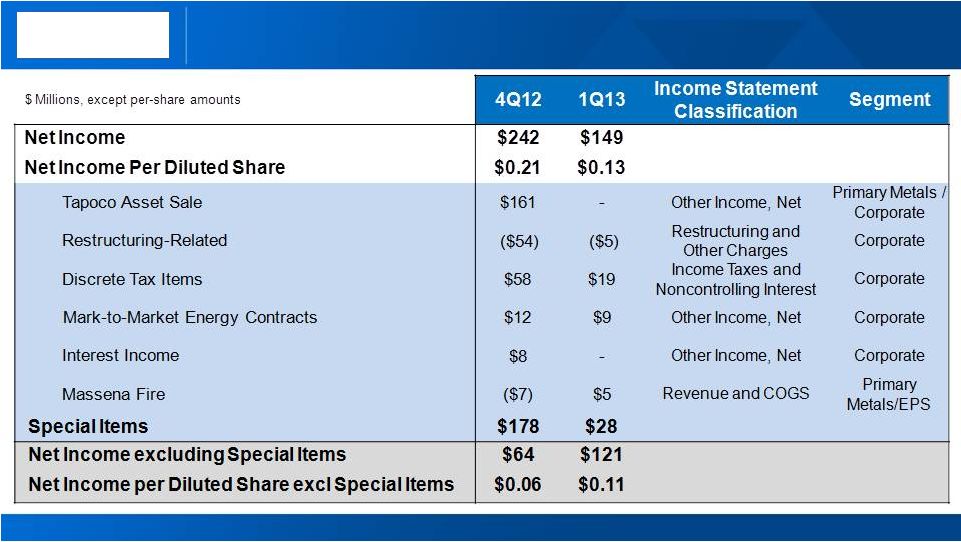

2 Cautionary Statement Forward-Looking Statements This presentation contains statements that relate to future events and expectations and as such constitute forward-looking statements. Forward-looking statements include those containing such words as “anticipates,” “estimates,” “expects,” “forecasts,” “intends,” “outlook,” “plans,” “projects,” “should,” “targets,” “will,” or other words of similar meaning. All statements that reflect Alcoa’s expectations, assumptions, or projections about the future other than statements of historical fact are forward-looking statements, including, without limitation, forecasts concerning global demand growth for aluminum, end-market conditions, supply/demand balances, and growth opportunities for aluminum in automotive, aerospace and other applications, trend projections, targeted financial results or operating performance, and statements about Alcoa’s strategies, outlook, and business and financial prospects. Forward-looking statements are subject to a number of known and unknown risks, uncertainties, and other factors and are not guarantees of future performance. Important factors that could cause actual results to differ materially from those in the forward-looking statements include: (a) material adverse changes in aluminum industry conditions, including global supply and demand conditions and fluctuations in London Metal Exchange-based prices for primary aluminum, alumina, and other products, and fluctuations in indexed-based and spot prices for alumina; (b) deterioration in global economic and financial market conditions generally; (c) unfavorable changes in the markets served by Alcoa, including automotive and commercial transportation, aerospace, building and construction, distribution, packaging, defense, and industrial gas turbine; (d) the impact of changes in foreign currency exchange rates on costs and results, particularly the Australian dollar, Brazilian real, Canadian dollar, euro, and Norwegian kroner; (e) increases in energy costs, including electricity, natural gas, and fuel oil, or the unavailability or interruption of energy supplies; (f) increases in the costs of other raw materials, including calcined petroleum coke, caustic soda, and liquid pitch; (g) Alcoa’s inability to achieve the level of revenue growth, cash generation, cost savings, improvement in profitability and margins, fiscal discipline, or strengthening of competitiveness and operations (including moving its alumina refining and aluminum smelting businesses down on the industry cost curves and increasing revenues in its Global Rolled Products and Engineered Products and Solutions segments) anticipated from its restructuring programs and productivity improvement, cash sustainability, and other initiatives; (h) Alcoa's inability to realize expected benefits, in each case as planned and by targeted completion dates, from sales of non-core assets, or from newly constructed, expanded, or acquired facilities, such as the upstream operations in Brazil and the investments in hydropower projects in Brazil, or from international joint ventures, including the joint venture in Saudi Arabia; (i) political, economic, and regulatory risks in the countries in which Alcoa operates or sells products, including unfavorable changes in laws and governmental policies, civil unrest, or other events beyond Alcoa’s control; (j) the outcome of contingencies, including legal proceedings, government investigations, and environmental remediation; (k) the business or financial condition of key customers, suppliers, and business partners; (l) adverse changes in tax rates or benefits; (m) adverse changes in discount rates or investment returns on pension assets; (n) the impact of cyber attacks and potential information technology or data security breaches; and (o) the other risk factors summarized in Alcoa's Form 10-K for the year ended December 31, 2012 and other reports filed with the Securities and Exchange Commission. Alcoa disclaims any obligation to update publicly any forward-looking statements, whether in response to new information, future events or otherwise, except as required by applicable law. Non-GAAP Financial Measures Some of the information included in this presentation is derived from Alcoa’s consolidated financial information but is not presented in Alcoa’s financial statements prepared in accordance with U.S. generally accepted accounting principles (GAAP). Certain of these data are considered “non-GAAP financial measures” under SEC rules. These non-GAAP financial measures supplement our GAAP disclosures and should not be considered an alternative to the GAAP measure. Reconciliations to the most directly comparable GAAP financial measures and management’s rationale for the use of the non-GAAP financial measures can be found in the Appendix to this presentation and on our website at www.alcoa.com under the “Invest” section. Any reference during the discussion today to EBITDA means adjusted EBITDA, for which we have provided calculations and reconciliations in the Appendix and on our website. [Alcoa Logo] |