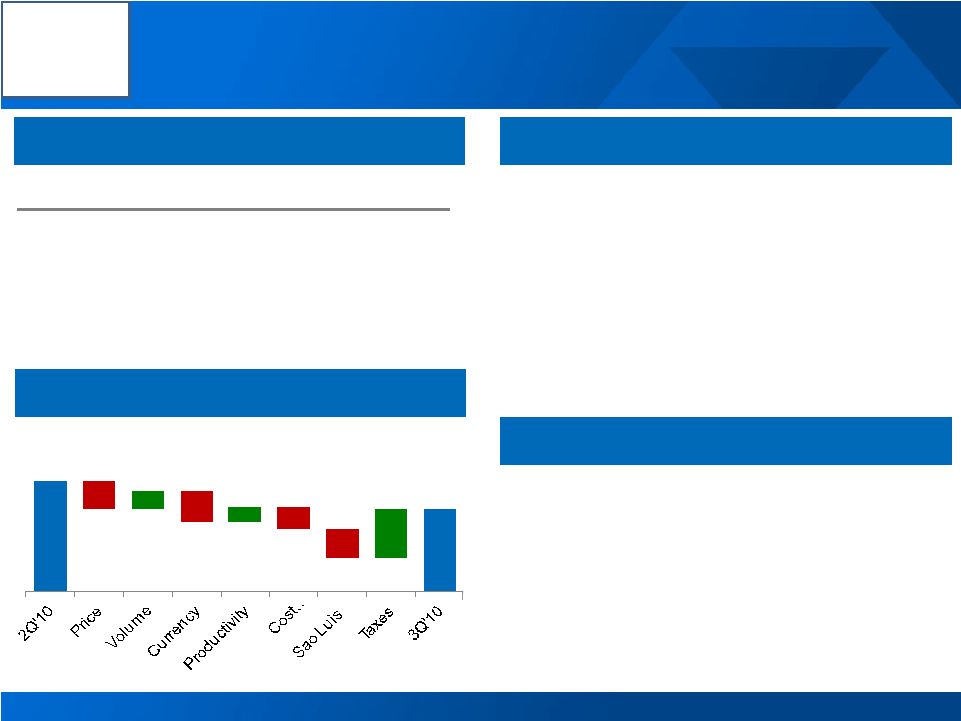

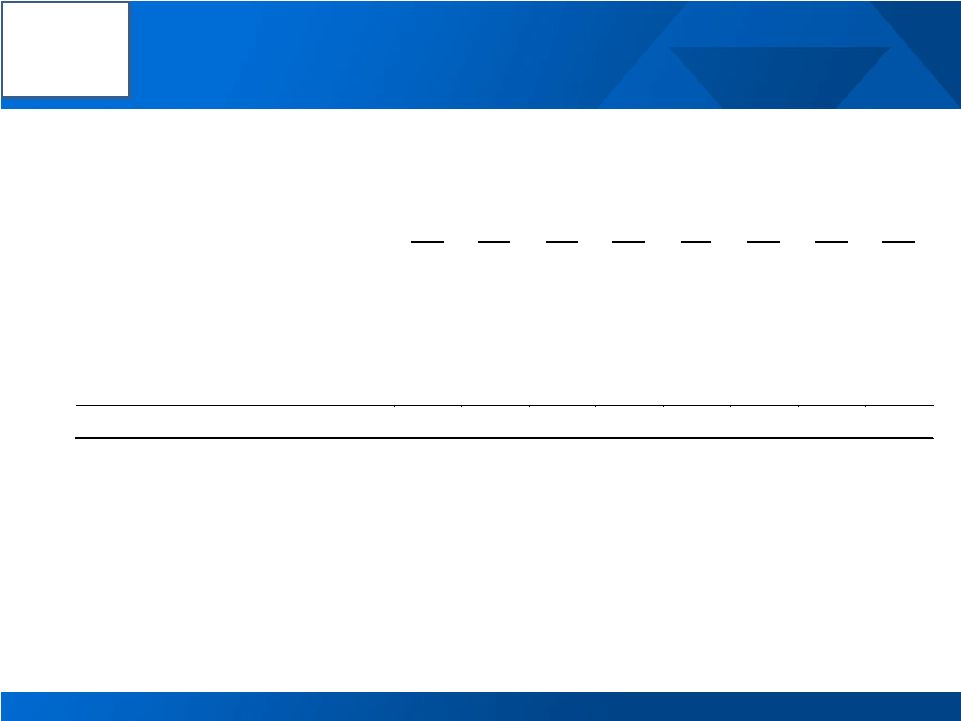

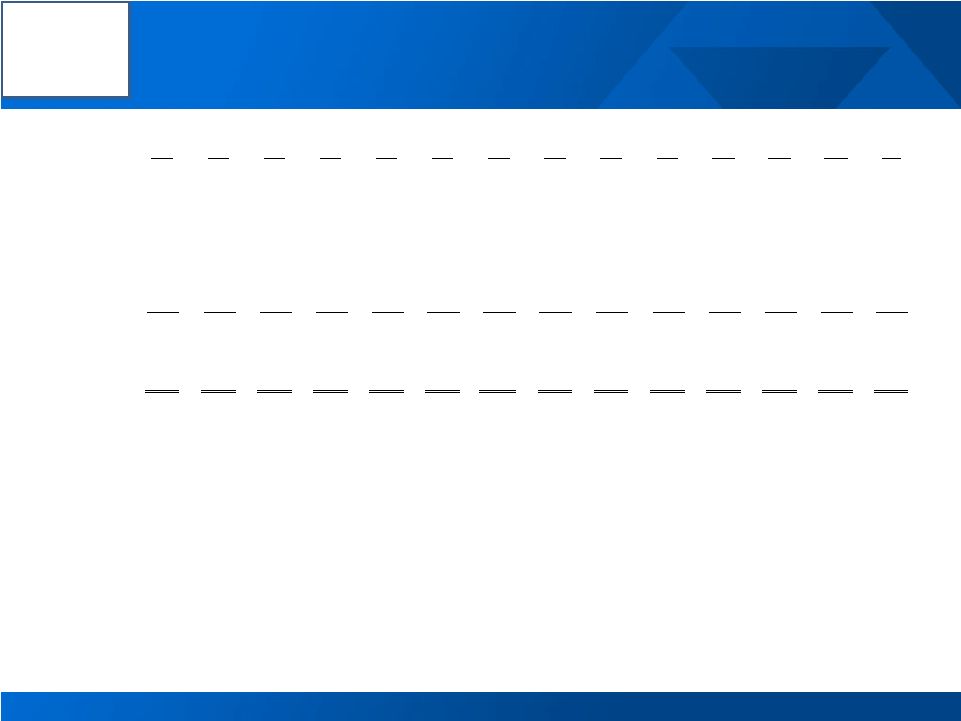

Alcoa Logo Reconciliation of Adjusted Income 32 (in millions) Quarter ended June 30, 2010 September 30, 2010 Net income attributable to Alcoa $ 136 $ 61 Loss from discontinued operations (1) – Income from continuing operations attributable to Alcoa 137 61 Restructuring and other charges 20 (1) Discrete tax items* (16) (38) Special items** (2) 74 Income from continuing operations attributable to Alcoa – as adjusted $ 139 $ 96 Income from continuing operations attributable to Alcoa – as adjusted is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because management reviews the operating results of Alcoa excluding the impacts of restructuring and other charges, discrete tax items, and special items. There can be no assurances that additional restructuring and other charges, discrete tax items, and special items will not occur in future periods. To compensate for this limitation, management believes that it is appropriate to consider both Income from continuing operations attributable to Alcoa determined under GAAP as well as Income from continuing operations attributable to Alcoa – as adjusted. * Discrete tax items include the following: for the quarter ended September 30, 2010, a benefit for the reversal of a valuation allowance related to net operating losses of an international subsidiary that are now realizable due to a settlement with a tax authority ($41); a charge for a tax rate change in Brazil ($11); and a benefit for the recovery of a portion of the unfavorable impact included in the quarter ended March 31, 2010 related to unbenefitted losses in Russia, China, and Italy ($8); and, for the quarter ended June 30, 2010, a benefit for a change in a Canadian provincial tax law permitting tax returns to be filed in U.S. dollars ($24), a charge based on settlement discussions of several matters with international taxing authorities ($18), and a benefit for the recovery of a portion of the unfavorable impact included in the quarter ended March 31, 2010 related to unbenefitted losses in Russia, China, and Italy ($10). ** Special items include the following: for the quarter ended September 30, 2010, unfavorable mark-to-market changes in derivative contracts ($29), recovery costs associated with the São Luís, Brazil facility due to a power outage and failure of a ship unloader in the first half of 2010 ($23), restart costs and lost volumes related to a June 2010 flood at the Avilés smelter in Spain ($13), and a net charge for the early repayment of Notes set to mature in 2011 through 2013 due to the premiums paid under the tender offers and call option (partially offset by gains from the termination of related in-the-money interest rate swaps) ($9); and, for the quarter ended June 30, 2010, favorable mark-to-market changes in derivative contracts ($22), a charge for costs associated with the potential strike and successful execution of a new agreement with the USW ($13), and a charge related to an unfavorable decision in Alcoa’s lawsuit against Luminant related to the Rockdale, TX facility ($7). |