORATE GOVERNANCE, PUBLIC RESPONSIBILITY

Other Public Directorships AVNET, INC.

|

Elizabeth C. Lempres

Age 63 Independent Director Since 2019

Committees AUDIT, COMPENSATION (CHAIR)

Other Public Directorships TRAEGER, INC. | ||

Jo Ann Jenkins has served as Chief Executive Officer of AARP, Inc., the nation’s largest nonprofit organization serving Americans aged 50 and older, since 2014. From 2013 to 2014, Ms. Jenkins served as Executive Vice President and Chief Operating Officer of AARP, and from 2010 to 2013 as President of the AARP Foundation. Prior to joining AARP, Ms. Jenkins served at the Library of Congress as Chief Operating Officer and Chief of Staff. She has also held a variety of senior roles at the U.S. Department of Agriculture, the U.S. Department of Transportation and the U.S. Department of Housing and Urban Development.

Contributions to the Board

• As the Chief Executive Officer of AARP, Ms. Jenkins brings to the board a deep understanding of strategic management and innovative marketing from her experiences leading and transforming one of the nation’s largest nonprofit organizations.

• Ms. Jenkins contributes valuable insights to the board on public policy, government affairs and community relations matters based on her senior leadership positions at the Library of Congress, U.S. Department of Agriculture, U.S. Department of Transportation and U.S. Department of Housing and Urban Development.

• Her public and private board service and advisory experiences deepen the board’s overall governance expertise.

Top Five Key Skills

| AXALTA COATING SYSTEM LTD. (2017–2022)

| ||

Elizabeth C. Lempres served as Senior Partner at McKinsey & Company, a management consulting firm, until her retirement in August 2017. Ms. Lempres joined McKinsey & Company in 1989 and held a variety of positions of increasing responsibility during her career including Senior Partner and Global Leader, Private Equity and Principal Investors from 2016 to 2017; and Senior Partner and Global Leader, Consumer Sector from 2010 to 2014. Prior to McKinsey & Company, she held positions in engineering-related fields at IBM and General Electric.

Contributions to the Board

• Ms. Lempres’ extensive senior leadership experience advising international consumer goods companies on complex management and strategy matters provides unique perspective and expertise to the board’s portfolio shaping and strategic planning processes and discussions.

• As former Senior Partner and Global Leader of McKinsey’s Consumer Sector, Ms. Lempres brings substantial global consulting experience in the consumer products and retail sectors to the board. Her experience leading teams across North America, Latin America, Europe, Asia and Africa also provides valuable perspective on the company’s international markets and operations.

• Ms. Lempres’ public company board experience, financial expertise and risk management skills are valuable assets to the board, the audit committee and the compensation and talent committee.

Top Five Key Skills

|

| 22 | General Mills, Inc. |

John G. Morikis

Age 61 Independent Director Since 2024

Committees AUDIT, FINANCE

Other Public Directorships SHERWIN-WILLIAMS FORTUNE BRANDS INNOVATIONS (2012-2024)

| |

Diane L. Neal

Age 68 Independent Director Since 2018

Committees FINANCE, PUBLIC RESPONSIBILITY

Other Public Directorships FOSSIL GROUP, INC. (2012–2022) | |

John G. Morikis has served as Executive Chairman of Sherwin-Williams since January 2024, and previously served as Chairman from 2017 to December 2023 and Chief Executive Officer from 2016 to December 2023. He joined Sherwin-Williams in 1984 as a management trainee and held roles of increasing responsibility throughout his career. Morikis previously served on the board of Fortune Brands Innovations.

Contributions to the Board

• From his tenure as Chairman and Chief Executive Officer of Sherwin-Williams, Mr. Morikis is attuned to the challenges of operating and growing an S&P 500 consumer-facing company, which provides an informed perspective on a variety of matters relevant to the company’s business strategy and operations.

• The variety of exposure to professional, industrial, commercial and retail customers developed during his career at Sherwin-Williams provides a unique viewpoint that benefits the board.

• Mr. Morikis’ public company board experience, financial and portfolio shaping expertise and risk management skills are valuable assets to the board, the finance committee and the audit committee.

Top Five Key Skills

| Diane L. Neal served as Chief Executive Officer of Sur La Table, Inc., a consumer-facing retail company, from 2014 until her retirement in January 2017. From 2012 to 2014, Ms. Neal served as an advisor to select retail companies including L Brands, Inc., the parent company of Bath & Body Works where she served as Chief Executive Officer from 2007 to 2011. Ms. Neal joined Bath & Body Works in 2006 as President and Chief Operating Officer. Ms. Neal served with Gap Inc. from 2004 to 2006, where she held the positions of President, Outlet Division and Senior Vice President, Merchandising, Outlet Division. Previously, she served at Target Corporation for more than 20 years in various executive and leadership roles, including President of Mervyn’s from 2001 to 2004.

Contributions to the Board

• Ms. Neal’s significant senior executive experience in consumer and retail facing businesses provides the board with valuable consumer and retail insights.

• As a senior executive for innovative and marketing-focused retail companies, Ms. Neal provides valuable perspectives on new and unique initiatives to meet evolving consumer needs and behaviors.

• Ms. Neal’s public company board experience and financial expertise strengthen our board and finance committee discussions.

Top Five Key Skills

|

| Notice of 2024 Annual Meeting of Shareholders | 23 |

Steve Odland

Age 65 Independent Director Since 2004

Committees FINANCE, PUBLIC RESPONSIBILITY

|

Maria A. Sastre

Age 69 Independent Director Since 2018

Committees COMPENSATION, CORPORATE GOVERNANCE (CHAIR) | ||

Steve Odland is the President and Chief Executive Officer of The Conference Board. From 2013 to June of 2018, Mr. Odland was President and Chief Executive Officer of The Conference Board’s public policy affiliate, the Committee for Economic Development. From 2011 to 2012, he was an Adjunct Professor in the graduate school of business at Lynn University and at Florida Atlantic University. Mr. Odland served as Chairman and Chief Executive Officer of Office Depot, Inc., an office merchandise retailer, from 2005 until 2010. From 2001 to 2005, he was Chairman and Chief Executive Officer of AutoZone, Inc., an auto parts retailer. Prior to that, he served as President and Chief Executive Officer of Tops Markets, Inc., a U.S. food retailer, from 1998 to 2000, and as President of the Foodservice Division of Sara Lee Bakery from 1997 to 1998. He was employed by The Quaker Oats Company from 1981 to 1996. Mr. Odland is also currently a Senior Advisor and a member of the Advisory Board at Solomon Partners, and a CNBC contributor.

Contributions to the Board

• As the former Chairman and Chief Executive Officer at Office Depot and Autozone and past President and Chief Executive Officer of Tops Markets, Mr. Odland brings business leadership and strategic planning skills, retail expertise and an operating background to the board.

• He provides valuable insights into food, consumer products marketing, brand-building, internet marketing and sales, food service and international management from his executive roles in the food industry at Tops Markets, Quaker Oats and Sara Lee.

• Mr. Odland also lends expertise on public policy, economics and corporate governance from his experience as President and Chief Executive Officer of The Conference Board.

Top Five Key Skills

|

Other Public Directorships O’REILLY AUTOMOTIVE, INC.

| ||

Maria A. Sastre served as President and Chief Operating Officer of Signature Flight Support Corporation, the world’s largest network of fixed-base operations and support services for private and business aviation, from 2013 until her retirement in 2018. Ms. Sastre joined Signature Flight in 2010 as its Chief Operating Officer. From 2009 to 2010, she was President and Chief Executive Officer of Take Stock in Children, Inc., a Florida based non-profit that helps low-income youth escape the cycle of poverty through education. Ms. Sastre served with Royal Caribbean Cruises LTD from 2000 to 2008, where she held the positions of Vice President, International, Asia, Latin America & Caribbean and Vice President of Hotel Operations. Previously, she had held various executive and leadership roles at United Airlines, Inc., Continental Airlines, Inc. and Eastern Airlines, Inc.

Contributions to the Board

• Ms. Sastre’s significant senior executive experience in consumer-facing businesses, together with over 20 years of public company board service at large retail grocery, restaurants and healthcare companies, provide the board with valuable consumer, food service and health and wellness insights.

• Her global management expertise overseeing operations and marketing initiatives in Asia and Latin America, as well as her international merger and acquisition work, deepens the board’s global perspective and marketing expertise.

• Ms. Sastre has significant corporate governance and public company board experience, including service on audit, corporate governance and talent and compensation committees and chairing finance and talent and compensation committees.

Top Five Key Skills

|

| 24 | General Mills, Inc. |

Eric D. Sprunk

Age 60 Independent Director Since 2015

Committees AUDIT (CHAIR), CORPORATE GOVERNANCE

Other Public Directorships BOMBARDIER INC. NORDSTROM, INC. UNIVERSAL MUSIC GROUP N.V.

|

Jorge A. Uribe

Age 67 Independent Director Since 2016

Committees COMPENSATION, PUBLIC RESPONSIBILITY (CHAIR)

Other Public Directorships INGREDION INCORPORATED

| ||

Eric D. Sprunk served as Chief Operating Officer of NIKE, Inc., an athletic footwear and apparel business, from 2013 until his retirement in April 2020. Mr. Sprunk joined NIKE in 1993, and held a variety of positions, including Regional General Manager of NIKE Europe Footwear from 1998 to 2000, Vice President & General Manager of the Americas from 2000 to 2001, Vice President of Global Footwear from 2001 to 2009 and Vice President of Merchandising and Product from 2009 to 2013. Prior to joining NIKE, Mr. Sprunk was a certified public accountant with the accounting firm Price-Waterhouse from 1987 to 1993.

Contributions to the Board

• As the former Chief Operating Officer at a global, brand-based consumer products company, Mr. Sprunk brings relevant marketing experience to the board, as well as operating expertise in key functions including manufacturing, technology, sourcing, sales and procurement. His experience as Vice President of Merchandising and Product also provides the board with valuable perspectives on product innovation and development.

• His global and regional international management experiences at NIKE provide the board with a unique perspective on developing and marketing innovative products in consumer markets around the world.

• Mr. Sprunk is a certified public accountant who has worked in senior financial roles at NIKE and Price-Waterhouse, which provides valuable financial and accounting expertise. Mr. Sprunk is one of the audit committee’s financial experts.

Top Five Key Skills

| Jorge A. Uribe served as Global Productivity and Organization Transformation Officer at The Procter & Gamble Company, a consumer products company, from 2012 until his retirement in 2015. Prior to 2012, Mr. Uribe served as Group President of Latin America at Procter & Gamble from 2004 to 2012, as Vice President, Marketing and Customer Business Development, Latin America from 2001 to 2004 and as Vice President, Venezuela and Andean Region from 1999 to 2001.

Contributions to the Board

• Mr. Uribe’s international management background, including multi-regional and multi-country responsibility for operations throughout Latin America, together with his personal experience living and working outside the U.S., provides valuable perspective on the company’s international markets and operations.

• As the former Global Productivity and Organization Transformation Officer of Procter & Gamble, Mr. Uribe brings first-hand experience in leading innovative organizational changes through efficiency improvement and cost management.

• The experiences developed throughout his career at Procter & Gamble deepen the board’s overall consumer products, innovation and marketing expertise.

Top Five Key Skills

|

| Notice of 2024 Annual Meeting of Shareholders | 25 |

Corporate Governance Policies and Practices | ||

Board Independence and Composition |  | Independent and diverse board of directors |

| Strong Independent Lead Director with authority to approve board meeting agendas | |

| Comprehensive director nomination and board refreshment process | |

| Executive sessions for independent directors at each board meeting | |

| Active and Engaged Board |  | Thoughtful management development and succession plans for the CEO and his direct reports |

| Strong oversight of culture, human capital management and leadership development programs and strategies | |

| Active shareholder engagement program with regular updates to the board | |

| Substantive annual board and committee evaluations | |

| Board and committee agendas developed annually to address core responsibilities | |

| Enterprise risk management processes at board and committee levels | |

| Extensive oversight of sustainability and public policy issues impacting our business | |

| Shareholder Rights |  | Annual director elections based on a majority vote |

| Right of shareholders to request a special meeting | |

| Proxy access by-law | |

| Board service policies limiting the number of public company boards on which our directors may serve | |

Our board is elected by our shareholders to oversee their interests in the long-term health and overall success of the company’s business. In exercising its fiduciary duties, the board represents and acts on behalf of our shareholders and is committed to strong corporate governance, as reflected in our corporate governance principles (available on our website at www.generalmills.com in the Investors section).

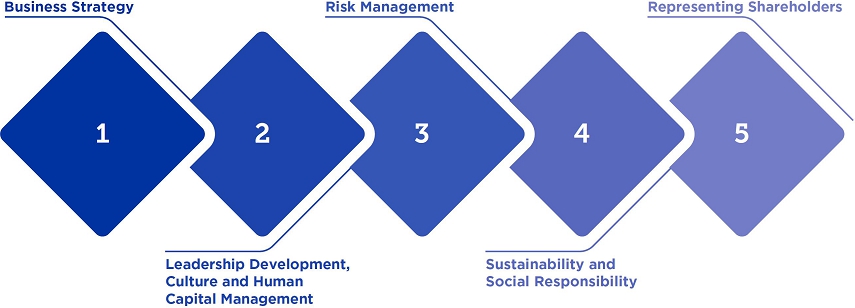

The board’s key responsibilities and priorities include:

| 26 | General Mills, Inc. |

The board’s significant industry and management expertise is critical in shaping the company’s business strategy. In an evolving and dynamic business environment, our directors are an important resource for thoughtful, candid and ongoing insights into strategic issues facing the company, including product portfolio development and innovation, strategic investments, acquisitions and divestitures, margin improvement and organizational design.

Board Responsibilities• Guiding and overseeing corporate strategy is the board’s primary focus, and the board’s oversight of strategy development and its assessment of management’s execution and progress against key priorities is deeply embedded in our annual board meeting calendar and agendas. • The board dedicates time at each board meeting to review and discuss long-term strategic planning, including consideration of external business dynamics, emerging trends and risks and potential strategic alternatives. These discussions provide an opportunity for the board to constructively engage with management to review and advance corporate strategy. • The board plays a significant role in overseeing the company’s portfolio shaping. At each board meeting, the board receives an update on the company’s portfolio shaping activities. The board provides independent strategic insights on the direction of the portfolio shaping processes and engages in robust discussions with management in connection with acquisitions and divestitures. • The board critically reviews significant capital investments and cash returns to shareholders through share repurchase plans and dividend payments. These strategic actions and investments are reviewed and approved by the board following open and engaged discussions of the full board. • As part of its oversight, the board reviews and discusses with management at each board meeting a set of detailed operating reports, including current financial performance versus plan. Focused discussions of key business issues, segment and business unit operations and strategic developments are also held at each board meeting. • At each board meeting, the independent directors meet in executive session to discuss business and strategic matters. These meetings are led by our Independent Lead Director.

| Board’s Actions ACCELERATE STRATEGY The board worked closely with management to develop our Accelerate strategy. This strategy prioritizes the markets and platforms with the best prospects for profitable growth, provides a roadmap for reshaping our portfolio and guides investments in key capabilities. The board receives updates at each meeting to critically oversee and assess the company’s execution of the Accelerate strategy to address challenges in the marketplace and drive future success.

ANNUAL AND ONGOING BUSINESS REVIEW At the beginning of each fiscal year, the board formally reviews our annual and longer-term business plans, financial targets and plans for achieving those targets. The board monitors performance against the company’s strategic objectives and financial targets throughout the year and helps ensure the integrity of our financial results.

|

| Notice of 2024 Annual Meeting of Shareholders | 27 |

Recruiting, developing and engaging our workforce is critical to executing our strategy and achieving business success. The board oversees and is regularly updated on the company’s leadership development and talent management strategies designed to recruit, develop and retain global business leaders who can drive financial and strategic growth objectives and build long-term shareholder value. The board formally reviews and discusses management development and succession plans for the Chief Executive Officer and his direct reports, including individual executive transitions. These reviews include an assessment of senior executives and their potential as successor to the Chief Executive Officer. To enhance the board’s understanding of the company’s talent pipeline, the board meets regularly with high-potential executives in formal and informal settings. The board has also adopted procedures to elect a successor in the event of the Chief Executive Officer’s sudden incapacity or departure.

Beyond leadership development, our board is continuously focused on culture and human capital management priorities for promoting a safe, inclusive and respectful work environment, where employees across our entire workforce feel empowered to speak on issues important to them, inspired to act ethically and with integrity, empowered to raise concerns and encouraged to implement new and innovative ideas in the best interests of the business.

Culture and Employee Engagement

The board is keenly interested in ensuring that the company maintains and promotes a culture that fosters the values, behaviors and attributes necessary to advance the company’s business strategy and purpose. The board receives regular updates on matters of employee culture and engagement.

Human Capital Management

The efficient production of high-quality products and successful execution of the Accelerate strategy requires a talented, skilled and engaged team of employees. The board receives regular updates on the development and progression of our senior leaders. More broadly, the board and the compensation and talent committee provide oversight on culture and human capital management topics, including diversity and inclusion, pay equity, and recruiting and development of critical talent. The compensation and talent committee further provides oversight of the company’s talent acquisition strategies and career development practices to ensure they are successfully supporting the company’s strategy and appropriately mitigating the risk of the loss or disengagement of critical talent.

Maintaining a safe and secure workplace for our employees is critical for our success. The board and the public responsibility committee oversee the company’s human safety program. The public responsibility committee receives regular updates from key business leaders on human safety matters at the company and in our supply chain to ensure appropriate oversight of health and safety matters across our entire value chain. The board and our senior leaders believe that respect for human rights is fundamental to our purpose of making food the world loves and to our commitment to ethical business conduct. | Beyond the Boardroom: Understanding Our Culture

To enhance the board’s understanding of the company’s work environment and culture, the board regularly conducts meetings and schedules visits at the company’s offices, food production facilities and innovation centers. The board also reviews critical feedback provided through regular employee engagement surveys and receives updates on management’s plans for addressing concerns or potential areas of improvement. |

| 28 | General Mills, Inc. |

Fostering a culture of inclusion and belonging strengthens our ability to recruit talent and allows our employees to thrive and succeed. We actively cultivate a culture that acknowledges, respects and values all dimensions of diversity – including gender, race, sexual orientation, ability, backgrounds and beliefs. The board receives regular updates on our diversity and inclusion initiatives and statistics and believes that diversity of input and perspectives is core to our business strategy. The compensation and talent committee oversees our strategies, practices and performance related to the support and advancement of workplace diversity, equity and inclusion and is committed to ensuring we are recruiting, retaining, developing and advancing a workforce that reflects the diversity of the consumers we serve. This commitment starts with our company leadership where women represent 38% of our officer population, and racially or ethnically diverse leaders represent 28% of our officers.

Fostering a culture of inclusion and belonging is strongly supported by the board and is embedded in our day-to-day ways of working through: Courageous Conversations, which bring the organization together to tackle difficult-to-address topics openly and candidly; an Allyship Framework, which supports our employees on their journey as allies with practical solutions for the workplace; Inclusion Contacts consisting of a library of topics used at the beginning of meetings to foster discussion, build empathy and increase understanding; and strong employee networks made available for our employee communities to have space to learn and grow.

We received numerous awards in fiscal 2024 recognizing our diversity and inclusion efforts. Listed below are a few of these recognitions, illustrating our commitment to standing for good.

|  |  |  |  |  | |||||

| Best Places to Work for LGBTQ+ Equality, Human Rights Campaign | Inclusion Index, Seramount | Disability Equality Index, Best Place to Work for Disability Inclusion | Best Companies for Multicultural Women, Seramount | Top Companies for Executive Women, Seramount | World’s Best Employers, Forbes |

| Notice of 2024 Annual Meeting of Shareholders | 29 |