- ALLY Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEFA14A Filing

Ally Financial (ALLY) DEFA14AAdditional proxy soliciting materials

Filed: 24 Apr 23, 5:29pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☒ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 |

Ally Financial Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

April 24, 2023

| RE: | Supplemental Disclosure in Response to Proxy Advisory Firm Recommendations |

Dear Ally Stockholders:

At the Ally 2023 Annual Meeting of Stockholders to be held on May 3, 2023, you are being asked to vote, on an advisory, non-binding basis, on a resolution to approve the compensation paid to our NEOs as disclosed in our 2023 proxy statement. Please see Proposal 2 (Say-on-Pay). We want to provide further context and detail on our compensation program and philosophy and hope that you consider the following information before you vote your shares. We recommend that stockholders vote “FOR” Proposal 2.

Compensation Philosophy and Stockholder Alignment

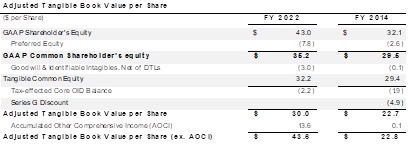

As further detailed in our proxy statement, our executive compensation philosophy is grounded in the core principle of long-term growth for the benefit of our stockholders. Our compensation program is designed to drive long-term value creation, and we believe that our program has been successful in supporting Ally’s trajectory since our 2014 IPO, including an improved return profile, disciplined capital allocation, and strong execution on other elements of our strategic plan such as customer growth and asset diversification and optimization. Please see Exhibit A to this letter for more detail.

We have historically received strong support for our compensation program from both stockholders and proxy advisory groups, with approximately 93% of shares voting at last year’s annual meeting having voted in favor of the compensation paid to our NEOs.

Our approach to incentive compensation for 2022 and its disclosure generally in the 2023 proxy statement are the same as prior years. Nevertheless, this year, proxy advisory groups have expressed concerns based on the non-formulaic approach used by our Compensation, Nominating, and Governance Committee (the “CNGC”) to determine incentive compensation. The feedback was based on their perception of a misalignment between performance (including relative TSR) and compensation. This resulted primarily from our relatively lower stock price at the end of 2022, which was primarily due to market concerns about consumer credit and specifically within the automotive-finance industry.

Of note, our relative TSR has since rebounded, and if we were to conduct the same analysis as of today, our relative TSR performance would have been above the median of each peer group used by the proxy advisory groups. Please see Exhibit B to this letter for more detail.

Determination of Incentive Compensation

In awarding incentive compensation, the CNGC considers overall performance and results by reviewing both a balanced scorecard and individual results against pre-established goals and objectives as further described in our proxy statement. Following a determination of NEO’s total amount of incentive compensation, the amount is allocated among a pre-determined mix of long-term equity-based incentive awards and the short-term cash incentive award. The long-term awards are granted in the form of PSUs that vest following a three-year performance period (earned based on objective financial metrics) and RSUs that vest over three years.

1

Common Market Practice in Financial Services: Consistent with common practice among many peers, our incentive-compensation approach does not use formulas but rather considers both absolute and relative achievement of overall goals and objectives, with a focus on long-term performance, risk management, and strategic and operational execution. This non-formulaic structure discourages excessive risk taking and accounts for the dynamics of the constantly evolving macro and business environment. We believe that our balanced scorecard approach drives performance in a manner that prioritizes safety and soundness and appropriately manages risk, which is essential to long-term value creation for the stockholders of a highly regulated financial institution like Ally.

Considerations of the Economic and Regulatory Environment: As a people-driven business, our long-term growth is dependent on our ability to attract and retain a core leadership team that has the experience and expertise necessary to navigate challenging business and economic environments while at the same time meeting the supervisory expectations of banking agencies and other governmental authorities. To that end, the CNGC, with the assistance of its compensation consultant, annually reviews compensation data of our peer group and industry competitors with which we compete for talent.

Oversight by Leaders with Significant Financial Services Background: The CNGC members are highly seasoned, experienced, and reputable leaders with decades-long experience in the financial services industry. The CNGC has a track record of exercising sound judgment in line with creating stockholder value in its evaluation of performance and allocation of rewards, including short-term incentives, using the balanced scorecard.

Notably, for 2022, the CNGC approved a decrease in incentive compensation for our CEO by 13% from 2021, which lowered reported summary compensation table pay by 7% in a year when many of our peers reported higher year-over-year compensation. Collectively, for 2022, our NEOs experienced a decrease of 10% in incentive compensation compared to 2021.

2022 CNGC Decision-Making Process

The unprecedented combination of inflation and monetary-policy response uniquely impacted Ally in 2022 given our concentration of consumer assets and a liability-sensitive balance sheet. Financial results were impacted by the pace and magnitude of interest-rate increases, which drove higher funding costs and reduced the market value of our securities portfolio impacting book value per share.

Nevertheless, each of our businesses and functions continued to make meaningful contributions through the execution of our strategic priorities and a focus toward generating long-term value for our stockholders.

2

| · | Core operational metrics reflect years of steady execution driving long-term growth, evidenced by strong auto originations, deposits growth and primary customer growth. |

| · | Despite the headwinds, we demonstrated our “Do It Right” approach, and continued to deliver results for our customers, employees and communities. |

| o | We maintained industry-leading 96% retail-deposit customer retention rates. |

| o | Our employees are our competitive advantage; our employee engagement reached an all-time high—retaining top decile scores—and we received multiple workplace and industry awards, including being recognized as one of the 100 Best Companies to Work For in 2023 by Fortune. |

| o | In 2022 our CEO was named Banker of the Year by American Banker. |

| o | We continued to make an impact in the communities in which we live and work through volunteerism and grants, including $18 million in total charitable giving. |

Despite economic and market challenges in 2022, prudent risk management, multi-factor decision making and a long-term view allowed Ally to continue achieving operational successes while also generating record net interest margin and total revenue. These actions also contributed to our resiliency during the first quarter of 2023, when the banking sector experienced significant turbulence in the wake of the failures of Silicon Valley Bank and Signature Bank. The value of our execution on strategic objectives has been evident, with core-funding through sticky and stable retail deposits as well as strong levels of liquidity and capital. And even though cautious actions since the beginning of 2022 around risk management and capital allocation (such as tightened underwriting and a pause in share repurchases) may pressure near-term earnings, we are positioned for meaningful earnings expansion longer-term.

To conclude, we thank you for your long-term investment and continued support of Ally and the trust you have placed in our leadership team, the CNGC and the Board of Directors. We ask for your continued support by voting “FOR” Proposal 2 (Say-on-Pay).

Sincerely,

/s/ Kim Fennebresque

Kim Fennebresque

Chairman, Compensation, Nominating and Governance Committee

3

Exhibit A

4

5

Exhibit B

6