Ally Financial Inc. 3Q10 Earnings Review November 3, 2010 Contact Ally Investor Relations at (866) 710-4623 or investor.relations@ally.com

Ally Financial Inc. 3Q10 Earnings Review November 3, 2010 Contact Ally Investor Relations at (866) 710-4623 or investor.relations@ally.com

Forward-Looking Statements and Additional Information The following should be read in conjunction with the financial statements, notes and other information contained in the Company’s 2009 Annual

Forward-Looking Statements and Additional Information The following should be read in conjunction with the financial statements, notes and other information contained in the Company’s 2009 Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. This information is preliminary and based on company data available at the time of the presentation In the presentation that follows and related comments by Ally Financial Inc. (“Ally”) management, the use of the words “expect,” “anticipate,”

“estimate,” “forecast,” “initiative,” “objective,” “plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “intend,” “evaluate,” “pursue,” “seek,” “may,”

“would,” “could,” “should,” “believe,” “potential,” “continue,” or similar expressions is intended to identify forward-looking statements. All statements

herein and in related management comments, other than statements of historical fact, including without limitation, statements about future events

and financial performance, are forward-looking statements that involve certain risks and uncertainties. While these statements represent our

current judgment on what the future may hold, and we believe these judgments are reasonable, these statements are not guarantees of any

events or financial results, and Ally’s actual results may differ materially due to numerous important factors that are described in the most recent

reports on SEC Forms 10-K and 10-Q for Ally, each of which may be revised or supplemented in subsequent reports on SEC Forms 10-Q and 8-

K. Such factors include, among others, the following: our inability to repay our outstanding obligations to the U.S. Department of the Treasury, or to

do so in a timely fashion and without disruption to our business; uncertainty of Ally's ability to enter into transactions or execute strategic

alternatives to realize the value of its Residential Capital, LLC (“ResCap”) operations; our inability to successfully accommodate the additional risk

exposure relating to providing wholesale and retail financing to Chrysler dealers and customers and the resulting impact to our financial stability;

uncertainty related to Chrysler’s and GM’s recent exits from bankruptcy; uncertainty related to the new financing arrangement between Ally and

Chrysler; securing low cost funding for Ally and ResCap and maintaining the mutually beneficial relationship between Ally and GM, and Ally and

Chrysler; our ability to maintain an appropriate level of debt and capital; the profitability and financial condition of GM and Chrysler; our ability to

realize the anticipated benefits associated with our conversion to a bank holding company, and the increased regulation and restrictions that we

are now subject to; continued challenges in the residential mortgage and capital markets; the potential for deterioration in the residual value of off-

lease vehicles; the continuing negative impact on ResCap of the decline in the U.S. housing market; any impact resulting from delayed foreclosure

sales or related matters; changes in U.S. government-sponsored mortgage programs or disruptions in the markets in which our mortgage

subsidiaries operate; disruptions in the market in which we fund Ally’s and ResCap’s operations, with resulting negative impact on our liquidity;

changes in our accounting assumptions that may require or that result from changes in the accounting rules or their application, which could result

in an impact on earnings; changes in the credit ratings of ResCap, Ally, Chrysler or GM; changes in economic conditions, currency exchange rates

or political stability in the markets in which we operate; and changes in the existing or the adoption of new laws, regulations, policies or other

activities of governments, agencies and similar organizations (including as a result of the recently enacted financial regulatory reform bill).

Investors are cautioned not to place undue reliance on forward-looking statements. Ally undertakes no obligation to update publicly or otherwise

revise any forward-looking statements except where expressly required by law. Reconciliation of non-GAAP financial measures included within

this presentation are provided in this presentation. Use of the term “loans” describes products associated with direct and indirect lending activities of Ally’s global operations. The specific products

include retail installment sales contracts, loans, lines of credit, leases or other financing products. The term “originate” refers to Ally’s purchase,

acquisition or direct origination of various “loan” products. 2

Third Quarter Highlights Ally earned core pre-tax income(1) of $636 million and net income of $269 million in the third quarter Premier Auto

Third Quarter Highlights Ally earned core pre-tax income(1) of $636 million and net income of $269 million in the third quarter Premier Auto

Finance

Provider Access Capital

Markets Improve Cost

Structure Franchise momentum continues with 48% year-over-year growth in consumer originations Maintained #1 position as leading U.S. new car lender Named preferred lender for Fiat in the U.S. Over $30 billion of new secured and unsecured funding transactions year-to-date Quarterly controllable expenses declined $146 million year-over-year Bank deposits grew $2.6 billion in the quarter and now comprise 29% of total funding Ally Bank retail deposits grew 29% year-over-year with CD retention rate of 88% Ally Bank is a leading franchise in the growing online banking market (1) Core pre-tax income is a non-GAAP financial measure. Please refer to slide 11 for further details De-Risk

Mortgage

Business European operations sold, representing $11 billion of assets Resort Finance portfolio ($1 billion UPB) sold at a gain Sold approximately $1.9 billion UPB of legacy mortgage assets at gains in 2010 Grow Deposits 3

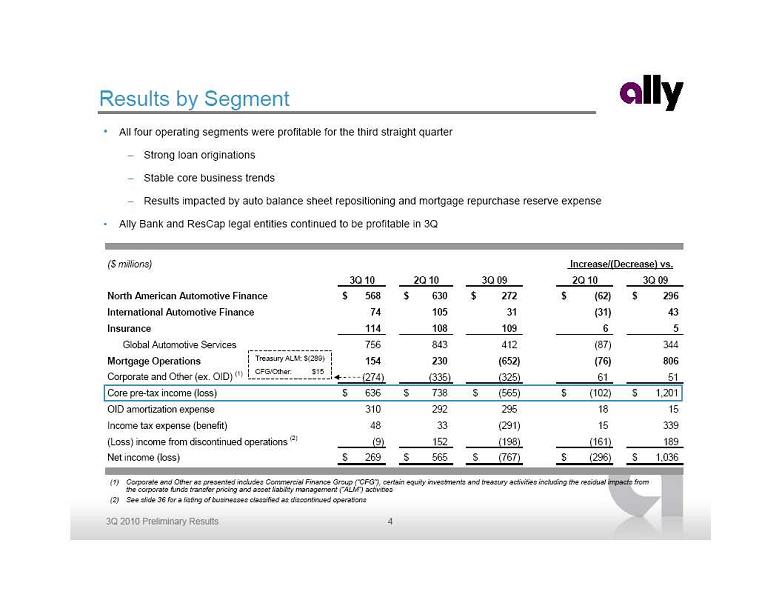

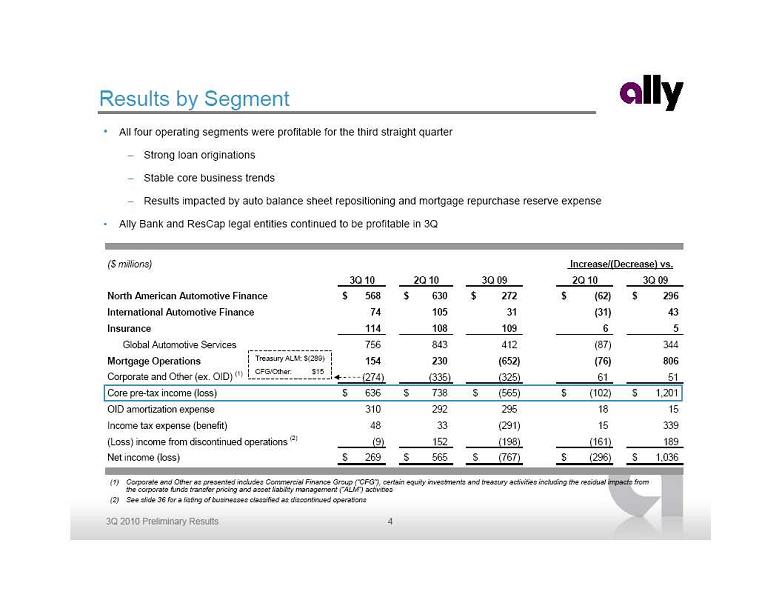

Results by Segment All four operating segments were profitable for the third straight quarter Strong loan originations Stable core business trends Results impacted by auto balance sheet repositioning and mortgage repurchase reserve expense Ally Bank and ResCap legal entities continued to be profitable in 3Q (1) Corporate and Other as presented includes Commercial Finance Group (“CFG”), certain equity investments and treasury activities including the residual impacts from

Results by Segment All four operating segments were profitable for the third straight quarter Strong loan originations Stable core business trends Results impacted by auto balance sheet repositioning and mortgage repurchase reserve expense Ally Bank and ResCap legal entities continued to be profitable in 3Q (1) Corporate and Other as presented includes Commercial Finance Group (“CFG”), certain equity investments and treasury activities including the residual impacts from

the corporate funds transfer pricing and asset liability management (“ALM”) activities (2) See slide 36 for a listing of businesses classified as discontinued operations Treasury ALM: $(289) CFG/Other: $15 ($ millions) 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 North American Automotive Finance 568 $ 630 $ 272 $ (62) $ 296 $ International Automotive Finance 74 105 31 (31) 43 Insurance 114 108 109 6 5 Global Automotive Services 756 843 412 (87) 344 Mortgage Operations 154 230 (652) (76) 806 Corporate and Other (ex. OID) (1) (274) (335) (325) 61 51 Core pre-tax income (loss) 636 $ 738 $ (565) $ (102) $ 1,201 $ OID amortization expense 310 292 295 18 15 Income tax expense (benefit) 48 33 (291) 15 339 (Loss) income from discontinued operations (2) (9) 152 (198) (161) 189 Net income (loss) 269 $ 565 $ (767) $ (296) $ 1,036 $ Increase/(Decrease) vs. 4

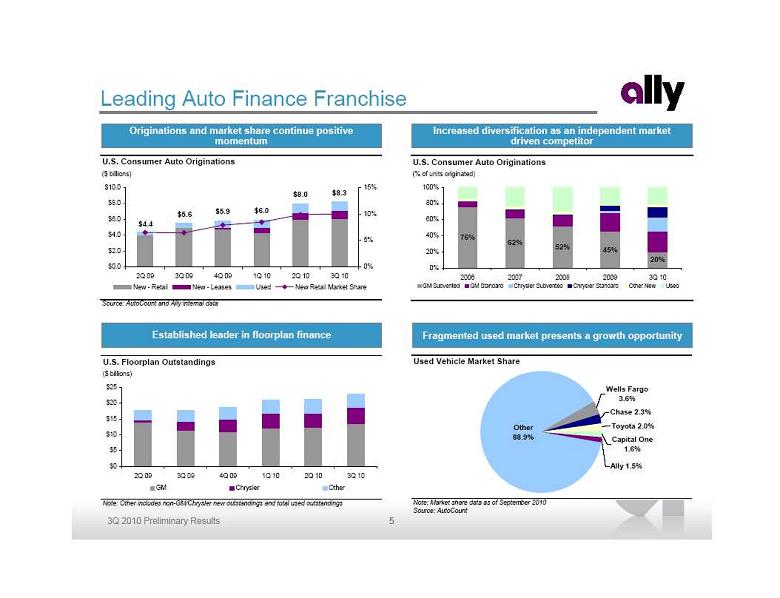

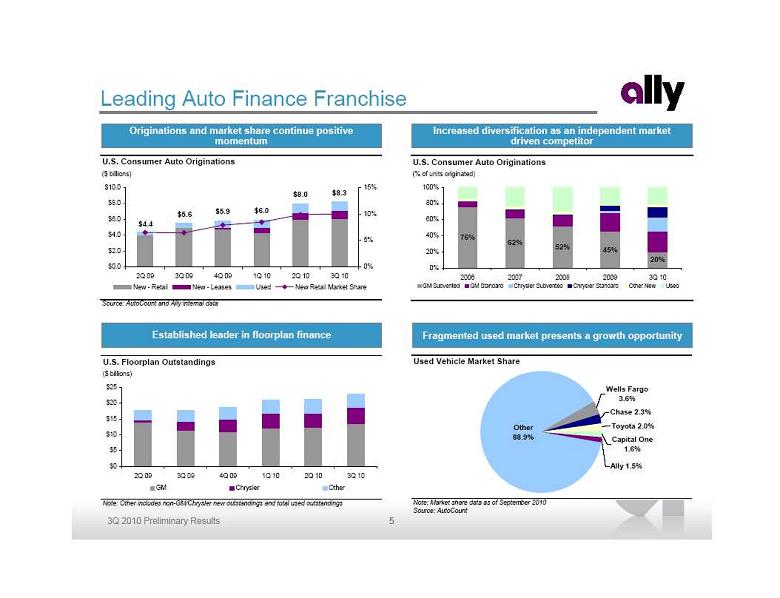

Leading Auto Finance Franchise Established leader in floorplan finance Increased diversification as an independent market

Leading Auto Finance Franchise Established leader in floorplan finance Increased diversification as an independent market

driven competitor Originations and market share continue positive

momentum Fragmented used market presents a growth opportunity U.S. Consumer Auto Originations ($ billions) Source: AutoCount and Ally internal data $5.9 $6.0 $8.0 $8.3 $4.4 $5.6 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 2Q 09 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 0% 5% 10% 15% New - Retail New - Leases Used New Retail Market Share U.S. Consumer Auto Originations (% of units originated) 76% 62% 52% 45% 20% 0% 20% 40% 60% 80% 100% 2006 2007 2008 2009 3Q 10 GM Subvented GM Standard Chrysler Subvented Chrysler Standard Other New Used U.S. Floorplan Outstandings ($ billions) Note: Other includes non-GM/Chrysler new outstandings and total used outstandings $0 $5 $10 $15 $20 $25 2Q 09 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 GM Chrysler Other Used Vehicle Market Share Note: Market share data as of September 2010 Source: AutoCount Other 88.9% Wells Fargo 3.6% Chase 2.3% Toyota 2.0% Capital One 1.6% Ally 1.5% 5

Success is Driven by Strong Dealer Relationships 90 years of understanding and serving dealer needs Floorplan lending and broad product offerings serve as strong foundation for deep dealer relationships Bank holding company structure provides added stability and cost-efficient funding Market leading, nationwide scale and infrastructure Drivers at the dealer level 84% of GM dealer stock 76% of Chrysler dealer stock 34% of GM consumer sales 49% of Chrysler consumer sales Nearly 3x market share of five largest competitors Ally U.S. Penetration Statistics Dealers Ally Dealer Rewards strategy supports broader

Success is Driven by Strong Dealer Relationships 90 years of understanding and serving dealer needs Floorplan lending and broad product offerings serve as strong foundation for deep dealer relationships Bank holding company structure provides added stability and cost-efficient funding Market leading, nationwide scale and infrastructure Drivers at the dealer level 84% of GM dealer stock 76% of Chrysler dealer stock 34% of GM consumer sales 49% of Chrysler consumer sales Nearly 3x market share of five largest competitors Ally U.S. Penetration Statistics Dealers Ally Dealer Rewards strategy supports broader

and deeper relationships Competitive and broad

retail product suite Commercial loans to

finance auto inventory and

operating assets Industry leading wholesale

internet auction channel Dealer inventory insurance

and retail vehicle service

contracts Rewards program to

recognize volume and

breadth of relationship Access to broad

application flow ensures

“first look” opportunities Dealer Products Consumer Products Floorplan Financing Floorplan Insurance SmartAuction Working Capital Loans Retail Loans Retail Leases Service Contracts GAP Protection 6

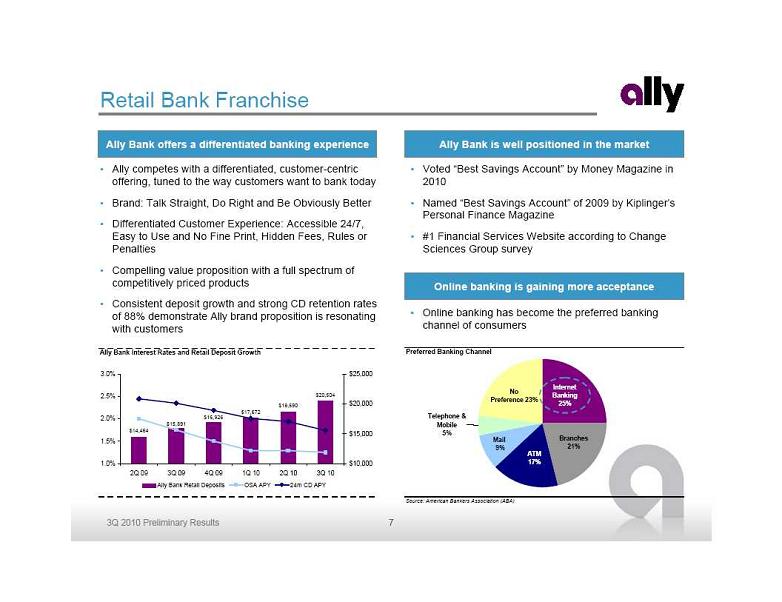

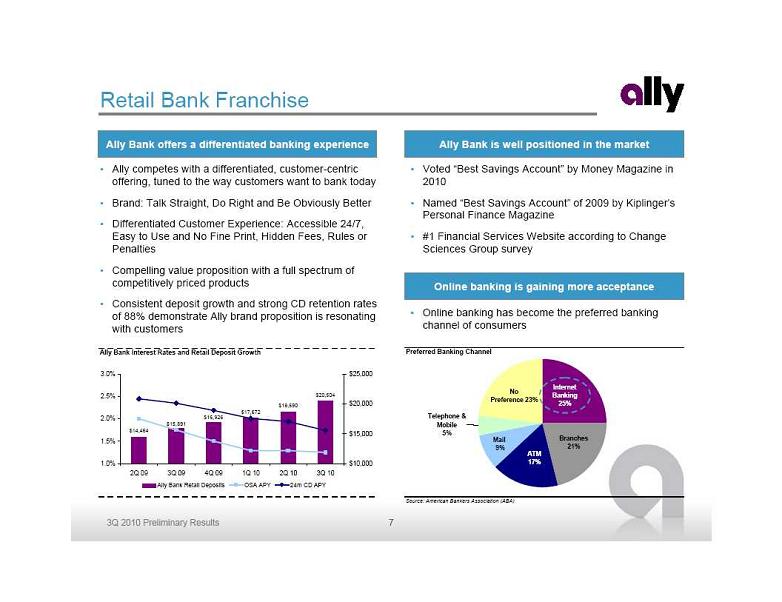

Retail Bank Franchise Ally Bank offers a differentiated banking experience Ally competes with a differentiated, customer-centric

Retail Bank Franchise Ally Bank offers a differentiated banking experience Ally competes with a differentiated, customer-centric

offering, tuned to the way customers want to bank today Brand: Talk Straight, Do Right and Be Obviously Better Differentiated Customer Experience: Accessible 24/7,

Easy to Use and No Fine Print, Hidden Fees, Rules or

Penalties Compelling value proposition with a full spectrum of

competitively priced products Consistent deposit growth and strong CD retention rates

of 88% demonstrate Ally brand proposition is resonating

with customers Voted “Best Savings Account” by Money Magazine in

2010 Named “Best Savings Account” of 2009 by Kiplinger’s

Personal Finance Magazine #1 Financial Services Website according to Change

Sciences Group survey Ally Bank is well positioned in the market Online banking has become the preferred banking

channel of consumers Online banking is gaining more acceptance Ally Bank Interest Rates and Retail Deposit Growth $14,464 $17,672 $18,690 $20,504 $16,926 $15,891 1.0% 1.5% 2.0% 2.5% 3.0% 2Q 09 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 $10,000 $15,000 $20,000 $25,000 Ally Bank Retail Deposits OSA APY 24m CD APY Preferred Banking Channel Source: American Bankers Association (ABA) Telephone & Mobile 5% Mail 9% ATM 17% Branches 21% No Preference 23% Internet Banking 25% 7

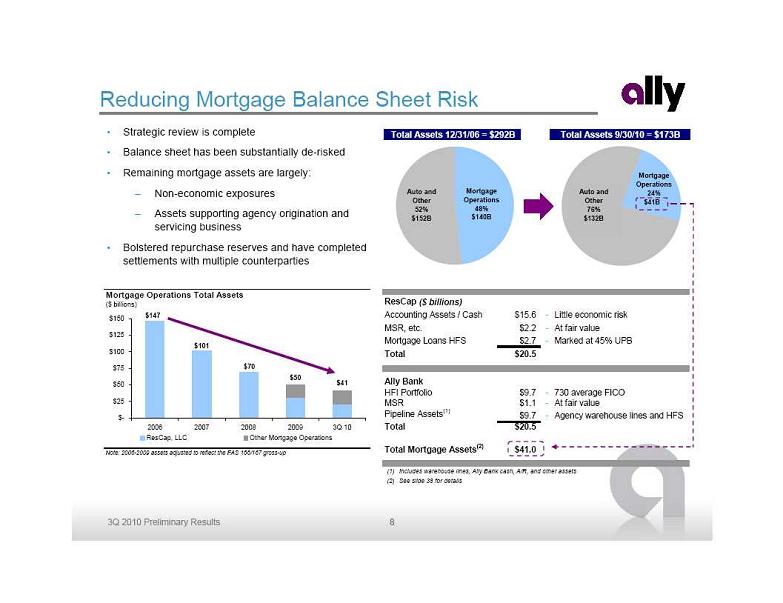

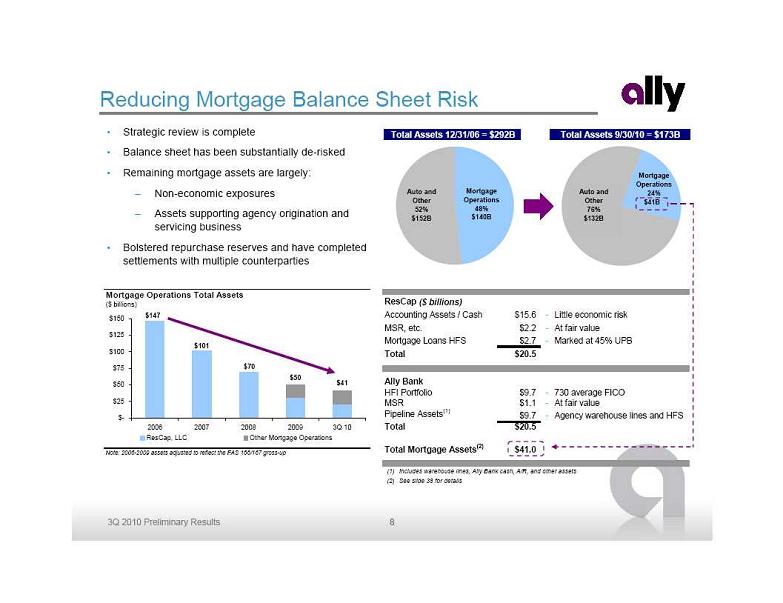

Reducing Mortgage Balance Sheet Risk Strategic review is complete Balance sheet has been substantially de-risked Remaining mortgage assets are largely: Non-economic exposures Assets supporting agency origination and

Reducing Mortgage Balance Sheet Risk Strategic review is complete Balance sheet has been substantially de-risked Remaining mortgage assets are largely: Non-economic exposures Assets supporting agency origination and

servicing business Bolstered repurchase reserves and have completed

settlements with multiple counterparties (1) Includes warehouse lines, Ally Bank cash, A/R, and other assets (2) See slide 38 for details Total Assets 12/31/06 = $292B Total Assets 9/30/10 = $173B Mortgage Operations 48% $140B Auto and Other 52% $152B Auto and Other 76% $132B Mortgage Operations 24% $41B ResCap ($ billions) Accounting Assets / Cash $15.6 - Little economic risk MSR, etc. $2.2 - At fair value Mortgage Loans HFS $2.7 - Marked at 45% UPB Total $20.5 Ally Bank HFI Portfolio $9.7 - 730 average FICO MSR $1.1 - At fair value Pipeline Assets (1) $9.7 - Agency warehouse lines and HFS Total $20.5 Total Mortgage Assets (2) $41.0 Mortgage Operations Total Assets ($ billions) Note: 2006-2009 assets adjusted to reflect the FAS 166/167 gross-up $101 $70 $50 $41 $- $25 $50 $75 $100 $125 $150 2006 2007 2008 2009 3Q 10 ResCap, LLC Other Mortgage Operations #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! $147 8

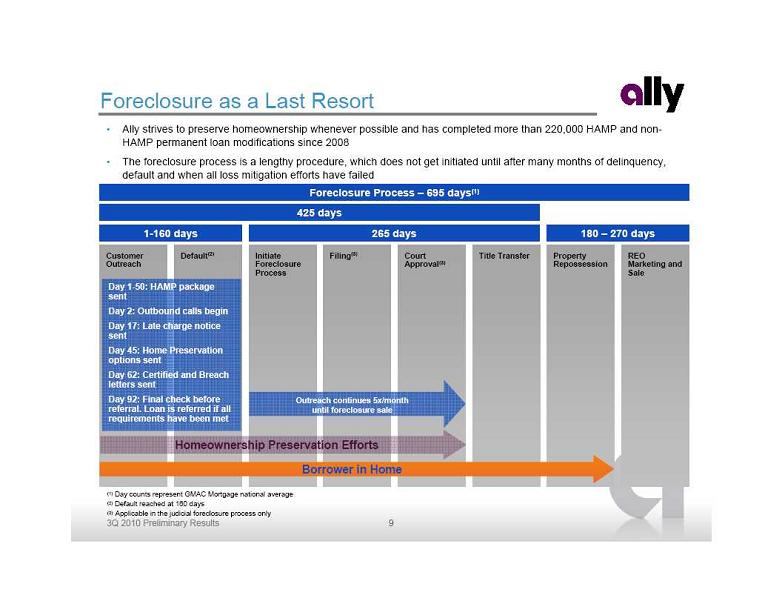

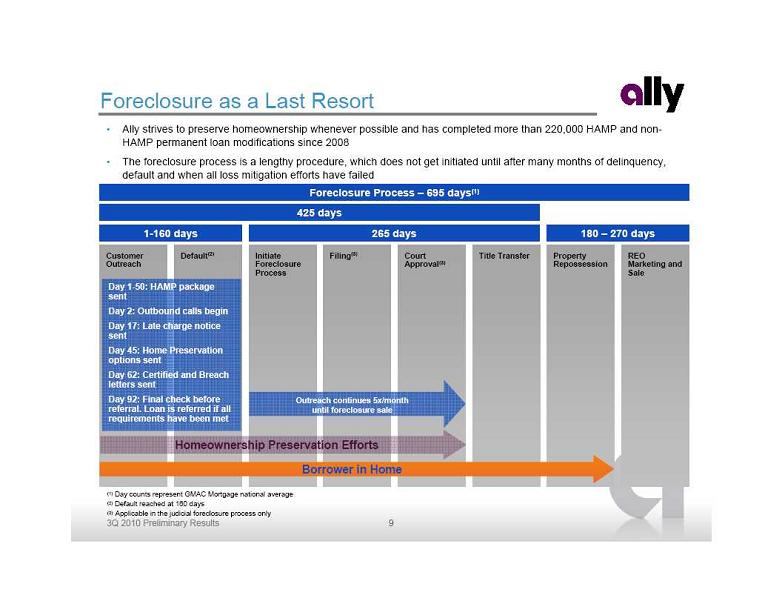

Default(2) Initiate Foreclosure Process Filing(3) Court

Default(2) Initiate Foreclosure Process Filing(3) Court

Approval(3) Title Transfer Property

Repossession REO Marketing and Sale Customer

Outreach Borrower in Home Homeownership Preservation Efforts 265 days 180 – 270 days (1) Day counts represent GMAC Mortgage national average (2) Default reached at 160 days (3) Applicable in the judicial foreclosure process only 425 days 1-160 days Foreclosure Process – 695 days(1) Outreach continues 5x/month until foreclosure sale Day 1-50: HAMP package

sent Day 2: Outbound calls begin Day 17: Late charge notice

sent Day 45: Home Preservation

options sent Day 62: Certified and Breach

letters sent Day 92: Final check before

referral. Loan is referred if all

requirements have been met Foreclosure as a Last Resort Ally strives to preserve homeownership whenever possible and has completed more than 220,000 HAMP and non-

HAMP permanent loan modifications since 2008 The foreclosure process is a lengthy procedure, which does not get initiated until after many months of delinquency,

default and when all loss mitigation efforts have failed 9

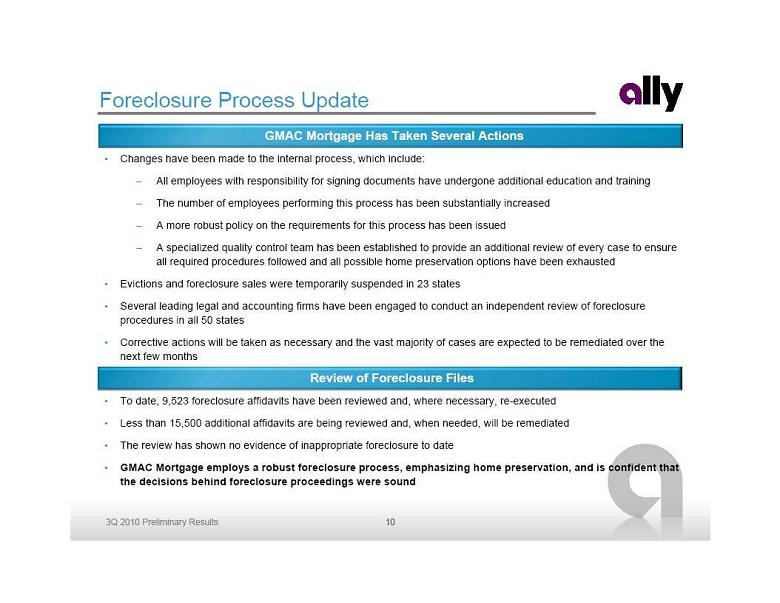

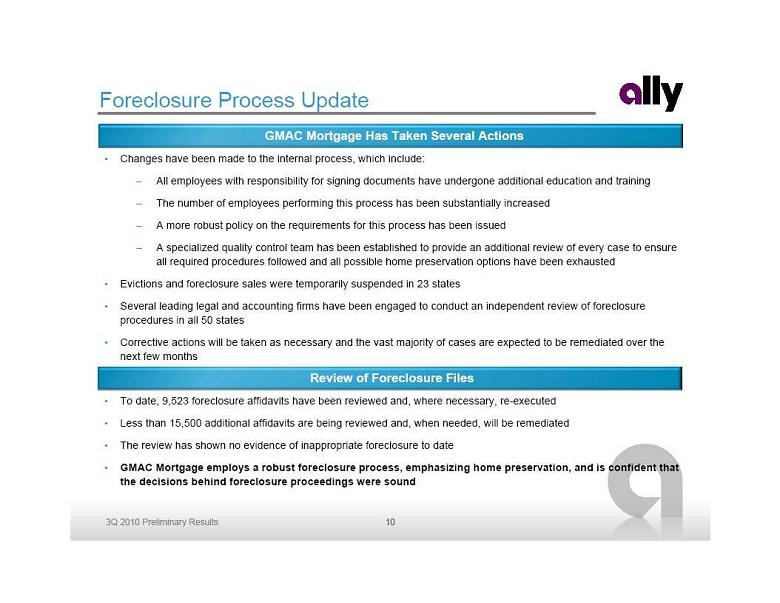

Foreclosure Process Update Changes have been made to the internal process, which include: All employees with responsibility for signing documents have undergone additional education and training The number of employees performing this process has been substantially increased A more robust policy on the requirements for this process has been issued A specialized quality control team has been established to provide an additional review of every case to ensure

Foreclosure Process Update Changes have been made to the internal process, which include: All employees with responsibility for signing documents have undergone additional education and training The number of employees performing this process has been substantially increased A more robust policy on the requirements for this process has been issued A specialized quality control team has been established to provide an additional review of every case to ensure

all required procedures followed and all possible home preservation options have been exhausted Evictions and foreclosure sales were temporarily suspended in 23 states Several leading legal and accounting firms have been engaged to conduct an independent review of foreclosure

procedures in all 50 states Corrective actions will be taken as necessary and the vast majority of cases are expected to be remediated over the

next few months To date, 9,523 foreclosure affidavits have been reviewed and, where necessary, re-executed Less than 15,500 additional affidavits are being reviewed and, when needed, will be remediated The review has shown no evidence of inappropriate foreclosure to date GMAC Mortgage employs a robust foreclosure process, emphasizing home preservation, and is confident that

the decisions behind foreclosure proceedings were sound GMAC Mortgage Has Taken Several Actions Review of Foreclosure Files 10

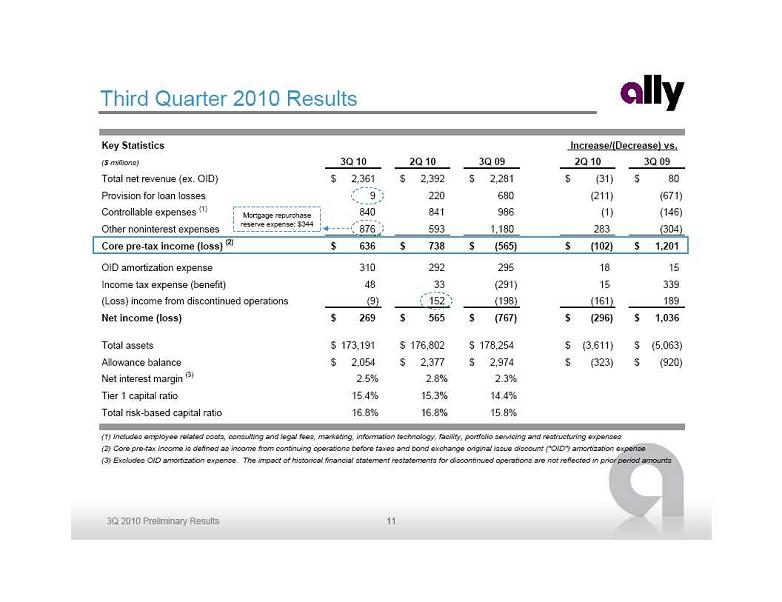

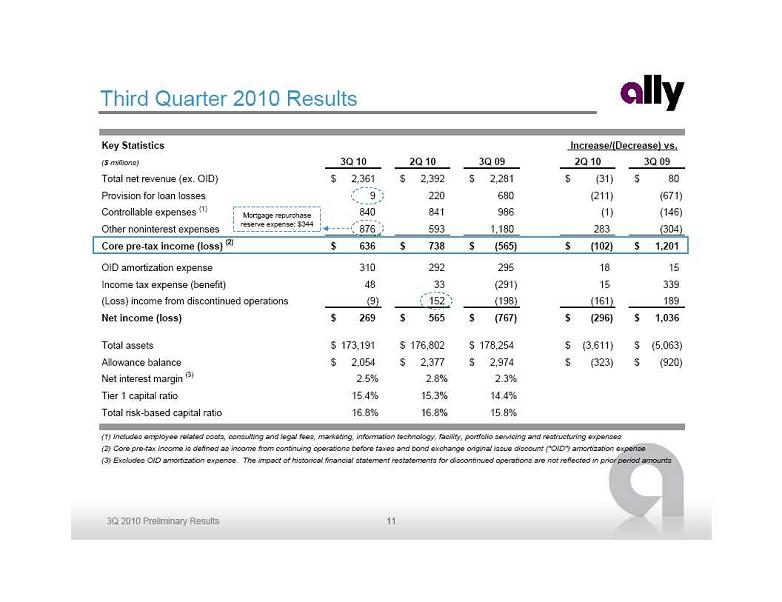

Third Quarter 2010 Results Mortgage repurchase

Third Quarter 2010 Results Mortgage repurchase

reserve expense: $344 Key Statistics ($ millions) 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 Total net revenue (ex. OID) 2,361 $ 2,392 $ 2,281 $ (31) $ 80 $ Provision for loan losses 9 220 680 (211) (671) Controllable expenses (1) 840 841 986 (1) (146) Other noninterest expenses 876 593 1,180 283 (304) Core pre-tax income (loss) (2) 636 $ 738 $ (565) $ (102) $ 1,201 $ OID amortization expense 310 292 295 18 15 Income tax expense (benefit) 48 33 (291) 15 339 (Loss) income from discontinued operations (9) 152 (198) (161) 189 Net income (loss) 269 $ 565 $ (767) $ (296) $ 1,036 $ Total assets 173,191 $ 176,802 $ 178,254 $ (3,611) $ (5,063) $ Allowance balance 2,054 $ 2,377 $ 2,974 $ (323) $ (920) $ Net interest margin (3) 2.5% 2.8% 2.3% Tier 1 capital ratio 15.4% 15.3% 14.4% Total risk-based capital ratio 16.8% 16.8% 15.8% (1) Includes employee related costs, consulting and legal fees, marketing, information technology, facility, portfolio servicing and restructuring expenses (2) Core pre-tax income is defined as income from continuing operations before taxes and bond exchange original issue discount ("OID") amortization expense (3) Excludes OID amortization expense. The impact of historical financial statement restatements for discontinued operations are not reflected in prior period amounts Increase/(Decrease) vs. 11

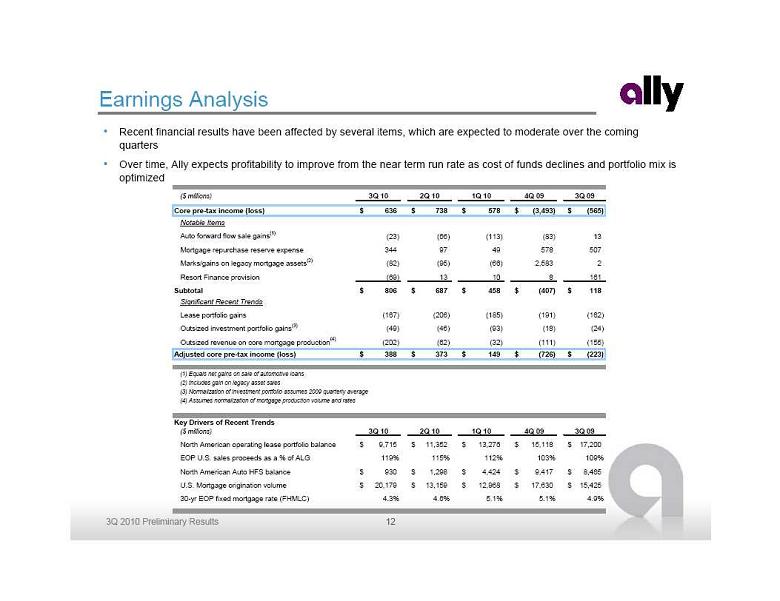

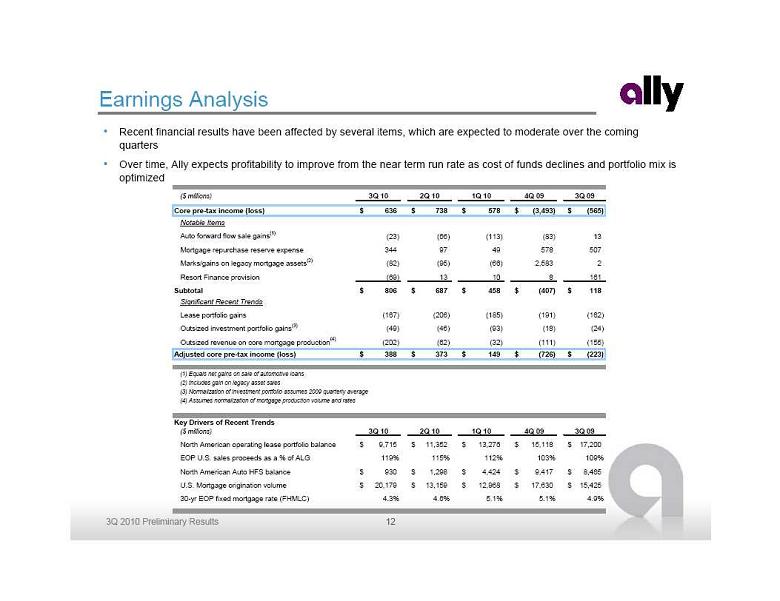

Earnings Analysis Recent financial results have been affected by several items, which are expected to moderate over the coming

Earnings Analysis Recent financial results have been affected by several items, which are expected to moderate over the coming

quarters Over time, Ally expects profitability to improve from the near term run rate as cost of funds declines and portfolio mix is

optimized ($ millions) 3Q 10 2Q 10 1Q 10 4Q 09 3Q 09 Core pre-tax income (loss) 636 $ 738 $ 578 $ (3,493) $ (565) $ Notable Items Auto forward flow sale gains (1) (23) (66) (113) (83) 13 Mortgage repurchase reserve expense 344 97 49 578 507 Marks/gains on legacy mortgage assets (2) (82) (95) (66) 2,583 2 Resort Finance provision (69) 13 10 8 161 Subtotal 806 $ 687 $ 458 $ (407) $ 118 $ Significant Recent Trends Lease portfolio gains (167) (206) (185) (191) (162) Outsized investment portfolio gains (3) (49) (46) (93) (18) (24) Outsized revenue on core mortgage production (4) (202) (62) (32) (111) (155) Adjusted core pre-tax income (loss) 388 $ 373 $ 149 $ (726) $ (223) $ (1) Equals net gains on sale of automotive loans (2) Includes gain on legacy asset sales (3) Normalization of investment portfolio assumes 2009 quarterly average (4) Assumes normalization of mortgage production volume and rates Key Drivers of Recent Trends ($ millions) 3Q 10 2Q 10 1Q 10 4Q 09 3Q 09 North American operating lease portfolio balance 9,715 $ 11,352 $ 13,276 $ 15,118 $ 17,200 $ EOP U.S. sales proceeds as a % of ALG 119% 115% 112% 103% 109% North American Auto HFS balance 930 $ 1,298 $ 4,424 $ 9,417 $ 8,465 $ U.S. Mortgage origination volume 20,179 $ 13,159 $ 12,968 $ 17,630 $ 15,425 $ 30-yr EOP fixed mortgage rate (FHMLC) 4.3% 4.6% 5.1% 5.1% 4.9% 12

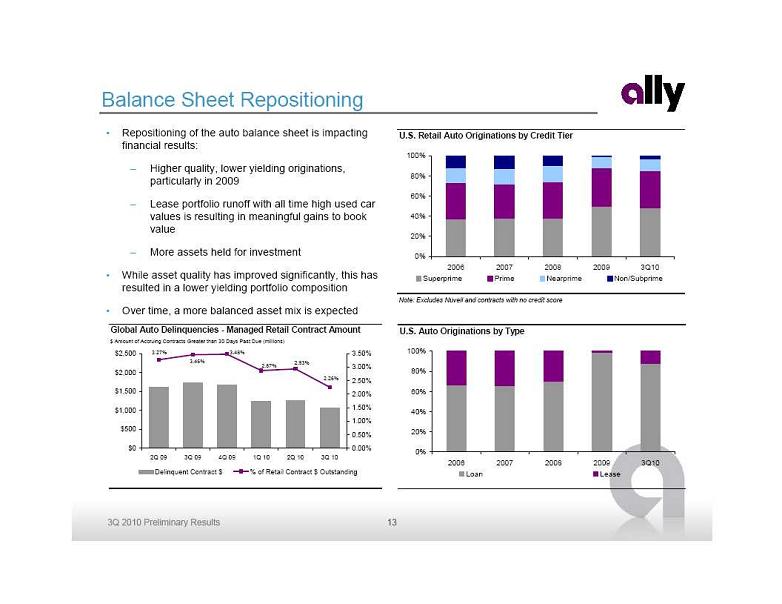

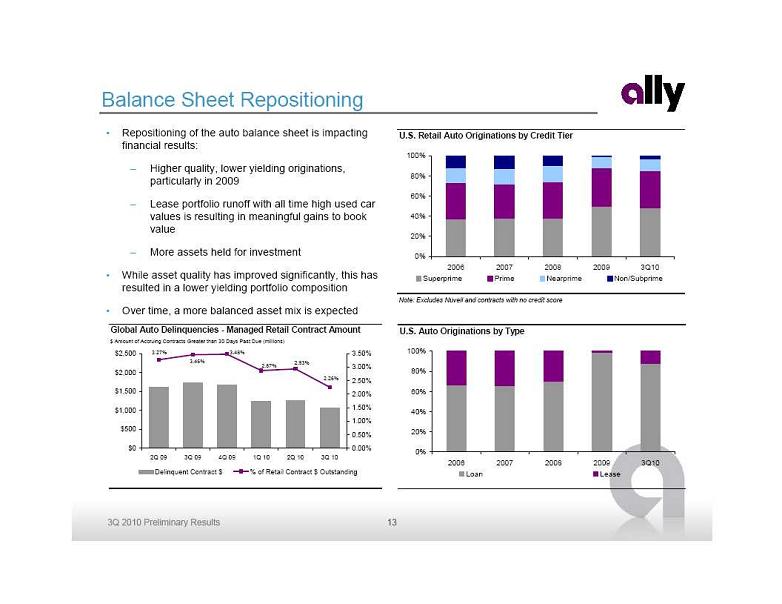

Balance Sheet Repositioning Repositioning of the auto balance sheet is impacting

Balance Sheet Repositioning Repositioning of the auto balance sheet is impacting

financial results: Higher quality, lower yielding originations,

particularly in 2009 Lease portfolio runoff with all time high used car

values is resulting in meaningful gains to book

value More assets held for investment While asset quality has improved significantly, this has

resulted in a lower yielding portfolio composition Over time, a more balanced asset mix is expected Global Auto Delinquencies - Managed Retail Contract Amount $ Amount of Accruing Contracts Greater than 30 Days Past Due (millions) 3.27% 3.46% 3.48% 2.87% 2.93% 2.26% $0 $500 $1,000 $1,500 $2,000 $2,500 2Q 09 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% Delinquent Contract $ % of Retail Contract $ Outstanding U.S. Auto Originations by Type 0% 20% 40% 60% 80% 100% 2006 2007 2008 2009 3Q10 Loan Lease U.S. Retail Auto Originations by Credit Tier Note: Excludes Nuvell and contracts with no credit score 0% 20% 40% 60% 80% 100% 2006 2007 2008 2009 3Q10 Superprime Prime Nearprime Non/Subprime 13

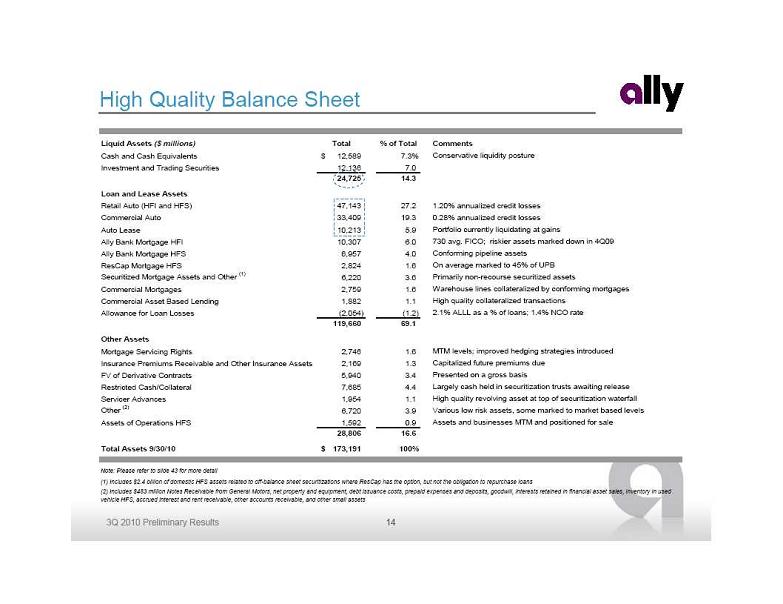

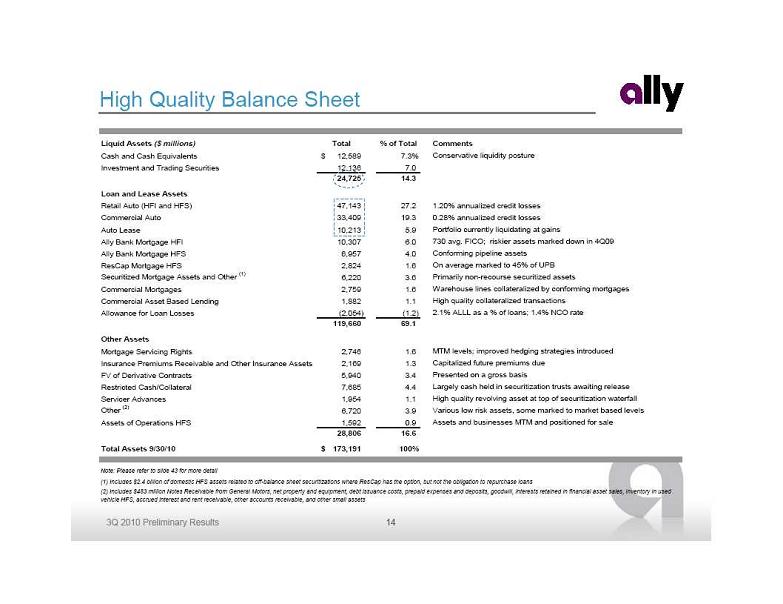

High Quality Balance Sheet Liquid Assets ($ millions) Total % of Total Comments Cash and Cash Equivalents 12,589 $ 7.3% Conservative liquidity posture Investment and Trading Securities 12,136 7.0 24,725 14.3 Loan and Lease Assets Retail Auto (HFI and HFS) 47,143 27.2 1.20% annualized credit losses Commercial Auto 33,409 19.3 0.28% annualized credit losses Auto Lease 10,213 5.9 Portfolio currently liquidating at gains Ally Bank Mortgage HFI 10,307 6.0 730 avg. FICO; riskier assets marked down in 4Q09 Ally Bank Mortgage HFS 6,957 4.0 Conforming pipeline assets ResCap Mortgage HFS 2,824 1.6 On average marked to 45% of UPB Securitized Mortgage Assets and Other (1) 6,220 3.6 Primarily non-recourse securitized assets Commercial Mortgages 2,759 1.6 Warehouse lines collateralized by conforming mortgages Commercial Asset Based Lending 1,882 1.1 High quality collateralized transactions Allowance for Loan Losses (2,054) (1.2) 2.1% ALLL as a % of loans; 1.4% NCO rate 119,660 69.1 Other Assets Mortgage Servicing Rights 2,746 1.6 MTM levels; improved hedging strategies introduced Insurance Premiums Receivable and Other Insurance Assets 2,169 1.3 Capitalized future premiums due FV of Derivative Contracts 5,940 3.4 Presented on a gross basis Restricted Cash/Collateral 7,685 4.4 Largely cash held in securitization trusts awaiting release Servicer Advances 1,954 1.1 High quality revolving asset at top of securitization waterfall Other (2) 6,720 3.9 Various low risk assets, some marked to market based levels Assets of Operations HFS 1,592 0.9 Assets and businesses MTM and positioned for sale 28,806 16.6 Total Assets 9/30/10 173,191 $ 100% (1) Includes $2.4 billion of domestic HFS assets related to off-balance sheet securitizations where ResCap has the option, but not the obligation to repurchase loans (2) Includes $483 million Notes Receivable from General Motors, net property and equipment, debt issuance costs, prepaid expenses and deposits, goodwill, interests retained in financial asset sales, inventory in used vehicle HFS, accrued interest and rent receivable, other accounts receivable, and other small assets Note: Please refer to slide 43 for more detail 14

High Quality Balance Sheet Liquid Assets ($ millions) Total % of Total Comments Cash and Cash Equivalents 12,589 $ 7.3% Conservative liquidity posture Investment and Trading Securities 12,136 7.0 24,725 14.3 Loan and Lease Assets Retail Auto (HFI and HFS) 47,143 27.2 1.20% annualized credit losses Commercial Auto 33,409 19.3 0.28% annualized credit losses Auto Lease 10,213 5.9 Portfolio currently liquidating at gains Ally Bank Mortgage HFI 10,307 6.0 730 avg. FICO; riskier assets marked down in 4Q09 Ally Bank Mortgage HFS 6,957 4.0 Conforming pipeline assets ResCap Mortgage HFS 2,824 1.6 On average marked to 45% of UPB Securitized Mortgage Assets and Other (1) 6,220 3.6 Primarily non-recourse securitized assets Commercial Mortgages 2,759 1.6 Warehouse lines collateralized by conforming mortgages Commercial Asset Based Lending 1,882 1.1 High quality collateralized transactions Allowance for Loan Losses (2,054) (1.2) 2.1% ALLL as a % of loans; 1.4% NCO rate 119,660 69.1 Other Assets Mortgage Servicing Rights 2,746 1.6 MTM levels; improved hedging strategies introduced Insurance Premiums Receivable and Other Insurance Assets 2,169 1.3 Capitalized future premiums due FV of Derivative Contracts 5,940 3.4 Presented on a gross basis Restricted Cash/Collateral 7,685 4.4 Largely cash held in securitization trusts awaiting release Servicer Advances 1,954 1.1 High quality revolving asset at top of securitization waterfall Other (2) 6,720 3.9 Various low risk assets, some marked to market based levels Assets of Operations HFS 1,592 0.9 Assets and businesses MTM and positioned for sale 28,806 16.6 Total Assets 9/30/10 173,191 $ 100% (1) Includes $2.4 billion of domestic HFS assets related to off-balance sheet securitizations where ResCap has the option, but not the obligation to repurchase loans (2) Includes $483 million Notes Receivable from General Motors, net property and equipment, debt issuance costs, prepaid expenses and deposits, goodwill, interests retained in financial asset sales, inventory in used vehicle HFS, accrued interest and rent receivable, other accounts receivable, and other small assets Note: Please refer to slide 43 for more detail 14

Asset Quality Summary Credit quality continued its favorable trend quarter-over-quarter Portfolio migrating to higher quality asset mix Allowance coverage remains strong relative to net charge-offs and non-performing loans Loan balances grew quarter-over-quarter driven by strong auto originations Ally Financial Consolidated (1) ($ millions) 3Q 10 2Q 10 1Q 10 4Q 09 3Q 09 Ending Loan Balance 95,770 $ 90,371 $ 86,468 $ 76,310 $ 86,281 $ 30+ Accruing DPD 1,173 1,380 1,366 1,329 1,787 30+ Accruing DPD % 1.2% 1.5% 1.6% 1.7% 2.1% Non-Performing Loans (NPLs) 1,592 2,294 2,443 2,699 5,953 Net Charge-Offs (NCOs) 334 307 316 3,866 1,034 Net Charge-Off Rate (2) 1.4% 1.4% 1.5% 18.2% 4.8% Provision Expense 9 220 146 3,069 680 Allowance Balance (ALLL) 2,054 2,377 2,480 2,445 2,974 ALLL as % of Loans (3) 2.1% 2.6% 2.9% 3.2% 3.4% ALLL as % of NPLs (3) 129.0% 103.6% 101.5% 90.6% 50.0% ALLL as % of NCOs (3) 153.8% 193.3% 196.1% 15.8% 71.9% (1) Loans within this table are classified as held-for-investment recorded at historical cost as these loans are included in our allowance for loan losses (2) Net charge-off ratios are calculated as annualized net charge-offs divided by average outstanding finance recievables and loans excluding loans measured at fair value, conditional repurchase loans and loans held-for-sale (3) ALLL coverage ratios are based on the allowance for loan losses related to loans held-for-investment excluding those loans held at fair value as a percentage of the unpaid principal balance, net of premiums and discounts 15

Asset Quality Summary Credit quality continued its favorable trend quarter-over-quarter Portfolio migrating to higher quality asset mix Allowance coverage remains strong relative to net charge-offs and non-performing loans Loan balances grew quarter-over-quarter driven by strong auto originations Ally Financial Consolidated (1) ($ millions) 3Q 10 2Q 10 1Q 10 4Q 09 3Q 09 Ending Loan Balance 95,770 $ 90,371 $ 86,468 $ 76,310 $ 86,281 $ 30+ Accruing DPD 1,173 1,380 1,366 1,329 1,787 30+ Accruing DPD % 1.2% 1.5% 1.6% 1.7% 2.1% Non-Performing Loans (NPLs) 1,592 2,294 2,443 2,699 5,953 Net Charge-Offs (NCOs) 334 307 316 3,866 1,034 Net Charge-Off Rate (2) 1.4% 1.4% 1.5% 18.2% 4.8% Provision Expense 9 220 146 3,069 680 Allowance Balance (ALLL) 2,054 2,377 2,480 2,445 2,974 ALLL as % of Loans (3) 2.1% 2.6% 2.9% 3.2% 3.4% ALLL as % of NPLs (3) 129.0% 103.6% 101.5% 90.6% 50.0% ALLL as % of NCOs (3) 153.8% 193.3% 196.1% 15.8% 71.9% (1) Loans within this table are classified as held-for-investment recorded at historical cost as these loans are included in our allowance for loan losses (2) Net charge-off ratios are calculated as annualized net charge-offs divided by average outstanding finance recievables and loans excluding loans measured at fair value, conditional repurchase loans and loans held-for-sale (3) ALLL coverage ratios are based on the allowance for loan losses related to loans held-for-investment excluding those loans held at fair value as a percentage of the unpaid principal balance, net of premiums and discounts 15

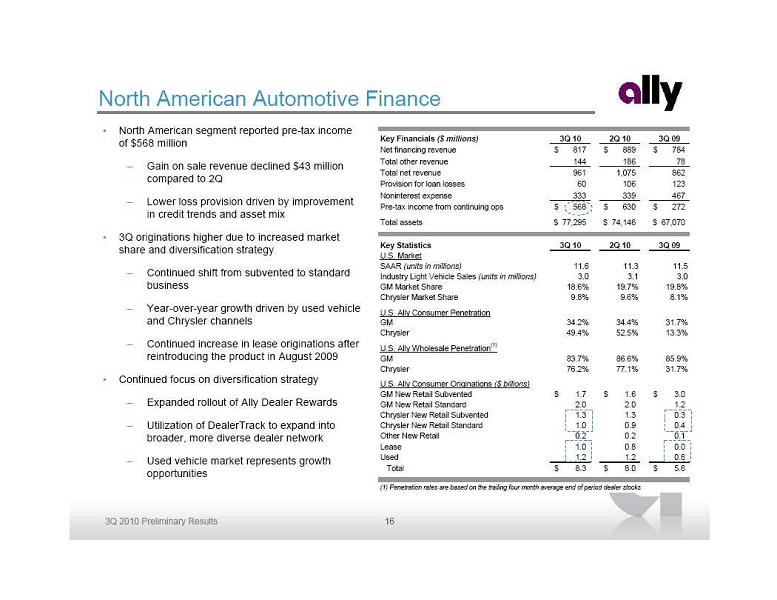

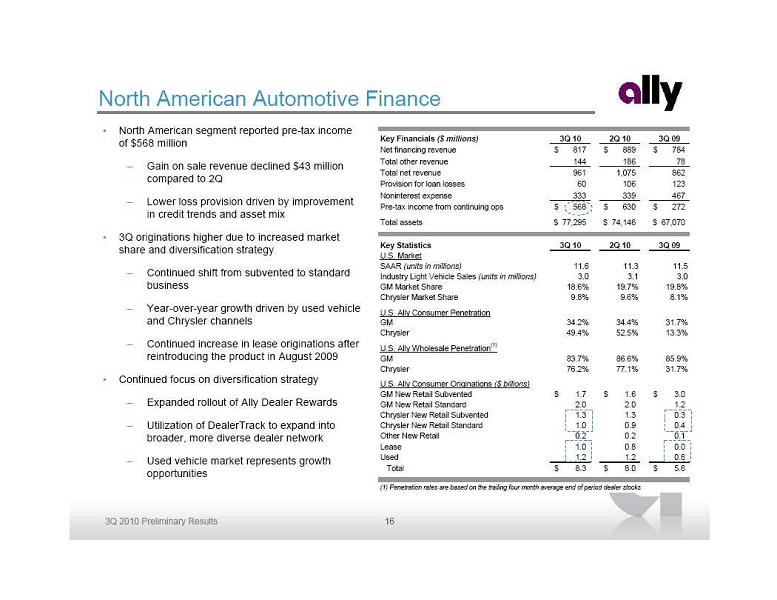

North American segment reported pre-tax income

North American segment reported pre-tax income

of $568 million Gain on sale revenue declined $43 million

compared to 2Q Lower loss provision driven by improvement

in credit trends and asset mix 3Q originations higher due to increased market

share and diversification strategy Continued shift from subvented to standard

business Year-over-year growth driven by used vehicle

and Chrysler channels Continued increase in lease originations after

reintroducing the product in August 2009 Continued focus on diversification strategy Expanded rollout of Ally Dealer Rewards Utilization of DealerTrack to expand into

broader, more diverse dealer network Used vehicle market represents growth

opportunities North American Automotive Finance Key Financials ($ millions) 3Q 10 2Q 10 3Q 09 Net financing revenue 817 $ 889 $ 784 $ Total other revenue 144 186 78 Total net revenue 961 1,075 862 Provision for loan losses 60 106 123 Noninterest expense 333 339 467 Pre-tax income from continuing ops 568 $ 630 $ 272 $ Total assets 77,295 $ 74,146 $ 67,070 $ Key Statistics 3Q 10 2Q 10 3Q 09 U.S. Market SAAR (units in millions) 11.6 11.3 11.5 Industry Light Vehicle Sales (units in millions) 3.0 3.1 3.0 GM Market Share 18.6% 19.7% 19.8% Chrysler Market Share 9.8% 9.6% 8.1% U.S. Ally Consumer Penetration GM 34.2% 34.4% 31.7% Chrysler 49.4% 52.5% 13.3% U.S. Ally Wholesale Penetration (1) GM 83.7% 86.6% 85.9% Chrysler 76.2% 77.1% 31.7% U.S. Ally Consumer Originations ($ billions) GM New Retail Subvented 1.7 $ 1.6 $ 3.0 $ GM New Retail Standard 2.0 2.0 1.2 Chrysler New Retail Subvented 1.3 1.3 0.3 Chrysler New Retail Standard 1.0 0.9 0.4 Other New Retail 0.2 0.2 0.1 Lease 1.0 0.8 0.0 Used 1.2 1.2 0.6 Total 8.3 $ 8.0 $ 5.6 $ (1) Penetration rates are based on the trailing four month average end of period dealer stocks 16

International operations earned $74 million of pre-

International operations earned $74 million of pre-

tax income compared to $105 million in 2Q Loan loss provision expense favorable due to

improved asset quality Noninterest expense increased due to certain

non-recurring items in 2Q Another strong quarter of originations in China,

Brazil and the U.K. Brazil up 56% year-over-year China up 67% year-over-year U.K. up 29% year-over-year Strong margins in key growth areas Continued focus on streamlining auto business Closed sale of Argentina auto finance Signed agreement to sell Ecuador auto

finance International Automotive Finance Key Financials ($ millions) 3Q 10 2Q 10 3Q 09 Net financing revenue 176 $ 174 $ 197 $ Total other revenue 77 86 79 Total net revenue 253 260 276 Provision for loan losses (5) 11 32 Noninterest expense 184 144 213 Pre-tax income from continuing ops 74 $ 105 $ 31 $ Total assets 17,500 $ 16,596 $ 24,118 $ Consumer Originations ($ millions) 3Q 10 2Q 10 3Q 09 Germany 277 $ 258 $ 337 $ Brazil 488 331 312 U.K. 210 209 163 Mexico 118 112 95 China (1) 679 507 407 Other 225 224 213 Total Continuing International Operations 1,997 $ 1,640 $ 1,526 $ (1) Originations in China part of a joint-venture in which Ally owns a minority interest 17

Global Auto Finance – Consumer Credit Trends Retail auto losses and delinquencies have returned

Global Auto Finance – Consumer Credit Trends Retail auto losses and delinquencies have returned

to historical levels Delinquency trends continued to show improvement

in 3Q, despite typical seasonal trends Sustained benefit from operational

improvements in collection activities Nuvell portfolio experienced strong

improvement Increased quality of newer vintages Stabilized economic conditions Credit losses increased slightly quarter-over-quarter Slight increase in frequency due to

seasonality Recoveries remained strong; however,

subsided from 2Q levels Nuvell gross losses remained flat to 2Q Global Delinquencies - Managed Retail Contract Amount $ Amount of Accruing Contracts Greater than 30 Days Past Due (millions) 2.91% 2.80% 2.62% 2.22% 2.16% 1.81% 2.26% 2.93% 2.87% 3.48% 3.46% 3.27% $0 $500 $1,000 $1,500 $2,000 $2,500 2Q 09 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% Nuvell Delinquent Contract $ Delinquent Contract $ (excluding Nuvell) % of Retail Contract $ Outstanding % of Retail Contract $ Outstanding (excluding Nuvell) Global Annualized Credit Losses - Managed Retail Contract Amount ($ millions) (1) 3Q and 4Q 2009 elevated due to change in charge-off policy 2.29% 3.29% 3.57% 2.04% 1.05% 1.20% 0.85% 0.77% 1.30% 2.48% 2.39% 1.80% $0 $100 $200 $300 $400 $500 2Q 09 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% Nuvell Credit Losses Credit Losses (excluding Nuvell) % of Avg. Managed Assets % of Avg. Managed Assets (excluding Nuvell) (1) (1) 18

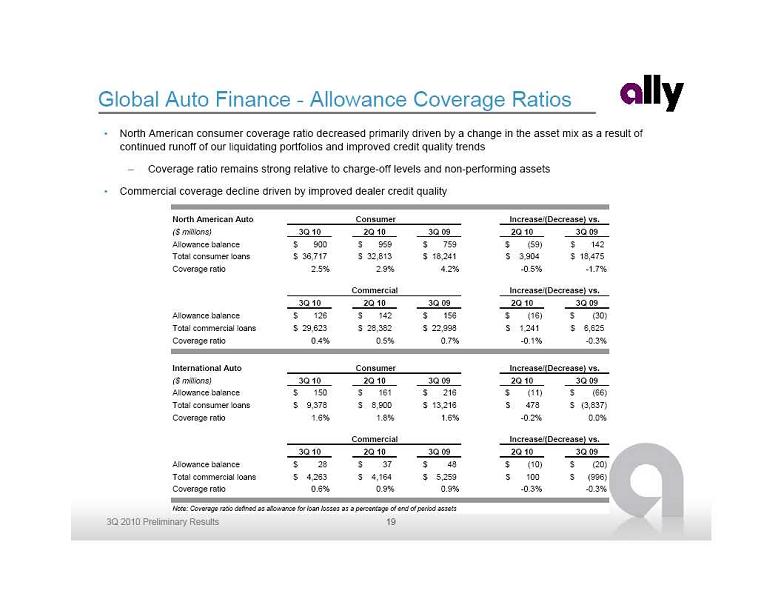

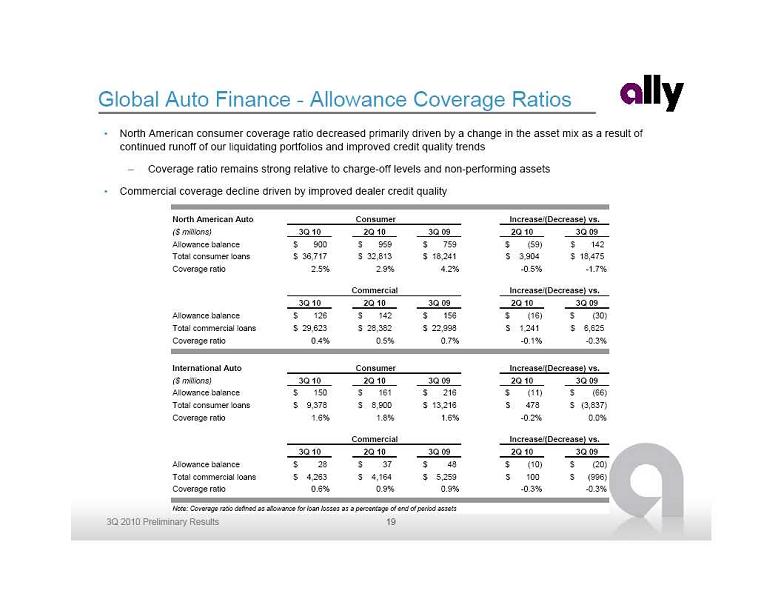

Global Auto Finance - Allowance Coverage Ratios North American consumer coverage ratio decreased primarily driven by a change in the asset mix as a result of

Global Auto Finance - Allowance Coverage Ratios North American consumer coverage ratio decreased primarily driven by a change in the asset mix as a result of

continued runoff of our liquidating portfolios and improved credit quality trends Coverage ratio remains strong relative to charge-off levels and non-performing assets Commercial coverage decline driven by improved dealer credit quality North American Auto Consumer ($ millions) 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 Allowance balance 900 $ 959 $ 759 $ (59) $ 142 $ Total consumer loans 36,717 $ 32,813 $ 18,241 $ 3,904 $ 18,475 $ Coverage ratio 2.5% 2.9% 4.2% -0.5% -1.7% Commercial 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 Allowance balance 126 $ 142 $ 156 $ (16) $ (30) $ Total commercial loans 29,623 $ 28,382 $ 22,998 $ 1,241 $ 6,625 $ Coverage ratio 0.4% 0.5% 0.7% -0.1% -0.3% International Auto Consumer ($ millions) 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 Allowance balance 150 $ 161 $ 216 $ (11) $ (66) $ Total consumer loans 9,378 $ 8,900 $ 13,216 $ 478 $ (3,837) $ Coverage ratio 1.6% 1.8% 1.6% -0.2% 0.0% Commercial 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 Allowance balance 28 $ 37 $ 48 $ (10) $ (20) $ Total commercial loans 4,263 $ 4,164 $ 5,259 $ 100 $ (996) $ Coverage ratio 0.6% 0.9% 0.9% -0.3% -0.3% Note: Coverage ratio defined as allowance for loan losses as a percentage of end of period assets Increase/(Decrease) vs. Increase/(Decrease) vs. Increase/(Decrease) vs. Increase/(Decrease) vs. 19

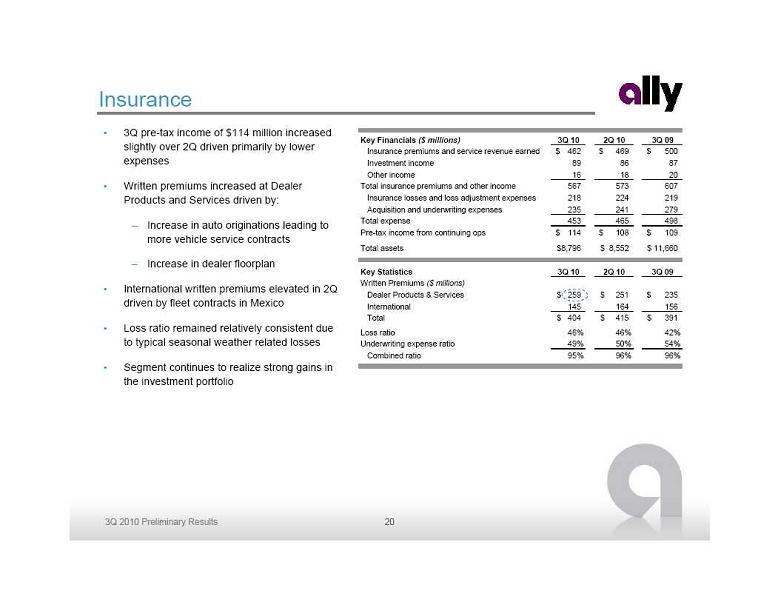

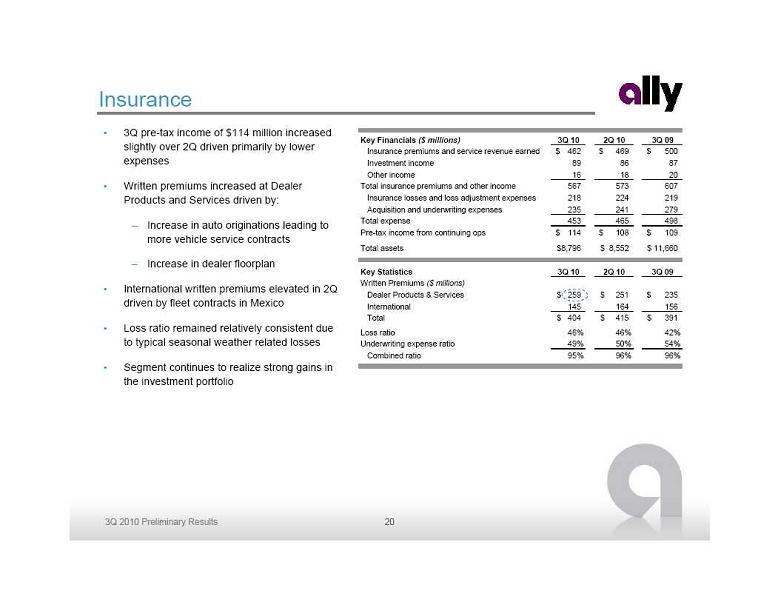

Insurance 3Q pre-tax income of $114 million increased

Insurance 3Q pre-tax income of $114 million increased

slightly over 2Q driven primarily by lower

expenses Written premiums increased at Dealer

Products and Services driven by: Increase in auto originations leading to

more vehicle service contracts Increase in dealer floorplan International written premiums elevated in 2Q

driven by fleet contracts in Mexico Loss ratio remained relatively consistent due

to typical seasonal weather related losses Segment continues to realize strong gains in

the investment portfolio Key Financials ($ millions) 3Q 10 2Q 10 3Q 09 Insurance premiums and service revenue earned 462 $ 469 $ 500 $ Investment income 89 86 87 Other income 16 18 20 Total insurance premiums and other income 567 573 607 Insurance losses and loss adjustment expenses 218 224 219 Acquisition and underwriting expenses 235 241 279 Total expense 453 465 498 Pre-tax income from continuing ops 114 $ 108 $ 109 $ Total assets 8,796 $ 8,552 $ 11,660 $ Key Statistics 3Q 10 2Q 10 3Q 09 Written Premiums ($ millions) Dealer Products & Services 259 $ 251 $ 235 $ International 145 164 156 Total 404 $ 415 $ 391 $ Loss ratio 46% 46% 42% Underwriting expense ratio 49% 50% 54% Combined ratio 95% 96% 96% 20

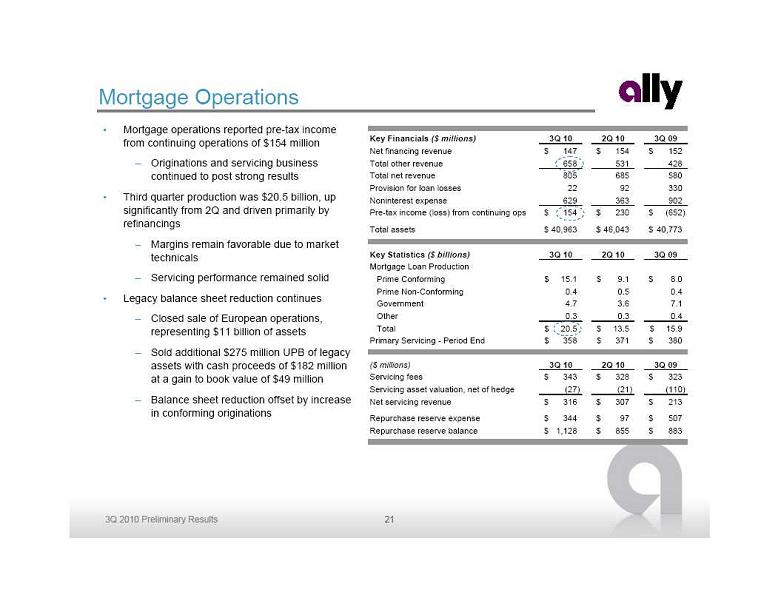

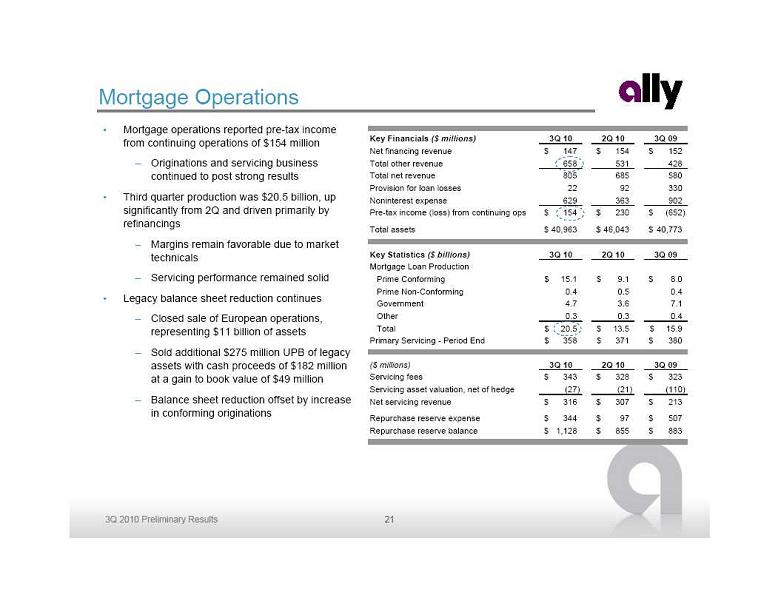

Mortgage Operations Mortgage operations reported pre-tax income

Mortgage Operations Mortgage operations reported pre-tax income

from continuing operations of $154 million Originations and servicing business

continued to post strong results Third quarter production was $20.5 billion, up

significantly from 2Q and driven primarily by

refinancings Margins remain favorable due to market

technicals Servicing performance remained solid Legacy balance sheet reduction continues Closed sale of European operations,

representing $11 billion of assets Sold additional $275 million UPB of legacy

assets with cash proceeds of $182 million

at a gain to book value of $49 million Balance sheet reduction offset by increase

in conforming originations Key Financials ($ millions) 3Q 10 2Q 10 3Q 09 Net financing revenue 147 $ 154 $ 152 $ Total other revenue 658 531 428 Total net revenue 805 685 580 Provision for loan losses 22 92 330 Noninterest expense 629 363 902 Pre-tax income (loss) from continuing ops 154 $ 230 $ (652) $ Total assets 40,963 $ 46,043 $ 40,773 $ Key Statistics ($ billions) 3Q 10 2Q 10 3Q 09 Mortgage Loan Production Prime Conforming 15.1 $ 9.1 $ 8.0 $ Prime Non-Conforming 0.4 0.5 0.4 Government 4.7 3.6 7.1 Other 0.3 0.3 0.4 Total 20.5 $ 13.5 $ 15.9 $ Primary Servicing - Period End 358 $ 371 $ 380 $ ($ millions) 3Q 10 2Q 10 3Q 09 Servicing fees 343 $ 328 $ 323 $ Servicing asset valuation, net of hedge (27) (21) (110) Net servicing revenue 316 $ 307 $ 213 $ Repurchase reserve expense 344 $ 97 $ 507 $ Repurchase reserve balance 1,128 $ 855 $ 883 $ 21

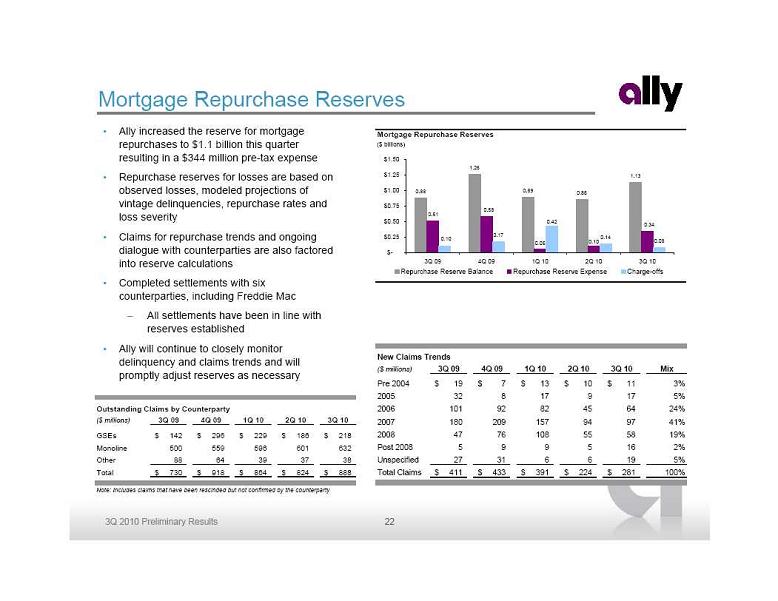

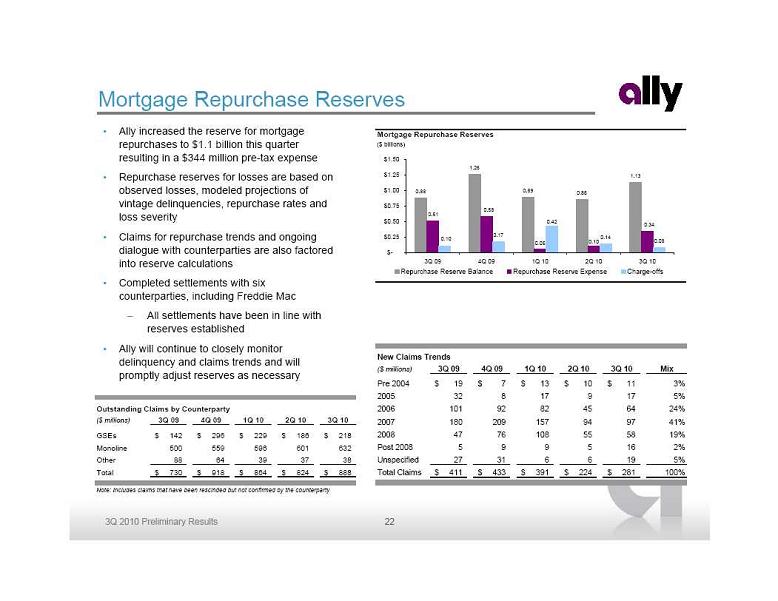

Mortgage Repurchase Reserves Ally increased the reserve for mortgage

Mortgage Repurchase Reserves Ally increased the reserve for mortgage

repurchases to $1.1 billion this quarter

resulting in a $344 million pre-tax expense Repurchase reserves for losses are based on

observed losses, modeled projections of

vintage delinquencies, repurchase rates and

loss severity Claims for repurchase trends and ongoing

dialogue with counterparties are also factored

into reserve calculations Completed settlements with six

counterparties, including Freddie Mac All settlements have been in line with

reserves established Ally will continue to closely monitor

delinquency and claims trends and will

promptly adjust reserves as necessary Mortgage Repurchase Reserves ($ billions) 0.88 1.26 0.89 0.86 1.13 0.05 0.17 0.14 0.08 0.34 0.10 0.58 0.51 0.42 0.10 $- $0.25 $0.50 $0.75 $1.00 $1.25 $1.50 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 Repurchase Reserve Balance Repurchase Reserve Expense Charge-offs New Claims Trends ($ millions) 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 Mix Pre 2004 19 $ 7 $ 13 $ 10 $ 11 $ 3% 2005 32 8 17 9 17 5% 2006 101 92 82 45 64 24% 2007 180 209 157 94 97 41% 2008 47 76 108 55 58 19% Post 2008 5 9 9 5 16 2% Unspecified 27 31 6 6 19 5% Total Claims 411 $ 433 $ 391 $ 224 $ 281 $ 100% Outstanding Claims by Counterparty ($ millions) 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 GSEs 142 $ 296 $ 229 $ 186 $ 218 $ Monoline 500 559 596 601 632 Other 88 64 39 37 38 Total 730 $ 918 $ 864 $ 824 $ 888 $ Note: Includes claims that have been rescinded but not confirmed by the counterparty 22

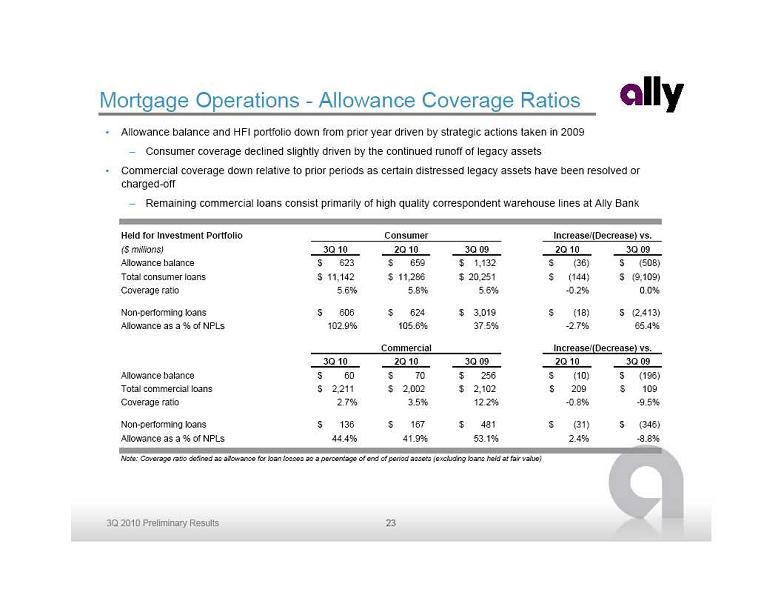

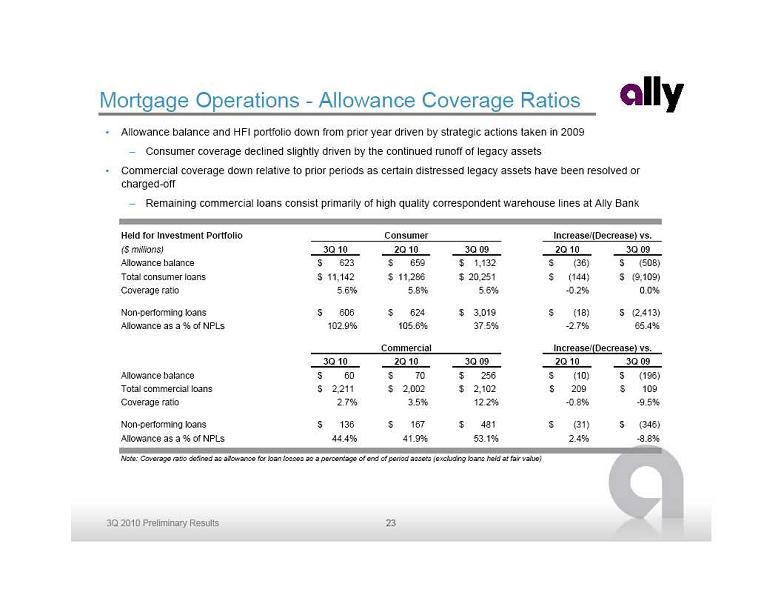

Mortgage Operations - Allowance Coverage Ratios Allowance balance and HFI portfolio down from prior year driven by strategic actions taken in 2009 Consumer coverage declined slightly driven by the continued runoff of legacy assets Commercial coverage down relative to prior periods as certain distressed legacy assets have been resolved or

Mortgage Operations - Allowance Coverage Ratios Allowance balance and HFI portfolio down from prior year driven by strategic actions taken in 2009 Consumer coverage declined slightly driven by the continued runoff of legacy assets Commercial coverage down relative to prior periods as certain distressed legacy assets have been resolved or

charged-off Remaining commercial loans consist primarily of high quality correspondent warehouse lines at Ally Bank Held for Investment Portfolio Consumer ($ millions) 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 Allowance balance 623 $ 659 $ 1,132 $ (36) $ (508) $ Total consumer loans 11,142 $ 11,286 $ 20,251 $ (144) $ (9,109) $ Coverage ratio 5.6% 5.8% 5.6% -0.2% 0.0% Non-performing loans 606 $ 624 $ 3,019 $ (18) $ (2,413) $ Allowance as a % of NPLs 102.9% 105.6% 37.5% -2.7% 65.4% Commercial 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 Allowance balance 60 $ 70 $ 256 $ (10) $ (196) $ Total commercial loans 2,211 $ 2,002 $ 2,102 $ 209 $ 109 $ Coverage ratio 2.7% 3.5% 12.2% -0.8% -9.5% Non-performing loans 136 $ 167 $ 481 $ (31) $ (346) $ Allowance as a % of NPLs 44.4% 41.9% 53.1% 2.4% -8.8% Note: Coverage ratio defined as allowance for loan losses as a percentage of end of period assets (excluding loans held at fair value) Increase/(Decrease) vs. Increase/(Decrease) vs. 23

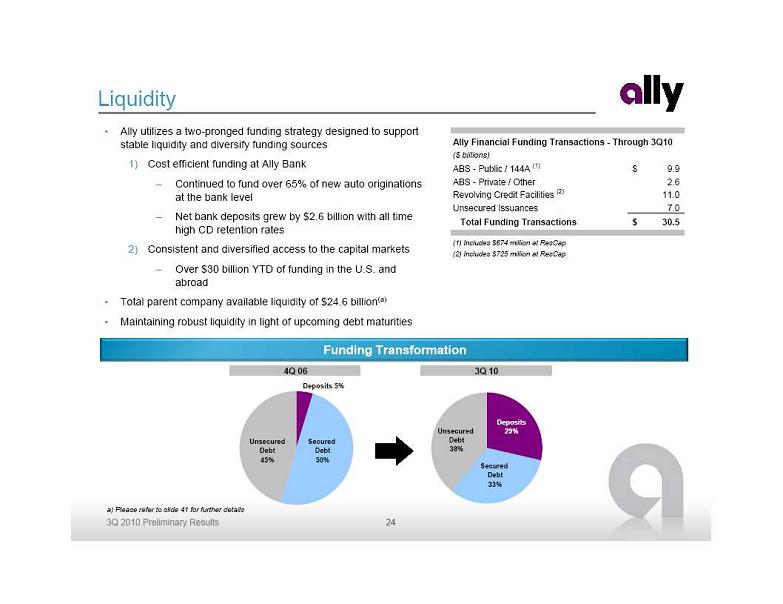

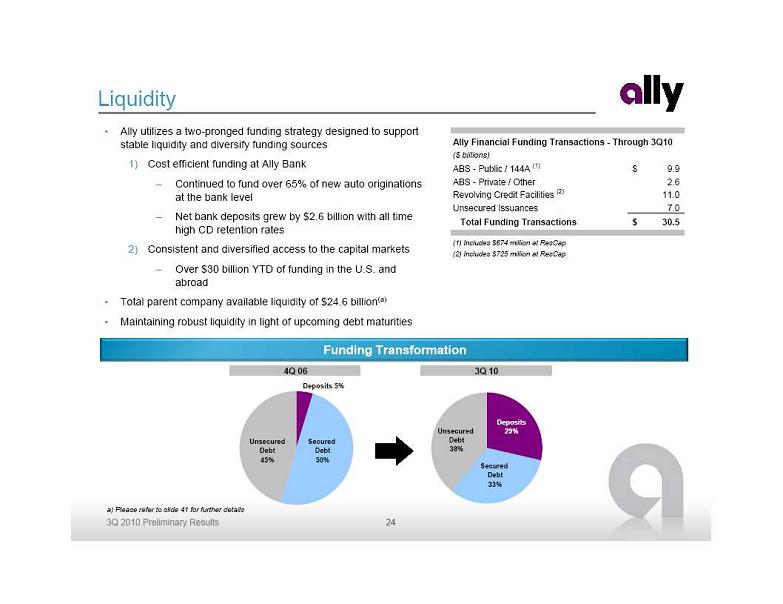

Liquidity Ally utilizes a two-pronged funding strategy designed to support

Liquidity Ally utilizes a two-pronged funding strategy designed to support

stable liquidity and diversify funding sources 1) Cost efficient funding at Ally Bank Continued to fund over 65% of new auto originations

at the bank level Net bank deposits grew by $2.6 billion with all time

high CD retention rates 2) Consistent and diversified access to the capital markets Over $30 billion YTD of funding in the U.S. and

abroad Total parent company available liquidity of $24.6 billion(a) Maintaining robust liquidity in light of upcoming debt maturities Funding Transformation a) Please refer to slide 41 for further details Ally Financial Funding Transactions - Through 3Q10 ($ billions) ABS - Public / 144A (1) 9.9 $ ABS - Private / Other 2.6 Revolving Credit Facilities (2) 11.0 Unsecured Issuances 7.0 Total Funding Transactions 30.5 $ (1) Includes $674 million at ResCap (2) Includes $725 million at ResCap 4Q 06 3Q 10 Deposits 5% Secured Debt 50% Unsecured Debt 45% Unsecured Debt 38% Secured Debt 33% Deposits 29% 24

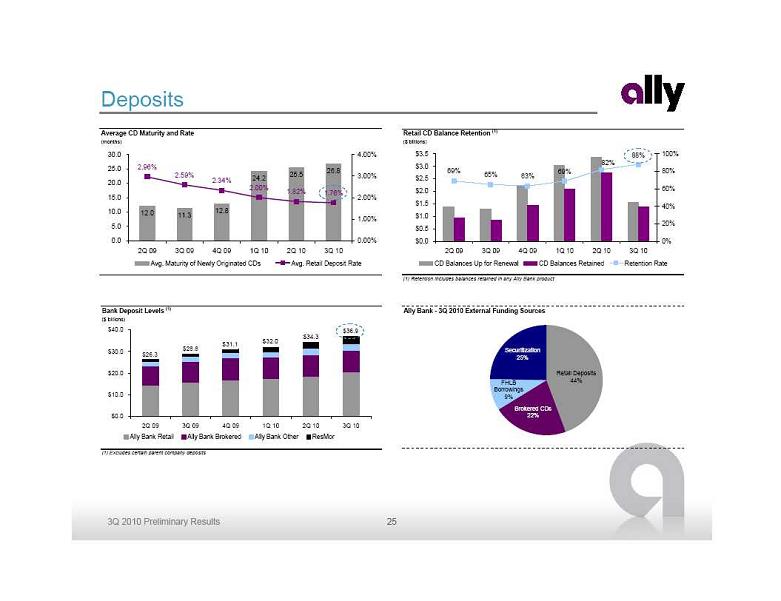

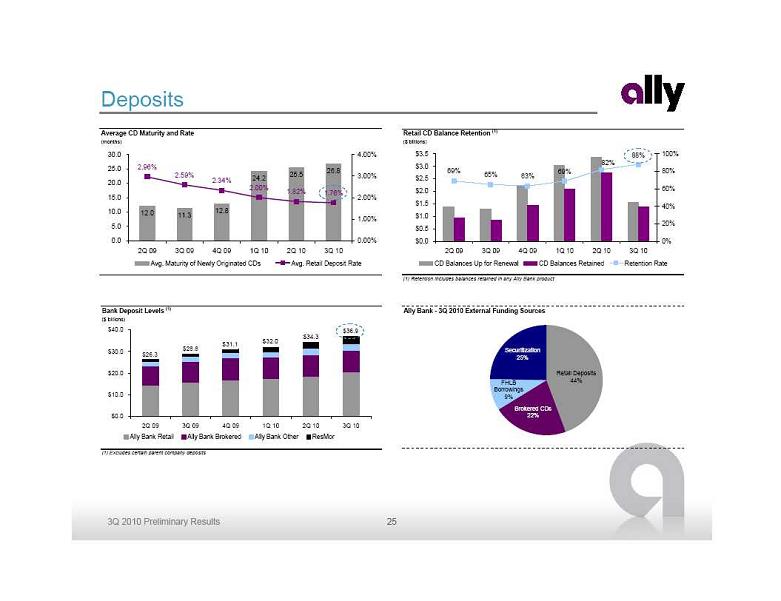

Deposits Average CD Maturity and Rate (months) 12.0 11.3 12.8 24.2 25.5 26.8 2.96% 2.59% 2.34% 2.00% 1.82% 1.76% 0.0 5.0 10.0 15.0 20.0 25.0 30.0 2Q 09 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 0.00% 1.00% 2.00% 3.00% 4.00% Avg. Maturity of Newly Originated CDs Avg. Retail Deposit Rate Retail CD Balance Retention (1) ($ billions) (1) Retention includes balances retained in any Ally Bank product 69% 65% 63% 69% 88% 82% $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 2Q 09 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 0% 20% 40% 60% 80% 100% CD Balances Up for Renewal CD Balances Retained Retention Rate Bank Deposit Levels (1) ($ billions) (1) Excludes certain parent company deposits $36.9 $34.3 $32.0 $31.1 $28.8 $26.3 $0.0 $10.0 $20.0 $30.0 $40.0 2Q 09 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 Ally Bank Retail Ally Bank Brokered Ally Bank Other ResMor Ally Bank - 3Q 2010 External Funding Sources Securitization 25% Brokered CDs 22% Retail Deposits 44% FHLB Borrowings 9% 25

Deposits Average CD Maturity and Rate (months) 12.0 11.3 12.8 24.2 25.5 26.8 2.96% 2.59% 2.34% 2.00% 1.82% 1.76% 0.0 5.0 10.0 15.0 20.0 25.0 30.0 2Q 09 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 0.00% 1.00% 2.00% 3.00% 4.00% Avg. Maturity of Newly Originated CDs Avg. Retail Deposit Rate Retail CD Balance Retention (1) ($ billions) (1) Retention includes balances retained in any Ally Bank product 69% 65% 63% 69% 88% 82% $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 2Q 09 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 0% 20% 40% 60% 80% 100% CD Balances Up for Renewal CD Balances Retained Retention Rate Bank Deposit Levels (1) ($ billions) (1) Excludes certain parent company deposits $36.9 $34.3 $32.0 $31.1 $28.8 $26.3 $0.0 $10.0 $20.0 $30.0 $40.0 2Q 09 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 Ally Bank Retail Ally Bank Brokered Ally Bank Other ResMor Ally Bank - 3Q 2010 External Funding Sources Securitization 25% Brokered CDs 22% Retail Deposits 44% FHLB Borrowings 9% 25

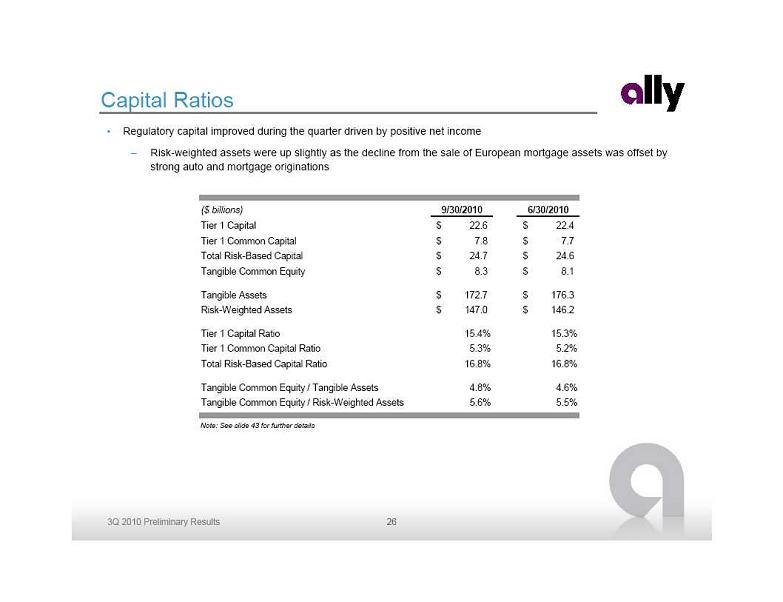

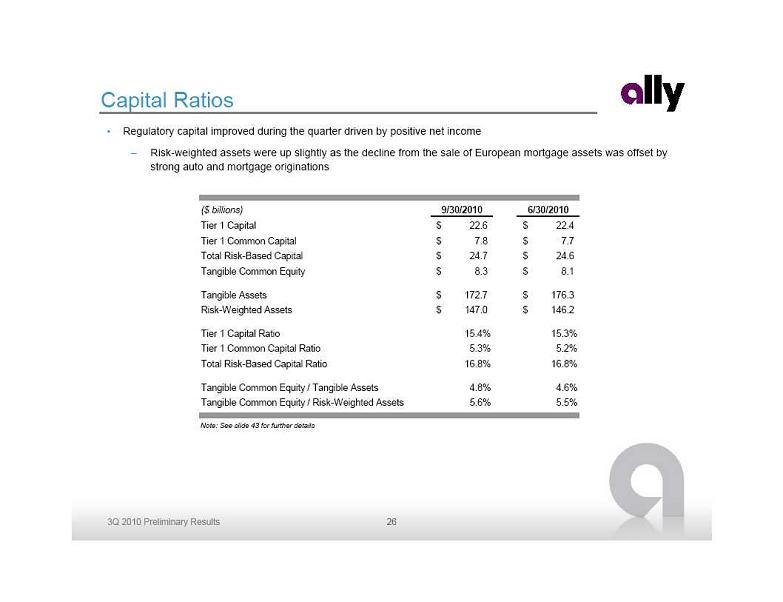

Capital Ratios Note: See slide 43 for further details Regulatory capital improved during the quarter driven by positive net income Risk-weighted assets were up slightly as the decline from the sale of European mortgage assets was offset by

Capital Ratios Note: See slide 43 for further details Regulatory capital improved during the quarter driven by positive net income Risk-weighted assets were up slightly as the decline from the sale of European mortgage assets was offset by

strong auto and mortgage originations ($ billions) 9/30/2010 6/30/2010 Tier 1 Capital 22.6 $ 22.4 $ Tier 1 Common Capital 7.8 $ 7.7 $ Total Risk-Based Capital 24.7 $ 24.6 $ Tangible Common Equity 8.3 $ 8.1 $ Tangible Assets 172.7 $ 176.3 $ Risk-Weighted Assets 147.0 $ 146.2 $ Tier 1 Capital Ratio 15.4% 15.3% Tier 1 Common Capital Ratio 5.3% 5.2% Total Risk-Based Capital Ratio 16.8% 16.8% Tangible Common Equity / Tangible Assets 4.8% 4.6% Tangible Common Equity / Risk-Weighted Assets 5.6% 5.5% 26

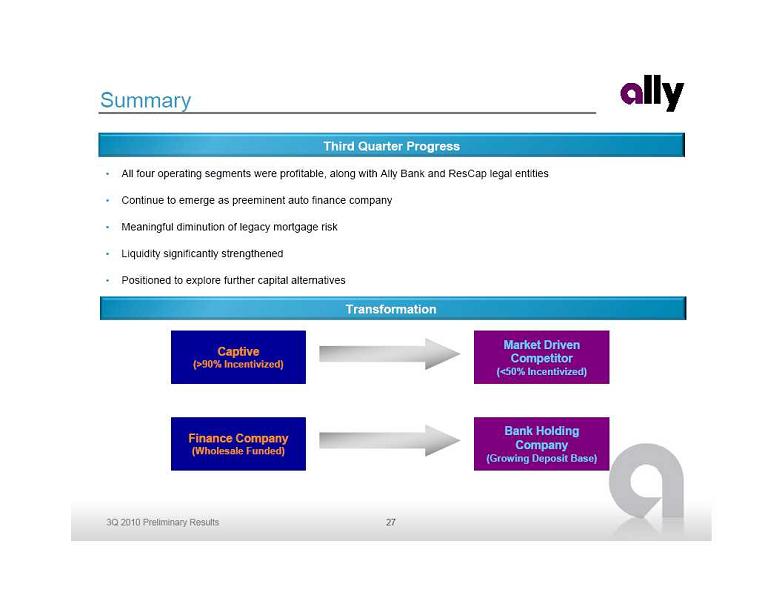

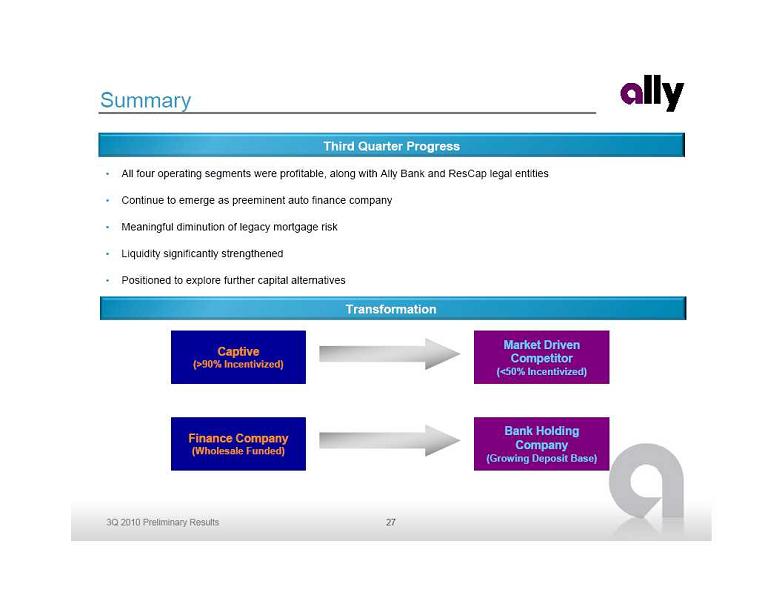

Summary All four operating segments were profitable, along with Ally Bank and ResCap legal entities Continue to emerge as preeminent auto finance company Meaningful diminution of legacy mortgage risk Liquidity significantly strengthened Positioned to explore further capital alternatives Third Quarter Progress Captive (>90% Incentivized) Finance Company (Wholesale Funded) Market Driven

Summary All four operating segments were profitable, along with Ally Bank and ResCap legal entities Continue to emerge as preeminent auto finance company Meaningful diminution of legacy mortgage risk Liquidity significantly strengthened Positioned to explore further capital alternatives Third Quarter Progress Captive (>90% Incentivized) Finance Company (Wholesale Funded) Market Driven

Competitor (<50% Incentivized) Bank Holding

Company (Growing Deposit Base) Transformation 27

Supplemental Charts

Supplemental Charts

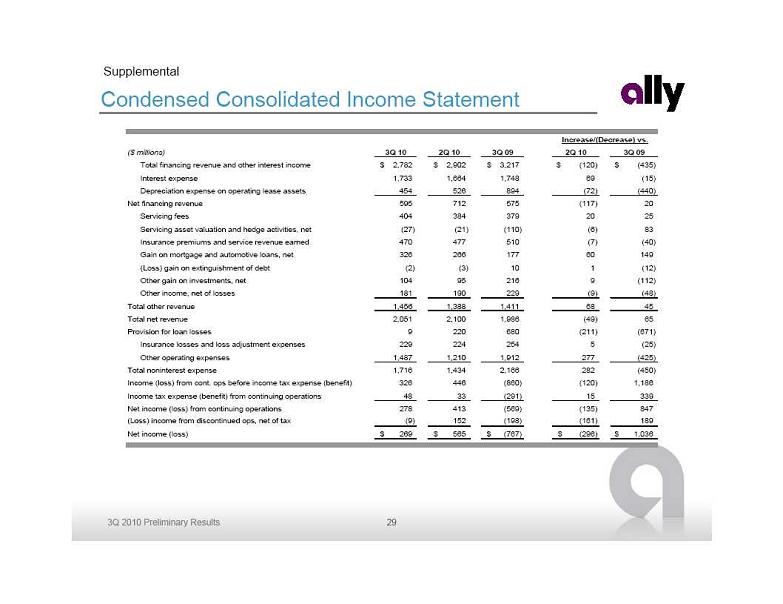

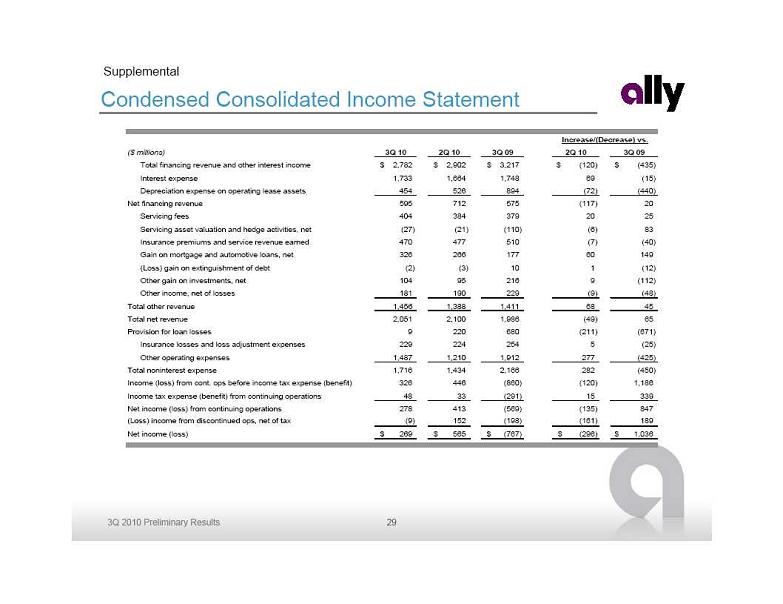

Condensed Consolidated Income Statement Supplemental ($ millions) 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 Total financing revenue and other interest income 2,782 $ 2,902 $ 3,217 $ (120) $ (435) $ Interest expense 1,733 1,664 1,748 69 (15) Depreciation expense on operating lease assets 454 526 894 (72) (440) Net financing revenue 595 712 575 (117) 20 Servicing fees 404 384 379 20 25 Servicing asset valuation and hedge activities, net (27) (21) (110) (6) 83 Insurance premiums and service revenue earned 470 477 510 (7) (40) Gain on mortgage and automotive loans, net 326 266 177 60 149 (Loss) gain on extinguishment of debt (2) (3) 10 1 (12) Other gain on investments, net 104 95 216 9 (112) Other income, net of losses 181 190 229 (9) (48) Total other revenue 1,456 1,388 1,411 68 45 Total net revenue 2,051 2,100 1,986 (49) 65 Provision for loan losses 9 220 680 (211) (671) Insurance losses and loss adjustment expenses 229 224 254 5 (25) Other operating expenses 1,487 1,210 1,912 277 (425) Total noninterest expense 1,716 1,434 2,166 282 (450) Income (loss) from cont. ops before income tax expense (benefit) 326 446 (860) (120) 1,186 Income tax expense (benefit) from continuing operations 48 33 (291) 15 339 Net income (loss) from continuing operations 278 413 (569) (135) 847 (Loss) income from discontinued ops, net of tax (9) 152 (198) (161) 189 Net income (loss) 269 $ 565 $ (767) $ (296) $ 1,036 $ Increase/(Decrease) vs. 29

Condensed Consolidated Income Statement Supplemental ($ millions) 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 Total financing revenue and other interest income 2,782 $ 2,902 $ 3,217 $ (120) $ (435) $ Interest expense 1,733 1,664 1,748 69 (15) Depreciation expense on operating lease assets 454 526 894 (72) (440) Net financing revenue 595 712 575 (117) 20 Servicing fees 404 384 379 20 25 Servicing asset valuation and hedge activities, net (27) (21) (110) (6) 83 Insurance premiums and service revenue earned 470 477 510 (7) (40) Gain on mortgage and automotive loans, net 326 266 177 60 149 (Loss) gain on extinguishment of debt (2) (3) 10 1 (12) Other gain on investments, net 104 95 216 9 (112) Other income, net of losses 181 190 229 (9) (48) Total other revenue 1,456 1,388 1,411 68 45 Total net revenue 2,051 2,100 1,986 (49) 65 Provision for loan losses 9 220 680 (211) (671) Insurance losses and loss adjustment expenses 229 224 254 5 (25) Other operating expenses 1,487 1,210 1,912 277 (425) Total noninterest expense 1,716 1,434 2,166 282 (450) Income (loss) from cont. ops before income tax expense (benefit) 326 446 (860) (120) 1,186 Income tax expense (benefit) from continuing operations 48 33 (291) 15 339 Net income (loss) from continuing operations 278 413 (569) (135) 847 (Loss) income from discontinued ops, net of tax (9) 152 (198) (161) 189 Net income (loss) 269 $ 565 $ (767) $ (296) $ 1,036 $ Increase/(Decrease) vs. 29

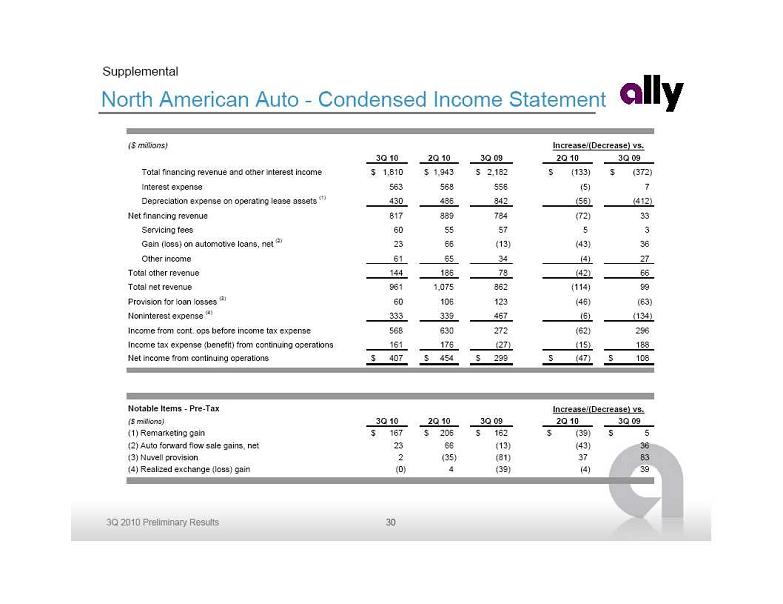

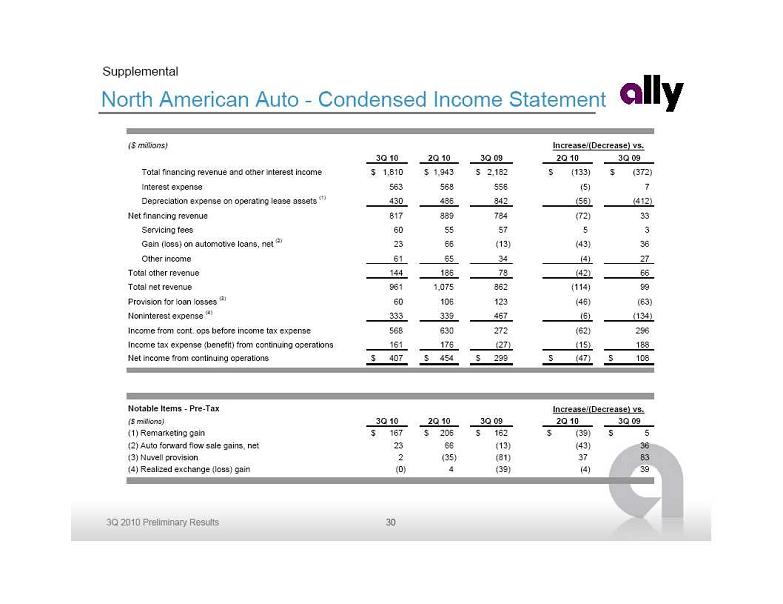

North American Auto - Condensed Income Statement Supplemental ($ millions) 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 Total financing revenue and other interest income 1,810 $ 1,943 $ 2,182 $ (133) $ (372) $ Interest expense 563 568 556 (5) 7 Depreciation expense on operating lease assets (1) 430 486 842 (56) (412) Net financing revenue 817 889 784 (72) 33 Servicing fees 60 55 57 5 3 Gain (loss) on automotive loans, net (2) 23 66 (13) (43) 36 Other income 61 65 34 (4) 27 Total other revenue 144 186 78 (42) 66 Total net revenue 961 1,075 862 (114) 99 Provision for loan losses (3) 60 106 123 (46) (63) Noninterest expense (4) 333 339 467 (6) (134) Income from cont. ops before income tax expense 568 630 272 (62) 296 Income tax expense (benefit) from continuing operations 161 176 (27) (15) 188 Net income from continuing operations 407 $ 454 $ 299 $ (47) $ 108 $ Notable Items - Pre-Tax ($ millions) 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 (1) Remarketing gain 167 $ 206 $ 162 $ (39) $ 5 $ (2) Auto forward flow sale gains, net 23 66 (13) (43) 36 (3) Nuvell provision 2 (35) (81) 37 83 (4) Realized exchange (loss) gain (0) 4 (39) (4) 39 Increase/(Decrease) vs. Increase/(Decrease) vs. 30

North American Auto - Condensed Income Statement Supplemental ($ millions) 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 Total financing revenue and other interest income 1,810 $ 1,943 $ 2,182 $ (133) $ (372) $ Interest expense 563 568 556 (5) 7 Depreciation expense on operating lease assets (1) 430 486 842 (56) (412) Net financing revenue 817 889 784 (72) 33 Servicing fees 60 55 57 5 3 Gain (loss) on automotive loans, net (2) 23 66 (13) (43) 36 Other income 61 65 34 (4) 27 Total other revenue 144 186 78 (42) 66 Total net revenue 961 1,075 862 (114) 99 Provision for loan losses (3) 60 106 123 (46) (63) Noninterest expense (4) 333 339 467 (6) (134) Income from cont. ops before income tax expense 568 630 272 (62) 296 Income tax expense (benefit) from continuing operations 161 176 (27) (15) 188 Net income from continuing operations 407 $ 454 $ 299 $ (47) $ 108 $ Notable Items - Pre-Tax ($ millions) 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 (1) Remarketing gain 167 $ 206 $ 162 $ (39) $ 5 $ (2) Auto forward flow sale gains, net 23 66 (13) (43) 36 (3) Nuvell provision 2 (35) (81) 37 83 (4) Realized exchange (loss) gain (0) 4 (39) (4) 39 Increase/(Decrease) vs. Increase/(Decrease) vs. 30

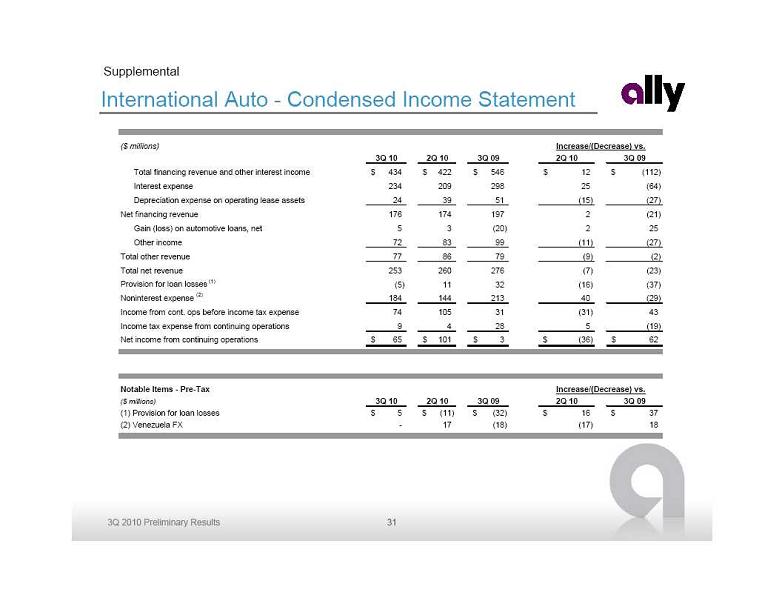

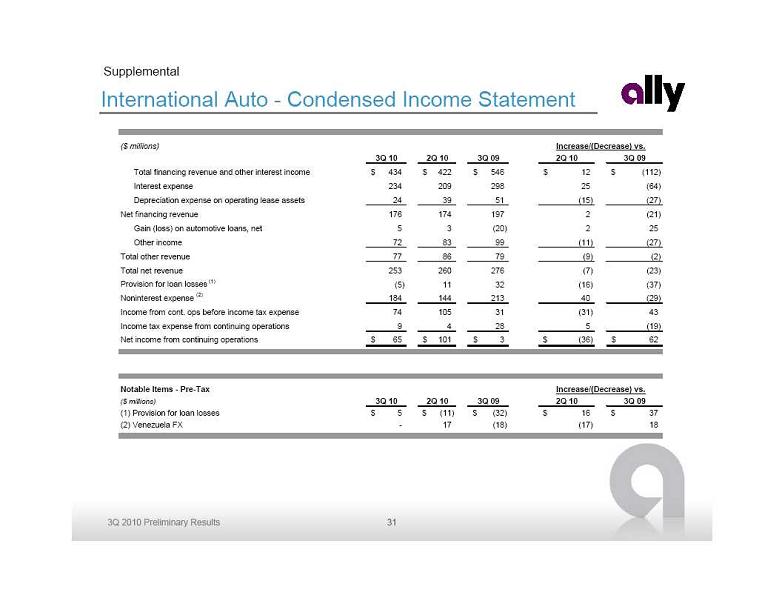

International Auto - Condensed Income Statement Supplemental ($ millions) 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 Total financing revenue and other interest income 434 $ 422 $ 546 $ 12 $ (112) $ Interest expense 234 209 298 25 (64) Depreciation expense on operating lease assets 24 39 51 (15) (27) Net financing revenue 176 174 197 2 (21) Gain (loss) on automotive loans, net 5 3 (20) 2 25 Other income 72 83 99 (11) (27) Total other revenue 77 86 79 (9) (2) Total net revenue 253 260 276 (7) (23) Provision for loan losses (1) (5) 11 32 (16) (37) Noninterest expense (2) 184 144 213 40 (29) Income from cont. ops before income tax expense 74 105 31 (31) 43 Income tax expense from continuing operations 9 4 28 5 (19) Net income from continuing operations 65 $ 101 $ 3 $ (36) $ 62 $ Notable Items - Pre-Tax ($ millions) 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 (1) Provision for loan losses 5 $ (11) $ (32) $ 16 $ 37 $ (2) Venezuela FX - 17 (18) (17) 18 Increase/(Decrease) vs. Increase/(Decrease) vs. 31

International Auto - Condensed Income Statement Supplemental ($ millions) 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 Total financing revenue and other interest income 434 $ 422 $ 546 $ 12 $ (112) $ Interest expense 234 209 298 25 (64) Depreciation expense on operating lease assets 24 39 51 (15) (27) Net financing revenue 176 174 197 2 (21) Gain (loss) on automotive loans, net 5 3 (20) 2 25 Other income 72 83 99 (11) (27) Total other revenue 77 86 79 (9) (2) Total net revenue 253 260 276 (7) (23) Provision for loan losses (1) (5) 11 32 (16) (37) Noninterest expense (2) 184 144 213 40 (29) Income from cont. ops before income tax expense 74 105 31 (31) 43 Income tax expense from continuing operations 9 4 28 5 (19) Net income from continuing operations 65 $ 101 $ 3 $ (36) $ 62 $ Notable Items - Pre-Tax ($ millions) 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 (1) Provision for loan losses 5 $ (11) $ (32) $ 16 $ 37 $ (2) Venezuela FX - 17 (18) (17) 18 Increase/(Decrease) vs. Increase/(Decrease) vs. 31

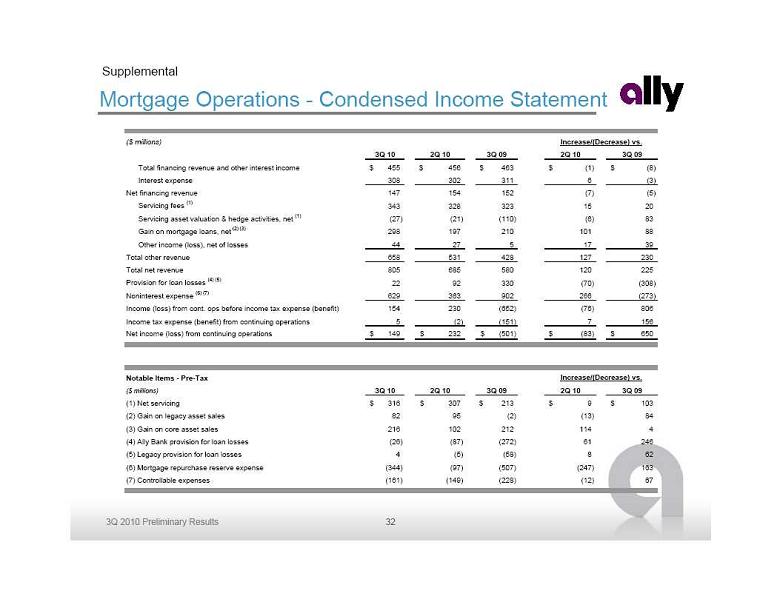

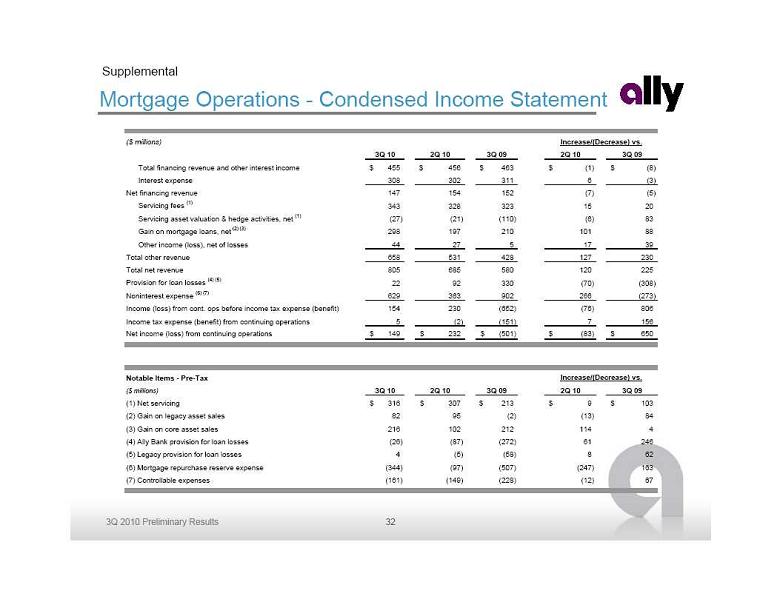

Mortgage Operations - Condensed Income Statement Supplemental ($ millions) 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 Total financing revenue and other interest income 455 $ 456 $ 463 $ (1) $ (8) $ Interest expense 308 302 311 6 (3) Net financing revenue 147 154 152 (7) (5) Servicing fees (1) 343 328 323 15 20 Servicing asset valuation & hedge activities, net (1) (27) (21) (110) (6) 83 Gain on mortgage loans, net (2) (3) 298 197 210 101 88 Other income (loss), net of losses 44 27 5 17 39 Total other revenue 658 531 428 127 230 Total net revenue 805 685 580 120 225 Provision for loan losses (4) (5) 22 92 330 (70) (308) Noninterest expense (6) (7) 629 363 902 266 (273) Income (loss) from cont. ops before income tax expense (benefit) 154 230 (652) (76) 806 Income tax expense (benefit) from continuing operations 5 (2) (151) 7 156 Net income (loss) from continuing operations 149 $ 232 $ (501) $ (83) $ 650 $ Notable Items - Pre-Tax ($ millions) 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 (1) Net servicing 316 $ 307 $ 213 $ 9 $ 103 $ (2) Gain on legacy asset sales 82 95 (2) (13) 84 (3) Gain on core asset sales 216 102 212 114 4 (4) Ally Bank provision for loan losses (26) (87) (272) 61 246 (5) Legacy provision for loan losses 4 (5) (58) 8 62 (6) Mortgage repurchase reserve expense (344) (97) (507) (247) 163 (7) Controllable expenses (161) (149) (228) (12) 67 Increase/(Decrease) vs. Increase/(Decrease) vs. 32

Mortgage Operations - Condensed Income Statement Supplemental ($ millions) 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 Total financing revenue and other interest income 455 $ 456 $ 463 $ (1) $ (8) $ Interest expense 308 302 311 6 (3) Net financing revenue 147 154 152 (7) (5) Servicing fees (1) 343 328 323 15 20 Servicing asset valuation & hedge activities, net (1) (27) (21) (110) (6) 83 Gain on mortgage loans, net (2) (3) 298 197 210 101 88 Other income (loss), net of losses 44 27 5 17 39 Total other revenue 658 531 428 127 230 Total net revenue 805 685 580 120 225 Provision for loan losses (4) (5) 22 92 330 (70) (308) Noninterest expense (6) (7) 629 363 902 266 (273) Income (loss) from cont. ops before income tax expense (benefit) 154 230 (652) (76) 806 Income tax expense (benefit) from continuing operations 5 (2) (151) 7 156 Net income (loss) from continuing operations 149 $ 232 $ (501) $ (83) $ 650 $ Notable Items - Pre-Tax ($ millions) 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 (1) Net servicing 316 $ 307 $ 213 $ 9 $ 103 $ (2) Gain on legacy asset sales 82 95 (2) (13) 84 (3) Gain on core asset sales 216 102 212 114 4 (4) Ally Bank provision for loan losses (26) (87) (272) 61 246 (5) Legacy provision for loan losses 4 (5) (58) 8 62 (6) Mortgage repurchase reserve expense (344) (97) (507) (247) 163 (7) Controllable expenses (161) (149) (228) (12) 67 Increase/(Decrease) vs. Increase/(Decrease) vs. 32

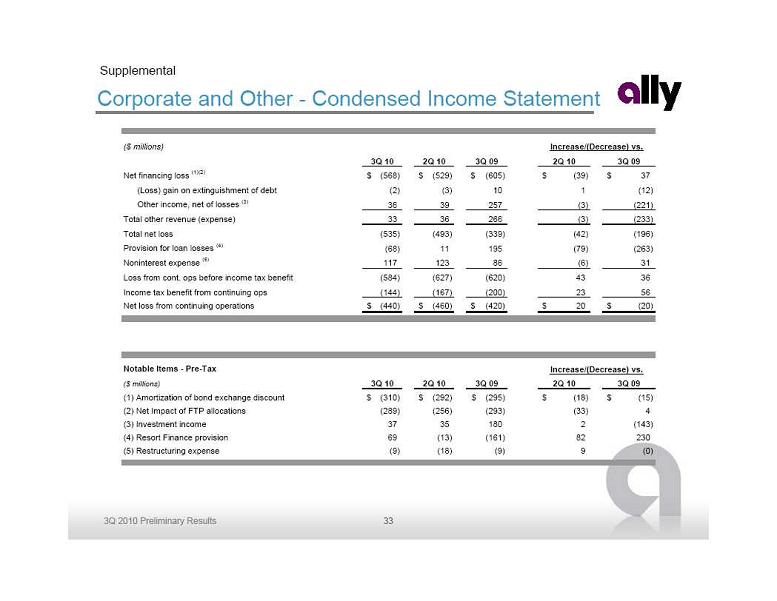

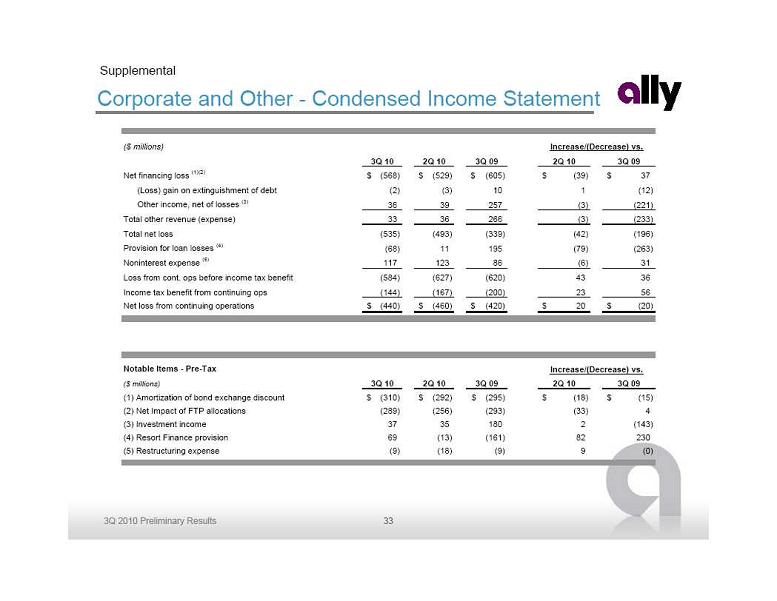

Corporate and Other - Condensed Income Statement Supplemental ($ millions) 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 Net financing loss (1)(2) (568) $ (529) $ (605) $ (39) $ 37 $ (Loss) gain on extinguishment of debt (2) (3) 10 1 (12) Other income, net of losses (3) 36 39 257 (3) (221) Total other revenue (expense) 33 36 266 (3) (233) Total net loss (535) (493) (339) (42) (196) Provision for loan losses (4) (68) 11 195 (79) (263) Noninterest expense (5) 117 123 86 (6) 31 Loss from cont. ops before income tax benefit (584) (627) (620) 43 36 Income tax benefit from continuing ops (144) (167) (200) 23 56 Net loss from continuing operations (440) $ (460) $ (420) $ 20 $ (20) $ Notable Items - Pre-Tax ($ millions) 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 (1) Amortization of bond exchange discount (310) $ (292) $ (295) $ (18) $ (15) $ (2) Net Impact of FTP allocations (289) (256) (293) (33) 4 (3) Investment income 37 35 180 2 (143) (4) Resort Finance provision 69 (13) (161) 82 230 (5) Restructuring expense (9) (18) (9) 9 (0) Increase/(Decrease) vs. Increase/(Decrease) vs. 33

Corporate and Other - Condensed Income Statement Supplemental ($ millions) 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 Net financing loss (1)(2) (568) $ (529) $ (605) $ (39) $ 37 $ (Loss) gain on extinguishment of debt (2) (3) 10 1 (12) Other income, net of losses (3) 36 39 257 (3) (221) Total other revenue (expense) 33 36 266 (3) (233) Total net loss (535) (493) (339) (42) (196) Provision for loan losses (4) (68) 11 195 (79) (263) Noninterest expense (5) 117 123 86 (6) 31 Loss from cont. ops before income tax benefit (584) (627) (620) 43 36 Income tax benefit from continuing ops (144) (167) (200) 23 56 Net loss from continuing operations (440) $ (460) $ (420) $ 20 $ (20) $ Notable Items - Pre-Tax ($ millions) 3Q 10 2Q 10 3Q 09 2Q 10 3Q 09 (1) Amortization of bond exchange discount (310) $ (292) $ (295) $ (18) $ (15) $ (2) Net Impact of FTP allocations (289) (256) (293) (33) 4 (3) Investment income 37 35 180 2 (143) (4) Resort Finance provision 69 (13) (161) 82 230 (5) Restructuring expense (9) (18) (9) 9 (0) Increase/(Decrease) vs. Increase/(Decrease) vs. 33

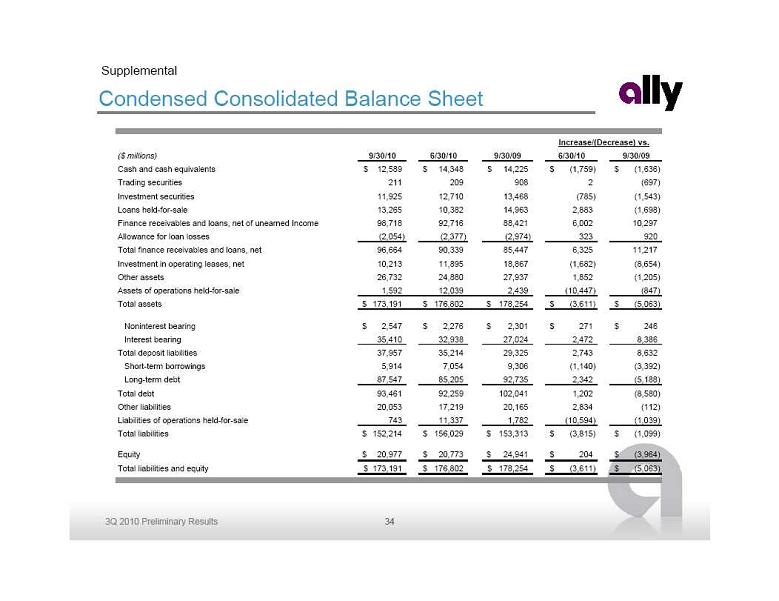

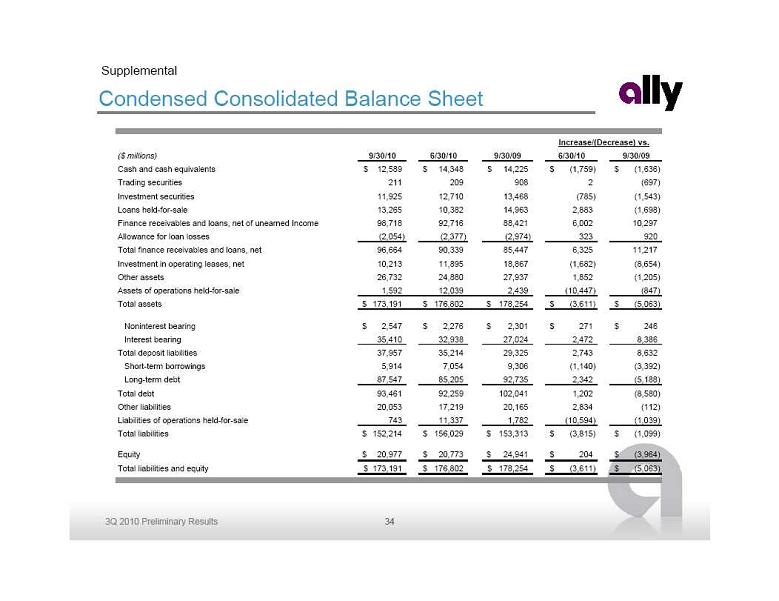

Condensed Consolidated Balance Sheet Supplemental ($ millions) 9/30/10 6/30/10 9/30/09 6/30/10 9/30/09 Cash and cash equivalents 12,589 $ 14,348 $ 14,225 $ (1,759) $ (1,636) $ Trading securities 211 209 908 2 (697) Investment securities 11,925 12,710 13,468 (785) (1,543) Loans held-for-sale 13,265 10,382 14,963 2,883 (1,698) Finance receivables and loans, net of unearned Income 98,718 92,716 88,421 6,002 10,297 Allowance for loan losses (2,054) (2,377) (2,974) 323 920 Total finance receivables and loans, net 96,664 90,339 85,447 6,325 11,217 Investment in operating leases, net 10,213 11,895 18,867 (1,682) (8,654) Other assets 26,732 24,880 27,937 1,852 (1,205) Assets of operations held-for-sale 1,592 12,039 2,439 (10,447) (847) Total assets 173,191 $ 176,802 $ 178,254 $ (3,611) $ (5,063) $ Noninterest bearing 2,547 $ 2,276 $ 2,301 $ 271 $ 246 $ Interest bearing 35,410 32,938 27,024 2,472 8,386 Total deposit liabilities 37,957 35,214 29,325 2,743 8,632 Short-term borrowings 5,914 7,054 9,306 (1,140) (3,392) Long-term debt 87,547 85,205 92,735 2,342 (5,188) Total debt 93,461 92,259 102,041 1,202 (8,580) Other liabilities 20,053 17,219 20,165 2,834 (112) Liabilities of operations held-for-sale 743 11,337 1,782 (10,594) (1,039) Total liabilities 152,214 $ 156,029 $ 153,313 $ (3,815) $ (1,099) $ Equity 20,977 $ 20,773 $ 24,941 $ 204 $ (3,964) $ Total liabilities and equity 173,191 $ 176,802 $ 178,254 $ (3,611) $ (5,063) $ Increase/(Decrease) vs. 34

Condensed Consolidated Balance Sheet Supplemental ($ millions) 9/30/10 6/30/10 9/30/09 6/30/10 9/30/09 Cash and cash equivalents 12,589 $ 14,348 $ 14,225 $ (1,759) $ (1,636) $ Trading securities 211 209 908 2 (697) Investment securities 11,925 12,710 13,468 (785) (1,543) Loans held-for-sale 13,265 10,382 14,963 2,883 (1,698) Finance receivables and loans, net of unearned Income 98,718 92,716 88,421 6,002 10,297 Allowance for loan losses (2,054) (2,377) (2,974) 323 920 Total finance receivables and loans, net 96,664 90,339 85,447 6,325 11,217 Investment in operating leases, net 10,213 11,895 18,867 (1,682) (8,654) Other assets 26,732 24,880 27,937 1,852 (1,205) Assets of operations held-for-sale 1,592 12,039 2,439 (10,447) (847) Total assets 173,191 $ 176,802 $ 178,254 $ (3,611) $ (5,063) $ Noninterest bearing 2,547 $ 2,276 $ 2,301 $ 271 $ 246 $ Interest bearing 35,410 32,938 27,024 2,472 8,386 Total deposit liabilities 37,957 35,214 29,325 2,743 8,632 Short-term borrowings 5,914 7,054 9,306 (1,140) (3,392) Long-term debt 87,547 85,205 92,735 2,342 (5,188) Total debt 93,461 92,259 102,041 1,202 (8,580) Other liabilities 20,053 17,219 20,165 2,834 (112) Liabilities of operations held-for-sale 743 11,337 1,782 (10,594) (1,039) Total liabilities 152,214 $ 156,029 $ 153,313 $ (3,815) $ (1,099) $ Equity 20,977 $ 20,773 $ 24,941 $ 204 $ (3,964) $ Total liabilities and equity 173,191 $ 176,802 $ 178,254 $ (3,611) $ (5,063) $ Increase/(Decrease) vs. 34

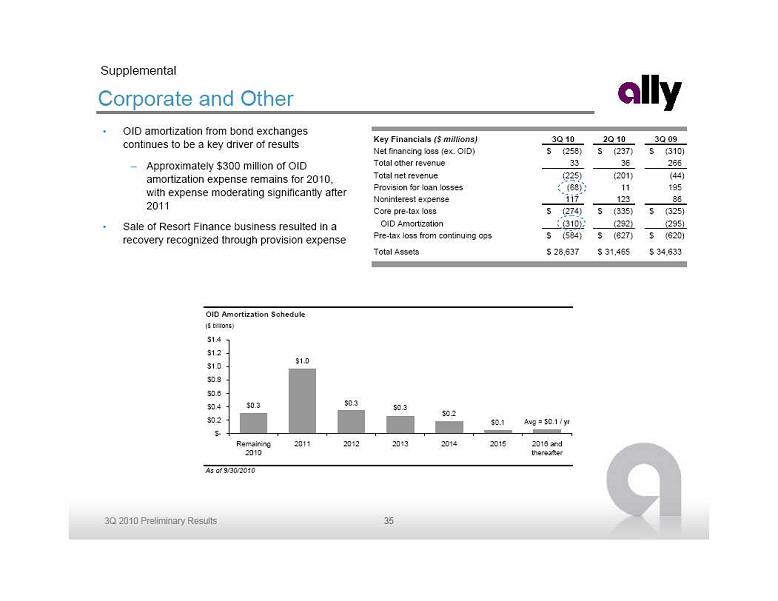

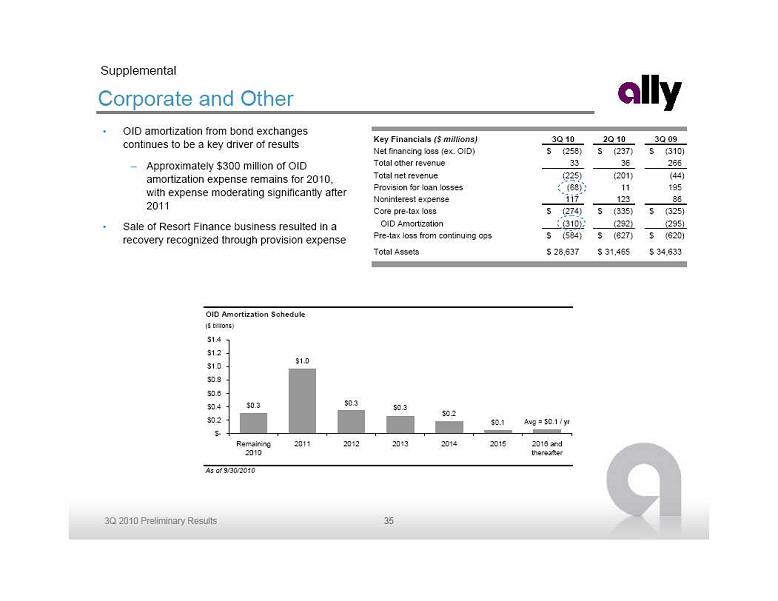

Corporate and Other OID amortization from bond exchanges

Corporate and Other OID amortization from bond exchanges

continues to be a key driver of results Approximately $300 million of OID

amortization expense remains for 2010,

with expense moderating significantly after

2011 Sale of Resort Finance business resulted in a

recovery recognized through provision expense Supplemental OID Amortization Schedule ($ billions) As of 9/30/2010 $0.3 $1.0 $0.3 $0.2 $0.1 Avg = $0.1 / yr $0.3 $- $0.2 $0.4 $0.6 $0.8 $1.0 $1.2 $1.4 Remaining 2010 2011 2012 2013 2014 2015 2016 and thereafter Key Financials ($ millions) 3Q 10 2Q 10 3Q 09 Net financing loss (ex. OID) (258) $ (237) $ (310) $ Total other revenue 33 36 266 Total net revenue (225) (201) (44) Provision for loan losses (68) 11 195 Noninterest expense 117 123 86 Core pre-tax loss (274) $ (335) $ (325) $ OID Amortization (310) (292) (295) Pre-tax loss from continuing ops (584) $ (627) $ (620) $ Total Assets 28,637 $ 31,465 $ 34,633 $ 35

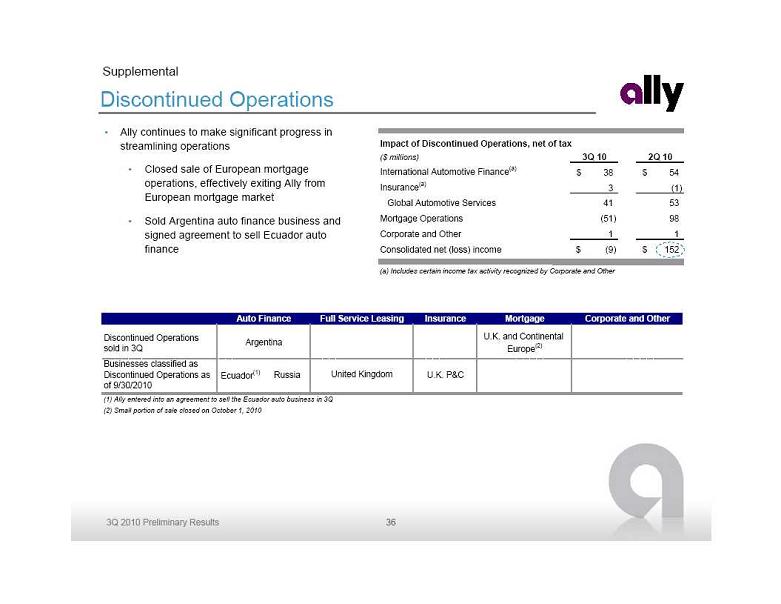

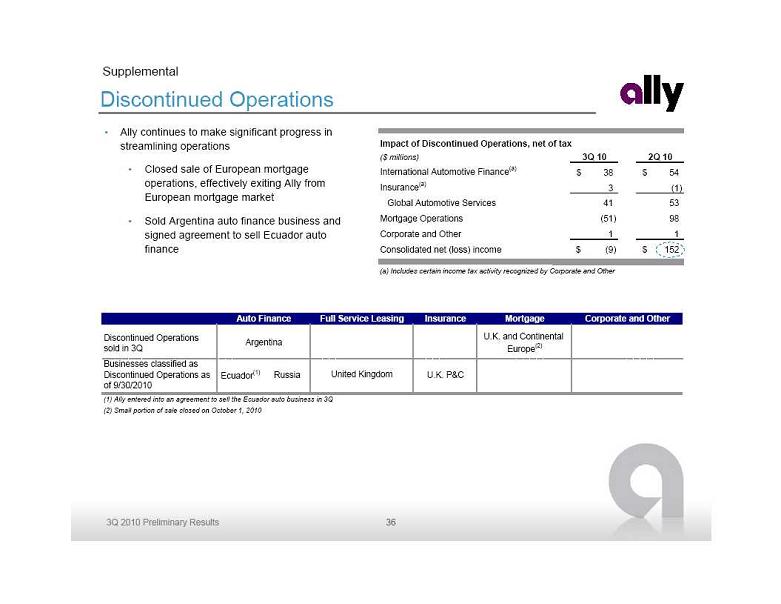

Discontinued Operations Ally continues to make significant progress in

Discontinued Operations Ally continues to make significant progress in

streamlining operations Closed sale of European mortgage

operations, effectively exiting Ally from

European mortgage market Sold Argentina auto finance business and

signed agreement to sell Ecuador auto

finance Supplemental Impact of Discontinued Operations, net of tax ($ millions) 3Q 10 2Q 10 International Automotive Finance (a) 38 $ 54 $ Insurance (a) 3 (1) Global Automotive Services 41 53 Mortgage Operations (51) 98 Corporate and Other 1 1 Consolidated net (loss) income (9) $ 152 $ (a) Includes certain income tax activity recognized by Corporate and Other Insurance Mortgage Corporate and Other Discontinued Operations sold in 3Q U.K. and Continental Europe (2) Businesses classified as Discontinued Operations as of 9/30/2010 Ecuador (1) Russia U.K. P&C (1) Ally entered into an agreement to sell the Ecuador auto business in 3Q (2) Small portion of sale closed on October 1, 2010 United Kingdom Auto Finance Full Service Leasing Argentina 36

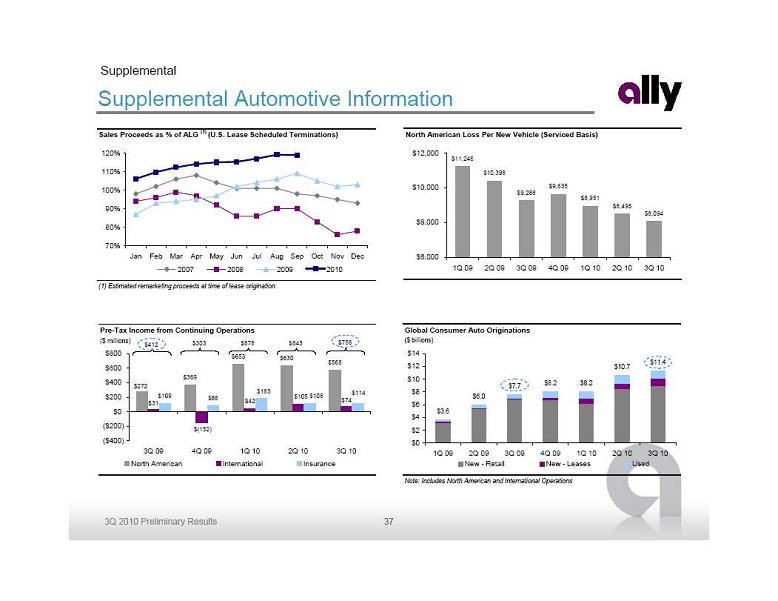

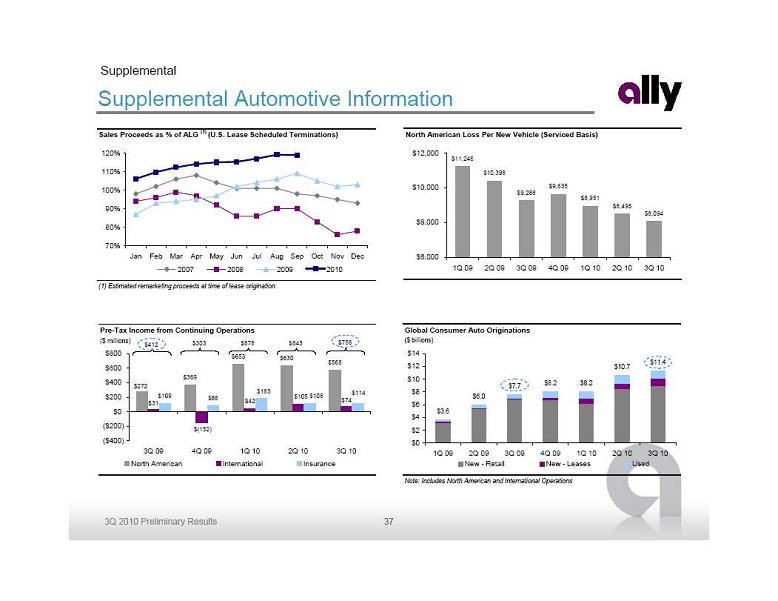

Supplemental Automotive Information $303 $878 $412 $756 $843 Supplemental Sales Proceeds as % of ALG (1) (U.S. Lease Scheduled Terminations) (1) Estimated remarketing proceeds at time of lease origination 70% 80% 90% 100% 110% 120% Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2007 2008 2009 2010 North American Loss Per New Vehicle (Serviced Basis) $11,246 $10,398 $9,288 $9,635 $8,951 $8,495 $8,094 $6,000 $8,000 $10,000 $12,000 1Q 09 2Q 09 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 Pre-Tax Income from Continuing Operations ($ millions) $369 $653 $630 $568 $42 $109 $86 $272 $105 $(152) $31 $74 $108 $183 $114 ($400) ($200) $0 $200 $400 $600 $800 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 North American International Insurance Global Consumer Auto Originations ($ billions) Note: Includes North American and International Operations $3.6 $6.0 $7.7 $8.2 $8.2 $10.7 $11.4 $0 $2 $4 $6 $8 $10 $12 $14 1Q 09 2Q 09 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 New - Retail New - Leases Used 37

Supplemental Automotive Information $303 $878 $412 $756 $843 Supplemental Sales Proceeds as % of ALG (1) (U.S. Lease Scheduled Terminations) (1) Estimated remarketing proceeds at time of lease origination 70% 80% 90% 100% 110% 120% Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2007 2008 2009 2010 North American Loss Per New Vehicle (Serviced Basis) $11,246 $10,398 $9,288 $9,635 $8,951 $8,495 $8,094 $6,000 $8,000 $10,000 $12,000 1Q 09 2Q 09 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 Pre-Tax Income from Continuing Operations ($ millions) $369 $653 $630 $568 $42 $109 $86 $272 $105 $(152) $31 $74 $108 $183 $114 ($400) ($200) $0 $200 $400 $600 $800 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 North American International Insurance Global Consumer Auto Originations ($ billions) Note: Includes North American and International Operations $3.6 $6.0 $7.7 $8.2 $8.2 $10.7 $11.4 $0 $2 $4 $6 $8 $10 $12 $14 1Q 09 2Q 09 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 New - Retail New - Leases Used 37

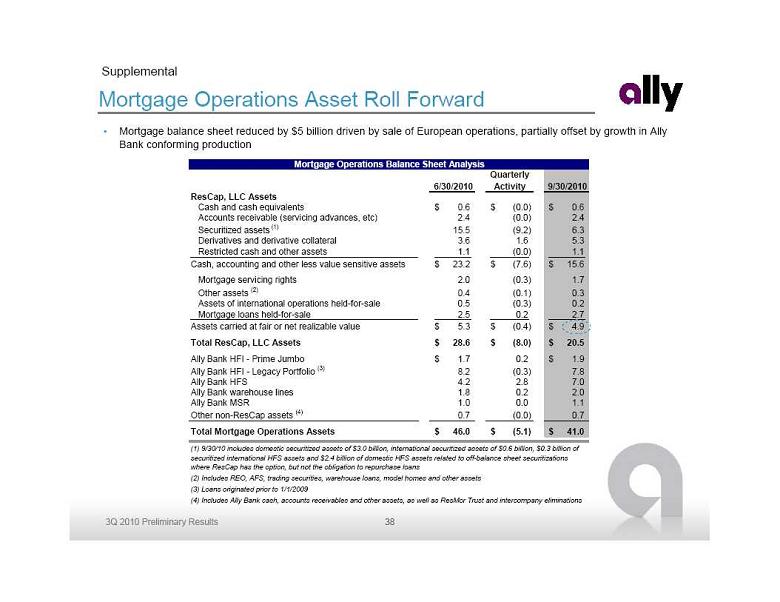

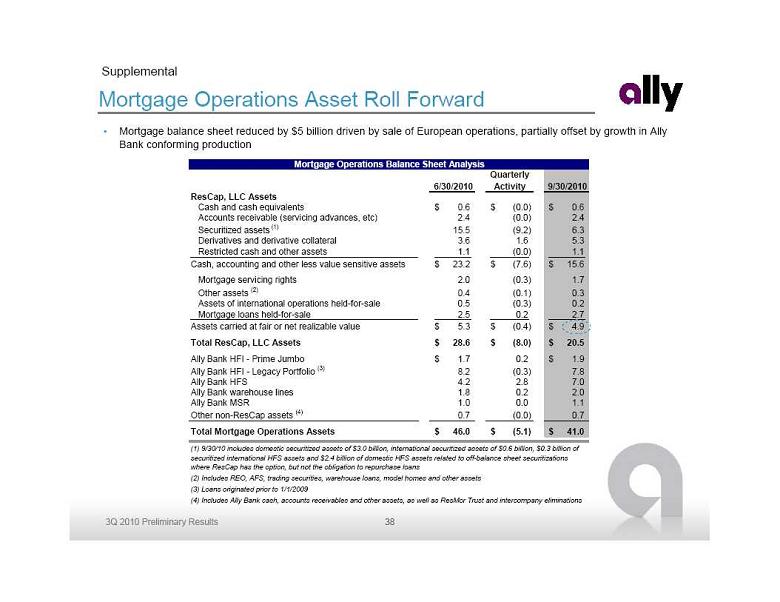

Mortgage Operations Asset Roll Forward Mortgage balance sheet reduced by $5 billion driven by sale of European operations, partially offset by growth in Ally

Mortgage Operations Asset Roll Forward Mortgage balance sheet reduced by $5 billion driven by sale of European operations, partially offset by growth in Ally

Bank conforming production Supplemental 6/30/2010 Quarterly Activity 9/30/2010 ResCap, LLC Assets Cash and cash equivalents 0.6 $ (0.0) $ 0.6 $ Accounts receivable (servicing advances, etc) 2.4 (0.0) 2.4 Securitized assets (1) 15.5 (9.2) 6.3 Derivatives and derivative collateral 3.6 1.6 5.3 Restricted cash and other assets 1.1 (0.0) 1.1 Cash, accounting and other less value sensitive assets 23.2 $ (7.6) $ 15.6 $ Mortgage servicing rights 2.0 (0.3) 1.7 Other assets (2) 0.4 (0.1) 0.3 Assets of international operations held-for-sale 0.5 (0.3) 0.2 Mortgage loans held-for-sale 2.5 0.2 2.7 Assets carried at fair or net realizable value 5.3 $ (0.4) $ 4.9 $ Total ResCap, LLC Assets 28.6 $ (8.0) $ 20.5 $ Ally Bank HFI - Prime Jumbo 1.7 $ 0.2 1.9 $ Ally Bank HFI - Legacy Portfolio (3) 8.2 (0.3) 7.8 Ally Bank HFS 4.2 2.8 7.0 Ally Bank warehouse lines 1.8 0.2 2.0 Ally Bank MSR 1.0 0.0 1.1 Other non-ResCap assets (4) 0.7 (0.0) 0.7 Total Mortgage Operations Assets 46.0 $ (5.1) $ 41.0 $ (4) Includes Ally Bank cash, accounts receivables and other assets, as well as ResMor Trust and intercompany eliminations Mortgage Operations Balance Sheet Analysis (1) 9/30/10 includes domestic securitized assets of $3.0 billion, international securitized assets of $0.6 billion, $0.3 billion of securitized international HFS assets and $2.4 billion of domestic HFS assets related to off-balance sheet securitizations where ResCap has the option, but not the obligation to repurchase loans (2) Includes REO, AFS, trading securities, warehouse loans, model homes and other assets (3) Loans originated prior to 1/1/2009 38

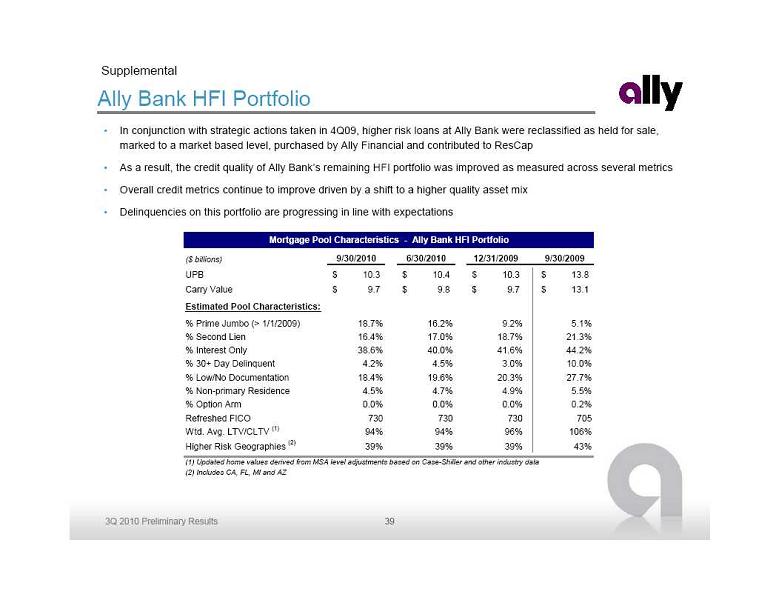

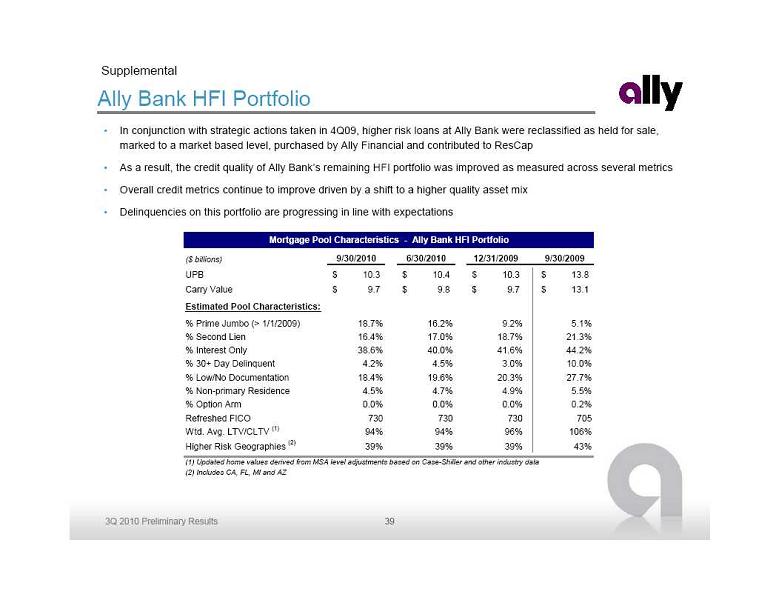

Ally Bank HFI Portfolio In conjunction with strategic actions taken in 4Q09, higher risk loans at Ally Bank were reclassified as held for sale,

Ally Bank HFI Portfolio In conjunction with strategic actions taken in 4Q09, higher risk loans at Ally Bank were reclassified as held for sale,

marked to a market based level, purchased by Ally Financial and contributed to ResCap As a result, the credit quality of Ally Bank’s remaining HFI portfolio was improved as measured across several metrics Overall credit metrics continue to improve driven by a shift to a higher quality asset mix Delinquencies on this portfolio are progressing in line with expectations Supplemental ($ billions) 9/30/2010 6/30/2010 12/31/2009 9/30/2009 UPB 10.3 $ 10.4 $ 10.3 $ 13.8 $ Carry Value 9.7 $ 9.8 $ 9.7 $ 13.1 $ Estimated Pool Characteristics: % Prime Jumbo (> 1/1/2009) 18.7% 16.2% 9.2% 5.1% % Second Lien 16.4% 17.0% 18.7% 21.3% % Interest Only 38.6% 40.0% 41.6% 44.2% % 30+ Day Delinquent 4.2% 4.5% 3.0% 10.0% % Low/No Documentation 18.4% 19.6% 20.3% 27.7% % Non-primary Residence 4.5% 4.7% 4.9% 5.5% % Option Arm 0.0% 0.0% 0.0% 0.2% Refreshed FICO 730 730 730 705 Wtd. Avg. LTV/CLTV (1) 94% 94% 96% 106% Higher Risk Geographies (2) 39% 39% 39% 43% (1) Updated home values derived from MSA level adjustments based on Case-Shiller and other industry data (2) Includes CA, FL, MI and AZ Mortgage Pool Characteristics - Ally Bank HFI Portfolio 39

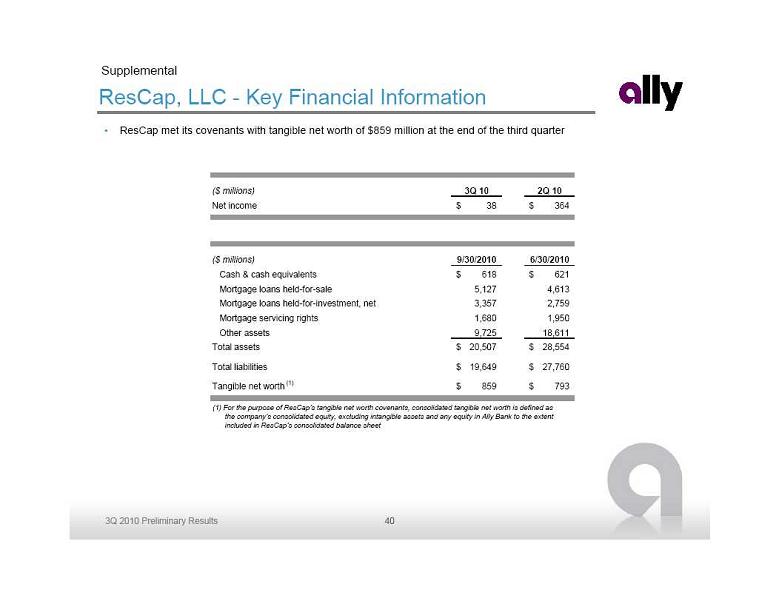

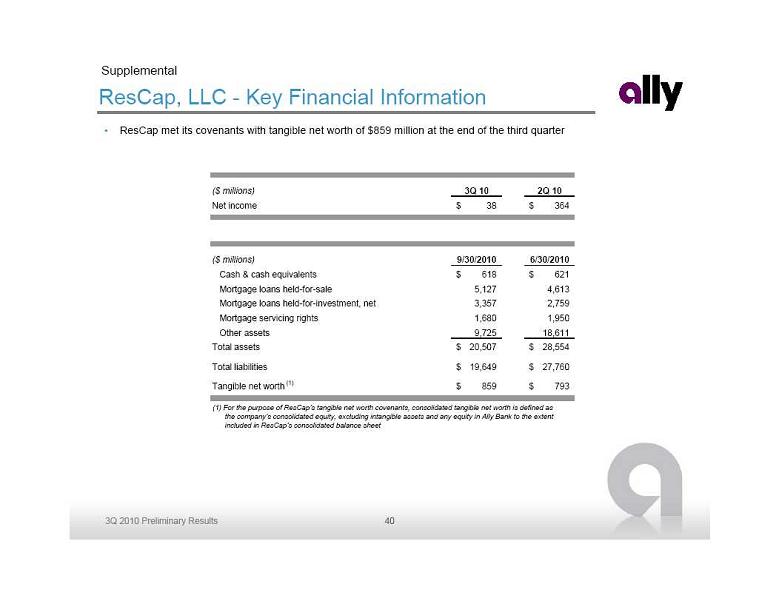

ResCap, LLC - Key Financial Information ResCap met its covenants with tangible net worth of $859 million at the end of the third quarter (1) For the purpose of ResCap’s tangible net worth covenants, consolidated tangible net worth is defined as

ResCap, LLC - Key Financial Information ResCap met its covenants with tangible net worth of $859 million at the end of the third quarter (1) For the purpose of ResCap’s tangible net worth covenants, consolidated tangible net worth is defined as

the company’s consolidated equity, excluding intangible assets and any equity in Ally Bank to the extent

included in ResCap’s consolidated balance sheet Supplemental ($ millions) 3Q 10 2Q 10 Net income 38 $ 364 $ ($ millions) 9/30/2010 6/30/2010 Cash & cash equivalents 618 $ 621 $ Mortgage loans held-for-sale 5,127 4,613 Mortgage loans held-for-investment, net 3,357 2,759 Mortgage servicing rights 1,680 1,950 Other assets 9,725 18,611 Total assets 20,507 $ 28,554 $ Total liabilities 19,649 $ 27,760 $ Tangible net worth (1) 859 $ 793 $ 40

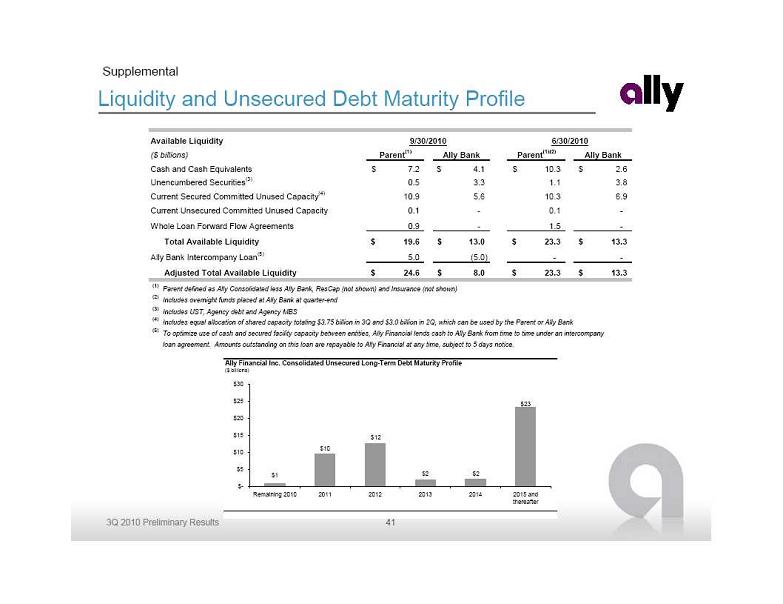

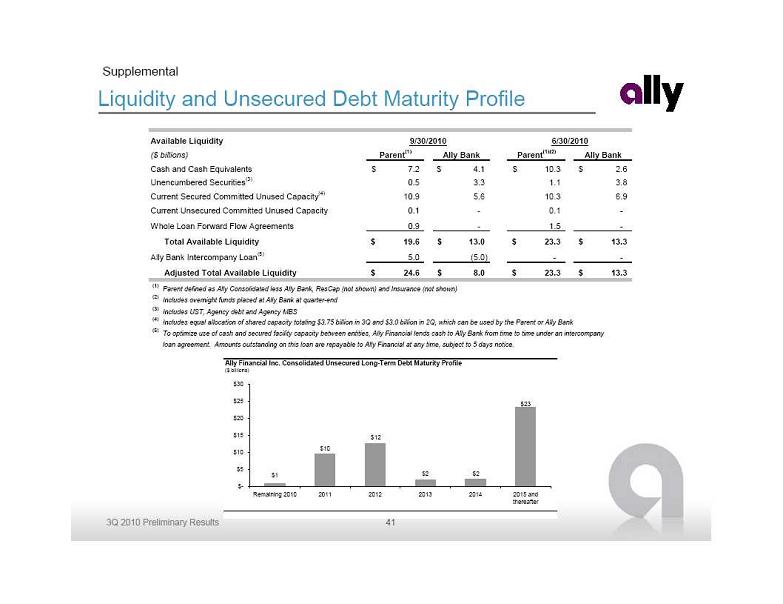

Liquidity and Unsecured Debt Maturity Profile Supplemental Available Liquidity 9/30/2010 6/30/2010 ($ billions) Parent (1) Ally Bank Parent (1)(2) Ally Bank Cash and Cash Equivalents 7.2 $ 4.1 $ 10.3 $ 2.6 $ Unencumbered Securities (3) 0.5 3.3 1.1 3.8 Current Secured Committed Unused Capacity (4) 10.9 5.6 10.3 6.9 Current Unsecured Committed Unused Capacity 0.1 - 0.1 - Whole Loan Forward Flow Agreements 0.9 - 1.5 - Total Available Liquidity 19.6 $ 13.0 $ 23.3 $ 13.3 $ Ally Bank Intercompany Loan (5) 5.0 (5.0) - - Adjusted Total Available Liquidity 24.6 $ 8.0 $ 23.3 $ 13.3 $ (1) Parent defined as Ally Consolidated less Ally Bank, ResCap (not shown) and Insurance (not shown) (2) Includes overnight funds placed at Ally Bank at quarter-end (3) Includes UST, Agency debt and Agency MBS (4) Includes equal allocation of shared capacity totaling $3.75 billion in 3Q and $3.0 billion in 2Q, which can be used by the Parent or Ally Bank (5) To optimize use of cash and secured facility capacity between entities, Ally Financial lends cash to Ally Bank from time to time under an intercompany loan agreement. Amounts outstanding on this loan are repayable to Ally Financial at any time, subject to 5 days notice. Ally Financial Inc. Consolidated Unsecured Long-Term Debt Maturity Profile ($ billions) $23 $2 $2 $12 $10 $1 $- $5 $10 $15 $20 $25 $30 Remaining 2010 2011 2012 2013 2014 2015 and thereafter 41

Liquidity and Unsecured Debt Maturity Profile Supplemental Available Liquidity 9/30/2010 6/30/2010 ($ billions) Parent (1) Ally Bank Parent (1)(2) Ally Bank Cash and Cash Equivalents 7.2 $ 4.1 $ 10.3 $ 2.6 $ Unencumbered Securities (3) 0.5 3.3 1.1 3.8 Current Secured Committed Unused Capacity (4) 10.9 5.6 10.3 6.9 Current Unsecured Committed Unused Capacity 0.1 - 0.1 - Whole Loan Forward Flow Agreements 0.9 - 1.5 - Total Available Liquidity 19.6 $ 13.0 $ 23.3 $ 13.3 $ Ally Bank Intercompany Loan (5) 5.0 (5.0) - - Adjusted Total Available Liquidity 24.6 $ 8.0 $ 23.3 $ 13.3 $ (1) Parent defined as Ally Consolidated less Ally Bank, ResCap (not shown) and Insurance (not shown) (2) Includes overnight funds placed at Ally Bank at quarter-end (3) Includes UST, Agency debt and Agency MBS (4) Includes equal allocation of shared capacity totaling $3.75 billion in 3Q and $3.0 billion in 2Q, which can be used by the Parent or Ally Bank (5) To optimize use of cash and secured facility capacity between entities, Ally Financial lends cash to Ally Bank from time to time under an intercompany loan agreement. Amounts outstanding on this loan are repayable to Ally Financial at any time, subject to 5 days notice. Ally Financial Inc. Consolidated Unsecured Long-Term Debt Maturity Profile ($ billions) $23 $2 $2 $12 $10 $1 $- $5 $10 $15 $20 $25 $30 Remaining 2010 2011 2012 2013 2014 2015 and thereafter 41

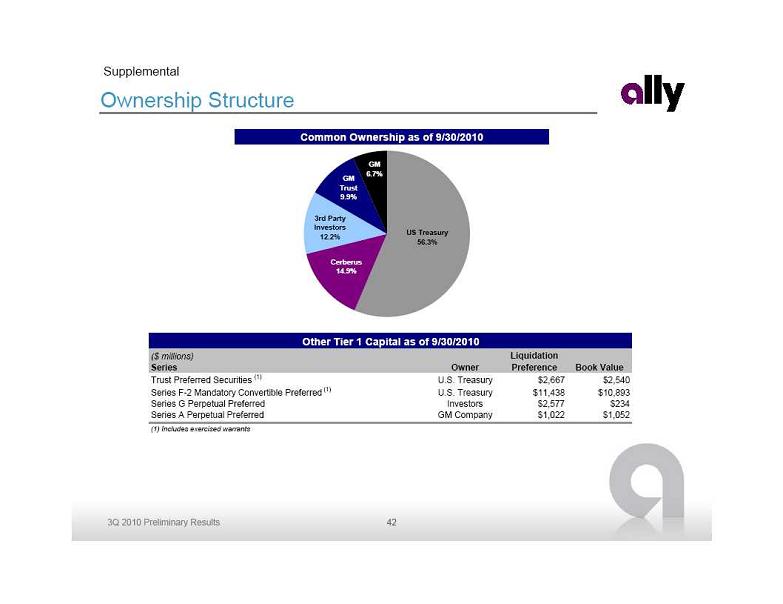

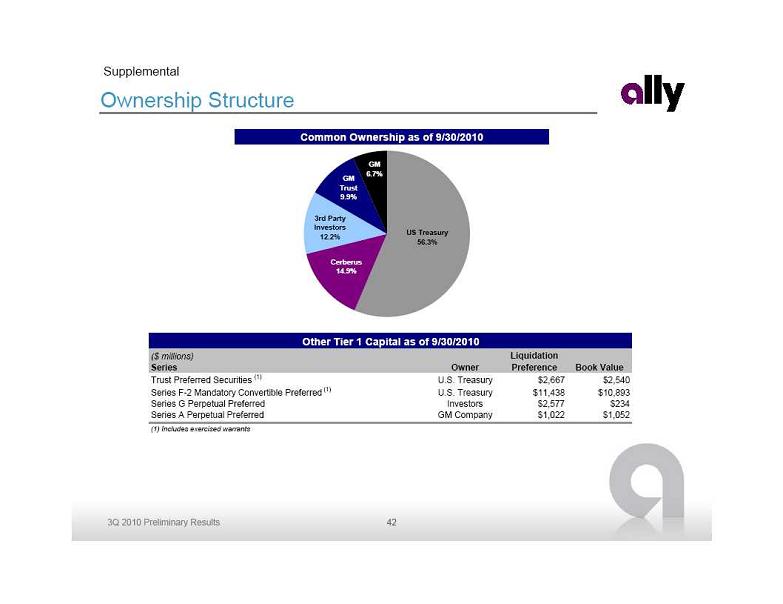

Ownership Structure Supplemental Common Ownership as of 9/30/2010 GM 6.7% GM Trust 9.9% 3rd Party Investors 12.2% Cerberus 14.9% US Treasury 56.3% ($ millions) Series Owner Liquidation Preference Book Value Trust Preferred Securities (1) U.S. Treasury $2,667 $2,540 Series F-2 Mandatory Convertible Preferred (1) U.S. Treasury $11,438 $10,893 Series G Perpetual Preferred Investors $2,577 $234 Series A Perpetual Preferred GM Company $1,022 $1,052 (1) Includes exercised warrants Other Tier 1 Capital as of 9/30/2010 42

Ownership Structure Supplemental Common Ownership as of 9/30/2010 GM 6.7% GM Trust 9.9% 3rd Party Investors 12.2% Cerberus 14.9% US Treasury 56.3% ($ millions) Series Owner Liquidation Preference Book Value Trust Preferred Securities (1) U.S. Treasury $2,667 $2,540 Series F-2 Mandatory Convertible Preferred (1) U.S. Treasury $11,438 $10,893 Series G Perpetual Preferred Investors $2,577 $234 Series A Perpetual Preferred GM Company $1,022 $1,052 (1) Includes exercised warrants Other Tier 1 Capital as of 9/30/2010 42

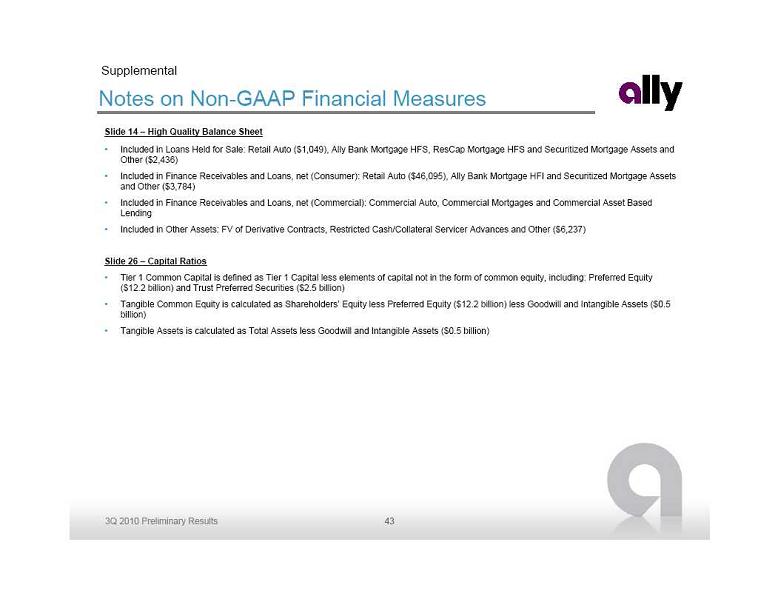

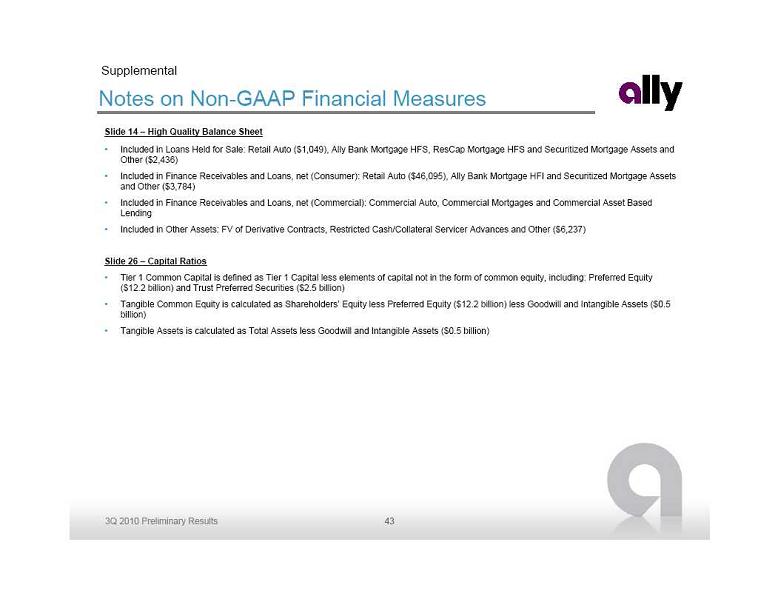

Notes on Non-GAAP Financial Measures Supplemental Slide 14 – High Quality Balance Sheet Included in Loans Held for Sale: Retail Auto ($1,049), Ally Bank Mortgage HFS, ResCap Mortgage HFS and Securitized Mortgage Assets and

Notes on Non-GAAP Financial Measures Supplemental Slide 14 – High Quality Balance Sheet Included in Loans Held for Sale: Retail Auto ($1,049), Ally Bank Mortgage HFS, ResCap Mortgage HFS and Securitized Mortgage Assets and

Other ($2,436) Included in Finance Receivables and Loans, net (Consumer): Retail Auto ($46,095), Ally Bank Mortgage HFI and Securitized Mortgage Assets

and Other ($3,784) Included in Finance Receivables and Loans, net (Commercial): Commercial Auto, Commercial Mortgages and Commercial Asset Based

Lending Included in Other Assets: FV of Derivative Contracts, Restricted Cash/Collateral Servicer Advances and Other ($6,237) Slide 26 – Capital Ratios Tier 1 Common Capital is defined as Tier 1 Capital less elements of capital not in the form of common equity, including: Preferred Equity

($12.2 billion) and Trust Preferred Securities ($2.5 billion) Tangible Common Equity is calculated as Shareholders’ Equity less Preferred Equity ($12.2 billion) less Goodwill and Intangible Assets ($0.5

billion) Tangible Assets is calculated as Total Assets less Goodwill and Intangible Assets ($0.5 billion) 43

Ally Financial Inc. 3Q10 Earnings Review November 3, 2010 Contact Ally Investor Relations at (866) 710-4623 or investor.relations@ally.com

Ally Financial Inc. 3Q10 Earnings Review November 3, 2010 Contact Ally Investor Relations at (866) 710-4623 or investor.relations@ally.com Forward-Looking Statements and Additional Information The following should be read in conjunction with the financial statements, notes and other information contained in the Company’s 2009 Annual

Forward-Looking Statements and Additional Information The following should be read in conjunction with the financial statements, notes and other information contained in the Company’s 2009 Annual Third Quarter Highlights Ally earned core pre-tax income(1) of $636 million and net income of $269 million in the third quarter Premier Auto

Third Quarter Highlights Ally earned core pre-tax income(1) of $636 million and net income of $269 million in the third quarter Premier Auto Results by Segment All four operating segments were profitable for the third straight quarter Strong loan originations Stable core business trends Results impacted by auto balance sheet repositioning and mortgage repurchase reserve expense Ally Bank and ResCap legal entities continued to be profitable in 3Q (1) Corporate and Other as presented includes Commercial Finance Group (“CFG”), certain equity investments and treasury activities including the residual impacts from

Results by Segment All four operating segments were profitable for the third straight quarter Strong loan originations Stable core business trends Results impacted by auto balance sheet repositioning and mortgage repurchase reserve expense Ally Bank and ResCap legal entities continued to be profitable in 3Q (1) Corporate and Other as presented includes Commercial Finance Group (“CFG”), certain equity investments and treasury activities including the residual impacts from Leading Auto Finance Franchise Established leader in floorplan finance Increased diversification as an independent market

Leading Auto Finance Franchise Established leader in floorplan finance Increased diversification as an independent market Success is Driven by Strong Dealer Relationships 90 years of understanding and serving dealer needs Floorplan lending and broad product offerings serve as strong foundation for deep dealer relationships Bank holding company structure provides added stability and cost-efficient funding Market leading, nationwide scale and infrastructure Drivers at the dealer level 84% of GM dealer stock 76% of Chrysler dealer stock 34% of GM consumer sales 49% of Chrysler consumer sales Nearly 3x market share of five largest competitors Ally U.S. Penetration Statistics Dealers Ally Dealer Rewards strategy supports broader

Success is Driven by Strong Dealer Relationships 90 years of understanding and serving dealer needs Floorplan lending and broad product offerings serve as strong foundation for deep dealer relationships Bank holding company structure provides added stability and cost-efficient funding Market leading, nationwide scale and infrastructure Drivers at the dealer level 84% of GM dealer stock 76% of Chrysler dealer stock 34% of GM consumer sales 49% of Chrysler consumer sales Nearly 3x market share of five largest competitors Ally U.S. Penetration Statistics Dealers Ally Dealer Rewards strategy supports broader Retail Bank Franchise Ally Bank offers a differentiated banking experience Ally competes with a differentiated, customer-centric

Retail Bank Franchise Ally Bank offers a differentiated banking experience Ally competes with a differentiated, customer-centric Reducing Mortgage Balance Sheet Risk Strategic review is complete Balance sheet has been substantially de-risked Remaining mortgage assets are largely: Non-economic exposures Assets supporting agency origination and