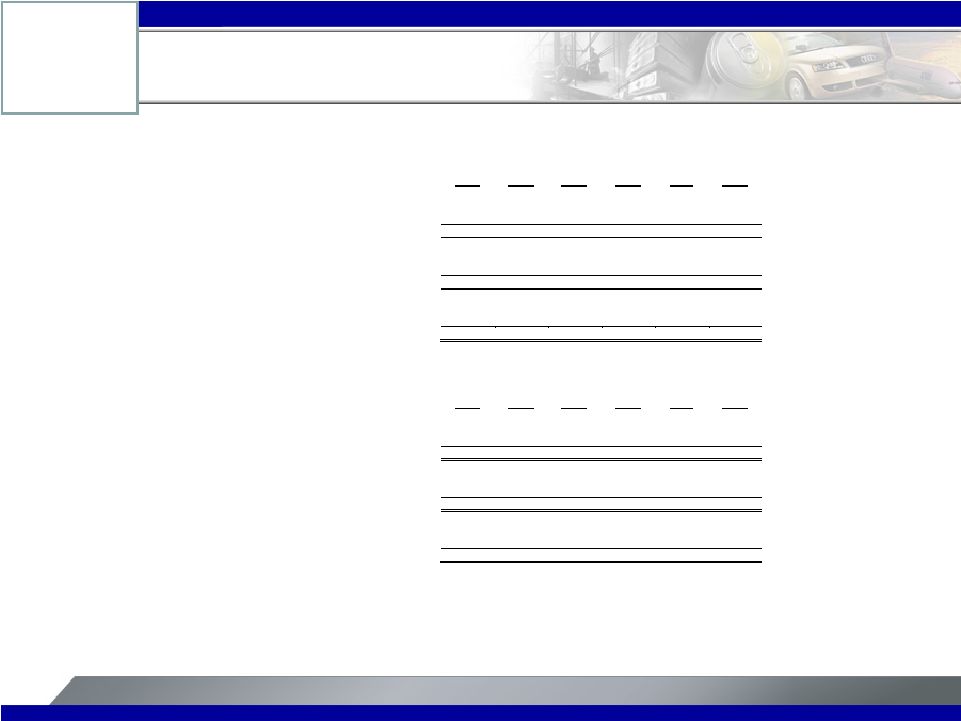

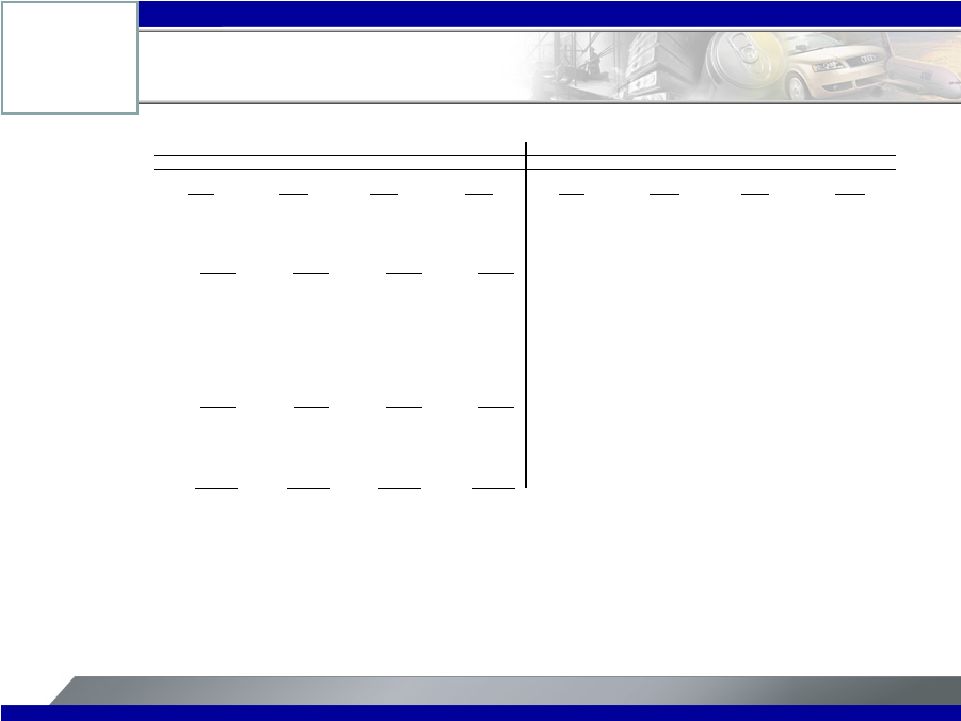

Alcoa Logo Other Reconciliations (in millions) Earnings before interest, taxes, depreciation, and amortization (EBITDA)* Quarter ended March 31, 2009 June 30, 2009 Change Net loss attributable to Alcoa $ (497) $ (454) $ 43 Add: Noncontrolling interests 10 (5) (15) Loss from discontinued operations 17 142 125 Benefit for income taxes (307) (108) 199 Other expenses (income), net 30 (89) (119) Interest expense 114 115 1 Restructuring and other charges 69 82 13 Provision for depreciation, depletion, and amortization 283 317 34 Sub-total 216 454 238 EBITDA $ (281) $ – $ 281 * Alcoa’s definition of EBITDA is net margin excluding depreciation, depletion, and amortization. Net margin is equivalent to sales minus the following items: cost of goods sold; selling, general administrative, and other expenses; and research and development expenses. EBITDA is a non-GAAP financial measure and should not be considered a substitute for any income or cash flow measure prepared in accordance with U.S. GAAP. Management believes that EBITDA is meaningful to investors because it provides additional information with respect to Alcoa’s financial performance. Because the calculation of EBITDA may vary among companies, the EBITDA presented by Alcoa may not be comparable to similarly titled measures of other companies. Effective Tax Rate Quarter ended March 31, 2009 June 30, 2009 Change Benefit for income taxes $ (307) $ (108) Loss from continuing operations before income taxes $ (777) $ (425) Effective tax rate 39.5% 25.4% (14.1)% Less: Discrete tax items** 5.0% – (5.0)% Effective tax rate, excluding discrete tax items 34.5% 25.4% (9.1)% * The discrete tax items in the quarter ended March 31, 2009 were income tax benefits of $28 (3.6%) related to a tax law change in Canada and $11 (1.4%) related to the Elkem/SAPA swap. Effective tax rate, excluding discrete tax items is a non-GAAP financial measure. Management believes that the Effective tax rate, excluding discrete tax items is meaningful to investors because it provides a view of Alcoa’s operational tax rate. Primary Metals Adjusted ATOI Quarter ended March 31, 2009 June 30, 2009 Change ATOI $ (212) $ (178) $ 34 Less: Gain on Elkem/SAPA swap 112 – (112) ATOI – as adjusted $ (324) $ (178) $ 146 ATOI – as adjusted is a non-GAAP financial measure. Management believes that ATOI – as adjusted is meaningful to investors because it provides better insight to the operational results and performance of the segment. 41 |