Exhibit 99.2

Exhibit 99.2

[GRAPHIC]

2nd Quarter 2004

Analyst Conference

July 22, 2004

New York, NY

[GRAPHIC]

Forward-Looking Statements

Today’s discussion may include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements relate to future events and expectations and involve known and unknown risks and uncertainties. Alcoa’s actual results or actions may differ materially from those projected in the forward-looking statements. For a summary of the specific risk factors that could cause results to differ materially from those expressed in the forward-looking statements, please refer to Alcoa’s Form 10-K for the year ended December 31, 2003, in addition to the Quarterly Report on Form 10-Q for the quarter ended March 31, 2004 filed with the Securities and Exchange Commission.

[GRAPHIC]

Alain J. P. Belda

Chairman and Chief Executive Officer

[GRAPHIC]

YTD Performance

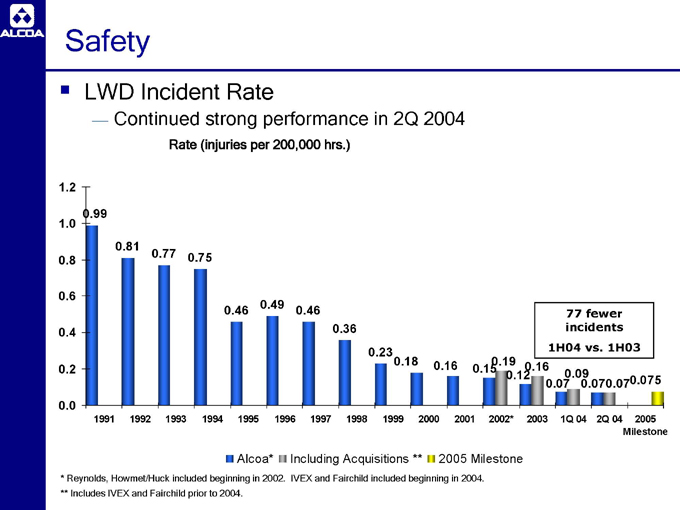

| | • | | Best safety performance ever |

1st half LWD of 0.07

90% of the company without an LWD in the first half

Strong operational execution

Record quarterly and YTD earnings

~ $500M of revenue growth YTD in addition to LME price increases

5 of 6 segments up YTD

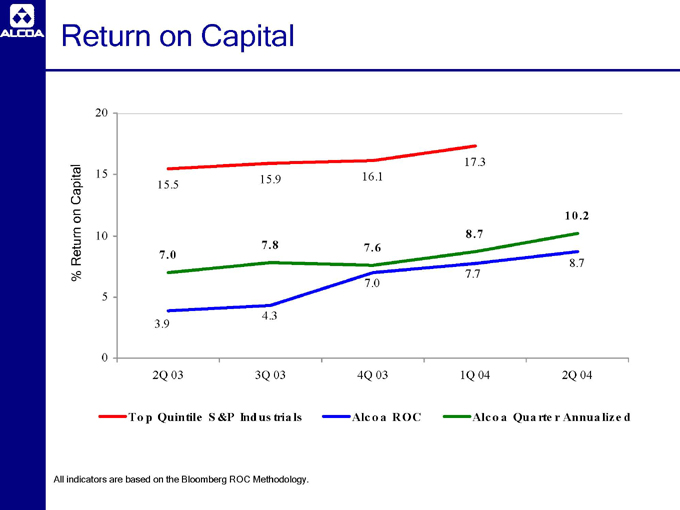

Double digit ROC achieved in Q2

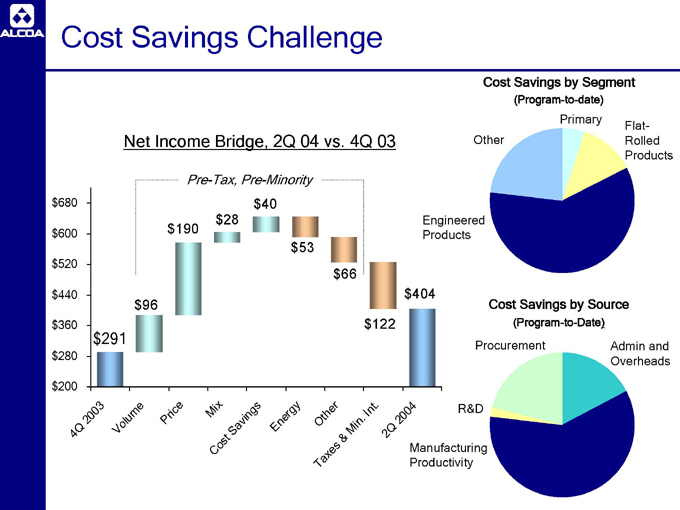

Realized $160M of annual savings towards cost challenge

[GRAPHIC]

2004 YTD Performance

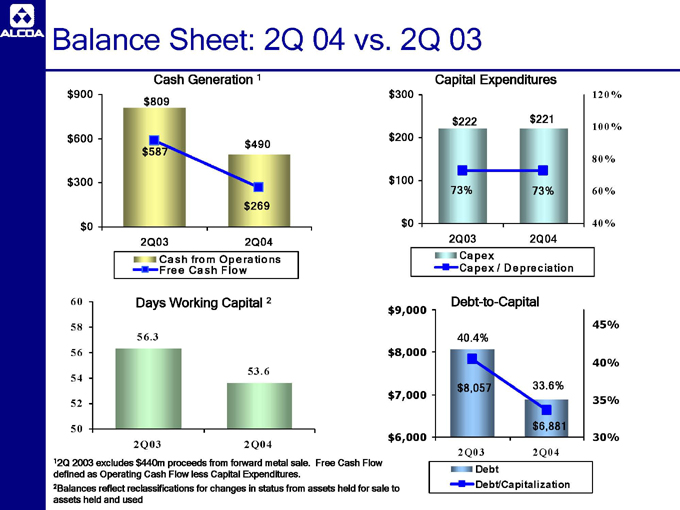

Financial discipline continues

Cap-ex held to 68% of depreciation

Debt-to-cap at 33.6% (target range 25-35%)

Days working capital at 53.6, down from 56.3 one year ago

Divestiture Process Complete

Total cash proceeds of ~ $640 million ($560m Alcoa Share), with certain businesses retained

[GRAPHIC]

Richard B. Kelson

Executive Vice President

Chief Financial Officer

[GRAPHIC]

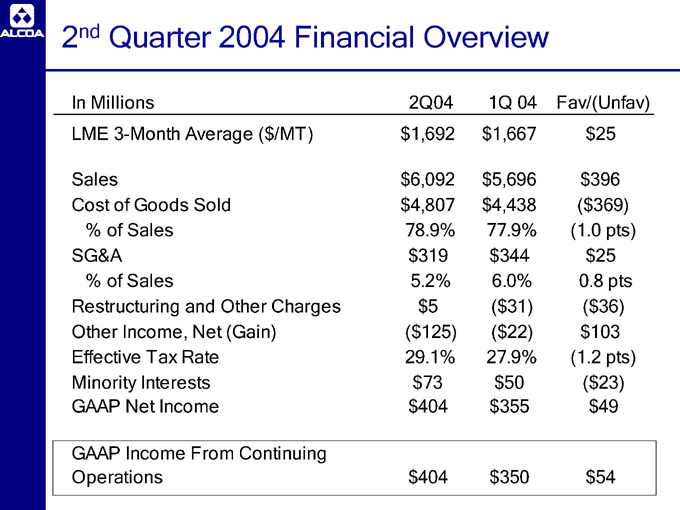

2nd Quarter Highlights

| | • | | Revenues increased 7% sequentially and 11% Y/Y to $6.1 billion, highest since 4Q 2000 |

| | • | | Revenue gains in every segment over prior quarter |

| | • | | Income from continuing operations highest ever, up 15% Q/Q and 86% Y/Y |

| | • | | Continued ROC improvement to 10.2% annualized – above cost of capital |

[GRAPHIC]

2nd Quarter Highlights (continued)

| | • | | SG&A declined to 5.2% of sales |

| | • | | Capex remained low at $221m, 73% of depreciation |

| | • | | Debt-to-Capital ratio declined to 33.6% |

[GRAPHIC]

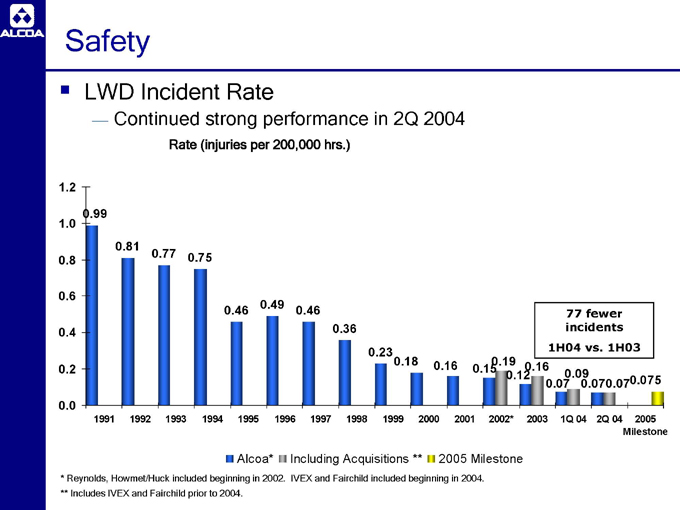

Safety

LWD Incident Rate

Continued strong performance in 2Q 2004

Rate (injuries per 200,000 hrs.)

[GRAPHIC]

* Reynolds, Howmet/Huck included beginning in 2002. IVEX and Fairchild included beginning in 2004.

** Includes IVEX and Fairchild prior to 2004.

[GRAPHIC]

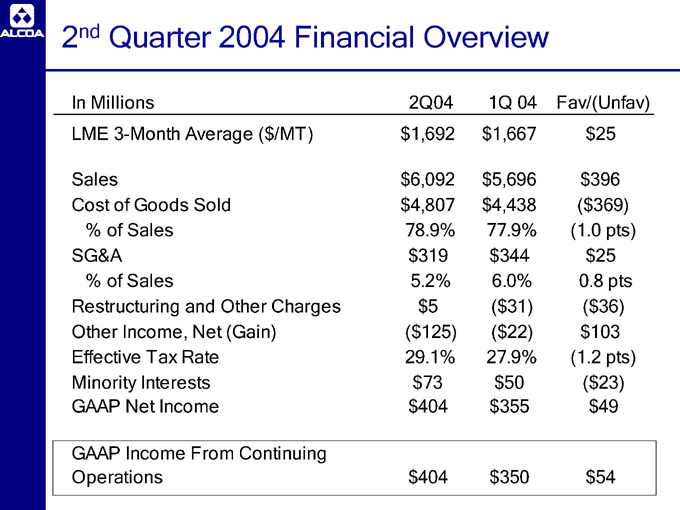

2nd Quarter 2004 Financial Overview

| | | | | | |

In Millions | | 2Q04 | | 1Q

04 | | Fav/(Unfav) |

LME 3-Month Average ($/MT) | | $1,692 | | $1,667 | | $25 |

Sales | | $6,092 | | $5,696 | | $396 |

Cost of Goods Sold | | $4,807 | | $4,438 | | ($369) |

% of Sales | | 78.9% | | 77.9% | | (1.0 pts) |

SG&A | | $319 | | $344 | | $25 |

% of Sales | | 5.2% | | 6.0% | | 0.8 pts |

Restructuring and Other Charges | | $5 | | ($31) | | ($36) |

Other Income, Net (Gain) | | ($125) | | ($22) | | $103 |

Effective Tax Rate | | 29.1% | | 27.9% | | (1.2 pts) |

Minority Interests | | $73 | | $50 | | ($23) |

GAAP Net Income | | $404 | | $355 | | $49 |

GAAP Income From Continuing Operations | | $404 | | $350 | | $54 |

[GRAPHIC]

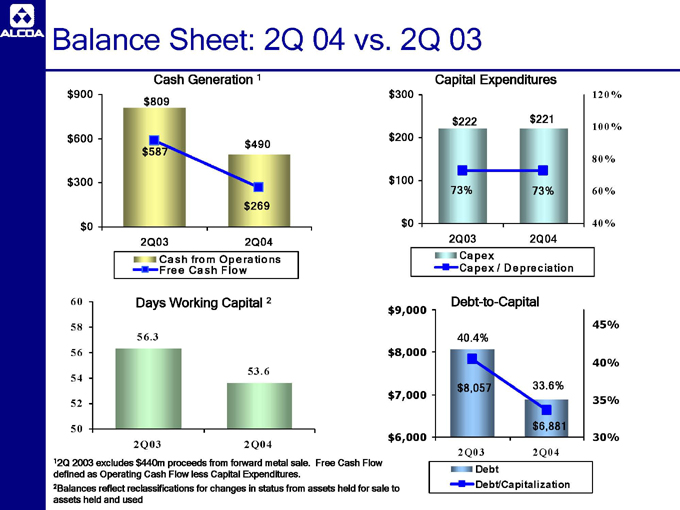

Balance Sheet: 2Q 04 vs. 2Q 03

| | |

[GRAPHIC] | | [GRAPHIC] |

| |

[GRAPHIC] | | [GRAPHIC] |

1 | | 2Q2003 excludes $440m proceeds from forward metal sale. Free Cash Flow defined as Operating Cash Flow less Capital Expenditures. |

2 | | Balances reflect reclassifications for changes in status from assets held for sale to assets held and used |

[GRAPHIC]

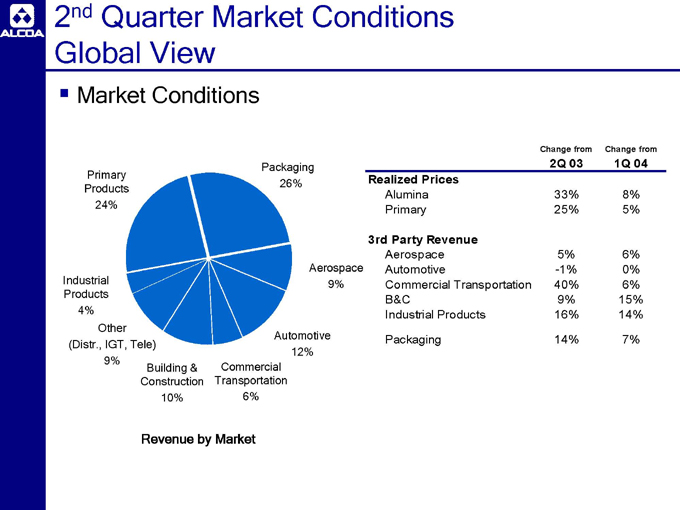

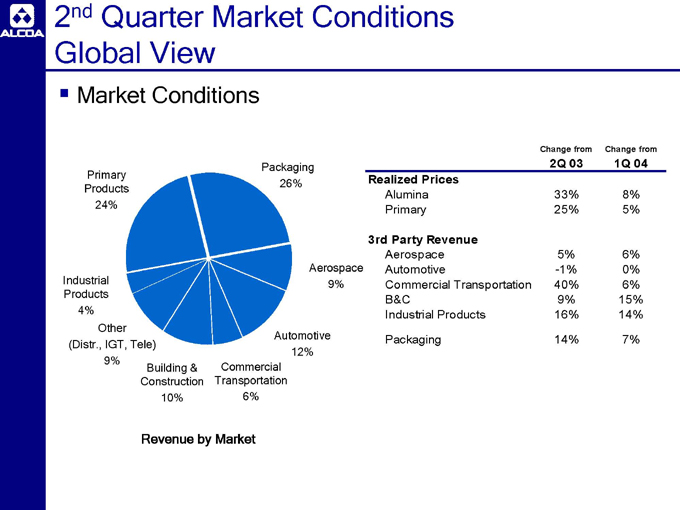

2nd Quarter Market Conditions Global View

[GRAPHIC]

| | | | |

| | | Change from

2Q 03 | | Change from

1Q 04 |

Realized Prices | | | | |

Alumina | | 33% | | 8% |

Primary | | 25% | | 5% |

3rd Party Revenue | | | | |

Aerospace | | 5% | | 6% |

Automotive | | -1% | | 0% |

Commercial Transportation | | 40% | | 6% |

B&C | | 9% | | 15% |

Industrial Products | | 16% | | 14% |

Packaging | | 14% | | 7% |

[GRAPHIC]

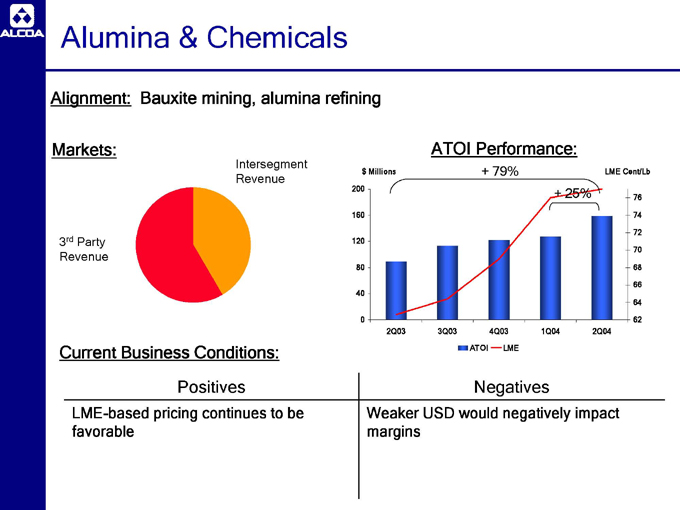

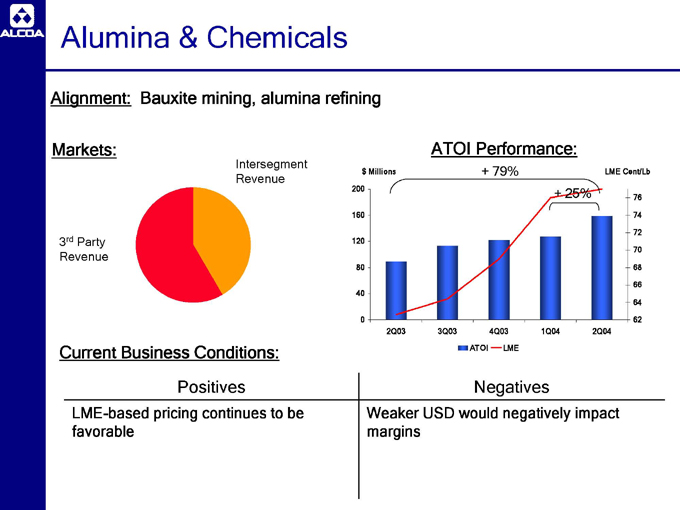

Alumina & Chemicals

Alignment: Bauxite mining, alumina refining

| | |

Markets: | | ATOI Performance: |

| |

[GRAPHIC] | | [GRAPHIC] |

Current Business Conditions:

| | |

Positives | | Negatives |

LME-based pricing continues to be favorable | | Weaker USD would negatively impact margins |

[GRAPHIC]

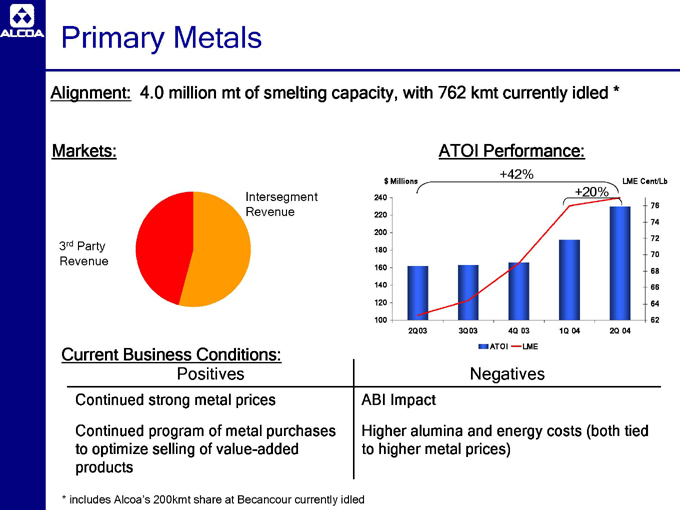

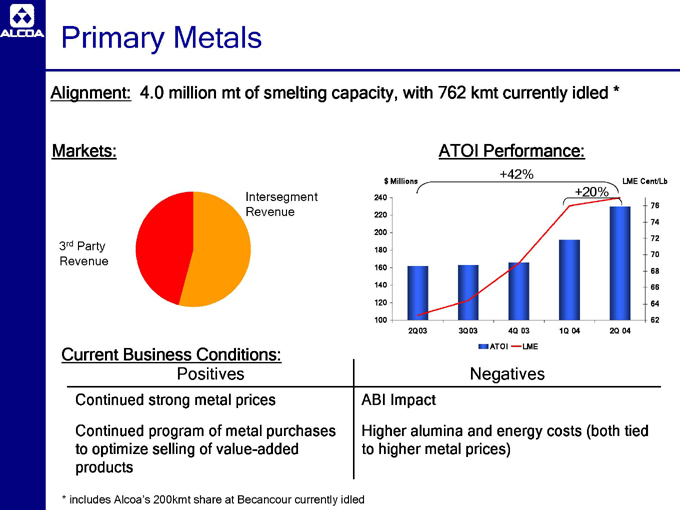

Primary Metals

Alignment: 4.0 million mt of smelting capacity, with 762 kmt currently idled *

| | |

Markets: | | ATOI Performance: |

| |

[GRAPHIC] | | [GRAPHIC] |

Current Business Conditions:

| | |

Positives | | Negatives |

Continued strong metal prices | | ABI Impact |

| |

Continued program of metal purchases to optimize selling of value-added products | | Higher alumina and energy costs (both tied to higher metal prices) |

* includes Alcoa’s 200kmt share at Becancour currently idled

[GRAPHIC]

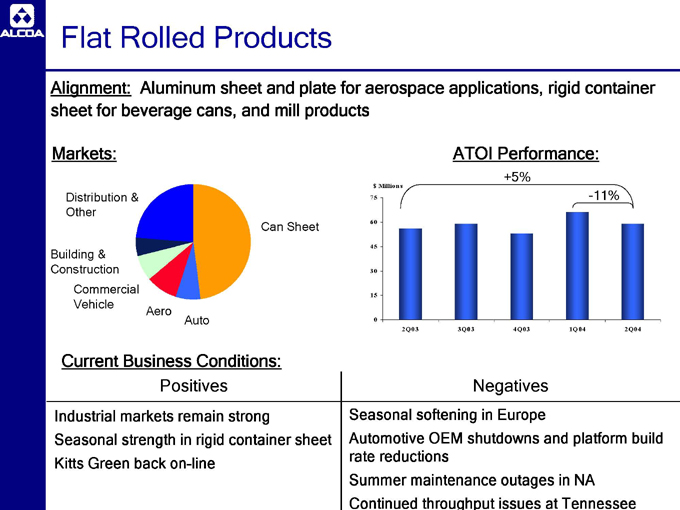

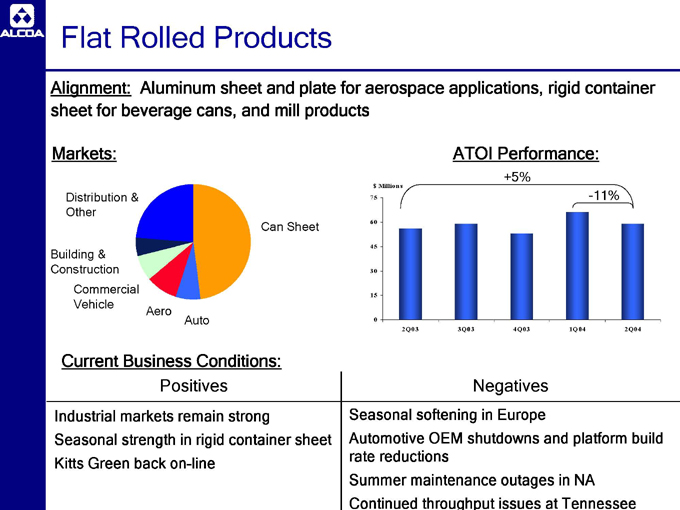

Flat Rolled Products

Alignment: Aluminum sheet and plate for aerospace applications, rigid container sheet for beverage cans, and mill products

| | |

Markets: | | ATOI Performance: |

| |

[GRAPHIC] | | [GRAPHIC] |

Current Business Conditions:

| | |

Positives | | Negatives |

| |

Industrial markets remain strong | | Seasonal softening in Europe |

| |

Seasonal strength in rigid container sheet | | Automotive OEM shutdowns and platform build rate reductions |

| |

Kitts Green back on-line | | Summer maintenance outages in NA |

| |

| | | Continued throughput issues at Tennessee |

[GRAPHIC]

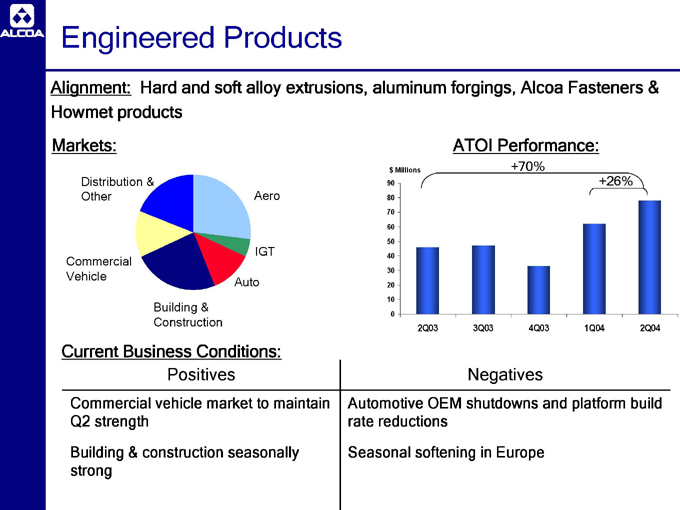

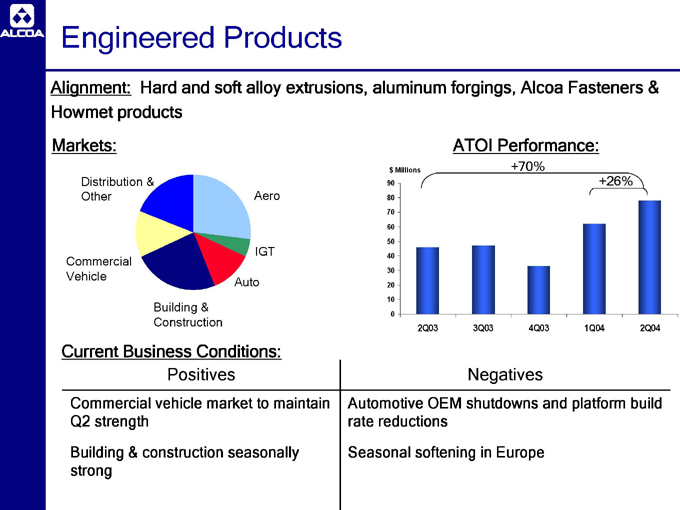

Engineered Products

Alignment: Hard and soft alloy extrusions, aluminum forgings, Alcoa Fasteners & Howmet products

| | |

Markets: | | ATOI Performance: |

| |

[GRAPHIC] | | [GRAPHIC] |

Current Business Conditions:

| | |

Positives | | Negatives |

| |

Commercial vehicle market to maintain Q2 strength | | Automotive OEM shutdowns and platform build rate reductions |

| |

Building & construction seasonally strong | | Seasonal softening in Europe |

[GRAPHIC]

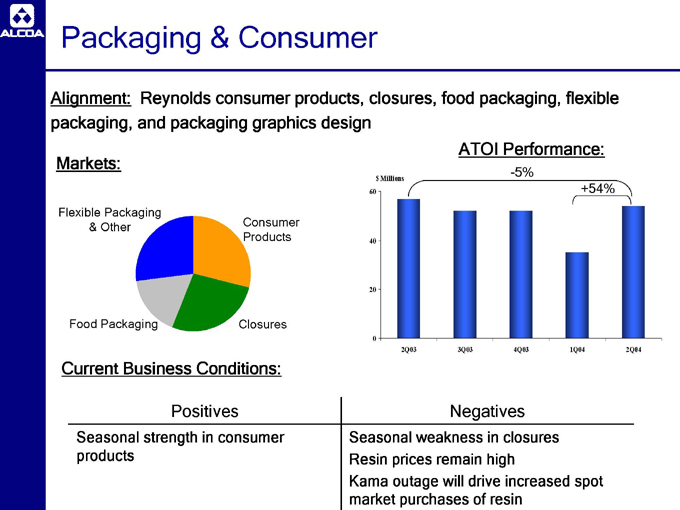

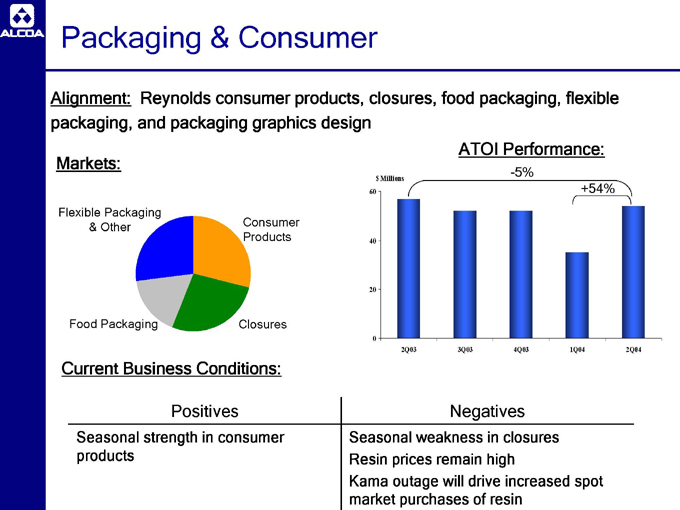

Packaging & Consumer

Alignment: Reynolds consumer products, closures, food packaging, flexible packaging, and packaging graphics design

| | |

Markets: | | ATOI Performance: |

| |

[GRAPHIC] | | [GRAPHIC] |

Current Business Conditions:

| | |

Positives | | Negatives |

Seasonal strength in consumer products | | Seasonal weakness in closures |

| | | Resin prices remain high |

| | | Kama outage will drive increased spot market purchases of resin |

[GRAPHIC]

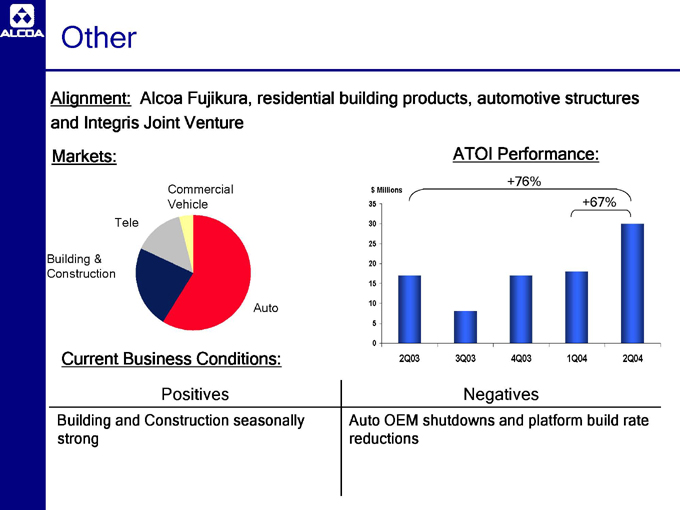

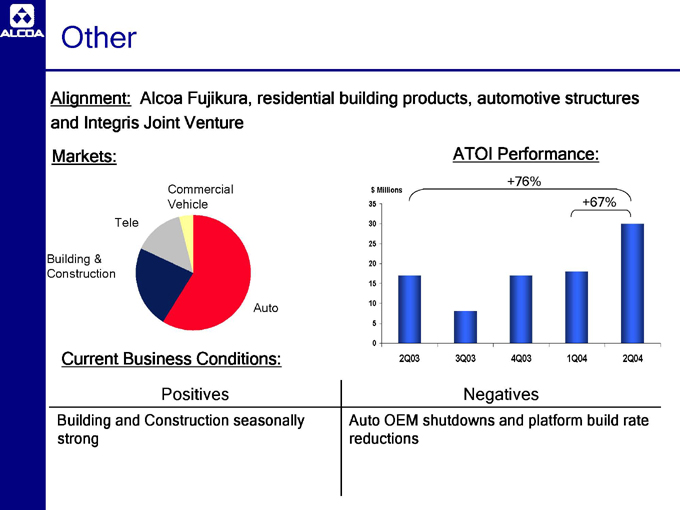

Other

Alignment: Alcoa Fujikura, residential building products, automotive structures and Integris Joint Venture

| | |

Markets: | | ATOI Performance: |

| |

[GRAPHIC] | | [GRAPHIC] |

Current Business Conditions:

| | |

Positives | | Negatives |

Building and Construction seasonally strong | | Auto OEM s hutdowns and platform build rate reductions |

[GRAPHIC]

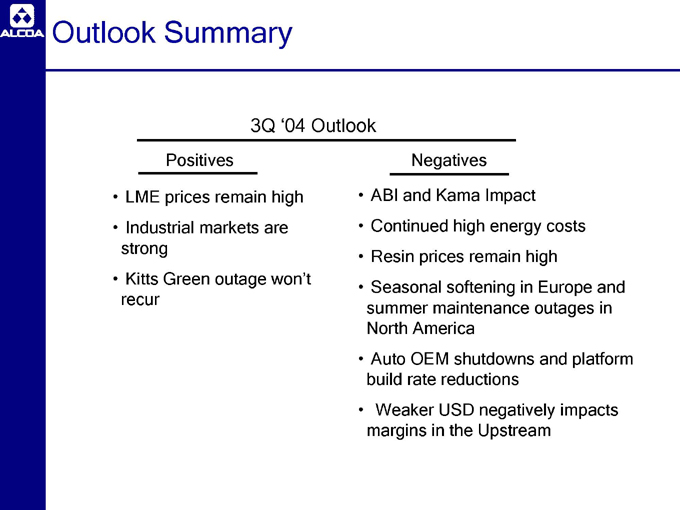

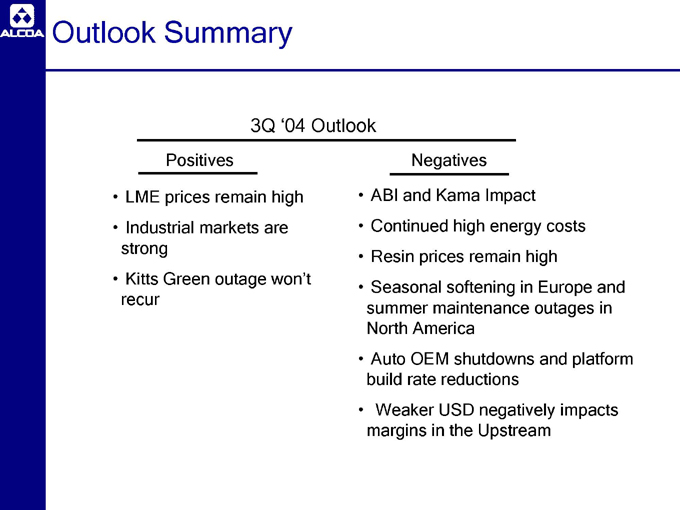

Outlook Summary

| | |

3Q ‘04 Outlook |

Positives | | Negatives |

LME prices remain high | | ABI and Kama Impact |

Industrial markets are strong | | Continued high energy costs |

Kitts Green outage won’t recur | | Resin prices remain high |

| | | Seasonal softening in Europe and summer maintenance outages in North America |

| | | Auto OEM shutdowns and platform build rate reductions |

| | | Weak er USD negatively impacts margins in the Upstream |

[GRAPHIC]

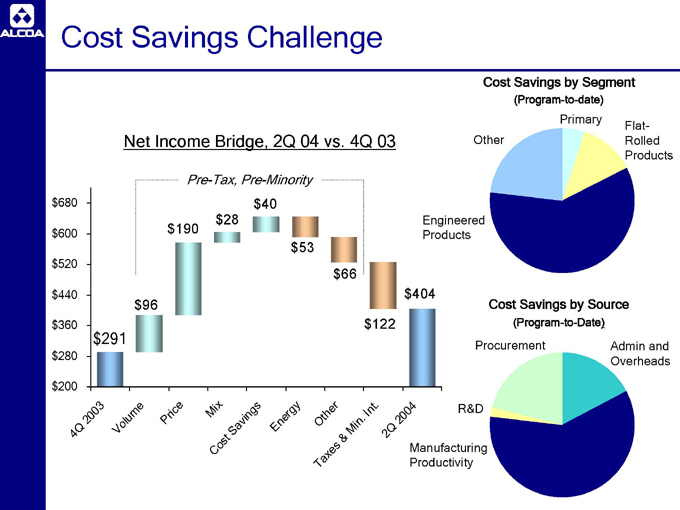

Cost Savings Challenge

| | |

[GRAPHIC] | | [GRAPHIC] |

| |

| | | [GRAPHIC] |

[GRAPHIC]

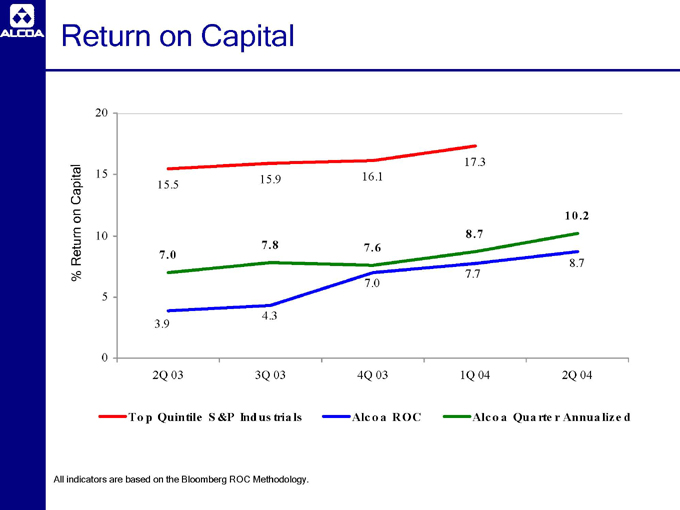

Return on Capital

[GRAPHIC]

All indicators are based on the Bloomberg ROC Methodology.

[GRAPHIC]

Alain J. P. Belda

Chairman and Chief Executive Officer

[GRAPHIC]

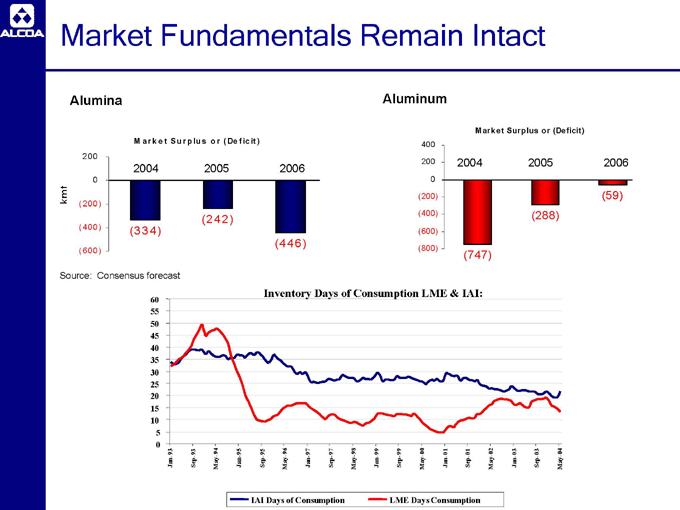

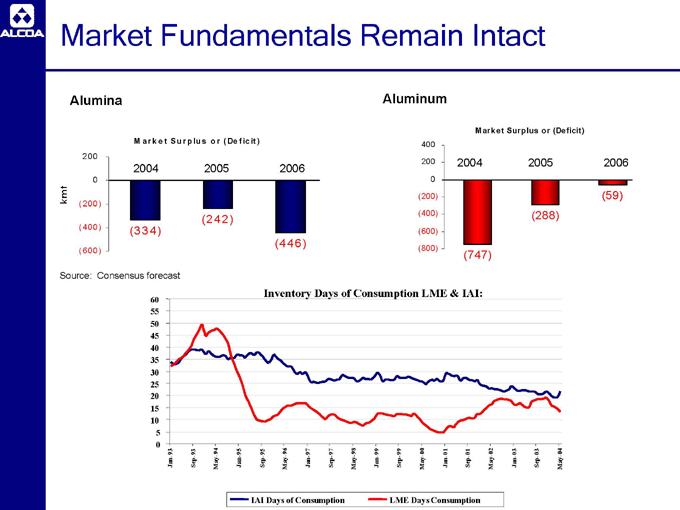

Market Fundamentals Remain Intact

| | |

Alumina | | Aluminum |

| |

[GRAPHIC] | | [GRAPHIC] |

Source: Consensus forecast

Inventory Days of Consumption LME & IAI:

[GRAPHIC]

[GRAPHIC]

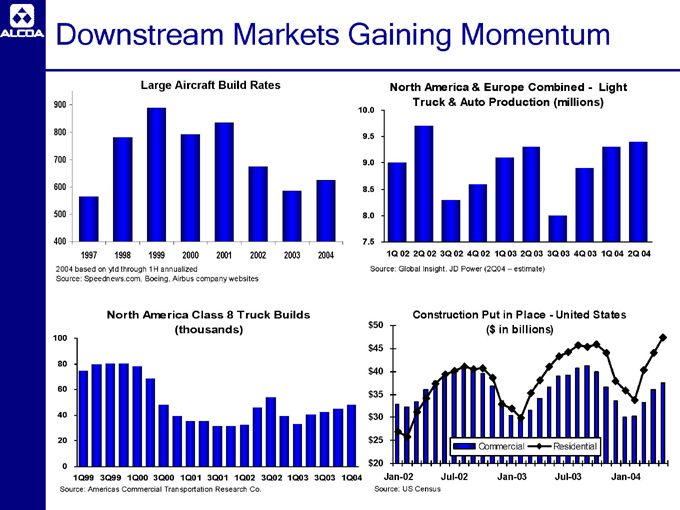

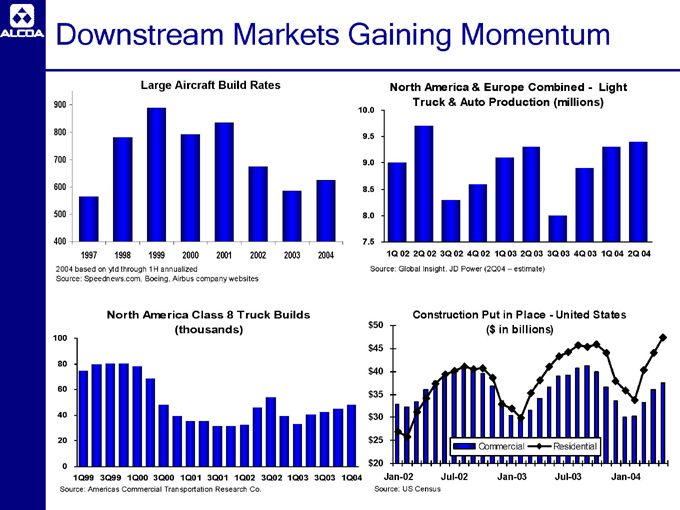

Downstream Markets Gaining Momentum

| | |

[GRAPHIC] | | [GRAPHIC] |

| |

[GRAPHIC] | | [GRAPHIC] |

[GRAPHIC]

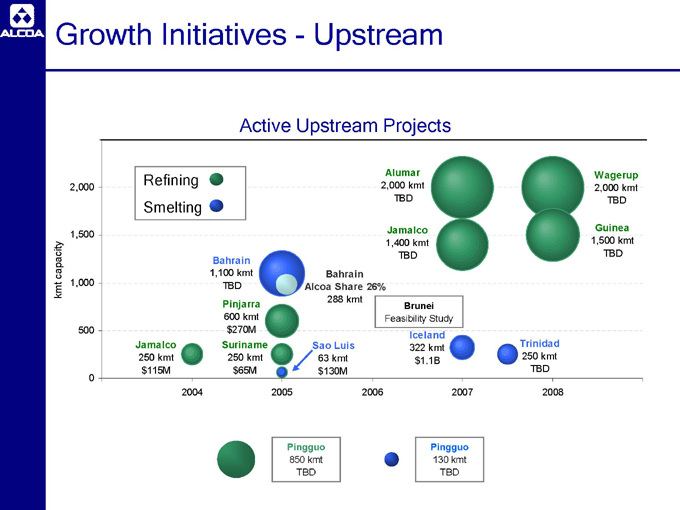

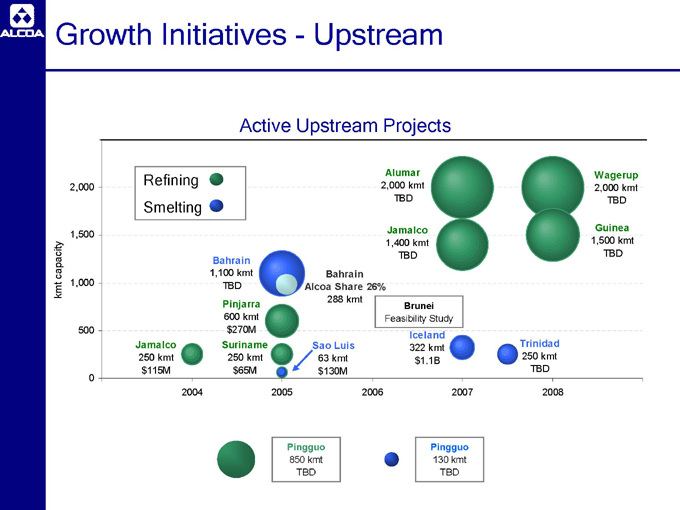

Growth Initiatives - Upstream

Active Upstream Projects

[GRAPHIC]

[GRAPHIC]

Growth Initiatives - Downstream

Fabricating facilities in Russia

Samara - flat rolled products, extrusions, and forgings

Belaya Kalitva - flat rolled products, extrusions, tubes, and forgings

Russian and global markets

Awaiting government approvals

Bohai rolling mill

Partnership with CITIC

Alcoa to invest $200M

Multiple markets, including transportation

Expect JV formation by the end of the year

[GRAPHIC]

Our Top Priorities

Long-term value creation

Values are our foundation

Cost control, capital discipline, customers - ABS is how we do business

Deliver on our short term goals

Manage the portfolio

Improve the balance sheet

Capitalize on improving market conditions

Strengthening US economy, key markets moving off lows

Continued strength in Asia with lingering weakness in Europe

Profitable Growth

Multiple opportunities for profitable growth - they must meet our hurdles

Organic and Acquisitions

Outperform the competition and industrial peers

[GRAPHIC]

For Additional Information, contact:

William F. Oplinger

Director, Investor Relations

Alcoa

390 Park Avenue

New York, N.Y. 10022-4608

Telephone: (212) 836-2674

Facsimile: (212) 836-2813

www.alcoa.com

[GRAPHIC]

Appendix

[GRAPHIC]

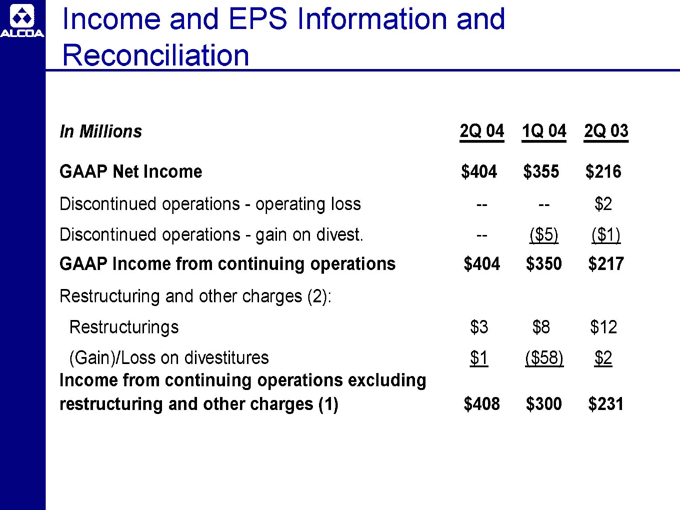

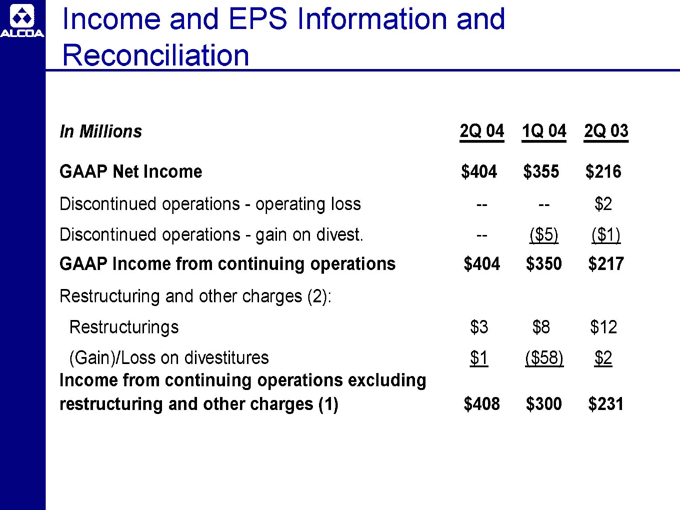

Income and EPS Information and Reconciliation

| | | | | | |

In Millions | | 2Q 04 | | 1Q

04 | | 2Q

03 |

GAAP Net Income | | $404 | | $355 | | $216 |

Discontinued operations - operating loss | | — | | — | | $2 |

Discontinued operations - gain on divest. | | — | | ($5) | | ($1) |

GAAP Income from continuing operations | | $404 | | $350 | | $217 |

Restructuring and other charges (2): | | | | | | |

Restructurings | | $3 | | $8 | | $12 |

(Gain)/Loss on divestitures | | $1 | | ($58) | | $2 |

Income from continuing operations excluding restructuring and other charges (1) | | $408 | | $300 | | $231 |

[GRAPHIC]

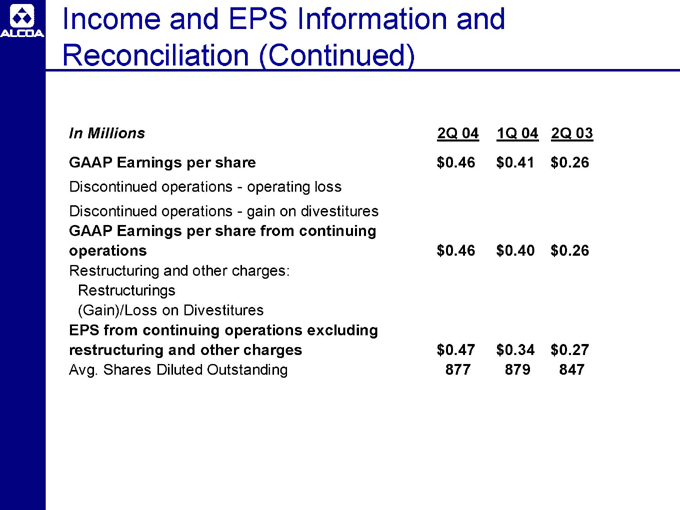

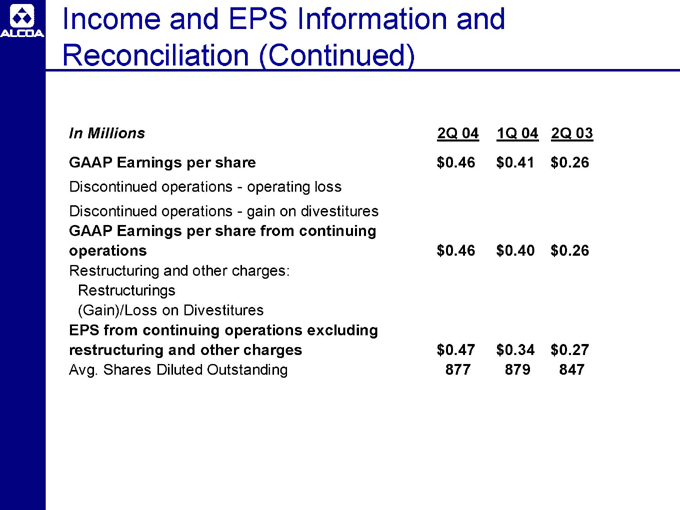

Income and EPS Information and Reconciliation (Continued)

| | | | | | |

In Millions | | 2Q

04 | | 1Q

04 | | 2Q

03 |

GAAP Earnings per share | | $0.46 | | $0.41 | | $0.26 |

Discontinued operations - operating loss | | | | | | |

Discontinued operations - gain on divestitures | | | | | | |

GAAP Earnings per share from continuing operations | | $0.46 | | $0.40 | | $0.26 |

Restructuring and other charges: | | | | | | |

Restructurings | | | | | | |

(Gain)/Loss on Divestitures | | | | | | |

EPS from continuing operations excluding restructuring and other charges | | $0.47 | | $0.34 | | $0.27 |

Avg. Shares Diluted Outstanding | | 877 | | 879 | | 847 |

[GRAPHIC]

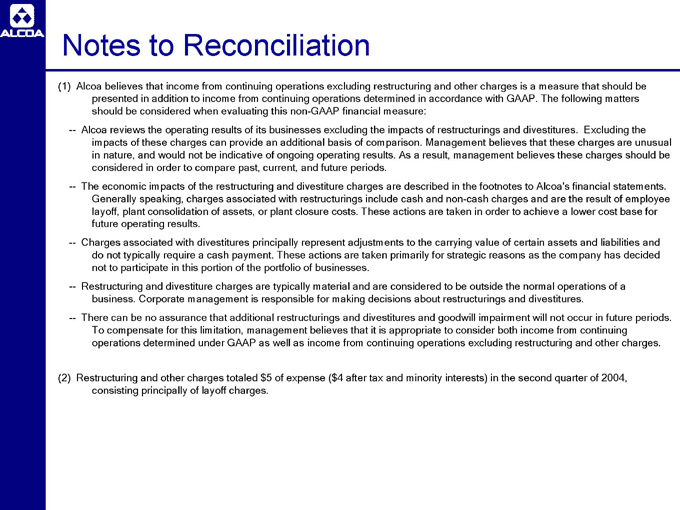

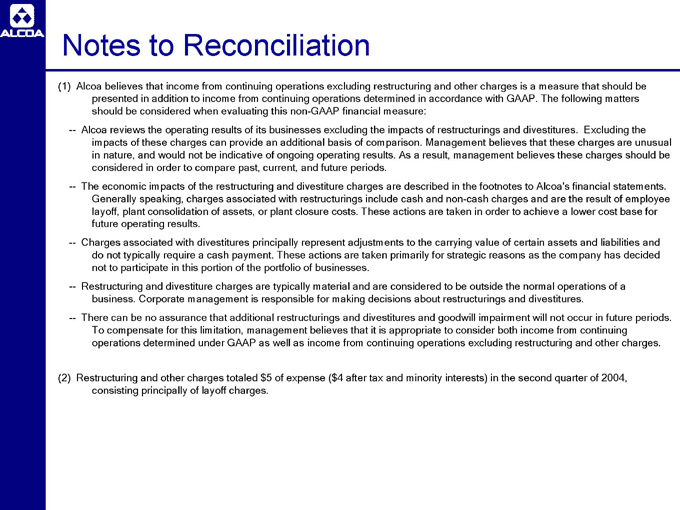

Notes to Reconciliation

(1) | | Alcoa believes that income from continuing operations excluding restructuring and other charges is a measure that should be presented in addition to income from continuing operations determined in accordance with GAAP. The following matters should be considered when evaluating this non-GAAP financial measure: |

| | • | | Alcoa reviews the operating results of its businesses excluding the impacts of restructurings and divestitures. Excluding the impacts of these charges can provide an additional basis of comparison. Management believes that these charges are unusual in nature, and would not be indicative of ongoing operating results. As a result, management believes these charges should be considered in order to compare past, current, and future periods. |

| | • | | The economic impacts of the restructuring and divestiture charges are described in the footnotes to Alcoa’s financial statements. Generally speaking, charges associated with restructurings include cash and non-cash charges and are the result of employee layoff, plant consolidation of assets, or plant closure costs. These actions are taken in order to achieve a lower cost base for future operating results. |

| | • | | Charges associated with divestitures principally represent adjustments to the carrying value of certain assets and liabilities and do not typically require a cash payment. These actions are taken primarily for strategic reasons as the company has decided not to participate in this portion of the portfolio of businesses. |

| | • | | Restructuring and divestiture charges are typically material and are considered to be outside the normal operations of a business. Corporate management is responsible for making decisions about restructurings and divestitures. |

| | • | | There can be no assurance that additional restructurings and divestitures and goodwill impairment will not occur in future periods. To compensate for this limitation, management believes that it is appropriate to consider both income from continuing operations determined under GAAP as well as income from continuing operations excluding restructuring and other charges. |

(2) | | Restructuring and other charges totaled $5 of expense ($4 after tax and minority interests) in the second quarter of 2004, consisting principally of layoff charges. |

[GRAPHIC]

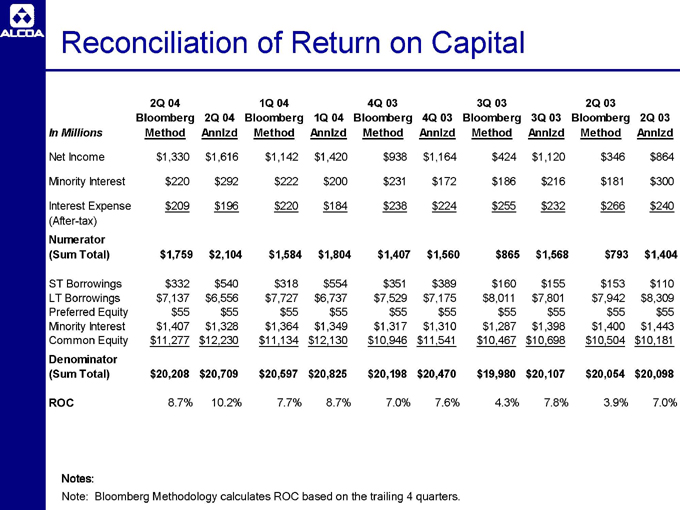

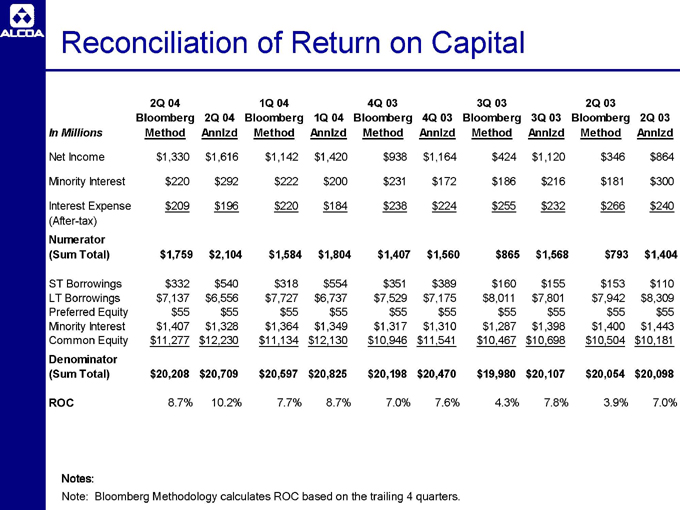

Reconciliation of Return on Capital

| | | | | | | | | | | | | | | | | | | | |

In Millions | | 2Q 04

Bloomberg Method | | 2Q 04 Annlzd | | 1Q 04 Bloomberg Method | | 1Q 04 Annlzd | | 4Q 03 Bloomberg Method | | 4Q 03

Annlzd | | 3Q 03 Bloomberg

Method | | 3Q 03 Annlzd | | 2Q 03 Bloomberg

Method | | 2Q 03 Annlzd |

Net Income | | $1,330 | | $1,616 | | $1,142 | | $1,420 | | $938 | | $1,164 | | $424 | | $1,120 | | $346 | | $864 |

Minority Interest | | $220 | | $292 | | $222 | | $

200 | | $231 | | $172 | | $186 | | $216 | | $181 | | $300 |

Interest Expense (After-tax) | | $209 | | $196 | | $220 | | $

184 | | $238 | | $224 | | $255 | | $232 | | $266 | | $240 |

Numerator (Sum Total) | | $1,759 | | $2,104 | | $1,584 | | $1,804 | | $1,407 | | $1,560 | | $865 | | $1,568 | | $793 | | $1,404 |

ST Borrowings | | $332 | | $540 | | $318 | | $

554 | | $351 | | $389 | | $160 | | $155 | | $153 | | $110 |

LT Borrowings | | $7,137 | | $6,556 | | $7,727 | | $6,737 | | $7,529 | | $7,175 | | $8,011 | | $7,801 | | $7,942 | | $8,309 |

Preferred Equity | | $55 | | $55 | | $55 | | $55 | | $55 | | $55 | | $55 | | $55 | | $55 | | $55 |

Minority Interest | | $1,407 | | $1,328 | | $1,364 | | $1,349 | | $1,317 | | $1,310 | | $1,287 | | $1,398 | | $1,400 | | $1,443 |

Common Equity | | $11,277 | | $12,230 | | $11,134 | | $12,130 | | $10,946 | | $11,541 | | $10,467 | | $10,698 | | $10,504 | | $10,181 |

Denominator (Sum Total) | | $20,208 | | $20,709 | | $20,597 | | $20,825 | | $20,198 | | $20,470 | | $19,980 | | $20,107 | | $20,054 | | $20,098 |

ROC | | 8.7% | | 10.2% | | 7.7% | | 8.7% | | 7.0% | | 7.6% | | 4.3% | | 7.8% | | 3.9% | | 7.0% |

Notes:

Note: Bloomberg Methodology calculates ROC based on the trailing 4 quarters.

[GRAPHIC]

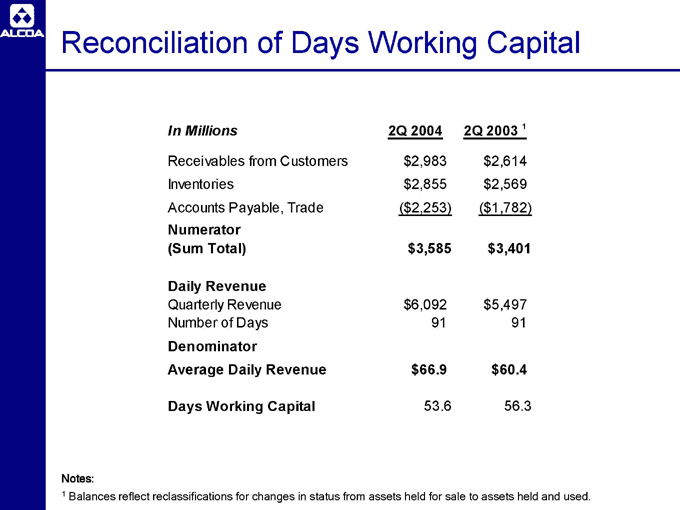

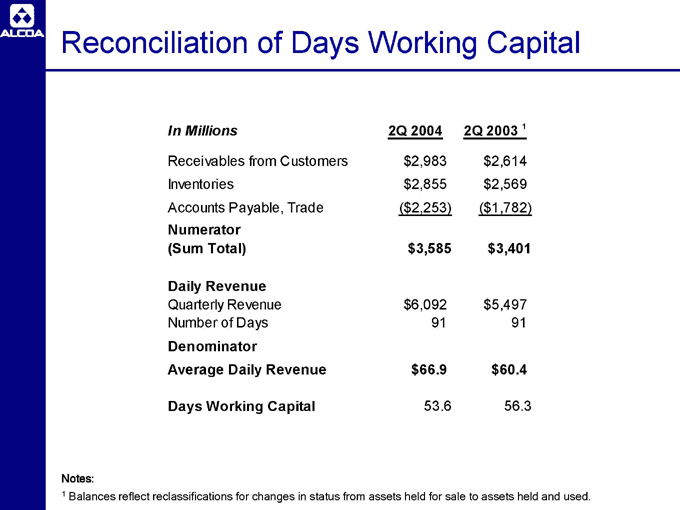

Reconciliation of Days Working Capital

| | | | |

In Millions | | 2Q

2004 | | 2Q 2003 1 |

Receivables from Customers | | $2,983 | | $2,614 |

Inventories | | $2,855 | | $2,569 |

Accounts Payable, Trade | | ($2,253) | | ($1,782) |

Numerator (Sum Total) | | $3,585 | | $3,401 |

Daily Revenue | | | | |

Quarterly Revenue | | $6,092 | | $5,497 |

Number of Days | | 91 | | 91 |

Denominator | | | | |

Average Daily Revenue | | $66.9 | | $60.4 |

Days Working Capital | | 53.6 | | 56.3 |

Notes:

1 | | Balances reflect reclassifications for changes in status from assets held for sale to assets held and used. |

[GRAPHIC]

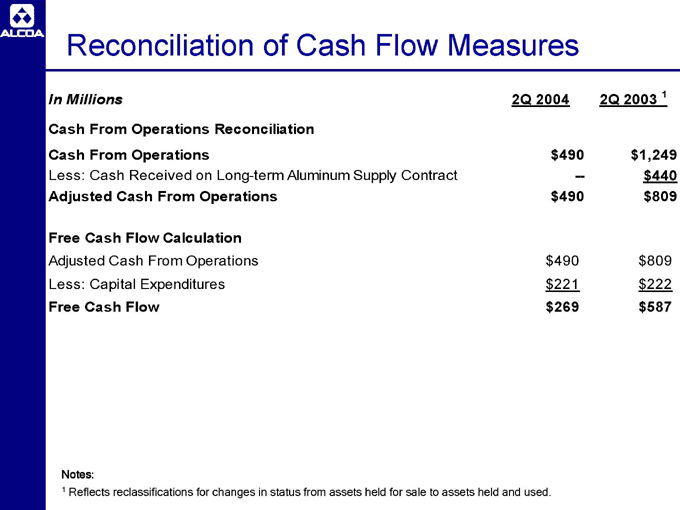

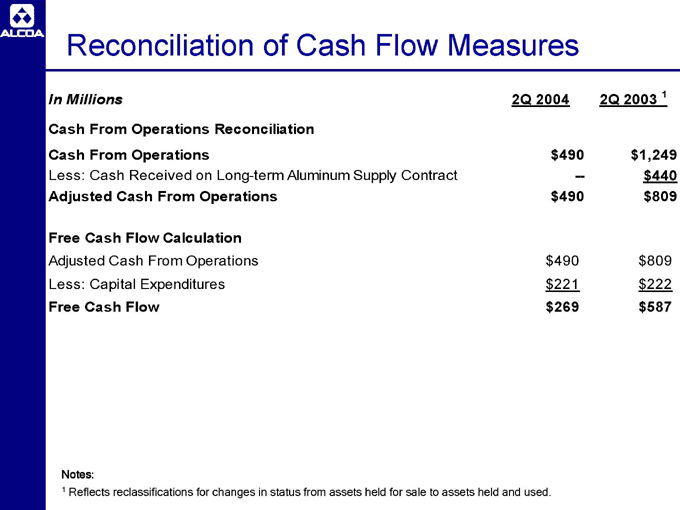

Reconciliation of Cash Flow Measures

| | | | |

In Millions | | 2Q 2004 | | 2Q 2003 1 |

Cash From Operations Reconciliation | | | | |

Cash From Operations | | $490 | | $1,249 |

Less: Cash Received on Long-term Aluminum Supply Contract | | — | | $440 |

Adjusted Cash From Operations | | $490 | | $809 |

Free Cash Flow Calculation | | | | |

Adjusted Cash From Operations | | $490 | | $809 |

Less: Capital Expenditures | | $221 | | $222 |

Free Cash Flow | | $269 | | $587 |

Notes:

1 | | Reflects reclassifications for changes in status from assets held for sale to assets held and used. |