UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K/A

AMENDMENT NO. 1

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

For the fiscal year ended June 30, 2002 OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the transition period from _______________ to _______________

Commission File number 0-14183

ENERGY WEST INCORPORATED

(Exact name of registrant as specified in its charter)

Montana 81-0141785

(State or other jurisdiction of (I.R.S. Employer

incorporation or organization) Identification No.)

1 First Avenue South, Great Falls, Mt. 59401

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code

(406)-791-7500 Securities to be registered pursuant to

Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Title of each class

Common Stock - Par Value $.15

Indicate by check mark whether the registrant (1) has filed all reports required

to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes [X] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405

of Regulation S-K (229.45 of this chapter) is not contained herein, and will not

be contained, to the best of registrant's knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K [ ].

1

The aggregate market value of the voting stock held by non-affiliates of the

registrant as of September 25, 2002: Common Stock, $.15 Par Value - $20,222,060.

The number of shares outstanding of the issuer's classes of common stock as of

September 25, 2002: Common Stock, $.15 Par Value - 2,573,734 shares.

2

Explanatory Note

Energy West Incorporated hereby amends Items 10, 11, 12 and 13 of Part III

and Item 15 of Part IV of its Annual Report on Form 10-K, which was filed with

the Securities and Exchange Commission on September 30, 2002.

PART III

Item 10 - Directors and Executive Officers of the Registrant

Board of Directors

E. W. `Gene' Argo, (60), is proposed for the first time as a director. He is the

President and General Manager of Midwest Energy, Inc., an electric cooperative

in Hays, Kansas, in which capacity he has served since 1992.

Edward J. Bernica, (53), has been a Director, President and Chief Executive

Officer of the Company since September 2001. Mr. Bernica served as Executive

Vice President, Chief Operating Officer and Chief Financial Officer for the

Company from 1999 to September 2001. From 1994 to 1999, he served the Company as

Vice President and Chief Financial Officer.

Andrew Davidson, (35), has been a Director of the Company since 1999. He has

been Vice President and Portfolio Manager for Davidson Investment Advisors and a

Financial Consultant for D.A. Davidson & Company since 1993.

David A. Flitner, (69), has been a Director of the Company since 1988. He has

been the owner of the Flitner Ranch and Hideout Adventures, Inc. a recreational

enterprise since 1994.

G. Montgomery Mitchell, (74), has been a Director of the Company since 1984, and

has served as Chairman of the Board of Directors since 1984. Mr. Mitchell was

Senior Vice President and Director of Stone and Webster Management Consultants,

Inc. from August 1980 until his retirement in 1993. Mr. Mitchell is also a

director of Energy South, Inc.

Terry M. Palmer, (58), has been a partner in the accounting firm Ernst & Young

LLP since 1979. He has announced his retirement from that firm effective October

31, 2002.

George D. Ruff, (65), has been a Director of the Company since November 1996.

Mr. Ruff served as Vice President of Montana Operations for US West from June of

1983 until his retirement in 1997.

Richard J. Schulte, (62), has been a Director of the Company since 1997. Mr.

Schulte has been a principal in Schulte Associates LLC, a consulting firm

providing management, marketing, e-commerce and organizational services to

energy related businesses since 1998. Mr. Schulte also operates a home repair

and construction company, a sole proprietorship doing business as LDDI. He also

serves as Chairman of the Board of Directors for American Society for Testing

and Materials (ASTM International). Mr. Schulte was President and CEO of

International Approval Services, Inc. from 1993 until 1998.

Information Concerning Directors Not Continuing in Office:

3

Thomas N. McGowen, Jr., (75), has been a Director of the Company since 1978. Mr.

McGowen is a retired attorney and is past President and Chairman of the Board of

Pabst Brewing Company. Mr. McGowen has chosen not to stand for re-election to

the Board of Directors.

Dean South, (60), has been a director of the Company since 1996. He currently

ranches north of Helena, Montana. Mr. South retired as Vice President of Western

Operation for Heritage Propane Corporation in 1991. He served as President and

Chief Operating Officer of Louis Dreyfus Propane Corporation from 1986 until

1989 and President of Northern Energy Company from 1981 until they merged with

Louis Dreyfus in 1986. He has accepted an offer of employment from the Company

and as a result has decided not to stand for re-election to the Board of

Directors.

Executive Officers

The following table sets forth the names and ages of, and the positions and

offices within the Company presently held by, the executive officers of the

Company:

Name Age Position

- -------------------------------------------------------------------------------

Edward J. Bernica 53 President and Chief Executive Officer

Sheila M. Rice 55 Vice President and Corporate

Administrator

John C. Allen 51 General Counsel, Vice-President and

Secretary

Tim A. Good 57 Vice-President and Manager of

Natural Gas Operations

Douglas R. Mann 55 Vice-President and Manager of Energy

West Propane Operations

JoAnn S. Hogan 36 Assistant Vice-President and

Treasurer

Robert B. Mease 55 Assistant Vice-President and

Controller

Edward J. Bernica was appointed President and Chief Executive Officer on

September 17, 2001. From March 1999 until September 17, 2001, he was Executive

Vice-President, Chief Operating Officer and Chief Financial Officer of the

Company. He joined the Company in November 1994, as Vice-President and Chief

Financial Officer.

Sheila M. Rice has been Vice-President of Energy West Incorporated and Corporate

Administrator since October of 2001. She was Vice President of Marketing from

1998 to 2001 and was Vice President and Division Manager of Energy West Montana

from 1993 until 1998.

John C. Allen has been General Counsel and Vice-President of the Company since

1992.

4

Tim A. Good has been Vice-President of the Company and Manager of the Company's

Natural Gas Operations since July 1, 2000. He served as Vice President and

Division Manager of the EWW Division from 1988 to July 1, 2000.

Douglas R. Mann has been Vice-President and Manager of Energy West Propane, Inc.

since July 1, 2000. From February, 1999 until July 1, 2000, he served as

Vice-President and Manager of the EWA Division. From 1995 until July 1, 1999, he

served as Assistant Vice-President and Manager of the Arizona Division.

JoAnn S. Hogan has been Assistant Vice-President and Treasurer of the Company

since January 2002. She served as Controller from 2000 to 2002. From 1995 to

2000, she served in various financial capacities for the Company including

assistant controller and tax manager.

Robert B. Mease has been Assistant Vice-President and Controller of the Company

since joining the Company in February 2002. From October 2000 to February 2002,

he served as a business consultant with Junkermier, Clark, Campanella & Stevens,

a public accounting firm. From 1998 to 2000 he was Vice-President and CFO of TMC

Sales, a steel manufacturer and wholesale distributor located in Seattle,

Washington. From 1994 to 1998, he was Vice-President of Finance for American

Agri-Technology, located in Great Falls, Montana.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the

Corporation's directors, executive officers and persons who own more than ten

percent of the Corporation's common stock to file reports of ownership and

changes in ownership with the Securities and Exchange Commission and the

National Association of Securities Dealers (NASD). Such persons are also

required to furnish the Corporation with copies of all such reports. Based

solely on its review of the copies of such reports received by the Corporation,

the Corporation believes that its directors and executive officers filed all

required reports during or with respect to the fiscal year ending June 30, 2002

on a timely basis with the exception of Mr. McGowen who filed a late Form 4 on

December 6, 2001, reporting the sale of 500 shares of Common Stock on October

18, 2001 and the sale of 1,000 shares of Common Stock on October 15, 2001, and a

late Form 4 on August 10, 2002, reporting the sale of 1,000 shares of Common

Stock on February 14, 2002.

5

Item 11. - Executive Compensation

Compensation Committee Report On Executive Compensation

The Compensation Committee of the Board of Directors (the "Committee")

reviews each salary adjustment for the Company's officers and recommends those

adjustments to the full board. The Committee also provides recommendations to

the full Board regarding the structure of incentive compensation including

contributions to the Company's Annual Management Incentive Plan, the Company's

Long Term Incentive Plan, the Company's Incentive Stock Option Plan, as well as

the Employee Stock Ownership Plan (ESOP). It also provides recommendations

regarding Director compensation.

The Committee's objectives are as follows:

1. The Committee seeks to attract and retain the necessary management

talent to successfully lead the Company. The Committee believes it must provide

a compensation package that is competitive in the marketplace with other

comparable companies.

2. The Committee encourages decision-making that enhances shareholder

value. The Committee believes that this objective is met by linking executive

pay to corporate performance.

The Compensation Committee believes that the various compensation plans it

employs achieve the above stated objectives. The plans just referred to are

summarized below. Total compensation for executive officers is determined by

marketplace survey data, Company performance and individual performance. A

control point and a salary range are established for each executive based on

market information of companies in the gas utility industry. Each executive

receives a base salary and annual incentive award which, when combined, place

the executive within the compensation range for the position. The amount of the

incentive award varies based upon the Company's performance. Incentive awards

have traditionally ranged from 0% to 85% of base salary.

The Annual Management Incentive Plan in place during the fiscal year

provided for the payment of a cash bonus depending on two criteria, earnings per

share relative to a predetermined target and achieving a predetermined Economic

Value Added (EVA) target. Incentives awarded under this plan increase as the

Company's performance, as measured by these two criteria, improves. In fiscal

year 2002, no payments were made to the CEO or other executive officers since

the targets established by the Management Incentive Plan were not met. In June

of 2002, the Committee amended the Management Incentive Plan to provide for

awards to executive officers of up to 15% of base salaries to executive officers

if the Company successfully satisfies the earnings per share target established

by the Board. The plan also permits for the payment of additional sums of

incentives if the target is exceeded.

Executive officers also receive up to 5% of their base salaries upon

completion of certain objectives that support the Company's Balanced Goal Card

objectives. During the fiscal year each executive officer received approximately

5% of his base salary as a result of this incentive.

The Energy West Long Term Incentive Plan was adopted in 1999. It has

established a targeted return of 50% to the Shareholder over the course of a

three year period beginning in fiscal year 2000. The Plan requires the

achievement of both annual earnings per share targets as well as an increase in

shareholder return before any payment under the plan is earned. In the Fiscal

Year ended 2001, $216,306 was earned by plan participants. This payment was made

as a result of the accomplishment of financial results in fiscal year 2001. A

total pool of $600,000 was available for distribution to participants over the

6

entire three year period. The financial targets required by the plan were not

met in fiscal year 2002 and no payments under this plan were earned in fiscal

year 2002 and the plan has expired according to its terms.

In September 1999, the Company adopted a Change of Control Severance Plan

that requires severance payments to employees whose employment is terminated as

a result of a change of control. This plan covers executive officers as well as

most other employees of the Company. The Plan requires payment of two weeks of

base salary for every year of service with a minimum payment of three months and

a maximum of one year of base salary for officers of the Company.

In August 2000, the Board adopted a Retention Bonus Plan under which $1.5

million dollars was authorized by the Board of Directors for allocation to key

employees, including the named executive officers who would be paid a cash

incentive for continued employment if the Company became involved in a potential

change of control negotiation with a third party.

Chief Executive Officer Compensation

Compensation for the Chief Executive Officer is accomplished through the

same combination of base salary, annual incentive aware and long term plans as

just discussed with respect to executive officers of the Company, with one

exception. When Mr. Geske served as President and Chief Executive Officer, the

Board instituted a Deferred Compensation Plan for the CEO. That plan paid Mr.

Geske certain amounts calculated by total return to the shareholder (share price

appreciation and dividend payments). The plan paid the incentive earned under

this plan into an escrow account on Mr. Geske's behalf. Mr. Geske became

eligible to receive the amount escrowed three years after it was earned. In the

fall of 2001, Mr. Geske retired from his position and as part of a separation

agreement received the amounts earned in fiscal year 2001 without waiting the

three years required by the Plan. The Board of Directors also authorized the

payment of $50,000 to Mr. Geske as part of the separation agreement.

Mr. Bernica was promoted to President and Chief Executive Officer in the

fall of 2001. His compensation is determined under the same mix of base salary

and incentive plans as are other executive officers of the Company. In fiscal

year 2002, Mr. Bernica received $4,299 for the achievement of his Balanced Goal

Card objectives. As indicated above, no payment in fiscal year 2002 was earned

under either of the other two incentive plans

The foregoing report is furnished by the Compensation Committee:

Thomas N. McGowen, Jr., Chairman; David A. Flitner, George D. Ruff

The following table sets forth the annual and long-term compensation of the

Chief Executive Officer and other named executive officers of the Company

earning compensation in excess of $100,000 in the fiscal year.

Summary Compensation Table

- ---------------------------------------------------------------------------------------------------------

Annual Compensation Long Term

Compensation

- ---------------------------------------------------------------------------------------------------------

Name and Principal Position Year Salary Bonus LTIP All Other

Payouts Compensa

tion

- ----------------------------------------- -------- ------------ -------- ----------- ----------

Larry D. Geske, Former President & CEO 2002 $ 35,497 $ 0 $ 0 $ 50,390

- ----------------------------------------- -------- ------------ -------- ----------- ----------

2001 119,315 63,745 129,114 20,119

- ----------------------------------------- -------- ------------ -------- ----------- ----------

2000 117,122 0 0 16,854

- ---------------------------------------------------------------------------------------------------------

7

- -------------------------------------------------------------------------------------------------------

Edward Bernica, President & CEO 2002 $ 111,099 $ 5,847 $ 0 $ 24,722

- ----------------------------------------- -------- ------------ -------- ----------- ----------

2001 107,458 62,201 28,841 16,921

- ----------------------------------------- -------- ------------ -------- ----------- ----------

2000 104,836 0 0 14,825

- ---------------------------------------------------------------------------------------------------------

Tim Good, VP Natural Gas Operations

2002 $ 100,604 $ 5,030 $ 0 $ 21,302

- ----------------------------------------- -------- ------------ -------- ----------- ----------

2001 96,293 55,859 18,026 17,051

- ----------------------------------------- -------- ------------ -------- ----------- ----------

2000 94,041 0 0 13,807

- ----------------------------------------------------------------------------------------------------------

Aggregated Option/SAR Exercises in Last Fiscal Year and FY-End Option /SAR Values

- ----------------------------------------------------------------------------------------------------------

Shares Number of Securities Underlying Value of Unexercised

Acquired Value Unexercised Options at Fiscal In-the-Money Options at Year

on Exercise Realized Year End ((#) End ($)

- --------------- ------------ --------- ------------------------------- --------------------------------

Name (#) ($) Exercisable Unexercisable Exercisable Unexercisable

- --------------- ------------ --------- -------------- --------------- ---------------- -------------

Edward Bernica 5,000 $14,750 3,856 964 0 0

- --------------- ------------ --------- -------------- --------------- ---------------- -------------

John Allen 5,000 $15,350 - - - -

- --------------- ------------ --------- -------------- -------------- ---------------- -------------

Larry Geske 10,000 $28,300 - - - -

- ----------------------------------------------------------------------------------------------------------

Director Compensation

The Company paid its outside directors an annual retainer of $4,000 per

year, $1,250 per Board meeting, $450 per Committee meeting held on a different

day from a full Board meeting and $250 for each Committee meeting held on the

same day as a full Board meeting. For Board or Committee meetings held by

telephone conference, the rate is one half the regular rate indicated.

The directors have the option under the Deferred Compensation Plan for

Directors to receive their compensation in the form of stock, cash, or in the

form of deferred stock equivalents. In addition to the annual retainer and

meeting fees, each Director may receive an annual award of Company Common Stock

pursuant to the Deferred Compensation Plan for Directors. Incentive awards are

paid in the form of Common Stock. The amount of Common Stock awarded is

determined by an amount equal to a percentage of Director's compensation

equivalent to the percentage of compensation paid to the Chief Executive Officer

under the Management Incentive Plan. For example, if the Chief Executive Officer

is paid an incentive under the Management Incentive Plan of 30%, that same 30%

would be applied to the total compensation paid to each director during the

fiscal year to arrive at a dollar amount. Those incentive dollars would then be

utilized to purchase Company Common Stock on behalf of each director. Incentives

associated with fiscal year 2002 did not result in the distribution of any

shares of stock since no payout was made to the CEO under the Management

Incentive Plan.

In addition any director residing in the Company's service territory is

entitled to a 50% discount for the energy provided in the Director's residence

by the Company. In 2002, the only director receiving this benefit was Mr. Andrew

Davidson.

8

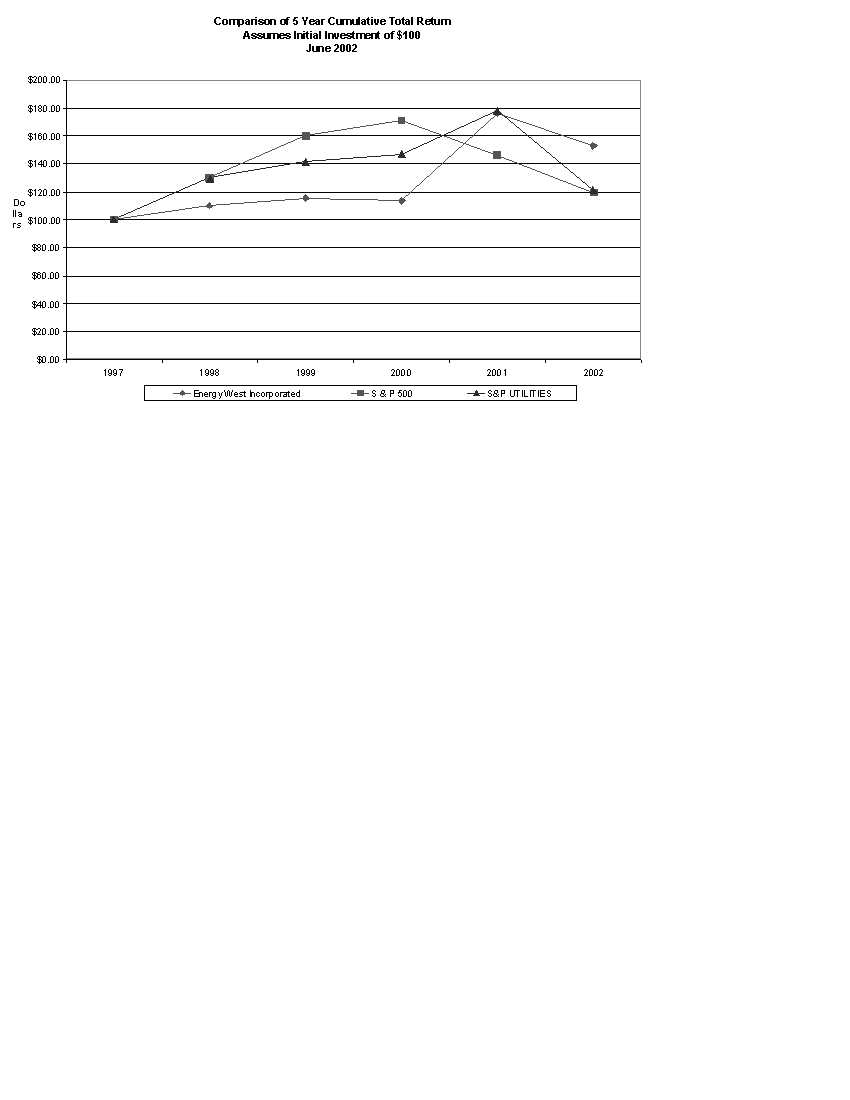

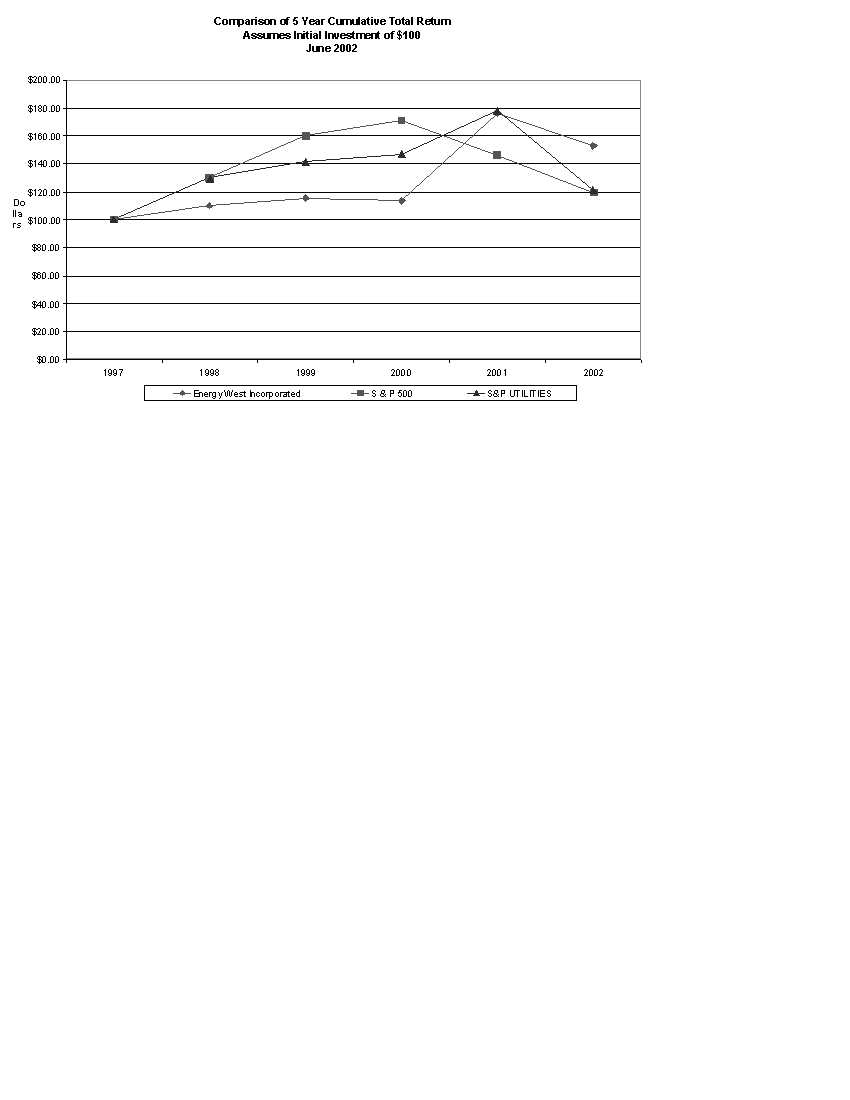

Performance of the Company's Common Stock

The following graph sets forth the cumulative total shareholder return (assuming

reinvestment of dividends) to shareholders of Energy West Incorporated during

the five year period ended June 30, 2002, as well as an overall stock market

index (S&P 500 Index) and the peer group index (S&P Utility Index).

9

Item 12. - Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding the beneficial

ownership of the Common Stock of the Company on or about October 1, 2002 (i) by

each shareholder who is known by the Company to own beneficially more than 5% of

the outstanding Common Stock, (ii) by each director, and (iii) by all executive

officers and directors as a group. Each beneficial owner has sole voting and

investment power unless otherwise indicated.

Name of Beneficial Owner Number of Shares Percent of Ownership

Beneficially Owned

Ian and Nancy Davidson 357,083 (a) 13.8 %

#8 3 Street North, Great Falls MT

Andrew Davidson 18,286 *

David Flitner 5,984 *

Thomas N. McGowen Jr 1,692 *

G. Montgomery Mitchell 14,072 *

George Ruff 10,261 *

Richard Schulte 8,897 *

Dean South 2,218 *

Edward Bernica 12,788 (b) *

Tim Good 23,171 (c) *

Larry Geske 125,258 (d) 4.8 %

All Directors and Officers as a group 282,380 (e) 11 %

(14 in number)

* Less than 1 %

(a) Shares shown as owned by Ian Davidson are owned in joint tenancy with

rights of survivorship, Mr. and Mrs. Davidson have sole power to vote and

to dispose of the shares. This information is provided in reliance on the

Form 4 filed by Mr. Davidson dated September 4, 2002.

(b) Amounts include 3,856 exercisable stock options to purchase Common Stock.

(c) Amounts include 3,200 exercisable stock options to purchase Common Stock.

(d) Shares shown as owned by Mr. Geske are those reported to the Company in the

most recent Form 4 available to the Company, dated December 2001.

(e) Includes 13,936 exercisable stock options to purchase Common Stock.

10

Equity Compensation Plan Information

- --------------------------------------------------------------------------------------------------------------------------

Plan Category Number of Securities to be Weighted-average Number of securities remaining

issued upon exercise of price of outstanding options, available for future issuance

outstanding options, warrants and rights. under equity compensation plans

warrants and rights. (excluding securities reflected

in column (a))

- ------------------------------- -------------------------- ------------------------------ --------------------------------

(a) (b) (c)

- ------------------------------- -------------------------- ------------------------------ --------------------------------

Equity compensation plans 62,276 shares $9.25 per share 82,564 shares

approved by security holders

- ------------------------------- -------------------------- ------------------------------ --------------------------------

Equity compensation plan not None Not Applicable Not Applicable

approved by security holders

- ------------------------------- -------------------------- ------------------------------ --------------------------------

TOTAL 62,276 shares $9.25 per share 82,564 shares

- ------------------------------- -------------------------- ------------------------------ --------------------------------

On October 12, 2001, the Company issued a total of 4,332.751 shares of its

Common Stock to four members of the Company's Board of Directors in lieu of cash

payments due such directors under the Company's Long Term Incentive Plan. The

shares were issued at a price of $11.45 per share, or an aggregate of $49,610.

Neither the Long Term Incentive Plan nor the issuance of shares thereunder have

been approved by the shareholders. The Company does not anticipate future

issuances of Stock in lieu of cash payments under the Long Term Incentive Plan.

11

Item 13 - Certain Relationships and Related Transactions

There are no transactions with management or others, or business

relationships with others, that require disclosure under Item 404 of Regulation

S-K.

Item 15 - Exhibits, Financial Statement Schedules and Reports on Form 8-K

(a) 1. Financial Statements included in Part II, Item 8 (these items were filed

with the Company's Form 10-K filed on September 30, 2002):

Report of Independent Auditors

Consolidated Balance Sheets

Consolidated Statements of Income

Consolidated Statements of Stockholders' Equity

Consolidated Statements of Cash Flows

Notes to Consolidated Financial Statements

2. Financial Statement Schedules included in Item 15(d):

Schedule II - Valuation and Qualifying Accounts

All other schedules are omitted because they are not applicable or the required

information is shown in the financial statements or notes thereto.

3. The Exhibits required to be filed by Item 601 of Regulation S-K are

listed under the heading "Exhibit Index," below.

(b) None.

(c) EXHIBITS. The Exhibits required to be filed by Item 601 of Regulation S-K

are listed under the heading "Exhibit Index," below.

(d) SCHEDULE II

VALUATION AND QUALIFYING ACCOUNTS

ENERGY WEST INC.

JUNE 30, 2002

Balance At Charged to

Beginning of Costs & Write-Offs Net Balance at

Period Expenses of Recoveries End of Period

- --------------------------- ------------ ---------- -------------- -------------

ALLOWANCE FOR UNCOLLECTABLE

ACCOUNTS

Year Ended June 30, 2000 $84,538 $104,132 $(100,671) $87,999

Year Ended June 30, 2001 $87,999 $169,785 $( 53,214) $204,570

Year Ended June 30, 2002 $204,570 $59,506 $(109,825) $154,251

12

SIGNATURES

Pursuant to the requirements of Section 13 or 15 (d) of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its

behalf by the undersigned, thereunto duly authorized.

Date: November 25, 2002 ENERGY WEST INCORPORATED

/s/ Edward J. Bernica

------------------------------------------------

Edward J. Bernica, President and Chief Executive

Officer (principal executive officer)

13

CERTIFICATIONS

I, Edward J. Bernica, certify that:

1. I have reviewed this amended annual report on Form 10-K/A of Energy

West Incorporated.

2. Based on my knowledge, this amended annual report does not contain any

untrue statement of a material fact or omit to state a material fact necessary

to make the statements made, in light of the circumstances under which such

statements were made, not misleading with respect to the period covered by this

amended annual report; and

Date: November 25, 2002

/s/ Edward J. Bernica

-------------------------------------

Edward J. Bernica

President and Chief Executive Officer

(principal executive officer)

I, Robert B. Mease, certify that:

1. I have reviewed this amended annual report on Form 10-K/A of Energy

West Incorporated.

2. Based on my knowledge, this amended annual report does not contain any

untrue statement of a material fact or omit to state a material fact necessary

to make the statements made, in light of the circumstances under which such

statements were made, not misleading with respect to the period covered by this

amended annual report; and

Date: November 25, 2002

/s/ Robert B. Mease

-------------------------------------

Robert B. Mease

Assistant Vice-President & Controller

(principal financial officer)

14

EXHIBIT INDEX

3.1 Restated Articles of Incorporation of the Company, as amended to date

(incorporated by reference to Exhibit 3.1 on Form 10-K/A for the fiscal

year ended June 30, 1996, filed with the Commission on July 9, 1997).

3.2 Bylaws of the Company, as amended to date (filed herewith).

4.1 Form of Indenture (including form of Note) relating to the Company's

Series 1993 Notes (incorporated by reference to Exhibit 4.1 to the

Company's Registration Statement on Form S-2, File No. 33-62680).

4.2 Loan Agreement, dated as of September 1, 1992, relating to the

Company's Series 1992A and Series 1992B Industrial Development Revenue

Bonds (incorporated by reference to Exhibit 4.2 to the Company's

Registration Statement on Form S-2, File No. 33-62680).

10.1 Replacement Credit Agreement dated as of February 8, 2001, by and

between the Company, Energy West Resources, Inc., Energy West

Development, Inc., Energy West Propane, Inc. and Wells Fargo Bank

Montana, National Association, successor in interest to Norwest Bank

Great Falls, National Association (filed herewith).

10.2 Amendment dated August 30, 2001 to Replacement Credit Agreement dated

as of February 8, 2001, by and between the Company, Energy West

Resources, Inc., Energy West Development, Inc., Energy West Propane,

Inc. and Wells Fargo Bank Montana, National Association, successor in

interest to Norwest Bank Great Falls, National Association (filed

herewith).

10.3 Second Amendment dated May 23, 2002 to Replacement Credit Agreement

dated as of February 8, 2001, by and between the Company, Energy West

Resources, Inc., Energy West Development, Inc., Energy West Propane,

Inc. and Wells Fargo Bank Montana, National Association, successor in

interest to Norwest Bank Great Falls, National Association (filed

herewith).

10.4 Credit Agreement dated as of February 12, 1997, by and between the

Company and First Bank Montana, National Association (incorporated by

reference to Exhibit 10.5 on Form 10-K/A for the fiscal year ended June

30, 1996, filed with the Commission on July 9, 1997).

10.5 First Amendment dated March 5, 1998 to the Credit Agreement dated as of

February 12, 1997, by and between the Company and First Bank Montana,

National Association (filed herewith).

10.6 Second Amendment dated March 16, 1998 to the Credit Agreement dated as

of February 12, 1997, by and between the Company and First Bank

Montana, National Association (filed herewith).

10.7 Third Amendment dated January 21, 1999 to the Credit Agreement dated as

of February 12, 1997, by and between the Company and U.S. Bank National

Association MT (f/k/a First Bank Montana, National Association) (filed

herewith).

10.8 Fourth Amendment dated March 25, 1999 to the Credit Agreement dated as

of February 12, 1997, by and between the Company and U.S. Bank National

Association MT (f/k/a First Bank Montana, National Association) (filed

herewith).

15

10.9 Fifth Amendment dated December 6, 1999 to the Credit Agreement dated as

of February 12, 1997, by and between the Company and U.S. Bank National

Association MT (f/k/a First Bank Montana, National Association) (filed

herewith).

10.10 Sixth Amendment dated March 27, 2000 to the Credit Agreement dated as

of February 12, 1997, by and between the Company and U.S. Bank National

Association MT (f/k/a First Bank Montana, National Association) (filed

herewith).

10.11 Seventh Amendment dated March 9, 2001 to the Credit Agreement dated as

of February 12, 1997, by and between the Company and U.S. Bank National

Association MT (f/k/a First Bank Montana, National Association) (filed

herewith).

10.12 Eight Amendment dated February 19, 2002 to the Credit Agreement dated

as of February 12, 1997, by and between the Company and U.S. Bank

National Association (f/k/a U.S. Bank National Association MT and First

Bank Montana, National Association) (filed herewith).

10.13 Delivered Gas Purchase Contract dated February 23, 1997, as amended by

that Letter Amendment Amending Gas Purchase Contract dated March 9,

1982; that Amendment to Delivered Gas Purchase Contract applicable as

of March 20, 1986; that Letter Agreement dated December 18, 1986; that

Letter Agreement dated April 12, 1988; that Letter Agreement dated

April 28, 1992; that Letter Agreement dated March 14, 1996; that Letter

Agreement dated April 15, 1996; a second Letter Agreement dated April

15, 1996; that Letter dated February 18, 1997; and that Letter dated

April 1, 1997, transmitting a Notice of Assignment effective February

26, 1993 (incorporated by reference to Exhibit 10.6 on Form 10-K/A for

the fiscal year ended June 30, 1996, filed with the Commission on July

9, 1997).

10.14 Delivered Gas Purchase Contract dated December 1, 1985, as amended by

that Letter Agreement dated July 1, 1986; that Letter Agreement dated

November 19, 1987; that Letter Agreement dated December 1, 1988; that

Letter Agreement dated July 30, 1992; that Assignment Conveyance and

Bill of Sale effective as of January 1, 1993; that Letter Agreement

dated March 8, 1993; that Letter Agreement dated October 21, 1993; that

Letter Agreement dated October 18, 1994; that Letter Agreement dated

January 30, 1995; that Letter Agreement dated August 30, 1995; that

Letter Agreement dated October 3, 1995; that Letter Agreement dated

October 31, 1995; that Letter Agreement dated December 21, 1995; that

Letter Agreement dated April 25, 1996; that Letter Agreement dated

January 29, 1997; and that Letter dated April 11, 1997 (incorporated by

reference to Exhibit 10.7 on Form 10-K/A for the fiscal year ended June

30, 1996, filed with the Commission on July 9, 1997).

10.15 Natural Gas Sale and Purchase Agreement dated July 20, 1992 between

Shell Canada Limited and the Company, as amended by that Letter

Agreement dated August 23, 1993; that Amending Agreement effective as

of November 1, 1994; and that Schedule A Incorporated Into and Forming

a art of That Natural Gas Sale and Purchase Agreement, effective as of

November 1, 1996 (incorporated by reference to Exhibit 10.8 on Form

10-K/A for the fiscal year ended June 30, 1996, filed with the

Commission on July 9, 1997).

10.16 Employee Stock Ownership Plan Trust Agreement (incorporated by

reference to Exhibit 10.2 to Registration Statement on Form S-1, File

No. 33-1672).*

10.17 1992 Stock Option Plan (incorporated by reference to Exhibit 10.10 on

Form 10-K/A for the fiscal year ended June 30, 1996, filed with the

Commission on July 9, 1997).*

16

10.18 Form of Incentive Stock Option under the 1992 Stock Option Plan

(incorporated by reference to Exhibit 10.11 on Form 10-K/A for the

fiscal year ended June 30, 1996, filed with the Commission on July 9,

1997).*

10.19 Management Incentive Plan (incorporated by reference to Exhibit 10.12

on Form 10-K/A for the fiscal year ended June 30, 1996, filed with the

Commission on July 9, 1997).*

10.20 Energy West Incorporated Retention Bonus Plan dated September 14, 2000

(incorporated by reference to Exhibit 10.1 on Form 10-Q for the quarter

ended September 30, 2000, filed with the Commission on November 14,

2000).*

10.21 Separation Agreement, Release and Waiver of Claims dated October, 2001

between Energy West Incorporated and Larry D. Geske (incorporated by

reference to Exhibit 10.17 to the Company's Annual Report on Form 10-K

for the fiscal year ended June 30, 2002, filed with the Commission on

September 30, 2002).*

10.22 Energy West Long-Term Incentive Plan (incorporated by reference to

Exhibit 10.18 to the Company's Annual Report on Form 10-K for the

fiscal year ended June 30, 2002, filed with the Commission on September

30, 2002).*

10.23 Energy West Senior Management Incentive Plan (incorporated by reference

to Exhibit 10.19 to the Company's Annual Report on Form 10-K for the

fiscal year ended June 30, 2002, filed with the Commission on September

30, 2002).*

10.24 Energy West Incorporated Deferred Compensation Plan for Directors

(incorporated by reference to Exhibit 10.20 to the Company's Annual

Report on Form 10-K for the fiscal year ended June 30, 2002, filed with

the Commission on September 30, 2002).*

21.1 Subsidiaries of the Company (incorporated by reference to Exhibit 21.1

to the Company's Annual Report on Form 10-K for the fiscal year ended

June 30, 2000, filed with the Commission on September 28, 2000).

23.1 Consent of Independent Auditors - Deloitte & Touche (incorporated by

reference to Exhibit 23.1 to the Company's Annual Report on Form 10-K

for the fiscal year ended June 30, 2002, filed with the Commission on

September 30, 2002).

23.2 Consent of Independent Auditors - Ernst & Young (incorporated by

reference to Exhibit 23.2 to the Company's Annual Report on Form 10-K

for the fiscal year ended June 30, 2002, filed with the Commission on

September 30, 2002).

99.1 Certification of Chief Executive Officer (filed herewith).

99.2 Certification of Principal Financial Officer (filed herewith).

* Represents a management contract or a compensatory plan or arrangement.

17