Exhibit 99.2

Merrill Lynch Global Metals, Mining and Steel Conference

Richard B. Kelson

Executive Vice President, Chief Financial Officer

May 10, 2005

Forward-Looking Statements

Today’s discussion may include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements relate to future events and expectations and involve known and unknown risks and uncertainties. Alcoa’s actual results or actions may differ materially from those projected in the forward-looking statements. For a summary of the specific risk factors that could cause results to differ materially from those expressed in the forward-looking statements, please refer to Alcoa’s Form 10-K for the year ended December 31, 2004 and Form 10-Q for the quarter ended March 31, 2005 filed with the Securities and Exchange Commission.

2

The Alcoa Investment Opportunity

Values driven organization

Broad market and geographic presence Commitment to operational excellence through the application of ABS

Unmatched growth opportunities Significant upside potential

3

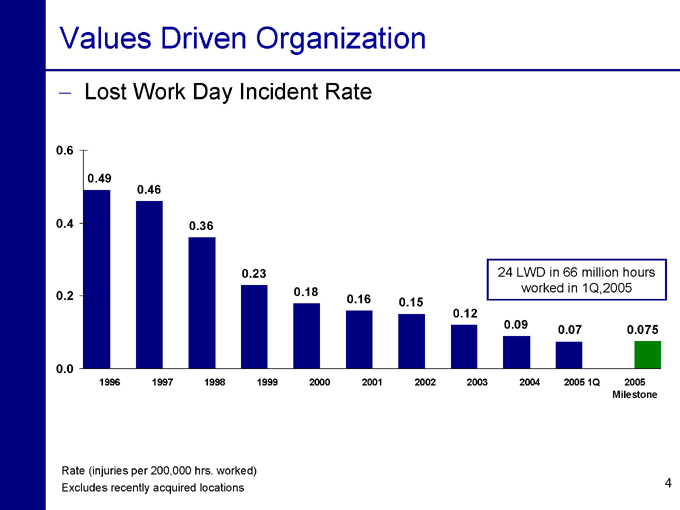

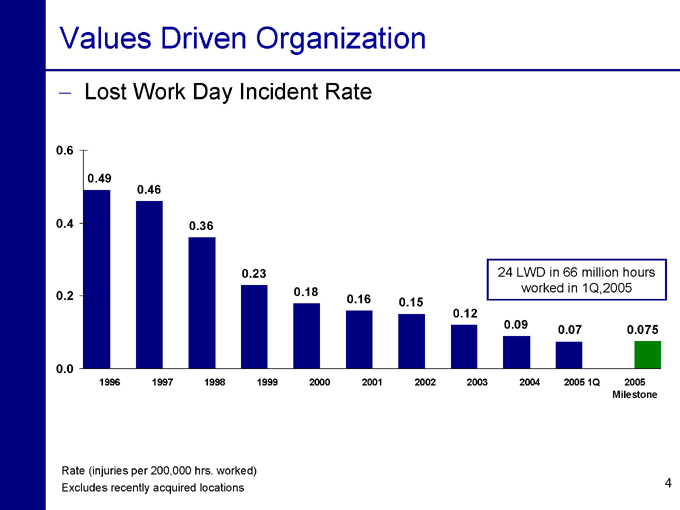

Values Driven Organization

Lost Work Day Incident Rate

0.6

0.4

0.2

0.0

24 LWD in 66 million hours worked in 1Q,2005

0.49

0.46

0.36

0.23

0.18

0.16

0.15

0.12

0.09

0.07

0.075

1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 1Q 2005 Milestone

Rate (injuries per 200,000 hrs. worked) Excludes recently acquired locations

4

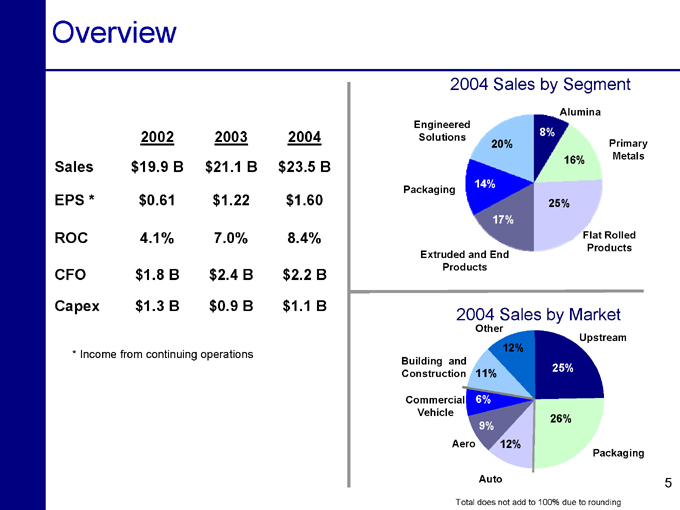

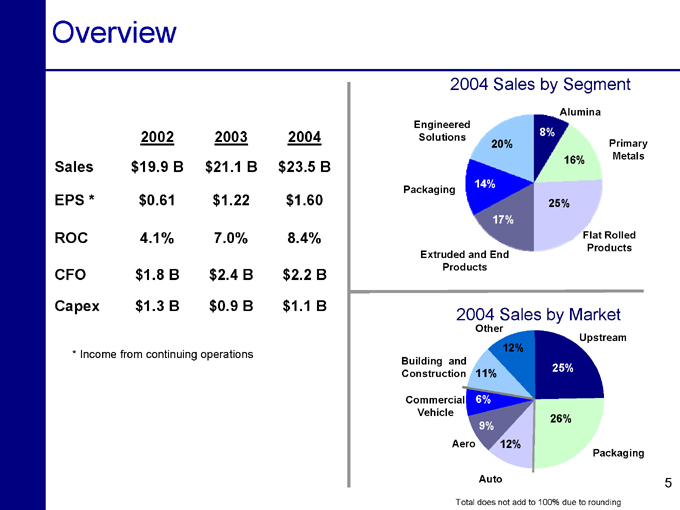

Overview

2002 2003 2004

Sales $19.9 B $21.1 B $23.5 B

EPS * $0.61 $1.22 $1.60

ROC 4.1% 7.0% 8.4%

CFO $1.8 B $2.4 B $2.2 B

Capex $1.3 B $0.9 B $1.1 B

* Income from continuing operations

2004 Sales by Segment

Engineered Solutions

20%

Packaging

14%

Extruded and End Products

17%

Flat Rolled Products

25%

Primary Metals

16%

Alumina

8%

2004 Sales by Market

Other

12%

Building and Construction

11%

Commercial Vehicle

6%

Aero

9%

Auto

12%

Packaging

26%

Upstream

25%

Total does not add to 100% due to rounding

5

Broad Geographic Presence

450 Locations 131,000 Employees

2004 Sales by Geography

Pacific

Europe

ROW

US

61%

22%

11%

6%

6

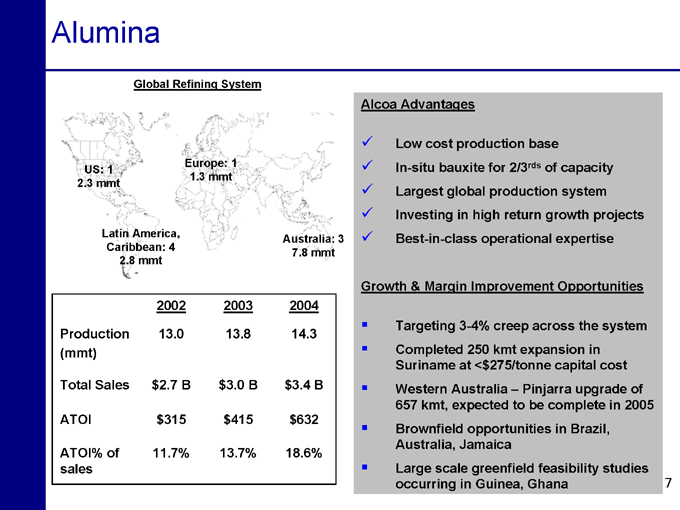

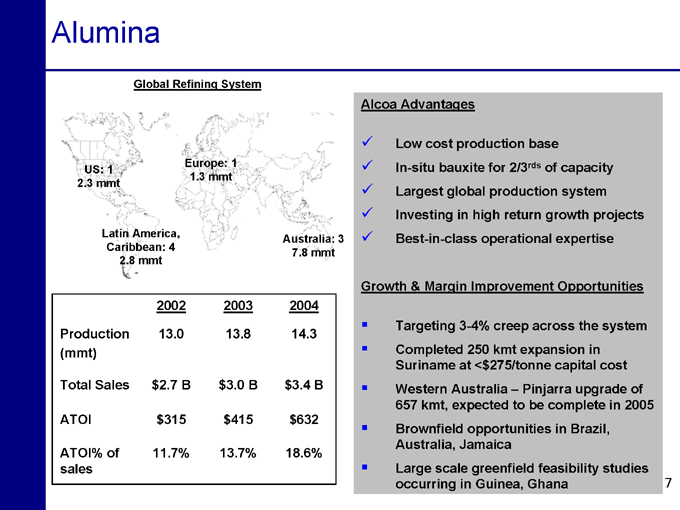

Alumina

Global Refining System

US: 1 2.3 mmt

Europe: 1 1.3 mmt

Latin America, Caribbean: 4 2.8 mmt

Australia: 3 7.8 mmt

Alcoa Advantages

Low cost production base

In-situ bauxite for 2/3rds of capacity Largest global production system Investing in high return growth projects Best-in-class operational expertise

Growth & Margin Improvement Opportunities

Targeting 3-4% creep across the system Completed 250 kmt expansion in Suriname at <$275/tonne capital cost Western Australia – Pinjarra upgrade of 657 kmt, expected to be complete in 2005 Brownfield opportunities in Brazil, Australia, Jamaica Large scale greenfield feasibility studies occurring in Guinea, Ghana

2002 2003 2004

Production 13.0 13.8 14.3

(mmt)

Total Sales $2.7 B $3.0 B $3.4 B

ATOI $315 $415 $632

ATOI% of 11.7% 13.7% 18.6%

sales

7

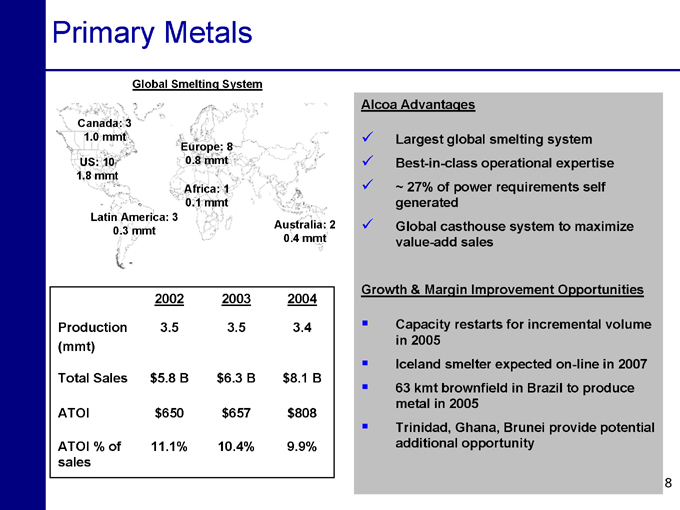

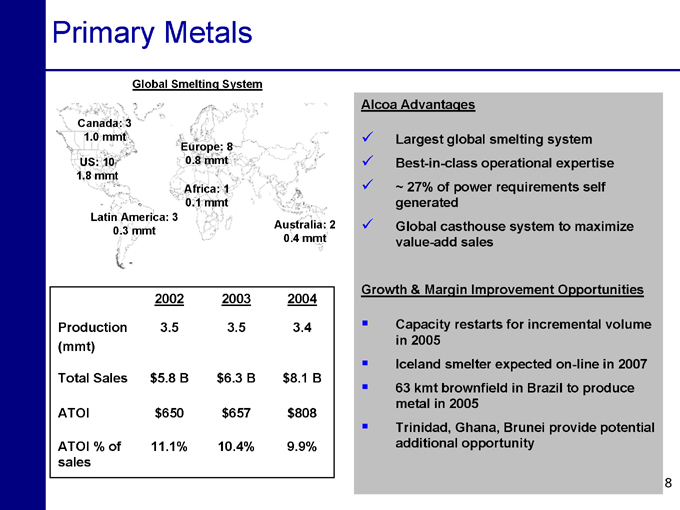

Primary Metals

Global Smelting System

Canada: 3 1.0 mmt

US: 10 1.8 mmt

Europe: 8 0.8 mmt

Latin America: 3 0.3 mmt

Africa: 1 0.1 mmt

Australia: 2 0.4 mmt

2002 2003 2004

Production 3.5 3.5 3.4

(mmt)

Total Sales $5.8 B $6.3 B $8.1 B

ATOI $650 $657 $808

ATOI % of 11.1% 10.4% 9.9%

sales

Alcoa Advantages

Largest global smelting system Best-in-class operational expertise ~ 27% of power requirements self generated Global casthouse system to maximize value-add sales

Growth & Margin Improvement Opportunities

Capacity restarts for incremental volume in 2005 Iceland smelter expected on-line in 2007 63 kmt brownfield in Brazil to produce metal in 2005 Trinidad, Ghana, Brunei provide potential additional opportunity

8

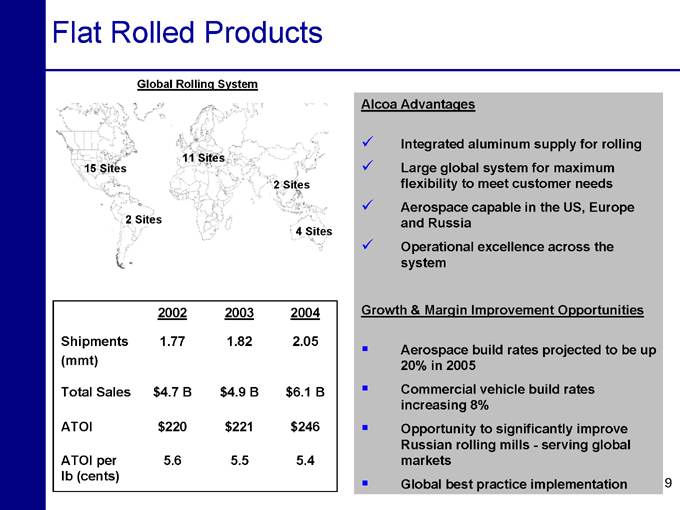

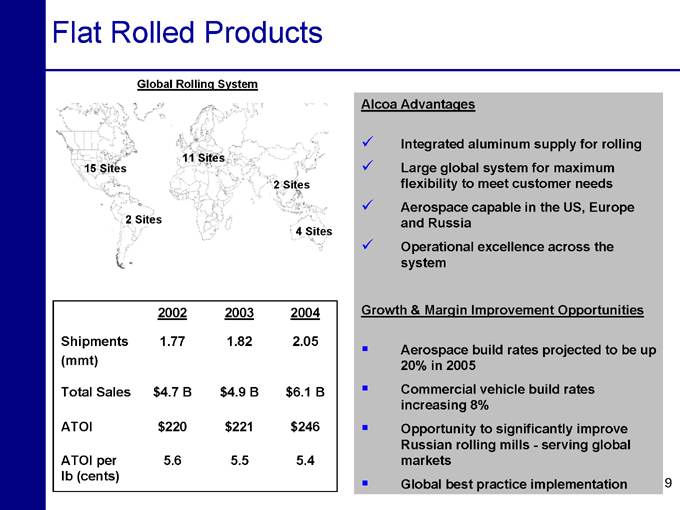

Flat Rolled Products

Global Rolling System

15 Sites

2 Sites

11 Sites

2 Sites

4 Sites

2002 2003 2004

Shipments 1.77 1.82 2.05

(mmt)

Total Sales $4.7 B $4.9 B $6.1 B

ATOI $220 $221 $246

ATOI per 5.6 5.5 5.4

lb (cents)

Alcoa Advantages

Integrated aluminum supply for rolling Large global system for maximum flexibility to meet customer needs Aerospace capable in the US, Europe and Russia Operational excellence across the system

Growth & Margin Improvement Opportunities

Aerospace build rates projected to be up 20% in 2005 Commercial vehicle build rates increasing 8% Opportunity to significantly improve Russian rolling mills—serving global markets Global best practice implementation

9

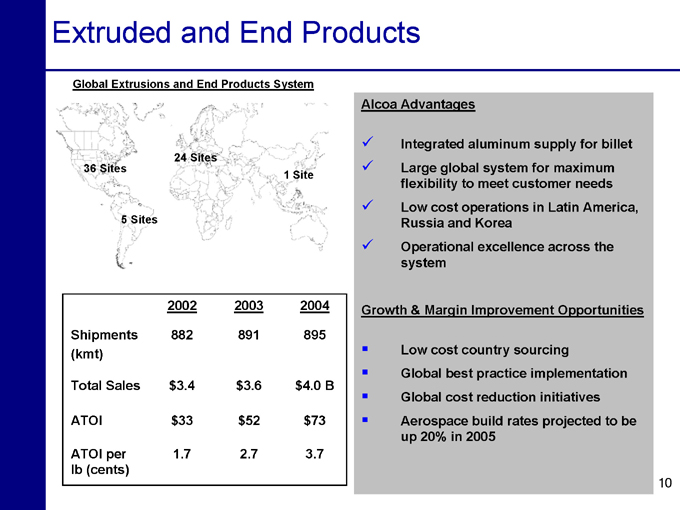

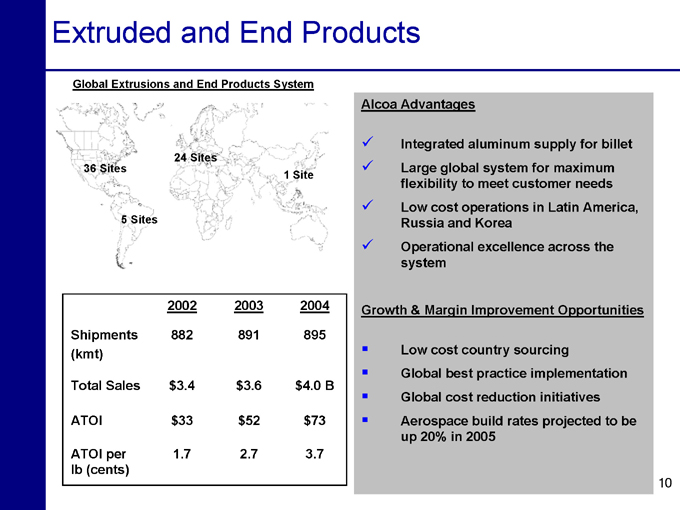

Extruded and End Products

Global Extrusions and End Products System

36 Sites

5 Sites

24 Sites

1 Site

2002 2003 2004

Shipments 882 891 895

(kmt)

Total Sales $3.4 $3.6 $4.0 B

ATOI $33 $52 $73

ATOI per 1.7 2.7 3.7

lb (cents)

Alcoa Advantages

Integrated aluminum supply for billet Large global system for maximum flexibility to meet customer needs Low cost operations in Latin America, Russia and Korea Operational excellence across the system

Growth & Margin Improvement Opportunities

Low cost country sourcing

Global best practice implementation Global cost reduction initiatives Aerospace build rates projected to be up 20% in 2005

10

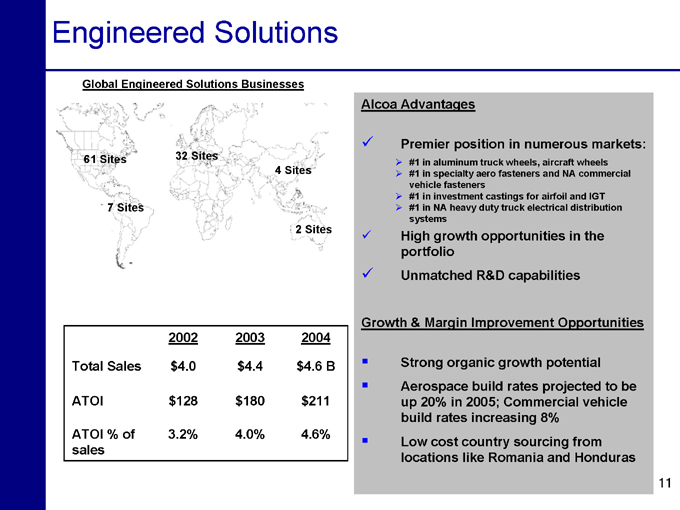

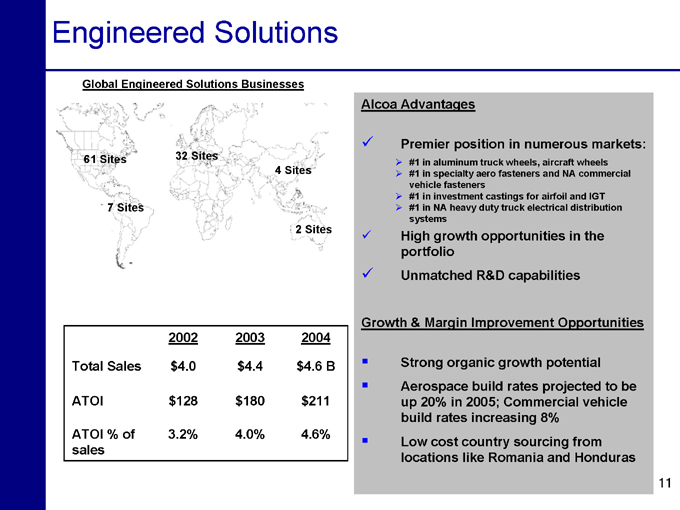

Engineered Solutions

Global Engineered Solutions Businesses

61 Sites

7 Sites

32 Sites

4 Sites

2 Sites

2002 2003 2004

Total Sales $4.0 $4.4 $4.6 B

ATOI $128 $180 $211

ATOI % of 3.2% 4.0% 4.6%

sales

Alcoa Advantages

Premier position in numerous markets:

#1 in aluminum truck wheels, aircraft wheels #1 in specialty aero fasteners and NA commercial vehicle fasteners #1 in investment castings for airfoil and IGT #1 in NA heavy duty truck electrical distribution systems

High growth opportunities in the portfolio Unmatched R&D capabilities

Growth & Margin Improvement Opportunities

Strong organic growth potential Aerospace build rates projected to be up 20% in 2005; Commercial vehicle build rates increasing 8% Low cost country sourcing from locations like Romania and Honduras

11

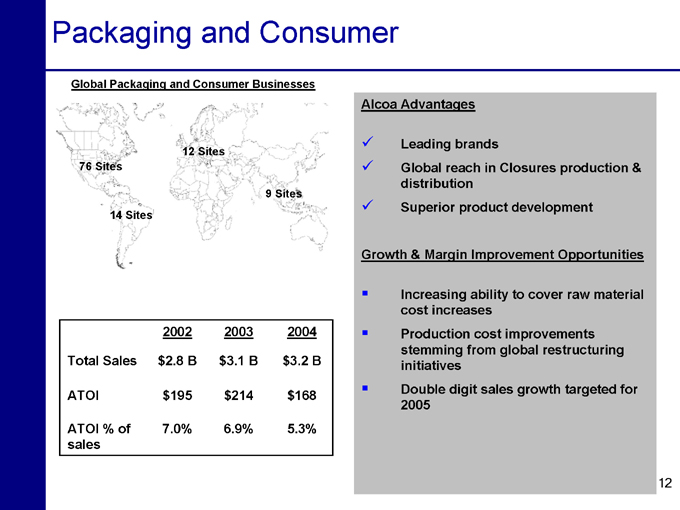

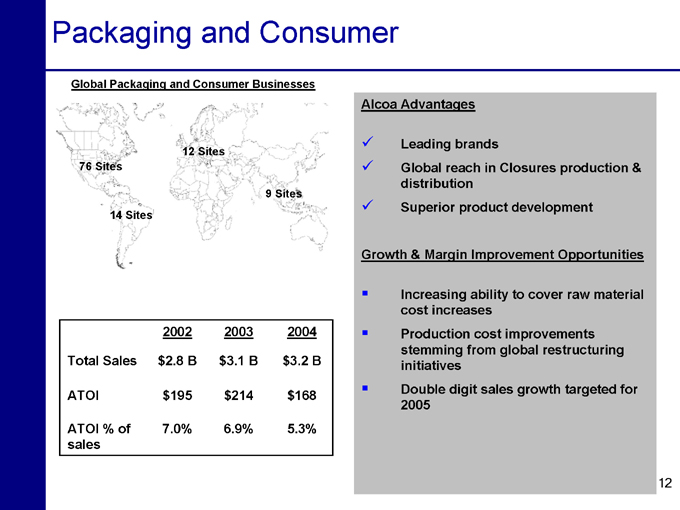

Packaging and Consumer

Global Packaging and Consumer Businesses

76 Sites

14 Sites

12 Sites

9 Sites

2002 2003 2004

Total Sales $2.8 B $3.1 B $3.2 B

ATOI $195 $214 $168

ATOI % of 7.0% 6.9% 5.3%

sales

Alcoa Advantages

Leading brands

Global reach in Closures production & distribution Superior product development

Growth & Margin Improvement Opportunities

Increasing ability to cover raw material cost increases Production cost improvements stemming from global restructuring initiatives Double digit sales growth targeted for 2005

12

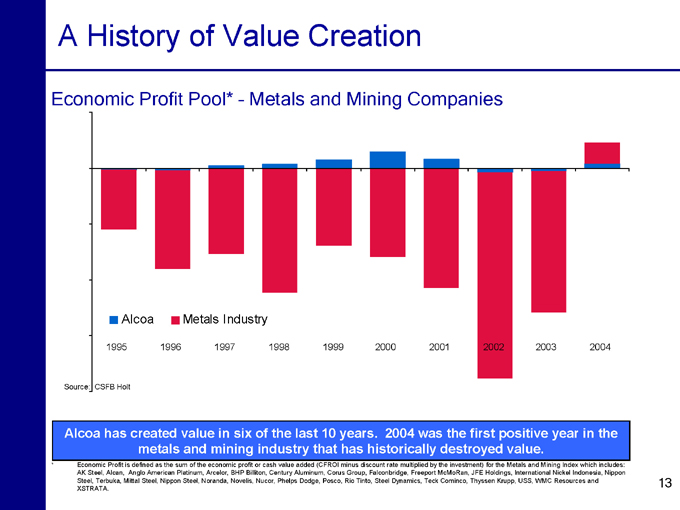

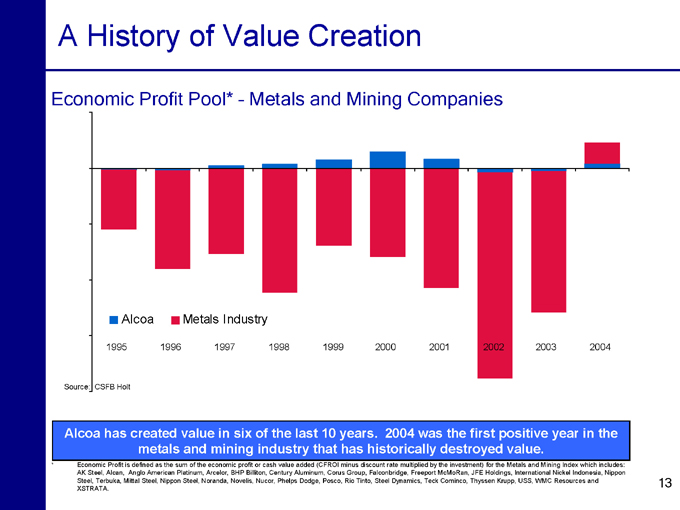

A History of Value Creation

Economic Profit Pool* – Metals and Mining Companies

Alcoa

Metals Industry

1995 1996 1997 1998 1999 2000 2001

2002

2003

2004

Source:

CSFB Holt

Alcoa has created value in six of the last 10 years. 2004 was the first positive year in the metals and mining industry that has historically destroyed value.

Economic Profit is defined as the sum of the economic profit or cash value added (CFROI minus discount rate multiplied by the investment) for the Metals and Mining Index which includes: AK Steel, Alcan, Anglo American Platinum, Arcelor, BHP Billiton, Century Aluminum, Corus Group, Falconbridge, Freeport McMoRan, JFE Holdings, International Nickel Indonesia, Nippon Steel, Terbuka, Mittal Steel, Nippon Steel, Noranda, Novelis, Nucor, Phelps Dodge, Posco, Rio Tinto, Steel Dynamics, Teck Cominco, Thyssen Krupp, USS, WMC Resources and XSTRATA.

13

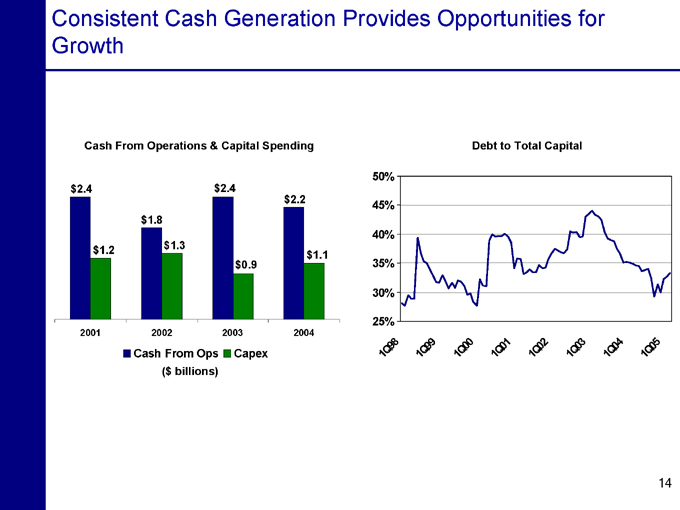

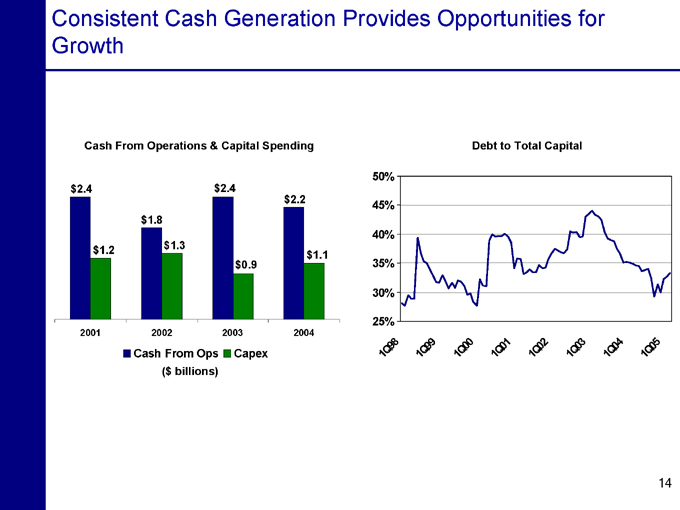

Consistent Cash Generation Provides Opportunities for Growth

Cash From Operations & Capital Spending $2.4 $1.2 $1.8 $1.3 $2.4 $0.9 $2.2 $1.1

2001 2002 2003 2004

Cash From Ops

Capex

($ billions)

Debt to Total Capital

50% 45% 40% 35% 30% 25%

1Q98

1Q99

1Q00

1Q01

1Q02

1Q03

1Q04

1Q05

14

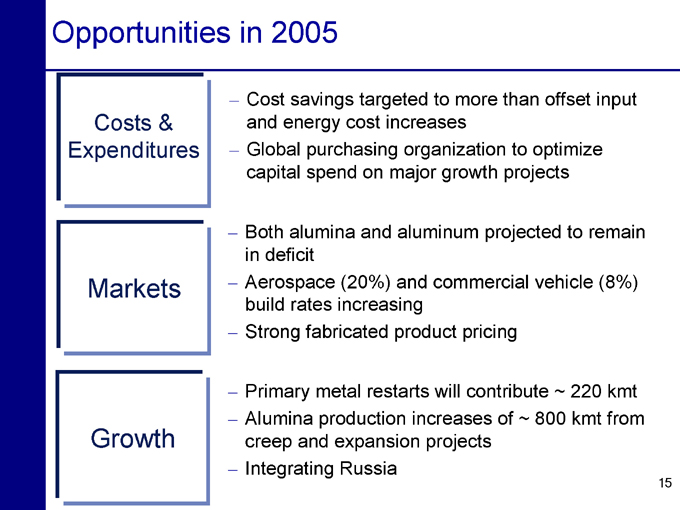

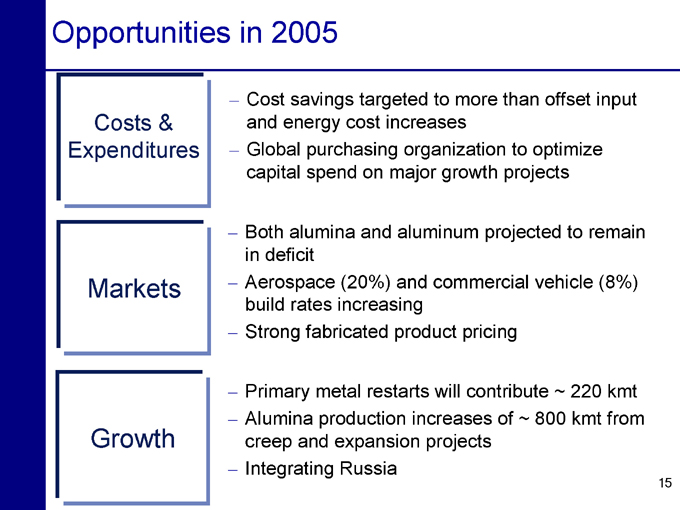

Opportunities in 2005

Costs & Expenditures

Cost savings targeted to more than offset input and energy cost increases Global purchasing organization to optimize capital spend on major growth projects

Markets

Both alumina and aluminum projected to remain in deficit Aerospace (20%) and commercial vehicle (8%) build rates increasing Strong fabricated product pricing

Growth

Primary metal restarts will contribute ~ 220 kmt Alumina production increases of ~ 800 kmt from creep and expansion projects Integrating Russia

15

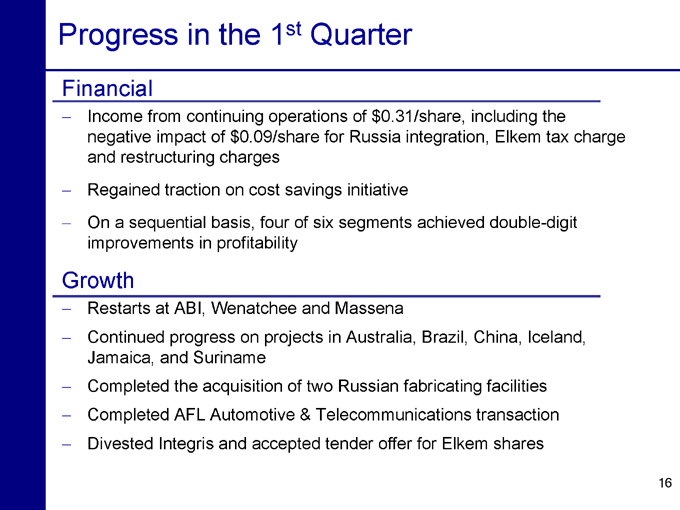

Progress in the 1st Quarter

Financial

Income from continuing operations of $0.31/share, including the negative impact of $0.09/share for Russia integration, Elkem tax charge and restructuring charges Regained traction on cost savings initiative On a sequential basis, four of six segments achieved double-digit improvements in profitability

Growth

Restarts at ABI, Wenatchee and Massena

Continued progress on projects in Australia, Brazil, China, Iceland, Jamaica, and Suriname Completed the acquisition of two Russian fabricating facilities Completed AFL Automotive & Telecommunications transaction Divested Integris and accepted tender offer for Elkem shares

16

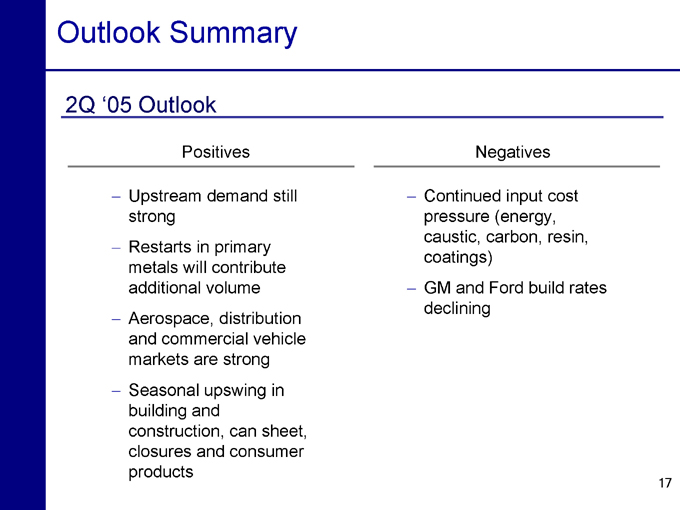

Outlook Summary

2Q ‘05 Outlook

Positives

Upstream demand still strong Restarts in primary metals will contribute additional volume Aerospace, distribution and commercial vehicle markets are strong Seasonal upswing in building and construction, can sheet, closures and consumer products

Negatives

Continued input cost pressure (energy, caustic, carbon, resin, coatings) GM and Ford build rates declining

17

The Alcoa Investment Opportunity

Values driven organization

Broad market and geographic presence Commitment to operational excellence through the application of ABS

Unmatched growth opportunities Significant upside potential

18

Appendix

Reconciliation of Return on Capital

In Millions 2004 2003 2002

Net Income $1,310 $938 $420

Minority Interest $242 $238 $135

Interest Expense $201 $237 $237

(After-tax)

Numerator (Sum Total) $1,753 $1,413 $792

ST Borrowings $767 $348 $193

LT Borrowings $6,019 $7,530 $7,375

Preferred Equity $55 $55 $56

Minority Interest $1,378 $1,317 $1,303

Common Equity $12,633 $10,946 $10,215

Denominator (Sum

Total) $20,852 $20,194 $19,142

ROC 8.4% 7.0% 4.1%

Note: Bloomberg Methodology calculates ROC based on the trailing 4 quarters.

20