- ALLY Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

Ally Financial (ALLY) CORRESPCorrespondence with SEC

Filed: 9 Jul 13, 12:00am

July 9, 2013

Mr. Christian Windsor

Special Counsel

Division of Corporation Finance

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

Dear Mr. Windsor:

This communication is provided in response to your letter dated June 13, 2013, regarding your review of Ally Financial Inc.’s (“Ally”, “the Company”, “we”, and “our”) Form 10-K for the Fiscal Year Ended December 31, 2012, filed with the U.S. Securities and Exchange Commission (“SEC”) on March 1, 2013, and Form 10-Q for the Fiscal Quarter Ended March 31, 2013, filed with the SEC on May 1, 2013. Our responses are presented below, following each of the respective comments communicated in your letter.

Form 10-K for the Fiscal Year Ended December 31, 2012

Item 1A. Risk Factors

The profitability and financial condition of our operations…, page 15

| 1. | We note your disclosure that “some competitors have or could have exclusive agreements with GM and/or Chrysler.” Tell us whether you are aware of any competitors that currently have exclusive agreements with GM and/or Chrysler and revise your disclosure in future filings as appropriate. |

Within this same risk factor (refer to page 15 of the Company’s 2012 Form 10-K), the Company disclosed that Chrysler “recently announced that it…entered into a ten-year agreement with Santander Consumer USA Inc. (Santander), pursuant to which Santander will provide a full range of wholesale and retail financing services to Chrysler dealers and consumers, beginning in May 2013.” The Company is unaware of any other competitors that currently have exclusive agreements with GM and/or Chrysler. However, the Company respectfully submits that it only became aware of the Chrysler / Santander agreement as a result of public disclosure made by Chrysler, and the Company would generally not be made aware of agreements that our competitors or other third parties enter into. In the event the Company did become aware of exclusive agreements in the future that any of our competitors have with GM and/or Chrysler, future filings would be revised if deemed appropriate.

| 2. | In future filings please add a separate risk factor to discuss the impact of the expiration of the exclusivity agreements with Chrysler and GM. |

The Company’s existing risk factor disclosure describes that the Company is not able to “predict the ultimate impact that the expiration of these agreements will have on our operations”, and that “the expiration of these agreements will likely increase competitive pressure on Ally, as some competitors have or could have exclusive agreements with GM and/or Chrysler.” Refer to page 15 of the Company’s 2012 Form 10-K. In future filings, the Company will separate this discussion into a stand-alone risk factor. Further, the Company will continue to evaluate the impact of the expiration of the exclusivity agreements with Chrysler and GM and revise future filings if appropriate.

United States Securities and Exchange Commission

Mr. Christian Windsor

July 9, 2013

Page 2

Item 11. Executive Compensation, page 214

| 3. | Please tell us why you have not disclosed the 2011 Incentive Compensation Plan, 2011 Executive Performance Plan, Employee Stock Purchase Plan and 2011 Non-Employee Directors Equity Compensation Plan, as you have done in the Form S-1 registration statement (File No. 333-173198). Refer to prior comment 17 in our letter dated May 8, 2012. |

The discussion of these plans in the Form S-1 registration statement (File No. 333-173198) has been provided in anticipation of the adoption of these plans in connection with an initial public offering, should one occur. The Company has not yet formally adopted any of these plans, and therefore respectfully submits that at this time it is not appropriate to include the descriptions in SEC filings other than the Form S-1 registration statement (File No. 333-173198).

Form 10-Q for Fiscal Quarter Ended March 31, 2013

Item 1. Financial Statements

Notes to Condensed Consolidated Financial Statements (unaudited)

Note 21. Income Taxes

| 4. | We note you have recorded a partial allowance for your deferred tax asset at December 31, 2012 and March 31, 2013 and have released a portion of the valuation allowance during fiscal 2012 and in the interim period of March 31, 2013. Please provide us with specific detailed information to support the realizability of the net deferred tax asset, and your accounting, at December 31, 2012 and March 31, 2013. Please make sure to address the following in your response: |

| • | We note that you have recognized significant cumulative losses from continuing operations during the fiscal 2007-2012 periods, and continued to recognize losses from continuing operations during the 3 months ended March 31, 2013. In determining the need for a valuation allowance, forming a conclusion that a valuation allowance is not necessary is difficult when there is negative evidence such as cumulative losses from continuing operations, which is considered a significant piece of negative evidence that is difficult to overcome (refer to paragraphs 21-23 of ASC 740-10-30). Furthermore the weight given to the potential effect of negative and positive evidence should be commensurate with the extent to which it can be objectively verified, specifically concerning forecasts of future taxable income. Your disclosures assert that positive evidence includes your assessment of forecasts of future taxable income that is sufficient to realize net operating loss carryforwards before their expiration. Given this information and the guidance provided in ASC 740-10-30, please provide us with specific evidence to support the realizability of the net deferred tax asset at March 31, 2013 and December 31, 2012. |

December 31, 2012 Valuation Allowance Determination

At December 31, 2012, the Company reported U.S. tax loss and tax credit carryforward deferred tax assets of approximately $2.6 billion. These deferred tax assets consisted primarily of net operating loss, capital loss, and foreign tax credit carryforwards. Additionally, the Company reported a related valuation allowance (“VA”) of approximately $1.6 billion (fully offsetting the capital loss carryforward deferred tax asset (“DTA”) and partially offsetting the foreign tax credit carryforward DTA as further discussed below).

United States Securities and Exchange Commission

Mr. Christian Windsor

July 9, 2013

Page 3

Ordinary Character Deferred Tax Analysis

The two primary pieces of evidence we considered when assessing the need for a valuation allowance at December 31, 2012 were 1) whether we had cumulative losses from continuing operations in recent years and 2) whether we had forecasts of taxable income sufficient to realize net operating loss carryforwards.

Assessing the need for a VA can be more challenging when there is negative evidence such as cumulative pretax losses in recent years (see ASC 740-10-30-21). ASC 740 does not specifically define “cumulative pretax losses in recent years”. When applying this guidance, the Company believes that cumulative pretax losses, adjusted for certain non-recurring items, for the current and the two preceding years creates a rebuttable presumption that deferred tax assets may not be realizable.

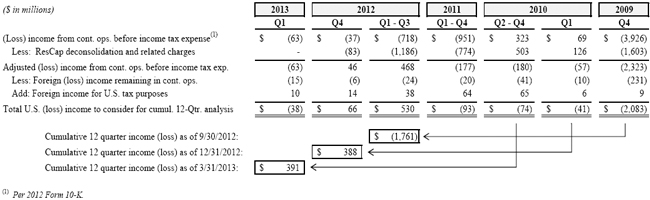

The Company has adopted and consistently applied a rolling 12-quarter cumulative loss analysis when assessing the need for a VA. For the VA analysis conducted at December 31, 2012, substantial pretax losses realized during the quarter ended December 31, 2009, were no longer included in the Company’s rolling 12-quarter cumulative loss analysis as that quarter was no longer part of the analysis period. The Company earned cumulative pretax income during 2010 through 2012, after adjusting for non-recurring items, and did not need to consider cumulative losses as negative evidence beginning in the fourth quarter of 2012. Please refer to the table below and subsequent discussion on removing Residential Capital, LLC (“ResCap”) results from the rolling 12-quarter cumulative loss analysis.

ResCap Historical Operating Results

On May 14, 2012, ResCap and certain of its wholly owned direct and indirect subsidiaries filed voluntary petitions for relief under Chapter 11 of the Bankruptcy Code in the United States Bankruptcy Court for the Southern District of New York (“the ResCap Bankruptcy Filing”). As a result of the ResCap Bankruptcy Filing, effective May 14, 2012, ResCap was deconsolidated from the financial statements of the Company and the Company’s remaining equity investment in ResCap was fully impaired.

To conduct the VA analysis as of December 31, 2012, the Company made adjustments to remove the historical impact of ResCap’s operating results from the rolling 12-quarter cumulative loss analysis. Consistent with ASC 740-10-30-22c, the Company is treating these losses as nonrecurring items that should be excluded from our analysis since they are not indicative of future taxable income as they are not expected to repeat.

United States Securities and Exchange Commission

Mr. Christian Windsor

July 9, 2013

Page 4

The ResCap bankruptcy case and the strategic actions surrounding the Company’s international operations are underway. Successful completion of these activities will enhance the Company’s capital position and will further clarify our mission to be the leading value-added auto finance provider to U.S. dealers, supported by a growing direct bank. These core businesses have been profitable historically and are projected to be in the future.

2013-2014 Forecast

Future taxable income exclusive of reversing temporary differences and net operating loss carryforwards constitutes positive evidence that should be considered for purposes of determining the need for a VA. The Company routinely prepares financial forecasts for managerial purposes and shares this forecast information with the Federal Reserve Board, the U.S. Department of Treasury, rating agencies, advisors and consultants. These forecasts are also routinely used as the starting point for purposes of forecasting future taxable income.

ASC 740-10-30-22 provides examples of positive evidence that should be considered when making a conclusion as to whether a valuation allowance is required when there is also negative evidence. ASC 740-10-30-22c provides the following potential positive evidence:

“A strong earnings history exclusive of the loss that created the future deductible amount (tax loss carryforward or deductible temporary difference) coupled with evidence indicating that the loss (for example, an unusual, infrequent, or extraordinary item) is an aberration rather than a continuing condition.”

Based on this provision, unusual or infrequent costs in the managerial forecast (such as any future payments under the ResCap bankruptcy Plan Support Agreement) were excluded when estimating future taxable income. All future forecasted results for ResCap were zero for purposes of our VA assessment at December 31, 2012.

These forecasts as of December 31, 2012 had shown sufficient positive U.S. taxable income in subsequent years (before net operating loss (“NOL”) carryforwards) to fully utilize our then existing U.S. federal NOL carryforward by the end of 2015, before the 2025 expiration date. This constituted positive evidence supporting our conclusion that a VA was no longer necessary against our ordinary character deferred tax assets.

Based on this review of the positive and negative evidence available (including the scheduling-out of all U.S. deferred tax assets and liabilities as of December 31, 2012), we concluded that there was sufficient positive evidence to support the reversal of our valuation allowance at December 31, 2012 for our U.S. federal, ordinary character net deferred tax asset position (excluding Separate Return Loss Year (“SRLY”) NOL carryforwards and some state deferred tax assets).

Capital Loss Carryforward Analysis

As stated previously, the Company had a capital loss carryforward DTA fully offset by a VA at December 31, 2012. Our consideration of the related positive and negative evidence follows.

In the second quarter of 2012, the Company began exploring strategic alternatives for substantially all of its international operations, including automotive finance, insurance and banking and deposit operations. As part of this initiative, on October 18, 2012, we announced that we reached an agreement to sell our Mexican insurance business, ABA Seguros, to the ACE Group. Further, on October 23, 2012, we announced that we reached an agreement to sell our Canadian auto finance operation, Ally Credit Canada Limited, and ResMor Trust to Royal Bank of Canada. Finally, on November 21, 2012, we agreed to sell our automotive finance

United States Securities and Exchange Commission

Mr. Christian Windsor

July 9, 2013

Page 5

operations in Europe and Latin America to General Motors Financial Company, Inc. (“GM Financial”). On the same date, we entered into an agreement with GM Financial to acquire our 40% interest in a motor vehicle finance joint venture in China.

The sale agreements are expected to result in significant capital gains that would allow for the utilization of capital loss carryforwards that existed at December 31, 2012. However, the closings of these sale transactions are subject to material conditions of closing, including the receipt of various required government and regulatory approvals.

The Company considered all available evidence, both positive and negative, to determine whether, based on the weight of that evidence, a VA against our capital loss carryforward DTA continued to be necessary at December 31, 2012. We considered the following:

| • | Positive Evidence – The sales agreements signed during 2012 are expected to result in significant capital gains. However, the closing of the sales transactions are subject to material conditions of closing. For example, closing is conditioned upon the receipt of various required government and regulatory approvals that are outside of our control. This constitutes weak positive evidence that should be weighted accordingly. |

| • | Negative Evidence – The capital loss carryforward period is only five years. This short carryforward period constitutes objectively verifiable negative evidence. |

| • | Negative Evidence – It is a challenge to produce capital gains of the correct character and magnitude to realize capital loss carryforwards. The Company does not forecast any significant capital gains, except for the gains associated with the sales agreements that are outside of our control. |

After considering the evidence above, in the Company’s judgment the negative evidence continued to outweigh the positive evidence. The negative evidence is objectively verifiable, and the positive evidence is not under our control and cannot be verified until each sale transaction closes. As such, the Company continued to maintain a VA against its net capital in nature deferred tax assets as of December 31, 2012. Our conclusion is also consistent with the pre-tax accounting treatment that precludes recognition of gains for book purposes before the sale transaction closes. The Company did, however, disclose to readers in our 2012 Form 10-K, Footnote 23 that,

“Successful completion during 2013 of the sales of entities currently held-for-sale may result in capital gains that would allow us to realized capital loss carryforwards. A related reversal of valuation allowance on these deferred tax assets would be recognized as an income tax benefit upon such utilization.”

Foreign Tax Credit Carryforward Analysis

At the end of 2011, the Company had a $111 million foreign tax credit carryforward (“FTCs”) DTA on its balance sheet, fully offset by a VA. In December of 2012, pre-sale intercompany dividends generated an additional $1.5 billion of FTCs. The Company’s ability to utilize a portion of these FTCs during the 10-year carryforward period (as further discussed below) stems primarily from the recapture and re-characterization of what is referred to for income tax purposes as overall domestic loss account (“ODL”).

An ODL is defined as the domestic loss for a tax year in which the taxpayer has elected to take the benefits of a FTC to the extent that loss offsets taxable income from foreign sources for that tax year. When a taxpayer sustains an ODL in any tax year, Internal Revenue Code Section 904(g) prescribes that the taxpayer re-characterizes in each subsequent year as foreign source income the lesser of:

| • | the full amount of the ODL to the extent it hasn’t been carried back, or |

United States Securities and Exchange Commission

Mr. Christian Windsor

July 9, 2013

Page 6

| • | fifty percent of the taxpayers U.S. source taxable income for that succeeding year. |

Given that the Company’s foreign source income for both 2012 and 2013 will be offset by domestic losses (by operation of U.S. tax law), the Company will generate a significant ODL account that will allow it to re-characterize its future U.S. source taxable income as foreign source income and allow it to utilize FTCs. After considering the same forecasts discussed earlier coupled with future ODL re-characterization, at December 31, 2012, the Company estimated that it will be able to utilize $670 million of FTCs in future years and therefore recorded a net benefit to reflect that amount (i.e., $1.558 billion of FTCs were recorded as a DTA at the end of 2012 which was offset by an $888 million VA).

March 31, 2013 Valuation Allowance Determination

Ordinary Character Deferred Tax Analysis

As of March 31, 2013, the Company’s cumulative 12-quarter U.S. pretax income was $391 million, excluding any profit or loss from ResCap and all ResCap and bankruptcy-related charges classified as discontinued operations. Additionally, the Company continues to forecast future positive taxable income sufficient to utilize its ordinary NOL carryforwards by 2016.

Capital Loss Carryforward Analysis

During the quarter ended March 31, 2013, the Company released the VA associated with capital loss carryforwards to the extent of capital gains realized from the sale of its Canadian operations on February 1, 2013. The Company continued to maintain a VA against its remaining net capital in nature deferred tax assets as of March 31, 2013, based on the same evidence considered at December 31, 2012.

Foreign Tax Credit Carryforward Analysis

At March 31, 2013, the Company continued to conclude that there was not sufficient positive evidence to suggest that the entire FTC carryforward DTA would reverse in the foreseeable future, and as such, we continued to maintain a VA against $865 million of this DTA. In making this assessment we considered all available positive and negative evidence, including updated taxable income forecasts and tax law enactments that occurred during the quarter.

| • | Given your plans to book an additional $1.55 billion legal liability expenses in the second quarter of 2013, as disclosed in the 8-K filed May 23, 2013, please provide us with a timeline of events surrounding this eventual legal contingencies at March 31, 2013 and December 31, 2012 and tell us how you factored this potential liability into your conclusion regarding the realizability of the net deferred tax asset at March 31, 2013 and December 31, 2012. |

Consistent with ASC 740-10-30-22c, the Company has excluded legal liability expenses related to ResCap from tax forecasts since they are nonrecurring and not indicative of future taxable income as they are not expected to repeat. Any incremental nonrecurring charges were not factored into the Company’s analysis of the realizability of its net deferred tax assets at March 31, 2013 or December 31, 2012.

ResCap’s historical operating results and related nonrecurring charges are classified as discontinued operations beginning in the quarter ended March 31, 2013. Paragraphs 21-23 of ASC 740-10-30 focus on continuing operations, both for historical operating performance and for tax forecasts, as evidence for the realizability of deferred tax assets.

United States Securities and Exchange Commission

Mr. Christian Windsor

July 9, 2013

Page 7

We will update our analysis of the realizability of deferred tax assets for the quarter ending June 30, 2013. If the Company were to include the $1.55 billion charge in taxable income forecasts at June 30, 2013, we anticipate that the analysis would forecast full utilization of our NOL carryforward during 2017, which would continue to be before the 2025 expiration date.

Item 2. Management’s Discussion and Analysis of Financial Condition

Capital Planning and Stress Tests, page 107

| 5. | We note your disclosure that you provided a capital plan, which was rejected by the Federal Reserve Board, and your disclosure that you continue to have ongoing discussions. In future filings, please discuss management’s view of the material actions and other changes that Ally may make in order to implement a capital program or otherwise to shore up its capital in response to the stress tests. |

The Company will revise future filings as appropriate.

*********************

The Company acknowledges that it is responsible for the adequacy and accuracy of the disclosure in the filing; staff comments or changes to disclosures in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and the Company may not assert staff comments as a defense in any proceedings initiated by the Commission or any person under the federal securities laws of the United States.

I hope this letter addresses points raised in your comment letter. If you have any questions or would like to discuss this further, please contact David DeBrunner at 313-656-6463.

| Sincerely, |

| /s/ David J. DeBrunner |

| David J. DeBrunner |

| Vice President, Chief Accounting Officer, and Corporate Controller |

| Ally Financial Inc. |

| cc: | David Irving, Staff Accountant, United States Securities and Exchange Commission |

James G. Mackey, Chief Financial Officer

Richard J. Sandler, Esq.,Davis Polk & Wardwell LLP