Exhibit 99.2

[ALCOA LOGO]

4th Quarter 2004 Analyst Conference

January 10, 2005 New York, NY

Forward-Looking Statements

Today’s discussion may include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements relate to future events and expectations and involve known and unknown risks and uncertainties. Alcoa’s actual results or actions may differ materially from those projected in the forward-looking statements. For a summary of the specific risk factors that could cause results to differ materially from those expressed in the forward-looking statements, please refer to Alcoa’s Form 10-K for the year ended December 31, 2003, in addition to the Quarterly Report on Form 10-Q for the quarter ended September 30, 2004 filed with the Securities and Exchange Commission.

2

Alain J. P. Belda

Chairman and Chief Executive Officer

2004 Review

Financial Performance

Income from continuing operations of $1.4 billion, up 33% from 2003 Highest annual sales in company history; revenue growth of $2.4 billion over 2003 Increased profitability in four out of six operating segments Cash from operations of $2.4 billion Second consecutive year of debt repayment greater than $1.1 billion

4

2004 Review

Values

Record safety achievement

Continue to strengthen financial controls

People and Organization

Resolved five day notices, Wenatchee and ABI industrial relations Created six global businesses to better serve customers

Growth & Portfolio Management

Broke ground at Iceland

Continued progress on brownfield expansions in refining and smelting – Australia, Brazil, Jamaica and Suriname Downstream projects progressing – Russia Divestitures of non-core assets

5

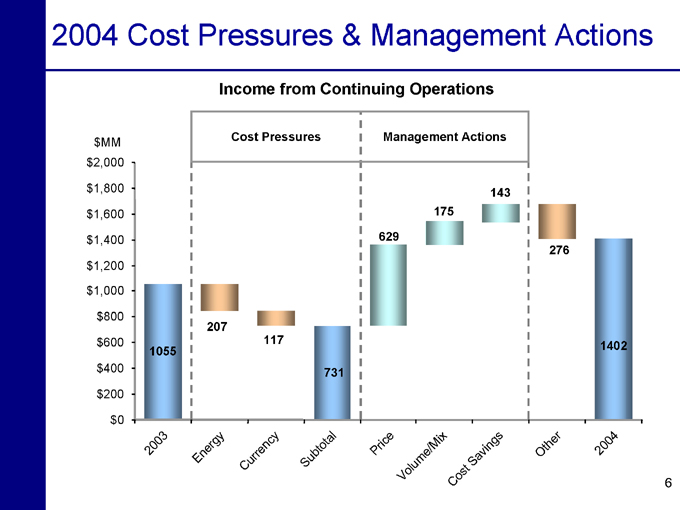

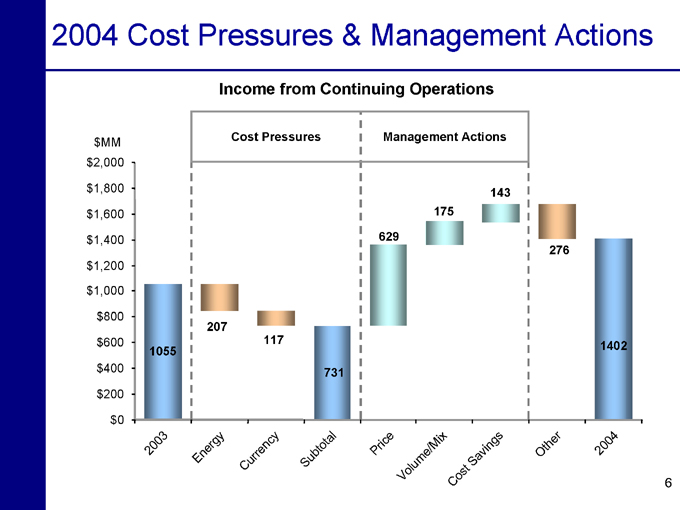

2004 Cost Pressures & Management Actions

Income from Continuing Operations $MM $2,000

$1,800 $1,600 $1,400

$1,200 $1,000

$800 $600 $400 $200 $0

Cost Pressures

Management Actions

2003

Energy

Currency

Subtotal

Price

Volume/Mix

Cost

Savings

Other

2004

1055

207

117

731

629

175

143

276

1402

6

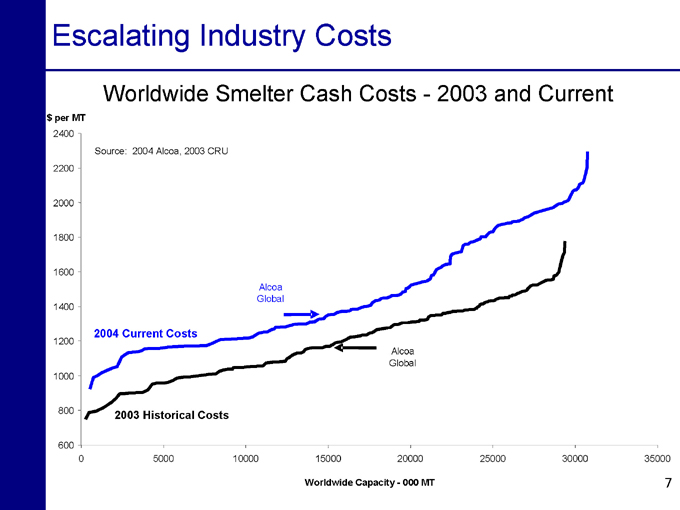

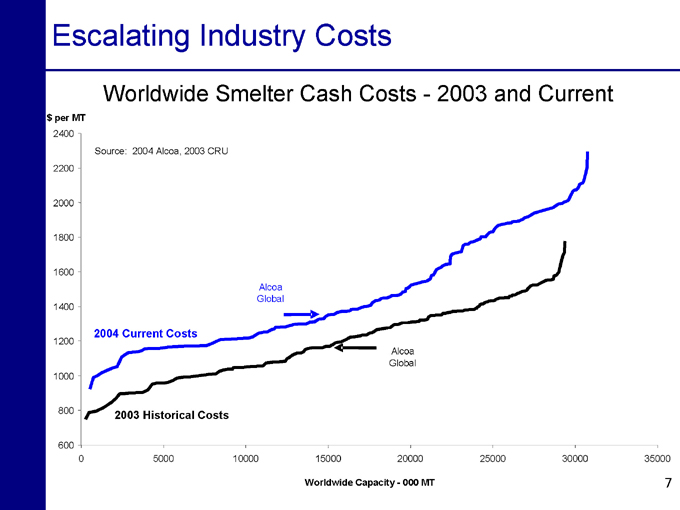

Escalating Industry Costs

Worldwide Smelter Cash Costs—2003 and Current $ per MT

2400

2200

2000

1800

1600

1400

1200

1000

800

600

Source: 2004 Alcoa, 2003 CRU

2004 Current Costs

Alcoa Global

2003 Historical Costs

Alcoa Global

0

5000

10000

15000

20000

25000

30000

35000

Worldwide Capacity—000 MT

7

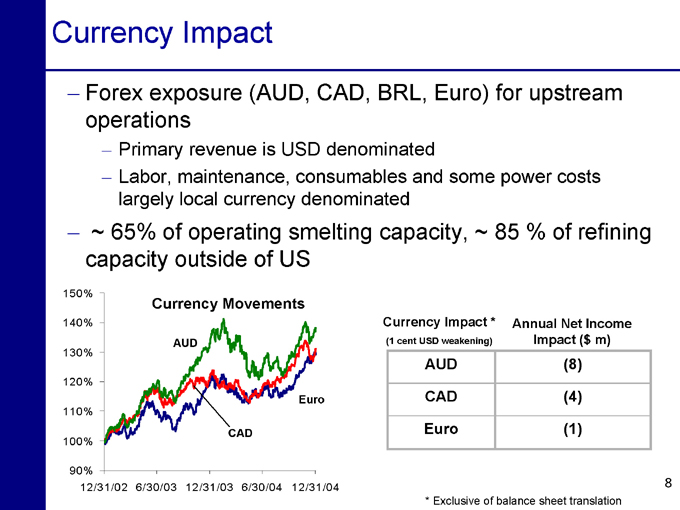

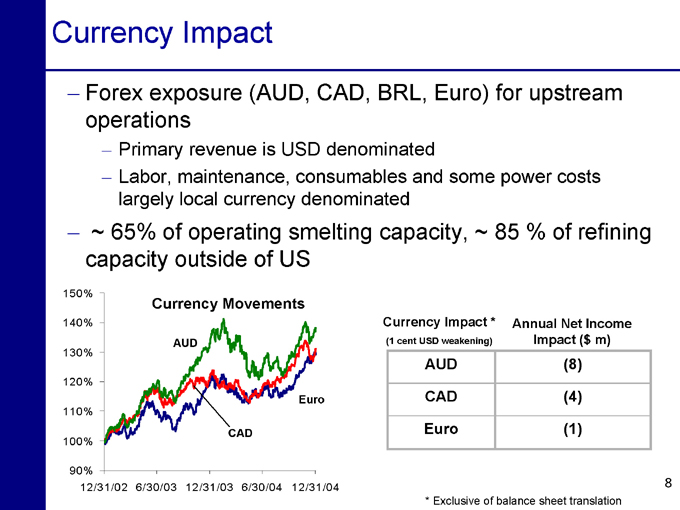

Currency Impact

Forex exposure (AUD, CAD, BRL, Euro) for upstream operations

Primary revenue is USD denominated

Labor, maintenance, consumables and some power costs largely local currency denominated

~ 65% of operating smelting capacity, ~ 85 % of refining capacity outside of US

150%

140%

130%

120%

110%

100%

90%

Currency Movements

AUD

CAD

Euro

12/31/02 6/30/03 12/31/03 6/30/04 12/31/04

Currency Impact *

(1 cent USD weakening)

Annual Net Income Impact ($ m)

AUD (8)

CAD (4)

Euro (1)

* Exclusive of balance sheet translation

8

2005 - Planned Savings to Overcome Cost Pressures

Cost Inflation

650

600

500

400

300

200

100

0

70

Other

125

Energy Costs

390

Raw Materials

Average unit cost increases for select raw materials

80%

60%

40%

20%

0%

Caustic

Resin

Alloying Materials

Fuel Oil

Cost Savings

650

600

500

400

300

200

100

0

SG&A

60

Procurement

80

Other Sustainable Cost Savings

103

Shop Floor Productivity

377

9

Opportunities in 2005

Costs & Expenditures

Markets

Growth

Cost savings targeted to offset input and energy cost increases

Global purchasing organization to optimize capital spend on major growth projects

Both alumina and aluminum projected to remain in deficit

Aerospace (20%) and commercial vehicle (8%) build rates increasing

Strong fabricated product pricing going into the year

Primary metal restarts will contribute over 200 kmt

Alumina production increases of ~ 800 kmt from creep and expansion projects

Expect to complete Russia fabricating investment in first half

10

[ALCOA LOGO]

Richard B. Kelson

Executive Vice President Chief Financial Officer

Financial Overview

4th Quarter income from continuing operations of 39 cents/share Revenue growth sequentially; YTD revenue highest ever Year-over-year improvements in 4 out of 6 operating segments Higher input costs continue to dampen cost savings achievement Trailing 4 quarters ROC of 8.5%; up 150 basis points from 2003 Lowered debt-to-capital to 29.3%

12

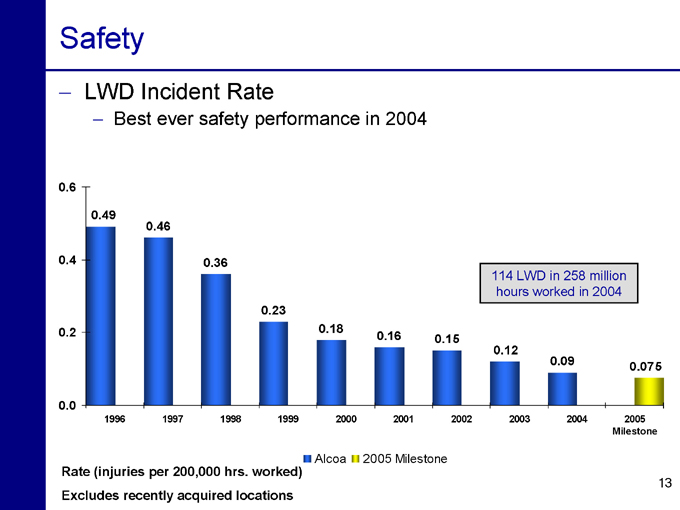

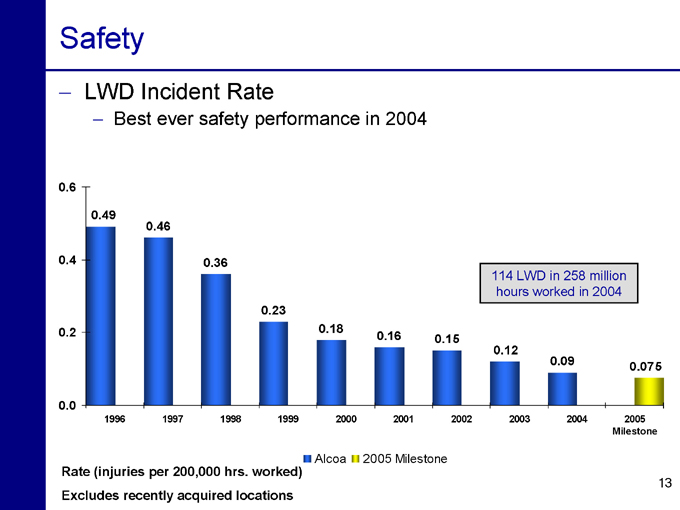

Safety

LWD Incident Rate

Best ever safety performance in 2004

0.6

0.4

0.2

0.0

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005 Milestone

0.49

0.46

0.36

0.23

0.18

0.16

0.15

0.12

0.09

0.075

114 LWD in 258 million hours worked in 2004

Alcoa

2005 Milestone

Rate (injuries per 200,000 hrs. worked) Excludes recently acquired locations

13

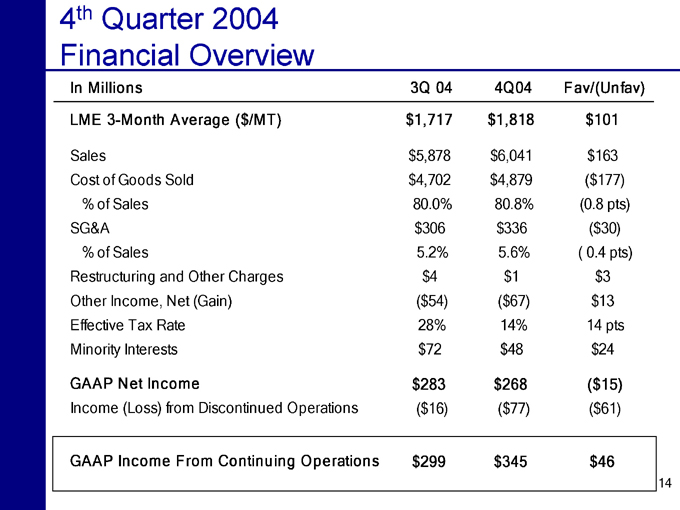

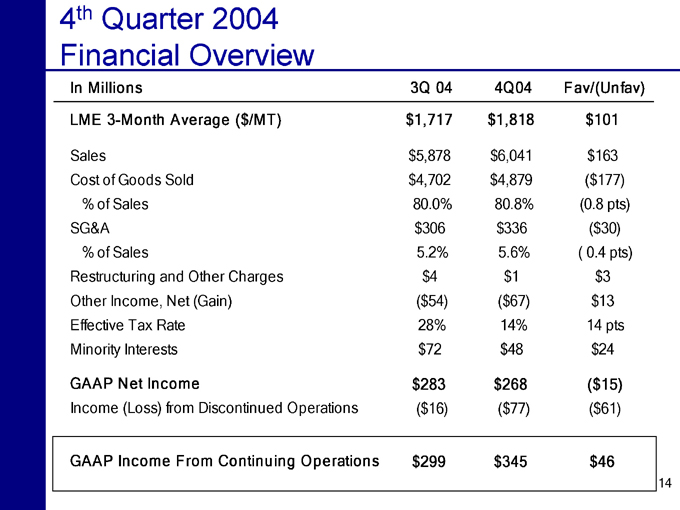

4th Quarter 2004 Financial Overview

In Millions 3Q 04 4Q04 Fav/(Unfav)

LME 3-Month Average ($/MT) $1,717 $1,818 $101

Sales $5,878 $6,041 $163

Cost of Goods Sold $4,702 $4,879 ($177)

% of Sales 80.0% 80.8% (0.8 pts)

SG&A $306 $336 ($30)

% of Sales 5.2% 5.6% (0.4 pts)

Restructuring and Other Charges $4 $1 $3

Other Income, Net (Gain) ($54) ($67) $13

Effective Tax Rate 28% 14% 14 pts

Minority Interests $72 $48 $24

GAAP Net Income $283 $268 ($15)

Income (Loss) from Discontinued Operations ($16) ($77) ($61)

GAAP Income From Continuing Operations $299 $345 $46

14

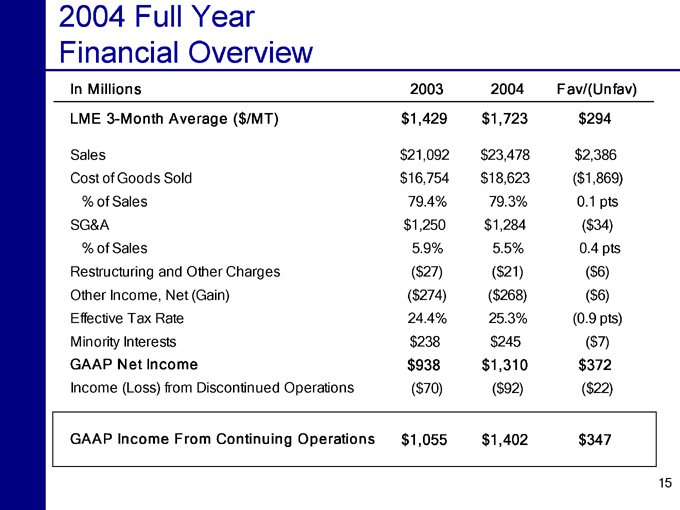

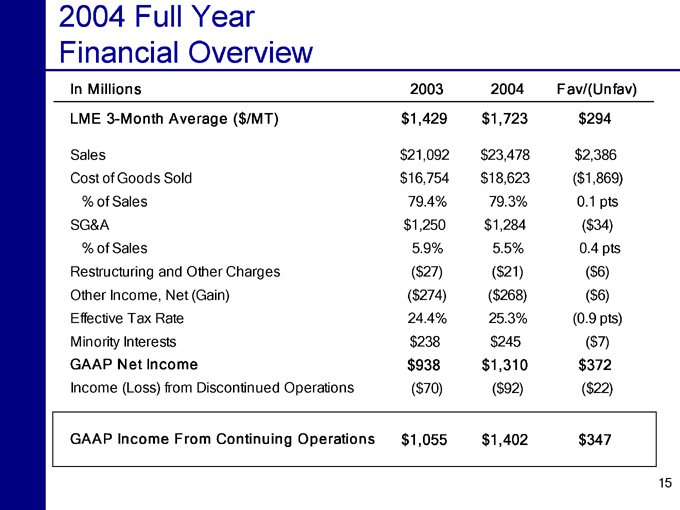

2004 Full Year Financial Overview

In Millions 2003 2004 Fav/(Unfav)

LME 3-Month Average ($/MT) $1,429 $1,723 $294

Sales $21,092 $23,478 $2,386

Cost of Goods Sold $16,754 $18,623 ($1,869)

% of Sales 79.4% 79.3% 0.1 pts

SG&A $1,250 $1,284 ( $34)

% of Sales 5.9% 5.5% 0.4 pts

Restructuring and Other Charges ($27) ($21) ($6)

Other Income, Net (Gain) ($274) ($268) ($6)

Effective Tax Rate 24.4% 25.3% (0.9 pts)

Minority Interests $238 $245 ($7)

GAAP Net Income $938 $1,310 $372

Income (Loss) from Discontinued Operations ($70) ($92) ( $22)

GAAP Income From Continuing Operations $1,055 $1,402 $347

15

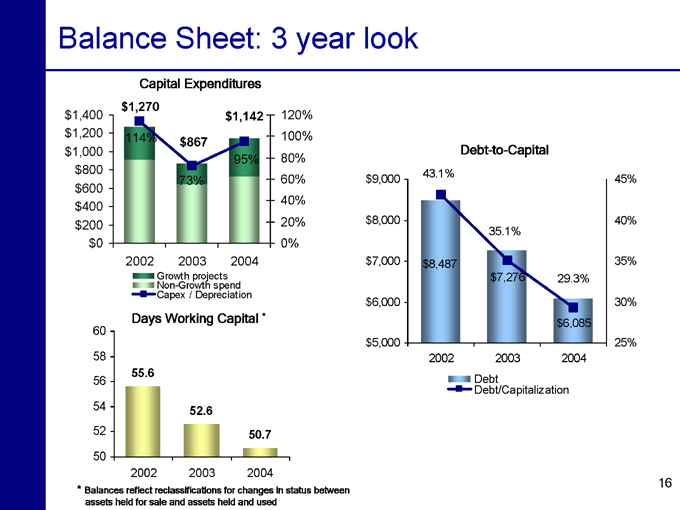

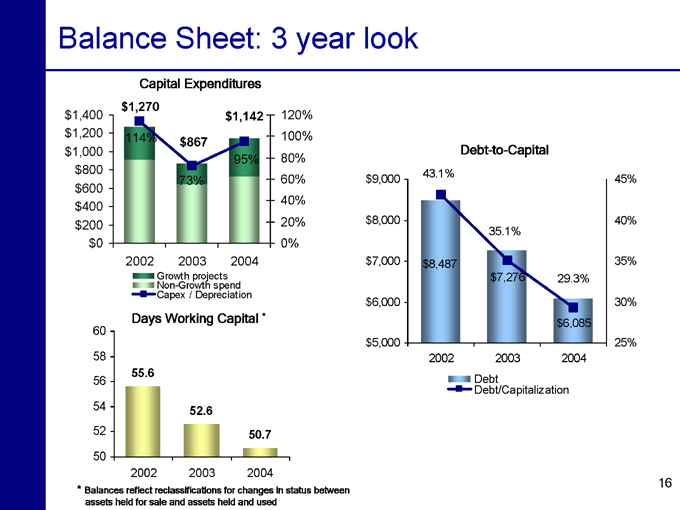

Balance Sheet: 3 year look

Capital Expenditures

$1,400

$1,200

$1,000

$800

$600

$400

$200

$0

$1,270

114% $867

73% $1,142

95%

2002 2003 2004

Growth projects Non-Growth spend Capex / Depreciation

120% 100% 80% 60% 40% 20% 0%

Days Working Capital *

60

58 56

54 52

50

2002

2003

2004

55.6

52.6

50.7

Debt-to-Capital

$9,000

$8,000

$7,000

$6,000

$5,000

2002

2003

2004

43.1%

35.1%

29.3%

$8,487

$7,276

$6,085

45%

40%

35%

30%

25%

Debt

Debt/Capitalization

* Balances reflect reclassifications for changes in status between assets held for sale and assets held and used

16

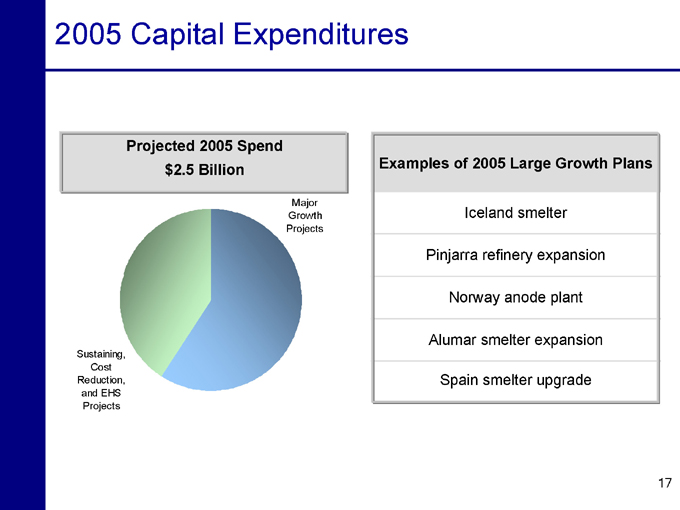

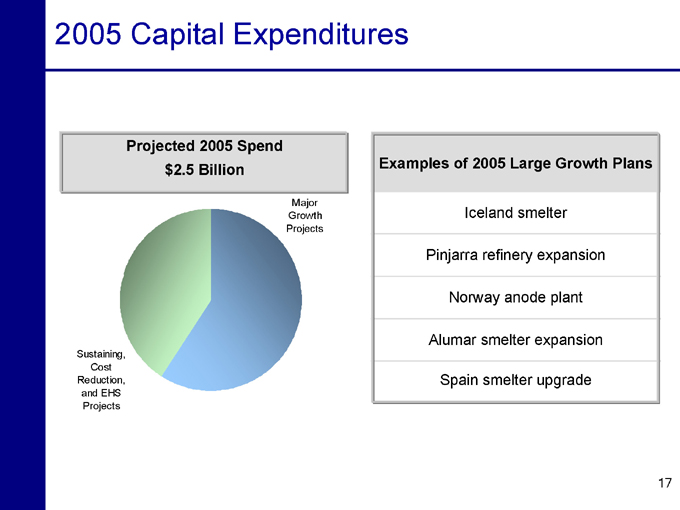

2005 Capital Expenditures

Projected 2005 Spend $2.5 Billion

Major Growth Projects

Sustaining, Cost Reduction, and EHS

Projects

Examples of 2005 Large Growth Plans

Iceland smelter

Pinjarra refinery expansion

Norway anode plant

Alumar smelter expansion

Spain smelter upgrade

17

Recent Transactions

Divestiture of Integris Metals

Alcoa sold its equity interest to Ryerson-Tull Immaterial gain on the transaction

Equity gains/losses had been going through the “other” segment

AFL Letter of Intent

Alcoa to own the Automotive business, Fujikura will own the Telecommunications business Share and cash transaction Telecommunications listed as “discontinued operations” as of 4Q04 with charge to reduce to fair value Telecommunications had been in the “other” segment

18

Pension and Stock Option Expense

Pension

2005 Earnings Impact ~ $20 million additional pre-tax Balance Sheet – 2004 minimum pension liability increased by $22 million Cash Flow Impact – No material change in funding required in 2005

Stock Options

Plan to expense options in 3rd Quarter, 2005

Currently evaluating binomial lattice model for valuation Further details will be provided in 2Q conference call

19

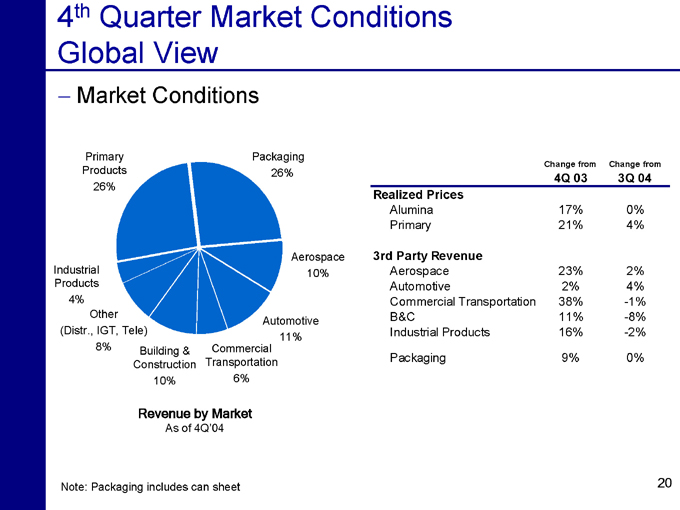

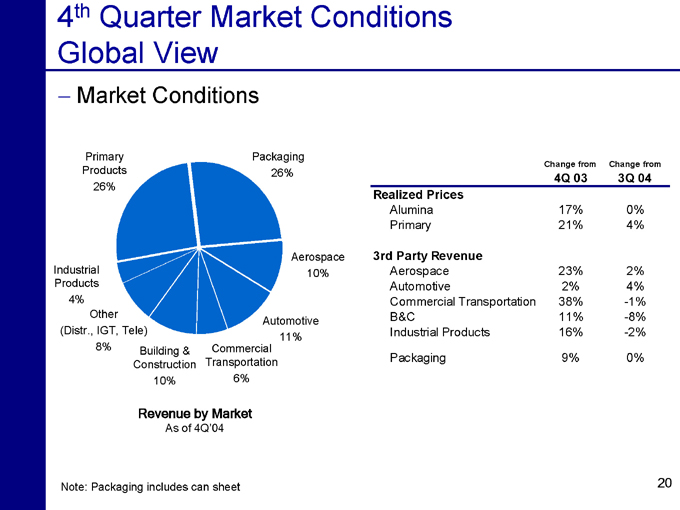

4th Quarter Market Conditions Global View

Market Conditions

Primary Products 26%

Industrial Products 4%

Other

(Distr., IGT, Tele)

8%

Building & Construction 10%

Commercial Transportation 6%

Automotive 11%

Aerospace 10%

Packaging 26%

Revenue by Market

As of 4Q’04

Change from Change from

4Q 03 3Q 04

Realized Prices

Alumina 17% 0%

Primary 21% 4%

3rd Party Revenue

Aerospace 23% 2%

Automotive 2% 4%

Commercial Transportation 38% -1%

B&C 11% -8%

Industrial Products 16% -2%

Packaging 9% 0%

Note: Packaging includes can sheet

20

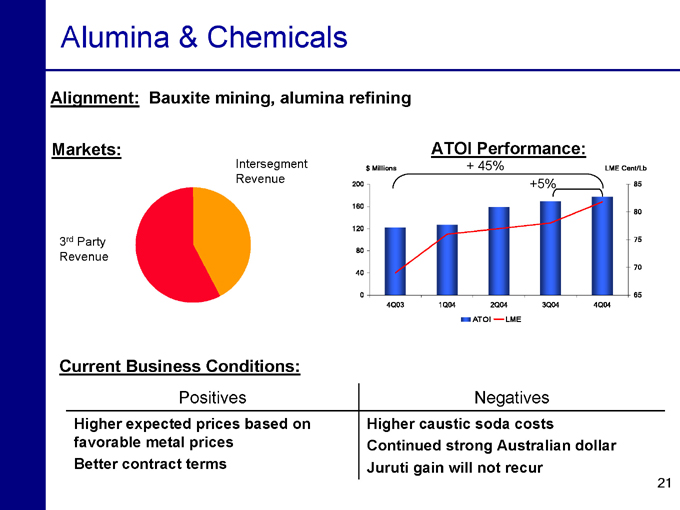

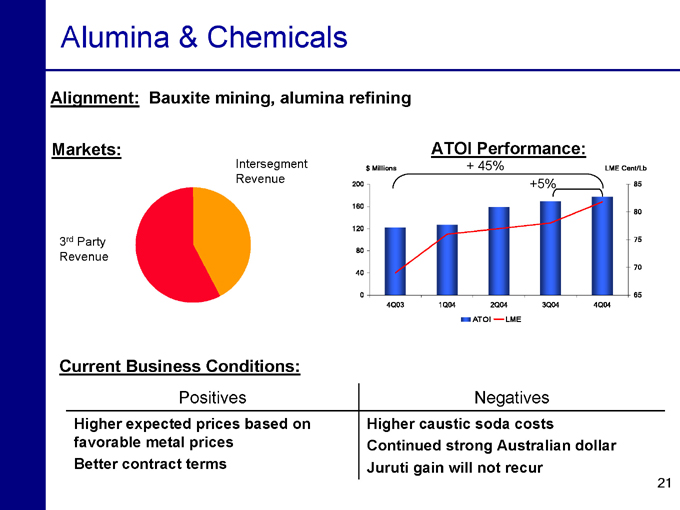

Alumina & Chemicals

Alignment: Bauxite mining, alumina refining

Markets:

3rd Party Revenue

Intersegment Revenue

ATOI Performance:

+ 45%

$ Millions

2001

60

120

80

40

0

4Q03

1Q04

2Q04

3Q04

4Q04

+5%

LME Cent/Lb

85 80 75 70 65

ATOI

LME

Current Business Conditions:

Positives

Higher expected prices based on favorable metal prices Better contract terms

Negatives

Higher caustic soda costs

Continued strong Australian dollar Juruti gain will not recur

21

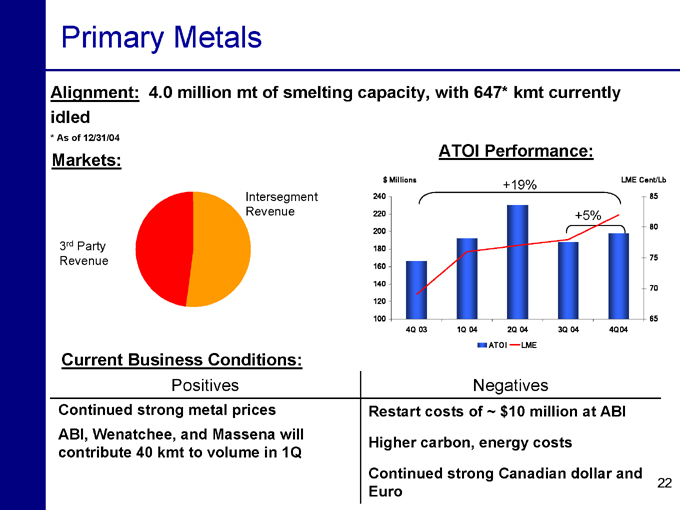

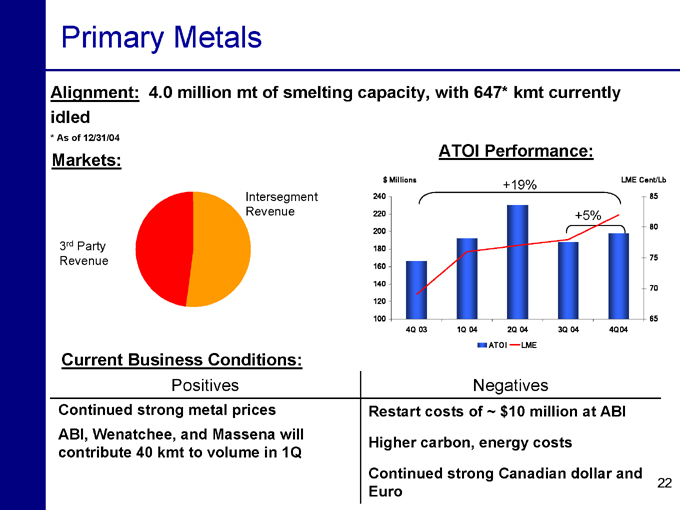

Primary Metals

Alignment: 4.0 million mt of smelting capacity, with 647* kmt currently idled

* As of 12/31/04

Markets:

Intersegment Revenue

3rd Party Revenue

ATOI Performance:

+19% $ Millions

240 220 200 180 160 140 120 100

4Q 03

1Q 04

2Q 04

3Q 04

4Q04

LME Cent/Lb

85

80

75

70

65

ATOI

LME

Current Business Conditions:

Positives

Continued strong metal prices ABI, Wenatchee, and Massena will contribute 40 kmt to volume in 1Q

Negatives

Restart costs of ~ $10 million at ABI

Higher carbon, energy costs

Continued strong Canadian dollar and Euro

22

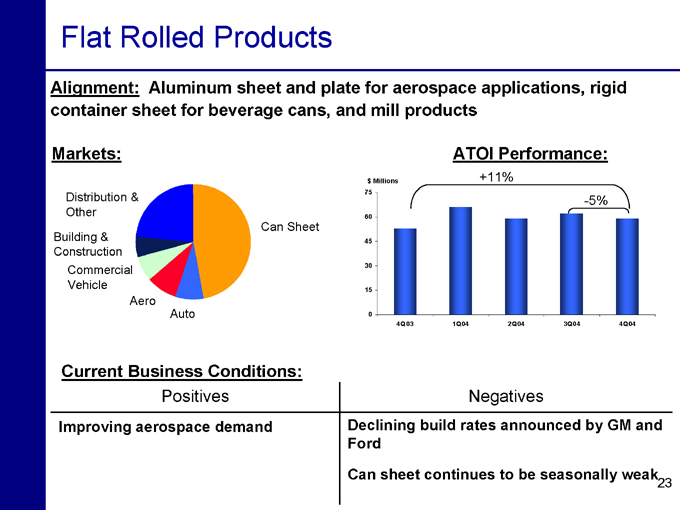

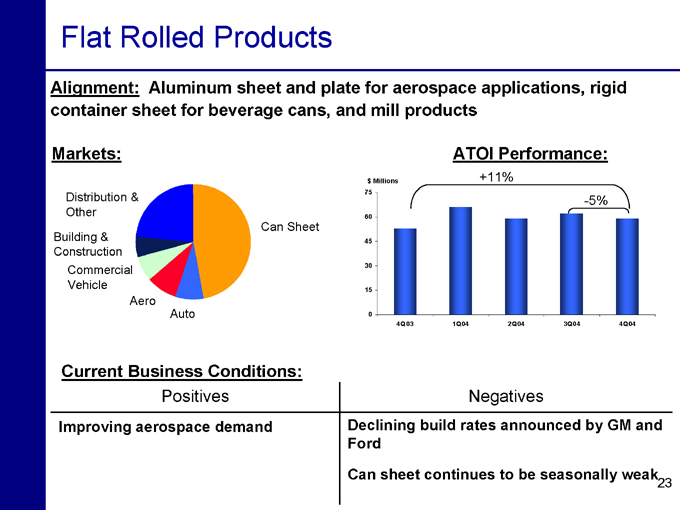

Flat Rolled Products

Alignment: Aluminum sheet and plate for aerospace applications, rigid container sheet for beverage cans, and mill products

Markets:

Distribution & Other

Building & Construction

Commercial Vehicle

Aero

Auto

Can Sheet

ATOI Performance:

+11% $ Millions

75

60

45

30

15

0

4Q03

1Q04

2Q04

3Q04

4Q04

-5%

Current Business Conditions:

Positives

Improving aerospace demand

Negatives

Declining build rates announced by GM and Ford

Can sheet continues to be seasonally weak

23

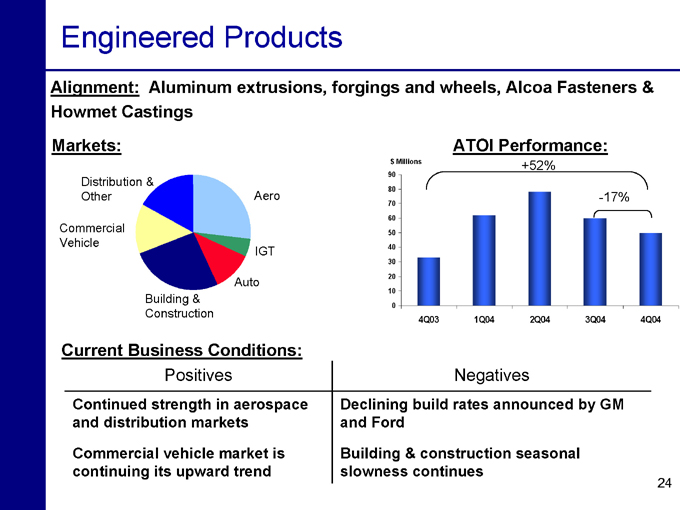

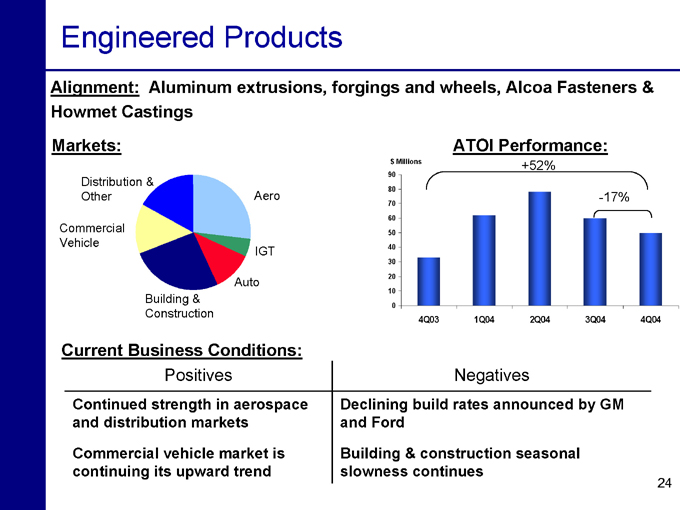

Engineered Products

Alignment: Aluminum extrusions, forgings and wheels, Alcoa Fasteners & Howmet Castings

Markets:

Distribution & Other

Commercial Vehicle

Building & Construction

Auto

IGT

Aero

ATOI Performance:

+52% $ Millions

90 80 70 60 50 40 30 20 10 0

4Q03

1Q04

2Q04

3Q04

4Q04

-17%

Current Business Conditions:

Positives

Continued strength in aerospace and distribution markets

Commercial vehicle market is continuing its upward trend

Negatives

Declining build rates announced by GM and Ford

Building & construction seasonal slowness continues

24

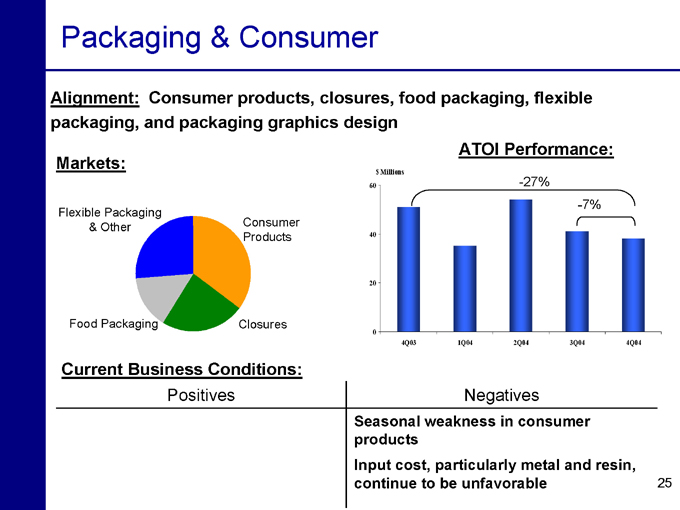

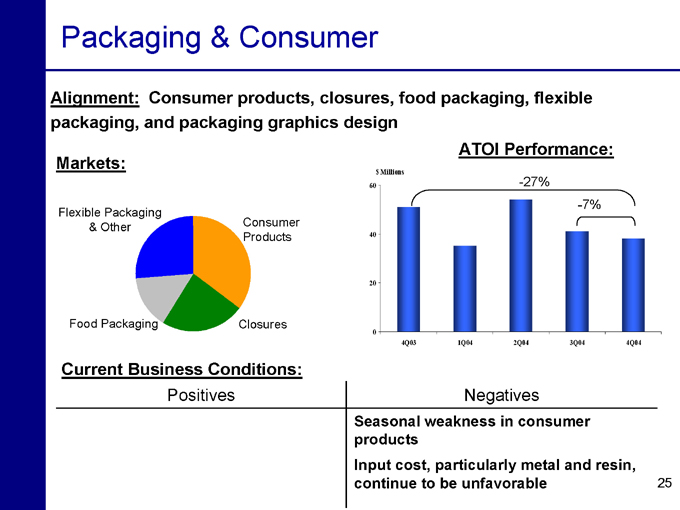

Packaging & Consumer

Alignment: Consumer products, closures, food packaging, flexible packaging, and packaging graphics design

Markets:

Flexible Packaging & Other

Food Packaging

Consumer Products

Closures

ATOI Performance:

-27% $ Millions

60 40 20 0

4Q03

1Q04

2Q04

3Q04

4Q04

-7%

Current Business Conditions:

Positives

Negatives

Seasonal weakness in consumer products Input cost, particularly metal and resin, continue to be unfavorable

25

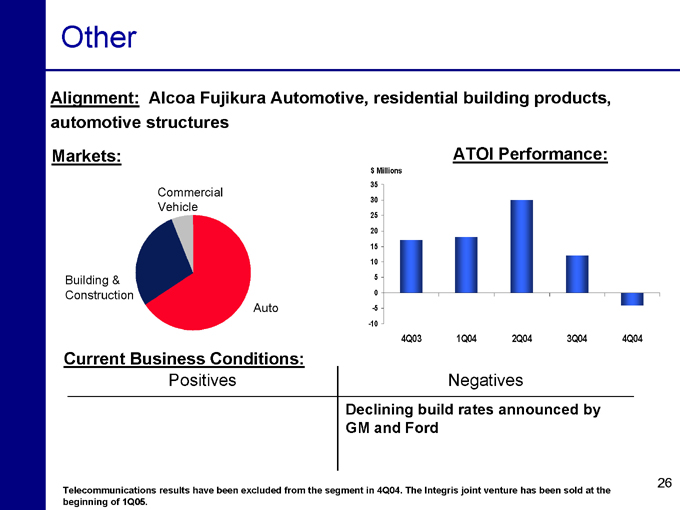

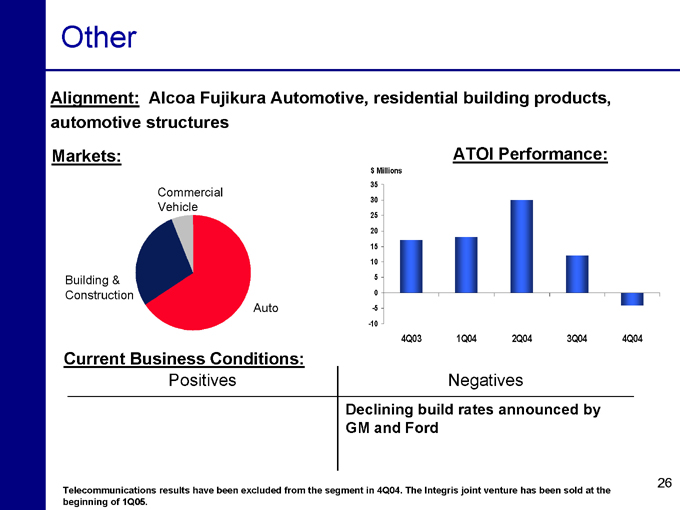

Other

Alignment: Alcoa Fujikura Automotive, residential building products, automotive structures

Markets:

Commercial Vehicle

Building & Construction

Auto

ATOI Performance: $ Millions

35 30 25 20 15 10 5 0 -5 -10

4Q03

1Q04

2Q04

3Q04

4Q04

Current Business Conditions:

Positives

Negatives

Declining build rates announced by GM and Ford

Telecommunications results have been excluded from the segment in 4Q04. The Integris joint venture has been sold at the beginning of 1Q05.

26

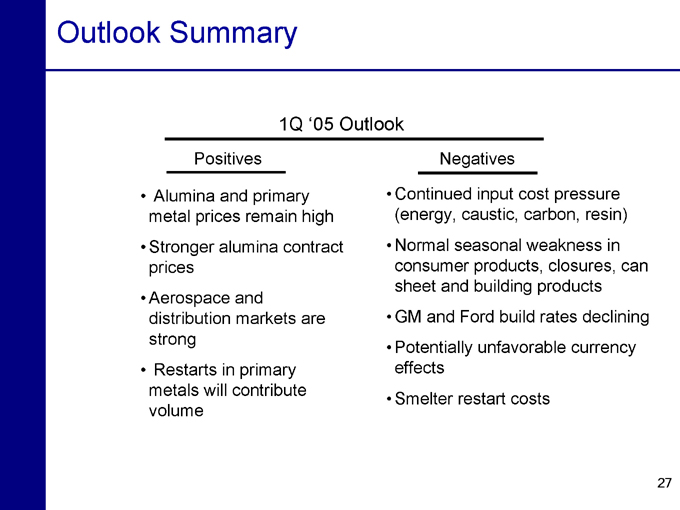

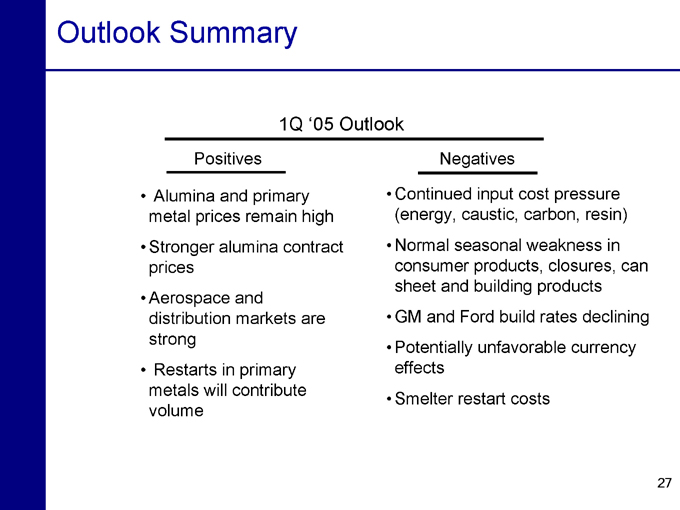

Outlook Summary

1Q ‘05 Outlook

Positives

Alumina and primary metal prices remain high

Stronger alumina contract prices

Aerospace and distribution markets are strong

Restarts in primary metals will contribute volume

Negatives

Continued input cost pressure (energy, caustic, carbon, resin)

Normal seasonal weakness in consumer products, closures, can sheet and building products

GM and Ford build rates declining

Potentially unfavorable currency effects

Smelter restart costs

27

2005 Challenges

Offset input cost increases with productivity and procurement initiatives

Capture higher prices across the enterprise, passing through higher input costs

Manage large capital projects effectively

Integrate Russian assets

28

For Additional Information, contact:

William F. Oplinger Director, Investor Relations

Alcoa

390 Park Avenue

New York, N.Y. 10022-4608 Telephone: (212) 836-2674 Facsimile: (212) 836-2813 www.alcoa.com

29

Appendix

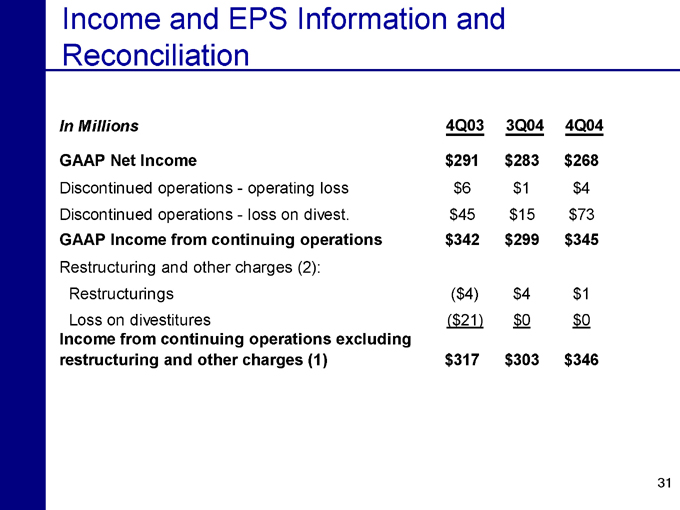

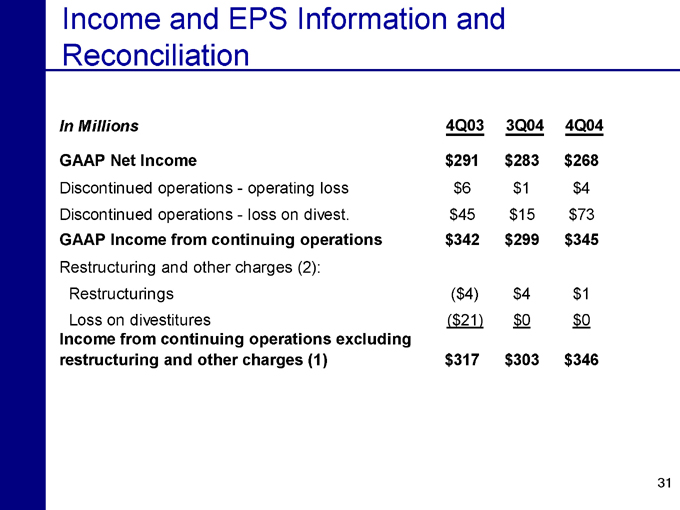

Income and EPS Information and Reconciliation

In Millions 4Q03 3Q04 4Q04

GAAP Net Income $291 $283 $268

Discontinued operations - operating loss $6 $1 $4

Discontinued operations - loss on divest. $45 $15 $73

GAAP Income from continuing operations $342 $299 $345

Restructuring and other charges (2):

Restructurings ($4) $4 $1

Loss on divestitures ($21) $0 $0

Income from continuing operations excluding

restructuring and other charges (1) $317 $303 $346

31

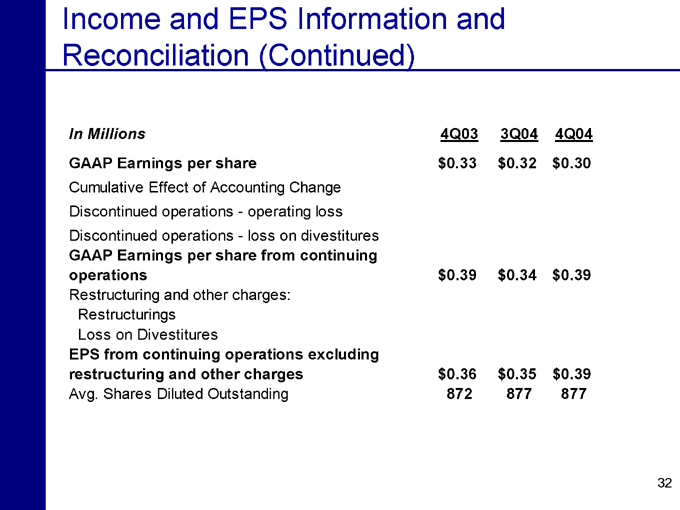

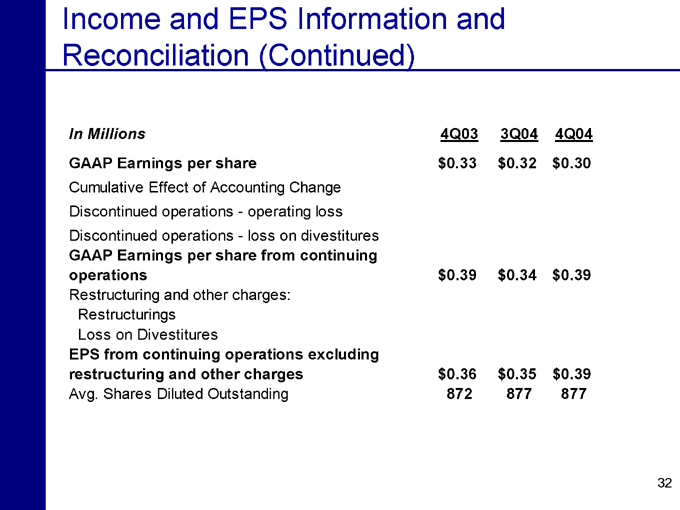

Income and EPS Information and Reconciliation (Continued)

In Millions 4Q03 3Q04 4Q04

GAAP Earnings per share $0.33 $0.32 $0.30

Cumulative Effect of Accounting Change

Discontinued operations - operating loss

Discontinued operations - loss on divestitures

GAAP Earnings per share from continuing

operations $0.39 $0.34 $0.39

Restructuring and other charges:

Restructurings

Loss on Divestitures

EPS from continuing operations excluding

restructuring and other charges $0.36 $0.35 $0.39

Avg. Shares Diluted Outstanding 872 877 877

32

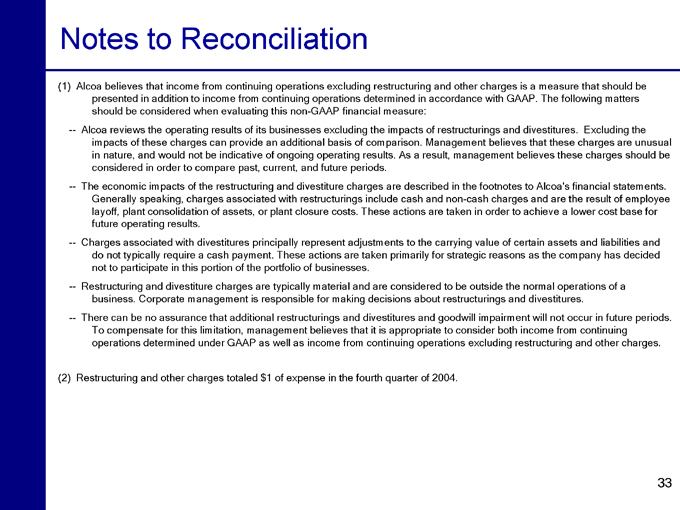

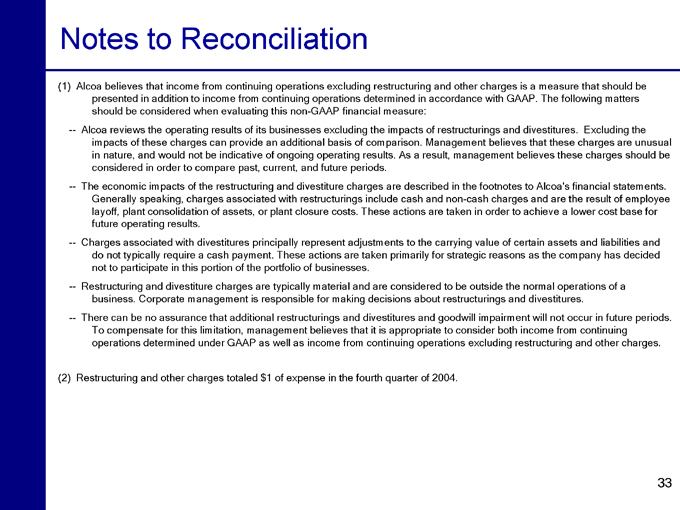

Notes to Reconciliation

(1) Alcoa believes that income from continuing operations excluding restructuring and other charges is a measure that should be presented in addition to income from continuing operations determined in accordance with GAAP. The following matters should be considered when evaluating this non-GAAP financial measure:

Alcoa reviews the operating results of its businesses excluding the impacts of restructurings and divestitures. Excluding the impacts of these charges can provide an additional basis of comparison. Management believes that these charges are unusual in nature, and would not be indicative of ongoing operating results. As a result, management believes these charges should be considered in order to compare past, current, and future periods.

The economic impacts of the restructuring and divestiture charges are described in the footnotes to Alcoa’s financial statements.

Generally speaking, charges associated with restructurings include cash and non-cash charges and are the result of employee layoff, plant consolidation of assets, or plant closure costs. These actions are taken in order to achieve a lower cost base for future operating results.

Charges associated with divestitures principally represent adjustments to the carrying value of certain assets and liabilities and do not typically require a cash payment. These actions are taken primarily for strategic reasons as the company has decided not to participate in this portion of the portfolio of businesses.

Restructuring and divestiture charges are typically material and are considered to be outside the normal operations of a business. Corporate management is responsible for making decisions about restructurings and divestitures.

There can be no assurance that additional restructurings and divestitures and goodwill impairment will not occur in future periods.

To compensate for this limitation, management believes that it is appropriate to consider both income from continuing operations determined under GAAP as well as income from continuing operations excluding restructuring and other charges.

(2) Restructuring and other charges totaled $1 of expense in the fourth quarter of 2004.

33

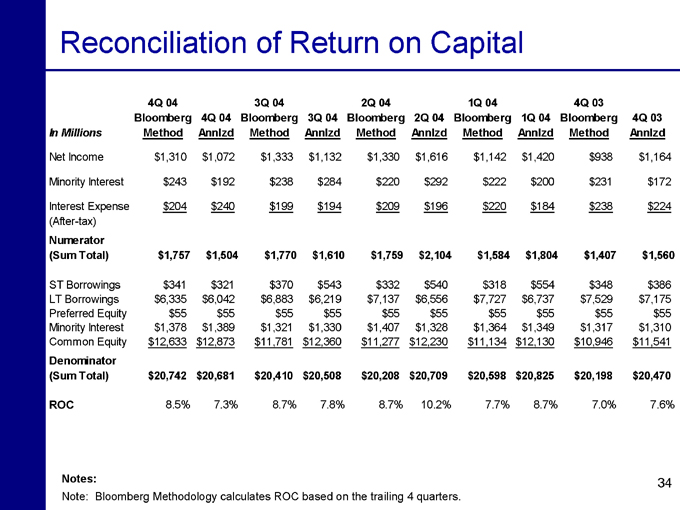

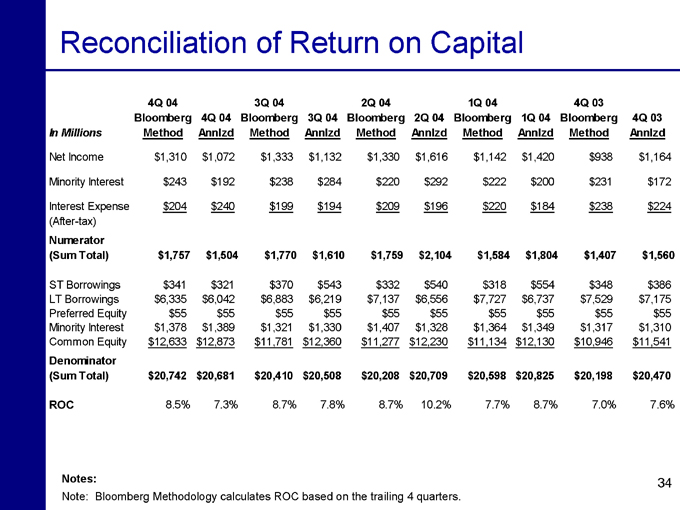

Reconciliation of Return on Capital

In Millions 4Q 04 Bloomberg Method 4Q 04 Annlzd 3Q 04 Bloomberg Method 3Q 04 Annlzd 2Q 04 Bloomberg Method 2Q 04 Annlzd 1Q 04 Bloomberg Method 1Q 04 Annlzd 4Q 03 Bloomberg Method 4Q 03 Annlzd

Net Income $1,310 $1,072 $1,333 $1,132 $1,330 $1,616 $1,142 $1,420 $938 $1,164

Minority Interest $243 $192 $238 $284 $220 $292 $222 $200 $231 $172

Interest Expense $204 $240 $199 $194 $209 $196 $220 $184 $238 $224

(After-tax)

Numerator

(Sum Total) $1,757 $1,504 $1,770 $1,610 $1,759 $2,104 $1,584 $1,804 $1,407 $1,560

ST Borrowings $341 $321 $370 $543 $332 $540 $318 $554 $348 $386

LT Borrowings $6,335 $6,042 $6,883 $6,219 $7,137 $6,556 $7,727 $6,737 $7,529 $7,175

Preferred Equity $55 $55 $55 $55 $55 $55 $55 $55 $55 $55

Minority Interest $1,378 $1,389 $1,321 $1,330 $1,407 $1,328 $1,364 $1,349 $1,317 $1,310

Common Equity $12,633 $12,873 $11,781 $12,360 $11,277 $12,230 $11,134 $12,130 $10,946 $11,541

Denominator

(Sum Total) $20,742 $20,681 $20,410 $20,508 $20,208 $20,709 $20,598 $20,825 $20,198 $20,470

ROC 8.5% 7.3% 8.7% 7.8% 8.7% 10.2% 7.7% 8.7% 7.0% 7.6%

Notes:

Note: Bloomberg Methodology calculates ROC based on the trailing 4 quarters.

34

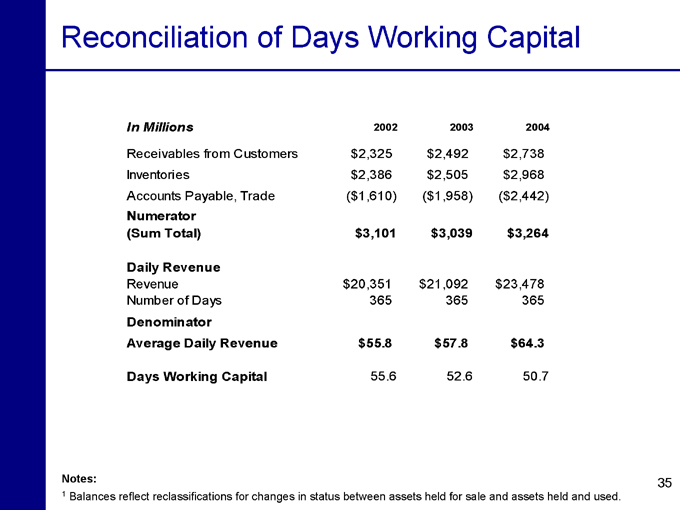

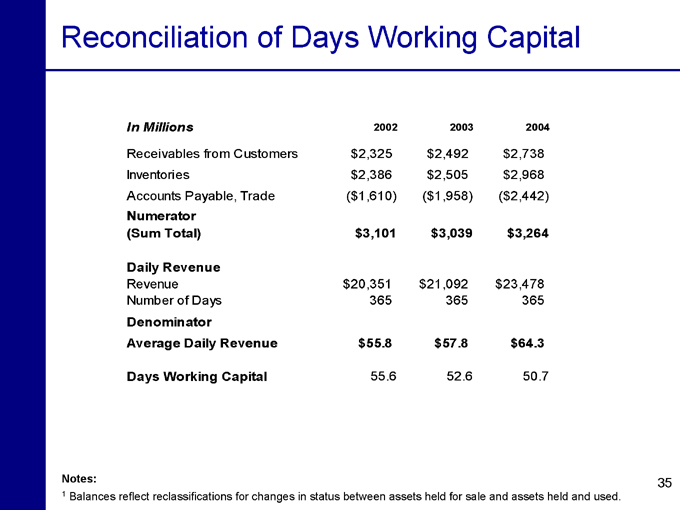

Reconciliation of Days Working Capital

2002 2003 2004

In Millions

Receivables from Customers $2,325 $2,492 $2,738

Inventories $2,386 $2,505 $2,968

Accounts Payable, Trade ($1,610) ($1,958) ($2,442)

Numerator

(Sum Total) $3,101 $3,039 $3,264

Daily Revenue

Revenue $20,351 $21,092 $23,478

Number of Days 365 365 365

Denominator

Average Daily Revenue $55.8 $57.8 $64.3

Days Working Capital 55.6 52.6 50.7

Notes:

1 Balances reflect reclassifications for changes in status between assets held for sale and assets held and used.

35