Glatfelter (NYSE: GLT)

Deutsche Bank Global Industrials and Basic Materials Conference

June 2012

Forward-Looking Statements and Use of non-GAAP Financial Measures

Certain statements included in this presentation, which pertain to future financial and business matters, are “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. These statements are based on management’s current expectations and are subject to numerous risks, uncertainties and other unpredictable or uncontrollable factors, which may cause actual results or performance to differ materially from the Company’s expectations. Various risks and factors that could cause future results to differ materially from those expressed in the forward-looking statements include, but are not limited to: changes in industry, business, market, political and economic conditions in the U.S. and other countries in which Glatfelter does business; demand for or pricing of its products; changes in tax legislation, governmental laws, regulations and policies; initiatives of regulatory authorities; acquisition integration risks; technological changes and innovations; market growth rates; cost reduction initiatives; the cost, and successful design and construction, of the Composite Fibers capacity expansion project, and other factors. In light of these risks, uncertainties and other factors, the forward-looking matters discussed in this presentation may not occur, and readers are cautioned not to place undue reliance on these forward-looking statements. The forward-looking statements speak only as of the date of this presentation and Glatfelter undertakes no obligation, and does not intend, to update these forward-looking statements to reflect events or circumstances occurring after the date of this presentation. More information about these factors is contained in Glatfelter’s filings with the U.S. Securities and Exchange Commission, which are available at www.glatfelter.com.

During the course of this presentation, certain non-U.S. GAAP financial measures will be presented. A reconciliation of these measures to U.S. GAAP financial measures is included in the appendix of this presentation.

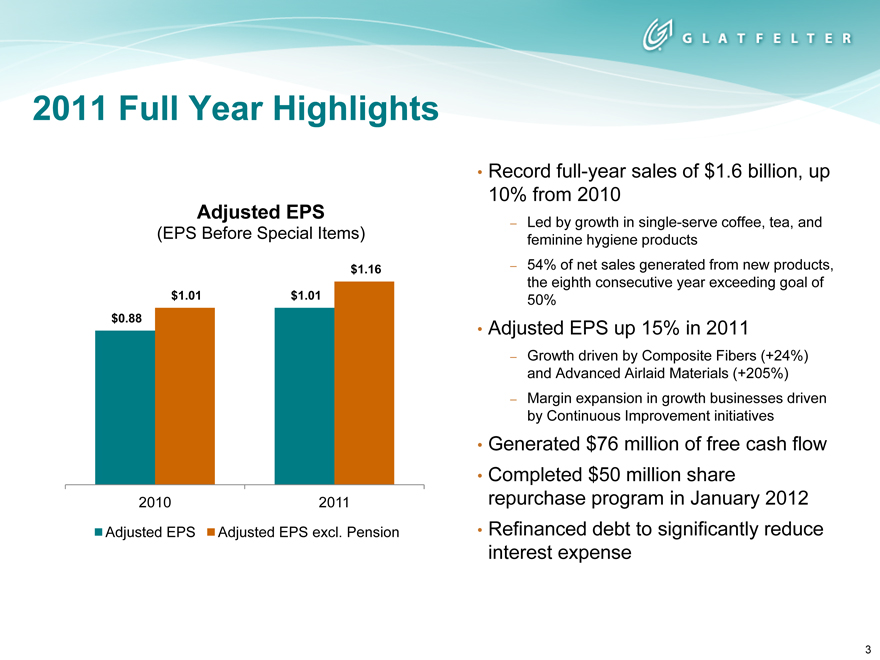

2011 Full Year Highlights

Adjusted EPS

(EPS Before Special Items)

$1.16

$1.01 $1.01

$0.88

2010 2011

Adjusted EPS Adjusted EPS excl. Pension

Record full-year sales of $1.6 billion, up 10% from 2010

Led by growth in single-serve coffee, tea, and feminine hygiene products

54% of net sales generated from new products, the eighth consecutive year exceeding goal of 50%

Adjusted EPS up 15% in 2011

Growth driven by Composite Fibers (+24%) and Advanced Airlaid Materials (+205%)

Margin expansion in growth businesses driven by Continuous Improvement initiatives

Generated $76 million of free cash flow Completed $50 million share repurchase program in January 2012 Refinanced debt to significantly reduce interest expense

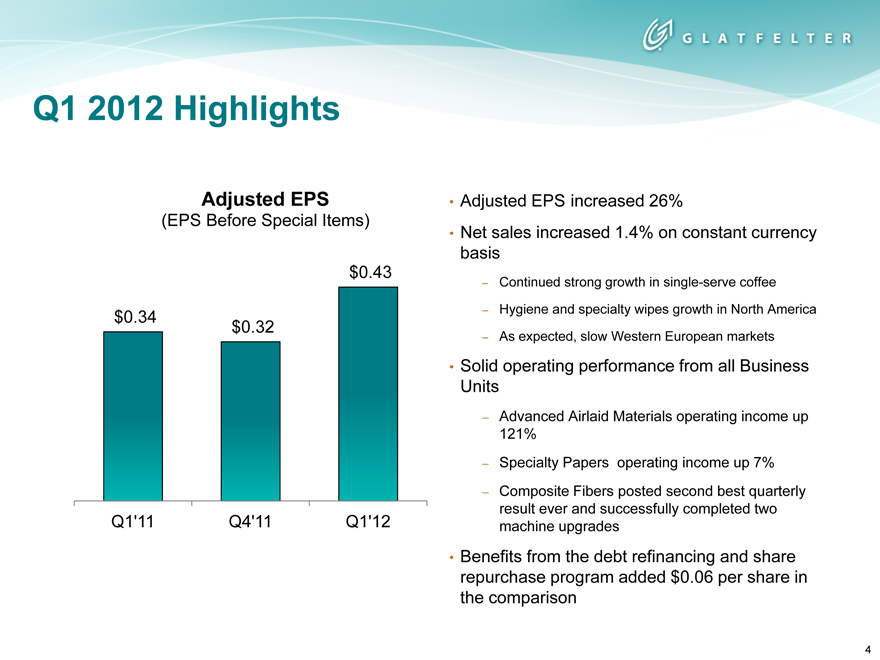

Q1 2012 Highlights

Adjusted EPS

(EPS Before Special Items)

$0.43

$0.34 $0.32

Q1’11 Q4’11 Q1’12

Adjusted EPS increased 26%

Net sales increased 1.4% on constant currency basis

Continued strong growth in single-serve coffee

Hygiene and specialty wipes growth in North America

As expected, slow Western European markets

Solid operating performance from all Business Units

Advanced Airlaid Materials operating income up 121%

Specialty Papers operating income up 7%

Composite Fibers posted second best quarterly result ever and successfully completed two machine upgrades

Benefits from the debt refinancing and share repurchase program added $0.06 per share in the comparison

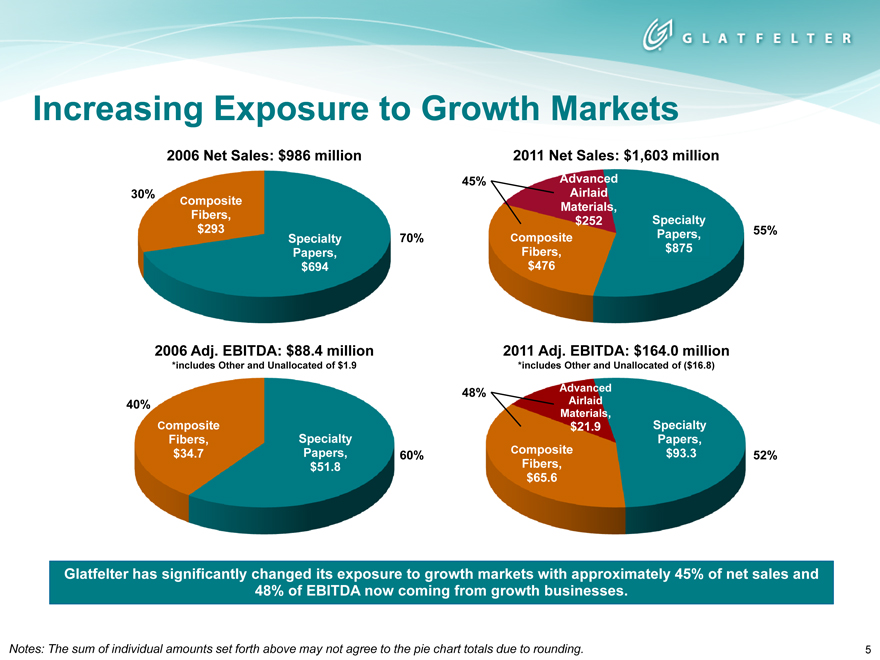

Increasing Exposure to Growth Markets

2006 Net Sales: $986 million 2011 Net Sales: $1,603 million

45% Advanced

30% Advanced Airlaid Airlaid

Composite

Fibers, Materials, $252 Materials Specialty

$293 $239 55%

Specialty 70% Composite Papers, Specialty Papers

Papers, Composite Fibers, Fibers $875 $863

$694 $476 $447

2006 Adj. EBITDA: $88.4 million 2011 Adj. EBITDA: $164.0 million

*includes Other and Unallocated of $1.9 *includes Other and Unallocated of ($16.8)

48% Advanced

40% Airlaid

Materials,

Composite $21.9 Specialty

Fibers, Specialty Papers,

$34.7 Papers, 60% Composite $93.3 52%

$51.8 Fibers,

$65.6

Glatfelter has significantly changed its exposure to growth markets with approximately 45% of net sales and 48% of EBITDA now coming from growth businesses.

Notes: The sum of individual amounts set forth above may not agree to the pie chart totals due to rounding.

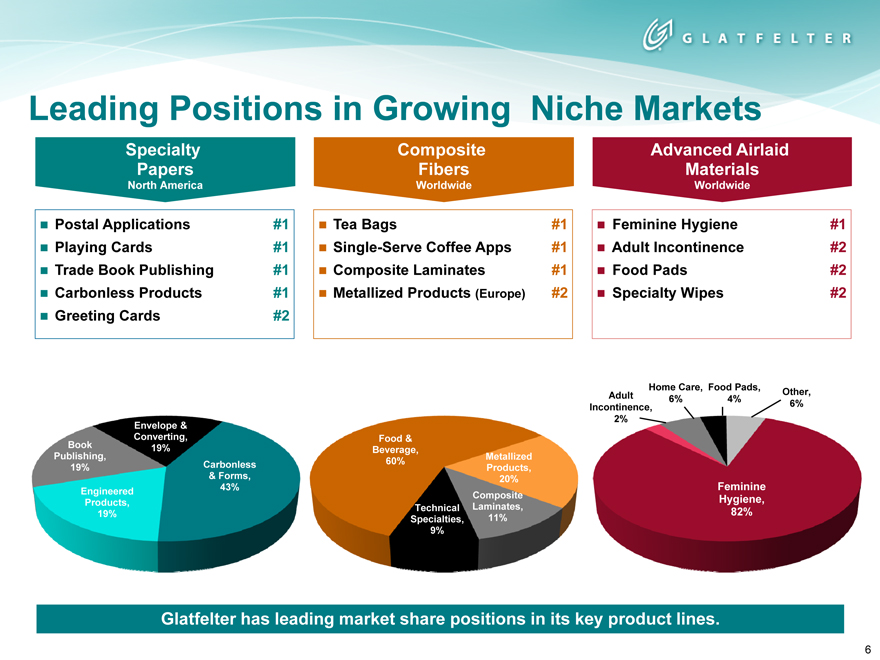

Leading Positions in Growing Niche Markets

Specialty Papers

North America

Postal Applications #1

Playing Cards #1

Trade Book Publishing #1

Carbonless Products #1

Greeting Cards #2

Composite Fibers

Worldwide

Tea Bags #1

Single-Serve Coffee Apps #1

Composite Laminates #1

Metallized Products (Europe) #2

Advanced Airlaid Materials

Worldwide

Feminine Hygiene #1

Adult Incontinence #2

Food Pads #2

Specialty Wipes #2

Home Care, Food Pads,

Adult 6% 4% Other,

Incontinence, 6%

2%

Envelope &

Converting, Food &

Book 19% Beverage,

Publishing, Metallized

19% Carbonless 60% Products,

& Forms, 20%

43% Feminine

Engineered Composite

Products, Technical Laminates, Hygiene,

19% 82%

Specialties, 11%

9%

Glatfelter has leading market share positions in its key product lines.

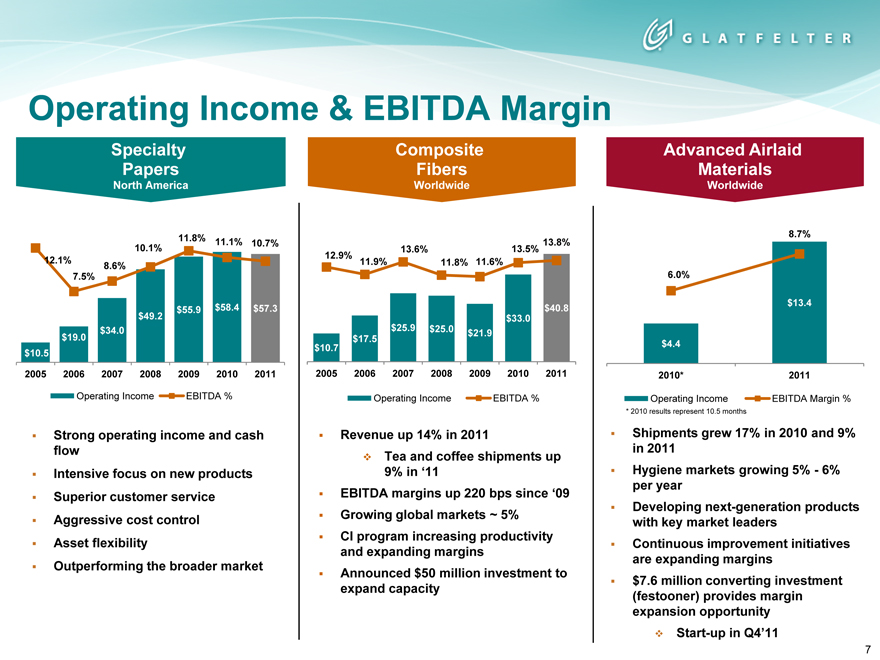

Operating Income & EBITDA Margin

Specialty Papers

North America

11.8% 11.1% 10.7%

10.1%

12.1% 8.6%

7.5%

$49.2 $55.9 $58.4 $57.3

$34.0

$19.0

$10.5

2005 2006 2007 2008 2009 2010 2011

Operating Income EBITDA %

Strong operating income and cash flow Intensive focus on new products Superior customer service Aggressive cost control Asset flexibility Outperforming the broader market

Composite Fibers

Worldwide

13.6% 13.5% 13.8%

12.9% 11.9% 11.8% 11.6%

$40.8

$33.0

$25.9 $25.0 $21.9

$17.5

$10.7

2005 2006 2007 2008 2009 2010 2011

Operating Income EBITDA %

Revenue up 14% in 2011

Tea and coffee shipments up 9% in ‘11

EBITDA margins up 220 bps since ‘09

Growing global markets ~ 5%

CI program increasing productivity and expanding margins

Announced $50 million investment to expand capacity

Advanced Airlaid Materials

Worldwide

8.7%

6.0%

$13.4

$4.4

2010* 2011

Operating Income EBITDA Margin %

* | | 2010 results represent 10.5 months |

Shipments grew 17% in 2010 and 9% in 2011 Hygiene markets growing 5%-6% per year bps since ‘09

Developing next-generation products with key market leaders Continuous improvement initiatives are expanding margins $7.6 million converting investment (festooner) provides margin expansion opportunity

Start-up in Q4’11

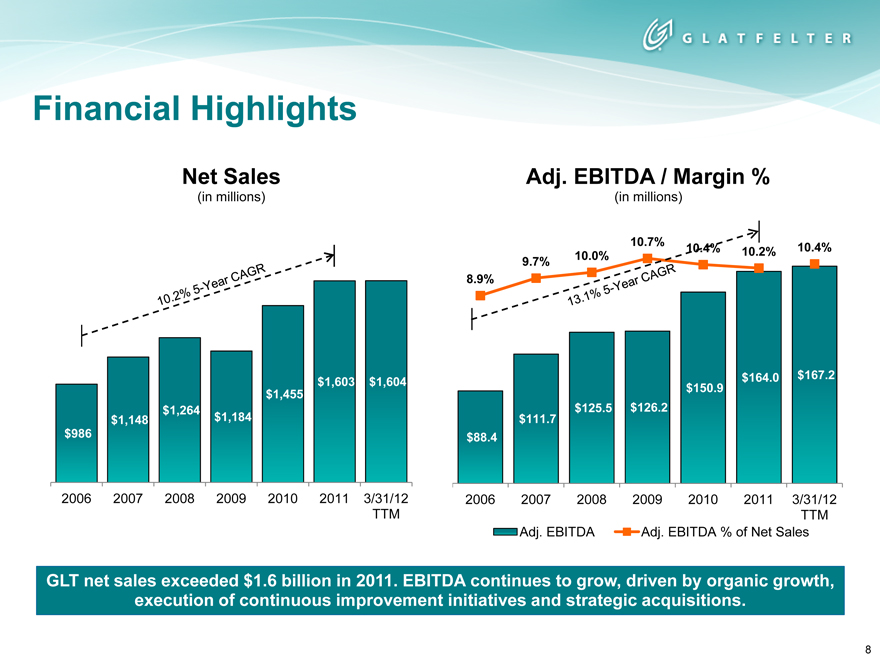

Financial Highlights

Net Sales

(in millions)

10.2% 5-Year CAGR

$1,603 $1,604

$1,455

$1,264

$1,148 $1,184

$986

2006 2007 2008 2009 2010 2011 3/31/12

TTM

Adj. EBITDA / Margin %

13.1% 5-Year CAGR

(in millions)

10.7%

9.7% 10.0% 10.4% 10.2% 10.4%

8.9%

$164.0 $167.2

$150.9

$125.5 $126.2

$111.7

$88.4

2006 2007 2008 2009 2010 2011 3/31/12

TTM

Adj. EBITDA Adj. EBITDA % of Net Sales

GLT net sales exceeded $1.6 billion in 2011. EBITDA continues to grow, driven by organic growth, execution of continuous improvement initiatives and strategic acquisitions.

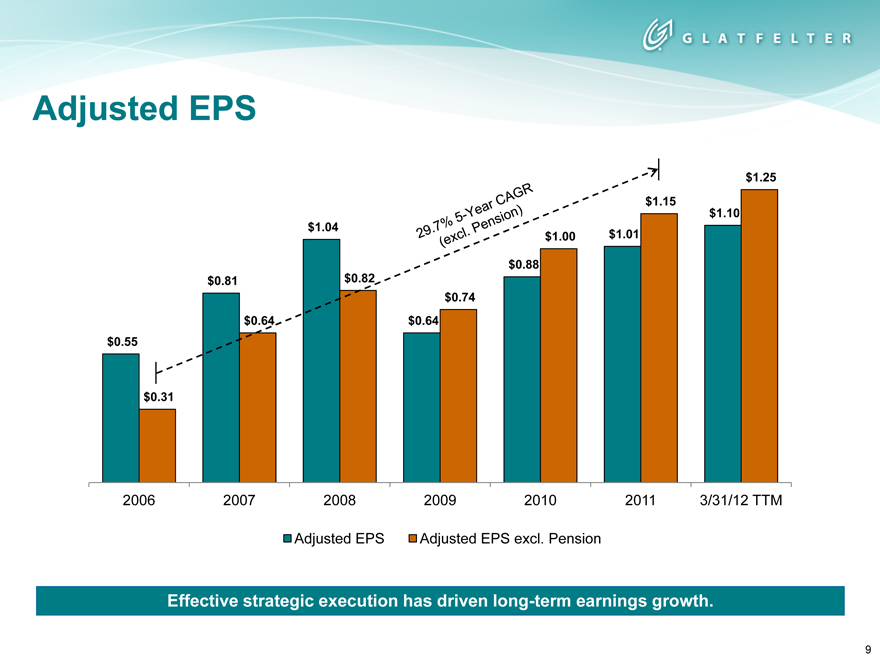

Adjusted EPS

$1.25 $1.15 $1.10 $1.04 $1.00 $1.01

$0.88 $0.81 $0.82 $0.74 $0.64 $0.64 $0.55

$0.31

2006 2007 2008 2009 2010 2011 3/31/12 TTM

Adjusted EPS Adjusted EPS excl. Pension

Effective strategic execution has driven long-term earnings growth.

9

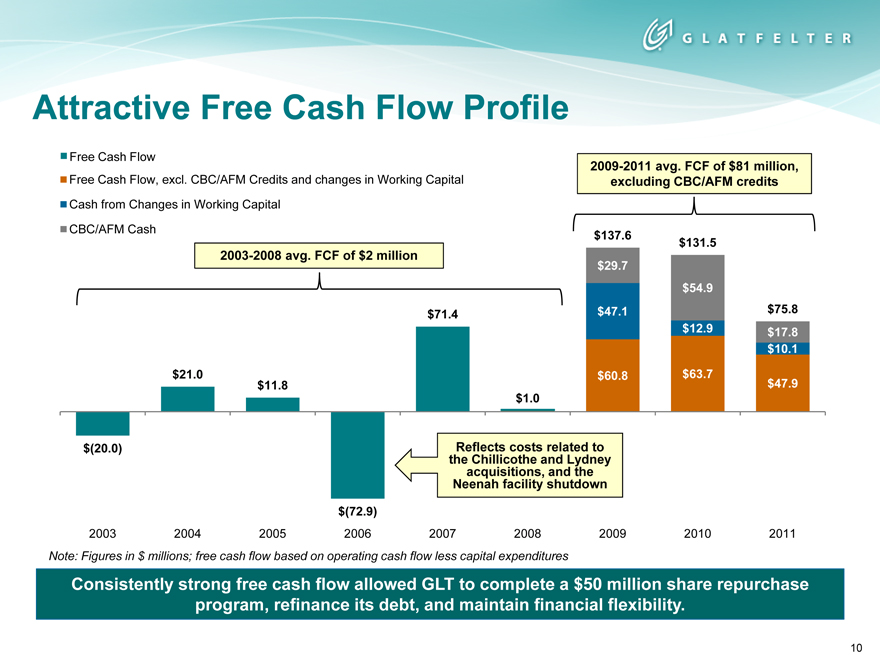

Attractive Free Cash Flow Profile

Free Cash Flow

Free Cash Flow, excl. CBC/AFM Credits and changes in Working Capital Cash from Changes in Working Capital CBC/AFM Cash

2003-2008 avg. FCF of $2 million

$21.0

$(20.0)

$11.8

$71.4

$1.0

$(72.9)

Reflects costs related to the Chillicothe and Lydney acquisitions, and the Neenah facility shutdown

2009-2011 avg. FCF of $81 million, excluding CBC/AFM credits

$137.6 $131.5 $29.7 $54.9

$47.1 $75.8

$12.9 $17.8 $10.1

$60.8 $63.7 $47.9

2003 2004 2005 2006 2007 2008 2009 2010 2011

Note: Figures in $ millions; free cash flow based on operating cash flow less capital expenditures

Consistently strong free cash flow allowed GLT to complete a $50 million share repurchase program, refinance its debt, and maintain financial flexibility.

10

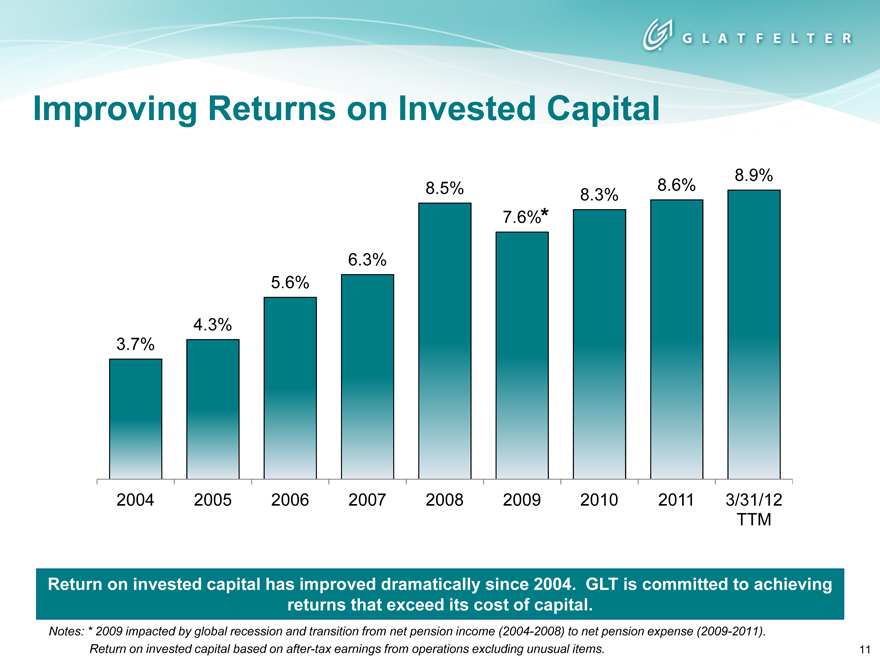

Improving Returns on Invested Capital

8.9%

8.5% 8.6%

8.3%

7.6%*

6.3%

5.6%

4.3%

3.7%

2004 2005 2006 2007 2008 2009 2010 2011 3/31/12 TTM

Return on invested capital has improved dramatically since 2004. GLT is committed to achieving returns that exceed its cost of capital.

Notes: * 2009 impacted by global recession and transition from net pension income (2004-2008) to net pension expense (2009-2011). Return on invested capital based on after-tax earnings from operations excluding unusual items.

11

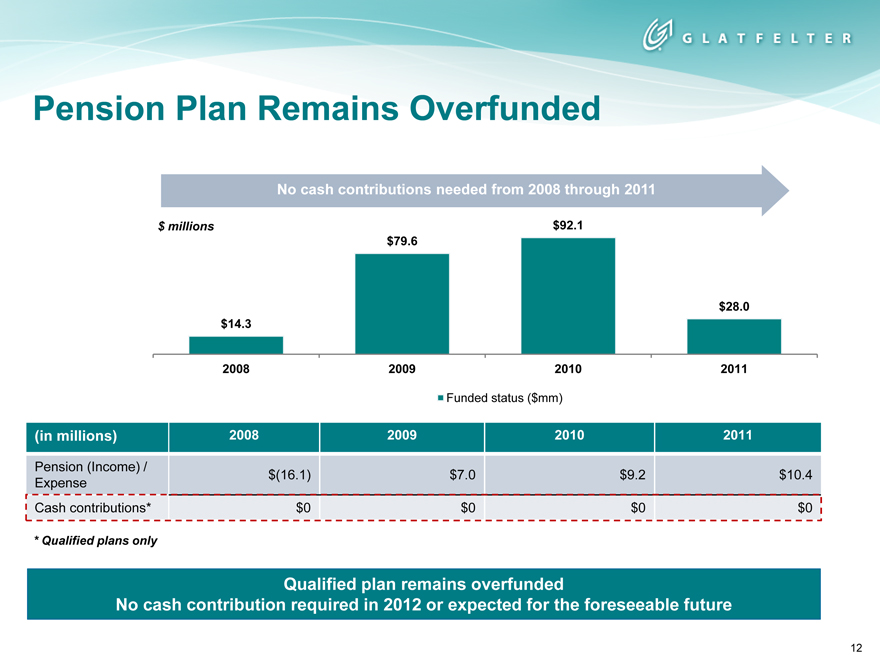

Pension Plan Remains Overfunded

No cash contributions needed from 2008 through 2011

$ millions $92.1

$79.6

$28.0

$14.3

2008 2009 2010 2011

Funded status ($mm)

(in millions) 2008 2009 2010 2011

Pension (Income) /

Expense $(16.1) $7.0 $9.2 $10.4

Cash contributions* $0 $0 $0 $0

Qualified plan remains overfunded

No cash contribution required in 2012 or expected for the foreseeable future

12

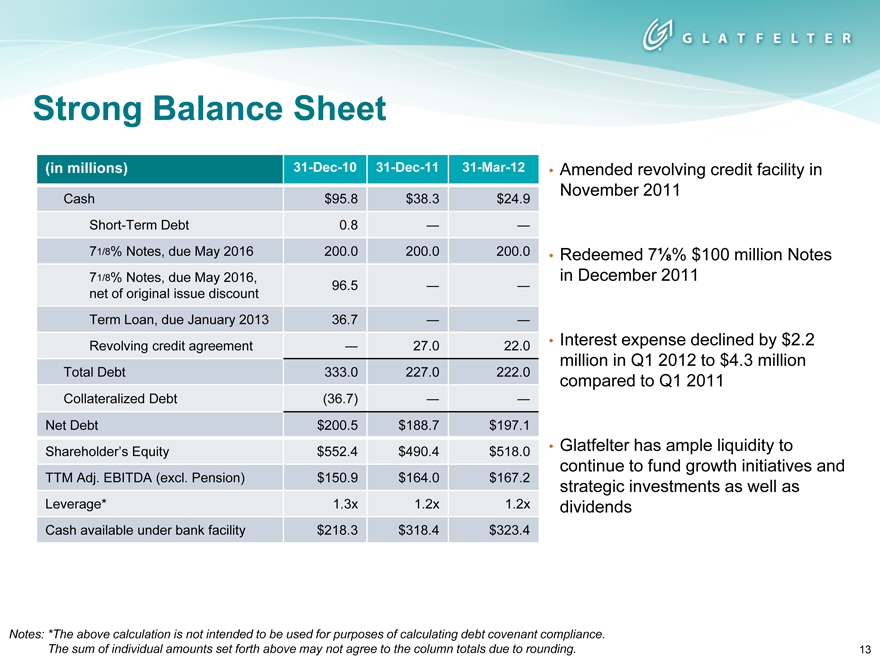

Strong Balance Sheet

(in millions) 31-Dec-10 31-Dec-11 31-Mar-12

Cash $95.8 $38.3 $24.9

Short-Term Debt 0.8 — —

71/8% Notes, due May 2016 200.0 200.0 200.0

71/8% Notes, due May 2016,

net of original issue discount 96.5 — —

Term Loan, due January 2013 36.7 — —

Revolving credit agreement — 27.0 22.0

Total Debt 333.0 227.0 222.0

Collateralized Debt (36.7) — —

Net Debt $200.5 $188.7 $197.1

Shareholder’s Equity $552.4 $490.4 $518.0

TTM Adj. EBITDA (excl. Pension) $150.9 $164.0 $167.2

Leverage* 1.3x 1.2x 1.2x

Cash available under bank facility $218.3 $318.4 $323.4

Amended revolving credit facility in November 2011

Redeemed 7 1/8% $100 million Notes in December 2011

Interest expense declined by $2.2 million in Q1 2012 to $4.3 million compared to Q1 2011

Glatfelter has ample liquidity to continue to fund growth initiatives and strategic investments as well as dividends

Notes: *The above calculation is not intended to be used for purposes of calculating debt covenant compliance. The sum of individual amounts set forth above may not agree to the column totals due to rounding.

13

Glatfelter Value Drivers

Strong Revenue Growth

5-year CAGR of 10.2%

Leading positions in global growth markets Tea and Coffee markets growing at 5% Feminine Hygiene market growing at 6%

Innovation leadership in key markets drives revenue growth opportunities

Expanding Margins

Driving cost reduction and productivity improvements

Leveraging leading positions in niche segments

Track Record of Profitable Growth

5-year EPS (excluding pension) CAGR of 30%

Improving returns on invested capital

Strong cash flow and financial strength to fund future growth

Strong balance sheet to fund growth opportunities

Timberland holdings of 32,000 acres

Pension plan overfunded

14

Appendix

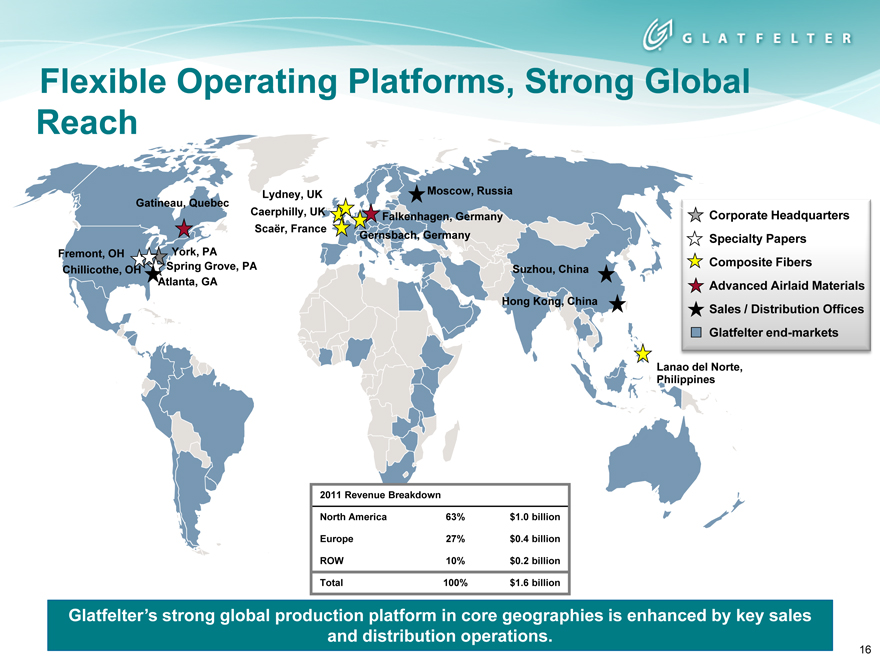

Lydney, UK Moscow, Russia Gatineau, Quebec

Caerphilly, UK Falkenhagen, Germany Corporate Headquarters Scaër, France Gernsbach, Germany Specialty Papers Fremont, OH York, PA Composite Fibers Chillicothe, OH Spring Grove, PA Suzhou, China Atlanta, GA Advanced Airlaid Materials Hong Kong, China Sales / Distribution Offices Glatfelter end-markets

Lanao del Norte, Philippines

Flexible Operating Platforms, Strong Global Reach

2011 Revenue Breakdown

North America 63% $1.0 billion

Europe 27% $0.4 billion

ROW 10% $0.2 billion

Total 100% $1.6 billion

Glatfelter’s strong global production platform in core geographies is enhanced by key sales and distribution operations.

16

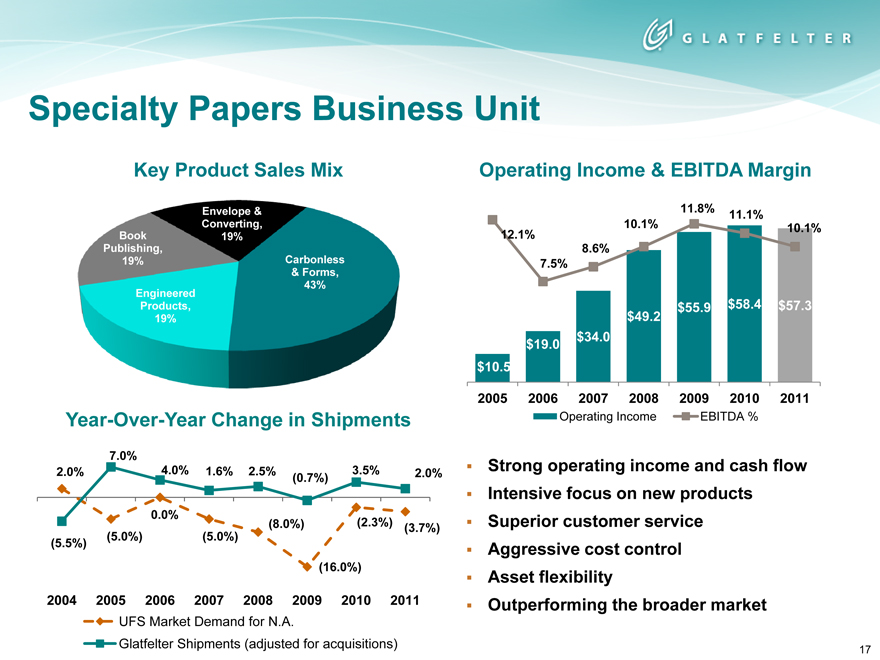

Specialty Papers Business Unit

Key Product Sales Mix

Envelope & Converting, Book 19% Publishing,

19% Carbonless

& Forms, 43% Engineered Products, 19%

Year-Over-Year Change in Shipments

7.0%

2.0% 4.0% 1.6% 2.5% 3.5% 2.0%

(0.7%)

0.0%

(8.0%) (2.3%)

(3.7%)

(5.0%) (5.0%)

(5.5%)

(16.0%)

2004 2005 2006 2007 2008 2009 2010 2011

UFS Market Demand for N.A.

Glatfelter Shipments (adjusted for acquisitions)

Operating Income & EBITDA Margin

11.8%

11.1%

12.1% 10.1% 10.1% 8.6% 7.5%

$49.2 $55.9 $58.4 $57.3

$34.0

$19.0

$10.5

2005 2006 2007 2008 2009 2010 2011

Operating Income EBITDA %

Strong operating income and cash flow

Intensive focus on new products

Superior customer service

Aggressive cost control

Asset flexibility

Outperforming the broader market

17

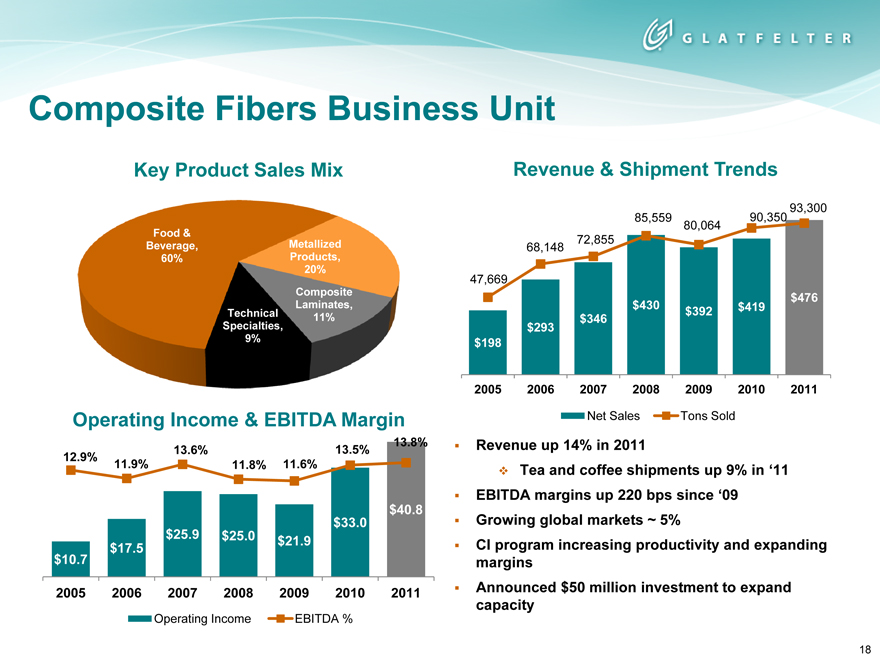

Composite Fibers Business Unit

Key Product Sales Mix

Food &

Beverage, Metallized 60% Products, 20%

Composite Laminates, Technical 11% Specialties, 9%

Operating Income & EBITDA Margin

13.8%

13.6% 13.5%

12.9%

11.9% 11.8% 11.6%

$40.8

$25.9 $33.0

$17.5 $25.0 $21.9

$10.7

2005 2006 2007 2008 2009 2010 2011

Operating Income EBITDA %

Revenue & Shipment Trends

93,300 85,559 90,350 80,064 72,855 68,148

47,669 $476 $430 $419 $392 $346 $293 $198

2005 2006 2007 2008 2009 2010 2011

Net Sales Tons Sold

Revenue up 14% in 2011

Tea and coffee shipments up 9% in ‘11 EBITDA margins up 220 bps since ‘09 Growing global markets ~ 5% CI program increasing productivity and expanding margins Announced $50 million investment to expand capacity

18

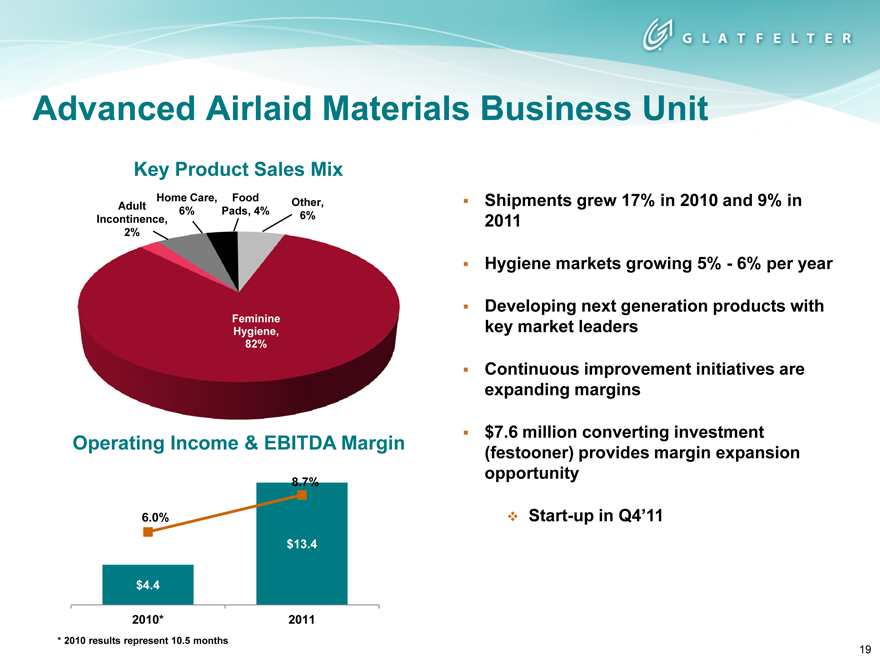

Advanced Airlaid Materials Business Unit

Key Product Sales Mix

Adult Incontinence, 2%

Home Care, 6%

Food Pads, 4%

Other, 6%

Feminine Hygiene, 82%

Shipments grew 17% in 2010 and 9% in 2011

Hygiene markets growing 5%—6% per year

Developing next generation products with key market leaders

Continuous improvement initiatives are expanding margins

$7.6 million converting investment (festooner) provides margin expansion opportunity

Start-up in Q4’11

Operating Income & EBITDA Margin

6.0%

8.7%

$13.4

$4.4

2010* 2011

* | | 2010 results represent 10.5 months |

19

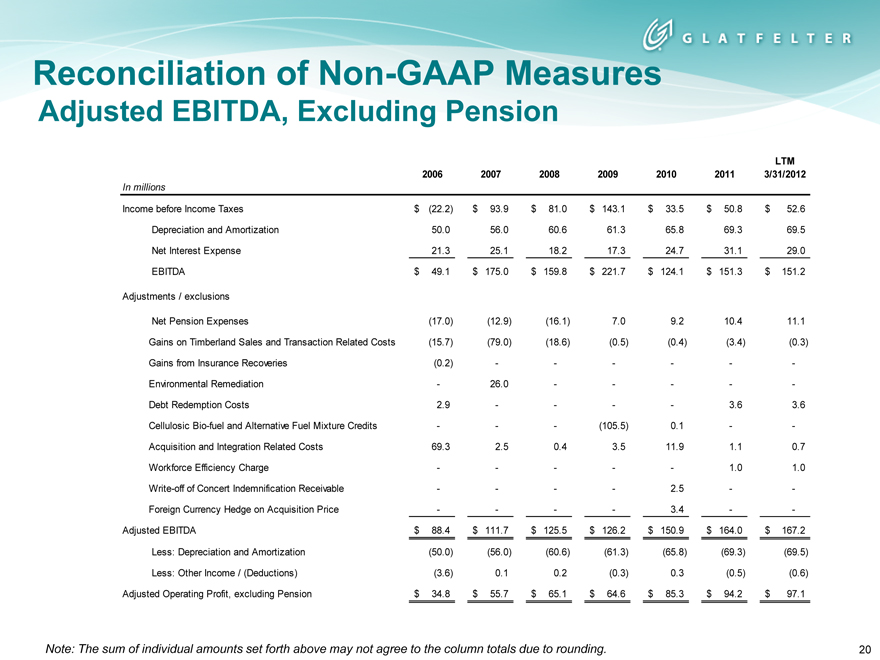

Reconciliation of Non-GAAP Measures

Adjusted EBITDA, Excluding Pension

LTM

2006 2007 2008 2009 2010 2011 3/31/2012

In millions

Income before Income Taxes $ (22.2) $ 93.9 $ 81.0 $ 143.1 $ 33.5 $ 50.8 $ 52.6

Depreciation and Amortization 50.0 56.0 60.6 61.3 65.8 69.3 69.5

Net Interest Expense 21.3 25.1 18.2 17.3 24.7 31.1 29.0

EBITDA $ 49.1 $ 175.0 $ 159.8 $ 221.7 $ 124.1 $ 151.3 $ 151.2

Adjustments / exclusions

Net Pension Expenses (17.0) (12.9) (16.1) 7.0 9.2 10.4 11.1

Gains on Timberland Sales and Transaction Related Costs (15.7) (79.0) (18.6) (0.5) (0.4) (3.4) (0.3)

Gains from Insurance Recoveries (0.2) ————— -

Environmental Remediation — 26.0 ———— -

Debt Redemption Costs 2.9 ———— 3.6 3.6

Cellulosic Bio-fuel and Alternative Fuel Mixture Credits ——— (105.5) 0.1 — -

Acquisition and Integration Related Costs 69.3 2.5 0.4 3.5 11.9 1.1 0.7

Workforce Efficiency Charge ————— 1.0 1.0

Write-off of Concert Indemnification Receivable ———— 2.5 — -

Foreign Currency Hedge on Acquisition Price ———— 3.4 — -

Adjusted EBITDA $ 88.4 $ 111.7 $ 125.5 $ 126.2 $ 150.9 $ 164.0 $ 167.2

Less: Depreciation and Amortization (50.0) (56.0) (60.6) (61.3) (65.8) (69.3) (69.5)

Less: Other Income / (Deductions) (3.6) 0.1 0.2 (0.3) 0.3 (0.5) (0.6)

Adjusted Operating Profit, excluding Pension $ 34.8 $ 55.7 $ 65.1 $ 64.6 $ 85.3 $ 94.2 $ 97.1

Note: The sum of individual amounts set forth above may not agree to the column totals due to rounding.

20

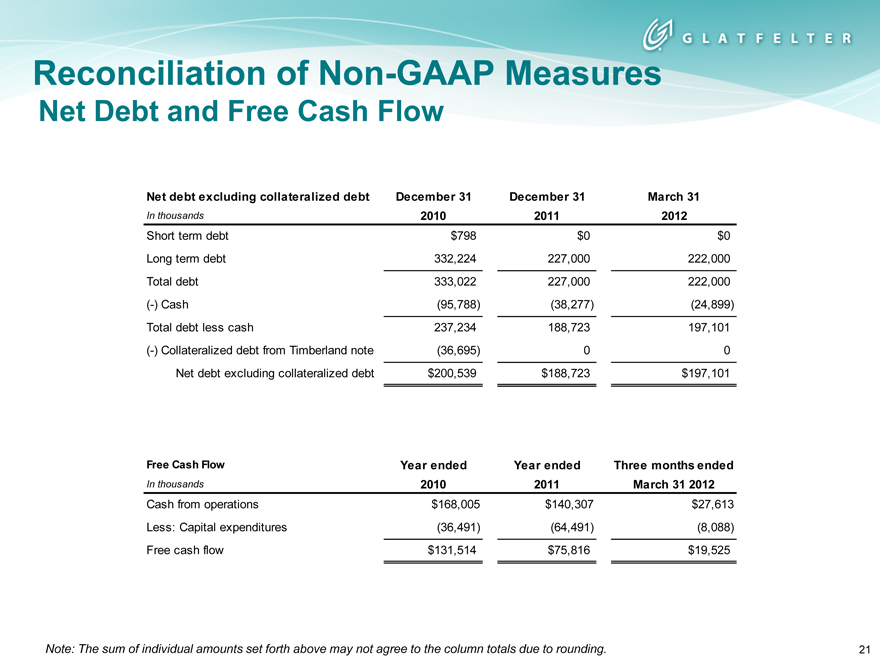

Reconciliation of Non-GAAP Measures

Net Debt and Free Cash Flow

Net debt excluding collateralized debt December 31 December 31 March 31

In thousands 2010 2011 2012

Short term debt $798 $0 $0

Long term debt 332,224 227,000 222,000

Total debt 333,022 227,000 222,000

(-) Cash (95,788) (38,277) (24,899)

Total debt less cash 237,234 188,723 197,101

(-) Collateralized debt from Timberland note (36,695) 0 0

Net debt excluding collateralized debt $200,539 $188,723 $197,101

Free Cash Flow Year ended Year ended Three months ended

In thousands 2010 2011 March 31 2012

Cash from operations $168,005 $140,307 $27,613

Less: Capital expenditures (36,491) (64,491) (8,088)

Free cash flow $131,514 $75,816 $19,525

Note: The sum of individual amounts set forth above may not agree to the column totals due to rounding.

21