Filed by The Gillette Company

Pursuant to Rule 425 under the

Securities Act of 1933 and deemed

filed pursuant to Rule 14a-12 of

the Securities Exchange Act of 1934

Subject Company: The Gillette Company

Commission File No.: 1-00922

The following presentation was prepared by The Gillette Company:

Investor Meetings

March 2005

|  |

There is No Doubt Gillette's Four Growth

Drivers Could Maintain Top Tier Performance

1

|  |

The Gillette Company + P&G

However, this Merger is

the Right Step ...

at the Right Time ...

with the Right Partner

2

|  |

It's a Unique Combination for Several Reasons

The Gillette Company + P&G

o Remarkable similarities in organizational structures

o Highly complementary brands, markets and technologies

o Both companies with great operating momentum going into the merger

3

|  |

And Gillette's Key Growth Drivers are a Great Match with P&G Core Strengths

Gillette P&G

Growth Drivers + Strengths

Advantaged Branding &

Categories + Marketing

Technology

Leadership + Innovation

Trade-Up + Go-to-Market

Turnaround

Mentality + Scale

4

|  |

Gillette Will Add Significant Support to P&G Strengths in Branding and Marketing

o Gillette leadership brands and advantaged categories will benefit from P&G

Consumer Knowledge

o Gillette brings expertise in Shopping Insights

- In-store execution

- New product launches

o P&G knows women and how to market to them

o Gillette's expertise is in marketing to men

5

|  |

Significant Growth Synergies Exist by Combining with P&G's Innovation

Capabilities

o Complementary consumer knowledge and technologies

o Ability to accelerate innovation by transferring knowledge and technologies

across a broader range of businesses, geographies and disciplines

o An unparalleled portfolio of brand platforms to launch innovation

6

|  |

We Have Complementary Consumer Knowledge and Technologies...

o In Oral Care...

o Skin Care...

o Shaving...

o Hair Removal

7

|  |

Two Areas With Strong Potential For Profitable Innovation Are...

o Women's Hair Removal

8

|  |

Two Areas With Strong Potential For Profitable Innovation Are...

o Men's Personal Care

9

|  |

The Two Companies Also Have Complementary Innovation Capabilities In Design

o Powerful emotional connections that deliver "wow" experiences for consumers

10

|  |

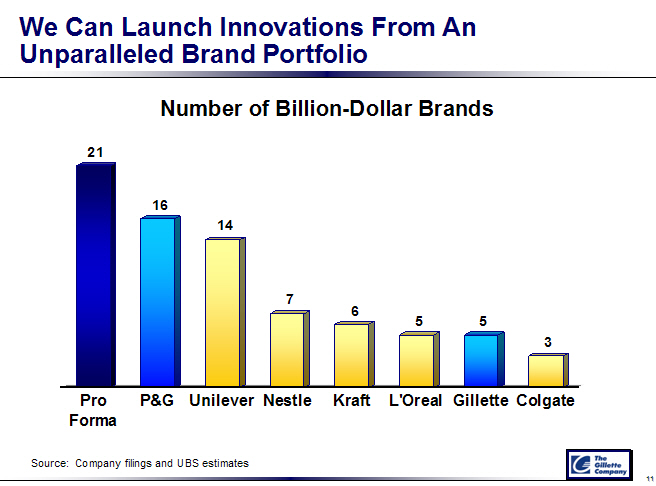

We Can Launch Innovations From An Unparalleled Brand Portfolio

Source: Company filings and UBS estimates

11

|  |

Quick Extension of Product Reach Will Result in Acceleration of Trade-Up

o Similar organization structures should result in smooth integration

o Market-based commercial selling units assure local customization and flexibility

o Increased capacity to execute with excellence

o Geographic reach will be strengthened and extended ... notably in developing markets

12

|  |

Gillette Provides Additional Opportunities to Strengthen P&G's Go-To-Market

Capabilities

o By bringing additional brands into the P&G line-up

o P&G can distribute Gillette brands more deeply and cost-effectively

13

|  |

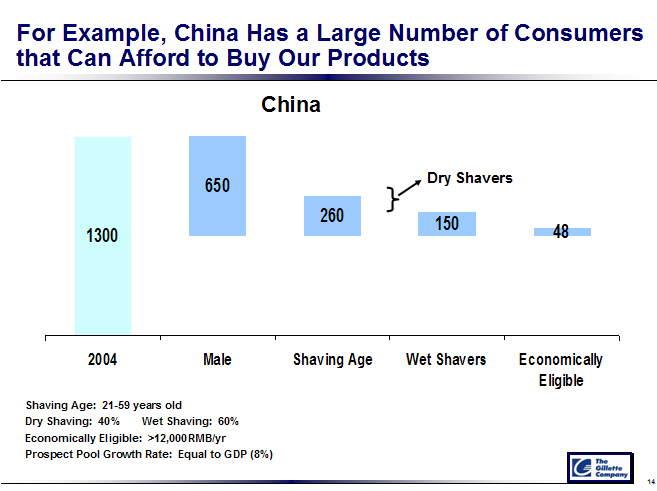

For Example, China Has a Large Number of Consumers that

Can Afford to Buy Our Products

Shaving Age: 21-59 years old

Dry Shaving: 40% Wet Shaving: 60%

Economically Eligible: >12,000RMB/yr

Prospect Pool Growth Rate: Equal to GDP (8%)

14

|  |

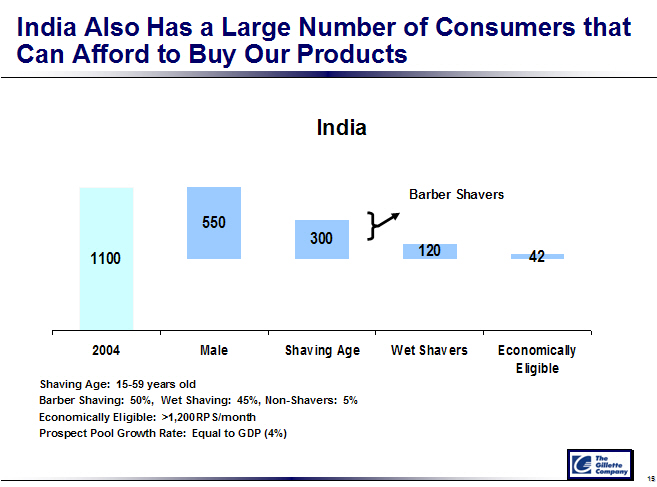

India Also Has a Large Number of Consumers that Can Afford to Buy Our Products

Shaving Age: 15-59 years old

Barber Shaving: 50%, Wet Shaving: 45%, Non-Shavers: 5%

Economically Eligible: >1,200RPS/month

Prospect Pool Growth Rate: Equal to GDP (4%)

15

|  |

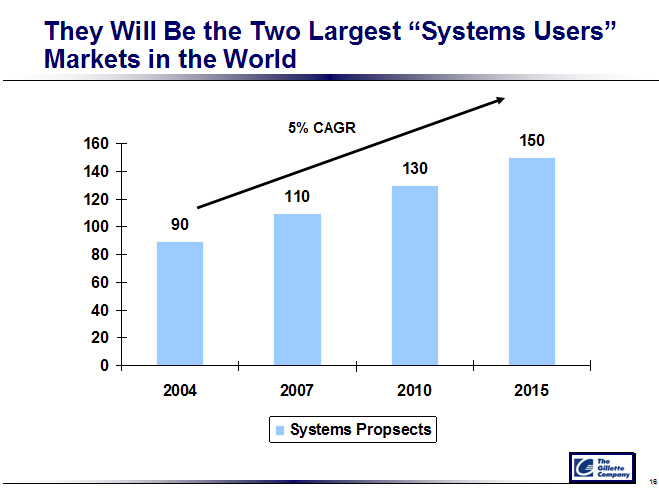

They Will Be the Two Largest "Systems Users" Markets in the World

16

|  |

They Will Be the Two Largest "Systems Users" Markets in the World ...

IF ...

- China's and India's prospect pools grow with GDP ... around 8% and 4%, respectively

AND ...

- Gillette can drive systems penetration of prospect pools to U.S. and European levels

BUT ...

- We need the infrastructure to drive and accelerate trade-up

17

|  |

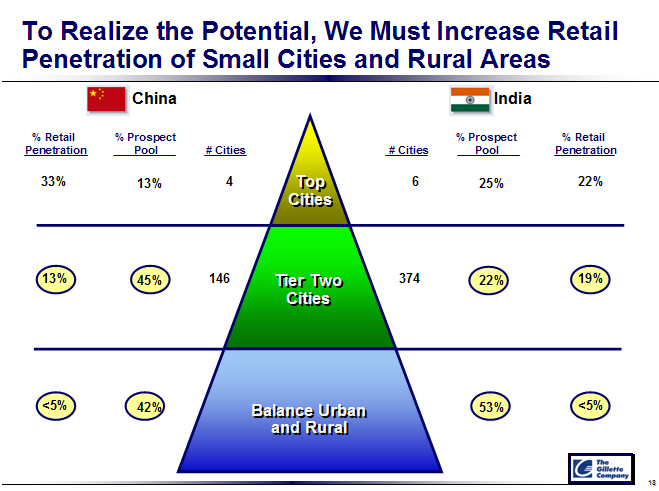

To Realize the Potential, We Must Increase Retail Penetration of Small Cities and Rural Areas

China India

% Retail % Prospect % Prospect % Retail

Penetration Pool # Cities # Cities Pool Penetration

----------- ---- -------- -------- ---- -----------

33% 13% 4 Top Cities 6 25% 22%

[13%] [45%] 146 Tier Two Cities 374 [22%] [19%]

[less [less

than 5%] [42%] Balance Urban and [53%] than 5%]

Rural

18

|  |

In China, Our Distribution Is Effective, But Limited

Shaving

Batteries 60 Cities

Oral Care

19

|  |

Combining With P&G's Infrastructure Will Accelerate Penetration and Trade-Up

P&G 14 Brands 2,000 Cities

11,000 Towns

20

|  |

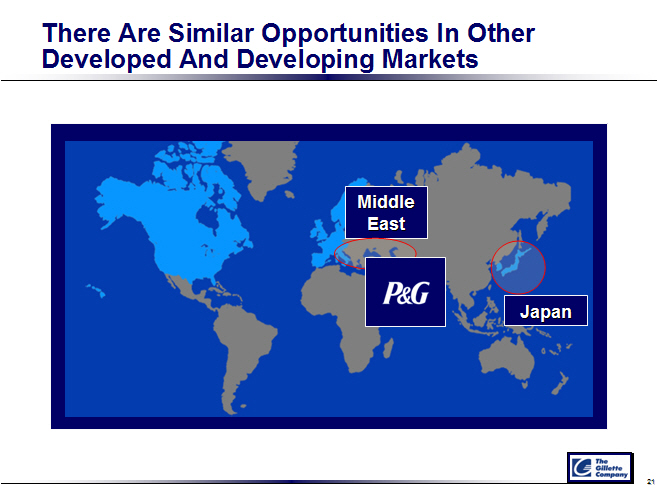

There Are Similar Opportunities In Other Developed And Developing Markets

Middle East

P&G

Japan

21

|  |

In Markets Like India and Brazil, We Will Add Critical Mass to Both Organizations

The Gillette Company

India

Brazil

22

|  |

Gillette Will Have the Scale and Resources to Grow

Faster and More Profitably Than on Its Own

o $1 to $1.2 billion in cost synergies by Year 3

o Complementary strategic, operating and financial discipline

- Shared focus on continually finding new ways to do more with less

o Overlapping infrastructures and both companies run SAP

23

|  |

Scale Is The Key To Commercializing Innovation Affordably And Profitably

o Scale is not just about size

o Scale is not just about cost, purchasing power or bargaining power

- Industry-leading scale can be created in consumer knowledge, in distribution, in innovation and

commercialization, in marketing, in R&D and business services

o The most important thing about scale is the ability to reinvest in technology and brand building

o The more you can reinvest, the more you can grow

24

|  |

P&G and Gillette

Strength + Strength = Success!!

25

|  |

The Gillette Company + P&G

The Best Consumer Products

Company In The World

26

|  |

FORWARD-LOOKING STATEMENTS

This document includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Investors are cautioned that such forward-looking statements with respect to revenues, earnings, performance, strategies, prospects and other aspects of the businesses of The Gillette Company (“Gillette”), The Procter & Gamble Company (“P&G”) and the combined company after completion of the proposed transaction are based on current expectations that are subject to risks and uncertainties. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward-looking statements. These factors include, but are not limited to, the following risks and uncertainties: those set forth in Gillette’s and P&G’s filings with the Securities and Exchange Commission (“SEC”), the failure to obtain and retain expected synergies from the proposed transaction, failure of Gillette and P&G stockholders to approve the transaction, delays in obtaining, or adverse conditions contained in, any required regulatory approvals, failure to consummate or delay in consummating the transaction for other reasons, changes in laws or regulations and other similar factors. Readers are referred to Gillette’s and P&G’s most recent reports filed with the SEC. Gillette and P&G are under no obligation to (and expressly disclaim any such obligation to) update or alter their forward-looking statements whether as a result of new information, future events or otherwise.

Additional Information and Where to Find It

This filing may be deemed to be solicitation material in respect of the proposed merger of Gillette and P&G. On March 14, 2005, P&G filed with the SEC a registration statement on Form S-4, including the preliminary joint proxy statement/prospectus constituting a part thereof. SHAREHOLDERS OFGILLETTE AND SHAREHOLDERS OF P&G ARE URGED TO READ THE REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC, INCLUDING THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUSTHAT WILL BE PART OF THE DEFINITIVE REGISTRATION STATEMENT, AS THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. The final joint proxy statement/prospectus will be mailed to shareholders of Gillette and shareholders of P&G. Investors and security holders may obtain a free copy of the disclosure documents (when they are available) and other documents filed by Gillette and P&G with the Commission at the Commission’s website atwww.sec.gov, from The Gillette Company, Prudential Tower, Boston, Massachusetts, 02199-8004, Attention: Office of the Secretary, or from The Procter & Gamble Company, Investor Relations, P.O. Box 599, Cincinnati, OH 45201-0599.

Participants in the Solicitation

Gillette, P&G and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from their respective shareholders in respect of the proposed transactions. Information regarding Gillette’s directors and executive officers is available in Gillette’s proxy statement for its 2004 annual meeting of shareholders, which was filed with the SEC on April 12, 2004, and information regarding P&G’s directors and executive officers is available in P&G’s proxy statement for its 2004 annual meeting of shareholders, which was filed with the SEC on August 27, 2004. Additional information regarding the interests of such potential participants will be included in the joint proxy statement/prospectus and the other relevant documents filed with the SEC when they become available.