The parties expect to close their transaction following receipt of regulatory and other approvals in the second or third quarter of 2021. Gray expects that the Quincy transaction will be immediately accretive to Gray’s free cash flow per share. Including expected year-one annualized synergies of approximately $23 million, the transaction purchase price represents a multiple of approximately 6.9 times a blended average of Quincy’s 2019/2020 earnings before interest, taxes, depreciation and amortization.

Gray intends to finance the transaction, net of divestiture proceeds, with cash on hand and/or new debt. Wells Fargo has provided a debt financing commitment for an incremental loan to finance up to the full purchase price of $925 million. Gray anticipates that its expected strong free cash flow generation throughout 2021 should allow Gray to continue to deleverage its capital structure following the closing. Gray expects that its total leverage ratio, net of all cash and net of proceeds from divestiture sales, would approximate 4.0 times trailing eight-quarter operating cash flow (as defined in our current senior credit facility), including estimated synergies, at year-end 2021.

The transaction has been approved unanimously by the Boards of Directors of both Gray and Quincy. No Gray shareholder vote will be required. Wells Fargo Securities, LLC served as financial advisor to Quincy. Cooley LLP served as primary legal counsel for Gray. Brooks, Pierce, McLendon, Humphrey & Leonard, LLP and Scholz, Loos, Palmer, Siebers and Duesterhaus LLP served as legal counsel for Quincy.

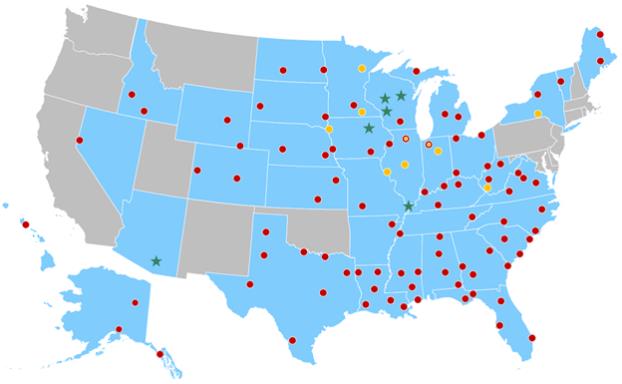

Gray currently owns and/or operates television stations and leading digital properties in 94 television markets. Gray’s television stations cover approximately 24 percent of US television households and broadcast over 400 separate programming streams, including roughly 150 affiliates of the Big Four broadcast networks. Gray also owns video program production, marketing, and digital businesses including Raycom Sports, Tupelo-Raycom, and RTM Studios, the producer of PowerNation programs and content.

Gray Contacts:

www.gray.tv

Hilton H. Howell, Jr., Executive Chairman and Chief Executive Officer, 404-266-5512

Pat LaPlatney, President and Co-Chief Executive Officer, 404-266-8333

Jim Ryan, Executive Vice President and Chief Financial Officer, 404-504-9828

Kevin P. Latek, Executive Vice President, Chief Legal and Development Officer, 404-266-8333

Quincy Contact:

https://www.quincymedia.com

Ralph M. Oakley, President and Chief Executive Officer, 217-221-3404

Forward Looking Statements:

This press release contains certain forward looking statements that are based largely on Gray’s current expectations and reflect various estimates and assumptions by Gray. These statements are statements other than those of historical fact, and may be identified by words such as “estimates,” “expect,” “anticipate,” “will,” “implied,” “assume” and similar expressions. Forward looking statements are subject to certain risks, trends and uncertainties that could cause actual results and achievements to differ materially from those expressed in such forward looking statements. Such risks, trends and uncertainties, which in some instances are beyond Gray’s control, include Gray’s

Page 3 of 4