4th Quarter Earnings Conference January 11, 2016 Exhibit 99.2

Forward-Looking Statements This presentation contains statements that relate to future events and expectations and as such constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include those containing such words as “anticipates,” “believes,” “could,” “estimates,” “expects,” “forecasts,” “goal,” “intends,” “may,” “outlook,” “plans,” “projects,” “seeks,” “sees,” “should,” “targets,” “will,” “would,” or other words of similar meaning. All statements that reflect Alcoa’s expectations, assumptions or projections about the future, other than statements of historical fact, are forward-looking statements, including, without limitation, forecasts concerning global demand growth for aluminum, supply/demand balances, and growth of the aerospace, automotive, and other end markets; statements regarding targeted financial results or operating performance; statements about Alcoa’s strategies, outlook, business and financial prospects, and Alcoa’s portfolio transformation; and statements regarding the separation transaction, including the future performance of Value-Add Company and Upstream Company if the separation is completed, the expected benefits of the separation, the expected timing of the Form 10 filing and the completion of the separation, and the expected qualification of the separation as a tax-free transaction. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties, and changes in circumstances that are difficult to predict. Although Alcoa believes that the expectations reflected in any forward-looking statements are based on reasonable assumptions, it can give no assurance that these expectations will be attained and it is possible that actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks and uncertainties. Such risks and uncertainties include, but are not limited to: (a) uncertainties as to the timing of the separation and whether it will be completed; (b) the possibility that various closing conditions for the separation may not be satisfied; (c) failure of the separation to qualify for the expected tax treatment; (d) the possibility that any third-party consents required in connection with the separation will not be received; (e) the impact of the separation on the businesses of Alcoa; (f) the risk that the businesses will not be separated successfully or such separation may be more difficult, time-consuming or costly than expected, which could result in additional demands on Alcoa’s resources, systems, procedures and controls, disruption of its ongoing business and diversion of management’s attention from other business concerns; (g) material adverse changes in aluminum industry conditions; (h) deterioration in global economic and financial market conditions generally; (i) unfavorable changes in the markets served by Alcoa; (j) the impact of changes in foreign currency exchange rates on costs and results; (k) increases in energy costs; (l) the inability to achieve the level of revenue growth, cash generation, cost savings, improvement in profitability and margins, fiscal discipline, or strengthening of competitiveness and operations (including executing on the Upstream business improvement plan, moving the Upstream alumina and aluminum businesses down on the industry cost curves, and increasing revenues and improving margins in the Value-Add businesses) anticipated from restructuring programs and productivity improvement, cash sustainability, technology advancements (including, without limitation, advanced aluminum alloys, Alcoa Micromill, and other materials and processes), and other initiatives; (m) Alcoa’s inability to realize expected benefits, in each case as planned and by targeted completion dates, from acquisitions, divestitures, facility closures, curtailments, or expansions, or international joint ventures; (n) political, economic, and regulatory risks in the countries in which Alcoa operates or sells products; (o) the outcome of contingencies, including legal proceedings, government or regulatory investigations, and environmental remediation; (p) the impact of cyber attacks and potential information technology or data security breaches; (q) the potential failure to retain key employees while the separation transaction is pending or after it is completed; (r) the risk that increased debt levels, deterioration in debt protection metrics, contraction in liquidity, or other factors could adversely affect the targeted credit ratings for Value-Add Company or Upstream Company; and (s) the other risk factors discussed in Alcoa’s Form 10-K for the year ended December 31, 2014, and other reports filed with the U.S. Securities and Exchange Commission (SEC). Alcoa disclaims any obligation to update publicly any forward-looking statements, whether in response to new information, future events or otherwise, except as required by applicable law. Market projections are subject to the risks discussed above and other risks in the market. Important Information 2

Important Information (continued) Non-GAAP Financial Measures Some of the information included in this presentation is derived from Alcoa’s consolidated financial information but is not presented in Alcoa’s financial statements prepared in accordance with accounting principles generally accepted in the United States of America (GAAP). Certain of these data are considered “non-GAAP financial measures” under SEC rules. These non-GAAP financial measures supplement our GAAP disclosures and should not be considered an alternative to the GAAP measure. Reconciliations to the most directly comparable GAAP financial measures and management’s rationale for the use of the non-GAAP financial measures can be found in the Appendix to this presentation. Alcoa has not provided a reconciliation of any forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures, due primarily to variability and difficulty in making accurate forecasts and projections, as not all of the information necessary for a quantitative reconciliation is available to Alcoa without unreasonable effort. Any reference to historical EBITDA means adjusted EBITDA, for which we have provided calculations and reconciliations in the Appendix.

Klaus Kleinfeld Chairman and Chief Executive Officer January 11, 2016

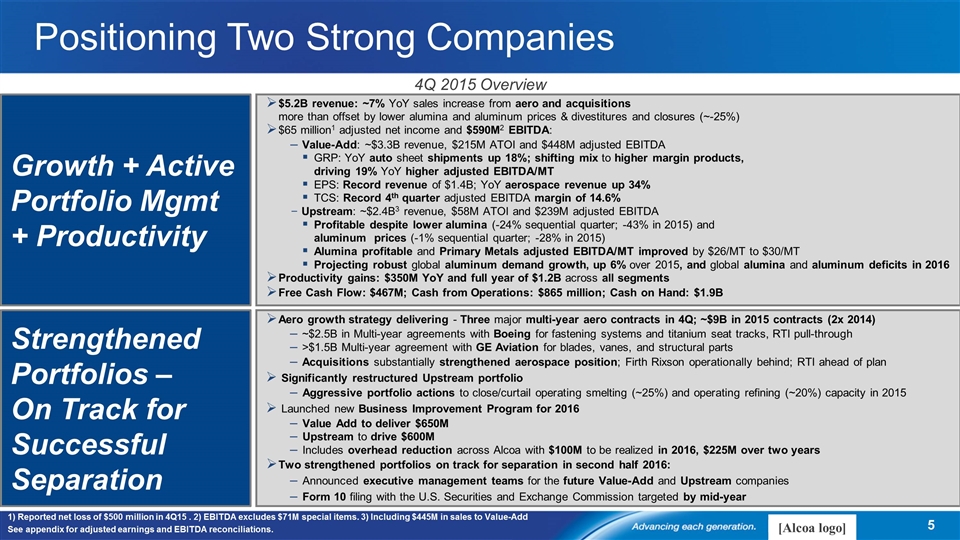

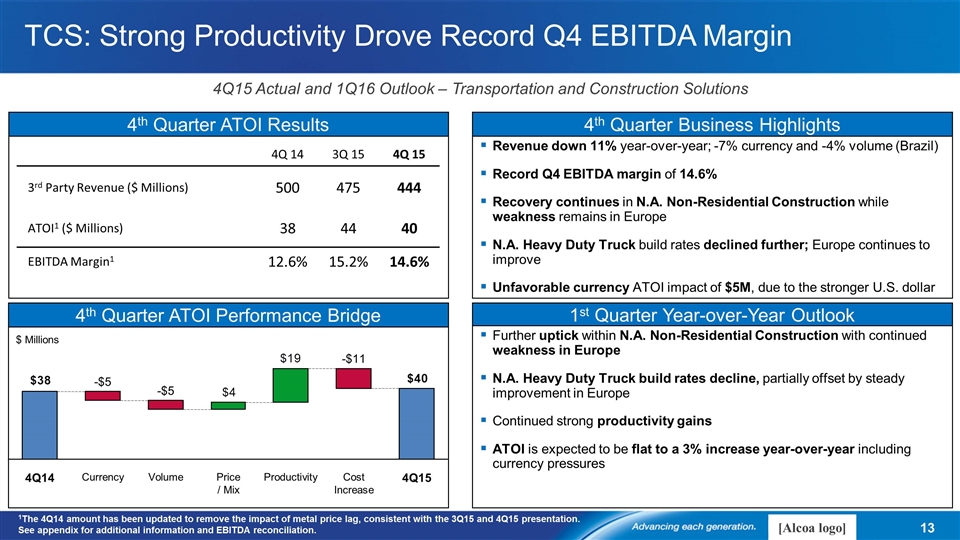

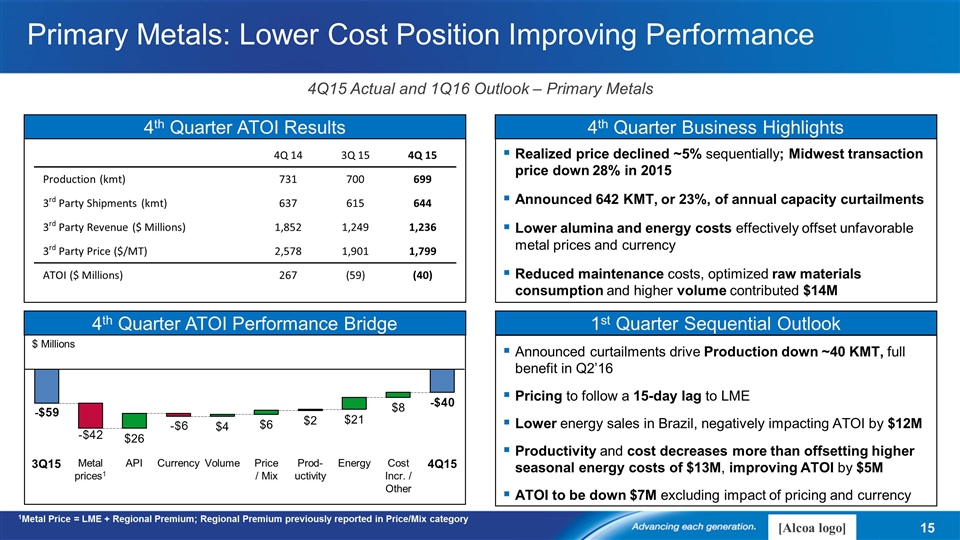

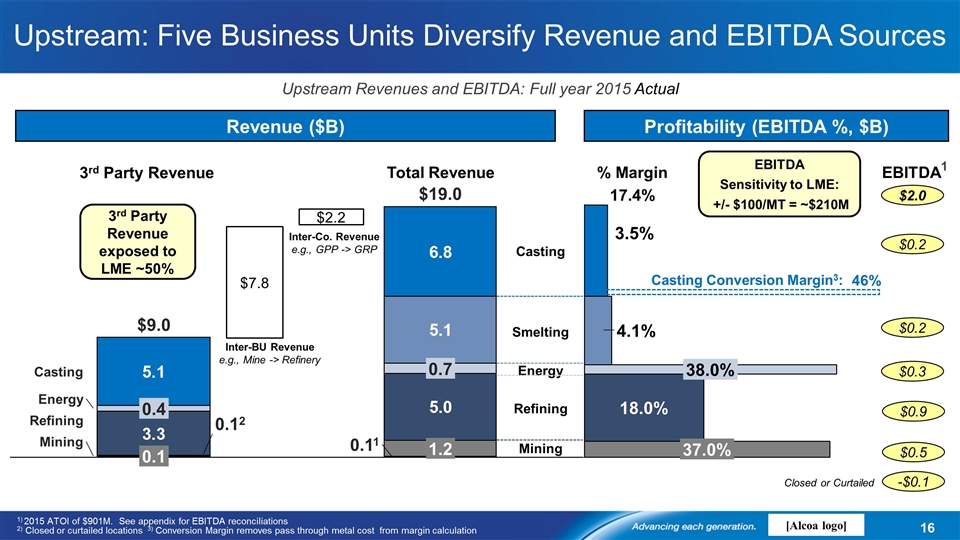

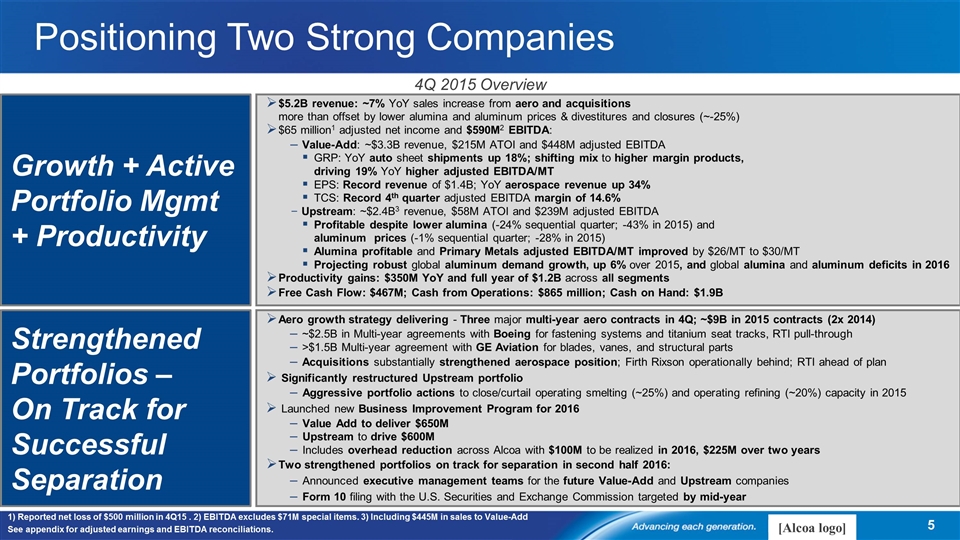

Growth + Active Portfolio Mgmt + Productivity $5.2B revenue: ~7% YoY sales increase from aero and acquisitions more than offset by lower alumina and aluminum prices & divestitures and closures (~-25%) $65 million1 adjusted net income and $590M2 EBITDA: Value-Add: ~$3.3B revenue, $215M ATOI and $448M adjusted EBITDA GRP: YoY auto sheet shipments up 18%; shifting mix to higher margin products, driving 19% YoY higher adjusted EBITDA/MT EPS: Record revenue of $1.4B; YoY aerospace revenue up 34% TCS: Record 4th quarter adjusted EBITDA margin of 14.6% Upstream: ~$2.4B3 revenue, $58M ATOI and $239M adjusted EBITDA Profitable despite lower alumina (-24% sequential quarter; -43% in 2015) and aluminum prices (-1% sequential quarter; -28% in 2015) Alumina profitable and Primary Metals adjusted EBITDA/MT improved by $26/MT to $30/MT Projecting robust global aluminum demand growth, up 6% over 2015, and global alumina and aluminum deficits in 2016 Productivity gains: $350M YoY and full year of $1.2B across all segments Free Cash Flow: $467M; Cash from Operations: $865 million; Cash on Hand: $1.9B 4Q 2015 Overview Strengthened Portfolios – On Track for Successful Separation Aero growth strategy delivering - Three major multi-year aero contracts in 4Q; ~$9B in 2015 contracts (2x 2014) ~$2.5B in Multi-year agreements with Boeing for fastening systems and titanium seat tracks, RTI pull-through >$1.5B Multi-year agreement with GE Aviation for blades, vanes, and structural parts Acquisitions substantially strengthened aerospace position; Firth Rixson operationally behind; RTI ahead of plan Significantly restructured Upstream portfolio Aggressive portfolio actions to close/curtail operating smelting (~25%) and operating refining (~20%) capacity in 2015 Launched new Business Improvement Program for 2016 Value Add to deliver $650M Upstream to drive $600M Includes overhead reduction across Alcoa with $100M to be realized in 2016, $225M over two years Two strengthened portfolios on track for separation in second half 2016: Announced executive management teams for the future Value-Add and Upstream companies Form 10 filing with the U.S. Securities and Exchange Commission targeted by mid-year 1) Reported net loss of $500 million in 4Q15 . 2) EBITDA excludes $71M special items. 3) Including $445M in sales to Value-Add See appendix for adjusted earnings and EBITDA reconciliations. Positioning Two Strong Companies

William Oplinger Executive Vice President and Chief Financial Officer January 11, 2016

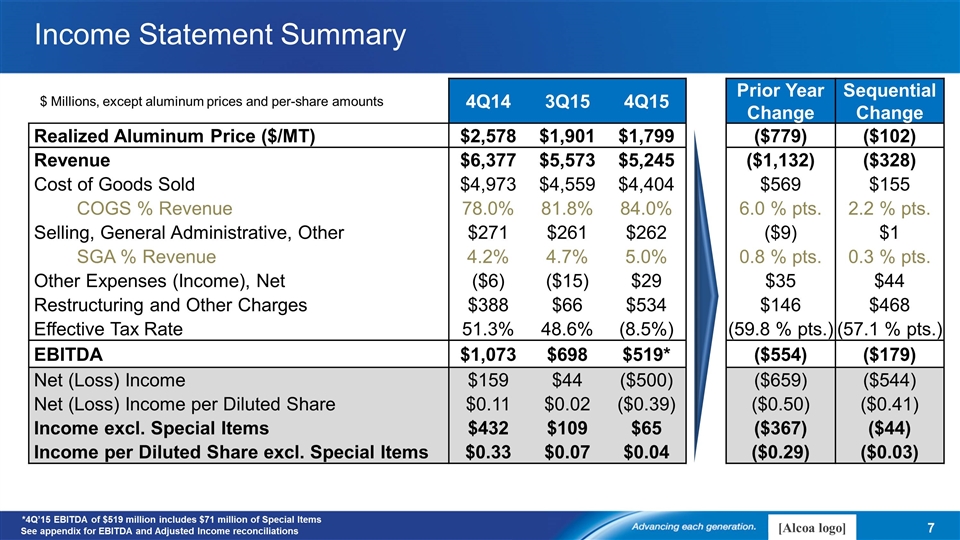

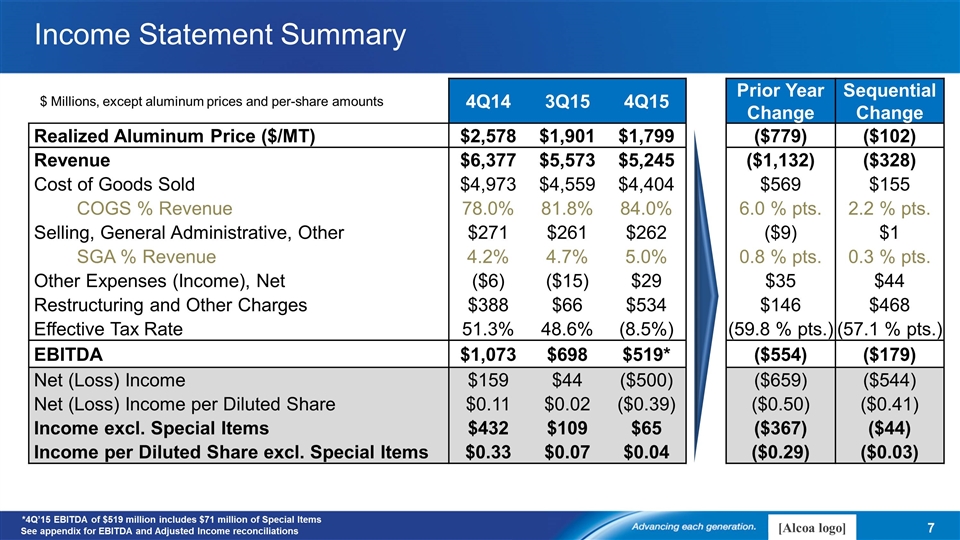

Income Statement Summary $ Millions, except aluminum prices and per-share amounts 4Q14 3Q15 4Q15 Prior Year Change Sequential Change Realized Aluminum Price ($/MT) $2,578 $1,901 $1,799 ($779) ($102) Revenue $6,377 $5,573 $5,245 ($1,132) ($328) Cost of Goods Sold $4,973 $4,559 $4,404 $569 $155 COGS % Revenue 78.0% 81.8% 84.0% 6.0 % pts. 2.2 % pts. Selling, General Administrative, Other $271 $261 $262 ($9) $1 SGA % Revenue 4.2% 4.7% 5.0% 0.8 % pts. 0.3 % pts. Other Expenses (Income), Net ($6) ($15) $29 $35 $44 Restructuring and Other Charges $388 $66 $534 $146 $468 Effective Tax Rate 51.3% 48.6% (8.5%) (59.8 % pts.) (57.1 % pts.) EBITDA $1,073 $698 $519* ($554) ($179) Net (Loss) Income $159 $44 ($500) ($659) ($544) Net (Loss) Income per Diluted Share $0.11 $0.02 ($0.39) ($0.50) ($0.41) Income excl. Special Items $432 $109 $65 ($367) ($44) Income per Diluted Share excl. Special Items $0.33 $0.07 $0.04 ($0.29) ($0.03) See appendix for EBITDA and Adjusted Income reconciliations *4Q’15 EBITDA of $519 million includes $71 million of Special Items

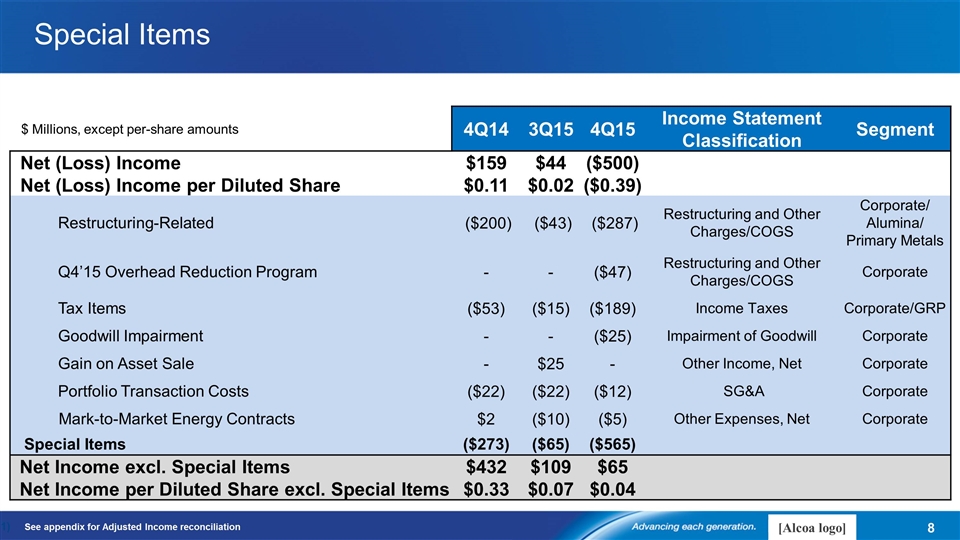

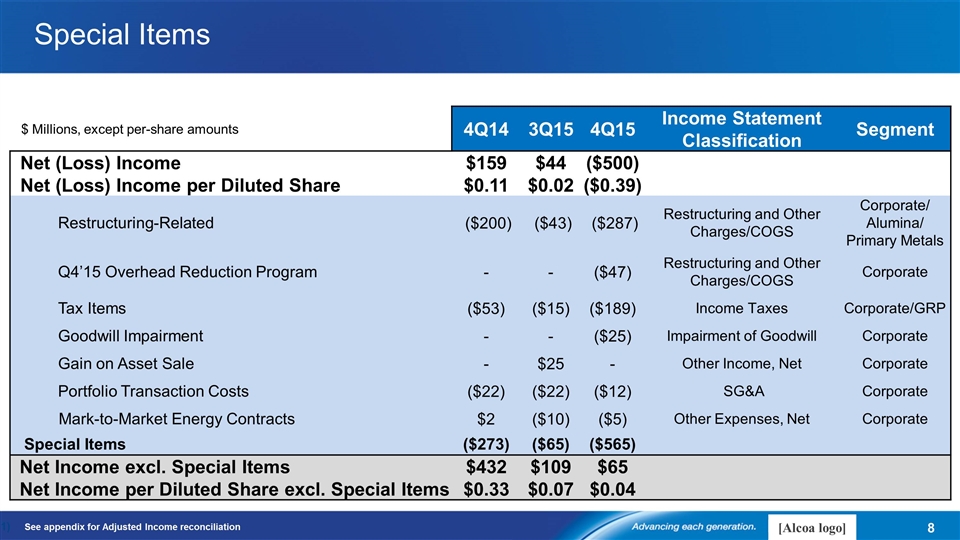

Special Items See appendix for Adjusted Income reconciliation $ Millions, except per-share amounts 4Q14 3Q15 4Q15 Income Statement Classification Segment Net (Loss) Income $159 $44 ($500) Net (Loss) Income per Diluted Share $0.11 $0.02 ($0.39) Restructuring-Related ($200) ($43) ($287) Restructuring and Other Charges/COGS Corporate/ Alumina/ Primary Metals Q4’15 Overhead Reduction Program - - ($47) Restructuring and Other Charges/COGS Corporate Tax Items ($53) ($15) ($189) Income Taxes Corporate/GRP Goodwill Impairment - - ($25) Impairment of Goodwill Corporate Gain on Asset Sale - $25 - Other Income, Net Corporate Portfolio Transaction Costs ($22) ($22) ($12) SG&A Corporate Mark-to-Market Energy Contracts $2 ($10) ($5) Other Expenses, Net Corporate Special Items ($273) ($65) ($565) Net Income excl. Special Items $432 $109 $65 Net Income per Diluted Share excl. Special Items $0.33 $0.07 $0.04

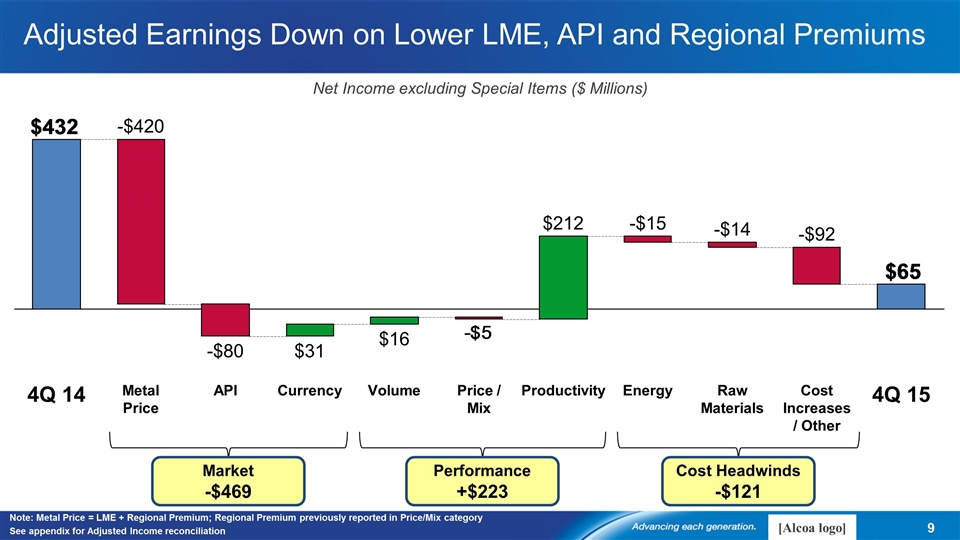

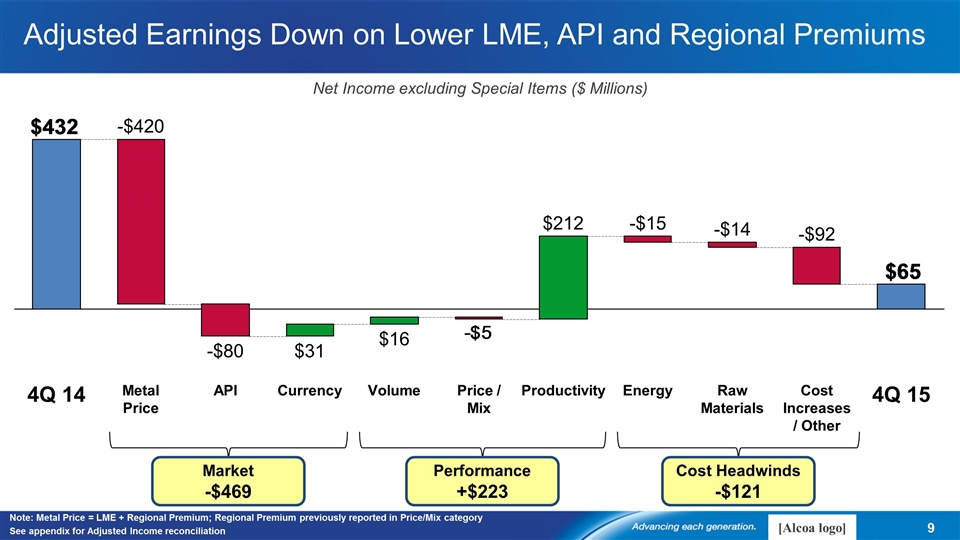

Net Income excluding Special Items ($ Millions) Adjusted Earnings Down on Lower LME, API and Regional Premiums Market -$469 Performance +$223 Cost Headwinds -$121 Note: Metal Price = LME + Regional Premium; Regional Premium previously reported in Price/Mix category See appendix for Adjusted Income reconciliation 4Q 15 4Q 14

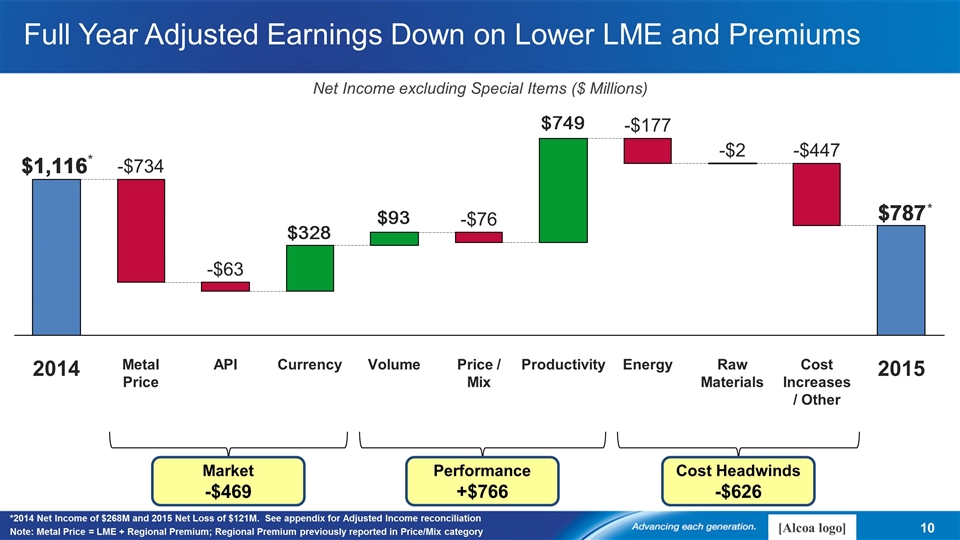

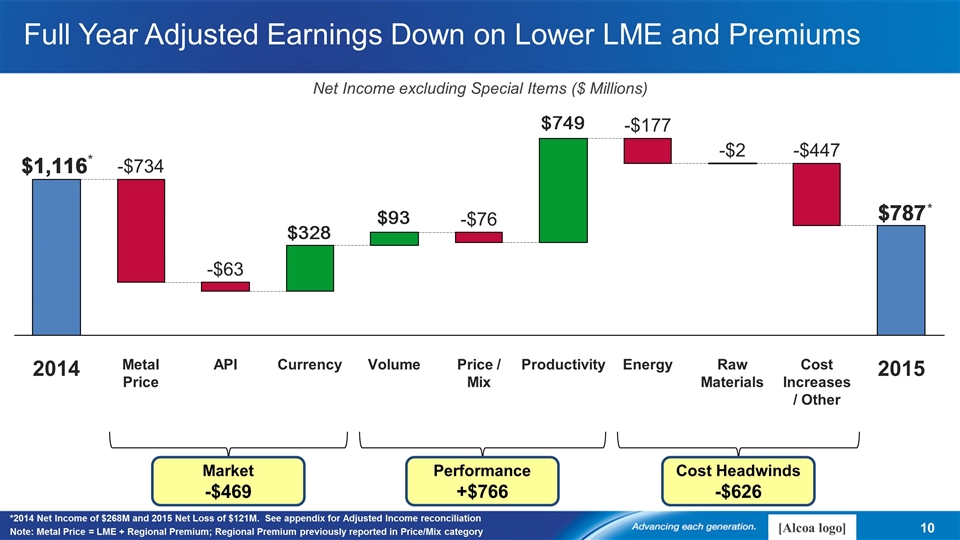

Net Income excluding Special Items ($ Millions) Full Year Adjusted Earnings Down on Lower LME and Premiums Market -$469 Performance +$766 Cost Headwinds -$626 *2014 Net Income of $268M and 2015 Net Loss of $121M. See appendix for Adjusted Income reconciliation Note: Metal Price = LME + Regional Premium; Regional Premium previously reported in Price/Mix category 2014 2015 * *

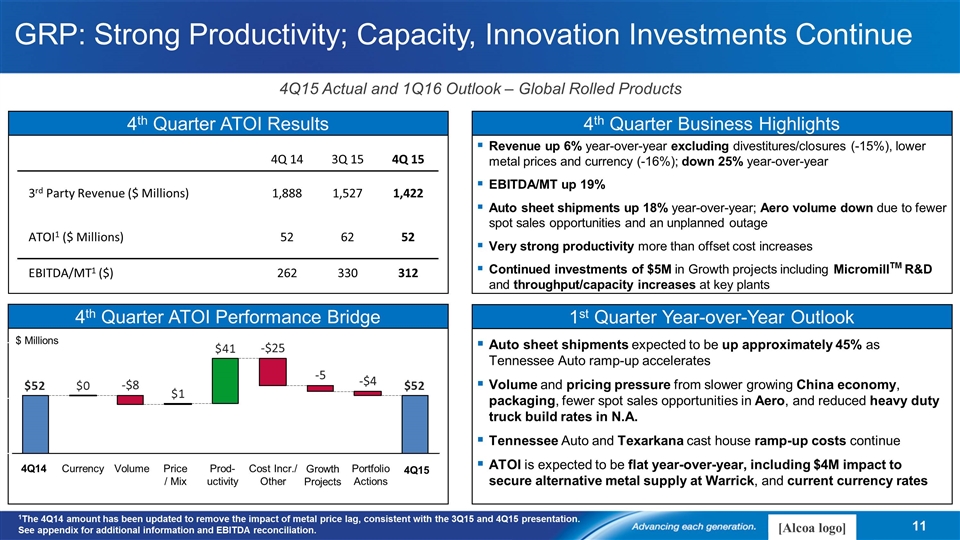

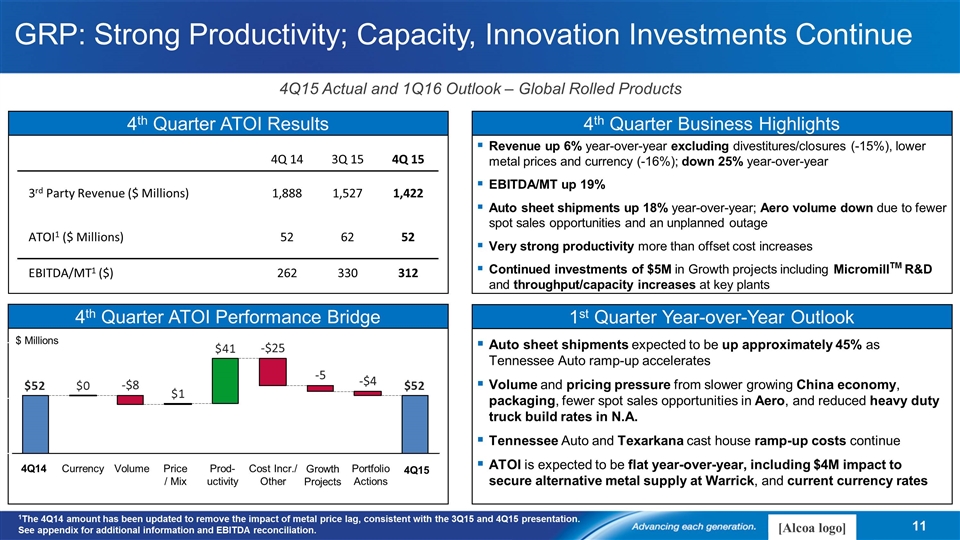

4Q 14 3Q 15 4Q 15 3rd Party Revenue ($ Millions) 1,888 1,527 1,422 ATOI1 ($ Millions) 52 62 52 EBITDA/MT1 ($) 262 330 312 4Q15 Actual and 1Q16 Outlook – Global Rolled Products GRP: Strong Productivity; Capacity, Innovation Investments Continue Revenue up 6% year-over-year excluding divestitures/closures (-15%), lower metal prices and currency (-16%); down 25% year-over-year EBITDA/MT up 19% Auto sheet shipments up 18% year-over-year; Aero volume down due to fewer spot sales opportunities and an unplanned outage Very strong productivity more than offset cost increases Continued investments of $5M in Growth projects including MicromillTM R&D and throughput/capacity increases at key plants Auto sheet shipments expected to be up approximately 45% as Tennessee Auto ramp-up accelerates Volume and pricing pressure from slower growing China economy, packaging, fewer spot sales opportunities in Aero, and reduced heavy duty truck build rates in N.A. Tennessee Auto and Texarkana cast house ramp-up costs continue ATOI is expected to be flat year-over-year, including $4M impact to secure alternative metal supply at Warrick, and current currency rates 1st Quarter Year-over-Year Outlook 4th Quarter Business Highlights 4th Quarter ATOI Results 1The 4Q14 amount has been updated to remove the impact of metal price lag, consistent with the 3Q15 and 4Q15 presentation. See appendix for additional information and EBITDA reconciliation. $ Millions 4th Quarter ATOI Performance Bridge 4Q15 Price / Mix Currency 4Q14 Growth Projects

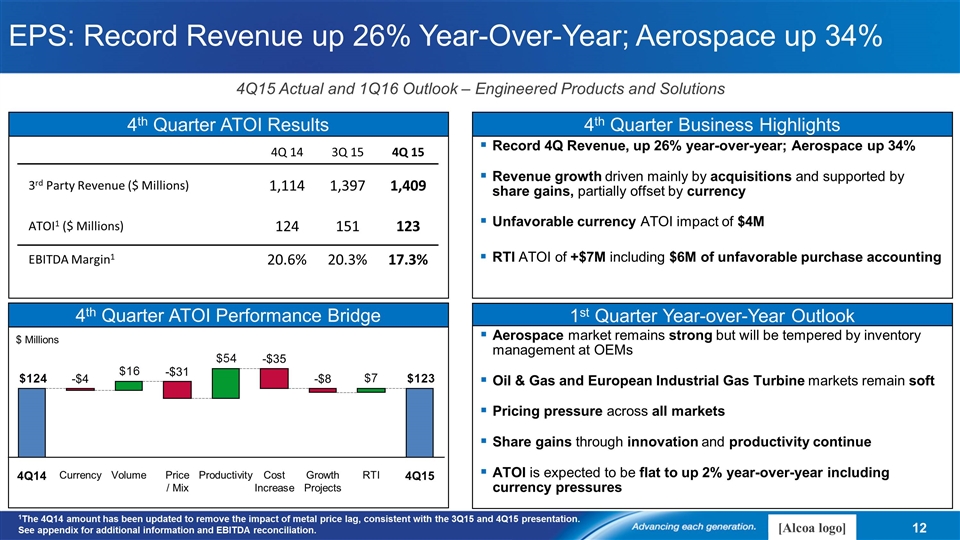

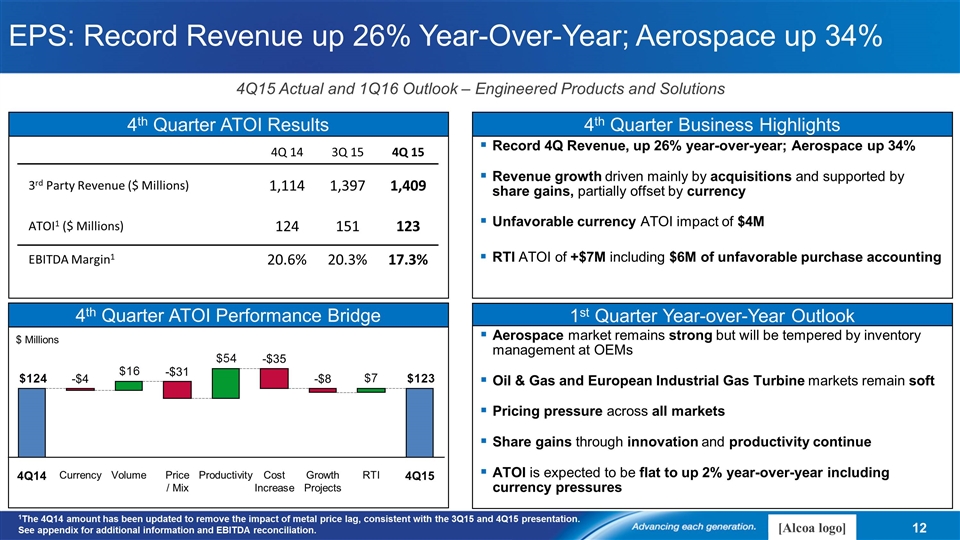

$ Millions 4Q 14 3Q 15 4Q 15 3rd Party Revenue ($ Millions) 1,114 1,397 1,409 ATOI1 ($ Millions) 124 151 123 EBITDA Margin1 20.6% 20.3% 17.3% 1st Quarter Year-over-Year Outlook 4th Quarter ATOI Performance Bridge 4Q15 Actual and 1Q16 Outlook – Engineered Products and Solutions Aerospace market remains strong but will be tempered by inventory management at OEMs Oil & Gas and European Industrial Gas Turbine markets remain soft Pricing pressure across all markets Share gains through innovation and productivity continue ATOI is expected to be flat to up 2% year-over-year including currency pressures Record 4Q Revenue, up 26% year-over-year; Aerospace up 34% Revenue growth driven mainly by acquisitions and supported by share gains, partially offset by currency Unfavorable currency ATOI impact of $4M RTI ATOI of +$7M including $6M of unfavorable purchase accounting 1The 4Q14 amount has been updated to remove the impact of metal price lag, consistent with the 3Q15 and 4Q15 presentation. See appendix for additional information and EBITDA reconciliation. 4th Quarter ATOI Results 4th Quarter Business Highlights EPS: Record Revenue up 26% Year-Over-Year; Aerospace up 34%

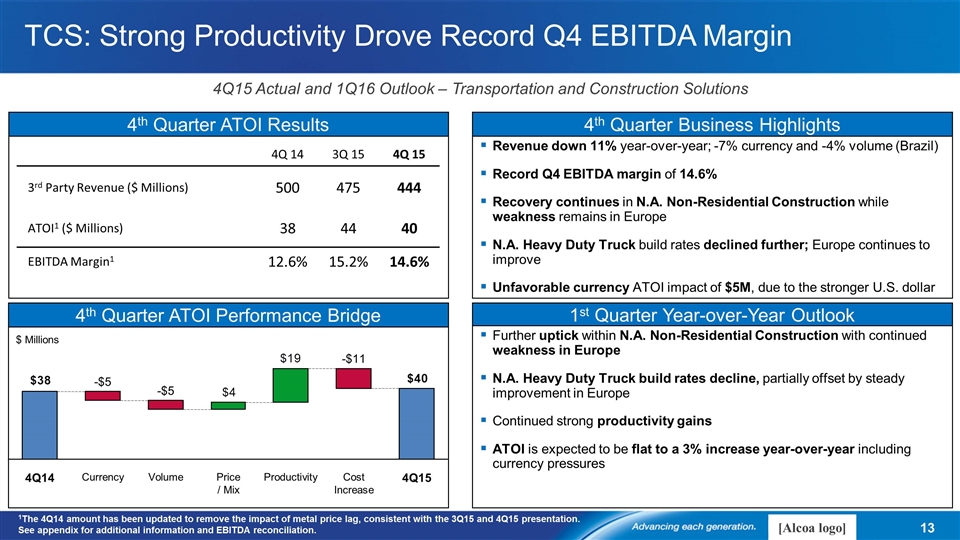

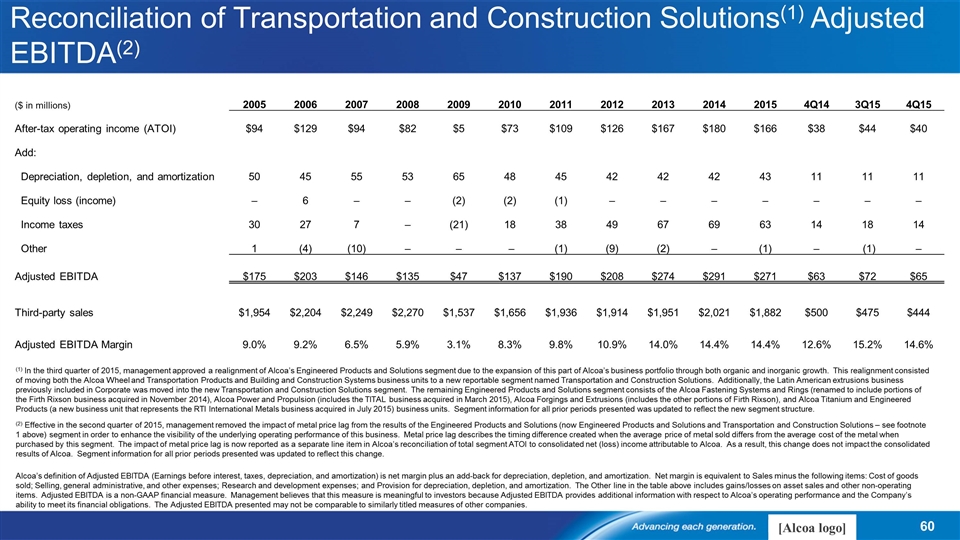

$ Millions 4Q 14 3Q 15 4Q 15 3rd Party Revenue ($ Millions) 500 475 444 ATOI1 ($ Millions) 38 44 40 EBITDA Margin1 12.6% 15.2% 14.6% 1st Quarter Year-over-Year Outlook 4th Quarter ATOI Performance Bridge 4Q15 Actual and 1Q16 Outlook – Transportation and Construction Solutions TCS: Strong Productivity Drove Record Q4 EBITDA Margin Further uptick within N.A. Non-Residential Construction with continued weakness in Europe N.A. Heavy Duty Truck build rates decline, partially offset by steady improvement in Europe Continued strong productivity gains ATOI is expected to be flat to a 3% increase year-over-year including currency pressures Revenue down 11% year-over-year; -7% currency and -4% volume (Brazil) Record Q4 EBITDA margin of 14.6% Recovery continues in N.A. Non-Residential Construction while weakness remains in Europe N.A. Heavy Duty Truck build rates declined further; Europe continues to improve Unfavorable currency ATOI impact of $5M, due to the stronger U.S. dollar 4th Quarter ATOI Results 4th Quarter Business Highlights 1The 4Q14 amount has been updated to remove the impact of metal price lag, consistent with the 3Q15 and 4Q15 presentation. See appendix for additional information and EBITDA reconciliation.

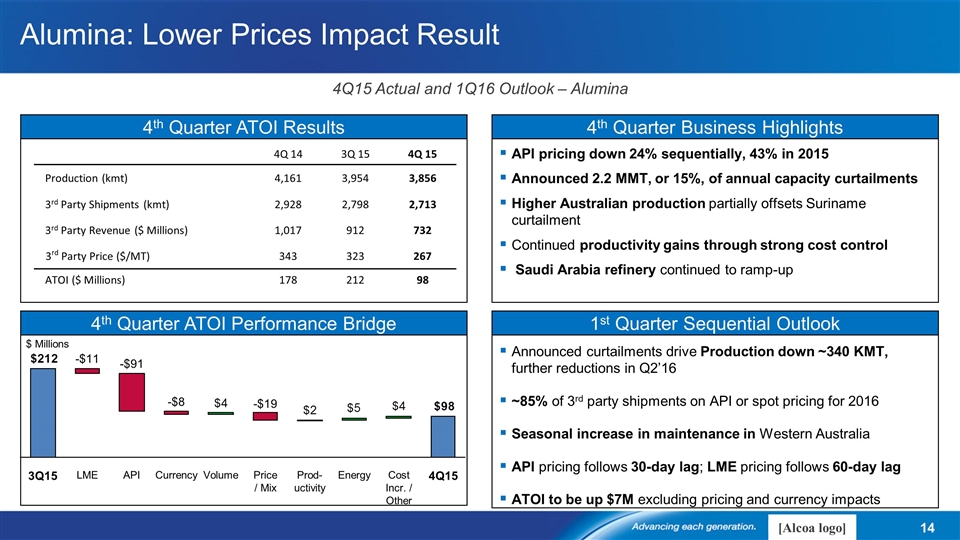

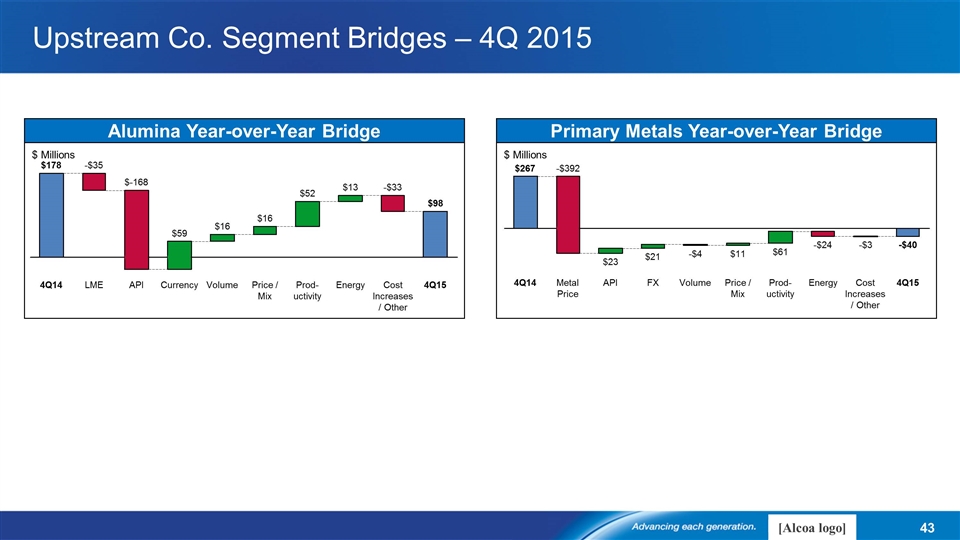

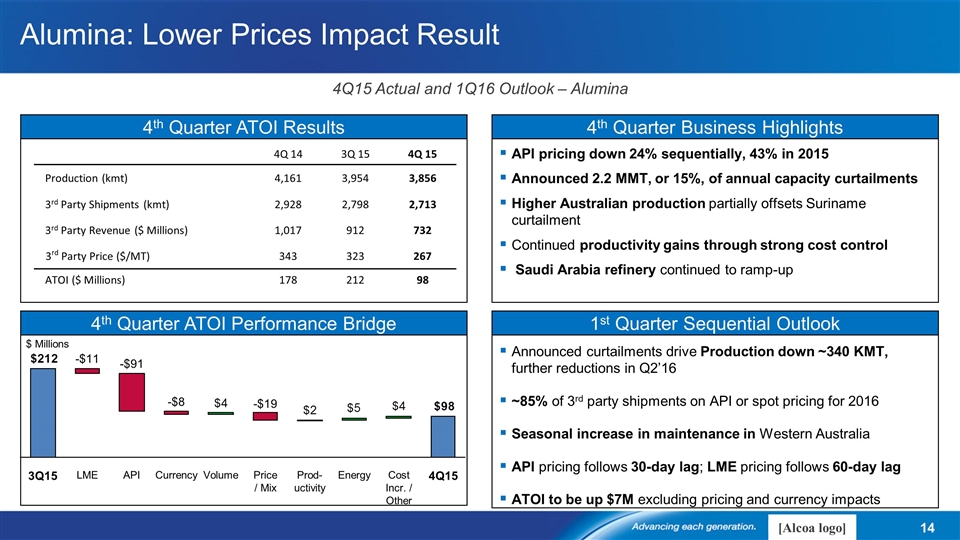

Alumina: Lower Prices Impact Result 4Q15 Actual and 1Q16 Outlook – Alumina API pricing down 24% sequentially, 43% in 2015 Announced 2.2 MMT, or 15%, of annual capacity curtailments Higher Australian production partially offsets Suriname curtailment Continued productivity gains through strong cost control Saudi Arabia refinery continued to ramp-up Announced curtailments drive Production down ~340 KMT, further reductions in Q2’16 ~85% of 3rd party shipments on API or spot pricing for 2016 Seasonal increase in maintenance in Western Australia API pricing follows 30-day lag; LME pricing follows 60-day lag ATOI to be up $7M excluding pricing and currency impacts 4Q 14 3Q 15 4Q 15 Production (kmt) 4,161 3,954 3,856 3rd Party Shipments (kmt) 2,928 2,798 2,713 3rd Party Revenue ($ Millions) 1,017 912 732 3rd Party Price ($/MT) 343 323 267 ATOI ($ Millions) 178 212 98 4th Quarter ATOI Results 4th Quarter Business Highlights 1st Quarter Sequential Outlook $ Millions 4th Quarter ATOI Performance Bridge

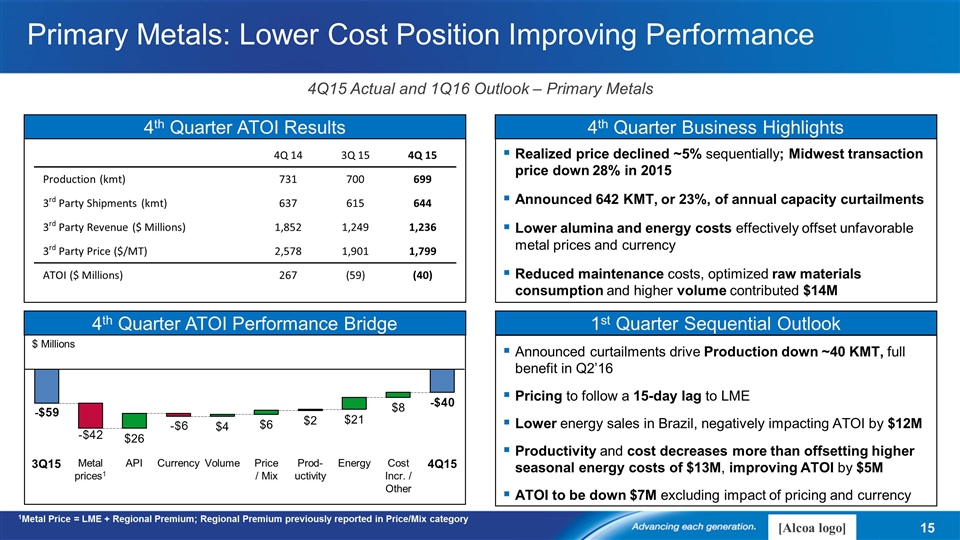

Primary Metals: Lower Cost Position Improving Performance $ Millions 4Q15 Actual and 1Q16 Outlook – Primary Metals Price / Mix Cost Incr. / Other Prod-uctivity 1 Realized price declined ~5% sequentially; Midwest transaction price down 28% in 2015 Announced 642 KMT, or 23%, of annual capacity curtailments Lower alumina and energy costs effectively offset unfavorable metal prices and currency Reduced maintenance costs, optimized raw materials consumption and higher volume contributed $14M Announced curtailments drive Production down ~40 KMT, full benefit in Q2’16 Pricing to follow a 15-day lag to LME Lower energy sales in Brazil, negatively impacting ATOI by $12M Productivity and cost decreases more than offsetting higher seasonal energy costs of $13M, improving ATOI by $5M ATOI to be down $7M excluding impact of pricing and currency 4Q 14 3Q 15 4Q 15 Production (kmt) 731 700 699 3rd Party Shipments (kmt) 637 615 644 3rd Party Revenue ($ Millions) 1,852 1,249 1,236 3rd Party Price ($/MT) 2,578 1,901 1,799 ATOI ($ Millions) 267 (59) (40) 4th Quarter ATOI Results 4th Quarter Business Highlights 4th Quarter ATOI Performance Bridge 1st Quarter Sequential Outlook 1Metal Price = LME + Regional Premium; Regional Premium previously reported in Price/Mix category

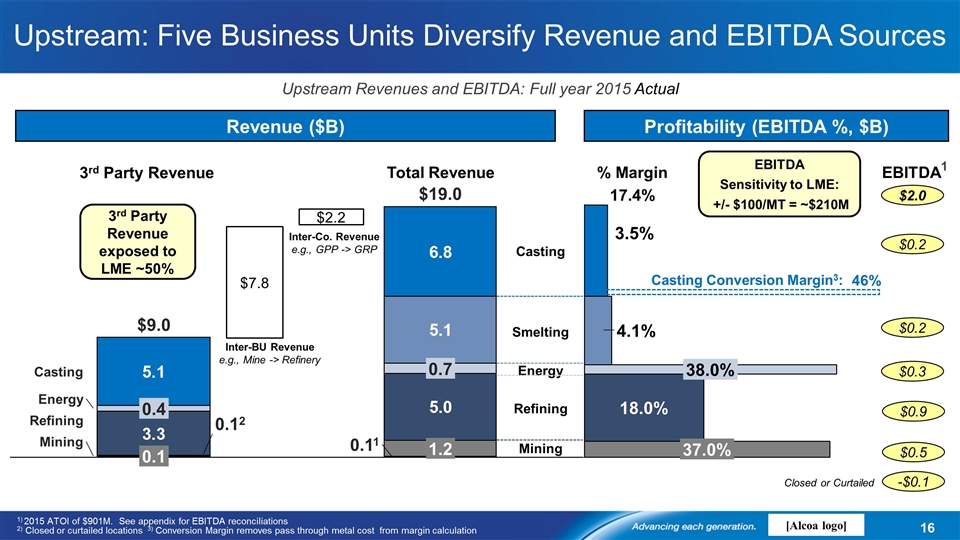

$ 1 $ 2 Upstream Revenues and EBITDA: Full year 2015 Actual Upstream: Five Business Units Diversify Revenue and EBITDA Sources Revenue ($B) $7.8 3rd Party Revenue exposed to LME ~50% Profitability (EBITDA %, $B) Total Revenue Inter-Co. Revenue e.g., GPP -> GRP Inter-BU Revenue e.g., Mine -> Refinery % Margin $2.2 EBITDA $0.9 $0.5 $0.2 $0.3 $0.2 3rd Party Revenue 17.4% $2.0 1) 2015 ATOI of $901M. See appendix for EBITDA reconciliations 2) Closed or curtailed locations 3) Conversion Margin removes pass through metal cost from margin calculation EBITDA Sensitivity to LME: +/- $100/MT = ~$210M -$0.1 Closed or Curtailed Casting Smelting Energy Refining Mining 46% Casting Conversion Margin3: 1

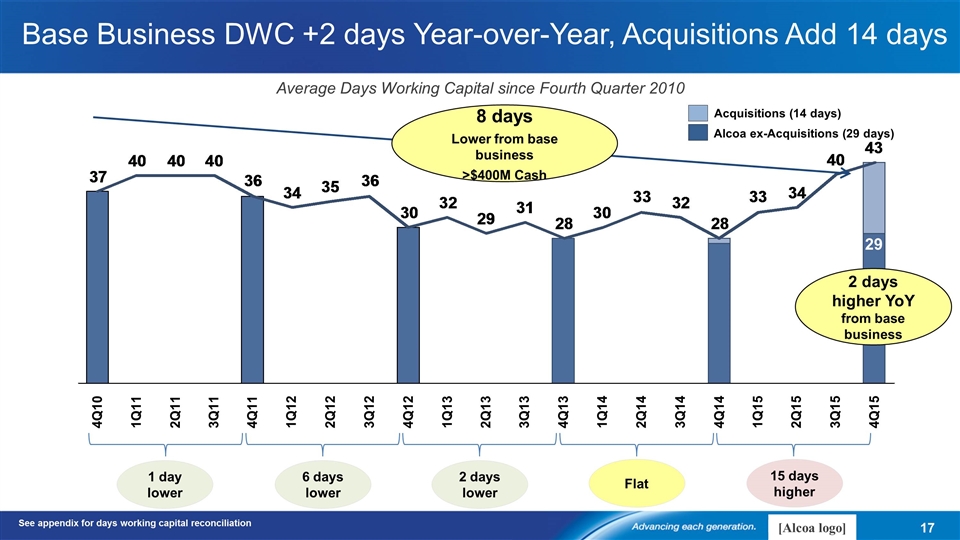

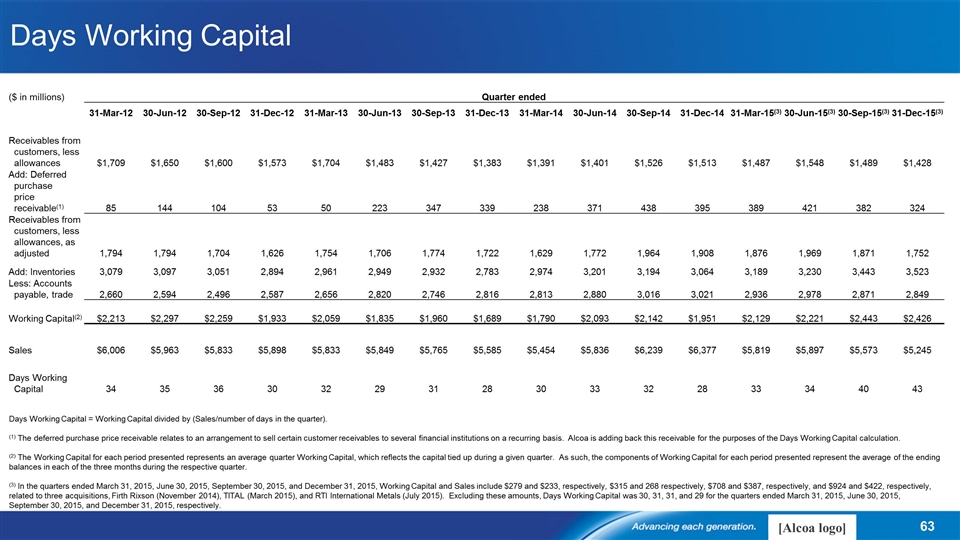

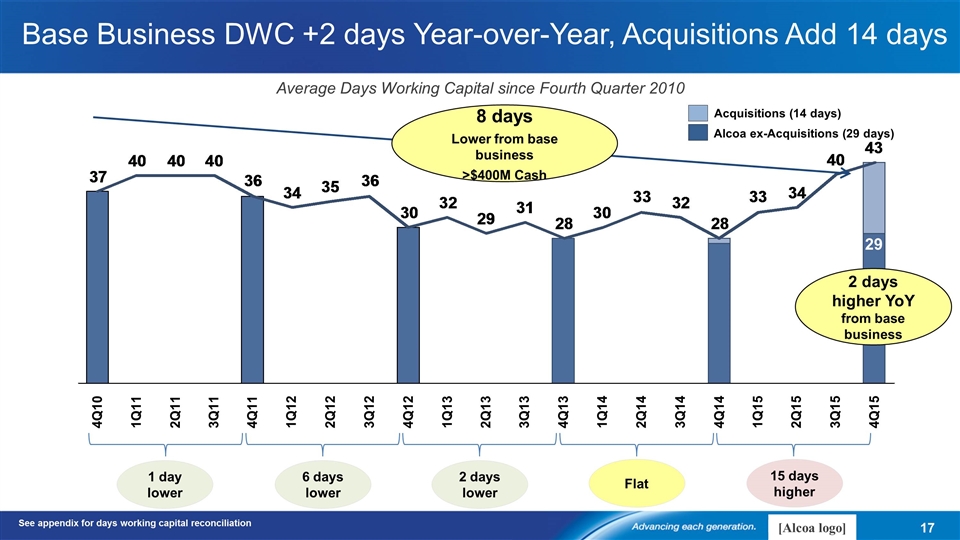

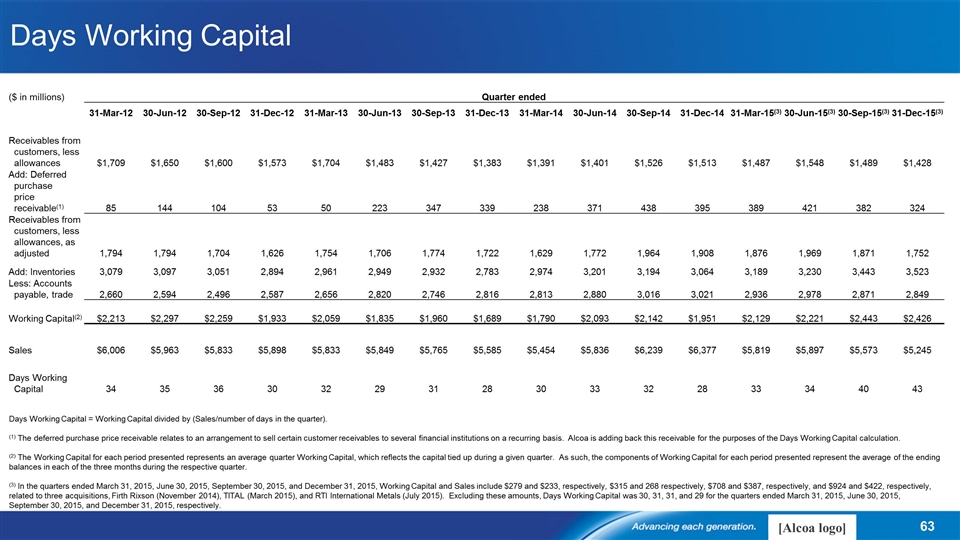

6 days lower Base Business DWC +2 days Year-over-Year, Acquisitions Add 14 days Average Days Working Capital since Fourth Quarter 2010 1 day lower See appendix for days working capital reconciliation 2 days lower 15 days higher Acquisitions (14 days) Alcoa ex-Acquisitions (29 days) 29 8 days Lower from base business >$400M Cash 2 days higher YoY from base business Flat

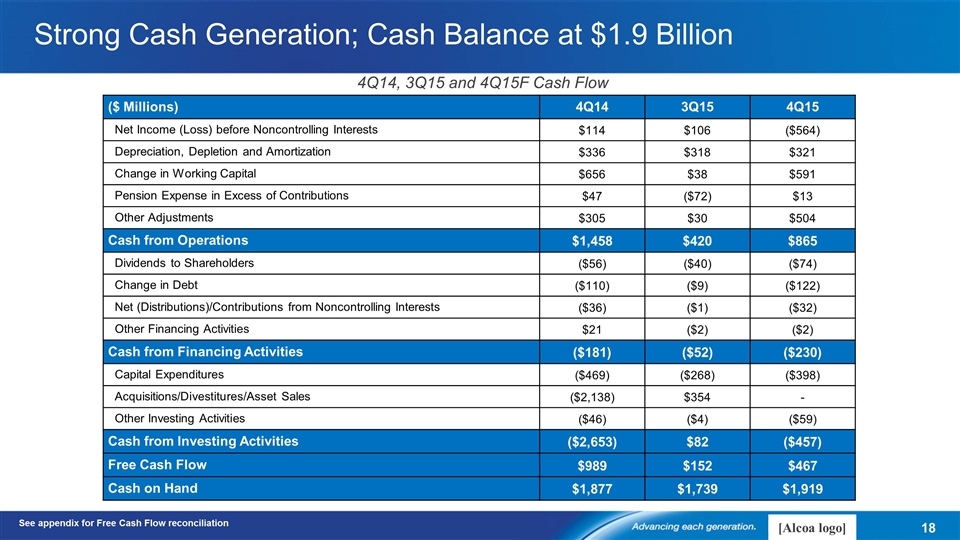

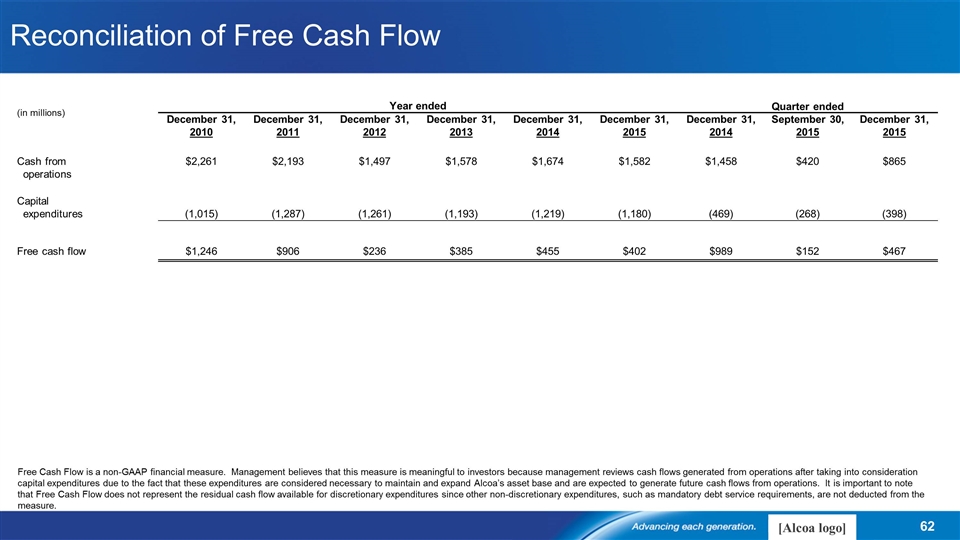

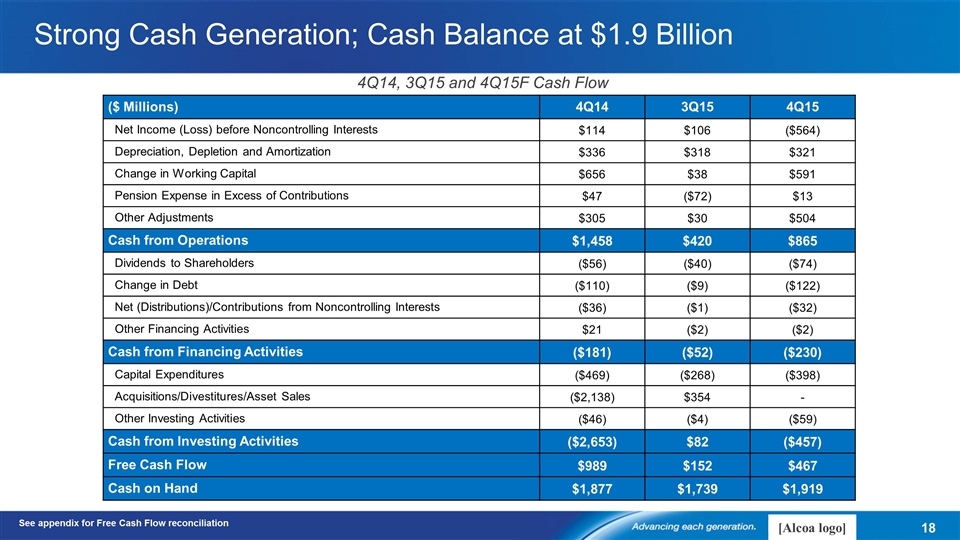

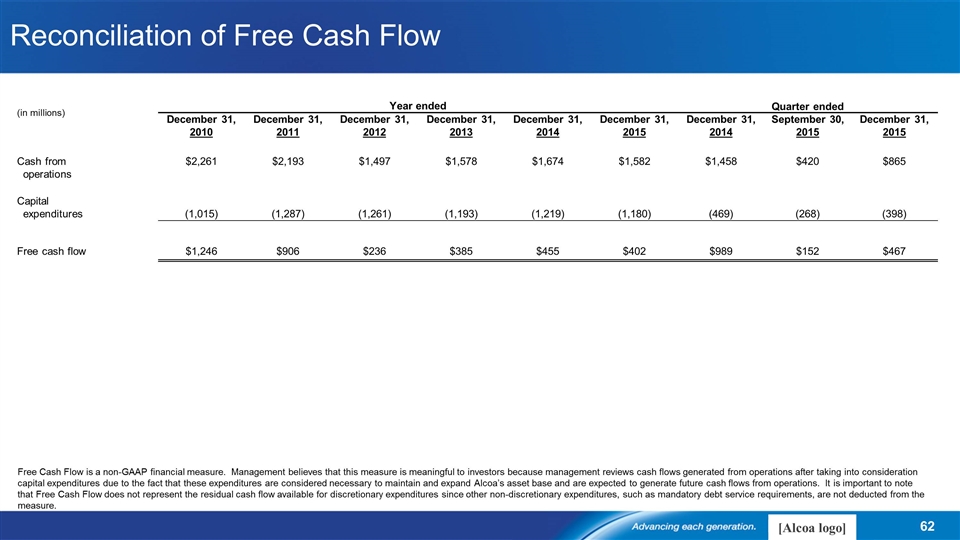

($ Millions) 4Q14 3Q15 4Q15 Net Income (Loss) before Noncontrolling Interests $114 $106 ($564) Depreciation, Depletion and Amortization $336 $318 $321 Change in Working Capital $656 $38 $591 Pension Expense in Excess of Contributions $47 ($72) $13 Other Adjustments $305 $30 $504 Cash from Operations $1,458 $420 $865 Dividends to Shareholders ($56) ($40) ($74) Change in Debt ($110) ($9) ($122) Net (Distributions)/Contributions from Noncontrolling Interests ($36) ($1) ($32) Other Financing Activities $21 ($2) ($2) Cash from Financing Activities ($181) ($52) ($230) Capital Expenditures ($469) ($268) ($398) Acquisitions/Divestitures/Asset Sales ($2,138) $354 - Other Investing Activities ($46) ($4) ($59) Cash from Investing Activities ($2,653) $82 ($457) Free Cash Flow $989 $152 $467 Cash on Hand $1,877 $1,739 $1,919 Strong Cash Generation; Cash Balance at $1.9 Billion 4Q14, 3Q15 and 4Q15F Cash Flow See appendix for Free Cash Flow reconciliation

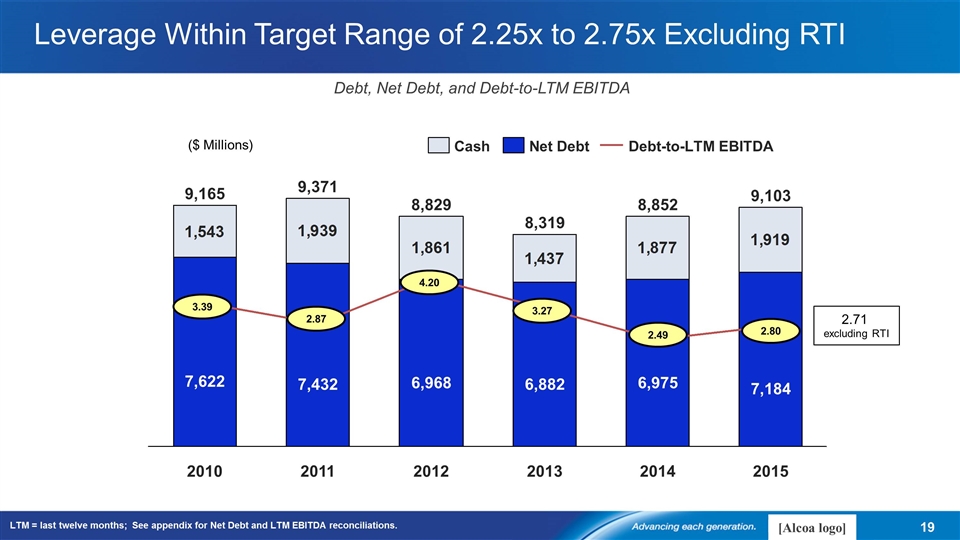

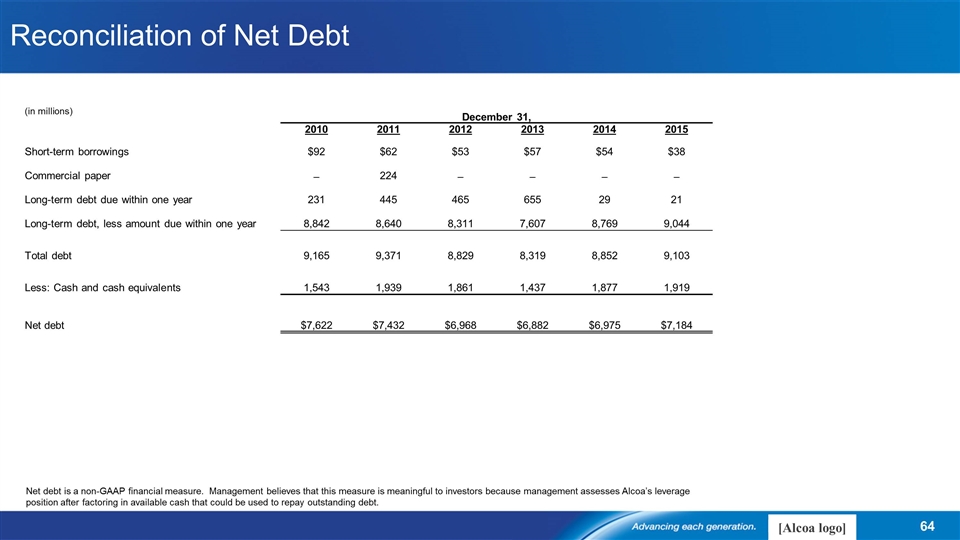

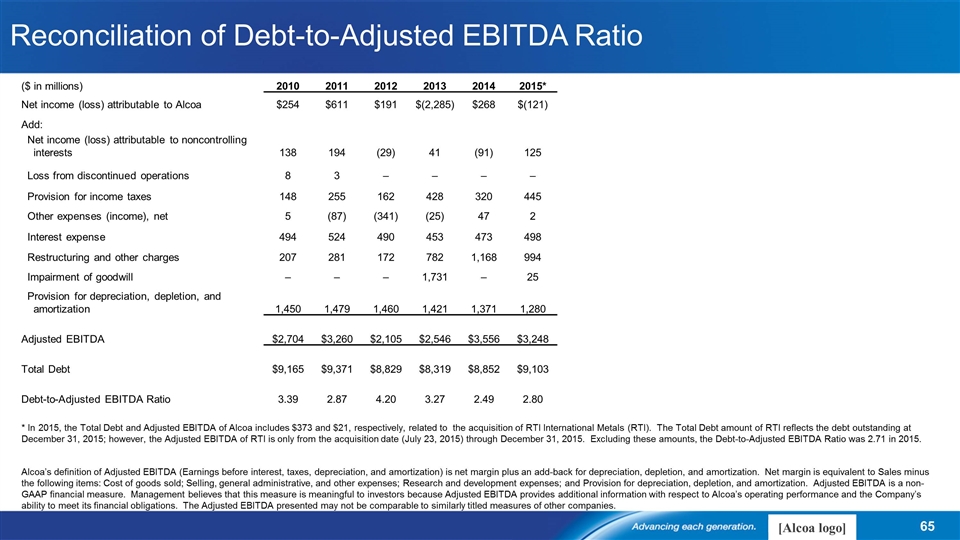

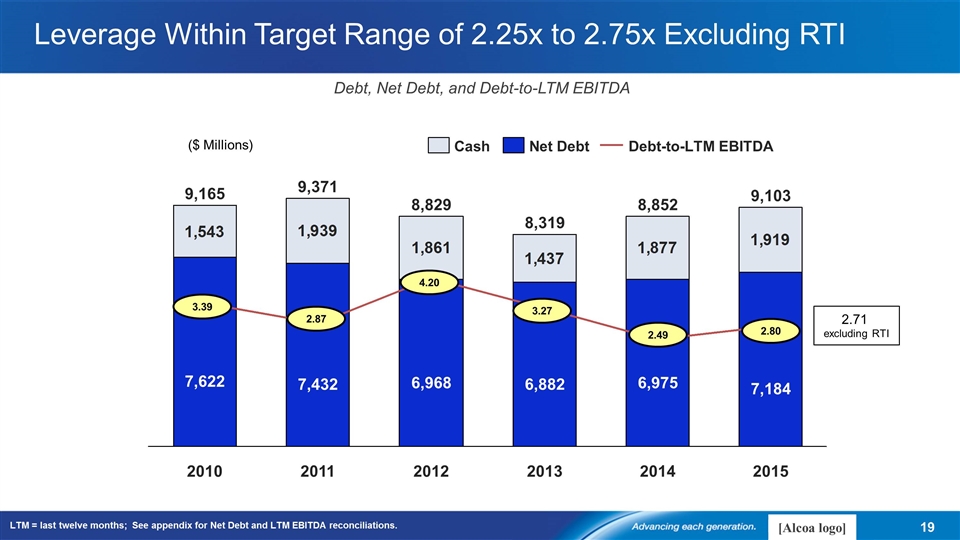

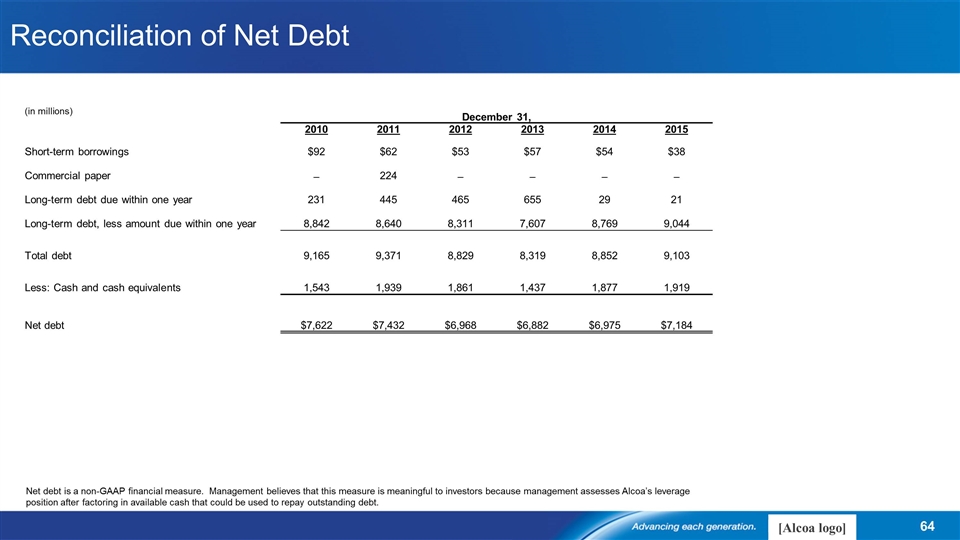

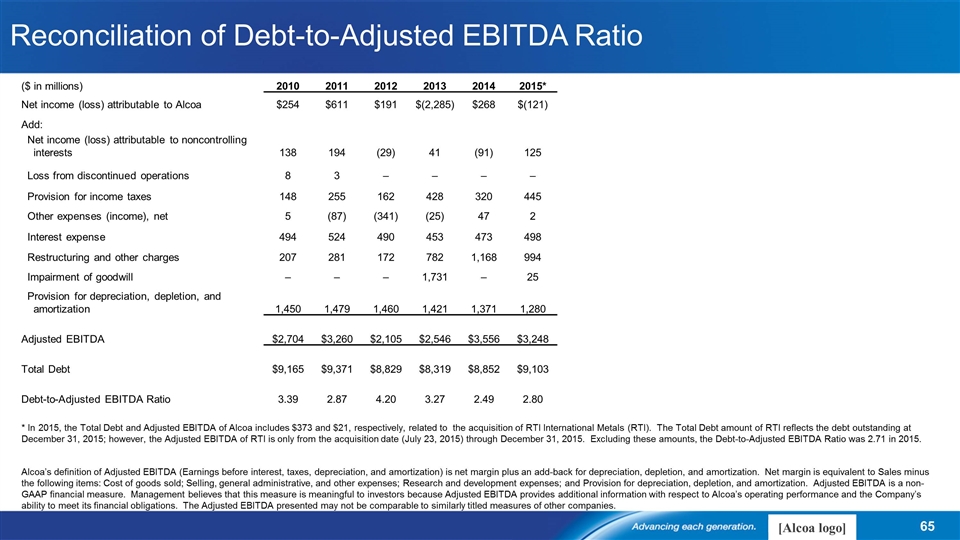

($ Millions) 3.27 3.39 2.87 LTM = last twelve months; See appendix for Net Debt and LTM EBITDA reconciliations. Debt, Net Debt, and Debt-to-LTM EBITDA Leverage Within Target Range of 2.25x to 2.75x Excluding RTI 2.49 4.20 2.80 2.71 excluding RTI

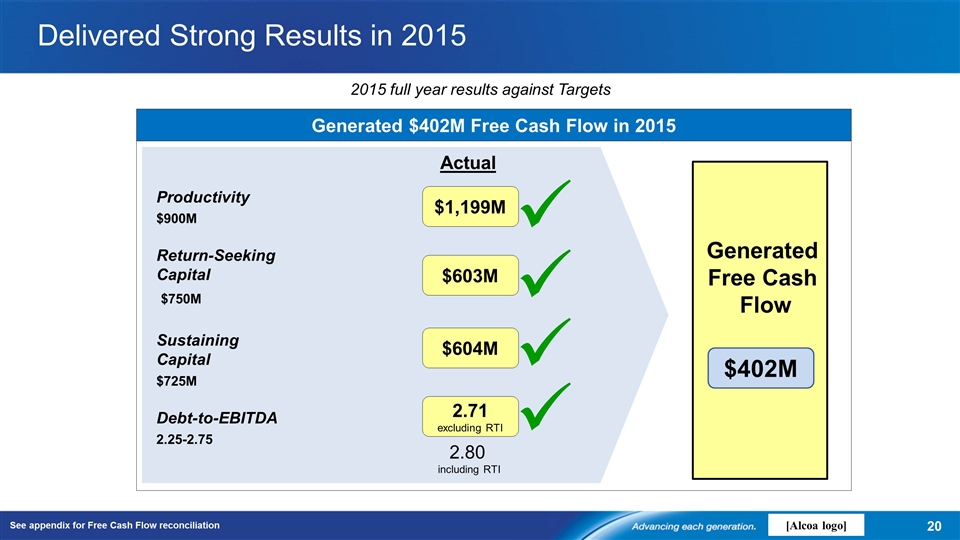

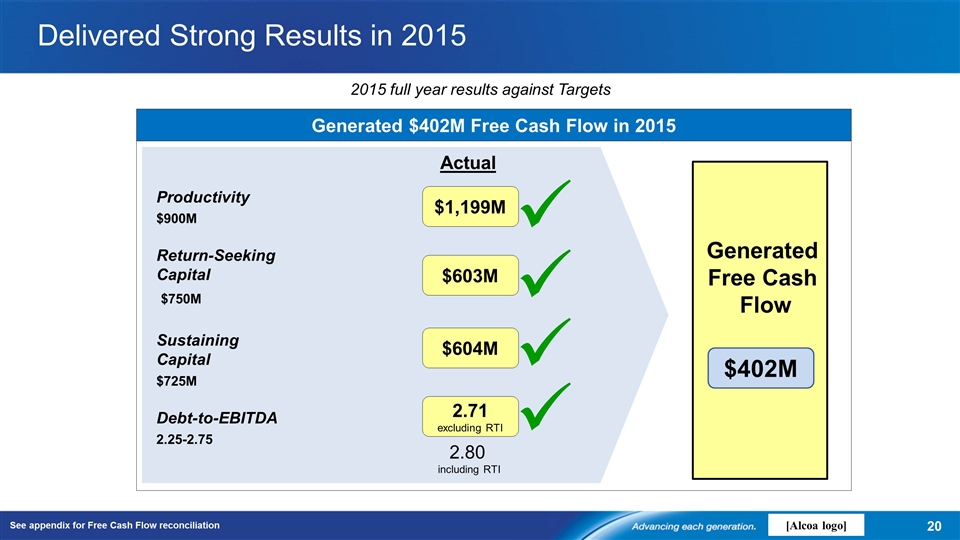

$1,199M $603M $604M 2.71 excluding RTI Generated $402M Free Cash Flow in 2015 Productivity $900M Return-Seeking Capital $750M Sustaining Capital $725M Debt-to-EBITDA 2.25-2.75 Generated Free Cash Flow Actual Delivered Strong Results in 2015 2015 full year results against Targets $402M See appendix for Free Cash Flow reconciliation 2.80 including RTI

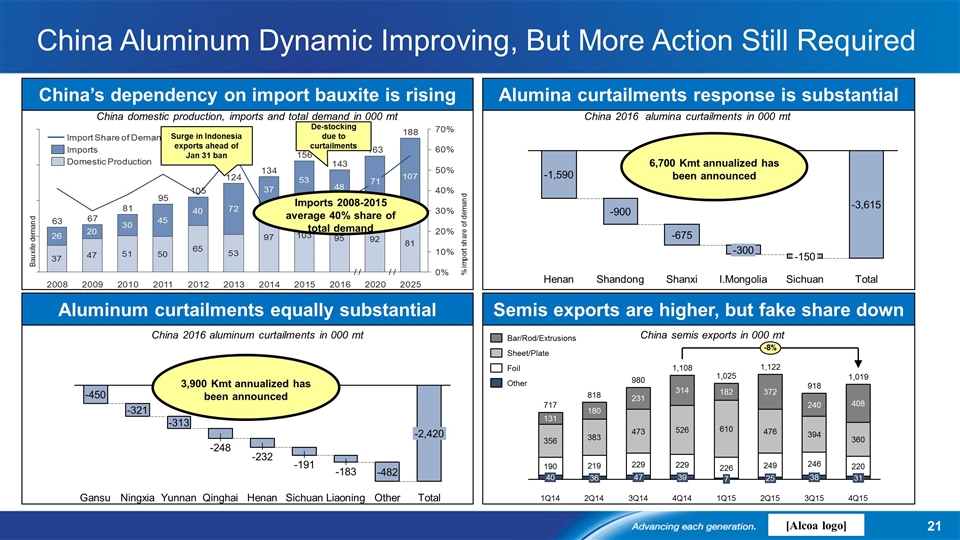

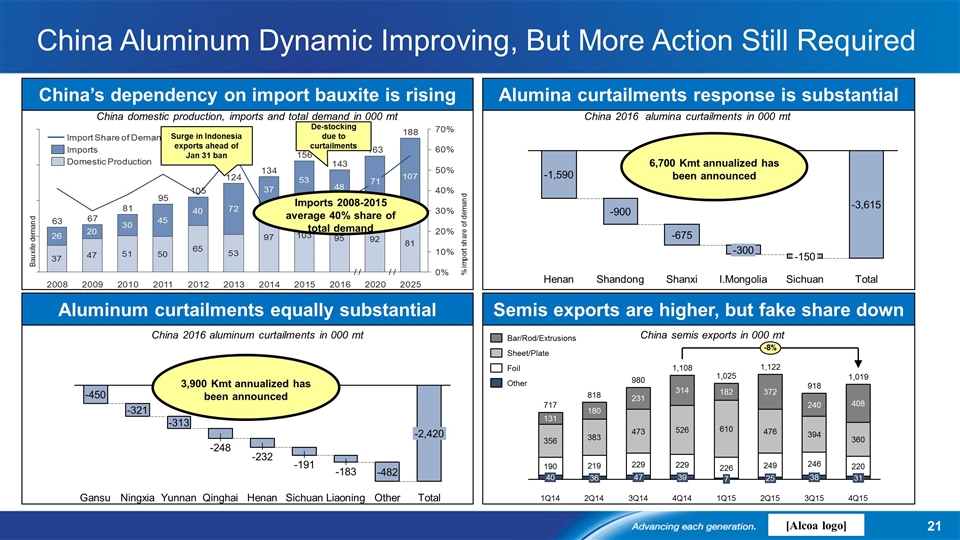

China’s dependency on import bauxite is rising China Aluminum Dynamic Improving, But More Action Still Required Alumina curtailments response is substantial Aluminum curtailments equally substantial Semis exports are higher, but fake share down China 2016 aluminum curtailments in 000 mt China semis exports in 000 mt - - - -3,615 -150 -300 6,700 Kmt annualized has been announced China 2016 alumina curtailments in 000 mt -2,420 -482 - -191 - - - - - 3,900 Kmt annualized has been announced China domestic production, imports and total demand in 000 mt Surge in Indonesia exports ahead of Jan 31 ban De-stocking due to curtailments Imports 2008-2015 average 40% share of total demand

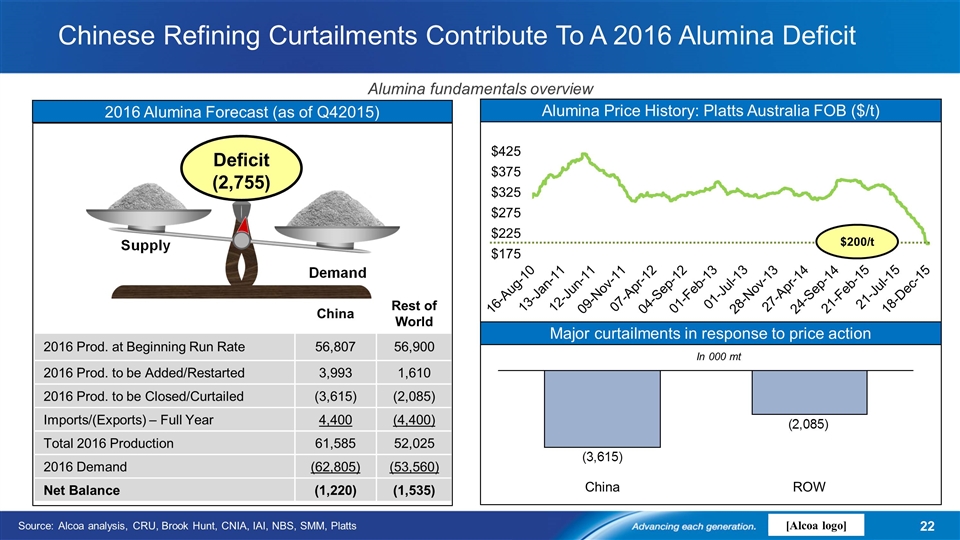

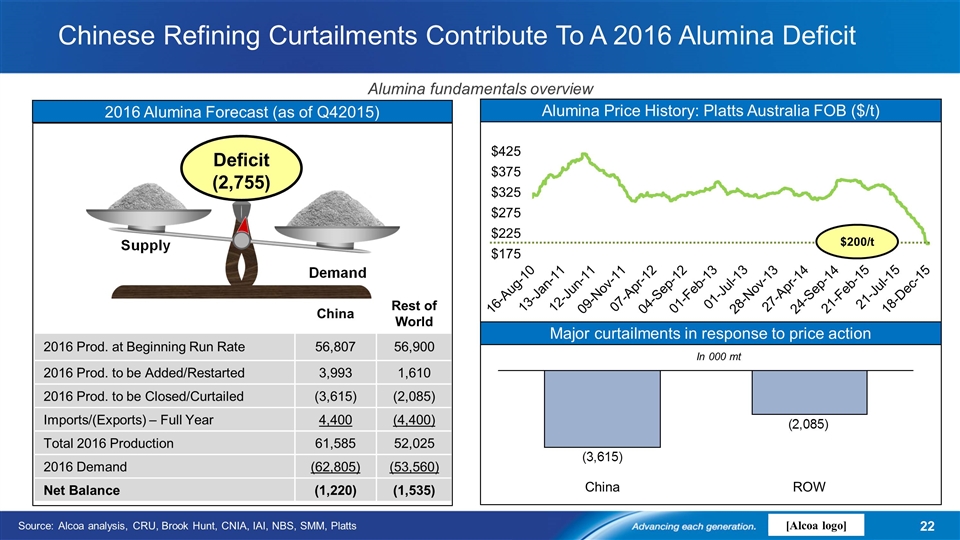

Chinese Refining Curtailments Contribute To A 2016 Alumina Deficit Source: Alcoa analysis, CRU, Brook Hunt, CNIA, IAI, NBS, SMM, Platts Alumina fundamentals overview 2016 Alumina Forecast (as of Q42015) China Rest of World 2016 Prod. at Beginning Run Rate 56,807 56,900 2016 Prod. to be Added/Restarted 3,993 1,610 2016 Prod. to be Closed/Curtailed (3,615) (2,085) Imports/(Exports) – Full Year 4,400 (4,400) Total 2016 Production 61,585 52,025 2016 Demand (62,805) (53,560) Net Balance (1,220) (1,535) Deficit (2,755) Alumina Price History: Platts Australia FOB ($/t) $200/t Major curtailments in response to price action In 000 mt

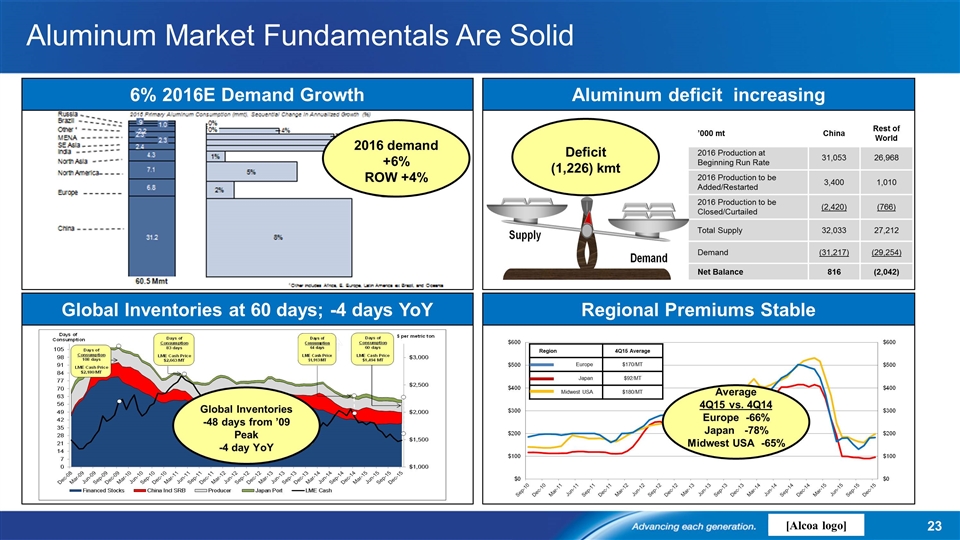

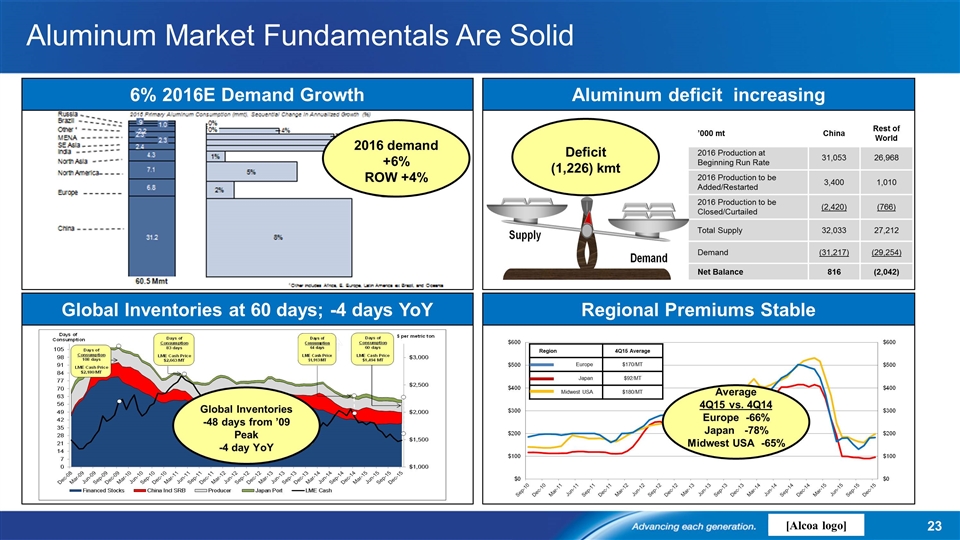

6% 2016E Demand Growth Aluminum Market Fundamentals Are Solid Aluminum deficit increasing Global Inventories at 60 days; -4 days YoY Regional Premiums Stable Average 4Q15 vs. 4Q14 Europe -66% Japan -78% Midwest USA -65% Region 4Q15 Average Europe $170/MT Japan $92/MT Midwest USA $180/MT Global Inventories -48 days from ’09 Peak -4 day YoY ’000 mt China Rest of World 2016 Production at Beginning Run Rate 31,053 26,968 2016 Production to be Added/Restarted 3,400 1,010 2016 Production to be Closed/Curtailed (2,420) (766) Total Supply 32,033 27,212 Demand (31,217) (29,254) Net Balance 816 (2,042) Deficit (1,226) Deficit (1,226) kmt 2016 demand +6% ROW +4%

Klaus Kleinfeld Chairman and Chief Executive Officer January 11, 2016

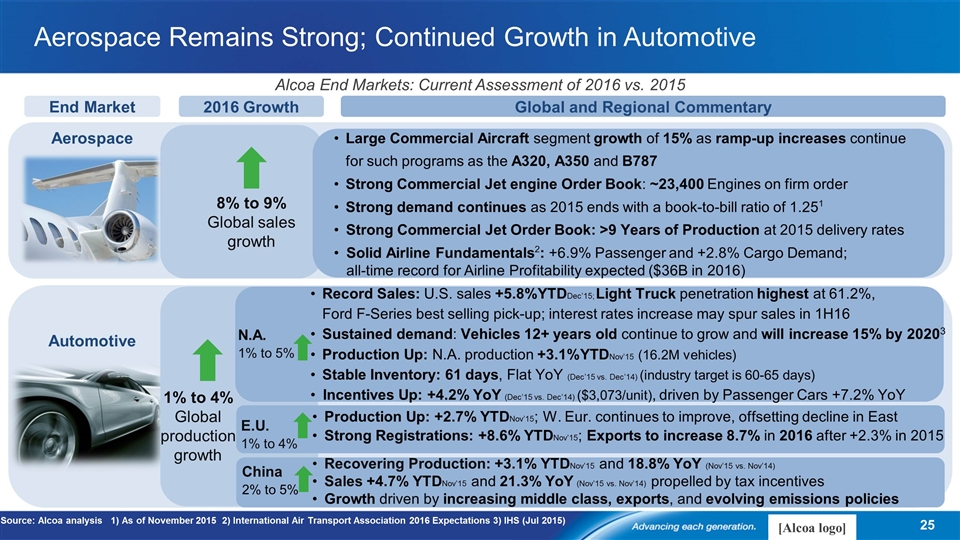

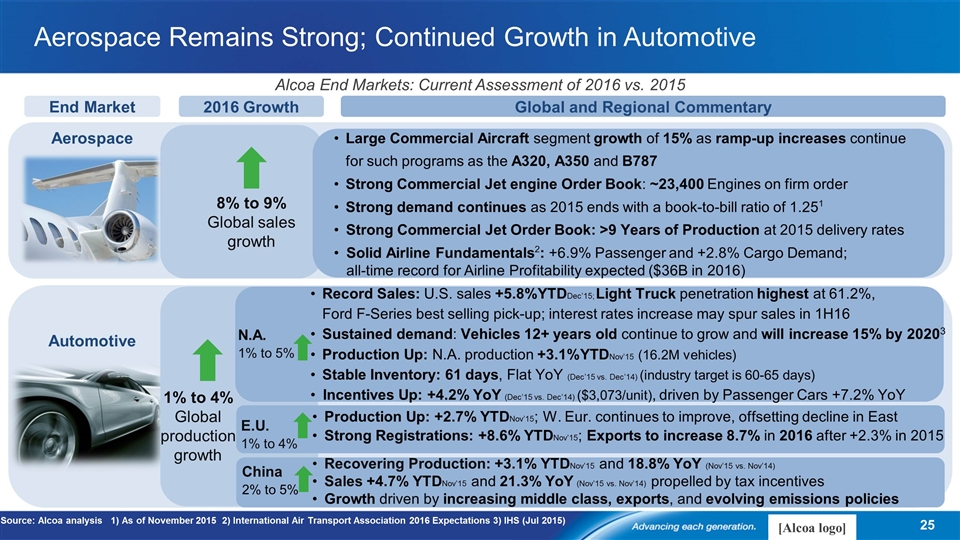

Aerospace Remains Strong; Continued Growth in Automotive End Market 2016 Growth Global and Regional Commentary Aerospace 8% to 9% Global sales growth Large Commercial Aircraft segment growth of 15% as ramp-up increases continue for such programs as the A320, A350 and B787 Strong Commercial Jet engine Order Book: ~23,400 Engines on firm order Strong demand continues as 2015 ends with a book-to-bill ratio of 1.251 Strong Commercial Jet Order Book: >9 Years of Production at 2015 delivery rates Solid Airline Fundamentals2: +6.9% Passenger and +2.8% Cargo Demand; all-time record for Airline Profitability expected ($36B in 2016) Source: Alcoa analysis 1) As of November 2015 2) International Air Transport Association 2016 Expectations 3) IHS (Jul 2015) Alcoa End Markets: Current Assessment of 2016 vs. 2015 Automotive 1% to 4% Global production growth E.U. 1% to 4% China 2% to 5% N.A. 1% to 5% 1% to 4% Global production growth Record Sales: U.S. sales +5.8%YTDDec’15; Light Truck penetration highest at 61.2%, Ford F-Series best selling pick-up; interest rates increase may spur sales in 1H16 Sustained demand: Vehicles 12+ years old continue to grow and will increase 15% by 20203 Production Up: N.A. production +3.1%YTDNov’15 (16.2M vehicles) Stable Inventory: 61 days, Flat YoY (Dec’15 vs. Dec’14) (industry target is 60-65 days) Incentives Up: +4.2% YoY (Dec’15 vs. Dec’14) ($3,073/unit), driven by Passenger Cars +7.2% YoY Production Up: +2.7% YTDNov’15; W. Eur. continues to improve, offsetting decline in East Strong Registrations: +8.6% YTDNov’15; Exports to increase 8.7% in 2016 after +2.3% in 2015 Recovering Production: +3.1% YTDNov’15 and 18.8% YoY (Nov’15 vs. Nov’14) Sales +4.7% YTDNov’15 and 21.3% YoY (Nov’15 vs. Nov’14) propelled by tax incentives Growth driven by increasing middle class, exports, and evolving emissions policies

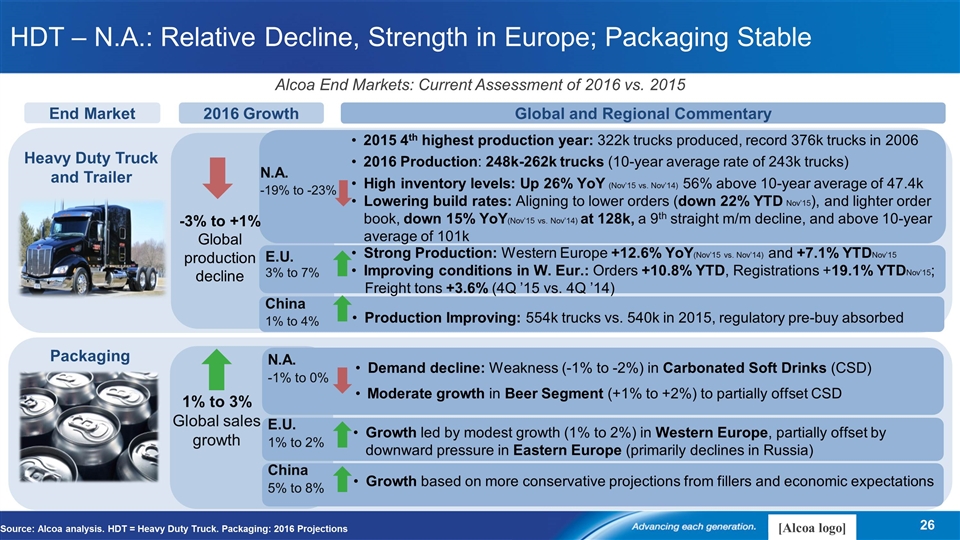

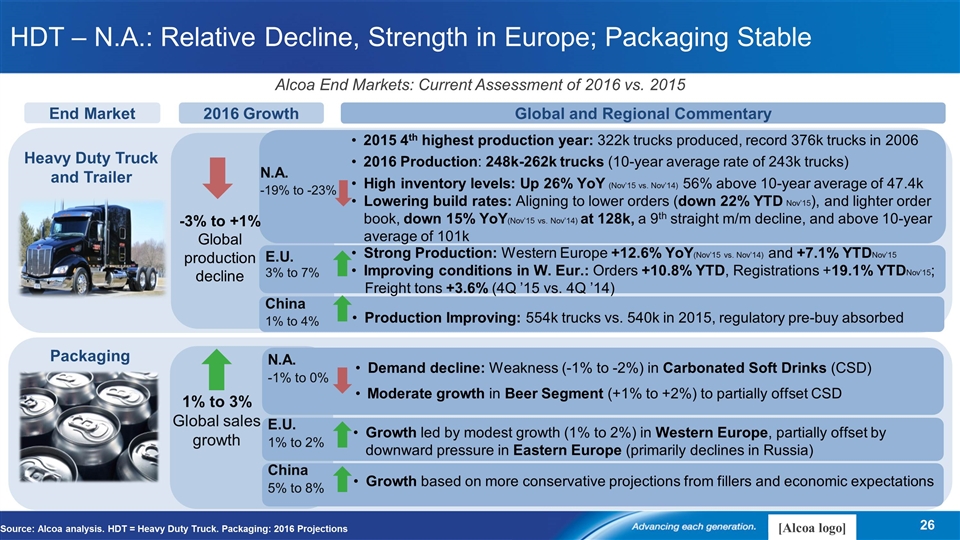

HDT – N.A.: Relative Decline, Strength in Europe; Packaging Stable End Market 2016 Growth Global and Regional Commentary Alcoa End Markets: Current Assessment of 2016 vs. 2015 Source: Alcoa analysis. HDT = Heavy Duty Truck. Packaging: 2016 Projections Heavy Duty Truck and Trailer -3% to +1% Global production decline Packaging 1% to 3% Global sales growth N.A. -1% to 0% E.U. 1% to 2% China 5% to 8% Demand decline: Weakness (-1% to -2%) in Carbonated Soft Drinks (CSD) Moderate growth in Beer Segment (+1% to +2%) to partially offset CSD Growth led by modest growth (1% to 2%) in Western Europe, partially offset by downward pressure in Eastern Europe (primarily declines in Russia) Growth based on more conservative projections from fillers and economic expectations N.A. -19% to -23% E.U. 3% to 7% China 1% to 4% -3% to +1% Global production decline Strong Production: Western Europe +12.6% YoY(Nov’15 vs. Nov’14) and +7.1% YTDNov’15 Improving conditions in W. Eur.: Orders +10.8% YTD, Registrations +19.1% YTDNov’15; Freight tons +3.6% (4Q ’15 vs. 4Q ’14) Production Improving: 554k trucks vs. 540k in 2015, regulatory pre-buy absorbed 2015 4th highest production year: 322k trucks produced, record 376k trucks in 2006 2016 Production: 248k-262k trucks (10-year average rate of 243k trucks) High inventory levels: Up 26% YoY (Nov’15 vs. Nov’14) 56% above 10-year average of 47.4k Lowering build rates: Aligning to lower orders (down 22% YTD Nov’15), and lighter order book, down 15% YoY(Nov’15 vs. Nov’14) at 128k, a 9th straight m/m decline, and above 10-year average of 101k

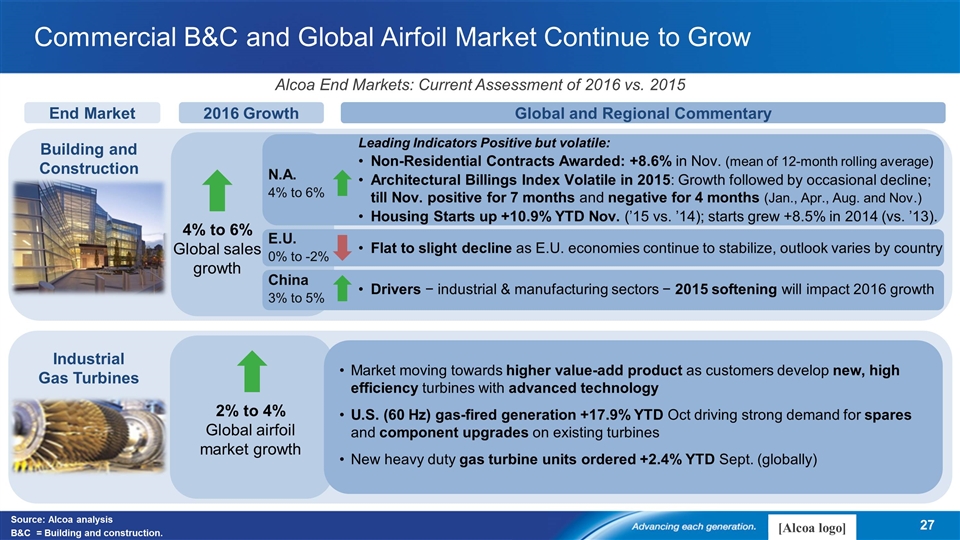

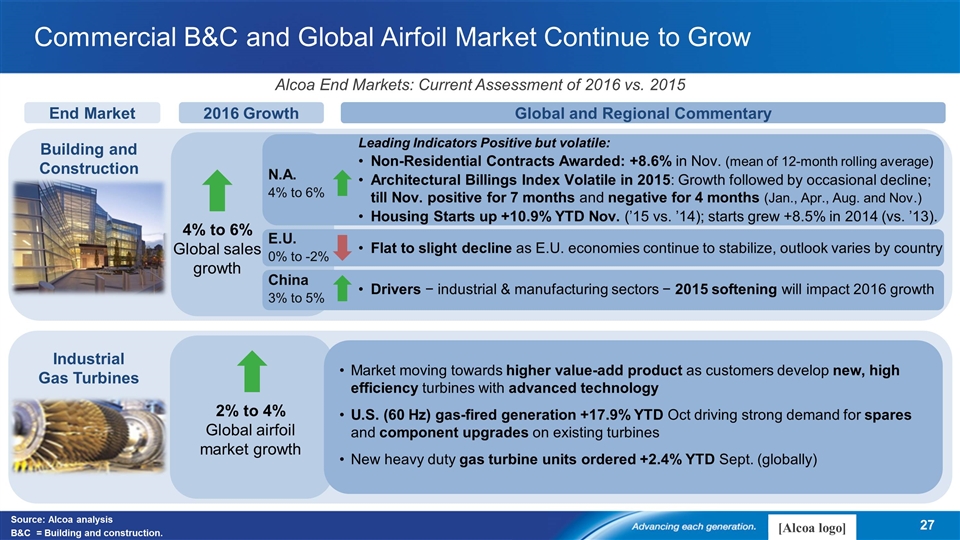

Commercial B&C and Global Airfoil Market Continue to Grow End Market 2016 Growth Global and Regional Commentary Source: Alcoa analysis B&C = Building and construction. Alcoa End Markets: Current Assessment of 2016 vs. 2015 Building and Construction Industrial Gas Turbines 2% to 4% Global airfoil market growth Market moving towards higher value-add product as customers develop new, high efficiency turbines with advanced technology U.S. (60 Hz) gas-fired generation +17.9% YTD Oct driving strong demand for spares and component upgrades on existing turbines New heavy duty gas turbine units ordered +2.4% YTD Sept. (globally) N.A. 4% to 6% E.U. 0% to -2% China 3% to 5% 4% to 6% Global sales growth Leading Indicators Positive but volatile: Non-Residential Contracts Awarded: +8.6% in Nov. (mean of 12-month rolling average) Architectural Billings Index Volatile in 2015: Growth followed by occasional decline; till Nov. positive for 7 months and negative for 4 months (Jan., Apr., Aug. and Nov.) Housing Starts up +10.9% YTD Nov. (’15 vs. ’14); starts grew +8.5% in 2014 (vs. ’13). Flat to slight decline as E.U. economies continue to stabilize, outlook varies by country Drivers − industrial & manufacturing sectors − 2015 softening will impact 2016 growth

Upstream: Cost Competitive Industry Leader MINING REFINING CASTING SMELTING ENERGY World’s largest bauxite miner1 Flexibility to profit from market cycles 1st quartile3 cost curve refiner Strategic global footprint Value-add products in key markets ALUMINA ALUMINUM Key Attributes Robust projected aluminum demand growth of 6% in 2016 and double between 2010 and 2020; 3rd Party bauxite demand projected to double by 2025 Attractive Portfolio: World’s largest, low cost bauxite miner at the 1st quartile1 on the cost curve (47M BDMT2) World’s largest, most attractive alumina business in the 1st quartile3 of the cost curve (17.3 MMT) Substantial energy assets with operational flexibility (Power production capacity of ~1,550 MW) Optimized smelting capacity (3.1 MMT) continuing to improve its 2nd quartile3 cost curve position 17 casthouses4 providing value-add products Diverse sites – close proximity to major markets Committed to disciplined capital allocation and prudent return of capital to shareholders 1) CRU analysis 2) Mined in 2015, including equity interests 3) CRU and Alcoa analysis 4) Includes Saudi Arabia Joint Venture BDMT = Bone Dry Metric Ton Upstream Co. Business Operations and Key Attributes [Alcoa logo]

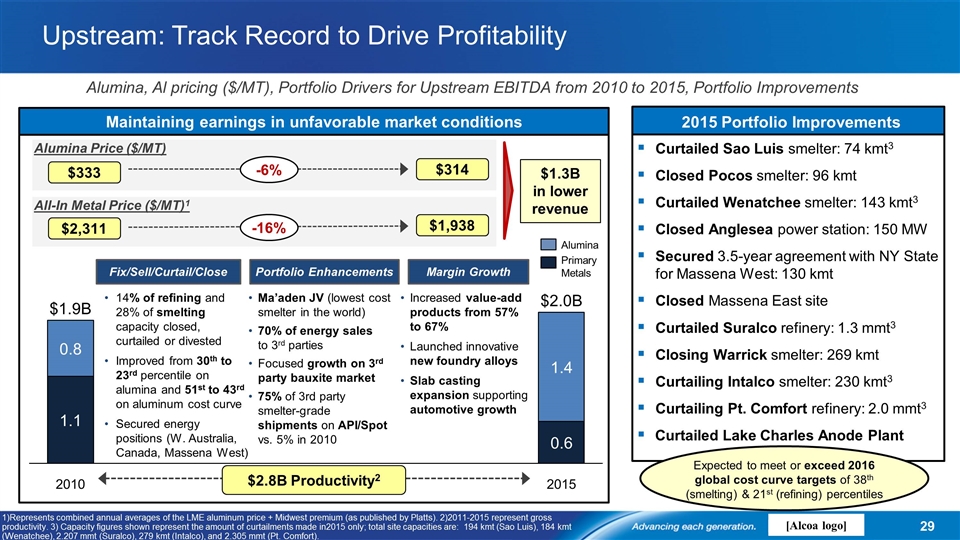

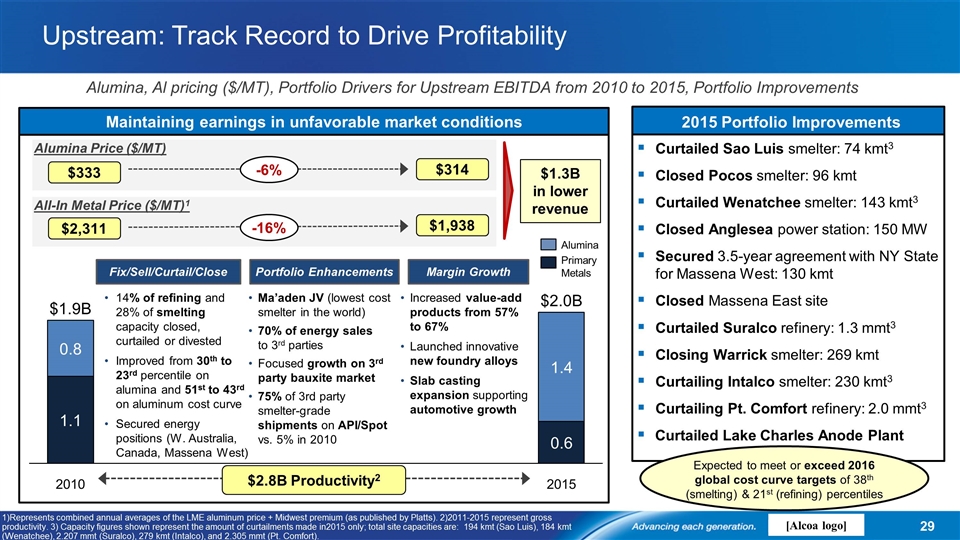

Upstream: Track Record to Drive Profitability Alumina, Al pricing ($/MT), Portfolio Drivers for Upstream EBITDA from 2010 to 2015, Portfolio Improvements $B $B $2.8B Productivity2 Maintaining earnings in unfavorable market conditions Alumina Price ($/MT) $333 $314 -6% All-In Metal Price ($/MT)1 $2,311 $1,938 -16% 14% of refining and 28% of smelting capacity closed, curtailed or divested Improved from 30th to 23rd percentile on alumina and 51st to 43rd on aluminum cost curve Secured energy positions (W. Australia, Canada, Massena West) Ma’aden JV (lowest cost smelter in the world) 70% of energy sales to 3rd parties Focused growth on 3rd party bauxite market 75% of 3rd party smelter-grade shipments on API/Spot vs. 5% in 2010 Increased value-add products from 57% to 67% Launched innovative new foundry alloys Slab casting expansion supporting automotive growth Represents combined annual averages of the LME aluminum price + Midwest premium (as published by Platts). 2)2011-2015 represent gross productivity. 3) Capacity figures shown represent the amount of curtailments made in2015 only; total site capacities are: 194 kmt (Sao Luis), 184 kmt (Wenatchee), 2.207 mmt (Suralco), 279 kmt (Intalco), and 2.305 mmt (Pt. Comfort). Curtailed Sao Luis smelter: 74 kmt3 Closed Pocos smelter: 96 kmt Curtailed Wenatchee smelter: 143 kmt3 Closed Anglesea power station: 150 MW Secured 3.5-year agreement with NY State for Massena West: 130 kmt Closed Massena East site Curtailed Suralco refinery: 1.3 mmt3 Closing Warrick smelter: 269 kmt Curtailing Intalco smelter: 230 kmt3 Curtailing Pt. Comfort refinery: 2.0 mmt3 Curtailed Lake Charles Anode Plant 2015 Portfolio Improvements Expected to meet or exceed 2016 global cost curve targets of 38th (smelting) & 21st (refining) percentiles $1.3B in lower revenue Fix/Sell/Curtail/Close Portfolio Enhancements Margin Growth Primary Metals

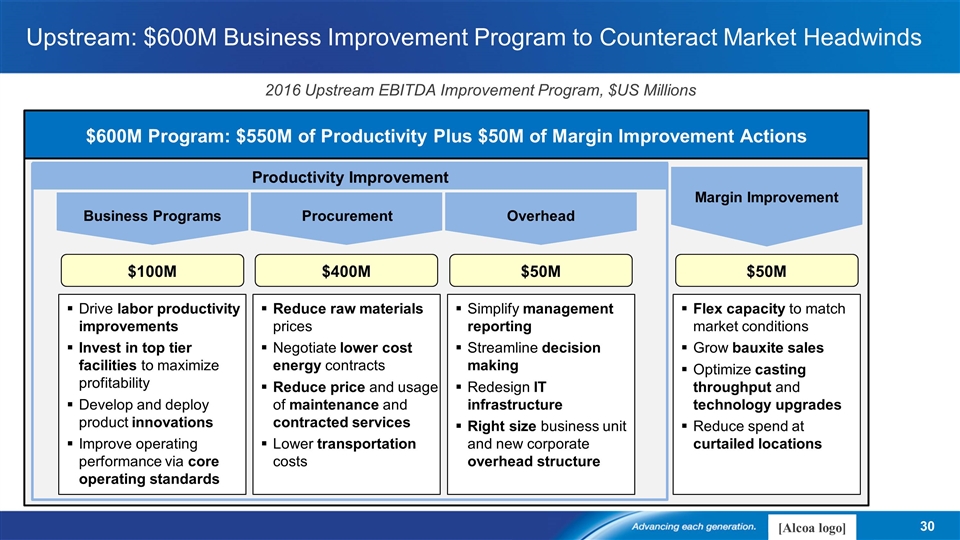

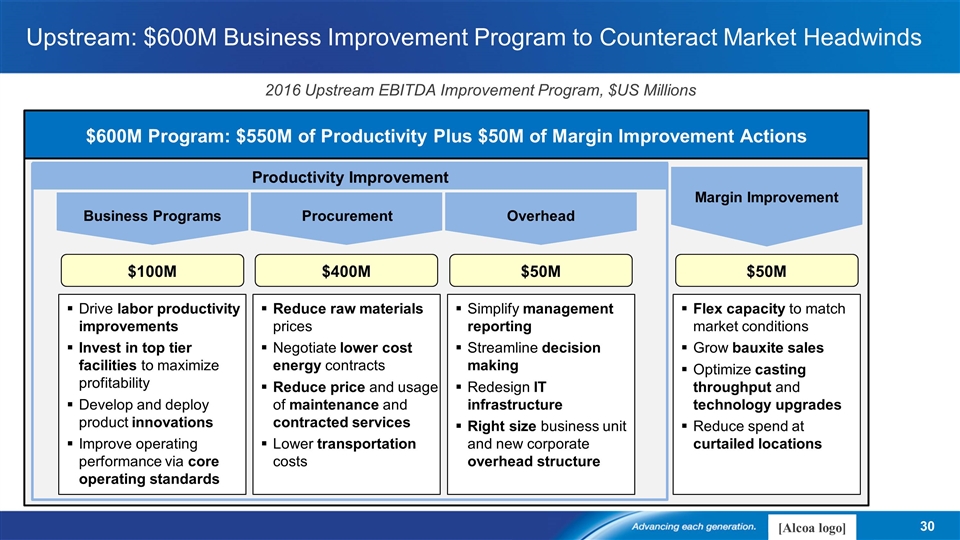

Business Programs Procurement Overhead Margin Improvement $600M Program: $550M of Productivity Plus $50M of Margin Improvement Actions 2016 Upstream EBITDA Improvement Program, $US Millions Upstream: $600M Business Improvement Program to Counteract Market Headwinds Drive labor productivity improvements Invest in top tier facilities to maximize profitability Develop and deploy product innovations Improve operating performance via core operating standards Reduce raw materials prices Negotiate lower cost energy contracts Reduce price and usage of maintenance and contracted services Lower transportation costs Simplify management reporting Streamline decision making Redesign IT infrastructure Right size business unit and new corporate overhead structure Flex capacity to match market conditions Grow bauxite sales Optimize casting throughput and technology upgrades Reduce spend at curtailed locations $100M $400M $50M $50M Productivity Improvement

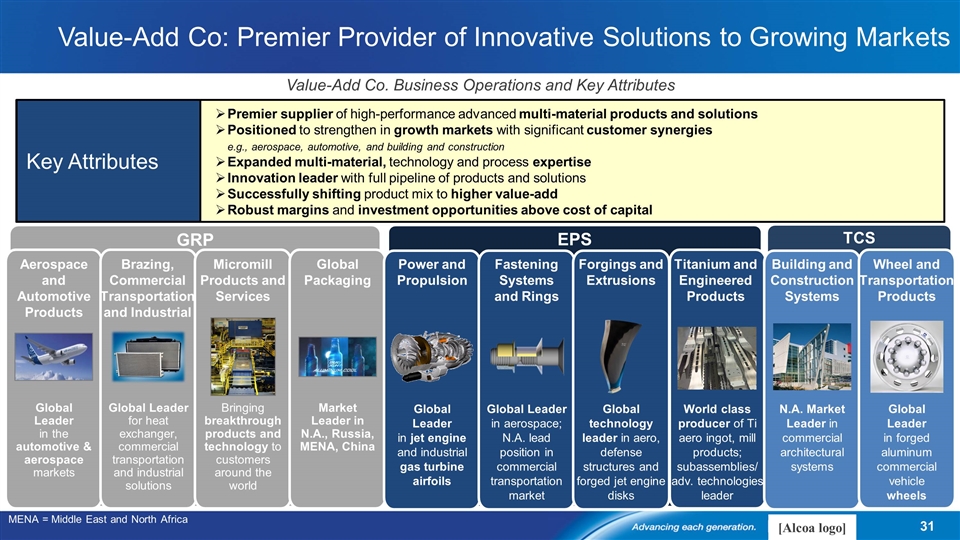

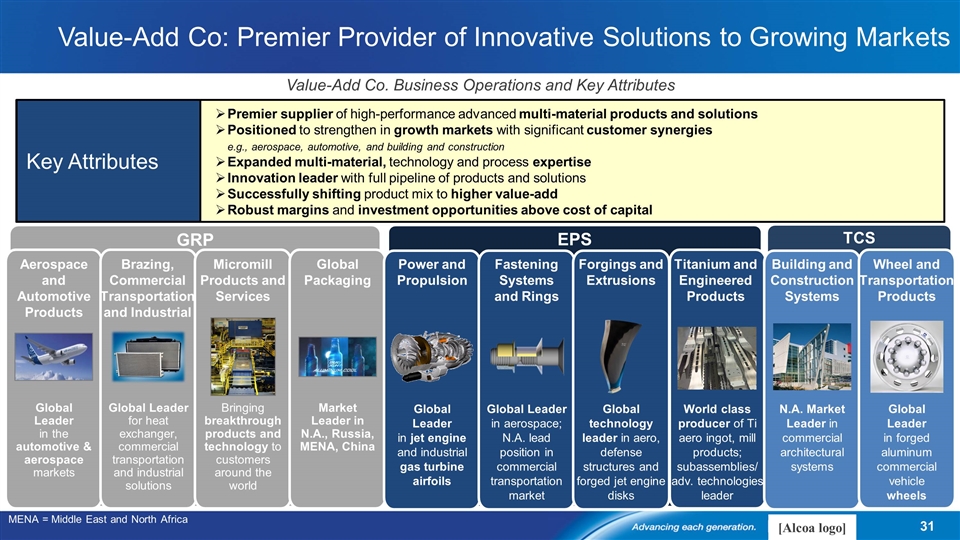

Value-Add Co: Premier Provider of Innovative Solutions to Growing Markets Value-Add Co. Business Operations and Key Attributes Premier supplier of high-performance advanced multi-material products and solutions Positioned to strengthen in growth markets with significant customer synergies e.g., aerospace, automotive, and building and construction Expanded multi-material, technology and process expertise Innovation leader with full pipeline of products and solutions Successfully shifting product mix to higher value-add Robust margins and investment opportunities above cost of capital Key Attributes MENA = Middle East and North Africa GRP Aerospace and Automotive Products Global Leader in the automotive & aerospace markets Brazing, Commercial Transportation and Industrial Global Leader for heat exchanger, commercial transportation and industrial solutions Micromill Products and Services Bringing breakthrough products and technology to customers around the world Global Packaging Market Leader in N.A., Russia, MENA, China EPS TCS Power and Propulsion Global Leader in jet engine and industrial gas turbine airfoils Fastening Systems and Rings Global Leader in aerospace; N.A. lead position in commercial transportation market Forgings and Extrusions Global technology leader in aero, defense structures and forged jet engine disks Titanium and Engineered Products World class producer of Ti aero ingot, mill products; subassemblies/ adv. technologies leader Building and Construction Systems N.A. Market Leader in commercial architectural systems Wheel and Transportation Products Global Leader in forged aluminum commercial vehicle wheels

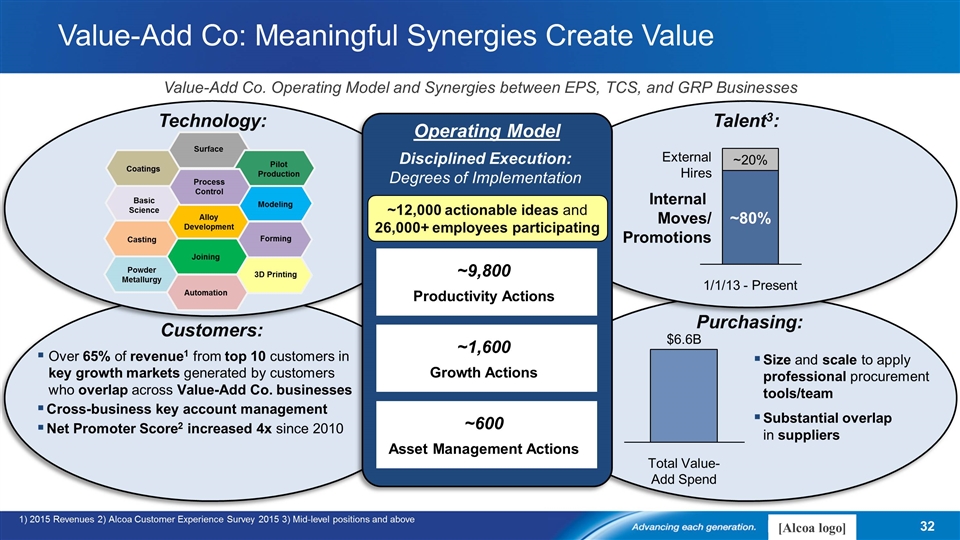

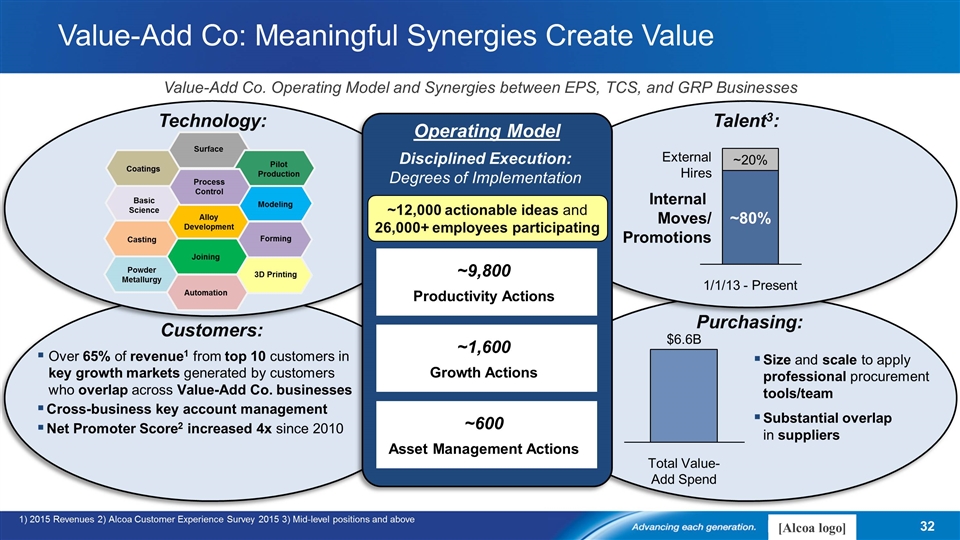

Value-Add Co: Meaningful Synergies Create Value Value-Add Co. Operating Model and Synergies between EPS, TCS, and GRP Businesses 1) 2015 Revenues 2) Alcoa Customer Experience Survey 2015 3) Mid-level positions and above Purchasing: Talent3: Technology: Customers: ~20% ~80% / Promotions Operating Model Over 65% of revenue1 from top 10 customers in key growth markets generated by customers who overlap across Value-Add Co. businesses Cross-business key account management Net Promoter Score2 increased 4x since 2010 Disciplined Execution: Degrees of Implementation ~12,000 actionable ideas and 26,000+ employees participating ~9,800 Productivity Actions ~1,600 Growth Actions ~600 Asset Management Actions $B Size and scale to apply professional procurement tools/team Substantial overlap in suppliers Alloy Development Coatings Modeling Casting Surface Basic Science Pilot Production Process Control Forming Joining Powder Metallurgy 3D Printing Automation

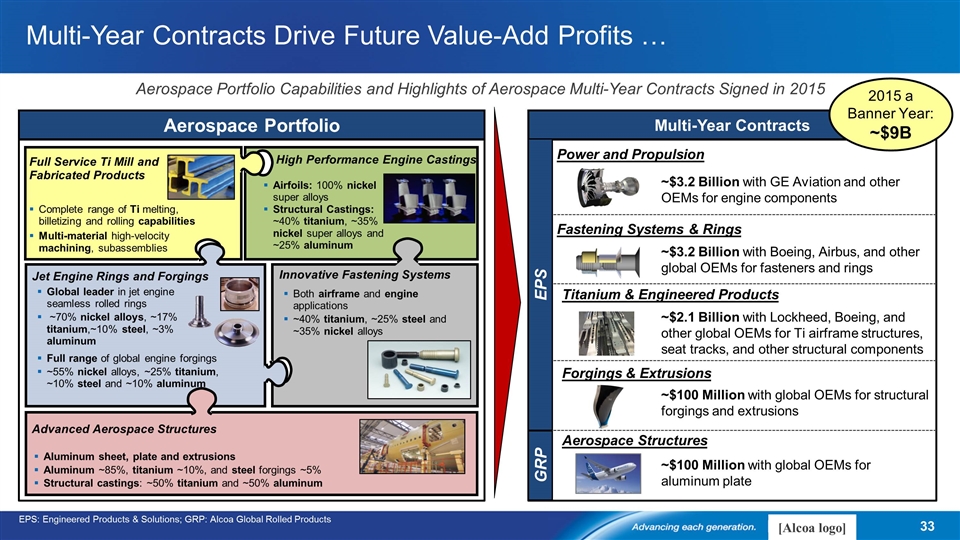

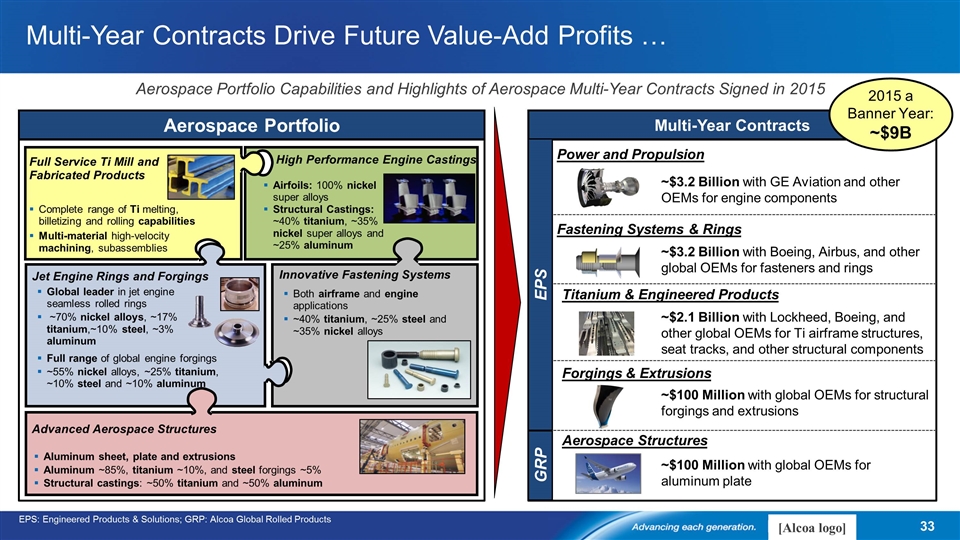

Multi-Year Contracts Drive Future Value-Add Profits … Aerospace Portfolio Capabilities and Highlights of Aerospace Multi-Year Contracts Signed in 2015 Aerospace Portfolio World class producer of Ti aero ingot, mill products; subassemblies/ adv. technologies leader Multi-Year Contracts ~$100 Million with global OEMs for structural forgings and extrusions ~$3.2 Billion with GE Aviation and other OEMs for engine components Power and Propulsion Forgings & Extrusions EPS: Engineered Products & Solutions; GRP: Alcoa Global Rolled Products Fastening Systems & Rings ~$3.2 Billion with Boeing, Airbus, and other global OEMs for fasteners and rings ~$2.1 Billion with Lockheed, Boeing, and other global OEMs for Ti airframe structures, seat tracks, and other structural components Titanium & Engineered Products Aerospace Structures ~$100 Million with global OEMs for aluminum plate EPS GRP High Performance Engine Castings Jet Engine Rings and Forgings Airfoils: 100% nickel super alloys Structural Castings: ~40% titanium, ~35% nickel super alloys and ~25% aluminum Innovative Fastening Systems Full Service Ti Mill and Fabricated Products Advanced Aerospace Structures Both airframe and engine applications ~40% titanium, ~25% steel and ~35% nickel alloys Aluminum sheet, plate and extrusions Aluminum ~85%, titanium ~10%, and steel forgings ~5% Structural castings: ~50% titanium and ~50% aluminum Complete range of Ti melting, billetizing and rolling capabilities Multi-material high-velocity machining, subassemblies Global leader in jet engine seamless rolled rings ~70% nickel alloys, ~17% titanium,~10% steel, ~3% aluminum Full range of global engine forgings ~55% nickel alloys, ~25% titanium, ~10% steel and ~10% aluminum 2015 a Banner Year: ~$9B

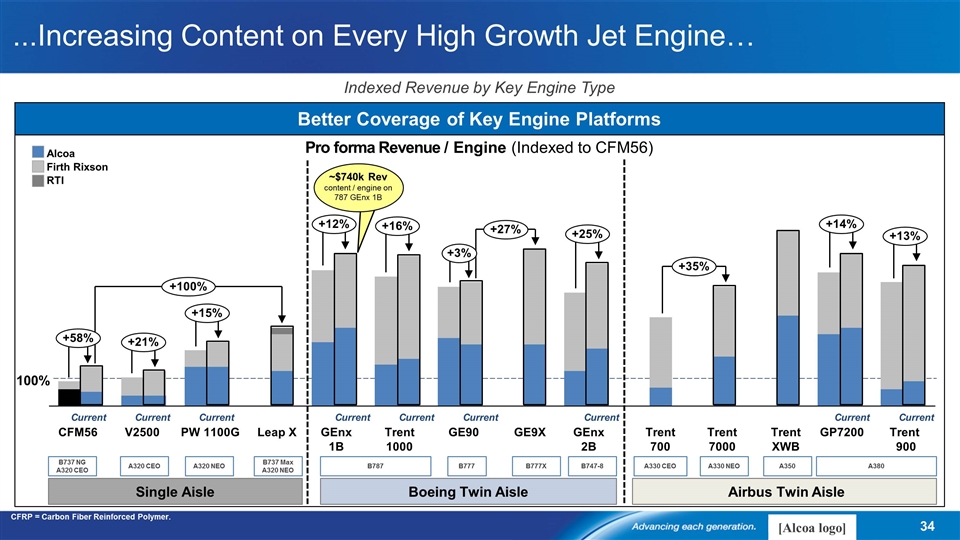

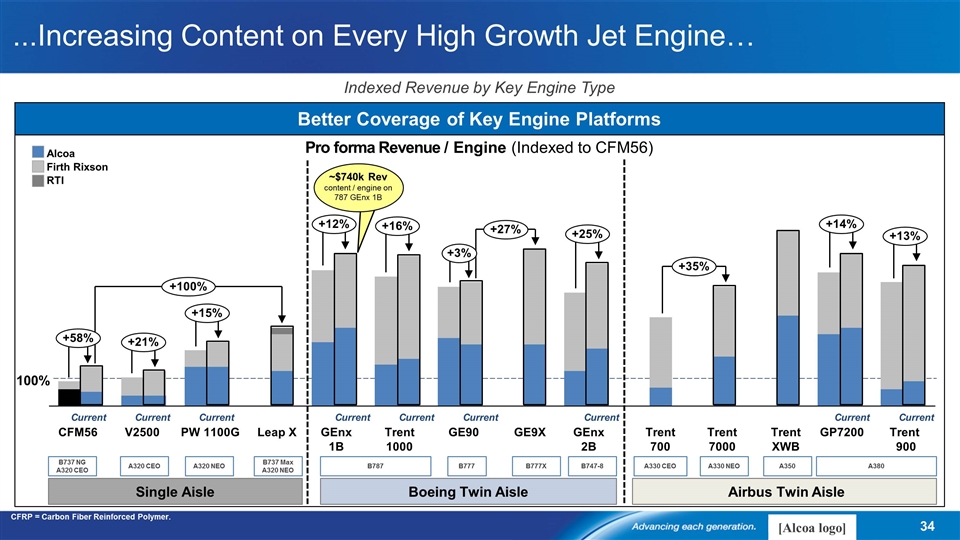

...Increasing Content on Every High Growth Jet Engine… Indexed Revenue by Key Engine Type CFRP = Carbon Fiber Reinforced Polymer. Better Coverage of Key Engine Platforms Pro forma Revenue / Engine (Indexed to CFM56) 100% Alcoa Firth Rixson RTI Airbus Twin Aisle Boeing Twin Aisle Single Aisle B737 NG A320 CEO A320 CEO A320 NEO B737 Max A320 NEO B787 B777 B747-8 A330 CEO A330 NEO A350 A380 B777X CFM56 V2500 PW 1100G Leap X GEnx 1B Trent 1000 GE90 GE9X GEnx 2B Trent 700 Trent 7000 Trent XWB GP7200 Trent 900 Current Current Current Current Current Current Current Current Current ~$740k Rev content / engine on 787 GEnx 1B

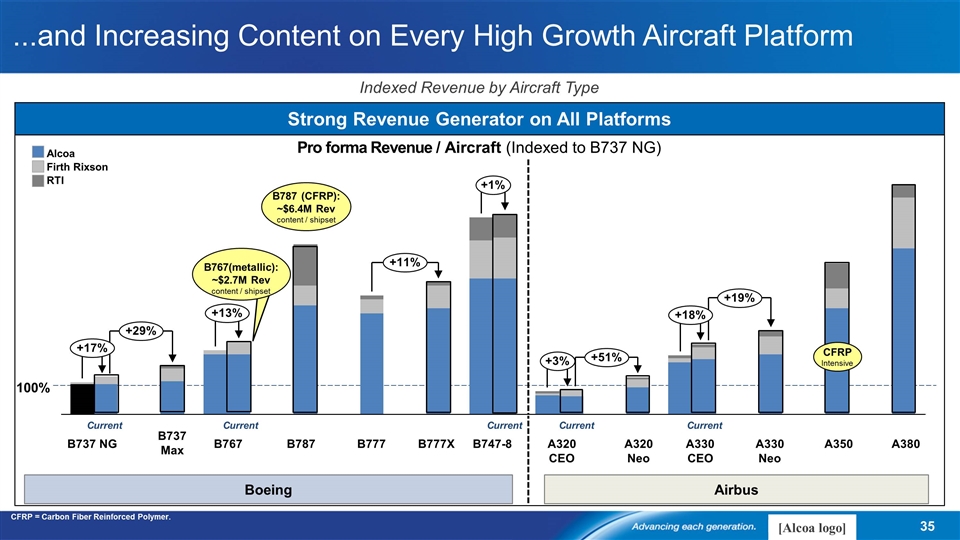

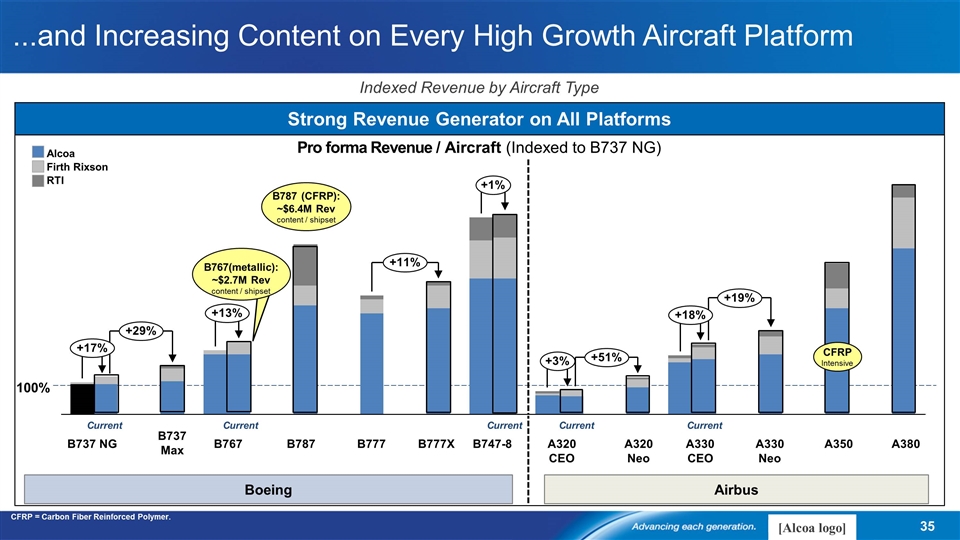

...and Increasing Content on Every High Growth Aircraft Platform Indexed Revenue by Aircraft Type CFRP = Carbon Fiber Reinforced Polymer. Strong Revenue Generator on All Platforms Pro forma Revenue / Aircraft (Indexed to B737 NG) 100% Alcoa Firth Rixson RTI B737 NG B737 Max B767 B787 B777 B777X B747-8 A320 CEO A320 Neo A330 CEO A330 Neo A350 A380 Current Current Current Current Boeing Airbus Current B787 (CFRP): ~$6.4M Rev content / shipset CFRP Intensive B767(metallic):~$2.7M Rev content / shipset

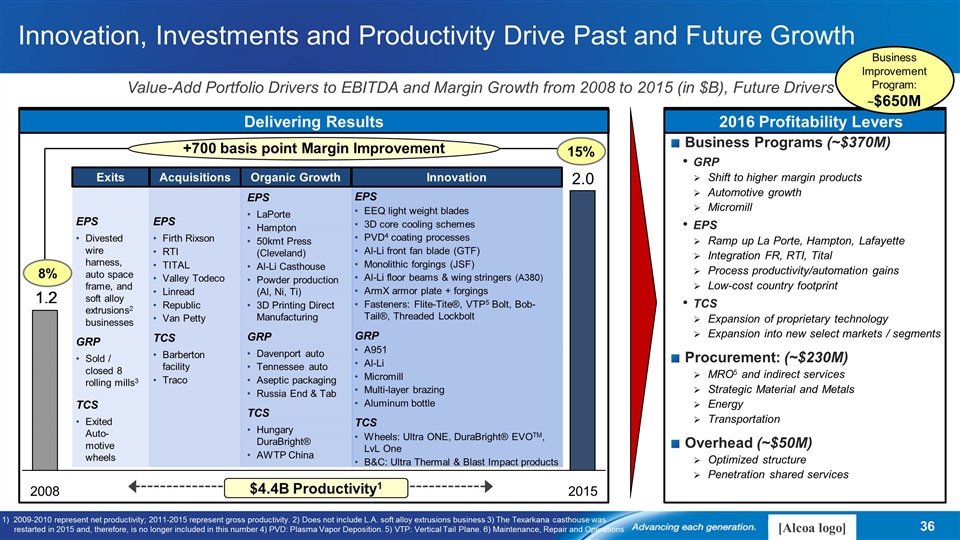

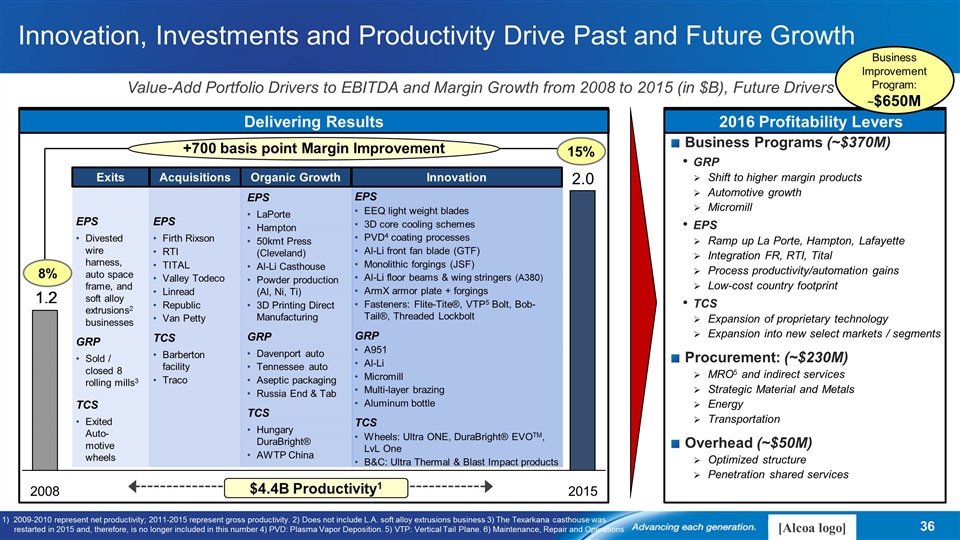

Innovation, Investments and Productivity Drive Past and Future Growth Value-Add Portfolio Drivers to EBITDA and Margin Growth from 2008 to 2015 (in $B), Future Drivers 2.0 +700 basis point Margin Improvement Delivering Results 15% 1) 2009-2010 represent net productivity; 2011-2015 represent gross productivity. 2) Does not include L.A. soft alloy extrusions business 3) The Texarkana casthouse was restarted in 2015 and, therefore, is no longer included in this number 4) PVD: Plasma Vapor Deposition. 5) VTP: Vertical Tail Plane. 6) Maintenance, Repair and Operations EPS EEQ light weight blades 3D core cooling schemes PVD4 coating processes Al-Li front fan blade (GTF) Monolithic forgings (JSF) Al-Li floor beams & wing stringers (A380) ArmX armor plate + forgings Fasteners: Flite-Tite®, VTP5 Bolt, Bob-Tail®, Threaded Lockbolt GRP A951 Al-Li Micromill Multi-layer brazing Aluminum bottle TCS Wheels: Ultra ONE, DuraBright® EVOTM, LvL One B&C: Ultra Thermal & Blast Impact products EPS Divested wire harness, auto space frame, and soft alloy extrusions2 businesses GRP Sold / closed 8 rolling mills3 TCS Exited Auto-motive wheels EPS Firth Rixson RTI TITAL Valley Todeco Linread Republic Van Petty TCS Barberton facility Traco EPS LaPorte Hampton 50kmt Press (Cleveland) Al-Li Casthouse Powder production (Al, Ni, Ti) 3D Printing Direct Manufacturing GRP Davenport auto Tennessee auto Aseptic packaging Russia End & Tab TCS Hungary DuraBright® AWTP China $4.4B Productivity1 8% Exits Acquisitions Innovation Organic Growth 2016 Profitability Levers Business Programs (~$370M) GRP Shift to higher margin products Automotive growth Micromill EPS Ramp up La Porte, Hampton, Lafayette Integration FR, RTI, Tital Process productivity/automation gains Low-cost country footprint TCS Expansion of proprietary technology Expansion into new select markets / segments Procurement: (~$230M) MRO5 and indirect services Strategic Material and Metals Energy Transportation Overhead (~$50M) Optimized structure Penetration shared services Business Improvement Program: ~$650M

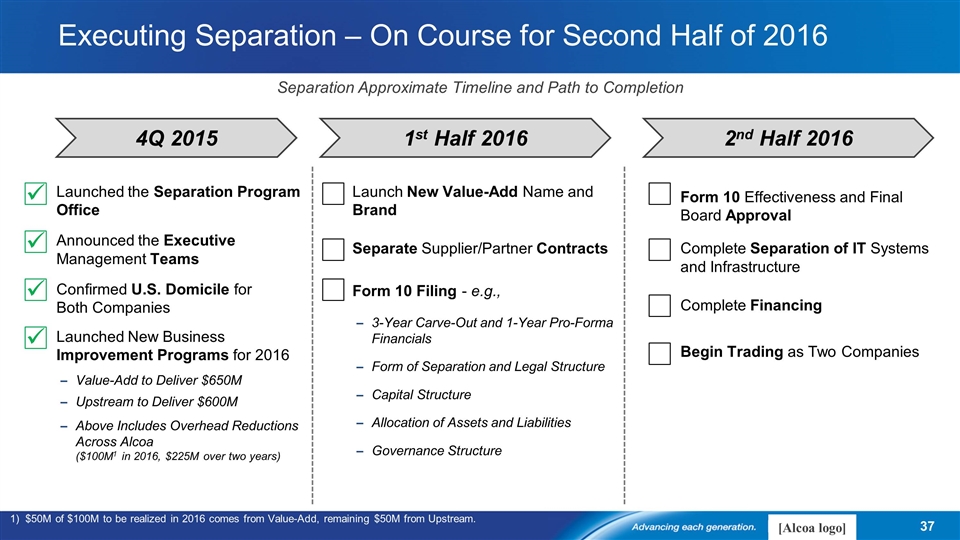

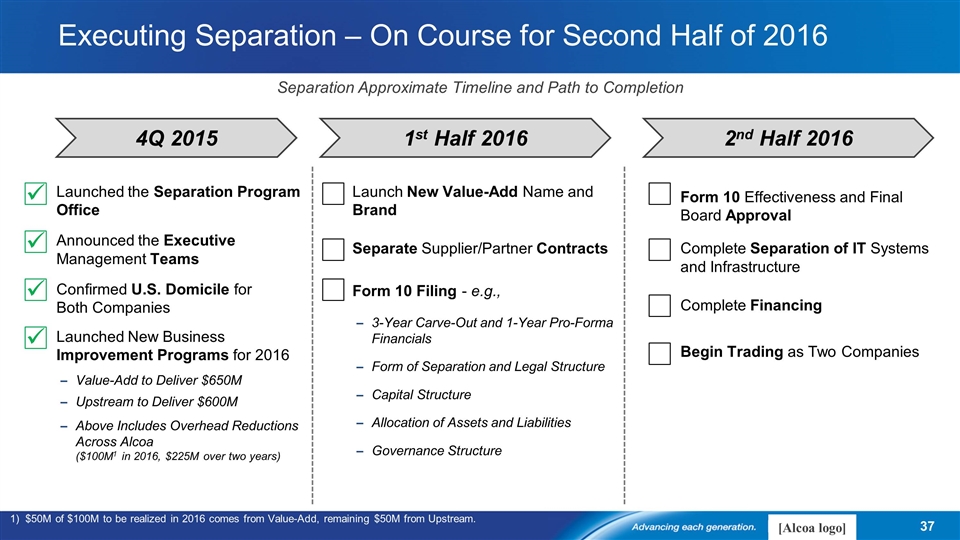

Executing Separation – On Course for Second Half of 2016 Separation Approximate Timeline and Path to Completion 4Q 2015 1st Half 2016 2nd Half 2016 Launch New Value-Add Name and Brand Separate Supplier/Partner Contracts Form 10 Filing - e.g., 3-Year Carve-Out and 1-Year Pro-Forma Financials Form of Separation and Legal Structure Capital Structure Allocation of Assets and Liabilities Governance Structure Form 10 Effectiveness and Final Board Approval Complete Separation of IT Systems and Infrastructure Complete Financing Begin Trading as Two Companies Launched the Separation Program Office Announced the Executive Management Teams Confirmed U.S. Domicile for Both Companies Launched New Business Improvement Programs for 2016 Value-Add to Deliver $650M Upstream to Deliver $600M Above Includes Overhead Reductions Across Alcoa ($100M1 in 2016, $225M over two years) ü ü ü ü 1) $50M of $100M to be realized in 2016 comes from Value-Add, remaining $50M from Upstream.

Value-Add Geared for Profitable Growth; Significant Aero, Auto Traction Robust Business Improvement Programs to Strengthen Both Portfolios Pulling All Upstream Levers to Improve Profitability On Track to Separate into Two Strong Companies On Track for Completing Separation 2nd Half of 2016

Nahla Azmy Vice President, Investor Relations Alcoa 390 Park Avenue New York, NY 10022-4608 Telephone: (212) 836-2674 Email: nahla.azmy@alcoa.com www.alcoa.com Additional Information

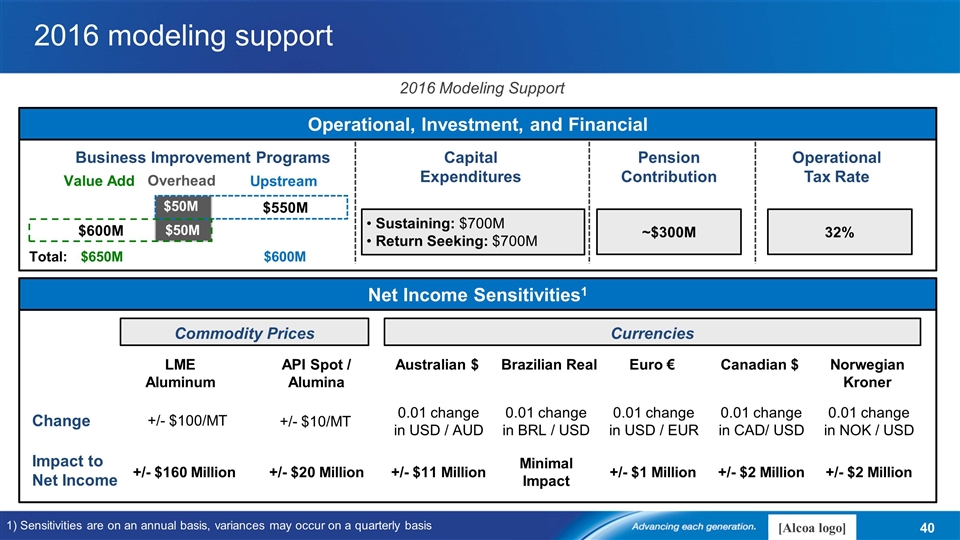

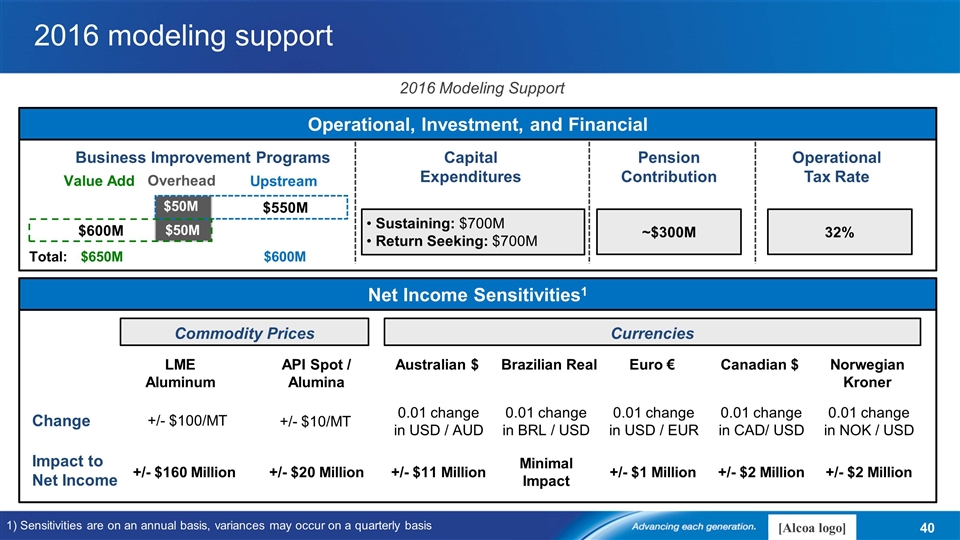

2016 modeling support 2016 Modeling Support Operational, Investment, and Financial Business Improvement Programs Operational Tax Rate Capital Expenditures Pension Contribution Sustaining: $700M Return Seeking: $700M ~$300M 32% Net Income Sensitivities1 Currencies Commodity Prices Change Impact to Net Income LME Aluminum API Spot / Alumina Australian $ Brazilian Real Euro € Canadian $ Norwegian Kroner 0.01 change in USD / AUD 0.01 change in BRL / USD 0.01 change in USD / EUR 0.01 change in CAD/ USD 0.01 change in NOK / USD +/- $11 Million Minimal Impact +/- $1 Million +/- $2 Million +/- $2 Million +/- $160 Million +/- $20 Million Total: +/- $10/MT $550M $600M Value Add Upstream Overhead $650M $600M $50M $50M 1) Sensitivities are on an annual basis, variances may occur on a quarterly basis +/- $100/MT

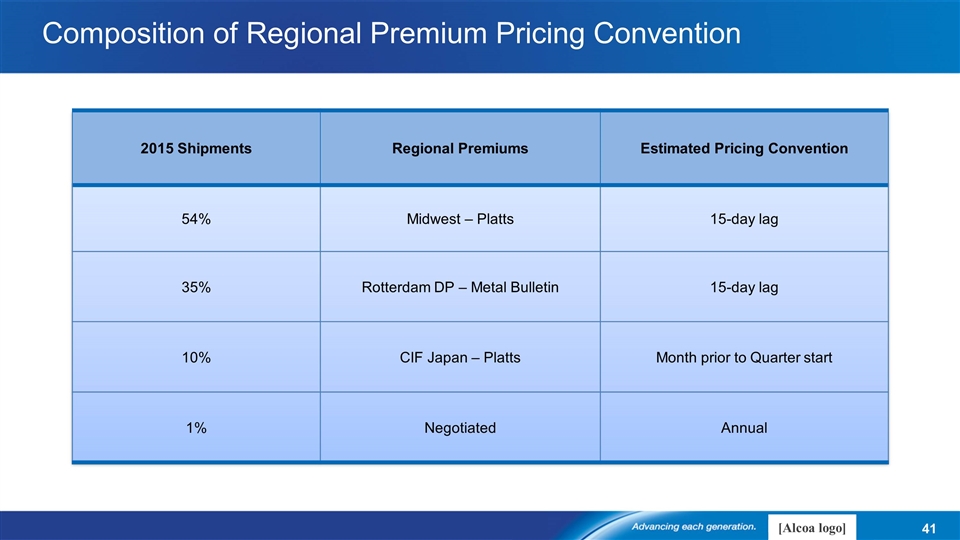

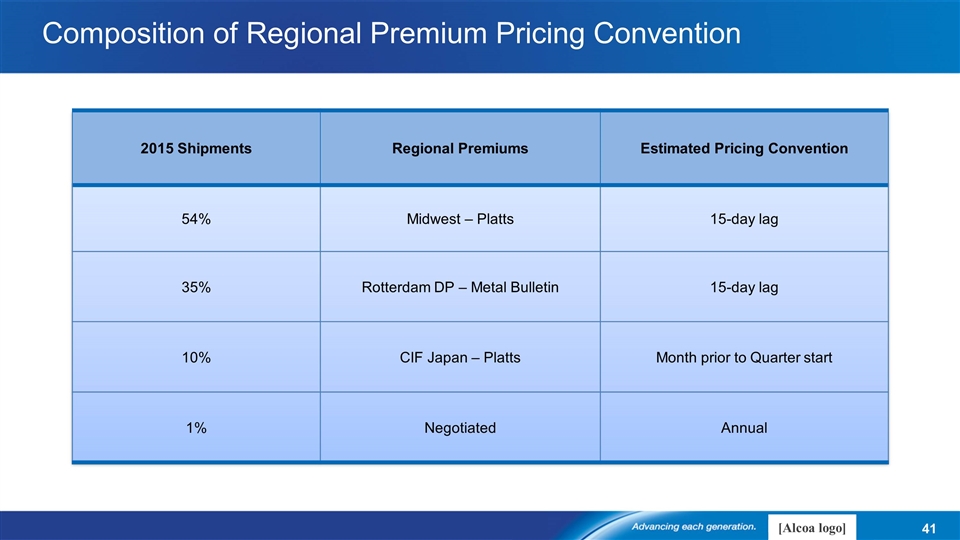

Composition of Regional Premium Pricing Convention 2015 Shipments Regional Premiums Estimated Pricing Convention 54% Midwest – Platts 15-day lag 35% Rotterdam DP – Metal Bulletin 15-day lag 10% CIF Japan – Platts Month prior to Quarter start 1% Negotiated Annual

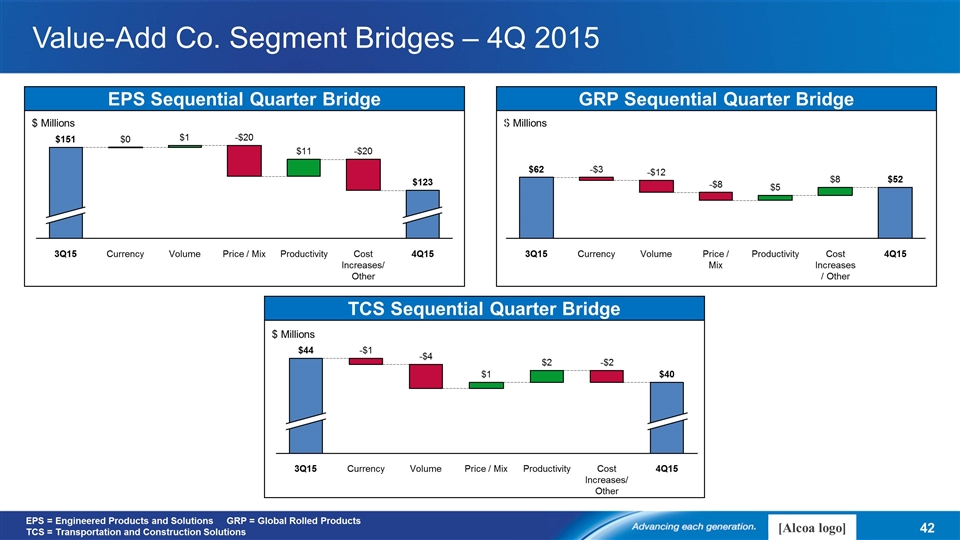

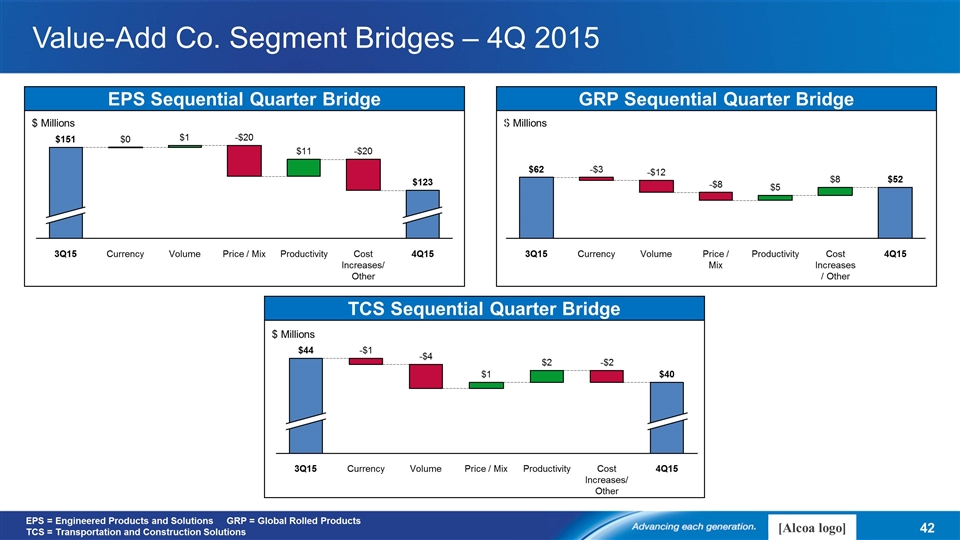

$ Millions $ Millions EPS Sequential Quarter Bridge Value-Add Co. Segment Bridges – 4Q 2015 GRP Sequential Quarter Bridge EPS = Engineered Products and Solutions GRP = Global Rolled Products TCS = Transportation and Construction Solutions Currency $ Millions TCS Sequential Quarter Bridge

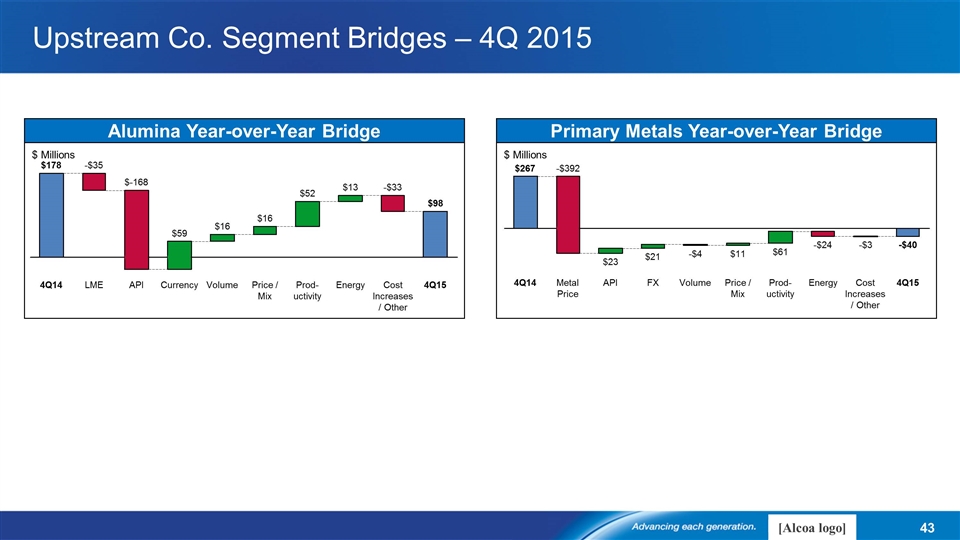

$ Millions $ Millions Upstream Co. Segment Bridges – 4Q 2015 Currency $ FX Alumina Year-over-Year Bridge Primary Metals Year-over-Year Bridge

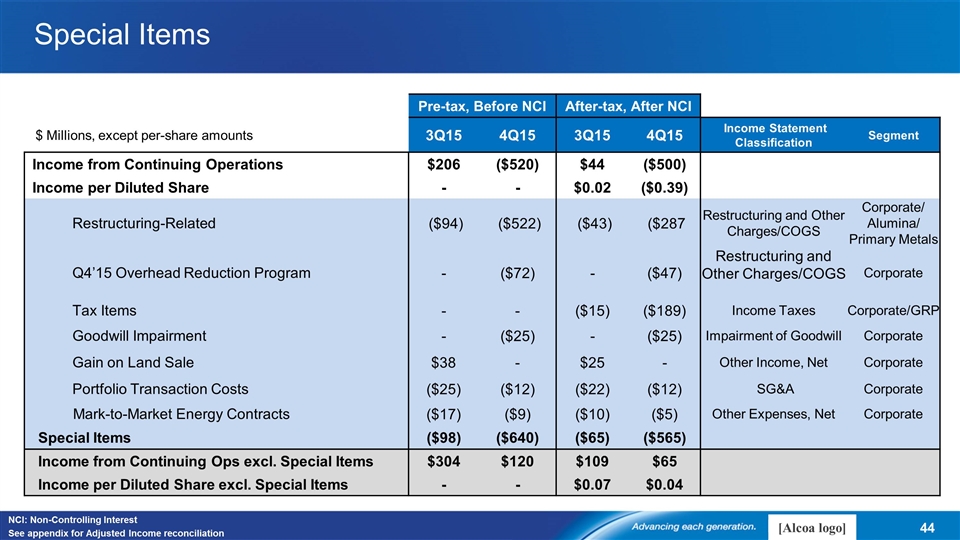

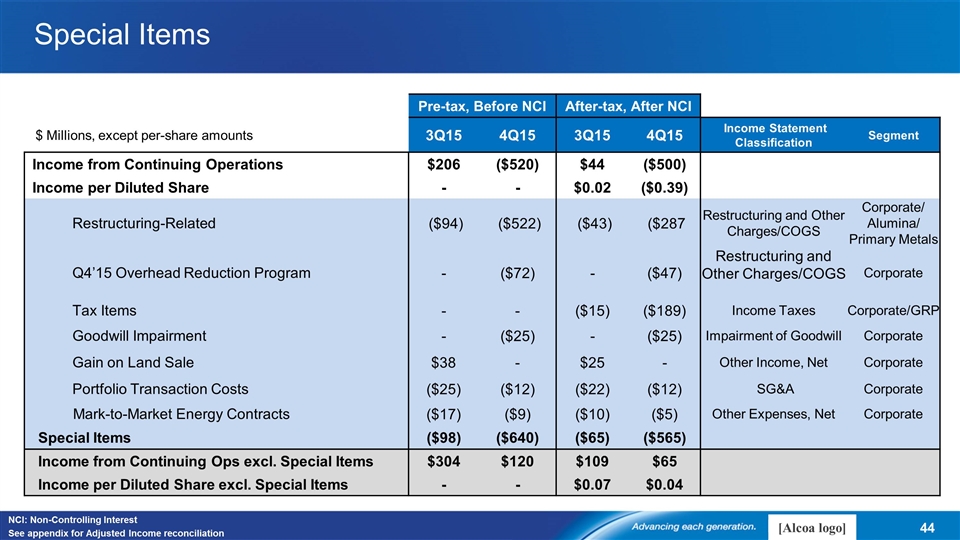

Special Items Pre-tax, Before NCI After-tax, After NCI $ Millions, except per-share amounts 3Q15 4Q15 3Q15 4Q15 Income Statement Classification Segment Income from Continuing Operations $206 ($520) $44 ($500) Income per Diluted Share - - $0.02 ($0.39) Restructuring-Related ($94) ($522) ($43) ($287 Restructuring and Other Charges/COGS Corporate/ Alumina/ Primary Metals Q4’15 Overhead Reduction Program - ($72) - ($47) Restructuring and Other Charges/COGS Corporate Tax Items - - ($15) ($189) Income Taxes Corporate/GRP Goodwill Impairment - ($25) - ($25) Impairment of Goodwill Corporate Gain on Land Sale $38 - $25 - Other Income, Net Corporate Portfolio Transaction Costs ($25) ($12) ($22) ($12) SG&A Corporate Mark-to-Market Energy Contracts ($17) ($9) ($10) ($5) Other Expenses, Net Corporate Special Items ($98) ($640) ($65) ($565) Income from Continuing Ops excl. Special Items $304 $120 $109 $65 Income per Diluted Share excl. Special Items - - $0.07 $0.04 NCI: Non-Controlling Interest See appendix for Adjusted Income reconciliation

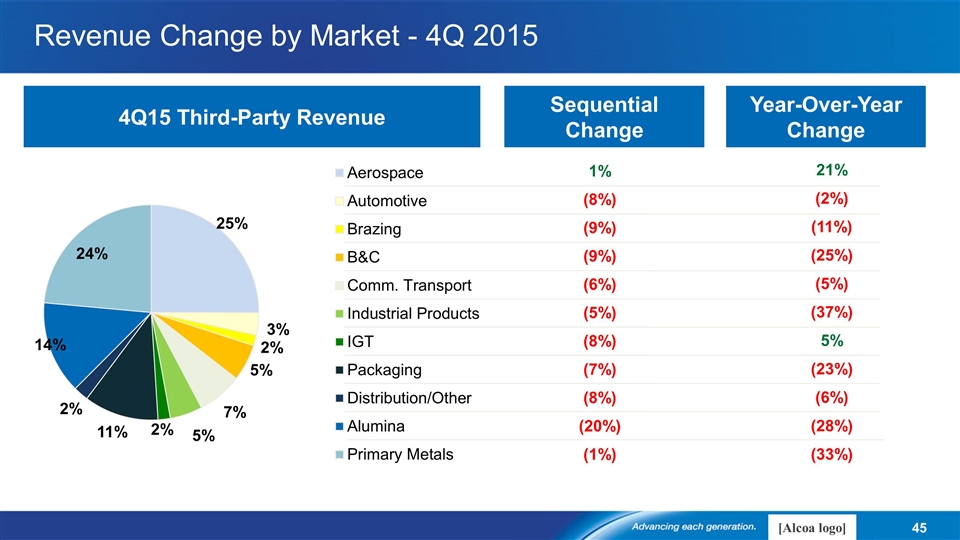

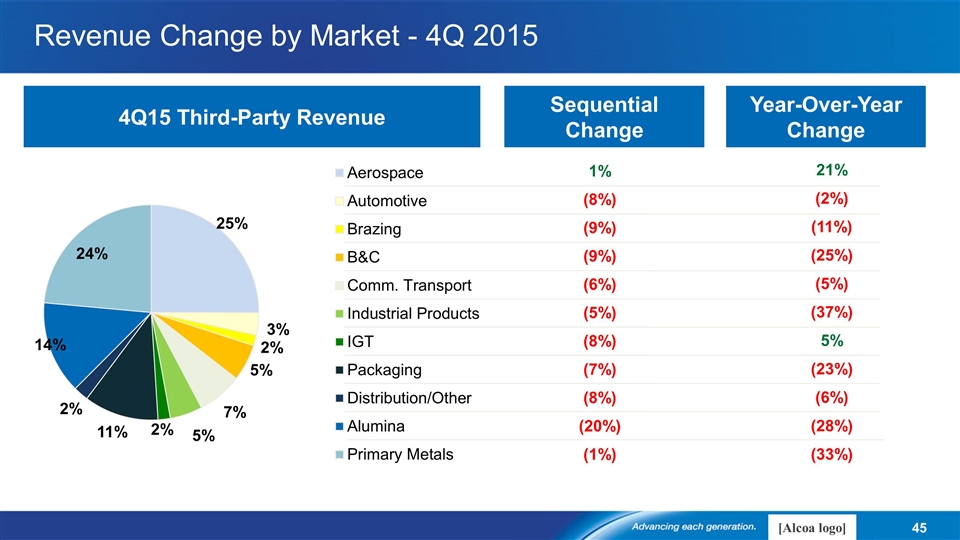

Revenue Change by Market - 4Q 2015 1% (8%) (9%) (9%) (6%) (5%) (8%) (7%) (8%) (20%) (1%) 21% (2%) (11%) (25%) (5%) (37%) 5% (23%) (6%) (28%) (33%) 4Q15 Third-Party Revenue Sequential Change Year-Over-Year Change

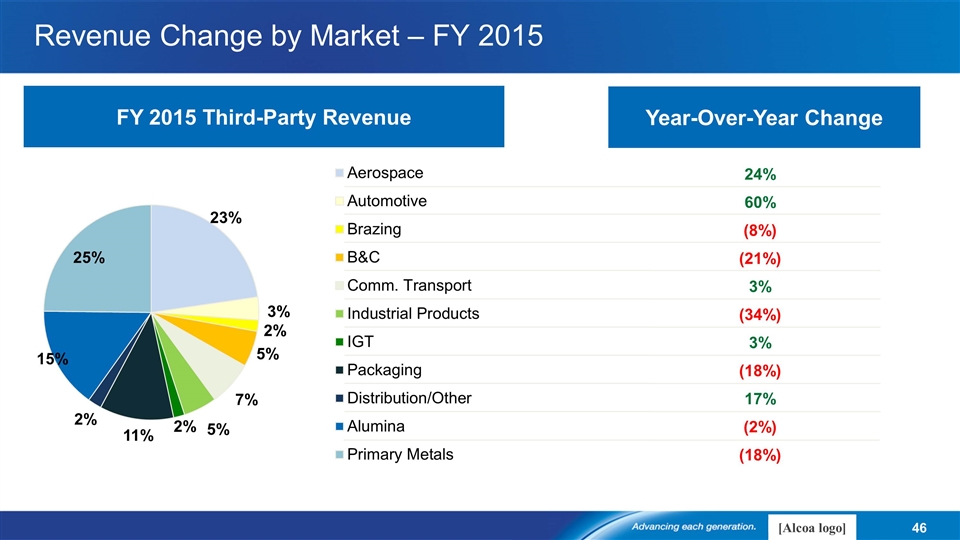

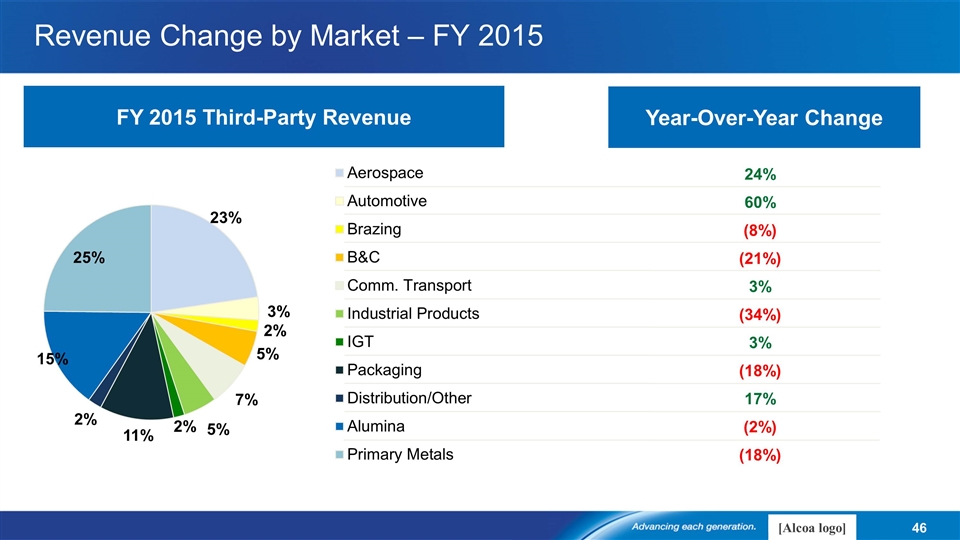

Year-Over-Year Change Revenue Change by Market – FY 2015 24% 60% (8%) (21%) 3% (34%) 3% (18%) 17% (2%) (18%) FY 2015 Third-Party Revenue

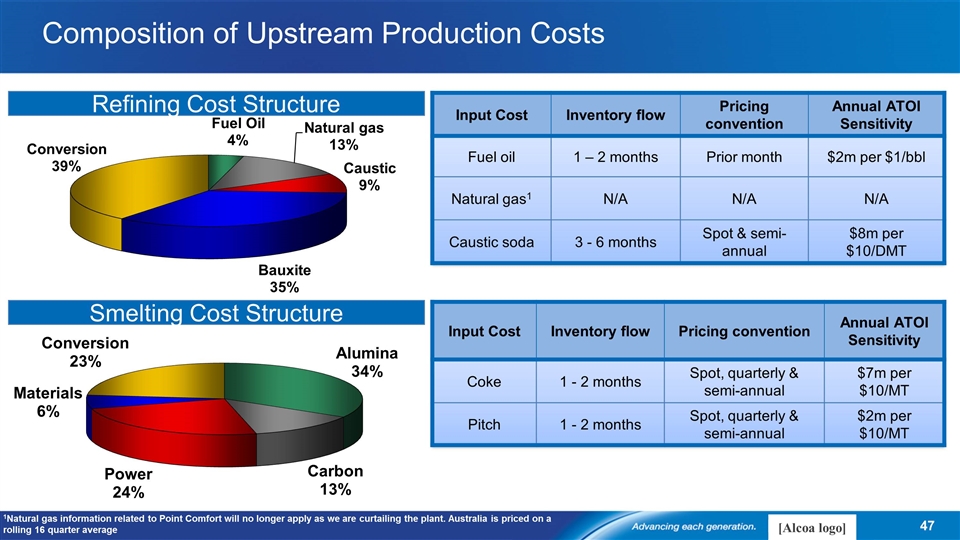

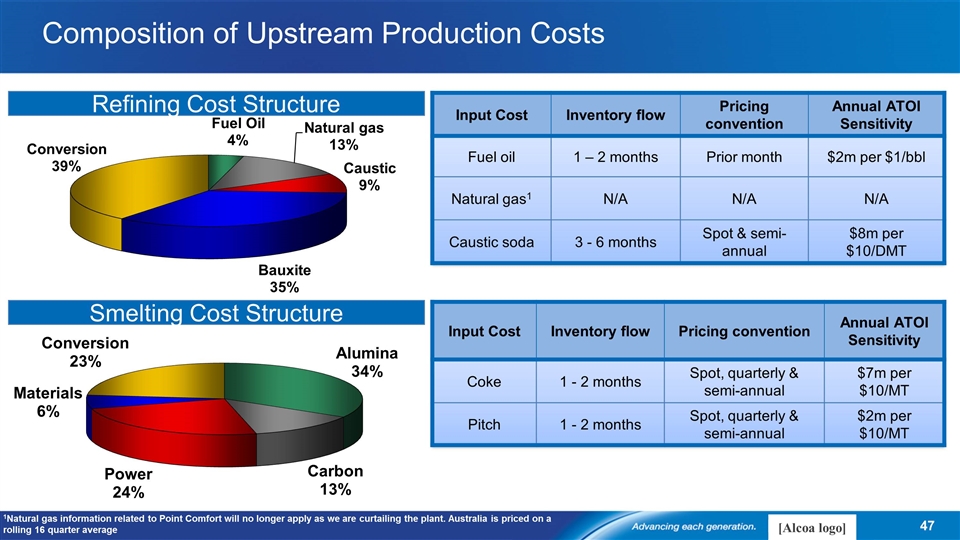

Composition of Upstream Production Costs Input Cost Inventory flow Pricing convention Annual ATOI Sensitivity Fuel oil 1 – 2 months Prior month $2m per $1/bbl Natural gas1 N/A N/A N/A Caustic soda 3 - 6 months Spot & semi-annual $8m per $10/DMT Refining Cost Structure Smelting Cost Structure Input Cost Inventory flow Pricing convention Annual ATOI Sensitivity Coke 1 - 2 months Spot, quarterly & semi-annual $7m per $10/MT Pitch 1 - 2 months Spot, quarterly & semi-annual $2m per $10/MT 1Natural gas information related to Point Comfort will no longer apply as we are curtailing the plant. Australia is priced on a rolling 16 quarter average

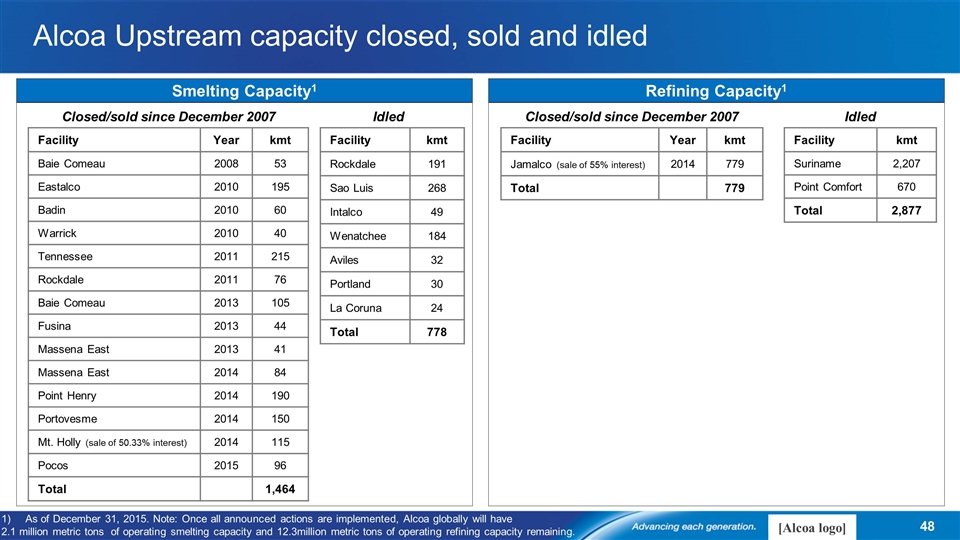

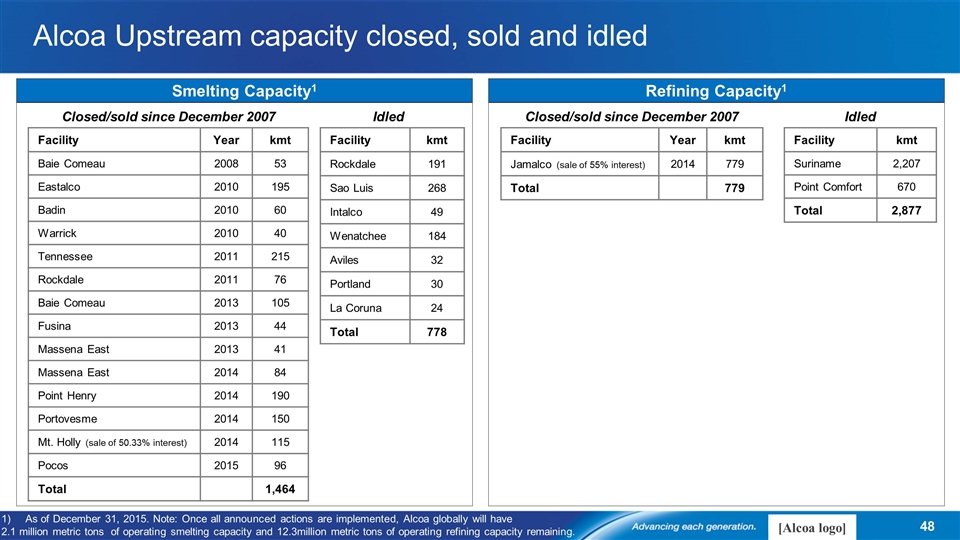

Alcoa Upstream capacity closed, sold and idled Facility Year kmt Baie Comeau 2008 53 Eastalco 2010 195 Badin 2010 60 Warrick 2010 40 Tennessee 2011 215 Rockdale 2011 76 Baie Comeau 2013 105 Fusina 2013 44 Massena East 2013 41 Massena East 2014 84 Point Henry 2014 190 Portovesme 2014 150 Mt. Holly (sale of 50.33% interest) 2014 115 Pocos 2015 96 Total 1,464 Closed/sold since December 2007 Facility kmt Rockdale 191 Sao Luis 268 Intalco 49 Wenatchee 184 Aviles 32 Portland 30 La Coruna 24 Total 778 Smelting Capacity1 Idled Refining Capacity1 Facility Year kmt Jamalco (sale of 55% interest) 2014 779 Total 779 Closed/sold since December 2007 Facility kmt Suriname 2,207 Point Comfort 670 Total 2,877 Idled As of December 31, 2015. Note: Once all announced actions are implemented, Alcoa globally will have 2.1 million metric tons of operating smelting capacity and 12.3million metric tons of operating refining capacity remaining.

Reconciliations [Alcoa logo]

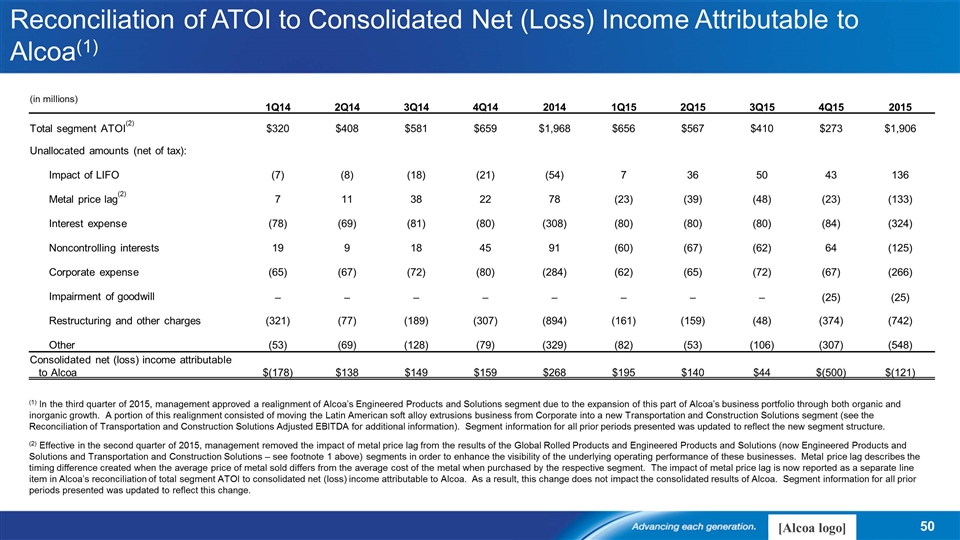

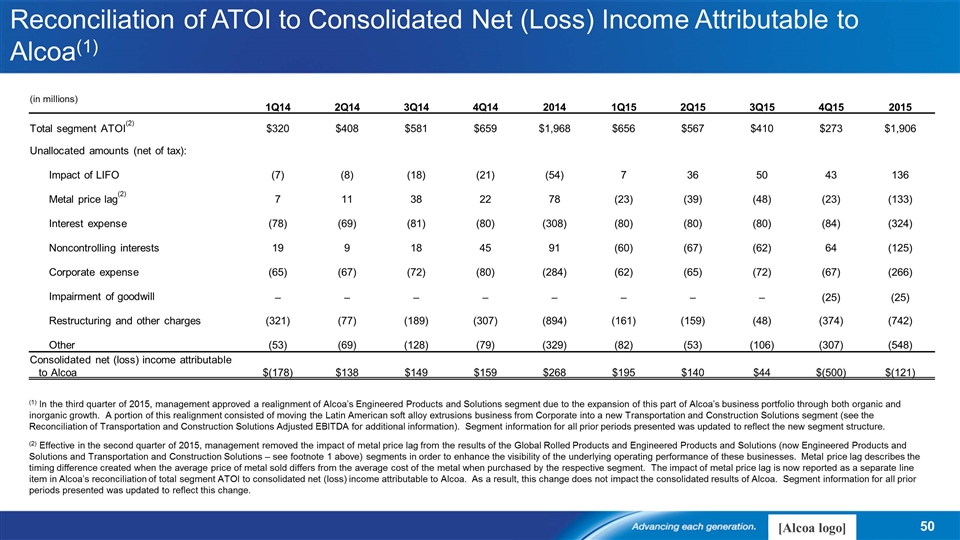

Reconciliation of ATOI to Consolidated Net (Loss) Income Attributable to Alcoa(1) (in millions) 1Q14 2Q14 3Q14 4Q14 2014 1Q15 2Q15 3Q15 4Q15 2015 Total segment ATOI(2) $320 $408 $581 $659 $1,968 $656 $567 $410 $273 $1,906 Unallocated amounts (net of tax): Impact of LIFO (7) (8) (18) (21) (54) 7 36 50 43 136 Metal price lag(2) 7 11 38 22 78 (23) (39) (48) (23) (133) Interest expense (78) (69) (81) (80) (308) (80) (80) (80) (84) (324) Noncontrolling interests 19 9 18 45 91 (60) (67) (62) 64 (125) Corporate expense (65) (67) (72) (80) (284) (62) (65) (72) (67) (266) Impairment of goodwill – – – – – – – – (25) (25) Restructuring and other charges (321) (77) (189) (307) (894) (161) (159) (48) (374) (742) Other (53) (69) (128) (79) (329) (82) (53) (106) (307) (548) Consolidated net (loss) income attributable to Alcoa $(178) $138 $149 $159 $268 $195 $140 $44 $(500) $(121) (1) In the third quarter of 2015, management approved a realignment of Alcoa’s Engineered Products and Solutions segment due to the expansion of this part of Alcoa’s business portfolio through both organic and inorganic growth. A portion of this realignment consisted of moving the Latin American soft alloy extrusions business from Corporate into a new Transportation and Construction Solutions segment (see the Reconciliation of Transportation and Construction Solutions Adjusted EBITDA for additional information). Segment information for all prior periods presented was updated to reflect the new segment structure. (2) Effective in the second quarter of 2015, management removed the impact of metal price lag from the results of the Global Rolled Products and Engineered Products and Solutions (now Engineered Products and Solutions and Transportation and Construction Solutions – see footnote 1 above) segments in order to enhance the visibility of the underlying operating performance of these businesses. Metal price lag describes the timing difference created when the average price of metal sold differs from the average cost of the metal when purchased by the respective segment. The impact of metal price lag is now reported as a separate line item in Alcoa’s reconciliation of total segment ATOI to consolidated net (loss) income attributable to Alcoa. As a result, this change does not impact the consolidated results of Alcoa. Segment information for all prior periods presented was updated to reflect this change.

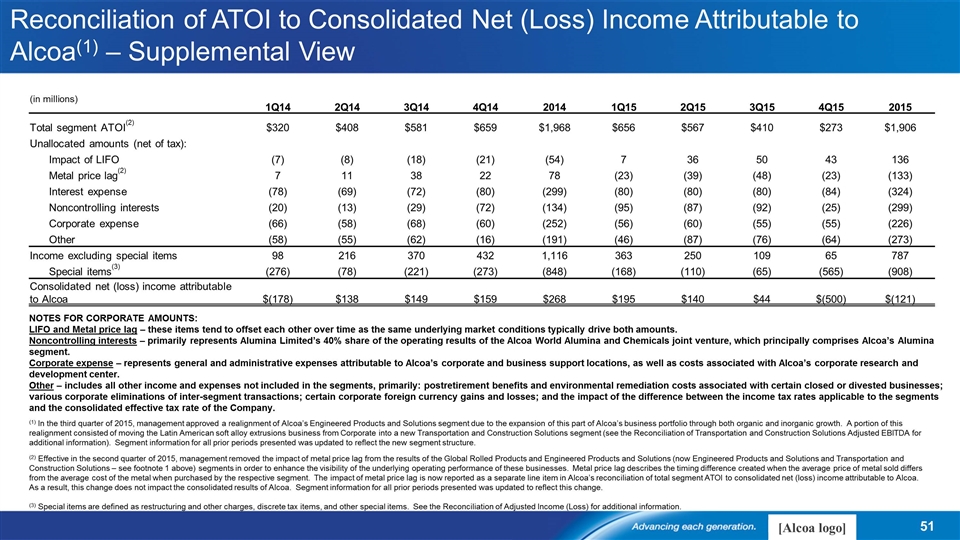

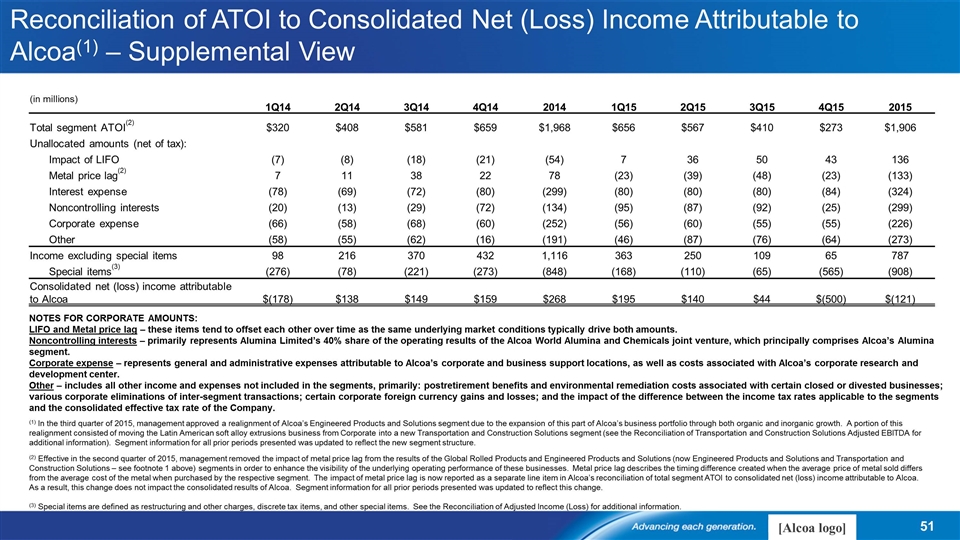

Reconciliation of ATOI to Consolidated Net (Loss) Income Attributable to Alcoa(1) – Supplemental View (in millions) 1Q14 2Q14 3Q14 4Q14 2014 1Q15 2Q15 3Q15 4Q15 2015 Total segment ATOI(2) $320 $408 $581 $659 $1,968 $656 $567 $410 $273 $1,906 Unallocated amounts (net of tax): Impact of LIFO (7) (8) (18) (21) (54) 7 36 50 43 136 Metal price lag(2) 7 11 38 22 78 (23) (39) (48) (23) (133) Interest expense (78) (69) (72) (80) (299) (80) (80) (80) (84) (324) Noncontrolling interests (20) (13) (29) (72) (134) (95) (87) (92) (25) (299) Corporate expense (66) (58) (68) (60) (252) (56) (60) (55) (55) (226) Other (58) (55) (62) (16) (191) (46) (87) (76) (64) (273) Income excluding special items 98 216 370 432 1,116 363 250 109 65 787 Special items(3) (276) (78) (221) (273) (848) (168) (110) (65) (565) (908) Consolidated net (loss) income attributable to Alcoa $(178) $138 $149 $159 $268 $195 $140 $44 $(500) $(121) (1) In the third quarter of 2015, management approved a realignment of Alcoa’s Engineered Products and Solutions segment due to the expansion of this part of Alcoa’s business portfolio through both organic and inorganic growth. A portion of this realignment consisted of moving the Latin American soft alloy extrusions business from Corporate into a new Transportation and Construction Solutions segment (see the Reconciliation of Transportation and Construction Solutions Adjusted EBITDA for additional information). Segment information for all prior periods presented was updated to reflect the new segment structure. (2) Effective in the second quarter of 2015, management removed the impact of metal price lag from the results of the Global Rolled Products and Engineered Products and Solutions (now Engineered Products and Solutions and Transportation and Construction Solutions – see footnote 1 above) segments in order to enhance the visibility of the underlying operating performance of these businesses. Metal price lag describes the timing difference created when the average price of metal sold differs from the average cost of the metal when purchased by the respective segment. The impact of metal price lag is now reported as a separate line item in Alcoa’s reconciliation of total segment ATOI to consolidated net (loss) income attributable to Alcoa. As a result, this change does not impact the consolidated results of Alcoa. Segment information for all prior periods presented was updated to reflect this change. (3) Special items are defined as restructuring and other charges, discrete tax items, and other special items. See the Reconciliation of Adjusted Income (Loss) for additional information. NOTES FOR CORPORATE AMOUNTS: LIFO and Metal price lag – these items tend to offset each other over time as the same underlying market conditions typically drive both amounts. Noncontrolling interests – primarily represents Alumina Limited’s 40% share of the operating results of the Alcoa World Alumina and Chemicals joint venture, which principally comprises Alcoa’s Alumina segment. Corporate expense – represents general and administrative expenses attributable to Alcoa’s corporate and business support locations, as well as costs associated with Alcoa’s corporate research and development center. Other – includes all other income and expenses not included in the segments, primarily: postretirement benefits and environmental remediation costs associated with certain closed or divested businesses; various corporate eliminations of inter-segment transactions; certain corporate foreign currency gains and losses; and the impact of the difference between the income tax rates applicable to the segments and the consolidated effective tax rate of the Company.

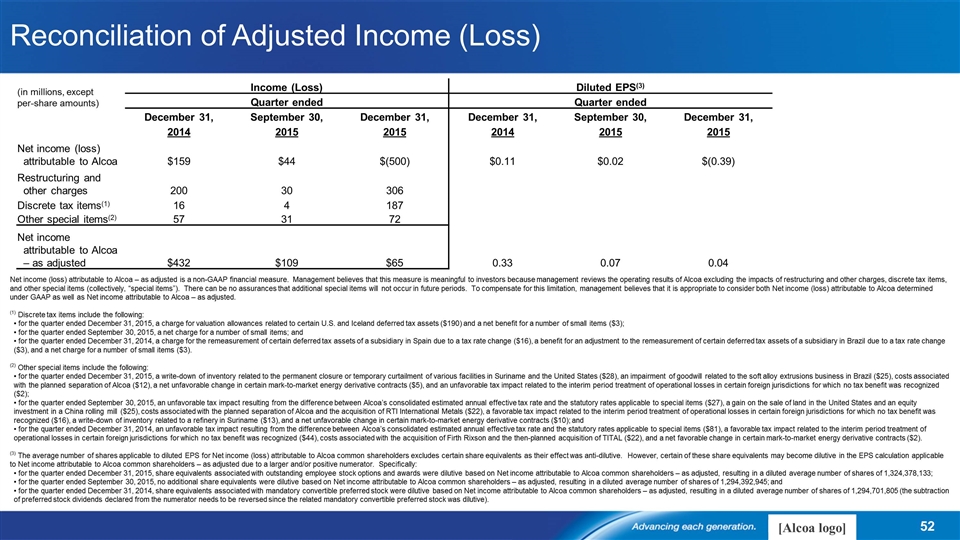

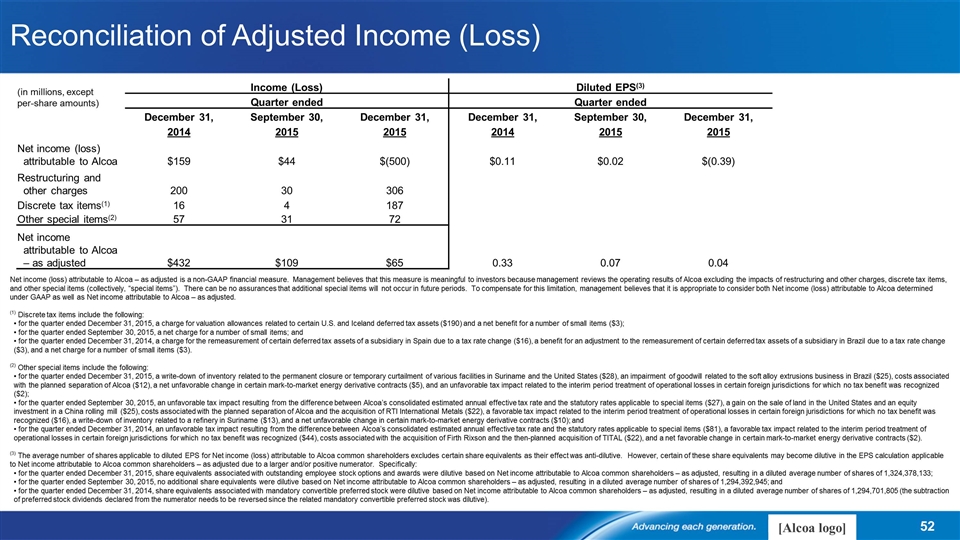

Reconciliation of Adjusted Income (Loss) (in millions, except per-share amounts) Income (Loss) Diluted EPS(3) Quarter ended Quarter ended December 31, September 30, December 31, December 31, September 30, December 31, 2014 2015 2015 2014 2015 2015 Net income (loss) attributable to Alcoa $159 $44 $(500) $0.11 $0.02 $(0.39) Restructuring and other charges 200 30 306 Discrete tax items(1) 16 4 187 Other special items(2) 57 31 72 Net income attributable to Alcoa – as adjusted $432 $109 $65 0.33 0.07 0.04 Net income (loss) attributable to Alcoa – as adjusted is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because management reviews the operating results of Alcoa excluding the impacts of restructuring and other charges, discrete tax items, and other special items (collectively, “special items”). There can be no assurances that additional special items will not occur in future periods. To compensate for this limitation, management believes that it is appropriate to consider both Net income (loss) attributable to Alcoa determined under GAAP as well as Net income attributable to Alcoa – as adjusted. (1) Discrete tax items include the following: for the quarter ended December 31, 2015, a charge for valuation allowances related to certain U.S. and Iceland deferred tax assets ($190) and a net benefit for a number of small items ($3); for the quarter ended September 30, 2015, a net charge for a number of small items; and for the quarter ended December 31, 2014, a charge for the remeasurement of certain deferred tax assets of a subsidiary in Spain due to a tax rate change ($16), a benefit for an adjustment to the remeasurement of certain deferred tax assets of a subsidiary in Brazil due to a tax rate change ($3), and a net charge for a number of small items ($3). (2) Other special items include the following: for the quarter ended December 31, 2015, a write-down of inventory related to the permanent closure or temporary curtailment of various facilities in Suriname and the United States ($28), an impairment of goodwill related to the soft alloy extrusions business in Brazil ($25), costs associated with the planned separation of Alcoa ($12), a net unfavorable change in certain mark-to-market energy derivative contracts ($5), and an unfavorable tax impact related to the interim period treatment of operational losses in certain foreign jurisdictions for which no tax benefit was recognized ($2); for the quarter ended September 30, 2015, an unfavorable tax impact resulting from the difference between Alcoa’s consolidated estimated annual effective tax rate and the statutory rates applicable to special items ($27), a gain on the sale of land in the United States and an equity investment in a China rolling mill ($25), costs associated with the planned separation of Alcoa and the acquisition of RTI International Metals ($22), a favorable tax impact related to the interim period treatment of operational losses in certain foreign jurisdictions for which no tax benefit was recognized ($16), a write-down of inventory related to a refinery in Suriname ($13), and a net unfavorable change in certain mark-to-market energy derivative contracts ($10); and for the quarter ended December 31, 2014, an unfavorable tax impact resulting from the difference between Alcoa’s consolidated estimated annual effective tax rate and the statutory rates applicable to special items ($81), a favorable tax impact related to the interim period treatment of operational losses in certain foreign jurisdictions for which no tax benefit was recognized ($44), costs associated with the acquisition of Firth Rixson and the then-planned acquisition of TITAL ($22), and a net favorable change in certain mark-to-market energy derivative contracts ($2). (3) The average number of shares applicable to diluted EPS for Net income (loss) attributable to Alcoa common shareholders excludes certain share equivalents as their effect was anti-dilutive. However, certain of these share equivalents may become dilutive in the EPS calculation applicable to Net income attributable to Alcoa common shareholders – as adjusted due to a larger and/or positive numerator. Specifically: for the quarter ended December 31, 2015, share equivalents associated with outstanding employee stock options and awards were dilutive based on Net income attributable to Alcoa common shareholders – as adjusted, resulting in a diluted average number of shares of 1,324,378,133; for the quarter ended September 30, 2015, no additional share equivalents were dilutive based on Net income attributable to Alcoa common shareholders – as adjusted, resulting in a diluted average number of shares of 1,294,392,945; and for the quarter ended December 31, 2014, share equivalents associated with mandatory convertible preferred stock were dilutive based on Net income attributable to Alcoa common shareholders – as adjusted, resulting in a diluted average number of shares of 1,294,701,805 (the subtraction of preferred stock dividends declared from the numerator needs to be reversed since the related mandatory convertible preferred stock was dilutive).

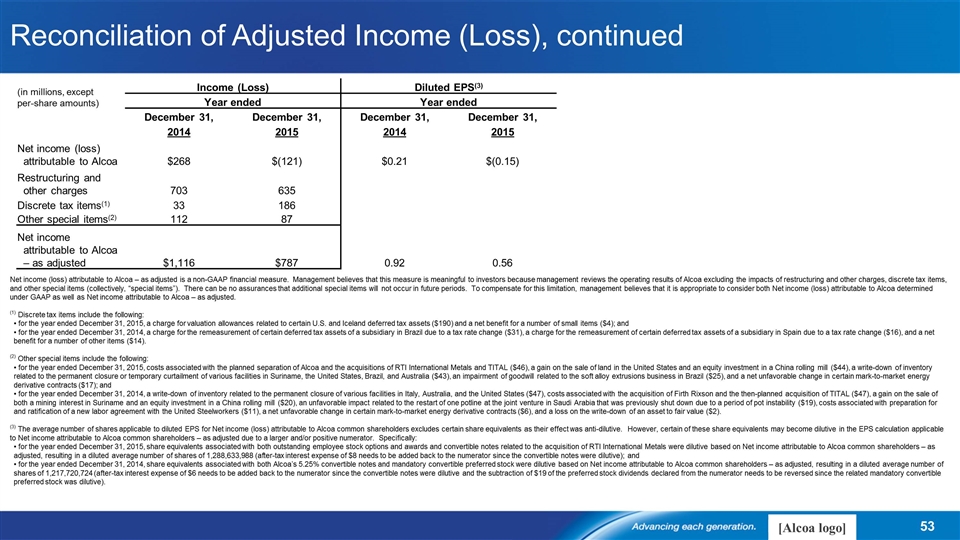

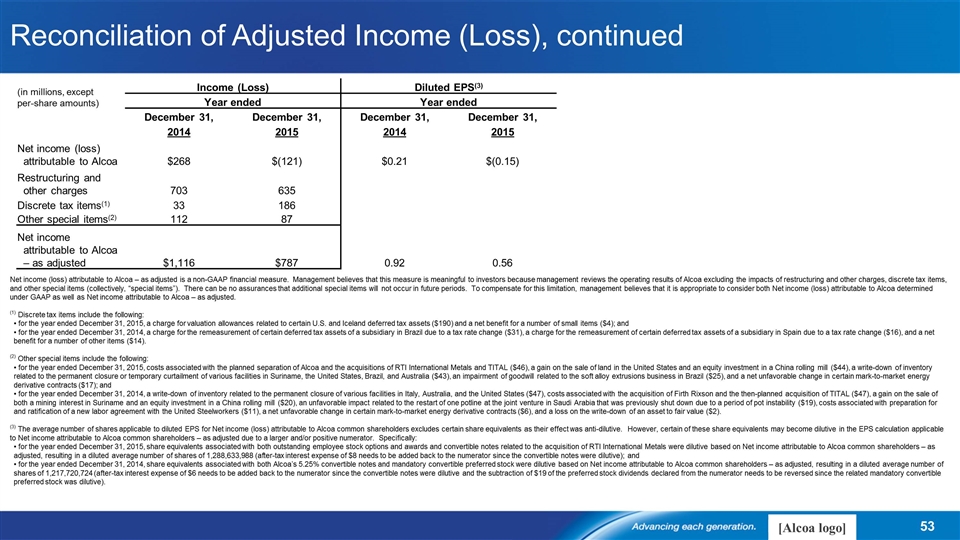

Reconciliation of Adjusted Income (Loss), continued (in millions, except per-share amounts) Income (Loss) Diluted EPS(3) Year ended Year ended December 31, December 31, December 31, December 31, 2014 2015 2014 2015 Net income (loss) attributable to Alcoa $268 $(121) $0.21 $(0.15) Restructuring and other charges 703 635 Discrete tax items(1) 33 186 Other special items(2) 112 87 Net income attributable to Alcoa – as adjusted $1,116 $787 0.92 0.56 Net income (loss) attributable to Alcoa – as adjusted is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because management reviews the operating results of Alcoa excluding the impacts of restructuring and other charges, discrete tax items, and other special items (collectively, “special items”). There can be no assurances that additional special items will not occur in future periods. To compensate for this limitation, management believes that it is appropriate to consider both Net income (loss) attributable to Alcoa determined under GAAP as well as Net income attributable to Alcoa – as adjusted. (1) Discrete tax items include the following: for the year ended December 31, 2015, a charge for valuation allowances related to certain U.S. and Iceland deferred tax assets ($190) and a net benefit for a number of small items ($4); and for the year ended December 31, 2014, a charge for the remeasurement of certain deferred tax assets of a subsidiary in Brazil due to a tax rate change ($31), a charge for the remeasurement of certain deferred tax assets of a subsidiary in Spain due to a tax rate change ($16), and a net benefit for a number of other items ($14). (2) Other special items include the following: for the year ended December 31, 2015, costs associated with the planned separation of Alcoa and the acquisitions of RTI International Metals and TITAL ($46), a gain on the sale of land in the United States and an equity investment in a China rolling mill ($44), a write-down of inventory related to the permanent closure or temporary curtailment of various facilities in Suriname, the United States, Brazil, and Australia ($43), an impairment of goodwill related to the soft alloy extrusions business in Brazil ($25), and a net unfavorable change in certain mark-to-market energy derivative contracts ($17); and for the year ended December 31, 2014, a write-down of inventory related to the permanent closure of various facilities in Italy, Australia, and the United States ($47), costs associated with the acquisition of Firth Rixson and the then-planned acquisition of TITAL ($47), a gain on the sale of both a mining interest in Suriname and an equity investment in a China rolling mill ($20), an unfavorable impact related to the restart of one potline at the joint venture in Saudi Arabia that was previously shut down due to a period of pot instability ($19), costs associated with preparation for and ratification of a new labor agreement with the United Steelworkers ($11), a net unfavorable change in certain mark-to-market energy derivative contracts ($6), and a loss on the write-down of an asset to fair value ($2). (3) The average number of shares applicable to diluted EPS for Net income (loss) attributable to Alcoa common shareholders excludes certain share equivalents as their effect was anti-dilutive. However, certain of these share equivalents may become dilutive in the EPS calculation applicable to Net income attributable to Alcoa common shareholders – as adjusted due to a larger and/or positive numerator. Specifically: for the year ended December 31, 2015, share equivalents associated with both outstanding employee stock options and awards and convertible notes related to the acquisition of RTI International Metals were dilutive based on Net income attributable to Alcoa common shareholders – as adjusted, resulting in a diluted average number of shares of 1,288,633,988 (after-tax interest expense of $8 needs to be added back to the numerator since the convertible notes were dilutive); and for the year ended December 31, 2014, share equivalents associated with both Alcoa’s 5.25% convertible notes and mandatory convertible preferred stock were dilutive based on Net income attributable to Alcoa common shareholders – as adjusted, resulting in a diluted average number of shares of 1,217,720,724 (after-tax interest expense of $6 needs to be added back to the numerator since the convertible notes were dilutive and the subtraction of $19 of the preferred stock dividends declared from the numerator needs to be reversed since the related mandatory convertible preferred stock was dilutive).

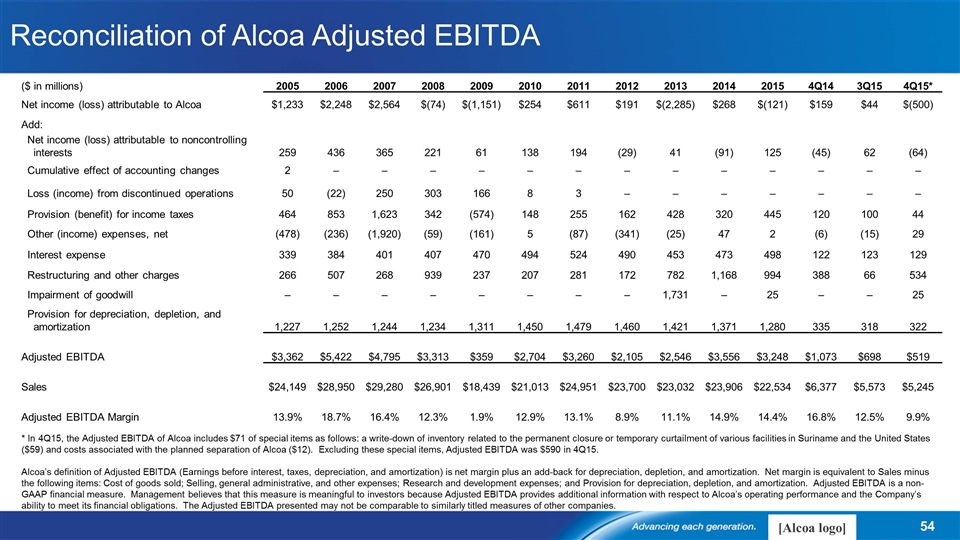

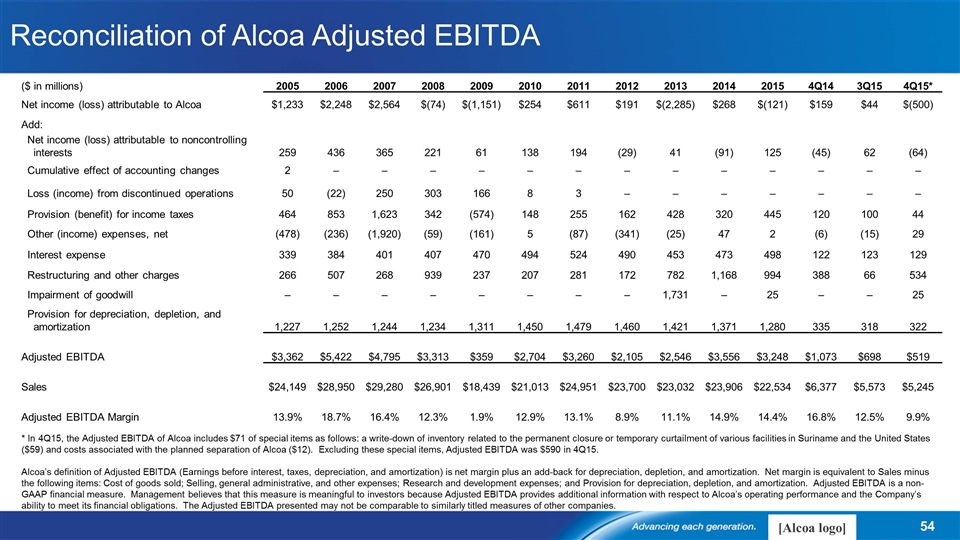

Reconciliation of Alcoa Adjusted EBITDA ($ in millions) 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 4Q14 3Q15 4Q15* Net income (loss) attributable to Alcoa $1,233 $2,248 $2,564 $(74) $(1,151) $254 $611 $191 $(2,285) $268 $(121) $159 $44 $(500) Add: Net income (loss) attributable to noncontrolling interests 259 436 365 221 61 138 194 (29) 41 (91) 125 (45) 62 (64) Cumulative effect of accounting changes 2 – – – – – – – – – – – – – Loss (income) from discontinued operations 50 (22) 250 303 166 8 3 – – – – – – – Provision (benefit) for income taxes 464 853 1,623 342 (574) 148 255 162 428 320 445 120 100 44 Other (income) expenses, net (478) (236) (1,920) (59) (161) 5 (87) (341) (25) 47 2 (6) (15) 29 Interest expense 339 384 401 407 470 494 524 490 453 473 498 122 123 129 Restructuring and other charges 266 507 268 939 237 207 281 172 782 1,168 994 388 66 534 Impairment of goodwill – – – – – – – – 1,731 – 25 – – 25 Provision for depreciation, depletion, and amortization 1,227 1,252 1,244 1,234 1,311 1,450 1,479 1,460 1,421 1,371 1,280 335 318 322 Adjusted EBITDA $3,362 $5,422 $4,795 $3,313 $359 $2,704 $3,260 $2,105 $2,546 $3,556 $3,248 $1,073 $698 $519 Sales $24,149 $28,950 $29,280 $26,901 $18,439 $21,013 $24,951 $23,700 $23,032 $23,906 $22,534 $6,377 $5,573 $5,245 Adjusted EBITDA Margin 13.9% 18.7% 16.4% 12.3% 1.9% 12.9% 13.1% 8.9% 11.1% 14.9% 14.4% 16.8% 12.5% 9.9% Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales minus the following items: Cost of goods sold; Selling, general administrative, and other expenses; Research and development expenses; and Provision for depreciation, depletion, and amortization. Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because Adjusted EBITDA provides additional information with respect to Alcoa’s operating performance and the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies. * In 4Q15, the Adjusted EBITDA of Alcoa includes $71 of special items as follows: a write-down of inventory related to the permanent closure or temporary curtailment of various facilities in Suriname and the United States ($59) and costs associated with the planned separation of Alcoa ($12). Excluding these special items, Adjusted EBITDA was $590 in 4Q15.

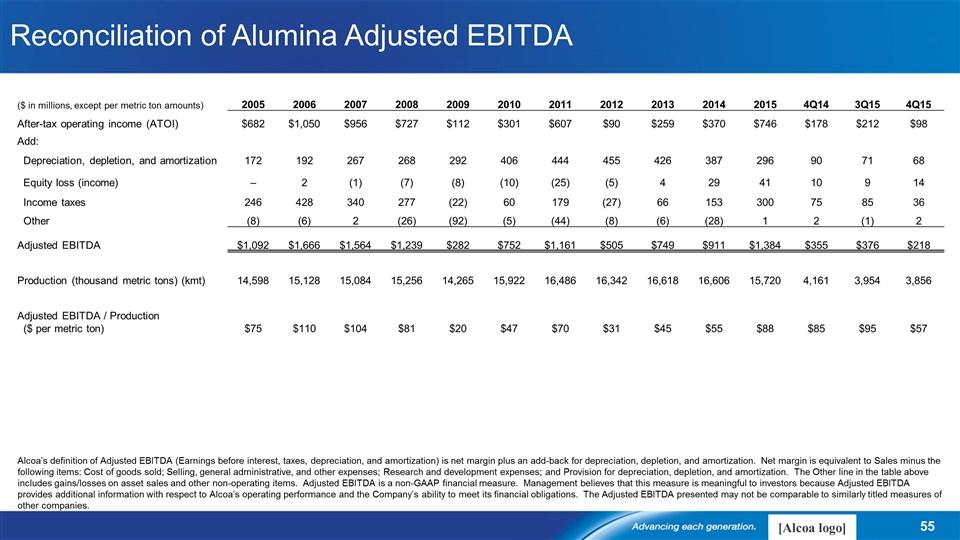

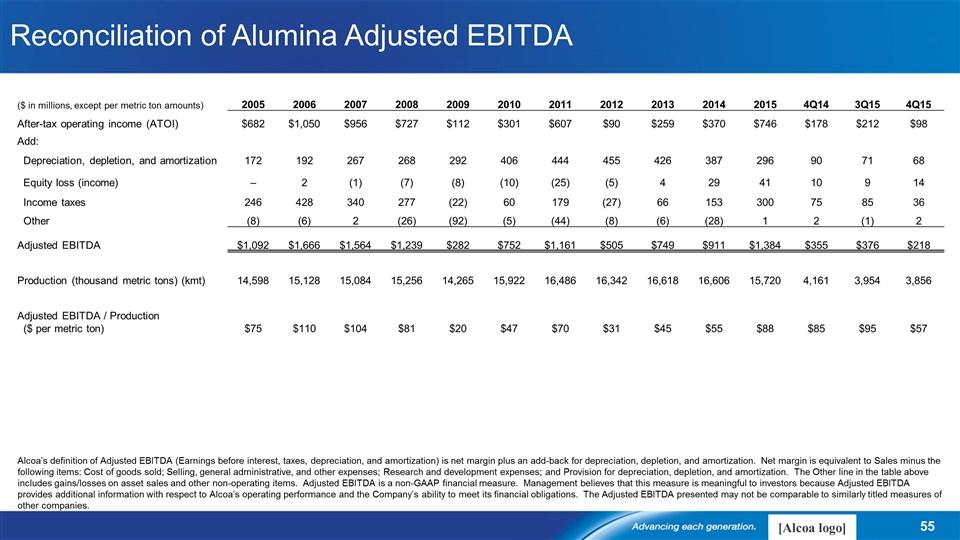

Reconciliation of Alumina Adjusted EBITDA ($ in millions, except per metric ton amounts) 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 4Q14 3Q15 4Q15 After-tax operating income (ATOI) $682 $1,050 $956 $727 $112 $301 $607 $90 $259 $370 $746 $178 $212 $98 Add: Depreciation, depletion, and amortization 172 192 267 268 292 406 444 455 426 387 296 90 71 68 Equity loss (income) – 2 (1) (7) (8) (10) (25) (5) 4 29 41 10 9 14 Income taxes 246 428 340 277 (22) 60 179 (27) 66 153 300 75 85 36 Other (8) (6) 2 (26) (92) (5) (44) (8) (6) (28) 1 2 (1) 2 Adjusted EBITDA $1,092 $1,666 $1,564 $1,239 $282 $752 $1,161 $505 $749 $911 $1,384 $355 $376 $218 Production (thousand metric tons) (kmt) 14,598 15,128 15,084 15,256 14,265 15,922 16,486 16,342 16,618 16,606 15,720 4,161 3,954 3,856 Adjusted EBITDA / Production ($ per metric ton) $75 $110 $104 $81 $20 $47 $70 $31 $45 $55 $88 $85 $95 $57 Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales minus the following items: Cost of goods sold; Selling, general administrative, and other expenses; Research and development expenses; and Provision for depreciation, depletion, and amortization. The Other line in the table above includes gains/losses on asset sales and other non-operating items. Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because Adjusted EBITDA provides additional information with respect to Alcoa’s operating performance and the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies.

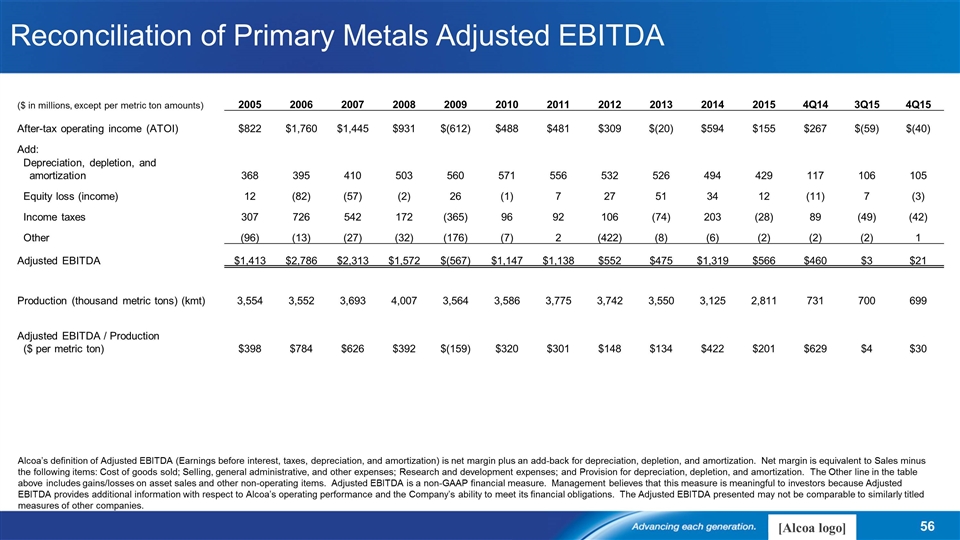

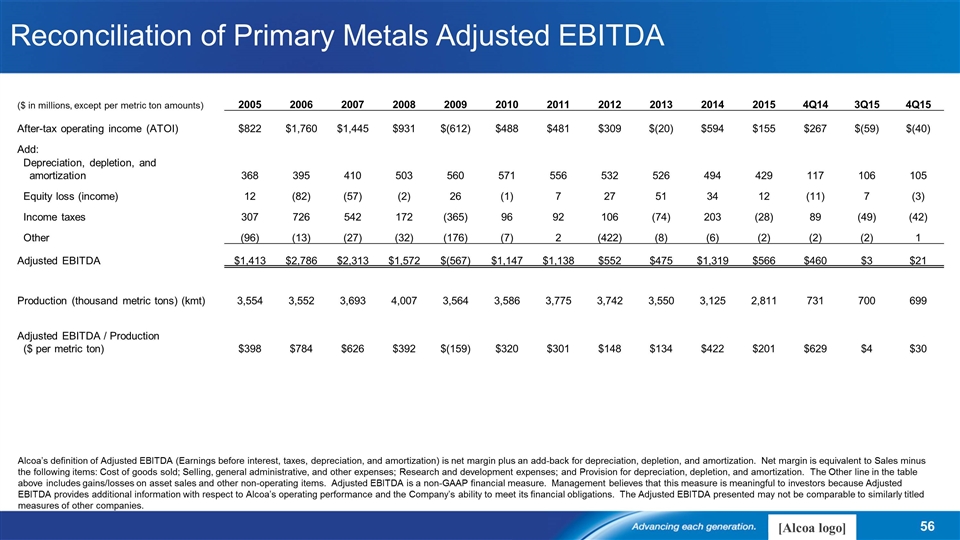

Reconciliation of Primary Metals Adjusted EBITDA ($ in millions, except per metric ton amounts) 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 4Q14 3Q15 4Q15 After-tax operating income (ATOI) $822 $1,760 $1,445 $931 $(612) $488 $481 $309 $(20) $594 $155 $267 $(59) $(40) Add: Depreciation, depletion, and amortization 368 395 410 503 560 571 556 532 526 494 429 117 106 105 Equity loss (income) 12 (82) (57) (2) 26 (1) 7 27 51 34 12 (11) 7 (3) Income taxes 307 726 542 172 (365) 96 92 106 (74) 203 (28) 89 (49) (42) Other (96) (13) (27) (32) (176) (7) 2 (422) (8) (6) (2) (2) (2) 1 Adjusted EBITDA $1,413 $2,786 $2,313 $1,572 $(567) $1,147 $1,138 $552 $475 $1,319 $566 $460 $3 $21 Production (thousand metric tons) (kmt) 3,554 3,552 3,693 4,007 3,564 3,586 3,775 3,742 3,550 3,125 2,811 731 700 699 Adjusted EBITDA / Production ($ per metric ton) $398 $784 $626 $392 $(159) $320 $301 $148 $134 $422 $201 $629 $4 $30 Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales minus the following items: Cost of goods sold; Selling, general administrative, and other expenses; Research and development expenses; and Provision for depreciation, depletion, and amortization. The Other line in the table above includes gains/losses on asset sales and other non-operating items. Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because Adjusted EBITDA provides additional information with respect to Alcoa’s operating performance and the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies.

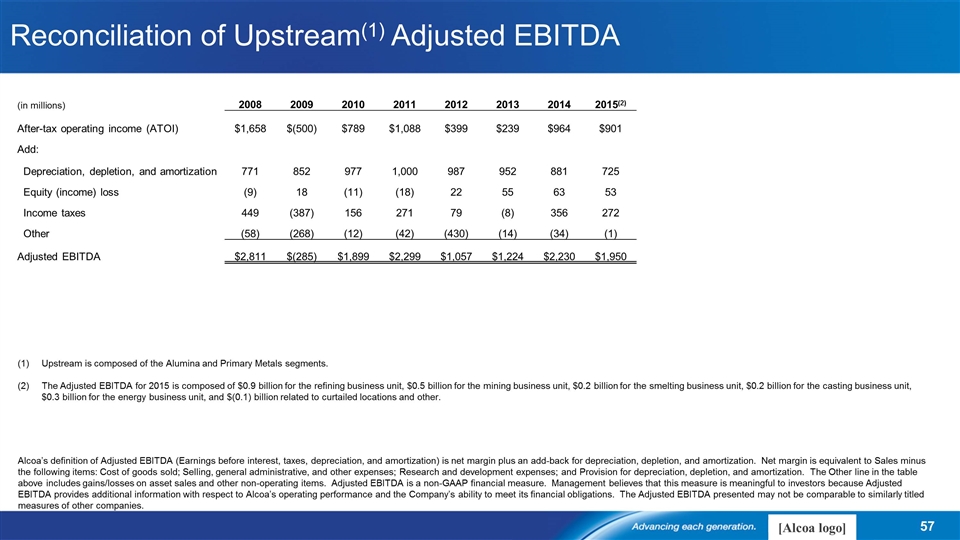

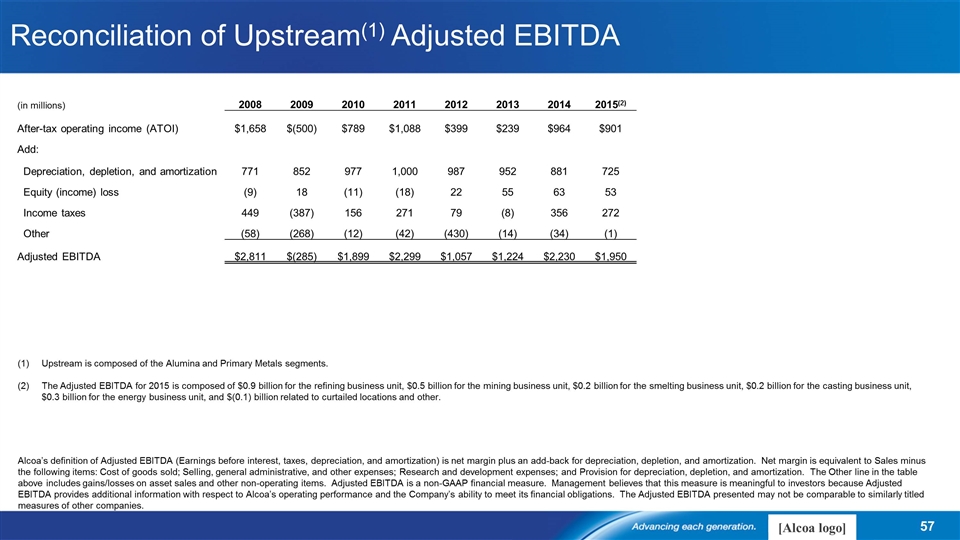

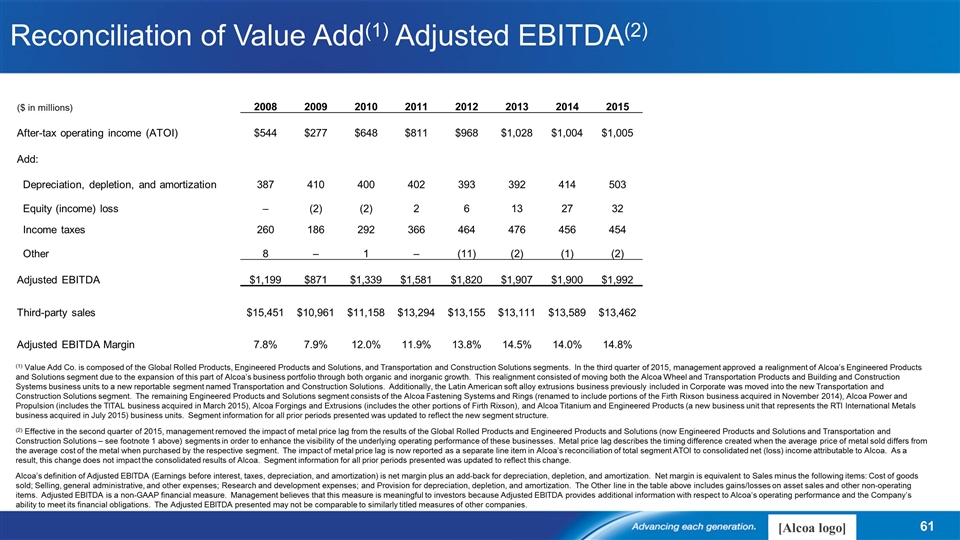

Reconciliation of Upstream(1) Adjusted EBITDA (in millions) 2008 2009 2010 2011 2012 2013 2014 2015(2) After-tax operating income (ATOI) $1,658 $(500) $789 $1,088 $399 $239 $964 $901 Add: Depreciation, depletion, and amortization 771 852 977 1,000 987 952 881 725 Equity (income) loss (9) 18 (11) (18) 22 55 63 53 Income taxes 449 (387) 156 271 79 (8) 356 272 Other (58) (268) (12) (42) (430) (14) (34) (1) Adjusted EBITDA $2,811 $(285) $1,899 $2,299 $1,057 $1,224 $2,230 $1,950 Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales minus the following items: Cost of goods sold; Selling, general administrative, and other expenses; Research and development expenses; and Provision for depreciation, depletion, and amortization. The Other line in the table above includes gains/losses on asset sales and other non-operating items. Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because Adjusted EBITDA provides additional information with respect to Alcoa’s operating performance and the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies. Upstream is composed of the Alumina and Primary Metals segments. The Adjusted EBITDA for 2015 is composed of $0.9 billion for the refining business unit, $0.5 billion for the mining business unit, $0.2 billion for the smelting business unit, $0.2 billion for the casting business unit, $0.3 billion for the energy business unit, and $(0.1) billion related to curtailed locations and other.

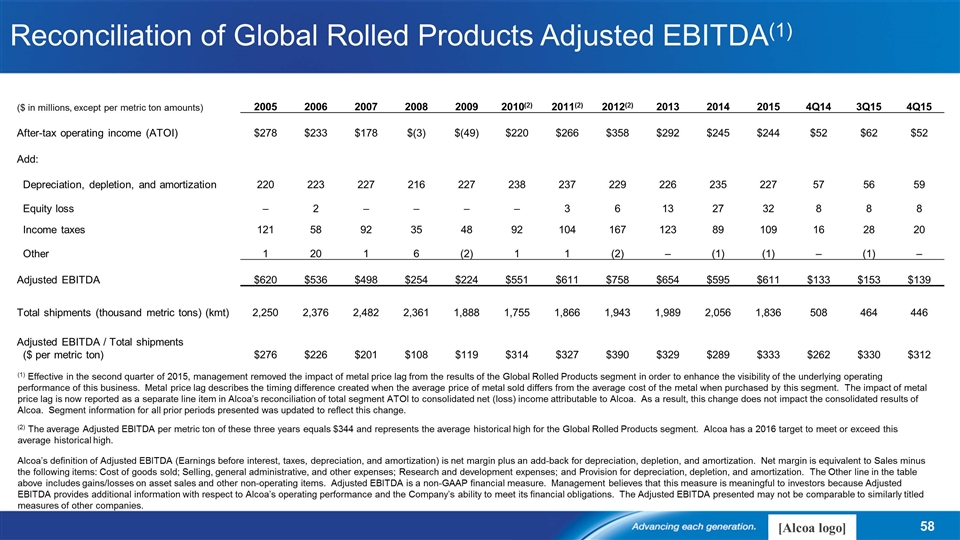

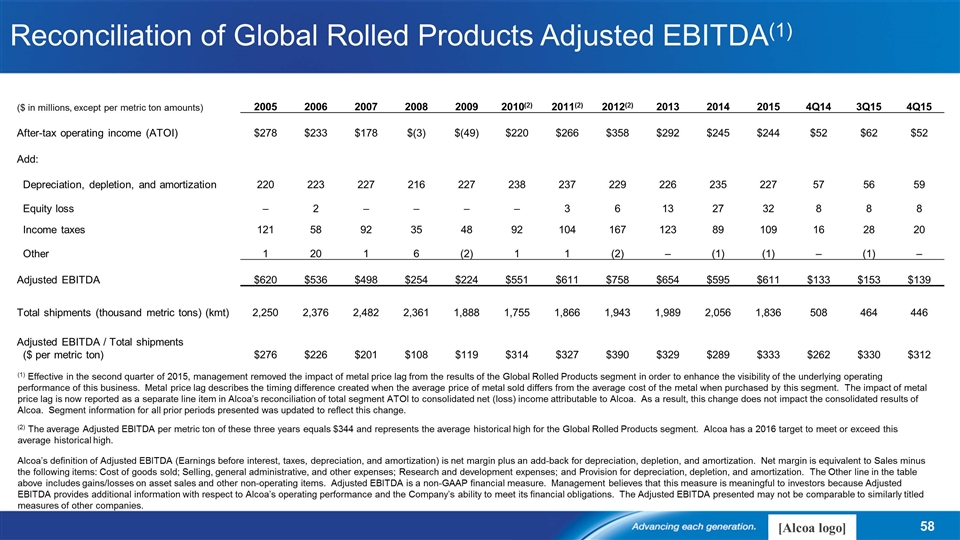

Reconciliation of Global Rolled Products Adjusted EBITDA(1) ($ in millions, except per metric ton amounts) 2005 2006 2007 2008 2009 2010(2) 2011(2) 2012(2) 2013 2014 2015 4Q14 3Q15 4Q15 After-tax operating income (ATOI) $278 $233 $178 $(3) $(49) $220 $266 $358 $292 $245 $244 $52 $62 $52 Add: Depreciation, depletion, and amortization 220 223 227 216 227 238 237 229 226 235 227 57 56 59 Equity loss – 2 – – – – 3 6 13 27 32 8 8 8 Income taxes 121 58 92 35 48 92 104 167 123 89 109 16 28 20 Other 1 20 1 6 (2) 1 1 (2) – (1) (1) – (1) – Adjusted EBITDA $620 $536 $498 $254 $224 $551 $611 $758 $654 $595 $611 $133 $153 $139 Total shipments (thousand metric tons) (kmt) 2,250 2,376 2,482 2,361 1,888 1,755 1,866 1,943 1,989 2,056 1,836 508 464 446 Adjusted EBITDA / Total shipments ($ per metric ton) $276 $226 $201 $108 $119 $314 $327 $390 $329 $289 $333 $262 $330 $312 Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales minus the following items: Cost of goods sold; Selling, general administrative, and other expenses; Research and development expenses; and Provision for depreciation, depletion, and amortization. The Other line in the table above includes gains/losses on asset sales and other non-operating items. Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because Adjusted EBITDA provides additional information with respect to Alcoa’s operating performance and the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies. (1) Effective in the second quarter of 2015, management removed the impact of metal price lag from the results of the Global Rolled Products segment in order to enhance the visibility of the underlying operating performance of this business. Metal price lag describes the timing difference created when the average price of metal sold differs from the average cost of the metal when purchased by this segment. The impact of metal price lag is now reported as a separate line item in Alcoa’s reconciliation of total segment ATOI to consolidated net (loss) income attributable to Alcoa. As a result, this change does not impact the consolidated results of Alcoa. Segment information for all prior periods presented was updated to reflect this change. (2) The average Adjusted EBITDA per metric ton of these three years equals $344 and represents the average historical high for the Global Rolled Products segment. Alcoa has a 2016 target to meet or exceed this average historical high.

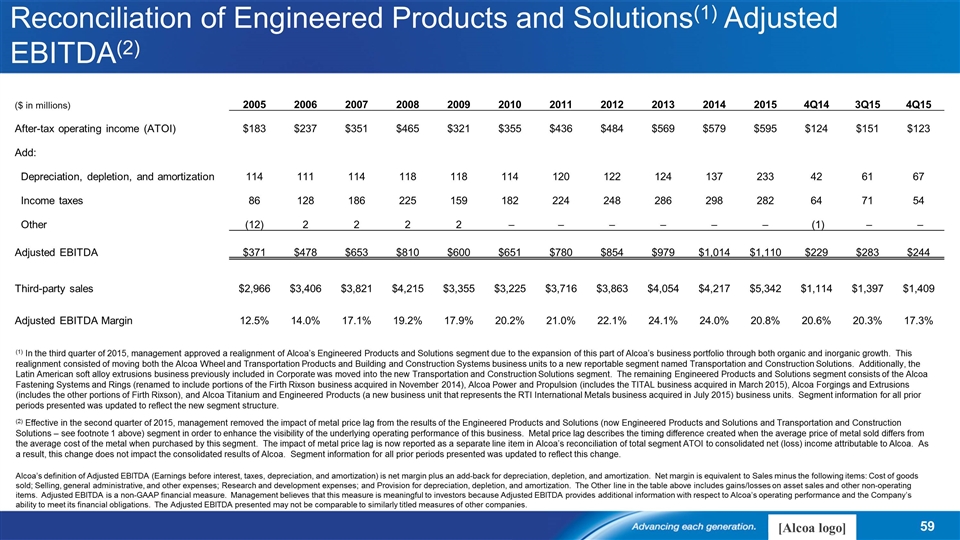

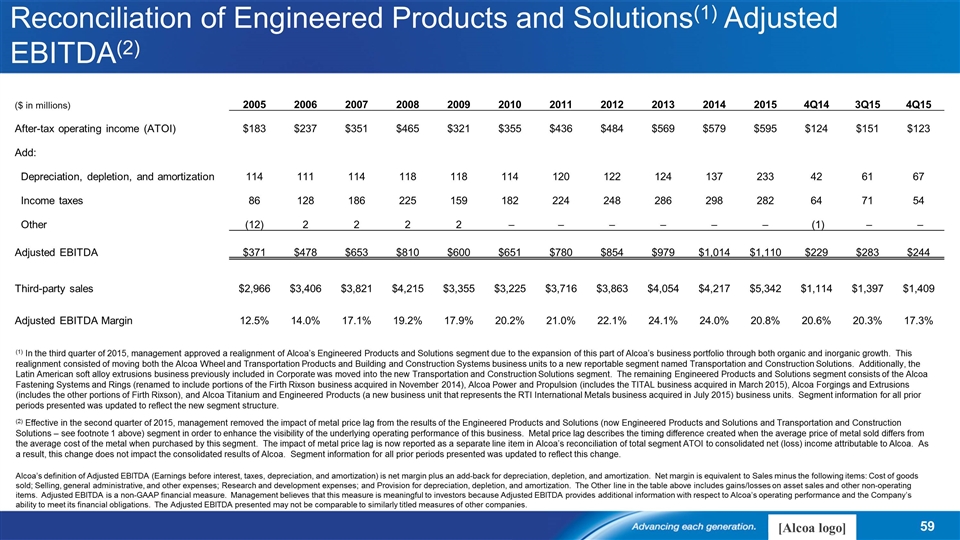

Reconciliation of Engineered Products and Solutions(1) Adjusted EBITDA(2) ($ in millions) 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 4Q14 3Q15 4Q15 After-tax operating income (ATOI) $183 $237 $351 $465 $321 $355 $436 $484 $569 $579 $595 $124 $151 $123 Add: Depreciation, depletion, and amortization 114 111 114 118 118 114 120 122 124 137 233 42 61 67 Income taxes 86 128 186 225 159 182 224 248 286 298 282 64 71 54 Other (12) 2 2 2 2 – – – – – – (1) – – Adjusted EBITDA $371 $478 $653 $810 $600 $651 $780 $854 $979 $1,014 $1,110 $229 $283 $244 Third-party sales $2,966 $3,406 $3,821 $4,215 $3,355 $3,225 $3,716 $3,863 $4,054 $4,217 $5,342 $1,114 $1,397 $1,409 Adjusted EBITDA Margin 12.5% 14.0% 17.1% 19.2% 17.9% 20.2% 21.0% 22.1% 24.1% 24.0% 20.8% 20.6% 20.3% 17.3% Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales minus the following items: Cost of goods sold; Selling, general administrative, and other expenses; Research and development expenses; and Provision for depreciation, depletion, and amortization. The Other line in the table above includes gains/losses on asset sales and other non-operating items. Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because Adjusted EBITDA provides additional information with respect to Alcoa’s operating performance and the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies. (1) In the third quarter of 2015, management approved a realignment of Alcoa’s Engineered Products and Solutions segment due to the expansion of this part of Alcoa’s business portfolio through both organic and inorganic growth. This realignment consisted of moving both the Alcoa Wheel and Transportation Products and Building and Construction Systems business units to a new reportable segment named Transportation and Construction Solutions. Additionally, the Latin American soft alloy extrusions business previously included in Corporate was moved into the new Transportation and Construction Solutions segment. The remaining Engineered Products and Solutions segment consists of the Alcoa Fastening Systems and Rings (renamed to include portions of the Firth Rixson business acquired in November 2014), Alcoa Power and Propulsion (includes the TITAL business acquired in March 2015), Alcoa Forgings and Extrusions (includes the other portions of Firth Rixson), and Alcoa Titanium and Engineered Products (a new business unit that represents the RTI International Metals business acquired in July 2015) business units. Segment information for all prior periods presented was updated to reflect the new segment structure. (2) Effective in the second quarter of 2015, management removed the impact of metal price lag from the results of the Engineered Products and Solutions (now Engineered Products and Solutions and Transportation and Construction Solutions – see footnote 1 above) segment in order to enhance the visibility of the underlying operating performance of this business. Metal price lag describes the timing difference created when the average price of metal sold differs from the average cost of the metal when purchased by this segment. The impact of metal price lag is now reported as a separate line item in Alcoa’s reconciliation of total segment ATOI to consolidated net (loss) income attributable to Alcoa. As a result, this change does not impact the consolidated results of Alcoa. Segment information for all prior periods presented was updated to reflect this change.

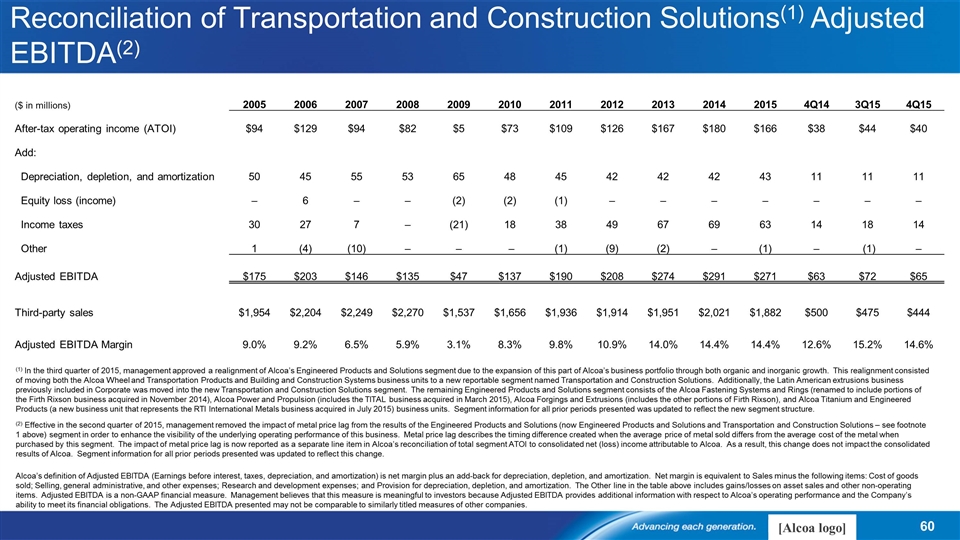

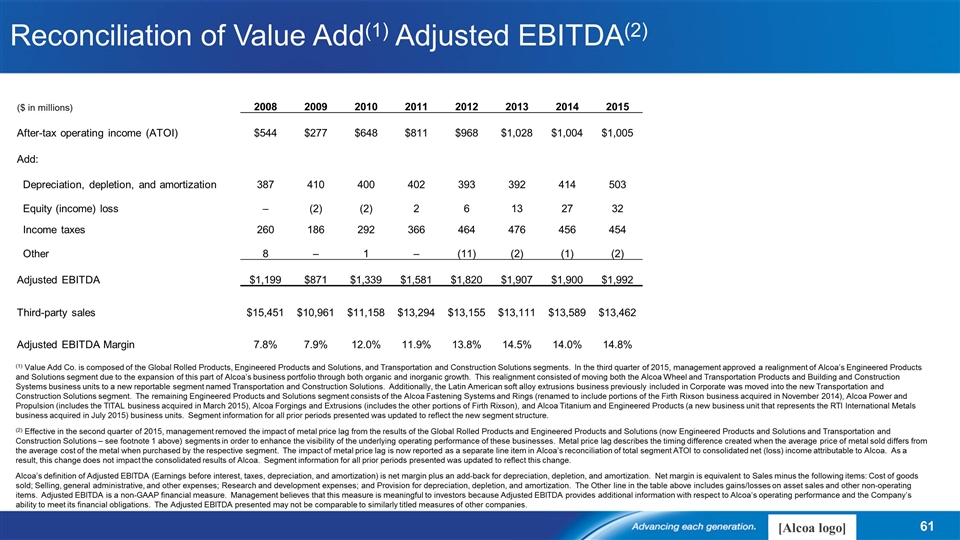

Reconciliation of Transportation and Construction Solutions(1) Adjusted EBITDA(2) ($ in millions) 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 4Q14 3Q15 4Q15 After-tax operating income (ATOI) $94 $129 $94 $82 $5 $73 $109 $126 $167 $180 $166 $38 $44 $40 Add: Depreciation, depletion, and amortization 50 45 55 53 65 48 45 42 42 42 43 11 11 11 Equity loss (income) – 6 – – (2) (2) (1) – – – – – – – Income taxes 30 27 7 – (21) 18 38 49 67 69 63 14 18 14 Other 1 (4) (10) – – – (1) (9) (2) – (1) – (1) – Adjusted EBITDA $175 $203 $146 $135 $47 $137 $190 $208 $274 $291 $271 $63 $72 $65 Third-party sales $1,954 $2,204 $2,249 $2,270 $1,537 $1,656 $1,936 $1,914 $1,951 $2,021 $1,882 $500 $475 $444 Adjusted EBITDA Margin 9.0% 9.2% 6.5% 5.9% 3.1% 8.3% 9.8% 10.9% 14.0% 14.4% 14.4% 12.6% 15.2% 14.6% Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales minus the following items: Cost of goods sold; Selling, general administrative, and other expenses; Research and development expenses; and Provision for depreciation, depletion, and amortization. The Other line in the table above includes gains/losses on asset sales and other non-operating items. Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because Adjusted EBITDA provides additional information with respect to Alcoa’s operating performance and the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies. (1) In the third quarter of 2015, management approved a realignment of Alcoa’s Engineered Products and Solutions segment due to the expansion of this part of Alcoa’s business portfolio through both organic and inorganic growth. This realignment consisted of moving both the Alcoa Wheel and Transportation Products and Building and Construction Systems business units to a new reportable segment named Transportation and Construction Solutions. Additionally, the Latin American extrusions business previously included in Corporate was moved into the new Transportation and Construction Solutions segment. The remaining Engineered Products and Solutions segment consists of the Alcoa Fastening Systems and Rings (renamed to include portions of the Firth Rixson business acquired in November 2014), Alcoa Power and Propulsion (includes the TITAL business acquired in March 2015), Alcoa Forgings and Extrusions (includes the other portions of Firth Rixson), and Alcoa Titanium and Engineered Products (a new business unit that represents the RTI International Metals business acquired in July 2015) business units. Segment information for all prior periods presented was updated to reflect the new segment structure. (2) Effective in the second quarter of 2015, management removed the impact of metal price lag from the results of the Engineered Products and Solutions (now Engineered Products and Solutions and Transportation and Construction Solutions – see footnote 1 above) segment in order to enhance the visibility of the underlying operating performance of this business. Metal price lag describes the timing difference created when the average price of metal sold differs from the average cost of the metal when purchased by this segment. The impact of metal price lag is now reported as a separate line item in Alcoa’s reconciliation of total segment ATOI to consolidated net (loss) income attributable to Alcoa. As a result, this change does not impact the consolidated results of Alcoa. Segment information for all prior periods presented was updated to reflect this change.