- HWM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Howmet Aerospace (HWM) 8-KCurrent Report

Filed: 27 Jan 04, 12:00am

Exhibit 99.2 [Alcoa Logo] 4th Quarter 2003 January 22, 2004 New York, NY Analyst Conference

Today’s discussion may include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act Such statements relate to future events and Alcoa’s actual results or actions may differ For a summary of the specific risk factors that could Forward-Looking Statements of 1995. expectations and involve known and unknown risks and uncertainties. materially from those projected in the forward-looking statements. cause results to differ materially from those expressed in the forward-looking statements, please refer to Alcoa’s Form 10-K for the year ended December 31, 2002, in addition to the Quarterly Report on Form 10-Q for the quarter ended September 30, 2003 filed with the Securities and Exchange Commission.

[Alcoa Logo] Richard B. Kelson Executive VP and CFO

Quarter Highlights Continued strong safety performance Revenues, income from continuing operations up sequentially and year-over-year Continued improvement in the balance sheet Disciplined capital spending Cost savings goal achieved th 4

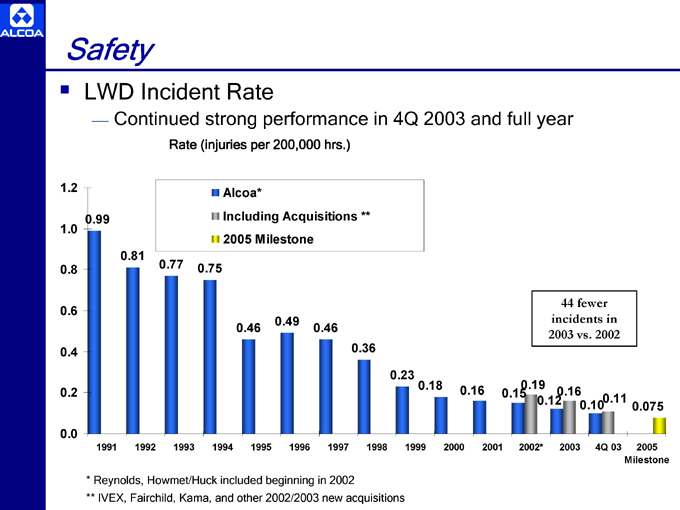

0.075 2005 Milestone 0.11 4Q 03 44 fewer 0.10 incidents in 2003 vs. 2002 0.16 2003 0.12 0.19 2002* 0.15 2001 0.16 2000 0.18 1999 0.23 1998 0.36 1997 0.46 1996 0.49 1995 Alcoa* Including Acquisitions ** 2005 Milestone 0.46 1994 0.75 Rate (injuries per 200,000 hrs.) 1993 0.77 1992 Continued strong performance in 4Q 2003 and full year 0.81 Safety LWD Incident Rate 0.99 1991 * Reynolds, Howmet/Huck included beginning in 2002 ** IVEX, Fairchild, Kama, and other 2002/2003 new acquisitions 1.2 1.0 0.8 0.6 0.4 0.2 0.0

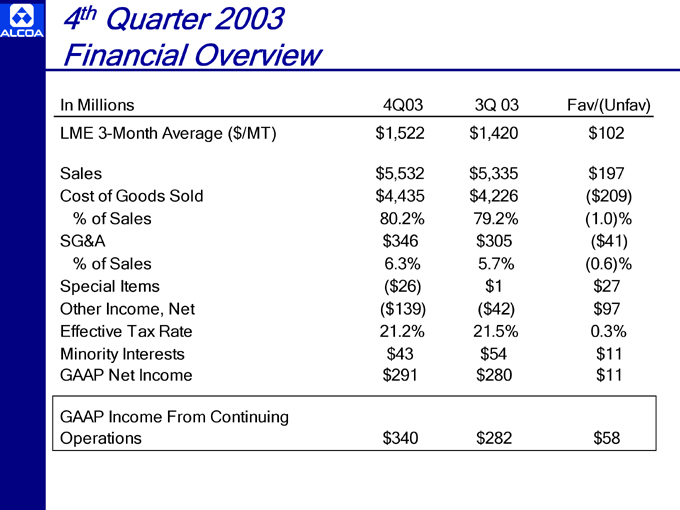

Fav/(Unfav) $102 $197 ($209) (1.0)% ($41) (0.6)% $27 $97 0.3% $11 $11 $58 3Q 03 $1,420 $5,335 $4,226 79.2% $305 5.7% $1 ($42) 21.5% $54 $280 $282 4Q03 $1,522 $5,532 $4,435 80.2% $346 6.3% ($26) ($139) 21.2% $43 $291 $340 Quarter 2003 th % of Sales % of Sales 4 Financial Overview In Millions LME 3-Month Average ($/MT) Sales Cost of Goods Sold SG&A Special Items Other Income, Net Effective Tax Rate Minority Interests GAAP Net Income GAAP Income From Continuing Operations

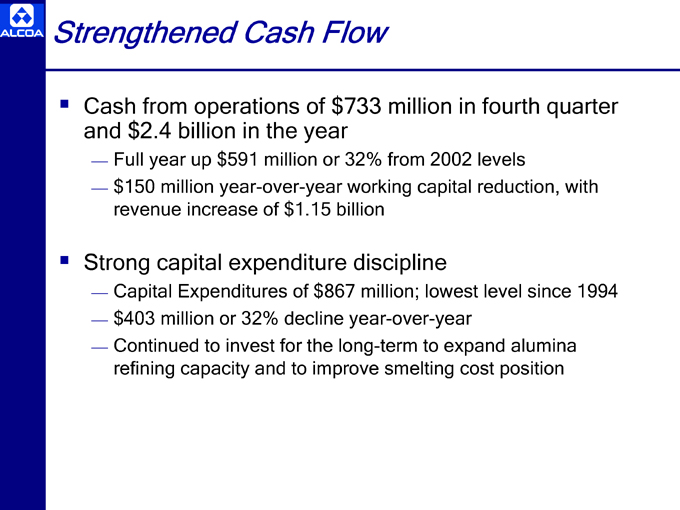

Full year up $591 million or 32% from 2002 levels $150 million year-over-year working capital reduction, with revenue increase of $1.15 billion Capital Expenditures of $867 million; lowest level since 1994 $403 million or 32% decline year-over-year Continued to invest for the long-term to expand alumina refining capacity and to improve smelting cost position Cash from operations of $733 million in fourth quarter and $2.4 billion in the year Strong capital expenditure discipline Strengthened Cash Flow

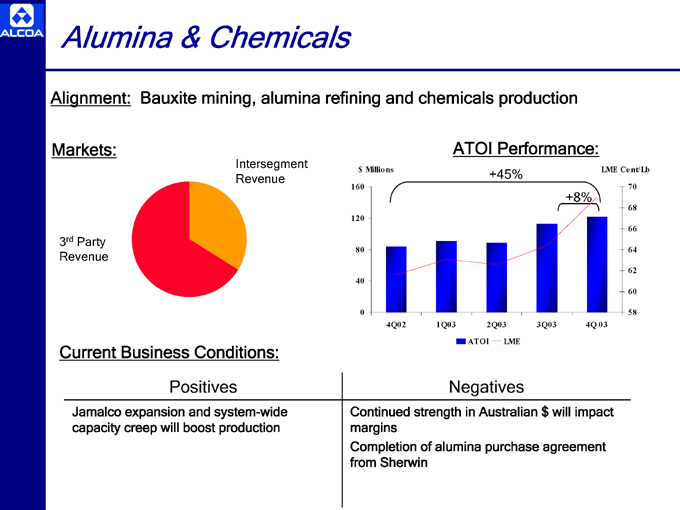

nt/Lb 70 68 66 64 62 60 58 LME Ce 4Q 03 +8% 3Q03 Performance: LME +45% 2Q03 ATOI ATOI Negatives 1Q03 ns 4Q02 $ Millio 160 120 80 40 0 Continued strength in Australian $ will impact margins Completion of alumina purchase agreement from Sherwin Intersegment Revenue Conditions: Bauxite mining, alumina refining and chemicals production Positives Business Party Jamalco expansion and system-wide capacity creep will boost production Alumina & Chemicals rd Current Alignment: Markets: 3 Revenue

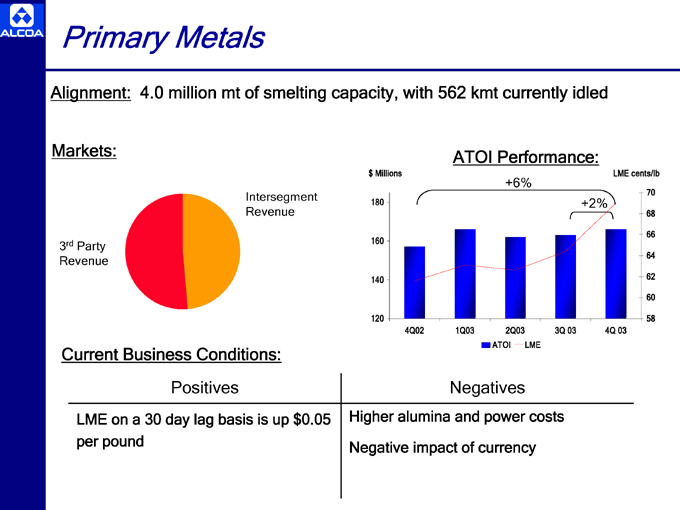

LME cents/lb 70 68 66 64 62 60 58 4Q 03 +2% 3Q 03 LME Performance: +6% 2Q03 ATOI ATOI 1Q03 Negatives 4Q02 $ Millions 180 160 140 120 Higher alumina and power costs Negative impact of currency Intersegment Revenue Conditions: 4.0 million mt of smelting capacity, with 562 kmt currently idled Positives Business Party LME on a 30 day lag basis is up $0.05 per pound Primary Metals rd Current Alignment: Markets: 3 Revenue

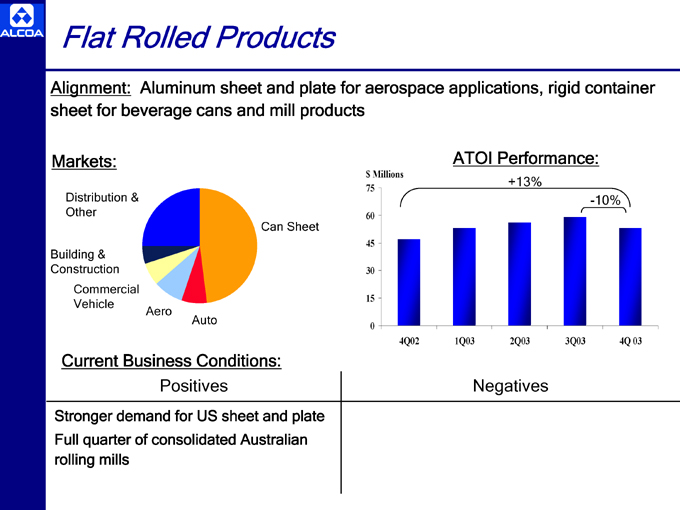

4Q 03 -10% 3Q03 Performance: +13% 2Q03 Negatives ATOI 1Q03 4Q02 $ Millions 75 60 45 30 15 0 Can Sheet Auto Conditions: Positives Aluminum sheet and plate for aerospace applications, rigid container Aero Business Flat Rolled Products Alignment: sheet for beverage cans and mill products Markets: Distribution & Other Building & Construction Commercial Vehicle Current Stronger demand for US sheet and plate Full quarter of consolidated Australian rolling mills

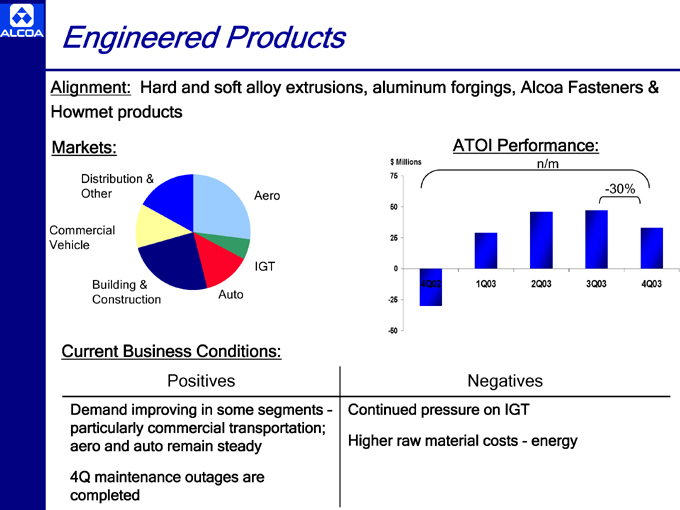

4Q03 -30% 3Q03 Performance: n/m 2Q03 energy 1Q03 Negatives ATOI 4Q02 $ Millions 75 50 25 0 -25 -50 Continued pressure on IGT Higher raw material costs - Aero IGT Auto Conditions: Hard and soft alloy extrusions, aluminum forgings, Alcoa Fasteners & Positives Business Distribution & Building & Construction Engineered Products Alignment: Howmet products Markets: Other Commercial Current Demand improving in some segments – particularly commercial transportation; aero and auto remain steady 4Q maintenance outages are completed Vehicle

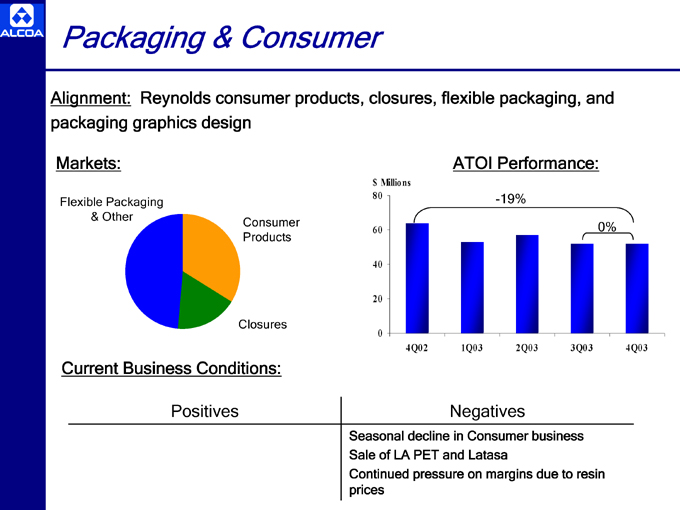

4Q03 0% 3Q03 Performance: 2Q03 -19% ATOI 1Q03 Negatives 4Q02 $ Millions 80 60 40 20 0 Seasonal decline in Consumer business Sale of LA PET and Latasa Continued pressure on margins due to resin prices Consumer Products Closures Conditions: Reynolds consumer products, closures, flexible packaging, and Positives Business & Other Packaging & Consumer Alignment: packaging graphics design Markets: Flexible Packaging Current

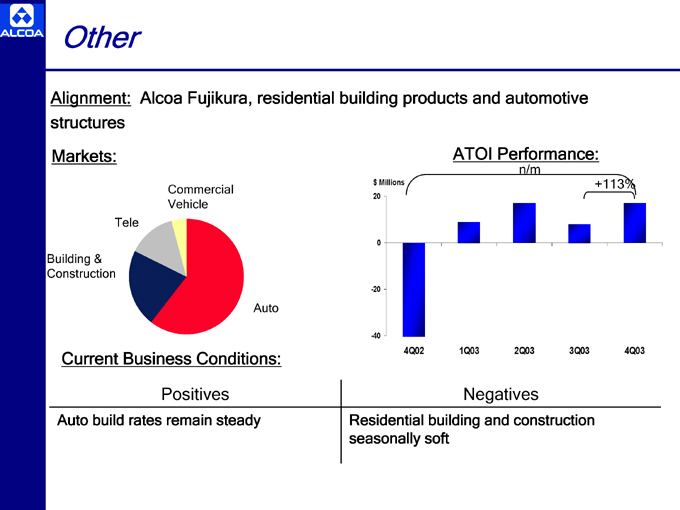

+113% 4Q03 3Q03 Performance:n/m 2Q03 Negatives ATOI 1Q03 4Q02 $ Millions 20 0 -20 -40 Residential building and construction seasonally soft Auto Conditions: Alcoa Fujikura, residential building products and automotive Commercial Vehicle Positives Business Tele Other Alignment: structures Markets: Building & Construction Current Auto build rates remain steady

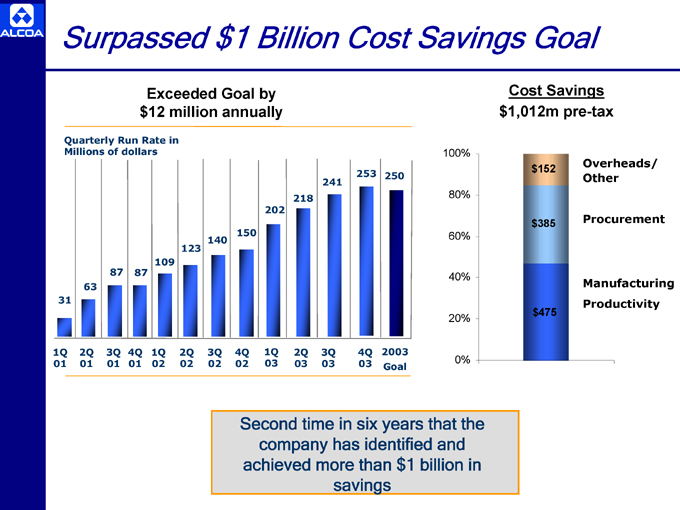

Overheads/ Other Procurement Manufacturing Productivity Savings $152 $385 $475 Cost $1,012m pre-tax 100% 80% 60% 40% 20% 0% 250 2003 Goal 253 4Q 03 savings 241 3Q 03 218 2Q 03 202 1Q 03 Second time in six years that the company has identified and achieved more than $1 billion in 150 4Q 02 140 3Q 02 123 2Q 02 Exceeded Goal by $12 million annually 109 1Q 02 87 4Q 01 87 3Q 01 Surpassed $1 Billion Cost Savings Goal Quarterly Run Rate in Millions of dollars 63 2Q 01 31 1Q 01

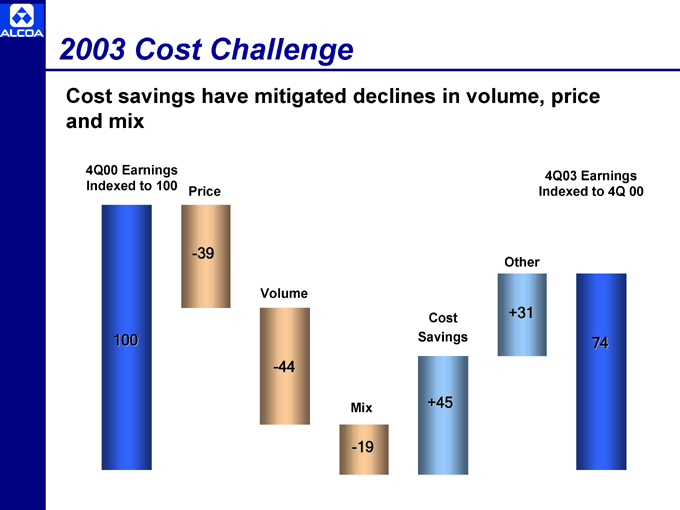

4Q03 Earnings Indexed to 4Q 00 74 Other +31 Cost Savings +45 Mix -19 Volume -44 Price -39 2003 Cost Challenge Cost savings have mitigated declines in volume, price and mix 4Q00 Earnings Indexed to 100 100

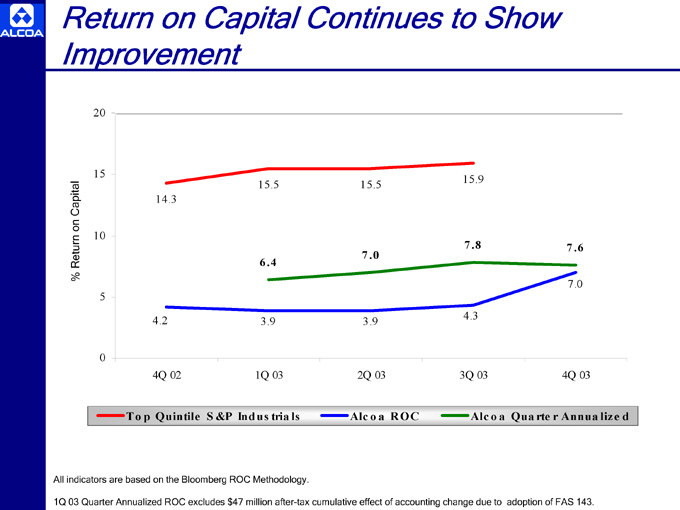

d lize 7.6 7.0 4Q 03 r Annua rte Qua adoption of FAS 143. a o 15.9 7.8 4.3 3Q 03 Alc ROC a 15.5 7.0 3.9 2Q 03 o Alc ls tria 15.5 6.4 3.9 1Q 03 us Ind &P S 14.3 4.2 4Q 02 Quintile p To 20 15 10 5 0 Return on Capital Continues to Show Improvement litap Can ornutRe % All indicators are based on the Bloomberg ROC Methodology. 1Q 03 Quarter Annualized ROC excludes $47 million after-tax cumulative effect of accounting change due to

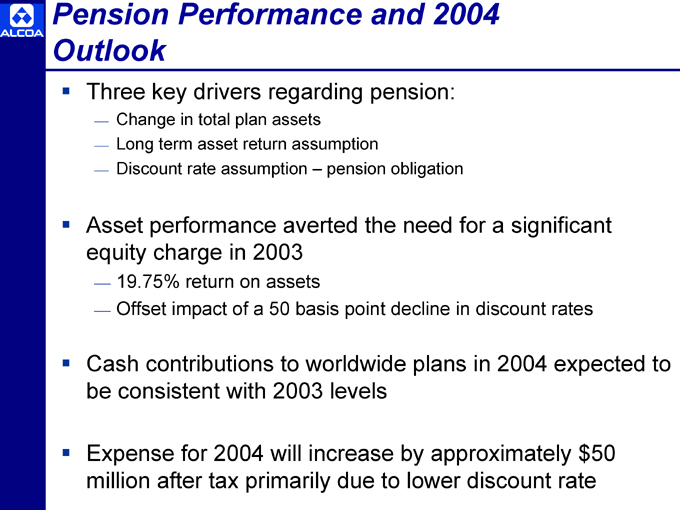

pension obligation Change in total plan assets Long term asset return assumption Discount rate assumption – 19.75% return on assets Offset impact of a 50 basis point decline in discount rates Three key drivers regarding pension: Asset performance averted the need for a significant equity charge in 2003 Cash contributions to worldwide plans in 2004 expected to be consistent with 2003 levels Expense for 2004 will increase by approximately $50 million after tax primarily due to lower discount rate Pension Performance and 2004 Outlook

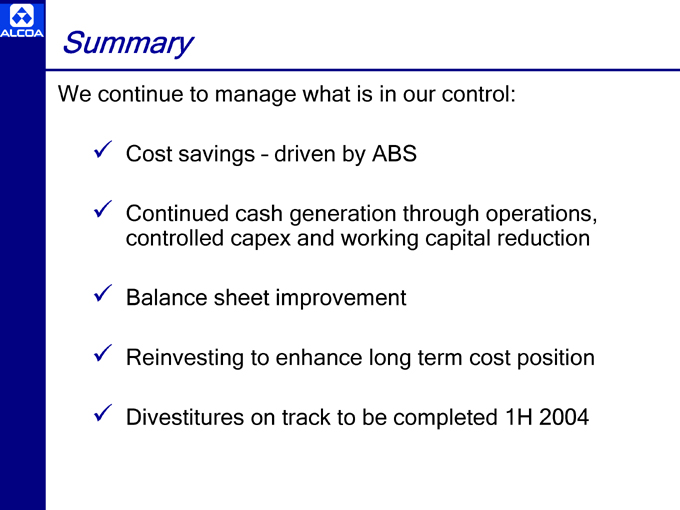

driven by ABS controlled capex and working capital reduction Cost savings – Continued cash generation through operations, Balance sheet improvement Reinvesting to enhance long term cost position Divestitures on track to be completed 1H 2004 Summary We continue to manage what is in our control: 9 9 9 9 9

[Aloco Logo] Belda Alain J.P. Chairman and CEO

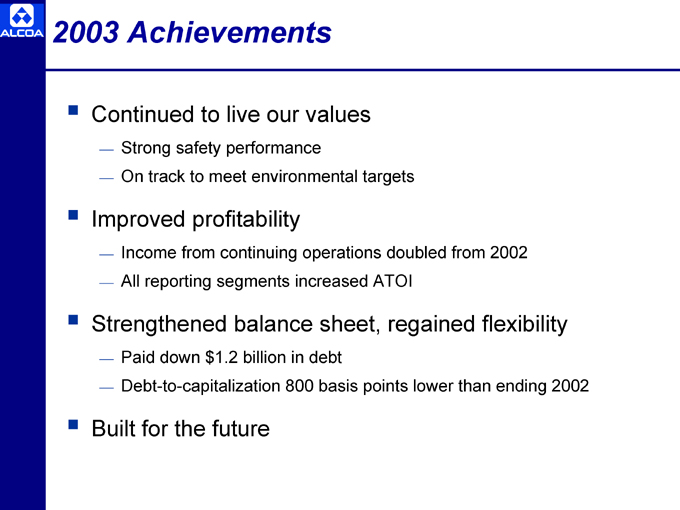

Strong safety performance On track to meet environmental targets Income from continuing operations doubled from 2002 All reporting segments increased ATOI Paid down $1.2 billion in debt Debt-to-capitalization 800 basis points lower than ending 2002 Continued to live our values Improved profitability Strengthened balance sheet, regained flexibility Built for the future 2003 Achievements

Actions completed 250kmt expansion 250kmt expansion underway 600 kmt expansion planned Sale Announced, close 1Q 04 progressing Barra Grande underway -Suriname—- Continued progress on Inert

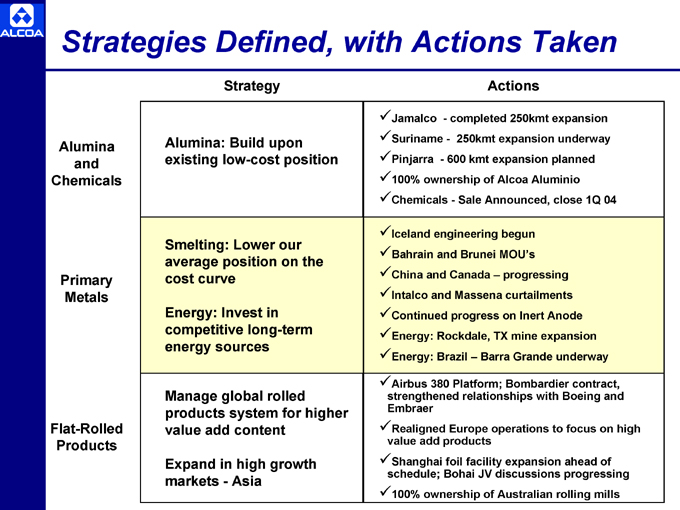

Anode Energy: Rockdale, TX mine expansion Energy: Brazil – Jamalco Pinjarra 100% ownership of Alcoa Aluminio Chemicals—Iceland engineering begun Bahrain and Brunei MOU’s China and Canada – Intalco and Massena curtailments Airbus 380 Platform; Bombardier contract, strengthened relationships with Boeing and Embraer Realigned Europe operations to focus on high value add products Shanghai foil facility expansion ahead of schedule; Bohai JV discussions progressing 100% ownership of Australian rolling mills 9 9 9 9 9 9 9 9 9 9 9 9 9 9 9 9 Strategy Alumina: Build upon existing low-cost position Energy: Invest in products system for higher Expand in high growth Asia Smelting: Lower our average position on the cost curve competitive long-term energy sources Manage global rolled value add content markets -Strategies Defined, with Actions Taken Alumina and Chemicals Primary Metals Flat-Rolled Products

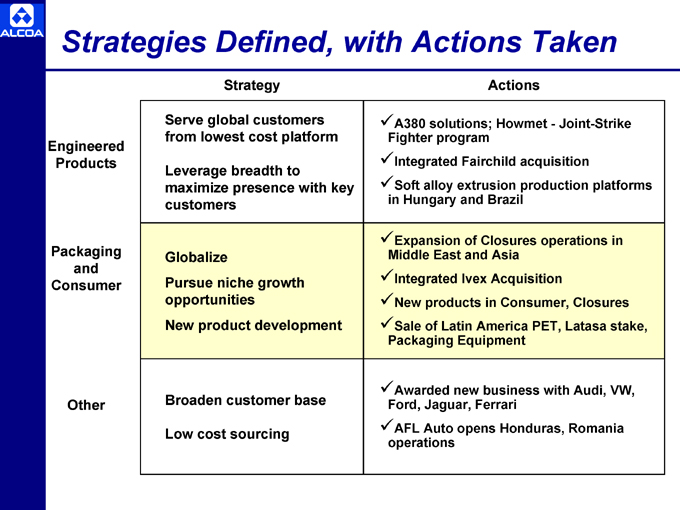

Joint-Strike Actions A380 solutions; Howmet—Integrated Fairchild acquisition Soft alloy extrusion production platforms Expansion of Closures operations in Middle East and Asia Integrated Ivex Acquisition New products in Consumer, Closures Sale of Latin America PET, Latasa stake, Packaging Equipment Awarded new business with Audi, VW, AFL Auto opens Honduras, Romania 9 Fighter program 9 9in Hungary and Brazil 9 9 9 9 9Ford, Jaguar, Ferrari 9operations Strategy from lowest cost platform Leverage breadth to maximize presence with key Pursue niche growth opportunities Serve global customers customers Globalize New product development Broaden customer base Low cost sourcing Strategies Defined, with Actions Taken Engineered Products Packaging and Consumer Other

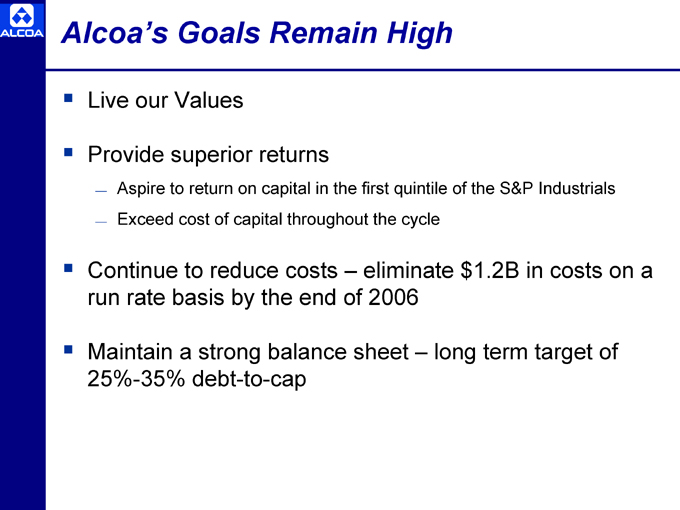

eliminate $1.2B in costs on a long term target of Aspire to return on capital in the first quintile of the S&P Industrials Exceed cost of capital throughout the cycle Live our Values Provide superior returns Continue to reduce costs – run rate basis by the end of 2006 Maintain a strong balance sheet – 25%-35% debt-to-cap Alcoa’s Goals Remain High

Bottom Line 2003 performance showed significant improvement over 2002 We continue to position the company for success in 2004 and beyond Alcoa’s strategy is clear and our actions are focused Our goals remain high

[Alcoa Logo]

New York, N.Y. 10022-4608 (212) 836-2674 (212) 836-2813 For Additional Information, contact: William F. Oplinger Director, Investor Relations Alcoa 390 Park Avenue Telephone: Facsimile: www.alcoa.com

[Alcoa Logo] Appendix

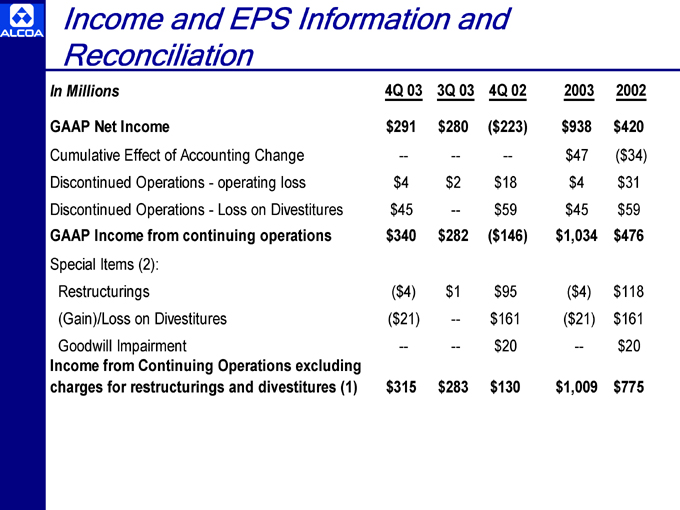

2002 $420 ($34) $31 $59 $476 $118 $161 $20 $775 2003 $938 $47 $4 $45 $1,034 ($4) ($21) — $1,009 02 — $18 $59 $95 $161 $20 $130 4Q ($223) ($146) 03 $280 — $2 — $282 $1 — — $283 3Q 03 $291 — $4 $45 $340 ($4) ($21) — $315 4Q Income and EPS Information and Reconciliation In Millions GAAP Net Income Cumulative Effect of Accounting Change Discontinued Operations—operating loss Discontinued Operations—Loss on Divestitures GAAP Income from continuing operations Special Items (2): Restructurings (Gain)/Loss on Divestitures Goodwill Impairment Income from Continuing Operations excluding charges for restructurings and divestitures (1)

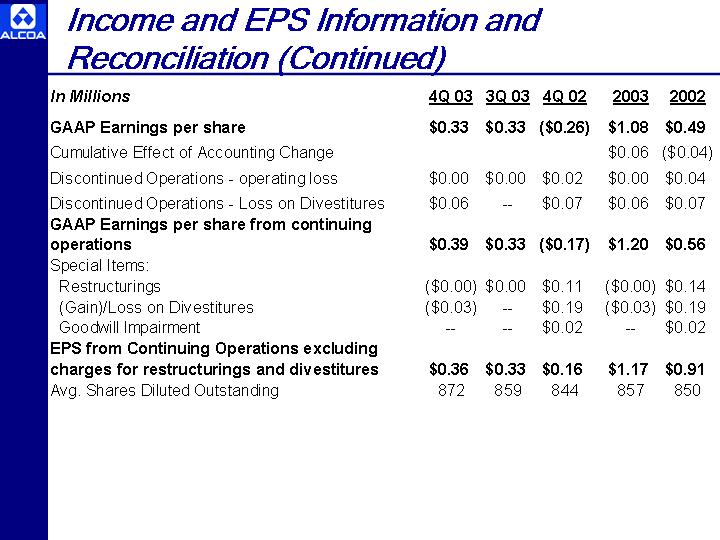

2002 $0.49 ($0.04 $0.04 $0.07 $0.56 $0.14 $0.19 $0.02 $0.91 850 2003 $1.08 $0.06 $0.00 $0.06 $1.20 ($0.00) ($0.03) — $1.17 857 02 844 4Q ($0.26) $0.02 $0.07 ($0.17) $0.11 $0.19 $0.02 $0.16 03 — — — 859 3Q $0.33 $0.00 $0.33 $0.00 $0.33 03 — 872 4Q $0.33 $0.00 $0.06 $0.39 ($0.00) ($0.03) $0.36 Income and EPS Information and Reconciliation (Continued) In Millions GAAP Earnings per share Cumulative Effect of Accounting Change Discontinued Operations—operating loss Discontinued Operations—Loss on Divestitures GAAP Earnings per share from continuing operations Special Items: Restructurings (Gain)/Loss on Divestitures Goodwill Impairment EPS from Continuing Operations excluding charges for restructurings and divestitures Avg. Shares Diluted Outstanding

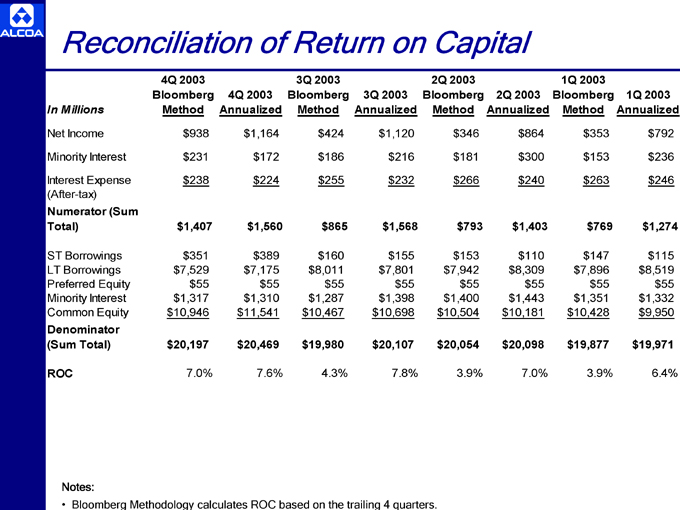

246 $55 6.4% $792 $236 $ $1,274 $115 9,950 1Q 2003 Annualized $8,519 $1,332 $ $19,971 $353 $153 263 $769 $147 $55 3.9% $ $7,896 $1,351 10,428 1Q 2003 Bloomberg Method $ $19,877 $864 $300 240

$110 $55 7.0% $ $1,403 $8,309 $1,443 10,181 2Q 2003 Annualized $ $20,098 266 $793 $55 3.9% $346 $181 $ $153 $7,942 $1,400 10,504 2Q 2003 Bloomberg Method $ $20,054 $216 232 $155 $55 7.8% $1,120 $ $1,568 $7,801 $1,398 10,698 3Q 2003 Annualized $ $20,107 255 $865 $55 4.3% $424 $186 $ $160 $8,011 $1,287 10,467 3Q 2003 Bloomberg Method $ $19,980 224 $55 7.6% $1,164 $172 $ $1,560 $389 $7,175 $1,310 11,541 4Q 2003 Annualized $ $20,469 $938 $231 238 $55 7.0% $ $1,407 $351 $7,529 $1,317 10,946 4Q 2003 Bloomberg Method $ $20,197 Bloomberg Methodology calculates ROC based on the trailing 4 quarters. Reconciliation of Return on Capital In Millions LT Borrowings Preferred Equity Minority Interest Common Equity Denominator Notes: Net Income Minority Interest Interest Expense (After-tax) Numerator (Sum Total) ST Borrowings (Sum Total) ROC

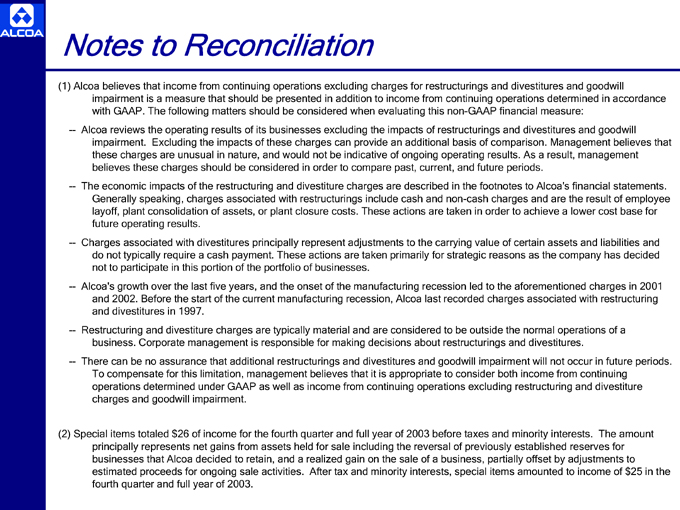

and The amount Excluding the impacts of these charges can provide an additional basis of comparison. Management believes that of ongoing operating results. As a result, management primarily for strategic reasons as the company has decided After tax and minority interests, special items amounted to income of $25 in the impairment is a measure that should be presented in addition to income from continuing operations determined in accordance with GAAP. The following matters should be considered when evaluating this non-GAAP financial measure: Alcoa reviews the operating results of its businesses excluding the impacts of restructurings and divestitures and goodwill impairment. these charges are unusual in nature, and would not be indicative believes these charges should be considered in order to compare past, current, and future periods. The economic impacts of the restructuring and divestiture charges are described in the footnotes to Alcoa’s financial statements. Generally speaking, charges associated with restructurings include cash and non-cash charges and are the result of employee layoff, plant consolidation of assets, or plant closure costs. These actions are taken in order to achieve a lower cost base for future operating results. Charges associated with divestitures principally represent adjustments to the carrying value of certain assets and liabilities do not typically require a cash payment. These actions are taken not to participate in this portion of the portfolio of businesses. Alcoa’s growth over the last five years, and the onset of the manufacturing recession led to the aforementioned charges in 2001 and 2002. Before the start of the current manufacturing recession, Alcoa last recorded charges associated with restructuring and divestitures in 1997. Restructuring and divestiture charges are typically material and are considered to be outside the normal operations of a business. Corporate management is responsible for making decisions about restructurings and divestitures. There can be no assurance that additional restructurings and divestitures and goodwill impairment will not occur in future periods. To compensate for this limitation, management believes that it is appropriate to consider both income from continuing operations determined under GAAP as well as income from continuing operations excluding restructuring and divestiture charges and goodwill impairment. principally represents net gains from assets held for sale including the reversal of previously established reserves for businesses that Alcoa decided to retain, and a realized gain on the sale of a business, partially offset by adjustments to estimated proceeds for ongoing sale activities. fourth quarter and full year of 2003. Notes to Reconciliation (1) Alcoa believes that income from continuing operations excluding charges for restructurings and divestitures and goodwill — — — — — — (2) Special items totaled $26 of income for the fourth quarter and full year of 2003 before taxes and minority interests.