Ally Financial (ALLY) 8-KAlly Financial Reports Third Quarter 2020 Financial Results

Filed: 16 Oct 20, 7:40am

Exhibit 99.2 Ally Financial Inc. 3Q 2020 Earnings Review October 16, 2020 Contact Ally Investor Relations at (866) 710-4623 or investor.relations@ally.com 3Q 2020 Preliminary Results 1Exhibit 99.2 Ally Financial Inc. 3Q 2020 Earnings Review October 16, 2020 Contact Ally Investor Relations at (866) 710-4623 or investor.relations@ally.com 3Q 2020 Preliminary Results 1

Forward-Looking Statements and Additional Information This presentation and related communications should be read in conjunction with the financial statements, notes, and other information contained in our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. This information is preliminary and based on company and third-party data available at the time of the presentation or related communication. This presentation and related communications contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts—such as statements about future effects of COVID-19 and our ability to navigate them, the outlook for financial and operating metrics and performance, and future capital allocation and actions. Forward-looking statements often use words such as “believe,” “expect,” “anticipate,” “intend,” “pursue,” “seek,” “continue,” “estimate,” “project,” “outlook,” “forecast,” “potential,” “target,” “objective,” “trend,” “plan,” “goal,” “initiative,” “priorities,” or other words of comparable meaning or future-tense or conditional verbs such as “may,” “will,” “should,” “would,” or “could.” Forward-looking statements convey our expectations, intentions, or forecasts about future events, circumstances, or results. All forward-looking statements, by their nature, are subject to assumptions, risks, and uncertainties, which may change over time and many of which are beyond our control. You should not rely on any forward-looking statement as a prediction or guarantee about the future. Actual future objectives, strategies, plans, prospects, performance, conditions, or results may differ materially from those set forth in any forward-looking statement. Some of the factors that may cause actual results or other future events or circumstances to differ from those in forward-looking statements are described in our Annual Report on Form 10-K for the year ended December 31, 2019, our subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, or other applicable documents that are filed or furnished with the U.S. Securities and Exchange Commission (collectively, our “SEC filings”). Any forward-looking statement made by us or on our behalf speaks only as of the date that it was made. We do not undertake to update any forward-looking statement to reflect the impact of events, circumstances, or results that arise after the date that the statement was made, except as required by applicable securities laws. You, however, should consult further disclosures (including disclosures of a forward-looking nature) that we may make in any subsequent SEC filings. This presentation and related communications contain specifically identified non-GAAP financial measures, which supplement the results that are reported according to U.S. generally accepted accounting principles (“GAAP”). These non-GAAP financial measures may be useful to investors but should not be viewed in isolation from, or as a substitute for, GAAP results. Differences between non- GAAP financial measures and comparable GAAP financial measures are reconciled in the presentation. Unless the context otherwise requires, the following definitions apply. The term “loans” means the following consumer and commercial products associated with our direct and indirect financing activities: loans, retail installment sales contracts, lines of credit, and other financing products excluding operating leases. The term “operating leases” means consumer- and commercial- vehicle lease agreements where Ally is the lessor and the lessee is generally not obligated to acquire ownership of the vehicle at lease-end or compensate Ally for the vehicle’s residual value. The terms “lend,” “finance,” and “originate” mean our direct extension or origination of loans, our purchase or acquisition of loans, or our purchase of operating leases, as applicable. The term “consumer” means all consumer products associated with our loan and operating-lease activities and all commercial retail installment sales contracts. The term “commercial” means all commercial products associated with our loan activities, other than commercial retail installment sales contracts. 3Q 2020 Preliminary Results 2Forward-Looking Statements and Additional Information This presentation and related communications should be read in conjunction with the financial statements, notes, and other information contained in our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. This information is preliminary and based on company and third-party data available at the time of the presentation or related communication. This presentation and related communications contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts—such as statements about future effects of COVID-19 and our ability to navigate them, the outlook for financial and operating metrics and performance, and future capital allocation and actions. Forward-looking statements often use words such as “believe,” “expect,” “anticipate,” “intend,” “pursue,” “seek,” “continue,” “estimate,” “project,” “outlook,” “forecast,” “potential,” “target,” “objective,” “trend,” “plan,” “goal,” “initiative,” “priorities,” or other words of comparable meaning or future-tense or conditional verbs such as “may,” “will,” “should,” “would,” or “could.” Forward-looking statements convey our expectations, intentions, or forecasts about future events, circumstances, or results. All forward-looking statements, by their nature, are subject to assumptions, risks, and uncertainties, which may change over time and many of which are beyond our control. You should not rely on any forward-looking statement as a prediction or guarantee about the future. Actual future objectives, strategies, plans, prospects, performance, conditions, or results may differ materially from those set forth in any forward-looking statement. Some of the factors that may cause actual results or other future events or circumstances to differ from those in forward-looking statements are described in our Annual Report on Form 10-K for the year ended December 31, 2019, our subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, or other applicable documents that are filed or furnished with the U.S. Securities and Exchange Commission (collectively, our “SEC filings”). Any forward-looking statement made by us or on our behalf speaks only as of the date that it was made. We do not undertake to update any forward-looking statement to reflect the impact of events, circumstances, or results that arise after the date that the statement was made, except as required by applicable securities laws. You, however, should consult further disclosures (including disclosures of a forward-looking nature) that we may make in any subsequent SEC filings. This presentation and related communications contain specifically identified non-GAAP financial measures, which supplement the results that are reported according to U.S. generally accepted accounting principles (“GAAP”). These non-GAAP financial measures may be useful to investors but should not be viewed in isolation from, or as a substitute for, GAAP results. Differences between non- GAAP financial measures and comparable GAAP financial measures are reconciled in the presentation. Unless the context otherwise requires, the following definitions apply. The term “loans” means the following consumer and commercial products associated with our direct and indirect financing activities: loans, retail installment sales contracts, lines of credit, and other financing products excluding operating leases. The term “operating leases” means consumer- and commercial- vehicle lease agreements where Ally is the lessor and the lessee is generally not obligated to acquire ownership of the vehicle at lease-end or compensate Ally for the vehicle’s residual value. The terms “lend,” “finance,” and “originate” mean our direct extension or origination of loans, our purchase or acquisition of loans, or our purchase of operating leases, as applicable. The term “consumer” means all consumer products associated with our loan and operating-lease activities and all commercial retail installment sales contracts. The term “commercial” means all commercial products associated with our loan activities, other than commercial retail installment sales contracts. 3Q 2020 Preliminary Results 2

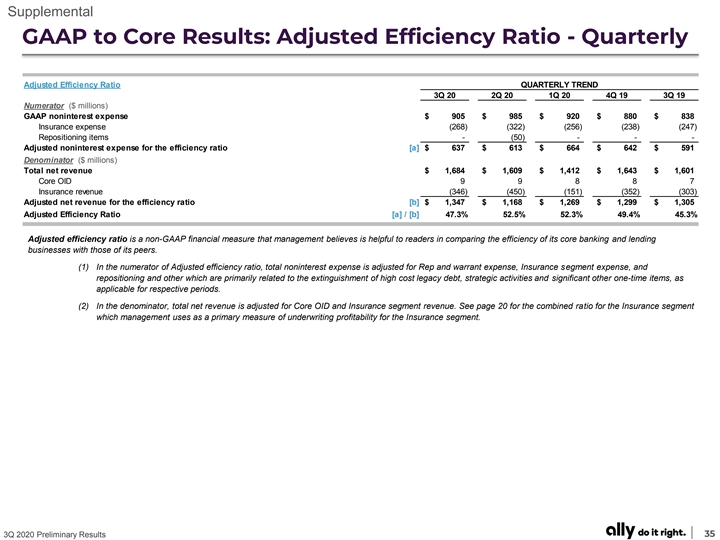

GAAP and Core Results: Quarterly ($ millions except per share data) 3Q 20 2Q 20 1Q 20 4Q 19 3Q 19 GAAP net income (loss) attributable to common shareholders (NIAC) $ 476 $ 241 $ (319) $ 378 $ 381 (1)(2) Core net income (loss) attributable to common shareholders $ 473 $ 228 $ (166) $ 364 $ 396 GAAP earnings per common share (EPS) (basic or diluted as applicable, NIAC) $ 1.26 $ 0.64 $ (0.85) $ 0.99 $ 0.97 (1)(3) Adjusted EPS $ 1.25 $ 0.61 $ (0.44) $ 0.95 $ 1.01 Return (NIAC) on GAAP shareholder's equity 13.6% 7.1% -9.1% 10.5% 10.6% (1)(4) Core ROTCE 15.2% 7.6% -5.4% 11.2% 12.3% GAAP common shareholder's equity per share $ 37.8 $ 37.0 $ 36.2 $ 38.5 $ 37.7 (1)(5) Adjusted tangible book value per share (Adjusted TBVPS) $ 34.6 $ 33.7 $ 32.8 $ 35.1 $ 34.7 Efficiency Ratio 53.7% 61.2% 65.2% 53.6% 52.3% (1)(6) Adjusted Efficiency Ratio 47.3% 52.5% 52.3% 49.4% 45.3% GAAP total net revenue $ 1,684 $ 1,609 $ 1,412 $ 1,643 $ 1,601 (1)(7) Adjusted total net revenue $ 1,680 $ 1,528 $ 1,606 $ 1,622 $ 1,620 (1) The following are non-GAAP financial measures which Ally believes are important to the reader of the Consolidated Financial Statements, but which are supplemental to and not a substitute for GAAP measures: Adjusted earnings per share (Adjusted EPS), Core pre-tax income (loss), Core net income (loss) attributable to common shareholders, Core return on tangible common equity (Core ROTCE), Adjusted efficiency ratio, Adjusted total net revenue, Net financing revenue (excluding Core OID), Adjusted other revenue, Core original issue discount (Core OID) amortization expense, Core outstanding original issue discount balance (Core OID balance), and Adjusted tangible book value per share (Adjusted TBVPS). These measures are used by management and we believe are useful to investors in assessing the company’s operating performance and capital. Refer to the Definitions of Non-GAAP Financial Measures and Other Key Terms, and Reconciliation to GAAP later in this document. (2) Core net income (loss) attributable to common shareholders is a non-GAAP financial measure that serves as the numerator in the calculations of Adjusted EPS and Core ROTCE and that, like those measures, is believed by management to help the reader better understand the operating performance of the core businesses and their ability to generate earnings. See pages 30 and 32 for calculation methodology and details. (3) Adjusted earnings per share (Adjusted EPS) is a non-GAAP financial measure that adjusts GAAP EPS for revenue and expense items that are typically strategic in nature or that management otherwise does not view as reflecting the operating performance of the company. Management believes Adjusted EPS can help the reader better understand the operating performance of the core businesses and their ability to generate earnings. See page 32 for calculation methodology and details. (4) Core return on tangible common equity (Core ROTCE) is a non-GAAP financial measure that management believes is helpful for readers to better understand the ongoing ability of the company to generate returns on its equity base that supports core operations. For purposes of this calculation, tangible common equity is adjusted for Core OID balance and the net deferred tax asset. See page 34 for calculation methodology and details. (5) Adjusted tangible book value per share (Adjusted TBVPS) is a non-GAAP financial measure that reflects the book value of equity attributable to shareholders even if tax-effected Core OID balance were accelerated immediately through the financial statements. As a result, management believes Adjusted TBVPS provides the reader with an assessment of value that is more conservative than GAAP common shareholder’s equity per share. See page 33 for calculation methodology and details. (6) Adjusted efficiency ratio is a non-GAAP financial measure that management believes is helpful to readers in comparing the efficiency of its core banking and lending businesses with those of its peers. Adjusted efficiency ratio generally adjusts for Insurance segment revenue and expense, rep and warrant expense, Core OID, and repositioning and other. See page 35 for calculation methodology and details. (7) Adjusted total net revenue is a non-GAAP financial measure that adjusts GAAP total net revenue for Core OID and for change in the fair value of equity securities due to the implementation of ASU 2016-01 which requires change in the fair value of equity securities to be recognized in current period net income as compared to periods prior to 1/1/18 in which such adjustments were recognized through other comprehensive income, a component of equity. See page 37 for calculation methodology and details. 3Q 2020 Preliminary Results 3GAAP and Core Results: Quarterly ($ millions except per share data) 3Q 20 2Q 20 1Q 20 4Q 19 3Q 19 GAAP net income (loss) attributable to common shareholders (NIAC) $ 476 $ 241 $ (319) $ 378 $ 381 (1)(2) Core net income (loss) attributable to common shareholders $ 473 $ 228 $ (166) $ 364 $ 396 GAAP earnings per common share (EPS) (basic or diluted as applicable, NIAC) $ 1.26 $ 0.64 $ (0.85) $ 0.99 $ 0.97 (1)(3) Adjusted EPS $ 1.25 $ 0.61 $ (0.44) $ 0.95 $ 1.01 Return (NIAC) on GAAP shareholder's equity 13.6% 7.1% -9.1% 10.5% 10.6% (1)(4) Core ROTCE 15.2% 7.6% -5.4% 11.2% 12.3% GAAP common shareholder's equity per share $ 37.8 $ 37.0 $ 36.2 $ 38.5 $ 37.7 (1)(5) Adjusted tangible book value per share (Adjusted TBVPS) $ 34.6 $ 33.7 $ 32.8 $ 35.1 $ 34.7 Efficiency Ratio 53.7% 61.2% 65.2% 53.6% 52.3% (1)(6) Adjusted Efficiency Ratio 47.3% 52.5% 52.3% 49.4% 45.3% GAAP total net revenue $ 1,684 $ 1,609 $ 1,412 $ 1,643 $ 1,601 (1)(7) Adjusted total net revenue $ 1,680 $ 1,528 $ 1,606 $ 1,622 $ 1,620 (1) The following are non-GAAP financial measures which Ally believes are important to the reader of the Consolidated Financial Statements, but which are supplemental to and not a substitute for GAAP measures: Adjusted earnings per share (Adjusted EPS), Core pre-tax income (loss), Core net income (loss) attributable to common shareholders, Core return on tangible common equity (Core ROTCE), Adjusted efficiency ratio, Adjusted total net revenue, Net financing revenue (excluding Core OID), Adjusted other revenue, Core original issue discount (Core OID) amortization expense, Core outstanding original issue discount balance (Core OID balance), and Adjusted tangible book value per share (Adjusted TBVPS). These measures are used by management and we believe are useful to investors in assessing the company’s operating performance and capital. Refer to the Definitions of Non-GAAP Financial Measures and Other Key Terms, and Reconciliation to GAAP later in this document. (2) Core net income (loss) attributable to common shareholders is a non-GAAP financial measure that serves as the numerator in the calculations of Adjusted EPS and Core ROTCE and that, like those measures, is believed by management to help the reader better understand the operating performance of the core businesses and their ability to generate earnings. See pages 30 and 32 for calculation methodology and details. (3) Adjusted earnings per share (Adjusted EPS) is a non-GAAP financial measure that adjusts GAAP EPS for revenue and expense items that are typically strategic in nature or that management otherwise does not view as reflecting the operating performance of the company. Management believes Adjusted EPS can help the reader better understand the operating performance of the core businesses and their ability to generate earnings. See page 32 for calculation methodology and details. (4) Core return on tangible common equity (Core ROTCE) is a non-GAAP financial measure that management believes is helpful for readers to better understand the ongoing ability of the company to generate returns on its equity base that supports core operations. For purposes of this calculation, tangible common equity is adjusted for Core OID balance and the net deferred tax asset. See page 34 for calculation methodology and details. (5) Adjusted tangible book value per share (Adjusted TBVPS) is a non-GAAP financial measure that reflects the book value of equity attributable to shareholders even if tax-effected Core OID balance were accelerated immediately through the financial statements. As a result, management believes Adjusted TBVPS provides the reader with an assessment of value that is more conservative than GAAP common shareholder’s equity per share. See page 33 for calculation methodology and details. (6) Adjusted efficiency ratio is a non-GAAP financial measure that management believes is helpful to readers in comparing the efficiency of its core banking and lending businesses with those of its peers. Adjusted efficiency ratio generally adjusts for Insurance segment revenue and expense, rep and warrant expense, Core OID, and repositioning and other. See page 35 for calculation methodology and details. (7) Adjusted total net revenue is a non-GAAP financial measure that adjusts GAAP total net revenue for Core OID and for change in the fair value of equity securities due to the implementation of ASU 2016-01 which requires change in the fair value of equity securities to be recognized in current period net income as compared to periods prior to 1/1/18 in which such adjustments were recognized through other comprehensive income, a component of equity. See page 37 for calculation methodology and details. 3Q 2020 Preliminary Results 3

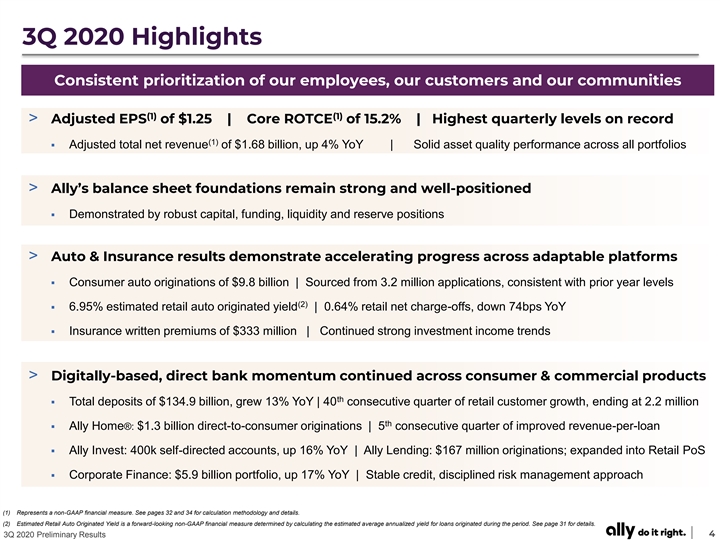

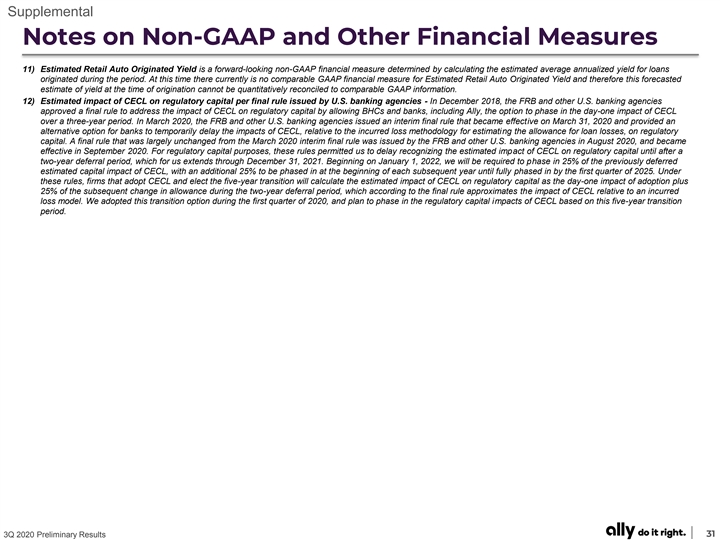

3Q 2020 Highlights Consistent prioritization of our employees, our customers and our communities (1) (1) > Adjusted EPS of $1.25 | Core ROTCE of 15.2% | Highest quarterly levels on record (1) ▪ Adjusted total net revenue of $1.68 billion, up 4% YoY | Solid asset quality performance across all portfolios > Ally’s balance sheet foundations remain strong and well-positioned ▪ Demonstrated by robust capital, funding, liquidity and reserve positions > Auto & Insurance results demonstrate accelerating progress across adaptable platforms ▪ Consumer auto originations of $9.8 billion | Sourced from 3.2 million applications, consistent with prior year levels (2) ▪ 6.95% estimated retail auto originated yield | 0.64% retail net charge-offs, down 74bps YoY ▪ Insurance written premiums of $333 million | Continued strong investment income trends > Digitally-based, direct bank momentum continued across consumer & commercial products th ▪ Total deposits of $134.9 billion, grew 13% YoY | 40 consecutive quarter of retail customer growth, ending at 2.2 million th ▪ Ally Home®: $1.3 billion direct-to-consumer originations | 5 consecutive quarter of improved revenue-per-loan ▪ Ally Invest: 400k self-directed accounts, up 16% YoY | Ally Lending: $167 million originations; expanded into Retail PoS ▪ Corporate Finance: $5.9 billion portfolio, up 17% YoY | Stable credit, disciplined risk management approach (1) Represents a non-GAAP financial measure. See pages 32 and 34 for calculation methodology and details. (2) Estimated Retail Auto Originated Yield is a forward-looking non-GAAP financial measure determined by calculating the estimated average annualized yield for loans originated during the period. See page 31 for details. 3Q 2020 Preliminary Results 43Q 2020 Highlights Consistent prioritization of our employees, our customers and our communities (1) (1) > Adjusted EPS of $1.25 | Core ROTCE of 15.2% | Highest quarterly levels on record (1) ▪ Adjusted total net revenue of $1.68 billion, up 4% YoY | Solid asset quality performance across all portfolios > Ally’s balance sheet foundations remain strong and well-positioned ▪ Demonstrated by robust capital, funding, liquidity and reserve positions > Auto & Insurance results demonstrate accelerating progress across adaptable platforms ▪ Consumer auto originations of $9.8 billion | Sourced from 3.2 million applications, consistent with prior year levels (2) ▪ 6.95% estimated retail auto originated yield | 0.64% retail net charge-offs, down 74bps YoY ▪ Insurance written premiums of $333 million | Continued strong investment income trends > Digitally-based, direct bank momentum continued across consumer & commercial products th ▪ Total deposits of $134.9 billion, grew 13% YoY | 40 consecutive quarter of retail customer growth, ending at 2.2 million th ▪ Ally Home®: $1.3 billion direct-to-consumer originations | 5 consecutive quarter of improved revenue-per-loan ▪ Ally Invest: 400k self-directed accounts, up 16% YoY | Ally Lending: $167 million originations; expanded into Retail PoS ▪ Corporate Finance: $5.9 billion portfolio, up 17% YoY | Stable credit, disciplined risk management approach (1) Represents a non-GAAP financial measure. See pages 32 and 34 for calculation methodology and details. (2) Estimated Retail Auto Originated Yield is a forward-looking non-GAAP financial measure determined by calculating the estimated average annualized yield for loans originated during the period. See page 31 for details. 3Q 2020 Preliminary Results 4

Ally’s Sustainable Competitive Advantage Auto & Insurance: Established, Market-leading Capabilities Tech, Digital Tools & Data Analytics Full-Market Reach Across Growing Dealer Base Established & Emerging Players | Franchised & Independent Modern Servicing System | Digital, Self-service Portals Full Product Suite + Real-time Market Insights Dynamic Underwriting + Disciplined Servicer Retail, Lease, Floorplan | Insurance | SmartAuction Full-Spectrum Credit Expertise | Customer-Focused Actions Strong Dealer-Partner + Differentiated Service Levels Proven Capabilities + Adaptable Model 100-years in Auto | Anticipating & Evolving with Market Enhanced Dealer Engagement | Experienced Field Reps & Teams Ally Bank: Early-Disruptor With Expanding Digital Consumer Platform Digitally-based, Frictionless Platforms Tech + Data-Driven Approach Leveraging Digital Model for Insights & Trends 0 Branches | Differentiated by Digital | Award-winning High Customer Growth + Low Cost to Acquire Diversified Consumer + Commercial Product Offerings 10-years of Growth | Millennial-driven Account Openings Save, Pay, Borrow & Invest | Ongoing Relationship Deepening Scalable Infrastructure + Strategically Partnered Award-winning Offerings + Leading Customer Service Positioned for Organic Growth | Enhancing-Partnerships Built for the Customer | Low Fees | Strong Loyalty & Satisfaction 3Q 2020 Preliminary Results 5Ally’s Sustainable Competitive Advantage Auto & Insurance: Established, Market-leading Capabilities Tech, Digital Tools & Data Analytics Full-Market Reach Across Growing Dealer Base Established & Emerging Players | Franchised & Independent Modern Servicing System | Digital, Self-service Portals Full Product Suite + Real-time Market Insights Dynamic Underwriting + Disciplined Servicer Retail, Lease, Floorplan | Insurance | SmartAuction Full-Spectrum Credit Expertise | Customer-Focused Actions Strong Dealer-Partner + Differentiated Service Levels Proven Capabilities + Adaptable Model 100-years in Auto | Anticipating & Evolving with Market Enhanced Dealer Engagement | Experienced Field Reps & Teams Ally Bank: Early-Disruptor With Expanding Digital Consumer Platform Digitally-based, Frictionless Platforms Tech + Data-Driven Approach Leveraging Digital Model for Insights & Trends 0 Branches | Differentiated by Digital | Award-winning High Customer Growth + Low Cost to Acquire Diversified Consumer + Commercial Product Offerings 10-years of Growth | Millennial-driven Account Openings Save, Pay, Borrow & Invest | Ongoing Relationship Deepening Scalable Infrastructure + Strategically Partnered Award-winning Offerings + Leading Customer Service Positioned for Organic Growth | Enhancing-Partnerships Built for the Customer | Low Fees | Strong Loyalty & Satisfaction 3Q 2020 Preliminary Results 5

Ally’s Customer Evolution 10-Years of Customer Growth Ally’s Growing Customer Base Ally Bank Customer Trends Retail Deposit Customers % Multi-Product Customers 8.5M+ 2.2M 2.0M customers 7% # of Customers 6% 1.2M 4.5M 0.8M Auto 0.4M <1% 2010 2013 2016 2019 3Q 2020 Note: Multi-product Customers represent Deposit Customers with an Ally Invest or Ally Home relationship. Insurance Ally Auto Dealer Relationship & Application Trends Active U.S. Dealer Relationships U.S. Consumer Applications 2.0M Retail Deposits 18.7K 18.3K 17.1K 14.9K 1.0M 12.6M 11.2M 12.4K 9.3M YTD 500k 7.8M Invest 3.7M 50K Home 2010 2013 2016 2019 3Q 2020 Note: Active U.S. Dealer Relationships include Ally active dealers, excluding RV Commercial and Consumer lines of business exited in 2Q 18. 3Q 2020 Preliminary Results 6Ally’s Customer Evolution 10-Years of Customer Growth Ally’s Growing Customer Base Ally Bank Customer Trends Retail Deposit Customers % Multi-Product Customers 8.5M+ 2.2M 2.0M customers 7% # of Customers 6% 1.2M 4.5M 0.8M Auto 0.4M <1% 2010 2013 2016 2019 3Q 2020 Note: Multi-product Customers represent Deposit Customers with an Ally Invest or Ally Home relationship. Insurance Ally Auto Dealer Relationship & Application Trends Active U.S. Dealer Relationships U.S. Consumer Applications 2.0M Retail Deposits 18.7K 18.3K 17.1K 14.9K 1.0M 12.6M 11.2M 12.4K 9.3M YTD 500k 7.8M Invest 3.7M 50K Home 2010 2013 2016 2019 3Q 2020 Note: Active U.S. Dealer Relationships include Ally active dealers, excluding RV Commercial and Consumer lines of business exited in 2Q 18. 3Q 2020 Preliminary Results 6

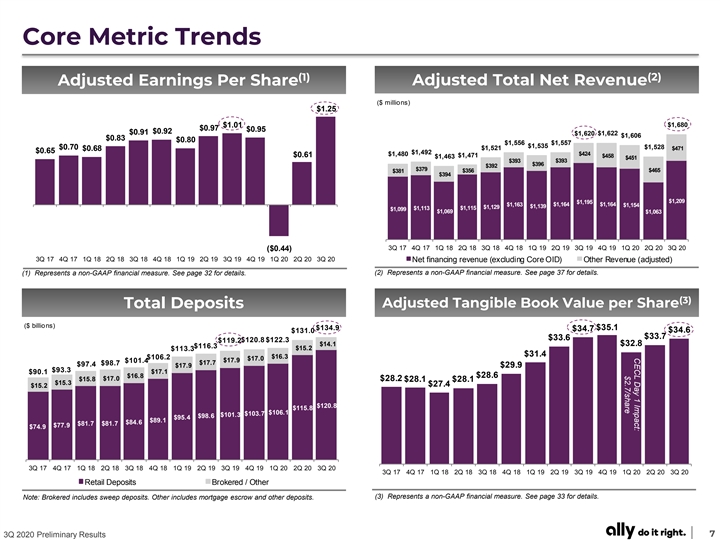

CECL Day 1 Impact: $2.7/share Core Metric Trends (1) (2) Adjusted Total Net Revenue Adjusted Earnings Per Share ($ millions) $1.25 $1,680 $1.01 $0.97 $0.95 $0.92 $0.91 $1,622 $1,620 $1,606 $0.83 $0.80 $1,556 $1,557 $1,535 $1,528 $0.70 $1,521 $471 $0.68 $0.65 $1,492 $1,480 $424 $0.61 $1,471 $458 $1,463 $451 $393 $393 $396 $392 $379 $465 $381 $356 $394 $1,209 $1,195 $1,163 $1,164 $1,164 $1,154 $1,139 $1,129 $1,113 $1,115 $1,099 $1,069 $1,063 3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 ($0.44) 3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 Net financing revenue (excluding Core OID) Other Revenue (adjusted) (1) Represents a non-GAAP financial measure. See page 32 for details. (2) Represents a non-GAAP financial measure. See page 37 for details. (3) Total Deposits Adjusted Tangible Book Value per Share ($ billions) $134.9 $35.1 $34.7 $131.0 $34.6 $33.7 $33.6 $120.8 $122.3 $119.2 $14.1 $32.8 $116.3 $15.2 $113.3 $31.4 $16.3 $106.2 $17.0 $17.9 $101.4 $98.7 $17.7 $97.4 $17.9 $29.9 $93.3 $90.1 $17.1 $16.8 $28.6 $15.8 $17.0 $28.2 $28.1 $28.1 $15.3 $27.4 $15.2 $120.8 $115.8 $106.1 $103.7 $101.3 $98.6 $95.4 $89.1 $84.6 $81.7 $81.7 $77.9 $74.9 3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 Retail Deposits Brokered / Other (3) Represents a non-GAAP financial measure. See page 33 for details. Note: Brokered includes sweep deposits. Other includes mortgage escrow and other deposits. 3Q 2020 Preliminary Results 7CECL Day 1 Impact: $2.7/share Core Metric Trends (1) (2) Adjusted Total Net Revenue Adjusted Earnings Per Share ($ millions) $1.25 $1,680 $1.01 $0.97 $0.95 $0.92 $0.91 $1,622 $1,620 $1,606 $0.83 $0.80 $1,556 $1,557 $1,535 $1,528 $0.70 $1,521 $471 $0.68 $0.65 $1,492 $1,480 $424 $0.61 $1,471 $458 $1,463 $451 $393 $393 $396 $392 $379 $465 $381 $356 $394 $1,209 $1,195 $1,163 $1,164 $1,164 $1,154 $1,139 $1,129 $1,113 $1,115 $1,099 $1,069 $1,063 3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 ($0.44) 3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 Net financing revenue (excluding Core OID) Other Revenue (adjusted) (1) Represents a non-GAAP financial measure. See page 32 for details. (2) Represents a non-GAAP financial measure. See page 37 for details. (3) Total Deposits Adjusted Tangible Book Value per Share ($ billions) $134.9 $35.1 $34.7 $131.0 $34.6 $33.7 $33.6 $120.8 $122.3 $119.2 $14.1 $32.8 $116.3 $15.2 $113.3 $31.4 $16.3 $106.2 $17.0 $17.9 $101.4 $98.7 $17.7 $97.4 $17.9 $29.9 $93.3 $90.1 $17.1 $16.8 $28.6 $15.8 $17.0 $28.2 $28.1 $28.1 $15.3 $27.4 $15.2 $120.8 $115.8 $106.1 $103.7 $101.3 $98.6 $95.4 $89.1 $84.6 $81.7 $81.7 $77.9 $74.9 3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 Retail Deposits Brokered / Other (3) Represents a non-GAAP financial measure. See page 33 for details. Note: Brokered includes sweep deposits. Other includes mortgage escrow and other deposits. 3Q 2020 Preliminary Results 7

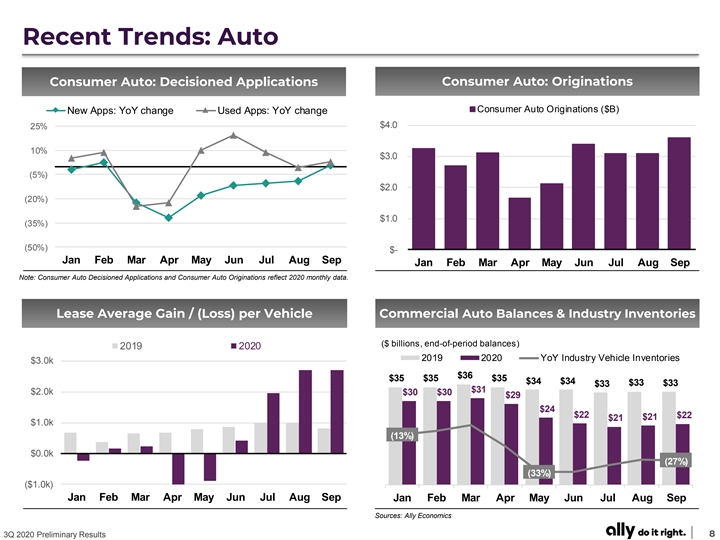

Recent Trends: Auto Consumer Auto: Decisioned Applications Consumer Auto: Originations Consumer Auto Originations ($B) New Apps: YoY change Used Apps: YoY change $4.0 25% 10% $3.0 (5%) $2.0 (20%) $1.0 (35%) (50%) $- Jan Feb Mar Apr May Jun Jul Aug Sep Jan Feb Mar Apr May Jun Jul Aug Sep Note: Consumer Auto Decisioned Applications and Consumer Auto Originations reflect 2020 monthly data. Lease Average Gain / (Loss) per Vehicle Commercial Auto Balances & Industry Inventories ($ billions, end-of-period balances) 2019 2020 2019 2020 YoY Industry Vehicle Inventories $3.0k $36 $35 $35 $35 $34 $34 $33 $33 $33 $31 $2.0k $30 $30 $29 $24 $22 $22 $21 $21 $1.0k (13%) $0.0k (27%) (33%) ($1.0k) Jan Feb Mar Apr May Jun Jul Aug Sep Jan Feb Mar Apr May Jun Jul Aug Sep Sources: Ally Economics 3Q 2020 Preliminary Results 8 ThousandsRecent Trends: Auto Consumer Auto: Decisioned Applications Consumer Auto: Originations Consumer Auto Originations ($B) New Apps: YoY change Used Apps: YoY change $4.0 25% 10% $3.0 (5%) $2.0 (20%) $1.0 (35%) (50%) $- Jan Feb Mar Apr May Jun Jul Aug Sep Jan Feb Mar Apr May Jun Jul Aug Sep Note: Consumer Auto Decisioned Applications and Consumer Auto Originations reflect 2020 monthly data. Lease Average Gain / (Loss) per Vehicle Commercial Auto Balances & Industry Inventories ($ billions, end-of-period balances) 2019 2020 2019 2020 YoY Industry Vehicle Inventories $3.0k $36 $35 $35 $35 $34 $34 $33 $33 $33 $31 $2.0k $30 $30 $29 $24 $22 $22 $21 $21 $1.0k (13%) $0.0k (27%) (33%) ($1.0k) Jan Feb Mar Apr May Jun Jul Aug Sep Jan Feb Mar Apr May Jun Jul Aug Sep Sources: Ally Economics 3Q 2020 Preliminary Results 8 Thousands

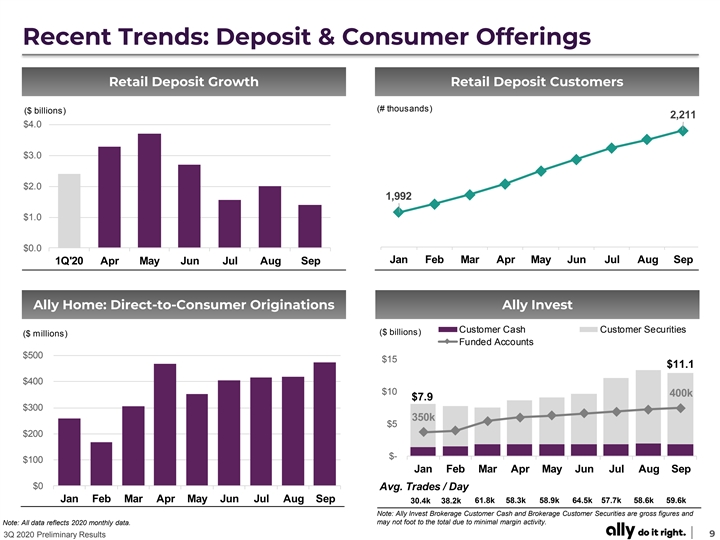

Recent Trends: Deposit & Consumer Offerings Retail Deposit Growth Retail Deposit Customers (# thousands) ($ billions) 2,211 $4.0 $3.0 $2.0 1,992 $1.0 $0.0 Jan Feb Mar Apr May Jun Jul Aug Sep 1Q'20 Apr May Jun Jul Aug Sep Ally Home: Direct-to-Consumer Originations Ally Invest Customer Cash Customer Securities ($ billions) ($ millions) Funded Accounts $500 $15 $11.1 $400 $10 400k $7.9 $300 350k $5 $200 $- $100 Jan Feb Mar Apr May Jun Jul Aug Sep $0 Avg. Trades / Day Jan Feb Mar Apr May Jun Jul Aug Sep 30.4k 38.2k 61.8k 58.3k 58.9k 64.5k 57.7k 58.6k 59.6k Note: Ally Invest Brokerage Customer Cash and Brokerage Customer Securities are gross figures and may not foot to the total due to minimal margin activity. Note: All data reflects 2020 monthly data. 3Q 2020 Preliminary Results 9Recent Trends: Deposit & Consumer Offerings Retail Deposit Growth Retail Deposit Customers (# thousands) ($ billions) 2,211 $4.0 $3.0 $2.0 1,992 $1.0 $0.0 Jan Feb Mar Apr May Jun Jul Aug Sep 1Q'20 Apr May Jun Jul Aug Sep Ally Home: Direct-to-Consumer Originations Ally Invest Customer Cash Customer Securities ($ billions) ($ millions) Funded Accounts $500 $15 $11.1 $400 $10 400k $7.9 $300 350k $5 $200 $- $100 Jan Feb Mar Apr May Jun Jul Aug Sep $0 Avg. Trades / Day Jan Feb Mar Apr May Jun Jul Aug Sep 30.4k 38.2k 61.8k 58.3k 58.9k 64.5k 57.7k 58.6k 59.6k Note: Ally Invest Brokerage Customer Cash and Brokerage Customer Securities are gross figures and may not foot to the total due to minimal margin activity. Note: All data reflects 2020 monthly data. 3Q 2020 Preliminary Results 9

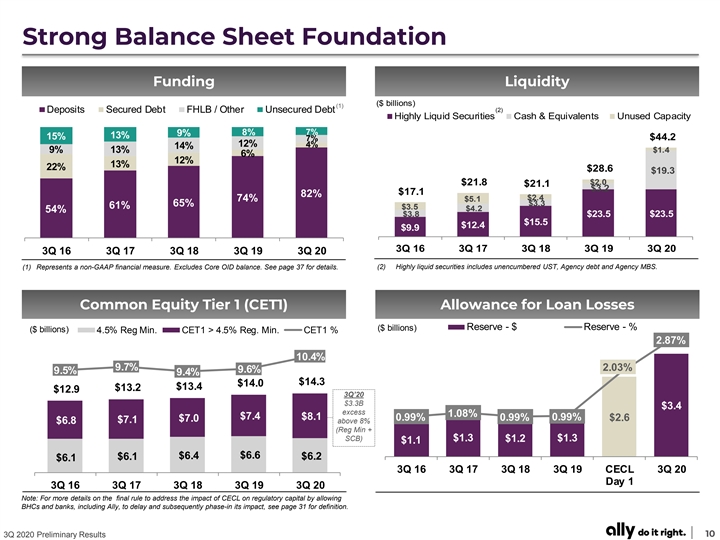

Strong Balance Sheet Foundation Funding Liquidity ($ billions) (1) (2) Deposits Secured Debt FHLB / Other Unsecured Debt Highly Liquid Securities Cash & Equivalents Unused Capacity 8% 7% 9% 13% 15% $44.2 7% 12% 4% 14% 9% 13% $1.4 6% 12% 13% 22% $28.6 $19.3 $21.8 $2.0 $21.1 $3.2 $17.1 82% $2.4 74% $5.1 $3.3 65% 61% $3.5 $4.2 54% $3.8 $23.5 $23.5 $15.5 $12.4 $9.9 3Q 16 3Q 17 3Q 18 3Q 19 3Q 20 3Q 16 3Q 17 3Q 18 3Q 19 3Q 20 (2) Highly liquid securities includes unencumbered UST, Agency debt and Agency MBS. (1) Represents a non-GAAP financial measure. Excludes Core OID balance. See page 37 for details. Common Equity Tier 1 (CET1) Allowance for Loan Losses Reserve - $ Reserve - % ($ billions) ($ billions) 4.5% Reg Min. CET1 > 4.5% Reg. Min. CET1 % 2.87% 10.4% 9.7% 2.03% 9.6% 9.5% 9.4% $14.3 $14.0 $13.4 $13.2 $12.9 3Q’20 $3.3B $3.4 excess 1.08% $7.4 $8.1 0.99% 0.99% 0.99% $2.6 $7.0 $7.1 above 8% $6.8 (Reg Min + SCB) $1.3 $1.2 $1.3 $1.1 $6.4 $6.6 $6.1 $6.2 $6.1 3Q 16 3Q 17 3Q 18 3Q 19 CECL 3Q 20 Day 1 3Q 16 3Q 17 3Q 18 3Q 19 3Q 20 Note: For more details on the final rule to address the impact of CECL on regulatory capital by allowing BHCs and banks, including Ally, to delay and subsequently phase-in its impact, see page 31 for definition. 3Q 2020 Preliminary Results 10Strong Balance Sheet Foundation Funding Liquidity ($ billions) (1) (2) Deposits Secured Debt FHLB / Other Unsecured Debt Highly Liquid Securities Cash & Equivalents Unused Capacity 8% 7% 9% 13% 15% $44.2 7% 12% 4% 14% 9% 13% $1.4 6% 12% 13% 22% $28.6 $19.3 $21.8 $2.0 $21.1 $3.2 $17.1 82% $2.4 74% $5.1 $3.3 65% 61% $3.5 $4.2 54% $3.8 $23.5 $23.5 $15.5 $12.4 $9.9 3Q 16 3Q 17 3Q 18 3Q 19 3Q 20 3Q 16 3Q 17 3Q 18 3Q 19 3Q 20 (2) Highly liquid securities includes unencumbered UST, Agency debt and Agency MBS. (1) Represents a non-GAAP financial measure. Excludes Core OID balance. See page 37 for details. Common Equity Tier 1 (CET1) Allowance for Loan Losses Reserve - $ Reserve - % ($ billions) ($ billions) 4.5% Reg Min. CET1 > 4.5% Reg. Min. CET1 % 2.87% 10.4% 9.7% 2.03% 9.6% 9.5% 9.4% $14.3 $14.0 $13.4 $13.2 $12.9 3Q’20 $3.3B $3.4 excess 1.08% $7.4 $8.1 0.99% 0.99% 0.99% $2.6 $7.0 $7.1 above 8% $6.8 (Reg Min + SCB) $1.3 $1.2 $1.3 $1.1 $6.4 $6.6 $6.1 $6.2 $6.1 3Q 16 3Q 17 3Q 18 3Q 19 CECL 3Q 20 Day 1 3Q 16 3Q 17 3Q 18 3Q 19 3Q 20 Note: For more details on the final rule to address the impact of CECL on regulatory capital by allowing BHCs and banks, including Ally, to delay and subsequently phase-in its impact, see page 31 for definition. 3Q 2020 Preliminary Results 10

3Q 2020 Financial Results ($ millions; except per share data) Increase / (Decrease) vs. 3Q 20 2Q 20 3Q 19 2Q 20 3Q 19 (1) $ 1,209 $ 1,063 $ 1,195 $ 146 $ 14 Net financing revenue (excluding Core OID) Core OID (9 ) (9) (7 ) (0) (2) Net financing revenue (as reported) $ 1,200 $ 1,054 $ 1,188 $ 146 $ 12 (2) 471 465 424 5 46 Other revenue (excluding change in fair value of equity securities) (2) 13 90 (1 1) (76) 25 Change in fair value of equity securities Other revenue (as reported) 484 555 413 (71) 71 Provision for credit losses 147 287 263 (140) (116) Noninterest expense 905 985 838 (80) 67 Pre-tax income from continuing operations $ 632 $ 337 $ 500 $ 295 $ 132 Income tax expense 156 95 119 61 37 (Loss) income from discontinued operations, net of tax - (1) - 1 - Net income $ 476 $ 241 $ 381 $ 235 $ 95 3Q 20 2Q 20 3Q 19 2Q 20 3Q 19 GAAP EPS (diluted) $ 1.26 $ 0 .64 $ 0 .97 $ 0.62 $ 0.29 Core OID, net of tax 0.02 0.02 0 .02 0 .00 0.00 Change in fair value of equity securities, net of tax (0.03) (0.19) 0.02 0 .16 (0.05) (3) - 0 .14 - (0 .14) - Repositioning, discontinued ops., and other, net of tax (4) $ 1 .25 $ 0.61 $ 1.01 $ 0.65 $ 0.25 Adjusted EPS (4) Core ROTCE 15.2% 7.6% 12.3% (4) 47.3% 52.5% 45.3% Adjusted Efficiency Ratio Effective Tax Rate 24.8% 28.2% 23.9% (1) Represents a non-GAAP financial measure. Adjusted for Core OID. See page 37 for calculation methodology and details. (2) Represents a non-GAAP financial measure. Adjusted for change in the fair value of equity securities due to the implementation of ASU 2016-01, which requires change in the fair value of equity securities to be recognized in current period net income as compared to periods prior to 1/1/18 in which such adjustments were recognized through other comprehensive income, a component of equity. For Non-GAAP calculation methodology and details see pages 36 and 37. (3) Repositioning and other, net of tax (as applicable) in 2Q 20 includes a $50 million Goodwill impairment at Ally Invest. See page 36 for calculation methodology and details. (4) Represents a non-GAAP financial measure. For Non-GAAP calculation methodology and details see pages 32 , 34 and 35. 3Q 2020 Preliminary Results 113Q 2020 Financial Results ($ millions; except per share data) Increase / (Decrease) vs. 3Q 20 2Q 20 3Q 19 2Q 20 3Q 19 (1) $ 1,209 $ 1,063 $ 1,195 $ 146 $ 14 Net financing revenue (excluding Core OID) Core OID (9 ) (9) (7 ) (0) (2) Net financing revenue (as reported) $ 1,200 $ 1,054 $ 1,188 $ 146 $ 12 (2) 471 465 424 5 46 Other revenue (excluding change in fair value of equity securities) (2) 13 90 (1 1) (76) 25 Change in fair value of equity securities Other revenue (as reported) 484 555 413 (71) 71 Provision for credit losses 147 287 263 (140) (116) Noninterest expense 905 985 838 (80) 67 Pre-tax income from continuing operations $ 632 $ 337 $ 500 $ 295 $ 132 Income tax expense 156 95 119 61 37 (Loss) income from discontinued operations, net of tax - (1) - 1 - Net income $ 476 $ 241 $ 381 $ 235 $ 95 3Q 20 2Q 20 3Q 19 2Q 20 3Q 19 GAAP EPS (diluted) $ 1.26 $ 0 .64 $ 0 .97 $ 0.62 $ 0.29 Core OID, net of tax 0.02 0.02 0 .02 0 .00 0.00 Change in fair value of equity securities, net of tax (0.03) (0.19) 0.02 0 .16 (0.05) (3) - 0 .14 - (0 .14) - Repositioning, discontinued ops., and other, net of tax (4) $ 1 .25 $ 0.61 $ 1.01 $ 0.65 $ 0.25 Adjusted EPS (4) Core ROTCE 15.2% 7.6% 12.3% (4) 47.3% 52.5% 45.3% Adjusted Efficiency Ratio Effective Tax Rate 24.8% 28.2% 23.9% (1) Represents a non-GAAP financial measure. Adjusted for Core OID. See page 37 for calculation methodology and details. (2) Represents a non-GAAP financial measure. Adjusted for change in the fair value of equity securities due to the implementation of ASU 2016-01, which requires change in the fair value of equity securities to be recognized in current period net income as compared to periods prior to 1/1/18 in which such adjustments were recognized through other comprehensive income, a component of equity. For Non-GAAP calculation methodology and details see pages 36 and 37. (3) Repositioning and other, net of tax (as applicable) in 2Q 20 includes a $50 million Goodwill impairment at Ally Invest. See page 36 for calculation methodology and details. (4) Represents a non-GAAP financial measure. For Non-GAAP calculation methodology and details see pages 32 , 34 and 35. 3Q 2020 Preliminary Results 11

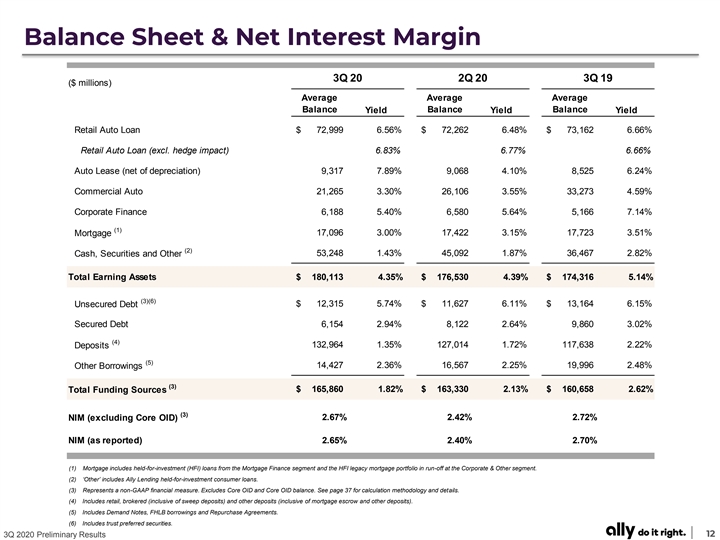

Balance Sheet & Net Interest Margin 3Q 20 2Q 20 3Q 19 ($ millions) Average Average Average Balance Yield Balance Yield Balance Yield Retail Auto Loan $ 72,999 6.56% $ 72,262 6.48% $ 73,162 6.66% Retail Auto Loan (excl. hedge impact) 6.83% 6.77% 6.66% Auto Lease (net of depreciation) 9,317 7.89% 9,068 4.10% 8,525 6.24% Commercial Auto 21,265 3.30% 26,106 3.55% 33,273 4.59% Corporate Finance 6,188 5.40% 6,580 5.64% 5,166 7.14% (1) Mortgage 17,096 3.00% 17,422 3.15% 17,723 3.51% (2) 53,248 1.43% 45,092 1.87% 36,467 2.82% Cash, Securities and Other Total Earning Assets $ 1 80,113 4.35% $ 176,530 4.39% $ 1 74,316 5.14% (3)(6) Unsecured Debt $ 12,315 5.74% $ 11,627 6.11% $ 13,164 6.15% Secured Debt 6,154 2.94% 8,122 2.64% 9,860 3.02% (4) Deposits 132,964 1.35% 127,014 1.72% 117,638 2.22% (5) 14,427 2.36% 16,567 2.25% 19,996 2.48% Other Borrowings (3) $ 1 65,860 1.82% $ 163,330 2.13% $ 160,658 2.62% Total Funding Sources (3) 2.67% 2.42% 2.72% NIM (excluding Core OID) NIM (as reported) 2.65% 2.40% 2.70% (1) Mortgage includes held-for-investment (HFI) loans from the Mortgage Finance segment and the HFI legacy mortgage portfolio in run-off at the Corporate & Other segment. (2) ‘Other’ includes Ally Lending held-for-investment consumer loans. (3) Represents a non-GAAP financial measure. Excludes Core OID and Core OID balance. See page 37 for calculation methodology and details. (4) Includes retail, brokered (inclusive of sweep deposits) and other deposits (inclusive of mortgage escrow and other deposits). (5) Includes Demand Notes, FHLB borrowings and Repurchase Agreements. (6) Includes trust preferred securities. 3Q 2020 Preliminary Results 12Balance Sheet & Net Interest Margin 3Q 20 2Q 20 3Q 19 ($ millions) Average Average Average Balance Yield Balance Yield Balance Yield Retail Auto Loan $ 72,999 6.56% $ 72,262 6.48% $ 73,162 6.66% Retail Auto Loan (excl. hedge impact) 6.83% 6.77% 6.66% Auto Lease (net of depreciation) 9,317 7.89% 9,068 4.10% 8,525 6.24% Commercial Auto 21,265 3.30% 26,106 3.55% 33,273 4.59% Corporate Finance 6,188 5.40% 6,580 5.64% 5,166 7.14% (1) Mortgage 17,096 3.00% 17,422 3.15% 17,723 3.51% (2) 53,248 1.43% 45,092 1.87% 36,467 2.82% Cash, Securities and Other Total Earning Assets $ 1 80,113 4.35% $ 176,530 4.39% $ 1 74,316 5.14% (3)(6) Unsecured Debt $ 12,315 5.74% $ 11,627 6.11% $ 13,164 6.15% Secured Debt 6,154 2.94% 8,122 2.64% 9,860 3.02% (4) Deposits 132,964 1.35% 127,014 1.72% 117,638 2.22% (5) 14,427 2.36% 16,567 2.25% 19,996 2.48% Other Borrowings (3) $ 1 65,860 1.82% $ 163,330 2.13% $ 160,658 2.62% Total Funding Sources (3) 2.67% 2.42% 2.72% NIM (excluding Core OID) NIM (as reported) 2.65% 2.40% 2.70% (1) Mortgage includes held-for-investment (HFI) loans from the Mortgage Finance segment and the HFI legacy mortgage portfolio in run-off at the Corporate & Other segment. (2) ‘Other’ includes Ally Lending held-for-investment consumer loans. (3) Represents a non-GAAP financial measure. Excludes Core OID and Core OID balance. See page 37 for calculation methodology and details. (4) Includes retail, brokered (inclusive of sweep deposits) and other deposits (inclusive of mortgage escrow and other deposits). (5) Includes Demand Notes, FHLB borrowings and Repurchase Agreements. (6) Includes trust preferred securities. 3Q 2020 Preliminary Results 12

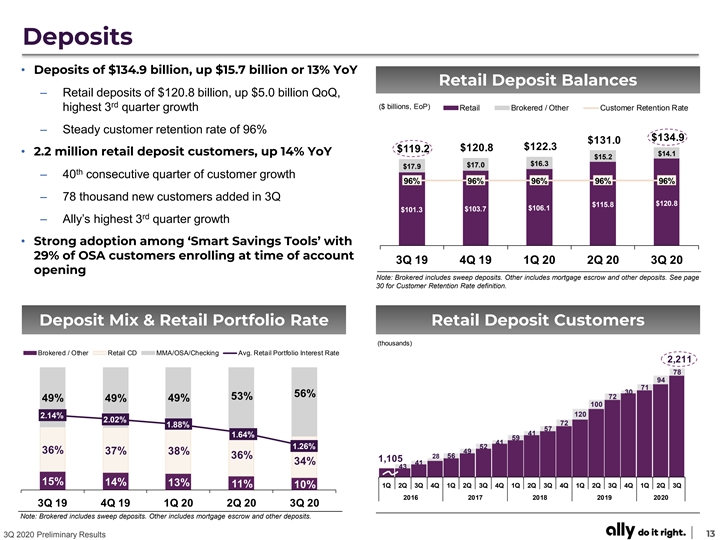

Deposits • Deposits of $134.9 billion, up $15.7 billion or 13% YoY Retail Deposit Balances – Retail deposits of $120.8 billion, up $5.0 billion QoQ, rd ($ billions, EoP) highest 3 quarter growth Retail Brokered / Other Customer Retention Rate – Steady customer retention rate of 96% $134.9 $131.0 $122.3 $120.8 $119.2 • 2.2 million retail deposit customers, up 14% YoY $14.1 $15.2 $16.3 $17.0 $17.9 th – 40 consecutive quarter of customer growth 96% 96% 96% 96% 96% – 78 thousand new customers added in 3Q $120.8 $115.8 $103.7 $106.1 $101.3 rd – Ally’s highest 3 quarter growth • Strong adoption among ‘Smart Savings Tools’ with 29% of OSA customers enrolling at time of account 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 opening Note: Brokered includes sweep deposits. Other includes mortgage escrow and other deposits. See page 30 for Customer Retention Rate definition. Deposit Mix & Retail Portfolio Rate Retail Deposit Customers (thousands) Brokered / Other Retail CD MMA/OSA/Checking Avg. Retail Portfolio Interest Rate 2,211 78 94 71 30 56% 72 53% 49% 49% 49% 100 120 2.14% 2.02% 72 1.88% 57 41 1.64% 59 41 1.26% 52 36% 37% 49 38% 56 36% 28 1,105 34% 41 43 15% 14% 13% 11% 10% 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 2016 2017 2018 2019 2020 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 Note: Brokered includes sweep deposits. Other includes mortgage escrow and other deposits. 3Q 2020 Preliminary Results 13Deposits • Deposits of $134.9 billion, up $15.7 billion or 13% YoY Retail Deposit Balances – Retail deposits of $120.8 billion, up $5.0 billion QoQ, rd ($ billions, EoP) highest 3 quarter growth Retail Brokered / Other Customer Retention Rate – Steady customer retention rate of 96% $134.9 $131.0 $122.3 $120.8 $119.2 • 2.2 million retail deposit customers, up 14% YoY $14.1 $15.2 $16.3 $17.0 $17.9 th – 40 consecutive quarter of customer growth 96% 96% 96% 96% 96% – 78 thousand new customers added in 3Q $120.8 $115.8 $103.7 $106.1 $101.3 rd – Ally’s highest 3 quarter growth • Strong adoption among ‘Smart Savings Tools’ with 29% of OSA customers enrolling at time of account 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 opening Note: Brokered includes sweep deposits. Other includes mortgage escrow and other deposits. See page 30 for Customer Retention Rate definition. Deposit Mix & Retail Portfolio Rate Retail Deposit Customers (thousands) Brokered / Other Retail CD MMA/OSA/Checking Avg. Retail Portfolio Interest Rate 2,211 78 94 71 30 56% 72 53% 49% 49% 49% 100 120 2.14% 2.02% 72 1.88% 57 41 1.64% 59 41 1.26% 52 36% 37% 49 38% 56 36% 28 1,105 34% 41 43 15% 14% 13% 11% 10% 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 2016 2017 2018 2019 2020 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 Note: Brokered includes sweep deposits. Other includes mortgage escrow and other deposits. 3Q 2020 Preliminary Results 13

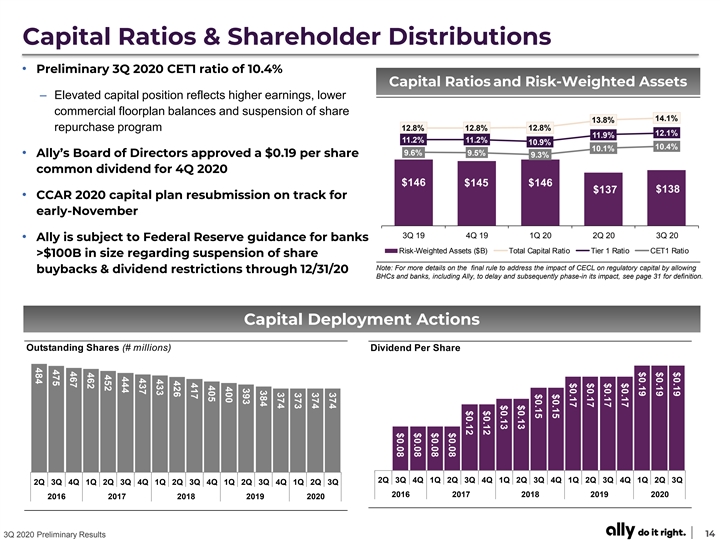

$0.19 $0.19 $0.19 $0.17 $0.17 $0.17 $0.17 $0.15 $0.15 $0.13 $0.13 $0.12 $0.12 $0.08 $0.08 $0.08 $0.08 $- 374 374 373 374 384 393 400 405 417 426 433 437 444 452 462 467 475 484 Capital Ratios & Shareholder Distributions • Preliminary 3Q 2020 CET1 ratio of 10.4% Capital Ratios and Risk-Weighted Assets – Elevated capital position reflects higher earnings, lower commercial floorplan balances and suspension of share 14.1% 13.8% repurchase program 12.8% 12.8% 12.8% 12.1% 11.9% 11.2% 11.2% 10.9% 10.4% 10.1% 9.6% 9.5% • Ally’s Board of Directors approved a $0.19 per share 9.3% common dividend for 4Q 2020 $146 $145 $146 $137 $138 • CCAR 2020 capital plan resubmission on track for early-November 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 • Ally is subject to Federal Reserve guidance for banks Risk-Weighted Assets ($B) Total Capital Ratio Tier 1 Ratio CET1 Ratio >$100B in size regarding suspension of share Note: For more details on the final rule to address the impact of CECL on regulatory capital by allowing buybacks & dividend restrictions through 12/31/20 BHCs and banks, including Ally, to delay and subsequently phase-in its impact, see page 31 for definition. Capital Deployment Actions Outstanding Shares (# millions) Dividend Per Share 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 2016 2017 2018 2019 2020 2016 2017 2018 2019 2020 3Q 2020 Preliminary Results 14$0.19 $0.19 $0.19 $0.17 $0.17 $0.17 $0.17 $0.15 $0.15 $0.13 $0.13 $0.12 $0.12 $0.08 $0.08 $0.08 $0.08 $- 374 374 373 374 384 393 400 405 417 426 433 437 444 452 462 467 475 484 Capital Ratios & Shareholder Distributions • Preliminary 3Q 2020 CET1 ratio of 10.4% Capital Ratios and Risk-Weighted Assets – Elevated capital position reflects higher earnings, lower commercial floorplan balances and suspension of share 14.1% 13.8% repurchase program 12.8% 12.8% 12.8% 12.1% 11.9% 11.2% 11.2% 10.9% 10.4% 10.1% 9.6% 9.5% • Ally’s Board of Directors approved a $0.19 per share 9.3% common dividend for 4Q 2020 $146 $145 $146 $137 $138 • CCAR 2020 capital plan resubmission on track for early-November 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 • Ally is subject to Federal Reserve guidance for banks Risk-Weighted Assets ($B) Total Capital Ratio Tier 1 Ratio CET1 Ratio >$100B in size regarding suspension of share Note: For more details on the final rule to address the impact of CECL on regulatory capital by allowing buybacks & dividend restrictions through 12/31/20 BHCs and banks, including Ally, to delay and subsequently phase-in its impact, see page 31 for definition. Capital Deployment Actions Outstanding Shares (# millions) Dividend Per Share 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 2016 2017 2018 2019 2020 2016 2017 2018 2019 2020 3Q 2020 Preliminary Results 14

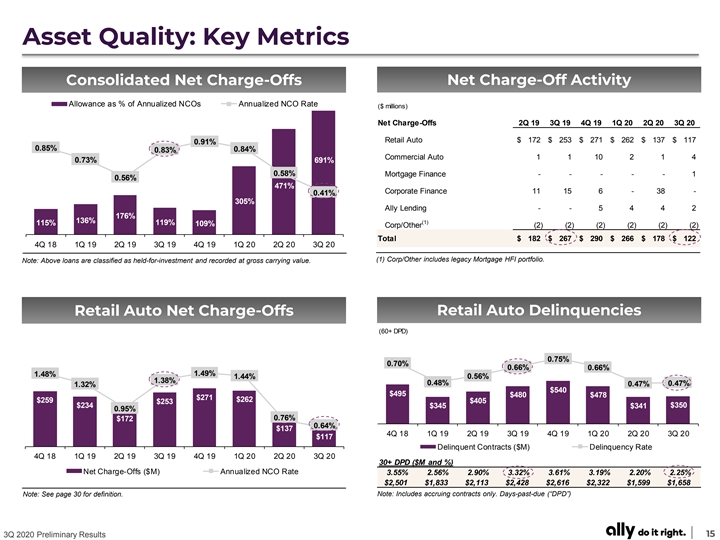

Asset Quality: Key Metrics Consolidated Net Charge-Offs Net Charge-Off Activity Allowance as % of Annualized NCOs Annualized NCO Rate ($ millions) Variance 550% 500% Net Charge-Offs 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 450% Retail Auto $ 172 $ 253 $ 271 $ 262 $ 137 $ 117 0.91% 400% 0.85% 0.84% 0.83% 350% Commercial Auto 1 1 10 2 1 4 0.73% 691% 300% 0.58% Mortgage Finance - - - - - 1 250% 0.56% 471% 200% Corporate Finance 11 15 6 - 38 - 0.41% 150% 305% Ally Lending - - 5 4 4 2 100% 176% 136% (1) 119% 115% 109% 50% Corp/Other (2) (2) (2) (2) (2) (2) 0% Total $ 182 $ 267 $ 290 $ 266 $ 178 $ 122 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 (1) Corp/Other includes legacy Mortgage HFI portfolio. Note: Above loans are classified as held-for-investment and recorded at gross carrying value. Retail Auto Delinquencies Retail Auto Net Charge-Offs (60+ DPD) 1.00% $500 $480 $460 $440 $420 0.75% $400 0.70% $380 0.66% 0.66% $360 1.49% $340 1.48% 1.44% 0.56% $320 1.38% 0.50% $300 0.48% 0.47% 1.32% 0.47% $280 $540 $260 $495 $240 $480 $478 $271 $220 $262 $259 $405 $253 $200 $234 $345 $350 $341 $180 0.95% $160 $140 0.76% $172 $120 0.00% $100 0.64% $137 $80 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 $60 $117 $40 $20 $0 Delinquent Contracts ($M) Delinquency Rate 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 30+ DPD ($M and %) Net Charge-Offs ($M) Annualized NCO Rate 3.55% 2.56% 2.90% 3.32% 3.61% 3.19% 2.20% 2.25% $2,501 $1,833 $2,113 $2,428 $2,616 $2,322 $1,599 $1,658 Note: Includes accruing contracts only. Days-past-due (“DPD”) Note: See page 30 for definition. 3Q 2020 Preliminary Results 15Asset Quality: Key Metrics Consolidated Net Charge-Offs Net Charge-Off Activity Allowance as % of Annualized NCOs Annualized NCO Rate ($ millions) Variance 550% 500% Net Charge-Offs 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 450% Retail Auto $ 172 $ 253 $ 271 $ 262 $ 137 $ 117 0.91% 400% 0.85% 0.84% 0.83% 350% Commercial Auto 1 1 10 2 1 4 0.73% 691% 300% 0.58% Mortgage Finance - - - - - 1 250% 0.56% 471% 200% Corporate Finance 11 15 6 - 38 - 0.41% 150% 305% Ally Lending - - 5 4 4 2 100% 176% 136% (1) 119% 115% 109% 50% Corp/Other (2) (2) (2) (2) (2) (2) 0% Total $ 182 $ 267 $ 290 $ 266 $ 178 $ 122 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 (1) Corp/Other includes legacy Mortgage HFI portfolio. Note: Above loans are classified as held-for-investment and recorded at gross carrying value. Retail Auto Delinquencies Retail Auto Net Charge-Offs (60+ DPD) 1.00% $500 $480 $460 $440 $420 0.75% $400 0.70% $380 0.66% 0.66% $360 1.49% $340 1.48% 1.44% 0.56% $320 1.38% 0.50% $300 0.48% 0.47% 1.32% 0.47% $280 $540 $260 $495 $240 $480 $478 $271 $220 $262 $259 $405 $253 $200 $234 $345 $350 $341 $180 0.95% $160 $140 0.76% $172 $120 0.00% $100 0.64% $137 $80 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 $60 $117 $40 $20 $0 Delinquent Contracts ($M) Delinquency Rate 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 30+ DPD ($M and %) Net Charge-Offs ($M) Annualized NCO Rate 3.55% 2.56% 2.90% 3.32% 3.61% 3.19% 2.20% 2.25% $2,501 $1,833 $2,113 $2,428 $2,616 $2,322 $1,599 $1,658 Note: Includes accruing contracts only. Days-past-due (“DPD”) Note: See page 30 for definition. 3Q 2020 Preliminary Results 15

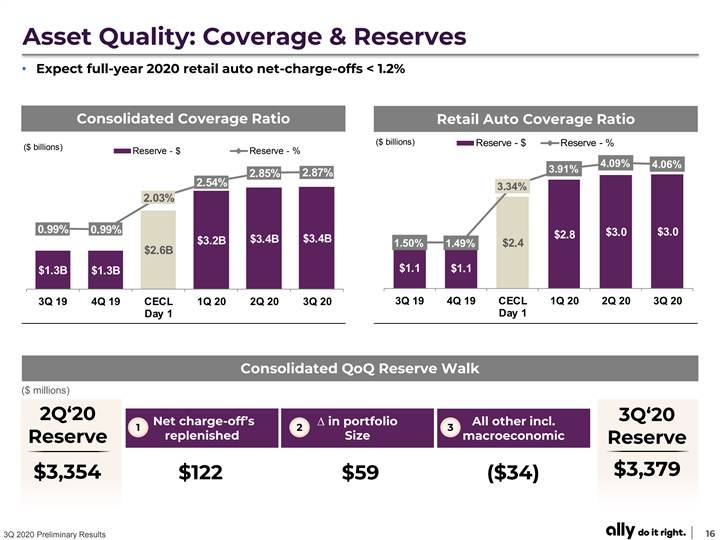

Asset Quality: Coverage & Reserves • Expect full-year 2020 retail auto net-charge-offs < 1.2% Consolidated Coverage Ratio Retail Auto Coverage Ratio ($ billions) Reserve - $ Reserve - % ($ billions) Reserve - $ Reserve - % 4.09% 4.06% 3.91% 2.87% 2.85% 2.54% 3.34% 2.03% 0.99% 0.99% $3.0 $3.0 $2.8 $3.4B $3.4B $3.2B 1.50% 1.49% $2.4 $2.6B $1.1 $1.1 $1.3B $1.3B 3Q 19 4Q 19 CECL 1Q 20 2Q 20 3Q 20 3Q 19 4Q 19 CECL 1Q 20 2Q 20 3Q 20 Day 1 Day 1 Consolidated QoQ Reserve Walk ($ millions) 2Q‘20 3Q‘20 Net charge-off’s ∆ in portfolio All other incl. 1 2 3 replenished Size macroeconomic Reserve Reserve $3,379 $3,354 $122 $59 ($34) 3Q 2020 Preliminary Results 16Asset Quality: Coverage & Reserves • Expect full-year 2020 retail auto net-charge-offs < 1.2% Consolidated Coverage Ratio Retail Auto Coverage Ratio ($ billions) Reserve - $ Reserve - % ($ billions) Reserve - $ Reserve - % 4.09% 4.06% 3.91% 2.87% 2.85% 2.54% 3.34% 2.03% 0.99% 0.99% $3.0 $3.0 $2.8 $3.4B $3.4B $3.2B 1.50% 1.49% $2.4 $2.6B $1.1 $1.1 $1.3B $1.3B 3Q 19 4Q 19 CECL 1Q 20 2Q 20 3Q 20 3Q 19 4Q 19 CECL 1Q 20 2Q 20 3Q 20 Day 1 Day 1 Consolidated QoQ Reserve Walk ($ millions) 2Q‘20 3Q‘20 Net charge-off’s ∆ in portfolio All other incl. 1 2 3 replenished Size macroeconomic Reserve Reserve $3,379 $3,354 $122 $59 ($34) 3Q 2020 Preliminary Results 16

Auto: COVID-19 Deferral Program Update • Ally provided COVID-19 assistance to ~30% or ~1.3M consumer auto accounts | ~99% expired as of 9/30/20 • Customer Engagement: Rolled out enhanced digital portal & new communication technology during 3Q • Preparedness: Ongoing utilization of scalable staffing model & resource capabilities Ally Deferral Population Trends Deferral Population % of Consumer Auto Accounts by Status @ 9/30/2020 30% 1.0% Expired: Re-extended 3% 2.4% Expired: 30+ Delinquent 8% or Charged-off 25% 20% 15% (1) Expired: Current or 89% 26.6% Paid-in-full 10% 5% 0% Mar'20 Apr'20 May'20 Jun'20 Jul'20 Aug'20 Sep'20 Note: Consumer Auto deferral program data as of 9/30/2020. (1) Current accounts are < 30 days past due. 3Q 2020 Preliminary Results 17Auto: COVID-19 Deferral Program Update • Ally provided COVID-19 assistance to ~30% or ~1.3M consumer auto accounts | ~99% expired as of 9/30/20 • Customer Engagement: Rolled out enhanced digital portal & new communication technology during 3Q • Preparedness: Ongoing utilization of scalable staffing model & resource capabilities Ally Deferral Population Trends Deferral Population % of Consumer Auto Accounts by Status @ 9/30/2020 30% 1.0% Expired: Re-extended 3% 2.4% Expired: 30+ Delinquent 8% or Charged-off 25% 20% 15% (1) Expired: Current or 89% 26.6% Paid-in-full 10% 5% 0% Mar'20 Apr'20 May'20 Jun'20 Jul'20 Aug'20 Sep'20 Note: Consumer Auto deferral program data as of 9/30/2020. (1) Current accounts are < 30 days past due. 3Q 2020 Preliminary Results 17

Auto Finance • Pre-tax income of $566 million, up $137 million YoY Increase/(Decrease) vs. and up $237 million QoQ Key Financials ($ millions) 3Q 20 2Q 20 3Q 19 Net financing revenue $ 1,102 $ 113 $ 24 – Net financing revenue up YoY and QoQ due to higher gains Total other revenue 61 21 2 on off-lease vehicles and increased retail revenue Total net revenue 1,163 134 26 Provision for credit losses 128 (128) ( 137) (1) Noninterest expense 469 25 26 – Provision expense reflects lower net charge-off activity Pre-tax income $ 566 $ 237 $ 137 U.S. auto earning assets (EOP) $ 1 04,792 $ 1,618 $ (10,085) – Noninterest expense reflects staffing and investments in servicing and collections activities Key Statistics Remarketing gains ($ millions) $ 81 $ 42 $ 70 • Earning assets of $104.8 billion, down $10.1 billion YoY Average gain per vehicle $ 2,437 $ 2,858 $ 1,494 and up $1.6 billion QoQ Off-lease vehicles terminated 28,917 2 ,132 (1,068) (On-balance sheet - # in units) Application Volume (# thousands) 3,240 142 6 – Commercial balances bottomed in July, with modest growth in August and September (1) Noninterest expense includes corporate allocations of $190 million in 3Q 2020, $197 million in 2Q 2020, and $184 million in 3Q 2019. – Consumer balances up modestly YoY and QoQ Retail Auto Trends (2) • Market-leading, adaptable franchise continuing to Portfolio Yield (ex. hedge) Est. Retail Auto Originated Yield Retail Auto NCO % deliver innovative solutions for dealers and customers 7.59% 7.55% 7.53% 7.50% – Application volume and origination flow remained robust, 7.33% 7.25% 7.07% 7.10% 6.95% including strong consumer demand for Used 6.83% 6.77% 6.74% 6.66% 6.66% 6.57% 6.46% 6.34% – All participating dealers who deferred wholesale charges as 6.17% part of the COVID-19 Dealer Assistance Plan are current 1.48% 1.49% 1.44% 1.38% 1.32% 1.32% 0.95% ▪ Remittance payments remain ahead of schedule 0.76% 0.64% 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 (2) Estimated Retail Auto Originated Yield is a forward-looking non-GAAP financial measure determined by calculating the estimated average annualized yield for loans originated during the period. See page 31 for details. 3Q 2020 Preliminary Results 18Auto Finance • Pre-tax income of $566 million, up $137 million YoY Increase/(Decrease) vs. and up $237 million QoQ Key Financials ($ millions) 3Q 20 2Q 20 3Q 19 Net financing revenue $ 1,102 $ 113 $ 24 – Net financing revenue up YoY and QoQ due to higher gains Total other revenue 61 21 2 on off-lease vehicles and increased retail revenue Total net revenue 1,163 134 26 Provision for credit losses 128 (128) ( 137) (1) Noninterest expense 469 25 26 – Provision expense reflects lower net charge-off activity Pre-tax income $ 566 $ 237 $ 137 U.S. auto earning assets (EOP) $ 1 04,792 $ 1,618 $ (10,085) – Noninterest expense reflects staffing and investments in servicing and collections activities Key Statistics Remarketing gains ($ millions) $ 81 $ 42 $ 70 • Earning assets of $104.8 billion, down $10.1 billion YoY Average gain per vehicle $ 2,437 $ 2,858 $ 1,494 and up $1.6 billion QoQ Off-lease vehicles terminated 28,917 2 ,132 (1,068) (On-balance sheet - # in units) Application Volume (# thousands) 3,240 142 6 – Commercial balances bottomed in July, with modest growth in August and September (1) Noninterest expense includes corporate allocations of $190 million in 3Q 2020, $197 million in 2Q 2020, and $184 million in 3Q 2019. – Consumer balances up modestly YoY and QoQ Retail Auto Trends (2) • Market-leading, adaptable franchise continuing to Portfolio Yield (ex. hedge) Est. Retail Auto Originated Yield Retail Auto NCO % deliver innovative solutions for dealers and customers 7.59% 7.55% 7.53% 7.50% – Application volume and origination flow remained robust, 7.33% 7.25% 7.07% 7.10% 6.95% including strong consumer demand for Used 6.83% 6.77% 6.74% 6.66% 6.66% 6.57% 6.46% 6.34% – All participating dealers who deferred wholesale charges as 6.17% part of the COVID-19 Dealer Assistance Plan are current 1.48% 1.49% 1.44% 1.38% 1.32% 1.32% 0.95% ▪ Remittance payments remain ahead of schedule 0.76% 0.64% 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 (2) Estimated Retail Auto Originated Yield is a forward-looking non-GAAP financial measure determined by calculating the estimated average annualized yield for loans originated during the period. See page 31 for details. 3Q 2020 Preliminary Results 18

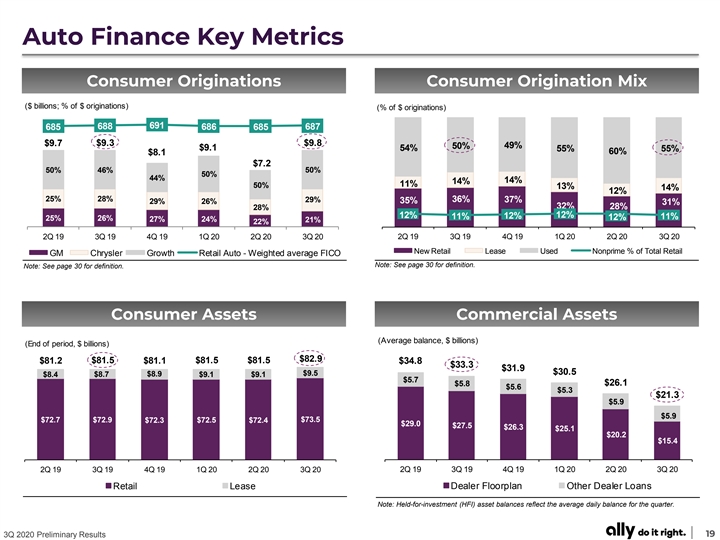

Auto Finance Key Metrics Consumer Originations Consumer Origination Mix ($ billions; % of $ originations) (% of $ originations) 688 691 685 686 685 687 $9.7 $9.3 $9.8 49% 50% $9.1 54% 55% 55% 60% $8.1 $7.2 50% 46% 50% 50% 44% 14% 14% 11% 50% 13% 14% 12% 25% 28% 29% 36% 37% 29% 26% 35% 31% 32% 28% 28% 12% 12% 11% 12% 11% 12% 25% 26% 27% 24% 21% 22% 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 New Retail Lease Used Nonprime % of Total Retail GM Chrysler Growth Retail Auto - Weighted average FICO Note: See page 30 for definition. Note: See page 30 for definition. Consumer Assets Commercial Assets (Average balance, $ billions) (End of period, $ billions) $82.9 $81.5 $81.5 $81.5 $81.2 $81.1 $34.8 $33.3 $31.9 $30.5 $9.5 $8.4 $8.7 $8.9 $9.1 $9.1 $5.7 $5.8 $26.1 $5.6 $5.3 $21.3 $5.9 $5.9 $73.5 $72.7 $72.9 $72.3 $72.5 $72.4 $29.0 $27.5 $26.3 $25.1 $20.2 $15.4 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 Retail Lease Dealer Floorplan Other Dealer Loans Note: Held-for-investment (HFI) asset balances reflect the average daily balance for the quarter. 3Q 2020 Preliminary Results 19Auto Finance Key Metrics Consumer Originations Consumer Origination Mix ($ billions; % of $ originations) (% of $ originations) 688 691 685 686 685 687 $9.7 $9.3 $9.8 49% 50% $9.1 54% 55% 55% 60% $8.1 $7.2 50% 46% 50% 50% 44% 14% 14% 11% 50% 13% 14% 12% 25% 28% 29% 36% 37% 29% 26% 35% 31% 32% 28% 28% 12% 12% 11% 12% 11% 12% 25% 26% 27% 24% 21% 22% 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 New Retail Lease Used Nonprime % of Total Retail GM Chrysler Growth Retail Auto - Weighted average FICO Note: See page 30 for definition. Note: See page 30 for definition. Consumer Assets Commercial Assets (Average balance, $ billions) (End of period, $ billions) $82.9 $81.5 $81.5 $81.5 $81.2 $81.1 $34.8 $33.3 $31.9 $30.5 $9.5 $8.4 $8.7 $8.9 $9.1 $9.1 $5.7 $5.8 $26.1 $5.6 $5.3 $21.3 $5.9 $5.9 $73.5 $72.7 $72.9 $72.3 $72.5 $72.4 $29.0 $27.5 $26.3 $25.1 $20.2 $15.4 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 Retail Lease Dealer Floorplan Other Dealer Loans Note: Held-for-investment (HFI) asset balances reflect the average daily balance for the quarter. 3Q 2020 Preliminary Results 19

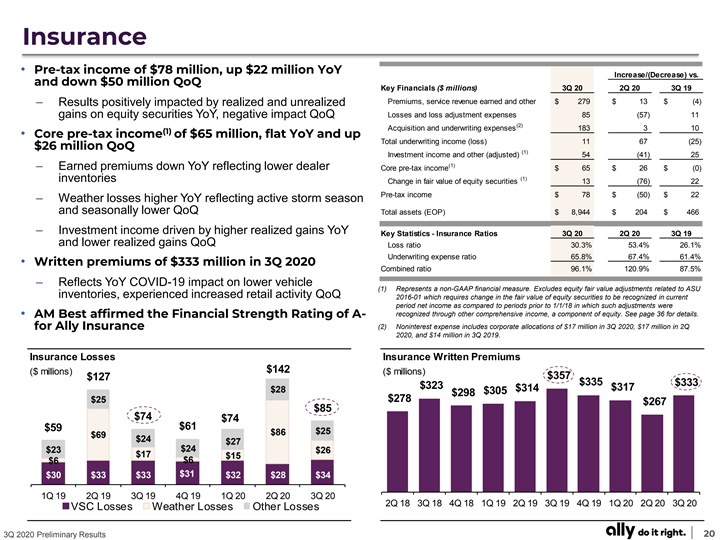

Insurance • Pre-tax income of $78 million, up $22 million YoY Increase/(Decrease) vs. and down $50 million QoQ Key Financials ($ millions) 3Q 20 2Q 20 3Q 19 Premiums, service revenue earned and other $ 279 $ 13 $ (4) – Results positively impacted by realized and unrealized Losses and loss adjustment expenses 85 (57) 11 gains on equity securities YoY, negative impact QoQ (2) Acquisition and underwriting expenses 183 3 10 (1) • Core pre-tax income of $65 million, flat YoY and up Total underwriting income (loss) 11 67 (25) $26 million QoQ (1) Investment income and other (adjusted) 54 (41) 25 (1) – Earned premiums down YoY reflecting lower dealer Core pre-tax income $ 65 $ 26 $ (0) (1) inventories Change in fair value of equity securities 13 (76) 22 Pre-tax income $ 78 $ ( 50) $ 22 – Weather losses higher YoY reflecting active storm season and seasonally lower QoQ Total assets (EOP) $ 8,944 $ 204 $ 466 – Investment income driven by higher realized gains YoY Key Statistics - Insurance Ratios 3Q 20 2Q 20 3Q 19 and lower realized gains QoQ Loss ratio 30.3% 53.4% 26.1% Underwriting expense ratio 65.8% 67.4% 61.4% • Written premiums of $333 million in 3Q 2020 Combined ratio 96.1% 120.9% 87.5% – Reflects YoY COVID-19 impact on lower vehicle (1) Represents a non-GAAP financial measure. Excludes equity fair value adjustments related to ASU inventories, experienced increased retail activity QoQ 2016-01 which requires change in the fair value of equity securities to be recognized in current period net income as compared to periods prior to 1/1/18 in which such adjustments were recognized through other comprehensive income, a component of equity. See page 36 for details. • AM Best affirmed the Financial Strength Rating of A- (2) Noninterest expense includes corporate allocations of $17 million in 3Q 2020, $17 million in 2Q for Ally Insurance 2020, and $14 million in 3Q 2019. Insurance Losses Insurance Written Premiums $142 ($ millions) ($ millions) $357 $127 $335 $333 $323 $317 $314 $28 $305 $298 $278 $25 $267 $85 $74 $74 $61 $59 $25 $86 $69 $24 $27 $24 $23 $26 $17 $15 $6 $6 $31 $30 $33 $33 $32 $28 $34 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 VSC Losses Weather Losses Other Losses 3Q 2020 Preliminary Results 20Insurance • Pre-tax income of $78 million, up $22 million YoY Increase/(Decrease) vs. and down $50 million QoQ Key Financials ($ millions) 3Q 20 2Q 20 3Q 19 Premiums, service revenue earned and other $ 279 $ 13 $ (4) – Results positively impacted by realized and unrealized Losses and loss adjustment expenses 85 (57) 11 gains on equity securities YoY, negative impact QoQ (2) Acquisition and underwriting expenses 183 3 10 (1) • Core pre-tax income of $65 million, flat YoY and up Total underwriting income (loss) 11 67 (25) $26 million QoQ (1) Investment income and other (adjusted) 54 (41) 25 (1) – Earned premiums down YoY reflecting lower dealer Core pre-tax income $ 65 $ 26 $ (0) (1) inventories Change in fair value of equity securities 13 (76) 22 Pre-tax income $ 78 $ ( 50) $ 22 – Weather losses higher YoY reflecting active storm season and seasonally lower QoQ Total assets (EOP) $ 8,944 $ 204 $ 466 – Investment income driven by higher realized gains YoY Key Statistics - Insurance Ratios 3Q 20 2Q 20 3Q 19 and lower realized gains QoQ Loss ratio 30.3% 53.4% 26.1% Underwriting expense ratio 65.8% 67.4% 61.4% • Written premiums of $333 million in 3Q 2020 Combined ratio 96.1% 120.9% 87.5% – Reflects YoY COVID-19 impact on lower vehicle (1) Represents a non-GAAP financial measure. Excludes equity fair value adjustments related to ASU inventories, experienced increased retail activity QoQ 2016-01 which requires change in the fair value of equity securities to be recognized in current period net income as compared to periods prior to 1/1/18 in which such adjustments were recognized through other comprehensive income, a component of equity. See page 36 for details. • AM Best affirmed the Financial Strength Rating of A- (2) Noninterest expense includes corporate allocations of $17 million in 3Q 2020, $17 million in 2Q for Ally Insurance 2020, and $14 million in 3Q 2019. Insurance Losses Insurance Written Premiums $142 ($ millions) ($ millions) $357 $127 $335 $333 $323 $317 $314 $28 $305 $298 $278 $25 $267 $85 $74 $74 $61 $59 $25 $86 $69 $24 $27 $24 $23 $26 $17 $15 $6 $6 $31 $30 $33 $33 $32 $28 $34 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 VSC Losses Weather Losses Other Losses 3Q 2020 Preliminary Results 20

Corporate Finance • Pre-tax income of $60 million, up $16 million YoY and Increase/(Decrease) vs. up $28 million QoQ Key Financials ($ millions) 3Q 20 2Q 20 3Q 19 Net financing revenue $ 75 $ (2) $ 15 (1) – Net financing revenue increase YoY reflects higher loan Adjusted total other revenue 8 3 (2) (1) Adjusted total net revenue 83 1 13 balances Provision for credit losses 1 (24) (2) (2) Noninterest expense 23 (3) 1 • $5.9 billion held-for-investment portfolio, up 17% YoY (1) Core pre-tax income $ 59 $ 28 $ 14 (1) Change in fair value of equity securities 1 0 2 – Credit continues to perform well despite current economic Pre-tax income $ 60 $ 28 $ 16 backdrop – risk management activities remain disciplined Total assets (EOP) $ 5,995 $ (211) $ 720 (1) Represents a non-GAAP financial measure. Excludes equity fair value adjustments related to ASU 2016-01 which requires change in the fair value of equity securities to be recognized in current – Growth in commitments reflects focused, steady origination period net income as compared to periods prior to 1/1/18 in which such adjustments were activities – utilization levels remain low recognized through other comprehensive income, a component of equity. See page 36 for details. (2) Noninterest expense includes corporate allocations of $8 million in 3Q 2020, $8 million in 2Q 2020, and $7 million in 3Q 2019. Key Corporate Finance HFI Loans and Unfunded Commitments % % % ~65 47 0 (end of period balances, $ billions) Portfolio Asset Based Portfolio w/ Direct Gas & Oil (3) Lending LIBOR Floor Exposure Metrics Corporate Finance Outstandings Loan Portfolio by Industry - 9/30/2020 Chemicals & Construction Wholesale $3.8 $2.5 $3.5 Paper Printing & Services Metals 1% 3% Other Publishing $2.6 4% 4% 1% $2.3 Other Manufactured Prod. Food And 3% Beverages 3% Machinery. Equip. Manufacturing Elect. $6.5 $6.0 $5.9 $5.7 7% Financial Services $5.0 19% Auto & Transportation 11% Other Retail Trade 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 1% Health Services 22% Held-for-investment loans Unfunded Commitments Other Services 21% (3) As of 9/30/2020 3Q 2020 Preliminary Results 21Corporate Finance • Pre-tax income of $60 million, up $16 million YoY and Increase/(Decrease) vs. up $28 million QoQ Key Financials ($ millions) 3Q 20 2Q 20 3Q 19 Net financing revenue $ 75 $ (2) $ 15 (1) – Net financing revenue increase YoY reflects higher loan Adjusted total other revenue 8 3 (2) (1) Adjusted total net revenue 83 1 13 balances Provision for credit losses 1 (24) (2) (2) Noninterest expense 23 (3) 1 • $5.9 billion held-for-investment portfolio, up 17% YoY (1) Core pre-tax income $ 59 $ 28 $ 14 (1) Change in fair value of equity securities 1 0 2 – Credit continues to perform well despite current economic Pre-tax income $ 60 $ 28 $ 16 backdrop – risk management activities remain disciplined Total assets (EOP) $ 5,995 $ (211) $ 720 (1) Represents a non-GAAP financial measure. Excludes equity fair value adjustments related to ASU 2016-01 which requires change in the fair value of equity securities to be recognized in current – Growth in commitments reflects focused, steady origination period net income as compared to periods prior to 1/1/18 in which such adjustments were activities – utilization levels remain low recognized through other comprehensive income, a component of equity. See page 36 for details. (2) Noninterest expense includes corporate allocations of $8 million in 3Q 2020, $8 million in 2Q 2020, and $7 million in 3Q 2019. Key Corporate Finance HFI Loans and Unfunded Commitments % % % ~65 47 0 (end of period balances, $ billions) Portfolio Asset Based Portfolio w/ Direct Gas & Oil (3) Lending LIBOR Floor Exposure Metrics Corporate Finance Outstandings Loan Portfolio by Industry - 9/30/2020 Chemicals & Construction Wholesale $3.8 $2.5 $3.5 Paper Printing & Services Metals 1% 3% Other Publishing $2.6 4% 4% 1% $2.3 Other Manufactured Prod. Food And 3% Beverages 3% Machinery. Equip. Manufacturing Elect. $6.5 $6.0 $5.9 $5.7 7% Financial Services $5.0 19% Auto & Transportation 11% Other Retail Trade 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 1% Health Services 22% Held-for-investment loans Unfunded Commitments Other Services 21% (3) As of 9/30/2020 3Q 2020 Preliminary Results 21

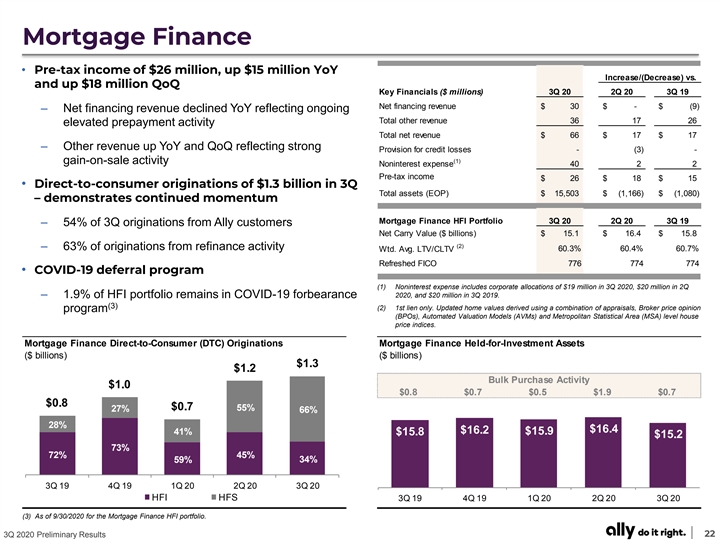

Mortgage Finance • Pre-tax income of $26 million, up $15 million YoY Increase/(Decrease) vs. and up $18 million QoQ Key Financials ($ millions) 3Q 20 2Q 20 3Q 19 Net financing revenue $ 30 $ - $ (9) – Net financing revenue declined YoY reflecting ongoing Total other revenue 36 17 26 elevated prepayment activity Total net revenue $ 66 $ 17 $ 17 – Other revenue up YoY and QoQ reflecting strong Provision for credit losses - (3) - (1) gain-on-sale activity Noninterest expense 40 2 2 Pre-tax income $ 26 $ 18 $ 15 • Direct-to-consumer originations of $1.3 billion in 3Q Total assets (EOP) $ 15,503 $ (1,166) $ (1,080) – demonstrates continued momentum Mortgage Finance HFI Portfolio 3Q 20 2Q 20 3Q 19 – 54% of 3Q originations from Ally customers Net Carry Value ($ billions) $ 15.1 $ 16.4 $ 15.8 (2) – 63% of originations from refinance activity 60.3% 60.4% 60.7% Wtd. Avg. LTV/CLTV Refreshed FICO 776 774 774 • COVID-19 deferral program (1) Noninterest expense includes corporate allocations of $19 million in 3Q 2020, $20 million in 2Q – 1.9% of HFI portfolio remains in COVID-19 forbearance 2020, and $20 million in 3Q 2019. (3) (2) 1st lien only. Updated home values derived using a combination of appraisals, Broker price opinion program (BPOs), Automated Valuation Models (AVMs) and Metropolitan Statistical Area (MSA) level house price indices. Mortgage Finance Direct-to-Consumer (DTC) Originations Mortgage Finance Held-for-Investment Assets ($ billions) ($ billions) $1.3 $1.2 Bulk Purchase Activity $1.0 $0.8 $0.7 $0.5 $1.9 $0.7 $0.8 $0.7 55% 27% 66% 28% $16.4 $16.2 41% $15.8 $15.9 $15.2 73% 72% 45% 59% 34% 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 HFI HFS 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 (3) As of 9/30/2020 for the Mortgage Finance HFI portfolio. 3Q 2020 Preliminary Results 22Mortgage Finance • Pre-tax income of $26 million, up $15 million YoY Increase/(Decrease) vs. and up $18 million QoQ Key Financials ($ millions) 3Q 20 2Q 20 3Q 19 Net financing revenue $ 30 $ - $ (9) – Net financing revenue declined YoY reflecting ongoing Total other revenue 36 17 26 elevated prepayment activity Total net revenue $ 66 $ 17 $ 17 – Other revenue up YoY and QoQ reflecting strong Provision for credit losses - (3) - (1) gain-on-sale activity Noninterest expense 40 2 2 Pre-tax income $ 26 $ 18 $ 15 • Direct-to-consumer originations of $1.3 billion in 3Q Total assets (EOP) $ 15,503 $ (1,166) $ (1,080) – demonstrates continued momentum Mortgage Finance HFI Portfolio 3Q 20 2Q 20 3Q 19 – 54% of 3Q originations from Ally customers Net Carry Value ($ billions) $ 15.1 $ 16.4 $ 15.8 (2) – 63% of originations from refinance activity 60.3% 60.4% 60.7% Wtd. Avg. LTV/CLTV Refreshed FICO 776 774 774 • COVID-19 deferral program (1) Noninterest expense includes corporate allocations of $19 million in 3Q 2020, $20 million in 2Q – 1.9% of HFI portfolio remains in COVID-19 forbearance 2020, and $20 million in 3Q 2019. (3) (2) 1st lien only. Updated home values derived using a combination of appraisals, Broker price opinion program (BPOs), Automated Valuation Models (AVMs) and Metropolitan Statistical Area (MSA) level house price indices. Mortgage Finance Direct-to-Consumer (DTC) Originations Mortgage Finance Held-for-Investment Assets ($ billions) ($ billions) $1.3 $1.2 Bulk Purchase Activity $1.0 $0.8 $0.7 $0.5 $1.9 $0.7 $0.8 $0.7 55% 27% 66% 28% $16.4 $16.2 41% $15.8 $15.9 $15.2 73% 72% 45% 59% 34% 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 HFI HFS 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 (3) As of 9/30/2020 for the Mortgage Finance HFI portfolio. 3Q 2020 Preliminary Results 22

Strategic Priorities Relentless Customer Focus and ‘Do It Right’ Culture Leading, adaptable Auto & Insurance businesses Lending and digitally-based Ally Bank platform Consumer & Commercial Ongoing customer growth & relationship Savings & deepening across scalable platforms Insurance Checking Accelerated growth in expanded product offerings Servicing Efficient & disciplined risk management and & Customer Investing capital deployment Solutions Focus on long-term execution & sustainable Payments returns across all products Steady execution in current environment | Delivering on long-term strategic objectives 3Q 2020 Preliminary Results 23Strategic Priorities Relentless Customer Focus and ‘Do It Right’ Culture Leading, adaptable Auto & Insurance businesses Lending and digitally-based Ally Bank platform Consumer & Commercial Ongoing customer growth & relationship Savings & deepening across scalable platforms Insurance Checking Accelerated growth in expanded product offerings Servicing Efficient & disciplined risk management and & Customer Investing capital deployment Solutions Focus on long-term execution & sustainable Payments returns across all products Steady execution in current environment | Delivering on long-term strategic objectives 3Q 2020 Preliminary Results 23

Supplemental 3Q 2020 Preliminary Results 24Supplemental 3Q 2020 Preliminary Results 24

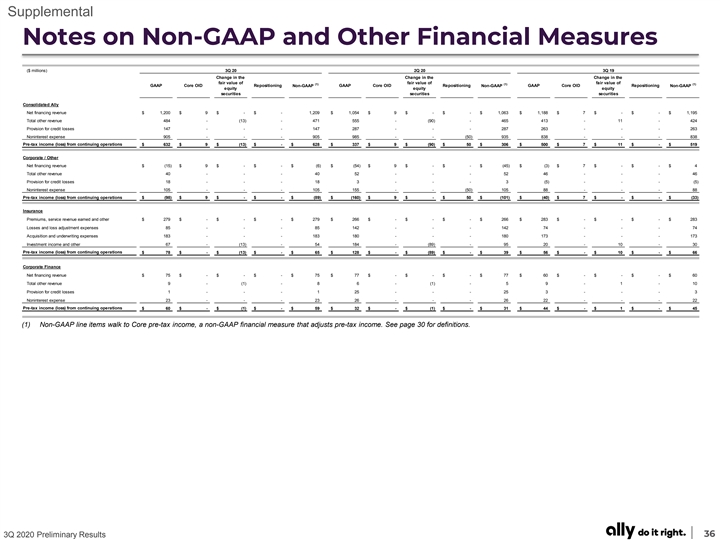

Supplemental Results by Segment Pre-Tax Income ($ millions) 3Q 20 2Q 20 3Q 19 Automotive Finance $ 566 $ 329 $ 429 Insurance 78 128 56 Dealer Financial Services $ 644 $ 457 $ 485 Corporate Finance 60 32 44 Mortgage Finance 26 8 11 Corporate and Other (9 8) (160) (4 0) Pre-tax income from continuing operations $ 632 $ 337 $ 500 (1) 9 9 7 Core OID (2) (1 3) (90) 11 Change in fair value of equity securities (3) - 50 - Repositioning and other (4) $ 628 $ 306 $ 519 Core pre-tax income (1) Core OID for all periods shown is applied to the pre-tax income of the Corporate and Other segment. (2) Change in fair value of equity securities impacts the Insurance and Corporate Finance segments. Reflects equity fair value adjustments related to ASU 2016-01 which requires change in the fair value of equity securities to be recognized in current period net income as compared to periods prior to 1/1/18 in which such adjustments were recognized through other comprehensive income, a component of equity. See pages 36 for details. (3) Repositioning and other include a $50 million Goodwill impairment at Ally Invest in 2Q 20. (4) Core pre-tax income is a non-GAAP financial measure that adjusts pre-tax income from continuing operations for Core OID, equity fair value adjustments related to ASU 2016-01, and, repositioning and other which are primarily related to the extinguishment of high cost legacy debt, strategic activities and significant other one- time items. Management believes core pre-tax income can help the reader better understand the operating performance of the core businesses and their ability to generate earnings. See page 36 for calculation methodology and details. 3Q 2020 Preliminary Results 25Supplemental Results by Segment Pre-Tax Income ($ millions) 3Q 20 2Q 20 3Q 19 Automotive Finance $ 566 $ 329 $ 429 Insurance 78 128 56 Dealer Financial Services $ 644 $ 457 $ 485 Corporate Finance 60 32 44 Mortgage Finance 26 8 11 Corporate and Other (9 8) (160) (4 0) Pre-tax income from continuing operations $ 632 $ 337 $ 500 (1) 9 9 7 Core OID (2) (1 3) (90) 11 Change in fair value of equity securities (3) - 50 - Repositioning and other (4) $ 628 $ 306 $ 519 Core pre-tax income (1) Core OID for all periods shown is applied to the pre-tax income of the Corporate and Other segment. (2) Change in fair value of equity securities impacts the Insurance and Corporate Finance segments. Reflects equity fair value adjustments related to ASU 2016-01 which requires change in the fair value of equity securities to be recognized in current period net income as compared to periods prior to 1/1/18 in which such adjustments were recognized through other comprehensive income, a component of equity. See pages 36 for details. (3) Repositioning and other include a $50 million Goodwill impairment at Ally Invest in 2Q 20. (4) Core pre-tax income is a non-GAAP financial measure that adjusts pre-tax income from continuing operations for Core OID, equity fair value adjustments related to ASU 2016-01, and, repositioning and other which are primarily related to the extinguishment of high cost legacy debt, strategic activities and significant other one- time items. Management believes core pre-tax income can help the reader better understand the operating performance of the core businesses and their ability to generate earnings. See page 36 for calculation methodology and details. 3Q 2020 Preliminary Results 25