- AJRD Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Aerojet Rocketdyne (AJRD) DEF 14ADefinitive proxy

Filed: 17 Feb 12, 12:00am

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrantþ

Filed by a Party other than the Registrant¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12

GenCorp Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þ No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

| 2001 Aerojet Road Rancho Cordova, CA 95742 |

February 17, 2012

Dear Shareholder:

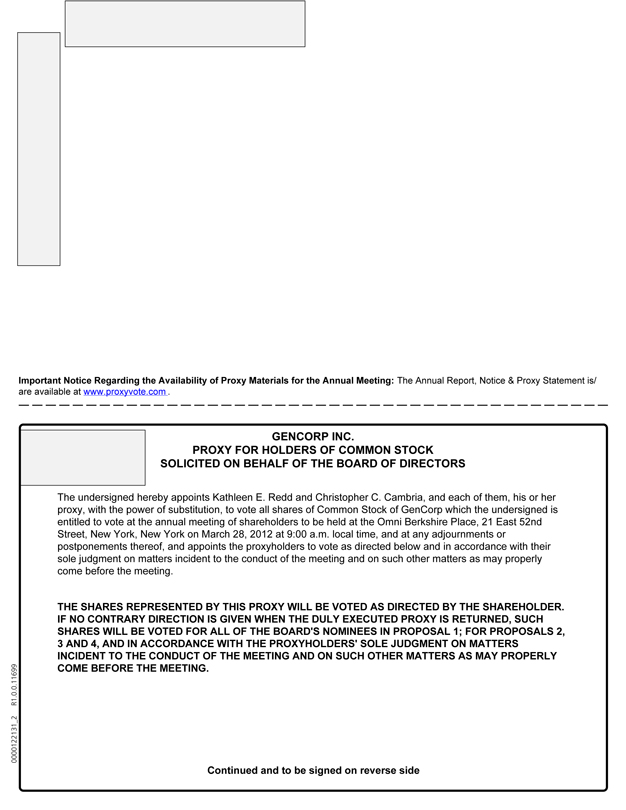

You are cordially invited to attend the 2012 Annual Meeting of Shareholders of GenCorp Inc., which will be held on March 28, 2012 at 9:00 a.m. Eastern time, at the Omni Berkshire Place, 21 East 52nd Street, New York, New York. Details of the business to be presented at the meeting can be found in the accompanying Notice of Annual Meeting and Proxy Statement.

We have elected to take advantage of the Securities and Exchange Commission’s rule that allows us to furnish our proxy materials to our shareholders over the Internet. We believe electronic delivery will expedite the receipt of materials and, by printing and mailing a smaller volume, will reduce the environmental impact of our annual meeting materials and help lower our costs. On or about February 17, 2012, a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) will be mailed to our shareholders. This Notice contains instructions on how to access the Notice of Annual Meeting, Proxy Statement and Annual Report to Shareholders online. You will not receive a printed copy of these materials, unless you specifically request one. The Notice of Internet Availability contains instructions on how to receive a paper copy of the proxy materials. For those participants who hold shares of GenCorp’s common stock in the GenCorp Retirement Savings Plan, you will receive a full set of annual meeting materials and a proxy card by mail.

On behalf of the Board of Directors and the management of GenCorp Inc., I extend our appreciation for your continued support.

Very truly yours,

JAMES R. HENDERSON

Chairman of the Board

| 2001 Aerojet Road Rancho Cordova, CA 95742 |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TIME: | 9:00 a.m. Eastern time on Wednesday, March, 28, 2012 | |

PLACE: | The Omni Berkshire Place, 21 East 52nd Street, New York, New York | |

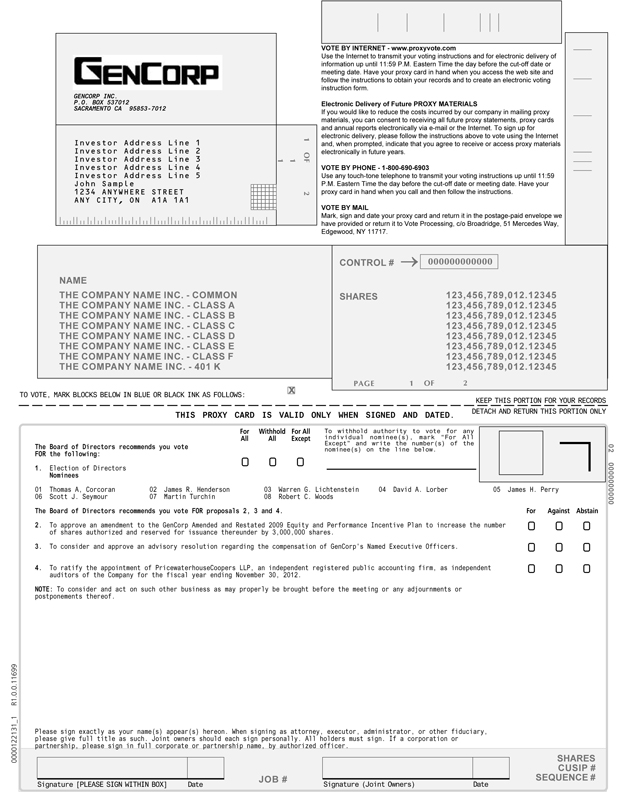

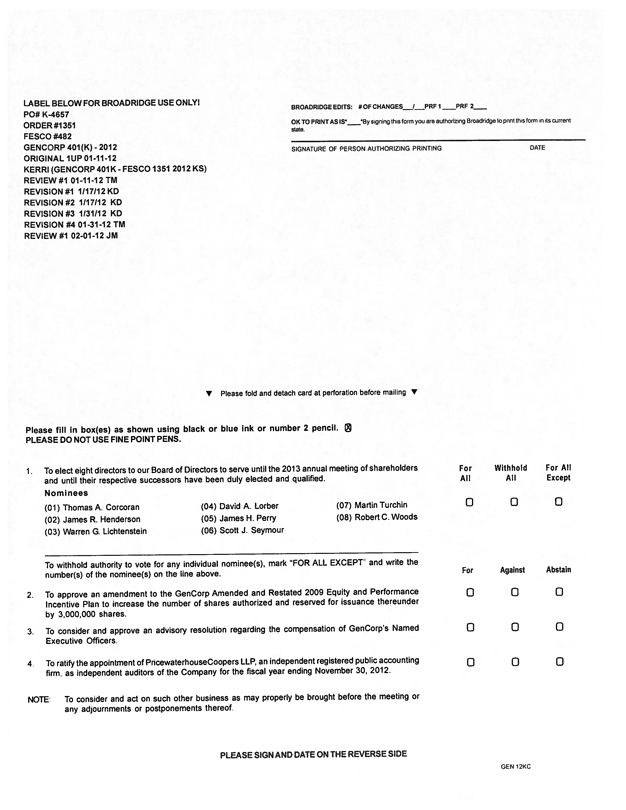

ITEMS OF BUSINESS: | 1. To elect eight directors to our Board of Directors to serve until the 2013 annual meeting of shareholders and until their respective successors have been duly elected and qualified; | |

2. To approve an amendment to the GenCorp Amended and Restated 2009 Equity and Performance Incentive Plan to increase the number of shares authorized and reserved for issuance thereunder by 3,000,000 shares; | ||

3. To consider and approve an advisory resolution regarding the compensation of GenCorp’s Named Executive Officers; | ||

4. To ratify the appointment of PricewaterhouseCoopers LLP, an independent registered public accounting firm, as independent auditors of the Company for the fiscal year ending November 30, 2012; and | ||

5. To consider and act on such other business as may properly be brought before the meeting or any adjournments or postponements thereof. | ||

RECORD DATE: | You are entitled to vote at the 2012 Annual Meeting if you were a shareholder of record at the close of business on January 31, 2012. | |

ANNUAL MEETING ADMISSION: | In addition to a form of valid photo identification, you must bring evidence of your ownership of GenCorp common stock (which, if you are a beneficial holder, can be obtained from your bank, broker or other record holder of your shares) in order to be admitted. | |

PROXY VOTING: | It is important that your shares be represented and voted at the meeting. You may vote your shares by voting in person at the meeting, by Internet, by telephone or by completing, signing, dating and returning a proxy card which will be mailed to you if you request delivery of a full set of proxy materials. Participants in the GenCorp Retirement Savings Plan must follow the voting instructions provided by Fidelity Management Trust Company. See details under the heading “How do I vote?” | |

INSPECTION OF LIST OF SHAREHOLDERS OF RECORD: | A list of the shareholders of record as of the record date will be available for inspection at the Annual Meeting. | |

By Order of the Board of Directors,

/s/ KATHLEEN E. REDD

Vice President,

Chief Financial Officerand Secretary

| 2001 Aerojet Road Rancho Cordova, CA 95742 |

PROXY STATEMENT

FOR THE 2012 ANNUAL MEETING OF SHAREHOLDERS

To Be Held On March 28, 2012

GENERAL INFORMATION

The Board of Directors (the “Board”) of GenCorp Inc., an Ohio corporation (“GenCorp” or the “Company”) solicits the enclosed proxy for use at the Company’s 2012 annual meeting of shareholders (the “Annual Meeting”) to be held at the Omni Berkshire Place, 21 East 52nd Street, New York, New York on March 28, 2012 at 9:00 a.m. Eastern time.

FREQUENTLY ASKED QUESTIONS

WHY DID I RECEIVE THIS PROXY STATEMENT?

The Board is soliciting your proxy to vote at the Annual Meeting because you were a shareholder of the Company’s common stock, par value $0.10 per share (“Common Stock”), at the close of business (5:00 p.m. Eastern time) on January 31, 2012, (the “Record Date”) and therefore you are entitled to vote at the Annual Meeting. This Proxy Statement contains information about the matters to be voted on at the meeting and the voting process, as well as information about the Company’s Board of Directors (“Directors”) and executive officers.

We are providing you with a Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”) and access to these proxy materials in connection with the solicitation by the Board of the Company to be used at the Annual Meeting and at any adjournment or postponement. The Notice of Internet Availability will be sent to shareholders of record and beneficial shareholders starting on or around February 17, 2012. The Proxy materials, including the Notice of Annual Meeting, Proxy Statement, and 2011 Annual Report, will be made available to shareholders on the Internet on February 17, 2012. For those participants who hold shares of GenCorp’s Common Stock in the GenCorp Retirement Savings Plan, you will receive a full set of annual meeting materials and a proxy card for those shares.

WHY DID I RECEIVE A NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS THIS YEAR INSTEAD OF A FULL SET OF PROXY MATERIALS?

Pursuant to the rules of the Securities and Exchange Commission (the “SEC”), we are providing access to the Company’s proxy materials over the Internet rather than printing and mailing them to all shareholders. We believe electronic delivery will expedite the receipt of these materials, reduce the environmental impact of our annual meeting materials and will help lower our costs. Therefore, the Notice of Internet Availability will be mailed to shareholders (or e-mailed, in the case of shareholders that have previously requested to receive proxy materials electronically) starting on or around February 17, 2012. The Notice of Internet Availability will provide instructions as to how shareholders may access and review the proxy materials on the website referred to in the Notice of Internet Availability or, alternatively, how to request that a copy of the proxy materials, including a proxy card, be sent to them by mail. The Notice of Internet Availability will also provide voting instructions. In addition, shareholders may request to receive the proxy materials in printed form by mail or electronically by e-mail on an ongoing basis for future shareholder meetings. Please note that, while our proxy materials are available at www.proxyvote.com referenced in the Notice of Internet Availability, no other information contained on the website is incorporated by reference in or considered to be a part of this Proxy Statement.

1

WHY DID I RECEIVE MORE THAN ONE NOTICE OF INTERNET AVAILABILITY?

You may receive multiple Notices of Internet Availability if you hold your shares of GenCorp’s Common Stock in multiple accounts (such as through a brokerage account). If you hold your shares of GenCorp’s Common Stock in multiple accounts you should vote your shares as described in each separate Notice of Internet Availability you receive.

IF GENCORP IS UTILIZING NOTICE OF INTERNET AVAILABILILTY, WHY DID I RECEIVE A FULL SET OF ANNUAL MEETING MATERIALS AND A PROXY CARD?

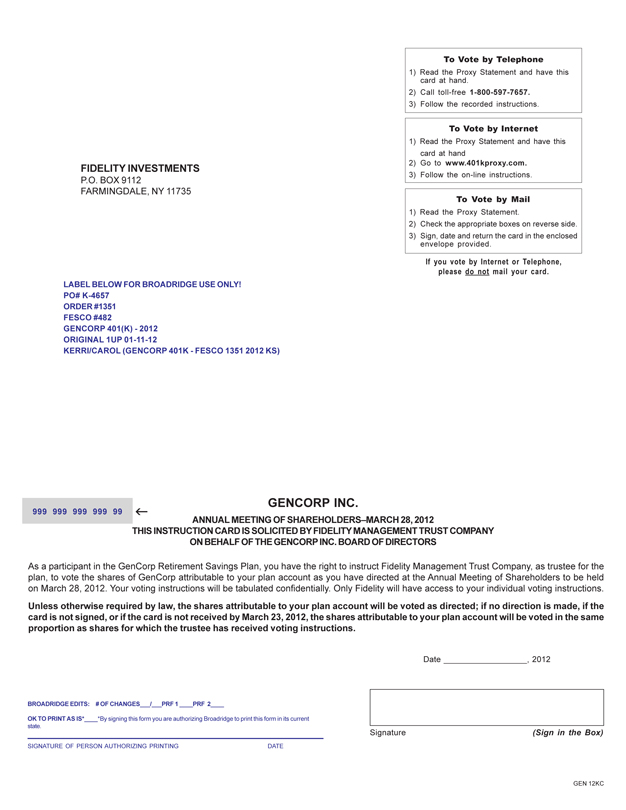

For those participants who hold shares of GenCorp’s Common Stock in the GenCorp Retirement Savings Plan, you will receive a full set of annual meeting materials and proxy card for those shares. Fidelity Management Trust Company, (the “Trustee”), is not utilizing Notice of Internet Availability for the GenCorp Retirement Savings Plan participants.

WHAT AM I VOTING ON?

You are voting on the following items of business at the Annual Meeting:

| • | To elect eight directors to our Board of Directors (the Board’s nominees are: Thomas A. Corcoran; James R. Henderson; Warren G. Lichtenstein; David A. Lorber; James H. Perry; Scott J. Seymour; Martin Turchin; and Robert C. Woods) to serve until the 2013 annual meeting of shareholders and until their respective successors have been duly elected and qualified (“Proposal 1”); |

| • | To approve an amendment to the GenCorp Amended and Restated 2009 Equity and Performance Incentive Plan (the “2009 Incentive Plan”) to increase the number of shares authorized and reserved for issuance thereunder by 3,000,000 shares (“Proposal 2”); |

| • | To consider and approve an advisory resolution regarding the compensation of GenCorp’s Named Executive Officers (“Proposal 3”); |

| • | To ratify the appointment of PricewaterhouseCoopers LLP (“PwC”), an independent registered public accounting firm, as independent auditors of the Company for the fiscal year ending November 30, 2012 (“Proposal 4”); and |

| • | Any other matter that may properly be brought before the Annual Meeting. |

WHO IS ENTITLED TO VOTE?

Shareholders of record as of the Record Date are entitled to vote at the Annual Meeting. Each share of Common Stock is entitled to one vote.

WHAT ARE THE VOTING RECOMMENDATIONS OF THE BOARD?

The Board recommends that you vote your shares “FOR” each of the Board’s eight nominees standing for election to the Board; “FOR” approval of an amendment to the 2009 Incentive Plan to increase the number of shares authorized and reserved for issuance thereunder by 3,000,000 shares; “FOR” the advisory resolution regarding the compensation of GenCorp’s Named Executive Officers; and “FOR” the ratification of PwC, an independent registered public accounting firm, as independent auditors of the Company.

HOW DO I VOTE?

It is important that your shares are represented at the Annual Meeting whether or not you attend the meeting in person. To make sure that your shares are represented, we urge you to vote as soon as possible.

2

SHARES HELD IN THE GENCORP RETIREMENT SAVINGS PLAN

Please follow the voting instructions provided by Fidelity Management Trust Company, the Trustee. You may sign, date and return a voting instruction card to the Trustee or submit voting instructions by telephone or the Internet. If you provide voting instructions by mail, telephone, or the Internet, the Trustee will vote your shares as you have directed (or not vote your shares, if that is your direction). If you do not provide voting instructions, the Trustee will vote your shares in the same proportion as shares for which the Trustee has received voting instructions. You must submit voting instructions to the Trustee by no later than March 23, 2012 at 11:59 p.m. Eastern time in order for your shares to be voted as you have directed by the Trustee at the Annual Meeting. GenCorp Retirement Savings Plan participants may not vote their Plan shares in person at the Annual Meeting.

SHARES HELD BY YOU, YOUR BROKER, BANK OR OTHER HOLDER OF RECORD

You may vote in several different ways:

In person at the Annual Meeting

You may vote in person at the Annual Meeting. You may also be represented by another person at the meeting by executing a proxy properly designating that person. If you are the beneficial owner of shares held in “street name,” you must obtain a legal proxy from your broker, bank or other holder of record and present it to the inspectors of election with your ballot to be able to vote at the meeting.

By telephone

You may vote by calling the toll-free telephone number indicated on your proxy card. Easy-to-follow voice prompts allow you to vote your shares and confirm that your voting instructions have been properly recorded.

By Internet

You may vote by going to the Internet web site indicated on your proxy card. Confirmation that your voting instructions have been properly recorded will be provided.

By mail

You may vote by completing, signing, dating and returning a proxy card which will be mailed to you if you request delivery of a full set of proxy materials. A postage-paid envelope will be provided along with the proxy card.

Telephone and Internet voting for shareholders of record will be available until 11:59 p.m. Eastern time on March 27, 2012. A mailed proxy card must be received by March 27, 2012 in order to be voted at the Annual Meeting. The availability of telephone and Internet voting for beneficial owners of other shares held in “street name” will depend on your broker, bank or other holder of record and we recommend that you follow the voting instructions on the Notice of Internet Availability that you receive from them.

If you are mailed a set of proxy materials and a proxy card or voting instruction card and you choose to vote by telephone or by Internet, you do not have to return your proxy card or voting instruction card. However, even if you plan to attend the Annual Meeting, we recommend that you vote your shares in advance so that your vote will be counted if you later decide not to attend the meeting.

MAY I ATTEND THE MEETING?

All shareholders and properly appointed proxy holders may attend the Annual Meeting. Shareholders who plan to attend must present valid photo identification. If you hold your shares in a brokerage account,

3

please also bring proof of your share ownership, such as a broker’s statement showing that you owned shares of the Company on the Record Date, or a legal proxy from your broker or nominee. A legal proxy is required if you hold your shares in a brokerage account and you plan to vote in person at the Annual Meeting. Shareholders of record will be verified against an official list available at the Annual Meeting. The Company reserves the right to deny admittance to anyone who cannot adequately show proof of share ownership as of the Record Date.

WHAT IS THE DIFFERENCE BETWEEN HOLDING SHARES AS A SHAREHOLDER OF RECORD AND AS A BENEFICIAL OWNER?

If your shares are registered directly in your name with GenCorp’s transfer agent, Computershare Shareowner Services, LLC, you are considered a “shareholder of record” or a “registered shareholder” of those shares. In this case, your Notice of Internet Availability has been sent to you directly by Broadridge Financial Solutions, Inc. If your shares are held in a stock brokerage account or by a bank, trust or other nominee or custodian, including shares you may own as a participant in the Company’s Retirement Savings Plan, you are considered the “beneficial owner” of those shares, which are held in “street name.” A Notice of Internet Availability has been forwarded to you by or on behalf of your broker, bank, trustee or other holder who is considered the shareholder of record of those shares. As the beneficial owner, you have the right to direct your broker, bank, trustee or other holder of record as to how to vote your shares by following their instructions for voting.

WHAT ARE BROKER NON-VOTES AND HOW ARE THEY COUNTED?

Broker non-votes occur when nominees, such as brokers and banks holding shares on behalf of the beneficial owners, are prohibited from exercising discretionary voting authority for beneficial owners who have not provided voting instructions at least ten days before the Annual Meeting. If no instructions are given within that time frame, the nominees may vote those shares on matters deemed “routine” by the New York Stock Exchange (“NYSE”). On non-routine matters such as Proposal Nos. 1 through 3, nominees cannot vote without instructions from the beneficial owner, resulting in so-called “broker non-votes.” Broker non-votes are not counted for the purposes of determining the number of shares present in person or represented by proxy on a voting matter. For these reasons, please promptly vote by telephone, or Internet, or sign, date and return the voting instruction card your broker or nominee has enclosed, in accordance with the instructions on the card.

MAY I CHANGE MY VOTE?

If you are a shareholder of record, you may revoke your proxy at any time before it is voted at the Annual Meeting by:

| • | Returning a later-dated, signed proxy card; |

| • | Sending written notice of revocation to the Company, c/o the Secretary; |

| • | Submitting a new, proper proxy by telephone, Internet or paper ballot, after the date of the earlier voted proxy; or |

| • | Attending the Annual Meeting and voting in person. |

If you are a beneficial owner of shares, you may submit new voting instructions by contacting your broker, bank or other nominee. You may also vote in person at the Annual Meeting if you obtain a legal proxy as described above.

4

WHAT VOTE IS REQUIRED TO APPROVE EACH PROPOSAL?

Directors are elected by a plurality of the votes cast at the Annual Meeting. Votes cast for a nominee will be counted in favor of election. Abstentions and broker non-votes will not count either in favor of, or against, election of a nominee. Proxies cannot be voted for a greater number of persons than the number of Directors set by the Board for election. Proposals 2 through 4, will require the affirmative vote of a majority of all of the votes cast. Abstentions and broker non-votes will have no effect on the outcome of the vote on Proposals 2 through 4.

DO SHAREHOLDERS HAVE CUMULATIVE VOTING RIGHTS WITH RESPECT TO THE ELECTION OF DIRECTORS?

No. Shareholders do not have cumulative voting rights with respect to the election of Directors.

WHAT CONSTITUTES A QUORUM?

As of the Record Date, 59,707,500 shares of Common Stock were outstanding. A majority of the outstanding shares entitled to vote at the Annual Meeting, represented in person or by proxy, will constitute a quorum. Shares represented by a proxy that directs that the shares abstain from voting or that a vote be withheld on a matter and broker “non-votes” will be included at the Annual Meeting for quorum purposes. Shares represented by proxy as to which no voting instructions are given as to matters to be voted upon will be included at the Annual Meeting for quorum purposes.

WHAT IS THE COMPANY’S INTERNET ADDRESS?

The Company’s Internet address iswww.GenCorp.com. You can access this Proxy Statement and the Company’s 2011 Annual Report on Form 10-K at this Internet address. The Company’s filings with the SEC are available free of charge via a link from this address. Copies are also available in print to any shareholder or other interested person who requests it by writing to Secretary, GenCorp Inc., 2001 Aerojet Road, Rancho Cordova, California 95742.

WILL ANY OTHER MATTERS BE VOTED ON?

As of the date of this Proxy Statement, our management knows of no other matter that will be presented for consideration at the Annual Meeting other than those matters discussed in this Proxy Statement. If any other matters properly come before the Annual Meeting and call for a vote of the shareholders, validly executed proxies in the enclosed form will be voted in accordance with the recommendation of the Board.

WHO IS SOLICITING PROXIES UNDER THIS PROXY STATEMENT?

The proxies being solicited hereby are being solicited by our Board. The cost of soliciting proxies in the enclosed form will be borne by the Company. Officers and regular employees of the Company may, but without compensation other than their regular compensation, solicit proxies by further mailing or personal conversations, or by telephone, facsimile or electronic means. The Company will, upon request, reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of stock.

ARE THERE DISSENTER’S OR APPRAISAL RIGHTS?

The Company’s shareholders are not entitled to dissenter’s or appraisal rights under Ohio law in connection with any of the Items of Business.

5

PROPOSAL 1

ELECTION OF DIRECTORS

The Company’s Amended Code of Regulations provides for a Board of not less than seven or more than seventeen Directors, and authorizes the Board to determine from time to time the number of Directors within that range that will constitute the Board by the affirmative vote of a majority of the members then in office. The Board has fixed the number of Directors to be elected at the Annual Meeting at eight.

The Board has proposed the following nominees for election as Directors at the Annual Meeting: Thomas A. Corcoran; James R. Henderson; Warren G. Lichtenstein; David A. Lorber; James H. Perry; Scott J. Seymour; Martin Turchin; and Robert C. Woods. Each nominee elected as a Director will continue in office until the next annual meeting of shareholders at which their successor has been elected, or until his resignation, removal from office, or death, whichever is earlier.

The Board recommends a vote FOR the election of these nominees as Directors.

Director Qualifications and Experience

The Board, acting through the Corporate Governance & Nominating Committee, seeks a Board that, as a whole, possesses the experience, skills, background and qualifications appropriate to function effectively in light of the Company’s current and evolving business circumstances. The Corporate Governance & Nominating Committee reviews the size of the Board, the tenure of its Directors and their skills, backgrounds and experiences in determining the slate of nominees and whether to seek one or more new candidates. The Committee seeks directors with established records of significant accomplishments in business and areas relevant to the Company’s strategies. With respect to the nomination of continuing Directors for re-election, the individual’s contributions to the Board are also considered.

All of our Directors bring to our Board a wealth of executive leadership experience derived from their service as executives and, in some cases, chief executive officers of large corporations. They also bring extensive board experience. The process undertaken by the Corporate Governance & Nominating Committee in recommending qualified director candidates is described in theDirector Nominations section on page 15.

Set forth below are the names and ages of the nominees for Directors and their principal occupations at present and for the past five years, as well as their particular experience, qualifications, attributes or skills that led the Board to conclude that the person should serve as a Director for the Company. There are, to the knowledge of the Company, no agreements or understandings by which these individuals were so selected. No family relationships exist between any Directors or executive officers, as such term is defined in Item 402 of Regulation S-K promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The information concerning the nominees set forth below is given as of December 31, 2011.

THOMAS A. CORCORAN

Director since 2008

Mr. Corcoran has been a Senior Advisor of The Carlyle Group, a private equity investment firm, and the President of Corcoran Enterprises, LLC, a management consulting company, since 2001. Previously Mr. Corcoran was also the President and Chief Executive Officer (“CEO”) of Gemini Air Cargo, Inc., a cargo airline owned by The Carlyle Group, from 2001 to 2004. Prior to that, Mr. Corcoran was President and CEO of Allegheny Teledyne Incorporated, a specialty metals producer from 1999 to 2000. Prior to that, Mr. Corcoran was President and Chief Operating Officer (“COO”) of Lockheed Martin’s Electronics and Space Sectors from 1993 to 1999. Mr. Corcoran began his career in 1967 at General Electric Company in

6

various positions. In 1990, Mr. Corcoran was elected a corporate officer and rose to the number two position in G.E. Aerospace as Vice President and General Manager of G.E. Aerospace Operations. Mr. Corcoran is a director with L-3 Communications Holdings, Inc. (Chairman of the Audit Committee) and ARINC, Inc., a Carlyle Group company. Mr. Corcoran is also Chairman of ONPATH Technologies, Inc., a privately owned high tech company. Mr. Corcoran was a Director with Force Protection, Inc., REMEC, Inc., United Industrial Corporation, LaBarge, Inc. (Audit Committee member), Aer Lingus, Ltd. based in Dublin, Ireland and Serco, Ltd. based in Surry, UK. Mr. Corcoran serves as a director of American Ireland Fund, is on the board of trustees of Stevens Institute of Technology and is a trustee emeritus at Worcester Polytechnic Institute. Mr. Corcoran brings to the Board considerable industry knowledge gained from extensive experience as a senior executive in the aerospace industry. Mr. Corcoran also brings to the Board significant public company board experience, including service as a director of a Fortune 500 company. Mr. Corcoran currently serves as a member of the Organization & Compensation Committee. Age 67.

JAMES R. HENDERSON

Director since 2008

Mr. Henderson was a Managing Director and operating partner of Steel Partners LLC (“Steel Partners”), a subsidiary of Steel Partners Holdings L.P. (“SPH”), a global diversified holding company that owns and operates businesses and has significant interests in leading companies in a variety of industries, including diversified industrial products, energy, defense, banking, insurance, and food products and services, until April 2011. He was associated with Steel Partners and its affiliates from August 1999 until April 2011. Mr. Henderson served as a director of DGT Holdings Corp., a manufacturer of proprietary high-voltage power conversion subsystems and components, from November 2003 until December 2011. Mr. Henderson also served as a director of SL Industries, Inc. (“SLI”), a company that designs, manufactures and markets power electronics, motion control, power protection, power quality electromagnetic and specialized communication equipment, from January 2002 to March 2010. Mr. Henderson was an Executive Vice President of SP Acquisition Holdings, Inc. (“SPAH”), a company formed for the purpose of acquiring one or more businesses or assets, from February 2007 until October 2009. He was a director of Angelica Corporation, a provider of healthcare linen management services, from August 2006 to August 2008. Mr. Henderson was a director and CEO of the predecessor entity of SPH, WebFinancial Corporation (“WebFinancial”), from June 2005 to April 2008, President and COO from November 2003 to April 2008, and was the Vice President of Operations from September 2000 to December 2003. He was also the CEO of WebBank, a wholly-owned subsidiary of SPH, from November 2004 to May 2005. He was a director of ECC International Corp., a manufacturer and marketer of computer controlled simulators for training personnel to perform maintenance and operation procedures on military weapons, from December 1999 to September 2003 and was acting CEO from July 2002 to March 2003. He served as the Chairman of the Board of Point Blank Solutions, Inc. (“Point Blank”), a designer and manufacturer of protective body armor, from August 2008 until October 2011, CEO from September 2009 until October 2011, and was Acting CEO from April 2009 to August 2009. Mr. Henderson was also the CEO and Chairman of the Board of Directors of certain subsidiaries of Point Blank. On April 14, 2010, Point Blank and certain of its subsidiaries filed voluntary petitions for relief under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware. The Chapter 11 petitions are being jointly administered under the caption “In re Point Blank Solutions, Inc., et. al.” Case No. 10-11255, which case is ongoing. He has served as the CEO of Point Blank Enterprises, Inc., the successor to the business of Point Blank, since October 2011. Mr. Henderson serves as a Manager of the Board of Managers of Easton Development Company, LLC, a subsidiary of GenCorp. Mr. Henderson’s substantial experience advising and managing public companies provides the Board with well-developed leadership skills and ability to promote the best interests of shareholders. Mr. Henderson currently serves as Chairman of the Board and Chairman of the Corporate Governance & Nominating Committee. Age 54.

7

WARREN G. LICHTENSTEIN

Director since 2008

Mr. Lichtenstein has served as the Chairman of the Board and CEO of the general partner of SPH since July 15, 2009. He is also the Chairman and CEO of Steel Partners and has been associated with Steel Partners and its affiliates since 1990. He is a Co-Founder of Steel Partners Japan Strategic Fund (Offshore), L.P., a private investment partnership investing in Japan, and Steel Partners China Access I LP, a private equity partnership investing in China. He also co-founded Steel Partners II, L.P., a private investment partnership that is now a wholly-owned subsidiary of SPH, in 1993. He has served as Chairman of the Board of Handy & Harman Ltd., a diversified manufacturer of engineered niche industrial products, since July 2005. He has served as a director of SLI since March 2010. He previously served as a director (formerly Chairman of the Board) of SLI from January 2002 to May 2008 and served as CEO from February 2002 to August 2005. Mr. Lichtenstein served as the Chairman of the Board, President and CEO of SPAH from February 2007 until October 2009. Mr. Lichtenstein has served as a director (currently Chairman of the Board) of Steel Excel Inc., a company whose business is expected to consist primarily of capital redeployment and identification of new, profitable operations in the sports, training, education, entertainment and lifestyle businesses, since October 2010. He served as a director of WebFinancial from 1996 to June 2005, as Chairman and CEO from December 1997 to June 2005 and as President from December 1997 to December 2003. From May 2001 to November 2007, Mr. Lichtenstein served as a director (formerly Chairman of the Board) of United Industrial Corporation, a company principally focused on the design, production and support of defense systems, which was acquired by Textron Inc. He served as a director of KT&G Corporation, South Korea’s largest tobacco company, from March 2006 to March 2008. Mr. Lichtenstein served as a director of Layne Christensen Company, a provider of products and services for the water, mineral, construction and energy markets, from January 2004 to October 2006. Mr. Lichtenstein is qualified to serve as a director due to his expertise in corporate finance, record of success in managing private investment funds and his service as a director of, and advisor to, a diverse group of public companies. Mr. Lichtenstein currently serves as a member of the Organization & Compensation Committee. Age 46.

DAVID A. LORBER

Director since 2006

Mr. Lorber is a Co-Founder and Portfolio Manager for FrontFour Capital Group LLC, a hedge fund since 2007. Mr. Lorber is also a Co-Founder and Principal of FrontFour Capital Corp. Previously, Mr. Lorber was a Senior Investment Analyst at Pirate Capital LLC, a hedge fund from 2003 to 2006. Prior to that, Mr. Lorber was an Analyst at Vantis Capital Management LLC, a money management firm and hedge fund from 2001 to 2003 and an Associate at Cushman & Wakefield, Inc. Mr. Lorber also serves as a Director of Fisher Communications Inc. and Huntingdon Real Estate Investment Trust and was a Trustee for IAT Air Cargo Facilities Income Fund from January 2009 to December 2009. Mr. Lorber brings to the Board significant financial and investment industry experience and experience as a public company director. Mr. Lorber currently serves as Chairman of the Organization & Compensation Committee and as a member of the Audit Committee. Age 33.

JAMES H. PERRY

Director since 2008

Mr. Perry has been a self employed financial consultant since 2008. Previously, Mr. Perry served as Vice President of United Industrial Corporation, which, through its wholly-owned subsidiary AAI Corporation, designs, produces and supports aerospace and defense systems, from 1998 to 2007, as Chief Financial Officer (“CFO”) from 1995 to 2007, as Treasurer from 1994 to 2005, and as Controller from 2005 to 2007.

8

Mr. Perry served as CFO of AAI Corporation from 2000 to 2007, as Treasurer from 2000 to 2005, and as Vice President from 1997 to 2007. Mr. Perry, a certified public accountant, held various positions in the Assurance practice of Ernst & Young LLP, a global leader in assurance, tax, transaction and advisory services, from 1987 to 1994. Mr. Perry’s background as a financial consultant, senior executive and certified public accountant provides the Board with sophisticated financial expertise and oversight. Mr. Perry currently serves as Chairman of the Audit Committee and as a member of the Organization & Compensation Committee. Age 50.

SCOTT J. SEYMOUR

Director since 2010

Mr. Seymour joined the Company on January 6, 2010, as President and CEO of the Company and was appointed President of Aerojet-General Corporation (“Aerojet”) on January 26, 2010. Prior to that, Mr. Seymour had served as a consultant to Northrop Grumman Corporation, a global defense and technology company (“Northrop”), since March 2008. Mr. Seymour joined Northrop in 1983. Prior to becoming a consultant in March 2008, Mr. Seymour most recently served as Corporate Vice President and President of Integrated Systems Sector of Northrop from 2002 until March 2008. Mr. Seymour also served as Vice President, Air Combat Systems, Vice President and B-2 Program Manager and Vice President, Palmdale Operations, of Northrop, from 1998 to 2001, 1996 to 1998 and 1993 to 1996, respectively. Prior to joining Northrop, Mr. Seymour was involved in the manufacture and flight-testing of F-14A, EF-111A and F/A-18A aircraft for each of Grumman Aerospace Corporation and McDonnell Aircraft Company. Mr. Seymour is a member of the National Museum United States Air Force Board of Managers and the Board of the Air Warrior Courage Foundation. He is also a member of the Florida Institute of Technology Board of Trustees and a director of the Astronauts Memorial Foundation. Mr. Seymour serves as a Manager of the Board of Managers of Easton Development Company, LLC, a subsidiary of GenCorp. Mr. Seymour’s extensive experience as a senior executive provides the Board with significant operational expertise and an in-depth knowledge of the aerospace and defense industry. Age 61.

MARTIN TURCHIN

Director since 2008

Mr. Turchin is a Vice-Chairman of CB Richard Ellis, the world’s largest real estate services company, a position he has held since 2003. Previously, Mr. Turchin served as a Vice-Chairman of a subsidiary of Insignia Financial Group, a real estate brokerage, consulting and management firm from 1996 to 2003. Prior to that, Mr. Turchin was a principal and Vice-Chairman of Edward S. Gordon Company, a real estate brokerage, consulting and management firm from 1985 to 1996. Mr. Turchin has been a director of Boston Properties, a real estate investment trust, for more than ten years. Mr. Turchin held various positions with Kenneth E. Laub & Company, Inc., a real estate company, where he was involved in real estate acquisition, financing, leasing and consulting from 1971 to 1985. Mr. Turchin also serves as a trustee for the Turchin Family Charitable Foundation. Mr. Turchin serves as a Manager of the Board of Managers of Easton Development Company, LLC, a subsidiary of GenCorp. Mr. Turchin’s considerable experience in the real estate industry and service as a director of public companies provides the board with valuable expertise in real estate matters and experience in advising companies. Mr. Turchin currently serves as a member of the Audit Committee and as a member of the Corporate Governance & Nominating Committee. Age 70.

ROBERT C. WOODS

Director since 2006

Mr. Woods is CEO and Founder of Palladian Capital Advisors, a national investment bank that provides capital raising and corporate finance advisory services for clients in the commercial real estate, home building, shipping and oil and gas industries. Mr. Woods has been an Investment Banker at Cornerstone

9

Capital Advisors (“Cornerstone”), a real estate investment bank, since 1987. Mr. Woods has also been a real estate developer for Palladian Partners (“Palladian”), a real estate development company since 1983. At both Cornerstone and Palladian, Mr. Woods’ experience includes developing and financing master planned communities. Previously, Mr. Woods was the Vice President of Development for the Cullen Center in Houston, Texas from 1982 to 1983, a Project Manager and Vice President of Development for Hines Interests LLC, a real estate development company from 1980 to 1983, a Project Manager for Trammell Crow, a real estate development company from 1979 to 1980. Mr. Woods was also a consulting professor of real estate finance at Stanford University from 2000 to 2005. Mr. Woods is a Chartered Financial Analyst (“CFA”). As a CFA and through extensive experience, Mr. Woods brings to the Board significant financial and real estate related knowledge and expertise. Mr. Woods currently serves as a member of the Audit Committee and as a member of the Corporate Governance & Nominating Committee. Age 59.

The Board unanimously recommends that shareholders vote FOR each of these nominees as Directors by executing and returning the proxy card or voting by one of the other ways indicated thereon. Proxies solicited by the Board will be so voted unless shareholders specify otherwise.

Voting for Directors

The Company has no provision for cumulative voting in the election of Directors. Therefore, holders of Common Stock are entitled to cast one vote for each share held on the Record Date for each of the candidates for election. Directors are elected by a plurality of the votes cast at the Annual Meeting; however, the Board has adopted a majority vote policy. Pursuant to such policy, in an uncontested election, any nominee for Director who receives a greater number of votes “withheld” for his election than votes “for” such election (a “Majority Withheld Vote”) shall promptly tender his resignation after such election for consideration by the Corporate Governance & Nominating Committee. In determining its recommendation to the Board, the Corporate Governance & Nominating Committee will consider all factors deemed relevant by its members. These factors may include the underlying reasons why shareholders “withheld” votes for election from such Director (if ascertainable), the length of service and qualifications of the Director whose resignation has been tendered, the Director’s contributions to the Company, whether by accepting such resignation the Company will no longer be in compliance with any applicable law, rule, regulation or governing document, and whether or not accepting the resignation is in the best interests of the Company and our shareholders. Within 90 days thereafter, the Board, taking into account the recommendation of the Corporate Governance & Nominating Committee and such additional information and factors that the Board believes to be relevant, must determine whether to accept or reject the resignation. The Director that tendered the resignation shall not participate in the consideration or determination of whether to accept such resignation. The Board shall disclose by press release its decision to accept or reject the resignation and, if applicable, the reasons for rejecting the resignation. If a majority of the Corporate Governance & Nominating Committee members receive a Majority Withheld Vote at the same election, then the independent Directors who did not receive a Majority Withheld Vote will appoint a committee of independent Directors to consider the resignation offers and recommend to the Board whether to accept or reject them.

Votes cast for a nominee will be counted in favor of election. Abstentions and broker non-votes will not count either in favor of, or against, election of a nominee. It is the intention of the persons named in the accompanying form of proxy to vote for the election of the Board’s nominees, unless authorization to do so is withheld. Proxies cannot be voted for a greater number of persons than the number of Directors set by the Board for election. If, prior to the Annual Meeting, a nominee becomes unable to serve as a Director for any reason, the proxy holders reserve the right to substitute another person of their choice in such nominee’s place and stead. It is not anticipated that any nominee will be unavailable for election at the Annual Meeting.

10

Retirement Policy

Under the Board’s retirement policy, a Director’s term of office normally expires at the annual meeting of shareholders following their 75th birthday. The Board’s retirement policy also provides that the Board may waive immediate compliance with the policy and request that a Director postpone their retirement until a subsequent date.

Meetings of the Board

The Board held eight meetings during fiscal year 2011. All of the Directors who served during fiscal year 2011 attended at least 75% of the regularly scheduled and special meetings of the Board and Board committees on which they served and to which they were invited in fiscal year 2011, except Mr. Lichtenstein. All of the Board’s nominees for election at the Annual Meeting are expected to attend the Annual Meeting. All but one of the Directors nominated for election at the 2011 annual meeting of shareholders were present at such meeting.

Meetings of Non-Employee Directors

Non-employee Directors (consists of all Directors other than Mr. Seymour) meet in executive session as part of each regularly scheduled Board meeting. In 2011, the Chairman of the Board, presided at all such executive sessions. In the event of the Chairman’s absence, a non-employee Director is chosen on a rotating basis to preside.

Board Leadership Structure

In February 2007, as part of its ongoing commitment to corporate governance, the Board made a decision to separate the positions of Chairman of the Board and CEO. Prior to February 2007, the positions of Chairman of the Board and CEO were historically held by the same person. In March 2007, the Company’s shareholders approved the Board’s recommendations to amend the Company’s Amended Code of Regulations (the “Code of Regulations”) to allow the Board the flexibility to choose whether to elect a non-executive Chairman, who would not be an officer of the Company, or have one person serve in both capacities. Since March 2007, the Board has appointed a non-executive to serve as Chairman of the Board.

Pursuant to the Company’s corporate governance guidelines, the duties of the non-executive Chairman of the Board include:

| • | preparing the agenda for Board meetings in consultation with the CEO; |

| • | presiding over all meetings of the shareholders and Board, including all executive sessions of the independent Directors; |

| • | serving as liaison between the CEO and the Board; |

| • | collaborating with senior management to provide timely information to the Board; and |

| • | collaborating with the Organization & Compensation Committee to review the performance of the CEO. |

As directors continue to have increasingly more oversight responsibilities, the Company believes it is beneficial to have an independent Chairman whose sole responsibility is leading the Board, leaving the CEO’s main focus on the Company’s business goals and promoting both short-term and long-term growth.

Pursuant to the Code of Regulations and the Company’s corporate governance guidelines, the Board determines the leadership structure of the Company. As part of the Board’s annual self-evaluation process, the Board evaluates the Company’s leadership structure to ensure that it provides the optimal structure for the Company and shareholders. At this time, the Board believes the current leadership structure, with

11

Mr. Seymour serving as CEO and Mr. Henderson serving as Chairman of the Board, is the most advantageous for the Company. However, the Board recognizes that there is no single, generally accepted approach to providing corporate leadership, and the Company’s leadership structure may change in the future as circumstances warrant.

Board Role in Risk Oversight

Management has the primary responsibility for identifying and managing the risks facing the Company, subject to the oversight of the Board. The Board strives to effectively oversee the Company’s enterprise-wide risk management in a way that balances managing risks while enhancing the long-term value of the Company for the benefit of the shareholders. The Board of Directors understands that its focus on effective risk oversight is critical to setting the Company’s tone and culture towards effective risk management. To administer its oversight function, the Board seeks to understand the Company’s risk philosophy by having discussions with management to establish a mutual understanding of the Company’s overall appetite for risk. The Company’s Board of Directors maintains an active dialogue with management about existing risk management processes and how management identifies, assesses and manages the Company’s most significant risk exposures. The Company’s Board receives frequent updates from management about the Company’s most significant risks so as to enable it to evaluate whether management is responding appropriately.

The Board of Directors relies on each of its committees to help oversee the risk management responsibilities relating to the functions performed by such committees. The Audit Committee periodically discusses with management the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures, including the Company’s risk assessment and risk management policies. The Organization & Compensation Committee helps the Board to identify the Company’s exposure to any risks potentially created by our compensation programs and practices. The Governance & Nominating Committee oversees risks relating to the Company’s corporate compliance programs and assists the Board and management in promoting an organizational culture that encourages commitment to ethical conduct and a commitment to compliance with the law. Each of these committees is required to regularly report on its actions and to make recommendations to the Board, including recommendations to assist the Board with its overall risk oversight function. The Board retains oversight responsibility for all subject matters not specifically assigned to a committee, including risks presented by the Company’s business strategy, competition, regulation, general industry trends, and capital structure.

Determination of Independence of Directors

The Board has determined that to be considered independent, a Director may not have a direct or indirect material relationship with the Company. A material relationship is one which impairs or inhibits, or has the potential to impair or inhibit, a Director’s exercise of critical and disinterested judgment on behalf of the Company and its shareholders. In making its assessment of independence, the Board considers any and all material relationships not merely from the standpoint of the Director, but also from that of persons or organizations with which the Director has or has had an affiliation, or those relationships which may be material, including commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships, among others. The Board also considers whether a Director was an employee of the Company within the last five years. The Board consults with the Company’s counsel to ensure that the Board’s determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent” Director, including those set forth in pertinent listing standards of the NYSE as in effect from time to time. The NYSE’s listing standards require that all listed companies have a majority of independent directors. For a director to be “independent” under the NYSE listing standards, the board of directors of a listed company must affirmatively determine that the director has no material relationship with the company, or its subsidiaries or affiliates, either directly or as a partner, shareholder or officer of an

12

organization that has a relationship with the company or its subsidiaries or affiliates. In accordance with the NYSE listing standards, the Board has affirmatively determined that each of the Board’s nominees, other than Mr. Seymour, have no material relationships with the Company, either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company.

To determine the independence of its Directors, the Company examined the following NYSE listing standards, which provide that a director is not independent if:

| • | the director is, or has been within the last three years, an employee of the listed Company, or an immediate family member is, or has been within the last three years, an executive officer of the listed Company; |

| • | the director has received, or has an immediate family member who has received, during any twelve-month period within the last three years, more than $120,000 in direct compensation from the listed Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service); |

| • | (a) the director is a current partner or employee of a firm that is the listed Company’s internal or external auditor; (b) the director has an immediate family member who is a current partner of such a firm; (c) the director has an immediate family member who is a current employee of such a firm and personally works on the listed Company’s audit; or (d) the director or an immediate family member was within the last three years (but is no longer) a partner or employee of such a firm and personally worked on the listed Company’s audit within that time; |

| • | the director or an immediate family member is, or has been within the last three years, employed as an executive officer of another company where any of the listed Company’s present executive officers at the same time serves or served on that company’s compensation committee; or |

| • | the director is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to or received payments from, the listed Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other listed Company’s consolidated gross revenues. |

On September 9, 2011, the Company repurchased $15.5 million principal amount of its 2 1/4% convertible subordinated debentures from SPH Group Holdings LLC for an aggregate purchase price of $15,438,000, plus brokerage commissions and accrued and unpaid interest, which was a related party transaction. A member of the Company’s Board of Directors, Mr. Lichtenstein, is the Chairman and CEO of the manager of SPH Group Holdings LLC.

Each of the Board’s nominees, other than Mr. Seymour, has been determined to be “independent” by the NYSE listing standards.

Board Committees

The Board maintains three standing committees: the Audit Committee; the Corporate Governance & Nominating Committee; and the Organization & Compensation Committee. In addition, non-standing committees include the Pricing Committee, the Authorization Committee, and the Benefits Management Committee. Assignments to, and chairs of, the committees are recommended by the Corporate Governance & Nominating Committee and approved by the Board. All committees report on their activities to the Board. Each standing committee operates under a charter approved by the Board. The charters for each of the standing committees are posted on the Company’s web site atwww.GenCorp.comand in print to any shareholder or interested party who requests them by writing to Secretary, GenCorp Inc., 2001 Aerojet Road, Rancho Cordova, California 95742.

13

The following table provides the membership and total number of meetings held by each standing committee of the Board in fiscal year 2011:

| Name | Audit | Corporate Governance & Nominating | Organization & Compensation | |||

Scott J. Seymour | ||||||

Thomas A. Corcoran | X | |||||

James R. Henderson | X* | |||||

Warren G. Lichtenstein | X | |||||

David A. Lorber | X | X* | ||||

James H. Perry | X* | X | ||||

Martin Turchin | X | X | ||||

Robert C. Woods | X | X | ||||

Total meetings in fiscal year 2011 | 5 | 2 | 5 |

| * | Committee Chairman |

The Audit Committee is a separately designated standing committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Board has determined that each member of the Audit Committee meets all applicable independence and financial literacy requirements under the NYSE listing standards. The Board has also determined that Mr. Perry is an “audit committee financial expert” under the applicable rules promulgated pursuant to the Exchange Act. The Audit Committee reviews and evaluates the scope of the audits to be performed by, the adequacy of services performed by, and the fees and compensation of, the independent auditors. The Audit Committee also reviews the Company’s audited financial statements with management and with the Company’s independent auditors and recommends to the Board to include the audited financial statements in the Annual Report on Form 10-K; approves in advance all audit and permitted non-audit services to be provided by the independent auditors; reviews and considers matters that may have a bearing upon continuing audit or independence; prepares the report of the Audit Committee to be included in the Company’s Proxy Statement; appoints the independent auditors to examine the consolidated financial statements of the Company; reviews and evaluates the scope and appropriateness of the Company’s internal audit function, internal audit plans and system of internal controls; reviews and evaluates the appropriateness of the Company’s selection or application of accounting principles and practices and financial reporting; receives periodic reports from the internal audit and law departments; and reviews and oversees the Company’s compliance with legal and regulatory requirements.

The Corporate Governance & Nominating Committee periodically reviews and makes recommendations to the Board concerning the criteria for selection and retention of Directors, the composition of the Board (including the Chairman of the Board), the structure and function of Board committees, and the retirement policy of Directors. The Corporate Governance & Nominating Committee also assists in identifying, and recommends to the Board, qualified candidates to serve as Directors of the Company and considers and makes recommendations to the Board concerning Director nominations submitted by shareholders. The Corporate Governance & Nominating Committee also periodically reviews and advises the Board regarding significant matters of public policy, including proposed actions by foreign and domestic governments that may significantly affect the Company; reviews and advises the Board regarding adoption or amendment of major Company policies and programs relating to matters of public policy; monitors the proposed adoption or amendment of significant environmental legislation and regulations and advises the Board regarding the impact such proposals may have upon the Company and, where appropriate, the nature of the Company’s response thereto; periodically reviews and advises the Board regarding the status of the Company’s environmental policies and performance under its environmental compliance programs; and periodically

14

reviews and reports to the Board regarding the status of, and estimated liabilities for, environmental remediation. The Board has determined that each member of the Corporate Governance & Nominating Committee meets all applicable independence requirements under the NYSE listing standards.

The Organization & Compensation Committee advises and recommends to the independent Directors the total compensation of the President and CEO. In addition, the Organization & Compensation Committee, with the counsel of the CEO, considers and establishes base pay and incentive pay for the other executive officers of the Company. The Organization & Compensation Committee also administers the Company’s deferred compensation plan and the 2009 Incentive Plan. The Organization & Compensation Committee periodically reviews the organization of the Company and its management, including major changes in the organization of the Company and the responsibility of management as proposed by the CEO; monitors executive development and succession planning; reviews the effectiveness and performance of senior management and makes recommendations to the Board concerning the appointment and removal of officers; periodically reviews the compensation philosophy, policies and practices of the Company and makes recommendations to the Board concerning major changes, as appropriate; annually reviews changes in the Company’s employee benefit, savings and retirement plans and reports thereon to the Board; and approves, and in some cases recommends to the Board for approval, the compensation of officers, and executives of the Company. The Organization & Compensation Committee also reviews and makes recommendations to the Board regarding the compensation and benefits for Directors.

From time to time, the Board forms special committees to address specific matters.

Director Nominations

The Corporate Governance & Nominating Committee identifies potential director candidates through a variety of means, including recommendations from members of the Corporate Governance & Nominating Committee, the Board, management and shareholders. The Corporate Governance & Nominating Committee also may retain the services of a consultant to assist in identifying candidates. The Corporate Governance & Nominating Committee will consider nominations submitted by shareholders. A shareholder who would like to recommend a nominee should write to the Chairman of the Corporate Governance & Nominating Committee, c/o Secretary, GenCorp Inc., 2001 Aerojet Road, Rancho Cordova, California 95742. Any such recommendation must include (i) the name and address of the candidate; (ii) a brief biographical description, including his or her occupation for at least the last five years, and a statement of the qualifications of the candidate; and (iii) the candidate’s signed consent to serve as a Director if elected and to be named in the Proxy Statement.

Such nominations must be received by the Chairman of the Corporate Governance & Nominating Committee no later than December 1st immediately preceding the date of the annual meeting of shareholders at which the nominee is to be considered for election. Since the date of the Company’s 2011 Proxy Statement, there have been no material changes to the procedures by which shareholders of the Company may recommend nominees to the Board.

The Corporate Governance & Nominating Committee seeks to create a Board that is, as a whole, strong in its collective knowledge and diversity of skills and experience and background with respect to accounting and finance, management and leadership, business judgment, industry knowledge and corporate governance. Although the Corporate Governance & Nominating Committee does not have a formal diversity policy relating to the identification and evaluation of nominees, the Corporate Governance & Nominating Committee, in addition to reviewing a candidate’s qualifications and experience in light of the needs of the Board and the Company at that time, reviews candidates in the context of the current composition of the Board and the evolving needs of the Company’s businesses.

15

Communications with Directors

Shareholders and other interested parties may communicate with the Board or individual Directors by mail addressed to: Chairman of the Corporate Governance & Nominating Committee, c/o Secretary, 2001 Aerojet Road, Rancho Cordova, California 95742. The Secretary may initially review communications to the Board or individual Directors and transmit a summary to the Board or individual Directors, but has discretion to exclude from transmittal any communications that are, in the reasonable judgment of the Secretary, inappropriate for submission to the intended recipient(s). Examples of communications that would be considered inappropriate for submission to the Board or a Director include, without limitation, customer complaints, solicitations, commercial advertisements, communications that do not relate directly or indirectly to the Company’s business or communications that relate to improper or irrelevant topics.

Compensation Committee Interlocks and Insider Participation

The Organization & Compensation Committee is composed entirely of non-employee independent Directors. As of November 30, 2011, the members of the Organization & Compensation Committee included David A. Lorber (Chairman), Thomas A. Corcoran, Warren G. Lichtenstein and James H. Perry. All non-employee independent Directors participate in decisions regarding the compensation of the President and CEO. None of the Company’s executive officers serve as a member of the Board or compensation committee of any entity that has one or more of its executive officers serving as a member of the Company’s Organization & Compensation Committee. In addition, none of the Company’s executive officers serve as a member of the Organization & Compensation Committee of any entity that has one or more of its executive officers serving as a member of the Company’s Board.

Director Compensation

The compensation of the Company’s non-employee Directors is determined by the Board upon the recommendations made by the Organization & Compensation Committee. The current Director compensation program was implemented by the Company in 2010 after evaluation of the recommendations by the Hay Group when retained by the Organization & Compensation Committee as outside consultants to assess the overall compensation structure for its non-employee Directors. Specifically, the Organization & Compensation Committee requested the Hay Group to measure the Company’s director compensation (in total and by pay component) against similarly sized U.S. companies in the aerospace/defense industry and in the broader general industry, using both proprietary compensation surveys and its knowledge of industry practices. The compensation program was re-evaluated in 2011 and determined to be competitive with the current market. The Director compensation program is more fully described below.

Annual Retainer Fees

Under our Director compensation program effective for the period ending on the date of each annual meeting of shareholders, each non-employee Director will receive an annual retainer fee of $55,000, with the exception of the Chairman of the Board who will receive an annual retainer fee of $110,000. Each non-employee Director will receive $5,000 for service on a standing or long-term special committee of the Board and $3,250 for service on a limited-purpose special committee of the Board. Non-employee Directors who served as Chairman of the Organization & Compensation Committee or Corporate Governance & Nominating Committee will receive an additional annual fee of $10,000 and the Chairman of the Audit Committee will receive an additional $15,000. Non-employee Directors who attend Board meetings in excess of six meetings between any two annual meetings of shareholders will receive $2,000 per each additional Board meeting and non-employee Directors who attend meetings of any single standing or long-term special committee meetings held in excess of six meetings between any two annual meetings of

16

shareholders will receive $1,500 per each additional committee meeting. The annual cash compensation for each non-employee Director serving as a Manager on the Board of Managers of Easton Development Company, LLC is $15,000.

Non-Employee Directors are given a choice to receive all such Director fees in cash or receiving all or part, but no less than 50%, of such fees in the form of fully vested Company Common Stock, calculated based on the closing price of the Common Stock as reported in the NYSE Composite Transactions in the Wall Street Journal (or if such information in such source is unavailable, a source providing similar information selected by the Company) as of the applicable Director pay date, pursuant to the 2009 Incentive Plan. If a non-employee Director elects for any year to receive all or a portion of such fees in the form of fully-vested Common Stock, an additional grant of restricted shares of Common Stock will be given equal in value to 50% of the amount of fees paid in fully-vested Common Stock vesting on the earlier of the Director’s retirement from service from the Board or one year from the date of grant.

Equity Grants

In March 2011, each non-employee Director received $75,000 worth of equity compensation, with the exception of the Chairman of the Board, who received $95,000 worth of equity compensation pursuant to the 2009 Incentive Plan. This grant consisted of 3,119 restricted shares of Common Stock and 15,454 Stock Appreciation Rights (“SARs”) for non-employee Directors other than the Chairman of the Board, who received 3,951 restricted shares of Common Stock and 19,576 SARs. These awards vest in 50% increments on the six-month and twelve-month anniversary of the grant date. Non-Employee Directors also receive a one-time award of 500 restricted shares of Common Stock as part of their initial election to the Board. All restricted shares of Common Stock may be voted, but ownership may not transfer until such shares are vested. Unless otherwise approved by the Board, unvested shares will be forfeited in the event of a voluntary resignation or refusal to stand for re-election. The SARs have a seven-year term under the 2009 Incentive Plan.

Equity Ownership Guidelines for Non-employee Directors

In October 2007, the Board adopted equity ownership guidelines under which non-employee Directors are required to own equity in the Company in an amount equal to $150,000. In calculating the amount of equity owned by a Director, the Board looks at the value of Common Stock owned by such Director (restricted stock and stock owned outright), the value of any phantom stock owned by such Director as part of the Deferred Compensation Plan for Non-Employee Directors, if any and the value of any vested “in the money” options or SARs (i.e. market value of Company stock in excess of the strike price for the stock option or SAR). Directors have five years to meet the thresholds set forth in these equity ownership guidelines. The Board routinely reviews these guidelines and considers adjustments when appropriate, including adjustments for material fluctuations in the Company’s stock price. The following table shows the current status of equity ownership for each non-employee Director as of January 10, 2012.

| Name | Value of Equity Ownership* | Date of Election | Years as a Director | |||||

Thomas A. Corcoran | $ 269,712 | 09/24/08 | 3.3 | |||||

James R. Henderson | 630,324 | 03/05/08 | 3.9 | |||||

Warren G. Lichtenstein | 372,985 | 03/05/08 | 3.9 | |||||

David A. Lorber | 420,753 | 03/31/06 | 5.9 | |||||

James H. Perry | 419,565 | 05/16/08 | 3.7 | |||||

Martin Turchin | 473,201 | 03/05/08 | 3.9 | |||||

Robert C. Woods | 192,398 | 03/31/06 | 5.9 | |||||

| * | Value is based on the stock price on January 10, 2012 of $5.50. |

17

Other

The GenCorp Foundation matches employee and Director gifts to accredited, non-profit colleges, universities, secondary and elementary public or private schools located in the United States. Gifts made were matched dollar for dollar up to $3,000 per calendar year.

Non-employee Directors may also elect to participate in the same health benefits programs at the same cost as offered to all of the Company’s employees. Three Directors participated in this plan in fiscal 2011. The Company also reimburses Directors for actual travel and other expenses incurred in attending Board and Committee meetings.

2011 DIRECTOR COMPENSATION TABLE

The following table sets forth information regarding compensation earned or paid to each non-employee Director who served on the Board of Directors in fiscal year 2011. Employee Directors are not compensated for services as a director.

| Name | Fees Earned or Paid ($)(1) | Stock Awards ($)(2)(3) | Option/SARs Awards ($)(2)(3) | All Other Compensation ($)(4) | Total ($) | |||||||||||||

Thomas A. Corcoran | $ | 66,987 | $ | 35,489 | $ | 56,248 | $ | 3,000 | $ 161,724 | |||||||||

James R. Henderson | 146,990 | 97,233 | 71,251 | — | 315,474 | |||||||||||||

Warren G. Lichtenstein | 69,988 | 53,731 | 56,248 | — | 179,967 | |||||||||||||

David A. Lorber | 86,988 | 62,234 | 56,248 | — | 205,470 | |||||||||||||

James H. Perry | 90,486 | 63,980 | 56,248 | — | 210,714 | |||||||||||||

Martin Turchin | 83,990 | 60,736 | 56,248 | 3,000 | 203,974 | |||||||||||||

Robert C. Woods | 67,000 | 18,745 | 56,248 | — | 141,993 | |||||||||||||

| (1) | The amounts reported in this column for each non-employee Director reflect the dollar amount of the Board and Committee fees paid in fiscal year 2011. Non-employee Directors have a choice to receive all or a portion of their director fees in fully vested Common Stock of the Company, in which the number of shares is determined by the closing price of the Common Stock as of the applicable pay date. If a Director elects to receive fees in Common Stock, an additional grant of restricted shares of Common Stock are given in an amount equal in value to 50% of the amount of fees paid in fully vested Common Stock. This additional grant is reported in the “Stock Awards” column. The following table shows director fees that were paid in fully vested Common Stock in fiscal year 2011. |

| Pay Date | Thomas A. Corcoran | James R. Henderson | Warren G. Lichtenstein | David A. Lorber | James H. Perry | Martin Turchin | Robert C. Woods | |||||||||||||||||||||||

01-18-11 | Stock Awards (#) | 1,334 | 5,339 | 2,669 | 2,669 | 2,669 | 2,669 | — | ||||||||||||||||||||||

01-18-11 | Grant Date Fair Value | $ 6,870 | $ 27,496 | $ 13,745 | $ 13,745 | $ 13,745 | $ 13,745 | $ — | ||||||||||||||||||||||

04-15-11 | Stock Awards (#) | 1,924 | 9,641 | 4,297 | 6,838 | 7,361 | 6,390 | — | ||||||||||||||||||||||

04-15-11 | Grant Date Fair Value | $ 12,871 | $ 64,498 | $ 28,747 | $ 45,747 | $ 49,245 | $ 42,749 | $ — | ||||||||||||||||||||||

07-15-11 | Stock Awards (#) | 1,100 | 4,440 | 2,200 | 2,200 | 2,200 | 2,200 | — | ||||||||||||||||||||||

07-15-11 | Grant Date Fair Value | $ 6,875 | $ 27,500 | $ 13,750 | $ 13,750 | $ 13,750 | $ 13,750 | $ — | ||||||||||||||||||||||

10-17-11 | Stock Awards (#) | 1,558 | 6,235 | 3,117 | 3,117 | 3,117 | 3,117 | — | ||||||||||||||||||||||

10-17-11 | Grant Date Fair Value | $ 6,871 | $ 27,496 | $ 13,746 | $ 13,746 | $ 13,746 | $ 13,746 | $ — | ||||||||||||||||||||||

| (2) | The amounts reported in these columns for each non-employee Director reflect the grant date fair value of stock awards given in fiscal year 2011. A description of these awards can be found under the section entitledLong-Term Incentives (Equity-Based Compensation) on page 33. A discussion of the assumptions used in calculating these values may be found in Note 9(c) in the audited financial statements in the Company’s Annual Report on Form 10-K for the fiscal year ended November 30, 2011. |

18

The following table shows each grant of restricted stock and SARs granted during fiscal year 2011 to each non-employee Director who served as a Director in fiscal year 2011, and the aggregate grant date fair value for each award.

| Name | Grant Date | Stock Awards (#) | SARs Awards (#) | Grant Date Fair Value ($) | ||||||||||||

Thomas A. Corcoran | 01-18-11 | 667 | (A) | $ 3,435 | ||||||||||||

| 03-30-11 | 15,454 | (B) | 56,248 | |||||||||||||

| 03-30-11 | 3,119 | (B) | 18,745 | |||||||||||||

| 04-15-11 | 962 | (A) | 6,436 | |||||||||||||

| 07-15-11 | 550 | (A) | 3,438 | |||||||||||||

| 10-17-11 | 779 | (A) | 3,435 | |||||||||||||

James R. Henderson | 01-18-11 | 2,669 | (A) | 13,745 | ||||||||||||

| 03-30-11 | 19,576 | (B) | 71,251 | |||||||||||||

| 03-30-11 | 3,951 | (B) | 23,746 | |||||||||||||

| 04-15-11 | 4,820 | (A) | 32,246 | |||||||||||||

| 07-15-11 | 2,200 | (A) | 13,750 | |||||||||||||

| 10-17-11 | 3,117 | (A) | 13,746 | |||||||||||||

Warren G. Lichtenstein | 01-18-11 | 1,334 | (A) | 6,870 | ||||||||||||

| 03-30-11 | 15,454 | (B) | 56,248 | |||||||||||||

| 03-30-11 | 3,119 | (B) | 18,745 | |||||||||||||

| 04-15-11 | 2,148 | (A) | 14,370 | |||||||||||||

| 07-15-11 | 1,100 | (A) | 6,875 | |||||||||||||

| 10-17-11 | 1,558 | (A) | 6,871 | |||||||||||||

David A. Lorber | 01-18-11 | 1,334 | (A) | 6,870 | ||||||||||||

| 03-30-11 | 15,454 | (B) | 56,248 | |||||||||||||

| 03-30-11 | 3,119 | (B) | 18,745 | |||||||||||||

| 04-15-11 | 3,419 | (A) | 22,873 | |||||||||||||

| 07-15-11 | 1,100 | (A) | 6,875 | |||||||||||||

| 10-17-11 | 1,558 | (A) | 6,871 | |||||||||||||

James H. Perry | 01-18-11 | 1,334 | (A) | 6,870 | ||||||||||||

| 03-30-11 | 15,454 | (B) | 56,248 | |||||||||||||

| 03-30-11 | 3,119 | (B) | 18,745 | |||||||||||||

| 04-15-11 | 3,680 | (A) | 24,619 | |||||||||||||

| 07-15-11 | 1,100 | (A) | 6,875 | |||||||||||||

| 10-17-11 | 1,558 | (A) | 6,871 | |||||||||||||

Martin Turchin | 01-18-11 | 1,334 | (A) | 6,870 | ||||||||||||

| 03-30-11 | 15,454 | (B) | 56,248 | |||||||||||||

| 03-30-11 | 3,119 | (B) | 18,745 | |||||||||||||

| 04-15-11 | 3,195 | (A) | 21,375 | |||||||||||||

| 07-15-11 | 1,100 | (A) | 6,875 | |||||||||||||

| 10-17-11 | 1,558 | (A) | 6,871 | |||||||||||||

Robert C. Woods | 03-30-11 | 15,454 | (B) | 56,248 | ||||||||||||

| 03-30-11 | 3,119 | (B) | 18,745 | |||||||||||||

| (A) | These shares vest on the earlier of the Director’s retirement from the Board or the one year anniversary of the grant date. |

19

| (B) | These equity awards vest in 50% increments on the six-month and twelve-month anniversary of the grant date. |

| (3) | The following table shows the amount of outstanding and unexercised SARs awards and unvested stock awards as of November 30, 2011 for each non-employee Director who served as a Director in fiscal year 2011. No Director held stock options as of November 30, 2011. |

| Name | Unvested Stock Awards | Outstanding and Unexercised SARs | ||

Thomas A. Corcoran | 23,391 | 63,933 | ||

James R. Henderson | 35,405 | 100,512 | ||

Warren G. Lichtenstein | 26,573 | 78,933 | ||

David A. Lorber | 27,844 | 83,933 | ||

James H. Perry | 28,105 | 78,933 | ||

Martin Turchin | 27,620 | 78,933 | ||

Robert C. Woods | 20,433 | 83,933 |

| (4) | All Other Compensation includes matching donations made by the GenCorp Foundation for gifts made in fiscal year 2011. |

20

Security Ownership of Officers and Directors

The following table lists share ownership of Common Stock by the Company’s current Directors and the Named Executive Officers, as well as the number of shares beneficially owned by all of the current Directors and executive officers as a group. Unless otherwise indicated, share ownership is direct. Amounts owned reflect ownership as of February 3, 2012.

| Beneficial Owner | Amount and Nature of Beneficial Ownership(1)(2) | Percent of Class | ||

Directors | ||||

Thomas A. Corcoran(3) | 45,139 | * | ||

James R. Henderson | 110,290 | * | ||