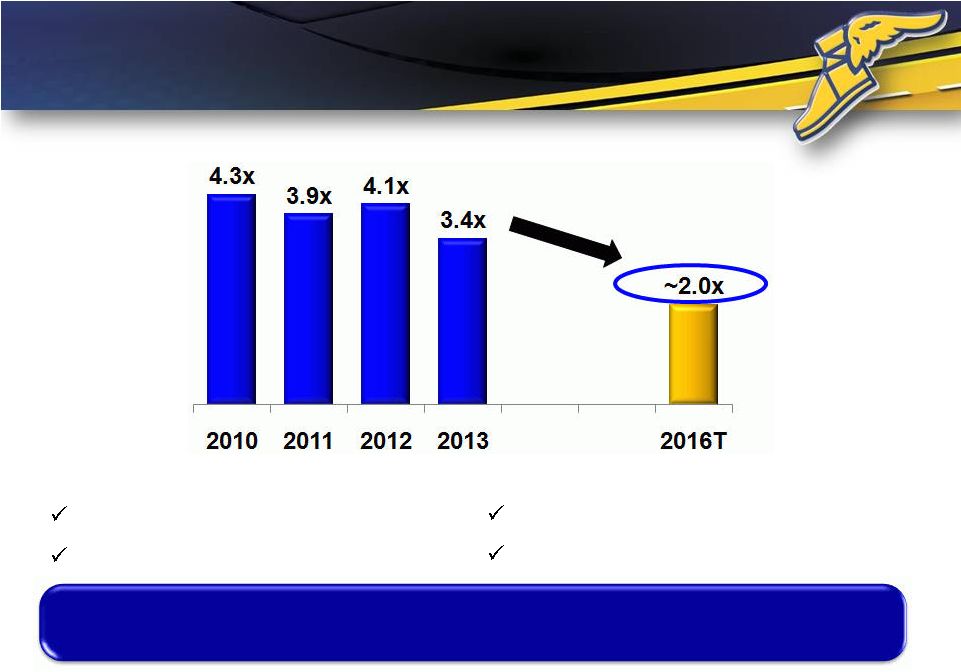

Use of Historical and Forward-Looking Non-GAAP Financial Measures 22 This presentation contains our historical total segment operating income and free cash flow from operations for certain periods, our targeted total segment operating income growth rate for 2015-16, our historical ratio of Adjusted Debt to EBITDAP for certain periods, and our targeted ratio of Adjusted Debt to EBITDAP for 2016. Total segment operating income, free cash flow from operations, and the ratio of Adjusted Debt to EBITDAP are important financial measures for the company but are not financial measures defined by U.S. GAAP, and should not be construed as an alternative to corresponding financial measures presented in accordance with U.S. GAAP. Total segment operating income is the sum of the individual strategic business units’ segment operating income as determined in accordance with U.S. GAAP. The most directly comparable GAAP financial measure is Income before Income Taxes. Management believes that total segment operating income is useful because it represents the aggregate value of income created by the company’s SBUs and excludes items not directly related to the SBUs for performance evaluation purposes. Free Cash Flow from Operations is the company’s Cash Flow from Operations as determined in accordance with U.S. GAAP before pension contributions and direct payments and rationalization payments, less capital expenditures. Management believes that Free Cash Flow from Operations is useful because it represents the cash generating capability of the company’s ongoing operations, after taking into consideration capital expenditures necessary to maintain its business and pursue growth opportunities. Adjusted Debt is the sum of our total debt and our global pension liability, each as determined in accordance with U.S. GAAP, and EBITDAP, as adjusted, represents net income (the most directly comparable GAAP financial measure) before interest expense, income tax expense, depreciation and amortization expense, net periodic pension cost, rationalization charges and other (income) and expense. We present the ratio of Adjusted Debt to EBITDAP because we believe it is widely used by investors as a means of evaluating a company’s leverage. It should be noted that other companies may calculate similarly titled non-GAAP financial measures differently and, as a result, the measures presented herein may not be comparable to such similarly titled measures reported by other companies. We are unable to present a quantitative reconciliation of our forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures, because management cannot reliably predict all of the necessary components of those GAAP financial measures without unreasonable effort. These components could be significant to the calculation of those GAAP financial measures in the future. |