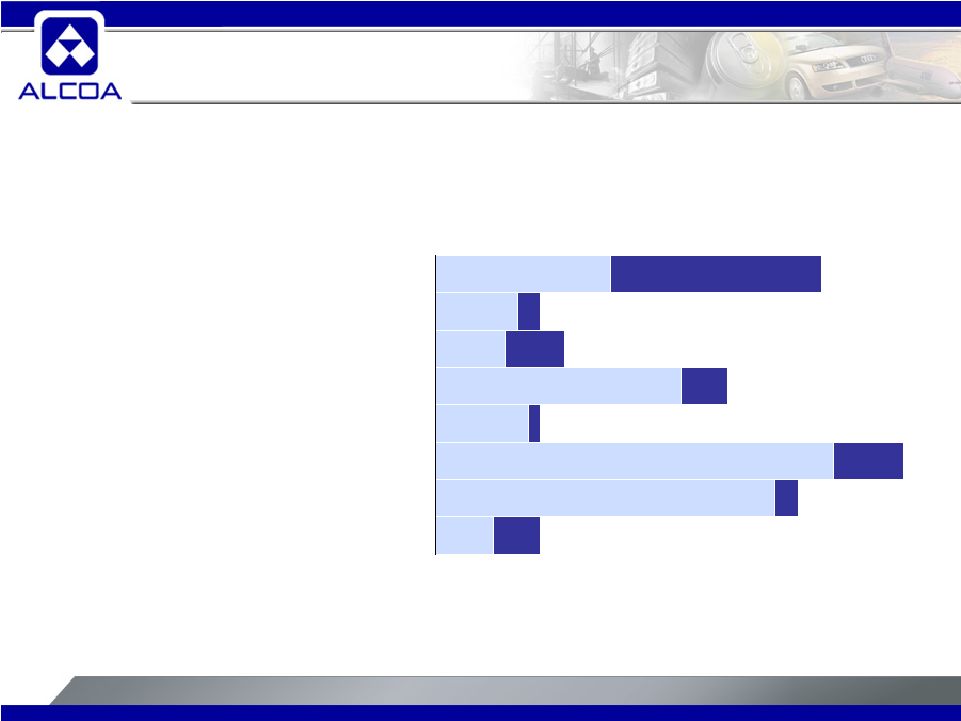

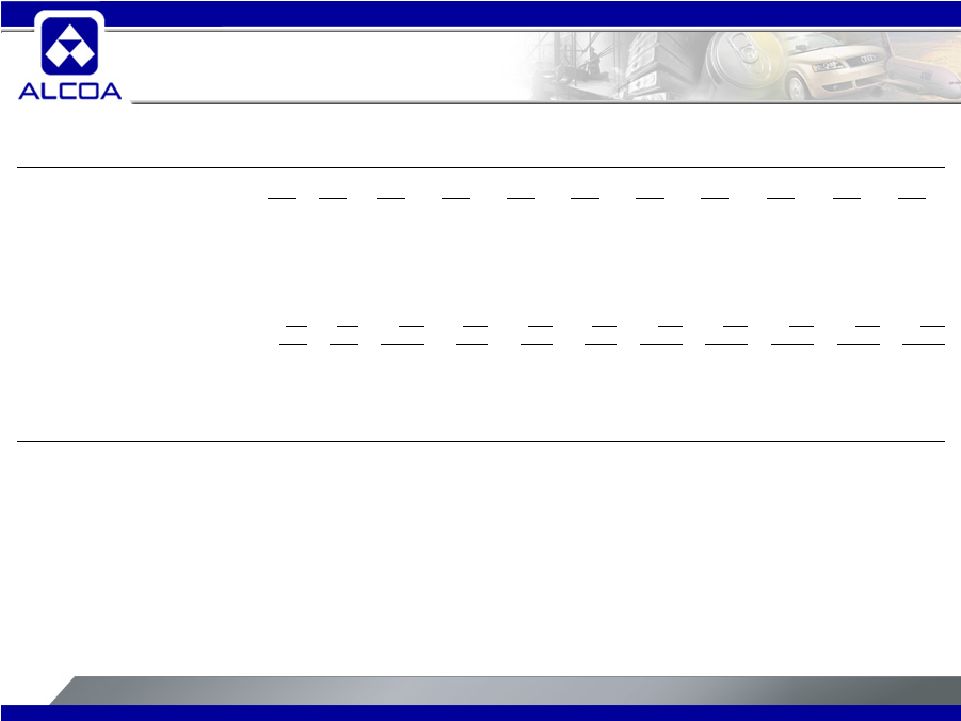

25 Reconciliation of Smelting EBITDA / MT ($ in millions) Primary Metals 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 After-tax operating income (ATOI) $372 $535 $1,000 $905 $650 $657 $808 $822 $1,760 $1,445 $931 Add: Depreciation, depletion, and amortization 176 216 311 327 300 310 326 368 395 410 503 Equity (income) loss (27) (42) (50) (52) (44) (55) (58) 12 (82) (57) (2) Income taxes 196 214 505 434 266 256 314 307 726 542 172 EBITDA $717 $923 $1,766 $1,614 $1,172 $1,168 $1,390 $1,509 $2,799 $2,340 $1,604 Production (thousand metric tons) (kmt) 2,471 2,851 3,539 3,488 3,500 3,508 3,376 3,554 3,552 3,693 4,007 EBITDA/Production $290 $324 $499 $463 $335 $333 $412 $425 $788 $634 $400 EBITDA is not a measure of financial performance under GAAP. Accordingly, it should not be considered as a substitute for net earnings (loss), operating earnings (loss), ATOI, cash flow provided by operating activities or other income or cash flow data prepared in accordance with GAAP. However, Alcoa’s management believes that EBITDA may provide additional information with respect to the Company’s performance or ability to meet its financial obligations. The ratio of EBITDA to production is an additional measure of financial performance. Because EBITDA excludes some, but not all, items that affect net earnings and may vary among companies, the EBITDA presented by Alcoa may not be comparable to similarly titled measures of other companies. |