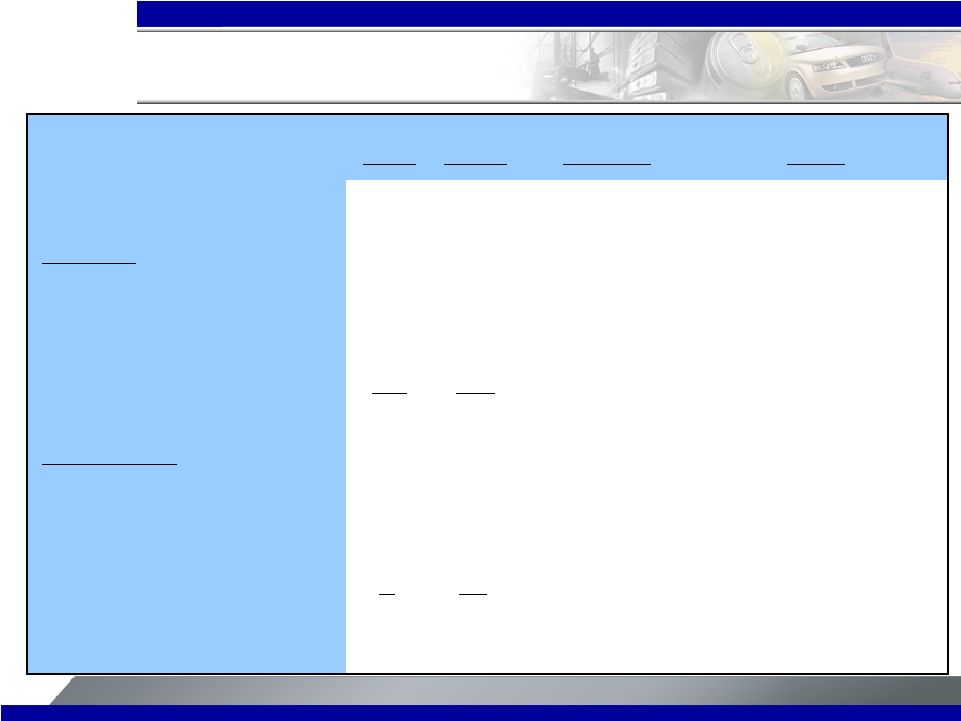

[Alcoa logo] Reconciliation of Return on Capital 41 Bloomberg Return on Capital (1) Bloomberg Return on Capital, Excluding Growth Investments (1) Year ended Year ended December 31, December 31, 2008 2008 Net income (loss) $ (74) Net income (loss) $ (74) Minority interests 221 Minority interests 221 Interest expense Interest expense (after tax) 231 (after tax) 231 Numerator $ 378 Numerator 378 Restructuring charges (3) 670 Net losses of growth investments (4) 300 Adjusted numerator $ 1,348 Average Balances Average Balances $ 521 $ 521 129 129 1,196 1,196 7,440 7,440 55 55 2,529 2,529 13,821 13,821 Denominator $ 25,691 Denominator 25,691 Restructuring chares (3) (436) Capital projects in progress and capital base of growth Investments (4) (5,117) Adjusted denominator $ 20,138 Return on capital 1.5% Return on capital, excluding growth investments and restructuring charges 6.7% (1) The Bloomberg Methodology calculates ROC based on the trailing four quarters. Average balances are calculated as (December 2008 ending balance + December 2007 ending balance) divided by 2 for the year ended December 31, 2008, and (December 2007 ending balance + December 2006 ending balance) divided by 2 for the year ended December 31, 2007. (2) Calculated as total shareholders’ equity less preferred stock. (3) Restructuring charges after-tax and minority interests for the years ended December 31, 2008 and 2007 were $670 million and $201 million, respectively. The pretax amounts are in Restructuring and other charges on Alcoa’s Statement of Consolidated Income. The $436 million is the average of the restructuring charges after-tax and minority interests for the years ended December 31, 2008 and 2007. (4) For all periods presented, growth investments include Russia, Bohai, and Kunshan. Short-term borrowings Short-term debt Commercial paper Long-term debt Preferred stock Minority interests Common equity (2) Short-term borrowings Short-term debt Commercial paper Long-term debt Preferred stock Minority interests Common equity (3) |