EXHIBIT 99.2

1st Quarter 2004 Analyst Conference

April 22, 2004

New York, NY

Forward-Looking Statements

Today’s discussion may include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements relate to future events and expectations and involve known and unknown risks and uncertainties. Alcoa’s actual results or actions may differ materially from those projected in the forward-looking statements. For a summary of the specific risk factors that could cause results to differ materially from those expressed in the forward-looking statements, please refer to Alcoa’s Form 10-K for the year ended December 31, 2003 filed with the Securities and Exchange Commission.

Richard B. Kelson

Executive Vice President Chief Financial Officer

1st Quarter Highlights

?Highest level of revenue since 2Q 2001

COGS sequential improvement to less than 78% of sales

?Income from operations up sequentially and year-over-year

?5 out of 6 segments up on a year-over-year basis

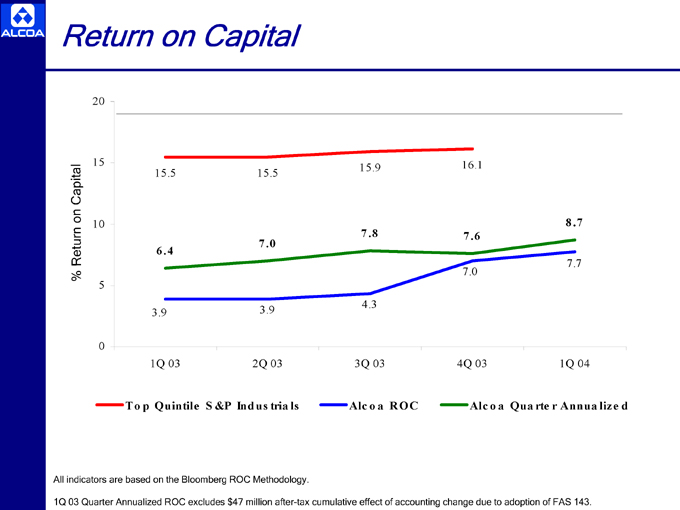

?Continued ROC improvement to 8.7% annualized

1st Quarter Highlights (continued)

?Strong start toward new 2006 cost challenge ?

Continued disciplined capital spending ?

Substantial completion of the divestiture program

?Debt to capitalization ratio within target range

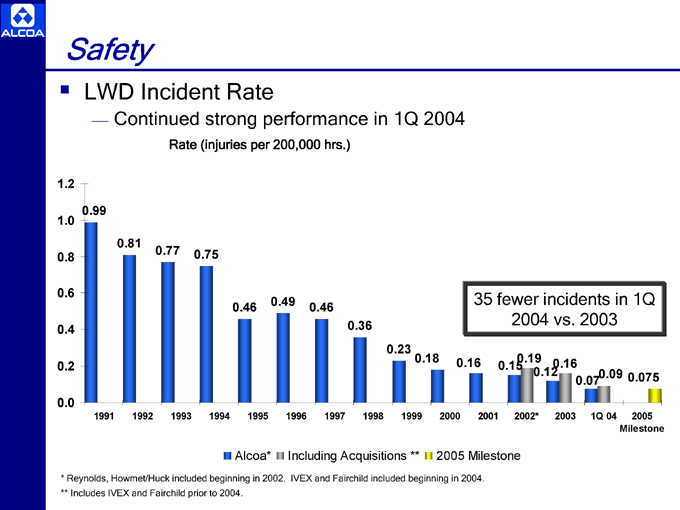

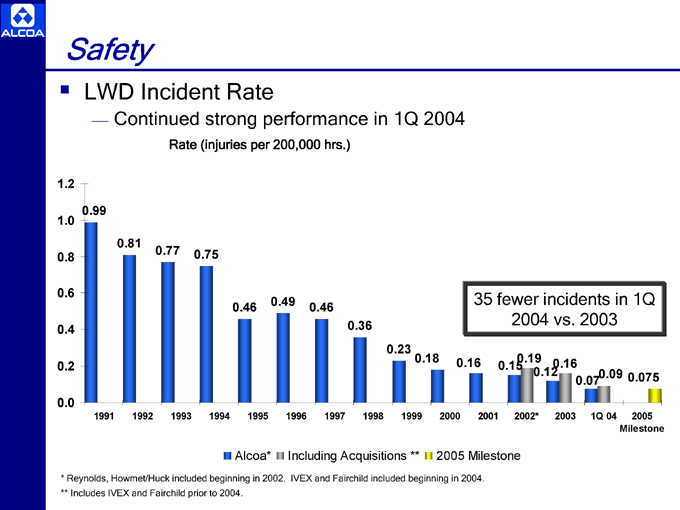

Safety

?LWD Incident Rate

??Continued strong performance in 1Q 2004

Rate (injuries per 200,000 hrs.)

fewer incidents in 1Q

2004 vs. 2003

0.99

0.81

0.77 0.75

0.49 35

0.46 0.46

0.36

0.23

0.18 0.16 0.19 0.16

0.15 0.12 0.09 0.075

0.07

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002* 2003 1Q 04 2005

Milestone

Alcoa* Including Acquisitions ** 2005 Milestone

* Reynolds, Howmet/Huck included beginning in 2002. IVEX and Fairchild included beginning in 2004. ** Includes IVEX and Fairchild prior to 2004.

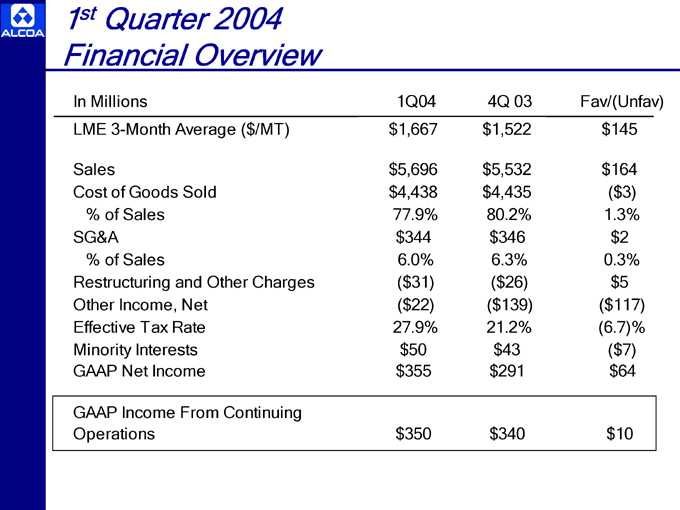

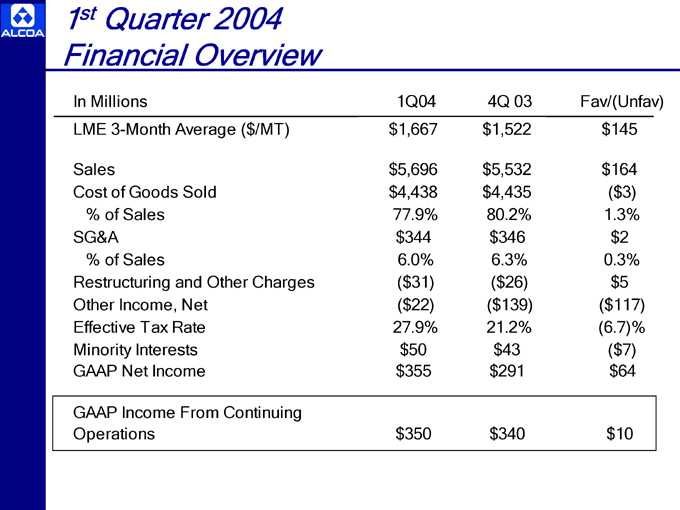

1st Quarter 2004 Financial Overview

In Millions 1Q04 4Q 03 Fav/(Unfav)

LME 3-Month Average ($/MT) $ 1,667 $ 1,522 $ 145

Sales $ 5,696 $ 5,532 $ 164

Cost of Goods Sold $ 4,438 $ 4,435 ($ 3)

% of Sales 77.9% 80.2% 1.3%

SG&A $ 344 $ 346 $ 2

% of Sales 6.0% 6.3% 0.3%

Restructuring and Other Charges ($ 31) ($ 26) $ 5

Other Income, Net ($ 22) ($ 139) ($ 117)

Effective Tax Rate 27.9% 21.2% (6.7)%

Minority Interests $ 50 $ 43 ($ 7)

GAAP Net Income $ 355 $ 291 $ 64

GAAP Income From Continuing

Operations $ 350 $ 340 $ 10

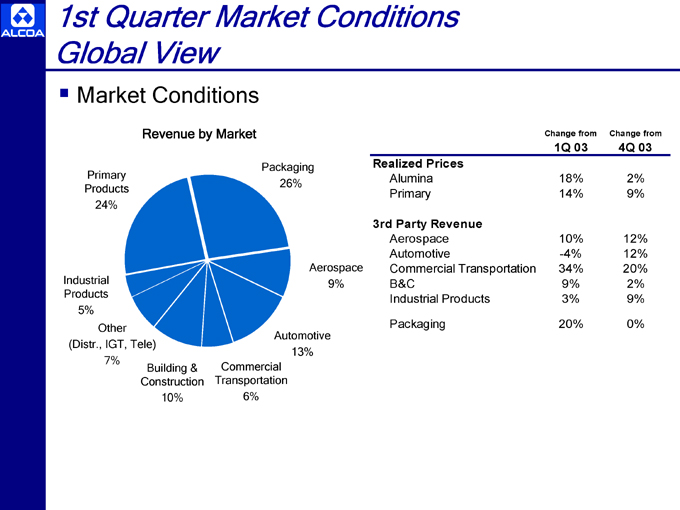

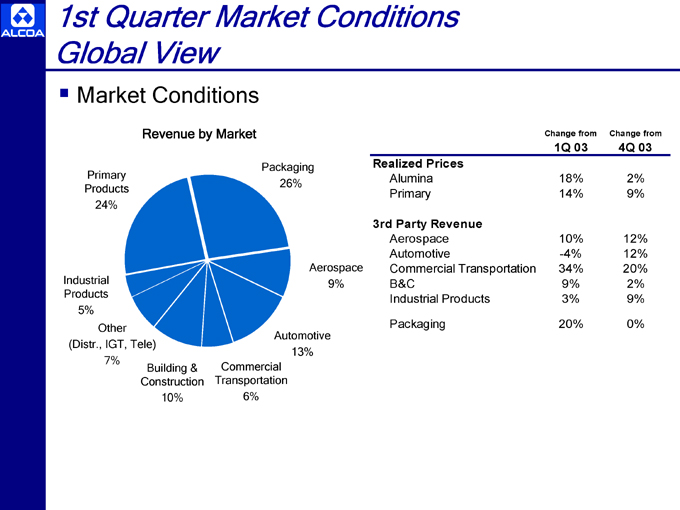

1st Quarter Market Conditions Global View

?Market Conditions

Revenue by Market

Primary Products 24%

Industrial Products 5%

Other (Distr., IGT, Tele) 7%

Building & Construction 10%

Commercial Transportation 6%

Packaging 26%

Aerospace 9%

Automotive 13%

Change from Change from

1Q 03 4Q 03

Realized Prices

Alumina 18% 2%

Primary 14% 9%

3rd Party Revenue

Aerospace 10% 12%

Automotive -4% 12%

Commercial Transportation 34% 20%

B&C 9% 2%

Industrial Products 3% 9%

Packaging 20% 0%

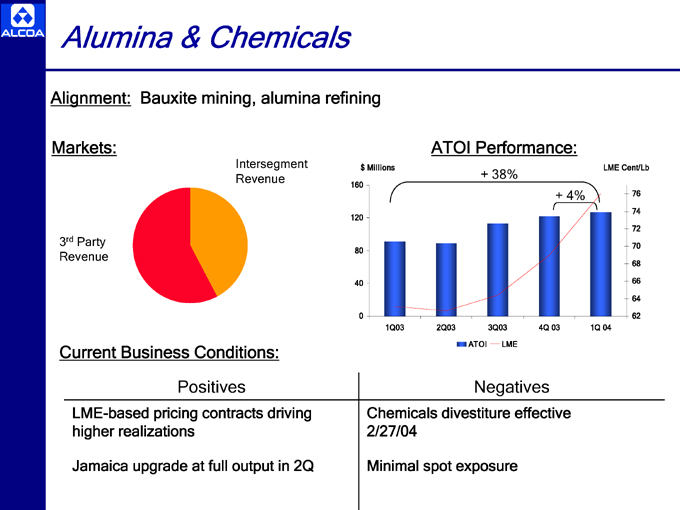

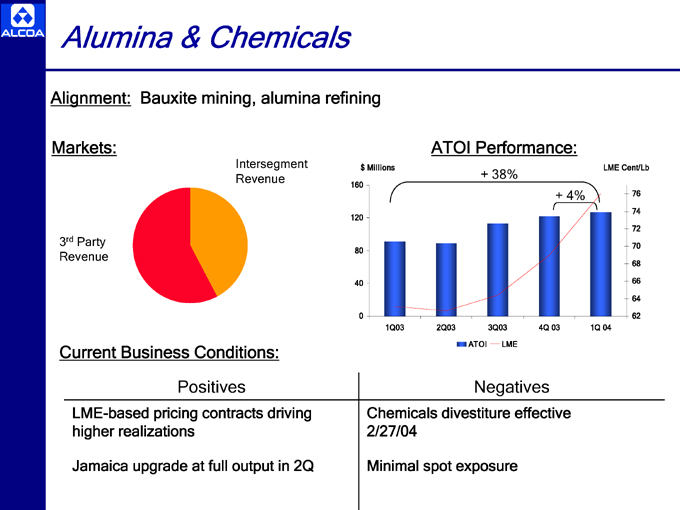

Alumina & Chemicals

Alignment: Bauxite mining, alumina refining

Markets:

Intersegment Revenue

3rd Party Revenue

ATOI Performance:

+ 38% LME

+ 4%

1Q03 2Q03 3Q03 4Q 03 1Q 04

ATOI LME

Current Business Conditions:

Positives

LME-based pricing contracts driving higher realizations

Jamaica upgrade at full output in 2Q

Negatives

Chemicals divestiture effective 2/27/04

Minimal spot exposure

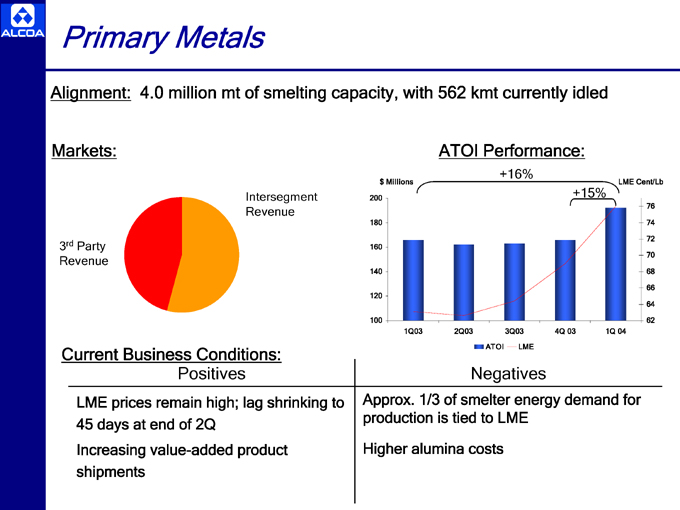

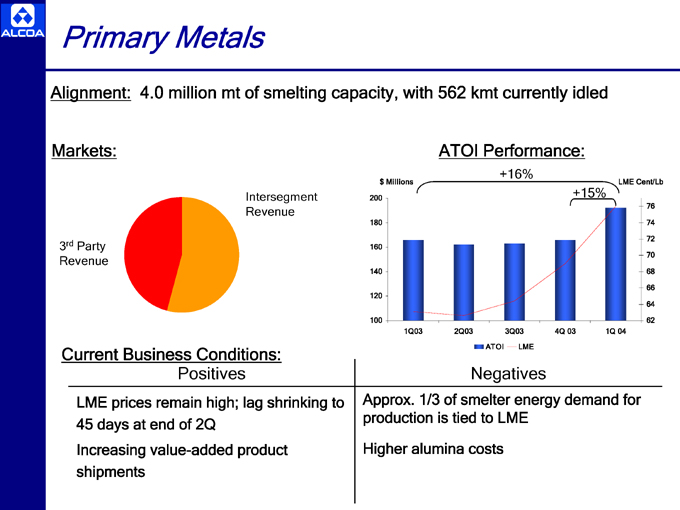

Primary Metals

Alignment: 4.0 million mt of smelting capacity, with 562 kmt currently idled

Markets:

Intersegment Revenue

3rd Party Revenue

ATOI Performance:

+16%

$ Millions LME Cent/Lb

200 +15%

76

180 74

72

160

70

140 68

66

120

64

100 62

1Q03 2Q03 3Q03 4Q 03 1Q 04

ATOI LME

Current Business Conditions: Positives

LME prices remain high; lag shrinking to 45 days at end of 2Q

Increasing value-added product shipments

Negatives

Approx. 1/3 of smelter energy demand for production is tied to LME

Higher alumina costs

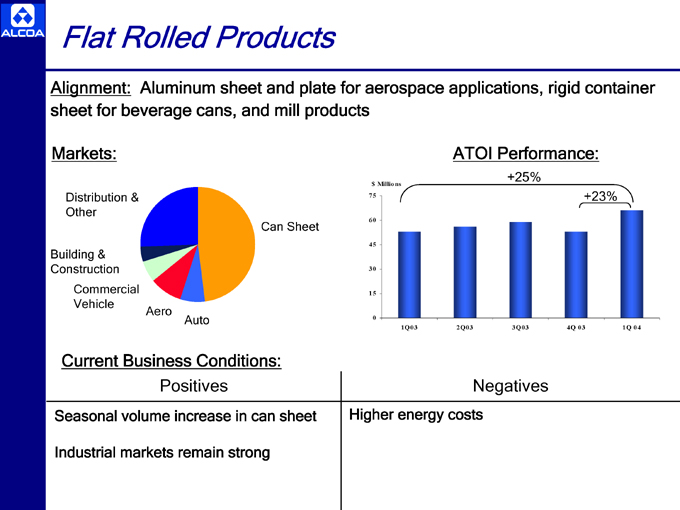

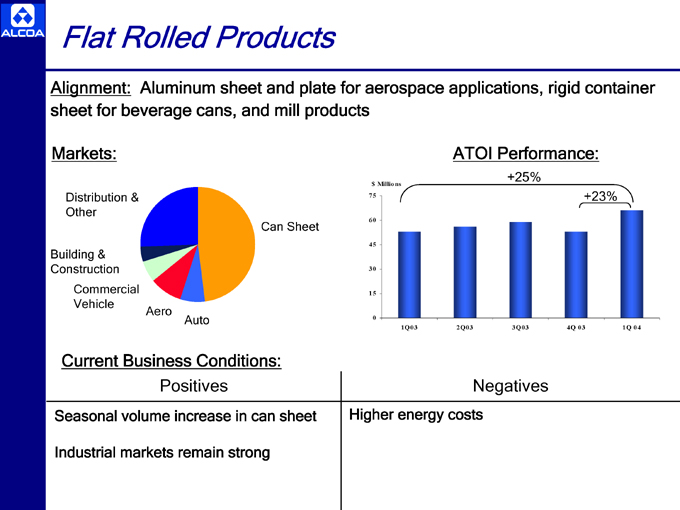

Flat Rolled Products

Alignment: Aluminum sheet and plate for aerospace applications, rigid container sheet for beverage cans, and mill products

Markets:

Distribution & Other

Building & Construction

Commercial Vehicle

Aero

Auto

Can Sheet

ATOI Performance:

+25%

$ Millions

75 +23%

60

45

30

15

0

1Q03 2Q03 3Q03 4Q 03 1Q 04

Current Business Conditions: Positives

Seasonal volume increase in can sheet

Industrial markets remain strong

Negatives

Higher energy costs

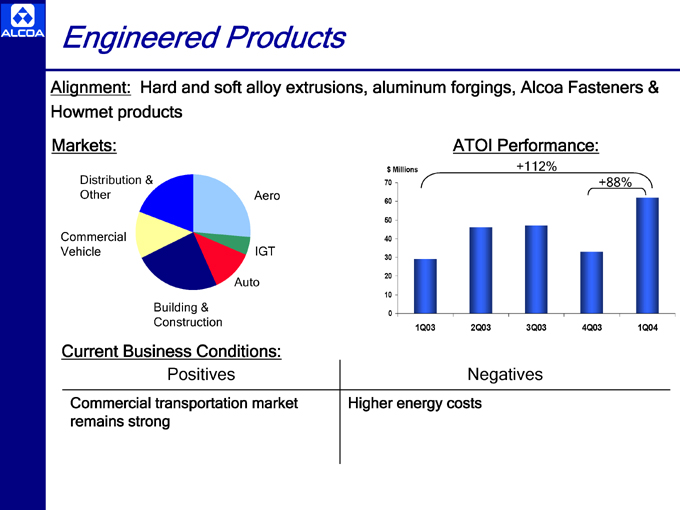

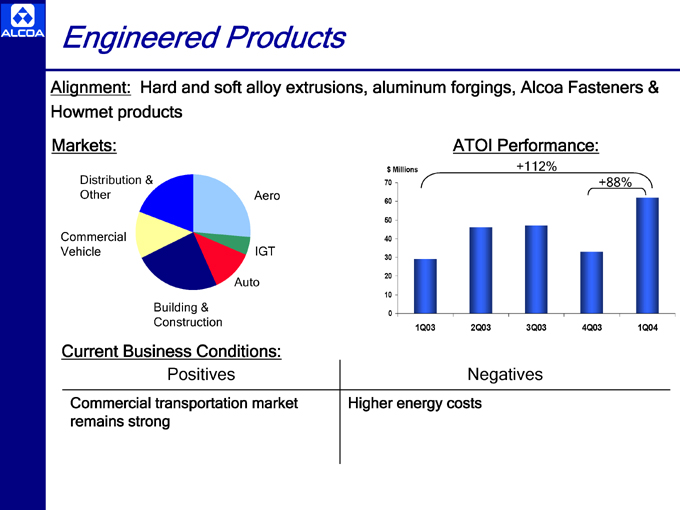

Engineered Products

Alignment: Hard and soft alloy extrusions, aluminum forgings, Alcoa Fasteners & Howmet products

Markets:

Distribution & Other

Commercial Vehicle

Building & Construction

Auto

IGT

Aero

ATOI Performance:

$ Millions +112%

70 +88%

60

50

40

30

20

10

0

1Q03 2Q03 3Q03 4Q03 1Q04

Current Business Conditions: Positives

Commercial transportation market remains strong

Negatives

Higher energy costs

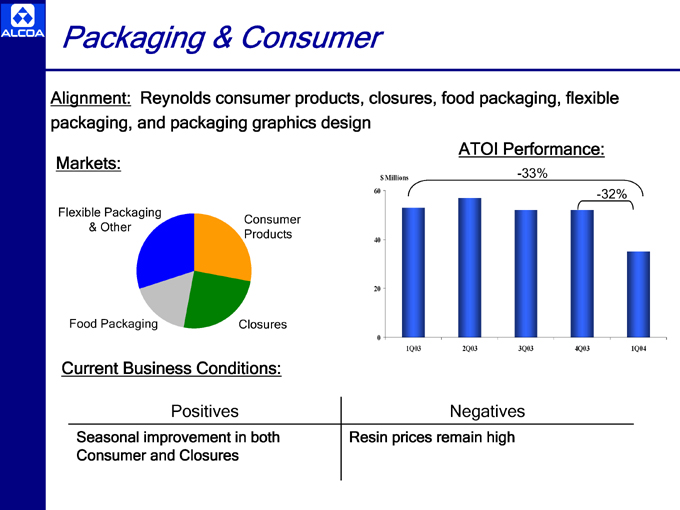

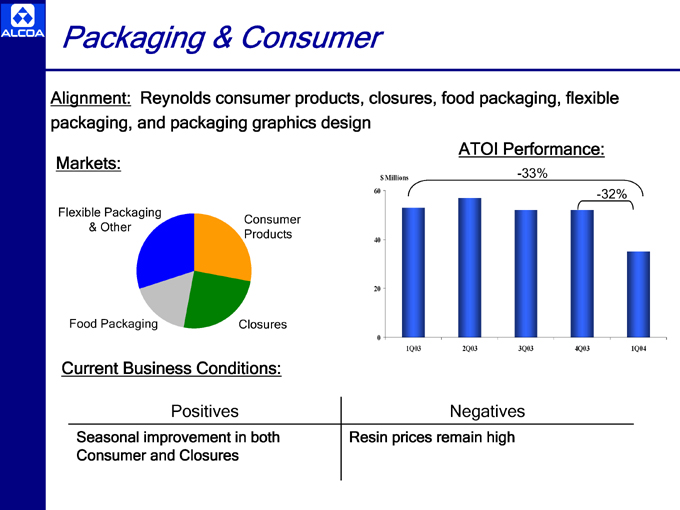

Packaging & Consumer

Alignment: Reynolds consumer products, closures, food packaging, flexible packaging, and packaging graphics design

Markets:

Flexible Packaging & Other

Food Packaging

Consumer Products

Closures

ATOI Performance:

$ Millions -33%

60 -32%

40

20

0

1Q03 2Q03 3Q03 4Q03 1Q04

Current Business Conditions:

Positives

Seasonal improvement in both Consumer and Closures

Negatives

Resin prices remain high

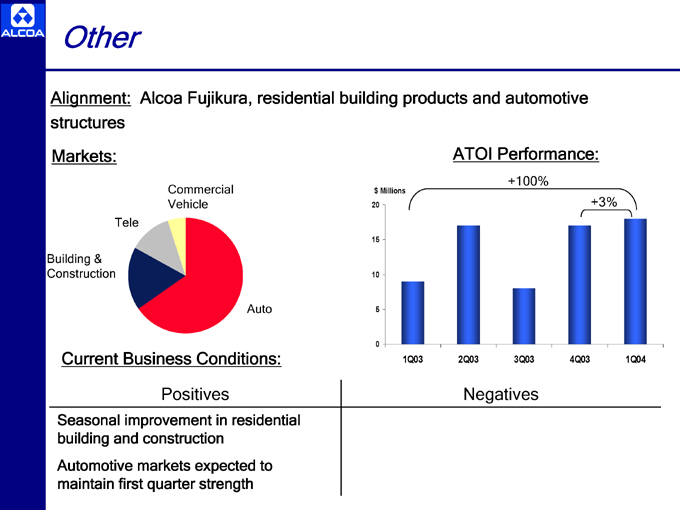

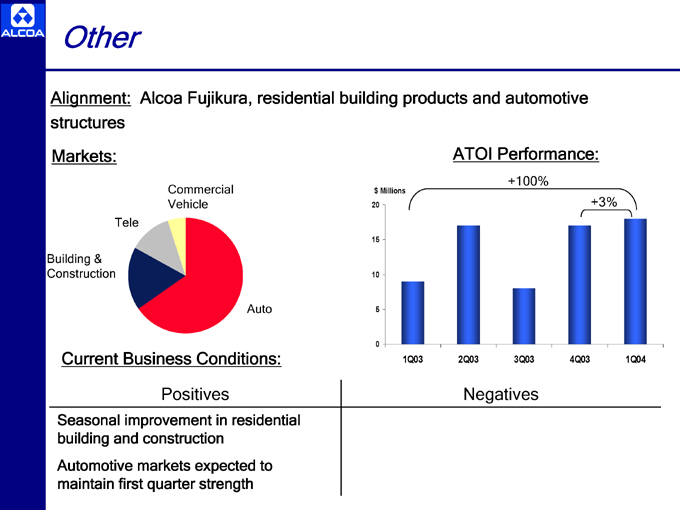

Other

Alignment: Alcoa Fujikura, residential building products and automotive structures

Markets:

Tele

Building & Construction

Auto

Commercial Vehicle

ATOI Performance:

+100%

$ Millions

20 +3%

15

10

5

0

1Q03 2Q03 3Q03 4Q03 1Q04

Current Business Conditions:

Positives

Seasonal improvement in residential building and construction Automotive markets expected to maintain first quarter strength

Negatives

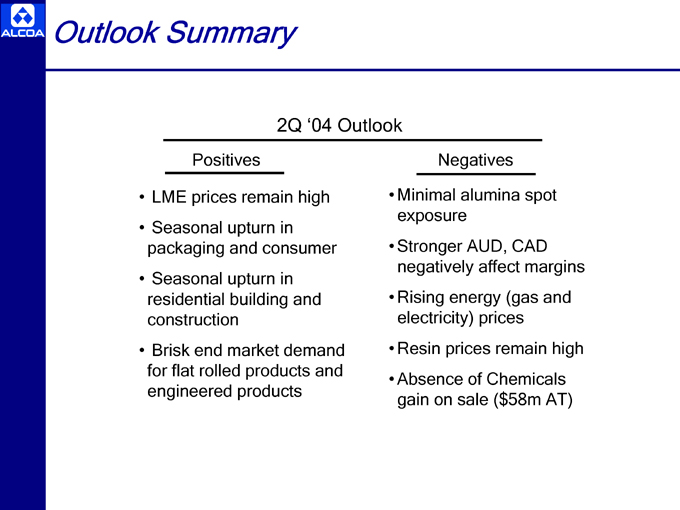

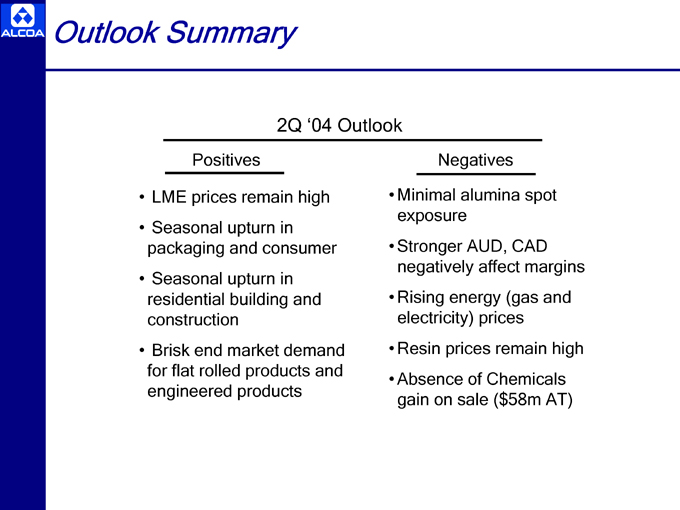

Outlook Summary

2Q ‘04 Outlook

Positives

• LME prices remain high

• Seasonal upturn in packaging and consumer

• Seasonal upturn in residential building and construction

• Brisk end market demand for flat rolled products and engineered products

Negatives

• Minimal alumina spot exposure

• Stronger AUD, CAD negatively affect margins

• Rising energy (gas and electricity) prices

• Resin prices remain high

• Absence of Chemicals gain on sale ($58m AT)

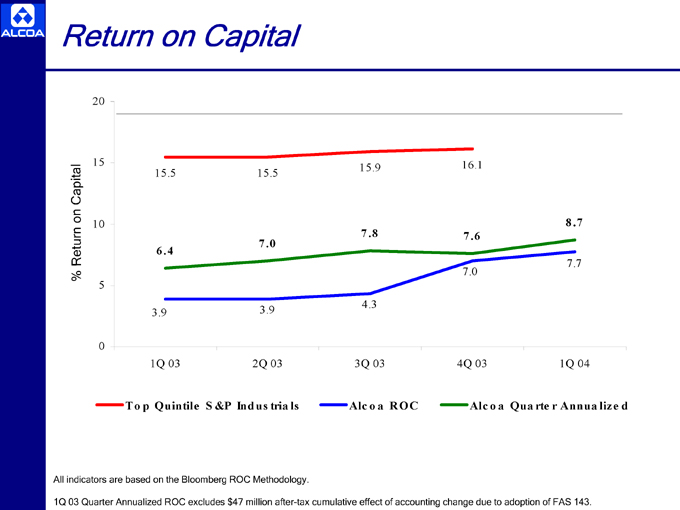

15.9 16.1

15.5 15.5

8.7

7.8 7.6

7.0

6.4

7.7

7.0

4.3

3.9 3.9

1Q 03 2Q 03 3Q 03 4Q 03 1Q 04

To p Quintile S &P Ind us tria ls Alc o a ROC Alc o a Qua rte r Annua lize d

All indicators are based on the Bloomberg ROC Methodology.

1Q 03 Quarter Annualized ROC excludes $47 million after-tax cumulative effect of accounting change due to adoption of FAS 143.

Bernt Reitan

Executive Vice President – Alcoa Group President, Primary Products

Agenda

?Biography

?Alumina and Smelting Operations

??Safety

??Customer Value

??Manufacturing Excellence

?Market Outlook

?Growth Opportunities

Biography – Bernt Reitan

?1980 – 2000 (Elkem ASA)

??1987 – 1988 Senior VP Materials and Technology

??1988 – 2000 Managing Director – Elkem Aluminium ANS

?2000 – Present (Alcoa Inc.)

??2000 President – Alcoa World Chemical

??2001 President – AWAC

??2003 President – Alcoa Primary Metals

??2004 Current Position

?Service on Industry Association Boards

??International Aluminium Institute

??European Aluminium Association

??Norwegian Metallurgical Industry Association

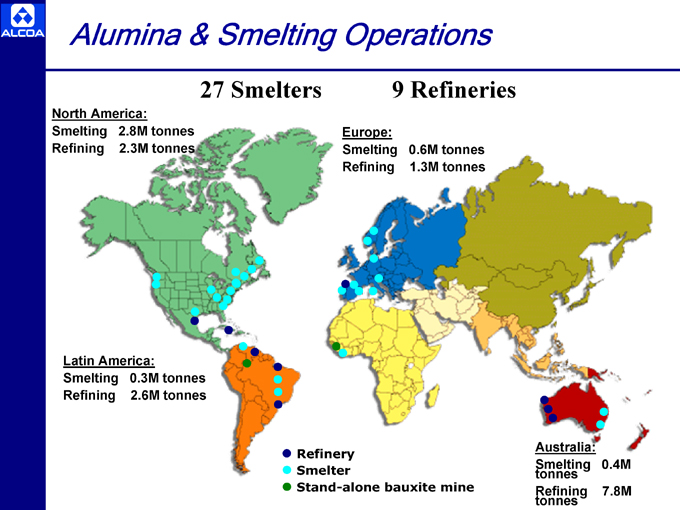

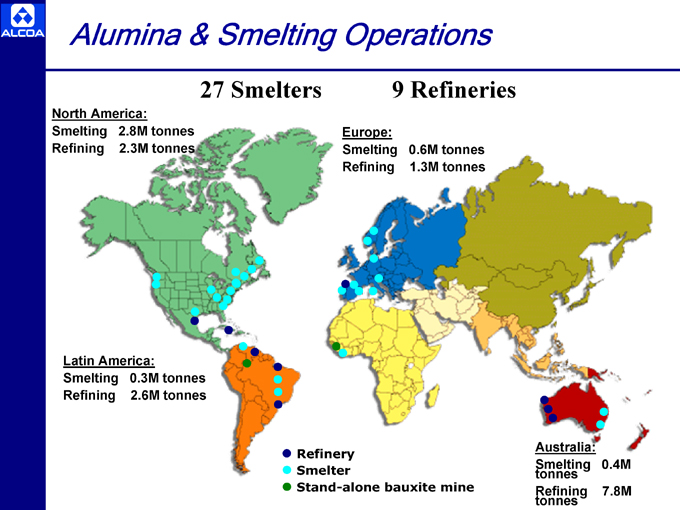

Alumina & Smelting

Operations

27 Smelters 9 Refineries

North America: Smelting 2.8M tonnes Refining 2.3M tonnes

Latin America: Smelting 0.3M tonnes

Refining 2.6M tonnes

Europe:

Smelting 0.6M tonnes

Refining 1.3M tonnes

Refinery Smelter

Stand-alone bauxite mine

Australia:

Smelting 0.4M

tonnes

Refining 7.8M

tonnes

Safety

(per 200,000 hours)

Lost Work Day Frequency Rate

0.19

0.14

0.11

0.10

2001 2002 2003 2004Q1

OSHA Recordable Frequency Rate

4.4

2.7

2.2

1.9

2001 2002 2003 2004Q1

Alcoa Primary Products Business Model

?Maximize Value-Added Products for Customers

Operational Excellence

?Growth

??Creep capacity

??Brownfield expansions

??Greenfield expansions

??Joint ventures and partnerships

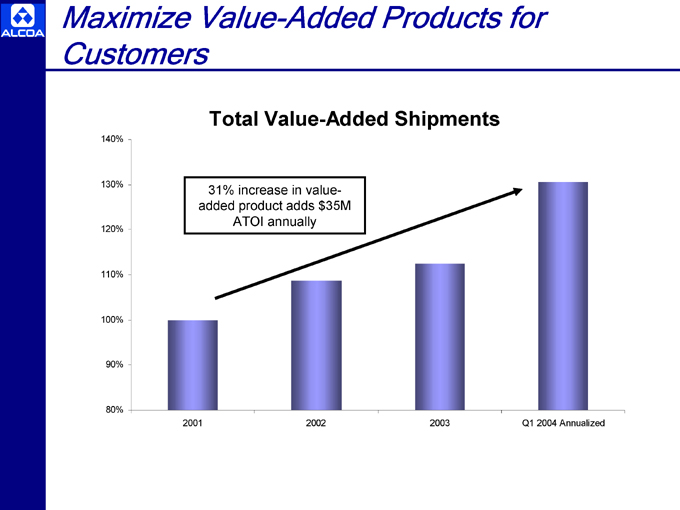

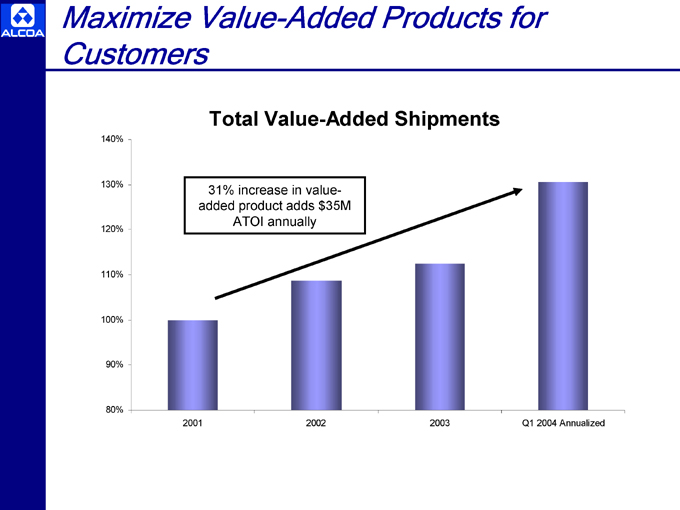

Maximize Value-Added Products for Customers

Total Value-Added Shipments

31% increase in value-added product adds $35M ATOI annually

2001 2002 2003 Q1 2004 Annualized

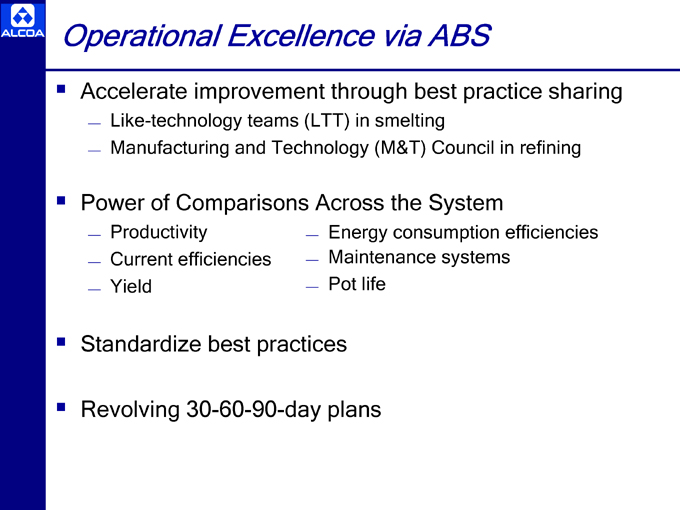

Operational Excellence via ABS

Accelerate improvement through best practice sharing

??Like-technology teams (LTT) in smelting

??Manufacturing and Technology (M&T) Council in refining

?Power of Comparisons Across the System

??Productivity ??Energy consumption efficiencies??Current efficiencies ??Maintenance systems??Yield ??Pot life

?Standardize best practices

?Revolving 30-60-90-day plans

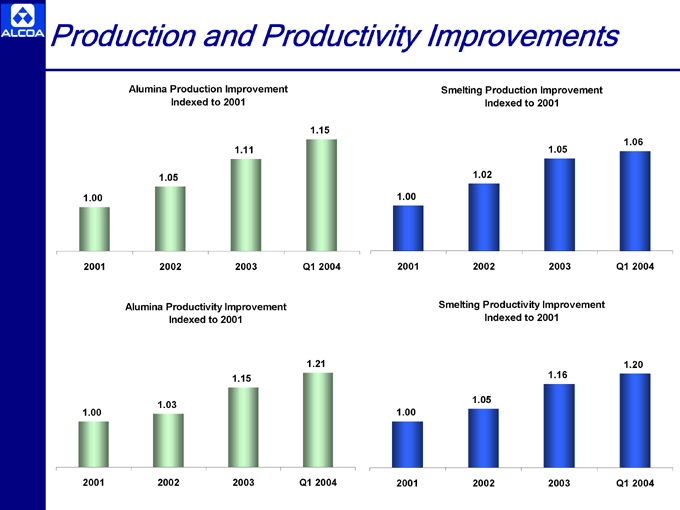

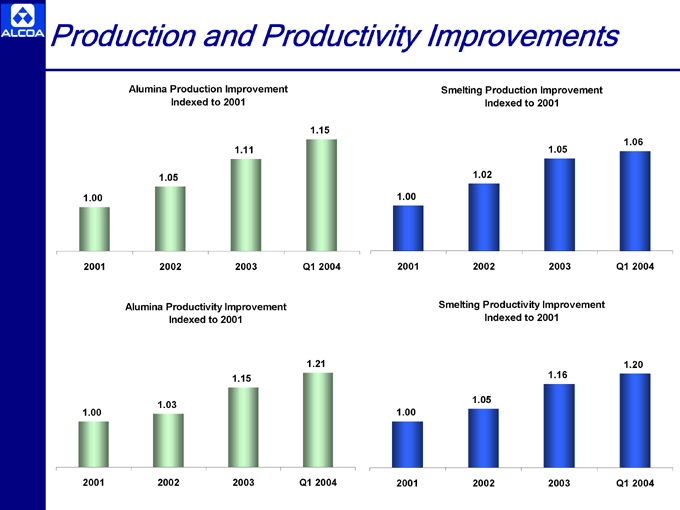

Production and Productivity Improvements

Alumina Production Improvement Indexed to 2001

1.15

1.11

1.05

1.00

2001 2002 2003 Q1 2004

Alumina Productivity Improvement Indexed to 2001

1.21

1.15

1.03

1.00

2001 2002 2003 Q1 2004

Smelting Production Improvement Indexed to 2001

1.06

1.05

1.02

1.00

2001 2002 2003 Q1 2004

Smelting Productivity Improvement Indexed to 2001

1.20

1.16

1.05

1.00

2001 2002 2003 Q1 2004

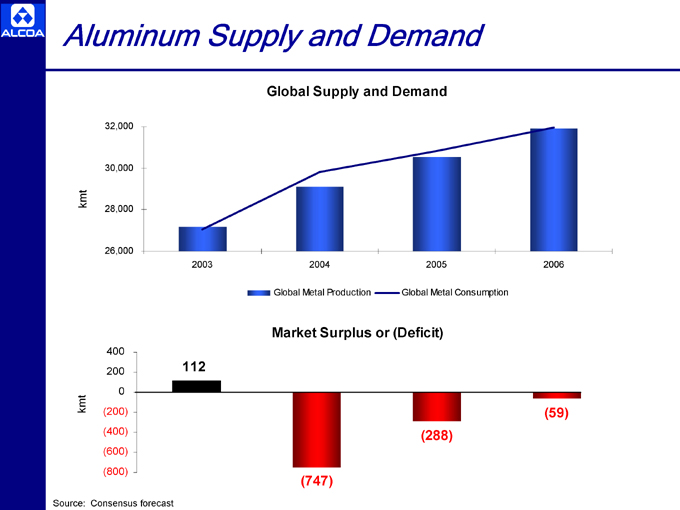

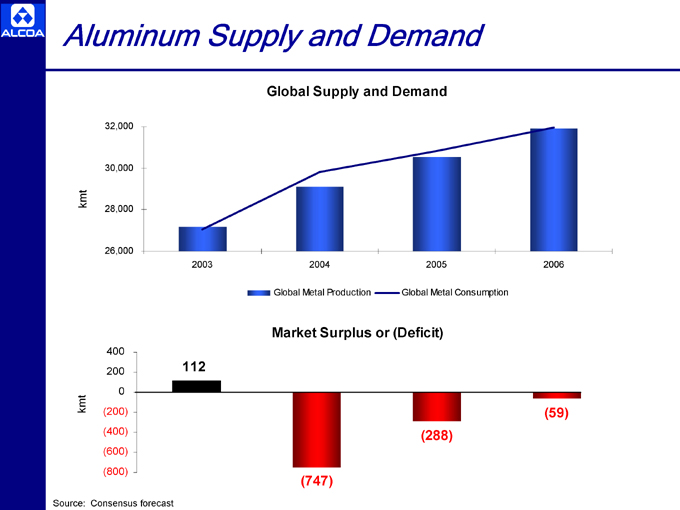

Aluminum Supply and Demand

Global Supply and Demand

2003 2004 2005 2006

Global Metal Production Global Metal Consumption

Market Surplus or (Deficit)

112

(59)

(288)

(747)

Source: Consensus forecast

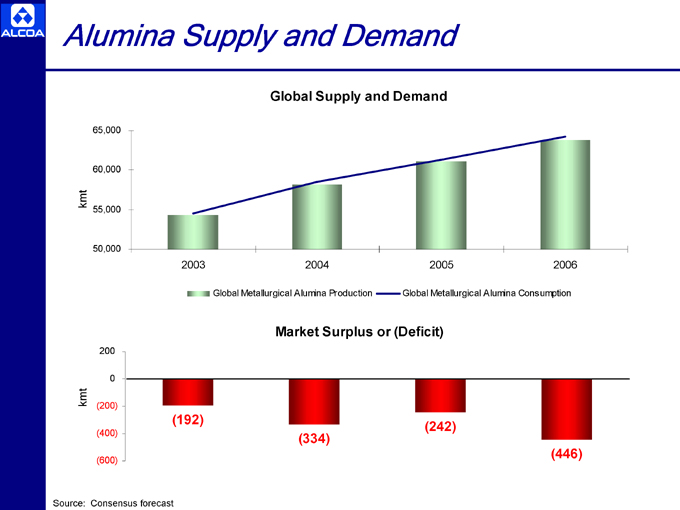

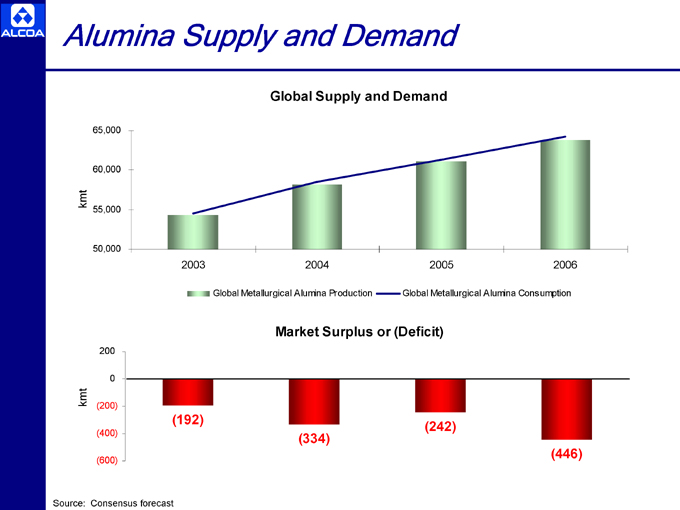

Alumina Supply and Demand

Global Supply and Demand

2003 2004 2005 2006

Global Metallurgical Alumina Production Global Metallurgical Alumina Consumption

(192)

(242)

(334)

(446)

Source: Consensus forecast

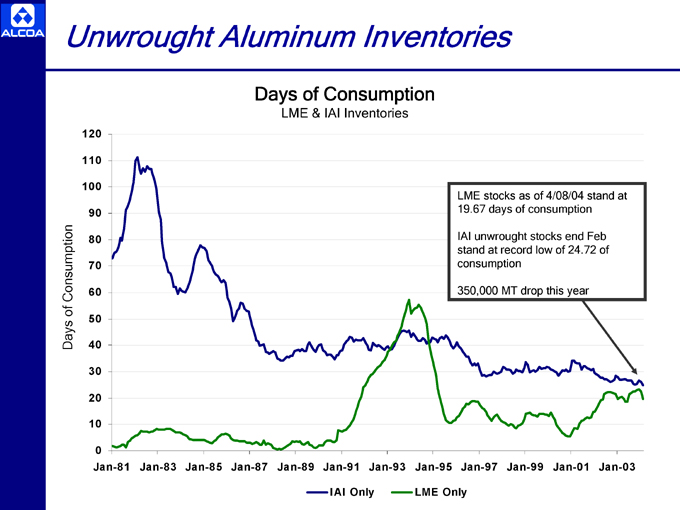

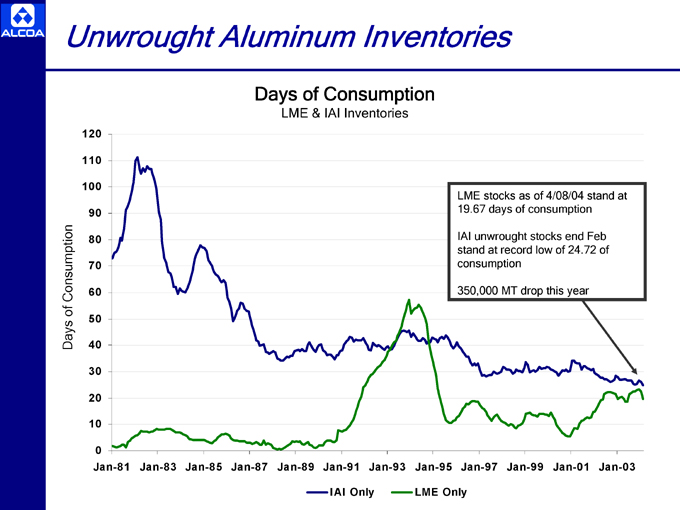

Unwrought Aluminum Inventories

Days of Consumption

LME & IAI Inventories

LME stocks as of 4/08/04 stand at 19.67 days of consumption

IAI unwrought stocks end Feb stand at record low of 24.72 of consumption

350,000 MT drop this year

Jan-81 Jan-83 Jan-85 Jan-87 Jan-89 Jan-91 Jan-93 Jan-95 Jan-97 Jan-99 Jan-01 Jan-03

IAI Only LME Only

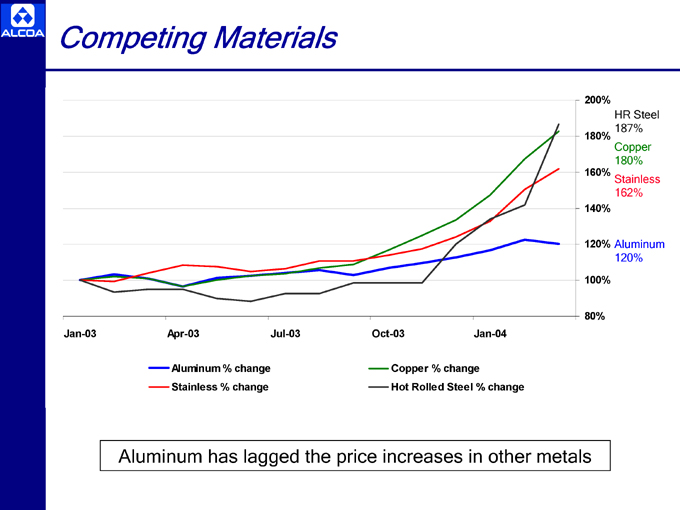

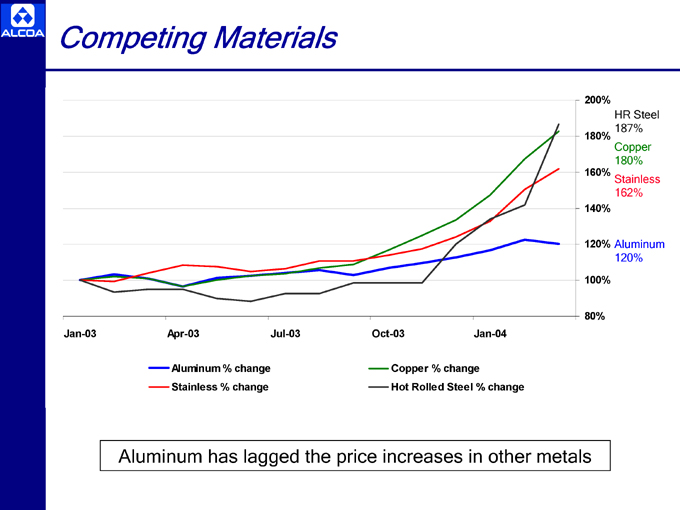

Jan-03 Apr-03 Jul-03 Oct-03 Jan-04

HR Steel 187% Copper 180% Stainless 162%

Aluminum 120%

Aluminum % change Copper % change

Stainless % change Hot Rolled Steel % change

Aluminum has lagged the price increases in other metals

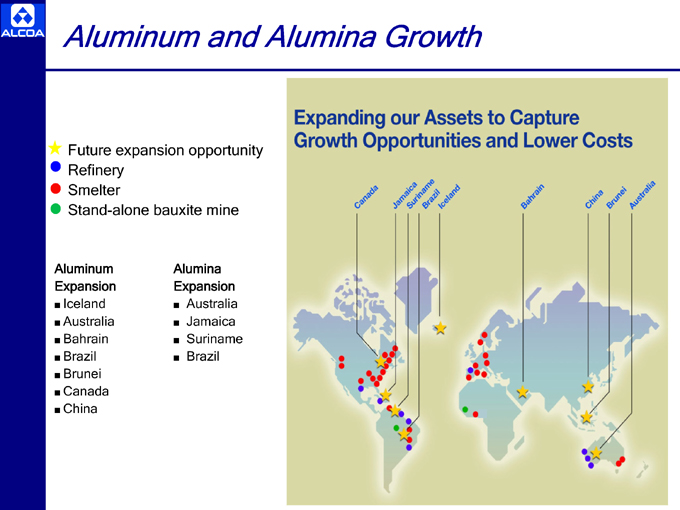

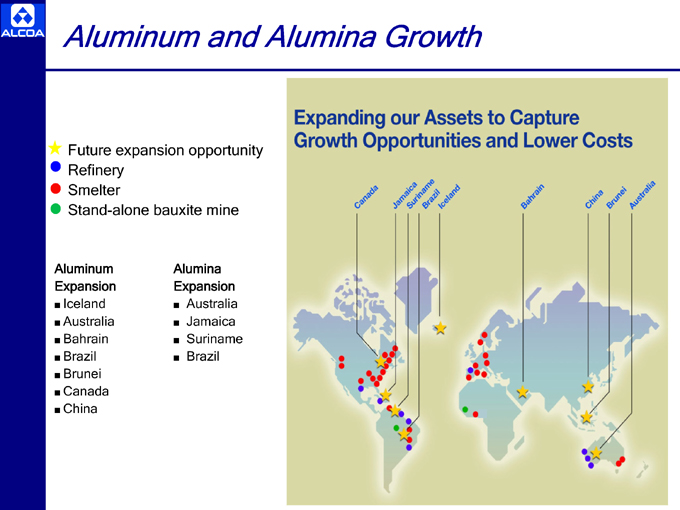

Aluminum and Alumina Growth

Future expansion opportunity Refinery Smelter Stand-alone bauxite mine

Aluminum Expansion

? Iceland

? Australia

? Bahrain

? Brazil

? Brunei

? Canada

? China

Alumina Expansion

? Australia

? Jamaica

? Suriname

? Brazil

For Additional Information, contact:

William F. Oplinger Director, Investor Relations

Alcoa

390 Park Avenue

New York, N.Y. 10022-4608 Telephone: (212) 836-2674 Facsimile: (212) 836-2813 www.alcoa.com

Appendix

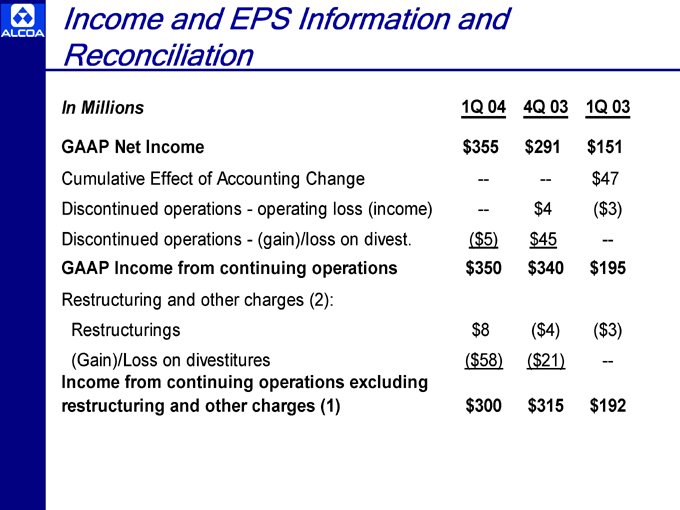

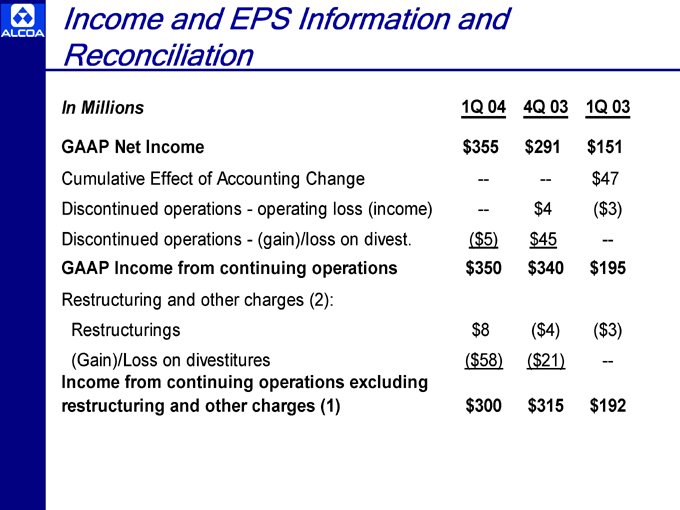

Income and EPS Information and Reconciliation

In Millions 1Q 04 4Q 03 1Q 03

GAAP Net Income $ 355 $ 291 $ 151

Cumulative Effect of Accounting Change — — $ 47

Discontinued operations—operating loss (income) — $ 4 ($ 3)

Discontinued operations—(gain)/loss on divest. ($ 5) $ 45 —

GAAP Income from continuing operations $ 350 $ 340 $ 195

Restructuring and other charges (2):

Restructurings $ 8 ($ 4) ($ 3)

(Gain)/Loss on divestitures ($ 58) ($ 21) —

Income from continuing operations excluding

restructuring and other charges (1) $ 300 $ 315 $ 192

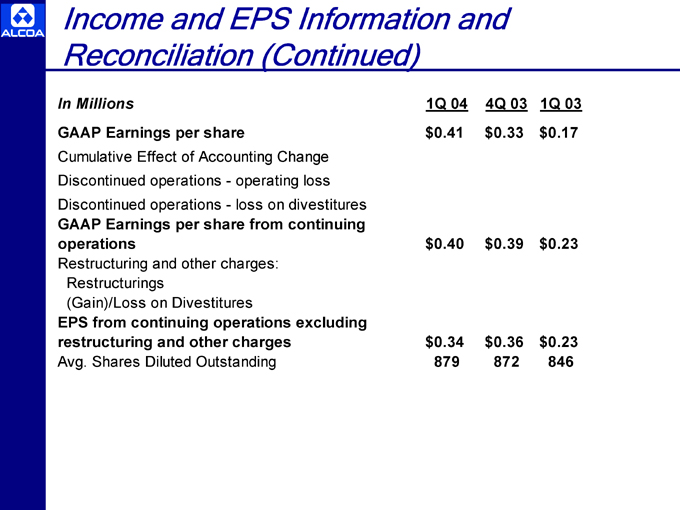

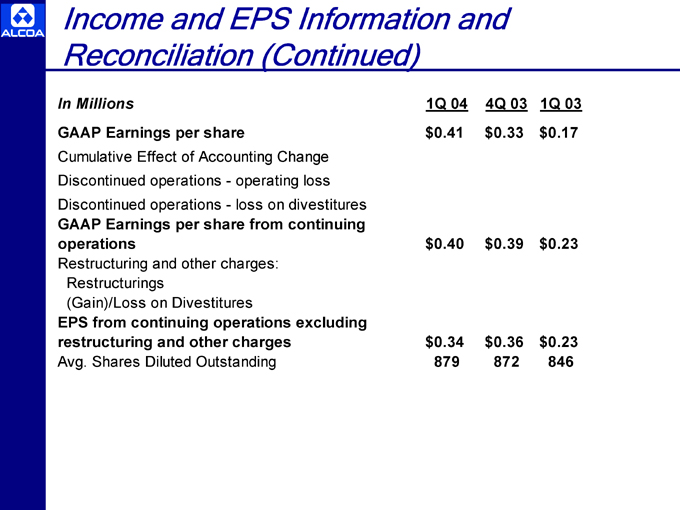

Income and EPS Information and Reconciliation (Continued)

In Millions 1Q 04 4Q 03 1Q 03

GAAP Earnings per share $ 0.41 $ 0.33 $ 0.17

Cumulative Effect of Accounting Change

Discontinued operations—operating loss

Discontinued operations—loss on divestitures

GAAP Earnings per share from continuing

operations $ 0.40 $ 0.39 $ 0.23

Restructuring and other charges:

Restructurings

(Gain)/Loss on Divestitures

EPS from continuing operations excluding

restructuring and other charges $ 0.34 $ 0.36 $ 0.23

Avg. Shares Diluted Outstanding 879 872 846

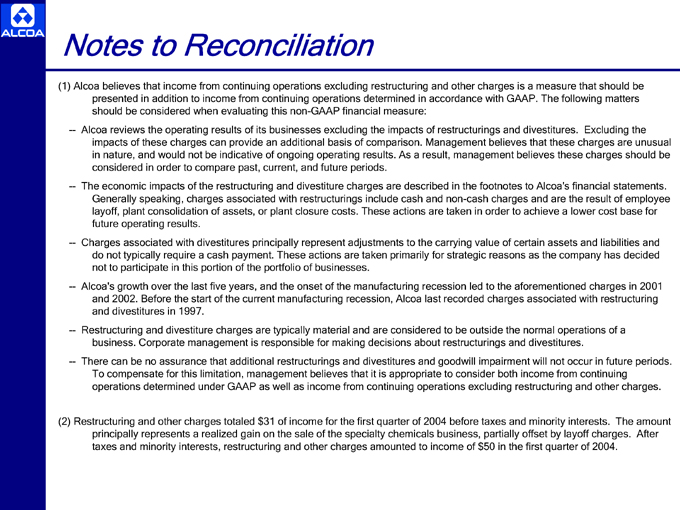

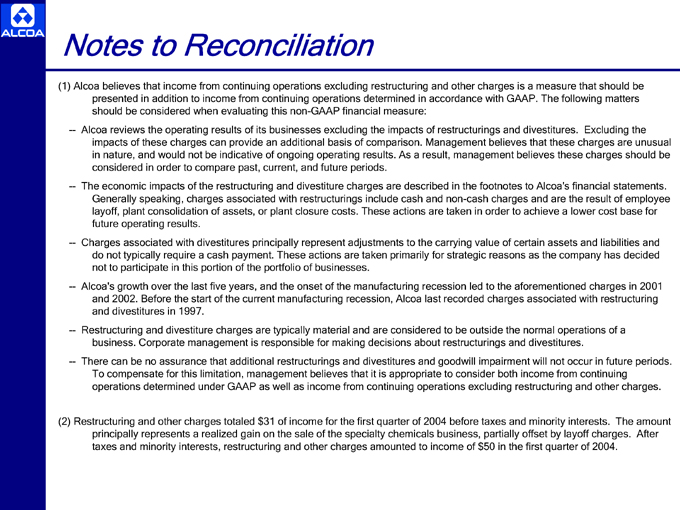

Notes to Reconciliation

(1) Alcoa believes that income from continuing operations excluding restructuring and other charges is a measure that should be presented in addition to income from continuing operations determined in accordance with GAAP. The following matters should be considered when evaluating this non-GAAP financial measure:

— Alcoa reviews the operating results of its businesses excluding the impacts of restructurings and divestitures. Excluding the impacts of these charges can provide an additional basis of comparison. Management believes that these charges are unusual in nature, and would not be indicative of ongoing operating results. As a result, management believes these charges should be considered in order to compare past, current, and future periods.

— The economic impacts of the restructuring and divestiture charges are described in the footnotes to Alcoa’s financial statements. Generally speaking, charges associated with restructurings include cash and non-cash charges and are the result of employee layoff, plant consolidation of assets, or plant closure costs. These actions are taken in order to achieve a lower cost base for future operating results.

— Charges associated with divestitures principally represent adjustments to the carrying value of certain assets and liabilities and do not typically require a cash payment. These actions are taken primarily for strategic reasons as the company has decided not to participate in this portion of the portfolio of businesses.

— Alcoa’s growth over the last five years, and the onset of the manufacturing recession led to the aforementioned charges in 2001 and 2002. Before the start of the current manufacturing recession, Alcoa last recorded charges associated with restructuring and divestitures in 1997.

— Restructuring and divestiture charges are typically material and are considered to be outside the normal operations of a business. Corporate management is responsible for making decisions about restructurings and divestitures.

— There can be no assurance that additional restructurings and divestitures and goodwill impairment will not occur in future periods. To compensate for this limitation, management believes that it is appropriate to consider both income from continuing operations determined under GAAP as well as income from continuing operations excluding restructuring and other charges.

(2) Restructuring and other charges totaled $31 of income for the first quarter of 2004 before taxes and minority interests. The amount principally represents a realized gain on the sale of the specialty chemicals business, partially offset by layoff charges. After taxes and minority interests, restructuring and other charges amounted to income of $50 in the first quarter of 2004.

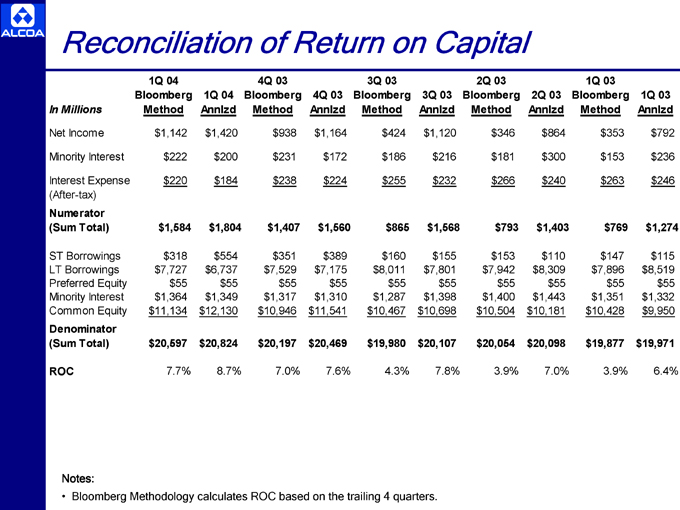

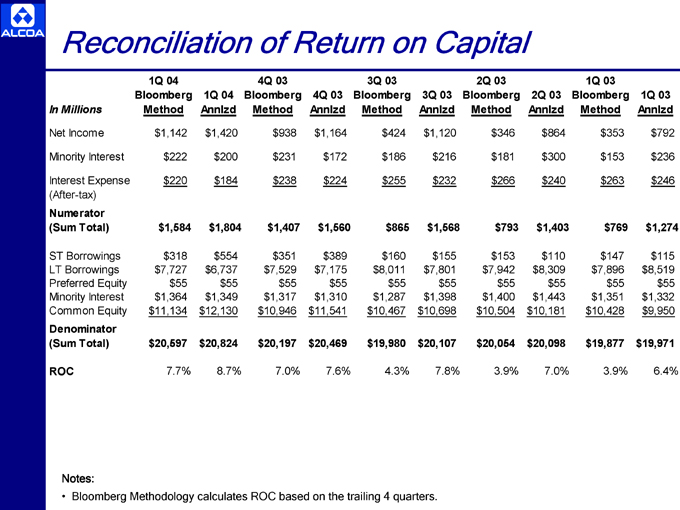

Reconciliation of Return on Capital

1Q 04 4Q 03 3Q 03 2Q 03 1Q 03

Bloomberg 1Q 04 Bloomberg 4Q 03 Bloomberg 3Q 03 Bloomberg 2Q 03 Bloomberg 1Q 03

In Millions Method Annlzd Method Annlzd Method Annlzd Method Annlzd Method Annlzd

Net Income $ 1,142 $ 1,420 $ 938 $ 1,164 $ 424 $ 1,120 $ 346 $ 864 $ 353 $ 792

Minority Interest $ 222 $ 200 $ 231 $ 172 $ 186 $ 216 $ 181 $ 300 $ 153 $ 236

Interest Expense $ 220 $ 184 $ 238 $ 224 $ 255 $ 232 $ 266 $ 240 $ 263 $ 246

(After-tax)

Numerator

(Sum Total) $ 1,584 $ 1,804 $ 1,407 $ 1,560 $ 865 $ 1,568 $ 793 $ 1,403 $ 769 $ 1,274

ST Borrowings $ 318 $ 554 $ 351 $ 389 $ 160 $ 155 $ 153 $ 110 $ 147 $ 115

LT Borrowings $ 7,727 $ 6,737 $ 7,529 $ 7,175 $ 8,011 $ 7,801 $ 7,942 $ 8,309 $ 7,896 $ 8,519

Preferred Equity $ 55 $ 55 $ 55 $ 55 $ 55 $ 55 $ 55 $ 55 $ 55 $ 55

Minority Interest $ 1,364 $ 1,349 $ 1,317 $ 1,310 $ 1,287 $ 1,398 $ 1,400 $ 1,443 $ 1,351 $ 1,332

Common Equity $ 11,134 $ 12,130 $ 10,946 $ 11,541 $ 10,467 $ 10,698 $ 10,504 $ 10,181 $ 10,428 $ 9,950

Denominator

(Sum Total) $ 20,597 $ 20,824 $ 20,197 $ 20,469 $ 19,980 $ 20,107 $ 20,054 $ 20,098 $ 19,877 $ 19,971

ROC 7.7% 8.7% 7.0% 7.6% 4.3% 7.8% 3.9% 7.0% 3.9% 6.4%

Notes:

• Bloomberg Methodology calculates ROC based on the trailing 4 quarters.