Exhibit 99.2

[Alcoa logo]

Quarter 2005 October 10, 2005

rd

Forward-Looking Statements

Today’s discussion may include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements relate to future events and expectations and involve known and unknown risks and uncertainties. Alcoa’s actual results or actions may differ materially from those projected in the forward-looking statements. For a summary of the specific risk factors that could cause results to differ materially from those expressed in the forward-looking statements, please refer to Alcoa’s Form 10-K for the year ended December 31, 2004 and Form 10-Q for the quarter ended June 30, 2005 filed with the Securities and Exchange Commission.

2

Richard B. Kelson Executive Vice President Chief Financial Officer

3rd Quarter Overview

Financial

- Income from continuing operations of $0.33/share

- Cash from operations of $792 million before discretionary pension contribution

- Revenue up 13% year-over-year to $6.6 billion; down sequentially on lower metal prices

- 3Q’05 ROC of 7.8%, trailing four quarters ROC of 8.3%. Trailing four quarters ROC excluding growth investments of 9.3%.

- Debt-to-cap 31.5%, within our target range

4

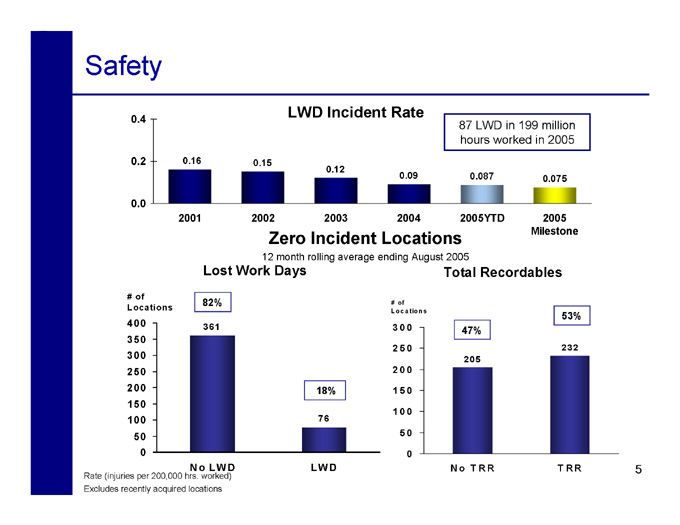

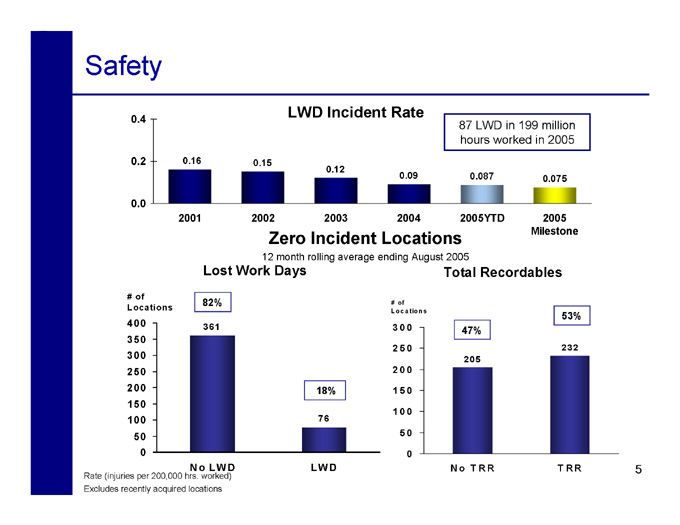

Safety

LWD Incident Rate

0.4

87 LWD in 199 million hours worked in 2005

0.2 0.16 0.15

0.12

0.09 0.087 0.075

0.0

2001 2002 2003 2004 2005YTD 2005

Zero Incident Locations Milestone

12 month rolling average ending August 2005

Lost Work Days Total Recordables

# of

82% # of

Locations Locations

53%

400 361 3 0 0

47%

350

2 5 0 232

300 205

250 2 0 0 200 18% 1 5 0

150

1 0 0

100 76

50 5 0

0 0

N o LW D LW D N o T R R T R R 5

Rate (injuries per 200,000 hrs. worked) Excludes recently acquired locations

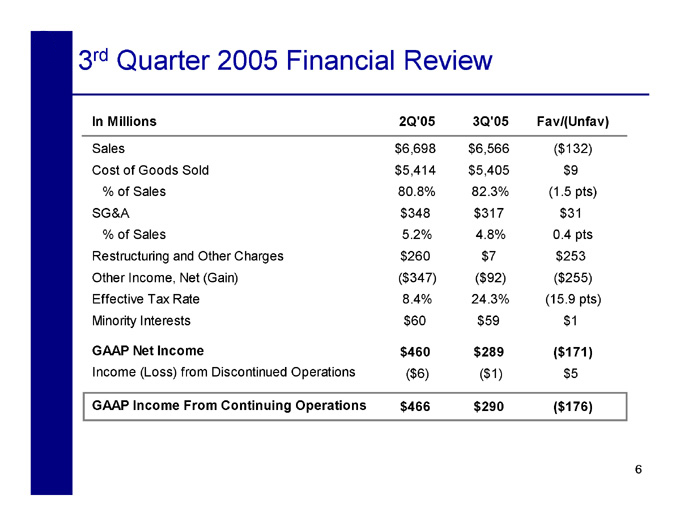

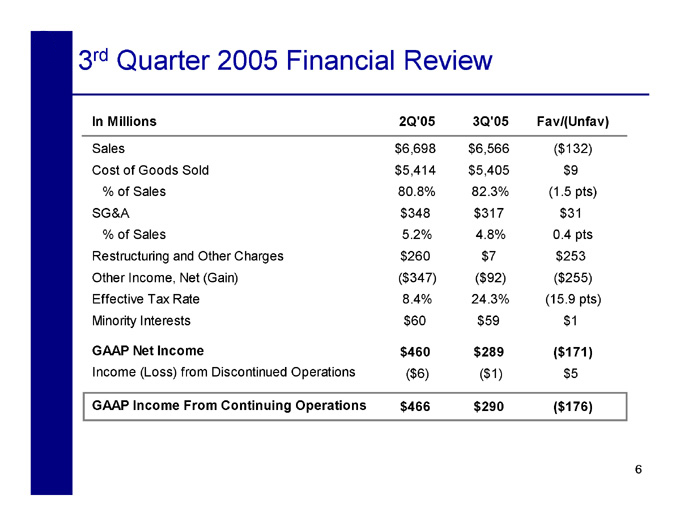

In Millions 2Q’05 3Q’05 Fav/(Unfav)

Sales $6,698 $6,566 ($132) Cost of Goods Sold $5,414 $5,405 $9 % of Sales 80.8% 82.3% (1.5 pts) SG&A $348 $317 $31 % of Sales 5.2% 4.8% 0.4 pts Restructuring and Other Charges $260 $7 $253 Other Income, Net (Gain) ($347) ($92) ($255) Effective Tax Rate 8.4% 24.3% (15.9 pts) Minority Interests $60 $59 $1

GAAP Net Income $460 $289 ($171)

Income (Loss) from Discontinued Operations ($6) ($1) $5

GAAP Income From Continuing Operations $466 $290 ($176)

6

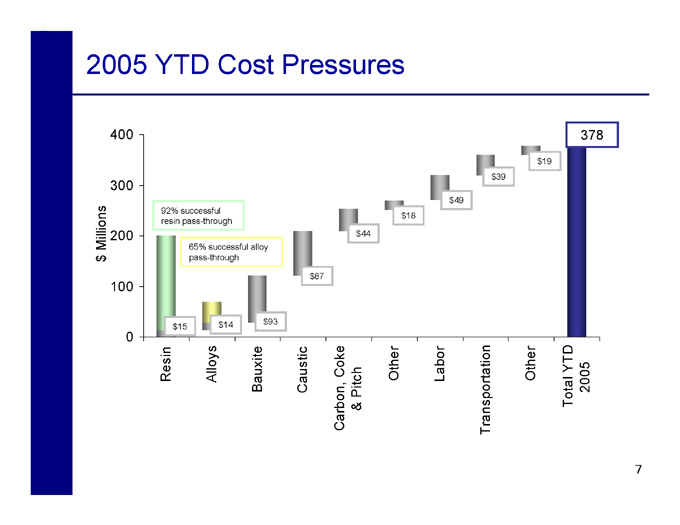

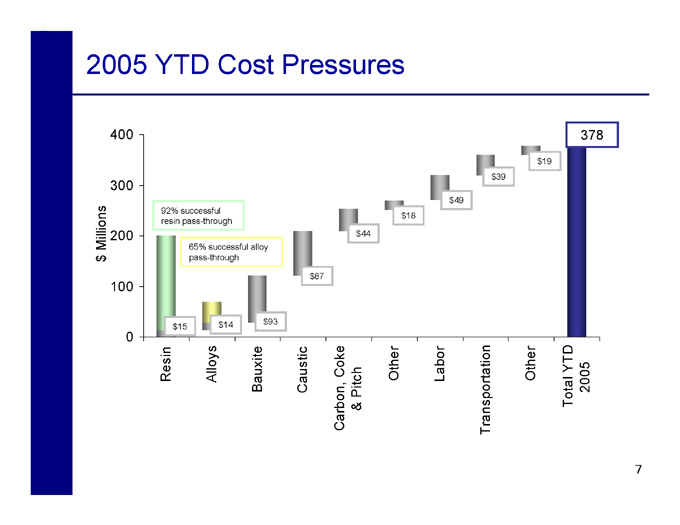

2005 YTD Cost Pressures

400 378

$19 $39

300

$49 92% successful $18 resin pass-through

200 $44

Millions 65% successful alloy pass-through

$

$87

100

$14 $93 $15

0

Resin Alloys Bauxite Caustic Other Labor Other Total YTD 2005 Carbon, Coke & Pitch Transportation

7

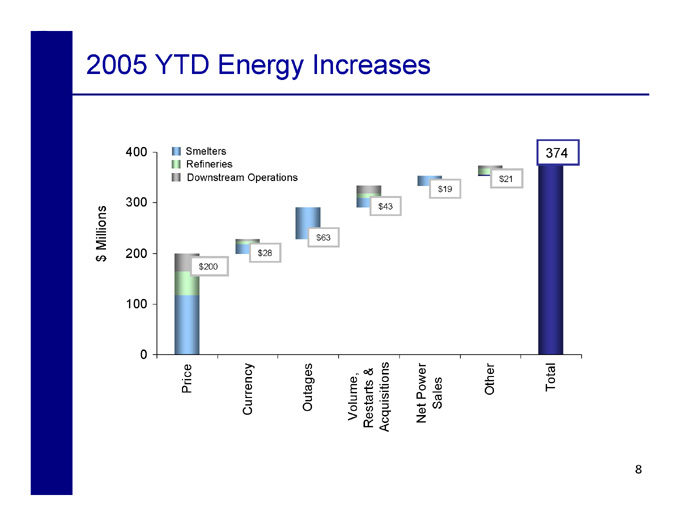

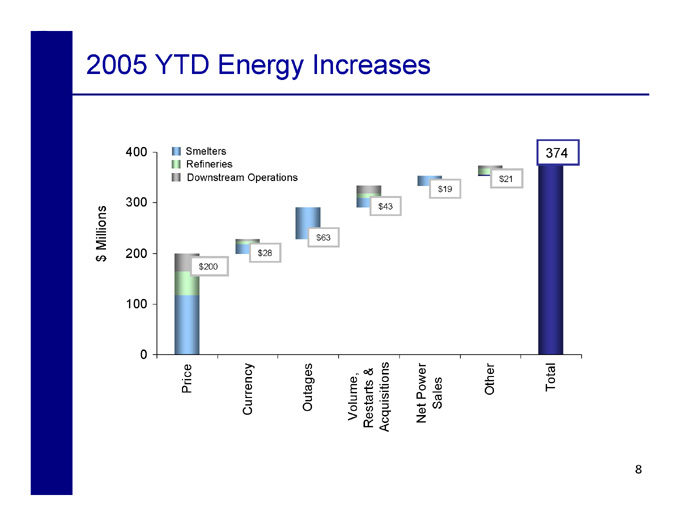

2005 YTD Energy Increases

400 Smelters 374 Refineries Downstream Operations $21 $19

300 $43

$ Millions $63

200 $28

$200

100

0

Price Currency Outages Volume, Restarts & Acquisitions Net Power Sales Other Total

8

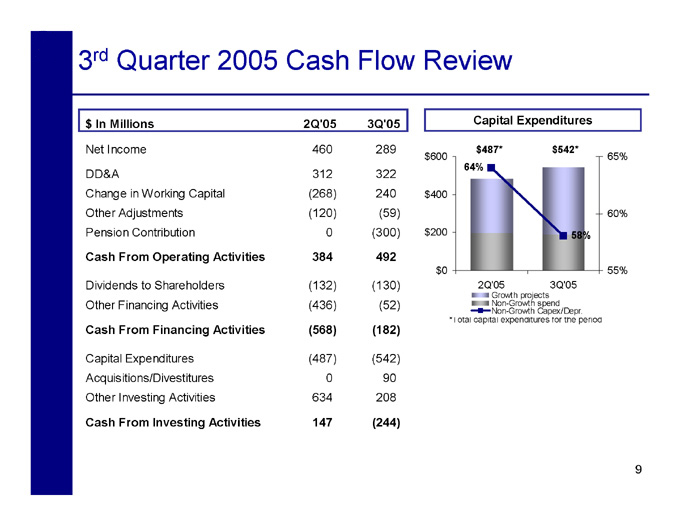

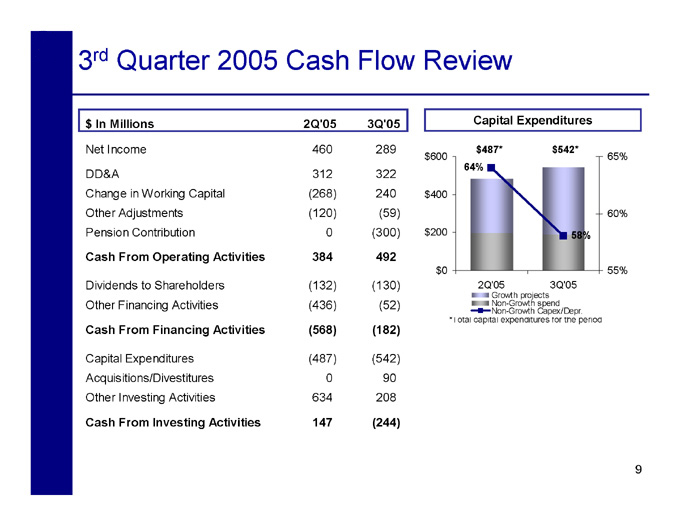

3rd Quarter 2005 Cash Flow Review

$ In Millions 2Q’05 3Q’05 Capital Expenditures

Net Income 460 289 $487* $542*

$600 65%

64%

DD&A 312 322

Change in Working Capital (268) 240 $400

Other Adjustments (120) (59) 60% Pension Contribution 0 (300) $200 58%

Cash From Operating Activities 384 492

$0 55%

Dividends to Shareholders (132) (130) 2Q’05 3Q’05

Growth projects

Other Financing Activities (436) (52) Non-Growth spend

Non-Growth Capex/Depr.

*Total capital expenditures for the period

Cash From Financing Activities (568) (182)

Capital Expenditures (487) (542) Acquisitions/Divestitures 0 90 Other Investing Activities 634 208

Cash From Investing Activities 147 (244)

9

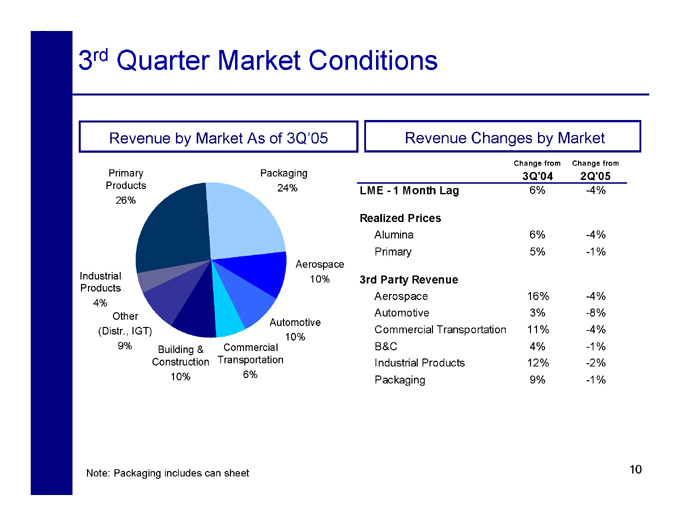

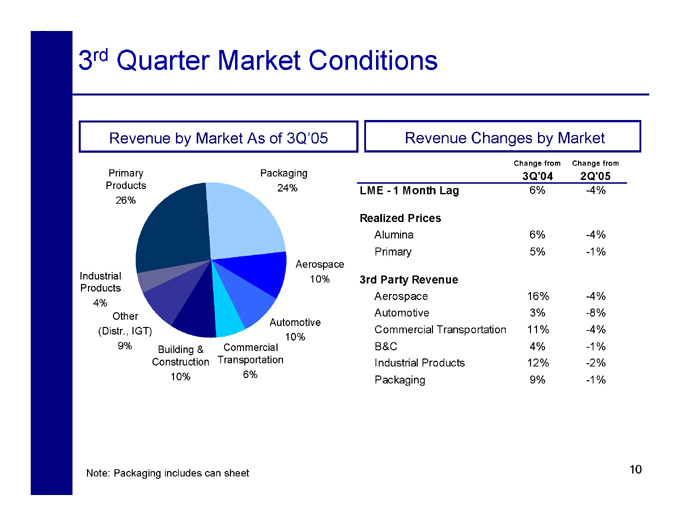

3rd Quarter Market Conditions

Revenue by Market As of 3Q’05 Revenue Changes by Market

Change from Change from

Primary Packaging 3Q’04 2Q’05 Products 24% 6% -4%

LME - 1 Month Lag

26%

Realized Prices

Alumina 6% -4% Primary 5% -1%

Aerospace

Industrial 10% 3rd Party Revenue

Products

Aerospace 16% -4%

4%

Other Automotive 3% -8%

Automotive

(Distr., IGT) Commercial Transportation 11% -4%

10%

9% Building & Commercial B&C 4% -1% Construction Transportation Industrial Products 12% -2% 10% 6%

Packaging 9% -1%

Note: Packaging includes can sheet 10

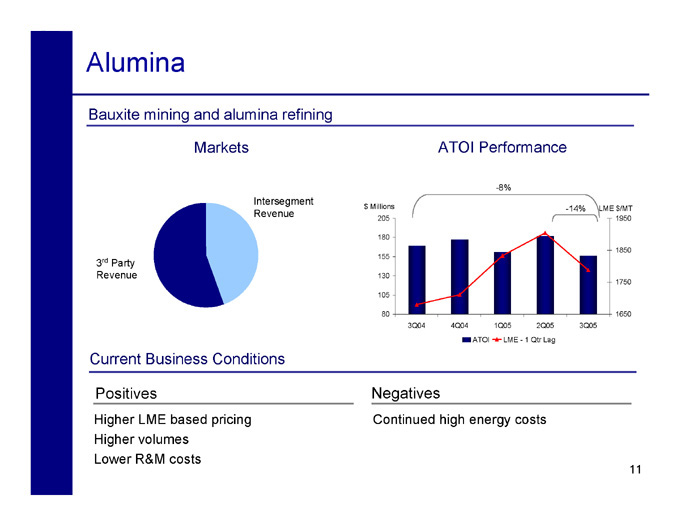

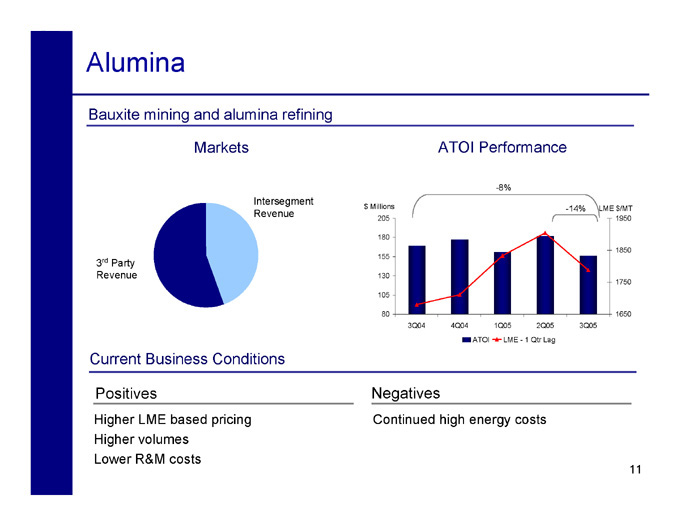

Alumina

Bauxite mining and alumina refining

Markets ATOI Performance

-8%

Intersegment

$ Millions -14% LME $/MT

Revenue

205 1950

180

1850 155

3rd Party

Revenue 130

1750 105

80 1650 3Q04 4Q04 1Q05 2Q05 3Q05 ATOI LME - 1 Qtr Lag

Current Business Conditions

Positives Negatives

Higher LME based pricing Continued high energy costs Higher volumes Lower R&M costs

11

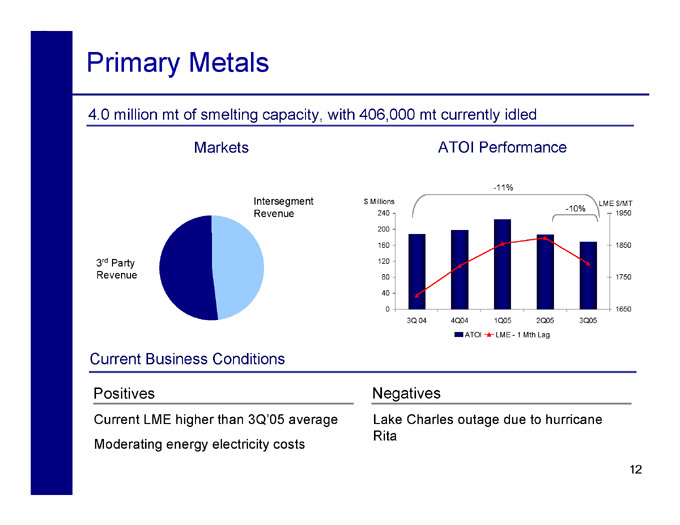

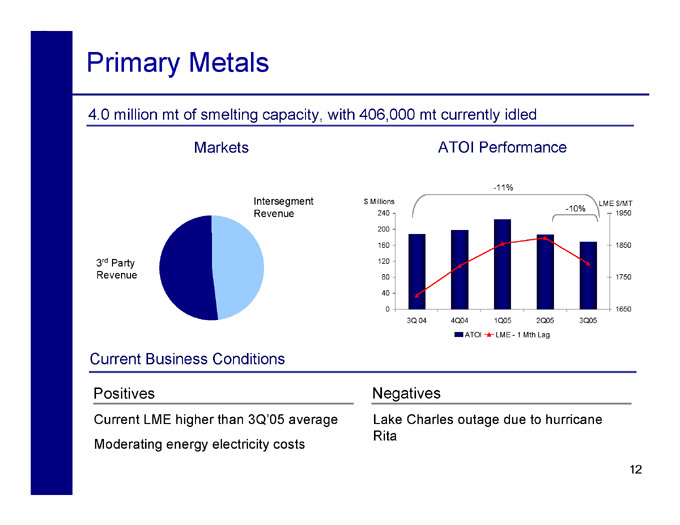

Primary Metals

4.0 million mt of smelting capacity, with 406,000 mt currently idled

Markets ATOI Performance

-11%

Intersegment $ Millions LME $/MT

-10%

Revenue 240 1950

200

160 1850

3rd Party 120

Revenue 80 1750

40

0 1650 3Q 04 4Q04 1Q05 2Q05 3Q05 ATOI LME - 1 Mth Lag

Current Business Conditions

Positives Negatives

Current LME higher than 3Q’05 average Lake Charles outage due to hurricane Rita Moderating energy electricity costs

12

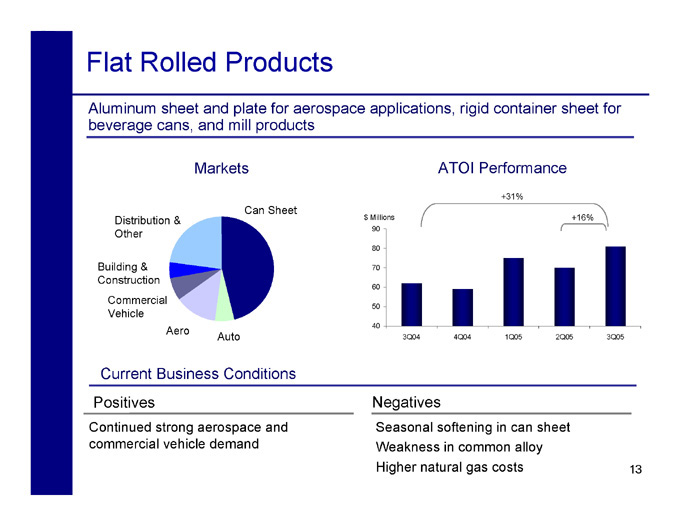

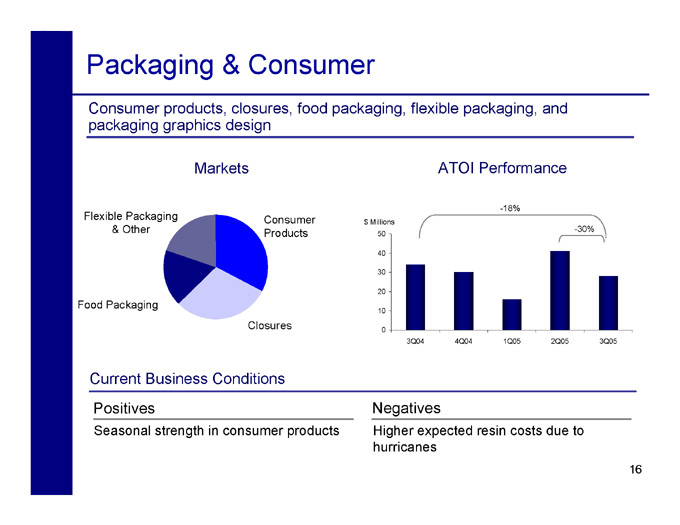

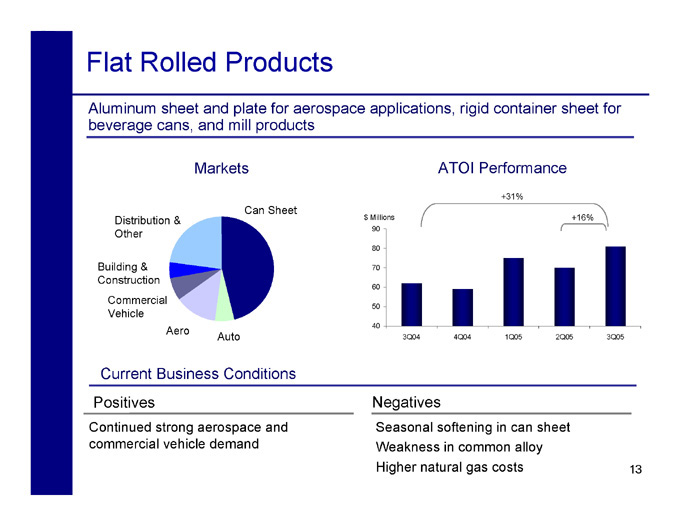

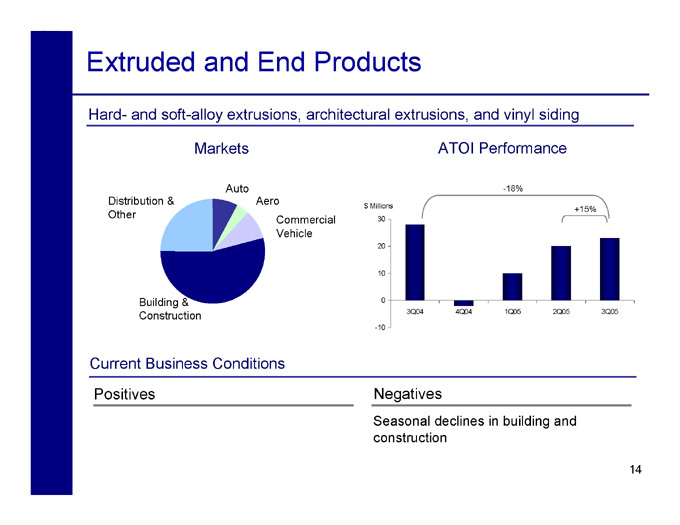

Flat Rolled Products

Aluminum sheet and plate for aerospace applications, rigid container sheet for beverage cans, and mill products

Markets ATOI Performance

+31%

Can Sheet

Distribution & $ Millions +16% Other 90

80

Building & 70 Construction

60

Commercial

50

Vehicle

Aero 40

Auto 3Q04 4Q04 1Q05 2Q05 3Q05

Current Business Conditions

Positives Negatives

Continued strong aerospace and Seasonal softening in can sheet commercial vehicle demand Weakness in common alloy

Higher natural gas costs 13

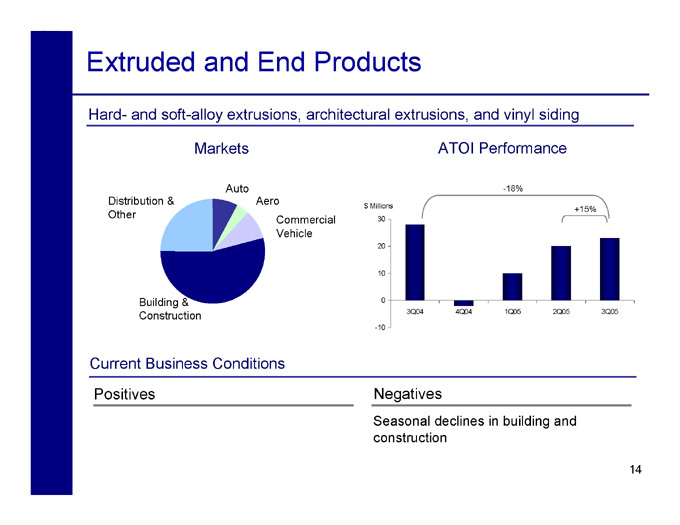

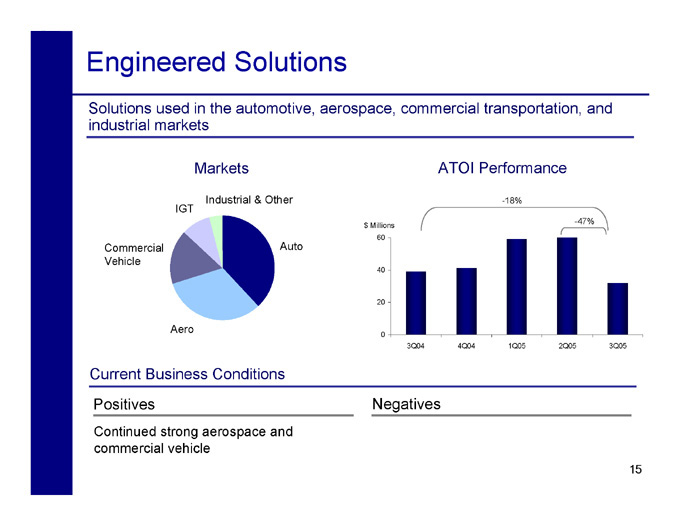

Engineered Solutions

Solutions used in the automotive, aerospace, commercial transportation, and industrial markets

Markets ATOI Performance

Industrial & Other -18% IGT

-47% $ Millions 60

Commercial Auto Vehicle

40

20

Aero

0

3Q04 4Q04 1Q05 2Q05 3Q05

Current Business Conditions

Positives Negatives

Continued strong aerospace and commercial vehicle

15

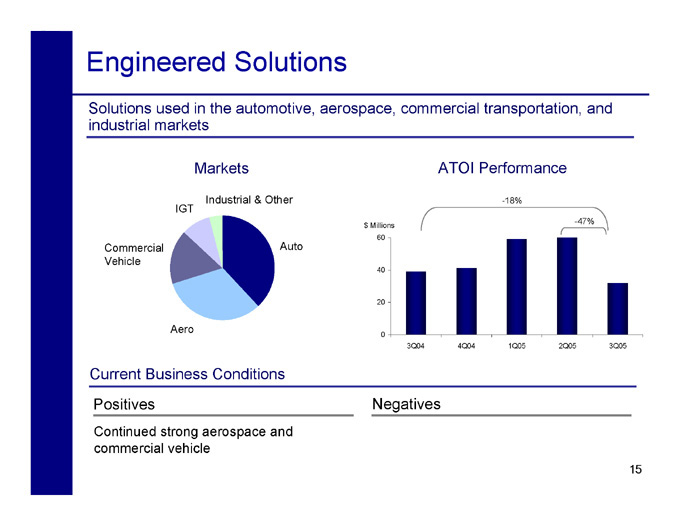

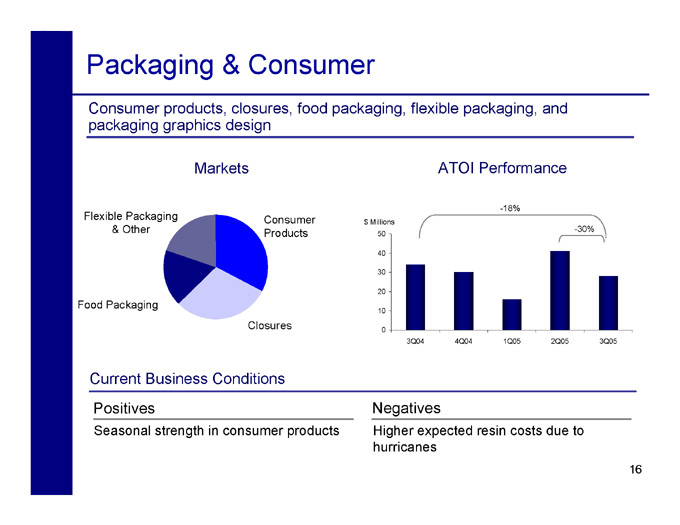

Packaging & Consumer

Consumer products, closures, food packaging, flexible packaging, and packaging graphics design

Markets ATOI Performance

-18%

Flexible Packaging Consumer

$ Millions

& Other -30% Products 50

40

30

20

Food Packaging

10

Closures 0

3Q04 4Q04 1Q05 2Q05 3Q05

Current Business Conditions

Positives Negatives

Seasonal strength in consumer products Higher expected resin costs due to hurricanes

16

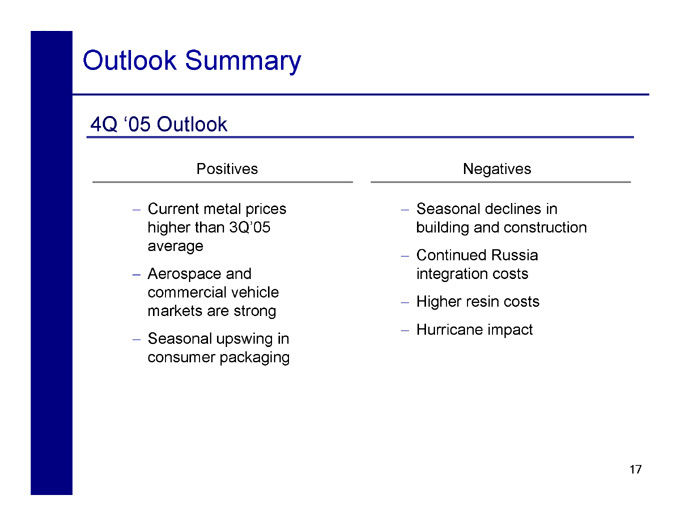

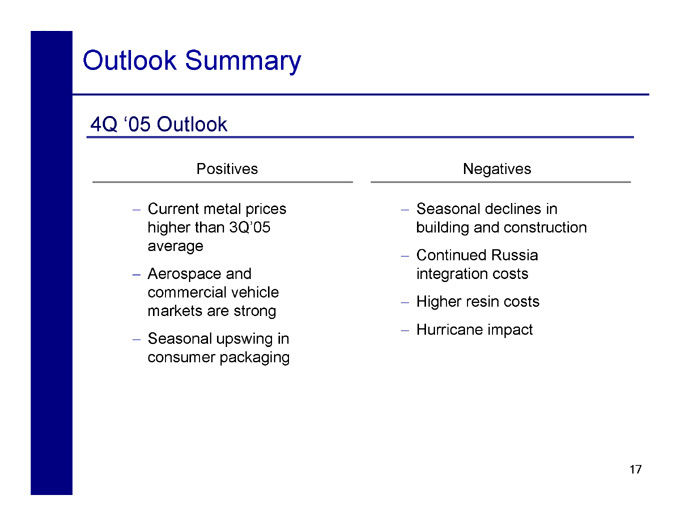

Outlook Summary

4Q ‘05 Outlook

Positives Negatives

- Current metal prices - Seasonal declines in higher than 3Q’05 building and construction average

- Continued Russia

- Aerospace and integration costs commercial vehicle

- Higher resin costs markets are strong

- Hurricane impact

- Seasonal upswing in consumer packaging

17

Alain Belda Chairman Chief Executive Officer

3Q Review

- Elevated input costs continue (caustic, resins)

- Energy costs unusually high

- 3rd quarter metal pricing lower based on one-month lag, prices have rebounded subsequently

- Productivity strides have been made, but not fully offsetting cost increases

- Aggressive creep and capacity growth are beginning to deliver expected benefits

19

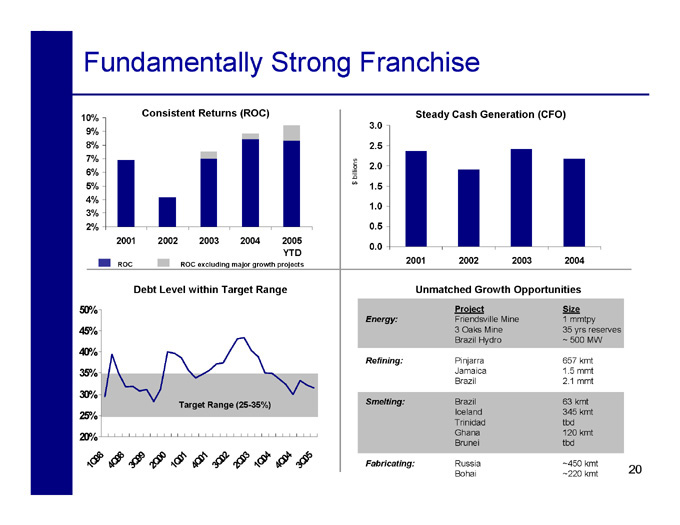

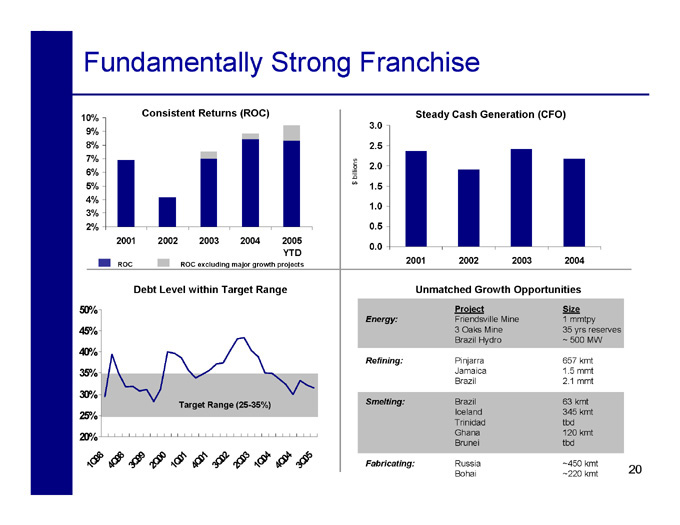

Fundamentally Strong Franchise

Consistent Returns (ROC) Steady Cash Generation (CFO)

10%

3.0 9%

8% 2.5 7% 2.0

6% billions

5% $ 1.5 4% 1.0 3%

2% 0.5 2001 2002 2003 2004 2005 0.0 YTD

ROC ROC excluding major growth projects 2001 2002 2003 2004

Debt Level within Target Range Unmatched Growth Opportunities

50% Project Size

Energy: Friendsville Mine 1 mmtpy 45% 3 Oaks Mine 35 yrs reserves Brazil Hydro ~ 500 MW

40%

Refining: Pinjarra 657 kmt 35% Jamaica 1.5 mmt Brazil 2.1 mmt

30%

Target Range (25-35%) Smelting: Brazil 63 kmt

25% Iceland 345 kmt Trinidad tbd 20% Ghana 120 kmt Brunei tbd

8 8 1 1 2 3 5

9 9 Q00 Q0 Q0 0 0 Q0 Fabricating: Russia ~450 kmt

1Q 4Q 3Q99 2 1 4 3Q 2Q 1Q044Q04 3 20

Bohai ~220 kmt

Strategic Direction Unchanged

- Executing on upstream growth projects including secure energy

- Integrating strategic investments in Russia, China

- Focused on portfolio management

- Systematically building ABS platforms to achieve operational excellence

- Capitalizing on strong market conditions (upstream, aerospace, commercial vehicle)

21

For Additional Information, contact:

William F. Oplinger Director, Investor Relations

Alcoa

390 Park Avenue

New York, N.Y. 10022-4608 Telephone: (212) 836-2674 Facsimile: (212) 836-2813 www.alcoa.com

22

Appendix

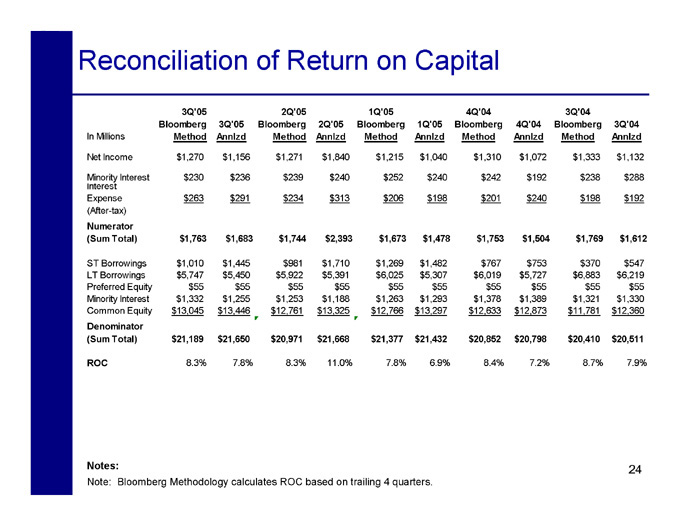

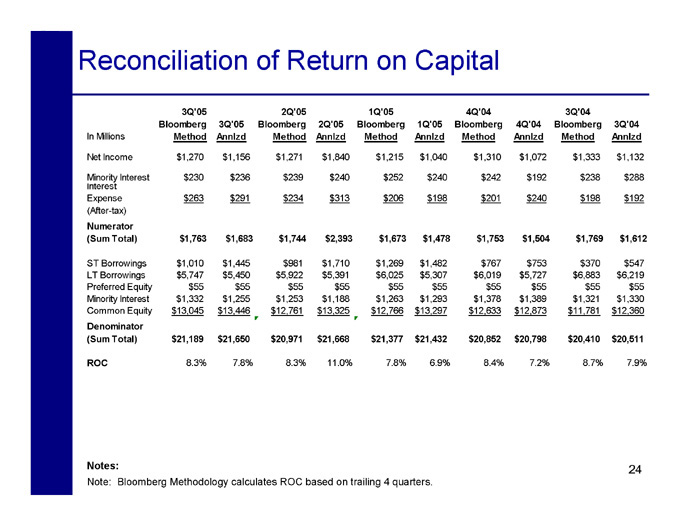

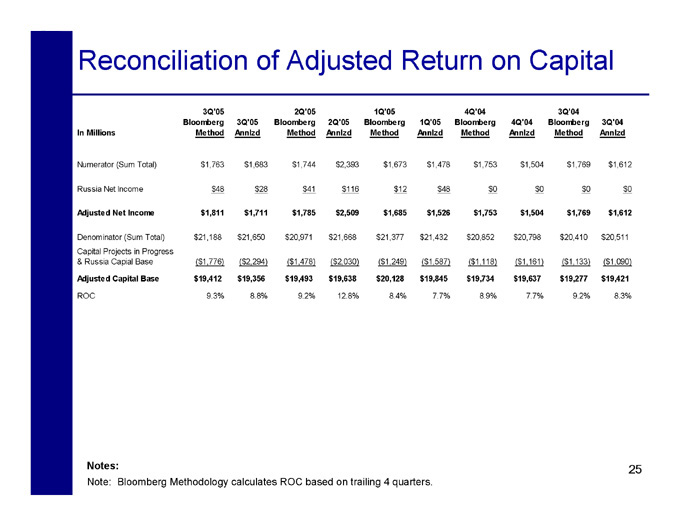

Reconciliation of Return on Capital

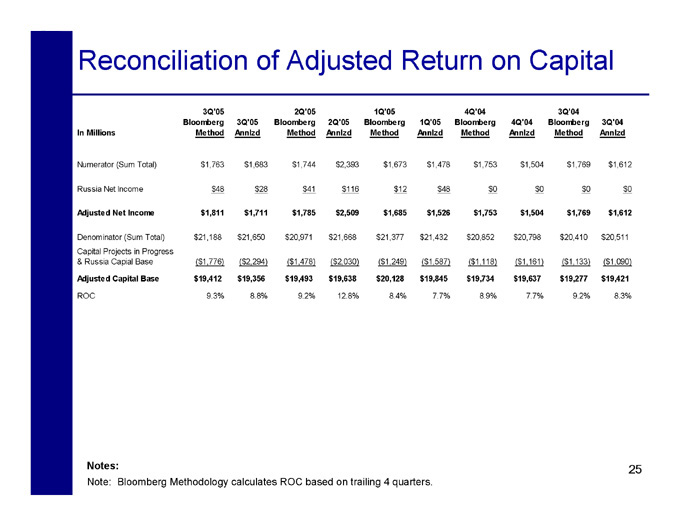

Reconciliation of Adjusted Return on Capital

3Q’05 2Q’05 1Q’05 4Q’04 3Q’04

Bloomberg 3Q’05 Bloomberg 2Q’05 Bloomberg 1Q’05 Bloomberg 4Q’04 Bloomberg 3Q’04 In Millions Method Annlzd Method Annlzd Method Annlzd Method Annlzd Method Annlzd

Numerator (Sum Total) $1,763 $1,683 $1,744 $2,393 $1,673 $1,478 $1,753 $1,504 $1,769 $1,612

Russia Net Income $48 $28 $41 $116 $12 $48 $0 $0 $0 $0

Adjusted Net Income $1,811 $1,711 $1,785 $2,509 $1,685 $1,526 $1,753 $1,504 $1,769 $1,612

Denominator (Sum Total) $21,188 $21,650 $20,971 $21,668 $21,377 $21,432 $20,852 $20,798 $20,410 $20,511 Capital Projects in Progress & Russia Capial Base ($1,776) ($2,294) ($1,478) ($2,030) ($1,249) ($1,587) ($1,118) ($1,161) ($1,133) ($1,090)

Adjusted Capital Base $19,412 $19,356 $19,493 $19,638 $20,128 $19,845 $19,734 $19,637 $19,277 $19,421

ROC 9.3% 8.8% 9.2% 12.8% 8.4% 7.7% 8.9% 7.7% 9.2% 8.3%

Notes: 25

Note: Bloomberg Methodology calculates ROC based on trailing 4 quarters.

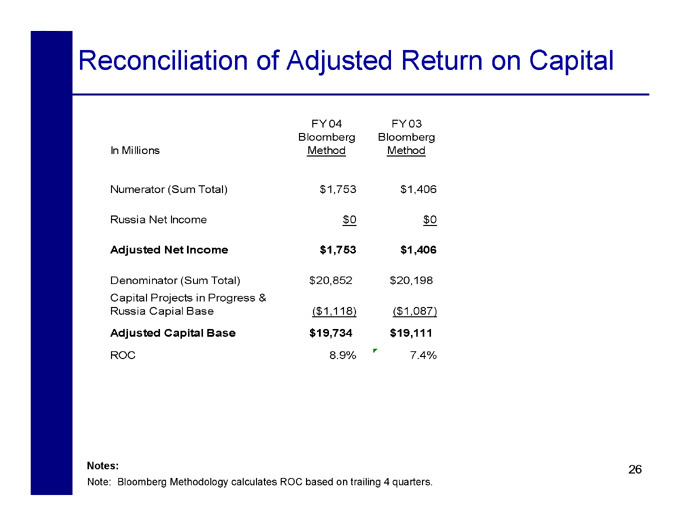

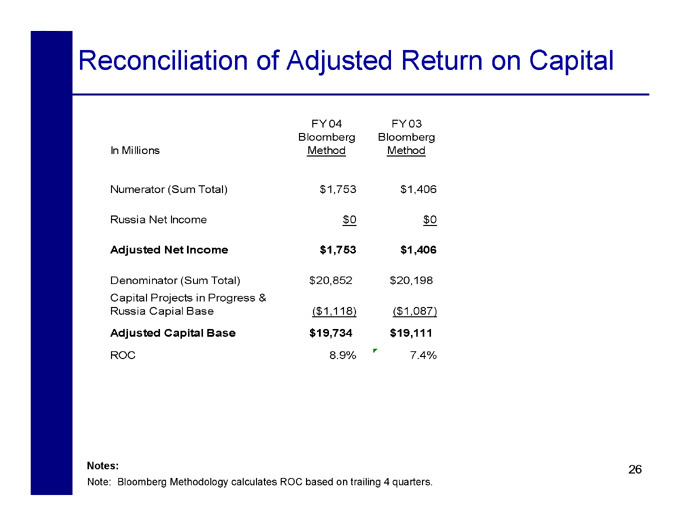

Reconciliation of Adjusted Return on Capital

FY 04 FY 03 Bloomberg Bloomberg In Millions Method Method

Numerator (Sum Total) $1,753 $1,406

Russia Net Income $0 $0

Adjusted Net Income $1,753 $1,406

Denominator (Sum Total) $20,852 $20,198 Capital Projects in Progress & Russia Capial Base ($1,118) ($1,087)

Adjusted Capital Base $19,734 $19,111

ROC 8.9% 7.4%

Notes: 26

Note: Bloomberg Methodology calculates ROC based on trailing 4 quarters.