Filed by: Berry Global Group, Inc.

Commission File No.: 001-35672

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company: Glatfelter Corporation (Commission File No.: 001-03560)

Below is a communication made by Berry Global Group, Inc. on September 4, 2024.

THE INFORMATION CONTAINED IN THE LENDER PRESENTATION BELOW HAS BEEN MADE AVAILABLE TO POTENTIAL LENDERS IN CONNECTION WITH THE FINANCING CONTEMPLATED BY THE PROPOSED MERGER OF BERRY’S HEALTH, HYGIENE AND SPECIALTIES GLOBAL NONWOVENS AND FILMS BUSINESS WITH GLATFELTER.

| Possibilities Made Real SPECIAL NOTICE REGARDING PUBLICLY AVAILABLE INFORMATION THE COMPANY HAS REPRESENTED THAT THE INFORMATION CONTAINED IN THIS LENDER PRESENTATION IS EITHER PUBLICLY AVAILABLE OR DOES NOT CONSTITUTE MATERIAL NON-PUBLIC INFORMATION WITH RESPECT TO THE COMPANY OR ITS SECURITIES. THE RECIPIENT OF THIS LENDER PRESENTATION HAS STATED THAT IT DOES NOT WISH TO RECEIVE MATERIAL NON-PUBLIC INFORMATION WITH RESPECT TO THE COMPANY OR ITS SECURITIES AND ACKNOWLEDGES THAT OTHER LENDERS HAVE RECEIVED A LENDER PRESENTATION THAT CONTAINS ADDITIONAL INFORMATION WITH RESPECT TO THE COMPANY OR ITS SECURITIES THAT MAY BE MATERIAL. NEITHER THE COMPANY NOR THE ARRANGER TAKES ANY RESPONSIBILITY FOR THE RECIPIENT'S DECISION TO LIMIT THE SCOPE OF THE INFORMATION IT HAS OBTAINED IN CONNECTION WITH ITS EVALUATION OF THE COMPANY AND THE FACILITY. |

| 2 Today’s Presenters Note: Incoming management of Magnera Corporation. |

| 1. Transaction Details 2. Transaction Rationale 3. Business Review 4. Key Credit Highlights 5. Financial Summary Agenda 3 |

| Transaction Details 4 |

| Executive Summary • On February 7, 2024, Berry Global (NYSE: BERY) and Glatfelter (NYSE: GLT) announced plans for tax-free spin-off and merger of Berry’s Health, Hygiene and Specialties Global Nonwovens and Films business (“HHNF”) with Glatfelter (the “Transaction”) • Berry Global is expected to receive net cash proceeds of approximately ~$1 billion at close • Berry shareholders will own ~90% of the combined company’s common shares upon consummation of the transaction. Glatfelter shareholders will own the remaining ~10% of the combined company • In connection with the Transaction, Glatfelter will complete a reverse stock split of all its issued and outstanding common stock • HHNF brings an extensive portfolio of proprietary technologies, with a strong focus on healthcare, hygiene, and specialty end markets, while Glatfelter provides a broad range of innovation capabilities and sustainability solutions • The new combined company (“Magnera” or “the Company”) will become a global leader in the growing specialty materials industry, serving the world’s largest brand owners across global end markets with favorable long-term growth dynamics • Magnera will offer a highly complementary product suite, including both polymer-based and fiber-based solutions, supported by strong innovation capabilities, with significant geographic diversification and a presence in all major markets • For the LTM period ending June 2024, the Company generated combined revenue of $3.5 billion and PF Adj. EBITDA of $455 million • Pro forma for the Transaction, the Company is expected to have Secured and Total Net Leverage of ~4.0x based on LTM PF Adj. EBITDA of $455 million, financed with: • $350 million 5-year Asset-Based Credit Facility (undrawn at close) • $1,585 million 7-year Senior Secured Term Loan B • $500 million Rolled 4.750% Senior Secured Notes due 2029 • Total cash contribution of >$200 million • The Company plans to launch the Term Loan B in early September with the Transaction targeted to close no later than early November 2024, subject to customary closing conditions and regulatory approvals 5 |

| Transaction Rationale 6 |

| Innovation Expertise Solutions to help forwarding our Customers’ Goals by Solving End User Problems Sustainability Leadership Collaborating Across the Value Chain to Achieve More Together for a Circular Economy Global Capabilities Serving Customers Around the World with Our Unmatched Global Capabilities 7 |

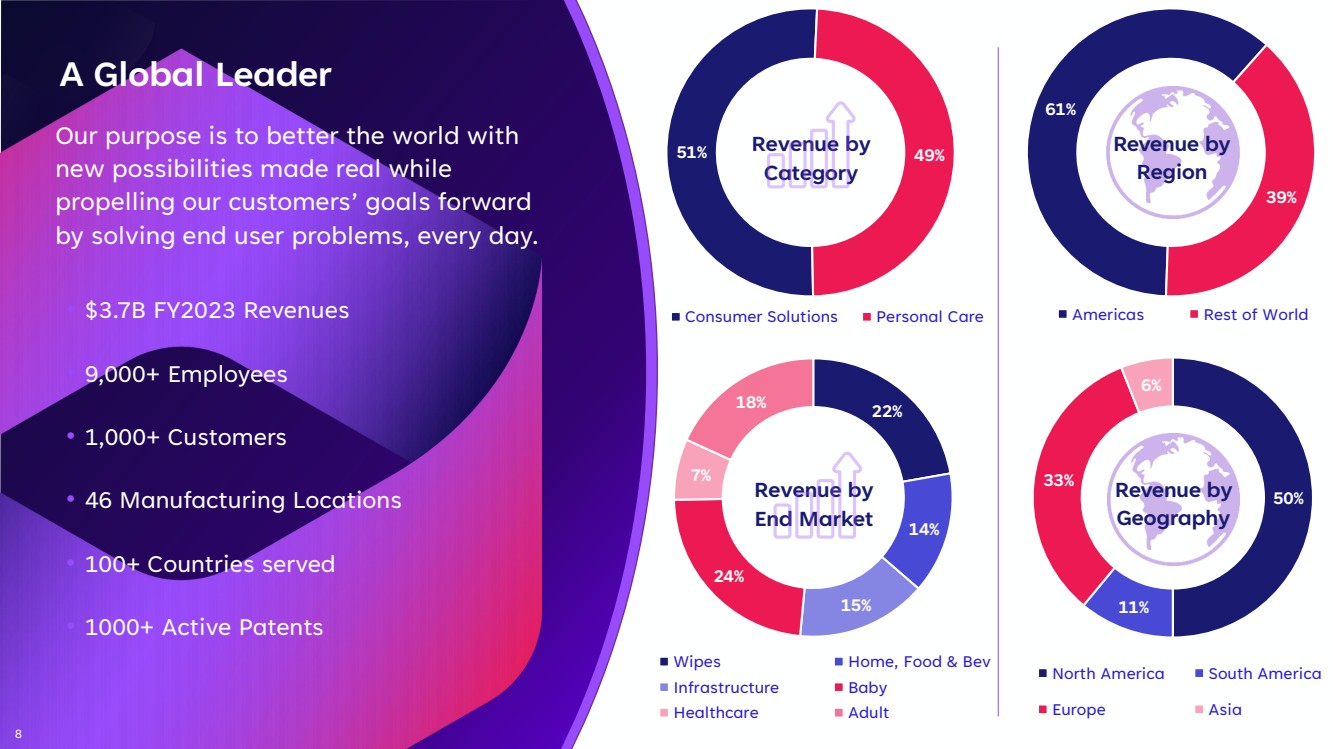

| 61% 39% Americas Rest of World Revenue by Region 51% 49% Consumer Solutions Personal Care Revenue by Category 22% 14% 15% 24% 7% 18% Wipes Home, Food & Bev Infrastructure Baby Healthcare Adult Revenue by End Market Our purpose is to better the world with new possibilities made real while propelling our customers’ goals forward by solving end user problems, every day. • $3.7B FY2023 Revenues • 9,000+ Employees • 1,000+ Customers • 46 Manufacturing Locations • 100+ Countries served • 1000+ Active Patents A Global Leader 50% 11% 33% 6% North America South America Europe Asia Revenue by Geography 8 |

| Creates a differentiated industry leader serving attractive, growing markets and several highly-profitable niches Brings together leading resin and fiber technologies, at scale, providing for broader solutions, unique innovation opportunities and greater customer choice Deepens relationships with the world’s leading brand owners, enabling critical innovation and partnership resources to support growth Combines well-invested, global footprint, positioned to serve global and regional customers across all major continents Combination Benefits 9 |

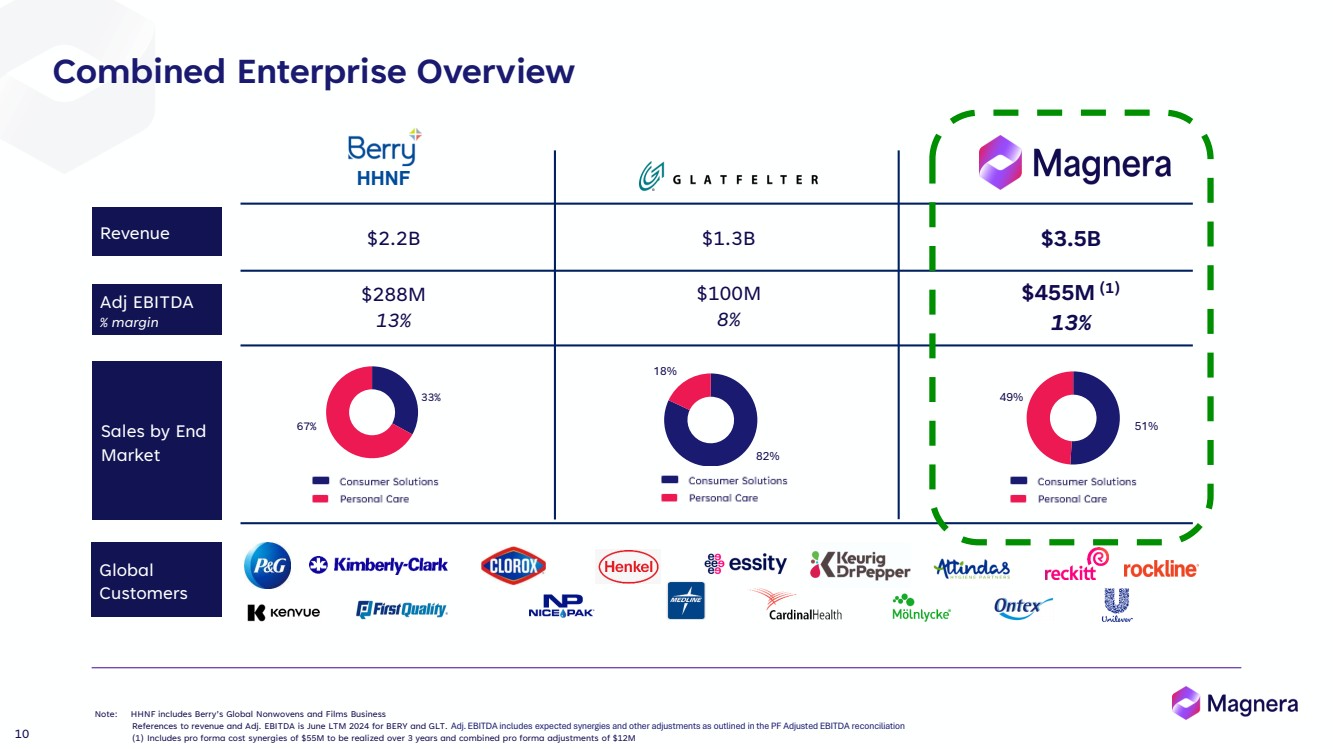

| $2.2B $1.3B Sales by End Market Global Customers $3.5B Adj EBITDA % margin $288M 13% $100M 8% $455M (1) 13% Revenue HHNF 33% 67% 82% 18% 51% 49% Note: HHNF includes Berry’s Global Nonwovens and Films Business References to revenue and Adj. EBITDA is June LTM 2024 for BERY and GLT. Adj. EBITDA includes expected synergies and other adjustments as outlined in the PF Adjusted EBITDA reconciliation (1) Includes pro forma cost synergies of $55M to be realized over 3 years and combined pro forma adjustments of $12M Combined Enterprise Overview 10 |

| Single-Serve Coffee Tea Bags Tabletop Decorative Filtration Media Laminate Disinfecting, Cleaning & Personal Care Wipes Healthcare & Surgical Suite Baby and Adult Care Laundry Care Geotextiles Agriculture Cable Wrap Bedding & Upholstery Building Wrap and Roofing Solutions Value-added niche businesses Sophisticated fiber-based businesses Wallcover Tree Shelters Shared Applications FIBC Bags Note: HHNF includes Berry’s Global Nonwovens and Films Business HHNF Distinct And Complementary Technology & Product Portfolios Broadest product offering in the industry for both polymer-based and fiber-based product applications 11 |

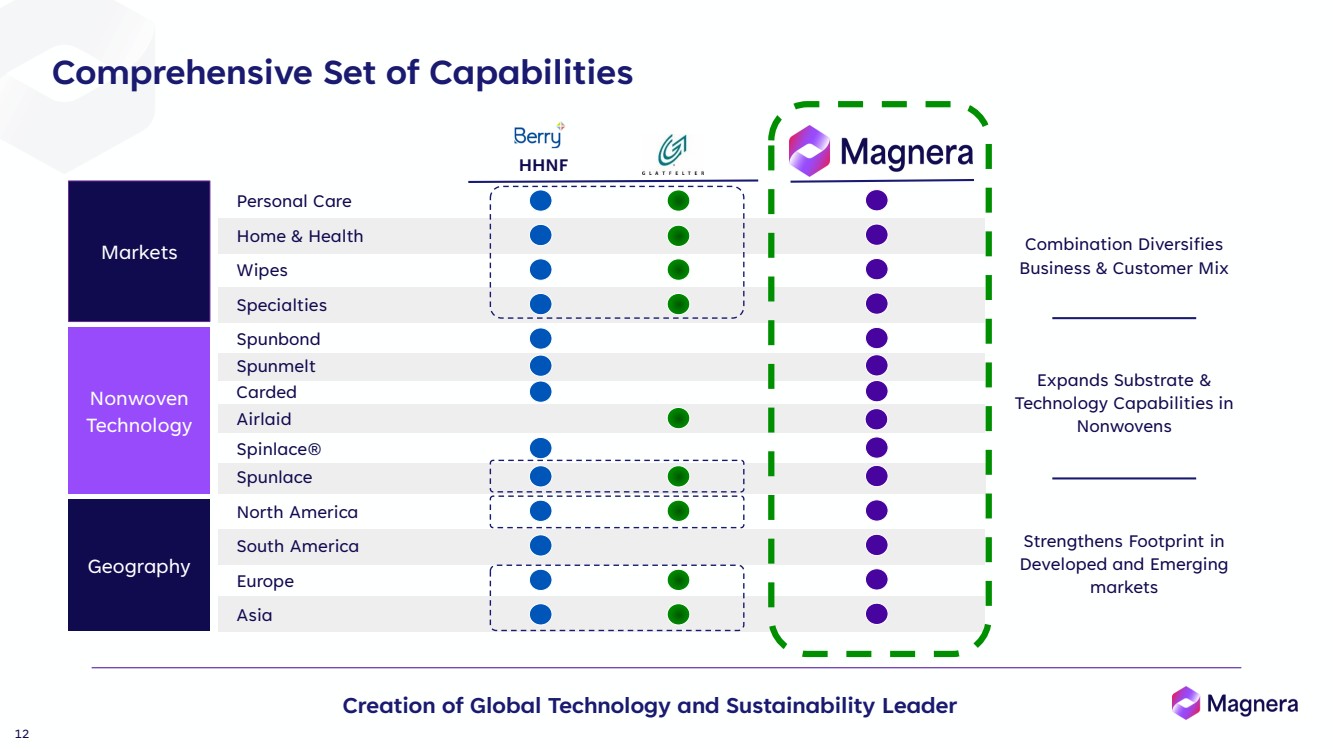

| Comprehensive Set of Capabilities Markets Nonwoven Technology Geography Personal Care Home & Health Wipes Specialties Spunbond Spunmelt Carded Spinlace® Spunlace North America South America Europe Asia HHNF Combination Diversifies Business & Customer Mix Expands Substrate & Technology Capabilities in Nonwovens Strengthens Footprint in Developed and Emerging markets Airlaid Creation of Global Technology and Sustainability Leader 12 |

| Business Review 13 |

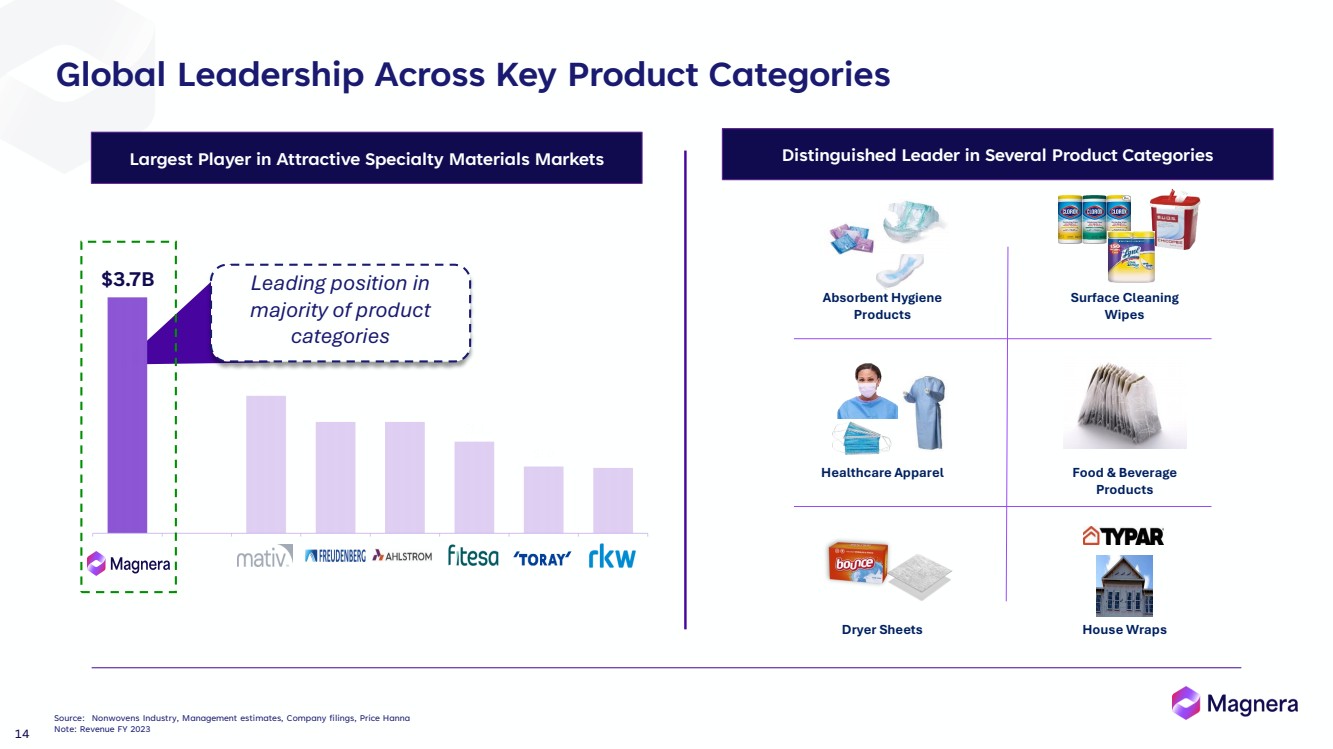

| Global Leadership Across Key Product Categories Source: Nonwovens Industry, Management estimates, Company filings, Price Hanna Note: Revenue FY 2023 $3.7B Food & Beverage Products Surface Cleaning Wipes Absorbent Hygiene Products Healthcare Apparel Dryer Sheets House Wraps Leading position in majority of product categories Largest Player in Attractive Specialty Materials Markets Distinguished Leader in Several Product Categories 14 |

| Manufacturing Sites and Global Centers of Excellence Broadest global plant network, well-positioned to serve global CPGs NORTH AMERICA • Gatineau, Canada • North Bay, Canada • Asheville, NC USA • Augusta, KY USA • Benson, NC USA • Fort Smith, AR USA • Madison, TN USA • McAlester, OK USA • Mooresville, NC USA • Mount Holly, NC USA • Nashville, TN USA • Old Hickory, TN USA • Old Hickory, TN USA • Statesville, NC USA • Washington, GA USA • Waynesboro, VA USA LATIN AMERICA • Atlacomulco, Mexico • Pilar, Argentina • Jundiaí, Brazil • Pouso Alegre, Brazil • São José Dos Pinhais, Brazil • Cali, Colombia • San Luis Potosi, Mexico ASIA • Nanhai, China • Suzhou, China • Newtech, Philippines EMEIA • Bailleul, France • Biesheim, France • Neuville, France • Scaër, France • Soultz, France • Aschersleben, Germany • Berlin, Germany • Dombühl, Germany • Dresden, Germany • Falkenhagen, Germany • Steinfurt, Germany • Gernsbach, Germany • Terno, Italy • Cuijk, The Netherlands • Asturias, Spain • Tarragona, Spain • Aberdare, UK • Caerphilly, UK • Lydney, UK • Maldon, UK 100+ Countries Served 46 Global Facilities ~9,000 Employees 1,000+ Customers 15 |

| Americas (61% of revenue) 16 62% 10% 28% Consumer Solutions 53% 12% 35% Personal Care FY2023 Revenue $2.3B 16 Infrastructure Home, Food & Bev Wipes Baby Healthcare Adult 51% 49% Personal Care Consumer Solutions Revenue by End Market |

| 46% 54% Personal Care Consumer Solutions Revenue by End Market FY2023 Revenue $1.4B Rest of World (39% of revenue) 17 40% 19% 41% Personal Care 21% 49% 30% Consumer Solutions Infrastructure Home, Food & Bev Wipes Baby Healthcare Adult |

| 18 Well Positioned to Serve Leading Global and Regional Customers Enhancing overall value proposition with cross-selling opportunities HHNF Shared Customers Opportunity to Strengthen and Reinforce Key Relationships |

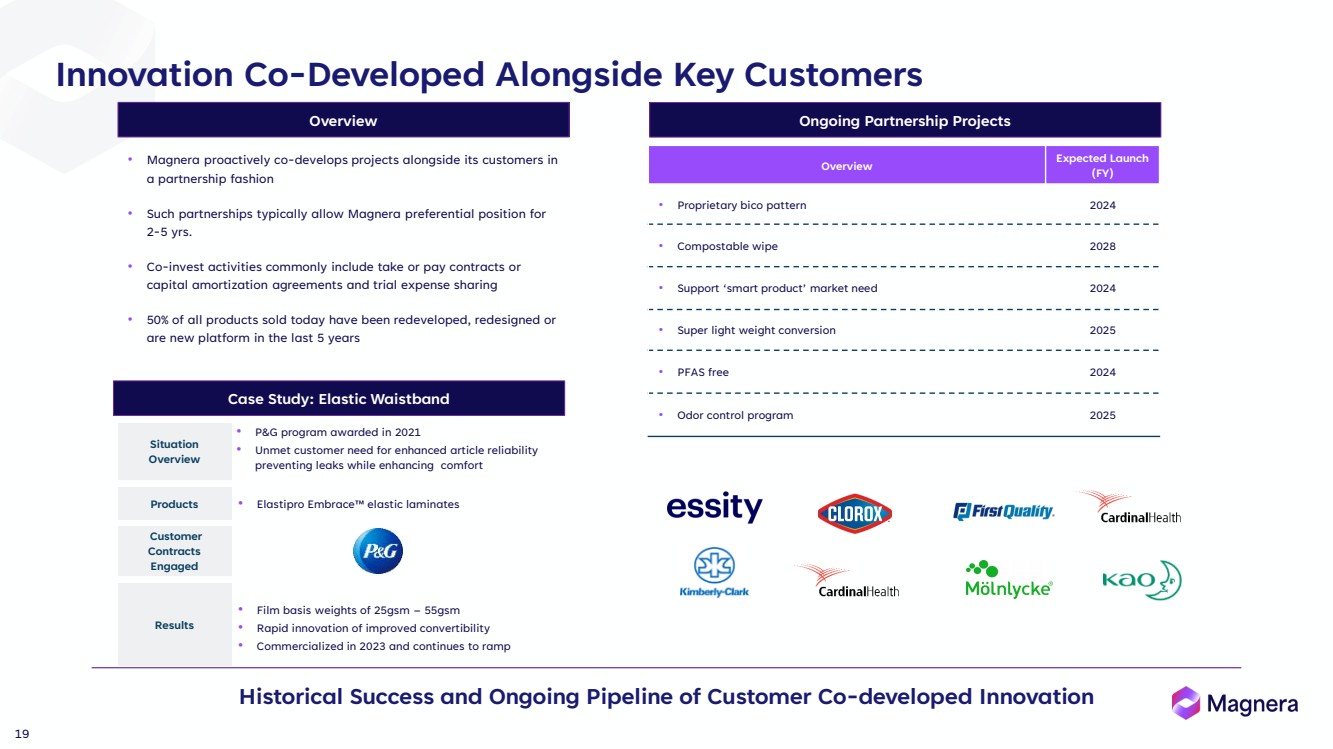

| Innovation Co-Developed Alongside Key Customers Overview Expected Launch (FY) • Proprietary bico pattern 2024 • Compostable wipe 2028 • Support ‘smart product’ market need 2024 • Super light weight conversion 2025 • PFAS free 2024 • Odor control program 2025 Products Customer Contracts Engaged Results • Film basis weights of 25gsm – 55gsm • Rapid innovation of improved convertibility • Commercialized in 2023 and continues to ramp Situation Overview • P&G program awarded in 2021 • Unmet customer need for enhanced article reliability preventing leaks while enhancing comfort • Elastipro Embrace elastic laminates • Magnera proactively co-develops projects alongside its customers in a partnership fashion • Such partnerships typically allow Magnera preferential position for 2-5 yrs. • Co-invest activities commonly include take or pay contracts or capital amortization agreements and trial expense sharing • 50% of all products sold today have been redeveloped, redesigned or are new platform in the last 5 years 89 Overview Ongoing Partnership Projects Case Study: Elastic Waistband Historical Success and Ongoing Pipeline of Customer Co-developed Innovation 19 |

| Key Credit Highlights 20 |

| 1. Global leadership across Key Product Categories 2. Large and fast-growing end markets 3. Tenured and diversified customer base of leading global CPGs 4. Broadest product and solution offering in the industry 5. Passthroughs protect material margins 6. Experienced and proven management team Key Credit Highlights 21 |

| Essential Components that Enhance Overall Performance of Customer Products Baby Soft, strong and highly absorbant material for infants and toddlers Healthcare High-performance protective material for healthcare applications Adult Functional, comfortable and disposable incontinence products for daily use Wipes Critical wipe solutions to keep people healthy Home, Food & Beverage Leading filtration and packaging products to protect and store food 22 Global Leadership Across Key Product Categories Mission Critical Products That Improve Everyday Lives 1. Infrastructure Rugged, high-performance solutions for building and construction applications |

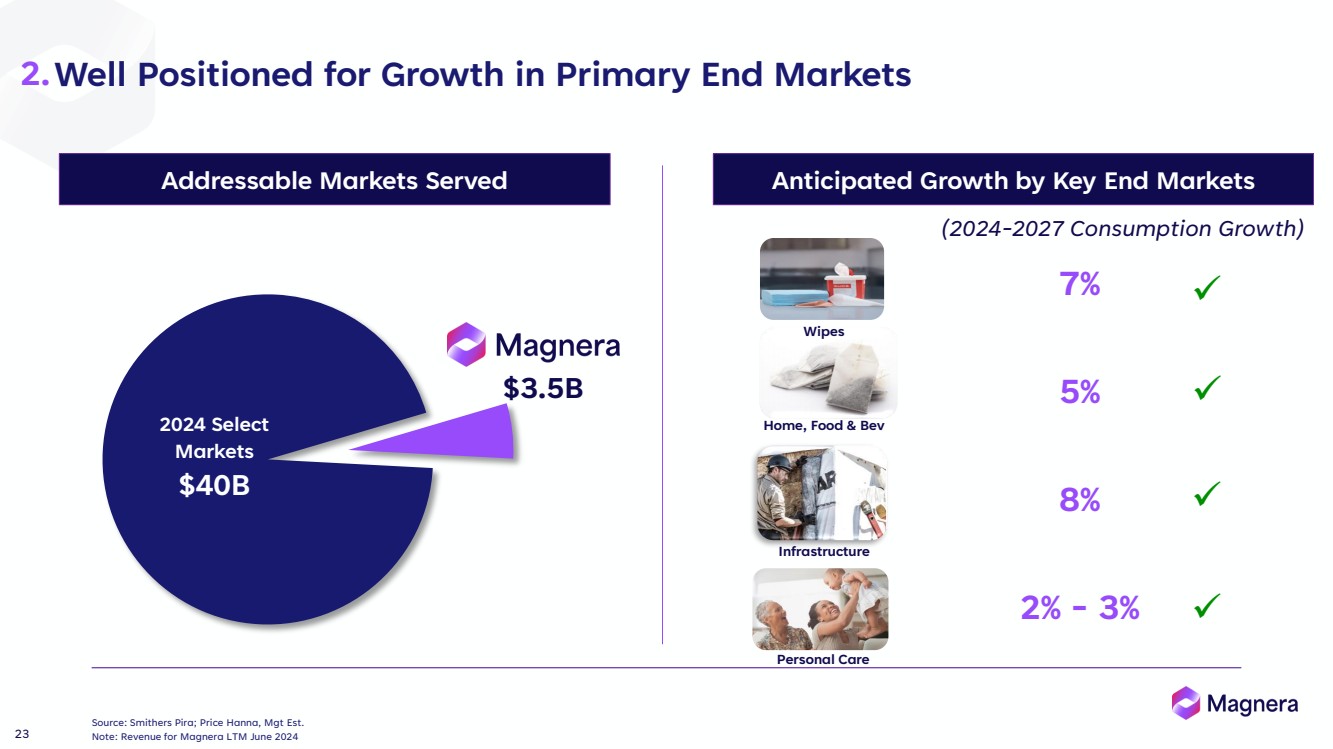

| Well Positioned for Growth in Primary End Markets Addressable Markets Served $3.5B 2024 Select Markets $40B Anticipated Growth by Key End Markets Wipes Personal Care Source: Smithers Pira; Price Hanna, Mgt Est. Note: Revenue for Magnera LTM June 2024 (2024-2027 Consumption Growth) 23 Home, Food & Bev Infrastructure 7% 5% 8% 2% - 3% ✓ ✓ ✓ ✓ 2. |

| 2.Key Drivers of Growth Will Benefit from Market Growth, Operational Execution, and Innovation Mega Trends Commercial & Operational Excellence Organic Growth Investments Strategic Opportunities • Attractive growth trends in health & personal care • Population growth with rising standards of living • Substitution from reusable products to disposable specialty materials • Aging population driving adult incontinence & healthcare demand • Prioritize customer relationships • Leverage global footprint • Global innovation and R&D • Execute on productivity opportunities • Sustainability offerings • Broad manufacturing platform • Technology and sustainability leadership • Penetration in key growth markets including Asia, Africa and India Multiple Strategic Angles Including: 1. Adjacent markets 2. Geographic expansion 3. Product line extensions 4. Differentiated technologies 5. Synergy capture 24 |

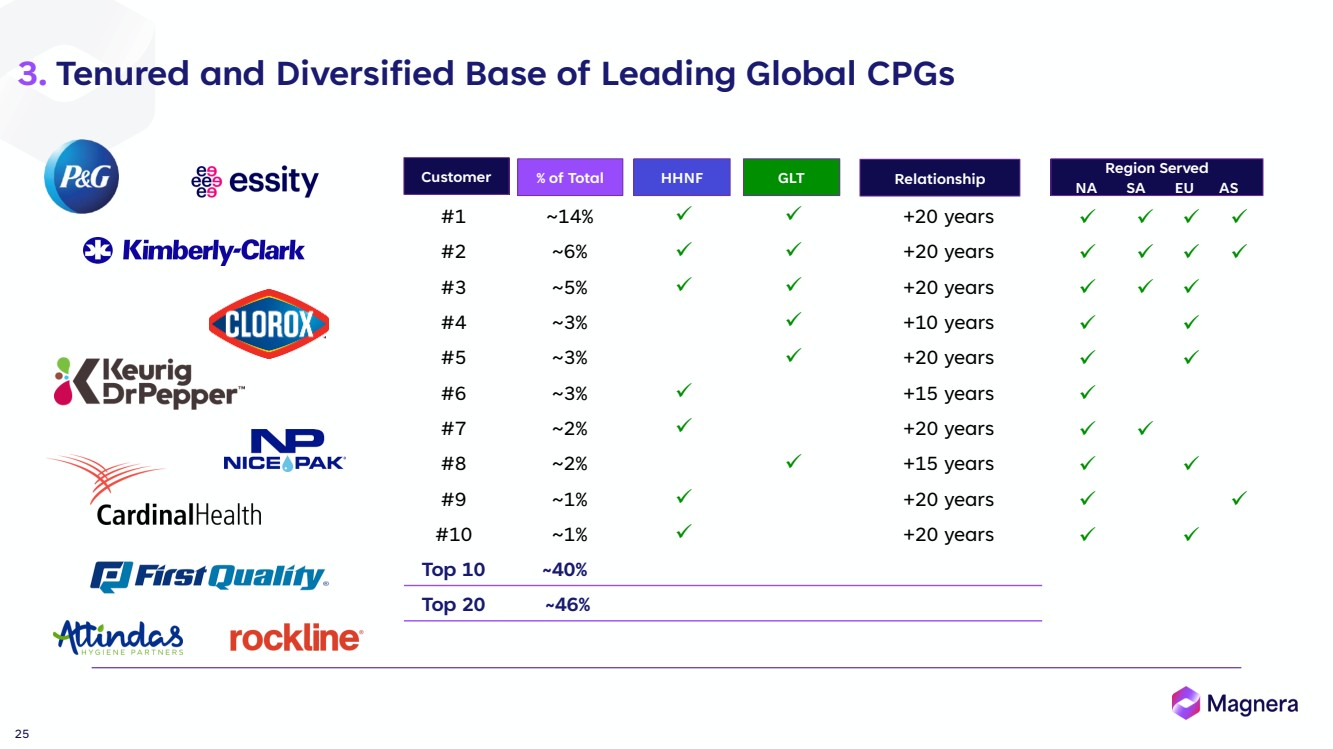

| Tenured and Diversified Base of Leading Global CPGs #1 ~14% ✓ ✓ +20 years #2 ~6% ✓ ✓ +20 years #3 ~5% ✓ ✓ +20 years #4 ~3% ✓ +10 years #5 ~3% ✓ +20 years #6 ~3% ✓ +15 years #7 ~2% ✓ +20 years #8 ~2% ✓ +15 years #9 ~1% ✓ +20 years #10 ~1% ✓ +20 years Top 10 ̴40% Top 20 ̴46% Customer % of Total HHNF GLT Relationship Region Served NA SA EU AS ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ 25 3. |

| 26 3. A History of Partnership with Leading Global and Regional Customers |

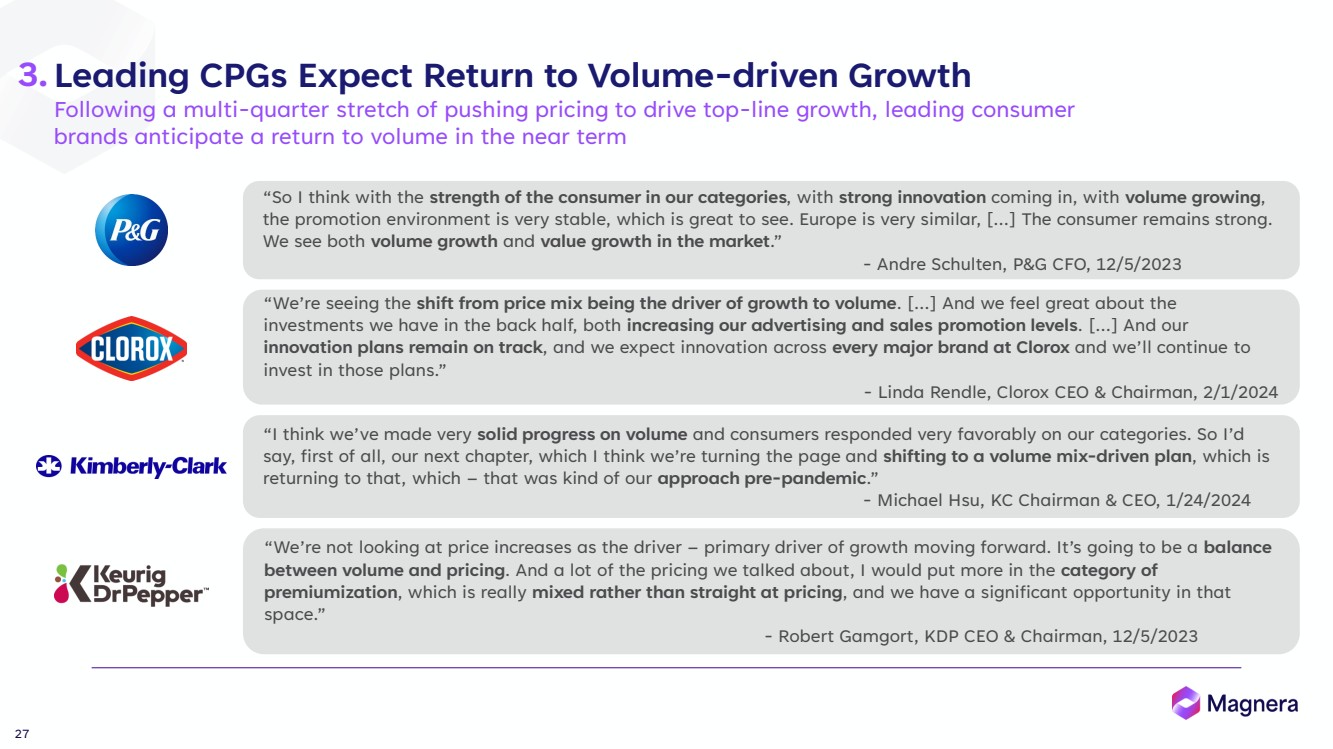

| “So I think with the strength of the consumer in our categories, with strong innovation coming in, with volume growing, the promotion environment is very stable, which is great to see. Europe is very similar, […] The consumer remains strong. We see both volume growth and value growth in the market.” - Andre Schulten, P&G CFO, 12/5/2023 “We’re seeing the shift from price mix being the driver of growth to volume. […] And we feel great about the investments we have in the back half, both increasing our advertising and sales promotion levels. […] And our innovation plans remain on track, and we expect innovation across every major brand at Clorox and we’ll continue to invest in those plans.” - Linda Rendle, Clorox CEO & Chairman, 2/1/2024 “I think we’ve made very solid progress on volume and consumers responded very favorably on our categories. So I’d say, first of all, our next chapter, which I think we’re turning the page and shifting to a volume mix-driven plan, which is returning to that, which – that was kind of our approach pre-pandemic.” - Michael Hsu, KC Chairman & CEO, 1/24/2024 “We’re not looking at price increases as the driver – primary driver of growth moving forward. It’s going to be a balance between volume and pricing. And a lot of the pricing we talked about, I would put more in the category of premiumization, which is really mixed rather than straight at pricing, and we have a significant opportunity in that space.” - Robert Gamgort, KDP CEO & Chairman, 12/5/2023 Leading CPGs Expect Return to Volume-driven Growth Following a multi-quarter stretch of pushing pricing to drive top-line growth, leading consumer brands anticipate a return to volume in the near term 27 3. |

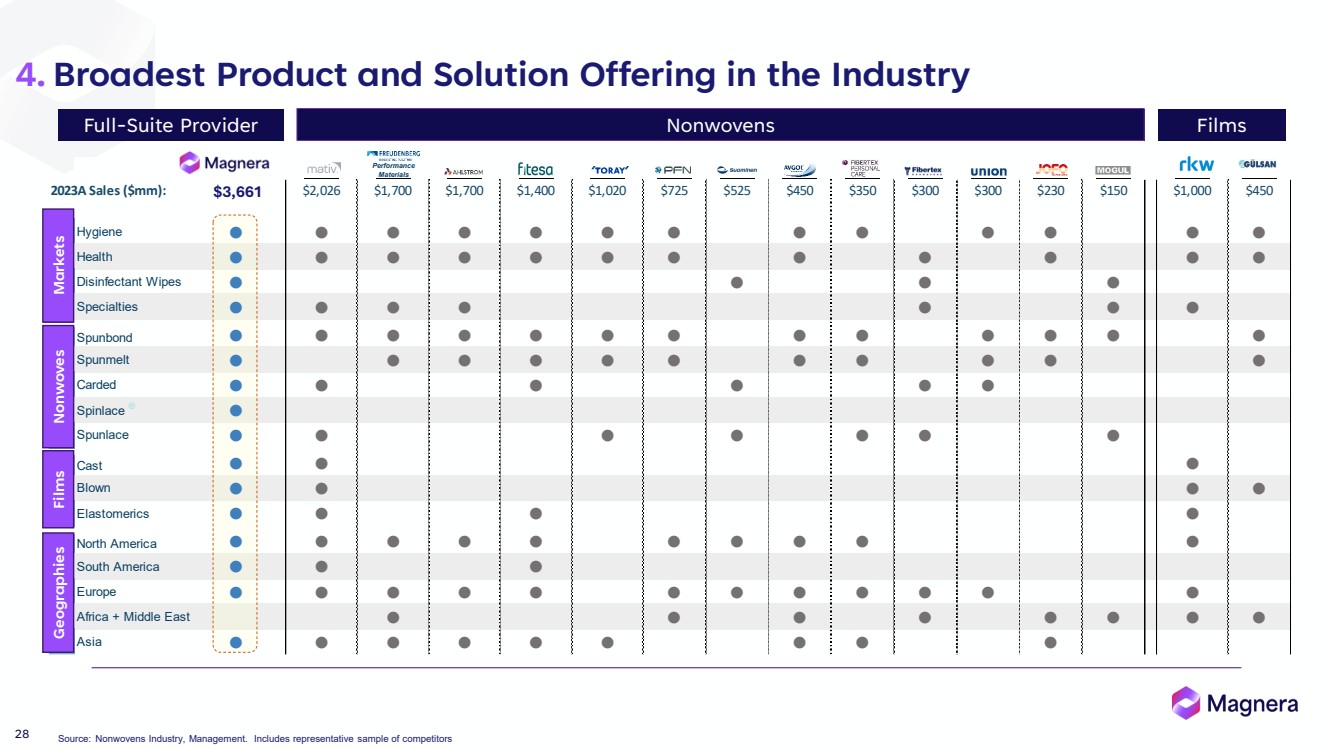

| Broadest Product and Solution Offering in the Industry NewCo AAAA AAAA AAAA AAAA AAAA AAAA AAAA AAAA AAAA AAAA AAAA AAAA AAAA AAAA AAAA 2023A Sales ($mm): $3,600 $2,026 $1,700 $1,700 $1,400 $1,020 $725 $525 $450 $350 $300 $300 $230 $150 $1,000 $450 Hygiene l l l l l l l l l l l l l Health l l l l l l l l l l l l Disinfectant Wipes l l l l Specialties l l l l l l l Spunbond l l l l l l l l l l l l l Spunmelt l l l l l l l l l l l Carded l l l l l l Spinlace ® l Spunlace l l l l l l l Cast l l l Blown l l l l Elastomerics l l l l North America l l l l l l l l l l South America l l l Europe l l l l l l l l l l l l Africa + Middle East l l l l l l l l Asia l l l l l l l l l Markets Films Geographies Nonwovens Full-Suite Provider Nonwovens Films Source: Nonwovens Industry, Management. Includes representative sample of competitors Performance Materials 28 $3,661 Markets Nonwoves Films Geographies 4. |

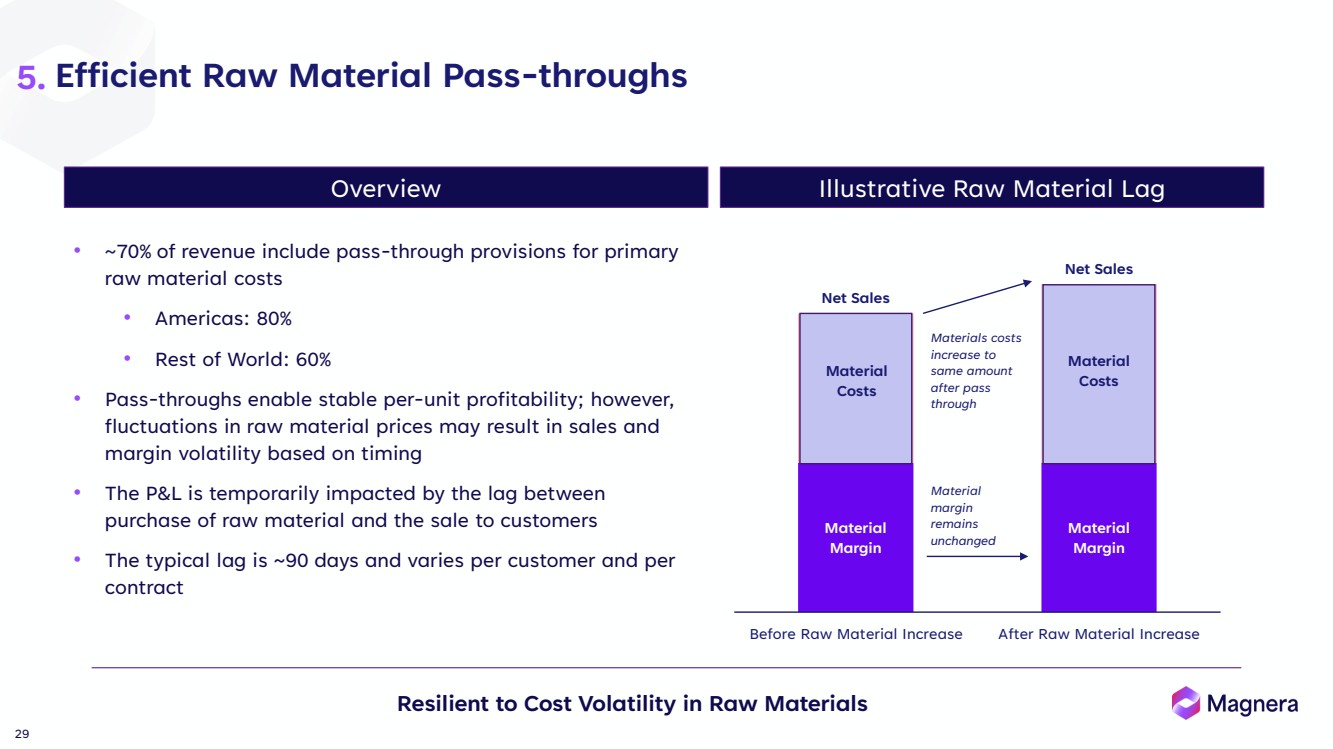

| Efficient Raw Material Pass-throughs Resilient to Cost Volatility in Raw Materials • ~70% of revenue include pass-through provisions for primary raw material costs • Americas: 80% • Rest of World: 60% • Pass-throughs enable stable per-unit profitability; however, fluctuations in raw material prices may result in sales and margin volatility based on timing • The P&L is temporarily impacted by the lag between purchase of raw material and the sale to customers • The typical lag is ~90 days and varies per customer and per contract Material Margin Material Margin Material Costs Material Costs Net Sales Net Sales Before Raw Material Increase After Raw Material Increase Materials costs increase to same amount after pass through Material margin remains unchanged Overview Illustrative Raw Material Lag Material Costs Material Costs 29 5. |

| World Class Management Team Focused on Value Creation Proven, Results Oriented, and Committed 30 Note: Incoming management of Magnera Corporation. 6. |

| Financial Summary 31 |

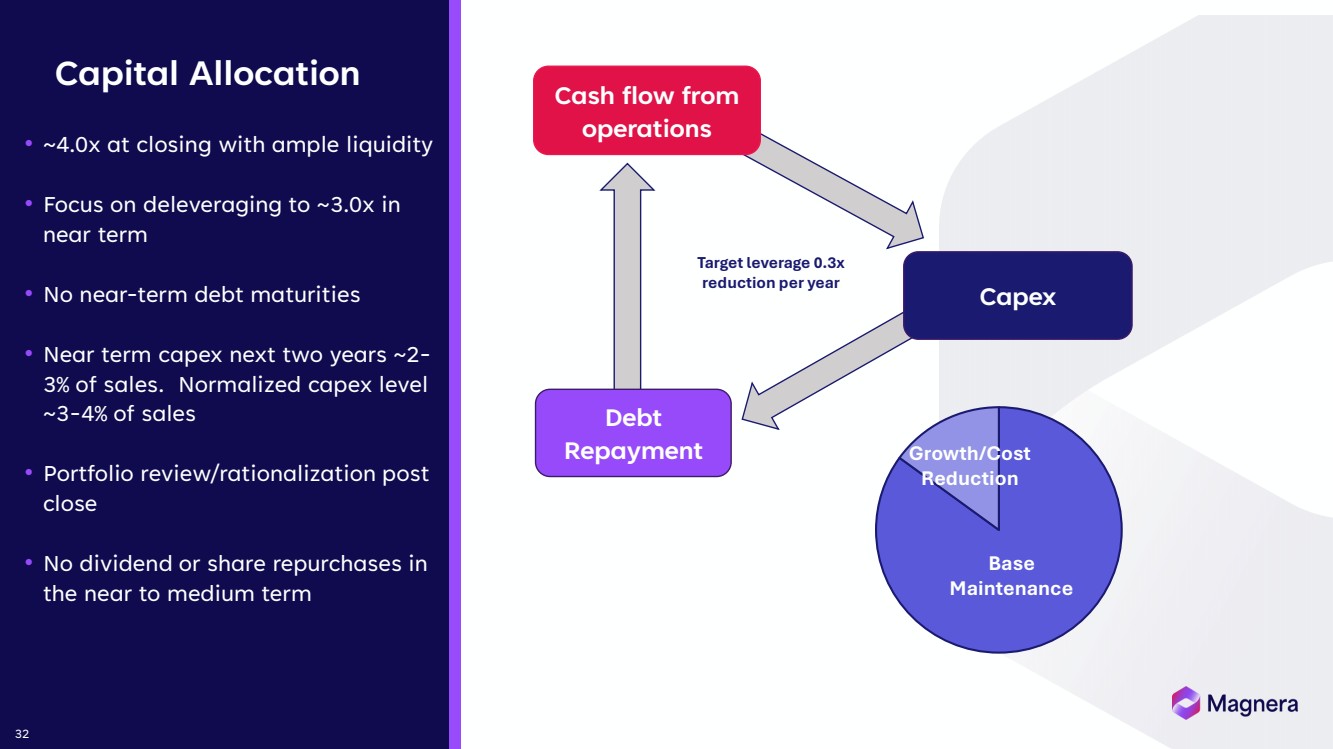

| Capital Allocation 32 Cash flow from operations Debt Repayment Target leverage 0.3x reduction per year Base Maintenance Growth/Cost Reduction Capex • ~4.0x at closing with ample liquidity • Focus on deleveraging to ~3.0x in near term • No near-term debt maturities • Near term capex next two years ~2- 3% of sales. Normalized capex level ~3-4% of sales • Portfolio review/rationalization post close • No dividend or share repurchases in the near to medium term |

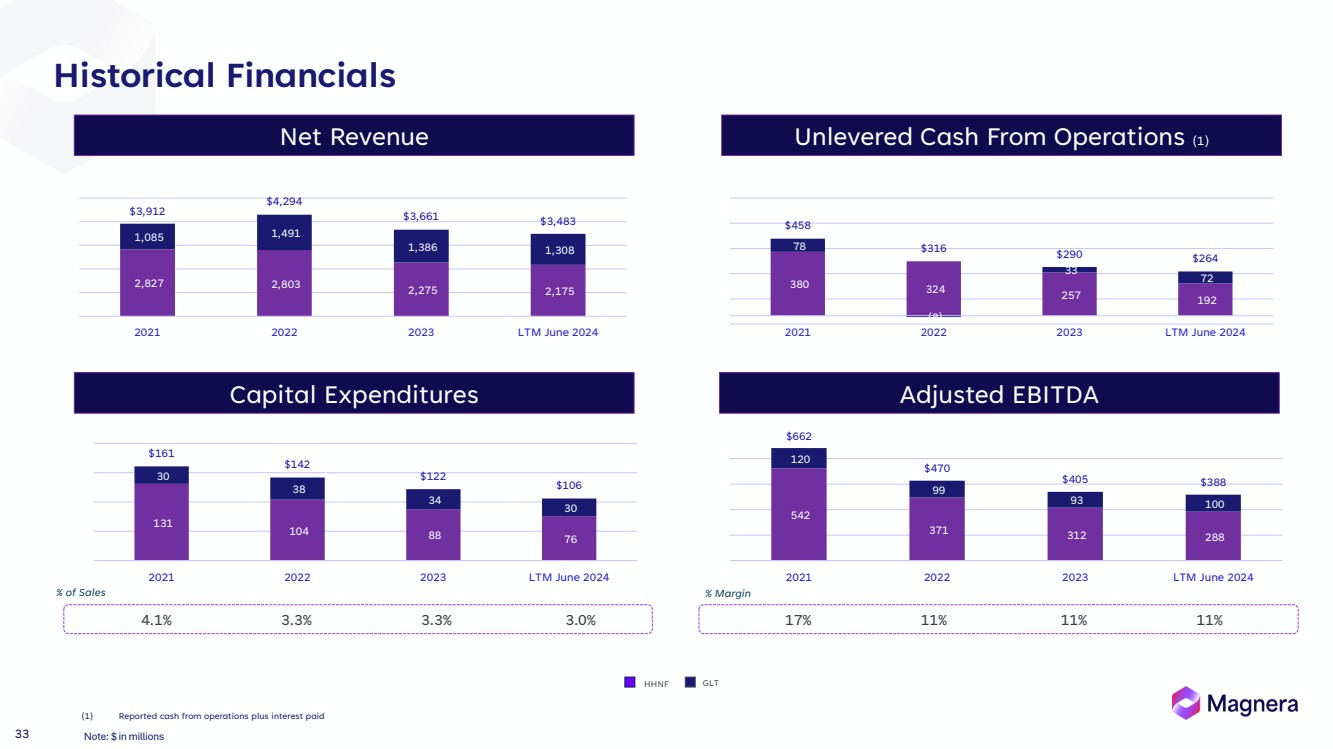

| Historical Financials 33 17% 11% 11% 11% % of Sales % Margin 4.1% 3.3% 3.3% 3.0% (1) Reported cash from operations plus interest paid HHNF GLT Net Revenue Capital Expenditures Adjusted EBITDA Unlevered Cash From Operations (1) 33 Note: $ in millions. 2,827 2,803 2,275 2,175 1,085 1,491 1,386 1,308 $3,912 $4,294 $3,661 $3,483 2021 2022 2023 LTM June 2024 542 371 312 288 120 99 93 100 $662 $470 $405 $388 2021 2022 2023 LTM June 2024 131 104 88 76 30 38 34 30 $161 $142 $122 $106 2021 2022 2023 LTM June 2024 380 324 257 192 78 (8) 33 72 $458 $316 $290 $264 2021 2022 2023 LTM June 2024 |

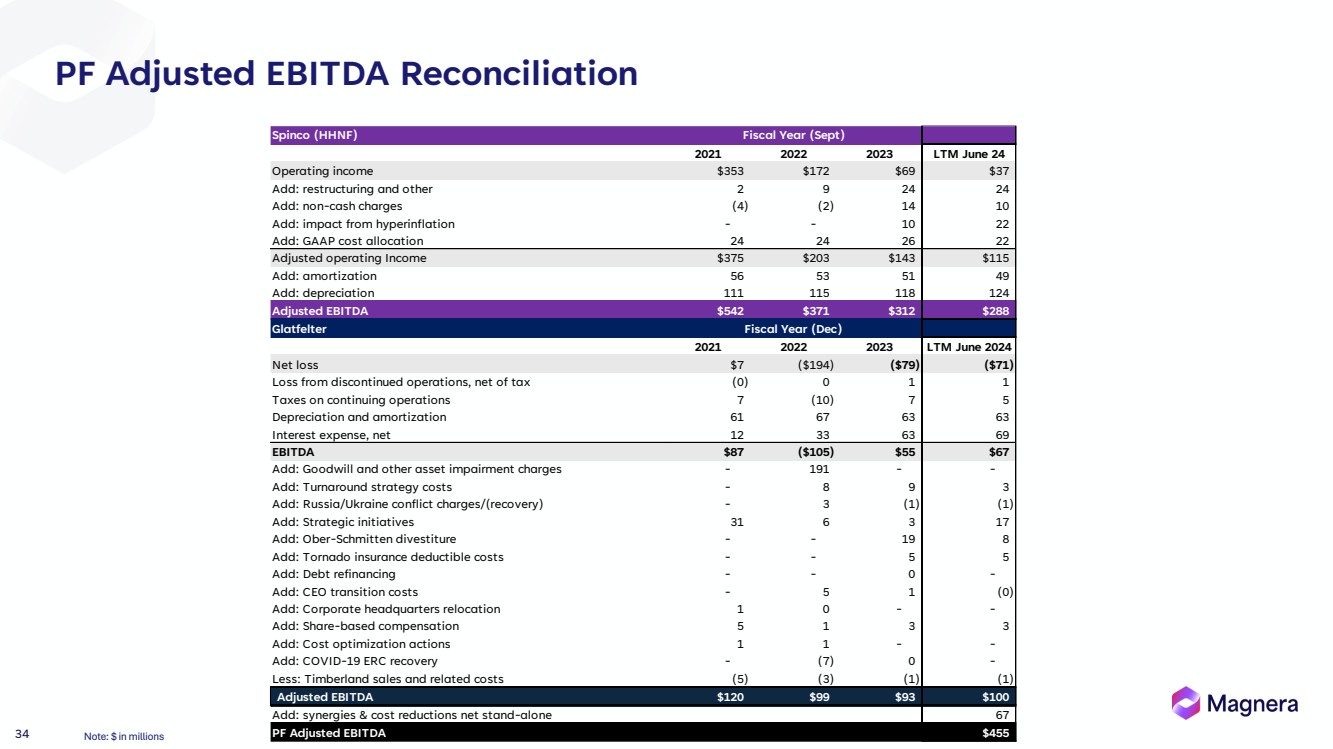

| PF Adjusted EBITDA Reconciliation 34 Note: $ in millions. Spinco (HHNF) 2021 2022 2023 LTM June 24 Operating income $353 $172 $69 $37 Add: restructuring and other 2 9 24 24 Add: non-cash charges (4) (2) 14 10 Add: impact from hyperinflation - - 10 22 Add: GAAP cost allocation 24 24 26 22 Adjusted operating Income $375 $203 $143 $115 Add: amortization 56 53 51 49 Add: depreciation 111 115 118 124 Adjusted EBITDA $542 $371 $312 $288 Glatfelter 2021 2022 2023 LTM June 2024 Net loss $7 ($194) ($79) ($71) Loss from discontinued operations, net of tax (0) 0 1 1 Taxes on continuing operations 7 (10) 7 5 Depreciation and amortization 61 67 63 63 Interest expense, net 12 33 63 69 EBITDA $87 ($105) $55 $67 Add: Goodwill and other asset impairment charges - 191 - - Add: Turnaround strategy costs - 8 9 3 Add: Russia/Ukraine conflict charges/(recovery) - 3 (1) (1) Add: Strategic initiatives 31 6 3 17 Add: Ober-Schmitten divestiture - - 19 8 Add: Tornado insurance deductible costs - - 5 5 Add: Debt refinancing - - 0 - Add: CEO transition costs - 5 1 (0) Add: Corporate headquarters relocation 1 0 - - Add: Share-based compensation 5 1 3 3 Add: Cost optimization actions 1 1 - - Add: COVID-19 ERC recovery - (7) 0 - Less: Timberland sales and related costs (5) (3) (1) (1) Adjusted EBITDA $120 $99 $93 $100 Add: synergies & cost reductions net stand-alone 67 PF Adjusted EBITDA $455 Fiscal Year (Sept) Fiscal Year (Dec) |

| Appendix 35 |

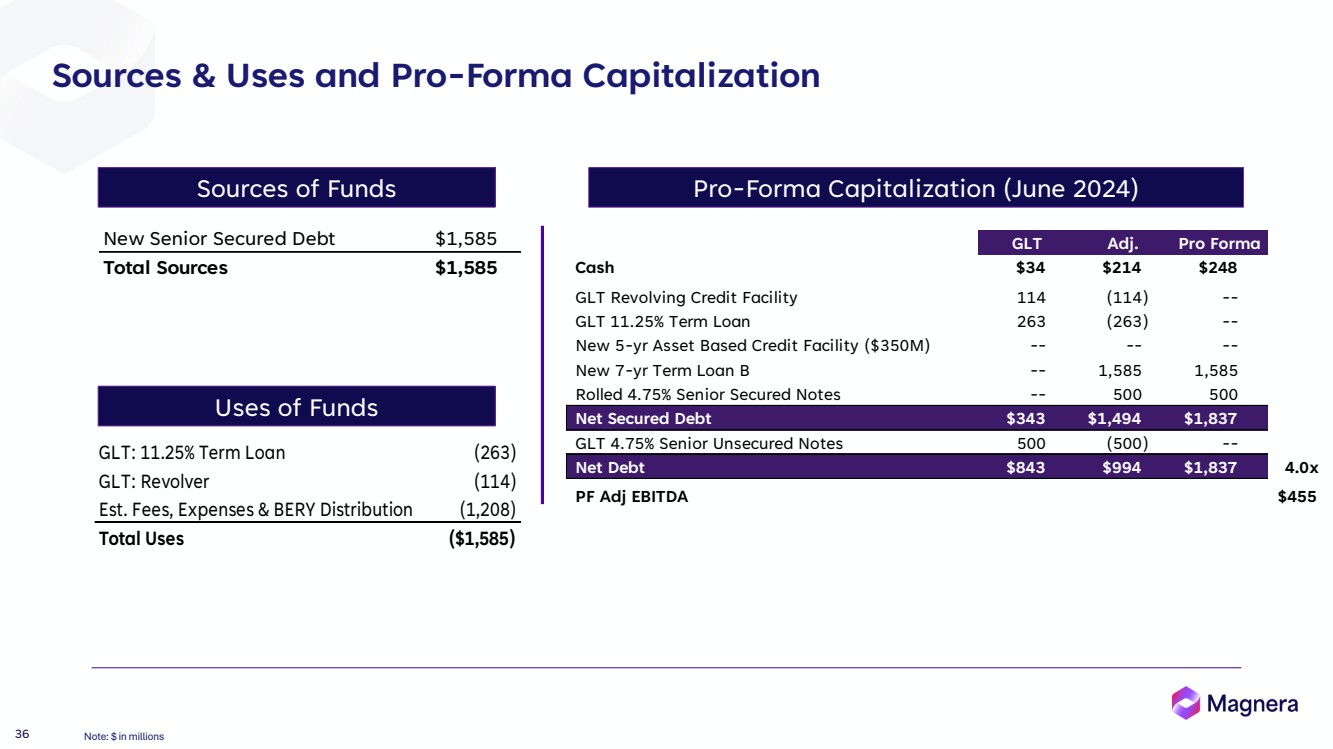

| Sources of Funds Uses of Funds Pro-Forma Capitalization (June 2024) GLT Adj. Pro Forma Cash $34 $214 $248 GLT Revolving Credit Facility 114 (114) -- GLT 11.25% Term Loan 263 (263) -- New 5-yr Asset Based Credit Facility ($350M) -- -- -- New 7-yr Term Loan B -- 1,585 1,585 Rolled 4.75% Senior Secured Notes -- 500 500 Net Secured Debt $343 $1,494 $1,837 GLT 4.75% Senior Unsecured Notes 500 (500) -- Net Debt $843 $994 $1,837 4.0x PF Adj EBITDA $455 New Senior Secured Debt $1,585 Total Sources $1,585 Sources & Uses and Pro-Forma Capitalization 36 GLT: 11.25% Term Loan (263) GLT: Revolver (114) Est. Fees, Expenses & BERY Distribution (1,208) Total Uses ($1,585) Note: $ in millions. |

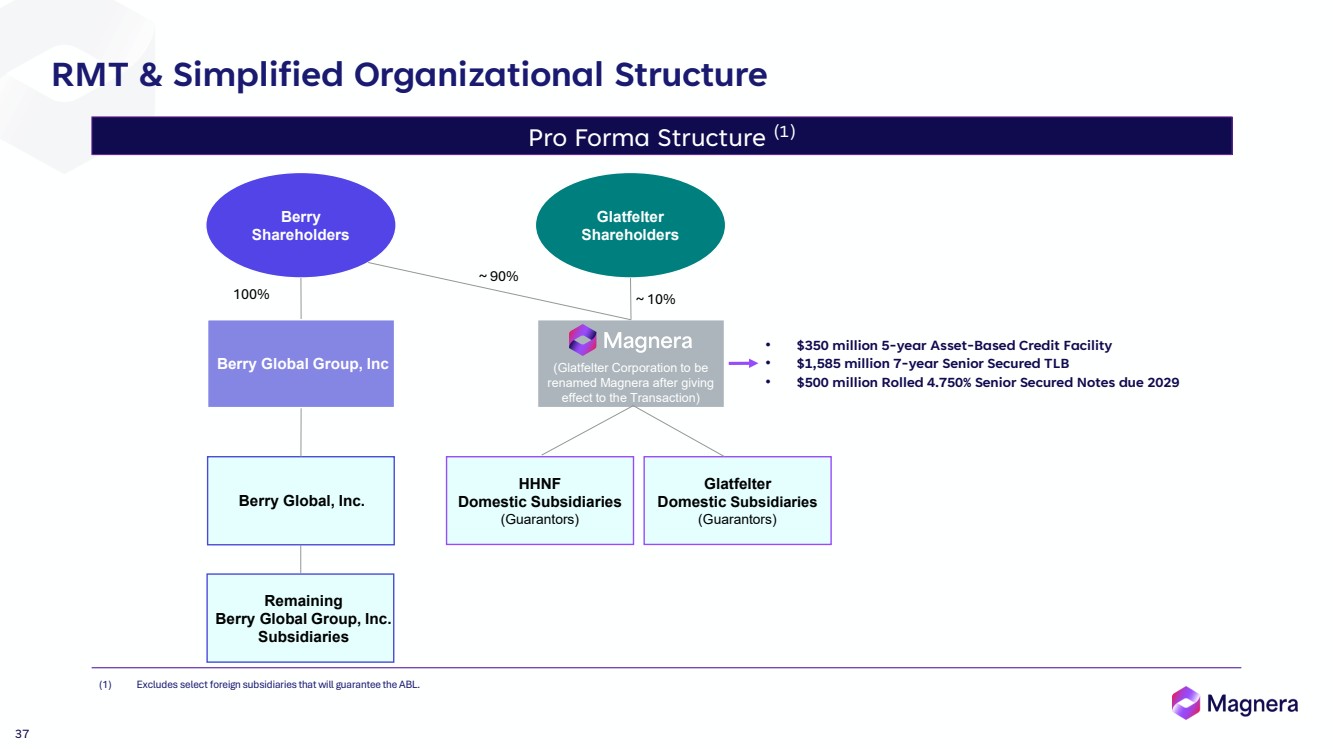

| Pro Forma Structure (1) 100% Berry Shareholders Glatfelter Shareholders (Glatfelter Corporation to be renamed Magnera after giving effect to the Transaction) ~ 90% ~ 10% Berry Global, Inc. Berry Global Group, Inc HHNF Domestic Subsidiaries (Guarantors) Glatfelter Domestic Subsidiaries (Guarantors) • $350 million 5-year Asset-Based Credit Facility • $1,585 million 7-year Senior Secured TLB • $500 million Rolled 4.750% Senior Secured Notes due 2029 RMT & Simplified Organizational Structure (1) Excludes select foreign subsidiaries that will guarantee the ABL. Remaining Berry Global Group, Inc. Subsidiaries 37 |

| ESG Culture Social We invest in our employees and support our communities. By living our Beliefs, we ensure the sustainability of our business, employees, customers and citizens across the globe. Environmental We utilize various substrates to create products rooted in efficiency and engineered for performance. We prioritize new innovative ways to conserve natural resources, increase efficiency and reduce waste. Sustainability Priorities We focus in areas where we can have the greatest local and global impact. Our efforts are directed at those topics of most interest to our employees, customers, investors and other stakeholders. Governance and Ethics Our vision to be the leading global supplier of specialty materials will be supported by strong corporate governance led by our Board of Directors and an unwavering commitment to ethical behavior and adherence to our Code of Business Conduct. 38 |

| One-Stop Solution Provider: Surgical Suite 2 6 5 1 3 4 1 1 Barrier & Elastic Film Facemasks, Surgical Gowns, Drapes & Caps Back Table Cover Protective Apparel Coating & Lamination Sterilization Wrap Ostomy 1 2 3 4 5 6 Healthcare Films • Resin blend for cost optimization and down gauging • Breathable and non-breathable Viral Barrier technology • Multiple breathability levels for comfort in surgical suite • Highest performing SMS medical barrier fabrics Healthcare Nonwovens • Breathable laminates for premium AAMI 4 protection • High barrier nonwovens for AAMI levels 1 – 3 • High-efficiency filtration at lower basis weights • Mechanical softness through embossing • Material science to improve hand and loft • Mono-material product design for improved recyclability Magnera Product Barrier & Elastic Film A Leading Producer of Specialty Materials and High-performance Protection Solutions for Healthcare Applications 39 |

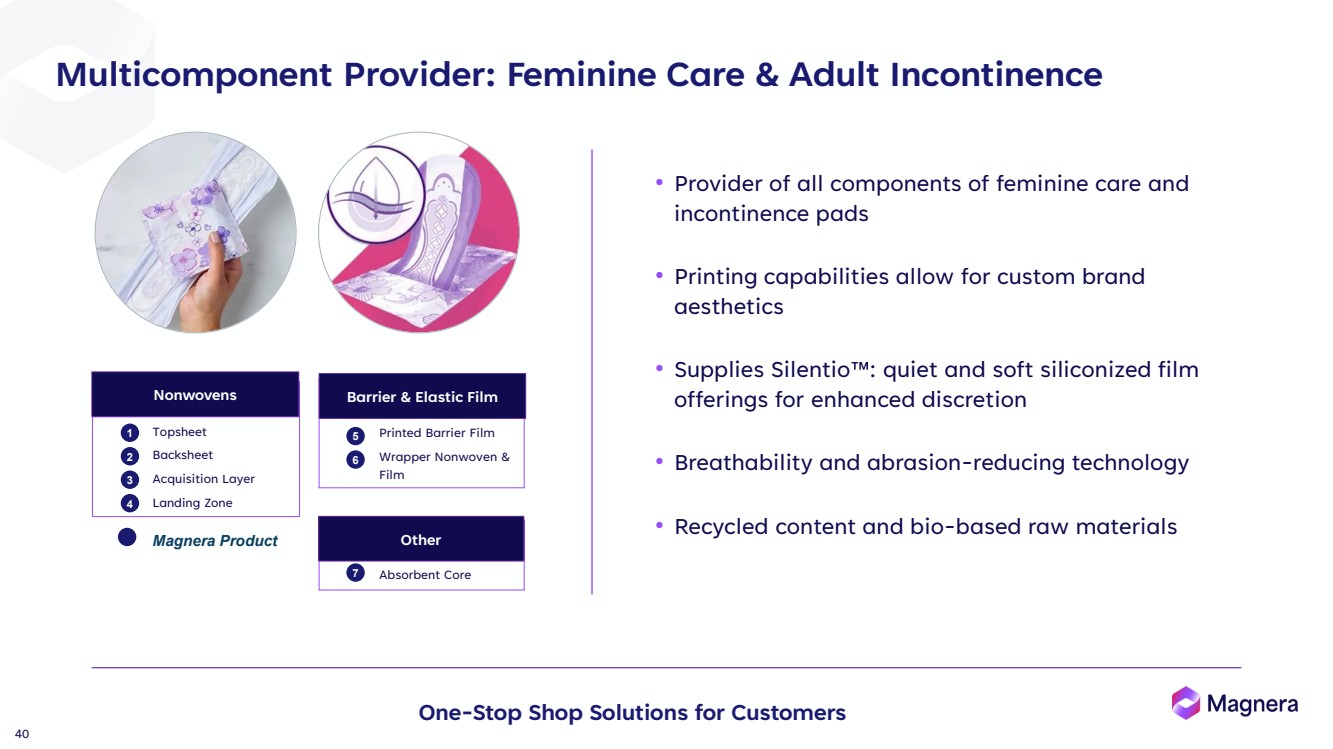

| Multicomponent Provider: Feminine Care & Adult Incontinence Printed Barrier Film Wrapper Nonwoven & Film Topsheet Backsheet Acquisition Layer Landing Zone 1 2 3 4 5 6 • Provider of all components of feminine care and incontinence pads • Printing capabilities allow for custom brand aesthetics • Supplies Silentio : quiet and soft siliconized film offerings for enhanced discretion • Breathability and abrasion-reducing technology • Recycled content and bio-based raw materials Other 7 Absorbent Core Magnera Product 94 One-Stop Shop Solutions for Customers Nonwovens Barrier & Elastic Film Other 40 |

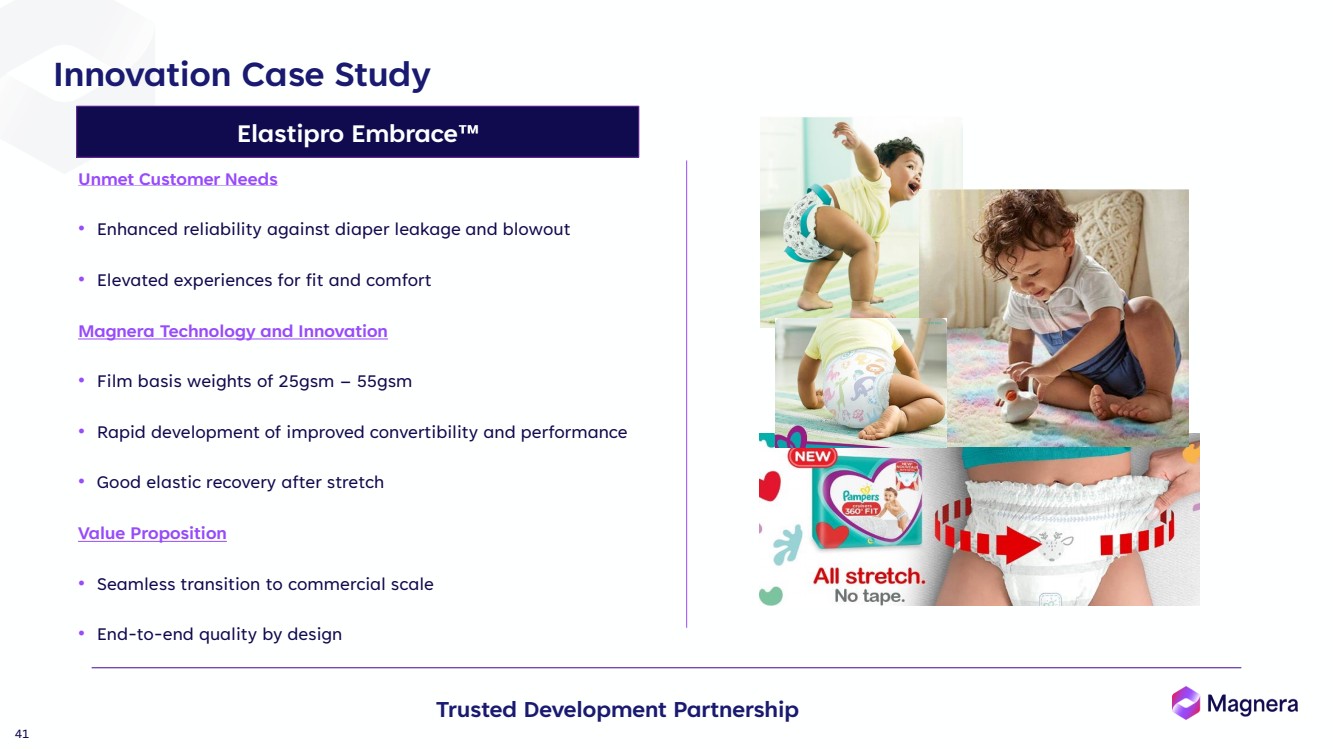

| Unmet Customer Needs • Enhanced reliability against diaper leakage and blowout • Elevated experiences for fit and comfort Magnera Technology and Innovation • Film basis weights of 25gsm – 55gsm • Rapid development of improved convertibility and performance • Good elastic recovery after stretch Value Proposition • Seamless transition to commercial scale • End-to-end quality by design Innovation Case Study 95 Trusted Development Partnership Elastipro Embrace 41 |

| September 4, 2024 Citibank, N.A. Ladies and Gentlemen: We refer to the proposed $1,585 million Term Loan B facility (the "Facility") for Treasure Holdco, Inc. (the "Company") that you are arranging at our request, and the Lender Presentation prepared in connection therewith (collectively, the "Lender Presentation"). We have reviewed or participated in preparing the Lender Presentation and the information contained therein. The Company has reviewed the information contained in the Lender Presentation and represents and warrants that the information contained in the Lender Presentation does not contain any untrue statement of a material fact or omit to state a material fact necessary in order to make the statements contained therein, in light of the circumstances under which they were made, not materially misleading. Any management projections or forward-looking statements included in the Lender Presentation taken as a whole are based on assumptions and estimates developed by management of the Company in good faith and management believes such assumptions and estimates to be reasonable as of the date of the Lender Presentation. Whether or not such projections or forward-looking statements are in fact achieved will depend upon future events, some of which are not within the control of the Company. Accordingly, actual results may vary from the projections and such variations may be material. No assurances are being given that the results in the projections will be achieved. The Company represents and warrants that the information contained in the Lender Presentation is either publicly available information or not material information (although it may be sensitive and proprietary) with respect to the Company or its securities for purposes of United States federal and state securities laws. We request that you distribute the Lender Presentation to such financial institutions as you may deem appropriate to include in the Facility. We agree that we will rely on, and that you are authorized to rely on, the undertakings, acknowledgments and agreements contained in the Notice to and Undertaking by Recipients accompanying the Lender Presentation or otherwise acknowledged by recipients in connection with the Lender Presentation. Yours sincerely, /s/ Mark Miles Mark Miles Chief Financial Officer Treasure Holdco, Inc. Treasure Holdco, Inc. Authorization Letter 42 |

| September 4, 2024 Citibank, N.A. Ladies and Gentlemen: We refer to the proposed $1,585 million Term Loan B facility (the "Facility") for Treasure Holdco, Inc. (the "Borrower") that you are arranging at the Borrower’s request, and the Lender Presentation prepared in connection therewith (collectively, the "Lender Presentation"). We have reviewed or participated in preparing the Lender Presentation and the information contained therein. Glatfelter Corporation (the “Company”) has reviewed the information contained in the Lender Presentation and represents and warrants that the information contained in the Lender Presentation does not contain any untrue statement of a material fact or omit to state a material fact necessary in order to make the statements contained therein, in light of the circumstances under which they were made, not materially misleading. Any management projections or forward-looking statements included in the Lender Presentation taken as a whole are based on assumptions and estimates developed by management of the Company in good faith and management believes such assumptions and estimates to be reasonable as of the date of the Lender Presentation. Whether or not such projections or forward-looking statements are in fact achieved will depend upon future events, some of which are not within the control of the Company. Accordingly, actual results may vary from the projections and such variations may be material. No assurances are being given that the results in the projections will be achieved. The Company represents and warrants that the information contained in the Lender Presentation is either publicly available information or not material information (although it may be sensitive and proprietary) with respect to the Company or its securities for purposes of United States federal and state securities laws. We request that you distribute the Lender Presentation to such financial institutions as you may deem appropriate to include in the Facility. We agree that we will rely on, and that you are authorized to rely on, the undertakings, acknowledgments and agreements contained in the Notice to and Undertaking by Recipients accompanying the Lender Presentation or otherwise acknowledged by recipients in connection with the Lender Presentation. Yours sincerely, /s/ Jill Urey Jill Urey Vice President, General Counsel & Compliance Glatfelter Corporation Glatfelter Corporation Authorization Letter 43 |

| This Lender Presentation (the "Lender Presentation") has been prepared solely for informational purposes from information supplied by or on behalf of Treasure Holdco, Inc. (the "Company"), and is being furnished by Citibank, N.A. (the "Arranger") to you in your capacity as a prospective lender (the "Recipient") in considering the proposed credit facility described in the Lender Presentation (the "Facility"). ACCEPTANCE OF THIS LENDER PRESENTATION CONSTITUTES AN AGREEMENT TO BE BOUND BY THE TERMS OF THIS NOTICE AND UNDERTAKING AND THE SPECIAL NOTICE SET FORTH ON THE COVER PAGE HEREOF (THE “SPECIAL NOTICE”). IF THE RECIPIENT IS NOT WILLING TO ACCEPT THE LENDER PRESENTATION AND OTHER EVALUATION MATERIAL (AS DEFINED HEREIN) ON THE TERMS SET FORTH IN THIS NOTICE AND UNDERTAKING AND THE SPECIAL NOTICE, IT MUST RETURN THE LENDER PRESENTATION AND ANY OTHER EVALUATION MATERIAL TO THE ARRANGER IMMEDIATELY WITHOUT MAKING ANY COPIES THEREOF, EXTRACTS THEREFROM OR USE THEREOF. I. Confidentiality As used herein: (a) "Evaluation Material" refers to the Lender Presentation and any other information regarding the Company or the Facility furnished or communicated to the Recipient by or on behalf of the Company in connection with the Facility (whether prepared or communicated by the Arranger or the Company, their respective advisors or otherwise) and (b) "Internal Evaluation Material" refers to all memoranda, notes, and other documents and analyses developed by the Recipient using any of the information specified under the definition of Evaluation Material. The Recipient acknowledges that the Company considers the Evaluation Material to include confidential, sensitive and proprietary information and agrees that it shall use reasonable precautions in accordance with its established procedures to keep the Evaluation Material confidential; provided however that (i) it may make any disclosure of such information to which the Company gives its prior written consent and (ii) any of such information may be disclosed to it, its affiliates, and its and their respective partners, directors, officers, employees, agents, advisors and other representatives (collectively, "Representatives") (it being understood that such Representatives shall be informed by it of the confidential nature of such information and shall be directed by the Recipient to treat such information in accordance with the terms of this Notice and Undertaking and the Special Notice). The Recipient agrees to be responsible for any breach of this Notice and Undertaking or the Special Notice that results from the actions or omissions of its Representatives. The Recipient shall be permitted to disclose the Evaluation Material in the event that it is required by law or regulation or requested by any governmental agency or other regulatory authority (including any self-regulatory organization having or claiming to have jurisdiction) or in connection with any legal proceedings. The Recipient agrees that it will notify the Arranger as soon as practical in the event of any such disclosure (other than at the request of a regulatory authority), unless such notification shall be prohibited by applicable law or legal process. The Recipient shall have no obligation hereunder with respect to any Evaluation Material to the extent that such information (i) is or becomes generally available to the public other than as a result of a disclosure by the Recipient in violation of this agreement, or (ii) was within the Recipient's possession prior to its being furnished pursuant hereto or is or becomes available to the Recipient on a non-confidential basis from a source other than the Company or its Representatives, provided that the source of such information was not known by the Recipient to be bound by a confidentiality agreement with, or other contractual, legal or fiduciary obligation of confidentiality to, the Company or any other party with respect to such information. In the event that the Recipient of the Evaluation Material decides not to participate in the Facility or transactions described herein, upon request of the Arranger, such Recipient shall as soon as practicable return all Evaluation Material (other than Internal Evaluation Material) to the Arranger or represent in writing to the Arranger that the Recipient has destroyed all copies of the Evaluation Material (other than Internal Evaluation Material) unless prohibited from doing so by the Recipient's internal policies and procedures. Notice To and Undertaking by Recipients 44 |

| II. Information The Recipient acknowledges and agrees that (i) the Arranger received the Evaluation Material from third party sources (including the Company) and it is provided to the Recipient for informational purposes, (ii) the Arranger and its affiliates bear no responsibility (and shall not be liable) for the accuracy or completeness (or lack thereof) of the Evaluation Material or any information contained therein, (iii) no representation regarding the Evaluation Material is made by the Arranger or any of its affiliates, (iv) neither the Arranger nor any of its affiliates has made any independent verification as to the accuracy or completeness of the Evaluation Material, and (v) the Arranger and its affiliates shall have no obligation to update or supplement any Evaluation Material or otherwise provide additional information. The Evaluation Material has been prepared to assist interested parties in making their own evaluation of the Company and the Facility and does not purport to be all-inclusive or to contain all of the information that a prospective participant may consider material or desirable in making its decision to become a lender. Each Recipient of the information and data contained herein should take such steps as it deems necessary to assure that it has the information it considers material or desirable in making its decision to become a lender and should perform its own independent investigation and analysis of the Facility or the transactions contemplated thereby and the creditworthiness of the Company. The Recipient represents that it is sophisticated and experienced in extending credit to entities similar to the Company. The information and data contained herein are not a substitute for the Recipient's independent evaluation and analysis and should not be considered as a recommendation by the Arranger or any of its affiliates that any Recipient enters into the Facility. The Evaluation Material may include certain forward looking statements and projections provided by the Company. Any such statements and projections reflect various estimates and assumptions by the Company concerning anticipated results. No representations or warranties are made by the Company or any of its affiliates as to the accuracy of any such statements or projections. Whether or not any such forward looking statements or projections are in fact achieved will depend upon future events, some of which are not within the control of the Company. Accordingly, actual results may vary from the projected results and such variations may be material. No assurances are being given that the results in the projections will be achieved. Statements contained herein describing documents and agreements are summaries only and such summaries are qualified in their entirety by reference to such documents and agreements. III. General It is understood that unless and until a definitive agreement regarding the Facility between the parties thereto has been executed, the Recipient will be under no legal obligation of any kind whatsoever with respect to the Facility by virtue of this Notice and Undertaking except for the matters specifically agreed to herein and in the Special Notice. The Recipient agrees that money damages would not be a sufficient remedy for breach of this Notice and Undertaking or of the Special Notice, and that in addition to all other remedies available at law or in equity, the Company and the Arranger shall be entitled to equitable relief, including injunction and specific performance, without proof of actual damages. This Notice and Undertaking and the Special Notice together embody the entire understanding and agreement between the Recipient and the Arranger with respect to the Evaluation Material and the Internal Evaluation Material and supersedes all prior understandings and agreements relating thereto. The terms and conditions of this Notice and Undertaking and the Special Notice shall apply until such time, if any, that the Recipient becomes a party to the definitive agreements regarding the Facility, and thereafter the provisions of such definitive agreements relating to confidentiality shall govern. If you do not enter into the Facility, the application of this Notice and Undertaking and the Special Notice shall terminate with respect to all Evaluation Material on the date falling one year after the date of the Lender Presentation. This Notice and Undertaking and the Special Notice shall be governed by and construed in accordance with the law of the State of New York, without regard to principles of conflicts of law (except Section 5- 1401 of the New York General Obligation Law to the extent that it mandates that the law of the State of New York govern). Notice To and Undertaking by Recipients (cont’d) 45 |

| About Magnera: Magnera will be formed from the spin-off and merger of Berry's HHNF business with Glatfelter. The combined company will serve thousands of customers worldwide, offering a wide range of products, including components for absorbent hygiene products, protective apparel, wipes, specialty building and construction products, products serving the food and beverage industry, and more. Magnera will begin using its name and branding immediately following the closing of the proposed merger. Forward-Looking Statements: Statements in this release that are not historical, including statements relating to the expected timing, completion and effects of the proposed transaction between Berry Global Group, Inc., a Delaware corporation (“Berry”), and Glatfelter Corporation, a Pennsylvania corporation (“Glatfelter” or the “Company”), are considered “forward-looking” within the meaning of the federal securities laws and are presented pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements because they contain words such as “believes,” “expects,” “may,” “will,” “should,” “would,” “could,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” “projects,” “outlook,” “anticipates” or “looking forward,” or similar expressions that relate to strategy, plans, intentions, or expectations. All statements relating to estimates and statements about the expected timing and structure of the proposed transaction, the ability of the parties to complete the proposed transaction, benefits of the transaction, including future financial and operating results, executive and Board transition considerations, the combined company’s plans, objectives, expectations and intentions, and other statements that are not historical facts are forward-looking statements. In addition, senior management of Berry and Glatfelter, from time to time may make forward-looking public statements concerning expected future operations and performance and other developments. Actual results may differ materially from those that are expected due to a variety of factors, including without limitation: the occurrence of any event, change or other circumstances that could give rise to the termination of the proposed transaction; the risk that Glatfelter shareholders may not approve the transaction proposals; the risk that the necessary regulatory approvals may not be obtained or may be obtained subject to conditions that are not anticipated or may be delayed; risks that any of the other closing conditions to the proposed transaction may not be satisfied in a timely manner; risks that the anticipated tax treatment of the proposed transaction is not obtained; risks related to potential litigation brought in connection with the proposed transaction; uncertainties as to the timing of the consummation of the proposed transaction; unexpected costs, charges or expenses resulting from the proposed transaction; risks and costs related to the implementation of the separation of the business, operations and activities that constitute the global nonwovens and hygiene films business of Berry (the “HHNF Business”) into Treasure Holdco, Inc., a Delaware corporation and a wholly owned subsidiary of Berry (“Spinco”), including timing anticipated to complete the separation; any changes to the configuration of the businesses included in the separation if implemented; the risk that the integration of the combined company is more difficult, time consuming or costly than expected; risks related to financial community and rating agency perceptions of each of Berry and Glatfelter and its business, operations, financial condition and the industry in which they operate; risks related to disruption of management time from ongoing business operations due to the proposed transaction; failure to realize the benefits expected from the proposed transaction; effects of the announcement, pendency or completion of the proposed transaction on the ability of the parties to retain customers and retain and hire key personnel and maintain relationships with their counterparties, and on their operating results and businesses generally; and other risk factors detailed from time to time in Glatfelter’s and Berry’s reports filed with the Securities and Exchange Commission (“SEC”), including annual reports on Form 10- K, quarterly reports on Form 10-Q, current reports on Form 8-K and other documents filed with the SEC. These risks, as well as other risks associated with the proposed transaction, are more fully discussed in the proxy statement/prospectus included in the registration statement filed with the SEC in connection with the proposed transaction. The foregoing list of important factors may not contain all of the material factors that are important to you. New factors may emerge from time to time, and it is not possible to either predict new factors or assess the potential effect of any such new factors. Accordingly, readers should not place undue reliance on those statements. All forward-looking statements are based upon information available as of the date hereof. All forward-looking statements are made only as of the date hereof and neither Berry nor Glatfelter undertake any obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. Non-GAAP Financial Measures: This presentation includes certain non‐GAAP financial measures such as EBITDA, adjusted EBITDA, pro forma adjusted EBITDA, and supplemental unaudited financial information intended to supplement, not substitute for, comparable measures under generally accepted accounting principles in the United States (GAAP). Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided in Berry and Glatfelter’s respective earnings release, presentations, and SEC filings. For further information about our non-GAAP measures, please see Berry and Glatfelter’s respective earnings releases and SEC filings. Additional Information and Where to Find It This communication may be deemed to be solicitation material in respect of the proposed transaction between Berry and Glatfelter. In connection with the proposed transaction, Berry and Glatfelter filed relevant materials with the SEC, including a registration statement on Form S-4 by Glatfelter that contains a preliminary proxy statement/prospectus relating to the proposed transaction. In addition, Spinco filed a registration statement on Form 10 in connection with its separation from Berry. The information in the preliminary proxy statement/prospectus is not complete and may be changed. This communication is not a substitute for the registration statements, proxy statement/prospectus or any other document which Berry and/or Glatfelter may file with the SEC. STOCKHOLDERS OF BERRY AND GLATFELTER ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain copies of the registration statements and proxy statement/prospectus as well as other filings containing information about Berry and Glatfelter, as well as Spinco, without charge, at the SEC’s website, www.sec.gov. Copies of documents filed with the SEC by Berry or Spinco will be made available free of charge on Berry’s investor relations website at ir.berryglobal.com. Copies of documents filed with the SEC by Glatfelter will be made available free of charge on Glatfelter's investor relations website at www.glatfelter.com/investors. No Offer or Solicitation: This presentation is for informational purposes only and is not intended to and does not constitute an offer to sell, or the solicitation of an offer to sell, subscribe for or buy, or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, sale or solicitation would be unlawful, prior to registration or qualification under the securities laws of any such jurisdiction. No offer or sale of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. Participants in Solicitation: Berry and its directors and executive officers, and Glatfelter and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from the holders of Glatfelter common stock and/or the offering of securities in respect of the proposed transaction. Information about the directors and executive officers of Berry, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth under the caption “Security Ownership of Beneficial Owners and Management” in the definitive proxy statement for Berry’s 2024 Annual Meeting of Stockholders, which was filed with the SEC on January 4, 2024 (www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/0001378992/000110465924001073/tm2325571d6_def14a.htm). Information about the directors and executive officers of Glatfelter including a description of their direct or indirect interests, by security holdings or otherwise, is set forth under the caption “Security Ownership of Certain Beneficial Owners and Management” in the proxy statement for Glatfelter's 2024 Annual Meeting of Shareholders, which was filed with the SEC on March 26, 2024 (www.sec.gov/ix?doc=/Archives/edgar/data/0000041719/000004171924000013/glt-20240322.htm). In addition, Curt Begle, the current President of Berry’s Health, Hygiene & Specialties Division, will be appointed as Chief Executive Officer, James M. Till, the current Executive Vice President and Controller of Berry, will be appointed as Executive Vice President, Chief Financial Officer & Treasurer, and Tarun Manroa, the current Executive Vice President and Chief Strategy Officer of Berry, will be appointed as Executive Vice President, Chief Operating Officer, of the combined company. Investors may obtain additional information regarding the interest of such participants by reading the proxy statement/prospectus regarding the proposed transaction when it becomes available. Safe Harbor Statements and Important Info 46 |