Preliminary

Preliminary

2008 Fourth Quarter and Full-Year Results

February 3, 2009

9:00 AM EST

Contact GMAC Investor Relations at (866) 710-4623 or investor.relations@gmacfs.com

Forward-Looking Statements In the presentation that follows and related comments by GMAC LLC (“GMAC”) management, the use of the words “expect,”

Forward-Looking Statements In the presentation that follows and related comments by GMAC LLC (“GMAC”) management, the use of the words “expect,”

“anticipate,” “estimate,” “forecast,” “initiative,” “objective,” “plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “intend,”

“evaluate,” “pursue,” “seek,” “may,” “would,” “could,” “should,” “believe,” “potential,” “continue,” or similar expressions is intended

to identify forward-looking statements. All statements herein and in related management comments, other than statements of

historical fact, including without limitation, statements about future events and financial performance, are forward-looking

statements that involve certain risks and uncertainties. While these statements represent our current judgment on what the future

may hold, and we believe these judgments are reasonable, these statements are not guarantees of any events or financial

results, and GMAC’s and Residential Capital, LLC’s (“ResCap”) actual results may differ materially due to numerous important

factors that are described in the most recent reports on SEC Forms 10-K and 10-Q for GMAC and ResCap, each of which may

be revised or supplemented in subsequent reports on SEC Forms 10-Q and 8-K. Such factors include, among others, the

following: securing low cost funding for GMAC and ResCap and maintaining the mutually beneficial relationship between GMAC

and General Motors Corporation (“GM”); our ability to maintain an appropriate level of debt; the profitability and financial condition

of GM; our ability to realize the anticipated benefits associated with our recent conversion to a bank holding company, and the

increased regulation and restrictions that we will be subject to; uncertainty concerning our ability to access additional federal

liquidity programs; recent developments in the residential mortgage and capital markets; continued deterioration in the residual

value of off-lease vehicles; the continuing negative impact on ResCap of the decline in the U.S. housing market; changes in U.S.

government-sponsored mortgage programs or disruptions in the markets in which our mortgage subsidiaries operate; disruptions

in the market in which we fund GMAC’s and ResCap’s operations, with resulting negative impact on our liquidity; changes in our

accounting assumptions that may require or that result from changes in the accounting rules or their application, which could

result in an impact on earnings; changes in the credit ratings of ResCap, GMAC or GM; changes in economic conditions,

currency exchange rates or political stability in the markets in which we operate; and changes in the existing or the adoption of

new laws, regulations, policies or other activities of governments, agencies and similar organizations. Investors are cautioned

not to place undue reliance on forward-looking statements. GMAC undertakes no obligation to update publicly or otherwise

revise any forward-looking statements except where expressly required by law. A reconciliation of certain non-GAAP financial

measures included within this presentation is provided in the supplemental charts. Use of the term “loans” describes products associated with direct and indirect lending activities of GMAC’s global operations.

The specific products include retail installment sales contracts, loans, lines of credit, leases or other financing products. The term

“originate” refers to GMAC’s purchase, acquisition or direct origination of various “loan” products. 2

Table of Contents GMAC Page 4 Global Auto Finance Page 7 Insurance Page 11 ResCap Page 13 Global Capital and Liquidity Page 21 GMAC General Items Page 25 Conclusion Page 28 Supplemental Page 29 3

Table of Contents GMAC Page 4 Global Auto Finance Page 7 Insurance Page 11 ResCap Page 13 Global Capital and Liquidity Page 21 GMAC General Items Page 25 Conclusion Page 28 Supplemental Page 29 3

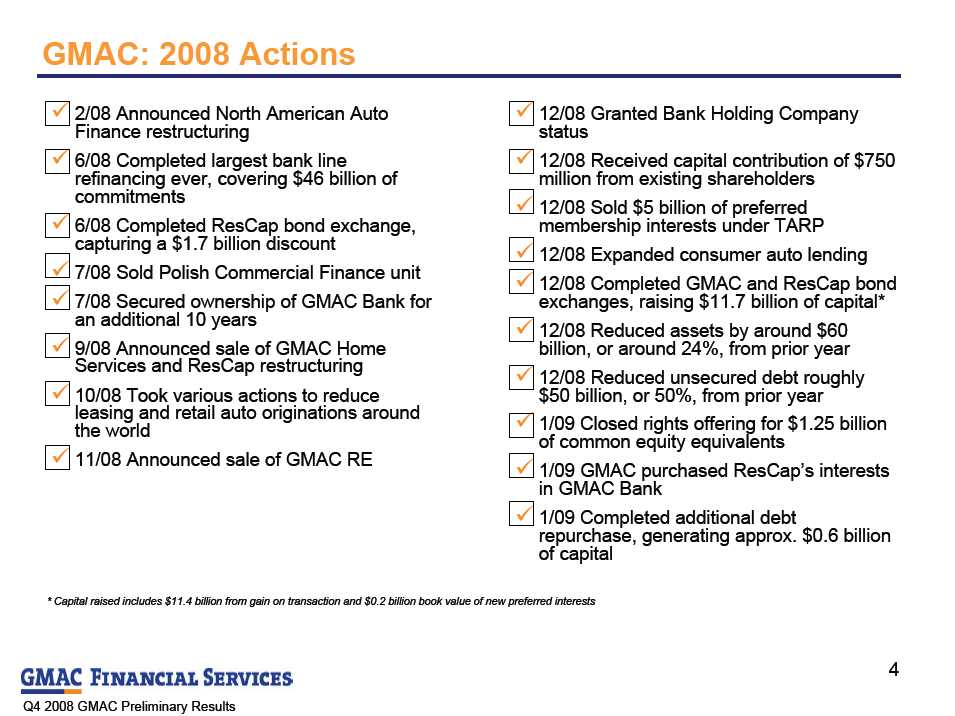

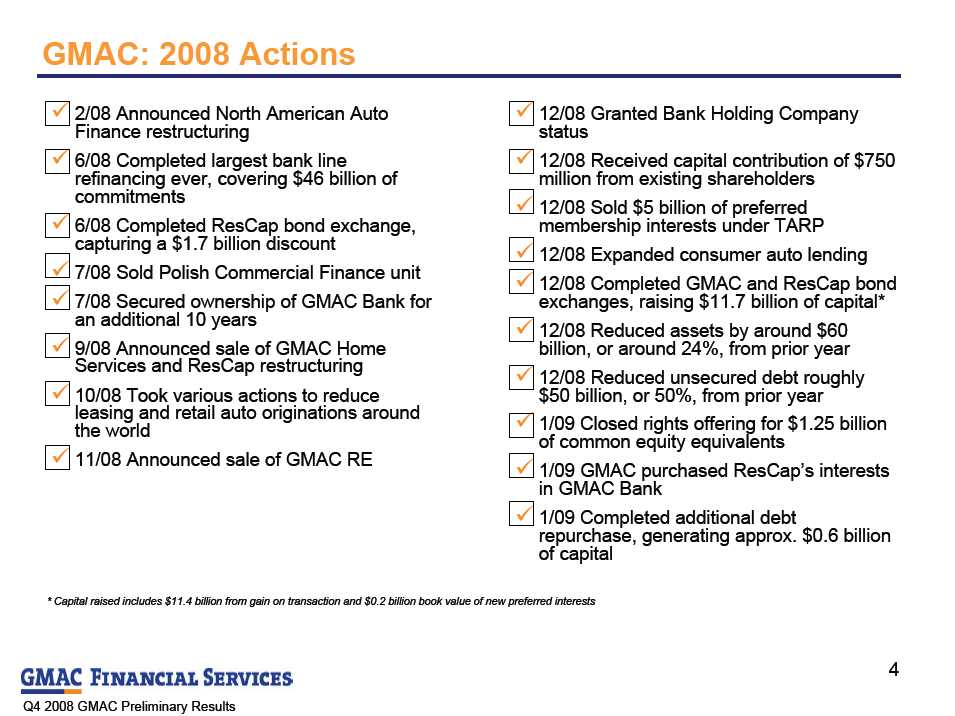

GMAC: 2008 Actions 2/08 Announced North American Auto

GMAC: 2008 Actions 2/08 Announced North American Auto

Finance restructuring 6/08 Completed largest bank line

refinancing ever, covering $46 billion of

commitments 6/08 Completed ResCap bond exchange,

capturing a $1.7 billion discount 7/08 Sold Polish Commercial Finance unit 7/08 Secured ownership of GMAC Bank for

an additional 10 years 9/08 Announced sale of GMAC Home

Services and ResCap restructuring 10/08 Took various actions to reduce

leasing and retail auto originations around

the world 11/08 Announced sale of GMAC RE 12/08 Granted Bank Holding Company

status 12/08 Received capital contribution of $750

million from existing shareholders 12/08 Sold $5 billion of preferred

membership interests under TARP 12/08 Expanded consumer auto lending 12/08 Completed GMAC and ResCap bond

exchanges, raising $11.7 billion of capital* 12/08 Reduced assets by around $60

billion, or around 24%, from prior year 12/08 Reduced unsecured debt roughly

$50 billion, or 50%, from prior year 1/09 Closed rights offering for $1.25 billion

of common equity equivalents 1/09 GMAC purchased ResCap’s interests

in GMAC Bank 1/09 Completed additional debt

repurchase, generating approx. $0.6 billion

of capital * Capital raised includes $11.4 billion from gain on transaction and $0.2 billion book value of new preferred interests 4

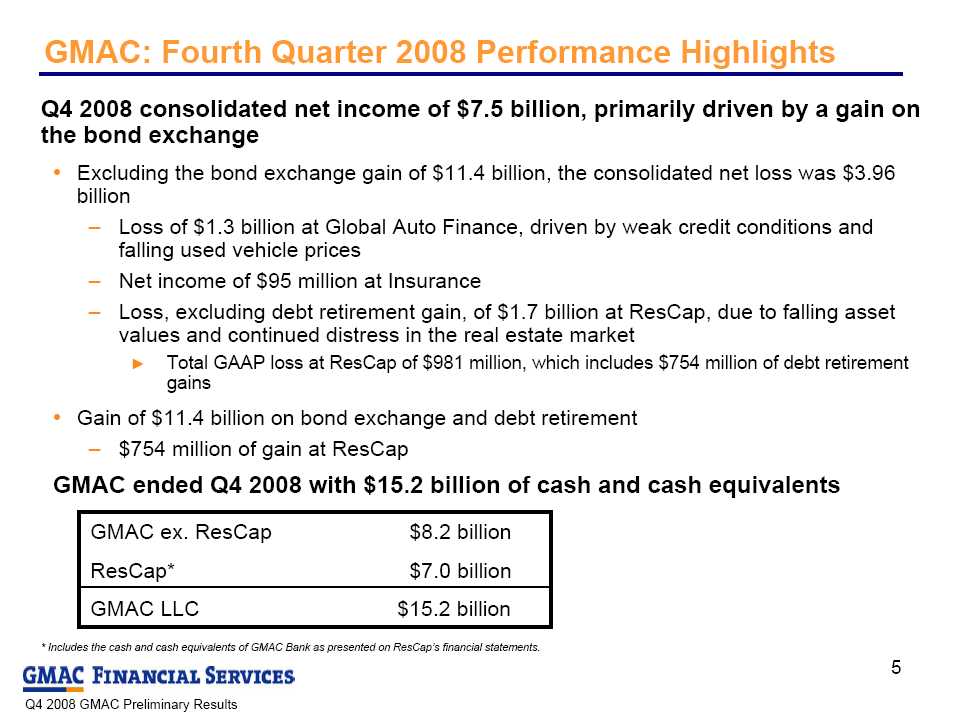

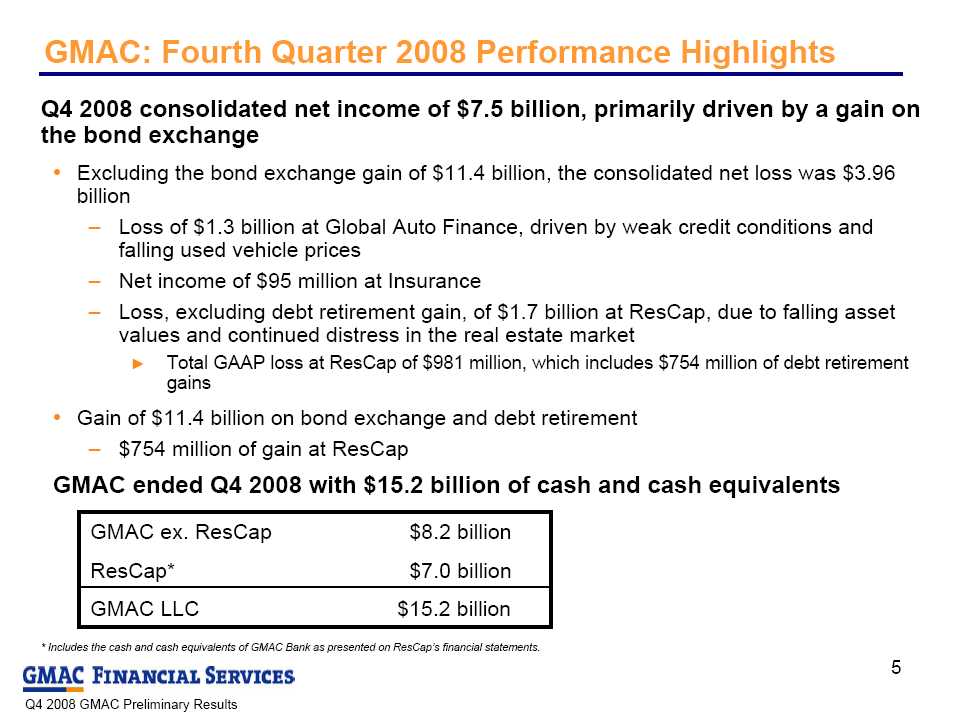

GMAC: Fourth Quarter 2008 Performance Highlights Q4 2008 consolidated net income of $7.5 billion, primarily driven by a gain on

GMAC: Fourth Quarter 2008 Performance Highlights Q4 2008 consolidated net income of $7.5 billion, primarily driven by a gain on

the bond exchange Excluding the bond exchange gain of $11.4 billion, the consolidated net loss was $3.96

billion Loss of $1.3 billion at Global Auto Finance, driven by weak credit conditions and

falling used vehicle prices Net income of $95 million at Insurance Loss, excluding debt retirement gain, of $1.7 billion at ResCap, due to falling asset

values and continued distress in the real estate market Total GAAP loss at ResCap of $981 million, which includes $754 million of debt retirement

gains Gain of $11.4 billion on bond exchange and debt retirement $754 million of gain at ResCap GMAC ended Q4 2008 with $15.2 billion of cash and cash equivalents GMAC ex. ResCap $8.2 billion ResCap* $7.0 billion GMAC LLC $15.2 billion * Includes the cash and cash equivalents of GMAC Bank as presented on ResCap’s financial statements. 5

GMAC: Net Income by Segment Net Income by Segment * ResCap total GAAP net income was $981 million, including $754 million debt retirement gains. ** Other segment includes Commercial Finance, equity investments and other corporate activities. Other had total GAAP net income of $9.66 billion, including $10.66 billion of

GMAC: Net Income by Segment Net Income by Segment * ResCap total GAAP net income was $981 million, including $754 million debt retirement gains. ** Other segment includes Commercial Finance, equity investments and other corporate activities. Other had total GAAP net income of $9.66 billion, including $10.66 billion of

bond exchange gain. ($ millions) Q4 '08 Q4 '07 North America ($1,202) $40 International (111) 97 Global Automotive Finance (1,313) 137 Insurance 95 68 ResCap excluding Debt Retirement* (1,735) (1,441) Other excluding Bond Exchange** (1,005) (50) Gain on Bond Exchange and Debt Retirement 11,420 562 Consolidated net income (loss) $7,462 ($724) 6

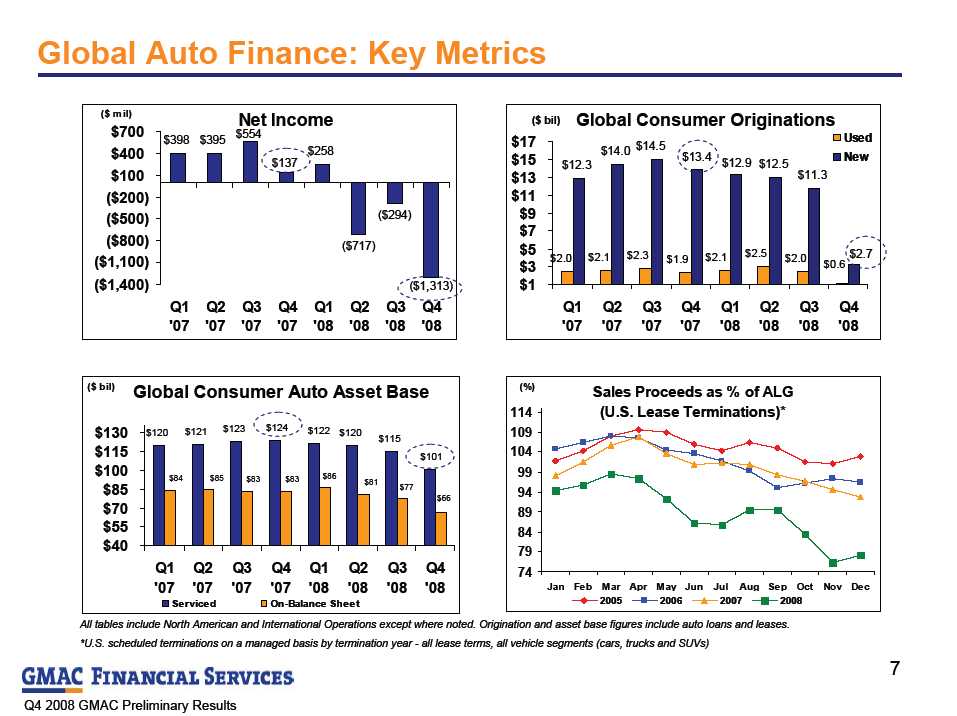

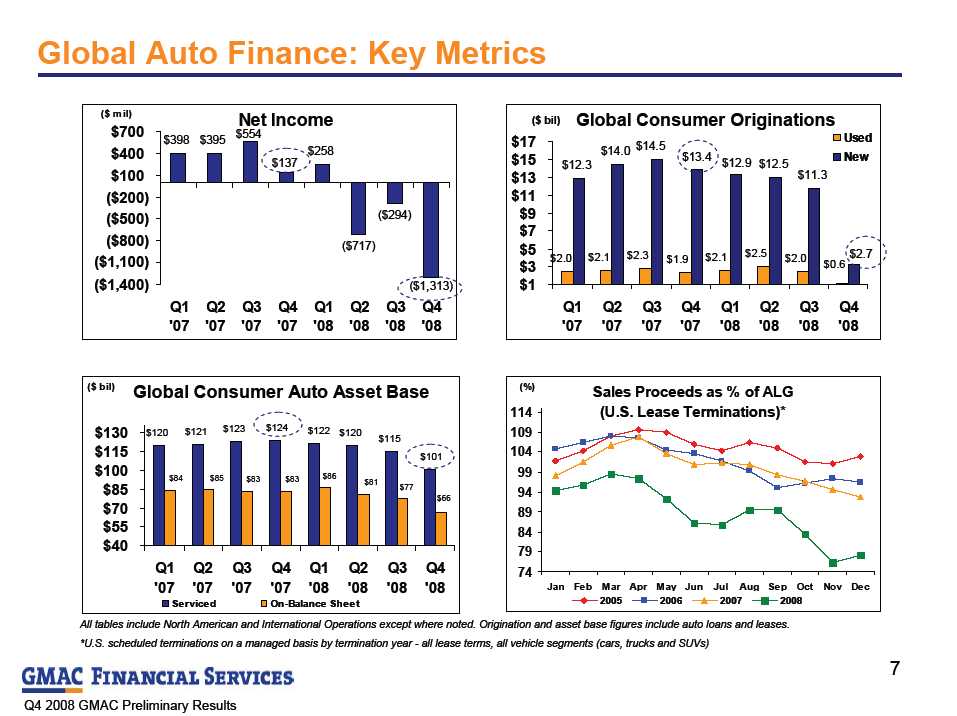

Global Auto Finance: Key Metrics ($ bil) All tables include North American and International Operations except where noted. Origination and asset base figures include auto loans and leases. *U.S. scheduled terminations on a managed basis by termination year - all lease terms, all vehicle segments (cars, trucks and SUVs) Net Income $398 $395 $258 ($717) ($294) ($1,313) $137 $554 ($1,400) ($1,100) ($800) ($500) ($200) $100 $400 $700 Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 ($ mil) Global Consumer Originations $12.3 $14.0 $12.5 $11.3 $2.0 $2.1 $2.3 $1.9 $2.1 $2.5 $0.6 $2.0 $2.7 $12.9 $14.5 $13.4 $1 $3 $5 $7 $9 $11 $13 $15 $17 Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 Used New Global Consumer Auto Asset Base $120 $121 $123 $120 $115 $122 $124 $101 $84 $85 $83 $83 $86 $81 $77 $66 $40 $55 $70 $85 $100 $115 $130 Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 Serviced On-Balance Sheet ($ bil) Sales Proceeds as % of ALG (U.S. Lease Terminations)* 74 79 84 89 94 99 104 109 114 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2005 2006 2007 2008 (%) 7

Global Auto Finance: Key Metrics ($ bil) All tables include North American and International Operations except where noted. Origination and asset base figures include auto loans and leases. *U.S. scheduled terminations on a managed basis by termination year - all lease terms, all vehicle segments (cars, trucks and SUVs) Net Income $398 $395 $258 ($717) ($294) ($1,313) $137 $554 ($1,400) ($1,100) ($800) ($500) ($200) $100 $400 $700 Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 ($ mil) Global Consumer Originations $12.3 $14.0 $12.5 $11.3 $2.0 $2.1 $2.3 $1.9 $2.1 $2.5 $0.6 $2.0 $2.7 $12.9 $14.5 $13.4 $1 $3 $5 $7 $9 $11 $13 $15 $17 Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 Used New Global Consumer Auto Asset Base $120 $121 $123 $120 $115 $122 $124 $101 $84 $85 $83 $83 $86 $81 $77 $66 $40 $55 $70 $85 $100 $115 $130 Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 Serviced On-Balance Sheet ($ bil) Sales Proceeds as % of ALG (U.S. Lease Terminations)* 74 79 84 89 94 99 104 109 114 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2005 2006 2007 2008 (%) 7

Global Auto Finance: Condensed Income Statement Notable Items (Pre-Tax) ($ millions) Q4 2008 Q4 2007 Revenue Total financing revenue $3,303 $3,804 Interest expense 2,276 2,314 Depreciation expense on operating leases 1,273 1,383 Impairment of investment in operating leases 425 - Net financing (loss) revenue (671) 107 Other revenue Servicing fees 71 89 Gain on automotive loans, net 169 165 Gain on extinguishment of debt 4 - Investment (loss) income (114) 116 Other income 592 743 Total other revenue 722 1,113 Total net revenue 51 1,220 Provision for credit losses 510 188 Noninterest expense 957 789 (Loss) income before income tax (benefit) expense (1,416) 243 Income tax (benefit) expense (103) 106 Net (loss) income ($1,313) $137 ($ millions) Q4 2008 Q4 2007 Impairment charges on operating leases ($425) - Valuation adjustment auto HFS (LOCOM) and retained interests ($249) - Credit loss provision for retail balloon contract residuals ($162) - 8

Global Auto Finance: Condensed Income Statement Notable Items (Pre-Tax) ($ millions) Q4 2008 Q4 2007 Revenue Total financing revenue $3,303 $3,804 Interest expense 2,276 2,314 Depreciation expense on operating leases 1,273 1,383 Impairment of investment in operating leases 425 - Net financing (loss) revenue (671) 107 Other revenue Servicing fees 71 89 Gain on automotive loans, net 169 165 Gain on extinguishment of debt 4 - Investment (loss) income (114) 116 Other income 592 743 Total other revenue 722 1,113 Total net revenue 51 1,220 Provision for credit losses 510 188 Noninterest expense 957 789 (Loss) income before income tax (benefit) expense (1,416) 243 Income tax (benefit) expense (103) 106 Net (loss) income ($1,313) $137 ($ millions) Q4 2008 Q4 2007 Impairment charges on operating leases ($425) - Valuation adjustment auto HFS (LOCOM) and retained interests ($249) - Credit loss provision for retail balloon contract residuals ($162) - 8

Global Auto Finance: Consumer Auto Loss Trends Net Retail Losses (% Avg Assets) Q4 2008 2.51% 0.85% 0.70% 1.49% 2.10% Q4 2007 1.31% -0.01% 0.47% 1.20% 1.05% Year over Year Change +120bps +86bps +23bp +29bps +105bps North Asia Latin

Global Auto Finance: Consumer Auto Loss Trends Net Retail Losses (% Avg Assets) Q4 2008 2.51% 0.85% 0.70% 1.49% 2.10% Q4 2007 1.31% -0.01% 0.47% 1.20% 1.05% Year over Year Change +120bps +86bps +23bp +29bps +105bps North Asia Latin

America EuropePacific America Global Losses are up significantly due to: Higher frequency in Europe and North

America Increased severity, especially in North

America Frequency is up, driven by economic

weakness and the seasoning of the portfolio The asset base is shrinking, pushing loss

ratios up 1.40% 1.34% 1.05% 0.92% 1.01% 1.55% 1.13% 2.10% 0.8% 1.0% 1.2% 1.4% 1.6% 1.8% 2.0% 2.2% Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 Global Annualized Credit Losses as % of Managed Retail Contracts 9

Global Auto Finance: Auto Delinquency Trends Loans > 30 Days Past Due Q4 2008 3.18% 1.52% 1.74% 4.06% 2.96% Q4 2007 2.77% 1.36% 1.90% 4.08% 2.68% Year over Year Change +41bps +16bps -16bps -2bps +28bps North Asia Latin

Global Auto Finance: Auto Delinquency Trends Loans > 30 Days Past Due Q4 2008 3.18% 1.52% 1.74% 4.06% 2.96% Q4 2007 2.77% 1.36% 1.90% 4.08% 2.68% Year over Year Change +41bps +16bps -16bps -2bps +28bps North Asia Latin

AmericaEuropePacific America Global Delinquency has historically been highly

correlated to the unemployment rate, which is

what we are seeing in North America Economic weakness, particularly in Spain,

has caused European credit performance to

deteriorate Overall delinquency rates are up due to

shrinking portfolios in North America and

Europe 2.42% 2.62% 2.52% 2.30% 2.46% 2.63% 2.96% 2.68% 2.2% 2.4% 2.6% 2.8% 3.0% 3.2% Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 Global Delinquencies as % of Average Managed Retail Contracts (Greater than 30 Days Past Due) 10

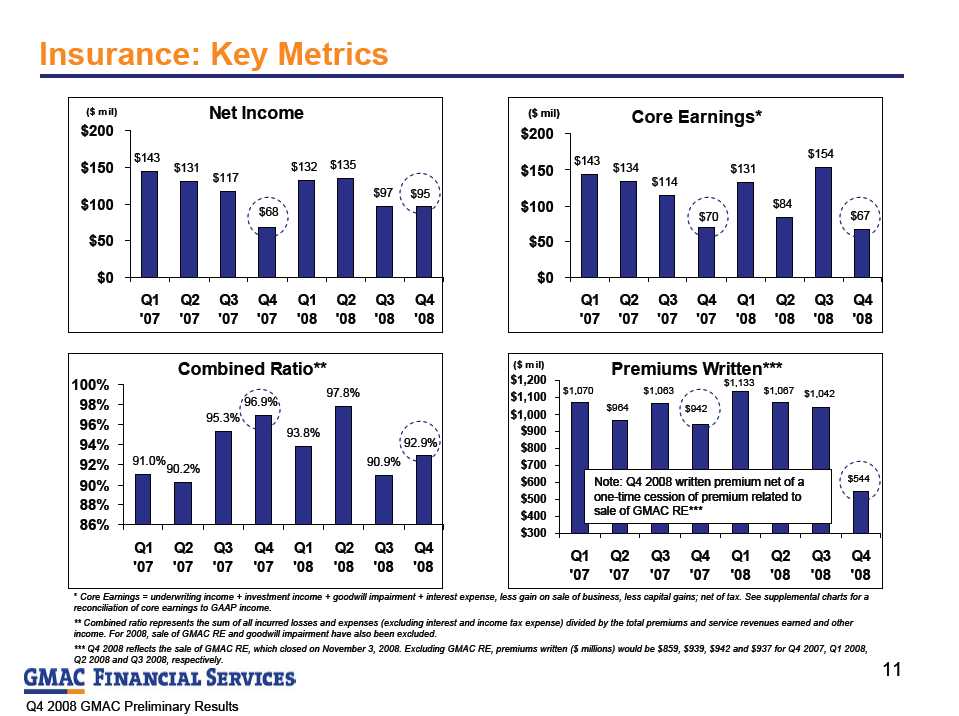

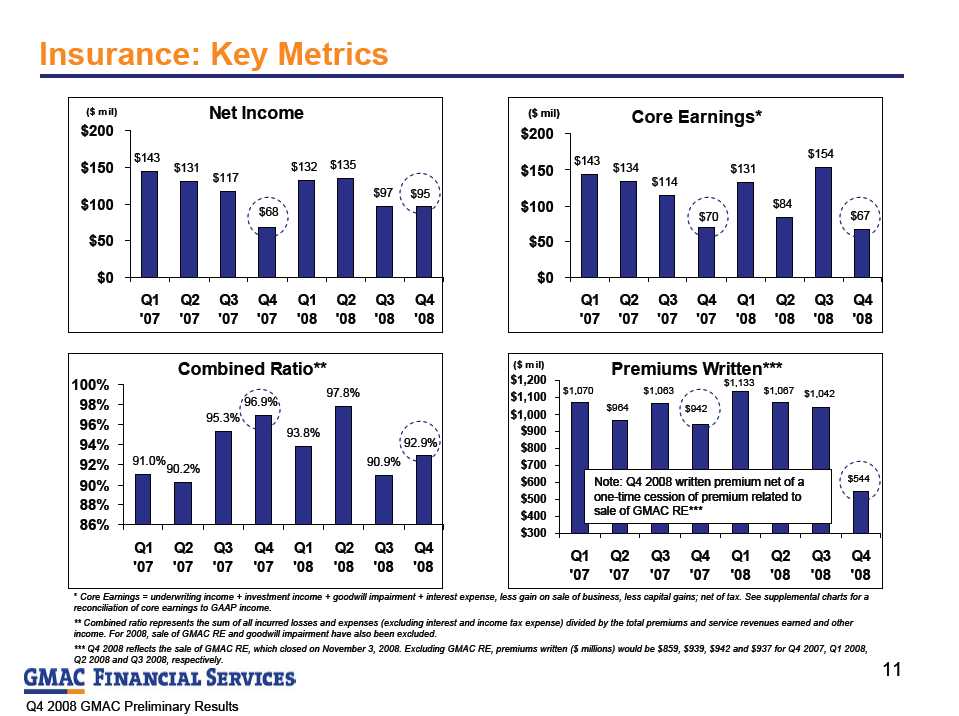

Insurance: Key Metrics ($ mil) * Core Earnings = underwriting income + investment income + goodwill impairment + interest expense, less gain on sale of business, less capital gains; net of tax. See supplemental charts for a

Insurance: Key Metrics ($ mil) * Core Earnings = underwriting income + investment income + goodwill impairment + interest expense, less gain on sale of business, less capital gains; net of tax. See supplemental charts for a

reconciliation of core earnings to GAAP income. ** Combined ratio represents the sum of all incurred losses and expenses (excluding interest and income tax expense) divided by the total premiums and service revenues earned and other

income. For 2008, sale of GMAC RE and goodwill impairment have also been excluded. *** Q4 2008 reflects the sale of GMAC RE, which closed on November 3, 2008. Excluding GMAC RE, premiums written ($ millions) would be $859, $939, $942 and $937 for Q4 2007, Q1 2008,

Q2 2008 and Q3 2008, respectively. Note: Q4 2008 written premium net of a

one-time cession of premium related to

sale of GMAC RE*** Net Income $143 $131 $117 $132 $135 $97 $95 $68 $0 $50 $100 $150 $200 Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 ($ mil) Core Earnings* $143 $134 $114 $131 $84 $154 $67 $70 $0 $50 $100 $150 $200 Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 Combined Ratio** 90.2% 95.3% 93.8% 97.8% 90.9% 92.9% 96.9% 91.0% 86% 88% 90% 92% 94% 96% 98% 100% Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 Premiums Written*** $1,070 $964 $1,063 $1,067 $544 $1,133 $942 $1,042 $300 $400 $500 $600 $700 $800 $900 $1,000 $1,100 $1,200 Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 ($ mil) 11

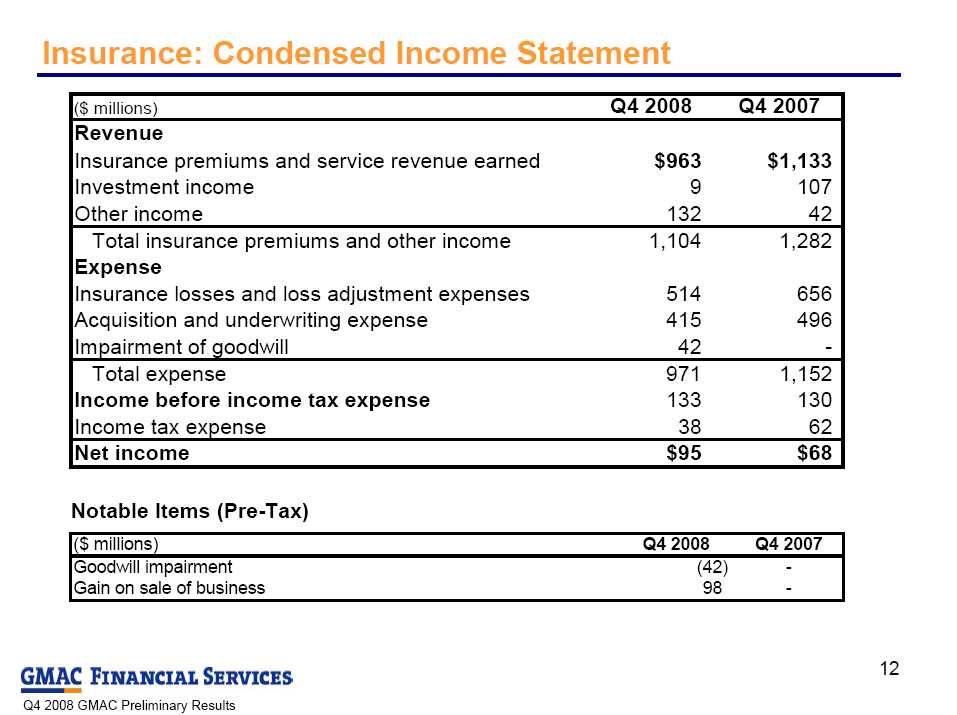

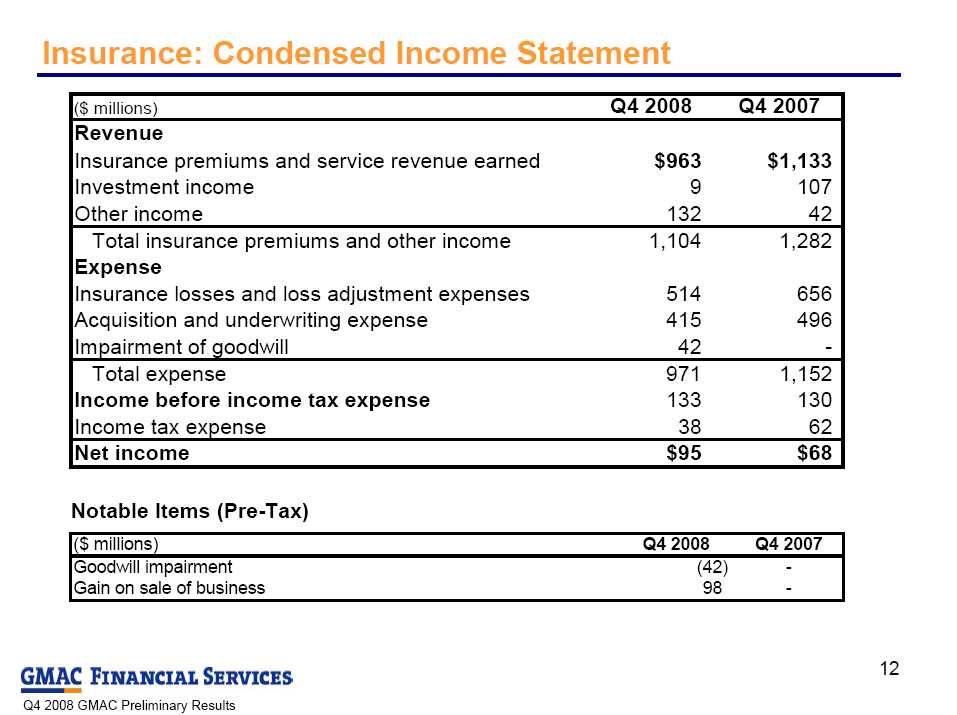

Insurance: Condensed Income Statement Notable Items (Pre-Tax) ($ millions) Q4 2008 Q4 2007 Revenue Insurance premiums and service revenue earned $963 $1,133 Investment income 9 107 Other income 132 42 Total insurance premiums and other income 1,104 1,282 Expense Insurance losses and loss adjustment expenses 514 656 Acquisition and underwriting expense 415 496 Impairment of goodwill 42 - Total expense 971 1,152 Income before income tax expense 133 130 Income tax expense 38 62 Net income $95 $68 ($ millions) Q4 2008 Q4 2007 Goodwill impairment (42) - Gain on sale of business 98 - 12

Insurance: Condensed Income Statement Notable Items (Pre-Tax) ($ millions) Q4 2008 Q4 2007 Revenue Insurance premiums and service revenue earned $963 $1,133 Investment income 9 107 Other income 132 42 Total insurance premiums and other income 1,104 1,282 Expense Insurance losses and loss adjustment expenses 514 656 Acquisition and underwriting expense 415 496 Impairment of goodwill 42 - Total expense 971 1,152 Income before income tax expense 133 130 Income tax expense 38 62 Net income $95 $68 ($ millions) Q4 2008 Q4 2007 Goodwill impairment (42) - Gain on sale of business 98 - 12

ResCap: Key Messages Operating and market environments Execution of strategic initiatives continues to reduce the balance sheet and

ResCap: Key Messages Operating and market environments Execution of strategic initiatives continues to reduce the balance sheet and

lower operating costs; however, weak real estate market conditions persist Credit-related costs remain at elevated levels Cost of funding is very high Significant portion of assets are in run-off; poor market for disposition of

non-conforming assets Capital and liquidity needs continue Remained compliant with key covenants Ongoing evaluation of plans to address capital and liquidity needs GMAC holds significant portions of ResCap debt from bond exchange Core origination and servicing business provides diversification for GMAC ResCap continues to rely on GMAC support 13

ResCap: Key Metrics 2 1 Q4 ’08 includes $754 million after-tax gain on extinguishment of debt. 2 Total assets include the assets of auto division of GMAC Bank as presented on ResCap’s financial statements. 3 Government and Prime Second Liens are included in Prime Non-conforming. 3 Of the total, $4.2 billion was securitized on-balance

ResCap: Key Metrics 2 1 Q4 ’08 includes $754 million after-tax gain on extinguishment of debt. 2 Total assets include the assets of auto division of GMAC Bank as presented on ResCap’s financial statements. 3 Government and Prime Second Liens are included in Prime Non-conforming. 3 Of the total, $4.2 billion was securitized on-balance

sheet at 12/31/08, with no economic exposure. 3 ResCap Net Income 1 ($981) ($1,912) ($1,860) ($859) ($910) ($254) ($2,261) ($921) ($2,400) ($1,400) ($400) $600 Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 ($ mil) ResCap Total Assets 2 $131 $126 $116 $89 $81 $73 $67 $58 $0 $50 $100 $150 Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 ($ bil) Primary Servicing - Period End $453 $461 $466 $453 $460 $437 $394 $426 $0 $200 $400 $600 Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 Prime Conforming Prime Non-conforming Nonprime ($ bil) ResCap Loan Production $9 $12 $18 $21 $21 $29 $35 $38 $0 $20 $40 $60 Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 Prime Conforming Prime Non-conforming Nonprime ($ bil) 14

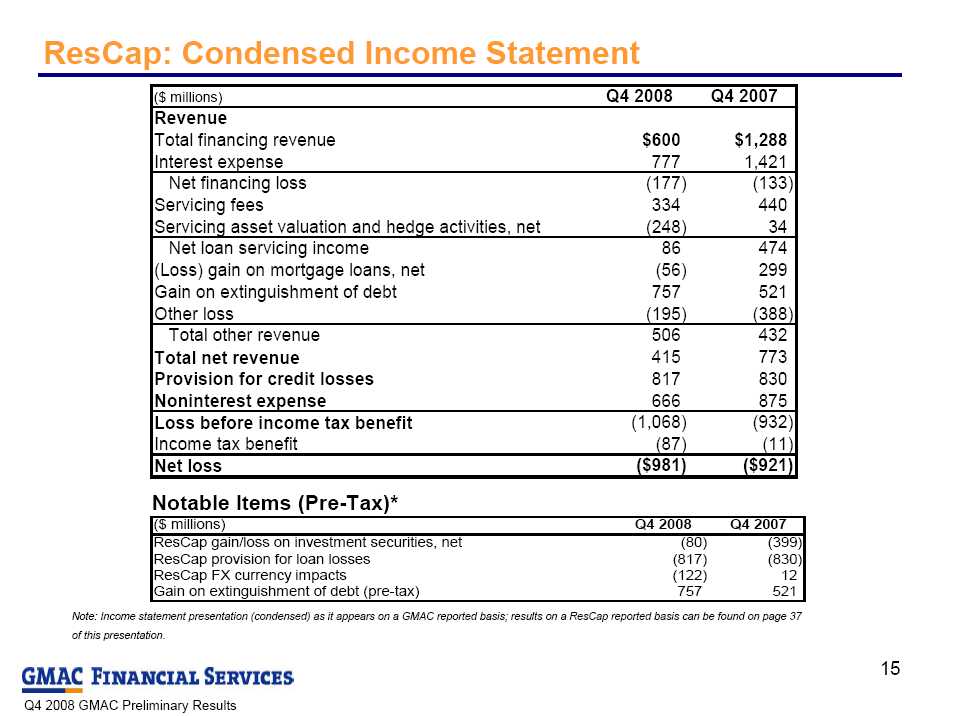

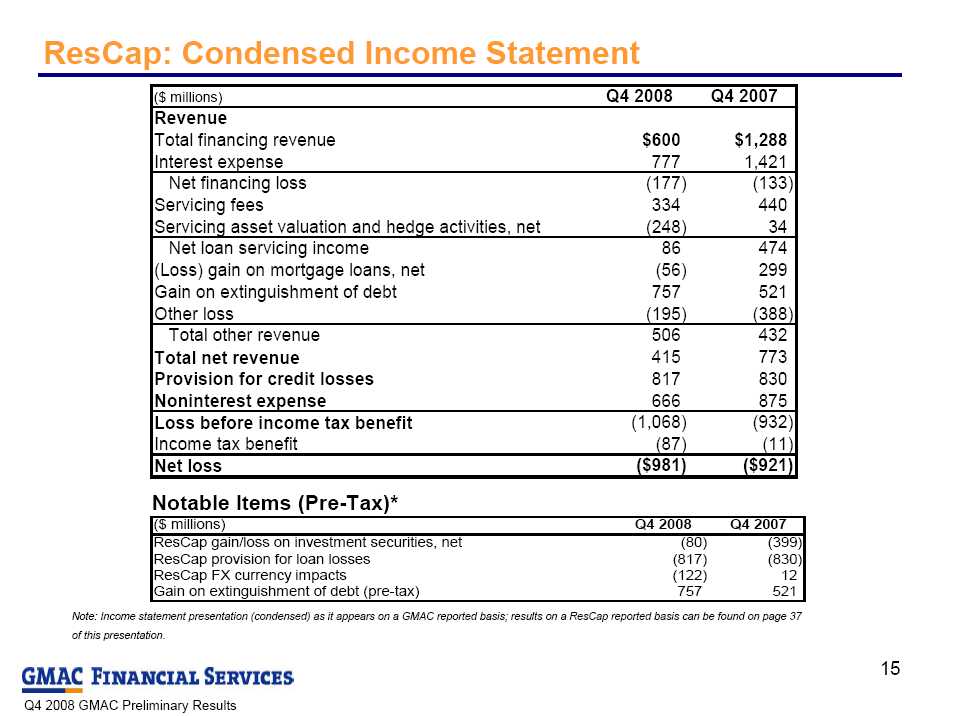

ResCap: Condensed Income Statement Note: Income statement presentation (condensed) as it appears on a GMAC reported basis; results on a ResCap reported basis can be found on page 37 of this presentation. Notable Items (Pre-Tax)* ($ millions) Q4 2008 Q4 2007 Revenue Total financing revenue $600 $1,288 Interest expense 777 1,421 Net financing loss (177) (133) Servicing fees 334 440 Servicing asset valuation and hedge activities, net (248) 34 Net loan servicing income 86 474 (Loss) gain on mortgage loans, net (56) 299 Gain on extinguishment of debt 757 521 Other loss (195) (388) Total other revenue 506 432 Total net revenue 415 773 Provision for credit losses 817 830 Noninterest expense 666 875 Loss before income tax benefit (1,068) (932) Income tax benefit (87) (11) Net loss ($981) ($921) ($ millions) Q4 2008 Q4 2007 ResCap gain/loss on investment securities, net (80) (399) ResCap provision for loan losses (817) (830) ResCap FX currency impacts (122) 12 Gain on extinguishment of debt (pre-tax) 757 521 15

ResCap: Condensed Income Statement Note: Income statement presentation (condensed) as it appears on a GMAC reported basis; results on a ResCap reported basis can be found on page 37 of this presentation. Notable Items (Pre-Tax)* ($ millions) Q4 2008 Q4 2007 Revenue Total financing revenue $600 $1,288 Interest expense 777 1,421 Net financing loss (177) (133) Servicing fees 334 440 Servicing asset valuation and hedge activities, net (248) 34 Net loan servicing income 86 474 (Loss) gain on mortgage loans, net (56) 299 Gain on extinguishment of debt 757 521 Other loss (195) (388) Total other revenue 506 432 Total net revenue 415 773 Provision for credit losses 817 830 Noninterest expense 666 875 Loss before income tax benefit (1,068) (932) Income tax benefit (87) (11) Net loss ($981) ($921) ($ millions) Q4 2008 Q4 2007 ResCap gain/loss on investment securities, net (80) (399) ResCap provision for loan losses (817) (830) ResCap FX currency impacts (122) 12 Gain on extinguishment of debt (pre-tax) 757 521 15

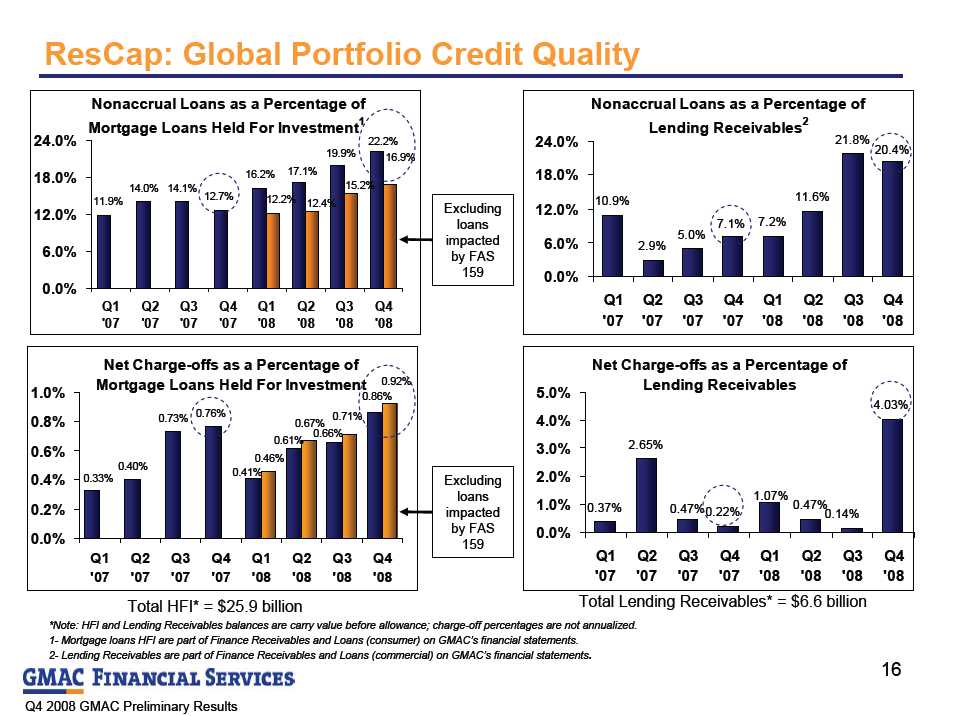

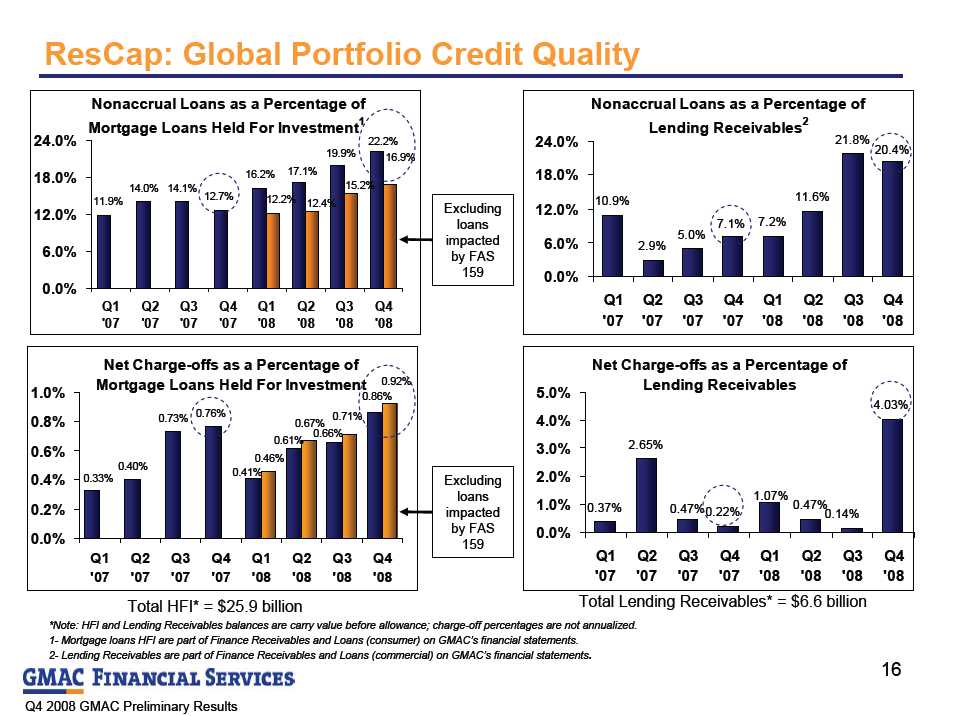

ResCap: Global Portfolio Credit Quality Excluding

ResCap: Global Portfolio Credit Quality Excluding

loans

impacted

by FAS

159 Excluding

loans

impacted

by FAS

159 Total HFI* = $25.9 billion Total Lending Receivables* = $6.6 billion *Note: HFI and Lending Receivables balances are carry value before allowance; charge-off percentages are not annualized. 1- Mortgage loans HFI are part of Finance Receivables and Loans (consumer) on GMAC’s financial statements. 2- Lending Receivables are part of Finance Receivables and Loans (commercial) on GMAC’s financial statements. Nonaccrual Loans as a Percentage of Mortgage Loans Held For Investment 1 14.0% 14.1% 16.2% 12.7% 17.1% 19.9% 22.2% 11.9% 12.2% 12.4% 15.2% 16.9% 0.0% 6.0% 12.0% 18.0% 24.0% Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 Nonaccrual Loans as a Percentage of Lending Receivables 2 10.9% 2.9% 5.0% 7.2% 11.6% 21.8% 20.4% 7.1% 0.0% 6.0% 12.0% 18.0% 24.0% Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 Net Charge-offs as a Percentage of Mortgage Loans Held For Investment 0.40% 0.73% 0.41% 0.76% 0.61% 0.66% 0.33% 0.86% 0.46% 0.67% 0.71% 0.92% 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 Net Charge-offs as a Percentage of Lending Receivables 0.37% 2.65% 0.47% 4.03% 0.14% 0.47% 0.22% 1.07% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 16

ResCap: Capital and Liquidity Total equity of $2.2 billion (12/31/08) ResCap received equity infusions of $1.67 billion from GMAC during Q4 2008, including $690

ResCap: Capital and Liquidity Total equity of $2.2 billion (12/31/08) ResCap received equity infusions of $1.67 billion from GMAC during Q4 2008, including $690

million of GMAC MSR debt forgiveness and the contribution of $976 million of ResCap bonds (face

value plus accrued interest) that resulted in a gain on the extinguishment of debt of $757* million Tangible net worth, without GMAC Bank, as required by certain bank facility covenants, was $350

million vs. $250 million covenant requirement** ResCap was also compliant with its minimum cash covenants at quarter end If ResCap were to need additional support, GMAC would provide that support so long as it was in

the best interests of GMAC stakeholders. While there can be no assurances, GMAC's recently

approved status as a regulated bank holding company has increased the importance of its support

for ResCap. Global ResCap cash and cash equivalents of $7.0 billion (12/31/08) ResCap cash and cash equivalents increased $98 million compared to Q3 2008 Of the total, $5.5 billion was held at GMAC Bank*** * Represents a before-tax number. ** For this purpose, consolidated tangible net worth is defined as the company’s consolidated equity, excluding intangible assets and any equity in GMAC Bank to the

extent included in the Company’s consolidated balance sheet. *** GMAC Bank Cash & Cash Equivalents as presented on GMAC Bank’s GAAP financial statements. 1 These figures include the auto division of GMAC Bank, as presented on ResCap’s financial statements. ($ billions) Q4 2008 Q3 2008 Q2 2008 Q1 2008 Q4 2007 Q3 2007 Q2 2007 Q1 2007 Cash and cash equivalents 1 $7.0 $6.9 $6.6 $4.2 $4.4 $6.5 $3.7 $2.6 Common equity $2.2 $2.3 $4.1 $5.7 $6.0 $6.2 $7.5 $7.2 17

GMAC Bank: IB Finance Transaction On January 30, GMAC acquired 100% of ResCap’s non-voting equity interest in IB

GMAC Bank: IB Finance Transaction On January 30, GMAC acquired 100% of ResCap’s non-voting equity interest in IB

Finance Holdings, the parent company of GMAC Bank Prior to the transaction, IB Finance was jointly owned by GMAC and ResCap (GMAC held 100% of

outstanding voting interests, and ResCap held non-voting equity interests) but consolidated with

ResCap for stand-alone reporting purposes At 12/31/08, ResCap stand-alone financial statements included $33 billion in assets associated

with IB Finance and a $1.9 billion minority interest associated with GMAC ownership in the entity Transaction Mechanics GMAC converted its $806 million of preferred interests in ResCap into $806 million of preferred

interests in IB Finance consistent with the terms of the Exchange Agreement entered into on

March 31, 2008 $830 million of ResCap debt was forgiven by GMAC in exchange for 100% of ResCap’s

remaining non-voting equity interest in IB Finance (“Class M Common Units”) ResCap has the right to market the Class M Common Units on similar terms and conditions to

third parties for a period of 60 days following the closing, and will receive any upside should a

third party buyer be identified All business arrangements between ResCap and GMAC Bank will remain in place at closing As a result of this, all voting and economic interests in IB Finance are now owned directly by GMAC IB Finance will no longer consolidate with ResCap for stand-alone reporting purposes GMAC segment reporting is unaffected by this transaction 18

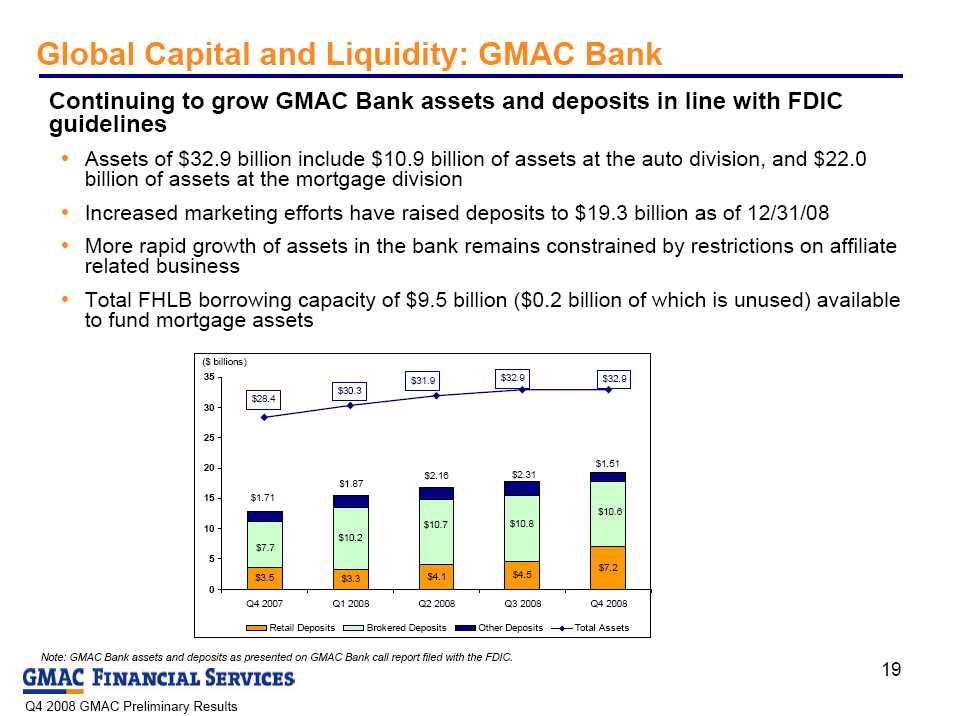

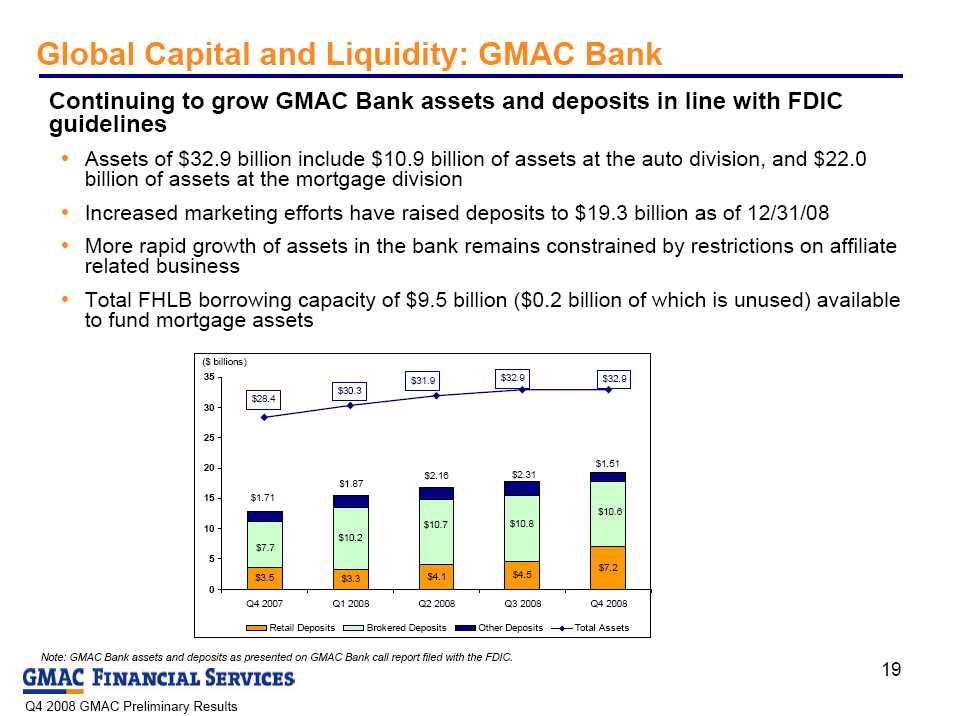

Global Capital and Liquidity: GMAC Bank Continuing to grow GMAC Bank assets and deposits in line with FDIC

Global Capital and Liquidity: GMAC Bank Continuing to grow GMAC Bank assets and deposits in line with FDIC

guidelines Assets of $32.9 billion include $10.9 billion of assets at the auto division, and $22.0

billion of assets at the mortgage division Increased marketing efforts have raised deposits to $19.3 billion as of 12/31/08 More rapid growth of assets in the bank remains constrained by restrictions on affiliate

related business Total FHLB borrowing capacity of $9.5 billion ($0.2 billion of which is unused) available

to fund mortgage assets Note: GMAC Bank assets and deposits as presented on GMAC Bank call report filed with the FDIC. $3.5 $3.3 $4.1 $4.5 $7.2 $7.7 $10.6 $10.8 $10.7 $10.2 $1.71 $1.87 $2.16 $2.31 $1.51 $28.4 $30.3 $31.9 $32.9 $32.9 0 5 10 15 20 25 30 35 Q4 2007 Q1 2008 Q2 2008 Q3 2008 Q4 2008 Retail Deposits Brokered Deposits Other Deposits Total Assets ($ billions) 19

GMAC Bank: Regulatory Restrictions for Auto Assets Banking regulations limit GMAC Bank’s ability to fund the majority of

GMAC Bank: Regulatory Restrictions for Auto Assets Banking regulations limit GMAC Bank’s ability to fund the majority of

GMAC’s U.S. auto assets Certain transactions with affiliates are extremely limited, without an exemption Currently, GM is considered an affiliate of GMAC Bank GMAC Bank can not fund the following unless regulators provide an

exemption: Dealer inventory finance for new GM vehicles, as long as GM is

considered an affiliate Consumer leasing Retail auto loans on vehicles for which GMAC provides the dealer

financing While these restrictions limit our ability to grow GMAC Bank assets, the

Bank remains a key funding source 20

Global Capital and Liquidity: Cash Roll Forward GMAC ResCap GMAC ($ billions) Consolidated Consolidated Bank Cash & Cash Equivalents (9/30/08) $13.5 $6.9 $4.9 Debt Maturities (5.5) (0.3) 0.0 Q4 Wholesale Securitization Maturities (0.7) 0.0 0.0 Asset RunOff net of On-Balance Sheet Securitizations 7.5 0.0 (0.2) Intercompany Secured Loans 0.0 (0.7) 0.0 Other* 0.4 1.1 0.7 Cash & Cash Equivalents (12/31/08) $15.2 $7.0 $5.5 Net Q4 Change in Cash & Cash Equivalents $1.7 $0.1 $0.6 * Includes receipt of $5.0 billion in TARP funds and cash tender payment of $2.5 billion for debt exchange Note: Numbers may not foot due to rounding 21

Global Capital and Liquidity: Cash Roll Forward GMAC ResCap GMAC ($ billions) Consolidated Consolidated Bank Cash & Cash Equivalents (9/30/08) $13.5 $6.9 $4.9 Debt Maturities (5.5) (0.3) 0.0 Q4 Wholesale Securitization Maturities (0.7) 0.0 0.0 Asset RunOff net of On-Balance Sheet Securitizations 7.5 0.0 (0.2) Intercompany Secured Loans 0.0 (0.7) 0.0 Other* 0.4 1.1 0.7 Cash & Cash Equivalents (12/31/08) $15.2 $7.0 $5.5 Net Q4 Change in Cash & Cash Equivalents $1.7 $0.1 $0.6 * Includes receipt of $5.0 billion in TARP funds and cash tender payment of $2.5 billion for debt exchange Note: Numbers may not foot due to rounding 21

Global Capital and Liquidity: Capital Base The bond exchange increased equity capital by $3.7 billion from principal reduction, cash tender and

Global Capital and Liquidity: Capital Base The bond exchange increased equity capital by $3.7 billion from principal reduction, cash tender and

issuance of other securities, $0.2 billion from converting principal to preferred stock and $7.7 billion from

recording the debt and preferred at fair market value GMAC now has four classes of preferred stock including preferred interests held by GM, two series of

interests held by the U.S. Treasury and interests issued in the bond exchanges ($ billions) Preferred Interests Common Interests Total Equity Total Equity at 9/30/08 $1.05 $8.19 $9.24 Q4 Net Loss Excluding Bond Exchange and Debt Retirement* (3.96) (3.96) Bond Exchange and Debt Retirement Gain* 11.42 11.42 Preferred Interests Issued During Bond Exchange 0.23 0.23 US Treasury TARP Investment 5.00 5.00 Common Equity Issued in Exchange for GM/Cerberus Contribution of Participation in ResCap $3.5 Bn Secured Facility 0.75 0.75 Accumulated Other Comprehensive Income (0.81) (0.81) Total Equity at 12/31/08 $6.28 $15.59 $21.85 Memo: Additional Debt Repurchase Completed 1/05/09 (est) 0.60 0.60 Rights Offering Completed 1/16/09 1.25 1.25 Proforma Total Capital** $6.28 $17.44 $23.70 Note: Numbers may not foot due to rounding. * Q4 total GAAP income was $7.5 billion, consisting of $11.4 billion bond exchange gain and $3.96 million of other losses ** 12/31/2008 capital plus impact of rights offering and debt repurchase; does not include any impact from January 2009 operating performance. 22

Global Capital and Liquidity: Capital Ratios

Global Capital and Liquidity: Capital Ratios

Capital ratios * The ratio of Tangible Equity/Tangible Assets excludes Intangibles of $1.4 billion (12/31/08), $1.5 billion (9/30/08) and $1.6 billion (12/31/07) from Total Equity and Total

Assets. ** Under a revolving credit facility, we are subject to a leverage ratio covenant under which adjusted consolidated debt should not exceed 11 times adjusted consolidated

net worth. Details on this calculation can be found on slide 33. 12/31/08 09/30/08 12/31/07 Total Equity / Total Assets 11.5% 4.4% 6.3% Tangible Equity / Tangible Assets* 10.9% 3.7% 5.7% Bank Agreement Leverage Ratio** 2.8x 10.0x N/A 23

Global Capital and Liquidity: Term Debt Maturity Profile Debt exchange did not significantly change GMAC’s overall maturity profile Unsecured and secured term maturities in 2009 are $30.5 billion, down only $2.0 billion

Global Capital and Liquidity: Term Debt Maturity Profile Debt exchange did not significantly change GMAC’s overall maturity profile Unsecured and secured term maturities in 2009 are $30.5 billion, down only $2.0 billion

from pre-exchange levels *Note: Pre-exchange maturities as of 9/30/2008 and post-exchange maturities as of 12/31/2008 reflect par value of debt. Excludes collateralized borrowings in

securitization trusts representing mortgage lending related debt that is repaid upon the principal payments of the underlying assets, of $7.0 billion (as of 9/30/08)

and $3.8 billion (as of 12/31/08). $7.4 $32.5 $31.3 $24.9 $8.9 $29.3 $7.8 $28.6 $30.5 $23.6 $26.5 0 5 10 15 20 25 30 35 2008 2009 2010 2011 2012 2013 and thereafter Pre-Exchange* Post-Exchange* ($ billions) 24

GMAC: Funding Strategy Within GMAC Bank: Increase deposits and shift toward a higher proportion of retail deposits Continue to access FHLB funding Access federal funding facilities as appropriate Outside GMAC Bank Maintain key components of current funding strategy Emphasis on secured committed facilities Maintain strong and deep lending relationships with key bank partners Manage asset originations to match available funding As origination patterns change, reshape funding to reflect this Expand funding in new ways where possible Applying for TLGP Exploring opportunities within TALF When markets return, access public ABS market and perhaps unsecured market Credit market challenges remain, and GMAC will continue to focus on

GMAC: Funding Strategy Within GMAC Bank: Increase deposits and shift toward a higher proportion of retail deposits Continue to access FHLB funding Access federal funding facilities as appropriate Outside GMAC Bank Maintain key components of current funding strategy Emphasis on secured committed facilities Maintain strong and deep lending relationships with key bank partners Manage asset originations to match available funding As origination patterns change, reshape funding to reflect this Expand funding in new ways where possible Applying for TLGP Exploring opportunities within TALF When markets return, access public ABS market and perhaps unsecured market Credit market challenges remain, and GMAC will continue to focus on

enhancing liquidity 25

GMAC: Selected BHC Requirements The transformation to a BHC involves a number of changes, including those

GMAC: Selected BHC Requirements The transformation to a BHC involves a number of changes, including those

to our current business model, corporate governance and reporting

requirements GMAC-GM operating agreements being revised GMAC Board will be reconstituted GMAC must comply with bank regulations and reporting requirements GMAC ownership will be restructured GM’s ownership is limited to no more than 9.9% of voting interest and economic GM has indicated it will contribute all equity in excess of this limit to two blind

trusts The trustees must dispose of all the equity in the trusts within 3 years Cerberus’ ownership is limited to no more than 14.9% of voting interest and 33% of

economic interest Cerberus will distribute excess equity to its investors GMAC Voting Interest Ownership (%) GM GM Trust 1 Treasury Trust 2 Cerberus Cerberus Co-Investors Total 9/30/08 49.0% - - 51.0% - 100.0% 1/16/09 59.9% - - 40.1% - 100.0% 3/31/2009 (expected) 9.9% 14.6% 35.4% 14.9% 25.2% 100.0% 1 Blind trust, of which GM will be the beneficiary. GM will appoint Trustee, subject to Federal Reserve approval 2 Blind trust, of which GM will be the beneficiary. U.S. Treasury will appoint Trustee 26

GMAC: Corporate Governance GMAC is required to reconstitute its board by March 24, 2009 The new board will be comprised of seven members including: One member appointed by Cerberus Two members appointed by the Trustee of the “Treasury Trust“ The Treasury Trust is a blind trust or trusts that will be established by GM to hold certain

GMAC: Corporate Governance GMAC is required to reconstitute its board by March 24, 2009 The new board will be comprised of seven members including: One member appointed by Cerberus Two members appointed by the Trustee of the “Treasury Trust“ The Treasury Trust is a blind trust or trusts that will be established by GM to hold certain

voting interests in GMAC. The Trustee will be appointed by the U.S. Treasury The GMAC CEO Three independent members appointed by the above four members. One independent member will appointed chairman by a majority of the

board 27

Conclusion The difficult economic and financial environment in 2008 threatened

Conclusion The difficult economic and financial environment in 2008 threatened

GMAC’s mission of lending to car buyers, homebuyers and auto dealers Our actions throughout the year have improved GMAC’s position, yet

challenges remain Stressed capital markets Poor economic conditions Weaker consumer and commercial credit Concentration of risk in Auto and Mortgage New regulatory requirements To address these challenges, GMAC will focus on 5 key priorities for

2009 1. Transition to and meet all bank holding requirements 2. Strengthen the company’s liquidity and capital position 3. Build a world class GMAC organization 4. Expand and diversify customer-focused revenue opportunities in auto and

mortgage, with available funding driving originations 5. Drive returns by repositioning the risk profile of GMAC’s revenue mix and asset

base, and maximizing efficiencies 28

Supplemental Charts

Supplemental Charts

29

GMAC: Preliminary Quarterly Consolidated Net Income Supplemental ($ millions) Q4 2008 Q4 2007 Revenue Total financing revenue $4,000 $5,193 Interest expense 2,917 3,653 Depreciation expense on operating lease assets 1,274 1,384 Impairment of investment in operating leases 425 - Net financing (loss) revenue (616) 156 Other revenue Net loan servicing income 157 563 Insurance premiums and service revenue earned 974 1,144 Gain on mortgage and automotive loans, net 113 464 Gain on extinguishment of debt 11,464 563 Investment loss (183) (75) Other (loss) income (491) 478 Total other revenue 12,034 3,137 Total net revenue 11,418 3,293 Provision for credit losses 1,340 1,021 Noninterest expense Insurance losses and loss adjustment expenses 537 656 Other operating expenses 2,137 2,191 Impairment of goodwill 42 - Total noninterest expense 2,716 2,847 Income (loss) before income tax (benefit) expense 7,362 (575) Income tax (benefit) expense (100) 149 Net income (loss) $7,462 ($724) 30

GMAC: Preliminary Quarterly Consolidated Net Income Supplemental ($ millions) Q4 2008 Q4 2007 Revenue Total financing revenue $4,000 $5,193 Interest expense 2,917 3,653 Depreciation expense on operating lease assets 1,274 1,384 Impairment of investment in operating leases 425 - Net financing (loss) revenue (616) 156 Other revenue Net loan servicing income 157 563 Insurance premiums and service revenue earned 974 1,144 Gain on mortgage and automotive loans, net 113 464 Gain on extinguishment of debt 11,464 563 Investment loss (183) (75) Other (loss) income (491) 478 Total other revenue 12,034 3,137 Total net revenue 11,418 3,293 Provision for credit losses 1,340 1,021 Noninterest expense Insurance losses and loss adjustment expenses 537 656 Other operating expenses 2,137 2,191 Impairment of goodwill 42 - Total noninterest expense 2,716 2,847 Income (loss) before income tax (benefit) expense 7,362 (575) Income tax (benefit) expense (100) 149 Net income (loss) $7,462 ($724) 30

GMAC: Preliminary Full-Year Consolidated Net Income Supplemental ($ millions) 2008 2007 Revenue Total financing revenue $18,395 $21,187 Interest expense 11,870 14,776 Depreciation expense on operating lease assets 5,483 4,915 Impairment of investment in operating leases 1,234 - Net financing (loss) revenue (192) 1,496 Other revenue Net loan servicing income 1,498 1,649 Insurance premiums and service revenue earned 4,329 4,378 (Loss) gain on mortgage and automotive loans, net (1,560) 508 Gain on extinguishment of debt 12,628 563 Investment (loss) income (446) 473 Other income 601 2,732 Total other revenue 17,050 10,303 Total net revenue 16,858 11,799 Provision for credit losses 3,683 3,096 Noninterest expense Insurance losses and loss adjustment expenses 2,522 2,451 Other operating expenses 8,734 7,739 Impairment of goodwill 58 455 Total noninterest expense 11,314 10,645 Income (loss) before income tax (benefit) expense 1,861 (1,942) Income tax (benefit) expense (7) 390 Net income (loss) $1,868 ($2,332) 31

GMAC: Preliminary Full-Year Consolidated Net Income Supplemental ($ millions) 2008 2007 Revenue Total financing revenue $18,395 $21,187 Interest expense 11,870 14,776 Depreciation expense on operating lease assets 5,483 4,915 Impairment of investment in operating leases 1,234 - Net financing (loss) revenue (192) 1,496 Other revenue Net loan servicing income 1,498 1,649 Insurance premiums and service revenue earned 4,329 4,378 (Loss) gain on mortgage and automotive loans, net (1,560) 508 Gain on extinguishment of debt 12,628 563 Investment (loss) income (446) 473 Other income 601 2,732 Total other revenue 17,050 10,303 Total net revenue 16,858 11,799 Provision for credit losses 3,683 3,096 Noninterest expense Insurance losses and loss adjustment expenses 2,522 2,451 Other operating expenses 8,734 7,739 Impairment of goodwill 58 455 Total noninterest expense 11,314 10,645 Income (loss) before income tax (benefit) expense 1,861 (1,942) Income tax (benefit) expense (7) 390 Net income (loss) $1,868 ($2,332) 31

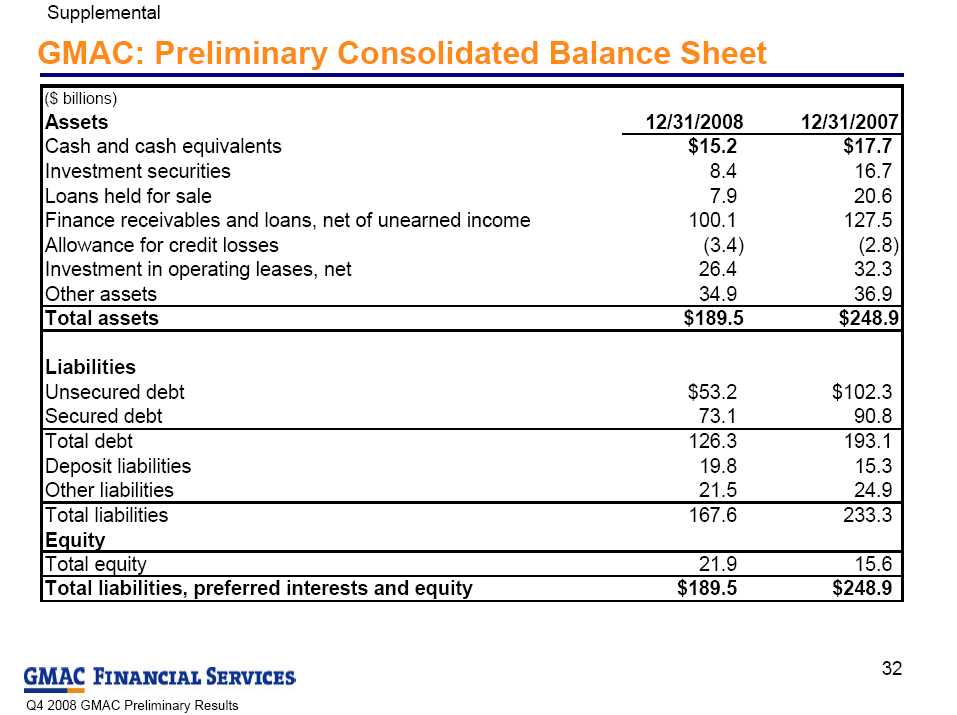

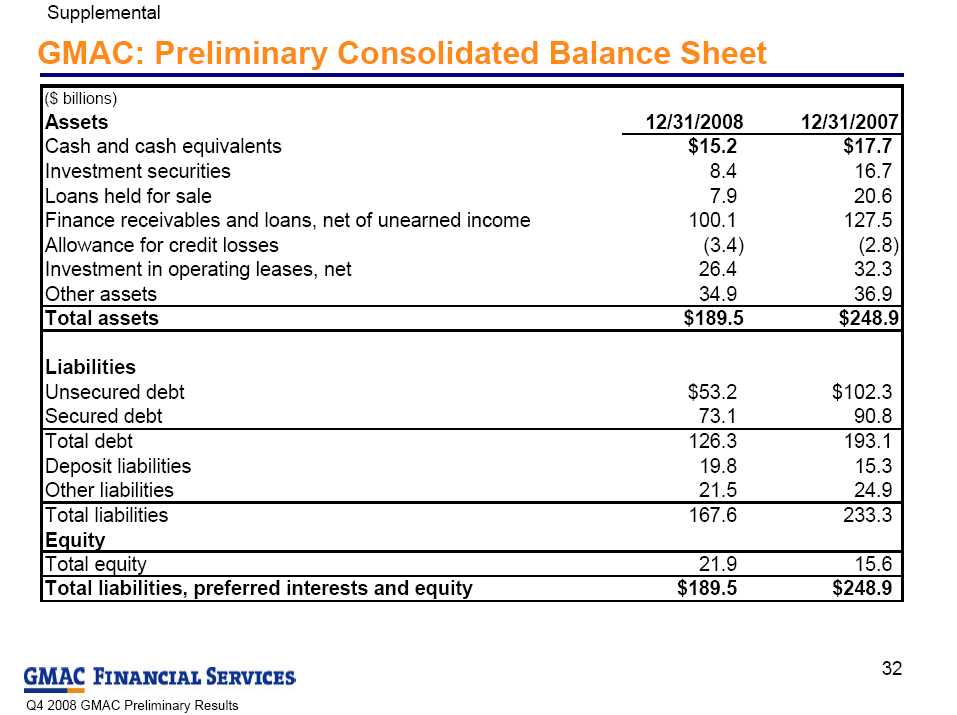

GMAC: Preliminary Consolidated Balance Sheet Supplemental ($ billions) Assets 12/31/2008 12/31/2007 Cash and cash equivalents $15.2 $17.7 Investment securities 8.4 16.7 Loans held for sale 7.9 20.6 Finance receivables and loans, net of unearned income 100.1 127.5 Allowance for credit losses (3.4) (2.8) Investment in operating leases, net 26.4 32.3 Other assets 34.9 36.9 Total assets $189.5 $248.9 Liabilities Unsecured debt $53.2 $102.3 Secured debt 73.1 90.8 Total debt 126.3 193.1 Deposit liabilities 19.8 15.3 Other liabilities 21.5 24.9 Total liabilities 167.6 233.3 Equity Total equity 21.9 15.6 Total liabilities, preferred interests and equity $189.5 $248.9 32

GMAC: Preliminary Consolidated Balance Sheet Supplemental ($ billions) Assets 12/31/2008 12/31/2007 Cash and cash equivalents $15.2 $17.7 Investment securities 8.4 16.7 Loans held for sale 7.9 20.6 Finance receivables and loans, net of unearned income 100.1 127.5 Allowance for credit losses (3.4) (2.8) Investment in operating leases, net 26.4 32.3 Other assets 34.9 36.9 Total assets $189.5 $248.9 Liabilities Unsecured debt $53.2 $102.3 Secured debt 73.1 90.8 Total debt 126.3 193.1 Deposit liabilities 19.8 15.3 Other liabilities 21.5 24.9 Total liabilities 167.6 233.3 Equity Total equity 21.9 15.6 Total liabilities, preferred interests and equity $189.5 $248.9 32

GMAC: Leverage Ratio as of 12/31/08 Supplemental Less: Adjusted December 31, 2008 ($ millions) GMAC LLC ResCap leverage metrics Consolidated borrowed funds: Total debt $126,321 $30,576 $95,745 Less: Obligations of bankruptcy-remote SPEs (54,876) (3,753) (51,123) Intersegment eliminations - (7,440) 7,440 Consolidated borrowed funds used for leverage ratio 71,445 19,383 52,062 Consolidated net worth: Total equity 21,854 2,187 19,667 Less: Intersegment credit extensions (866) - (866) Consolidated net worth used for leverage ratio $20,988 $2,187 $18,801 Leverage ratio 2.8 33

GMAC: Leverage Ratio as of 12/31/08 Supplemental Less: Adjusted December 31, 2008 ($ millions) GMAC LLC ResCap leverage metrics Consolidated borrowed funds: Total debt $126,321 $30,576 $95,745 Less: Obligations of bankruptcy-remote SPEs (54,876) (3,753) (51,123) Intersegment eliminations - (7,440) 7,440 Consolidated borrowed funds used for leverage ratio 71,445 19,383 52,062 Consolidated net worth: Total equity 21,854 2,187 19,667 Less: Intersegment credit extensions (866) - (866) Consolidated net worth used for leverage ratio $20,988 $2,187 $18,801 Leverage ratio 2.8 33

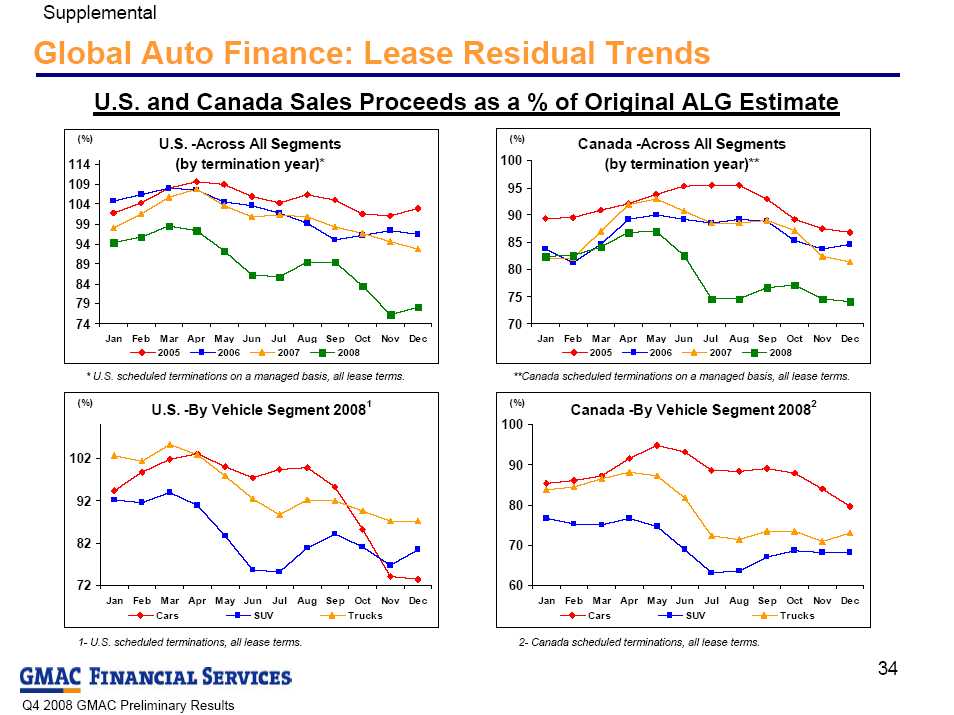

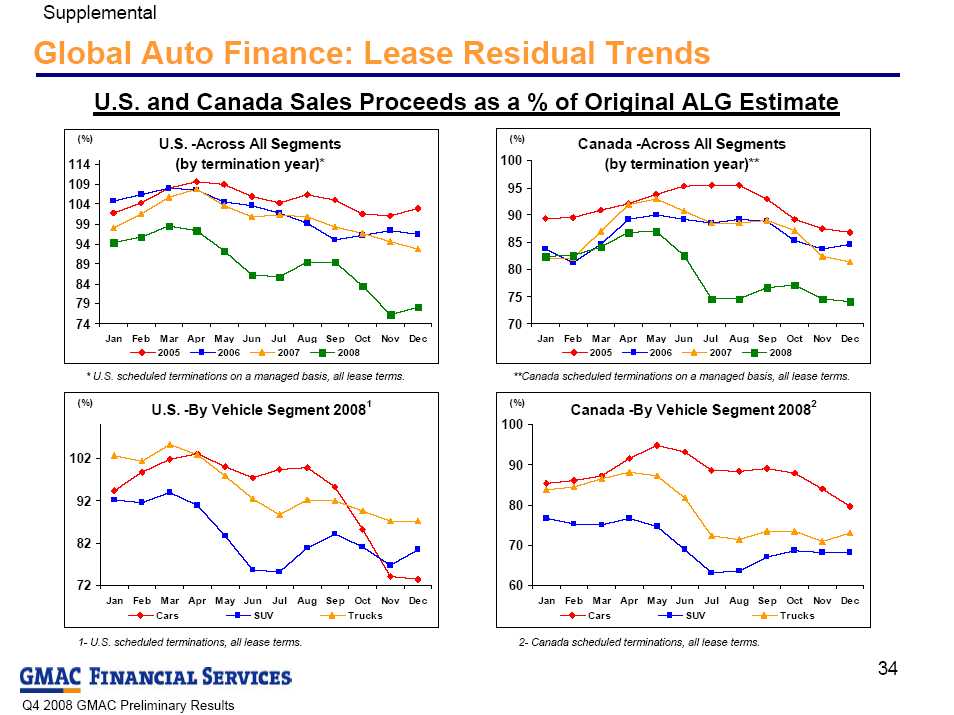

Global Auto Finance: Lease Residual Trends U.S. and Canada Sales Proceeds as a % of Original ALG Estimate * U.S. scheduled terminations on a managed basis, all lease terms. **Canada scheduled terminations on a managed basis, all lease terms. Supplemental 1- U.S. scheduled terminations, all lease terms. 2- Canada scheduled terminations, all lease terms. U.S. -Across All Segments (by termination year)* 74 79 84 89 94 99 104 109 114 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2005 2006 2007 2008 (%) Canada -Across All Segments (by termination year)** 70 75 80 85 90 95 100 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2005 2006 2007 2008 (%) U.S. -By Vehicle Segment 2008 1 72 82 92 102 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Cars SUV Trucks (%) Canada -By Vehicle Segment 2008 2 60 70 80 90 100 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Cars SUV Trucks (%) 34

Global Auto Finance: Lease Residual Trends U.S. and Canada Sales Proceeds as a % of Original ALG Estimate * U.S. scheduled terminations on a managed basis, all lease terms. **Canada scheduled terminations on a managed basis, all lease terms. Supplemental 1- U.S. scheduled terminations, all lease terms. 2- Canada scheduled terminations, all lease terms. U.S. -Across All Segments (by termination year)* 74 79 84 89 94 99 104 109 114 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2005 2006 2007 2008 (%) Canada -Across All Segments (by termination year)** 70 75 80 85 90 95 100 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2005 2006 2007 2008 (%) U.S. -By Vehicle Segment 2008 1 72 82 92 102 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Cars SUV Trucks (%) Canada -By Vehicle Segment 2008 2 60 70 80 90 100 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Cars SUV Trucks (%) 34

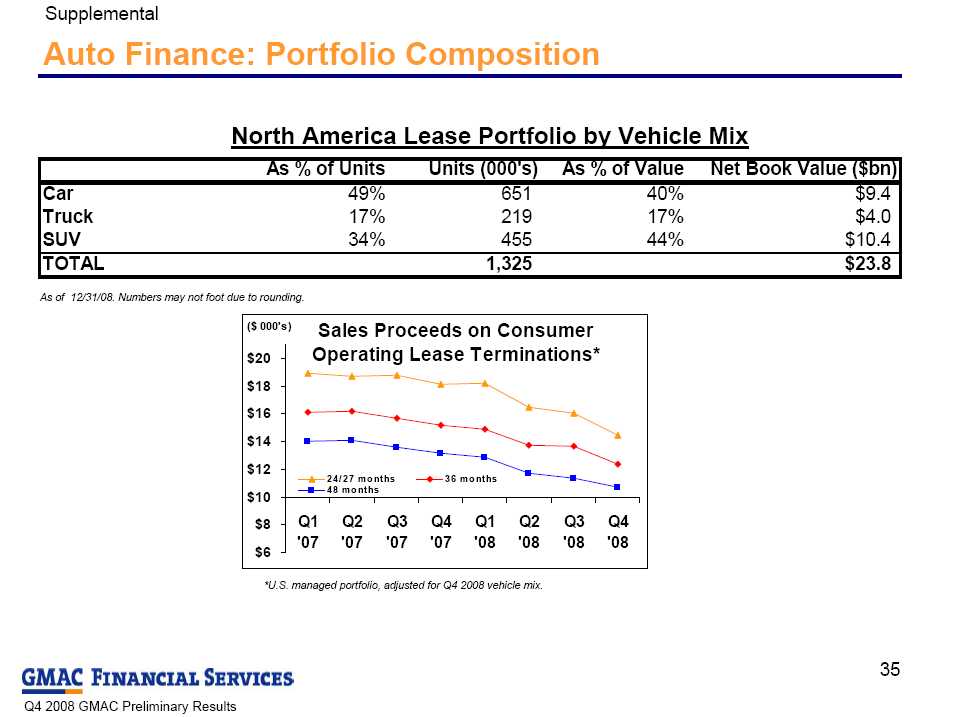

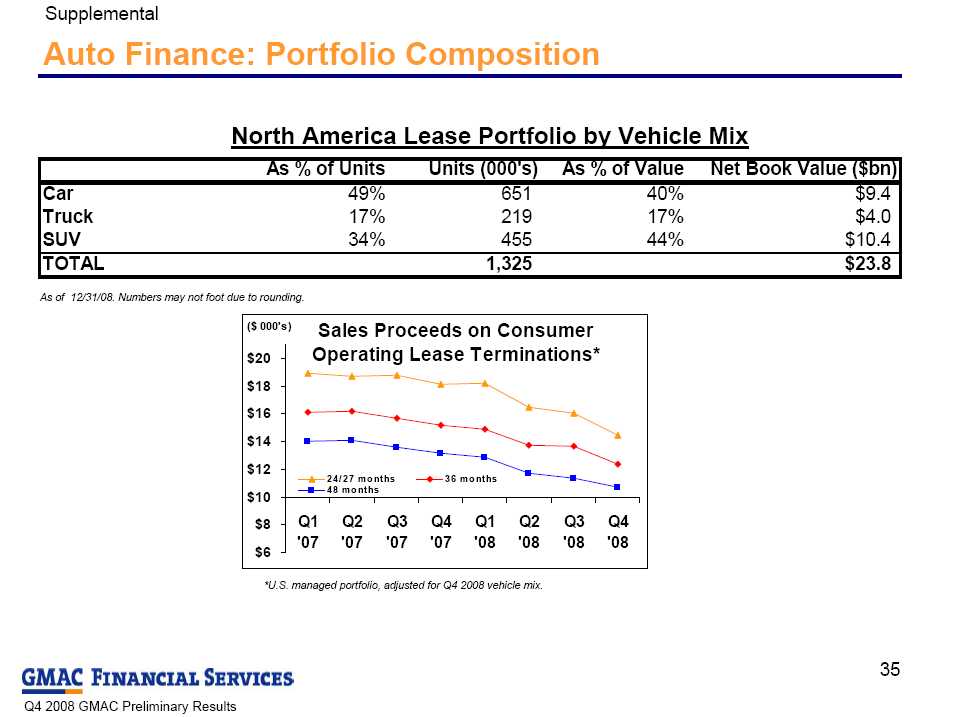

Auto Finance: Portfolio Composition Supplemental North America Lease Portfolio by Vehicle Mix As of 12/31/08. Numbers may not foot due to rounding. *U.S. managed portfolio, adjusted for Q4 2008 vehicle mix. As % of Units Units (000's) As % of Value Net Book Value ($bn) Car 49% 651 40% $9.4 Truck 17% 219 17% $4.0 SUV 34% 455 44% $10.4 TOTAL 1,325 $23.8 Sales Proceeds on Consumer Operating Lease Terminations* $6 $8 $10 $12 $14 $16 $18 $20 Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 24/27 months 36 months 48 months ($ 000's) 35

Auto Finance: Portfolio Composition Supplemental North America Lease Portfolio by Vehicle Mix As of 12/31/08. Numbers may not foot due to rounding. *U.S. managed portfolio, adjusted for Q4 2008 vehicle mix. As % of Units Units (000's) As % of Value Net Book Value ($bn) Car 49% 651 40% $9.4 Truck 17% 219 17% $4.0 SUV 34% 455 44% $10.4 TOTAL 1,325 $23.8 Sales Proceeds on Consumer Operating Lease Terminations* $6 $8 $10 $12 $14 $16 $18 $20 Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 24/27 months 36 months 48 months ($ 000's) 35

Reconciliation of Insurance Core Earnings Supplemental 3. Amount within investment income in Forms 10-Q and 10-K. 2. Amount within other income in Forms 10-Q and 10-K. 1. Amount within acquisition and underwriting expense in Forms 10-Q and 10-K. ($ millions) 4Q 2008 3Q 2008 2Q 2008 1Q 2008 4Q 2007 3Q 2007 2Q 2007 1Q 2007 Net Income $95 $97 $135 $132 $68 $117 $131 $143 Add: Impairment of Goodwill 1 42 Add: Pre-tax interest (benefit) expense 1 2 (2) (72) 5 8 9 5 4 Less: Pre-tax gain on sale of business 2 98 Less: Pre-tax capital (losses) gains 3 (63) (90) 6 7 5 13 1 4 Add: Estimated taxes (37) (31) 27 1 (1) 1 (1) 0 Core Earnings $67 $154 $84 $131 $70 $114 $134 $143 36

Reconciliation of Insurance Core Earnings Supplemental 3. Amount within investment income in Forms 10-Q and 10-K. 2. Amount within other income in Forms 10-Q and 10-K. 1. Amount within acquisition and underwriting expense in Forms 10-Q and 10-K. ($ millions) 4Q 2008 3Q 2008 2Q 2008 1Q 2008 4Q 2007 3Q 2007 2Q 2007 1Q 2007 Net Income $95 $97 $135 $132 $68 $117 $131 $143 Add: Impairment of Goodwill 1 42 Add: Pre-tax interest (benefit) expense 1 2 (2) (72) 5 8 9 5 4 Less: Pre-tax gain on sale of business 2 98 Less: Pre-tax capital (losses) gains 3 (63) (90) 6 7 5 13 1 4 Add: Estimated taxes (37) (31) 27 1 (1) 1 (1) 0 Core Earnings $67 $154 $84 $131 $70 $114 $134 $143 36

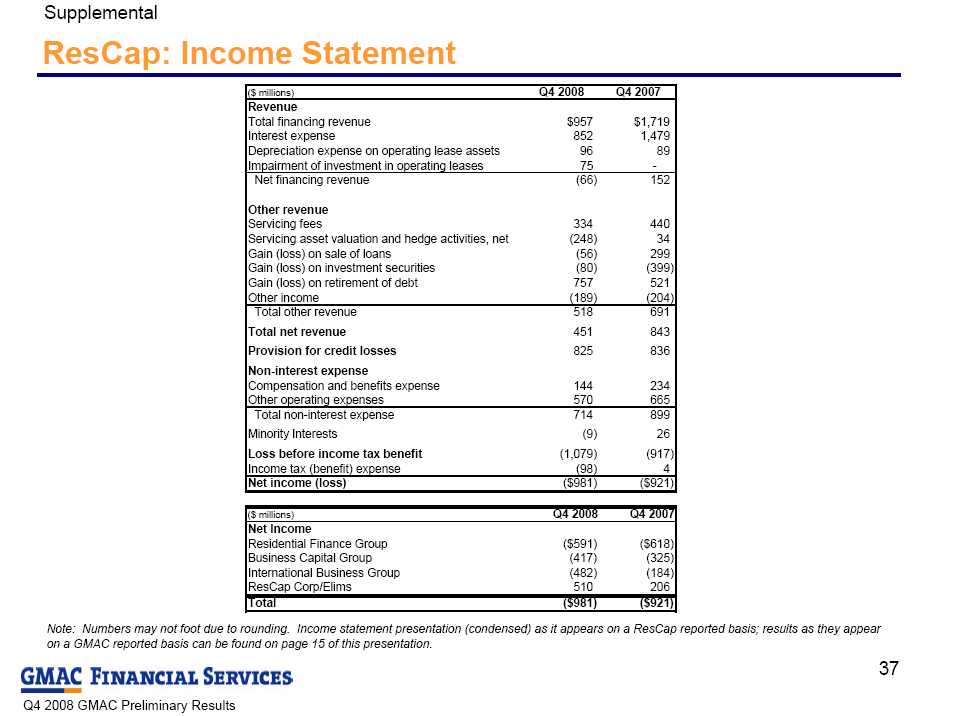

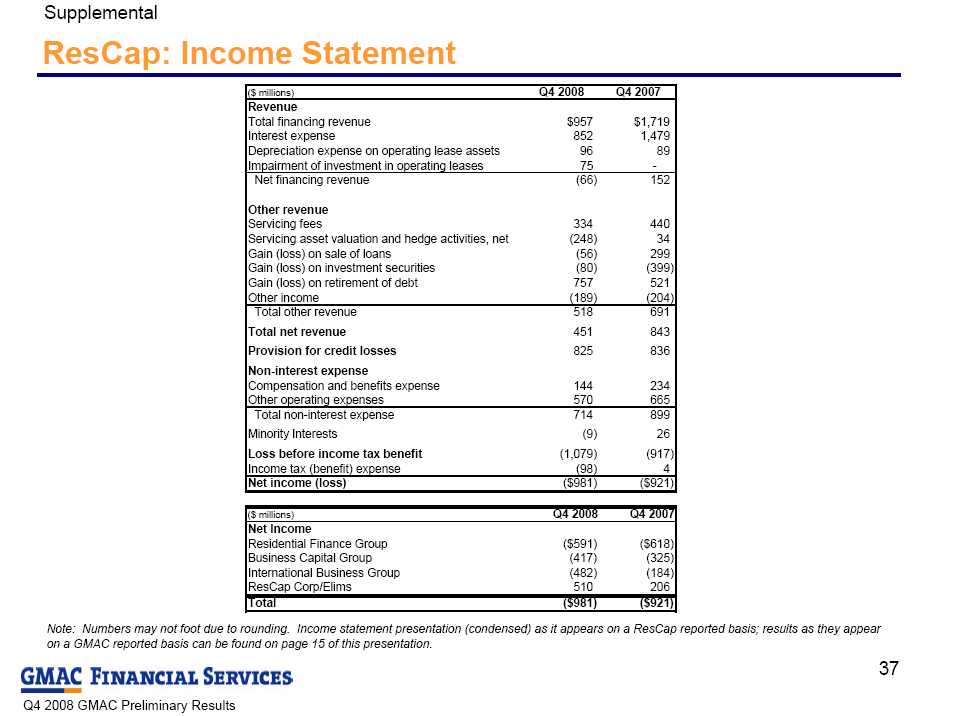

ResCap: Income Statement Note: Numbers may not foot due to rounding. Income statement presentation (condensed) as it appears on a ResCap reported basis; results as they appear

ResCap: Income Statement Note: Numbers may not foot due to rounding. Income statement presentation (condensed) as it appears on a ResCap reported basis; results as they appear

on a GMAC reported basis can be found on page 15 of this presentation. Supplemental ($ millions) Q4 2008 Q4 2007 Revenue Total financing revenue $957 $1,719 Interest expense 852 1,479 Depreciation expense on operating lease assets 96 �� 89 Impairment of investment in operating leases 75 - Net financing revenue (66) 152 Other revenue Servicing fees 334 440 Servicing asset valuation and hedge activities, net (248) 34 Gain (loss) on sale of loans (56) 299 Gain (loss) on investment securities (80) (399) Gain (loss) on retirement of debt 757 521 Other income (189) (204) Total other revenue 518 691 Total net revenue 451 843 Provision for credit losses 825 836 Non-interest expense Compensation and benefits expense 144 234 Other operating expenses 570 665 Total non-interest expense 714 899 Minority Interests (9) 26 Loss before income tax benefit (1,079) (917) Income tax (benefit) expense (98) 4 Net income (loss) ($981) ($921) ($ millions) Q4 2008 Q4 2007 Net Income Residential Finance Group ($591) ($618) Business Capital Group (417) (325) International Business Group (482) (184) ResCap Corp/Elims 510 206 Total ($981) ($921) 37

ResCap: Mortgage Production 1 International includes some nonprime production. 1 1 Supplemental 1 International includes some nonprime production.

ResCap: Mortgage Production 1 International includes some nonprime production. 1 1 Supplemental 1 International includes some nonprime production.

Note: Totals may not foot due to rounding. ($ billions) Q4 2008 Q3 2008 Q2 2008 Q1 2008 Q4 2007 Q3 2007 Q2 2007 Q1 2007 Prime conforming $5.2 $6.8 $12.2 $15.4 $13.0 $12.2 $12.7 $9.6 Total conforming 5.2 6.8 12.2 15.4 13.0 12.2 12.7 9.6 Prime non-conforming 0.0 0.3 0.4 0.5 0.7 5.0 9.8 12.3 Government 2.9 4.1 3.8 2.0 1.2 1.0 0.8 0.6 Nonprime - - - 0.0 0.1 0.2 0.7 3.3 Prime second-lien 0.0 0.1 0.7 0.8 0.6 1.8 3.1 5.3 Total non-conforming 3.0 4.5 4.8 3.3 2.6 8.0 14.5 21.5 Total domestic 8.2 11.2 17.0 18.7 15.5 20.2 27.1 31.0 International 1 0.4 0.6 1.0 2.2 5.3 9.1 7.7 6.5 TOTAL $8.5 $11.9 $18.1 $20.9 $20.8 $29.3 $34.9 $37.5 Mortgage Loan Production by Type 0 5 10 15 20 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 Prime Conforming Prime Non-conforming Government Nonprime Prime Second-lien Total International ($ bil) Mortgage Loan Production 0 10 20 30 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 Total Domestic Total International ($ bil) 38

ResCap: Nonprime and Prime Exposure Prime and Other2 1) The nonprime category includes high FICO/high LTV loans, high FICO alternative attribute loans, purchased distressed assets, and subprime assets (Weighted Average

ResCap: Nonprime and Prime Exposure Prime and Other2 1) The nonprime category includes high FICO/high LTV loans, high FICO alternative attribute loans, purchased distressed assets, and subprime assets (Weighted Average

FICO 618) for the domestic business and international loans with at least some adverse credit history. 2) Prime and Other includes Prime Conforming, Prime Non-conforming, Prime Second-Lien, and Government. 3) HFI is before allowance. Loans HFI are part of Finance receivables and loans (consumer) on GMAC’s financial statements. * Warehouse lending receivables are part of Finance receivables and Loans (commercial) on GMAC’s financial statements. Nonprime1 $4.2 billion of securitized assets (largely

non-prime) at 12/31/08, with no

economic exposure Supplemental Loan Servicing Portfolio $36 $40 $44 $48 $53 $358 $386 $393 $412 $401 $0 $150 $300 $450 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 ($ bil) Warehouse Lending Receivables* $0.2 $0.2 $0.1 $1.3 $1.2 $0.1 $0.2 $1.5 $1.6 $1.5 $0.0 $0.5 $1.0 $1.5 $2.0 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 ($ bil) Held For Sale $5.9 $3.4 $0.8 $2.0 $1.1 $0.3 $2.6 $2.3 $9.2 $10.0 $0 $2 $4 $6 $8 $10 $12 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 ($ bil) Loans Held For Investment 3 $23.1 $20.3 $16.9 $5.6 $9.7 $7.7 $6.7 $25.3 $24.8 $23.3 $0 $15 $30 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 ($ bil) 39

HFS and HFI Q4 08 transfers: HFS to HFI $240 million HFI to HFS $17 million ResCap: Global HFS Portfolio Supplemental Note: ResCap’s HFS is part of total Loans Held for Sale Q4 2008 Total HFS Portfolio of $2.6 billion 10% 33% 11% 0% 46% Prime Conforming Prime Nonconforming Nonprime Prime Second-lien Government Q4 2008 Distribution of $10.0 billion (Issuance and whole loan sales) 5% 67% 28% Non-Agency Public Securitizations Agency Non-Agency Whole Loans 40

HFS and HFI Q4 08 transfers: HFS to HFI $240 million HFI to HFS $17 million ResCap: Global HFS Portfolio Supplemental Note: ResCap’s HFS is part of total Loans Held for Sale Q4 2008 Total HFS Portfolio of $2.6 billion 10% 33% 11% 0% 46% Prime Conforming Prime Nonconforming Nonprime Prime Second-lien Government Q4 2008 Distribution of $10.0 billion (Issuance and whole loan sales) 5% 67% 28% Non-Agency Public Securitizations Agency Non-Agency Whole Loans 40

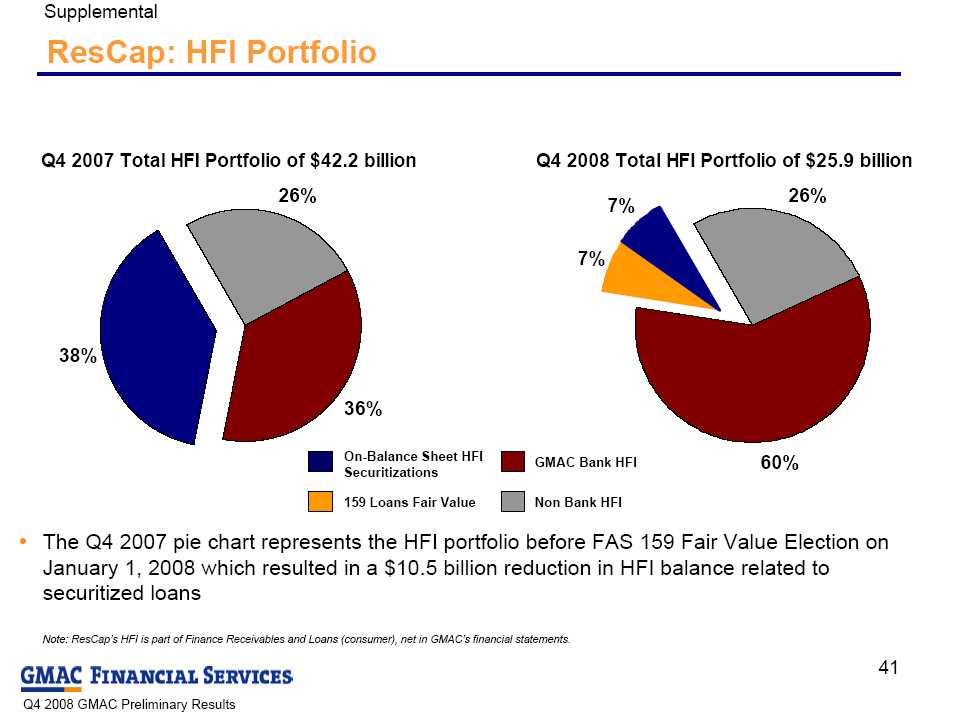

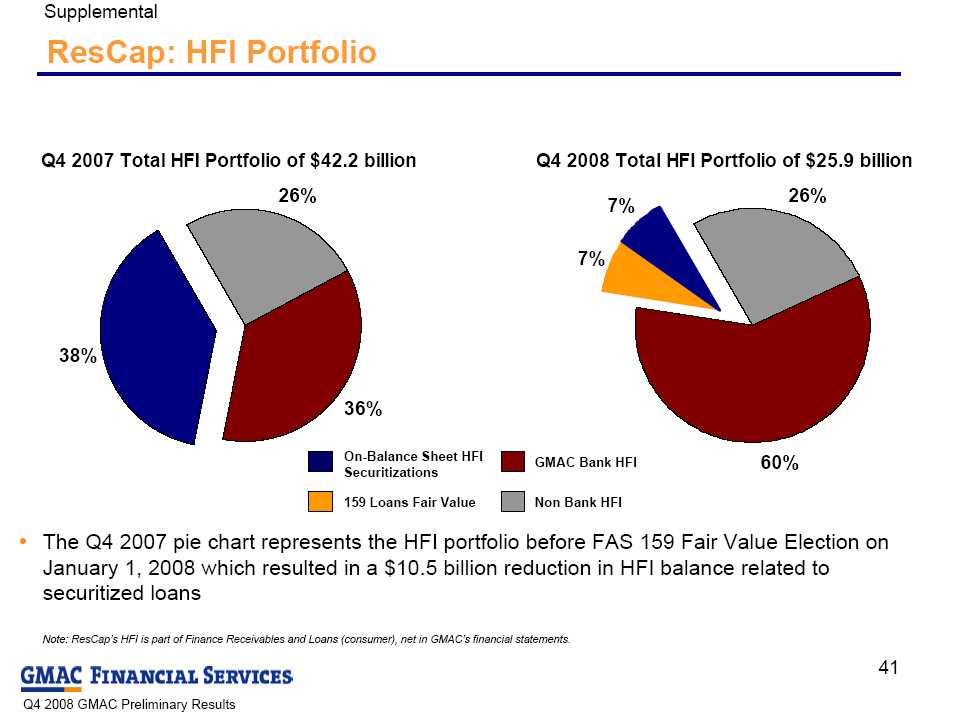

ResCap: HFI Portfolio GMAC Bank HFI On-Balance Sheet HFI

ResCap: HFI Portfolio GMAC Bank HFI On-Balance Sheet HFI

Securitizations Non Bank HFI 159 Loans Fair Value The Q4 2007 pie chart represents the HFI portfolio before FAS 159 Fair Value Election on

January 1, 2008 which resulted in a $10.5 billion reduction in HFI balance related to

securitized loans Supplemental Note: ResCap’s HFI is part of Finance Receivables and Loans (consumer), net in GMAC’s financial statements. Q4 2007 Total HFI Portfolio of $42.2 billion Q4 2008 Total HFI Portfolio of $25.9 billion 26% 26% 60% 36% 38% 7% 7% 41

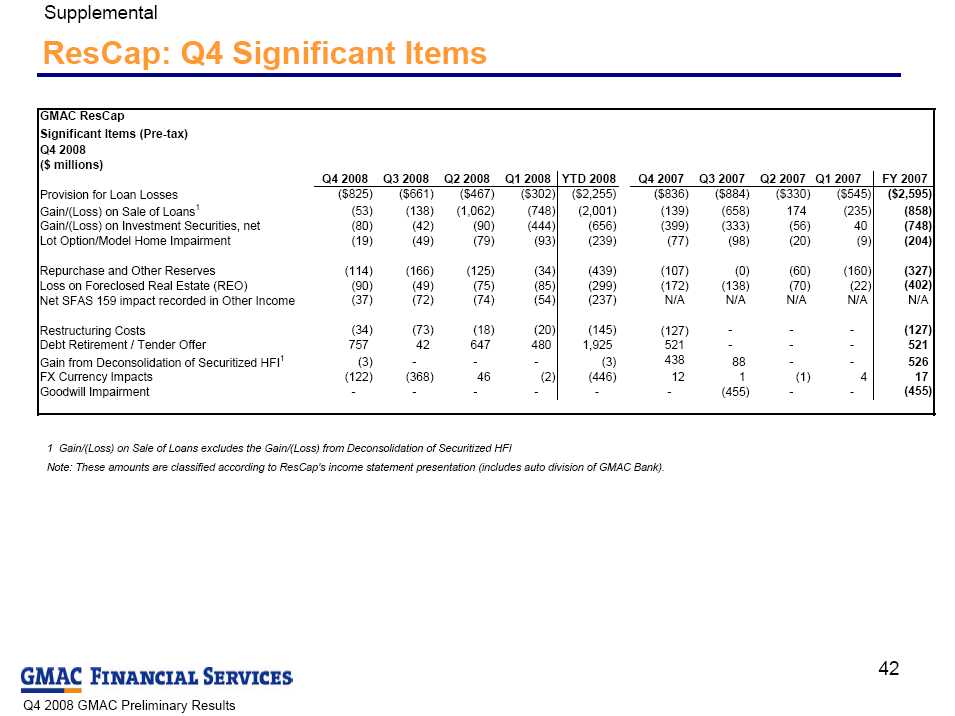

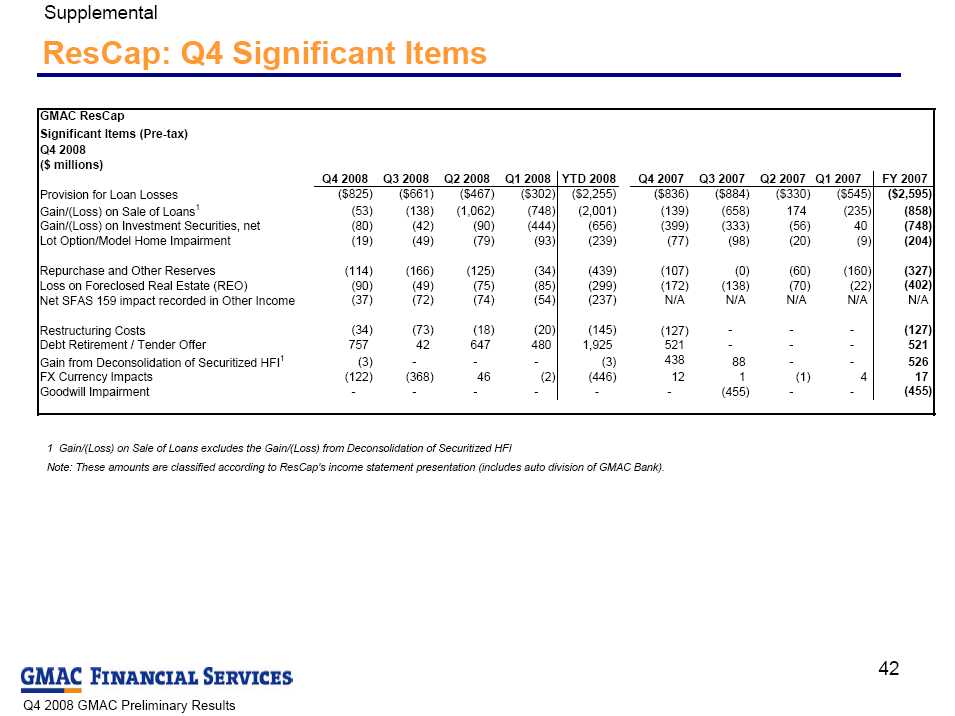

ResCap: Q4 Significant Items 1 Gain/(Loss) on Sale of Loans excludes the Gain/(Loss) from Deconsolidation of Securitized HFI Note: These amounts are classified according to ResCap's income statement presentation (includes auto division of GMAC Bank). Supplemental GMAC ResCap Significant Items (Pre-tax) Q4 2008 ($ millions) Q4 2008 Q3 2008 Q2 2008 Q1 2008 YTD 2008 Q4 2007 Q3 2007 Q2 2007 Q1 2007 FY 2007 Provision for Loan Losses ($825) ($661) ($467) ($302) ($2,255) ($836) ($884) ($330) ($545) ($2,595) Gain/(Loss) on Sale of Loans 1 (53) (138) (1,062) (748) (2,001) (139) (658) 174 (235) (858) Gain/(Loss) on Investment Securities, net (80) (42) (90) (444) (656) (399) (333) (56) 40 (748) Lot Option/Model Home Impairment (19) (49) (79) (93) (239) (77) (98) (20) (9) (204) Repurchase and Other Reserves (114) (166) (125) (34) (439) (107) (0) (60) (160) (327) Loss on Foreclosed Real Estate (REO) (90) (49) (75) (85) (299) (172) (138) (70) (22) (402) Net SFAS 159 impact recorded in Other Income (37) (72) (74) (54) (237) N/A N/A N/A N/A N/A Restructuring Costs (34) (73) (18) (20) (145) (127) - - - (127) Debt Retirement / Tender Offer 757 42 647 480 1,925 521 - - - 521 Gain from Deconsolidation of Securitized HFI 1 (3) - - - (3) 438 88 - - 526 FX Currency Impacts (122) (368) 46 (2) (446) 12 1 (1) 4 17 Goodwill Impairment - - - - - - (455) - - (455) 42

ResCap: Q4 Significant Items 1 Gain/(Loss) on Sale of Loans excludes the Gain/(Loss) from Deconsolidation of Securitized HFI Note: These amounts are classified according to ResCap's income statement presentation (includes auto division of GMAC Bank). Supplemental GMAC ResCap Significant Items (Pre-tax) Q4 2008 ($ millions) Q4 2008 Q3 2008 Q2 2008 Q1 2008 YTD 2008 Q4 2007 Q3 2007 Q2 2007 Q1 2007 FY 2007 Provision for Loan Losses ($825) ($661) ($467) ($302) ($2,255) ($836) ($884) ($330) ($545) ($2,595) Gain/(Loss) on Sale of Loans 1 (53) (138) (1,062) (748) (2,001) (139) (658) 174 (235) (858) Gain/(Loss) on Investment Securities, net (80) (42) (90) (444) (656) (399) (333) (56) 40 (748) Lot Option/Model Home Impairment (19) (49) (79) (93) (239) (77) (98) (20) (9) (204) Repurchase and Other Reserves (114) (166) (125) (34) (439) (107) (0) (60) (160) (327) Loss on Foreclosed Real Estate (REO) (90) (49) (75) (85) (299) (172) (138) (70) (22) (402) Net SFAS 159 impact recorded in Other Income (37) (72) (74) (54) (237) N/A N/A N/A N/A N/A Restructuring Costs (34) (73) (18) (20) (145) (127) - - - (127) Debt Retirement / Tender Offer 757 42 647 480 1,925 521 - - - 521 Gain from Deconsolidation of Securitized HFI 1 (3) - - - (3) 438 88 - - 526 FX Currency Impacts (122) (368) 46 (2) (446) 12 1 (1) 4 17 Goodwill Impairment - - - - - - (455) - - (455) 42

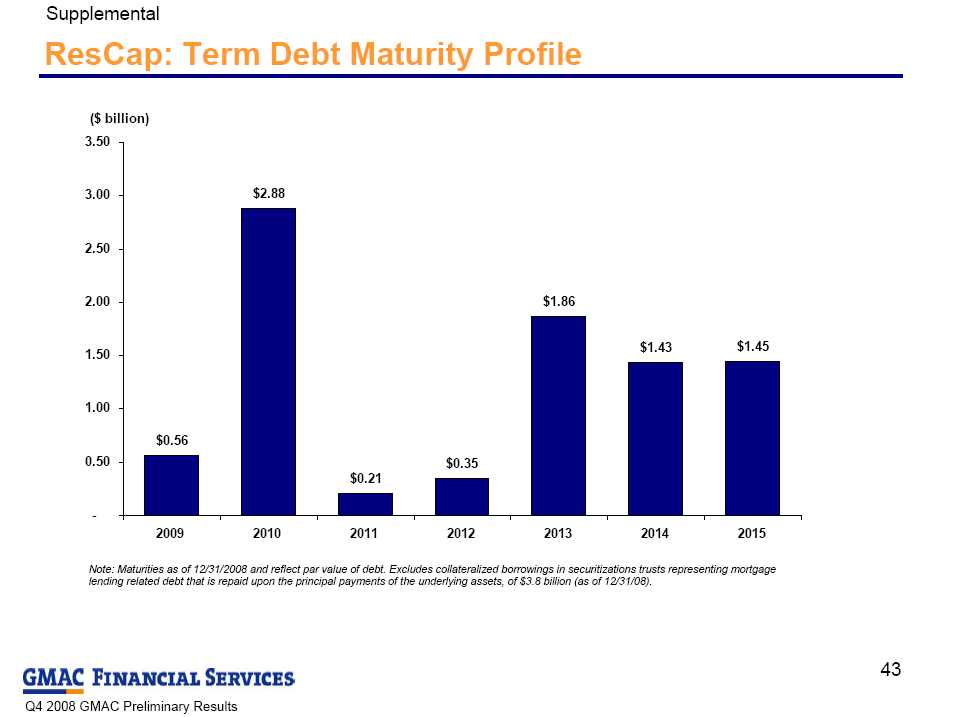

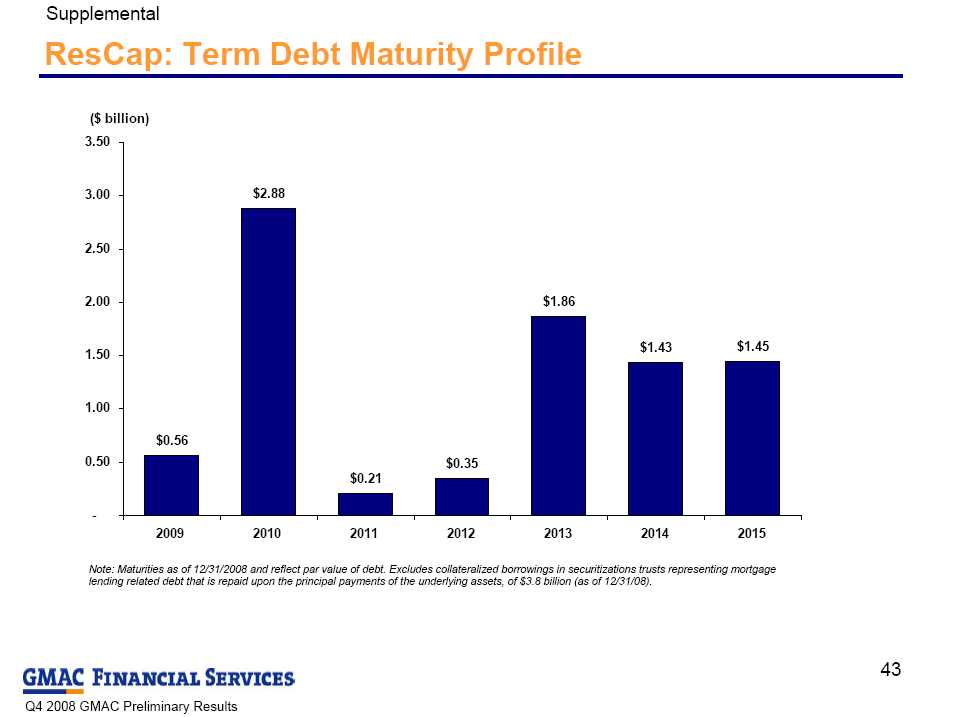

ResCap: Term Debt Maturity Profile Supplemental Note: Maturities as of 12/31/2008 and reflect par value of debt. Excludes collateralized borrowings in securitizations trusts representing mortgage

ResCap: Term Debt Maturity Profile Supplemental Note: Maturities as of 12/31/2008 and reflect par value of debt. Excludes collateralized borrowings in securitizations trusts representing mortgage

lending related debt that is repaid upon the principal payments of the underlying assets, of $3.8 billion (as of 12/31/08). $0.56 $2.88 $0.21 $0.35 $1.86 $1.43 $1.45 - 0.50 1.00 1.50 2.00 2.50 3.00 3.50 2009 2010 2011 2012 2013 2014 2015 ($ billion) 43

Preliminary

Preliminary Forward-Looking Statements In the presentation that follows and related comments by GMAC LLC (“GMAC”) management, the use of the words “expect,”

Forward-Looking Statements In the presentation that follows and related comments by GMAC LLC (“GMAC”) management, the use of the words “expect,” Table of Contents GMAC Page 4 Global Auto Finance Page 7 Insurance Page 11 ResCap Page 13 Global Capital and Liquidity Page 21 GMAC General Items Page 25 Conclusion Page 28 Supplemental Page 29 3

Table of Contents GMAC Page 4 Global Auto Finance Page 7 Insurance Page 11 ResCap Page 13 Global Capital and Liquidity Page 21 GMAC General Items Page 25 Conclusion Page 28 Supplemental Page 29 3 GMAC: 2008 Actions 2/08 Announced North American Auto

GMAC: 2008 Actions 2/08 Announced North American Auto GMAC: Fourth Quarter 2008 Performance Highlights Q4 2008 consolidated net income of $7.5 billion, primarily driven by a gain on

GMAC: Fourth Quarter 2008 Performance Highlights Q4 2008 consolidated net income of $7.5 billion, primarily driven by a gain on  GMAC: Net Income by Segment Net Income by Segment * ResCap total GAAP net income was $981 million, including $754 million debt retirement gains. ** Other segment includes Commercial Finance, equity investments and other corporate activities. Other had total GAAP net income of $9.66 billion, including $10.66 billion of

GMAC: Net Income by Segment Net Income by Segment * ResCap total GAAP net income was $981 million, including $754 million debt retirement gains. ** Other segment includes Commercial Finance, equity investments and other corporate activities. Other had total GAAP net income of $9.66 billion, including $10.66 billion of Global Auto Finance: Key Metrics ($ bil) All tables include North American and International Operations except where noted. Origination and asset base figures include auto loans and leases. *U.S. scheduled terminations on a managed basis by termination year - all lease terms, all vehicle segments (cars, trucks and SUVs) Net Income $398 $395 $258 ($717) ($294) ($1,313) $137 $554 ($1,400) ($1,100) ($800) ($500) ($200) $100 $400 $700 Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 ($ mil) Global Consumer Originations $12.3 $14.0 $12.5 $11.3 $2.0 $2.1 $2.3 $1.9 $2.1 $2.5 $0.6 $2.0 $2.7 $12.9 $14.5 $13.4 $1 $3 $5 $7 $9 $11 $13 $15 $17 Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 Used New Global Consumer Auto Asset Base $120 $121 $123 $120 $115 $122 $124 $101 $84 $85 $83 $83 $86 $81 $77 $66 $40 $55 $70 $85 $100 $115 $130 Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 Serviced On-Balance Sheet ($ bil) Sales Proceeds as % of ALG (U.S. Lease Terminations)* 74 79 84 89 94 99 104 109 114 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2005 2006 2007 2008 (%) 7

Global Auto Finance: Key Metrics ($ bil) All tables include North American and International Operations except where noted. Origination and asset base figures include auto loans and leases. *U.S. scheduled terminations on a managed basis by termination year - all lease terms, all vehicle segments (cars, trucks and SUVs) Net Income $398 $395 $258 ($717) ($294) ($1,313) $137 $554 ($1,400) ($1,100) ($800) ($500) ($200) $100 $400 $700 Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 ($ mil) Global Consumer Originations $12.3 $14.0 $12.5 $11.3 $2.0 $2.1 $2.3 $1.9 $2.1 $2.5 $0.6 $2.0 $2.7 $12.9 $14.5 $13.4 $1 $3 $5 $7 $9 $11 $13 $15 $17 Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 Used New Global Consumer Auto Asset Base $120 $121 $123 $120 $115 $122 $124 $101 $84 $85 $83 $83 $86 $81 $77 $66 $40 $55 $70 $85 $100 $115 $130 Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 Serviced On-Balance Sheet ($ bil) Sales Proceeds as % of ALG (U.S. Lease Terminations)* 74 79 84 89 94 99 104 109 114 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2005 2006 2007 2008 (%) 7 Global Auto Finance: Condensed Income Statement Notable Items (Pre-Tax) ($ millions) Q4 2008 Q4 2007 Revenue Total financing revenue $3,303 $3,804 Interest expense 2,276 2,314 Depreciation expense on operating leases 1,273 1,383 Impairment of investment in operating leases 425 - Net financing (loss) revenue (671) 107 Other revenue Servicing fees 71 89 Gain on automotive loans, net 169 165 Gain on extinguishment of debt 4 - Investment (loss) income (114) 116 Other income 592 743 Total other revenue 722 1,113 Total net revenue 51 1,220 Provision for credit losses 510 188 Noninterest expense 957 789 (Loss) income before income tax (benefit) expense (1,416) 243 Income tax (benefit) expense (103) 106 Net (loss) income ($1,313) $137 ($ millions) Q4 2008 Q4 2007 Impairment charges on operating leases ($425) - Valuation adjustment auto HFS (LOCOM) and retained interests ($249) - Credit loss provision for retail balloon contract residuals ($162) - 8

Global Auto Finance: Condensed Income Statement Notable Items (Pre-Tax) ($ millions) Q4 2008 Q4 2007 Revenue Total financing revenue $3,303 $3,804 Interest expense 2,276 2,314 Depreciation expense on operating leases 1,273 1,383 Impairment of investment in operating leases 425 - Net financing (loss) revenue (671) 107 Other revenue Servicing fees 71 89 Gain on automotive loans, net 169 165 Gain on extinguishment of debt 4 - Investment (loss) income (114) 116 Other income 592 743 Total other revenue 722 1,113 Total net revenue 51 1,220 Provision for credit losses 510 188 Noninterest expense 957 789 (Loss) income before income tax (benefit) expense (1,416) 243 Income tax (benefit) expense (103) 106 Net (loss) income ($1,313) $137 ($ millions) Q4 2008 Q4 2007 Impairment charges on operating leases ($425) - Valuation adjustment auto HFS (LOCOM) and retained interests ($249) - Credit loss provision for retail balloon contract residuals ($162) - 8 Global Auto Finance: Consumer Auto Loss Trends Net Retail Losses (% Avg Assets) Q4 2008 2.51% 0.85% 0.70% 1.49% 2.10% Q4 2007 1.31% -0.01% 0.47% 1.20% 1.05% Year over Year Change +120bps +86bps +23bp +29bps +105bps North Asia Latin

Global Auto Finance: Consumer Auto Loss Trends Net Retail Losses (% Avg Assets) Q4 2008 2.51% 0.85% 0.70% 1.49% 2.10% Q4 2007 1.31% -0.01% 0.47% 1.20% 1.05% Year over Year Change +120bps +86bps +23bp +29bps +105bps North Asia Latin  Global Auto Finance: Auto Delinquency Trends Loans > 30 Days Past Due Q4 2008 3.18% 1.52% 1.74% 4.06% 2.96% Q4 2007 2.77% 1.36% 1.90% 4.08% 2.68% Year over Year Change +41bps +16bps -16bps -2bps +28bps North Asia Latin

Global Auto Finance: Auto Delinquency Trends Loans > 30 Days Past Due Q4 2008 3.18% 1.52% 1.74% 4.06% 2.96% Q4 2007 2.77% 1.36% 1.90% 4.08% 2.68% Year over Year Change +41bps +16bps -16bps -2bps +28bps North Asia Latin  Insurance: Key Metrics ($ mil) * Core Earnings = underwriting income + investment income + goodwill impairment + interest expense, less gain on sale of business, less capital gains; net of tax. See supplemental charts for a

Insurance: Key Metrics ($ mil) * Core Earnings = underwriting income + investment income + goodwill impairment + interest expense, less gain on sale of business, less capital gains; net of tax. See supplemental charts for a Insurance: Condensed Income Statement Notable Items (Pre-Tax) ($ millions) Q4 2008 Q4 2007 Revenue Insurance premiums and service revenue earned $963 $1,133 Investment income 9 107 Other income 132 42 Total insurance premiums and other income 1,104 1,282 Expense Insurance losses and loss adjustment expenses 514 656 Acquisition and underwriting expense 415 496 Impairment of goodwill 42 - Total expense 971 1,152 Income before income tax expense 133 130 Income tax expense 38 62 Net income $95 $68 ($ millions) Q4 2008 Q4 2007 Goodwill impairment (42) - Gain on sale of business 98 - 12

Insurance: Condensed Income Statement Notable Items (Pre-Tax) ($ millions) Q4 2008 Q4 2007 Revenue Insurance premiums and service revenue earned $963 $1,133 Investment income 9 107 Other income 132 42 Total insurance premiums and other income 1,104 1,282 Expense Insurance losses and loss adjustment expenses 514 656 Acquisition and underwriting expense 415 496 Impairment of goodwill 42 - Total expense 971 1,152 Income before income tax expense 133 130 Income tax expense 38 62 Net income $95 $68 ($ millions) Q4 2008 Q4 2007 Goodwill impairment (42) - Gain on sale of business 98 - 12 ResCap: Key Messages Operating and market environments Execution of strategic initiatives continues to reduce the balance sheet and

ResCap: Key Messages Operating and market environments Execution of strategic initiatives continues to reduce the balance sheet and ResCap: Key Metrics 2 1 Q4 ’08 includes $754 million after-tax gain on extinguishment of debt. 2 Total assets include the assets of auto division of GMAC Bank as presented on ResCap’s financial statements. 3 Government and Prime Second Liens are included in Prime Non-conforming. 3 Of the total, $4.2 billion was securitized on-balance

ResCap: Key Metrics 2 1 Q4 ’08 includes $754 million after-tax gain on extinguishment of debt. 2 Total assets include the assets of auto division of GMAC Bank as presented on ResCap’s financial statements. 3 Government and Prime Second Liens are included in Prime Non-conforming. 3 Of the total, $4.2 billion was securitized on-balance ResCap: Condensed Income Statement Note: Income statement presentation (condensed) as it appears on a GMAC reported basis; results on a ResCap reported basis can be found on page 37 of this presentation. Notable Items (Pre-Tax)* ($ millions) Q4 2008 Q4 2007 Revenue Total financing revenue $600 $1,288 Interest expense 777 1,421 Net financing loss (177) (133) Servicing fees 334 440 Servicing asset valuation and hedge activities, net (248) 34 Net loan servicing income 86 474 (Loss) gain on mortgage loans, net (56) 299 Gain on extinguishment of debt 757 521 Other loss (195) (388) Total other revenue 506 432 Total net revenue 415 773 Provision for credit losses 817 830 Noninterest expense 666 875 Loss before income tax benefit (1,068) (932) Income tax benefit (87) (11) Net loss ($981) ($921) ($ millions) Q4 2008 Q4 2007 ResCap gain/loss on investment securities, net (80) (399) ResCap provision for loan losses (817) (830) ResCap FX currency impacts (122) 12 Gain on extinguishment of debt (pre-tax) 757 521 15

ResCap: Condensed Income Statement Note: Income statement presentation (condensed) as it appears on a GMAC reported basis; results on a ResCap reported basis can be found on page 37 of this presentation. Notable Items (Pre-Tax)* ($ millions) Q4 2008 Q4 2007 Revenue Total financing revenue $600 $1,288 Interest expense 777 1,421 Net financing loss (177) (133) Servicing fees 334 440 Servicing asset valuation and hedge activities, net (248) 34 Net loan servicing income 86 474 (Loss) gain on mortgage loans, net (56) 299 Gain on extinguishment of debt 757 521 Other loss (195) (388) Total other revenue 506 432 Total net revenue 415 773 Provision for credit losses 817 830 Noninterest expense 666 875 Loss before income tax benefit (1,068) (932) Income tax benefit (87) (11) Net loss ($981) ($921) ($ millions) Q4 2008 Q4 2007 ResCap gain/loss on investment securities, net (80) (399) ResCap provision for loan losses (817) (830) ResCap FX currency impacts (122) 12 Gain on extinguishment of debt (pre-tax) 757 521 15 ResCap: Global Portfolio Credit Quality Excluding

ResCap: Global Portfolio Credit Quality Excluding ResCap: Capital and Liquidity Total equity of $2.2 billion (12/31/08) ResCap received equity infusions of $1.67 billion from GMAC during Q4 2008, including $690

ResCap: Capital and Liquidity Total equity of $2.2 billion (12/31/08) ResCap received equity infusions of $1.67 billion from GMAC during Q4 2008, including $690 GMAC Bank: IB Finance Transaction On January 30, GMAC acquired 100% of ResCap’s non-voting equity interest in IB

GMAC Bank: IB Finance Transaction On January 30, GMAC acquired 100% of ResCap’s non-voting equity interest in IB Global Capital and Liquidity: GMAC Bank Continuing to grow GMAC Bank assets and deposits in line with FDIC

Global Capital and Liquidity: GMAC Bank Continuing to grow GMAC Bank assets and deposits in line with FDIC GMAC Bank: Regulatory Restrictions for Auto Assets Banking regulations limit GMAC Bank’s ability to fund the majority of

GMAC Bank: Regulatory Restrictions for Auto Assets Banking regulations limit GMAC Bank’s ability to fund the majority of Global Capital and Liquidity: Cash Roll Forward GMAC ResCap GMAC ($ billions) Consolidated Consolidated Bank Cash & Cash Equivalents (9/30/08) $13.5 $6.9 $4.9 Debt Maturities (5.5) (0.3) 0.0 Q4 Wholesale Securitization Maturities (0.7) 0.0 0.0 Asset RunOff net of On-Balance Sheet Securitizations 7.5 0.0 (0.2) Intercompany Secured Loans 0.0 (0.7) 0.0 Other* 0.4 1.1 0.7 Cash & Cash Equivalents (12/31/08) $15.2 $7.0 $5.5 Net Q4 Change in Cash & Cash Equivalents $1.7 $0.1 $0.6 * Includes receipt of $5.0 billion in TARP funds and cash tender payment of $2.5 billion for debt exchange Note: Numbers may not foot due to rounding 21

Global Capital and Liquidity: Cash Roll Forward GMAC ResCap GMAC ($ billions) Consolidated Consolidated Bank Cash & Cash Equivalents (9/30/08) $13.5 $6.9 $4.9 Debt Maturities (5.5) (0.3) 0.0 Q4 Wholesale Securitization Maturities (0.7) 0.0 0.0 Asset RunOff net of On-Balance Sheet Securitizations 7.5 0.0 (0.2) Intercompany Secured Loans 0.0 (0.7) 0.0 Other* 0.4 1.1 0.7 Cash & Cash Equivalents (12/31/08) $15.2 $7.0 $5.5 Net Q4 Change in Cash & Cash Equivalents $1.7 $0.1 $0.6 * Includes receipt of $5.0 billion in TARP funds and cash tender payment of $2.5 billion for debt exchange Note: Numbers may not foot due to rounding 21 Global Capital and Liquidity: Capital Base The bond exchange increased equity capital by $3.7 billion from principal reduction, cash tender and

Global Capital and Liquidity: Capital Base The bond exchange increased equity capital by $3.7 billion from principal reduction, cash tender and Global Capital and Liquidity: Capital Ratios

Global Capital and Liquidity: Capital Ratios Global Capital and Liquidity: Term Debt Maturity Profile Debt exchange did not significantly change GMAC’s overall maturity profile Unsecured and secured term maturities in 2009 are $30.5 billion, down only $2.0 billion

Global Capital and Liquidity: Term Debt Maturity Profile Debt exchange did not significantly change GMAC’s overall maturity profile Unsecured and secured term maturities in 2009 are $30.5 billion, down only $2.0 billion GMAC: Funding Strategy Within GMAC Bank: Increase deposits and shift toward a higher proportion of retail deposits Continue to access FHLB funding Access federal funding facilities as appropriate Outside GMAC Bank Maintain key components of current funding strategy Emphasis on secured committed facilities Maintain strong and deep lending relationships with key bank partners Manage asset originations to match available funding As origination patterns change, reshape funding to reflect this Expand funding in new ways where possible Applying for TLGP Exploring opportunities within TALF When markets return, access public ABS market and perhaps unsecured market Credit market challenges remain, and GMAC will continue to focus on

GMAC: Funding Strategy Within GMAC Bank: Increase deposits and shift toward a higher proportion of retail deposits Continue to access FHLB funding Access federal funding facilities as appropriate Outside GMAC Bank Maintain key components of current funding strategy Emphasis on secured committed facilities Maintain strong and deep lending relationships with key bank partners Manage asset originations to match available funding As origination patterns change, reshape funding to reflect this Expand funding in new ways where possible Applying for TLGP Exploring opportunities within TALF When markets return, access public ABS market and perhaps unsecured market Credit market challenges remain, and GMAC will continue to focus on GMAC: Selected BHC Requirements The transformation to a BHC involves a number of changes, including those

GMAC: Selected BHC Requirements The transformation to a BHC involves a number of changes, including those GMAC: Corporate Governance GMAC is required to reconstitute its board by March 24, 2009 The new board will be comprised of seven members including: One member appointed by Cerberus Two members appointed by the Trustee of the “Treasury Trust“ The Treasury Trust is a blind trust or trusts that will be established by GM to hold certain

GMAC: Corporate Governance GMAC is required to reconstitute its board by March 24, 2009 The new board will be comprised of seven members including: One member appointed by Cerberus Two members appointed by the Trustee of the “Treasury Trust“ The Treasury Trust is a blind trust or trusts that will be established by GM to hold certain Conclusion The difficult economic and financial environment in 2008 threatened

Conclusion The difficult economic and financial environment in 2008 threatened  Supplemental Charts

Supplemental Charts GMAC: Preliminary Quarterly Consolidated Net Income Supplemental ($ millions) Q4 2008 Q4 2007 Revenue Total financing revenue $4,000 $5,193 Interest expense 2,917 3,653 Depreciation expense on operating lease assets 1,274 1,384 Impairment of investment in operating leases 425 - Net financing (loss) revenue (616) 156 Other revenue Net loan servicing income 157 563 Insurance premiums and service revenue earned 974 1,144 Gain on mortgage and automotive loans, net 113 464 Gain on extinguishment of debt 11,464 563 Investment loss (183) (75) Other (loss) income (491) 478 Total other revenue 12,034 3,137 Total net revenue 11,418 3,293 Provision for credit losses 1,340 1,021 Noninterest expense Insurance losses and loss adjustment expenses 537 656 Other operating expenses 2,137 2,191 Impairment of goodwill 42 - Total noninterest expense 2,716 2,847 Income (loss) before income tax (benefit) expense 7,362 (575) Income tax (benefit) expense (100) 149 Net income (loss) $7,462 ($724) 30

GMAC: Preliminary Quarterly Consolidated Net Income Supplemental ($ millions) Q4 2008 Q4 2007 Revenue Total financing revenue $4,000 $5,193 Interest expense 2,917 3,653 Depreciation expense on operating lease assets 1,274 1,384 Impairment of investment in operating leases 425 - Net financing (loss) revenue (616) 156 Other revenue Net loan servicing income 157 563 Insurance premiums and service revenue earned 974 1,144 Gain on mortgage and automotive loans, net 113 464 Gain on extinguishment of debt 11,464 563 Investment loss (183) (75) Other (loss) income (491) 478 Total other revenue 12,034 3,137 Total net revenue 11,418 3,293 Provision for credit losses 1,340 1,021 Noninterest expense Insurance losses and loss adjustment expenses 537 656 Other operating expenses 2,137 2,191 Impairment of goodwill 42 - Total noninterest expense 2,716 2,847 Income (loss) before income tax (benefit) expense 7,362 (575) Income tax (benefit) expense (100) 149 Net income (loss) $7,462 ($724) 30 GMAC: Preliminary Full-Year Consolidated Net Income Supplemental ($ millions) 2008 2007 Revenue Total financing revenue $18,395 $21,187 Interest expense 11,870 14,776 Depreciation expense on operating lease assets 5,483 4,915 Impairment of investment in operating leases 1,234 - Net financing (loss) revenue (192) 1,496 Other revenue Net loan servicing income 1,498 1,649 Insurance premiums and service revenue earned 4,329 4,378 (Loss) gain on mortgage and automotive loans, net (1,560) 508 Gain on extinguishment of debt 12,628 563 Investment (loss) income (446) 473 Other income 601 2,732 Total other revenue 17,050 10,303 Total net revenue 16,858 11,799 Provision for credit losses 3,683 3,096 Noninterest expense Insurance losses and loss adjustment expenses 2,522 2,451 Other operating expenses 8,734 7,739 Impairment of goodwill 58 455 Total noninterest expense 11,314 10,645 Income (loss) before income tax (benefit) expense 1,861 (1,942) Income tax (benefit) expense (7) 390 Net income (loss) $1,868 ($2,332) 31

GMAC: Preliminary Full-Year Consolidated Net Income Supplemental ($ millions) 2008 2007 Revenue Total financing revenue $18,395 $21,187 Interest expense 11,870 14,776 Depreciation expense on operating lease assets 5,483 4,915 Impairment of investment in operating leases 1,234 - Net financing (loss) revenue (192) 1,496 Other revenue Net loan servicing income 1,498 1,649 Insurance premiums and service revenue earned 4,329 4,378 (Loss) gain on mortgage and automotive loans, net (1,560) 508 Gain on extinguishment of debt 12,628 563 Investment (loss) income (446) 473 Other income 601 2,732 Total other revenue 17,050 10,303 Total net revenue 16,858 11,799 Provision for credit losses 3,683 3,096 Noninterest expense Insurance losses and loss adjustment expenses 2,522 2,451 Other operating expenses 8,734 7,739 Impairment of goodwill 58 455 Total noninterest expense 11,314 10,645 Income (loss) before income tax (benefit) expense 1,861 (1,942) Income tax (benefit) expense (7) 390 Net income (loss) $1,868 ($2,332) 31 GMAC: Preliminary Consolidated Balance Sheet Supplemental ($ billions) Assets 12/31/2008 12/31/2007 Cash and cash equivalents $15.2 $17.7 Investment securities 8.4 16.7 Loans held for sale 7.9 20.6 Finance receivables and loans, net of unearned income 100.1 127.5 Allowance for credit losses (3.4) (2.8) Investment in operating leases, net 26.4 32.3 Other assets 34.9 36.9 Total assets $189.5 $248.9 Liabilities Unsecured debt $53.2 $102.3 Secured debt 73.1 90.8 Total debt 126.3 193.1 Deposit liabilities 19.8 15.3 Other liabilities 21.5 24.9 Total liabilities 167.6 233.3 Equity Total equity 21.9 15.6 Total liabilities, preferred interests and equity $189.5 $248.9 32