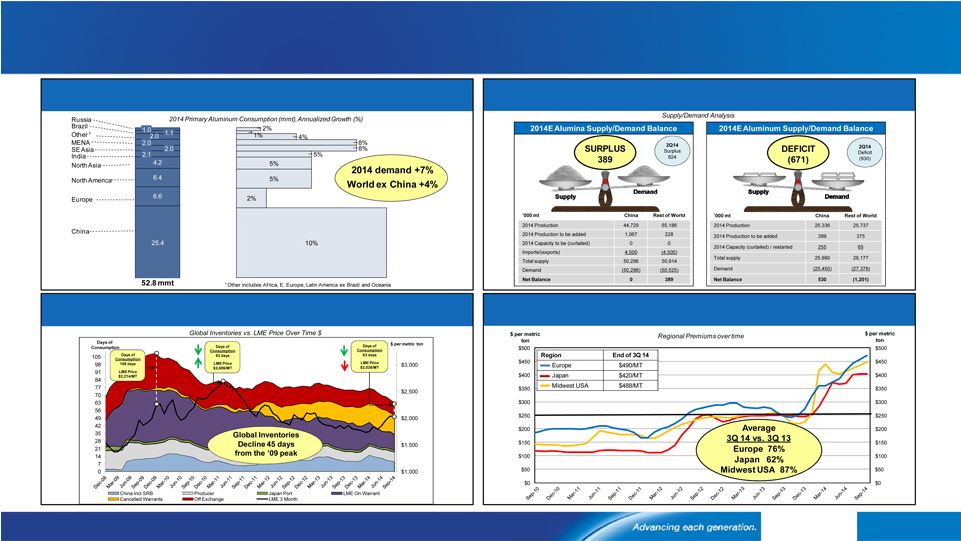

Cautionary Statement 2 [Alcoa logo] Forward-Looking Statements This presentation contains statements that relate to future events and expectations and as such constitute forward-looking statements. Forward-looking statements include those containing such words as “anticipates,” “estimates,” “expects,” “forecasts,” “intends,” “outlook,” “plans,” “projects,” “sees,” “should,” “targets,” “will,” or other words of similar meaning. All statements that reflect Alcoa’s expectations, assumptions or projections about the future other than statements of historical fact are forward-looking statements, including, without limitation, forecasts concerning global demand growth for aluminum, end market conditions, supply/demand balances, and growth opportunities for aluminum in automotive, aerospace, and other applications; targeted financial results or operating performance; statements about Alcoa’s strategies, outlook, and business and financial prospects; and statements regarding Alcoa’s portfolio transformation and the proposed acquisition of the Firth Rixson business, including the expected benefits of the transaction and Firth Rixson’s expected sales growth and contribution to revenues and EBITDA. These statements reflect beliefs and assumptions that are based on Alcoa’s perception of historical trends, current conditions and expected future developments, as well as other factors management believes are appropriate in the circumstances. Forward-looking statements are subject to a number of known and unknown risks and uncertainties and are not guarantees of future performance. Important factors that could cause actual results to differ materially from those expressed or implied in the forward-looking statements include: (a) material adverse changes in aluminum industry conditions, including global supply and demand conditions and fluctuations in London Metal Exchange-based prices and premiums, as applicable, for primary aluminum, alumina, and other products, and fluctuations in indexed-based and spot prices for alumina; (b) deterioration in global economic and financial market conditions generally; (c) unfavorable changes in the markets served by Alcoa, including aerospace, automotive, commercial transportation, building and construction, packaging, and industrial gas turbine; (d) the impact of changes in foreign currency exchange rates on costs and results, particularly the Australian dollar, Brazilian real, Canadian dollar, euro, and Norwegian kroner; (e) increases in energy costs or the unavailability or interruption of energy supplies; (f) increases in the costs of other raw materials; (g) Alcoa’s inability to achieve the level of revenue growth, cash generation, cost savings, improvement in profitability and margins, fiscal discipline, or strengthening of competitiveness and operations (including moving its alumina refining and aluminum smelting businesses down on the industry cost curves and increasing revenues and improving margins in its Global Rolled Products and Engineered Products and Solutions segments) anticipated from its restructuring programs and productivity improvement, cash sustainability, technology, and other initiatives; (h) Alcoa’s inability to realize expected benefits, in each case as planned and by targeted completion dates, from sales of non-core assets, or from newly constructed, expanded, or acquired facilities, or from international joint ventures, including the joint venture in Saudi Arabia; (i) political, economic, and regulatory risks in the countries in which Alcoa operates or sells products, including unfavorable changes in laws and governmental policies, civil unrest, imposition of sanctions, expropriation of assets, or other events beyond Alcoa’s control; (j) the outcome of contingencies, including legal proceedings, government investigations, and environmental remediation; (k) the impact of cyber attacks and potential information technology or data security breaches; (l) failure to receive, delays in the receipt of, or unacceptable or burdensome conditions imposed in connection with, all required regulatory approvals, or the inability to satisfy the other closing conditions to the proposed Firth Rixson acquisition; (m) the risk that the Firth Rixson business will not be integrated successfully or such integration may be more difficult, time-consuming or costly than expected; (n) the possibility that certain assumptions with respect to Firth Rixson or the proposed transaction could prove to be inaccurate; (o) the loss of customers, suppliers and other business relationships of Alcoa or Firth Rixson as a result of the proposed acquisition; and (p) the other risk factors summarized in Alcoa’s Form 10-K for the year ended December 31, 2013, Forms 10-Q for the quarters ended March 31, 2014 and June 30, 2014, and other reports filed with the Securities and Exchange Commission (SEC). Alcoa disclaims any obligation to update publicly any forward-looking statements, whether in response to new information, future events or otherwise, except as required by applicable law. Market projections are subject to the risks discussed above and other risks in the market. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities. The common shares of Alcoa to be issued in the Firth Rixson acquisition will only be issued pursuant to the terms of the definitive agreement for the acquisition of Firth Rixson. Non-GAAP Financial Measures Some of the information included in this presentation is derived from Alcoa’s consolidated financial information but is not presented in Alcoa’s financial statements prepared in accordance with accounting principles generally accepted in the United States of America (GAAP). Certain of these data are considered “non-GAAP financial measures” under SEC rules. These non-GAAP financial measures supplement our GAAP disclosures and should not be considered an alternative to the GAAP measure. Reconciliations to the most directly comparable GAAP financial measures and management’s rationale for the use of the non-GAAP financial measures can be found in the Appendix to this presentation. Any reference to historical EBITDA means adjusted EBITDA, for which we have provided calculations and reconciliations in the Appendix. Alcoa has not provided a reconciliation of any forward-looking non-GAAP financial measure to the most directly comparable GAAP financial measure, due primarily to variability and difficulty in making accurate forecasts and projections, as not all of the information necessary for a quantitative reconciliation is available to Alcoa without unreasonable effort. |