Exhibit 10.4

|

AMENDED AND RESTATED CREDIT AGREEMENT

dated as of

December 27, 2007

among

THE GREAT ATLANTIC & PACIFIC

TEA COMPANY, INC.,

and

The Other Borrowers Party Hereto,

as Borrowers

and

The Lenders Party Hereto,

and

BANK OF AMERICA, N.A.,

as Administrative Agent and Collateral Agent

and

JPMORGAN CHASE BANK, N.A.

WELLS FARGO RETAIL FINANCE LLC

As Co-Syndication Agents

and

THE CIT GROUP/BUSINESS CREDIT, INC.

as Documentation Agent

and

BANC OF AMERICA SECURITIES LLC

JPMORGAN CHASE BANK, N.A.

as Co-Lead Arrangers

|

TABLE OF CONTENTS

|

| Page |

|

| |

ARTICLE I Definitions | 6 | |

|

| |

| SECTION 1.01 Defined Terms | 6 |

| SECTION 1.02 Classification of Loans and Borrowings | 48 |

| SECTION 1.03 Terms Generally | 48 |

| SECTION 1.04 Accounting Terms; GAAP | 49 |

| SECTION 1.05 Borrowing Base Adjustments | 49 |

| SECTION 1.06 Letter of Credit Amounts | 50 |

|

|

|

ARTICLE II The Credits | 50 | |

|

| |

| SECTION 2.01 Loans; Mandatory Advances of Tranche A-1 Loans | 50 |

| SECTION 2.02 Increase in Tranche A Commitments | 52 |

| SECTION 2.03 Loans and Borrowings | 53 |

| SECTION 2.04 Requests for Borrowings | 54 |

| SECTION 2.05 Swingline Loans | 55 |

| SECTION 2.06 Letters of Credit | 55 |

| SECTION 2.07 Funding of Borrowings | 60 |

| SECTION 2.08 Interest Elections | 61 |

| SECTION 2.09 Termination or Reduction of Commitments | 62 |

| SECTION 2.10 Repayment of Loans; Evidence of Debt | 64 |

| SECTION 2.11 Prepayment of Loans | 65 |

| SECTION 2.12 Fees | 69 |

| SECTION 2.13 Interest | 70 |

| SECTION 2.14 Alternate Rate of Interest | 71 |

| SECTION 2.15 Increased Costs | 71 |

| SECTION 2.16 Break Funding Payments | 72 |

| SECTION 2.17 Taxes | 73 |

| SECTION 2.18 Payments Generally; Pro Rata Treatment; Sharing of Setoffs | 75 |

| SECTION 2.19 Mitigation Obligations; Replacement of Lenders | 76 |

| SECTION 2.20 Designation of Company as each Borrowers’ Agent | 77 |

|

| |

ARTICLE III Representations and Warranties | 78 | |

|

| |

| SECTION 3.01 Organization; Powers | 78 |

| SECTION 3.02 Authorization; Enforceability | 78 |

| SECTION 3.03 Governmental Approvals; No Conflicts | 78 |

| SECTION 3.04 Financial Condition; No Material Adverse Change | 78 |

| SECTION 3.05 Properties | 79 |

| SECTION 3.06 Litigation and Environmental Matters | 80 |

| SECTION 3.07 Compliance with Laws and Agreements | 80 |

| SECTION 3.08 Investment Company Status | 80 |

| SECTION 3.09 Taxes | 80 |

| SECTION 3.10 Employee Benefit Plans | 81 |

| SECTION 3.11 Disclosure | 81 |

| SECTION 3.12 Subsidiaries | 81 |

| SECTION 3.13 Insurance | 81 |

| SECTION 3.14 Labor Matters | 81 |

| SECTION 3.15 Security Documents | 81 |

| SECTION 3.16 Federal Reserve Regulations | 83 |

|

| |

ARTICLE IV Conditions | 83 | |

|

| |

| SECTION 4.01 Restatement Effective Date | 83 |

| SECTION 4.02 Each Credit Event | 84 |

|

| |

ARTICLE V Affirmative Covenants | 85 | |

|

| |

| SECTION 5.01 Financial Statements and Other Information | 85 |

| SECTION 5.02 Notices of Material Events | 88 |

| SECTION 5.03 Information Regarding Collateral | 89 |

| SECTION 5.04 Existence; Conduct of Business | 89 |

| SECTION 5.05 Payment of Obligations | 90 |

| SECTION 5.06 Maintenance of Properties | 90 |

| SECTION 5.07 Insurance | 90 |

| SECTION 5.08 Casualty and Condemnation | 91 |

| SECTION 5.09 Books and Records; Inspection and Audit Rights | 92 |

| SECTION 5.10 Compliance with Laws | 92 |

| SECTION 5.11 Use of Proceeds and Letters of Credit | 92 |

| SECTION 5.12 Additional Subsidiaries | 93 |

| SECTION 5.13 Further Assurances | 93 |

| SECTION 5.14 Cash Management | 94 |

| SECTION 5.15 Priority of Claims Waivers | 97 |

| SECTION 5.16 Benefit Plans Payments | 97 |

|

| |

ARTICLE VI Negative Covenants | 97 | |

|

| |

| SECTION 6.01 Indebtedness; Certain Equity Securities | 97 |

| SECTION 6.02 Liens | 99 |

| SECTION 6.03 Fundamental Changes | 100 |

| SECTION 6.04 Investments, Loans, Advances, Guarantees and Acquisitions | 101 |

| SECTION 6.05 Asset Sales | 102 |

| SECTION 6.06 Sale and Leaseback Transactions | 103 |

| SECTION 6.07 Hedging Agreements | 103 |

| SECTION 6.08 Restricted Payments; Certain Payments of Indebtedness | 104 |

| SECTION 6.09 Transactions with Affiliates | 105 |

| SECTION 6.10 Restrictive Agreements | 105 |

| SECTION 6.11 Amendment of Material Documents | 105 |

| SECTION 6.12 Minimum Excess Availability | 105 |

| SECTION 6.13 Limitation on Change in Fiscal Year | 105 |

|

| |

ARTICLE VII Events of Default | 106 | |

|

| |

| SECTION 7.01 Events of Default | 106 |

| SECTION 7.02 Remedies Upon Event of Default | 108 |

| SECTION 7.03 Application of Funds | 109 |

ARTICLE VIII The Agents | 111 | |

|

| |

| SECTION 8.01 Appointment and Administration by Administrative Agent | 111 |

| SECTION 8.02 Appointment of Collateral Agent | 112 |

| SECTION 8.03 Agreement of Applicable Lenders | 112 |

| SECTION 8.04 Liability of Agents | 112 |

| SECTION 8.05 Notice of Default | 113 |

| SECTION 8.06 Credit Decisions | 114 |

| SECTION 8.07 Reimbursement and Indemnification | 114 |

| SECTION 8.08 Rights of Agents | 115 |

| SECTION 8.09 Notice of Transfer | 115 |

| SECTION 8.10 Successor Agents | 115 |

| SECTION 8.11 Relation Among the Lenders | 115 |

| SECTION 8.12 Reports and Financial Statements | 115 |

| SECTION 8.13 Agency for Perfection | 116 |

| SECTION 8.14 Delinquent Lender | 117 |

| SECTION 8.15 Collateral and Guaranty Matters | 117 |

| SECTION 8.16 Syndication Agent; Documentation Agent and Lead Arranger | 118 |

|

| |

ARTICLE IX Miscellaneous | 118 | |

|

| |

| SECTION 9.01 Notices | 118 |

| SECTION 9.02 Waivers; Amendments | 120 |

| SECTION 9.03 Expenses; Indemnity; Damage Waiver | 122 |

| SECTION 9.04 Successors and Assigns | 123 |

| SECTION 9.05 Survival | 128 |

| SECTION 9.06 Counterparts; Integration; Effectiveness | 128 |

| SECTION 9.07 Severability | 128 |

| SECTION 9.08 Right of Setoff | 129 |

| SECTION 9.09 GOVERNING LAW; JURISDICTION; CONSENT TO SERVICE OF PROCESS | 129 |

| SECTION 9.10 WAIVER OF JURY TRIAL | 130 |

| SECTION 9.11 Headings | 130 |

| SECTION 9.12 Confidentiality | 130 |

| SECTION 9.13 Interest Rate Limitation | 131 |

| SECTION 9.14 Patriot Act | 131 |

| SECTION 9.15 Foreign Asset Control Regulations | 131 |

| SECTION 9.16 Additional Waivers | 132 |

| SECTION 9.17 No Advisory or Fiduciary Responsibility | 133 |

| SECTION 9.18 Press Releases | 134 |

| SECTION 9.19 Existing Credit Agreement Amended and Restated | 134 |

SCHEDULES: |

|

|

|

|

|

|

|

|

|

Schedule A |

| — |

| Priming Jurisdictions |

Schedule B |

| — |

| Distribution Centers |

Schedule C |

| — |

| Financial and Collateral Reports |

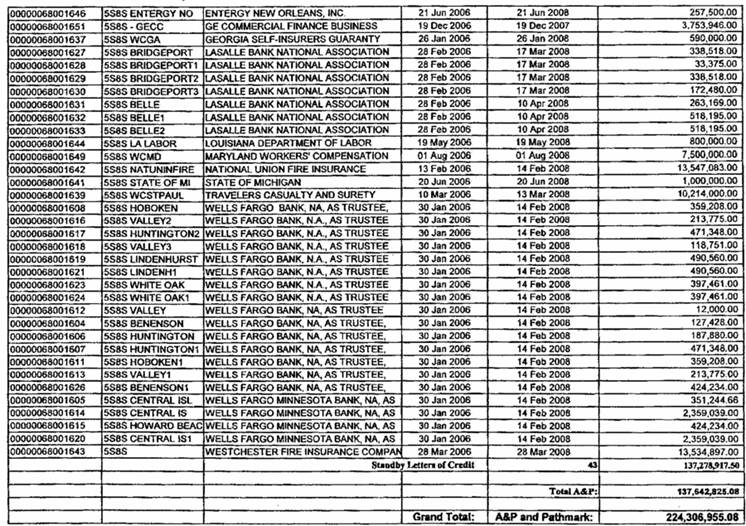

Schedule 1.01(A) |

| — |

| Existing Letters of Credit |

Schedule 1.01(B) |

| — |

| Title Policy Endorsements |

Schedule 1.01(C) |

|

|

| Principal Properties |

Schedule 1.01(D) |

|

|

| Immaterial Subsidiaries |

Schedule 2.01 |

| — |

| Lenders and Commitments |

Schedule 3.01 |

|

|

| Subsidiaries not in Good Standing |

Schedule 3.06 |

| — |

| Disclosed Matters |

Schedule 3.12 |

| — |

| Subsidiaries |

Schedule 3.13 |

| — |

| Insurance |

Schedule 3.15(b) |

| — |

| UCC Filings |

Schedule 3.15(c) |

| — |

| Intellectual Property Filings |

Schedule 5.01 |

|

|

| Internet Addresses |

Schedule 5.14(a) |

| — |

| DDA Accounts |

Schedule 5.14(b) |

| — |

| Credit Card Arrangements |

Schedule 5.14(c) |

| — |

| Third Party Insurance Payors |

Schedule 5.14(d)(iii) |

| — |

| Blocked Accounts |

Schedule 5.14(i) |

| — |

| Disbursement Accounts |

Schedule 6.01 |

| — |

| Existing Indebtedness |

Schedule 6.02 |

| — |

| Existing Liens |

Schedule 6.04 |

| — |

| Existing Investments |

Schedule 6.10 |

| — |

| Existing Restrictions |

|

|

|

|

|

EXHIBITS: |

|

|

|

|

|

|

|

|

|

Exhibit A |

| — |

| Form of Assignment and Acceptance |

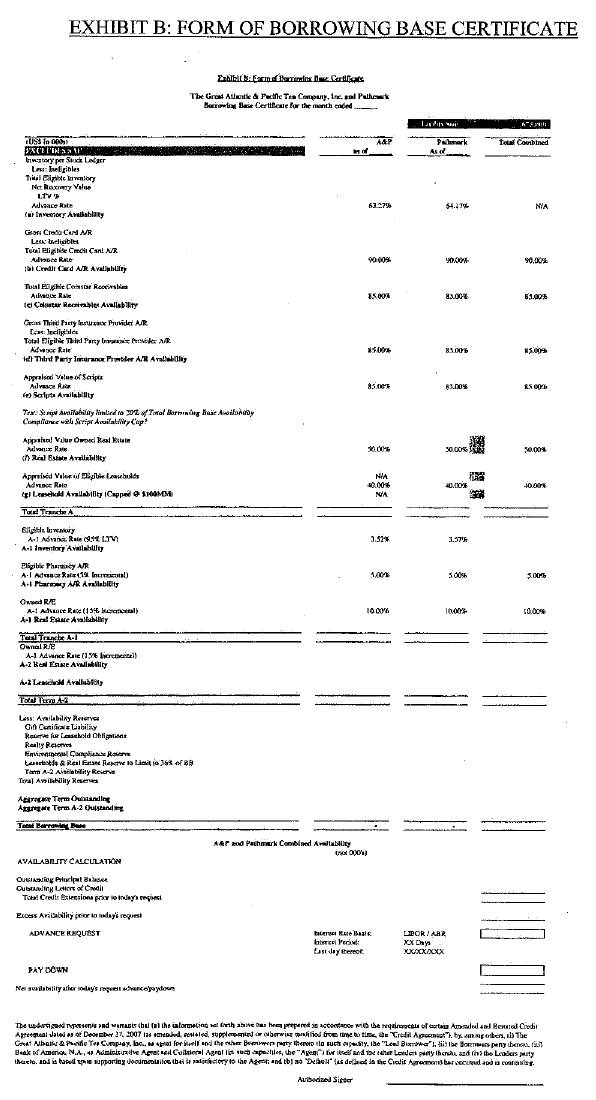

Exhibit B |

| — |

| Form of Borrowing Base Certificate |

Exhibit C |

| — |

| Form of Guaranty |

Exhibit D |

| — |

| Form of Indemnity, Subrogation and Contribution Agreement |

Exhibit E |

| — |

| Form of Perfection Certificate |

Exhibit F |

| — |

| Form of Pledge Agreement |

Exhibit G |

| — |

| Form of Security Agreement |

Exhibit H |

| — |

| Form of Additional Commitment Lender Joinder Agreement |

Exhibit I |

| — |

| Form of Opinion General Counsel of the Loan Parties |

Exhibit J |

| — |

| Form of Opinion of Cahill Gordon & Reindel LLP |

Exhibit K |

| — |

| Form of Credit Card Notification |

Exhibit L |

| — |

| Form of Insurance Provider Notification |

Exhibit M |

| — |

| Form of Blocked Account Agreement |

Exhibit N |

| — |

| Form of Coinstar Notification |

Exhibit O |

| — |

| Form of DDA Notification |

Exhibit P-1 |

| — |

| Form of Priority of Claims Waiver (Landlord) |

Exhibit P-2 |

|

|

| Form of Priority Claims Waiver (Bailee) |

Exhibit Q-1 |

|

|

| Form of Mortgage |

Exhibit Q-2 |

|

|

| Form of Mortgage (Principal Properties) |

Exhibit R |

|

|

| Form of New Borrower Joinder Agreement |

AMENDED AND RESTATED CREDIT AGREEMENT

AMENDED AND RESTATED CREDIT AGREEMENT (this “Agreement”) dated as of December 27, 2007, among

THE GREAT ATLANTIC & PACIFIC TEA COMPANY, INC., a Maryland corporation;

the other BORROWERS party hereto,

the LENDERS party hereto, and

BANK OF AMERICA, N.A., a national banking association, as Administrative Agent and Collateral Agent.

W I T NE S S E T H

WHEREAS, the Borrowers have entered into a Credit Agreement dated as of December 3, 2007 with Bank of America, N.A., as Administrative Agent and Collateral Agent for the Lenders party thereto and such Lenders (as amended and in effect, the “Existing Credit Agreement”); and

WHEREAS, the Borrowers, the Agent and the Lenders desire to amend and restate the Existing Credit Agreement as set forth herein.

NOW, THEREFORE, the parties hereto agree that the Existing Credit Agreement shall be amended and restated in its entirety to read as follows:

ARTICLE I

Definitions

SECTION 1.01 Defined Terms. As used in this Agreement, the following terms have the meanings specified below:

“ABR”, when used in reference to any Loan or Borrowing, refers to whether such Loan, or the Loans comprising such Borrowing, are bearing interest at a rate determined by reference to the Alternate Base Rate.

“Act” has the meaning set forth in Section 9.14.

“Additional Availability Amount” shall mean the sum of (a) the product of (i) 15% (or such lesser rate as determined from time to time by the Administrative Agent in its commercially reasonable discretion in accordance with Section 1.05) and (ii) the Appraised Value of all Eligible Real Estate (other than Eligible Real Estate consisting of the Principal Properties), plus (b) the product of (i) 15% (or such lesser rate as determined from time to time by the Administrative Agent in its commercially reasonable discretion in accordance with Section 1.05) and (ii) the Appraised Value of all Principal Properties; plus (c) during the period commencing on the Restatement Effective Date and ending on and including November 30, 2009, the lesser of

(x) the Term A-2 Leasehold Cap and (y) the product of (i) the Leasehold Advance Rate (or such lesser rate as determined from time to time by the Administrative Agent in its commercially reasonable discretion in accordance with Section 1.05) and (ii) the Appraised Value of all Eligible Leaseholds.

“Additional Commitment Lender” has the meaning set forth in Section 2.02(a).

“Adjusted LIBO Rate” means, for any Interest Period, an interest rate per annum (rounded upwards, if necessary, to the next 1/16 of 1%) equal to (a) the LIBO Rate for such Interest Period multiplied by (b) the Statutory Reserve Rate.

“Administrative Agent” means Bank of America, N.A., in its capacity as administrative agent for the Lenders hereunder, together with its successors and assigns.

“Administrative Questionnaire” means an Administrative Questionnaire in a form supplied by the Administrative Agent.

“Affected LIBOR Loans” has the meaning set forth in Section 2.11(k).

“Affiliate” means, with respect to a specified Person, another Person that directly, or indirectly through one or more intermediaries, Controls or is Controlled by or is under common Control with the Person specified.

“Agent” means each of the Administrative Agent and the Collateral Agent.

“Agent’s Account” has the meaning set forth in Section 5.14(f).

“Agreement” has the meaning set forth in the preamble hereto.

“Aggregate Commitments” means the sum of the Aggregate Tranche A Commitments of all the Tranche A Lenders, the Aggregate Tranche A-1 Commitments of all the Tranche A-1 Lenders, the Aggregate Term Outstandings of all Term Lenders, and the Aggregate Term A-2 Outstandings of all Term A-2 Lenders. As of the Restatement Effective Date, the Aggregate Commitments are $675,000,000.

“Aggregate Revolving Commitments” means, collectively, the Aggregate Tranche A Commitments and the Aggregate Tranche A-1 Commitments.

“Aggregate Term A-2 Outstandings” means, at any time, the aggregate outstanding principal balance of the Term A-2 Loans of all Term A-2 Lenders at such time. As of the Restatement Effective Date, the Aggregate Term A-2 Outstandings are $50,000,000.

“Aggregate Term Outstandings” means, at any time, the aggregate outstanding principal balance of the Term Loans of all Term Lenders at such time. As of the Restatement Effective Date, the Aggregate Term Outstandings are $82,900,000.

“Aggregate Tranche A Commitments” means, at any time, the sum of the Tranche A Commitments at such time. As of the Restatement Effective Date, the Aggregate Tranche A Commitments are $502,100,000.

“Aggregate Tranche A-1 Commitments” means, at any time, the sum of the Tranche A-1 Commitments at such time. As of the Restatement Effective Date, the Aggregate Tranche A-1 Commitments are $40,000,000.

“Alternate Base Rate” means, for any day, a rate per annum equal to the greatest of (a) the Prime Rate in effect on such day, (b) the Federal Funds Effective Rate in effect on such day plus one-half of one percent (0.50%). Any change in the Alternate Base Rate due to a change in the Prime Rate or the Federal Funds Effective Rate shall be effective from and including the effective date of such change in the Prime Rate or the Federal Funds Effective Rate, respectively.

“Applicable Law” means as to any Person, all statutes, rules, regulations, orders, or other requirements having the force of law and applicable to such Person, and all court orders and injunctions, and/or similar rulings and applicable to such Person, in each case of or by any Governmental Authority, or court, or tribunal which has jurisdiction over such Person, or any property of such Person.

“Applicable Margin” means, for any Interest Payment Date with respect to a particular Type of Loan, (a) from and after the Restatement Effective Date through March 31, 2008, the percentages set forth in Level 3 of the applicable pricing grid below; and (b) thereafter, the applicable rate per annum set forth in the applicable pricing grid below based upon the Average Daily Excess Availability during the immediately preceding fiscal quarter:

(a) If Eligible Leaseholds are included in the Tranche A Borrowing Base and the Tranche A-1 Borrowing Base:

Level |

| Average |

| ABR |

| Applicable A and |

| ABR |

| Applicable |

| Applicable |

| ABR |

| Tranche |

| Tranche |

|

1 |

| Greater than or equal to $400,000,000 |

| 0.75 | % | 2.00 | % | 1.75 | % | 3.25 | % | 5.25 | % | 3.75 | % | 0.25 | % | 0.50 | % |

2 |

| Greater than or equal to $200,000,000 but less than $400,000,000 |

| 0.75 | % | 2.25 | % | 2.00 | % | 3.50 | % | 5.25 | % | 3.75 | % | 0.25 | % | 0.50 | % |

3 |

| Less than $200,000,000 |

| 1.00 | % | 2.50 | % | 2.25 | % | 3.75 | % | 5.25 | % | 3.75 | % | 0.25 | % | 0.375 | % |

(b) If Eligible Leaseholds are not included in the Tranche A Borrowing Base and the Tranche A-1 Borrowing Base:

Level |

| Average |

| ABR |

| Applicable |

| ABR |

| Applicable |

| Applicable (Term A-2 |

| ABR Loan) |

| Tranche |

| Tranche |

|

1 |

| Greater than or equal to $400,000,000 |

| 0.50 | % | 1.75 | % | 1.75 | % | 3.25 | % | 5.25 | % | 3.75 | % | 0.25 | % | 0.50 | % |

2 |

| Greater than or equal to $200,000,000 but less than $400,000,000 |

| 0.50 | % | 2.00 | % | 2.00 | % | 3.50 | % | 5.25 | % | 3.75 | % | 0.25 | % | 0.50 | % |

3 |

| Less than $200,000,000 |

| 0.75 | % | 2.25 | % | 2.25 | % | 3.75 | % | 5.25 | % | 3.75 | % | 0.25 | % | 0.375 | % |

Except as provided in the following sentence, the Applicable Margin shall be adjusted quarterly as of the first day of each fiscal quarter of the Company commencing April 1, 2008, based upon the Average Daily Excess Availability for the immediately preceding fiscal quarter. Upon the occurrence and during the continuance of an Event of Default, at the election of the Required Lenders, interest shall be determined in the manner set forth in Section 2.13(c).

“Applicable Percentage” means (a) with respect to each Credit Extension under the Tranche A Commitments, the Tranche A Applicable Percentage, (b) with respect to each Credit Extension under the Tranche A-1 Commitments, the Tranche A-1 Applicable Percentage, (c) with respect to the Term Loan, the Term Applicable Percentage (d) with respect to the Term A-2 Loan, the Term A-2 Applicable Percentage and (e) with respect to each Lender, that percentage of the Aggregate Commitments of all Lenders hereunder to make Credit Extensions to the Borrowers, in each case as the context provides. If any of the Tranche A Commitments or Tranche A-1 Commitments have terminated or expired, the Applicable Percentage with respect to such Commitments shall be determined based upon such Commitments as most recently in effect.

“Appraised Value” means (a) with respect to the Borrowers’ Eligible Inventory, the net appraised orderly liquidation value (which is expressed as a percentage of Cost) of the Borrowers’ Eligible Inventory as set forth in the Borrowers’ inventory stock ledger or (b) with respect to the Borrowers’ Scripts, the orderly liquidation value of the Borrowers’ Scripts as set forth in the most recent appraisal of the Borrowers’ Scripts conducted by an independent appraiser reasonably satisfactory to the Administrative Agent or (c) with respect to the Borrowers’ Eligible Real Estate, the fair market value of the Borrowers’ Eligible Real Estate as set forth in the most recent appraisal of the Borrowers’ Eligible Real Estate conducted by an

independent appraiser reasonably satisfactory to the Administrative Agent, which appraisal shall assume, among other things, a marketing time of not greater than twelve (12) months or less than three (3) months or (d) with respect to the Borrowers’ Eligible Leaseholds, the forced liquidation value of the Borrowers’ Eligible Leaseholds as set forth in the most recent appraisal of the Borrowers’ Eligible Leaseholds conducted by an independent appraiser reasonably satisfactory to the Administrative Agent, which appraisal shall assume, among other things, a marketing time of not greater than twelve (12) months or less than three (3) months; provided that the Appraised Value of Eligible Real Estate and Eligible Leaseholds shall in no event exceed the maximum amount of the Obligations at any time specified to be secured by a Mortgage thereon.

“Approved Fund” means any Fund that is administered or managed by (a) a Lender, (b) an Affiliate of a Lender or (c) an entity or an Affiliate of an entity that administers or manages a Lender.

“Asset Swap” means any transaction or series of related transactions pursuant to which the Borrowers or one or more of the Subsidiaries shall exchange, with a Person not a Subsidiary, one or more stores or facilities owned by them for one or more stores or facilities owned by third parties where no more than 10% of the aggregate consideration delivered by the Borrowers and the Subsidiaries shall consist of consideration other than the stores and facilities being so exchanged.

“Assignee Group” means two or more Eligible Assignees that are Affiliates of one another or two or more Approved Funds managed by the same investment advisor.

“Assignment and Acceptance” means an assignment and acceptance entered into by a Lender and an assignee (with the consent of any party whose consent is required by Section 9.04), and accepted by the Administrative Agent, in the form of Exhibit A or any other form approved by the Administrative Agent.

“Availability Period” means the period from and including the Effective Date to the earliest of (a) the Maturity Date, (b) the date of termination of the Aggregate Revolving Commitments pursuant to Section 7.02, and (c) the date of termination of the Aggregate Revolving Commitments pursuant to Section 2.09.

“Availability Reserves” means such reserves as the Administrative Agent from time to time determines in the Administrative Agent’s reasonable credit judgment as being appropriate (a) to reflect the impediments to the Agents’ ability to realize upon the Collateral or (b) to reflect costs, expenses and other amounts that the Agents may incur or be required to pay to realize upon the Collateral. Availability Reserves may include (but are not limited to) reserves based on (i) the aggregate dollar amount represented by gift certificates then outstanding and entitling the holder thereof to use all or a portion thereof to pay all or a portion of the purchase price for any Inventory as of such day, (ii) the Reserve for Leasehold Obligations, (iii) the PACA/PASA Liability Reserve (to the extent Inventory subject to PACA or PASA is included in the Tranche A Borrowing Base or the Tranche A-1 Borrowing Base), (iv) the maximum aggregate amount (giving effect to any netting agreements) that the Company and its Subsidiaries would be required to pay under any Hedging Agreements secured by the Security Documents the obligations under which constitute Obligations if such Hedging Agreements were terminated,

determined as of the most recent date for which financial statements have been delivered pursuant to Section 5.01(a), (b) or (c), (v) outstanding Taxes and other governmental charges, including, ad valorem, real estate, personal property, sales, and other Taxes (in each case to the extent such Taxes or other governmental charges are due and payable (except if being contested in good faith in appropriate proceedings and for which adequate reserves have been taken) and entitle any Person to a Lien on any Collateral that has priority over, or is otherwise superior in right to, the Lien in such Collateral Agent for the benefit of the Secured Parties), (vi) Cash Management Reserves, (vii) Bank Products Reserves, and (viii) Realty Reserves. Provided no Default or Event of Default has occurred and is continuing, the Administrative Agent shall give the Borrowers ten (10) days pr ior notice of the imposition of any Availability Reserve not described in clauses (i) through (viii) above.

“Average Daily Excess Availability” means, for any period, the average daily Excess Availability for such period.

“Bank of America” means Bank of America, N.A. and its successors.

“Bank Products” means any services or facilities provided to any Loan Party by any Lender or any of its Affiliates (but excluding Cash Management Services) on account of, without limitation, (a) Hedging Agreements, (b) purchase cards, and (c) leasing.

“Bank Product Reserves” means such reserves as the Administrative Agent from time to time determine in its discretion as being appropriate to reflect the liabilities and obligations of the Loan Parties with respect to Bank Products then provided or outstanding.

“Blocked Account Agreement” means with respect to an account established by a Loan Party, an agreement, in form and substance satisfactory to the Collateral Agent, establishing Control (as defined in the Security Agreement) of such account by the Collateral Agent and whereby the bank maintaining such account agrees, upon the occurrence and during the continuance of a Triggering Event, to comply only with the instructions originated by the Collateral Agent without the further consent of any Loan Party.

“Blocked Accounts” has the meaning set forth in Section 5.14(d).

“Board” means the Board of Governors of the Federal Reserve System of the United States of America.

“Borrowers” means the Company, Compass Foods, Inc., Shopwell, Inc., Waldbaum, Inc., Super Fresh Food Markets, Inc., Super Market Service Corp., Super Fresh/Sav-A-Center, Inc., Hopelawn Property I, Inc., Lo-Lo Discount Stores, Inc., Food Basics, Inc., Tradewell Foods of Conn., Inc., Pathmark Stores, Inc., APW Supermarkets, Inc., McLean Avenue Plaza Corp., Superplus Food Warehouse, Inc., Bridge Stuart Inc., East Brunswick Stuart LLC, Plainbridge LLC, Upper Darby Stuart, LLC, Bergen Street Pathmark, Inc., Lancaster Pike Stuart, LLC, AAL Realty Corp., and MacDade Boulevard Stuart, LLC.

“Borrowing” means (i) a group of Loans of the same Type, made, converted or continued on the same date and, in the case of LIBOR Loans, as to which a single Interest Period is in effect or (ii) a Swingline Loan.

“Borrowing Base Certificate” means a certificate substantially in the form of Exhibit B hereto (with such changes therein as may be required by the Administrative Agent to reflect the components of and reserves against the Tranche A Borrowing Base and the Tranche A-1 Borrowing Base as provided for hereunder from time to time), executed and certified as accurate and complete by a Financial Officer of the Company which shall include appropriate exhibits, schedules, supporting documentation, and additional reports (i) as outlined in Schedule 1 to Exhibit B and (ii) as reasonably requested by the Administrative Agent.

“Borrowing Request” means a request by a Borrower for a Borrowing in accordance with Section 2.04.

“Business Day” means any day that is not a Saturday, Sunday or other day on which commercial banks in Boston, Massachusetts or New York, New York are authorized or required by law to remain closed; provided that, when used in connection with a LIBOR Loan, the term “Business Day” shall also exclude any day on which banks are not open for dealings in dollar deposits in the London interbank market.

“Capital Lease Obligations” of any Person means the obligations of such Person to pay rent or other amounts under any lease of (or other arrangement conveying the right to use) real or personal property, or a combination thereof, which obligations are required to be classified and accounted for as liabilities on a balance sheet of such Person under GAAP, and the amount of such obligations shall be the capitalized amount thereof determined in accordance with GAAP.

“Cash and Cash Equivalents” means:

(a) Dollars;

(b) securities issued or directly and fully guaranteed or insured by the United States of America or any agency or instrumentality of the United States of America (provided that the full faith and credit of the United States of America is pledged in support of those securities) having maturities of not more than one year from the date of acquisition;

(c) obligations issued or fully guaranteed by any state of the United States of America or any political subdivision of any such state or province or any instrumentality thereof maturing within one year from the date of acquisition and having a rating of either “A” or better from S&P, A2 or better from Moody’s;

(d) certificates of deposit and eurodollar time deposits with maturities of one year or less from the date of acquisition, banker’s acceptances with maturities not exceeding one year and overnight bank deposits, in each case, with any Lender or with any United States commercial bank having capital and surplus in excess of $300,000,000;

(e) repurchase obligations with a term of not more than seven days for underlying securities of the types described in clauses (2), (3), and (4) above entered into with any financial institution meeting the qualifications specified in clause (4) above;

(f) commercial paper rated at least “P-2” by Moody’s, at least “A-2” by S&P and in each case maturing within one year after the date of acquisition; and

(g) money market funds that are SEC.270.2a-7 compliant or enhanced cash funds having a weighted average maturity of not greater than 120 days.

“Cash Receipts” has the meaning set forth in Section 5.14(f).

“Cash Management Reserves “ means such reserves as the Administrative Agent, from time to time, determines in its discretion as being appropriate to reflect the reasonably anticipated liabilities and obligations of the Loan Parties with respect to Cash Management Services then provided or outstanding.

“Cash Management Services” means any one or more of the following types or services or facilities provided to any Loan Party by any Lender or any of its Affiliates (a) ACH transactions, (b) cash management services, including, without limitation, controlled disbursement services, treasury, depository, overdraft, and electronic funds transfer services, (c) foreign exchange facilities, and (d) credit or debit cards.

“Change in Control” means, at any time, (a) the board of directors of the Company shall cease to consist of a majority of the Continuing Directors, or (b) any person or group (within the meaning of Sections 13(d) and 14(d) of the Securities and Exchange Act of 1934, as amended) other than a Permitted Holder shall acquire a majority of the voting power represented by the Company’s outstanding capital stock entitled to vote in the election of directors of the Company.

“Change in Law” means (a) the adoption of any law, rule or regulation after the date of this Agreement, (b) any change in any law, rule or regulation or in the interpretation or application thereof by any Governmental Authority after the date of this Agreement or (c) compliance by any Lender or the Issuing Bank (or, for purposes of Section 2.15(b), by any lending office of such Lender or by such Lender’s or such Issuing Bank’s holding company, if any) with any request, guideline or directive (whether or not having the force of law) of any Governmental Authority made or issued after the date of this Agreement.

“Charges” has the meaning set forth in Section 9.13.

“Code” means the Internal Revenue Code of 1986, as amended from time to time.

“Coinstar Advance Rate” means 85%.

“Coinstar Installation Agreements” means that certain Coinstar Installation Agreement, dated April 29, 2002 (as the same may be amended, supplemented and otherwise modified from time to time with the prior written consent of the Administrative Agent), between the Company and Coinstar, Inc., together with each other installation agreement between the Company (or any of its Subsidiaries) and Coinstar, Inc. in form and substance satisfactory to the Administrative Agent.

“Coinstar Notification” has the meaning set forth in Section 5.14(d).

“Coinstar Receivable” means each “Account” (as defined in the UCC ) together with all income, payments and proceeds thereof due and owing to the Company (or any of its Subsidiaries) by Coinstar, Inc., pursuant to any contract between the Company (or any of its

Subsidiaries) and Coinstar, Inc., including but not limited to the Coinstar Installation Agreements.

“Collateral” means any and all “Collateral” or “Mortgaged Property”, as defined in any applicable Security Document.

“Collateral Agent” means Bank of America, N.A., in its capacity as collateral agent for the Secured Parties under the Security Documents.

“Commercial Letter of Credit” means any letter of credit or similar instrument (including, without limitation, banker’s acceptances) issued for the purpose of providing credit support in connection with the purchase of any materials, goods or services by a Borrower in the ordinary course of business of such Borrower.

“Commitment” means, with respect to each Lender, its Tranche A Commitment, its Tranche A-1 Commitment, its Term Commitment and its Term A-2 Commitment.

“Commitment Increase” has the meaning set forth in Section 2.02(a).

“Commitment Increase Date” has the meaning set forth in Section 2.02(c).

“Company” means The Great Atlantic & Pacific Tea Company, Inc., a Maryland corporation.

“Continuing Directors” means directors of the Company who are in office on the Effective Date and each other director, whose nomination for election to the board of directors of the Company is recommended by a majority of the then Continuing Directors or a Permitted Holder.

“Control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of a Person, whether through the ability to exercise voting power, by contract or otherwise. “Controlling” and “Controlled” have meanings correlative thereto.

“Convertible Notes” means collectively, the Company’s Convertible Senior Notes issued on December 18, 2007 in the aggregate principal amount of $420,000,000 to refinance the Bridge Financing Facility (as defined in the Existing Credit Agreement). The Convertible Notes shall be deemed Indebtedness under this Agreement (and not Equity Interests) unless and until such securities are converted into or exchanged for shares of capital stock of the Company.

“Cost” means the cost of purchases as reported on the Borrowers’ stock ledger, based upon the Borrowers’ accounting practices, which practices are in effect on the Effective Date or thereafter consented to by the Administrative Agent. “Cost” does not include inventory capitalization costs or other non-purchase price charges (such as deferred freight) used in the Borrowers’ calculation of cost of goods sold.

“Credit Card Notification” has the meaning set forth in Section 5.14(d).

“Credit Card Receivables” means each “Account” (as defined in the UCC) together with all income, payments and proceeds thereof, owed by a major credit or debit card issuer (including, but not limited to, Visa, Mastercard and American Express and such other issuers approved by the Administrative Agent) to a Loan Party resulting from charges by a customer of a Loan Party on credit or debit cards issued by such issuer in connection with the sale of goods by a Loan Party, or services performed by a Loan Party, in each case in the ordinary course of its business.

“Credit Extension” mean (a) a Borrowing or (b) an L/C Credit Extension.

“Credit Party” or “Credit Parties” means (a) individually, (i) each Lender and its Affiliates, (ii) each Agent, (iii) the Issuing Bank, (iv) the Lead Arranger, (v) each beneficiary of each indemnification obligation undertaken by any Loan Party under any Loan Document, (vi) any other Person to whom Obligations under this Agreement and other Loan Documents are owing, and (vii) the successors and assigns of each of the foregoing, and (b) collectively, all of the foregoing.

“Currency and Commodity Hedging Agreement” means any foreign currency exchange agreement, commodity price protection agreement or other currency exchange rate or commodity price hedging arrangement.

“DDAs” means any checking, savings or other demand deposit account maintained by a Loan Party.

“DDA Notification” has the meaning set forth in Section 5.14(d).

“Declining Lender” has the meaning set forth in Section 2.11(p).

“Default” means any event or condition which constitutes an Event of Default or which upon notice, lapse of time or both would, unless cured or waived, become an Event of Default.

“Delinquent Lender” has the meaning set forth in Section 8.14(a).

“Disbursement Accounts” has the meaning set forth in Section 5.14(i).

“Disclosed Matters” means the actions, suits and proceedings and the environmental matters disclosed in Schedule 3.06.

“Distribution Center Shrink Percentage” shall be applicable to Inventory located at the Distribution Centers and shall mean, at the end of each fiscal quarter, average shrink expressed in terms of cost value resulting from the physical inventories performed at each Distribution Center during the two (2) fiscal quarters ending on such date, expressed as a percentage of the cost value of Inventory.

“Distribution Center Shrink Reserve” shall be equal to the product of (a) the excess of the Distribution Center Shrink Percentage over 1%, multiplied by (b) Inventory at the Distribution Centers as of the date of the most recent Borrowing Base Certificate.

“Distribution Centers” means (i) the warehouse facilities operated by the Loan Parties on the date hereof as set forth in Schedule B and (ii) any warehouse facility located in the United States and operated by Loan Parties that is designated as a Distribution Center by (a) giving 30 days prior written notice to the Administrative Agent and (b) effecting the execution, filing and recordation of such financing statements, the delivery of such Priority of Claims Waivers as required hereby and taking any and all such further actions as may be reasonably requested by the Administrative Agent.

“Dollars” and the symbol “$” mean the lawful currency of the United States.

“Effective Date” means December 3, 2007.

“Eligible Assignee” means (a) a Lender or any Affiliate of a Lender; (b) an Approved Fund; and (c) any other Person having a combined capital and surplus in excess of $500,000,000 approved by (i) the Administrative Agent, the Issuing Bank and the Swingline Lender, and (ii) unless an Event of Default has occurred and is continuing, the Company (each such approval under clauses (i) and (ii) not to be unreasonably withheld or delayed); provided that notwithstanding the foregoing, “Eligible Assignee” shall not include a natural person or a Loan Party or any of the Loan Parties’ Affiliates or Subsidiaries.

“Eligible Coinstar Receivables” means, at the time of any determination thereof, each Coinstar Receivable that satisfies the following criteria at the time of creation and continues to meet the same at the time of such determination: such Coinstar Receivable (i) has been earned and represents the bona fide amounts due to the Company or another Loan Party from Coinstar, Inc. and in each case originated in the ordinary course of business of the Company or another Loan Party and (ii) is not ineligible for inclusion in the calculation of the Tranche A Borrowing Base or Tranche A-1 Borrowing Base pursuant to any of clauses (a) through (i) below. Without limiting the foregoing, to qualify as Eligible Coinstar Receivable, an Account shall indicate no Person other than the Company or another Loan Party (other than an Excluded Subsidiary) as payee or remit tance party. In determining the amount to be so included, the face amount of an Account shall be reduced by, without duplication, to the extent not reflected in such face amount, (i) the amount of all accrued and actual discounts, claims, credits or credits pending, promotional program allowances, price adjustments, finance charges or other allowances (including any amount that the Company or another Loan Party, as applicable, may be obligated to rebate to a customer) and (ii) the aggregate amount of all cash received in respect of such Account but not yet applied by the Company or another Loan Party to reduce the amount of such Coinstar Receivable. Any Coinstar Receivables meeting the foregoing criteria shall be deemed Eligible Coinstar Receivables but only as long as such Coinstar Receivable is not included in any material respect within any of the following categories, in which case such Coinstar Receivable shall not constitute an Eligible Conistar Receivable:

(a) such Coinstar Receivable is not owned by the Company or another Loan Party, (other than an Excluded Subsidiary) and the Company or another Loan Party (other than an Excluded Subsidiary) does not have good or marketable title to such receivable free and clear of any Lien of any Person other than the Collateral Agent;

(b) such Coinstar Receivable does not constitute an “Account” (as defined in the UCC) or such receivables have been outstanding for more than ten (10) Business Days;

(c) either the Company (or the applicable Loan Party) or Coinstar, Inc. is the subject of any bankruptcy or insolvency proceedings;

(d) such Coinstar Receivable is not a valid, legally enforceable obligation of Coinstar, Inc.;

(e) such Coinstar Receivable is not subject to a properly perfected first priority security interest in favor of the Collateral Agent, or is not in form and substance reasonably satisfactory to the Administrative Agent, or is subject to any Lien whatsoever (other than the Lien of the Collateral Agent);

(f) such Coinstar Receivable otherwise does not conform to all representations, warranties, covenants and agreements in the Loan Documents relating to receivables;

(g) Coinstar, Inc. has not received the Coinstar Notification in accordance with the provisions of Section 5.14(d);

(h) such Coinstar Receivable does not meet such other usual and customary eligibility criteria for receivables as the Administrative Agent may determine from time to time in its commercially reasonable discretion; or

(i) such Coinstar Receivable is evidenced by “chattel paper” or an “instrument” of any kind unless such “chattel paper” or “instrument” is in the possession of the Collateral Agent, and to the extent necessary or appropriate, endorsed to the Collateral Agent.

“Eligible Credit Card Accounts Receivable” means at the time of any determination thereof, each Credit Card Receivable that satisfies the following criteria at the time of creation and continues to meet the same at the time of such determination: such Credit Card Receivable (i) has been earned and represents the bona fide amounts due to the Company or another Loan Party from a credit card payment processor and/or credit card issuer, and in each case originated in the ordinary course of business of the Company and the related Loan Party and (ii) is not ineligible for inclusion in the calculation of the Tranche A Borrowing Base or the Tranche A-1 Borrowing Base pursuant to any of clauses (a) through (j) below. Without limiting the foregoing, to qualify as an Eligible Credit Card Accounts Receivable, an Account shall indicate no Person other than the Comp any or the related Loan Party (other than an Excluded Subsidiary) as payee or remittance party. In determining the amount to be so included, the face amount of an Account shall be reduced by, without duplication, to the extent not reflected in such face amount, (i) the amount of all accrued and actual discounts, claims, credits or credits pending, promotional program allowances, price adjustments, finance charges or other allowances (including any amount that the Company or the related Loan Party, as applicable, may be obligated to rebate to a customer, a credit card payment processor, or credit card issuer pursuant to the terms of any agreement or understanding (written or oral)) and (ii) the aggregate amount of all cash received in respect of such Account but not yet applied by the Company or the related Loan Party to reduce the amount of such Credit Card Receivable. Any Credit Card Receivables meeting the foregoing criteria shall be deemed Eligible Credit Card Receivables but only as long as such

Credit Card Receivable is not included in any material respect within any of the following categories, in which case such Credit Card Receivable shall not constitute an Eligible Credit Card Receivable:

(a) such Credit Card Receivable is not owned by a Loan Party (other than an Excluded Subsidiary) and such Loan Party does not have good or marketable title to such Credit Card Receivable free and clear of any Lien of any Person other than the Collateral Agent;

(b) such Credit Card Receivable does not constitute an “Account” (as defined in the UCC) or such Credit Card Receivable has been outstanding for more than seven (7) business days;

(c) the issuer or payment processor of the applicable credit card with respect to such Credit Card Receivable is the subject of any bankruptcy or insolvency proceedings;

(d) such Credit Card Receivable is not a valid, legally enforceable obligation of the applicable issuer with respect thereto;

(e) such Credit Card Receivable is not subject to a properly perfected first priority security interest in favor of the Collateral Agent, or is not in form and substance reasonably satisfactory to the Administrative Agent, or is subject to any Lien whatsoever other than Permitted Encumbrances contemplated by the credit card processor agreements and for which appropriate reserves (as determined by the Administrative Agent) have not been established or maintained by the Borrowers;

(f) the Credit Card Receivable does not conform to all representations, warranties or other provisions in the Loan Documents relating to Credit Card Receivables;

(g) such Credit Card Receivable is owed by a Person that has not received a Credit Card Notification in accordance with the provisions of Section 5.14(d);

(h) such Credit Card Receivable is subject to risk of set-off, non-collection or not being processed due to unpaid and/or accrued credit card processor fee balances, limited to the lesser of the balance of Credit Card Receivable or unpaid credit card processor fees;

(i) such Credit Card Receivable is evidenced by “chattel paper” or an “instrument” of any kind unless such “chattel paper” or “instrument” is in the possession of the Collateral Agent, and to the extent necessary or appropriate, endorsed to the Collateral Agent; or

(j) such Credit Card Receivable does not meet such other usual and customary eligibility criteria for Credit Card Receivables as the Administrative Agent may determine from time to time in its commercially reasonable discretion.

“Eligible Inventory” means, at the time of any determination thereof the Inventory of the Company or a Loan Party at the time of such determination that is not ineligible for inclusion in the Tranche A Borrowing Base or the Tranche A-1 Borrowing Base pursuant to any of the clauses (a) through (o) below. Without limiting the foregoing, to qualify as Eligible Inventory no Person other than the Company or a Loan Party (other than an Excluded Subsidiary) shall

have any direct or indirect ownership, interest or title to such Inventory and no Person other than the Company or a Loan Party (other than an Excluded Subsidiary), shall be indicated on any purchase order or invoice with respect to such Inventory as having or purporting to have an interest therein. Any Inventory meeting the foregoing criteria shall be deemed Eligible Inventory but only as long as such Inventory is not included in any material respect within any of the following categories, in which case such Inventory shall not constitute an Eligible Inventory:

(a) it is located at a reclamation center of any Distribution Center or is otherwise held at any Distribution Center for return to vendor;

(b) it is supplies, packaging, selling or display materials;

(c) it is produce, floral, seafood, meat, bakery, dairy, deli, or fuel (provided that fuel in an aggregate amount not to exceed $1,000,000 may be deemed eligible inventory for purposes of calculating the Tranche A Borrowing Base and the Tranche A-1 Borrowing Base);

(d) it is not owned solely by the Company or any other Loan Party or is owned by an Excluded Subsidiary;

(e) it is on consignment to the Company or any other Loan Party;

(f) it is not located at property that is owned or leased by the Company or any other Loan Party or is in transit from vendors to such a property; provided that (I) Inventory in third party storage facilities located in jurisdictions other than Priming Jurisdictions shall, if not otherwise excluded, be included as Eligible Inventory, minus any claims or Liens, other than Permitted Encumbrances, that vendors, landlords, public warehouse operators or any third party bailee may have against such property, from time to time, and (II) Inventory located in Priming Jurisdictions shall not be included in Eligible Inventory pursuant to this paragraph (f) unless either (A) the applicable vendor, landlord, public warehouse or any third party bailee has provided to the related Loan Party a Priority of Claims Waiver in form and substance reasonably satisfactory to the Administrative Agent, or (B)(i) the Borrowers have deposited with the Collateral Agent collateral consisting of Cash and Cash Equivalents an amount equal to the Reserve for Leasehold Obligations (as applicable) with respect to such property or (ii) the Administrative Agent has established an appropriate Reserve for Leasehold Obligations, or (C) Borrowers’ obligations to such vendor, landlord, public warehouse or third party bailee are supported by a standby letter of credit issued by a Lender pursuant to this Agreement in an amount at least equal to the Reserve for Leasehold Obligations;

(g) it is not located in the United States of America;

(h) it is not subject to a perfected first priority Lien in favor of the Collateral Agent securing the Obligations, regardless of its location, other than Permitted Encumbrances;

(i) it (i) is damaged, defective, “seconds,” or otherwise unmerchantable, (ii) is to be returned to the vendor, (iii) is not in good condition, (iv) does not meet all standards imposed by any Governmental Authority having regulatory authority over it, or (v) is not currently saleable in the normal course of business of the Company and the Subsidiaries;

(j) it is inventory located at any Distribution Center on such date that represents over 13 weeks old inventory based on date of receipt determined at an individual product level (provided that such inventory shall be eligible for purposes of calculating the Tranche A Borrowing Base and the Tranche A-1 Borrowing Base to the extent of fifty percent (50%) of the book value thereof);

(k) it is Inventory that is accounted for in both the Company’s Distribution Center and Store Inventory;

(l) it includes any profits or transfer price additions charged or accrued in connection with transfers of Inventory between the Company and its Subsidiaries or Affiliates;

(m) it is accounted for in the Store Shrink Reserve;

(n) it is accounted for in the Distribution Center Shrink Reserve; or

(o) it is accounted for in the Company’s reserve which adjusts Inventory valued under the Company’s historical retail method of accounting to actual cost value (product mix) or adjusts Inventory for unallocated earned allowances (net costing).

“Eligible Leaseholds” means any Real Estate meeting in all material respects the following criteria:

(a) A Loan Party (other than an Excluded Subsidiary) is the lessee under a Lease for such Real Estate, the terms and conditions of which are reasonably satisfactory to the Administrative Agent;

(b) Without limiting the provisions of clause (a), above, the Lease may be mortgaged and collaterally assigned to the Collateral Agent without the prior consent of the lessor (or if consent is required, such consent has been obtained on terms and conditions reasonably satisfactory to the Administrative Agent);

(c) Unless waived by the Administrative Agent, the Lease contains customary estoppels, cure rights, and other provisions protecting a leasehold mortgagee’s interests in the Lease as the Administrative Agent may determine in its commercially reasonable discretion or if not contained therein, such provisions have been included in a landlord agreement in form and substance reasonably satisfactory to the Administrative Agent. Notwithstanding the foregoing, all Leases upon which the Collateral Agent obtains a Mortgage on the Effective Date shall be deemed to have satisfied this requirement;

(d) The Loan Parties shall not be in default of the terms of the Lease and no event shall have occurred, or solely with the passage of time, giving of notice or both, would permit the lessor to terminate the Lease;

(e) The Collateral Agent shall have received evidence that all actions that the Collateral Agent may reasonably deem necessary or appropriate in order to create valid first and subsisting Liens (subject only to those Liens permitted by Section 6.02 hereof which have

priority over the Lien of the Collateral Agent by operation of Applicable Law or otherwise reasonably acceptable to the Administrative Agent) on the leasehold interest has been taken;

(f) The Administrative Agent shall have received an appraisal (based upon Appraised Value) of such leasehold interest complying with the requirements of FIRREA by a third party appraiser reasonably acceptable to the Administrative Agent and otherwise in form and substance reasonably satisfactory to the Administrative Agent; and

(g) The Real Estate Eligibility Requirements have been satisfied.

“Eligible Real Estate” means any Real Estate meeting in all material respects the following criteria:

(a) A Loan Party (other than an Excluded Subsidiary) owns such Real Estate in fee simple absolute;

(b) The Administrative Agent shall have received evidence that all actions that the Administrative Agent may reasonably deem necessary or appropriate in order to create valid first and subsisting Liens (subject only to those Liens permitted by Section 6.02 hereof which have priority over the Lien of the Collateral Agent by operation of Applicable Law or otherwise reasonably acceptable to the Administrative Agent) on the property described in the Mortgages has been taken.

(c) The Administrative Agent shall have received an appraisal (based upon Appraised Value) of such Real Estate complying with the requirements of FIRREA by a third party appraiser reasonably acceptable to the Administrative Agent and otherwise in form and substance reasonably satisfactory to the Administrative Agent; and

(d) The Real Estate Eligibility Requirements have been satisfied.

“Eligible Third Party Insurance Provider Accounts Receivable” means, at the time of any determination thereof, each third party insurance provider “Account” (as defined in the UCC) together with all income, payments and proceeds thereof, that satisfies the following criteria at the time of creation and continues to meet the same at the time of such determination: such Account (i) has been earned and submitted for reimbursement to, and represents the bona fide amounts due to the Company or other Loan Party (other than an Excluded Subsidiary) from, a third party insurance provider, in each case originated in the ordinary course of business of the Company or the related Loan Party and (ii) is not ineligible for inclusion in the calculation of the Tranche A Borrowing Base and the Tranche A-1 Borrowing Base pursuant to any of clauses (a) through (p)&nbs p;below. Without limiting the foregoing, to qualify as an Eligible Third Party Insurance Provider Accounts Receivable, a third party insurance provider account receivable shall indicate no Person other than the Company or the related Loan Party (other than an Excluded Subsidiary) as payee or remittance party. In determining the amount to be so included, the face amount of such an account shall be reduced by, without duplication, to the extent not reflected in such face amount, (i) the amount of all accrued and actual discounts, claims, credits or credits pending, promotional program allowances, price adjustments, finance charges or other allowances (including any amount that the Company or the

related Loan Party, as applicable, may be obligated to rebate to a third party insurance provider pursuant to the terms of any agreement or understanding (written or oral)) and (ii) the aggregate amount of all cash received in respect of such Account but not yet applied by the Company or the related Loan Party to reduce the amount of such Account. All third party insurance provider accounts receivable meeting the foregoing criteria shall be deemed Eligible Third Party Insurance Provider Accounts Receivable but only as long as such third party insurance provider account receivable is not included in any material respect within any of the following categories, in which case such third party insurance provider account receivable shall not constitute an Eligible Third Party Insurance Provider Accounts Receivable:

(a) an invoice (in form and substance satisfactory to the Administrative Agent) with respect to such third party insurance provider accounts receivable has not been sent to the applicable account debtor;

(b) such third party insurance provider accounts receivable does not constitute an “Account” (as defined in the UCC);

(c) such third party insurance provider accounts receivable are not due and payable in full, or are subject to any bill and hold arrangement, or more than 90 days have elapsed since the date of the sale of goods giving rise to such third party insurance provider accounts receivable;

(d) the aggregate amount of accounts due from third party insurance providers exceeds Fifteen Million Dollars ($15,000,000) for which more than 60 days but not more than 90 days have elapsed since the date of the sale of goods or rendering of services giving rise to such third party insurance provider accounts receivable;

(e) such third party insurance provider accounts receivable did not arise from the provision of goods authorized by a physician’s prescription, and such goods have been performed or provided;

(f) such third party insurance provider accounts receivable arose from the provision of durable medical equipment;

(g) such third party insurance provider accounts receivable (i) are not owned by a Loan Party and such Loan Party does not have good or marketable title to such third party insurance provider accounts receivable or (ii) are owned by an Excluded Subsidiary;

(h) such third party insurance provider accounts receivable are subject to any assignment, claim, lien, or security interest, except in favor of the Administrative Agent and the Lenders;

(i) such third party insurance provider accounts receivable are not subject to a properly perfected first priority security interest in favor of the Collateral Agent, or is not in form and substance reasonably satisfactory to the Administrative Agent, or is subject to any Lien whatsoever other than Permitted Encumbrances and for which appropriate reserves (as determined by the Administrative Agent) have not been established or maintained by the Borrowers;

(j) such third party insurance provider accounts receivable are not valid and legally enforceable obligations of the account debtor, are with recourse, or are subject to any claim for credit, defense, offset, chargeback, counterclaim or adjustment by the account debtor (other than any discount allowed for prompt payment and reconciliations in the ordinary course of business), and the assignment or pledging thereof violates any agreement to which the account debtor is subject;

(k) such third party insurance provider accounts receivable did not arise in the ordinary course of business of the Company and its Subsidiaries, or a notice of the bankruptcy, insolvency, failure, or suspension or termination of business of the account debtor has been received by the Company or the related Loan Party, or the payor thereunder shall have provided written notice to anyone of a challenge or dispute of its obligations thereunder;

(l) such third party insurance provider accounts receivable do not conform to all representations, warranties or other provisions of the Loan Documents relating to such third party insurance provider accounts receivable;

(m) such third party insurance provider accounts receivable are obligations payable under Medicare, Medicaid or any other governmental program or the related account debtor is any unit of government;

(n) such third party insurance provider accounts receivable is owed by a Person that has not received an Insurance Provider Notification in accordance with the provisions of Section 5.14(d);

(o) such third party insurance provider accounts receivable do not meet other usual and customary eligibility criteria for third party insurance provider accounts receivable, including the payors thereunder, as determined by the Administrative Agent in its commercially reasonable discretion; or

(p) such third party insurance provider accounts receivable is evidenced by “chattel paper” or an “instrument” of any kind unless such “chattel paper” or “instrument” is in the possession of the Collateral Agent, and to the extent necessary or appropriate, endorsed to the Collateral Agent.

“Environmental Compliance Reserve” means, with respect to Eligible Real Estate and Eligible Leaseholds, any reserve which the Agents, from time to time in their discretion establish for estimable amounts that are reasonably likely to be expended by any of the Loan Parties in order for such Loan Party and its operations and property (a) to comply with any notice from a Governmental Authority asserting non-compliance with Environmental Laws, or (b) to correct any such non-compliance with Environmental Laws or to provide for any Environmental Liability.

“Environmental Laws” means all laws, rules, regulations, codes, ordinances, orders, decrees, judgments, injunctions, or binding agreements issued, promulgated or entered into by any Governmental Authority, relating in any way to the pollution or protection of the environment or the preservation or reclamation of natural resources, including those relating to

the management, release or threatened release of any Hazardous Material, or to employee health and safety matters.

“Environmental Liability” means any liability, obligation, damage, loss, claim, action, suit, judgment, order, fine, penalty, fee, expense or cost, contingent or otherwise (including any liability for costs of environmental remediation, or natural resource damages, administrative oversight costs, and indemnities), of the Company or any Subsidiary arising under any Environmental Law resulting from or based upon (a) compliance or noncompliance with any Environmental Law, (b) the generation, use, handling, transportation, storage, treatment or disposal or presence of any Hazardous Materials, (c) exposure to any Hazardous Materials, (d) the release or threatened release of any Hazardous Materials into the environment or (e) any contract or agreement pursuant to which liability is assumed or imposed with respect to any of the foregoing.

“Equity Interests” means, as to any Person, all of the authorized shares of capital stock of (or other ownership or profit interests in) such Person, including all classes of common and preferred capital stock, all of the warrants, options or other rights for the purchase or acquisition from such Person of shares of capital stock of (or other ownership or profit interests in) such Person, all of the securities convertible into or exchangeable for shares of capital stock of (or other ownership or profit interests in) such Person or warrants, rights or options for the purchase or acquisition from such Person of such shares (or such other interests), and all of the other ownership or profit interests in such Person (including partnership, membership or trust interests therein), rights to receive distributions of cash and other property, and to receive allocations of items of incom e, gain, loss, deduction and credit and similar items from such Person, whether voting or nonvoting, whether or not such interests include rights entitling the holder thereof to exercise control over such Person, and whether or not such shares, warrants, options, rights or other interests are outstanding on any date of determination.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended from time to time.

“ERISA Affiliate” means any trade or business (whether or not incorporated) that, together with the Company, is treated as a single employer under Section 414(b) or (c) of the Code or, solely for purposes of Section 302 of ERISA and Section 412 of the Code, is treated as a single employer under Section 414 of the Code.

“ERISA Event” means (a) any “reportable event”, as defined in Section 4043 of ERISA or the regulations issued thereunder with respect to a Plan (other than an event for which the 30-day notice period is waived); (b) the existence with respect to any Plan of an “accumulated funding deficiency” (as defined in Section 412 of the Code or Section 302 of ERISA), whether or not waived; (c) the filing pursuant to Section 412(d) of the Code or Section 303(d) of ERISA of an application for a waiver of the minimum funding standard with respect to any Plan; (d) the incurrence by the Company or any of its ERISA Affiliates of any liability under Title IV of ERISA with respect to the termination of any Plan; (e) the receipt by the Company or any ERISA Affiliate from the PBGC or a plan administrator of any notice r elating to an intention to terminate any Plan or Plans or to appoint a trustee to administer any Plan; (f) the incurrence by the Company or any of its ERISA Affiliates of any liability with respect to the withdrawal or

partial withdrawal from any Plan or Multiemployer Plan; or (g) the receipt by the Company or any ERISA Affiliate of any notice, or the receipt by any Multiemployer Plan from the Company or any ERISA Affiliate of any notice, concerning the imposition of Withdrawal Liability or a determination that a Multiemployer Plan is, or is expected to be, insolvent or in reorganization, within the meaning of Title IV of ERISA.

“Event of Default” has the meaning set forth in Section 7.01.

“Excess Amount” has the meaning set forth in Section 2.06(d).

“Excess Availability” means, as of any date of determination thereof by the Administrative Agent, the result, if a positive number, of:

(a) The lesser of:

(i) the Tranche A-1 Borrowing Base (or if the Tranche A-1 Commitments have been terminated, the Tranche A Borrowing Base); or

(ii) the Aggregate Commitments;

minus

(b) The aggregate of the outstanding Credit Extensions.

In calculating Excess Availability at any time and for any purpose under this Agreement, the Company shall certify to the Administrative Agent that all accounts payable and Taxes are being paid on a timely basis and consistent with past practices (absent which the Administrative Agent may establish a reserve therefor).

“Exchange Act Filings” means all filings made by the Company pursuant to the Securities and Exchange Act of 1934, and the rules promulgated thereunder, since and including the annual report of the Company on Form 10-K for the fiscal year ended immediately prior to the date as of which representation and warranty is made or deemed to be made hereunder.

“Excluded Subsidiary” means each Subsidiary of the Company which (a) is affected by any event or circumstance referred to in any of Sections 7.01 (h), (i), (j), or (p) and (b) meets all the following conditions: (i) the Company’s direct and indirect investments in and advances to the Subsidiary is less than 1% of the total assets of the Company consolidated as of the end of the most recently completed fiscal year; (ii) the Company’s direct and indirect proportionate share of the total assets (after intercompany eliminations) of the Subsidiary is less than 1% of the total assets of the Company consolidated as of the end of the most recently completed fiscal year; and (iii) the Company’s direct and indirect equity in the income from continuing operations before income taxes, extraordinary items and cumulative effect of a change in accounting principle of the Subsidiary is less than 1% of such income of the Company consolidated for the most recently completed fiscal year; provided that, (A) all Excluded Subsidiaries shall be considered to be a single consolidated Subsidiary for purposes of determining whether the conditions specified in clauses (i), (ii) and (iii) above are satisfied and (ii) a Subsidiary shall not be an Excluded Subsidiary if such Subsidiary holds rights under any long-term contracts for the

purchase of inventory accounting for more than 5% of the total inventory purchased by the Company and its Subsidiaries during the most recently completed four fiscal quarters.

“Excluded Taxes” means, with respect to the Administrative Agent, any Lender (including for this purpose the Issuing Bank) or any other recipient of any payment to be made by or on account of any obligation of any Borrower hereunder, (a) taxes imposed on (or measured by) its net income, profits or overall gross income or receipts, and franchise or similar taxes, imposed by the United States of America, by a jurisdiction under the laws of which such recipient is organized or in which its principal office is located or, in the case of any Lender, in which its applicable lending office is located, or by any other jurisdiction with which the recipient has or had any other present or former connection (other than a connection arising solely from entering into, performing its obligations under, receiving a payment under or enforcing this Agreement or the other Loan Documents), ( b) any branch profits taxes imposed by the United States of America or any similar tax imposed by any jurisdiction described in clause (a) above, (c) in the case of a Non-U.S. Lender, any withholding tax that is imposed on amounts payable to such Non-U.S. Lender (A) pursuant to a Tax law in effect on the date such Non-U.S. Lender becomes a party hereto or a Participant through the purchase of a participation hereunder, the date such Non-U.S. Lender designates a new Lending Office, or, with respect to any additional position in any Obligation acquired after such Non-U.S. Lender becomes a party hereto, the date such additional position was acquired by such Non-U.S. Lender, or (B) is attributable to such Non-U.S. Lender’s failure or inability (other than as a result of a Change in Law occurring after the date such Non-U.S. Lender becomes a party to this Agreement, a Participant through the purchase of a participation hereunder, or with respect to any additional position in any Obli gation acquired after such Non-U.S. Lender becomes a party hereto, the date such additional position was acquired by such Non-U.S. Lender) to comply with Section 2.17(e), except, in each case described in clause (A) or (B), to the extent that such Non-U.S. Lender (or its assignor, if any) was entitled, at the time of designation of a new lending office, assignment or acquisition of such additional position in any Obligation (as applicable), to receive additional amounts from the Borrowers with respect to such withholding tax pursuant to Section 2.17, and (d) any U.S. federal, state or local backup withholding tax.

“Executive Order” has the meaning set forth in Section 9.15.

“Existing Credit Agreement” has the meaning set forth in the recitals hereto.

“Existing Letters of Credit” means each of the Letters of Credit issued by a Lender and outstanding on the Effective Date, as listed on Schedule 1.01(A).

“Exposure” means, at any time, the aggregate principal amount, without duplication, of outstanding Loans, Swingline Exposure, and L/C Exposure at such time. The Exposure of any Lender at any time shall be the sum of, without duplication, its L/C Exposure, plus its Swingline Exposure, plus the aggregate principal amount of its outstanding Loans at such time.

“Federal Funds Effective Rate” means, for any day, the weighted average (rounded upwards, if necessary, to the next 1/100 of 1%) of the rates on overnight Federal funds transactions with members of the Federal Reserve System arranged by Federal funds brokers, as published on the next succeeding Business Day by the Federal Reserve Bank of New York, or, if

such rate is not so published for any day that is a Business Day, the average (rounded upwards, if necessary, to the next 1/100 of 1%) of the quotations for such day for such transactions received by the Administrative Agent from three Federal funds brokers of recognized standing selected by it.

“Financial Officer” of any corporation means the chief financial officer, principal accounting officer, treasurer, controller or any vice president-finance, vice-president-financial services or vice-president -treasury services of such corporation.

“FIRREA” means the Financial Institutions Reform, Recovery and Enforcement Act of 1989, as amended from time to time.

“Foreign Assets Control Regulations” has the meaning set forth in Section 9.15.

“Foreign Subsidiary” means any Subsidiary that is organized under the laws of a jurisdiction other than the United States of America or any State thereof or the District of Columbia.

“Fund” shall mean any person that is (or will be) engaged in making, purchasing, holding or otherwise investing in commercial loans and similar extensions of credit in the ordinary course of its business.

“GAAP” means generally accepted accounting principles in the United States of America.

“Governmental Authority” means the government of the United States of America, any other nation or any political subdivision thereof, whether state or local, and any agency, authority, instrumentality, regulatory body, court, central bank or other entity exercising executive, legislative, judicial, taxing, regulatory or administrative powers or functions of or pertaining to government.

“Guarantee” of or by any Person (the “guarantor”) means any obligation, contingent or otherwise, of the guarantor guaranteeing or having the economic effect of guaranteeing any Indebtedness or other obligation of any other Person (the “primary obligor”) in any manner, whether directly or indirectly, and including any obligation of the guarantor, direct or indirect, (a) to purchase or pay (or advance or supply funds for the purchase or payment of) such Indebtedness or other obligation or to purchase (or to advance or supply funds for the purchase of) any security for the payment thereof, (b) to purchase or lease property, securities or services for the purpose of assuring the owner of such Indebtedness or other obligation of the payment thereof, (c) to maintain working capital, equity capital or any other financial statement condi tion or liquidity of the primary obligor so as to enable the primary obligor to pay such Indebtedness or other obligation or (d) as an account party in respect of any letter of credit or letter of guaranty issued to support such Indebtedness or obligation; provided that the term Guarantee shall not include endorsements for collection or deposit in the ordinary course of business. The amount of any Guarantee by a person shall be deemed to be an amount equal to the stated amount or determinable amount of the primary obligation in respect of which such Guarantee is made or, if not stated or determinable, the maximum reasonably anticipated liability in respect thereof

(assuming such person is required to perform thereunder) as determined by such person in good faith.

“Guaranty” means the Guaranty among the Loan Parties and the Administrative Agent dated the Effective Date, substantially in the form of Exhibit C.

“Hazardous Materials” means all explosive, radioactive, hazardous or toxic substances, wastes or other pollutants, including petroleum or petroleum distillates, asbestos or asbestos containing materials, polychlorinated biphenyls, radon gas, infectious or medical wastes, and all other substances or wastes of any nature regulated pursuant to any Environmental Law.

“HBA” means health and beauty aids.

“Hedging Agreement” means any Currency and Commodity Hedging Agreement or Interest Rate Hedging Agreement.

“Immaterial Subsidiaries” means the Subsidiaries of the Company listed on Schedule 1.01(D), which the Company intends to dissolve, liquidate or merge into another Loan Party.

“Incremental Availability” means, at any time of calculation, the additional amount available to be borrowed by the Borrowers based upon the difference between the Tranche A-1 Borrowing Base and the Tranche A Borrowing Base as reflected on the most recent Borrowing Base Certificate delivered by the Borrowers to the Administrative Agent pursuant to Section 5.01(f) hereof.