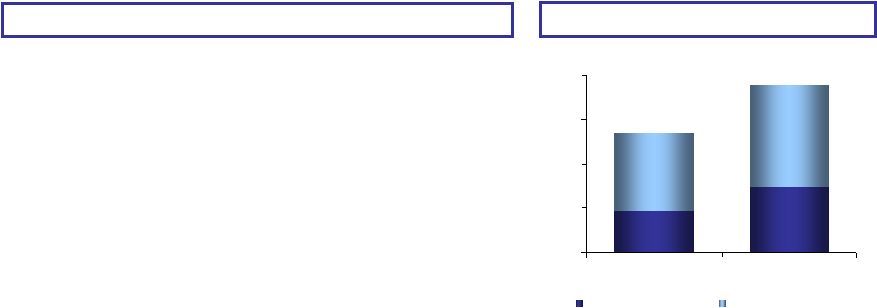

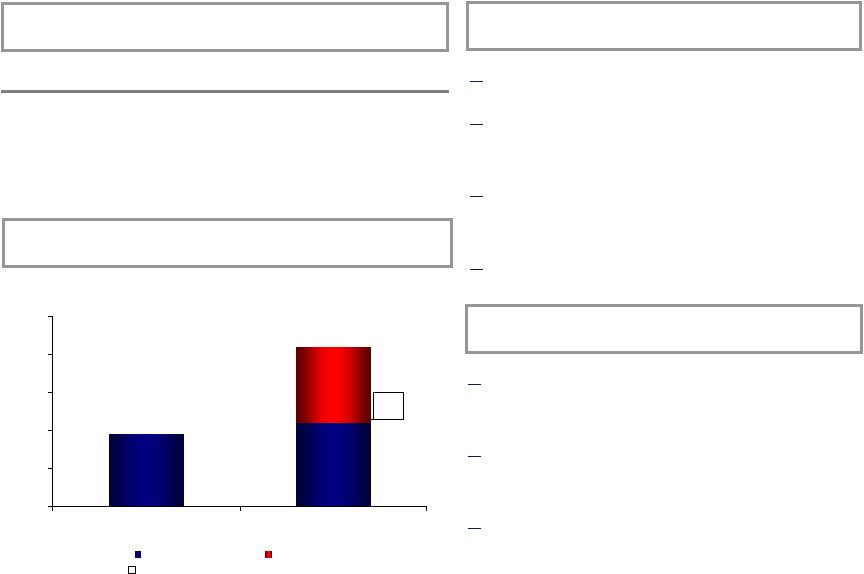

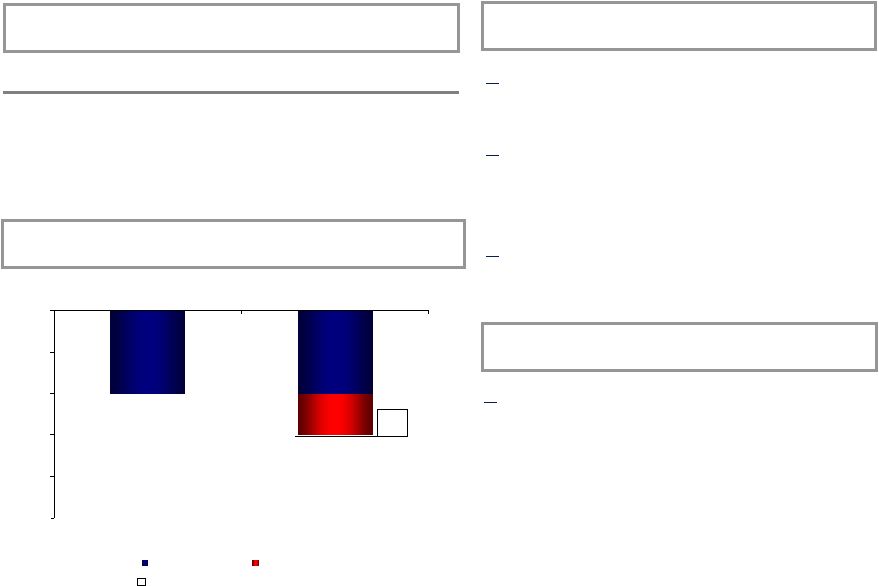

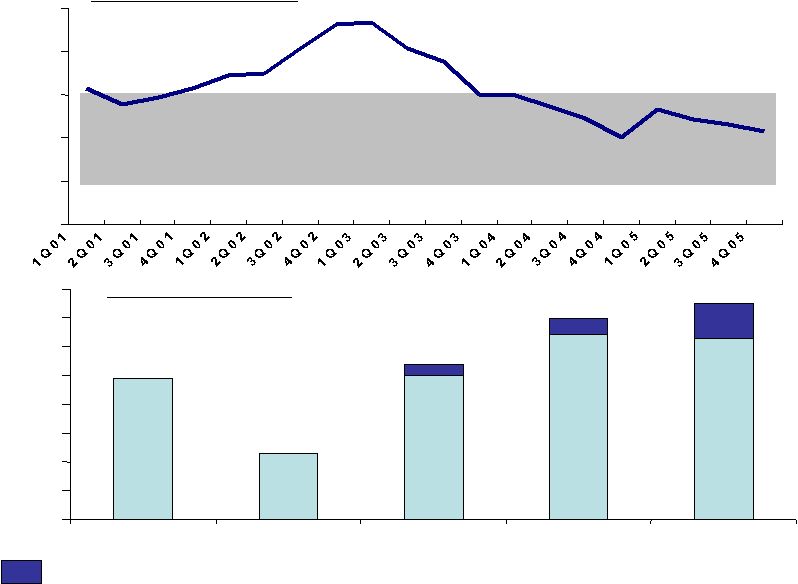

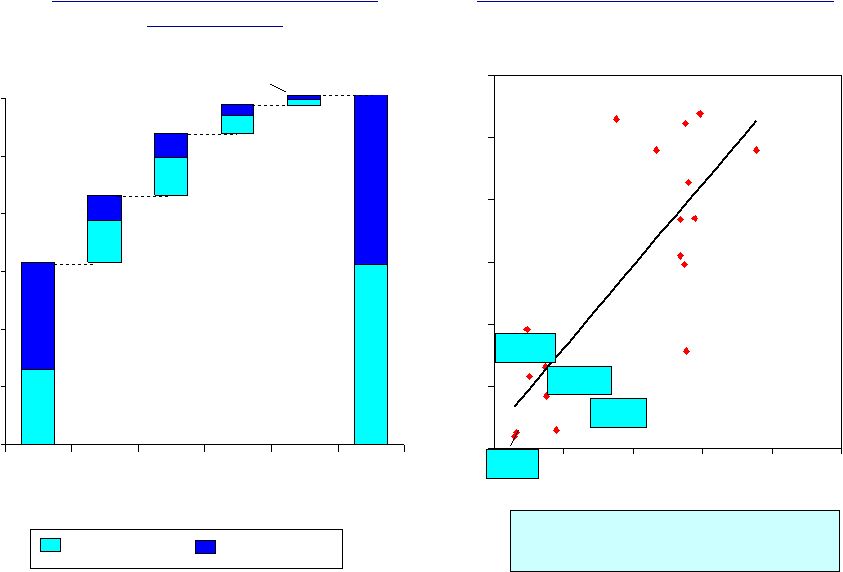

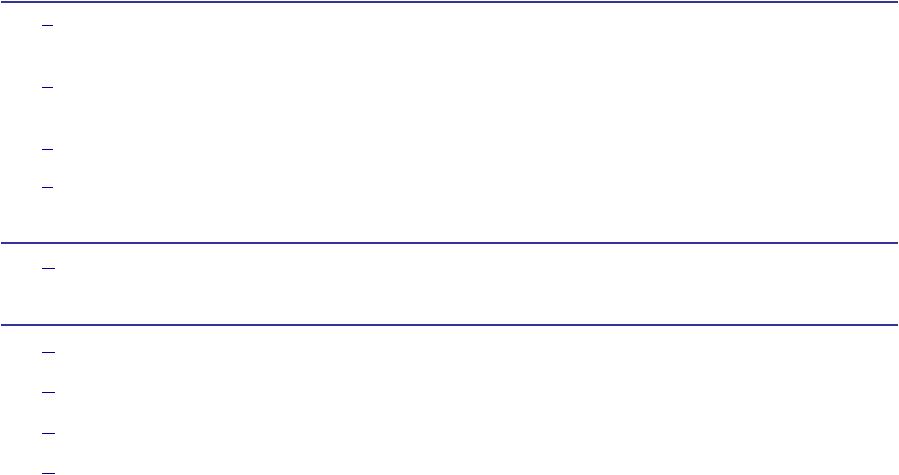

Reconciliation of Adjusted Return on Capital Return on Capital (ROC) is presented based on Bloomberg Methodology which calculates ROC based on trailing four quarters. Return on capital, excluding growth investments, is a non- GAAP financial measure. Management believes that this measure is meaningful to investors because it provides greater insight with respect to the underlying operating performance of the company’s productive assets. The company has significant growth investments underway in its upstream and downstream businesses, as previously noted, with expected completion dates over the next several years. As these investments generally require a period of time before they are productive, management believes that a return on capital measure excluding these growth investments is more representative of current operating performance. (1) FY05 calculated as (December 2004 ending balance + December 2005 ending balance) divided by 2. FY05 FY04 FY03 Bloomberg Bloomberg Bloomberg In Millions Method Method Method Numerator (Sum Total) $1,753 $1,753 $1,414 Russia Net Income Impact $69 $0 $0 Adjusted Net Income $1,822 $1,753 $1,414 Average Balances (1) ST Borrowings $1,112 $767 $345 LT Borrowings $5,312 $6,019 $7,530 Preferred Equity $55 $55 $55 Minority Interest $1,391 $1,378 $1,317 Common Equity $13,282 $12,633 $10,946 Denominator (Sum Total) $21,152 $20,852 $20,193 Capital Projects in Progress & Russia Capital Base ($1,913) ($1,140) ($1,132) Adjusted Capital Base $19,239 $19,712 $19,061 Return on Capital, Excluding Growth Investments 9.5% 8.9% 7.4% |