UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [_]

Check the appropriate box:

| [_] | | Preliminary Proxy Statement |

| [_] | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | | Definitive Proxy Statement |

| [_] | | Definitive Additional Materials |

| [_] | | Soliciting Material Pursuant to (S) 240.14a-11(c) or (S) 240.14a-12 |

GIANT GROUP, LTD.

(Name of Registrant As Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [_] | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) Title | | of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| [_] | | Fee paid previously with preliminary materials. |

| [_] | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 5, 2002

The 2002 annual meeting of stockholders (the “Annual Meeting”) of GIANT GROUP, LTD., a Delaware corporation (the “Company”), will be held at the offices of Christensen, Miller, Fink, Jacobs, Glaser, Weil & Shapiro, LLP, 2121 Avenue of the Stars, 18th Floor, Los Angeles, California 90067 on Wednesday June 5, 2002. The Annual Meeting will begin at 9 a.m., Pacific Daylight Time, for the following purposes:

| | 1. | | to elect a Board of five directors to serve until the 2003 annual meeting of stockholders and until their successors are elected and qualified; |

| | 2. | | to ratify the appointment of Stonefield Josephson, Inc. as the Company’s independent auditors for the fiscal year ended December 31, 2002, and |

| | 3. | | to transact other business as may properly come before the Annual Meeting and any adjournment or postponement thereof. |

The Board of Directors has fixed the close of business on April 8, 2002 as the record date. Anyone holding shares of the Company’s $.01 par value common stock (“Common Stock”) on April 8, 2002 is entitled to:

| | 1. | | receive notice of the date, time and location of the Annual Meeting, and |

| | 2. | | to vote at the Annual Meeting and any adjournment or postponement thereof. |

Whether or not you expect to attend the Annual Meeting in person, you are urged to vote to ensure your representation and the presence of a quorum at the Annual Meeting. Please mark, date and sign the enclosed proxy and mail it in the self-addressed envelope. If you mailed in your proxy card and then decide to attend the Annual Meeting, you may revoke your proxy and vote your shares in person.

| | By | order of the Board of Directors, |

Beverly Hills, California

April 28, 2002

GIANT GROUP, LTD.

9440 SANTA MONICA BOULEVARD

SUITE 407

BEVERLY HILLS, CALIFORNIA 90210

PROXY STATEMENT

General Information

This proxy statement and the accompanying proxy card (“proxy materials”) are furnished to the stockholders of GIANT GROUP, LTD., a Delaware Corporation (“Company”), in connection with the solicitation of proxies by the Board of Directors (“Board”) for use in voting at the Company’s annual meeting of stockholders (“Annual Meeting”). The Annual Meeting will be held on Wednesday June 5, 2002 at 9 a.m. Pacific Daylight Time at the offices of Christensen, Miller, Fink, Jacobs, Glaser, Weil & Shapiro, LLP, 2121 Avenue of the Stars, 18th Floor, Los Angeles, California 90067. Proxy materials are first being provided to stockholders on or about April 29, 2002.

The Board has fixed the record date at the close of business on April 8, 2002. Any holder of shares of the Company’s $.01 par value common stock (“Common Stock”) on April 8, 2002 is entitled to receive notice of this Annual Meeting’s date, time and location and cast one vote for each share of Common Stock owned. On April 8, 2002, 2,690,854 shares of Common Stock were outstanding.

Proxy solicitation may be made personally or by telephone or telegram by Company officers or employees. The Company will not pay additional compensation for these services. The Company will reimburse brokers, banks and other custodians, nominees and fiduciaries for their expenses in sending proxy materials to beneficial owners.

Voting Procedures

At the Annual Meeting, stockholders will be requested to act upon the proposals set forth in this Proxy Statement. If you are not present at the Annual Meeting, your shares can be voted only when represented by proxy. The shares represented by your proxy will be voted in accordance with your directions if the proxy is properly signed, dated and returned to the Company before or at the Annual Meeting. If no instructions are specified in the proxy with respect to any proposal, the shares represented will be voted for the nominees for the Board listed in this Proxy Statement and for the ratification of Stonefield Josephson, Inc. as independent auditors for the Company. If any other matters shall properly come before the Annual Meeting, the enclosed proxy will be voted in accordance with the best judgment of the persons voting such proxy.

A proxy may be revoked at any time prior to it being voted at the Annual Meeting. The stockholder can revoke his/her proxy by delivering a signed writing revoking the proxy or a duly executed proxy bearing a later date to the Secretary of the Company. The stockholder can revoke his/her proxy by appearing and voting in person at the Annual Meeting. The mere presence at the Annual Meeting of a person appointing a proxy does not revoke the appointment. Please note that it is important to date your proxy because the last dated proxy will revoke any earlier dated proxies and will be the one that is voted at the Annual Meeting.

A majority of the outstanding shares of Common Stock represented at the Annual Meeting, in person or by proxy, will constitute a quorum. The votes of stockholders present in person or represented by proxy at the Annual Meeting will be tabulated by an inspector of election appointed by the Company. Abstentions and broker non-votes will have no effect on the outcome of the vote for the election of directors or the ratification of accountants.

2

Principal Holders

The following are stockholders who are beneficial owners of more than 5% of Common Stock on April 8, 2002 . The list is based on the Company’s knowledge through filings with the Securities and Exchange Commission (the “SEC”) and other information. Unless otherwise indicated, the named person has sole voting and dispositive power with respect to the shares held by him/her.

Name & Address of Beneficial Owner

| | Amount and Nature of Beneficial Ownership(1)

| | Percent of Class(2)

| |

| Burt Sugarman | | 2,138,021 shares(3)(4) | | 59.55 | % |

| 9440 Santa Monica Boulevard, Suite 407 | | | | | |

| Beverly Hills, CA 90210 | | | | | |

|

| Mary Hart Sugarman | | 2,138,021 shares(3)(5) | | 59.55 | % |

| 9440 Santa Monica Boulevard, Suite 407 | | | | | |

| Beverly Hills, CA 90210 | | | | | |

|

| Dimensional Fund Advisors, Inc | | 258,700 shares(6) | | 9.61 | % |

| 1299 Ocean Avenue, 11th Floor | | | | | |

| Santa Monica, CA 90401 | | | | | |

|

| Gary Koncikowski | | 254,450 shares(7) | | 9.46 | % |

| PO Box 751 | | | | | |

| Lake George, NY 12845 | | | | | |

| 1. | | The following is deemed to be the beneficial owner of a security: |

| | • | | person has or shares the power to vote or to direct the voting of such security; |

| | • | | person has the power to dispose or to direct the disposition of such security; |

| | • | | person has the right to acquire beneficial ownership within 60 days, or |

| | • | | person living in the same house with spouse, children or other relatives who own security. |

| 2. | | Computed on the basis of 2,690,854 shares of Common Stock issued and outstanding on April 8, 2002 plus each reporting person’s stock options, currently exercisable or exercisable within 60 days of April 8, 2002. |

| 3. | | The number of options have been adjusted to reflect the Company’s February 2002 plan to exchange options. Under this plan, option holders elected to exchange their options for a fewer number of options at an exercise price of $.45, the closing price on February 1, 2002. The expiration date remains the same as the date prior to the exchange. The plan was approved by the Executive and Compensation Committee of the Board. As a result, Mr. Sugarman exchanged options to purchase 1,799,202 shares of Common Stock were exchanged for options to purchase 899,601 shares of Common Stock. |

| 4. | | Includes 899,601 shares underlying presently exercisable options and 148,950 shares owned by Mr. Sugarman’s spouse. |

| 5. | | Includes 1,089,470 shares owned by Mrs. Sugarman’s spouse and 899,601 shares underlying presently exercisable options held by Mrs. Sugarman’s spouse |

| 6. | | Information included in Form 13-G filed with the SEC on January 30, 2002. |

| 7. | | Information included in Form 13-G filed with the SEC on January 30, 2002. |

3

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Nominees

At the Annual Meeting, five Directors are to be elected to serve until the annual meeting of stockholders in 2003 and until their successors are elected and qualified. The Board has nominated Burt Sugarman, David Gotterer, Terry Christensen, David Malcolm and Jeffrey Rosenthal.

The Board has no reason to expect that any of the nominees will be unable to stand for election. In the event that a vacancy among the original nominees occurs prior to the Annual Meeting, the proxies will be voted for a substitute nominee or nominees named by the Board and for the remaining nominees.

The following table sets forth information on April 8, 2002 about each nominee for Director and the ownership of equity securities by all Directors and Executive Officers of the Company as a group:

| | | Age

| | Director Since

| | Shares and Percent of Common Stock Owned(1)

|

BURT SUGARMAN Mr. Sugarman has been Chairman of the Board of the Company since 1983, and President and Chief Executive Officer since May 1985. He is a director of Checkers Drive-In Restaurants, Inc. (NASDAQ) (“Checkers”). | | 63 | | 1982 | | 2,138,021 shs(2) 59.6% |

|

DAVID GOTTERER Mr. Gotterer has been vice chairman of the Company since May 1986. He has been a senior partner in the accounting firm of Mason & Company, LLP, New York, New York for more than the last five years. He is a Director of Checkers. | | 73 | | 1984 | | 97,531 shs(3)(4) 3.5% |

|

TERRY CHRISTENSEN Mr. Christensen has been a senior partner in the law firm Christensen, Miller, Fink, Jacobs, Glaser, Weil & Shapiro, LLP, Los Angeles, California for more than the last five years. He is a director of MGM Mirage and Checkers. | | 61 | | 1994 | | 65,000 shs(4) 2.4% |

|

DAVID MALCOLM Mr. Malcolm has served as chairman of the board of Suncoast Financial Corporation, a mortgage banking company and a developer of several thousand homes in the San Diego region for more than the last five years. Mr. Malcolm recently sold West Coast Restaurant Enterprises, where he was president and founder for more than the last five years. He is a director of Scripps Institute of Oceanography and St Vincent de Paul for the homeless in San Diego. | | 49 | | 1996 | | 25,000 shs(4) 1% |

|

JEFFREY ROSENTHAL Mr. Rosenthal is president and chairman of Rose Investments LLC, a private investment firm. Prior to his current position, he served as chairman of Fairfare Media Works for more than the last five years. | | 44 | | 1997 | | 21,250 shs(4) 1% |

|

| All Directors and Executive Officers as a group (6 persons) | | | | | | 2,350,552 shs 61.8% |

4

| | 1. | | Unless otherwise indicated, the beneficial owner has both sole voting and investment powers with respect to his shares. Computed on the basis of 2,690,854 shares of Common Stock outstanding on April 8, 2002 plus stock options of each reporting person currently exercisable or exercisable within 60 days of April 8, 2002. The number of options have been adjusted to reflect the Company’s February 2002 plan to exchange options. Under this plan, option holders elected to exchange their options for a fewer number of options at an exercise price of $.45, the closing price on February 1, 2002. The expiration date remains the same as the date prior to the exchange. The plan was approved by the Executive and Compensation Committee of the Board. As a result, the Directors and Executive Officers as a group exchanged options to purchase 2,076,000 shares of Common Stock for options to purchase 1,107,000 shares of Common Stock. |

| | 2. | | Includes 899,601 shares underlying presently exercisable options and includes 148,950 shares owned by Mr. Sugarman’s spouse. Mrs. Sugarman has sole voting and dispositive power with respect to such shares. |

| | 3. | | Excludes 45,731 shares underlying presently exercisable options held by Mr. Gotterer, as to which he disclaims beneficial ownership since a business partner is entitled to the beneficial ownership of such shares upon any exercise of such options. |

| | 4. | | Shares underlying presently exercisable options. |

THE BOARD RECOMMENDS A VOTE FOR THE ELECTION OF EACH OF

THE NOMINEES NAMED ABOVE

Annual Meetings of the Board

During the 2001 fiscal year, the Board met on 3 occasions, and acted by written consent on 1 occasion. Each of the Directors who served as a Director in 2001 attended at least 75% of all meetings of the Board and all meetings held by all committees of the Board on which such Director served.

Committees of the Board

The Company has an Executive Committee, a Compensation Committee, an Option Committee, an Incentive Compensation Committee and an Audit Committee. The members of each Committee are appointed by the Board for a term beginning after the first regular meeting of the Board following the Annual Meeting of stockholders. The members serve until their respective successors are elected and qualified.

The Executive Committee, consisting of Messrs. Sugarman, Gotterer and Christensen, did not meet formally during 2001. The members, when they deem necessary, consult on an informal basis in connection with the functions of this Committee. This Committee was established to act in the place of the Board between meetings.

The Compensation Committee presently consists of Messrs. Gotterer and Christensen. The Compensation Committee did not meet formally during 2001.

The Option Committee presently consists of Messrs. Gotterer and Christensen. The Option Committee did not meet formally during 2001. The Option Committee administers the Company’s stock option plans.

The Incentive Compensation Committee presently consists of Messrs. Malcolm and Rosenthal. The Incentive Compensation Committee did not meet formally during 2001.

The Audit Committee is comprised of three independent directors, as defined in the New York Stock Exchange listing standards, and currently does not operate under a written charter. The Audit Committee met once and acted by written consent once in 2001. Audit Committee members, when they deem necessary, consult on an informal basis in connection with functions of this Committee. The members of the Audit Committee are Terry Christensen (Chairman), David Malcolm and Jeffrey Rosenthal.

5

There is no standing nominating committee or other committee performing similar functions.

Audit Committee Report

The following is the Audit Committee report related to the Company’s audited Consolidated Balance Sheet at December 31, 2001 and 2000 and the related audited Consolidated Statement of Operations, Cash Flows and Stockholders’s equity for the fiscal year ended December 31, 2001. The Company’s independent auditors, Stonefield Josephson, Inc. (‘Stonefield”) represented to the Audit Committee that the remaining consolidated financial statements could not be prepared in accordance with accounting principles generally accepted in the United States due to the audit scope limitation related to Periscope Sportsware, Inc., a discontinued subsidiary of the Company (see Form 10-K for fiscal year ended December 31, 2001).

| | • | | The Audit Committee has reviewed and discussed the Company’s audited financial statements with management. |

| | • | | The Audit Committee discussed with Stonefield the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees). The Audit Committee has received the written disclosures and the letter from Stonefield required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). The Audit Committee discussed with the independent auditors their independence from the Company. |

| | • | | Based on the review and discussions referred to above, the Audit Committee recommended to the Board that the Consolidated Balance Sheet at December 31, 2001 and 2000 and the related audited Consolidated Statement of Operations, Cash Flows and Stockholders’s equity for the fiscal year ended December 31, 2001 and the remaining financial statements for the two years ended December 31, 2000 be included in the Company’s 2001 Annual Report on Form10-K. |

| | Submitted by the Audit Committee |

| | of the Board of Directors |

| | Terry Christensen (Chairman) |

Compensation of Directors

Non-employee Directors of the Company are compensated at a rate of $10,000 per annum, plus $500 for each Board meeting attended. Members of the Audit Committee are compensated for their services at the rate of $250 per meeting attended.

Non-employee Directors participate in the Company’s 1996 Stock Option Plan for Non-Employee Directors, as amended (the “Amended Director Plan”). Each non-employee Director receives 5,000 options on each May 20 or, if a Director was not a Board member on May 20, 1996 (the adoption date of the Director Plan), on each anniversary of their election to the Board. In addition, each non-employee Director who is appointed to the Executive Committee will receive 5,000 options upon their appointment and 5,000 options on each anniversary. Each option has a five-year term and is immediately exercisable. The exercise price of each option is the fair market price of the options on the date of grant. On December 31, 2001, options to purchase 180,000 shares were outstanding.

Certain non-employee Director’s current, exercisable options were granted under the Company’s 1985 Non-Qualified Stock Option Plan. No further grants may be made under the plan. On December 31, 2001, options to purchase 146,750 shares were outstanding. One director disclaims beneficial ownership of 63,375 of these options since a business partner is entitled to the beneficial ownership of such shares upon any exercise of such options.

6

On February 1, 2002 the Executive and Compensation Committee of the Board approved a plan for the exchange options to purchase Common Stock. Option holders elected to exchange their options for a fewer number of options at an exercise price of $.45, the closing price on February 1, 2002. The expiration date remains the same as the date prior to the exchange. As a result, options to purchase 271,750 shares of Common Stock were exchanged by the non-employee Directors for options to purchase 203,813 shares of Common Stock. One director disclaims beneficial ownership of 45,731 of these options since a business partner is entitled to the beneficial ownership of such shares upon any exercise of such options.

Compensation Committee Report

The Compensation Committee is responsible for developing and making recommendations to the Company with respect to compensation policies for Executive Officers, addressing such matters as salaries, bonuses, incentive plans, benefits and overall compensation. The Company’s 1997 Incentive Compensation Plan for Executive Officers (the “Incentive Plan”) is administered by the Incentive Compensation Committee. No amounts were earned under the Incentive Plan in 2001.

The objective of the Compensation Committee in determining the type and amount of compensation for Executive Officers is to provide a level of compensation that allows the Company to attract and retain competent executives. The Compensation Committee believes that there should be a correlation between the performance of the Company and the individual executive’s performance and compensation. The Compensation Committee did not award any bonus to the Executive Officers of the Company for 2001.

| | Submitted by the Compensation |

| | Committee of the Board of Directors |

Compensation Committee Interlocks and Insider Participation

During 2001, Terry Christensen served on the Compensation Committee of the Board. Mr. Christensen’s law firm, Christensen, Miller, Fink, Jacobs, Glaser, Weil & Shapiro, LLP, received approximately $73,000 for advising the Company in certain corporate matters and representing the Company in certain litigation during 2001.

Summary Compensation Table

The following table sets forth information concerning the annual and long-term compensation for services in all capacities to the Company for the three years ended December 31, 2001, 2000, and 1999 of the Chief Executive Officer. No other executive officer received cash compensation in excess of $100,000 for services performed for the Company during 2001.

| | | Annual Compensation(1)

|

Name and Principal Position

| | Year

| | Salary

| | Other(2)

| | Other(3)

|

| Burt Sugarman | | 2001 | | $ | 370,000 | | $ | 2,128 | | $ | 25,000 |

| President and CEO and | | 2000 | | | 472,435 | | | 2,942 | | | 27,481 |

| Chairman of the Board | | 1999 | | | 1,000,000 | | | 7,644 | | | 27,475 |

| (1) | | No restricted stock awards or options were awarded in 2001, 2000 and 1999. |

| (2) | | Amounts represent the use of the Company’s automobile. |

| (3) | | Represents amounts paid to Mr. Sugarman by Checkers. |

7

Employment Agreement

Mr. Sugarman is employed as Chairman of the Board, President and Chief Operating Officer pursuant to an employment agreement with the Company dated December 3, 1998 and which expires on December 31, 2005. The agreement provides that Mr. Sugarman is to receive an annual base salary of $1,000,000 increased annually by 10% over the prior year to a maximum of $1,600,000, life insurance in the face amount of $5,000,000, and an annual bonus in an amount determined from year to year by the Compensation Committee of the Board of Directors, at its discretion, and certain additional benefits. The employment agreement is terminable prior to the expiration of the term of the agreement (1) by the Company for cause (as defined in the contract) and (2) by Mr. Sugarman (a) for cause (as defined in the contract), (b) at any time for any reason, after January 1, 2000 or (c) if Mr. Sugarman ceases to own or control at least 10% of the Common Stock of the Company. Should the employment agreement be terminated by the Company without cause or by Mr. Sugarman for cause or for other reasons described in the preceding sentence, Mr. Sugarman would be entitled to (1) continuation of all health insurance benefits through the expiration of the term of the agreement, or for 40 months from termination, whichever period is longer and (2) a lump sum payment in an amount equal to the greater of (a) two times the annual base salary, and (b) the amount which would have been payable throughout the remainder of the term of the agreement or 40 months, whichever is shorter, provided that if the agreement is terminated within one year following a change in ownership of the Company (as defined in the contract), Mr. Sugarman will receive a lump sum payment equal to 2.99 times the average annual compensation paid to Mr. Sugarman by the Company during the five years prior to such change in ownership. In the event of Mr. Sugarman’s disability or death, he or his estate would be entitled to receive a lump sum payment equal to the greater of (a) two times the annual base salary and (b) the amount which would have been payable throughout the remainder of the term of the agreement and continuation of all health insurance benefits for the remainder of the term. In the event of Mr. Sugarman’s death, the Company would also be obligated to continue all health insurance benefits for Mr. Sugarman’s immediate family for two years.

In January 2000, Mr. Sugarman had voluntarily authorized the Company to decrease his annual salary to $450,000 from $1,100,000. Effective June 30, 2001, Mr. Sugarman voluntarily authorized the Company to decrease his annual salary to $290,000 from $450,000. Mr. Sugarman, at his discretion, may, at any time, increase his salary to the current level as stated in his current contract. In such case, no retroactive salary adjustment will be made.

In January 2000, Mr. Sugarman had voluntarily authorized the Company to retroactively cancel the severance pay due to him per his employment agreement with the Company.

Option Plans

Options are currently outstanding under the Company’s 1985 Non-Qualified Stock Option Plan (the “1985 Stock Option Plan”). The 1985 Stock Option Plan had provided for the grant of options to purchase 3,000,000 shares of Common Stock. No further grants may be made under this plan. On December 31, 2001, Mr. Sugarman and the Company’s Chief Financial Officer (“CFO”) owned 1,599,202 and 5,000 options, respectively, to purchase shares of Common Stock.

Options are also currently outstanding under the Company’s 1996 Employee Stock Option Plan, as amended (the “Amended 1996 Stock Option Plan”). The Amended 1996 Stock Option Plan presently provides for the grant of options to purchase 1,000,000 shares of Common Stock to officers and key management personnel of the Company. On December 31, 2001, Mr. Sugarman owned 200,000 options to purchase shares of Common Stock.

On February 1, 2002 the Executive and Compensation Committee of the Board approved a plan for the exchange options to purchase Common Stock. Option holders elected to exchange their options for a fewer number of options at an exercise price of $.45, the closing price of the stock. The expiration date remains the same as the date prior to the exchange. As a result, options to purchase 1,799,202 and 5,000 shares of Common Stock were exchanged by Mr. Sugarman and the CFO for options to purchase 899,601and 3,750 shares of Common Stock, respectively.

8

Fiscal Year End Option Value

During the fiscal year ended 2001, Mr. Sugarman did not exercise any options to purchase Common Stock. Based upon the closing price of the Common Stock on December 31, 2001 of $.49 minus the option exercise price of $6.75 per share for 1,599,202 shares and $8.25 per share for 200,000 shares, unexercised in the money options had $0 value at December 31, 2001.

Performance Graph

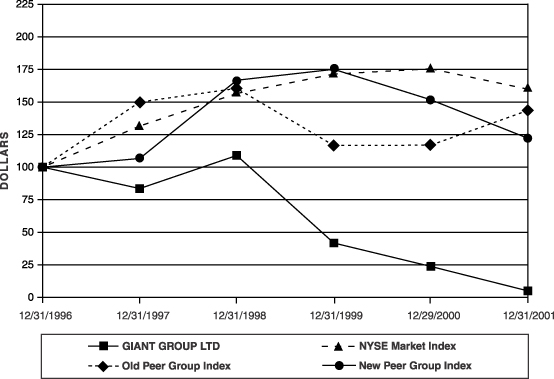

The following graph compares the yearly percentage change in the Company’s cumulative total stockholder return on its Common Stock for the five years ended December 31, 2001, based upon the market price of the Common Stock as reported on the OTC Bulletin Board (“OTC”) with the cumulative total return (and assuming reinvestment of dividends) with (1) the NYSE Stock Index, (2) an index of a group of companies in the apparel business, selected by the Company, consisting of Kellwood Company, Tropical Sportswear International, and Perry Ellis International (Peer Group I) and (3) an index of a group of companies in the fast food industry, selected by the Company, consisting of Checkers, McDonald’s and Wendy’s (“Peer Group 2”). Supreme International, which was included in Peer Group I in prior years, is excluded this year because it was acquired by Perry Ellis International in 1999. In addition, Happy Kids was included in Peer Group I in prior years but is excluded from the index this year because it was acquired by RHG in 1999. RHG is not a publicly traded company.

In 2000, the Company discontinued its apparel operations, which was its principal business activity since 1998. The Company is involved in the double drive-thru hamburger restaurant business through its equity investment in Checkers. On April 8, 2002, including warrants, the Company’s investment is approximately 9% of Checkers common stock.

Comparison of 5-year Cumulative Total Return Among

Giant Group, Ltd. and Peer Group Indexes

Total Return to Stockholders

9

RATIFICATION OF AUDITOR

PROPOSAL NO. 2

Stonefield Josephson, Inc. (“Stonefield”) has been selected by the Board to serve as the independent auditor for the Company for the fiscal year ending December 31, 2002. The Company retained Stonefield on October 19, 2001 to act as its independent auditor for the third quarter ended September 30, 2001 and the year ended December 31, 2001.

A representative of Stonefield is expected to be available by telephone or in person and will be given the opportunity to make a statement if he or she so desires and to respond to appropriate questions from stockholders.

The Company has been informed by Stonefield that neither the firm nor any members or their associates has any direct financial interest or material indirect financial interest in the Company. During the Company’s fiscal year ended December 31, 2001, the Company was billed the following aggregate fees by Stonefield:

| | • | | Audit Fees. The aggregate fees billed by Stonefield for professional services rendered for the audit of the Company’s Consolidated Financial Statements for the fiscal year ended December 31, 2001 and the review of the Consolidated Financial Statements included in the Company’s Form 10-Q for the third quarter ended September 30, 2001 was approximately $53,000. |

| | • | | Financial Information Systems Design and Implementation Fees. No services were rendered by and no fees were billed to the Company for the professional services described in paragraph (c) (4) (ii) of Rule 2-01 of Regulation S-X by Stonefield for the fiscal year ended December 31, 2001. |

THE BOARD RECOMMENDS A VOTE FOR THE RATIFICATION OF THE APPOINTMENT OF STONEFIELD AS THE COMPANY’S INDEPENDENT AUDITOR FOR FISCAL 2002.

Prior Fiscal Year Auditor

October 18, 2001, Company management and the Audit Committee determined that it would be in the best interest of the Company to dismiss its independent auditor, BDO Seidman, LLP (“BDO”). BDO acted as the Company’s independent auditor for the fiscal year ended December 31, 2000 and for the quarters ended March 31, 2001 and June 30, 2001.

There was no disagreement between the Company and BDO on any matter of accounting principles or practice, financial statement disclosure or auditing scope or procedure for the year ended December 31, 2000 and the interim period ended October 18, 2001.

BDO issued a Report dated February 13, 2001 on the Company’s Consolidated Financial Statements for the three years ended December 31, 2000. This Report included an unqualified opinion on the Company’s Consolidated Balance Sheet as of December 31, 2000. BDO could not express an opinion on the Company’s Consolidated Balance Sheet as of December 31, 1999 and the Consolidated Statements of Operations, Retained Earnings and Cash Flows for the three years ended December 31, 2000. BDO was not able to apply any audit procedures related to these financial statements due to the unavailability of records of Periscope, one of the Company’s wholly-owned subsidiaries. Periscope delivered peaceful possession of its assets and records to a third party and also filed a voluntary petition under Chapter 7 of the bankruptcy code in the fourth quarter of 2000. The Bankruptcy Trustee also received Periscope records.

10

During the Company’s fiscal year ended December 31, 2000 and the interim period ended October 18,2001:

| | 1. | | BDO has not advised the Company that internal controls necessary for the Company to develop reliable financial statements do not exist; |

| | 2. | | BDO has not advised the Company that information came to BDO’s attention that led BDO to no longer rely on Company management’s representations, or that has made BDO unwilling to be associated with the financial statements prepared by Company management; |

| | 3. | | BDO has not advised the Company that BDO needed to expand significantly the scope of its audit, or that information came to BDO’s attention during such time period that if further investigated may (i) materially impact the fairness or reliability of either a previously-issued audit report or the underlying financial statements, or the financial statements issued or to be issued covering the fiscal periods subsequent to the date of the most-recent financial statements covered by an audit report or (ii) cause BDO to be unwilling to rely on management’s representations or be associated with the Company’s financial statements; and |

BDO has not advised the Company that information came to BDO’s attention of the type described in Subparagraph (3), the issue not resolved prior to BDO’s dismissal.

COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACT

Section 16(a) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), requires the Company’s Executive Officers, Directors and persons who own more than ten percent of the Company’s Common Stock (“Reporting Persons”) to file reports of ownership and changes in ownership with the SEC. Reporting Persons are required by SEC regulations to furnish the Company with copies of all Section 16(a) reports.

The Company has reviewed copies of Section 16(a) reports received from Reporting Persons for the fiscal year ended December 31, 2001. The Company believes, based solely on this review, all Reporting Persons complied with the applicable SEC filing requirements on a timely basis.

STOCKHOLDER PROPOSALS

Requirements for stockholder proposals to be brought before the Annual Meeting

Stockholder’s written proposals to be considered properly brought before the Annual Meeting, must be received by the Company’s Secretary at the Company’s principal executive office no later than the tenth day following the day on which public announcement of the date of the Annual Meeting is first made. The written proposal must contain, for each matter of business the stockholder proposes to bring before the Annual Meeting:

| | • | | a brief description of the business and the reasons for bringing the business before the Annual Meeting, |

| | • | | name and address of record of stockholder proposing the business, |

| | • | | number of shares of Common Stock beneficially owned by the stockholder, and |

| | • | | any material interest of the proposing stockholder in the business. |

Requirements for stockholder proposals to be considered for inclusion in the Company’s Proxy Materials for the 2003 Annual Meeting of stockholders

Stockholder proposals to be considered for inclusion in the Company’s Proxy Materials for the 2003 Annual Meeting of stockholders, submitted pursuant to Rule 14a-8 under the Exchange Act, must be received in

11

writing by the Company’s Secretary at the Company’s principal executive office no later than December 31, 2002.

Stockholders may nominate persons for director by submitting the name of the person(s) to be included in the proxy materials, including all information required to be disclosed for the solicitation of proxies for election of directors. In addition, the stockholder must also submit his/her name, address of record and number of shares of Common Stock owned. This information must be submitted in writing and received by the Company’s Secretary at the Company’s principal executive office no later than the tenth day following the day on which public announcement of the date of the Annual Meeting is first made.

OTHER BUSINESS

The Board does not know of any matters to be presented for action at the Annual Meeting other than as set forth in this Proxy Statement. If any other business should properly come before the Annual Meeting, the persons named in the proxy intend to vote thereon with their best judgment.

The Company’s Annual Report to Stockholders for the fiscal year ended December 31, 2001 accompanies this Proxy Statement.

THE COMPANY’S 2001 ANNUAL REPORT ON FORM 10-K WILL BE PROVIDED WITHOUT CHARGE TO EACH STOCKHOLDER UPON WRITTEN REQUEST. EACH REQUEST MUST SET FORTH A GOOD FAITH REPRESENTATION THAT, AS OF APRIL 8, 2002, THE PERSON MAKING THE REQUEST WAS THE BENEFICIAL OWNER OF SHARES OF COMMON STOCK OF THE COMPANY. THE REQUEST SHOULD BE DIRECTED TO: PASQUALE A. AMBROGIO, SECRETARY, GIANT GROUP, LTD., 9440 SANTA MONICA BOULEVARD, SUITE 407, BEVERLY HILLS, CALIFORNIA 90210, TELEPHONE (310) 273-5678.

| | By | Order of the Board of Directors, |

Beverly Hills, California

April 28, 2002

12

GIANT GROUP, LTD.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS FOR THE ANNUAL

MEETING OF STOCKHOLDERS—WEDNESDAY JUNE 5, 2002

The undersigned hereby appoints Burt Sugarman and David Gotterer, and each of them, proxies with power of substitution each for and in the name of the undersigned to vote all shares of Common Stock of GIANT GROUP, LTD., a Delaware corporation (the ‘‘Company’’), that the undersigned would be entitled to vote at the Company’s 2002 Annual Meeting of Stockholders (the ‘‘Meeting’’), and at any adjournments thereof, upon the matters set forth in the Notice of the Meeting as stated hereon, hereby revoking any proxy heretofore given. In their discretion, the proxies are further authorized to vote upon such other business as may properly come before the Meeting.

The undersigned acknowledges receipt of the Notice of the Meeting and the accompanying Proxy Statement and Annual Report.

1. Election of Directors

¨ FOR all nominees listed below (except as marked to the contrary below) | | ¨ WITHHOLD AUTHORITY to vote for all the nominees listed below |

Terry Christensen • David Gotterer • David Malcolm • Jeffrey Rosenthal • Burt Sugarman

2. Ratification of the appointment of Stonefield Josephsen, Inc. as independent auditors.

The Board of Directors recommends a vote FOR.

¨ FOR | | ¨ AGAINST | | ¨ ABSTAIN |

THE BOARD RECOMMENDS A VOTE ‘‘FOR’’ PROPOSALS 1 AND 2. THIS PROXY WILL BE VOTED AS DIRECTED OR, IF NO CONTRARY DIRECTION IS INDICATED, WILL BE VOTED FOR THE ELECTION OF THE NOMINEES FOR DIRECTORS LISTED ABOVE AND FOR RATIFICATION OF THE APPOINTMENT OF THE AUDITORS AND AS SAID PROXIES DEEM ADVISABLE ON SUCH OTHER MATTERS AS MAY COME BEFORE THE MEETING.

| | (Please sign as name appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such.) |

Date

| | Signature, if held jointly |

STOCKHOLDERS ARE URGED TO MARK, DATE, SIGN AND RETURN THIS PROXY IN THE ENVELOPE PROVIDED, WHICH REQUIRES NO POSTAGE IF MAILED WITHIN THE UNITED STATES