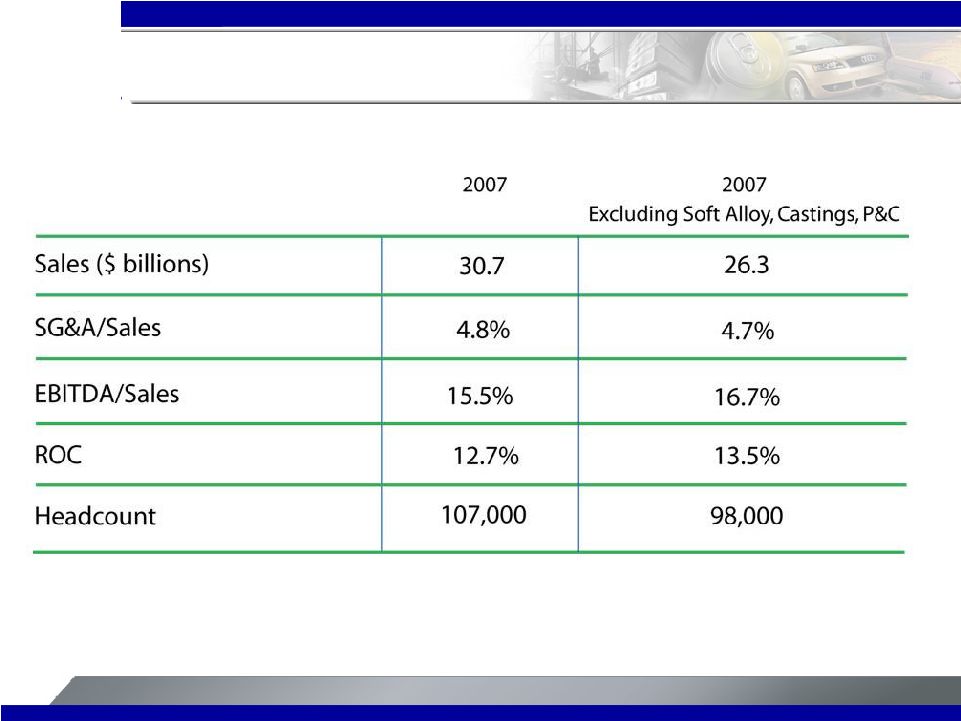

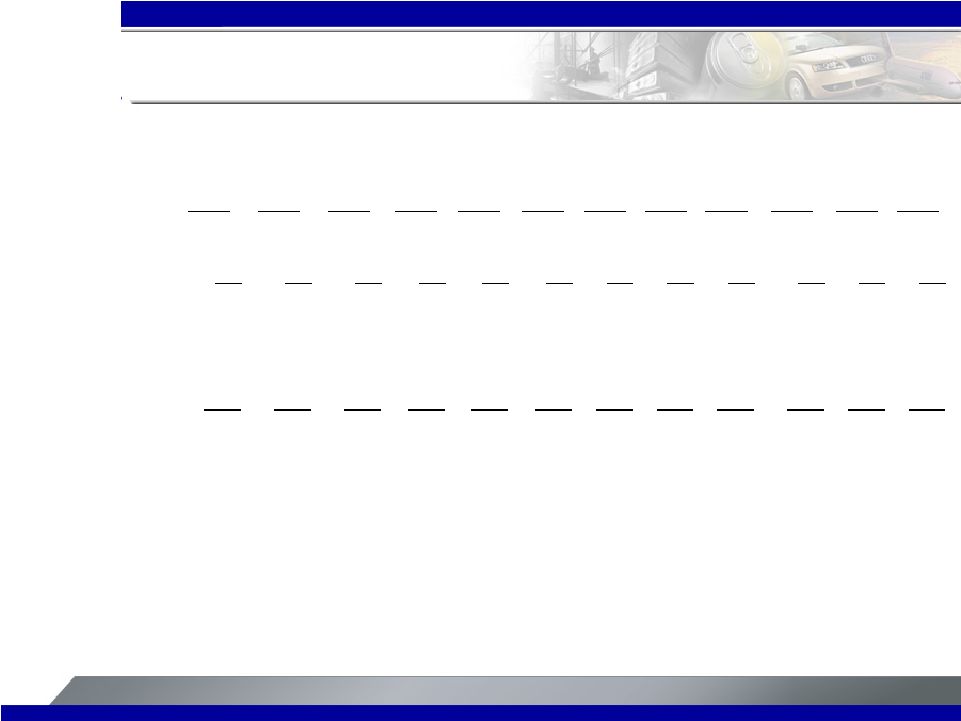

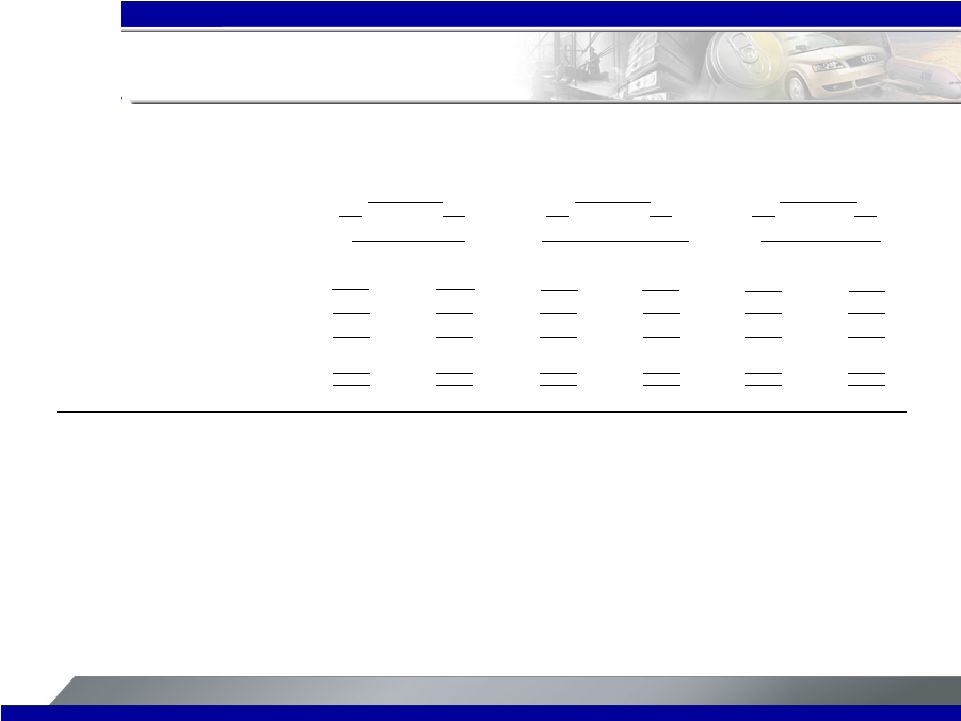

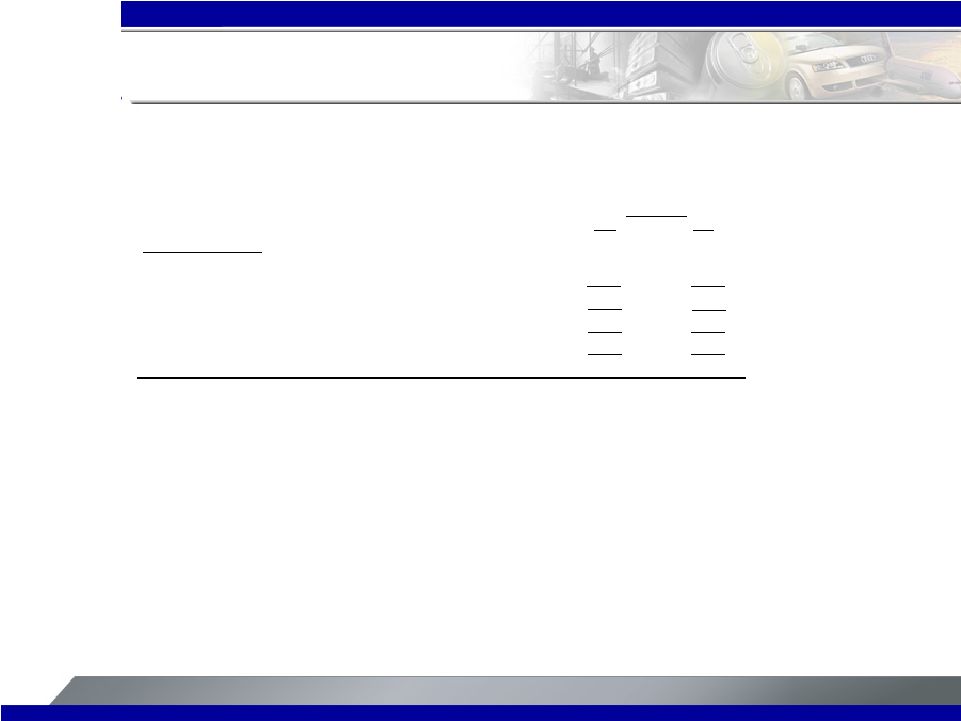

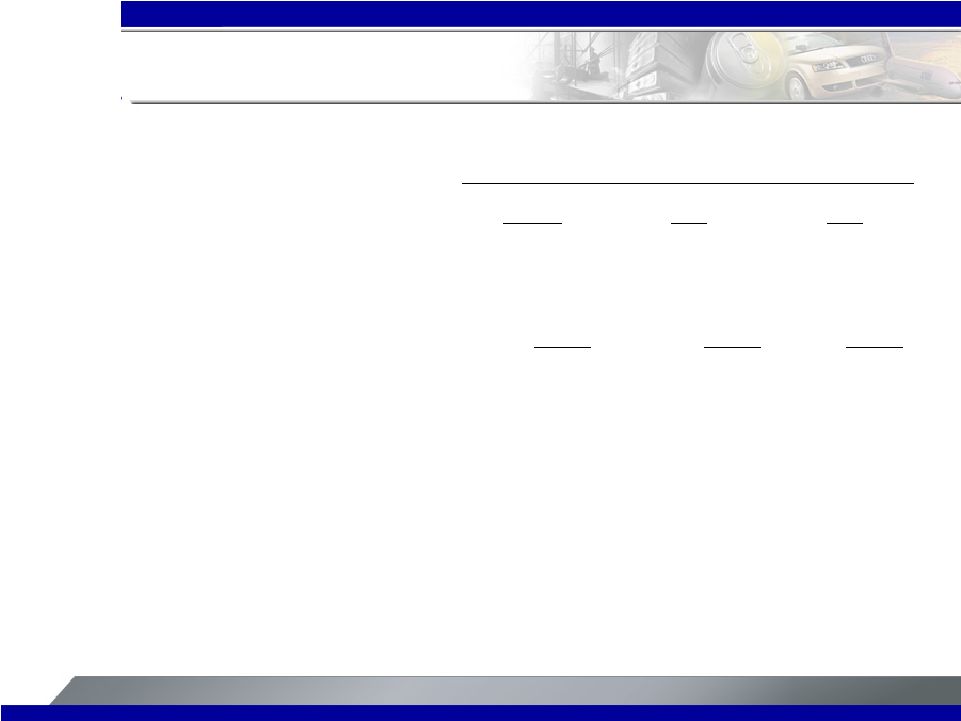

43 [Alcoa logo] Return on capital, excluding growth investments is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because it provides greater insight with respect to the underlying operating performance of the company’s productive assets. The company has significant growth investments underway in its upstream and downstream businesses, as previously noted, with expected completion dates over the next several years. As these investments generally require a period of time before they are productive, management believes that a return on capital measure excluding these growth investments is more representative of current operating performance. Reconciliation of Adjusted Return on Capital 4Q'07 3Q'07 2Q'07 1Q'07 4Q'06 3Q'06 2Q'06 1Q'06 4Q'05 3Q'05 2Q'05 1Q'05 Bloomberg Bloomberg Bloomberg Bloomberg Bloomberg Bloomberg Bloomberg Bloomberg Bloomberg Bloomberg Bloomberg Bloomberg (In Millions) Method Method Method Method Method Method Method Method Method Method Method Method Numerator (sum total) $3,191 $2,936 $2,975 $3,029 $2,975 $2,803 $2,501 $2,159 $1,753 $1,763 $1,744 $1,673 Russia, Bohai, and Kunshan net losses ($91) ($57) ($51) ($79) ($74) ($85) ($78) ($86) ($71) ($48) ($41) ($12) Adjusted numerator $3,282 $2,993 $3,026 $3,108 $3,049 $2,888 $2,579 $2,245 $1,824 $1,811 $1,785 $1,685 Average Balances Denominator (sum total) $25,064 $24,924 $25,123 $23,885 $22,474 $22,982 $22,421 $22,236 $21,144 $21,185 $20,967 $21,376 Capital projects in progress and Russia, Bohai, and Kunshan capital base $4,620 $4,430 $4,521 $3,945 $3,655 $2,540 $2,330 $2,139 $1,913 $1,776 $1,478 $1,403 Adjusted denominator $20,444 $20,494 $20,602 $19,940 $18,819 $20,442 $20,091 $20,097 $19,231 $19,409 $19,489 $19,973 Return on capital, excluding growth investments 16.1% 14.6% 14.7% 15.6% 16.2% 14.1% 12.8% 11.2% 9.5% 9.3% 9.2% 8.4% |