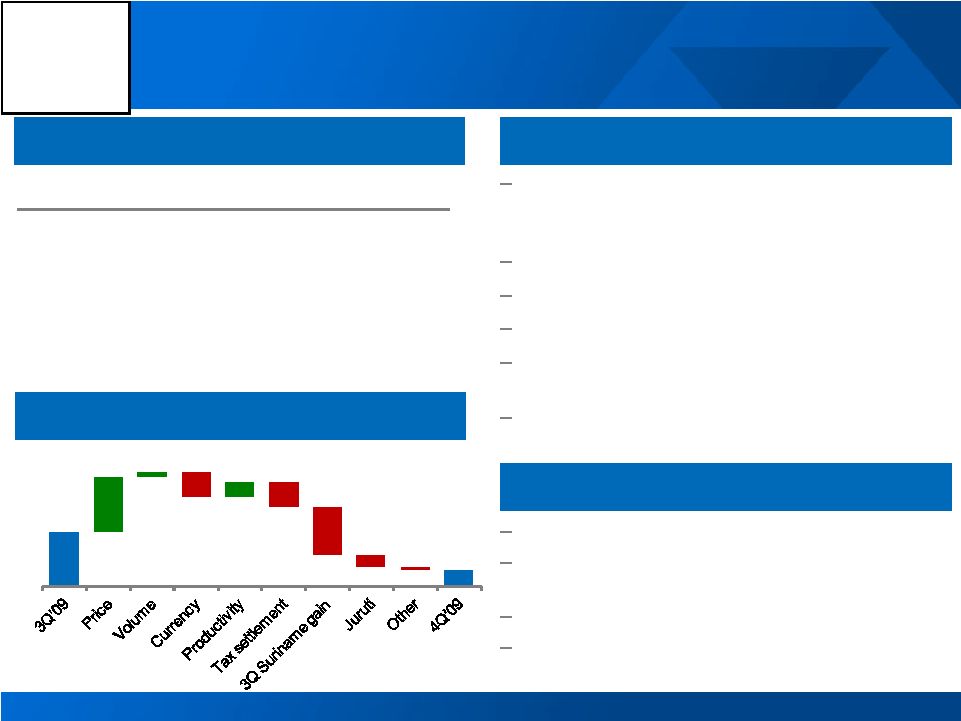

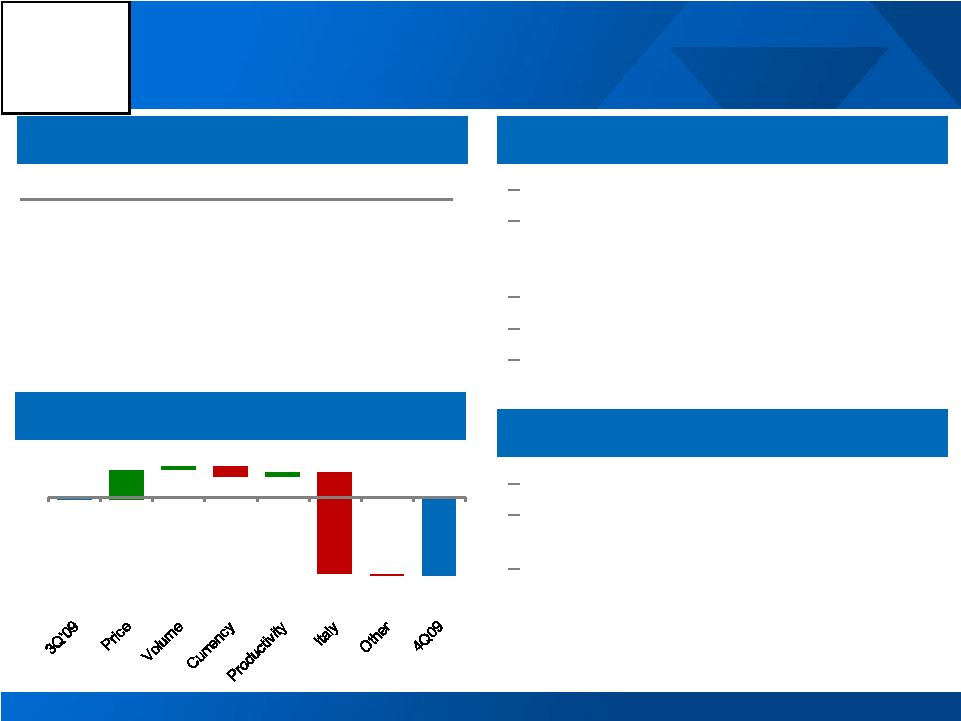

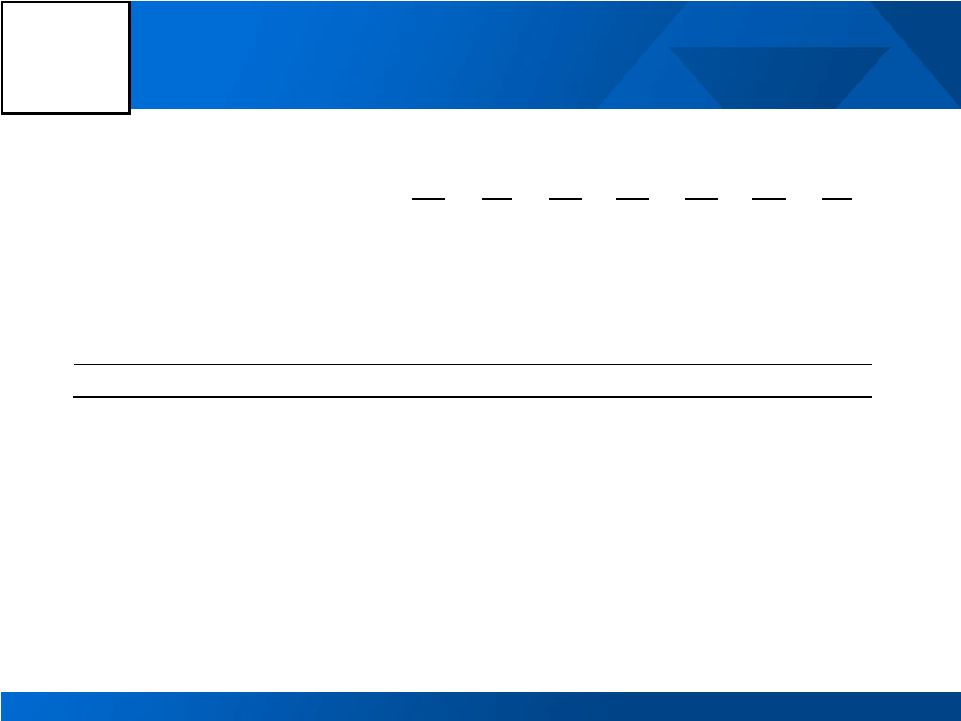

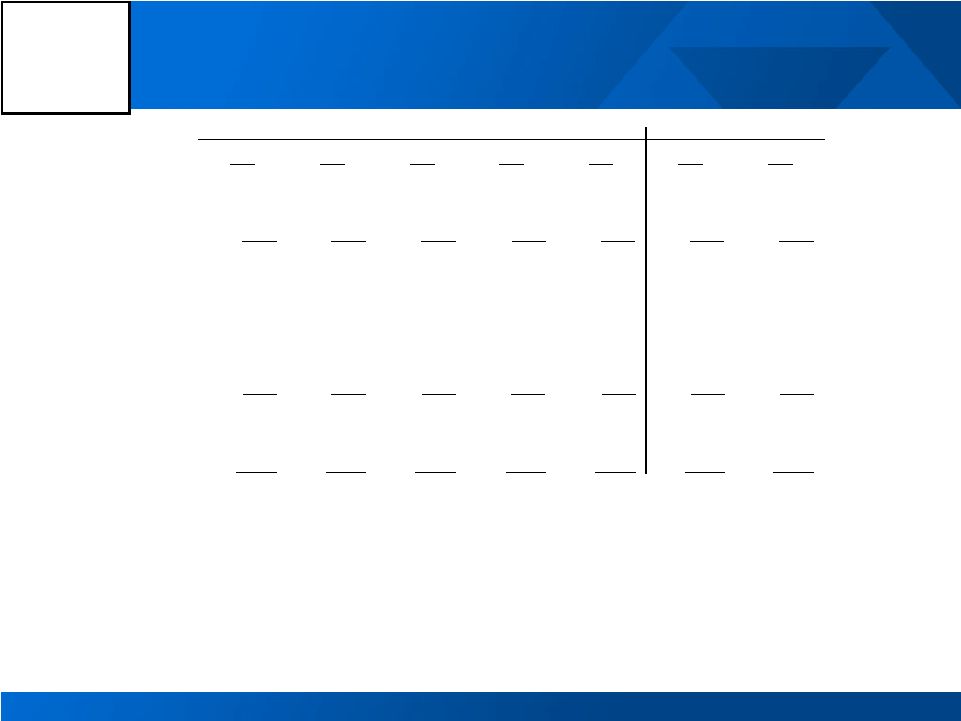

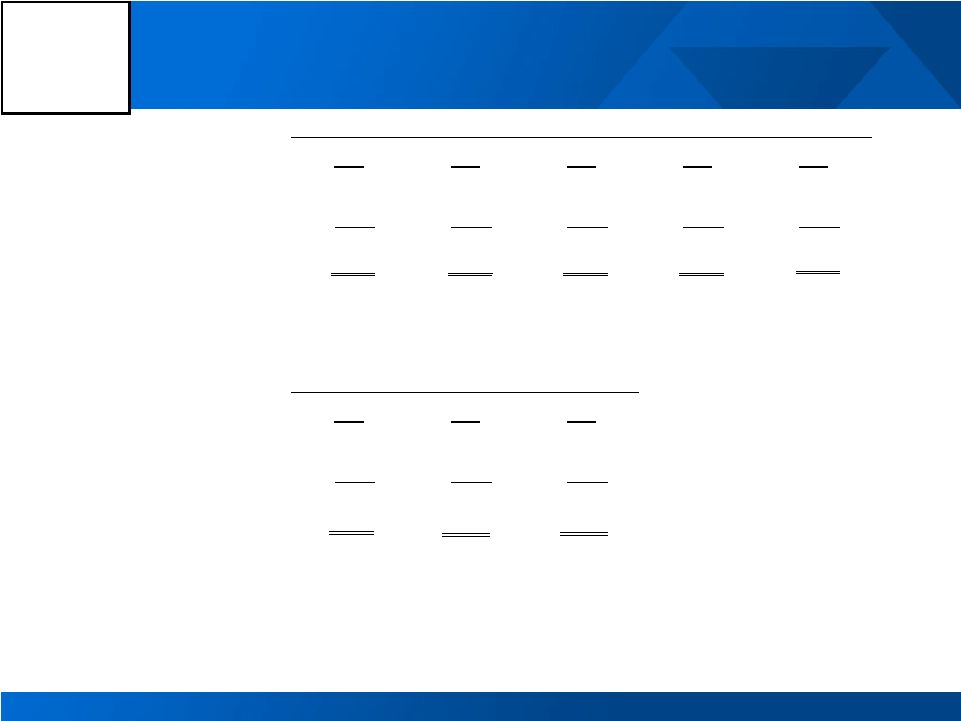

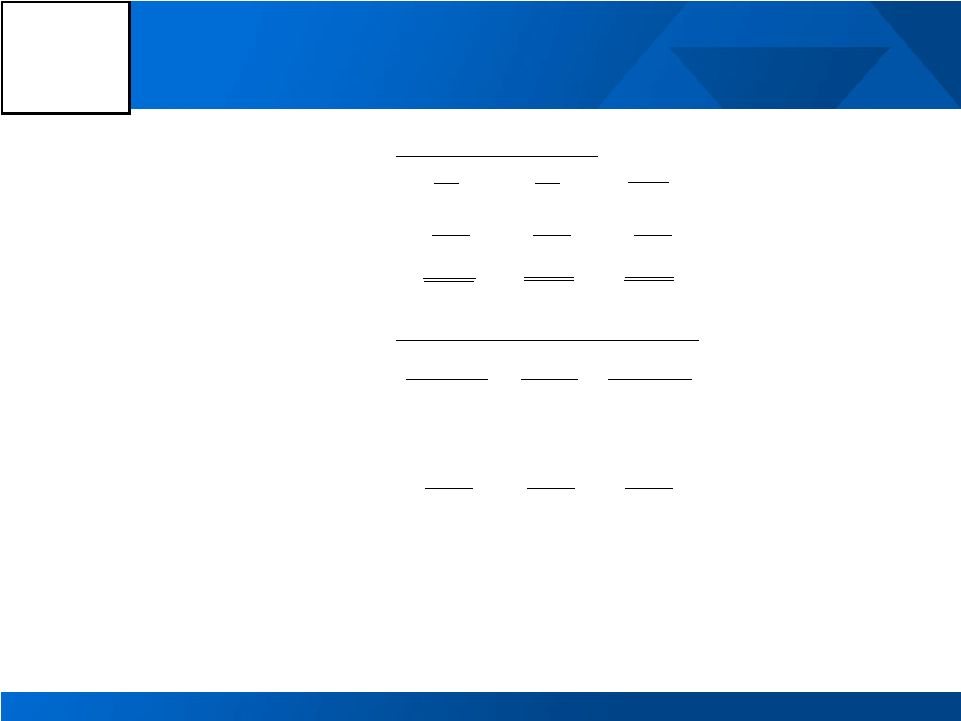

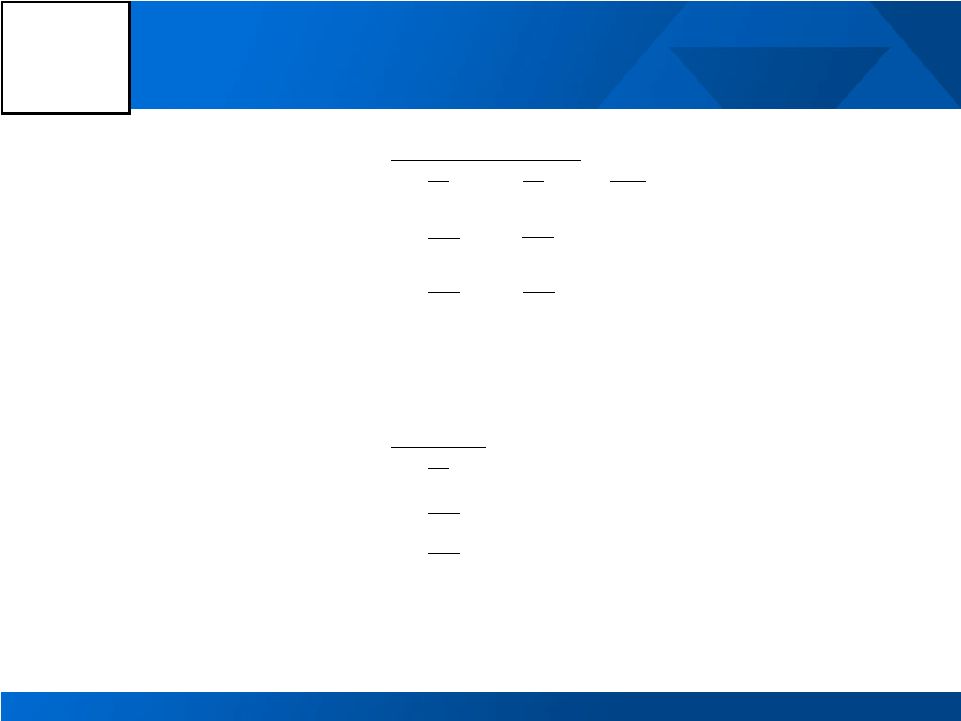

[Alcoa Logo] Reconciliation of Adjusted (Loss) Income 40 (in millions) Quarter ended Year ended December 31, 2008 March 31, 2009 June 30, 2009 September 30, 2009 December 31, 2009 December 31, 2008 December 31, 2009 Net (loss) income attributable to Alcoa $ (1,191) $ (497) $ (454) $ 77 $ (277) $ (74) $ (1,151) (Loss) income from discontinued operations (262) (17) (142) 4 (11) (303) (166) (Loss) income from continuing operations attributable to Alcoa (929) (480) (312) 73 (266) 229 (985) Restructuring and other charges 614 46 56 1 49 670 152 Discrete tax items* 65 (28) – – (82) 84 (110) Special items** 29 (15) – (35) 308 29 258 (Loss) income from continuing operations attributable to Alcoa – as adjusted $ (221) $ (477) $ (256) $ 39 $ 9 $ 1,012 $ (685) Discrete tax items include the following: a benefit for the reorganization of an equity investment in Canada (-$71), a charge for the write-off of deferred tax assets related to operations in Italy ($41), a benefit for a tax rate change in Iceland (-$31), and a benefit for the reversal of a valuation allowance on net operating losses in Norway (-$21) for the quarter ended December 31, 2009; a benefit for a tax law change in Canada for the quarter ended March 31, 2009; a charge for non-cash tax on repatriated earnings for the quarter ended December 31, 2008; and, the previously mentioned item for the quarter ended December 31, 2008 and a charge related to the sale of the Packaging and Consumer businesses for the year ended December 31, 2008. Special items include the following: charges related to a recent European Commission’s ruling on electricity pricing for smelters in Italy ($250), a tax settlement related to an equity investment in Brazil ($24), an estimated loss on excess power at our Intalco smelter ($19), and an environmental accrual for smelters in Italy ($15) for the quarter ended December 31, 2009; a gain on an acquisition in Suriname for the quarter ended September 30, 2009; a gain on the Elkem/SAPA swap (-$133) and a loss on the sale of Shining Prospect ($118) for the quarter ended March 31, 2009; and, charges for environmental reserve ($26), obsolete inventory ($16), and accounts receivable reserve ($11), and a refund of an indemnification payment (-$24) for the quarter ended December 31, 2008. ** (Loss) income from continuing operations attributable to Alcoa – as adjusted is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because management reviews the operating results of Alcoa excluding the impacts of restructuring and other charges, discrete tax items, and special items. There can be no assurances that additional restructuring and other charges, discrete tax items, and special items will not occur in future periods. To compensate for this limitation, management believes that it is appropriate to consider both (Loss) income from continuing operations attributable to Alcoa determined under GAAP as well as (Loss) income from continuing operations attributable to Alcoa – as adjusted. * |