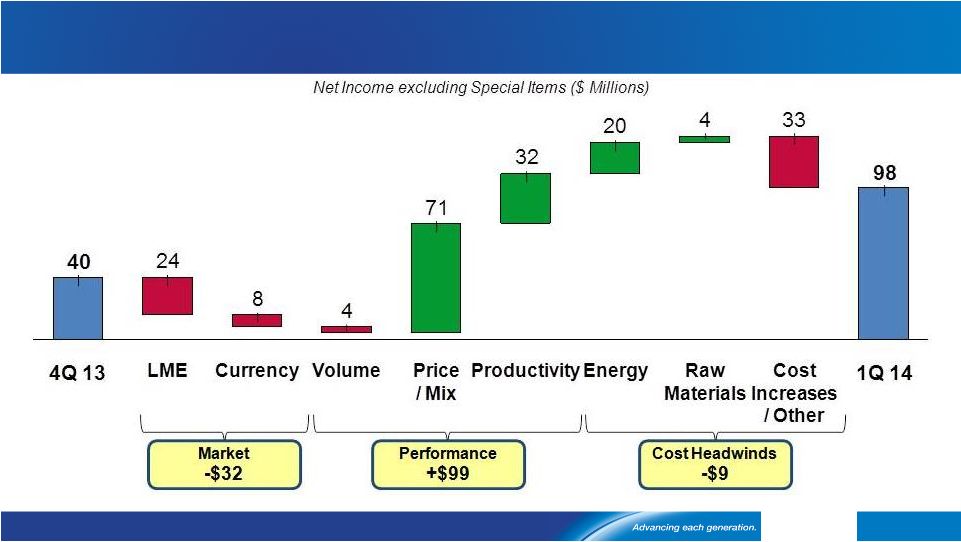

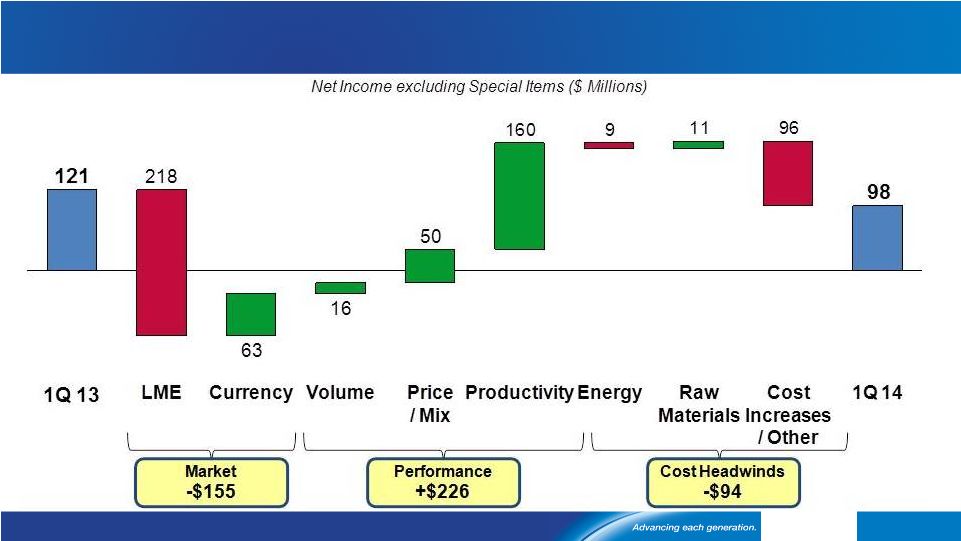

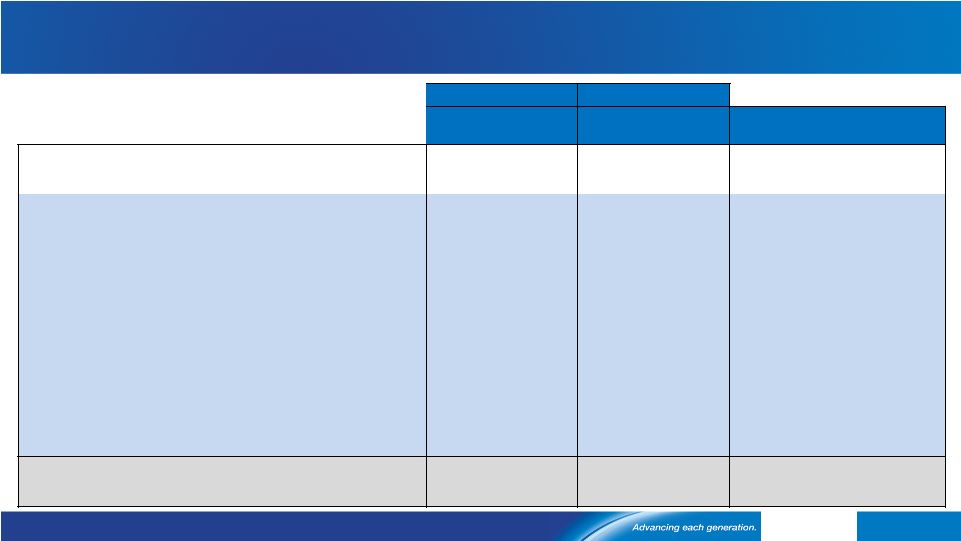

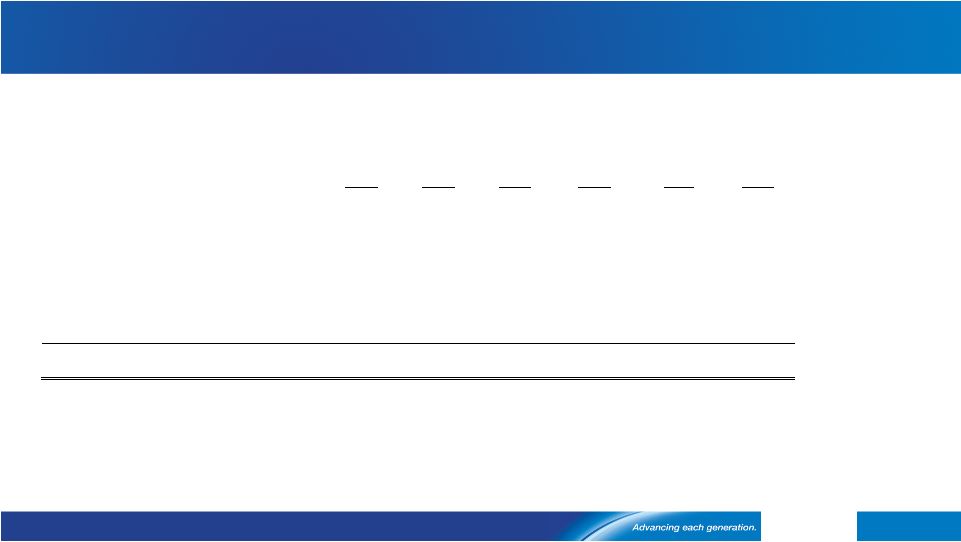

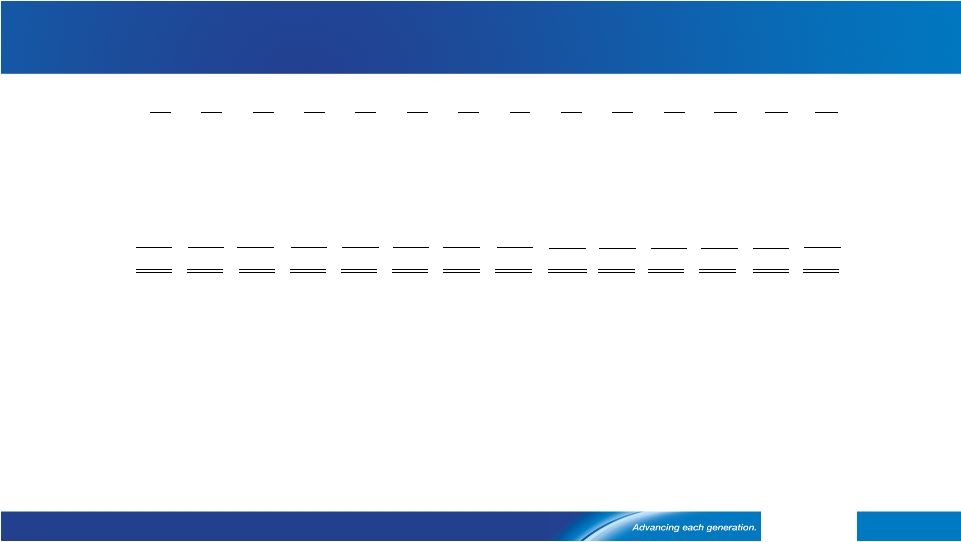

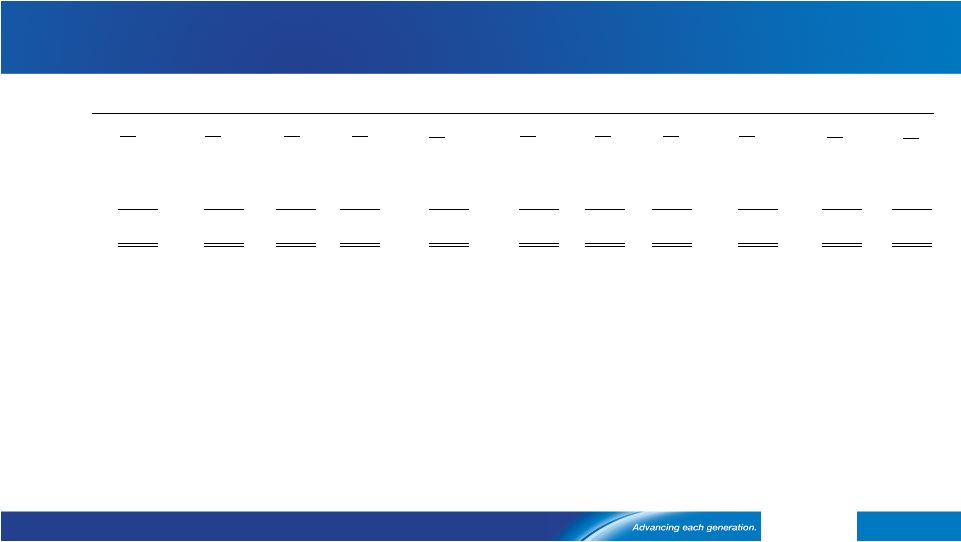

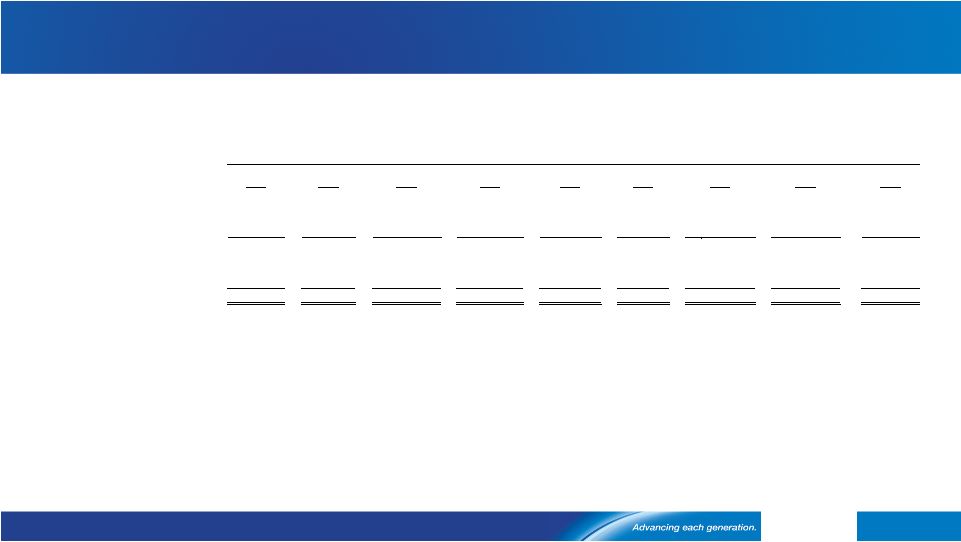

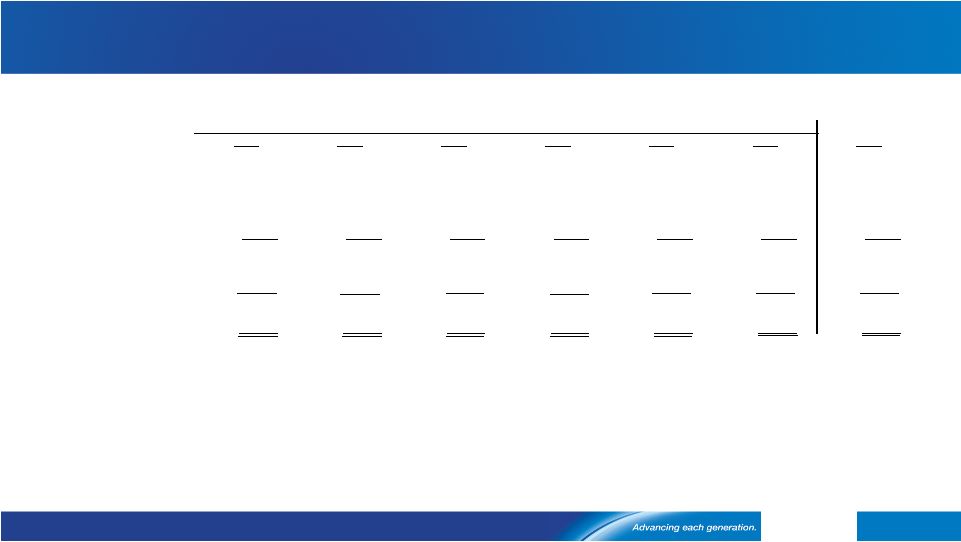

Reconciliation of Adjusted Income 39 o[Alcoa logo] (in millions, except per- share amounts) Income (Loss) Diluted EPS Quarter ended Quarter ended March 31, December 31, March 31, March 31, December 31, March 31, 2013 2013 2014 2013 2013 2014 Net income (loss) attributable to Alcoa $ 149 $ (2,339) $ (178) $ 0.13 $ (2.19) $ (0.16) Restructuring and other charges 5 302 274 Discrete tax items* (19) 364 (6) Other special items** (14) 1,713 8 Net income attributable to Alcoa – as adjusted $ 121 $ 40 $ 98 0.11 0.04 0.09 Net income attributable to Alcoa – as adjusted is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because management reviews the operating results of Alcoa excluding the impacts of restructuring and other charges, discrete tax items, and other special items (collectively, “special items”). There can be no assurances that additional special items will not occur in future periods. To compensate for this limitation, management believes that it is appropriate to consider both Net (loss) income attributable to Alcoa determined under GAAP as well as Net income attributable to Alcoa – as adjusted. * Discrete tax items include the following: • for the quarter ended March 31, 2014, a net benefit for a number of small items ($6); • for the quarter ended December 31, 2013, a charge for valuation allowances related to certain Spain and U.S. deferred tax assets ($372) and a net benefit for other miscellaneous items ($8); and • for the quarter ended March 31, 2013, a benefit related to the reinstatement under the American Taxpayer Relief Act of 2012 of two tax provisions that were applied in 2013 to Alcoa’s U.S. income tax return for calendar year 2012 ($19). ** Other special items include the following: • for the quarter ended March 31, 2014, a tax benefit representing the difference between Alcoa’s consolidated estimated annual effective tax rate and the statutory rates applied to restructuring and other charges ($72), an unfavorable tax impact related to the interim period treatment of operational losses in certain foreign jurisdictions for which no tax benefit was recognized ($56), the write-off of inventory related to the permanent closure of a smelter and two rolling mills in Australia and a smelter in the United States ($20), an unfavorable impact related to the restart of one potline at the joint venture in Saudi Arabia that was previously shut down due to a period of pot instability ($13), a gain on the sale of a mining interest in Suriname ($11), and a loss on the writedown of an asset to fair value ($2); • for the quarter ended December 31, 2013, an impairment of goodwill ($1,719), an unfavorable impact related to a temporary shutdown of one of the two smelter potlines at the joint venture in Saudi Arabia due to a period of pot instability ($9), a net favorable change in certain mark-to-market energy derivative contracts ($7), an insurance recovery related to the March 2012 cast house fire at the Massena, NY location ($5), and a favorable tax impact related to the interim period treatment of operational losses in certain foreign jurisdictions for which no tax benefit was recognized during the nine months ended September 30, 2013 ($3); and • for the quarter ended March 31, 2013, a net favorable change in certain mark-to-market energy derivative contracts ($9) and a net insurance recovery related to the March 2012 cast house fire at the Massena, NY location ($5). |