Exhibit 99.2

1st Quarter 2005 Analyst Conference

April 6, 2005

Forward-Looking Statements

Today’s discussion may include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements relate to future events and expectations and involve known and unknown risks and uncertainties. Alcoa’s actual results or actions may differ materially from those projected in the forward-looking statements. For a summary of the specific risk factors that could cause results to differ materially from those expressed in the forward-looking statements, please refer to Alcoa’s Form 10-K for the year ended December 31, 2004 filed with the Securities and Exchange Commission.

2

Richard B. Kelson

Executive Vice President Chief Financial Officer

1st Quarter Overview

Financial

Income from continuing operations of $0.31/share Income from continuing operations included $0.09/share for Russia integration, Elkem tax charge and restructuring charges Revenue up 4% sequentially to $6.3 billion Regained traction on cost savings initiative On a sequential basis, four of six segments achieved double-digit improvements in profitability Trailing 4 quarters ROC of 7.8%

4

1st Quarter Overview

Growth

Restarts at ABI, Wenatchee and Massena

Continued progress on projects in Australia, Brazil, China, Iceland, Jamaica, and Suriname Completed the acquisition of two Russian fabricating facilities Completed AFL Automotive & Telecommunications transaction Divested Integris and accepted tender offer for Elkem shares

Restructuring

Continued restructuring to streamline operations

5

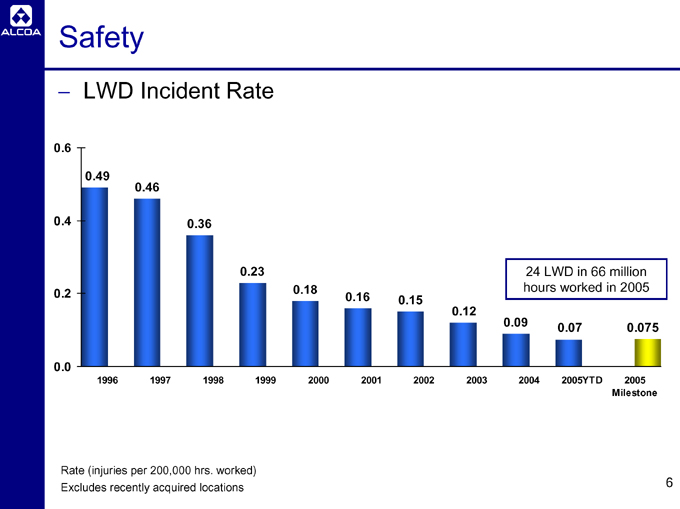

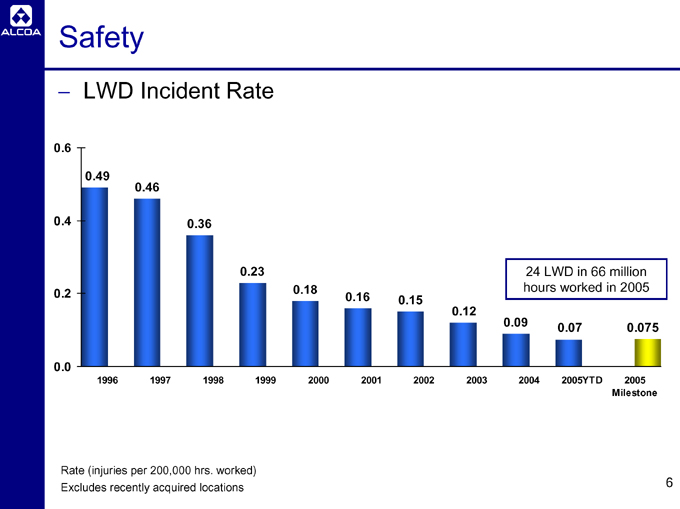

Safety

LWD Incident Rate

0.6 0.4 0.2 0.0

0.49

0.46

0.36

0.23

0.18

0.16

0.15

0.12

0.09

0.07

0.075

1996 1997 1998 1999 2000 2001 2002 2003 2004 2005YTD 2005 Milestone

24 LWD in 66 million hours worked in 2005

Rate (injuries per 200,000 hrs. worked) Excludes recently acquired locations

6

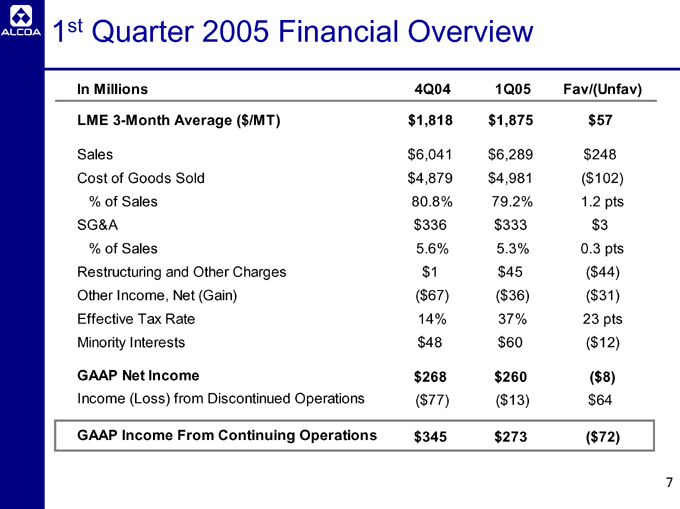

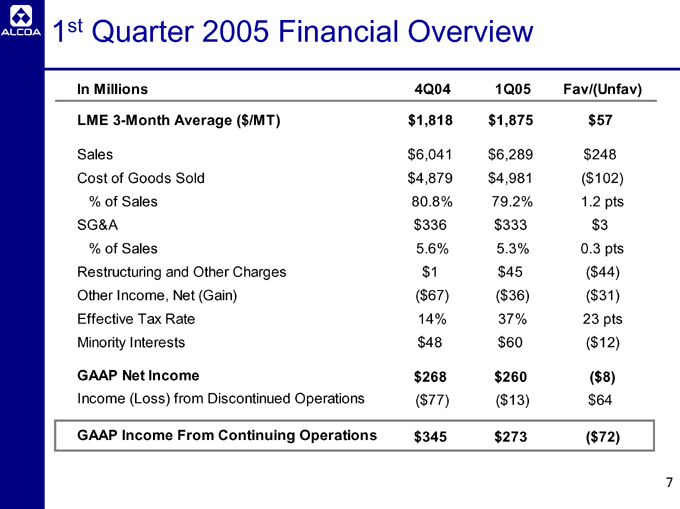

1st Quarter 2005 Financial Overview

In Millions 4Q04 1Q05 Fav/(Unfav)

LME 3-Month Average ($/MT) $1,818 $1,875 $57

Sales $6,041 $6,289 $248

Cost of Goods Sold $4,879 $4,981 ($102)

% of Sales 80.8% 79.2% 1.2 pts

SG&A $336 $ 333 $3

% of Sales 5.6% 5.3% 0.3 pts

Restructuring and Other Charges $1 $ 45 ($44)

Other Income, Net (Gain) ($67) ($ 36) ($31)

Effective Tax Rate 14% 37% 23 pts

Minority Interests $48 $60 ($12)

GAAP Net Income $268 $260 ($8)

Income (Loss) from Discontinued Operations ($77) ($13) $64

GAAP Income From Continuing Operations $345 $273 ($72)

7

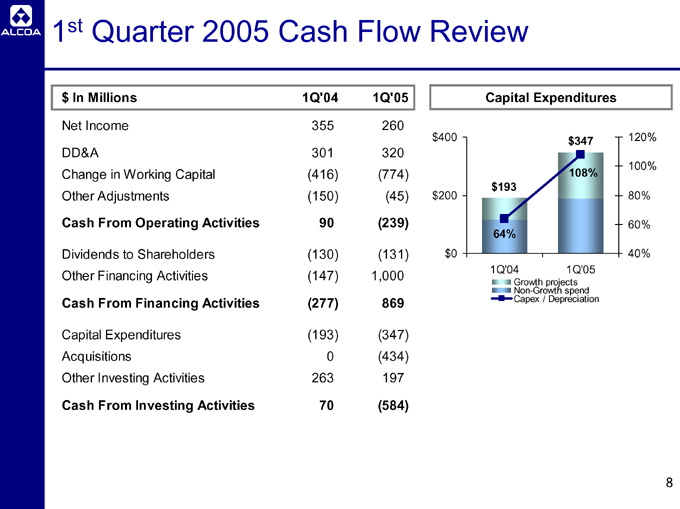

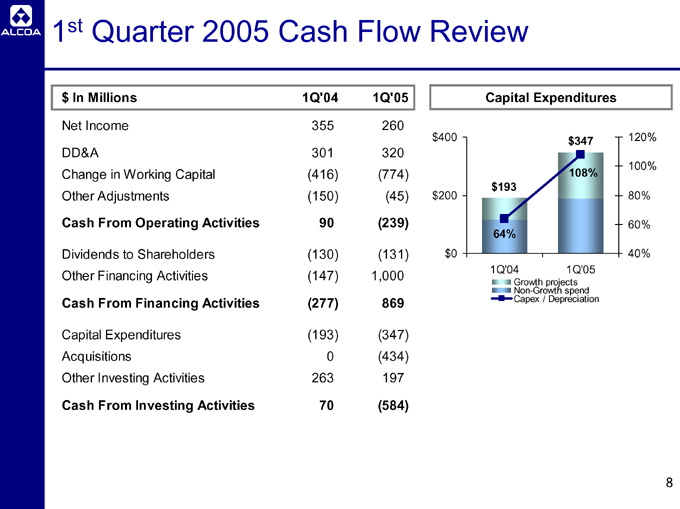

1st Quarter 2005 Cash Flow Review

$ In Millions 1Q’04 1Q’05

Net Income 355 260

DD&A 301 320

Change in Working Capital (416) (774)

Other Adjustments (150) (45)

Cash From Operating Activities 90 (239)

Dividends to Shareholders (130) (131)

Other Financing Activities (147) 1,000

Cash From Financing Activities (277) 869

Capital Expenditures (193) (347)

Acquisitions 0 (434)

Other Investing Activities 263 197

Cash From Investing Activities 70 (584)

Capital Expenditures $400 $200 $0

120% 100% 80% 60% 40% $193 $347 64% 108%

1Q’04 1Q’05

Growth projects Non-Growth spend Capex / Depreciation

8

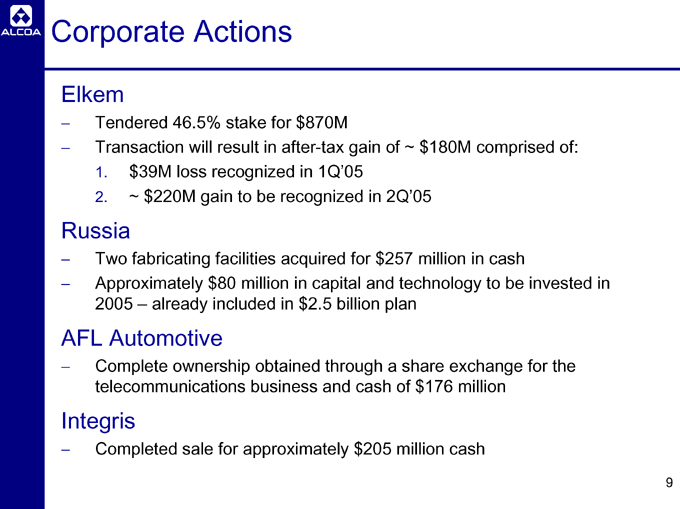

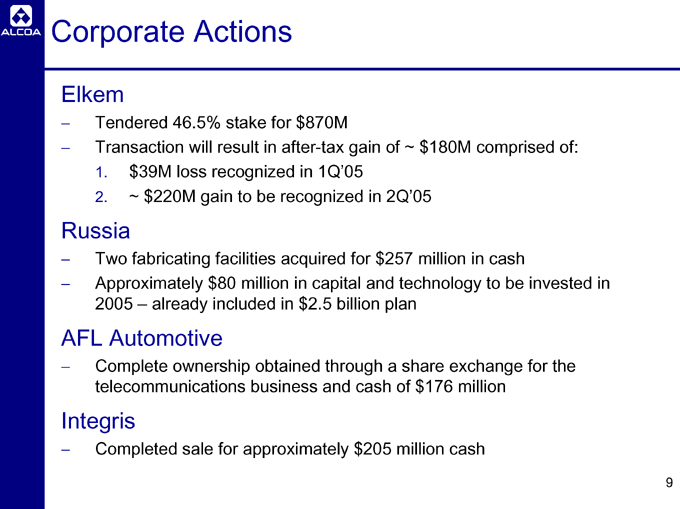

Corporate Actions

Elkem

Tendered 46.5% stake for $870M

Transaction will result in after-tax gain of ~ $180M comprised of:

1. $39M loss recognized in 1Q’05

2. ~ $220M gain to be recognized in 2Q’05

Russia

Two fabricating facilities acquired for $257 million in cash

Approximately $80 million in capital and technology to be invested in 2005 – already included in $2.5 billion plan

AFL Automotive

Complete ownership obtained through a share exchange for the telecommunications business and cash of $176 million

Integris

Completed sale for approximately $205 million cash

9

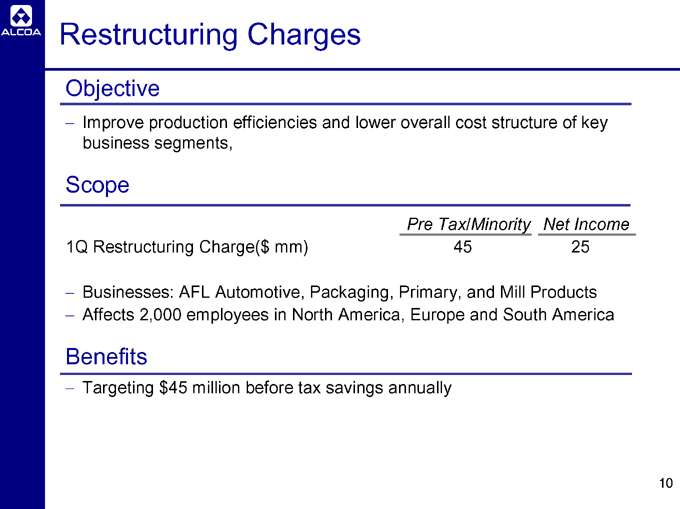

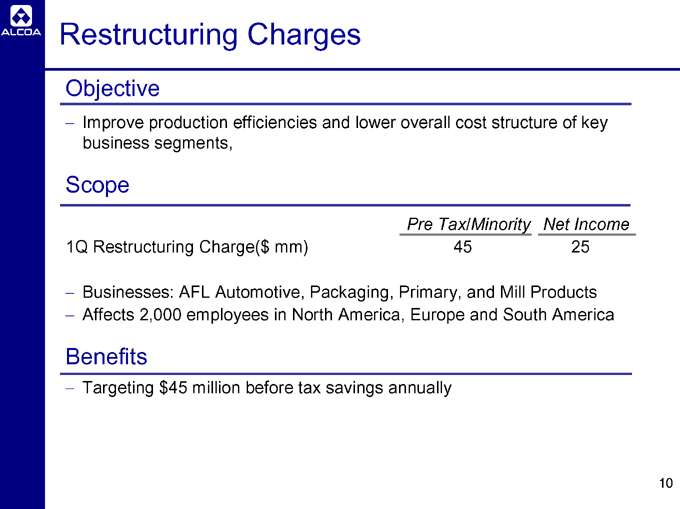

Restructuring Charges

Objective

Improve production efficiencies and lower overall cost structure of key business segments,

Scope

Pre Tax/Minority Net Income

1Q Restructuring Charge($ mm) 45 25

Businesses: AFL Automotive, Packaging, Primary, and Mill Products Affects 2,000 employees in North America, Europe and South America

Benefits

Targeting $45 million before tax savings annually

10

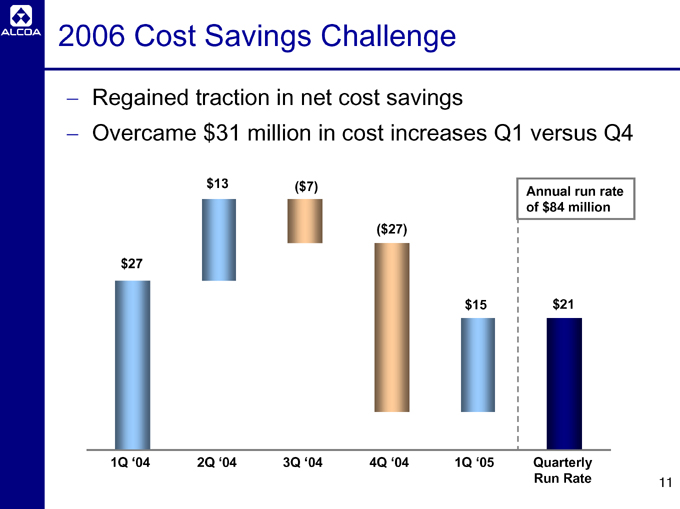

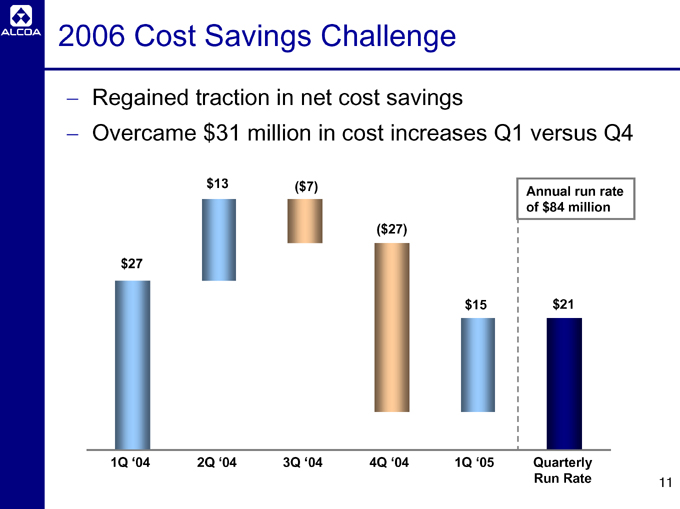

2006 Cost Savings Challenge

Regained traction in net cost savings

Overcame $31 million in cost increases Q1 versus Q4 $27 $13

($7)

($27) $15 $21

Annual run rate of $84 million

1Q ‘04 2Q ‘04 3Q ‘04 4Q ‘04 1Q ‘05 Quarterly Run Rate

11

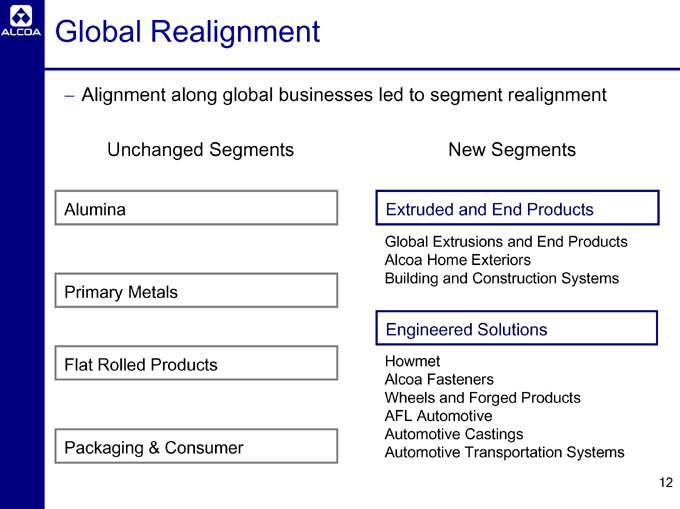

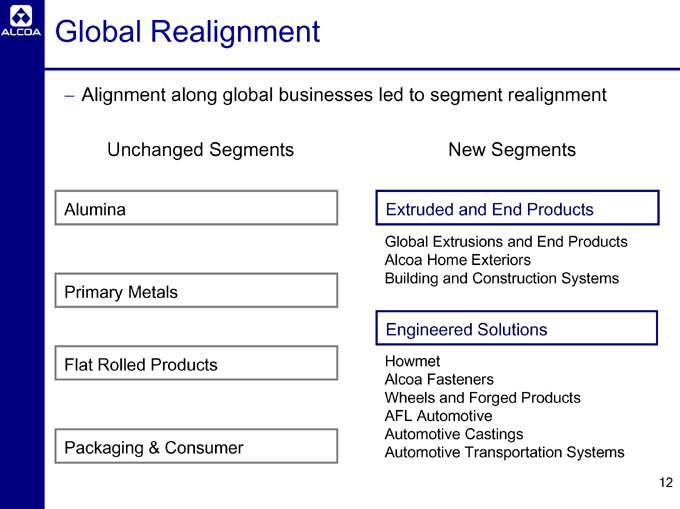

Global Realignment

Alignment along global businesses led to segment realignment

Unchanged Segments

Alumina Primary Metals Flat Rolled Products Packaging & Consumer

New Segments

Extruded and End Products

Global Extrusions and End Products Alcoa Home Exteriors Building and Construction Systems

Engineered Solutions

Howmet Alcoa Fasteners

Wheels and Forged Products AFL Automotive Automotive Castings Automotive Transportation Systems

12

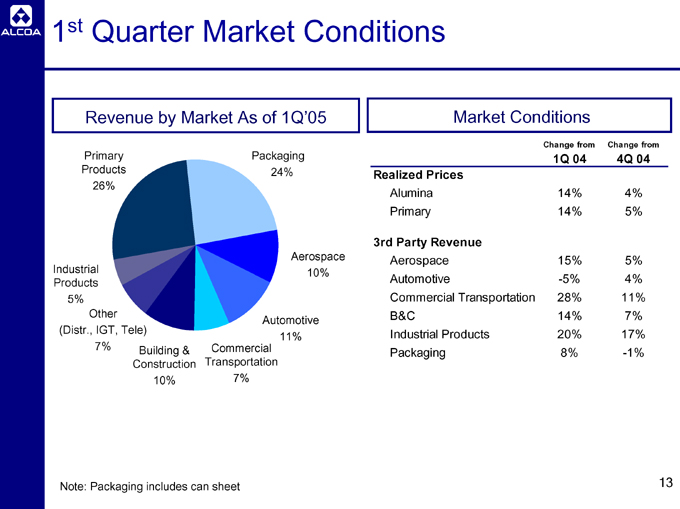

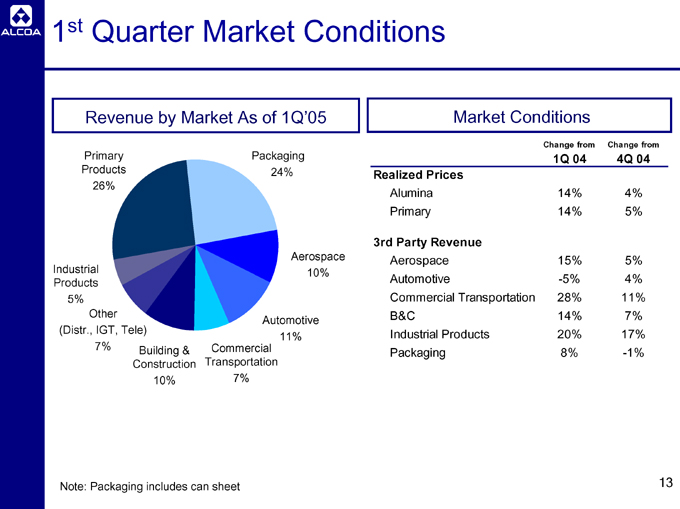

1st Quarter Market Conditions

Revenue by Market As of 1Q’05

Primary Products 26%

Industrial Products 5%

Other (Distr., IGT, Tele) 7%

Commercial Transportation 7%

Automotive 11%

Aerospace 10%

Packaging 24%

Market Conditions

Building & Construction 10%

Change from 1Q 04 Change from 4Q 04

Realized Prices

Alumina 14% 4%

Primary 14% 5%

3rd Party Revenue

Aerospace 15% 5%

Automotive -5% 4%

Commercial Transportation 28% 11%

B&C 14% 7%

Industrial Products 20% 17%

Packaging 8% -1%

Note: Packaging includes can sheet

13

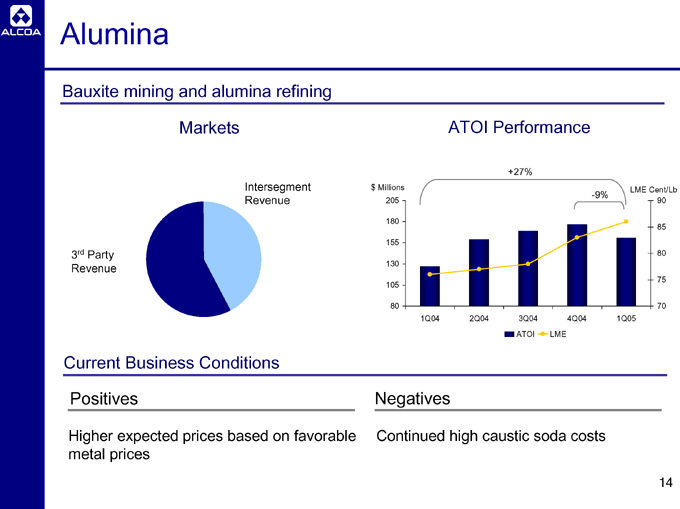

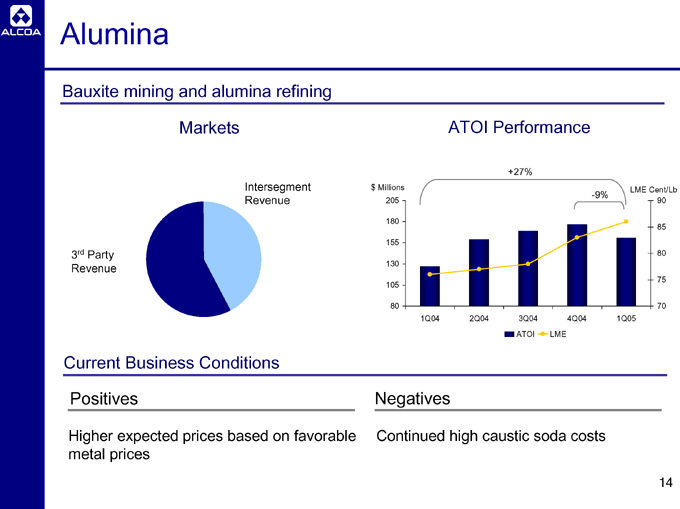

Alumina

Bauxite mining and alumina refining

Markets

3rd Party Revenue

Intersegment Revenue

Current Business Conditions

ATOI Performance $ Millions 205

180 155 130 105 80

+27%

-9%

LME Cent/Lb

90 85 80 75 70

1Q04 2Q04 3Q04 4Q04 1Q05 ATOI LME

Positives

Higher expected prices based on favorable metal prices

Negatives

Continued high caustic soda costs

14

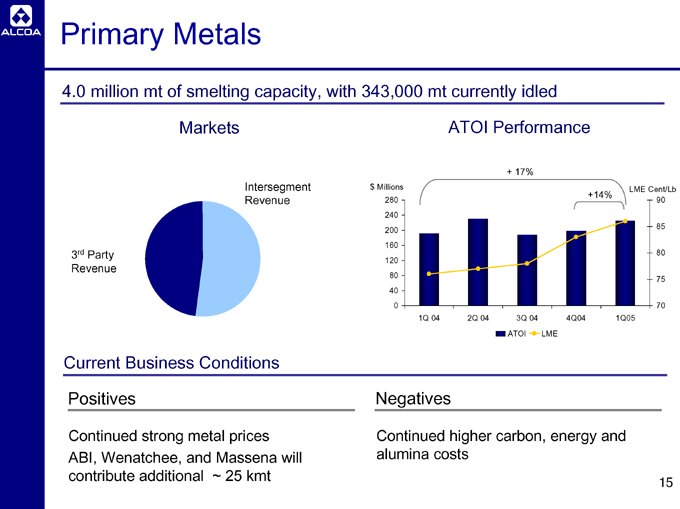

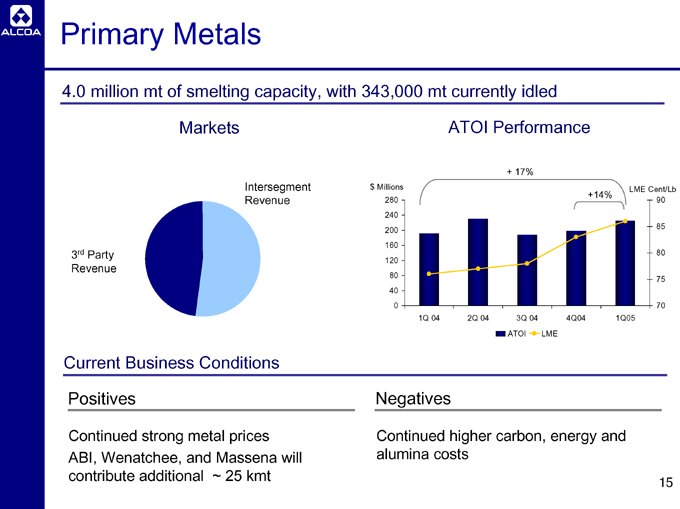

Primary Metals

4.0 million mt of smelting capacity, with 343,000 mt currently idled

Markets

3rd Party Revenue

Intersegment Revenue

ATOI Performance $ Millions 280 240 200 160 120 80 40 0

+ 17%

+14%

LME Cent/Lb

90 85 80 75 70

1Q 04 2Q 04 3Q 04 4Q04 1Q05 ATOI LME

Current Business Conditions

Positives

Continued strong metal prices ABI, Wenatchee, and Massena will contribute additional ~ 25 kmt

Negatives

Continued higher carbon, energy and alumina costs

15

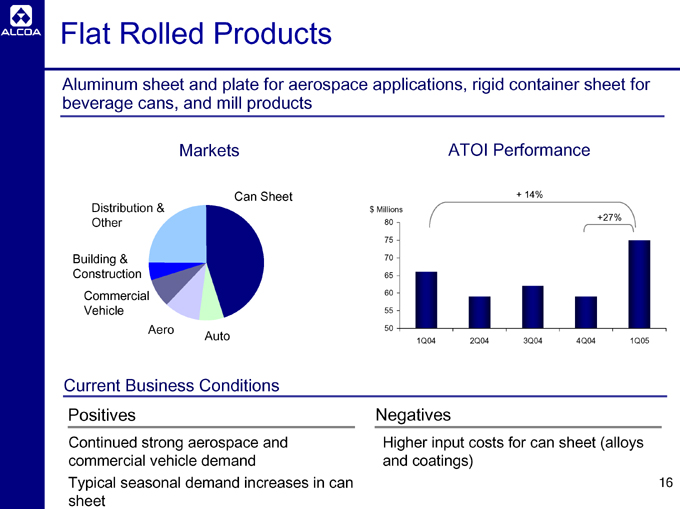

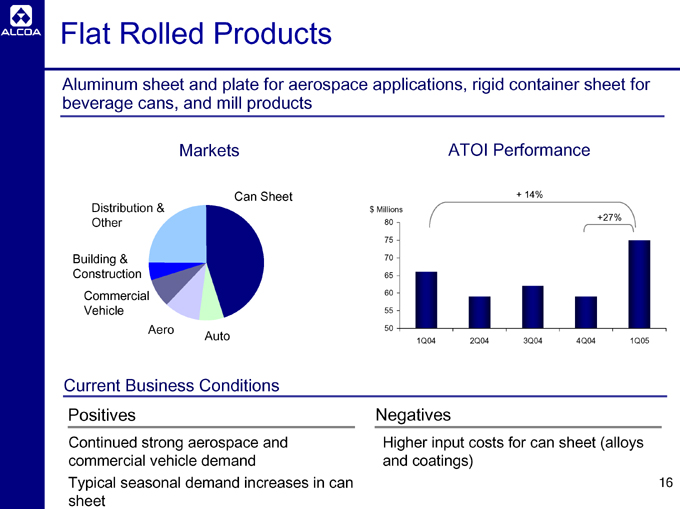

Flat Rolled Products

Aluminum sheet and plate for aerospace applications, rigid container sheet for beverage cans, and mill products

Markets

Distribution & Other

Building & Construction

Commercial Vehicle

Aero

Auto

Can Sheet

ATOI Performance $ Millions 80

75 70 65 60 55 50

+ 14%

+27%

1Q04 2Q04 3Q04 4Q04 1Q05

Current Business Conditions

Positives

Continued strong aerospace and commercial vehicle demand

Typical seasonal demand increases in can sheet

Negatives

Higher input costs for can sheet (alloys and coatings)

16

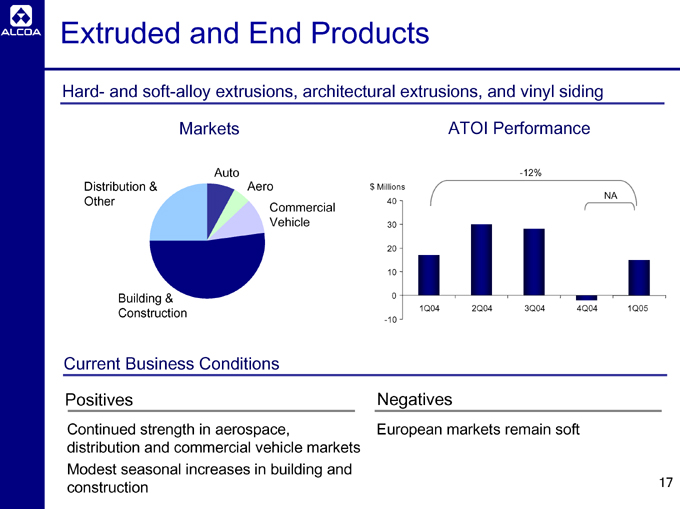

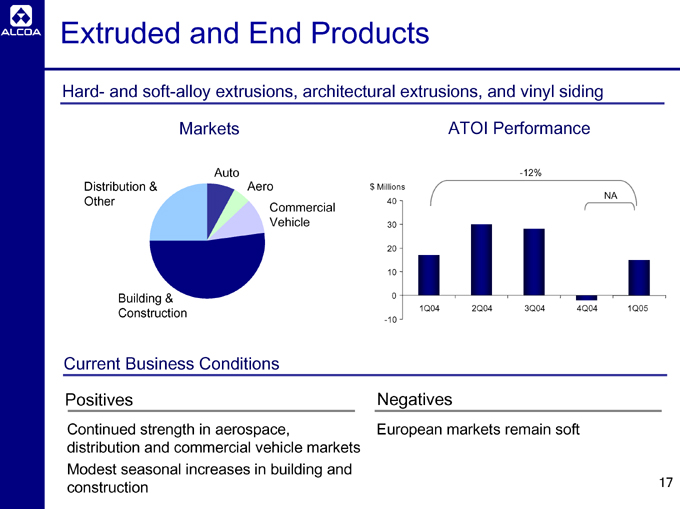

Extruded and End Products

Hard- and soft-alloy extrusions, architectural extrusions, and vinyl siding

Markets

Distribution & Other

Building & Construction

Auto

Aero

Commercial Vehicle

ATOI Performance $ Millions 40

30 20 10 0 -10

-12%

NA

1Q04 2Q04 3Q04 4Q04 1Q05

Current Business Conditions

Positives

Continued strength in aerospace, distribution and commercial vehicle markets Modest seasonal increases in building and construction

Negatives

European markets remain soft

17

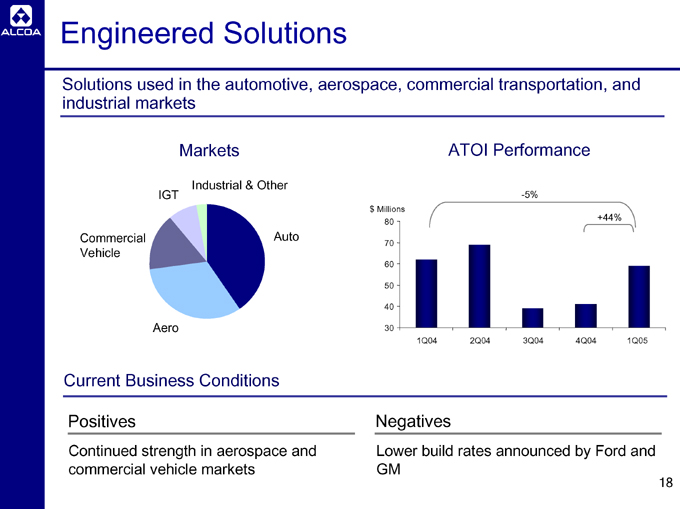

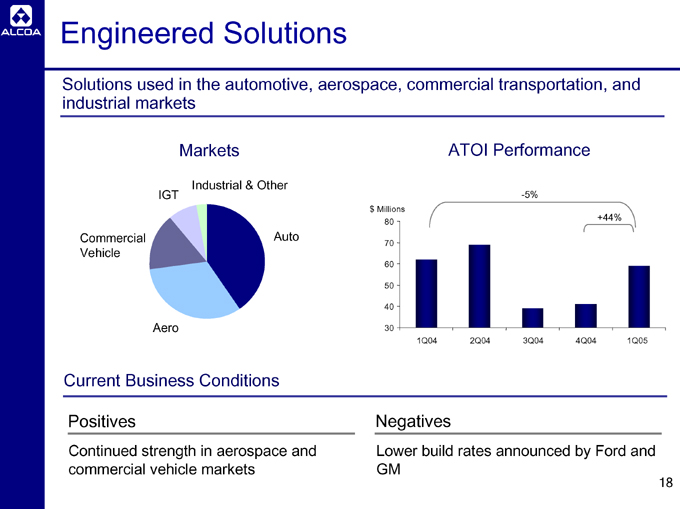

Engineered Solutions

Solutions used in the automotive, aerospace, commercial transportation, and industrial markets

Markets

IGT

Commercial Vehicle

Aero

Industrial & Other

Auto

ATOI Performance $ Millions 80

70 60 50 40 30

-5%

+44%

1Q04 2Q04 3Q04 4Q04 1Q05

Current Business Conditions

Positives

Continued strength in aerospace and commercial vehicle markets

Negatives

Lower build rates announced by Ford and GM

18

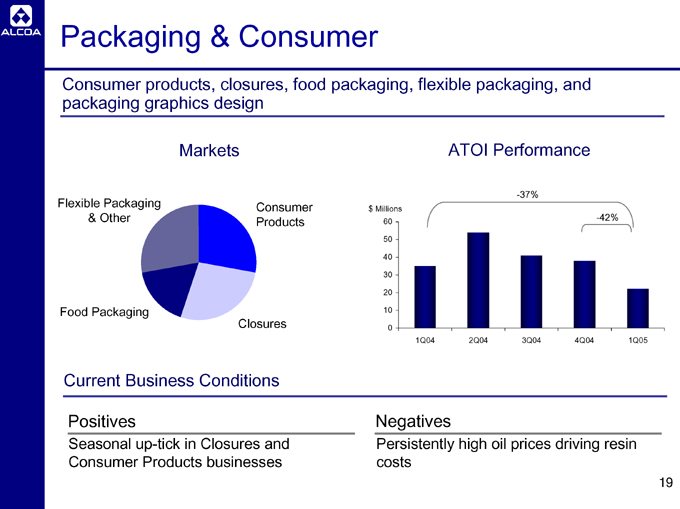

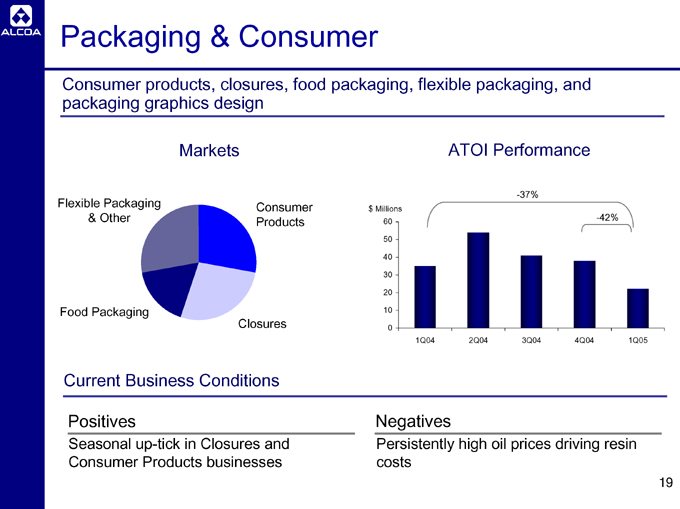

Packaging & Consumer

Consumer products, closures, food packaging, flexible packaging, and packaging graphics design

Markets

Flexible Packaging & Other

Food Packaging

Consumer Products

Closures

ATOI Performance $ Millions

60 50 40 30 20 10 0

-37%

-42%

1Q04 2Q04 3Q04 4Q04 1Q05

Current Business Conditions

Positives

Seasonal up-tick in Closures and Consumer Products businesses

Negatives

Persistently high oil prices driving resin costs

19

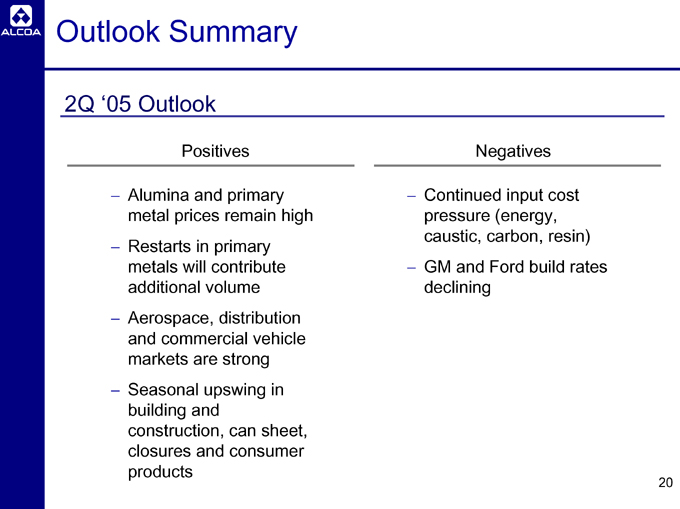

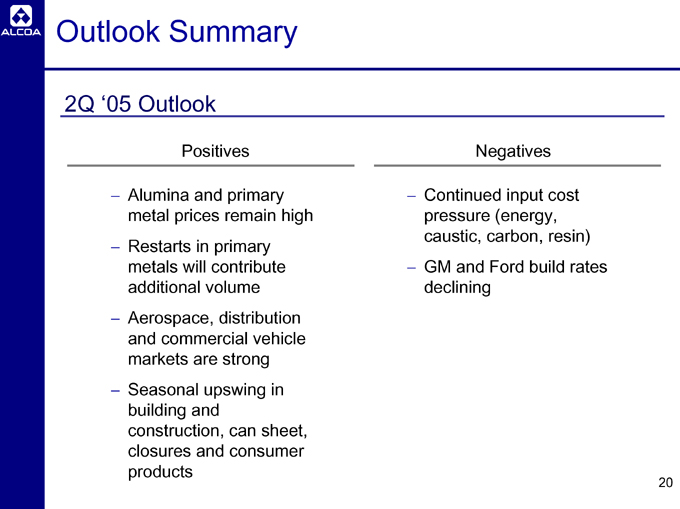

Outlook Summary

2Q ‘05 Outlook

Positives

Alumina and primary metal prices remain high Restarts in primary metals will contribute additional volume Aerospace, distribution and commercial vehicle markets are strong Seasonal upswing in building and construction, can sheet, closures and consumer products

Negatives

Continued input cost pressure (energy, caustic, carbon, resin) GM and Ford build rates declining

20

Bernt Reitan

Executive Vice President – Alcoa Group President, Primary Products

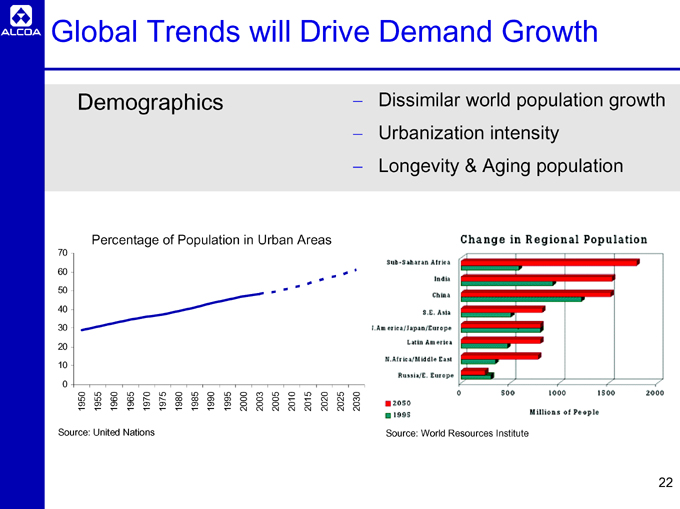

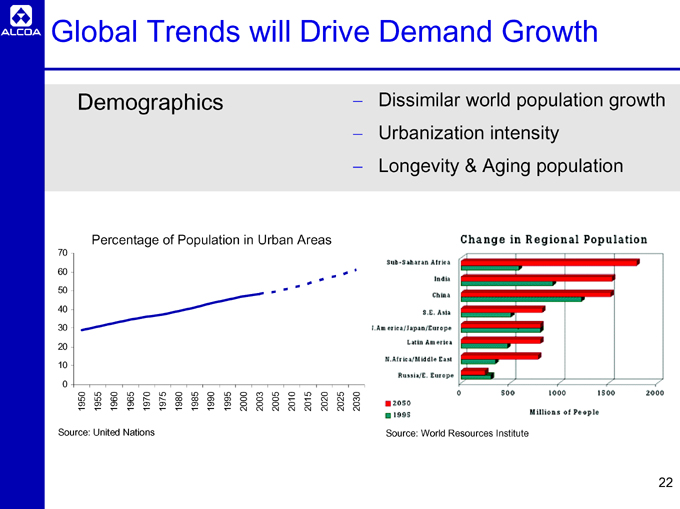

Global Trends will Drive Demand Growth

Demographics

Dissimilar world population growth Urbanization intensity Longevity & Aging population

Percentage of Population in Urban Areas

70

60 50

40 30

20 10

0

1950 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2003 2005 2010 2015 2020 2025 2030

Source: United Nations

Source: World Resources Institute

22

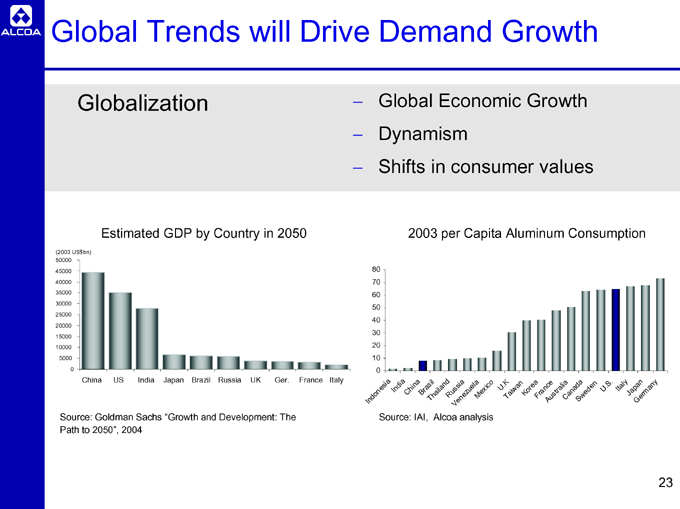

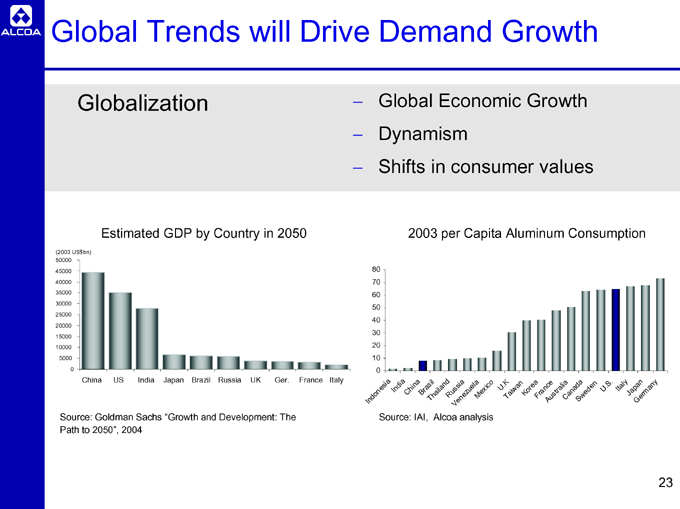

Global Trends will Drive Demand Growth

Globalization

Global Economic Growth Dynamism Shifts in consumer values

Estimated GDP by Country in 2050

(2003 US$bn)

50000 45000 40000 35000 30000 25000 20000 15000 10000 5000 0

China US India Japan Brazil Russia UK Ger. France Italy

Source: Goldman Sachs “Growth and Development: The Path to 2050”, 2004

2003 per Capita Aluminum Consumption

80 70 60 50 40 30 20 10 0

Indonesia India

China Brasil Thailand Russia Venezuela Mexico U.K Taiwan Korea France Australia Canada Sweden U.S. Italy Japan Germany

Source: IAI, Alcoa analysis

23

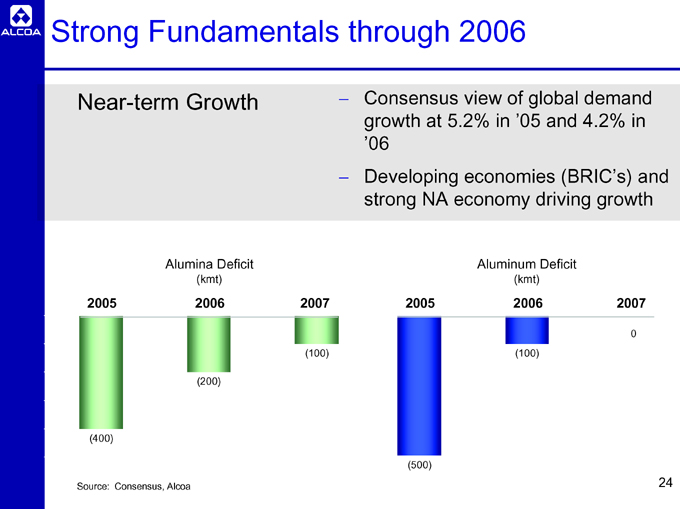

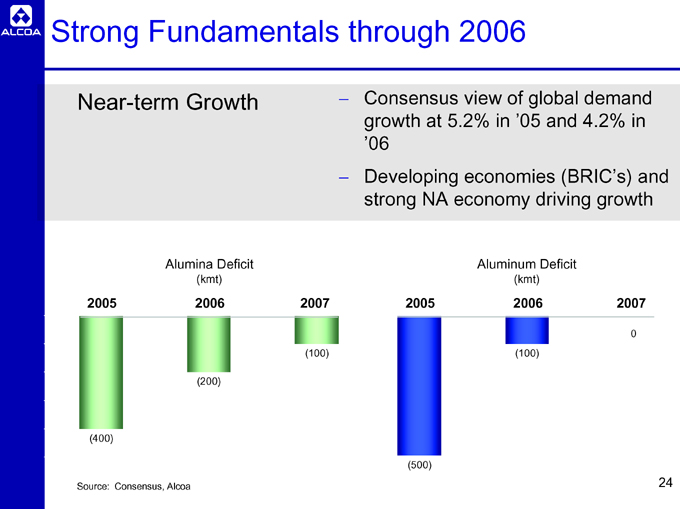

Strong Fundamentals through 2006

Near-term Growth

Consensus view of global demand growth at 5.2% in ‘05 and 4.2% in ‘06 Developing economies (BRIC’s) and strong NA economy driving growth

2005

Alumina Deficit

(kmt)

2006

2007

2005

Aluminum Deficit

(kmt)

2006

2007

(400)

(200)

(100)

(500)

(100)

0

Source: Consensus, Alcoa

24

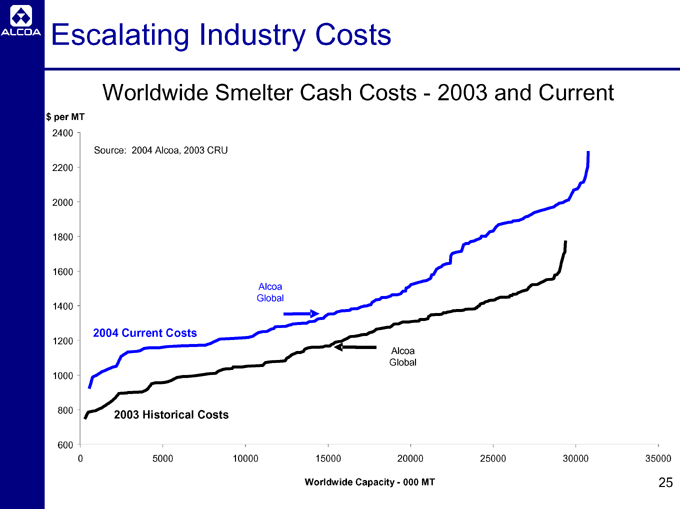

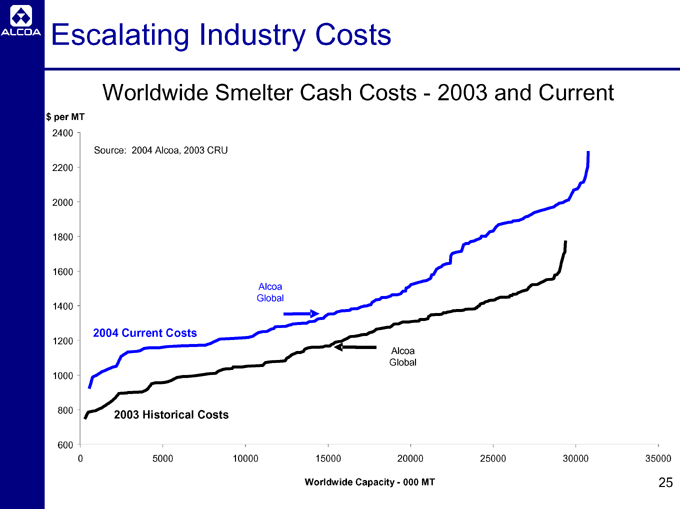

Escalating Industry Costs

Worldwide Smelter Cash Costs - 2003 and Current $ per MT

2400 2200 2000 1800 1600 1400 1200 1000 800 600

0 5000 10000 15000 20000 25000 30000 35000

Source: 2004 Alcoa, 2003 CRU

2004 Current Costs

Alcoa Global

Alcoa Global

2003 Historical Costs

Worldwide Capacity - 000 MT

25

Managing the System

Alumina Production Improvement

Indexed to 2001

1.0 1.07 1.13 1.17

2001 2002 2003 2004

Alumina Productivity Improvement

Indexed to 2001

1.0 1.14 1.22 1.34

2001 2002 2003 2004

Smelting Production Improvement

Indexed to 2001 -Continuously operating smelters

1.0

1.03

1.06

1.08

2001 2002 2003 2004

Smelting Productivity Improvement

Indexed to 2001

1.0

1.05

1.16

1.19

2001 2002 2003 2004

26

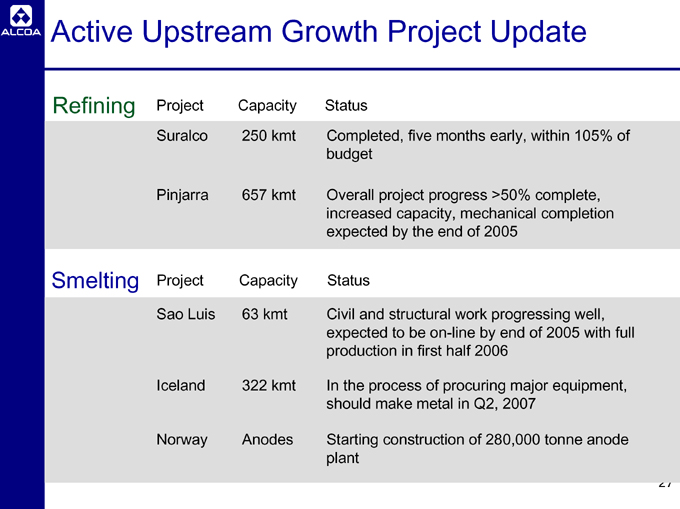

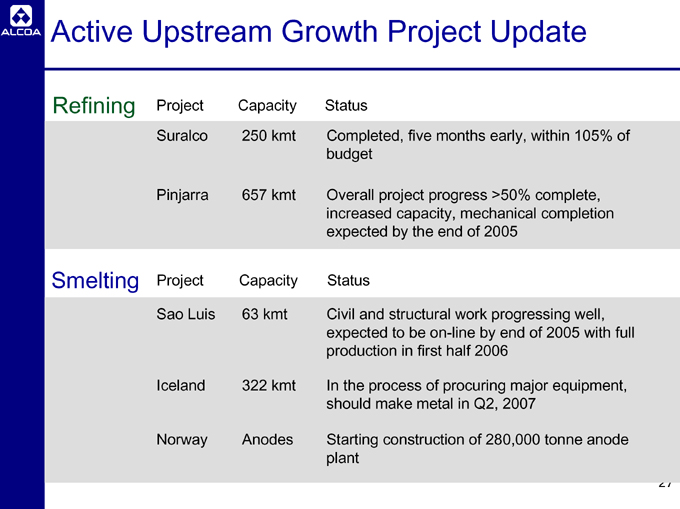

Active Upstream Growth Project Update

Refining Project Capacity Status

Suralco 250 kmt Completed, five months early, within 105% of budget

Pinjarra 657 kmt Overall project progress >50% complete, increased capacity, mechanical completion expected by the end of 2005

Smelting Project Capacity Status

Sao Luis 63 kmt Civil and structural work progressing well, expected to be on-line by end of 2005 with full production in first half 2006

Iceland 322 kmt In the process of procuring major equipment, should make metal in Q2, 2007

Norway Anodes Starting construction of 280,000 tonne anode plant

27

Alcoa’s Upstream Opportunity

Strong underlying growth dynamics Current strong market fundamentals

Our Focus

Safety and environmental compliance Operational excellence through ABS Creep Productivity improvements Cost control

Enhanced revenue through value added products Value creating growth opportunities

28

For Additional Information, contact:

William F. Oplinger Director, Investor Relations

Alcoa

390 Park Avenue

New York, N.Y. 10022-4608 Telephone: (212) 836-2674 Facsimile: (212) 836-2813 www.alcoa.com

29

Appendix

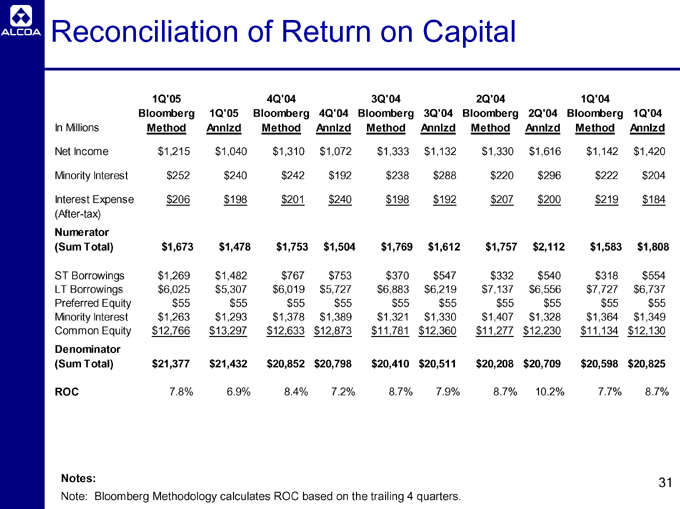

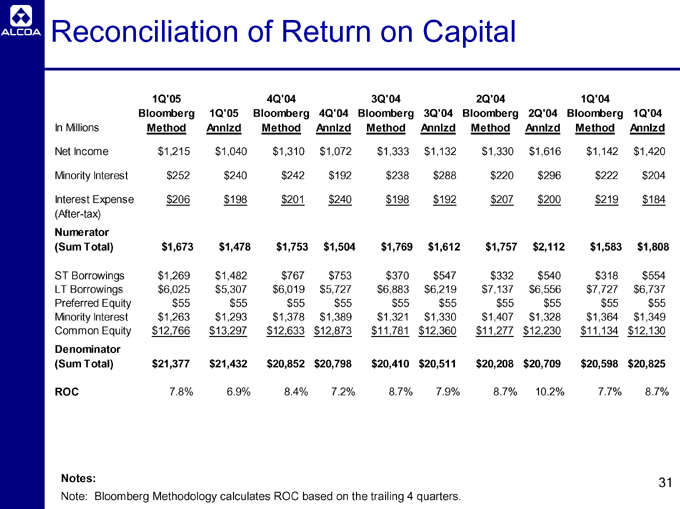

Reconciliation of Return on Capital

In Millions 1Q’05 Bloomberg Method 1Q’05 Annlzd 4Q’04 Bloomberg Method 4Q’04 Annlzd 3Q’04 Bloomberg Method 3Q’04 Annlzd 2Q’04 Bloomberg Method 2Q’04 Annlzd 1Q’04 Bloomberg Method 1Q’04 Annlzd

Net Income $1,215 $1,040 $1,310 $1,072 $1,333 $1,132 $1,330 $1,616 $1,142 $1,420

Minority Interest $252 $240 $242 $192 $238 $288 $220 $296 $222 $204

Interest Expense $206 $198 $201 $240 $198 $192 $207 $200 $219 $184

(After-tax)

Numerator

(Sum Total) $1,673 $1,478 $1,753 $1,504 $1,769 $1,612 $1,757 $2,112 $1,583 $1,808

ST Borrowings $1,269 $1,482 $767 $753 $370 $547 $332 $540 $318 $554

LT Borrowings $6,025 $5,307 $6,019 $5,727 $6,883 $6,219 $7,137 $6,556 $7,727 $6,737

Preferred Equity $55 $55 $55 $55 $55 $55 $55 $55 $55 $55

Minority Interest $1,263 $1,293 $1,378 $1,389 $1,321 $1,330 $1,407 $1,328 $1,364 $1,349

Common Equity $12,766 $13,297 $12,633 $12,873 $11,781 $12,360 $11,277 $12,230 $11,134 $12,130

Denominator

(Sum Total) $21,377 $21,432 $20,852 $20,798 $20,410 $20,511 $20,208 $20,709 $20,598 $20,825

ROC 7.8% 6.9% 8.4% 7.2% 8.7% 7.9% 8.7% 10.2% 7.7% 8.7%

Notes:

Note: Bloomberg Methodology calculates ROC based on the trailing 4 quarters.

31