Ally Financial Inc. 2Q 2017 Earnings Review Contact Ally Investor Relations at (866) 710-4623 or investor.relations@ally.com July 27, 2017 Exhibit 99.2

Forward-Looking Statements and Additional Information This presentation and related communications should be read in conjunction with the financial statements, notes, and other information contained in our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. This information is preliminary and based on company and third-party data available at the time of the presentation or related communication. This presentation and related communications contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts—such as our statements about targets and expectations for various financial and operating metrics. Forward-looking statements often use words such as “believe,” “expect,” “anticipate,” “intend,” “pursue,” “seek,” “continue,” “estimate,” “project,” “outlook,” “forecast,” “potential,” “target,” “objective,” “trend,” “plan,” “goal,” “initiative,” “priorities,” or other words of comparable meaning or future-tense or conditional verbs such as “may,” “will,” “should,” “would,” or “could.” Forward-looking statements convey our expectations, intentions, or forecasts about future events, circumstances, or results. All forward-looking statements, by their nature, are subject to assumptions, risks, and uncertainties, which may change over time and many of which are beyond our control. You should not rely on any forward-looking statement as a prediction or guarantee about the future. Actual future objectives, strategies, plans, prospects, performance, conditions, or results may differ materially from those set forth in any forward-looking statement. Some of the factors that may cause actual results or other future events or circumstances to differ from those in forward-looking statements are described in our Annual Report on Form 10-K for the year ended December 31, 2016, our subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, or other applicable documents that are filed or furnished with the U.S. Securities and Exchange Commission (collectively, our “SEC filings”). Any forward-looking statement made by us or on our behalf speaks only as of the date that it was made. We do not undertake to update any forward-looking statement to reflect the impact of events, circumstances, or results that arise after the date that the statement was made, except as required by applicable securities laws. You, however, should consult further disclosures (including disclosures of a forward-looking nature) that we may make in any subsequent SEC filings. This presentation and related communications contain specifically identified non-GAAP financial measures, which supplement the results that are reported according to generally accepted accounting principles (“GAAP”). These non-GAAP financial measures may be useful to investors but should not be viewed in isolation from, or as a substitute for, GAAP results. Differences between non-GAAP financial measures and comparable GAAP financial measures are reconciled in the presentation. Our use of the term “loans” describes all of the products associated with our direct and indirect lending activities. The specific products include loans, retail installment sales contracts, lines of credit, leases, and other financing products. The term “lend” or “originate” refers to our direct origination of loans or our purchase or acquisition of loans.

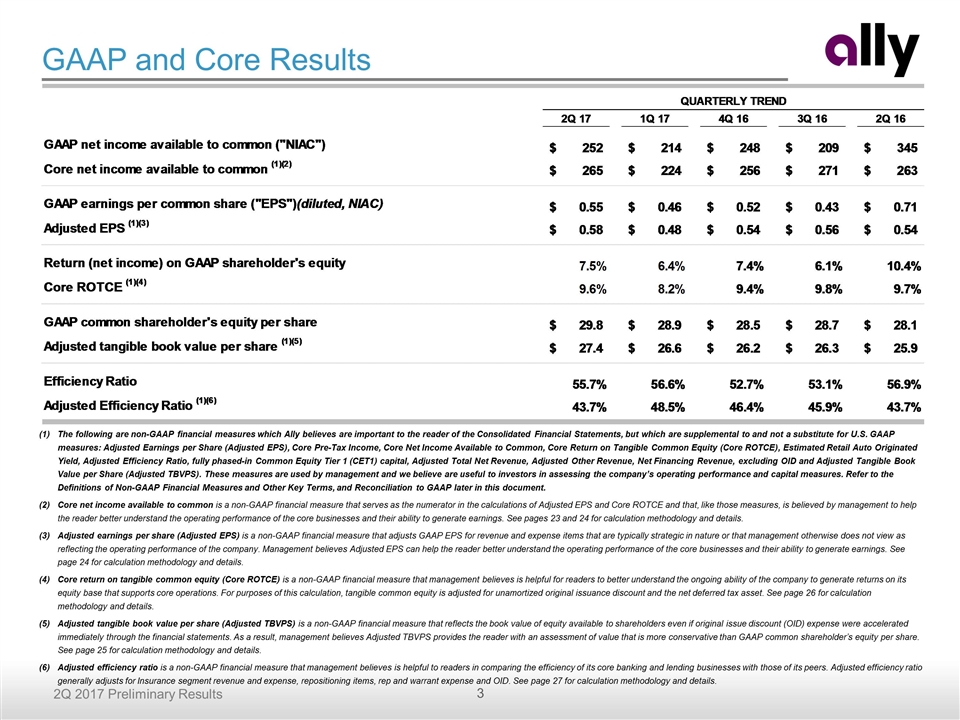

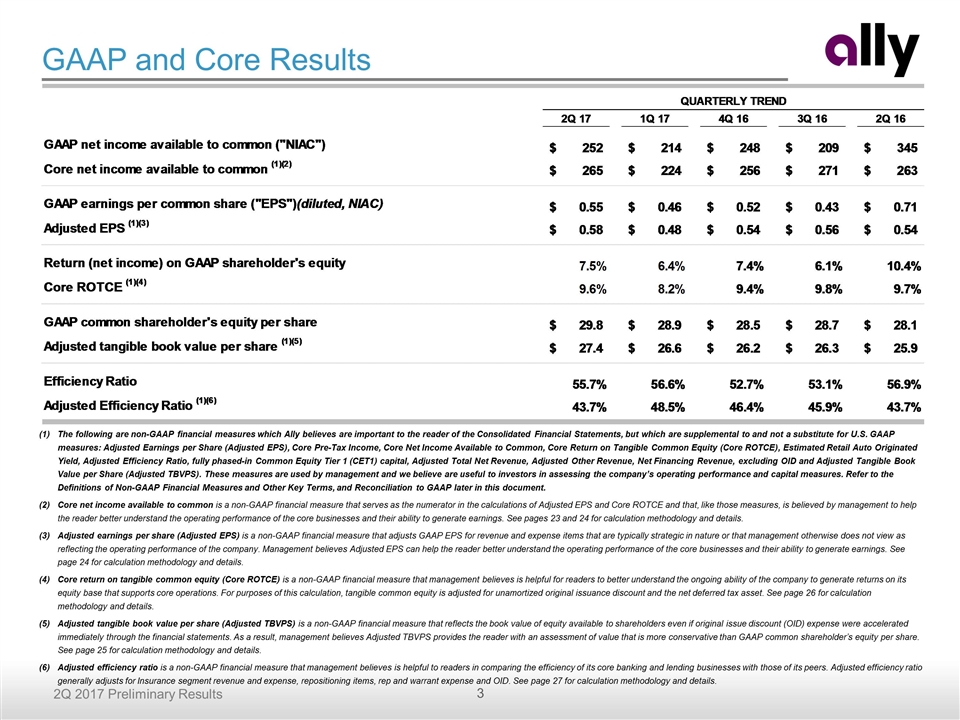

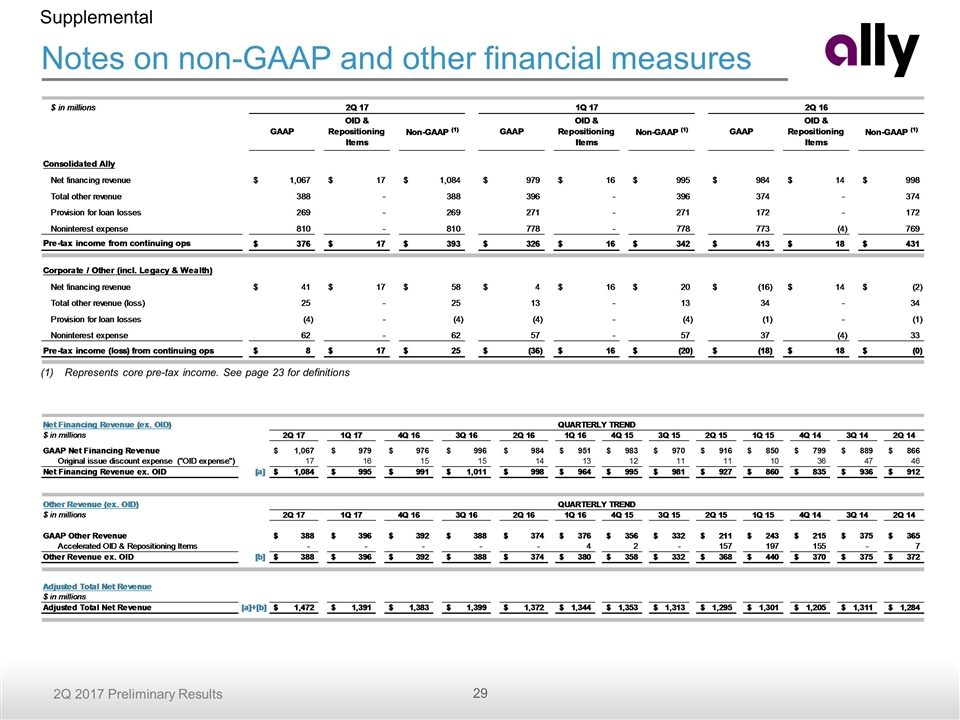

GAAP and Core Results The following are non-GAAP financial measures which Ally believes are important to the reader of the Consolidated Financial Statements, but which are supplemental to and not a substitute for U.S. GAAP measures: Adjusted Earnings per Share (Adjusted EPS), Core Pre-Tax Income, Core Net Income Available to Common, Core Return on Tangible Common Equity (Core ROTCE), Estimated Retail Auto Originated Yield, Adjusted Efficiency Ratio, fully phased-in Common Equity Tier 1 (CET1) capital, Adjusted Total Net Revenue, Adjusted Other Revenue, Net Financing Revenue, excluding OID and Adjusted Tangible Book Value per Share (Adjusted TBVPS). These measures are used by management and we believe are useful to investors in assessing the company’s operating performance and capital measures. Refer to the Definitions of Non-GAAP Financial Measures and Other Key Terms, and Reconciliation to GAAP later in this document. Core net income available to common is a non-GAAP financial measure that serves as the numerator in the calculations of Adjusted EPS and Core ROTCE and that, like those measures, is believed by management to help the reader better understand the operating performance of the core businesses and their ability to generate earnings. See pages 23 and 24 for calculation methodology and details. Adjusted earnings per share (Adjusted EPS) is a non-GAAP financial measure that adjusts GAAP EPS for revenue and expense items that are typically strategic in nature or that management otherwise does not view as reflecting the operating performance of the company. Management believes Adjusted EPS can help the reader better understand the operating performance of the core businesses and their ability to generate earnings. See page 24 for calculation methodology and details. Core return on tangible common equity (Core ROTCE) is a non-GAAP financial measure that management believes is helpful for readers to better understand the ongoing ability of the company to generate returns on its equity base that supports core operations. For purposes of this calculation, tangible common equity is adjusted for unamortized original issuance discount and the net deferred tax asset. See page 26 for calculation methodology and details. Adjusted tangible book value per share (Adjusted TBVPS) is a non-GAAP financial measure that reflects the book value of equity available to shareholders even if original issue discount (OID) expense were accelerated immediately through the financial statements. As a result, management believes Adjusted TBVPS provides the reader with an assessment of value that is more conservative than GAAP common shareholder’s equity per share. See page 25 for calculation methodology and details. Adjusted efficiency ratio is a non-GAAP financial measure that management believes is helpful to readers in comparing the efficiency of its core banking and lending businesses with those of its peers. Adjusted efficiency ratio generally adjusts for Insurance segment revenue and expense, repositioning items, rep and warrant expense and OID. See page 27 for calculation methodology and details.

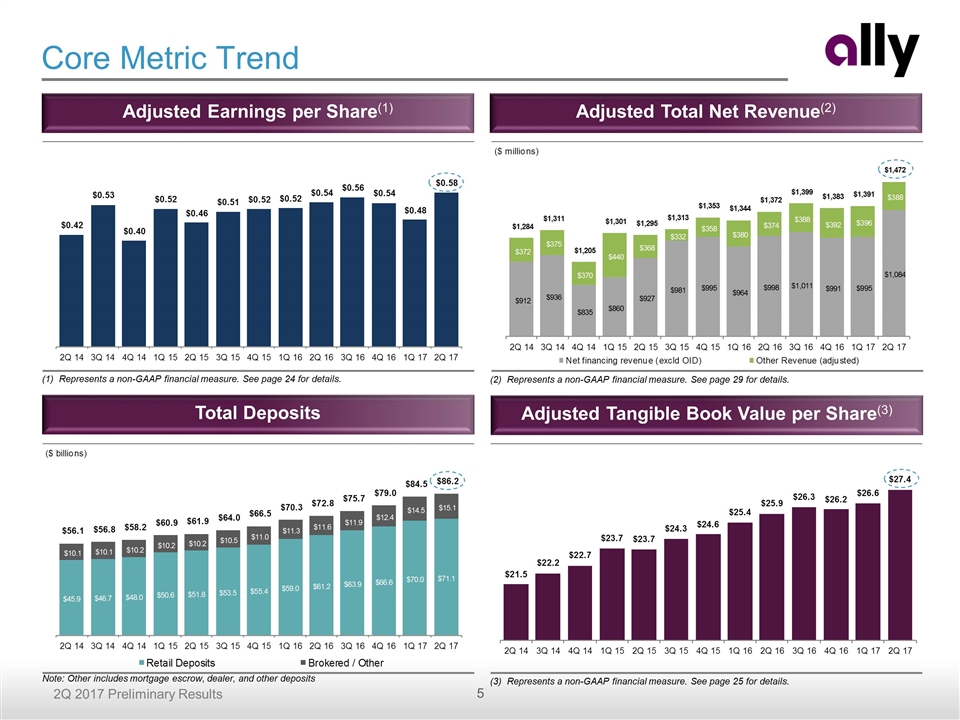

Second Quarter Highlights Represents a non-GAAP financial measure. See page 24 and page 29 for calculation methodology and details. Strong financial results and strategic path on track Adjusted EPS(1) of 58 cents – up 7% YoY Advancing key new customer products – Ally Invest and Ally Home® Retail auto net charge-off rate of 1.20% – tracking to 1.4 - 1.6% guidance for full year Auto lease yield of 6.6% up from 5.7% in 1Q 2Q total deposit growth of $1.7 billion – YTD 2017 total deposit growth of $7.2 billion CCAR non-objection to increase both dividend and share repurchases Adjusted total net revenue(1) of $1.47 billion – up $100 million YoY

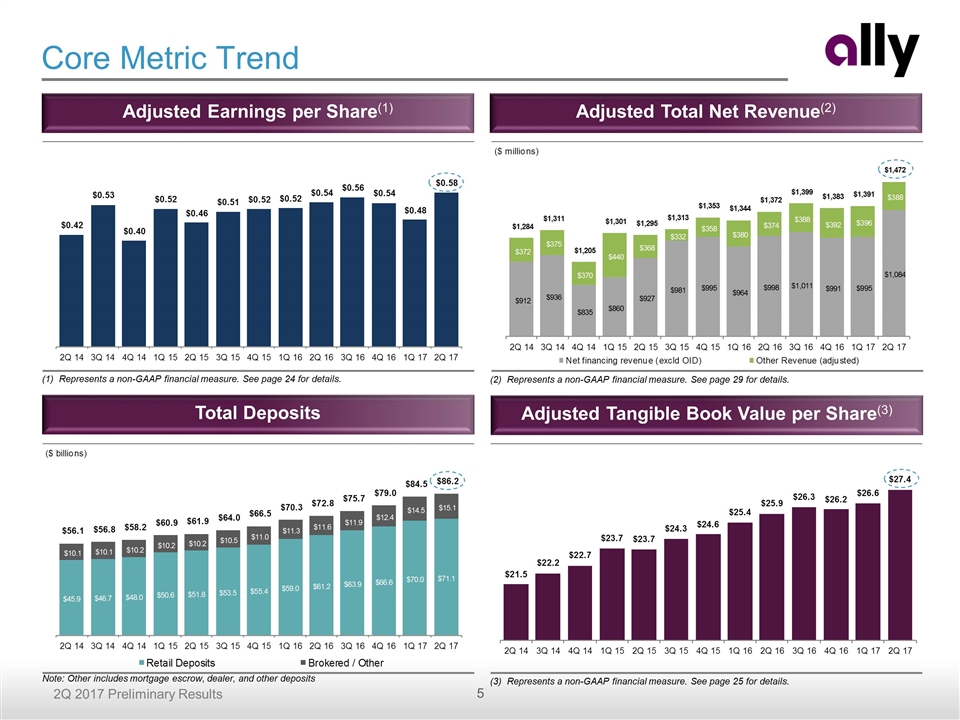

Core Metric Trend Adjusted Earnings per Share(1) Adjusted Total Net Revenue(2) Total Deposits Adjusted Tangible Book Value per Share(3) (3) Represents a non-GAAP financial measure. See page 25 for details. (1) Represents a non-GAAP financial measure. See page 24 for details. (2) Represents a non-GAAP financial measure. See page 29 for details. Note: Other includes mortgage escrow, dealer, and other deposits

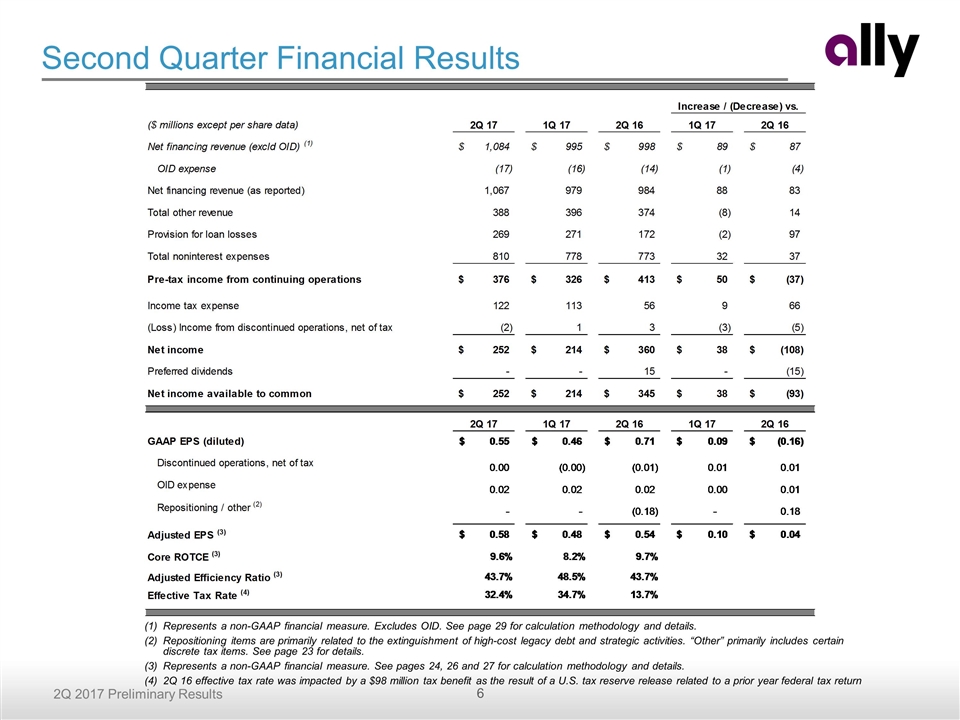

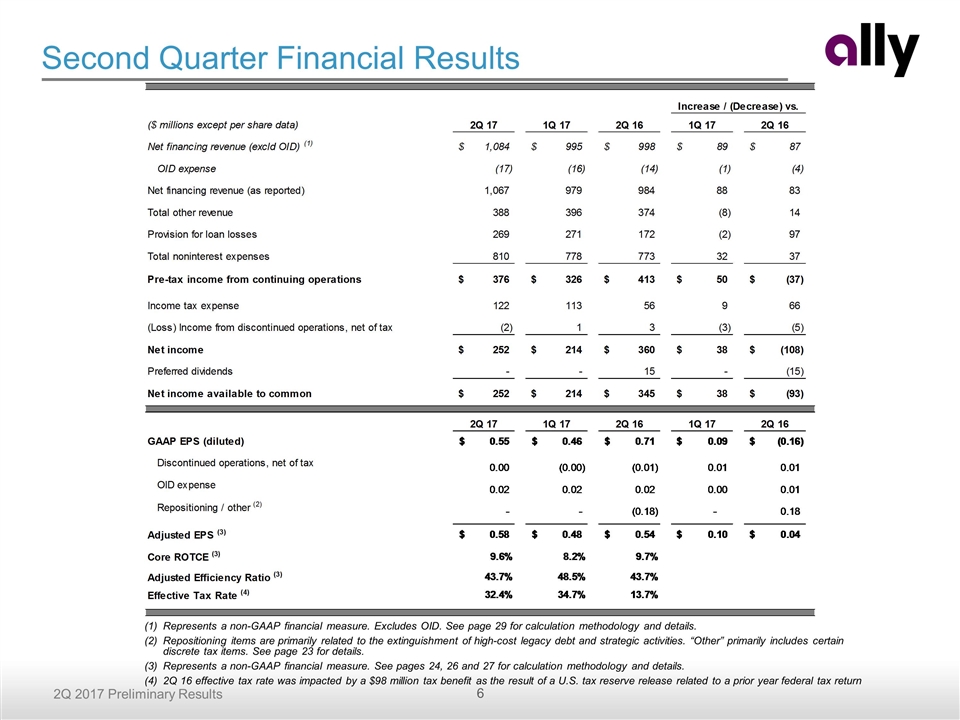

Second Quarter Financial Results Represents a non-GAAP financial measure. Excludes OID. See page 29 for calculation methodology and details. Repositioning items are primarily related to the extinguishment of high-cost legacy debt and strategic activities. “Other” primarily includes certain discrete tax items. See page 23 for details. Represents a non-GAAP financial measure. See pages 24, 26 and 27 for calculation methodology and details. 2Q 16 effective tax rate was impacted by a $98 million tax benefit as the result of a U.S. tax reserve release related to a prior year federal tax return

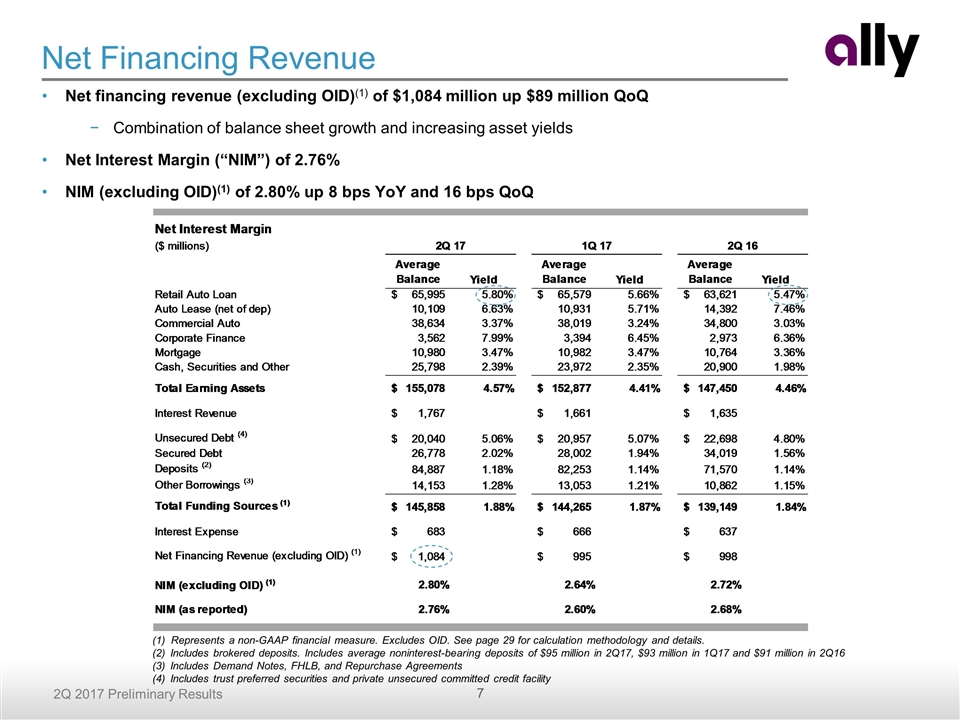

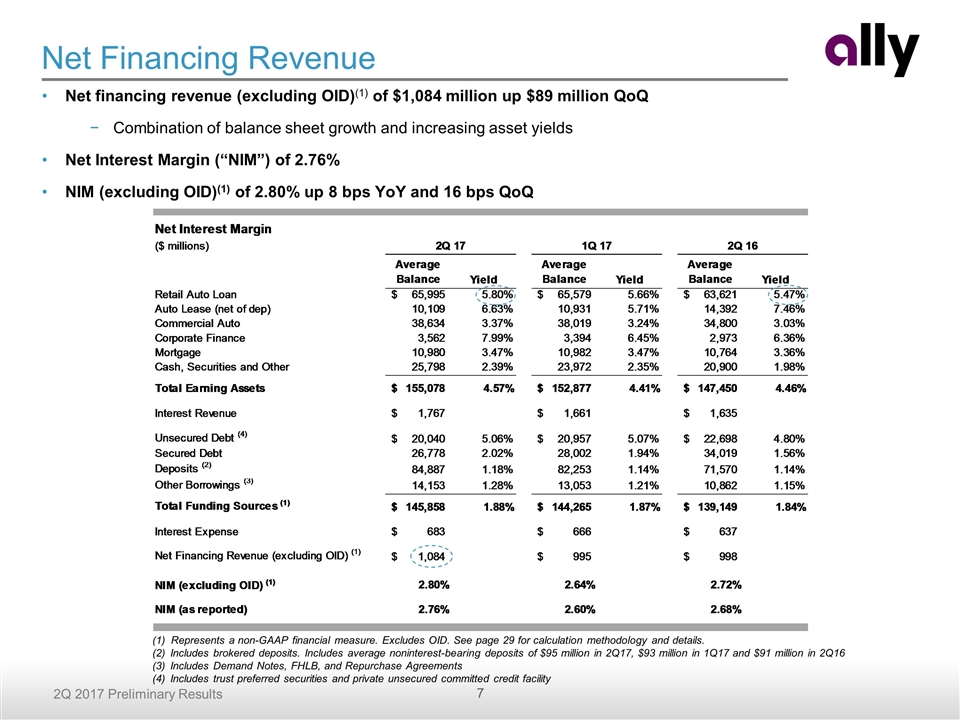

Net Financing Revenue Net financing revenue (excluding OID)(1) of $1,084 million up $89 million QoQ Combination of balance sheet growth and increasing asset yields Net Interest Margin (“NIM”) of 2.76% NIM (excluding OID)(1) of 2.80% up 8 bps YoY and 16 bps QoQ Represents a non-GAAP financial measure. Excludes OID. See page 29 for calculation methodology and details. Includes brokered deposits. Includes average noninterest-bearing deposits of $95 million in 2Q17, $93 million in 1Q17 and $91 million in 2Q16 Includes Demand Notes, FHLB, and Repurchase Agreements Includes trust preferred securities and private unsecured committed credit facility

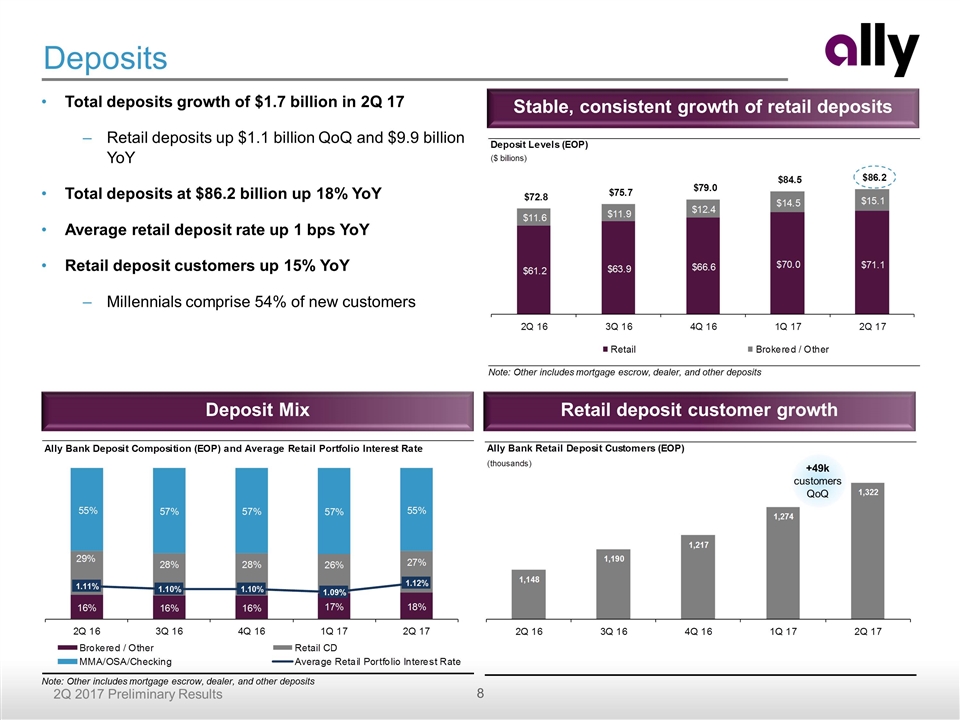

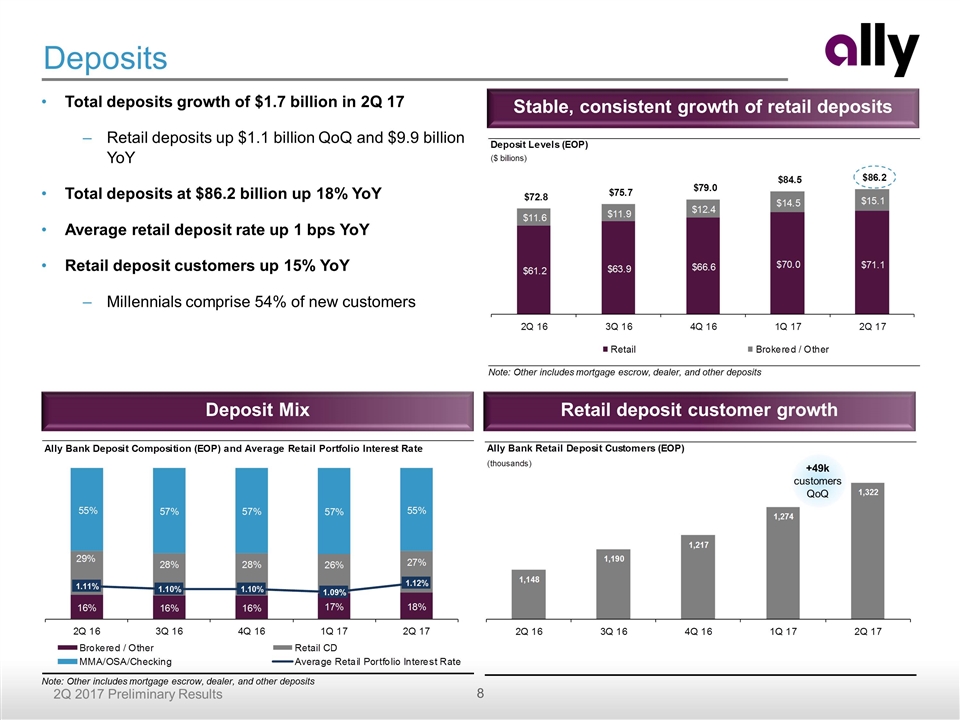

Deposits Total deposits growth of $1.7 billion in 2Q 17 Retail deposits up $1.1 billion QoQ and $9.9 billion YoY Total deposits at $86.2 billion up 18% YoY Average retail deposit rate up 1 bps YoY Retail deposit customers up 15% YoY Millennials comprise 54% of new customers Stable, consistent growth of retail deposits Deposit Mix Retail deposit customer growth Note: Other includes mortgage escrow, dealer, and other deposits Note: Other includes mortgage escrow, dealer, and other deposits +49k customers QoQ

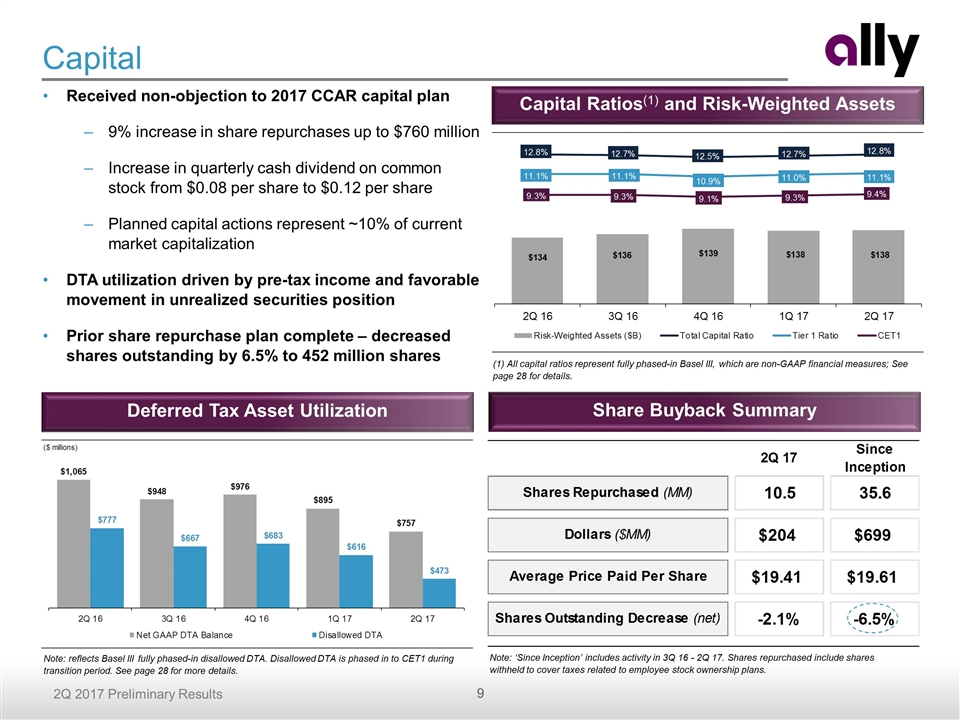

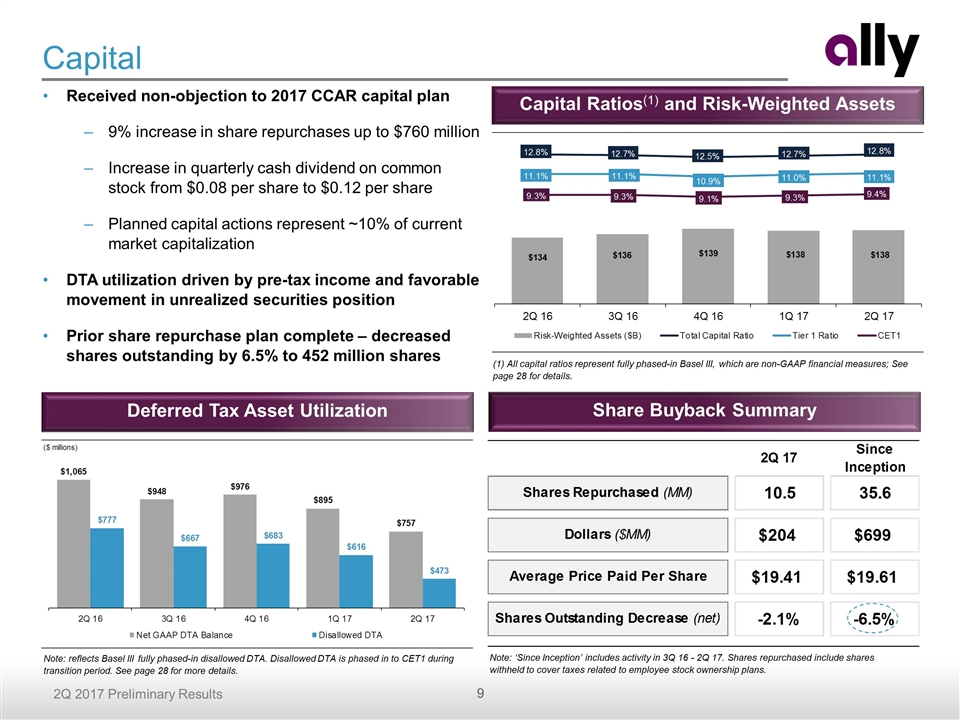

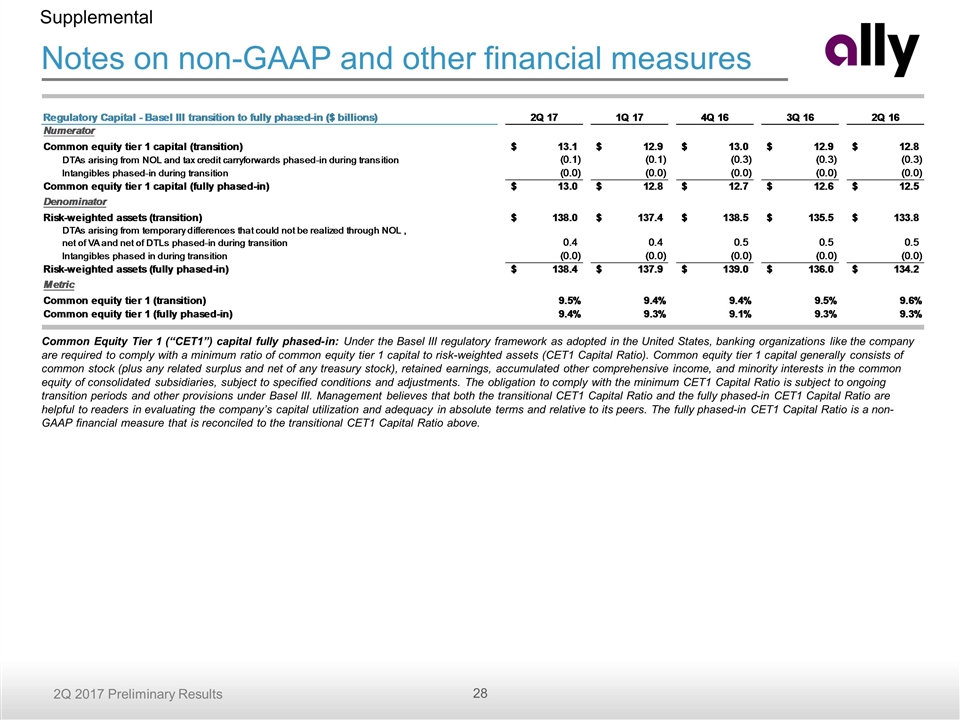

Capital (1) All capital ratios represent fully phased-in Basel III, which are non-GAAP financial measures; See page 28 for details. Capital Ratios(1) and Risk-Weighted Assets Deferred Tax Asset Utilization Note: reflects Basel III fully phased-in disallowed DTA. Disallowed DTA is phased in to CET1 during transition period. See page 28 for more details. Share Buyback Summary Note: ‘Since Inception’ includes activity in 3Q 16 - 2Q 17. Shares repurchased include shares withheld to cover taxes related to employee stock ownership plans. Received non-objection to 2017 CCAR capital plan 9% increase in share repurchases up to $760 million Increase in quarterly cash dividend on common stock from $0.08 per share to $0.12 per share Planned capital actions represent ~10% of current market capitalization DTA utilization driven by pre-tax income and favorable movement in unrealized securities position Prior share repurchase plan complete – decreased shares outstanding by 6.5% to 452 million shares

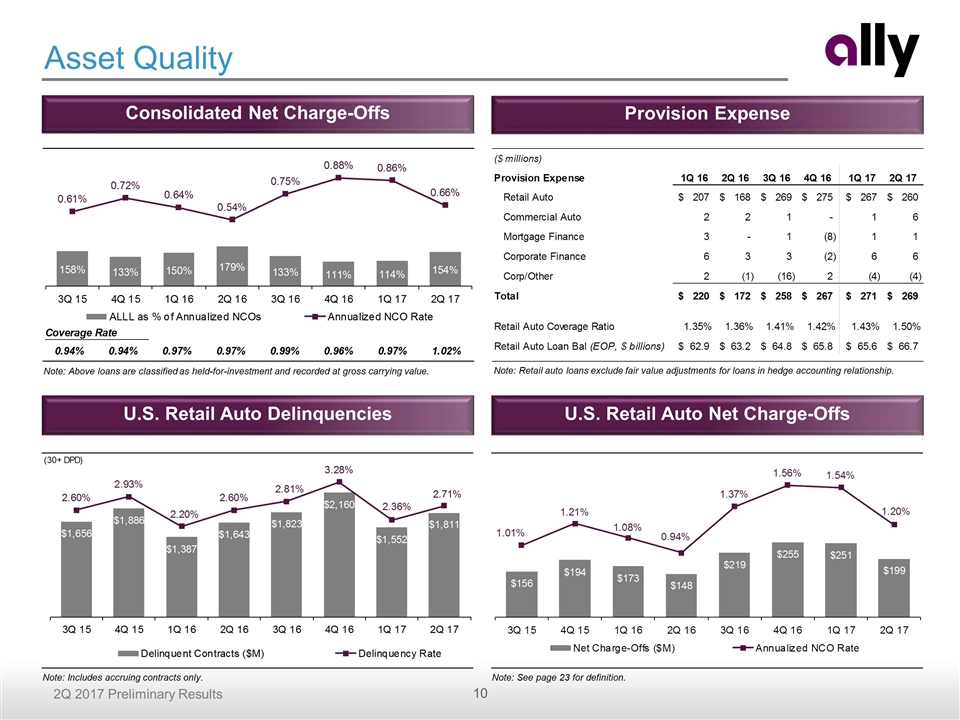

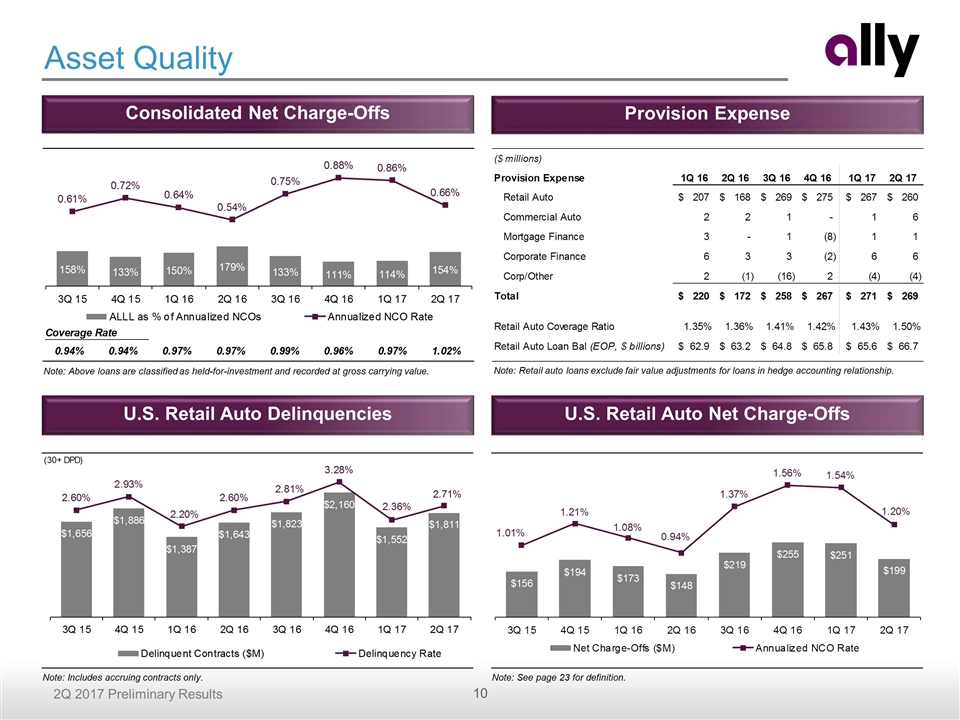

Consolidated Net Charge-Offs Provision Expense Asset Quality U.S. Retail Auto Net Charge-Offs U.S. Retail Auto Delinquencies Note: Above loans are classified as held-for-investment and recorded at gross carrying value. Note: Includes accruing contracts only. Note: See page 23 for definition. Note: Retail auto loans exclude fair value adjustments for loans in hedge accounting relationship.

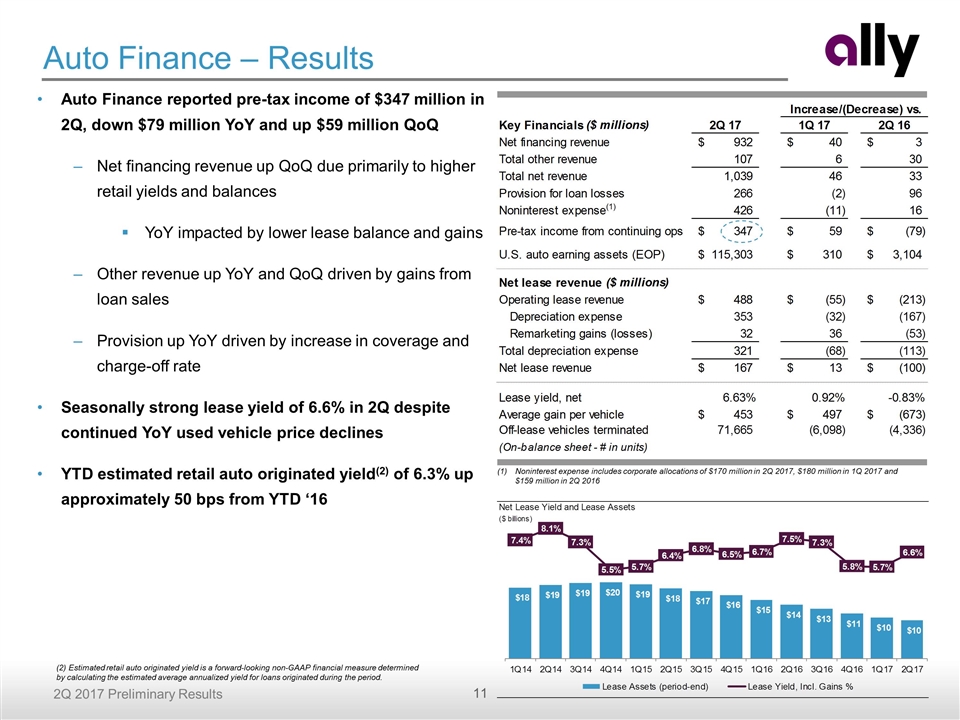

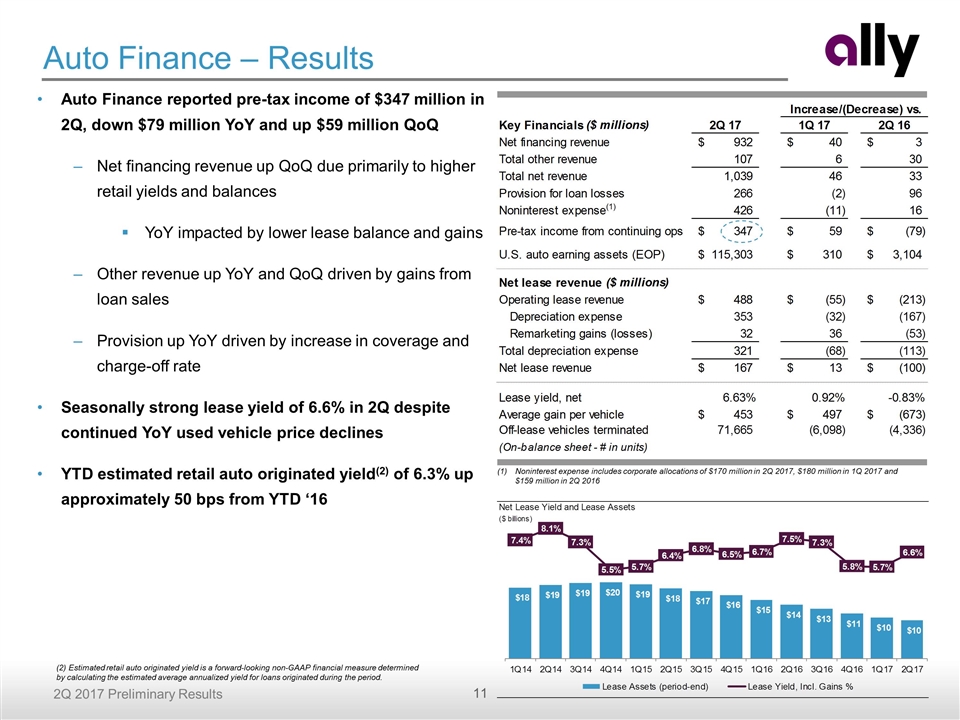

Auto Finance reported pre-tax income of $347 million in 2Q, down $79 million YoY and up $59 million QoQ Net financing revenue up QoQ due primarily to higher retail yields and balances YoY impacted by lower lease balance and gains Other revenue up YoY and QoQ driven by gains from loan sales Provision up YoY driven by increase in coverage and charge-off rate Seasonally strong lease yield of 6.6% in 2Q despite continued YoY used vehicle price declines YTD estimated retail auto originated yield(2) of 6.3% up approximately 50 bps from YTD ‘16 Auto Finance – Results Noninterest expense includes corporate allocations of $170 million in 2Q 2017, $180 million in 1Q 2017 and $159 million in 2Q 2016 (2) Estimated retail auto originated yield is a forward-looking non-GAAP financial measure determined by calculating the estimated average annualized yield for loans originated during the period.

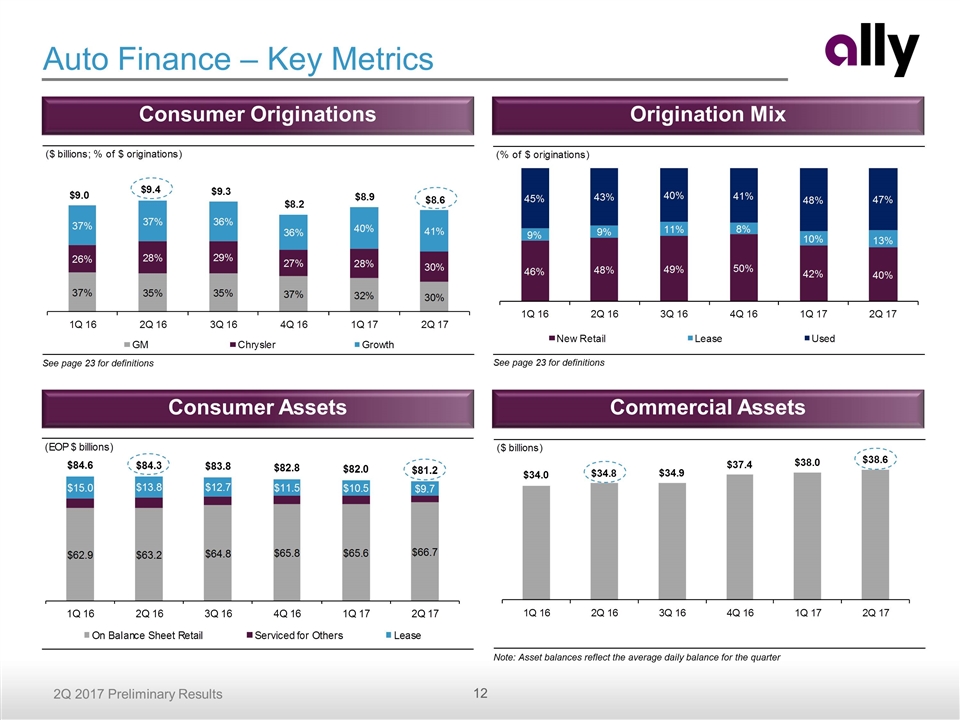

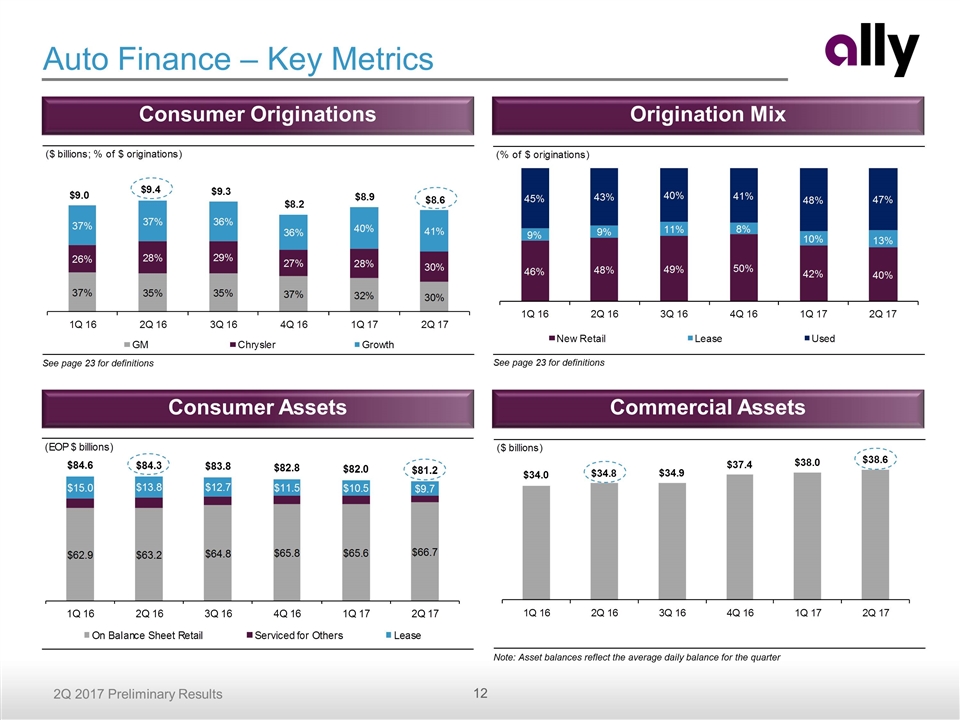

Auto Finance – Key Metrics See page 23 for definitions Consumer Assets Commercial Assets Consumer Originations Origination Mix Note: Asset balances reflect the average daily balance for the quarter See page 23 for definitions

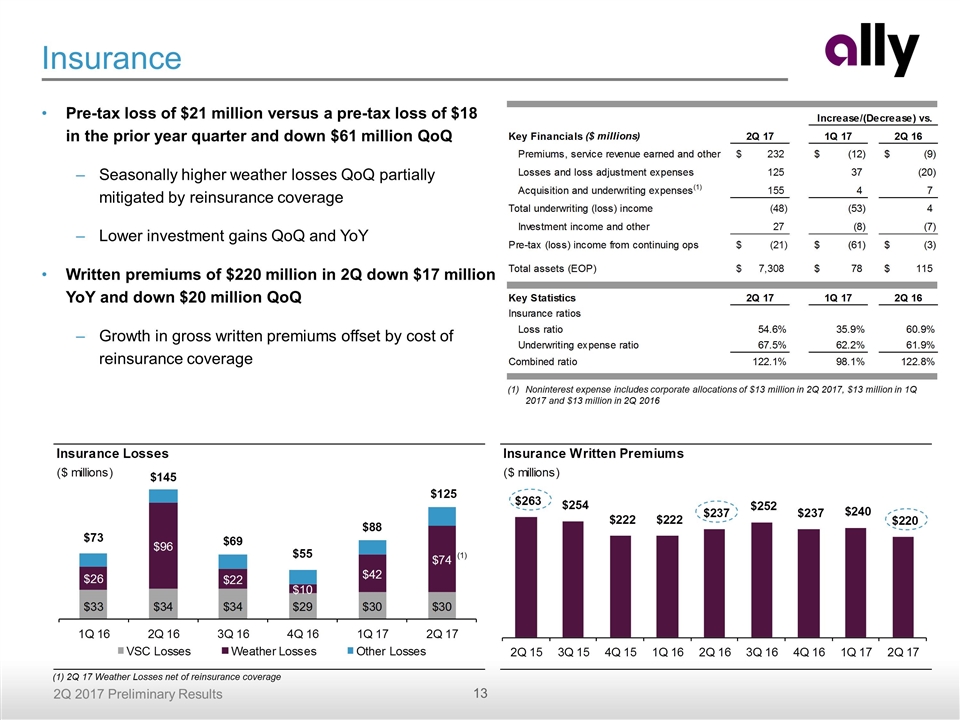

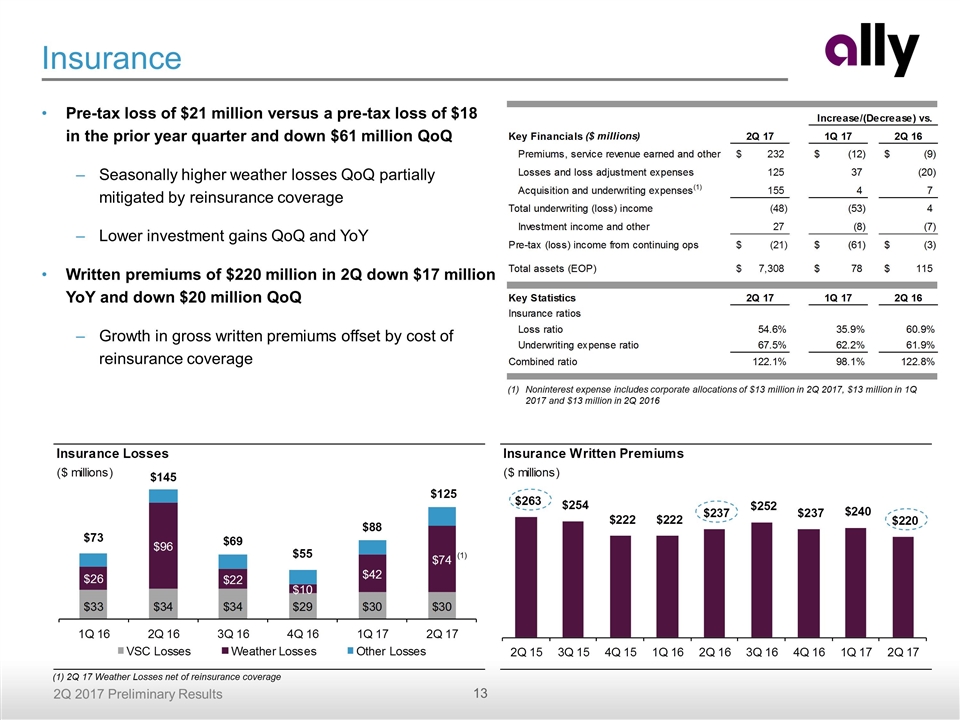

Insurance Pre-tax loss of $21 million versus a pre-tax loss of $18 in the prior year quarter and down $61 million QoQ Seasonally higher weather losses QoQ partially mitigated by reinsurance coverage Lower investment gains QoQ and YoY Written premiums of $220 million in 2Q down $17 million YoY and down $20 million QoQ Growth in gross written premiums offset by cost of reinsurance coverage Noninterest expense includes corporate allocations of $13 million in 2Q 2017, $13 million in 1Q 2017 and $13 million in 2Q 2016 (1) (1) 2Q 17 Weather Losses net of reinsurance coverage

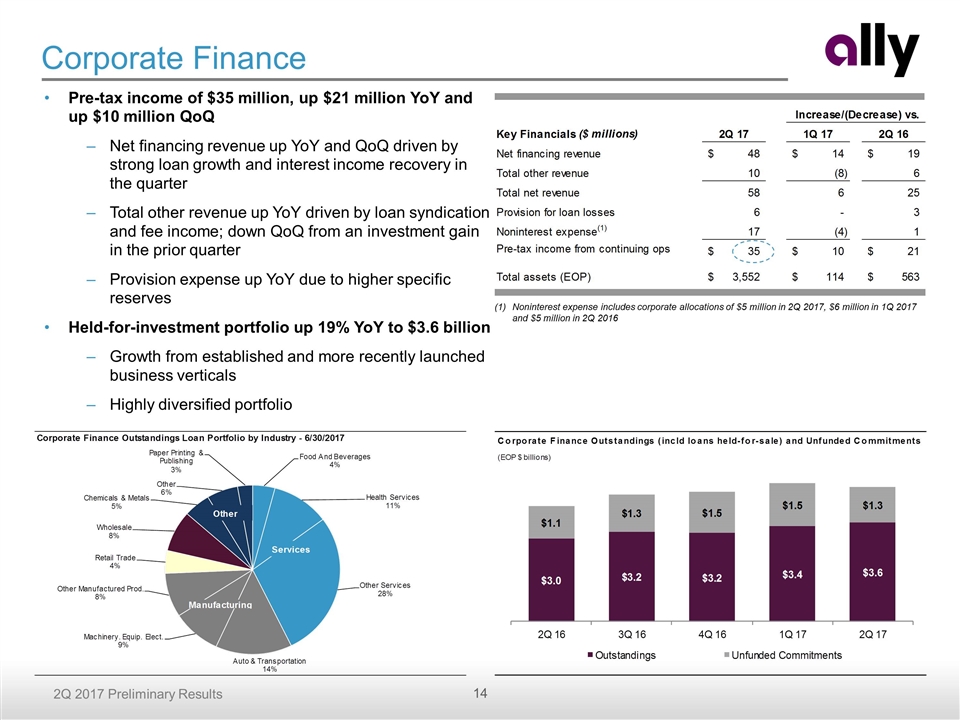

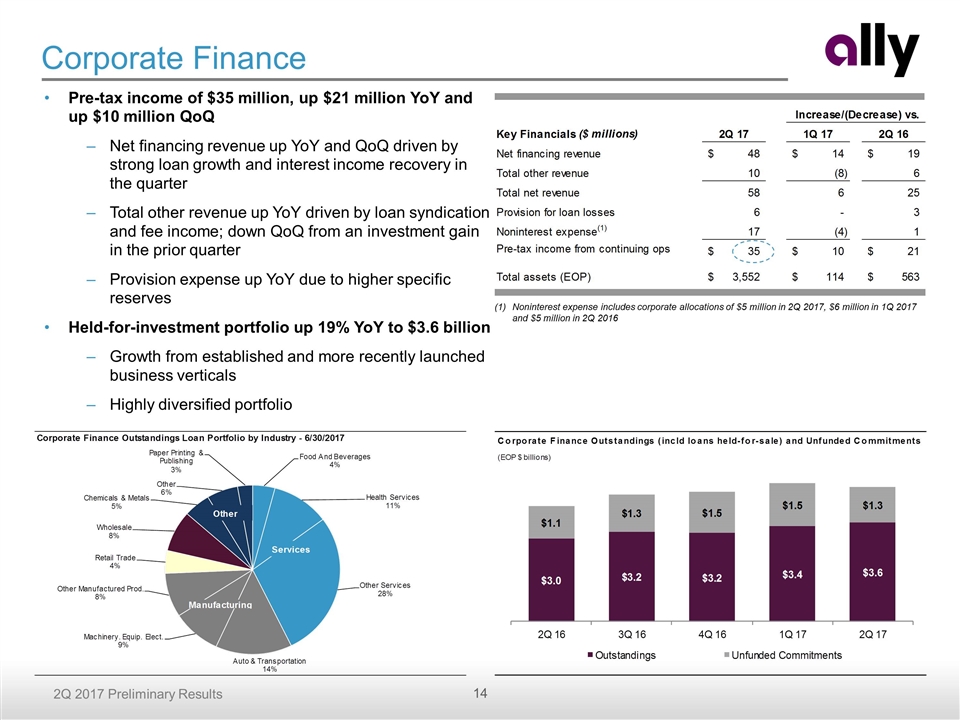

Pre-tax income of $35 million, up $21 million YoY and up $10 million QoQ Net financing revenue up YoY and QoQ driven by strong loan growth and interest income recovery in the quarter Total other revenue up YoY driven by loan syndication and fee income; down QoQ from an investment gain in the prior quarter Provision expense up YoY due to higher specific reserves Held-for-investment portfolio up 19% YoY to $3.6 billion Growth from established and more recently launched business verticals Highly diversified portfolio Corporate Finance Noninterest expense includes corporate allocations of $5 million in 2Q 2017, $6 million in 1Q 2017 and $5 million in 2Q 2016

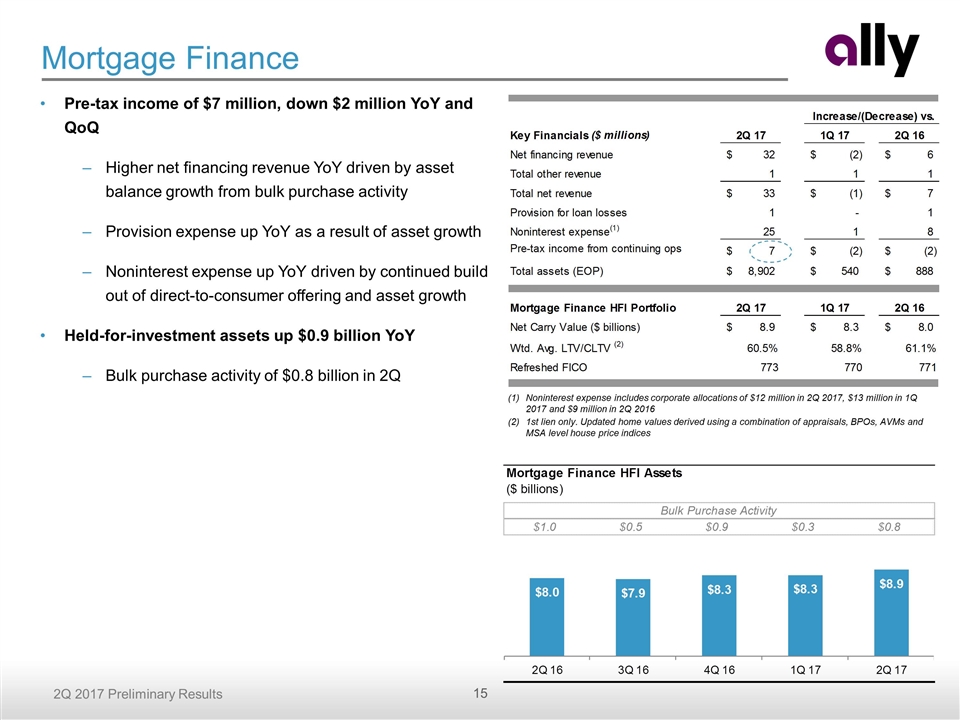

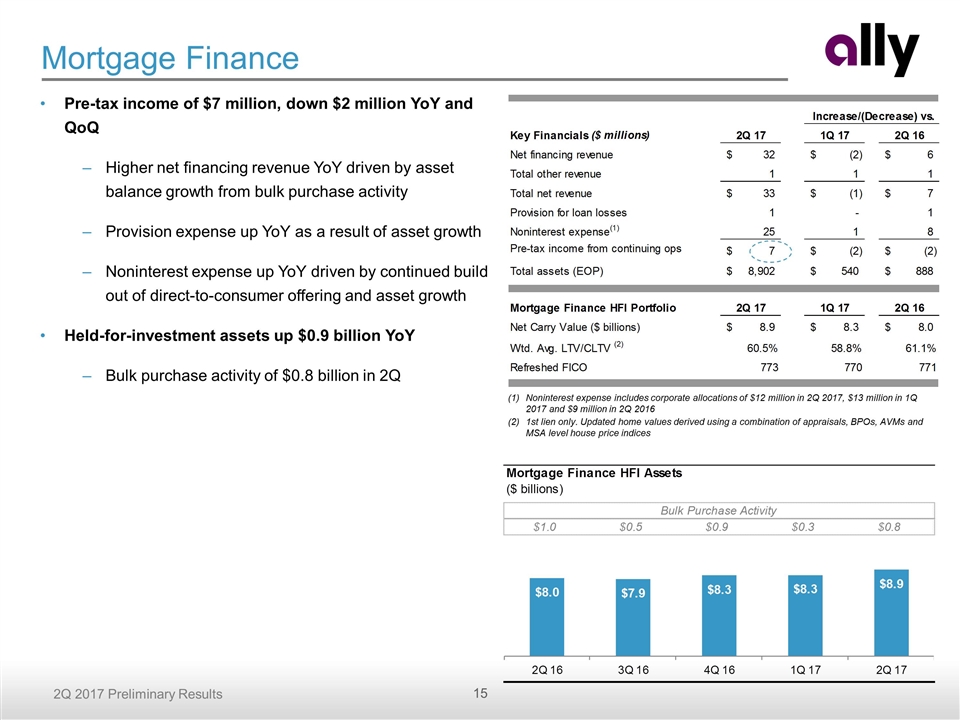

Mortgage Finance Noninterest expense includes corporate allocations of $12 million in 2Q 2017, $13 million in 1Q 2017 and $9 million in 2Q 2016 1st lien only. Updated home values derived using a combination of appraisals, BPOs, AVMs and MSA level house price indices Pre-tax income of $7 million, down $2 million YoY and QoQ Higher net financing revenue YoY driven by asset balance growth from bulk purchase activity Provision expense up YoY as a result of asset growth Noninterest expense up YoY driven by continued build out of direct-to-consumer offering and asset growth Held-for-investment assets up $0.9 billion YoY Bulk purchase activity of $0.8 billion in 2Q

Plan for Driving Strong Shareholder Returns – On Track Medium-term defined as over the next 3-4 years. Represents a non-GAAP financial measure. See page 24 and 26 for calculation methodology and details. Continue to optimize retail auto returns to ensure strong profitability through the cycle Unlock value of Ally’s brand Deposits are key long-term value driver Diversify and strengthen the franchise Demonstrate smart growth and product expansion Demonstrate credit metrics are contained within a range Deliver medium-term financial targets – 15% Adjusted EPS(1) CAGR and 12% Core ROTCE(1) Protect and grow book value Return significant capital to shareholders Grow and solidify customer relationships to position for the long-term

Supplemental Charts

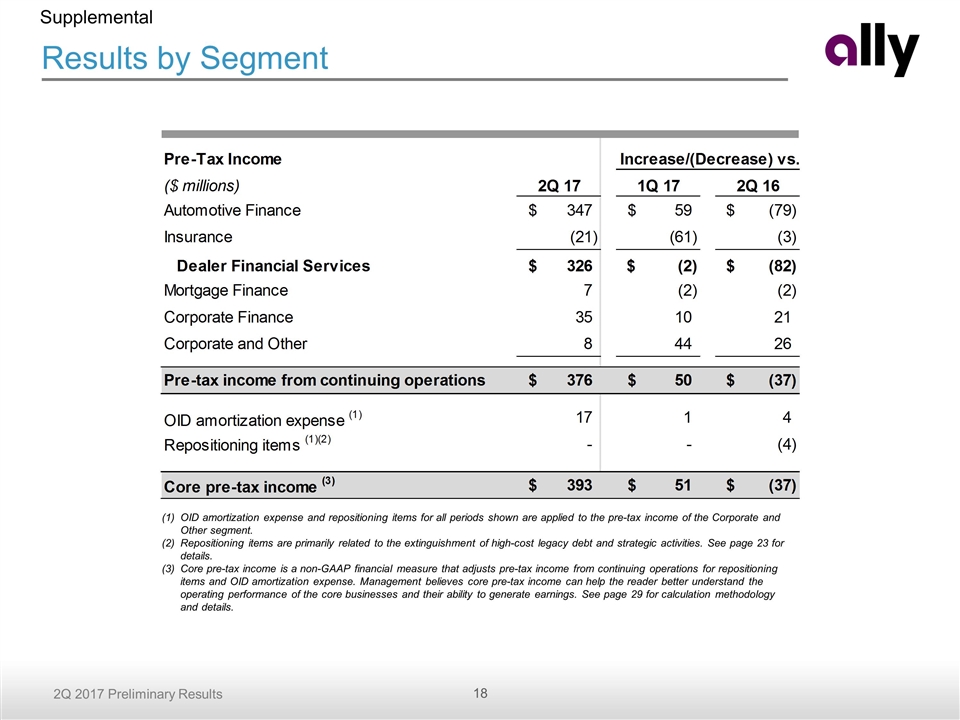

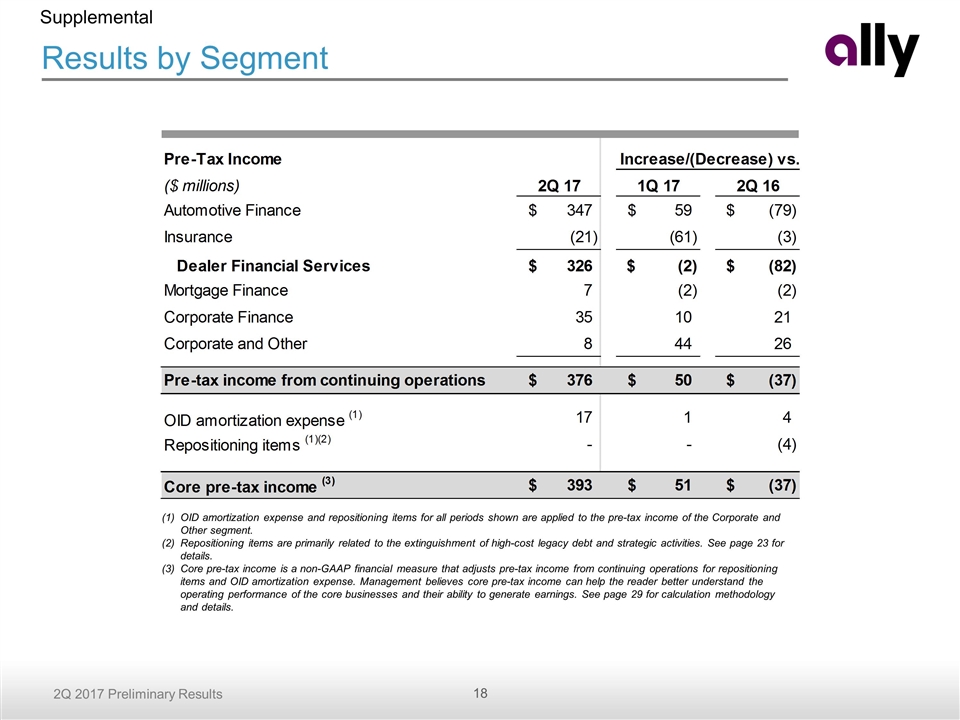

Results by Segment OID amortization expense and repositioning items for all periods shown are applied to the pre-tax income of the Corporate and Other segment. Repositioning items are primarily related to the extinguishment of high-cost legacy debt and strategic activities. See page 23 for details. Core pre-tax income is a non-GAAP financial measure that adjusts pre-tax income from continuing operations for repositioning items and OID amortization expense. Management believes core pre-tax income can help the reader better understand the operating performance of the core businesses and their ability to generate earnings. See page 29 for calculation methodology and details. Supplemental

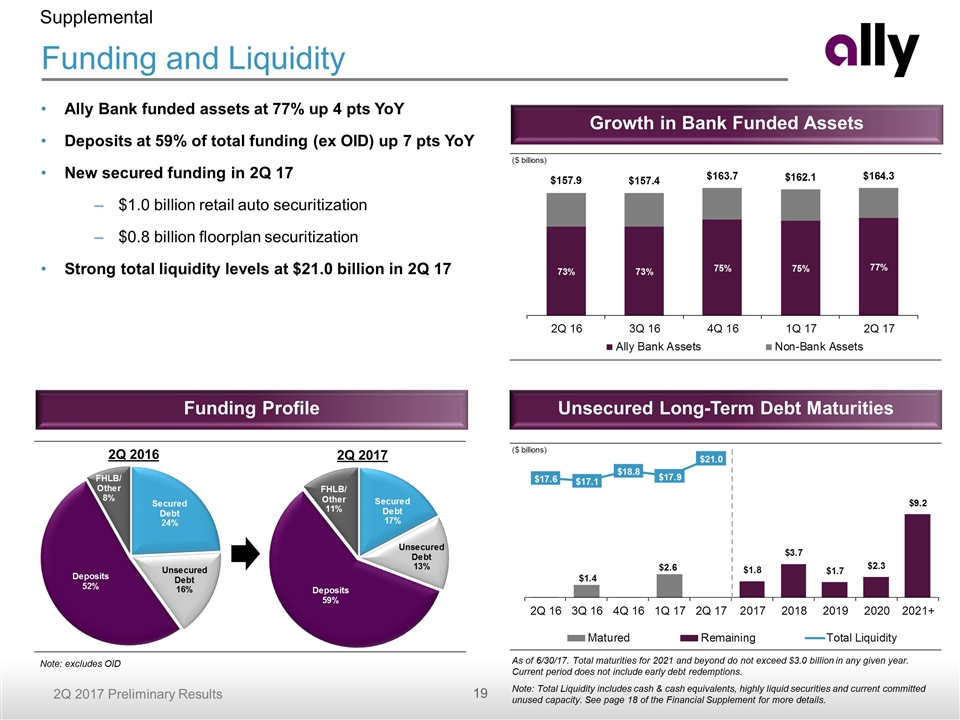

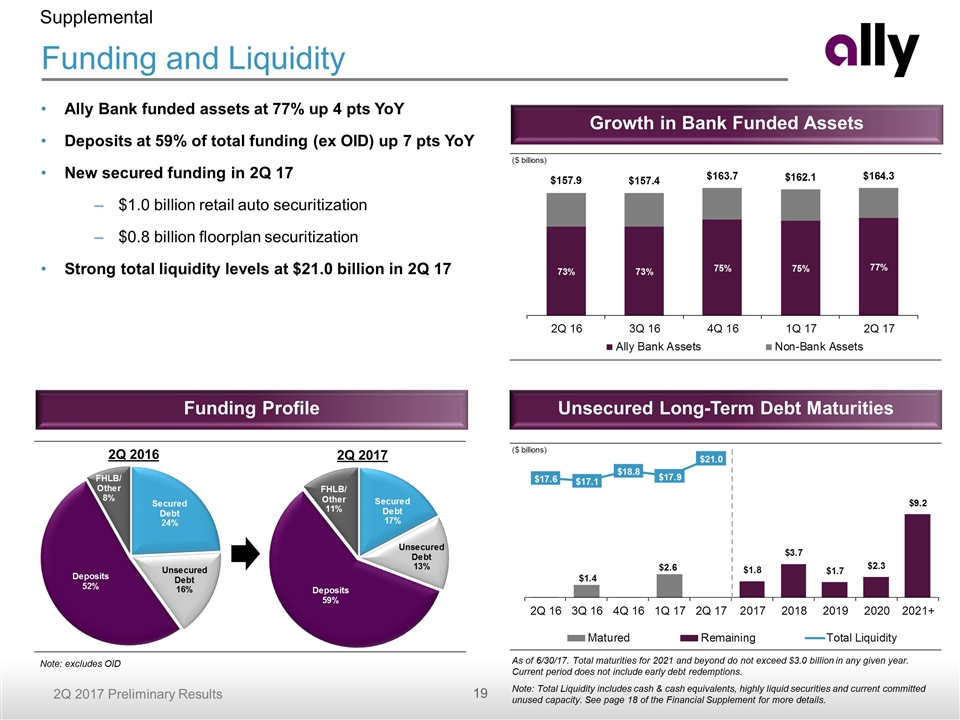

Ally Bank funded assets at 77% up 4 pts YoY Deposits at 59% of total funding (ex OID) up 7 pts YoY New secured funding in 2Q 17 $1.0 billion retail auto securitization $0.8 billion floorplan securitization Strong total liquidity levels at $21.0 billion in 2Q 17 Funding and Liquidity As of 6/30/17. Total maturities for 2021 and beyond do not exceed $3.0 billion in any given year. Current period does not include early debt redemptions. Note: Total Liquidity includes cash & cash equivalents, highly liquid securities and current committed unused capacity. See page 18 of the Financial Supplement for more details. Unsecured Long-Term Debt Maturities Growth in Bank Funded Assets Funding Profile 2Q 2016 2Q 2017 Supplemental Note: excludes OID

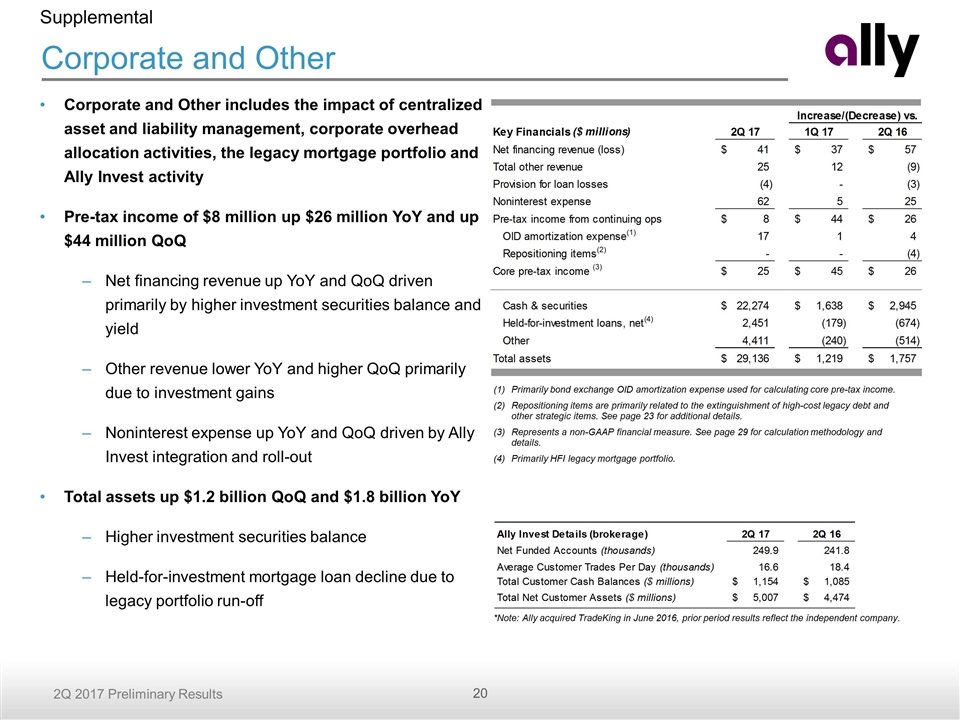

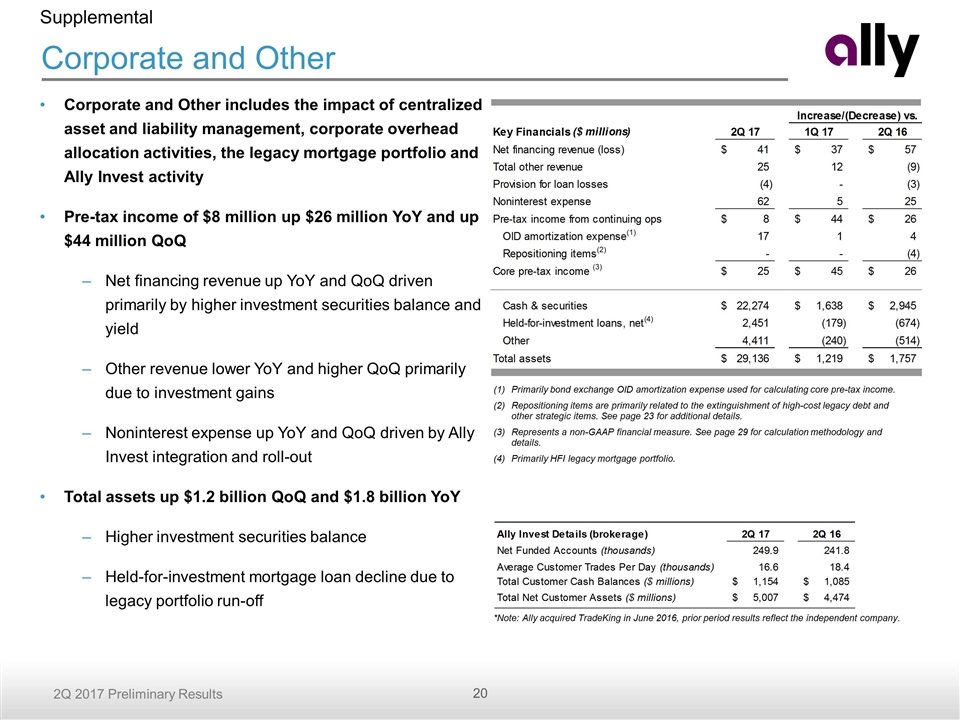

Primarily bond exchange OID amortization expense used for calculating core pre-tax income. Repositioning items are primarily related to the extinguishment of high-cost legacy debt and other strategic items. See page 23 for additional details. Represents a non-GAAP financial measure. See page 29 for calculation methodology and details. Primarily HFI legacy mortgage portfolio. Corporate and Other Supplemental Corporate and Other includes the impact of centralized asset and liability management, corporate overhead allocation activities, the legacy mortgage portfolio and Ally Invest activity Pre-tax income of $8 million up $26 million YoY and up $44 million QoQ Net financing revenue up YoY and QoQ driven primarily by higher investment securities balance and yield Other revenue lower YoY and higher QoQ primarily due to investment gains Noninterest expense up YoY and QoQ driven by Ally Invest integration and roll-out Total assets up $1.2 billion QoQ and $1.8 billion YoY Higher investment securities balance Held-for-investment mortgage loan decline due to legacy portfolio run-off *Note: Ally acquired TradeKing in June 2016, prior period results reflect the independent company.

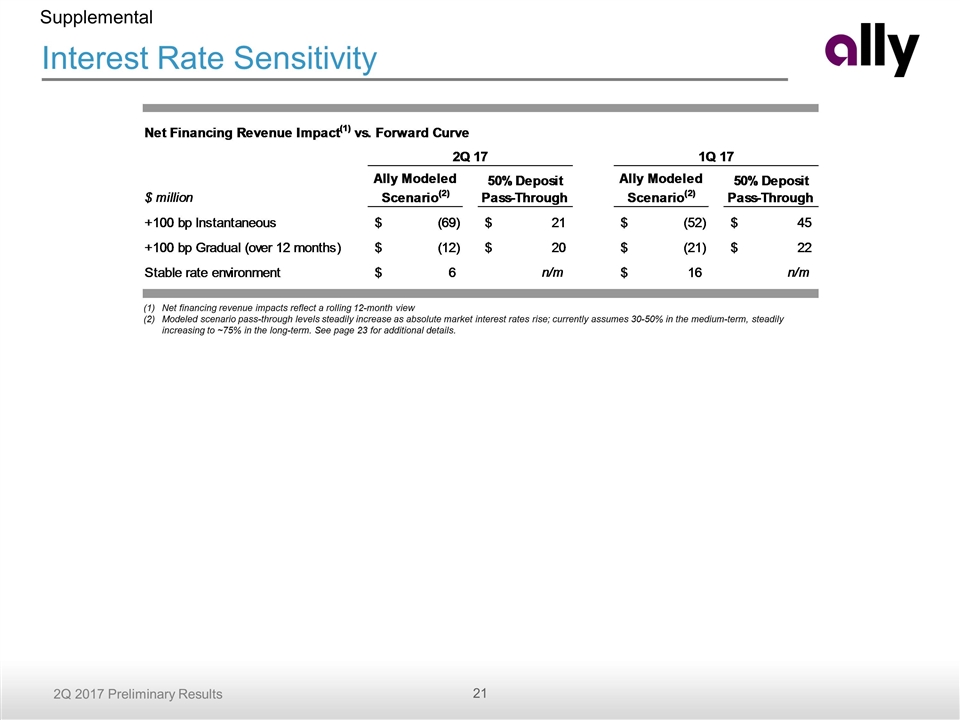

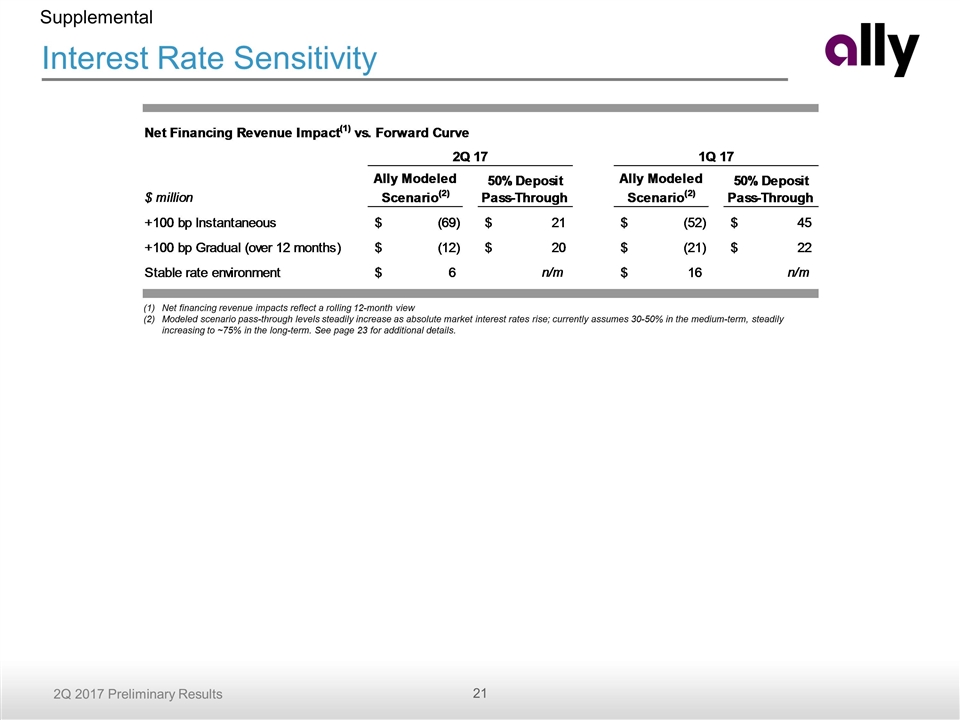

Interest Rate Sensitivity Net financing revenue impacts reflect a rolling 12-month view Modeled scenario pass-through levels steadily increase as absolute market interest rates rise; currently assumes 30-50% in the medium-term, steadily increasing to ~75% in the long-term. See page 23 for additional details. Supplemental

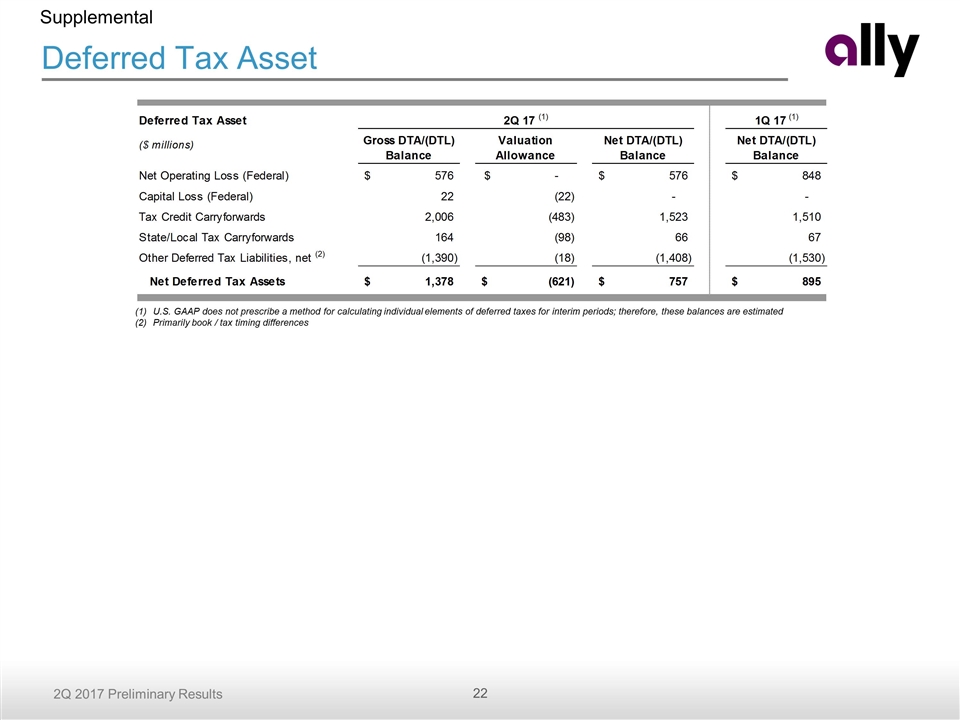

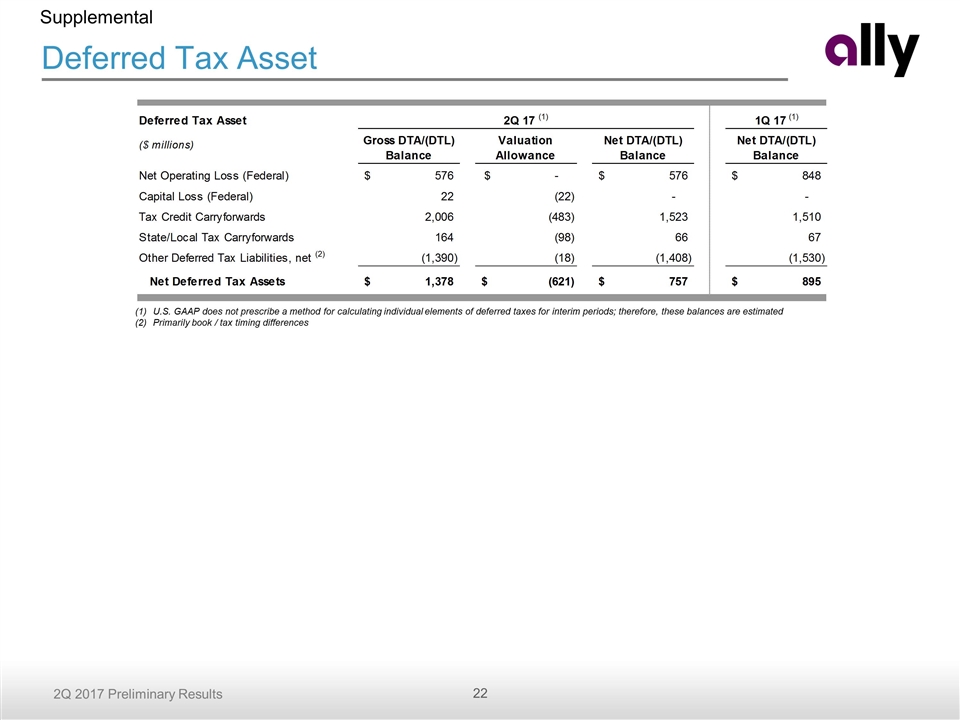

Deferred Tax Asset Supplemental U.S. GAAP does not prescribe a method for calculating individual elements of deferred taxes for interim periods; therefore, these balances are estimated Primarily book / tax timing differences

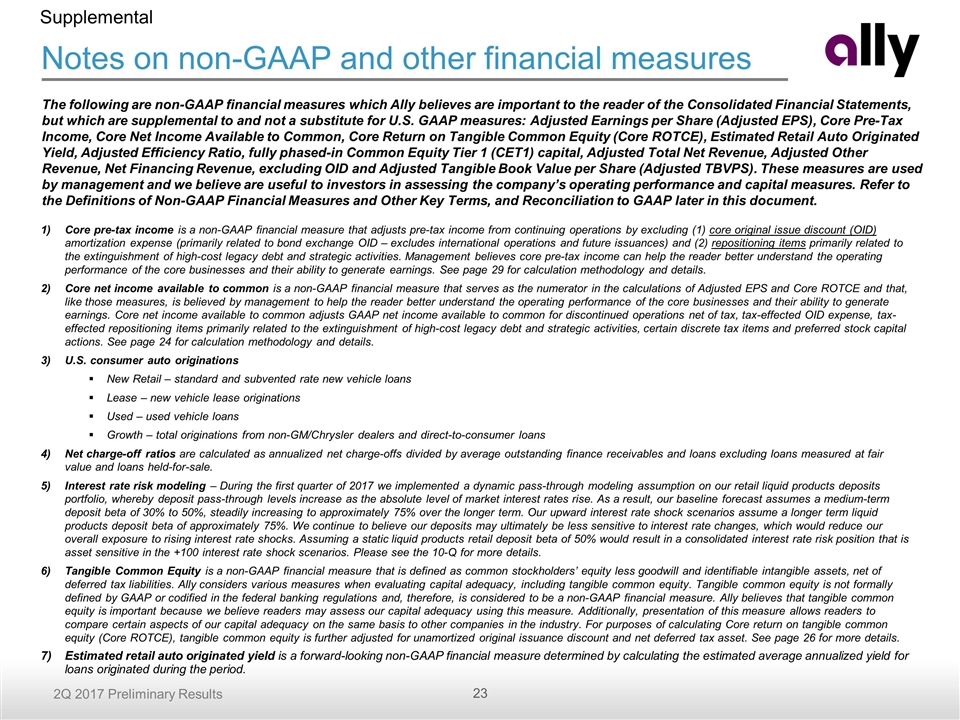

Notes on non-GAAP and other financial measures Supplemental Core pre-tax income is a non-GAAP financial measure that adjusts pre-tax income from continuing operations by excluding (1) core original issue discount (OID) amortization expense (primarily related to bond exchange OID – excludes international operations and future issuances) and (2) repositioning items primarily related to the extinguishment of high-cost legacy debt and strategic activities. Management believes core pre-tax income can help the reader better understand the operating performance of the core businesses and their ability to generate earnings. See page 29 for calculation methodology and details. Core net income available to common is a non-GAAP financial measure that serves as the numerator in the calculations of Adjusted EPS and Core ROTCE and that, like those measures, is believed by management to help the reader better understand the operating performance of the core businesses and their ability to generate earnings. Core net income available to common adjusts GAAP net income available to common for discontinued operations net of tax, tax-effected OID expense, tax-effected repositioning items primarily related to the extinguishment of high-cost legacy debt and strategic activities, certain discrete tax items and preferred stock capital actions. See page 24 for calculation methodology and details. U.S. consumer auto originations New Retail – standard and subvented rate new vehicle loans Lease – new vehicle lease originations Used – used vehicle loans Growth – total originations from non-GM/Chrysler dealers and direct-to-consumer loans Net charge-off ratios are calculated as annualized net charge-offs divided by average outstanding finance receivables and loans excluding loans measured at fair value and loans held-for-sale. Interest rate risk modeling – During the first quarter of 2017 we implemented a dynamic pass-through modeling assumption on our retail liquid products deposits portfolio, whereby deposit pass-through levels increase as the absolute level of market interest rates rise. As a result, our baseline forecast assumes a medium-term deposit beta of 30% to 50%, steadily increasing to approximately 75% over the longer term. Our upward interest rate shock scenarios assume a longer term liquid products deposit beta of approximately 75%. We continue to believe our deposits may ultimately be less sensitive to interest rate changes, which would reduce our overall exposure to rising interest rate shocks. Assuming a static liquid products retail deposit beta of 50% would result in a consolidated interest rate risk position that is asset sensitive in the +100 interest rate shock scenarios. Please see the 10-Q for more details. Tangible Common Equity is a non-GAAP financial measure that is defined as common stockholders’ equity less goodwill and identifiable intangible assets, net of deferred tax liabilities. Ally considers various measures when evaluating capital adequacy, including tangible common equity. Tangible common equity is not formally defined by GAAP or codified in the federal banking regulations and, therefore, is considered to be a non-GAAP financial measure. Ally believes that tangible common equity is important because we believe readers may assess our capital adequacy using this measure. Additionally, presentation of this measure allows readers to compare certain aspects of our capital adequacy on the same basis to other companies in the industry. For purposes of calculating Core return on tangible common equity (Core ROTCE), tangible common equity is further adjusted for unamortized original issuance discount and net deferred tax asset. See page 26 for more details. Estimated retail auto originated yield is a forward-looking non-GAAP financial measure determined by calculating the estimated average annualized yield for loans originated during the period. The following are non-GAAP financial measures which Ally believes are important to the reader of the Consolidated Financial Statements, but which are supplemental to and not a substitute for U.S. GAAP measures: Adjusted Earnings per Share (Adjusted EPS), Core Pre-Tax Income, Core Net Income Available to Common, Core Return on Tangible Common Equity (Core ROTCE), Estimated Retail Auto Originated Yield, Adjusted Efficiency Ratio, fully phased-in Common Equity Tier 1 (CET1) capital, Adjusted Total Net Revenue, Adjusted Other Revenue, Net Financing Revenue, excluding OID and Adjusted Tangible Book Value per Share (Adjusted TBVPS). These measures are used by management and we believe are useful to investors in assessing the company’s operating performance and capital measures. Refer to the Definitions of Non-GAAP Financial Measures and Other Key Terms, and Reconciliation to GAAP later in this document.

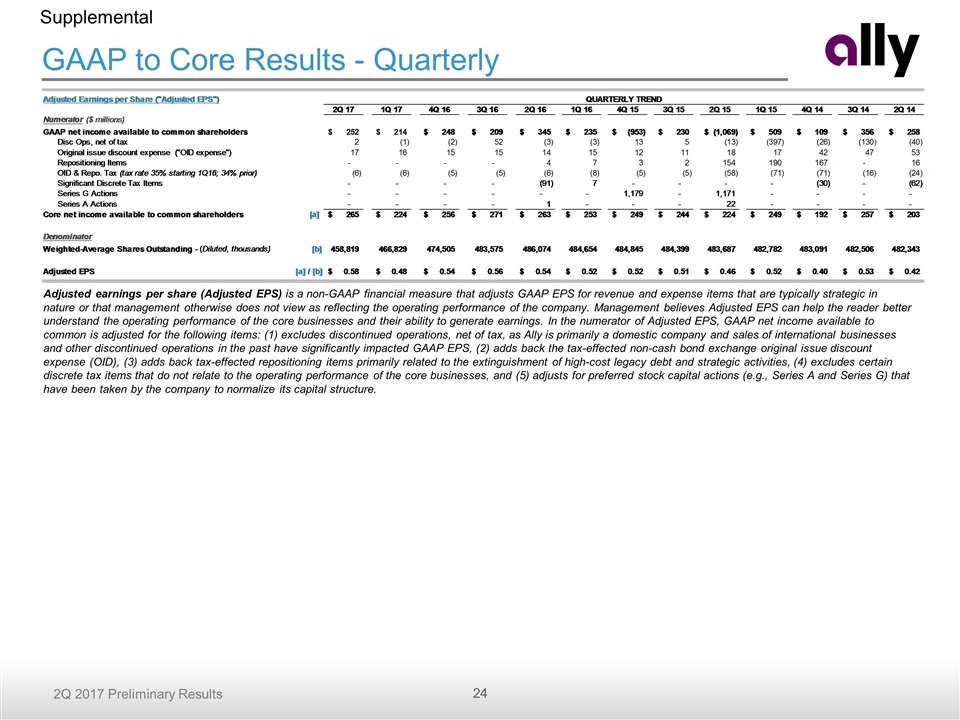

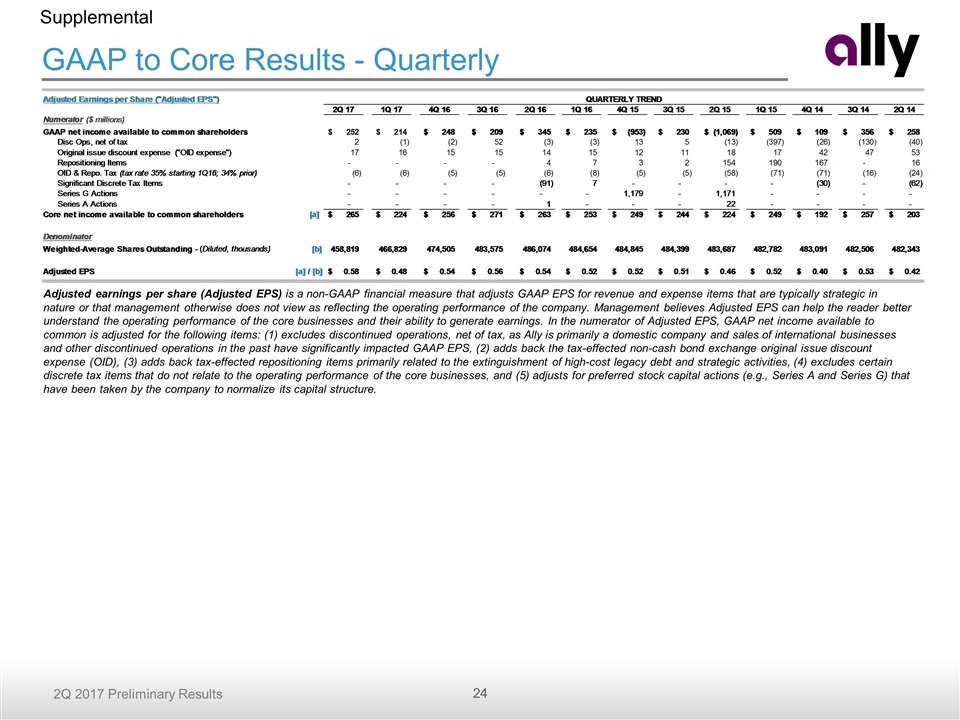

GAAP to Core Results - Quarterly Supplemental Adjusted earnings per share (Adjusted EPS) is a non-GAAP financial measure that adjusts GAAP EPS for revenue and expense items that are typically strategic in nature or that management otherwise does not view as reflecting the operating performance of the company. Management believes Adjusted EPS can help the reader better understand the operating performance of the core businesses and their ability to generate earnings. In the numerator of Adjusted EPS, GAAP net income available to common is adjusted for the following items: (1) excludes discontinued operations, net of tax, as Ally is primarily a domestic company and sales of international businesses and other discontinued operations in the past have significantly impacted GAAP EPS, (2) adds back the tax-effected non-cash bond exchange original issue discount expense (OID), (3) adds back tax-effected repositioning items primarily related to the extinguishment of high-cost legacy debt and strategic activities, (4) excludes certain discrete tax items that do not relate to the operating performance of the core businesses, and (5) adjusts for preferred stock capital actions (e.g., Series A and Series G) that have been taken by the company to normalize its capital structure.

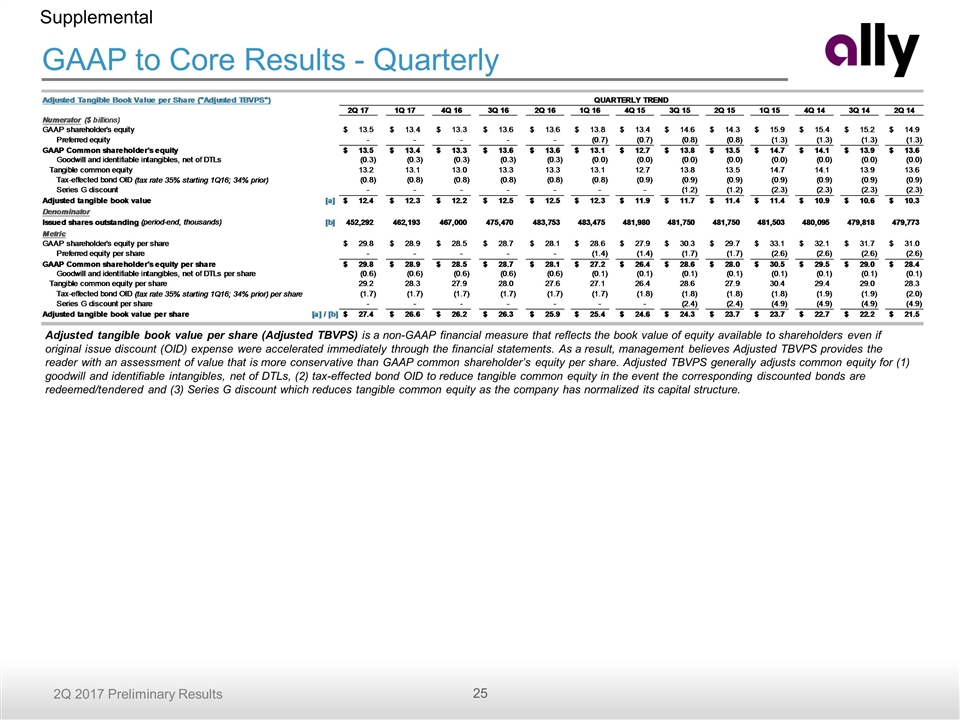

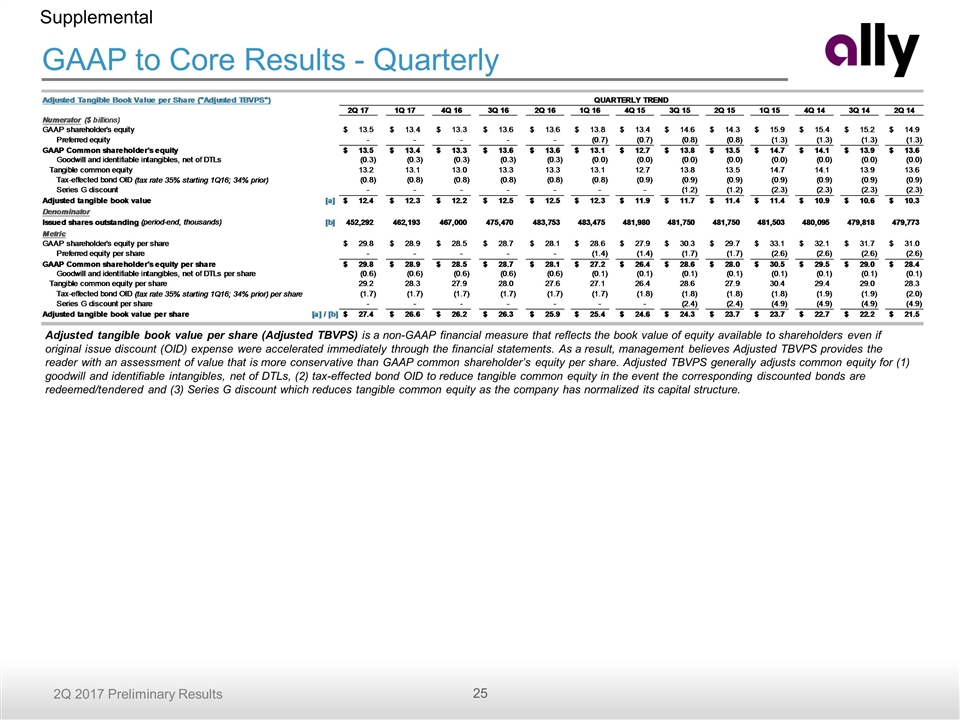

GAAP to Core Results - Quarterly Supplemental Adjusted tangible book value per share (Adjusted TBVPS) is a non-GAAP financial measure that reflects the book value of equity available to shareholders even if original issue discount (OID) expense were accelerated immediately through the financial statements. As a result, management believes Adjusted TBVPS provides the reader with an assessment of value that is more conservative than GAAP common shareholder’s equity per share. Adjusted TBVPS generally adjusts common equity for (1) goodwill and identifiable intangibles, net of DTLs, (2) tax-effected bond OID to reduce tangible common equity in the event the corresponding discounted bonds are redeemed/tendered and (3) Series G discount which reduces tangible common equity as the company has normalized its capital structure.

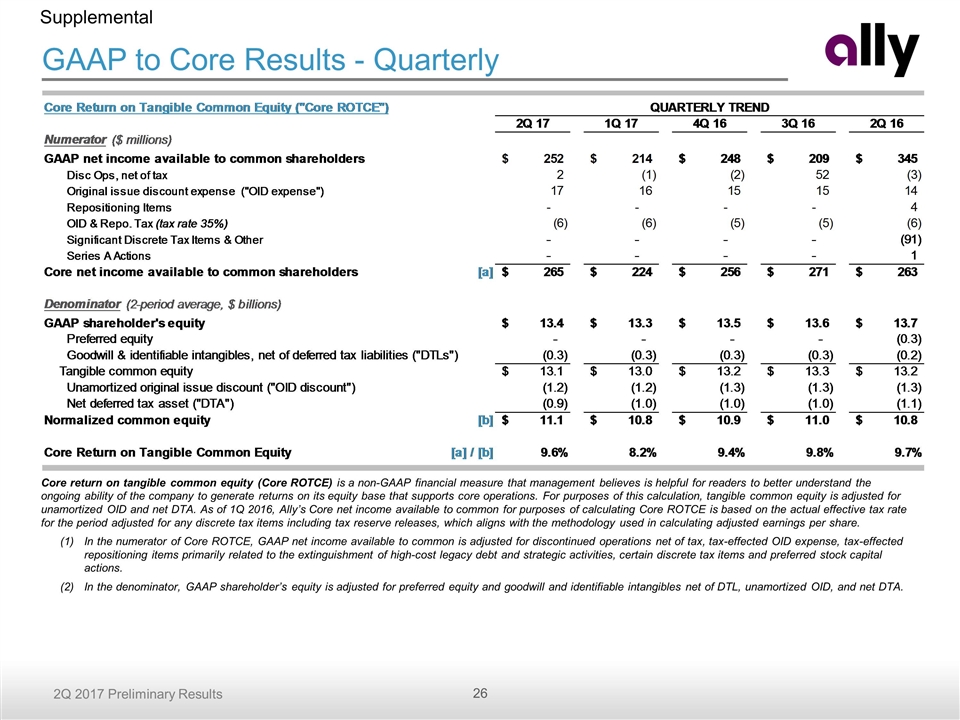

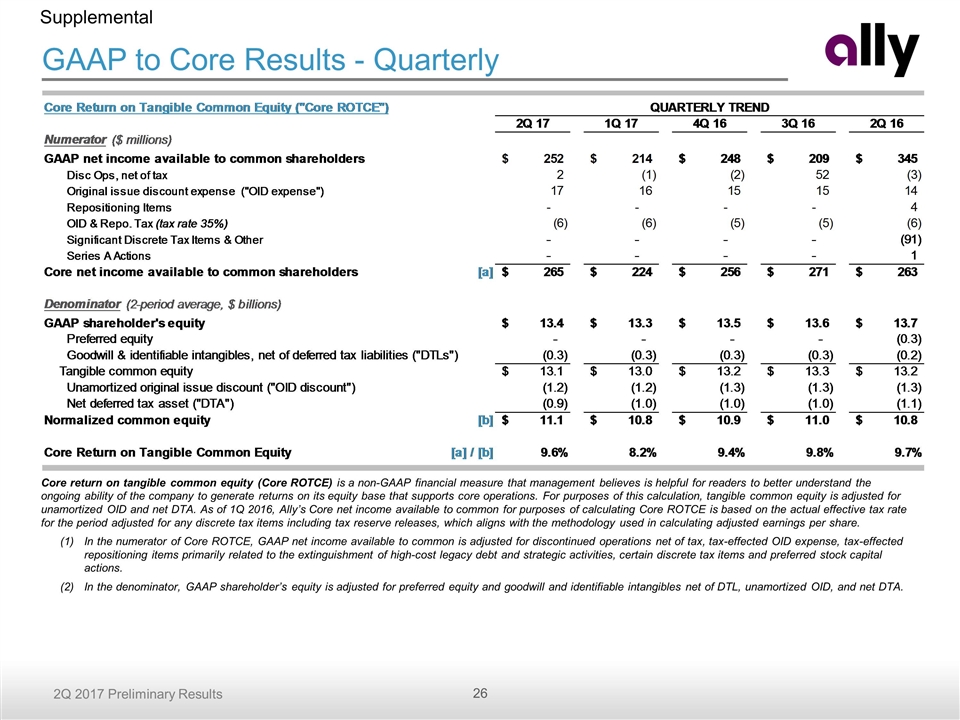

GAAP to Core Results - Quarterly Supplemental Core return on tangible common equity (Core ROTCE) is a non-GAAP financial measure that management believes is helpful for readers to better understand the ongoing ability of the company to generate returns on its equity base that supports core operations. For purposes of this calculation, tangible common equity is adjusted for unamortized OID and net DTA. As of 1Q 2016, Ally’s Core net income available to common for purposes of calculating Core ROTCE is based on the actual effective tax rate for the period adjusted for any discrete tax items including tax reserve releases, which aligns with the methodology used in calculating adjusted earnings per share. In the numerator of Core ROTCE, GAAP net income available to common is adjusted for discontinued operations net of tax, tax-effected OID expense, tax-effected repositioning items primarily related to the extinguishment of high-cost legacy debt and strategic activities, certain discrete tax items and preferred stock capital actions. In the denominator, GAAP shareholder’s equity is adjusted for preferred equity and goodwill and identifiable intangibles net of DTL, unamortized OID, and net DTA.

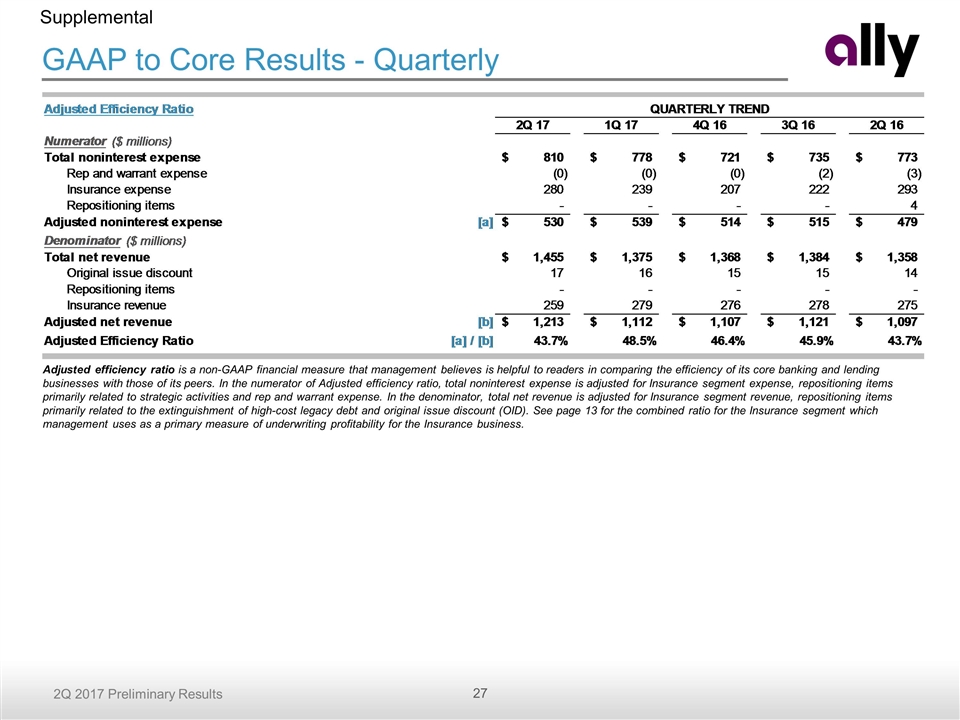

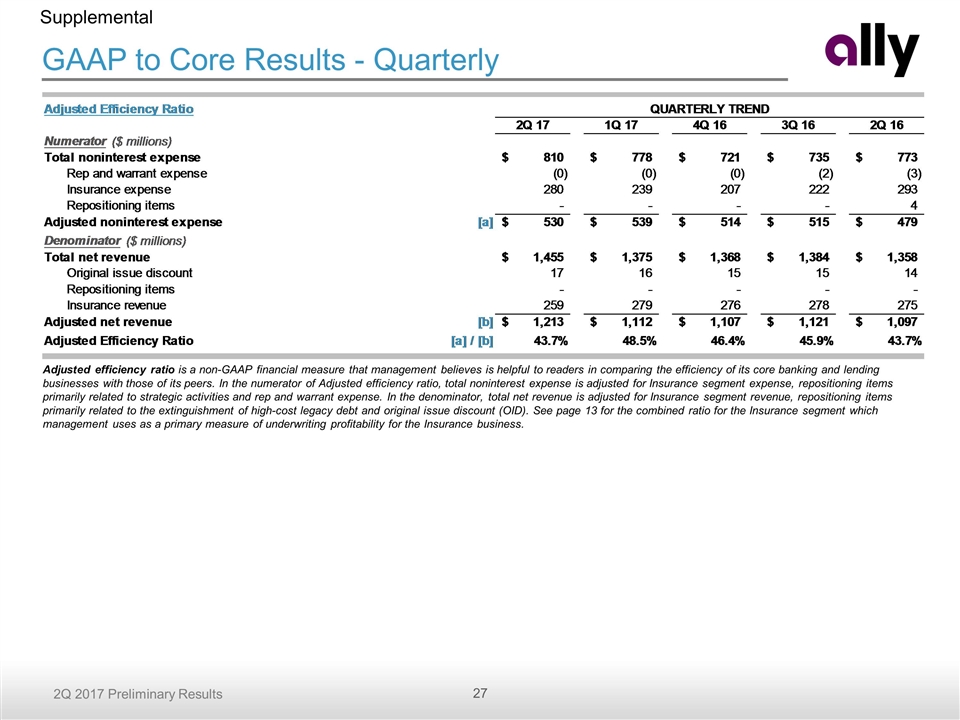

GAAP to Core Results - Quarterly Supplemental Adjusted efficiency ratio is a non-GAAP financial measure that management believes is helpful to readers in comparing the efficiency of its core banking and lending businesses with those of its peers. In the numerator of Adjusted efficiency ratio, total noninterest expense is adjusted for Insurance segment expense, repositioning items primarily related to strategic activities and rep and warrant expense. In the denominator, total net revenue is adjusted for Insurance segment revenue, repositioning items primarily related to the extinguishment of high-cost legacy debt and original issue discount (OID). See page 13 for the combined ratio for the Insurance segment which management uses as a primary measure of underwriting profitability for the Insurance business.

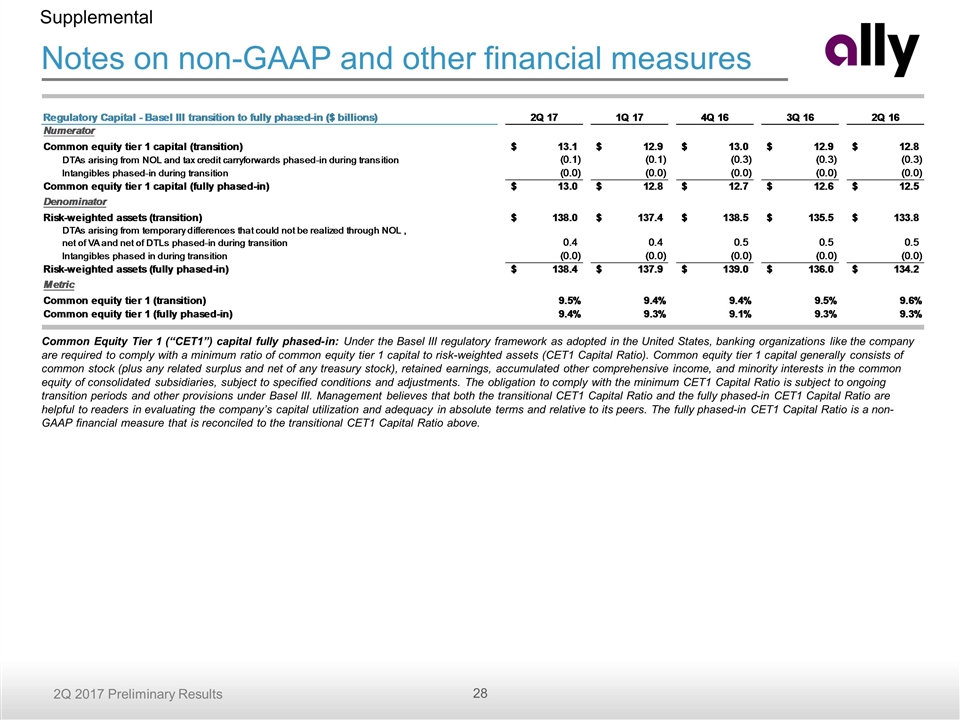

Notes on non-GAAP and other financial measures Supplemental Common Equity Tier 1 (“CET1”) capital fully phased-in: Under the Basel III regulatory framework as adopted in the United States, banking organizations like the company are required to comply with a minimum ratio of common equity tier 1 capital to risk-weighted assets (CET1 Capital Ratio). Common equity tier 1 capital generally consists of common stock (plus any related surplus and net of any treasury stock), retained earnings, accumulated other comprehensive income, and minority interests in the common equity of consolidated subsidiaries, subject to specified conditions and adjustments. The obligation to comply with the minimum CET1 Capital Ratio is subject to ongoing transition periods and other provisions under Basel III. Management believes that both the transitional CET1 Capital Ratio and the fully phased-in CET1 Capital Ratio are helpful to readers in evaluating the company’s capital utilization and adequacy in absolute terms and relative to its peers. The fully phased-in CET1 Capital Ratio is a non-GAAP financial measure that is reconciled to the transitional CET1 Capital Ratio above.

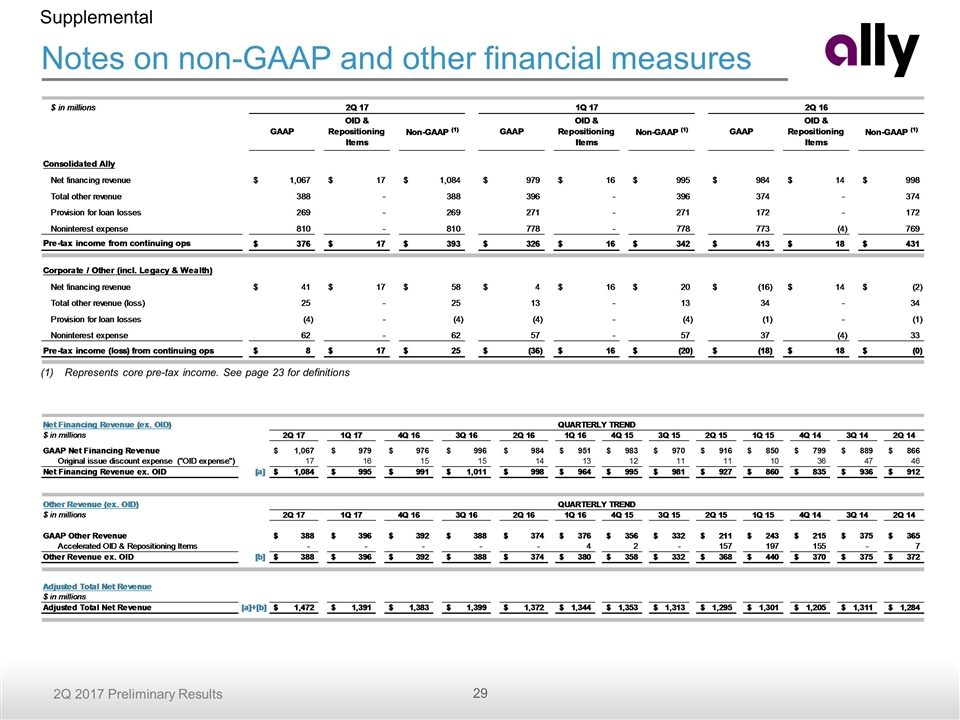

Notes on non-GAAP and other financial measures Supplemental Represents core pre-tax income. See page 23 for definitions