1 Ally Financial Inc. Morgan Stanley Financials Conference June 15, 2016

2 Forward-Looking Statements and Additional Information The following should be read in conjunction with the financial statements, notes and other information contained in the Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. In the presentation that follows and related comments by Ally Financial Inc. (“Ally”) management, the use of the words “expect,” “anticipate,” “estimate,” “forecast,” “initiative,” “objective,” “plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “explore,” “positions,” “intend,” “evaluate,” “pursue,” “seek,” “may,” “would, ” “could, ” “should, ” “believe, ” “potential, ” “continue,” or the negative of these words, or similar expressions is intended to identify forward-looking statements. All statements herein and in related management comments, other than statements of historical fact, including without limitation, statements about future events and financial performance, are forward-looking statements that involve certain risks and uncertainties. While these statements represent our current judgment on what the future may hold, and we believe these judgments are reasonable, these statements are not guarantees of any events or financial results, and Ally’s actual results may differ materially due to numerous important factors that are described in the most recent reports on SEC Forms 10-K and 10-Q for Ally, each of which may be revised or supplemented in subsequent reports filed with the SEC. Such factors include, among others, the following: maintaining the mutually beneficial relationship between Ally and General Motors (“GM”), and Ally and Chrysler Group LLC (“Chrysler”); our ability to maintain relationships with automotive dealers; our ability to realize the anticipated benefits associated with being a financial holding company, and the significant regulation and restrictions that we are now subject to; the potential for deterioration in the residual value of off-lease vehicles; disruptions in the market in which we fund our operations, with resulting negative impact on our liquidity; changes in our accounting assumptions that may require or that result from changes in the accounting rules or their application, which could result in an impact on earnings; changes in the credit ratings of Ally, Chrysler, or GM; changes in economic conditions, currency exchange rates or political stability in the markets in which we operate; and changes in the existing or the adoption of new laws, regulations, policies or other activities of governments, agencies and similar organizations (including as a result of the Dodd-Frank Act and Basel III). Investors are cautioned not to place undue reliance on forward-looking statements. Ally undertakes no obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new information, future events or other such factors that affect the subject of these statements, except where expressly required by law. Certain non-GAAP measures are provided in this presentation which are important to the reader of the Consolidated Financial Statements but should be supplemental to primary U.S. GAAP measures. Reconciliation of non-GAAP financial measures included within this presentation are provided in this presentation. Use of the term “loans” describes products associated with direct and indirect lending activities of Ally’s operations. The specific products include retail installment sales contracts, lines of credit, leases or other financing products. The term “originate” refers to Ally’s purchase, acquisition or direct origination of various “loan” products.

3 Building the leading digital financial services company Approach to Banking Franchise • Brand that resonates with customers – Talk Straight, Do Right, Be Obviously Better – Best Online Bank by MONEY® Magazine • Leading Digital Interface – Simple, intuitive design integrated across channels – Expanding mobile capabilities • Superior Customer Experience – Digital conveniences with 24/7 human customer service – Drives strong retention rates • No Branches = Great Rates – Highly scalable and efficient – Competitive rates, low fees • Aligns with Strategic Priorities – Reinforce customer relationship to strengthen franchise – Reduce cost of funds and capital markets footprint

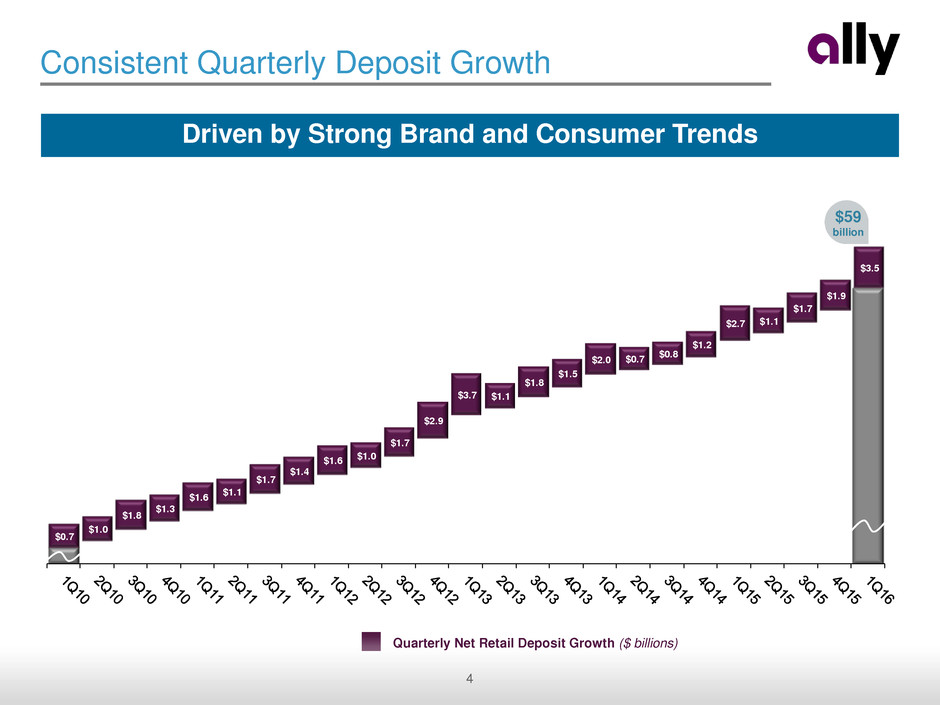

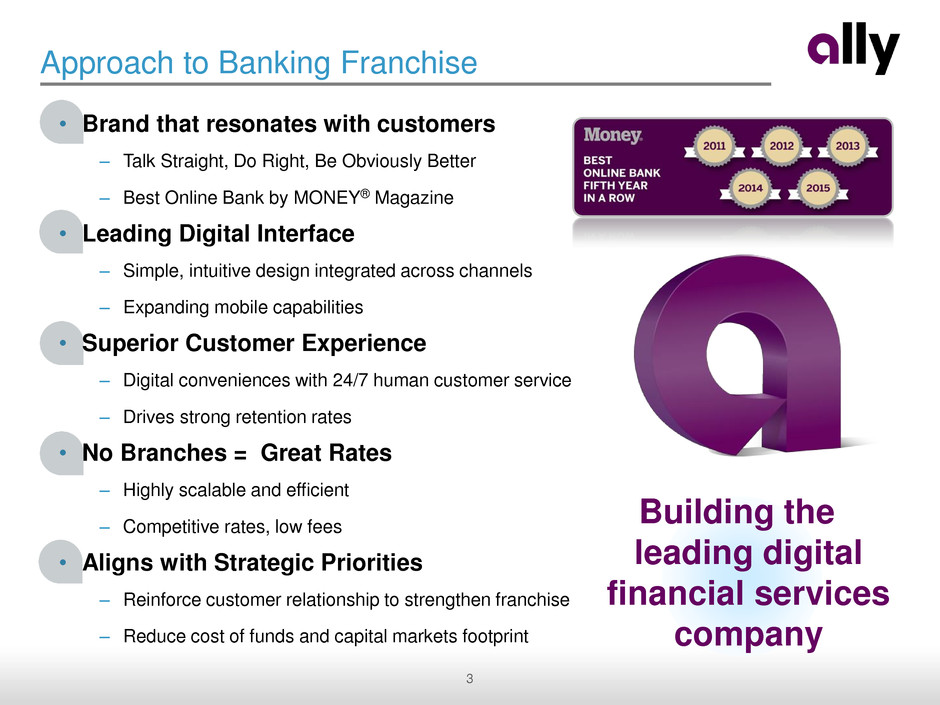

4 $59 billion Consistent Quarterly Deposit Growth Driven by Strong Brand and Consumer Trends Quarterly Net Retail Deposit Growth ($ billions) $0.7 $1.0 $1.8 $1.3 $1.6 $1.1 $1.7 $1.4 $1.6 $1.0 $1.7 $2.9 $3.7 $1.1 $1.8 $1.5 $2.0 $0.7 $0.8 $1.2 $2.7 $1.1 $1.7 $1.9 $3.5

5 1.1 million 20k 17k 26k 21k 32k 23k 28k 27k 27k 25k 29k 43k 69k 31k 32k 29k 42k 29k 31k 24k 45k 35k 37k 26k 53k Consistent Customer Growth 324 thousand Quarterly Net Customer Growth Ally Bank Deposit Customers Strong Foundation for Product Expansion Average growth of ~30k net customers per quarter

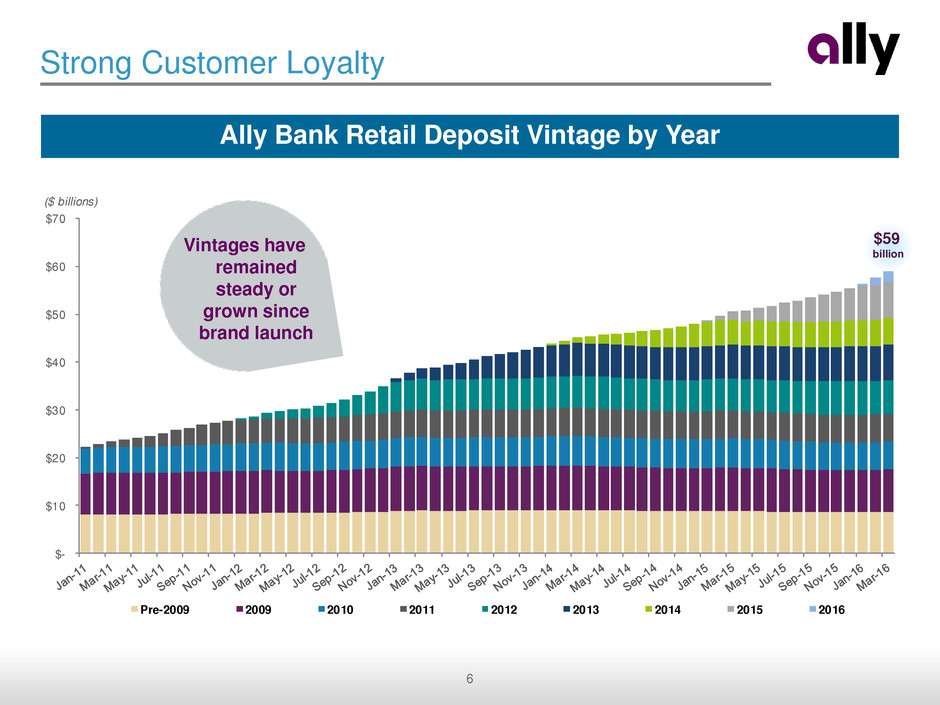

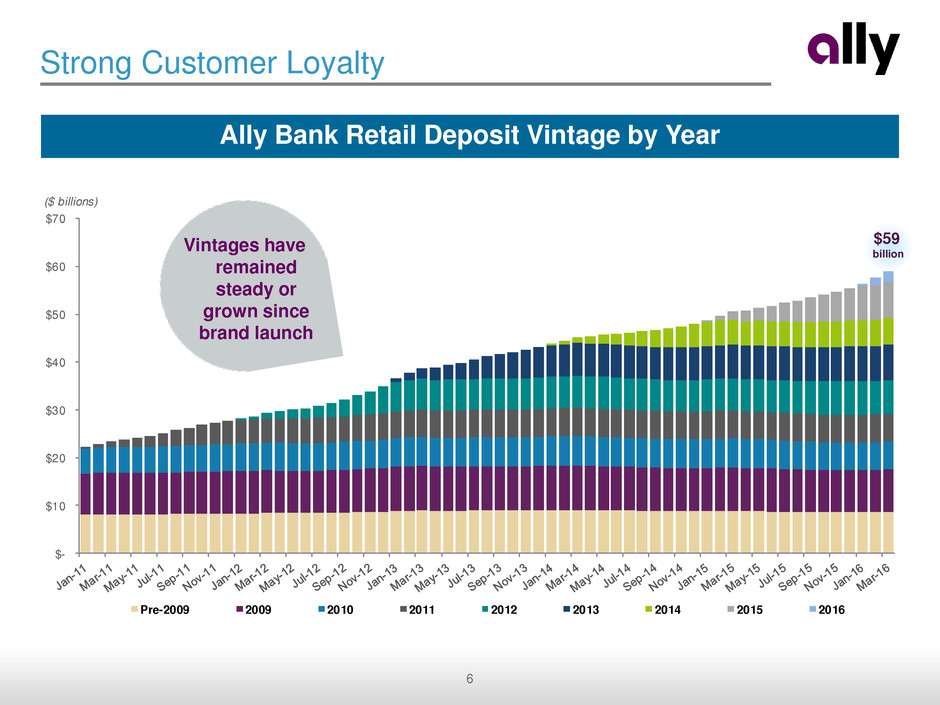

6 Strong Customer Loyalty Ally Bank Retail Deposit Vintage by Year $59 billion Vintages have remained steady or grown since brand launch ($ billions) $- $10 $20 $30 $40 $50 $60 $70 Pre-2009 2009 2010 2011 2012 2013 2014 2015 2016

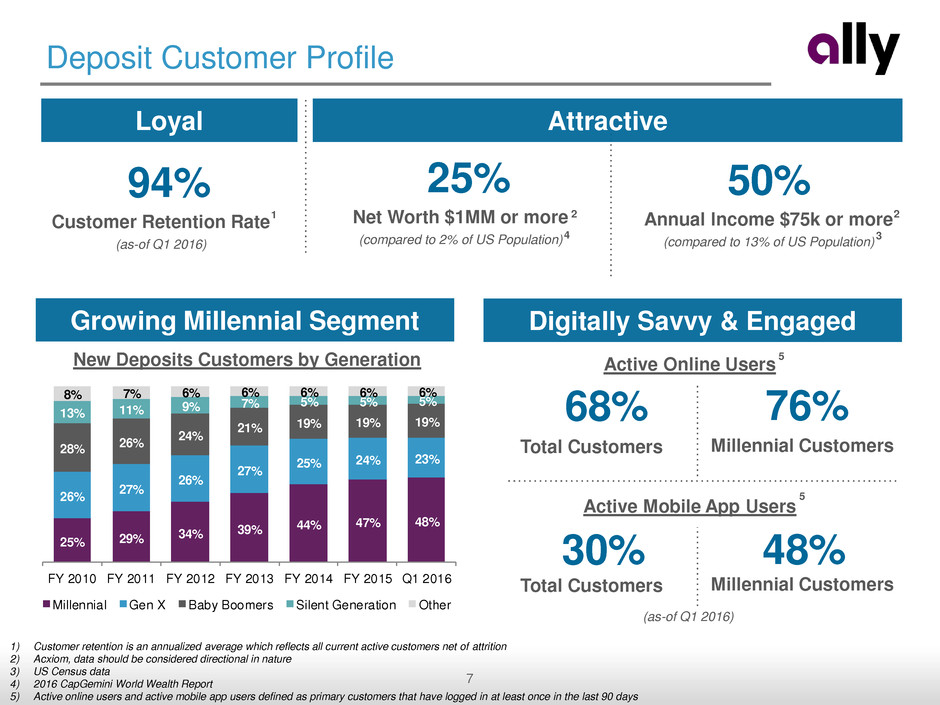

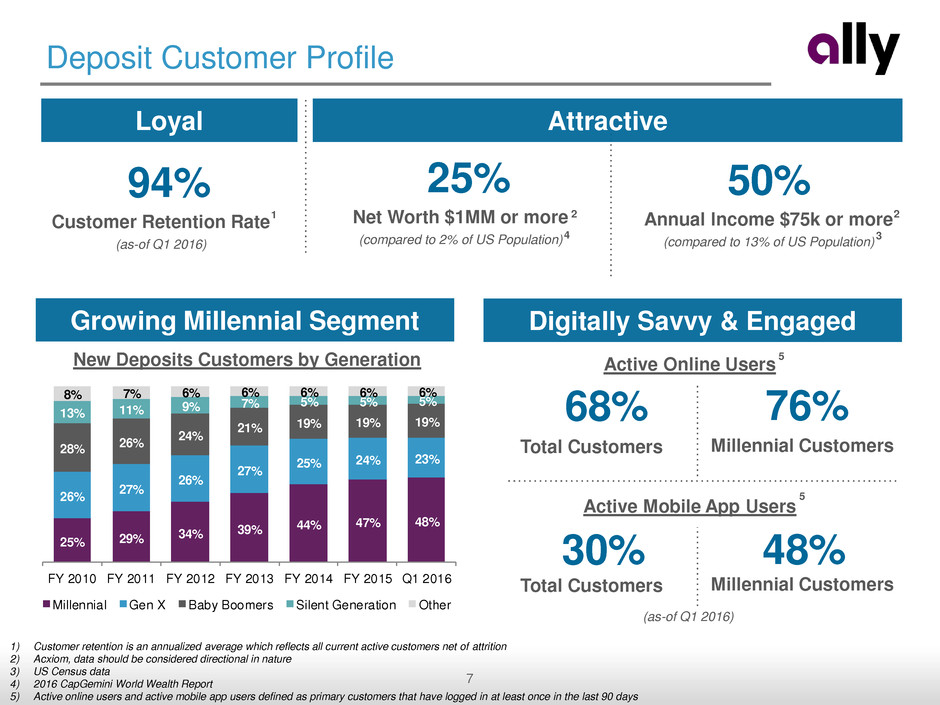

7 76% Deposit Customer Profile 94% Customer Retention Rate (as-of Q1 2016) New Deposits Customers by Generation 25% Net Worth $1MM or more (compared to 2% of US Population) 50% Annual Income $75k or more (compared to 13% of US Population) Loyal Attractive Growing Millennial Segment Digitally Savvy & Engaged 68% Total Customers 30% Active Mobile App Users 48% Millennial Customers Total Customers Millennial Customers Active Online Users (as-of Q1 2016) 2 2 3 4 1) Customer retention is an annualized average which reflects all current active customers net of attrition 2) Acxiom, data should be considered directional in nature 3) US Census data 4) 2016 CapGemini World Wealth Report 5) Active online users and active mobile app users defined as primary customers that have logged in at least once in the last 90 days 5 5 1 25% 29% 34% 39% 44% 47% 48% 26% 27% 26% 27% 25% 24% 23% 28% 26% 24% 21% 19% 19% 19% 13% 11% 9% 7% 5% 5% 5% 8% 7% 6% 6% 6% 6% 6% FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 Q1 2016 Millennial Gen X Baby Boomers Silent Generation Other

8 Strategic Benefits of Product Expansion Capitalize on secular trends in digital financial services − Customer demographics and preferences are on our side Improve shareholder returns − Optimize auto finance and grow higher ROE products Drive incremental growth − Within capital allocation and risk management framework Strengthen financial profile − Diversification, reinforce customer relationship and reduce capital markets funding

9 Credit Card Customer Opportunity Ally Bank’s most requested product 85% of existing Ally customers currently use credit cards1 67% affluent millennials using credit cards2 1 Drive Shareholder Value Deepen customer relationships Modest fee income with ability to expand over time 2 Appropriate Risk vs. Return Co-branded issuance Not on balance sheet (initially) Low capital, low risk 3 1) Ally Bank Consumer Forum, Credit Card Study, 2015 2) 2015 U.S. Affluent Millennial Research Survey

10 Direct-to-Consumer Mortgage Customer Opportunity $8-10 trillion consumer mortgage market opportunity >30% home buyers are millennials1 90% of Ally customers are Prime credit (FICO > 640) 1 Drive Shareholder Value Expect $2-3 billion of incremental annual originations, with potential upside Conforming mortgages to be sold to GSEs High-quality, prime jumbos retained on balance sheet 2 Appropriate Risk vs. Return Outsourcing fulfillment and servicing No MSR Only prime jumbo loans retained 3 1) NAR Generational Survey: Millennials Lead All Buyers, Most Likely to Use Real Estate Agent, March 11, 2015

11 Customer Opportunity Natural extension of deposits business from self-directed customer base Online wealth management currently ~25% of the market and growing rapidly1 Significant opportunity to capture $30 trillion intergenerational wealth transfer over next few decades2 Drive Shareholder Value Expect significant customer growth under Ally umbrella Meaningful profit opportunity through brokerage fees, management fees and funding synergies Seasoned management team 2 Appropriate Risk vs. Return Incremental deposits reduce capital markets funding Introduces a significant fee income stream (not dependent on the balance sheet) 3 Online Brokerage and Digital Wealth Management 1 1) 2015 Cerulli and Associates data 2) Morganstanley.com – The $30 Trillion Challenge, Apr. 2015

12 Summary Ally has built a unique, modern banking franchise with a customer-centric focus − Highly loyal customer base − Digital − Branchless – scalable, efficient and no geographic constraints Building the leading digital financial services company Ally is positioned to continue to benefit from secular shifts in consumer preferences − Demonstrated by successful, consistent deposit growth − New products will follow this blueprint Product expansion aligns with strategic priorities − Improve shareholder returns − Drive thoughtful long-term growth − Diversify and strengthen financial profile