- HWM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Howmet Aerospace (HWM) 8-KRegulation FD Disclosure

Filed: 2 Jun 11, 12:00am

Nomura Aluminum Seminar June 2 , 2011 Exhibit 99 Alcoa Logo nd |

Cautionary Statement 2 Alcoa Logo Forward-Looking Statements This presentation contains statements that relate to future events and expectations and as such constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include those containing such words as “anticipates,” “estimates,” “expects,” “forecasts,” “intends,” “outlook,” “plans,” “projects,” “should,” “targets,” “will,” or other words of similar meaning. All statements that reflect Alcoa’s expectations, assumptions, or projections about the future other than statements of historical fact are forward- looking statements, including, without limitation, forecasts concerning global demand for aluminum, aluminum end-market growth, aluminum consumption rates, or other trend projections, targeted financial results or operating performance, and statements about Alcoa’s strategies, objectives, goals, targets, outlook, and business and financial prospects. Forward-looking statements are subject to a number of known and unknown risks, uncertainties, and other factors and are not guarantees of future performance. Important factors that could cause actual results to differ materially from those in the forward-looking statements include: (a) material adverse changes in aluminum industry conditions, including global supply and demand conditions and fluctuations in London Metal Exchange-based prices for primary aluminum, alumina, and other products, and fluctuations in indexed-based and spot prices for alumina; (b) unfavorable changes in general business and economic conditions, in the global financial markets, or in the markets served by Alcoa, including automotive and commercial transportation, aerospace, building and construction, distribution, packaging, consumer electronics, oil and gas, defense, and industrial gas turbines; (c) the impact of changes in foreign currency exchange rates on costs and results, particularly the Australian dollar, Brazilian real, Canadian dollar, and Euro; (d) increases in energy costs, including electricity, natural gas, and fuel oil, or the unavailability or interruption of energy supplies; (e) increases in the costs of other raw materials, including caustic soda or carbon products; (f) Alcoa’s inability to achieve the level of revenue growth, cash generation, cost savings, improvement in profitability and margins, fiscal discipline, or strengthening of operations (including moving its alumina refining and aluminum smelting businesses down on the industry cost curve and increasing revenues in its Flat-Rolled Products and Engineered Products and Solutions segments), anticipated from its productivity improvement, cash sustainability and other initiatives; (g) Alcoa's inability to realize expected benefits from newly constructed, expanded or acquired facilities or from international joint ventures as planned and by targeted completion dates, including the joint venture in Saudi Arabia or the upstream operations in Brazil; (h) political, economic, and regulatory risks in the countries in which Alcoa operates or sells products, including unfavorable changes in laws and governmental policies, civil unrest, or other events beyond Alcoa’s control; (i) the outcome of contingencies, including legal proceedings, government investigations, and environmental remediation; (j) the business or financial condition of key customers, suppliers, and business partners; (k) changes in tax rates or benefits; and (l) the other risk factors summarized in Alcoa's Form 10-K for the year ended December 31, 2010, and other reports filed with the Securities and Exchange Commission (SEC). Alcoa disclaims any obligation to update publicly any forward-looking statements, whether in response to new information, future events or otherwise, except as required by applicable law. |

Perspective: viewpoint of presentation Differentiation: Alcoa and what makes us special Looking Back: sustainably improving our cost structure Looking Forward: setting rigorous 3- to 5-year goals 3 Alcoa Logo |

Perspective: viewpoint of presentation Differentiation: Alcoa and what makes us special Looking Back: sustainably improving our cost structure Looking Forward: setting rigorous 3- to 5-year goals 4 Alcoa Logo |

5 Founded in 1888 200+ locations 31 countries $21.0 billion 2010 revenue 10 times safer workplace than US average Award-winning sustainability leadership 120 years of aluminum technical leadership Alcoa: long-lasting, global and focused on delivering value Alcoa Logo Number of Employees (2010) U.S. 24,000 Europe 17,000 Other Americas 11,000 Pacific 7,000 59,000 |

Building a solid foundation and setting the right standard 6 Renewable Energy Carbon Sequestration Carbothermic Embracing diversity & talent to live our values… …conserving natural resources… …innovating continuously… …and creating impacts through our values. CO2 Reductions Alcoa Logo |

Aluminum: the miracle metal Lightweight Recyclable Non corrosive Fuel efficient Durable High strength Highly conductive Malleable 7 Alcoa Logo |

Partnering with our customers to drive innovation Titanium coated Reynobond Kawneer Light Shelf Aluminum Bottle LvL ONE™ Truck Wheel 8 Building and Construction Beverage Packaging Industrial Gas Turbines Aerospace Consumer Electronics Commercial Transportation Alcoa Logo |

9 Upstream portfolio: bauxite, alumina, aluminum and energy 9 Mining #1 in Bauxite Refining Smelting Energy #1 in Alumina Global leader in Smelting $7.1B Revenues In 2010 ~ 2/3 smelter capacity powered with renewable energy $2.8B Revenues in 2010 Alcoa Logo |

10 10 Midstream portfolio: Global Rolled Products Global Rolled Products Portfolio Global Aerospace Regional Commodities Aerospace Jumbo Aircraft Twin Aisles Single Aisles Can / Packaging Automotive Sheet Lithographic Sheet Commercial Transportation Brazing HVAC Defense Consumer Electronics Industrial Products Building & Construction Common Alloys Regional Specialties B737 A320 B777 A330/A340 B747-8 A380 $4.7B Revenues in 2010 Alcoa Logo |

Power & Propulsion Forgings & Extrusions Wheels BCS Fastening Systems $1.1B $0.9B $0.6B $0.5B Global leader in aerospace Fastening Systems. Global leader in jet engine and industrial gas turbine airfoils Global leader in aluminum commercial vehicle wheels Global technology leader in aerospace and defense NA Market leader in commercial architectural systems 2010 Revenues: $4.6 billion Employees: ~21,000 Locations: 88 Facilities in 20 Countries 11 $1.5B Downstream portfolio: Engineered Products & Solutions Technically complex & highly differentiated products focused on aerospace, power generation, commercial transportation and B&C markets Engineered Products & Solutions Alcoa Logo |

Perspective: viewpoint of presentation Differentiation: Alcoa and what makes us special Looking Back: sustainably improving our cost structure Looking Forward: setting rigorous 3- to 5-year goals 12 Alcoa Logo |

Driving cost improvements in 2009 and 2010 13 2009 2010 $ Millions $2,000 $ Millions $1,998 $1,500 2009 Target 2009 Actual 1 Procurement and other productivity Procurement 2010 Original Target 2010 Revised Target Overhead $2,500 $2,643 2010 Actual 2009 2010 $ Millions $400 $ Millions $412 $200 2009 Target 2009 Actual 2010 Original Target 2010 Revised Target $500 $509 2010 Actual Alcoa Logo 1 |

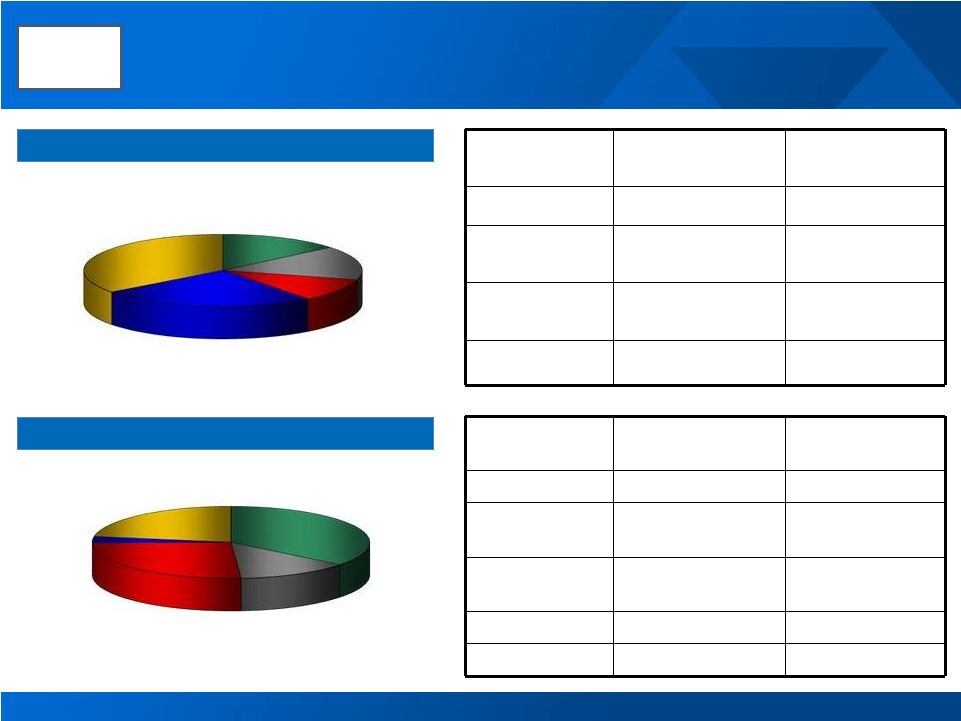

14 Upstream costs are tied to several key commodities Input Cost Inventory flow Pricing convention Fuel oil 1 - 2 months Prior month Natural gas 1 - 2 months Rolling 16 quarters Caustic soda 3 - 6 months Spot & semi- annual Bauxite 2 - 3 months 6 - 9 month lag Input Cost Inventory flow Pricing convention Alumina 1 - 2 months 2 - 3 month lags Power 1 - 2 months 40% LME linked - 3 month lag Carbon 1 - 2 months Spot & semi- annual Materials 1 - 2 months 1 - 3 month lag Conversion 1 month Immediate Refining Cost Structure Smelting Cost Structure Alcoa Logo Conversion 35% Fuel Oil 14% Natural gas 15% Caustic 11% Bauxite 25% Power 26% Carbon 13% Alumina 36% Conversion 22% Materials 3% |

15 Currency and raw materials continue to trend upwards 1 PACE - CPC USGC (PACE MidPoint) 2 CMAI - Caustic Soda Average Acquisition - FOB USGC ($/DMT) 3 Bloomberg Daily Average - Gulf Coast 3% Sulfur Fuel Oil 4 NYMEX LME Cash AUD/USD Currency / USD Aluminum $ / Tonne LME Cash Caustic Soda Index 2 Index Prices Aluminum $ / Tonne CPC Pace Index BRL/USD CAD/USD EUR/USD Fuel Oil Index Natural Gas 4 Alcoa Logo 3 1 |

16 Sustainable advantage in an inflationary environment • Expanding internal calcining capacity • Lake Charles has increased capacity by 20% this year alone • Evaluating opportunities for backward integration • Optimizing contract lengths and pricing periods Firm Actions to Gain Advantage in Raw Materials • Optimizing material specifications to leverage multiple locations • Utilizing new and non-traditional sources of raw materials • Global arbitrage through our extensive, world-wide logistics network • Trading and alliance partnerships San Ciprian: leveraging our global operations Complex blending at Lake Charles: super blends of up to 6 cokes Alcoa Logo |

Perspective: viewpoint of presentation Differentiation: Alcoa and what makes us special Looking Back: sustainably improving our cost structure Looking Forward: setting rigorous 3- to 5-year goals 17 Alcoa Logo |

Accelerating shareholder value in 2011 and beyond 18 Upstream 2015 Cost Curve Changes Refining Cost Curve Position Smelting Cost Curve Position Midstream 2013 Revenue Targets Downstream 2013 Revenue Targets 2011 Financial Targets Sustaining Capex $1.0B Growth Capex $0.5B Debt-to- cap Ratio 30 to 35% Positive Free Cash Flow Ma’aden Investment $0.4B Alcoa Logo |

Alcoa Logo Alcoa Logo |