[17380.COV]1

ENTERGY CORPORATION

2002 INVESTOR GUIDE

AND

STATISTICAL REPORT

[17380.COV]2

Entergy stands committedto providing useful, meaningful financial disclosure. We continue to focus on enhancing the value of the information we provide to investors. We have assembled the facts and statistics in this Investor Guide to support your review of Entergy. Again this year, we’re providing this information in electronic form, on the CD below, in order to facilitate easier access and analysis.

Entergy Investor Relations

Entergy Corporation is an integrated energy company engaged primarily in electric power production, retail distribution operations, energy marketing and trading, and gas transportation. Entergy owns and operates power plants with approximately 30,000 megawatts of electric generating capacity, and it is the second-largest nuclear generator in the United States. Entergy delivers electricity to 2.6 million utility customers in Arkansas, Louisiana, Mississippi, and Texas. Through Entergy-Koch, LP, it is a leading provider of wholesale energy marketing and trading services, as well as an operator of natural gas pipeline and storage facilities. Entergy has annual revenues of over $8 billion and more than 15,000 employees.

[17380.TX]1

2 | ||

3 | ||

4 | ||

6 | ||

15 | ||

16 | ||

16 | ||

17 | ||

18 | ||

18 | ||

19 | ||

20 | ||

21 | ||

23 | ||

24 | ||

25 | ||

26 | ||

27 | ||

32 | ||

33 | ||

33 | ||

34 | ||

35 | ||

39 | ||

40 | ||

40 | ||

41 | ||

41 | ||

Entergy-Koch, LP, Non-Nuclear Wholesale Asset Business | 42 | |

43 | ||

43 | ||

44 | ||

45 |

[GRAPHICS APPEARS HERE]

ABOUT THIS PUBLICATION

This publication is unaudited and should be used in conjunction with Entergy’s 2002 Annual Report to Shareholders and Form 10-K filed with the Securities and Exchange Commission. It has been prepared for information purposes and is not intended for use in connection with any sale or purchase of, or any offer to buy, any securities of Entergy Corporation or its subsidiaries.

FORWARD-LOOKING INFORMATION

The following constitutes a “Safe Harbor” statement under the Private Securities Litigation Reform Act of 1995: From time to time, Entergy makes statements concerning its expectations, beliefs, plans, objectives, goals, strategies, and future events or performance. Such statements are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Although Entergy believes that these forward-looking statements and the underlying assumptions are reasonable, it cannot provide assurance that they will prove correct. Forward-looking statements involve a number of risks and uncertainties, and there are factors that could cause actual results to differ materially from those expressed or implied in the statements. Some of those factors include, but are not limited to: resolution of pending and future rate cases and negotiations, including the Entergy New Orleans rate case and various performance-based rate discussions, and other regulatory decisions, including those related to Entergy’s utility supply plan, Entergy’s ability to reduce its operation and maintenance costs, particularly at its Non-Utility Nuclear generating facilities including the uncertainty of negotiations with unions to agree to such reductions, the performance of Entergy’s generating plants, and particularly the capacity factor at its nuclear generating facilities, prices for power generated by Entergy’s unregulated generating facilities—particularly the ability to extend or replace the existing power purchase agreements for the Non-Utility Nuclear plants—and the prices and availability of power Entergy must purchase for its utility customers, Entergy’s ability to develop and execute on a point of view regarding prices of electricity, natural gas, and other energy-related commodities, Entergy-Koch’s profitability in trading electricity, natural gas, and other energy-related commodities, changes in the number of participants in the energy trading market, and in their creditworthiness and risk profile, changes in the financial markets, particularly those affecting the availability of capital and Entergy’s ability to refinance existing debt and to fund investments and acquisitions, actions of rating agencies, including changes in the ratings of debt and preferred stock, changes in inflation and interest rates, Entergy’s ability to purchase and sell assets at attractive prices and on other attractive terms, volatility and changes in markets for electricity, natural gas, and other energy-related commodities, changes in utility regulation, including the beginning or end of retail and wholesale competition, the ability to recover net utility assets and other potential stranded costs, and the establishment of SeTrans or another regional transmission organization, changes in regulation of nuclear generating facilities and nuclear materials and fuel, including possible shutdown of Indian Point or other nuclear generating facilities, changes in environmental, tax, and other laws, including requirements for reduced emissions of sulfur, nitrogen, carbon, and other substances, the economic climate, and particularly growth in Entergy’s service territory, variations in weather, hurricanes, and other disasters, advances in technology, the potential impacts of threatened or actual terrorism and war, the success of Entergy’s strategies to reduce taxes, the effects of litigation, changes in accounting standards, changes in corporate governance and securities law requirements and Entergy’s ability to attract and retain talented management and directors.

1

[17380.TX]2

In 2002, Entergy Corporation sustained its record of strong performance. The company also enhanced its financial strength and flexibility to succeed in the continued down cycle in power markets.

We achieved our goals to grow operational earnings 8 to 10 percent, to sustain strong cash flow, to improve net margin, to strengthen our balance sheet, and to improve liquidity. In short, we ended the year in a strong financial position, in a market that punished many participants for not exercising financial discipline. Entergy produced total shareholder return of 20.2 percent in 2002, compared to a 15 percentlossfor the S&P Electric Utilities Index.

In 2002, Entergy’s as reported earnings were $2.64 per share, down from $3.23 per share in 2001, as a result of special charges related to our wholesale power development business. Excluding those charges, 2002 operational earnings were $3.81 per share, an increase of 18 percent. Operational earnings improved at each of our businesses—the utility, Entergy Nuclear, and Energy Commodity Services.

In addition in 2002:

| • | We generated more than $2 billion in operating cash flow for the second consecutive year, which is nearly $500 million more than we averaged from 1998 to 2000. |

| • | We lowered our end-of-year net debt ratio by more than 3 percentage points while growing our cash balance by over a half billion dollars to $1.3 billion, and we pre-funded more than $600 million of debt maturities at the utility. We ended 2002 with the third-lowest net debt level for Entergy in more than a dozen years. |

Entergy continues to concentrate on long-term financial goals aimed at enhancing the financial strength and vitality of each of our businesses. These long-term goals are aimed at top-tier operational performance, financial flexibility, and strong investment returns:

| • | Operational performance:We will continue to grow earnings per share at an average annual rate of 8 to 10 percent per year, grow cash flows at commensurate levels, and achieve and sustain top-quartile cost and margin positions to ensure that our revenue dollars are highly productive through the down cycle. |

| • | Financial flexibility:We will maintain a flexible and competitive capital structure that is appropriately aligned with the risk in our businesses and the cyclical nature of our industry. We will assure adequate liquidity at all times by appropriately matching financial assets and liabilities. We will secure improved credit ratings that recognize the fundamental strength and competitive positions of our businesses, with a goal of achieving and maintaining an “A” rating over the long term. |

| • | Investment returns:Finally, we will only reinvest free cash flow that isn’t returned to shareholders in businesses in which we have a distinctive competitive advantage. We will strive for above-market returns with high capital productivity and expect returns on capital to exceed 10 percent. |

We are hopeful that all of these efforts will result in top-quartile total shareholder return through a competitive dividend and stock price appreciation.

At the same time, we remain committed to the highest standards of integrity, transparency and disclosure. This Investor Guide reflects our continual efforts to improve the quality of the information we provide to the financial community. We hope that the financial and operational data presented here will be useful to you, and we are grateful for your interest in Entergy.

C. John Wilder

Chief Financial Officer

April 16, 2003

2

[17380.TX]3

Earnings Per Share - | Earnings Per Share - | Operating Cash Flow | Net Debt Ratio | ||||

As Reported ($/share) | Operational ($/share) | ($ billions) | (%) |

|

|

|

|

2002 | 2001 | 2000 | 1999 | 1998 | ||||||||||||||||

($ millions, except percentages and per share amounts) | ||||||||||||||||||||

SELECTED FINANCIAL DATA | ||||||||||||||||||||

Operating Revenues | $ | 8,305 |

| $ | 9,621 |

| $ | 10,022 |

| $ | 8,766 |

| $ | 11,495 |

| |||||

Consolidated Net Income | $ | 623 |

| $ | 751 |

| $ | 711 |

| $ | 595 |

| $ | 786 |

| |||||

As Reported Earnings Per Share—Basic | $ | 2.69 |

| $ | 3.29 |

| $ | 3.00 |

| $ | 2.25 |

| $ | 3.00 |

| |||||

As Reported Earnings Per Share—Diluted | $ | 2.64 |

| $ | 3.23 |

| $ | 2.97 |

| $ | 2.25 |

| $ | 3.00 |

| |||||

Special Items(a) Impact Per Share— Positive (negative) Impact on As Reported Earnings | $ | (1.17 | ) | $ | — |

| $ | (0.15 | ) | $ | 0.08 |

| $ | 0.78 |

| |||||

Operational Earnings Per Share—Diluted | ||||||||||||||||||||

Including Weather | $ | 3.81 |

| $ | 3.23 |

| $ | 3.12 |

| $ | 2.17 |

| $ | 2.22 |

| |||||

Excluding Weather | $ | 3.82 |

| $ | 3.24 |

| $ | 2.80 |

| $ | 2.08 |

| $ | 1.92 |

| |||||

Weather Impact—EPS | $ | (0.01 | ) | $ | (0.01 | ) | $ | 0.32 |

| $ | 0.09 |

| $ | 0.30 |

| |||||

Shares of Common Stock Outstanding: | ||||||||||||||||||||

End of Year |

| 222,421,677 |

|

| 220,732,703 |

|

| 219,604,583 |

|

| 239,036,911 |

|

| 246,620,169 |

| |||||

Weighted Average—Basic |

| 223,047,431 |

|

| 220,944,270 |

|

| 226,580,449 |

|

| 245,127,460 |

|

| 246,396,469 |

| |||||

Weighted Average—Diluted |

| 227,303,103 |

|

| 224,733,662 |

|

| 228,541,307 |

|

| 245,326,883 |

|

| 246,572,328 |

| |||||

Return on Average Common Equity—As Reported |

| 7.85 | % |

| 10.04 | % |

| 9.62 | % |

| 7.77 | % |

| 10.71 | % | |||||

Return on Average Common Equity—Operational |

| 11.33 | % |

| 10.04 | % |

| 10.13 | % |

| 7.48 | % |

| 7.92 | % | |||||

Common Dividends Paid Per Share | $ | 1.34 |

| $ | 1.28 |

| $ | 1.22 |

| $ | 1.20 |

| $ | 1.50 |

| |||||

Common Dividend Payout Ratio |

| 51 | % |

| 39 | % |

| 41 | % |

| 53 | % |

| 50 | % | |||||

Year End Closing Market Price of Common Stock |

| 45.59 |

|

| 39.11 |

|

| 42.31 |

|

| 25.75 |

|

| 31.13 |

| |||||

Book Value Per Share at End of Period | $ | 35.24 |

| $ | 33.78 |

| $ | 31.89 |

| $ | 29.78 |

| $ | 28.82 |

| |||||

Market Value of Equity | $ | 10,140 |

| $ | 8,633 |

| $ | 9,292 |

| $ | 6,155 |

| $ | 7,676 |

| |||||

Price to Earnings Ratio—As Reported |

| 17.27 |

|

| 12.11 |

|

| 14.25 |

|

| 11.44 |

|

| 10.38 |

| |||||

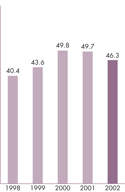

Net Debt to Net Capital |

| 46.3 | % |

| 49.7 | % |

| 49.8 | % |

| 43.6 | % |

| 40.4 | % | |||||

Operating Cash Flow | $ | 2,182 |

| $ | 2,216 |

| $ | 1,968 |

| $ | 1,389 |

| $ | 1,836 |

| |||||

| (a) | Special items are those events that are not routine, are related to prior periods, or are related to discontinued operations. |

Operational metrics are non-GAAP measures as they are calculated using operational net income, which excludes the impact of special items. As reported metrics are computed in accordance with GAAP as they include all components of net income, including special items. A reconciliation of operational earnings per share to as reported earnings per share and details on special items can be found on pages 4 - 5.

See page 44 for definitions of certain measures.

3

[17380.TX]4

ENTERGY CORPORATION CONSOLIDATED QUARTERLY RESULTS

2002 VS. 2001

2002 | 2001 | YTD Change | |||||||||||||||||||||||||||||||

1Q | 2Q | 3Q | 4Q | YTD | 1Q | 2Q | 3Q | 4Q | YTD | ||||||||||||||||||||||||

$/share | |||||||||||||||||||||||||||||||||

AS REPORTED | |||||||||||||||||||||||||||||||||

U.S. Utility | 0.45 |

| 0.85 |

| 1.07 |

| 0.19 |

| 2.57 |

| 0.51 |

| 0.74 |

| 0.99 |

| 0.20 |

| 2.45 |

| 0.12 |

| |||||||||||

Parent & Other | (0.03 | ) | (0.02 | ) | (0.02 | ) | (0.11 | ) | (0.17 | ) | (0.04 | ) | 0.03 |

| (0.06 | ) | (0.20 | ) | (0.26 | ) | 0.09 |

| |||||||||||

Competitive Businesses | |||||||||||||||||||||||||||||||||

Entergy Nuclear | 0.18 |

| 0.24 |

| 0.32 |

| 0.15 |

| 0.88 |

| 0.13 |

| 0.15 |

| 0.16 |

| 0.13 |

| 0.57 |

| 0.31 |

| |||||||||||

Energy Commodity Services | |||||||||||||||||||||||||||||||||

Non-Nuclear Wholesale Assets | (1.17 | ) | (0.07 | ) | 0.07 |

| (0.05 | ) | (1.22 | ) | 0.01 |

| (0.06 | ) | 0.14 |

| (0.08 | ) | — |

| (1.22 | ) | |||||||||||

Entergy-Koch Trading | 0.14 |

| 0.03 |

| 0.12 |

| 0.07 |

| 0.36 |

| 0.05 |

| 0.16 |

| 0.12 |

| 0.01 |

| 0.34 |

| 0.02 |

| |||||||||||

Gulf South Pipeline | 0.08 |

| 0.03 |

| 0.03 |

| 0.08 |

| 0.22 |

| 0.03 |

| 0.04 |

| 0.04 |

| 0.03 |

| 0.13 |

| 0.09 |

| |||||||||||

Total Energy Commodity Services | (0.95 | ) | (0.01 | ) | 0.22 |

| 0.10 |

| (0.64 | ) | 0.09 |

| 0.14 |

| 0.30 |

| (0.04 | ) | 0.47 |

| (1.11 | ) | |||||||||||

Total Competitive Businesses | (0.77 | ) | 0.23 |

| 0.54 |

| 0.25 |

| 0.24 |

| 0.22 |

| 0.29 |

| 0.46 |

| 0.09 |

| 1.04 |

| (0.80 | ) | |||||||||||

Consolidated Earnings | (0.35 | ) | 1.06 |

| 1.59 |

| 0.33 |

| 2.64 |

| 0.69 |

| 1.06 |

| 1.39 |

| 0.09 |

| 3.23 |

| (0.59 | ) | |||||||||||

LESS SPECIAL ITEMS | |||||||||||||||||||||||||||||||||

U.S. Utility | — |

| — |

| — |

| — |

| — |

| (0.01 | ) | — |

| — |

| — |

| (0.01 | ) | 0.01 |

| |||||||||||

Parent & Other | — |

| — |

| — |

| — |

| — |

| (0.05 | ) | — |

| — |

| (0.03 | ) | (0.08 | ) | 0.08 |

| |||||||||||

Competitive Businesses | |||||||||||||||||||||||||||||||||

Entergy Nuclear | — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| |||||||||||

Energy Commodity Services | |||||||||||||||||||||||||||||||||

Non-Nuclear Wholesale Assets | (1.15 | ) | (0.11 | ) | 0.09 |

| (0.01 | ) | (1.17 | ) | — |

| — |

| 0.15 |

| (0.06 | ) | 0.09 |

| (1.26 | ) | |||||||||||

Entergy-Koch Trading | — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| |||||||||||

Gulf South Pipeline | — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| |||||||||||

Total Energy Commodity Services | (1.15 | ) | (0.11 | ) | 0.09 |

| (0.01 | ) | (1.17 | ) | — |

| — |

| 0.15 |

| (0.06 | ) | 0.09 |

| (1.26 | ) | |||||||||||

Total Competitive Businesses | (1.15 | ) | (0.11 | ) | 0.09 |

| (0.01 | ) | (1.17 | ) | — |

| — |

| 0.15 |

| (0.06 | ) | 0.09 |

| (1.26 | ) | |||||||||||

Total Special Items | (1.15 | ) | (0.11 | ) | 0.09 |

| (0.01 | ) | (1.17 | ) | (0.06 | ) | — |

| 0.15 |

| (0.09 | ) | — |

| (1.17 | ) | |||||||||||

OPERATIONAL | |||||||||||||||||||||||||||||||||

U.S. Utility | 0.45 |

| 0.85 |

| 1.07 |

| 0.19 |

| 2.57 |

| 0.52 |

| 0.74 |

| 0.99 |

| 0.20 |

| 2.46 |

| 0.11 |

| |||||||||||

Parent & Other | (0.03 | ) | (0.02 | ) | (0.02 | ) | (0.11 | ) | (0.17 | ) | 0.01 |

| 0.03 |

| (0.06 | ) | (0.17 | ) | (0.18 | ) | 0.01 |

| |||||||||||

Competitive Businesses | |||||||||||||||||||||||||||||||||

Entergy Nuclear | 0.18 |

| 0.24 |

| 0.32 |

| 0.15 |

| 0.88 |

| 0.13 |

| 0.15 |

| 0.16 |

| 0.13 |

| 0.57 |

| 0.31 |

| |||||||||||

Energy Commodity Services | |||||||||||||||||||||||||||||||||

Non-Nuclear Wholesale Assets | (0.02 | ) | 0.04 |

| (0.02 | ) | (0.04 | ) | (0.05 | ) | 0.01 |

| (0.06 | ) | (0.01 | ) | (0.02 | ) | (0.09 | ) | 0.04 |

| |||||||||||

Entergy-Koch Trading | 0.14 |

| 0.03 |

| 0.12 |

| 0.07 |

| 0.36 |

| 0.05 |

| 0.16 |

| 0.12 |

| 0.01 |

| 0.34 |

| 0.02 |

| |||||||||||

Gulf South Pipeline | 0.08 |

| 0.03 |

| 0.03 |

| 0.08 |

| 0.22 |

| 0.03 |

| 0.04 |

| 0.04 |

| 0.03 |

| 0.13 |

| 0.09 |

| |||||||||||

Total Energy Commodity Services | 0.20 |

| 0.10 |

| 0.13 |

| 0.11 |

| 0.53 |

| 0.09 |

| 0.14 |

| 0.15 |

| 0.02 |

| 0.38 |

| 0.15 |

| |||||||||||

Total Competitive Businesses | 0.38 |

| 0.34 |

| 0.45 |

| 0.26 |

| 1.41 |

| 0.22 |

| 0.29 |

| 0.31 |

| 0.15 |

| 0.95 |

| 0.46 |

| |||||||||||

Consolidated Earnings | 0.80 |

| 1.17 |

| 1.50 |

| 0.34 |

| 3.81 |

| 0.75 |

| 1.06 |

| 1.24 |

| 0.18 |

| 3.23 |

| 0.58 |

| |||||||||||

Weather Impact | 0.03 |

| — |

| (0.04 | ) | — |

| (0.01 | ) | 0.05 |

| — |

| (0.04 | ) | (0.02 | ) | (0.01 | ) | — |

| |||||||||||

Totals may not foot due to rounding.

4

[17380.TX]5

ENTERGY CORPORATION SPECIAL ITEMS [shown as positive/(negative) impact on earnings]

2002 VS. 2001

2002 | 2001 | YTD Change | ||||||||||||||||||||||||||||

1Q | 2Q | 3Q | 4Q | YTD | 1Q | 2Q | 3Q | 4Q | YTD | |||||||||||||||||||||

$/share | ||||||||||||||||||||||||||||||

U.S. UTILITY SPECIAL ITEMS | ||||||||||||||||||||||||||||||

Merger expenses | — |

| — |

| — | — |

| — |

| (0.01 | ) | — | — | — |

| (0.01 | ) | 0.01 |

| |||||||||||

Total | — |

| — |

| — | — |

| — |

| (0.01 | ) | — | — | — |

| (0.01 | ) | 0.01 |

| |||||||||||

PARENT & OTHER SPECIAL ITEMS | ||||||||||||||||||||||||||||||

Merger expenses | — |

| — |

| — | — |

| — |

| (0.05 | ) | — | — | — |

| (0.05 | ) | 0.05 |

| |||||||||||

Write-down of MyHomeKey investment | — |

| — |

| — | — |

| — |

| — |

| — | — | (0.03 | ) | (0.03 | ) | 0.03 |

| |||||||||||

Total | — |

| — |

| — | — |

| — |

| (0.05 | ) | — | — | (0.03 | ) | (0.08 | ) | 0.08 |

| |||||||||||

COMPETITIVE BUSINESSES SPECIAL ITEMS | ||||||||||||||||||||||||||||||

Energy Commodity Services | ||||||||||||||||||||||||||||||

Gain (loss) on disposition of assets | — |

| — |

| 0.09 | 0.14 |

| 0.23 |

| — |

| — | 0.15 | (0.14 | ) | 0.01 |

| 0.22 |

| |||||||||||

Asset and contract impairments | (0.44 | ) | (0.04 | ) | — | (0.15 | ) | (0.62 | ) | — |

| — | — | — |

| — |

| (0.62 | ) | |||||||||||

Turbine commitment | (0.62 | ) | 0.10 |

| — | — |

| (0.52 | ) | — |

| — | — | — |

| — |

| (0.52 | ) | |||||||||||

Development costs | (0.09 | ) | — |

| — | — |

| (0.09 | ) | — |

| — | — | — |

| — |

| (0.09 | ) | |||||||||||

Restructuring | — |

| (0.17 | ) | — | — |

| (0.17 | ) | — |

| — | — | (0.02 | ) | (0.02 | ) | (0.15 | ) | |||||||||||

Damhead Creek mark to market gas contract | — |

| — |

| — | — |

| — |

| — |

| — | — | 0.10 |

| 0.10 |

| (0.10 | ) | |||||||||||

Total | (1.15 | ) | (0.11 | ) | 0.09 | (0.01 | ) | (1.17 | ) | — |

| — | 0.15 | (0.06 | ) | 0.09 |

| (1.26 | ) | |||||||||||

Total Special Items | (1.15 | ) | (0.11 | ) | 0.09 | (0.01 | ) | (1.17 | ) | (0.06 | ) | — | 0.15 | (0.09 | ) | — |

| (1.17 | ) | |||||||||||

5

[17380.TX]6

CONSOLIDATING INCOME STATEMENT

U.S. | Parent | Competitive Businesses | Eliminations | Consolidated | ||||||||||||||||

In thousands, except share data, for the year ended December 31, 2002. | ||||||||||||||||||||

OPERATING REVENUES: | ||||||||||||||||||||

Domestic electric | $ | 6,648,156 |

| $ | — |

| $ | — |

| $ | (1,742 | ) | $ | 6,646,414 |

| |||||

Natural gas |

| 125,353 |

|

| — |

|

| — |

|

| — |

|

| 125,353 |

| |||||

Competitive businesses |

| — |

|

| 40,729 |

|

| 1,494,909 |

|

| (2,369 | ) |

| 1,533,268 |

| |||||

Total |

| 6,773,509 |

|

| 40,729 |

|

| 1,494,909 |

|

| (4,111 | ) |

| 8,305,035 |

| |||||

OPERATING EXPENSES: | ||||||||||||||||||||

Operating and Maintenance: | ||||||||||||||||||||

Fuel, fuel-related expenses, and gas purchased for resale |

| 1,941,349 |

|

| — |

|

| 213,247 |

|

| — |

|

| 2,154,596 |

| |||||

Purchased power |

| 764,350 |

|

| 2,339 |

|

| 68,840 |

|

| (3,195 | ) |

| 832,334 |

| |||||

Gross Margin |

| 4,067,810 |

|

| 38,390 |

|

| 1,212,822 |

|

| (916 | ) |

| 5,318,105 |

| |||||

Margin % |

| 60.1 | % |

| 94.3 | % |

| 81.1 | % |

| 22.3 | % |

| 64.0 | % | |||||

Nuclear refueling outage expenses |

| 58,802 |

|

| — |

|

| 46,791 |

|

| — |

|

| 105,592 |

| |||||

Provision for turbine commitments, assets impairments and restructuring charges |

| — |

|

| — |

|

| 428,456 |

|

| — |

|

| 428,456 |

| |||||

Other operation and maintenance |

| 1,678,569 |

|

| 85,617 |

|

| 725,880 |

|

| (1,954 | ) |

| 2,488,112 |

| |||||

Decommissioning |

| 30,458 |

|

| — |

|

| — |

|

| — |

|

| 30,458 |

| |||||

Taxes other than income taxes |

| 333,204 |

|

| 2,546 |

|

| 44,712 |

|

| — |

|

| 380,462 |

| |||||

Total |

| 4,806,731 |

|

| 90,502 |

|

| 1,527,926 |

|

| (5,149 | ) |

| 6,420,010 |

| |||||

EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION, AND AMORTIZATION |

| 1,966,778 |

|

| (49,773 | ) |

| (33,017 | ) |

| 1,038 |

|

| 1,885,025 |

| |||||

Margin % |

| 29.0 | % |

| (122.2 | )% |

| (2.2 | )% |

| (25.2 | )% |

| 22.7 | % | |||||

DEPRECIATION AND AMORTIZATION: | ||||||||||||||||||||

Depreciation and amortization |

| 769,799 |

|

| 5,143 |

|

| 64,239 |

|

| — |

|

| 839,181 |

| |||||

Other regulatory charges (credits) |

| (141,836 | ) |

| — |

|

| — |

|

| — |

|

| (141,836 | ) | |||||

Total |

| 627,963 |

|

| 5,143 |

|

| 64,239 |

|

| — |

|

| 697,345 |

| |||||

OPERATING INCOME (LOSS) |

| 1,338,815 |

|

| (54,916 | ) |

| (97,256 | ) |

| 1,038 |

|

| 1,187,680 |

| |||||

Margin % |

| 19.8 | % |

| (134.8 | )% |

| (6.5 | )% |

| (25.2 | )% |

| 14.3 | % | |||||

OTHER INCOME (DEDUCTIONS): | ||||||||||||||||||||

Allowance for equity funds used during construction |

| 31,658 |

|

| — |

|

| — |

|

| — |

|

| 31,658 |

| |||||

Gain/(loss) on sale of assets—net |

| 5,394 |

|

| 2 |

|

| 1,216 |

|

| — |

|

| 6,612 |

| |||||

Interest and dividend income |

| 23,231 |

|

| 35,433 |

|

| 97,401 |

|

| (37,741 | ) |

| 118,325 |

| |||||

Equity in earnings of unconsolidated equity affiliates |

| (2 | ) |

| — |

|

| 183,880 |

|

| — |

|

| 183,878 |

| |||||

Miscellaneous—net |

| (12,678 | ) |

| 5,243 |

|

| 15,753 |

|

| (1,038 | ) |

| 7,280 |

| |||||

Total |

| 47,603 |

|

| 40,678 |

|

| 298,250 |

|

| (38,779 | ) |

| 347,753 |

| |||||

INTEREST AND OTHER CHARGES: | ||||||||||||||||||||

Interest on long-term debt |

| 443,154 |

|

| 640 |

|

| 63,810 |

|

| — |

|

| 507,604 |

| |||||

Other interest—net |

| 28,249 |

|

| 34,939 |

|

| 91,071 |

|

| (37,741 | ) |

| 116,519 |

| |||||

Distributions on preferred securities of subsidiaries |

| 18,838 |

|

| — |

|

| — |

|

| — |

|

| 18,838 |

| |||||

Allowance for borrowed funds used during construction |

| (24,538 | ) |

| — |

|

| — |

|

| — |

|

| (24,538 | ) | |||||

Total |

| 465,703 |

|

| 35,579 |

|

| 154,881 |

|

| (37,741 | ) |

| 618,423 |

| |||||

INCOME (LOSS) BEFORE INCOME TAXES |

| 920,715 |

|

| (49,817 | ) |

| 46,113 |

|

| — |

|

| 917,010 |

| |||||

Income taxes |

| 313,752 |

|

| (11,252 | ) |

| (8,562 | ) |

| — |

|

| 293,938 |

| |||||

INCOME (LOSS) BEFORE CUMULATIVE EFFECT OF ACCOUNTING CHANGE |

| 606,963 |

|

| (38,565 | ) |

| 54,675 |

|

| — |

|

| 623,072 |

| |||||

CUMULATIVE EFFECT OF ACCOUNTING CHANGE (NET OF TAXES) |

| — |

|

| — |

|

| — |

|

| — |

|

| — |

| |||||

CONSOLIDATED NET INCOME (LOSS) |

| 606,963 |

|

| (38,565 | ) |

| 54,675 |

|

| — |

|

| 623,072 |

| |||||

Preferred dividend requirements of subsidiaries and other |

| 23,712 |

|

| — |

|

| — |

|

| — |

|

| 23,712 |

| |||||

EARNINGS (LOSS) APPLICABLE TO COMMON STOCK | $ | 583,251 |

| $ | (38,565 | ) | $ | 54,675 |

| $ | — |

| $ | 599,360 |

| |||||

Margin % |

| 8.6 | % |

| (94.7 | )% |

| 3.7 | % |

| — |

|

| 7.2 | % | |||||

EARNINGS PER AVERAGE COMMON SHARE: | ||||||||||||||||||||

Basic | $ | 2.61 |

| $ | (0.17 | ) | $ | 0.25 |

|

| — |

| $ | 2.69 |

| |||||

Diluted | $ | 2.57 |

| $ | (0.17 | ) | $ | 0.24 |

|

| — |

| $ | 2.64 |

| |||||

AVERAGE NUMBER OF COMMON SHARES OUTSTANDING: | ||||||||||||||||||||

Basic |

| 223,047,431 |

| |||||||||||||||||

Diluted |

| 227,303,103 |

| |||||||||||||||||

Totals may not foot due to rounding.

6

[17380.TX]7

CONSOLIDATED STATEMENTS OF INCOME

2002 | 2001 | 2000 | ||||||||||

In thousands, except share data, for the years ended December 31, | ||||||||||||

OPERATING REVENUES: | ||||||||||||

Domestic electric | $ | 6,646,414 |

| $ | 7,244,827 |

| $ | 7,219,686 |

| |||

Natural gas |

| 125,353 |

|

| 185,902 |

|

| 165,872 |

| |||

Competitive businesses |

| 1,533,268 |

|

| 2,190,170 |

|

| 2,636,571 |

| |||

Total |

| 8,305,035 |

|

| 9,620,899 |

|

| 10,022,129 |

| |||

OPERATING EXPENSES: | ||||||||||||

Operating and maintenance: | ||||||||||||

Fuel, fuel-related expenses, and gas purchased for resale |

| 2,154,596 |

|

| 3,681,677 |

|

| 2,645,835 |

| |||

Purchased power |

| 832,334 |

|

| 1,021,432 |

|

| 2,662,881 |

| |||

Nuclear refueling outage expenses |

| 105,592 |

|

| 89,145 |

|

| 70,511 |

| |||

Provision for turbine commitments, asset impairments and |

| 428,456 |

|

| — |

|

| — |

| |||

Other operation and maintenance |

| 2,488,112 |

|

| 2,151,742 |

|

| 1,943,814 |

| |||

Decommissioning |

| 30,458 |

|

| 3,189 |

|

| 39,484 |

| |||

Taxes other than income taxes |

| 380,462 |

|

| 399,849 |

|

| 370,344 |

| |||

Depreciation and amortization |

| 839,181 |

|

| 721,033 |

|

| 746,125 |

| |||

Other regulatory charges (credits)—net |

| (141,836 | ) |

| (20,510 | ) |

| 34,073 |

| |||

Total |

| 7,117,355 |

|

| 8,047,557 |

|

| 8,513,067 |

| |||

OPERATING INCOME |

| 1,187,680 |

|

| 1,573,342 |

|

| 1,509,062 |

| |||

OTHER INCOME: | ||||||||||||

Allowance for equity funds used during construction |

| 31,658 |

|

| 26,209 |

|

| 32,022 |

| |||

Gain on sale of assets—net |

| 6,612 |

|

| 5,226 |

|

| 2,340 |

| |||

Interest and dividend income |

| 118,325 |

|

| 159,805 |

|

| 163,050 |

| |||

Equity in earnings of unconsolidated equity affiliates |

| 183,878 |

|

| 162,882 |

|

| 13,715 |

| |||

Miscellaneous—net |

| 7,280 |

|

| (4,769 | ) |

| 27,077 |

| |||

Total |

| 347,753 |

|

| 349,353 |

|

| 238,204 |

| |||

INTEREST AND OTHER CHARGES: | ||||||||||||

Interest on long-term debt |

| 507,604 |

|

| 544,920 |

|

| 477,071 |

| |||

Other interest—net |

| 116,519 |

|

| 197,638 |

|

| 85,635 |

| |||

Distributions on preferred securities of subsidiaries |

| 18,838 |

|

| 18,838 |

|

| 18,838 |

| |||

Allowance for borrowed funds used during construction |

| (24,538 | ) |

| (21,419 | ) |

| (24,114 | ) | |||

Total |

| 618,423 |

|

| 739,977 |

|

| 557,430 |

| |||

INCOME BEFORE INCOME TAXES AND CUMULATIVE EFFECT OF ACCOUNTING CHANGE |

| 917,010 |

|

| 1,182,718 |

|

| 1,189,836 |

| |||

Income taxes |

| 293,938 |

|

| 455,693 |

|

| 478,921 |

| |||

INCOME BEFORE CUMULATIVE EFFECT OF ACCOUNTING CHANGE |

| 623,072 |

|

| 727,025 |

|

| 710,915 |

| |||

CUMULATIVE EFFECT OF ACCOUNTING CHANGE (NET OF INCOME TAXES OF $ 10,064) |

| — |

|

| 23,482 |

|

| — |

| |||

CONSOLIDATED NET INCOME |

| 623,072 |

|

| 750,507 |

|

| 710,915 |

| |||

Preferred dividend requirements and other |

| 23,712 |

|

| 24,311 |

|

| 31,621 |

| |||

EARNINGS APPLICABLE TO COMMON STOCK | $ | 599,360 |

| $ | 726,196 |

| $ | 679,294 |

| |||

Earnings per average common share before cumulative effect | ||||||||||||

Basic | $ | 2.69 |

| $ | 3.18 |

| $ | 3.00 |

| |||

Diluted | $ | 2.64 |

| $ | 3.13 |

| $ | 2.97 |

| |||

Earnings per average common share: | ||||||||||||

Basic | $ | 2.69 |

| $ | 3.29 |

| $ | 3.00 |

| |||

Diluted | $ | 2.64 |

| $ | 3.23 |

| $ | 2.97 |

| |||

Dividends declared per common share | $ | 1.34 |

| $ | 1.28 |

| $ | 1.22 |

| |||

Average number of common shares outstanding: | ||||||||||||

Basic |

| 223,047,431 |

|

| 220,944,270 |

|

| 226,580,449 |

| |||

Diluted |

| 227,303,103 |

|

| 224,733,662 |

|

| 228,541,307 |

| |||

7

[17380.TX]8

FINANCIAL STATEMENTS

CONSOLIDATING BALANCE SHEET

U.S. Utility | Parent & Other | Competitive Businesses | Eliminations | Consolidated | ||||||||||||||||

In thousands, as of December 31, 2002. | ||||||||||||||||||||

ASSETS | ||||||||||||||||||||

CURRENT ASSETS: | ||||||||||||||||||||

Cash and cash equivalents: | ||||||||||||||||||||

Cash | $ | 118,625 |

| $ | 5,011 |

| $ | 46,152 |

| $ | — |

| $ | 169,788 |

| |||||

Temporary cash investments—at cost, which approximates market |

| 969,077 |

|

| 24,518 |

|

| 171,665 |

|

| — |

|

| 1,165,260 |

| |||||

Special deposits |

| — |

|

| 31 |

|

| 249 |

|

| — |

|

| 280 |

| |||||

Total cash and cash equivalents |

| 1,087,702 |

|

| 29,560 |

|

| 218,066 |

|

| — |

|

| 1,335,328 |

| |||||

Other temporary investments |

| — |

|

| — |

|

| — |

|

| — |

|

| — |

| |||||

Notes receivable |

| 13 |

|

| 501,161 |

|

| 403,393 |

|

| (902,490 | ) |

| 2,078 |

| |||||

Accounts receivable: | ||||||||||||||||||||

Customer |

| 321,942 |

|

| 1,273 |

|

| — |

|

| — |

|

| 323,215 |

| |||||

Allowance for doubtful accounts |

| (24,421 | ) |

| (2,364 | ) |

| (500 | ) |

| — |

|

| (27,285 | ) | |||||

Associated companies |

| 19,907 |

|

| 159,628 |

|

| (137,645 | ) |

| (41,889 | ) |

| — |

| |||||

Other |

| 112,438 |

|

| 1,083 |

|

| 131,100 |

|

| — |

|

| 244,621 |

| |||||

Accrued unbilled revenues |

| 318,101 |

|

| 1,032 |

|

| — |

|

| — |

|

| 319,133 |

| |||||

Total receivables |

| 747,967 |

|

| 160,652 |

|

| (7,046 | ) |

| (41,889 | ) |

| 859,684 |

| |||||

Deferred fuel costs |

| 55,653 |

|

| — |

|

| — |

|

| — |

|

| 55,653 |

| |||||

Accumulated deferred income taxes |

| 14,872 |

|

| 18 |

|

| — |

|

| (14,890 | ) |

| — |

| |||||

Fuel inventory—at average cost |

| 94,183 |

|

| — |

|

| 2,266 |

|

| 18 |

|

| 96,467 |

| |||||

Materials and supplies—at average cost |

| 333,977 |

|

| 25 |

|

| 191,898 |

|

| — |

|

| 525,900 |

| |||||

Deferred nuclear refueling outage costs |

| 51,541 |

|

| — |

|

| 112,106 |

|

| — |

|

| 163,646 |

| |||||

Prepayments and other |

| 131,092 |

|

| 3,557 |

|

| 32,176 |

|

| — |

|

| 166,827 |

| |||||

Total |

| 2,517,000 |

|

| 694,973 |

|

| 952,859 |

|

| (959,251 | ) |

| 3,205,583 |

| |||||

OTHER PROPERTY AND INVESTMENTS: | ||||||||||||||||||||

Investment in affiliates—at equity |

| 214 |

|

| 8,897,127 |

|

| 823,996 |

|

| (8,897,127 | ) |

| 824,209 |

| |||||

Decommissioning trust funds |

| 839,405 |

|

| — |

|

| 1,229,793 |

|

| — |

|

| 2,069,198 |

| |||||

Non-utility property—at cost (less accumulated depreciation) |

| 222,519 |

|

| 74,204 |

|

| 571 |

|

| — |

|

| 297,294 |

| |||||

Other |

| 21,084 |

|

| 33,677 |

|

| 559,378 |

|

| (343,249 | ) |

| 270,889 |

| |||||

Total |

| 1,083,222 |

|

| 9,005,008 |

|

| 2,613,738 |

|

| (9,240,376 | ) |

| 3,461,590 |

| |||||

PROPERTY, PLANT, AND EQUIPMENT: | ||||||||||||||||||||

Electric |

| 25,226,879 |

|

| 8,498 |

|

| 1,554,161 |

|

| — |

|

| 26,789,538 |

| |||||

Property under capital lease |

| 746,624 |

|

| — |

|

| — |

|

| — |

|

| 746,624 |

| |||||

Natural gas |

| 209,913 |

|

| 57 |

|

| — |

|

| — |

|

| 209,969 |

| |||||

Construction work in progress |

| 797,128 |

|

| 27,927 |

|

| 411,786 |

|

| (3,949 | ) |

| 1,232,891 |

| |||||

Nuclear fuel under capital lease |

| 259,433 |

|

| — |

|

| — |

|

| — |

|

| 259,433 |

| |||||

Nuclear fuel |

| 24,475 |

|

| — |

|

| 239,134 |

|

| — |

|

| 263,609 |

| |||||

Total property, plant and equipment |

| 27,264,452 |

|

| 36,482 |

|

| 2,205,081 |

|

| (3,949 | ) |

| 29,502,064 |

| |||||

Less—accumulated depreciation and amortization |

| 12,140,375 |

|

| 4,703 |

|

| 162,035 |

|

| — |

|

| 12,307,112 |

| |||||

Property, plant and equipment—net |

| 15,124,077 |

|

| 31,779 |

|

| 2,043,046 |

|

| (3,949 | ) |

| 17,194,952 |

| |||||

DEFERRED DEBITS AND OTHER ASSETS: | ||||||||||||||||||||

Regulatory assets: | ||||||||||||||||||||

SFAS 109 regulatory asset—net |

| 844,105 |

|

| — |

|

| — |

|

| — |

|

| 844,105 |

| |||||

Unamortized loss on reacquired debt |

| 155,161 |

|

| — |

|

| — |

|

| — |

|

| 155,161 |

| |||||

Other regulatory assets |

| 738,328 |

|

| — |

|

| — |

|

| — |

|

| 738,328 |

| |||||

Long-term receivables |

| 24,703 |

|

| — |

|

| — |

|

| — |

|

| 24,703 |

| |||||

Goodwill |

| 374,099 |

|

| — |

|

| 3,073 |

|

| — |

|

| 377,172 |

| |||||

Other |

| 213,431 |

|

| 492,721 |

|

| 779,032 |

|

| (538,809 | ) |

| 946,375 |

| |||||

Total |

| 2,349,827 |

|

| 492,721 |

|

| 782,105 |

|

| (538,809 | ) |

| 3,085,844 |

| |||||

TOTAL ASSETS | $ | 21,074,126 |

| $ | 10,224,481 |

| $ | 6,391,748 |

| $ | (10,742,385 | ) | $ | 26,947,969 |

| |||||

Totals may not foot due to rounding.

8

[17380.TX]9

CONSOLIDATING BALANCE SHEET

U.S. | Parent | Competitive Businesses | Eliminations | Consolidated | ||||||||||||||||

In thousands, as of December 31, 2002. | ||||||||||||||||||||

LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||||||||||||||

CURRENT LIABILITIES: | ||||||||||||||||||||

Currently maturing long-term debt | $ | 1,110,741 |

| $ | — |

| $ | 80,579 |

| $ | — |

| $ | 1,191,320 |

| |||||

Notes payable: | ||||||||||||||||||||

Associated companies |

| — |

|

| 421,155 |

|

| 482,447 |

|

| (903,602 | ) |

| — |

| |||||

Other |

| 47 |

|

| — |

|

| 304 |

|

| — |

|

| 351 |

| |||||

Accounts payable: | ||||||||||||||||||||

Associated companies |

| (11,912 | ) |

| 150,651 |

|

| (102,580 | ) |

| (36,160 | ) |

| — |

| |||||

Other |

| 704,964 |

|

| 17,729 |

|

| 132,752 |

|

| — |

|

| 855,446 |

| |||||

Customer deposits |

| 198,100 |

|

| 179 |

|

| 163 |

|

| — |

|

| 198,442 |

| |||||

Taxes accrued |

| 75,044 |

|

| 25,943 |

|

| 284,328 |

|

| — |

|

| 385,315 |

| |||||

Accumulated deferred income taxes |

| — |

|

| — |

|

| 41,359 |

|

| (14,890 | ) |

| 26,468 |

| |||||

Nuclear refueling outage costs |

| 14,244 |

|

| — |

|

| — |

|

| — |

|

| 14,244 |

| |||||

Interest accrued |

| 165,903 |

|

| 3,138 |

|

| 6,399 |

|

| — |

|

| 175,440 |

| |||||

Obligations under capital leases |

| 153,822 |

|

| — |

|

| — |

|

| — |

|

| 153,822 |

| |||||

Other |

| 68,830 |

|

| 12,844 |

|

| 98,147 |

|

| (8,479 | ) |

| 171,341 |

| |||||

Total |

| 2,479,783 |

|

| 631,639 |

|

| 1,023,898 |

|

| (963,131 | ) |

| 3,172,189 |

| |||||

DEFERRED CREDITS AND OTHER LIABILITIES: | ||||||||||||||||||||

Accumulated deferred income taxes and taxes accrued |

| 4,512,358 |

|

| 11,245 |

|

| (272,804 | ) |

| — |

|

| 4,250,800 |

| |||||

Accumulated deferred investment tax credits |

| 447,925 |

|

| — |

|

| — |

|

| — |

|

| 447,925 |

| |||||

Obligations under capital leases |

| 155,934 |

|

| — |

|

| 9 |

|

| — |

|

| 155,943 |

| |||||

Other regulatory liabilities |

| 185,579 |

|

| — |

|

| — |

|

| — |

|

| 185,579 |

| |||||

Decommissioning |

| 302,202 |

|

| — |

|

| 1,263,796 |

|

| — |

|

| 1,565,997 |

| |||||

Transition to competition |

| 79,098 |

|

| — |

|

| — |

|

| — |

|

| 79,098 |

| |||||

Regulatory reserves |

| 56,438 |

|

| — |

|

| — |

|

| — |

|

| 56,438 |

| |||||

Accumulated provisions |

| 299,462 |

|

| 1,679 |

|

| 88,726 |

|

| — |

|

| 389,868 |

| |||||

Other |

| 1,044,074 |

|

| 103,273 |

|

| 503,199 |

|

| (505,314 | ) |

| 1,145,232 |

| |||||

Total |

| 7,083,070 |

|

| 116,197 |

|

| 1,582,926 |

|

| (505,314 | ) |

| 8,276,880 |

| |||||

Long-term debt |

| 5,542,438 |

|

| 915,611 |

|

| 697,352 |

|

| (68,402 | ) |

| 7,086,999 |

| |||||

Preferred stock with sinking fund |

| 24,327 |

|

| — |

|

| — |

|

| — |

|

| 24,327 |

| |||||

Preferred stock without sinking fund |

| 334,337 |

|

| — |

|

| 91,940 |

|

| (91,940 | ) |

| 334,337 |

| |||||

Company-obligated mandatorily redeemable preferred securities of subsidiary trusts holding solely junior subordinated deferrable debentures |

| 215,000 |

|

| — |

|

| — |

|

| — |

|

| 215,000 |

| |||||

SHAREHOLDERS’ EQUITY: | ||||||||||||||||||||

Common stock, $.01 par value, authorized 500,000,000 shares; issued 248,174,087 shares in 2002 |

| 2,225,870 |

|

| 1,360 |

|

| 1,696,327 |

|

| (3,921,075 | ) |

| 2,482 |

| |||||

Paid-in capital |

| 1,784,097 |

|

| 5,757,779 |

|

| 1,030,284 |

|

| (3,905,407 | ) |

| 4,666,753 |

| |||||

Retained earnings |

| 1,500,609 |

|

| 3,553,724 |

|

| 337,699 |

|

| (1,453,338 | ) |

| 3,938,693 |

| |||||

Accumulated other comprehensive income (loss) |

| 4,595 |

|

| (4,498 | ) |

| (25,362 | ) |

| 2,906 |

|

| (22,360 | ) | |||||

Less—treasury stock, at cost (25,752,410 shares in 2002) |

| 120,000 |

|

| 747,331 |

|

| 43,316 |

|

| (163,316 | ) |

| 747,331 |

| |||||

Total |

| 5,395,171 |

|

| 8,561,034 |

|

| 2,995,632 |

|

| (9,113,598 | ) |

| 7,838,237 |

| |||||

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 21,074,126 |

| $ | 10,224,481 |

| $ | 6,391,748 |

| $ | (10,742,385 | ) | $ | 26,947,969 |

| |||||

Totals may not foot due to rounding.

9

[17380.TX]10

FINANCIAL STATEMENTS

CONSOLIDATED BALANCE SHEETS

2002 | 2001 | |||||||

In thousands, as of December 31, | ||||||||

ASSETS | ||||||||

CURRENT ASSETS: | ||||||||

Cash and cash equivalents: | ||||||||

Cash | $ | 169,788 |

| $ | 129,866 |

| ||

Temporary cash investments—at cost, which approximates market |

| 1,165,260 |

|

| 618,327 |

| ||

Special deposits |

| 280 |

|

| 3,380 |

| ||

Total cash and cash equivalents |

| 1,335,328 |

|

| 751,573 |

| ||

Other temporary investments |

| — |

|

| 150,000 |

| ||

Notes receivable |

| 2,078 |

|

| 2,137 |

| ||

Accounts receivable: | ||||||||

Customer |

| 323,215 |

|

| 294,799 |

| ||

Allowance for doubtful accounts |

| (27,285 | ) |

| (28,355 | ) | ||

Other |

| 244,621 |

|

| 295,771 |

| ||

Accrued unbilled revenues |

| 319,133 |

|

| 268,680 |

| ||

Total receivables |

| 859,684 |

|

| 830,895 |

| ||

Deferred fuel costs |

| 55,653 |

|

| 172,444 |

| ||

Accumulated deferred income taxes |

| — |

|

| 6,488 |

| ||

Fuel inventory—at average cost |

| 96,467 |

|

| 97,497 |

| ||

Materials and supplies—at average cost |

| 525,900 |

|

| 460,644 |

| ||

Deferred nuclear refueling outage costs |

| 163,646 |

|

| 79,755 |

| ||

Prepayments and other |

| 166,827 |

|

| 205,097 |

| ||

Total |

| 3,205,583 |

|

| 2,756,530 |

| ||

OTHER PROPERTY AND INVESTMENTS: | ||||||||

Investment in affiliates—at equity |

| 824,209 |

|

| 766,103 |

| ||

Decommissioning trust funds |

| 2,069,198 |

|

| 1,775,950 |

| ||

Non-utility property—at cost (less accumulated depreciation) |

| 297,294 |

|

| 295,616 |

| ||

Other |

| 270,889 |

|

| 495,542 |

| ||

Total |

| 3,461,590 |

|

| 3,333,211 |

| ||

PROPERTY, PLANT AND EQUIPMENT: | ||||||||

Electric |

| 26,789,538 |

|

| 26,359,676 |

| ||

Property under capital lease |

| 746,624 |

|

| 753,310 |

| ||

Natural gas |

| 209,969 |

|

| 201,841 |

| ||

Construction work in progress |

| 1,232,891 |

|

| 882,829 |

| ||

Nuclear fuel under capital lease |

| 259,433 |

|

| 265,464 |

| ||

Nuclear fuel |

| 263,609 |

|

| 232,387 |

| ||

Total property, plant and equipment |

| 29,502,064 |

|

| 28,695,507 |

| ||

Less—accumulated depreciation and amortization |

| 12,307,112 |

|

| 11,805,578 |

| ||

Property, plant and equipment—net |

| 17,194,952 |

|

| 16,889,929 |

| ||

DEFERRED DEBITS AND OTHER ASSETS: | ||||||||

Regulatory assets: | ||||||||

SFAS 109 regulatory asset—net |

| 844,105 |

|

| 946,126 |

| ||

Unamortized loss on reacquired debt |

| 155,161 |

|

| 166,546 |

| ||

Other regulatory assets |

| 738,328 |

|

| 707,439 |

| ||

Long-term receivables |

| 24,703 |

|

| 28,083 |

| ||

Goodwill |

| 377,172 |

|

| 377,172 |

| ||

Other |

| 946,375 |

|

| 705,275 |

| ||

Total |

| 3,085,844 |

|

| 2,930,641 |

| ||

TOTAL ASSETS | $ | 26,947,969 |

| $ | 25,910,311 |

| ||

10

[17380.TX]11

CONSOLIDATED BALANCE SHEETS

2002 | 2001 | |||||||

In thousands, as of December 31, | ||||||||

LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

CURRENT LIABILITIES: | ||||||||

Currently maturing long-term debt | $ | 1,191,320 |

| $ | 682,771 |

| ||

Notes payable |

| 351 |

|

| 351,018 |

| ||

Accounts payable |

| 855,446 |

|

| 592,529 |

| ||

Customer deposits |

| 198,442 |

|

| 188,230 |

| ||

Taxes accrued |

| 385,315 |

|

| 550,133 |

| ||

Accumulated deferred income taxes |

| 26,468 |

|

| — |

| ||

Nuclear refueling outage costs |

| 14,244 |

|

| 2,080 |

| ||

Interest accrued |

| 175,440 |

|

| 192,420 |

| ||

Obligations under capital leases |

| 153,822 |

|

| 149,352 |

| ||

Other |

| 171,341 |

|

| 396,616 |

| ||

Total |

| 3,172,189 |

|

| 3,105,149 |

| ||

DEFERRED CREDITS AND OTHER LIABILITIES: | ||||||||

Accumulated deferred income taxes and taxes accrued |

| 4,250,800 |

|

| 3,974,664 |

| ||

Accumulated deferred investment tax credits |

| 447,925 |

|

| 471,090 |

| ||

Obligations under capital leases |

| 155,943 |

|

| 181,085 |

| ||

Other regulatory liabilities |

| 185,579 |

|

| 135,878 |

| ||

Decommissioning |

| 1,565,997 |

|

| 1,194,333 |

| ||

Transition to competition |

| 79,098 |

|

| 231,512 |

| ||

Regulatory reserves |

| 56,438 |

|

| 37,591 |

| ||

Accumulated provisions |

| 389,868 |

|

| 425,399 |

| ||

Other |

| 1,145,232 |

|

| 801,040 |

| ||

Total |

| 8,276,880 |

|

| 7,452,592 |

| ||

Long-term debt |

| 7,086,999 |

|

| 7,321,028 |

| ||

Preferred stock with sinking fund |

| 24,327 |

| �� |

| 26,185 |

| |

Preferred stock without sinking fund |

| 334,337 |

|

| 334,337 |

| ||

Company-obligated mandatorily redeemable preferred securities of subsidiary trusts holding solely junior subordinated deferrable debentures |

| 215,000 |

|

| 215,000 |

| ||

SHAREHOLDERS’ EQUITY: | ||||||||

Common stock, $.01 par value, authorized 500,000,000 shares; issued 248,174,087 shares in 2002 and in 2001 |

| 2,482 |

|

| 2,482 |

| ||

Paid-in capital |

| 4,666,753 |

|

| 4,662,704 |

| ||

Retained earnings |

| 3,938,693 |

|

| 3,638,448 |

| ||

Accumulated other comprehensive loss |

| (22,360 | ) |

| (88,794 | ) | ||

Less—treasury stock, at cost (25,752,410 shares in 2002 and 27,441,384 shares in 2001) |

| 747,331 |

|

| 758,820 |

| ||

Total |

| 7,838,237 |

|

| 7,456,020 |

| ||

Commitments and Contingencies | ||||||||

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 26,947,969 |

| $ | 25,910,311 |

| ||

11

[17380.TX]12

FINANCIAL STATEMENTS

CONSOLIDATED STATEMENTS OF CASH FLOW

2002 | 2001 | 2000 | ||||||||||

In thousands, for the years ended December 31, | ||||||||||||

OPERATING ACTIVITIES | ||||||||||||

Consolidated net income | $ | 623,072 |

| $ | 750,507 |

| $ | 710,915 |

| |||

Noncash items included in net income: | ||||||||||||

Reserve for regulatory adjustments |

| 18,848 |

|

| (359,199 | ) |

| 18,482 |

| |||

Other regulatory charges (credits)—net |

| (141,836 | ) |

| (20,510 | ) |

| 34,073 |

| |||

Depreciation, amortization, and decommissioning |

| 869,638 |

|

| 724,222 |

|

| 785,609 |

| |||

Deferred income taxes and investment tax credits |

| (256,664 | ) |

| 87,752 |

|

| 124,457 |

| |||

Allowance for equity funds used during construction |

| (31,658 | ) |

| (26,209 | ) |

| (32,022 | ) | |||

Cumulative effect of accounting change |

| — |

|

| (23,482 | ) |

| — |

| |||

Gain on sale of assets—net |

| (6,612 | ) |

| (5,226 | ) |

| (2,340 | ) | |||

Equity in undistributed earnings of subsidiaries and unconsolidated affiliates |

| (181,878 | ) |

| (150,799 | ) |

| (13,715 | ) | |||

Provision for turbine commitments and asset impairments |

| 428,456 |

|

| — |

|

| — |

| |||

Changes in working capital (net of effects from acquisitions and dispositions): | ||||||||||||

Receivables |

| (43,957 | ) |

| 302,230 |

|

| (437,146 | ) | |||

Fuel inventory |

| 1,030 |

|

| (3,419 | ) |

| (20,447 | ) | |||

Accounts payable |

| 286,230 |

|

| (415,160 | ) |

| 543,606 |

| |||

Taxes accrued |

| 462,956 |

|

| 486,676 |

|

| 20,871 |

| |||

Interest accrued |

| 7,209 |

|

| 17,287 |

|

| 45,789 |

| |||

Deferred fuel |

| 156,181 |

|

| 495,007 |

|

| (38,001 | ) | |||

Other working capital accounts |

| (286,232 | ) |

| (39,978 | ) |

| 102,336 |

| |||

Provision for estimated losses and reserves |

| 10,533 |

|

| 19,093 |

|

| 6,019 |

| |||

Changes in other regulatory assets |

| 71,132 |

|

| 119,215 |

|

| (66,903 | ) | |||

Other |

| 195,255 |

|

| 257,541 |

|

| 186,264 |

| |||

Net cash flow provided by operating activities |

| 2,181,703 |

|

| 2,215,548 |

|

| 1,967,847 |

| |||

INVESTING ACTIVITIES | ||||||||||||

Construction/capital expenditures |

| (1,530,301 | ) |

| (1,380,417 | ) |

| (1,493,717 | ) | |||

Allowance for equity funds used during construction |

| 31,658 |

|

| 26,209 |

|

| 32,022 |

| |||

Nuclear fuel purchases |

| (250,309 | ) |

| (130,670 | ) |

| (121,127 | ) | |||

Proceeds from sale/leaseback of nuclear fuel |

| 183,664 |

|

| 71,964 |

|

| 117,154 |

| |||

Proceeds from sale of businesses |

| 215,088 |

|

| 784,282 |

|

| 61,519 |

| |||

Investment in other non-utility properties |

| (216,956 | ) |

| (647,015 | ) |

| (222,119 | ) | |||

Decrease (increase) in other investments |

| 38,964 |

|

| (631,975 | ) |

| (15,943 | ) | |||

Changes in other temporary investments—net |

| 150,000 |

|

| (150,000 | ) |

| 321,351 |

| |||

Decommissioning trust contributions and realized change in trust assets |

| (84,914 | ) |

| (95,571 | ) |

| (63,805 | ) | |||

Other regulatory investments |

| (39,390 | ) |

| (3,460 | ) |

| (385,331 | ) | |||

Other |

| 114,033 |

|

| (68,067 | ) |

| (44,016 | ) | |||

Net cash flow used in investing activities |

| (1,388,463 | ) |

| (2,224,720 | ) |

| (1,814,012 | ) | |||

12

[17380.TX]13

CONSOLIDATED STATEMENTS OF CASH FLOW

2002 | 2001 | 2000 | ||||||||||

In thousands, for the years ended December 31, | ||||||||||||

FINANCING ACTIVITIES: | ||||||||||||

Proceeds from the issuance of: | ||||||||||||

Long-term debt |

| 1,197,330 |

|

| 682,402 |

|

| 904,522 |

| |||

Common stock |

| 130,061 |

|

| 64,345 |

|

| 41,908 |

| |||

Retirement of: | ||||||||||||

Long-term debt |

| (1,341,274 | ) |

| (962,112 | ) |

| (181,329 | ) | |||

Repurchase of common stock |

| (118,499 | ) |

| (36,895 | ) |

| (550,206 | ) | |||

Redemption of preferred stock |

| (1,858 | ) |

| (39,574 | ) |

| (157,658 | ) | |||

Changes in short-term borrowings—net |

| 244,333 |

|

| (37,004 | ) |

| 267,000 |

| |||

Dividends paid: | ||||||||||||

Common stock |

| (298,991 | ) |

| (269,122 | ) |

| (271,019 | ) | |||

Preferred stock |

| (23,712 | ) |

| (24,044 | ) |

| (32,400 | ) | |||

Net cash flow provided by (used in) financing activities |

| (212,610 | ) |

| (622,004 | ) |

| 20,818 |

| |||

Effect of exchange rates on cash and cash equivalents |

| 3,125 |

|

| 325 |

|

| (5,948 | ) | |||

Net increase (decrease) in cash and cash equivalents |

| 583,755 |

|

| (630,851 | ) |

| 168,705 |

| |||

Cash and cash equivalents at beginning of period |

| 751,573 |

|

| 1,382,424 |

|

| 1,213,719 |

| |||

Cash and cash equivalents at end of period | $ | 1,335,328 |

| $ | 751,573 |

| $ | 1,382,424 |

| |||

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | ||||||||||||

Cash paid (received) during the period for: | ||||||||||||

Interest—net of amount capitalized | $ | 633,931 |

| $ | 708,748 |

| $ | 505,414 |

| |||

Income taxes | $ | 57,856 |

| $ | (113,466 | ) | $ | 345,361 |

| |||

Noncash investing and financing activities: | ||||||||||||

Debt assumed by the Damhead Creek purchaser | $ | 488,432 |

|

| — |

|

| — |

| |||

Decommissioning trust funds acquired in nuclear power plant acquisitions | $ | 310,000 |

| $ | 430,000 |

|

| — |

| |||

Change in unrealized depreciation of decommissioning trust assets | $ | (72,982 | ) | $ | (34,517 | ) | $ | (11,577 | ) | |||

Long-term debt refunded with proceeds from long-term debt issued in prior period | $ | (47,000 | ) |

| — |

|

| — |

| |||

Proceeds from long-term debt issued for the purpose of refunding prior long-term debt |

| — |

| $ | 47,000 |

|

| — |

| |||

Acquisition of Indian Point 3 and FitzPatrick: | ||||||||||||

Fair value of assets acquired |

| — |

|

| — |

| $ | 917,667 |

| |||

Initial cash paid at closing |

| — |

|

| — |

| $ | 50,000 |

| |||

Liabilities assumed and notes issued to seller |

| — |

|

| — |

| $ | 867,667 |

| |||

13

[17380.TX]14

FINANCIAL STATEMENTS

CONSOLIDATED STATEMENTS OF RETAINED EARNINGS, COMPREHENSIVE INCOME, AND PAID-IN CAPITAL

2002 | 2001 | 2000 | ||||||||||||||||||||||

In thousands, for the years ended December 31, | ||||||||||||||||||||||||

RETAINED EARNINGS | ||||||||||||||||||||||||

Retained Earnings—Beginning of period | $ | 3,638,448 |

| $ | 3,190,639 |

| $ | 2,786,467 |

| |||||||||||||||

Add: Earnings applicable to common stock |

| 599,360 |

| $ | 599,360 |

|

| 726,196 |

| $ | 726,196 |

|

| 679,294 |

| $ | 679,294 |

| ||||||

Deduct: | ||||||||||||||||||||||||

Dividends declared on common stock |

| 299,031 |

|

| 278,342 |

|

| 275,929 |

| |||||||||||||||

Capital stock and other expenses |

| 84 |

|

| 45 |

|

| (807 | ) | |||||||||||||||

Total |

| 299,115 |

|

| 278,387 |

|

| 275,122 |

| |||||||||||||||

Retained Earnings—End of period | $ | 3,938,693 |

| $ | 3,638,448 |

| $ | 3,190,639 |

| |||||||||||||||

ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS) (NET OF TAX ): | ||||||||||||||||||||||||

Balance at beginning of period: | ||||||||||||||||||||||||

Accumulated derivative instrument fair value changes | $ | (17,973 | ) | $ | — |

| $ | — |

| |||||||||||||||

Other accumulated comprehensive (loss) items |

| (70,821 | ) |

| (75,033 | ) |

| (73,805 | ) | |||||||||||||||

Total |

| (88,794 | ) |

| (75,033 | ) |

| (73,805 | ) | |||||||||||||||

Cumulative effect to January 1, 2002 of accounting change regarding fair value of derivative instruments |

| — |

|

| (18,021 | ) |

| — |

| |||||||||||||||

Net derivative instrument fair value changes arising during the period |

| 35,286 |

|

| 35,286 |

|

| 48 |

|

| 48 |

|

| — |

|

| — |

| ||||||

Foreign currency translation adjustments |

| 65,948 |

|

| (15,487 | ) |

| 4,615 |

|

| 4,615 |

|

| (5,216 | ) |

| (5,216 | ) | ||||||

Minimum pension liability adjustment |

| (10,489 | ) |

| (10,489 | ) |

| — |

|

| — |

|

| — |

|

| — |

| ||||||

Net unrealized investment gains (losses) |

| (24,311 | ) |

| (24,311 | ) |

| (403 | ) |

| (403 | ) |

| 3,988 |

|

| 3,988 |

| ||||||

Balance at end of period: | ||||||||||||||||||||||||

Accumulated derivative instrument fair value changes |

| 17,313 |

|

| (17,973 | ) |

| — |

| |||||||||||||||

Other accumulated comprehensive (loss) items |

| (39,673 | ) |

| (70,821 | ) |

| (75,033 | ) | |||||||||||||||

Total | $ | (22,360 | ) | $ | (88,794 | ) | $ | (75,033 | ) | |||||||||||||||

Comprehensive Income | $ | 584,359 |

| $ | 730,456 |

| $ | 678,066 |

| |||||||||||||||

PAID-IN CAPITAL | ||||||||||||||||||||||||

Paid-in Capital—Beginning of period | $ | 4,662,704 |

| $ | 4,660,483 |

| $ | 4,636,163 |

| |||||||||||||||

Add: | ||||||||||||||||||||||||

Common stock issuances related to stock plans |

| 4,049 |

|

| 2,221 |

|

| 24,320 |

| |||||||||||||||

Paid-in Capital—End of period | $ | 4,666,753 |

| $ | 4,662,704 |

| $ | 4,660,483 |

| |||||||||||||||

14

[17380.TX]15

ENTERGY CORPORATION KEY FINANCIAL PERFORMANCE MEASURES

FOR THE YEARS ENDED DECEMBER 31, 2002 VS. 2001

FOR 12 MONTHS ENDING DECEMBER 31, | ||||||||||||

2002 | 2001 | Change | ||||||||||

($ millions) | ||||||||||||

Operating Cash Flow |

| 2,182 |

|

| 2,216 |

|

| (34 | ) | |||

Return on Average Invested Capital—As Reported |

| 5.98 | % |

| 7.26 | % |

| (1.28 | )% | |||

Return on Average Invested Capital—Operational |

| 7.56 | % |

| 7.26 | % |

| 0.30 | % | |||

Return on Average Common Equity—As Reported |

| 7.85 | % |

| 10.04 | % |

| (2.19 | )% | |||

Return on Average Common Equity—Operational |

| 11.33 | % |

| 10.04 | % |

| 1.29 | % | |||

Net Margin—As Reported |

| 7.22 | % |

| 7.56 | % |

| (0.34 | )% | |||

Net Margin—Operational |

| 10.43 | % |

| 7.55 | % |

| 2.88 | % | |||

Book Value Per Share | $ | 35.24 |

| $ | 33.78 |

| $ | 1.46 |

| |||

End of Period Shares Outstanding (millions) |

| 222.4 |

|

| 220.7 |

|

| 1.7 |

| |||

AS OF DECEMBER 31, | ||||||||||||

2002 | 2001 | Change | ||||||||||

| ($ millions) | ||||||||||||

Revolver Capacity |

| 1,018 |

|

| 1,210 |

|

| (192 | ) | |||

Total Gross Liquidity |

| 2,353 |

|

| 1,962 |

|

| 391 |

| |||

Total Debt |

| 8,588 |

|

| 8,227 |

|

| 361 |

| |||

Off-balance Sheet Liabilities: | ||||||||||||

Project Debt |

| — |

|

| 265 |

|

| (265 | ) | |||

Debt of Joint Ventures—Entergy’s Share |

| 409 |

|

| 347 |

|

| 62 |

| |||

Leases—Entergy’s Share |

| 395 |

|

| 343 |

|

| 52 |

| |||

Total Off-balance Sheet Liabilities |

| 804 |

|

| 955 |

|

| (151 | ) | |||

Rating or Other Contingent Liabilities |

| — |

|

| 225 |

|

| (225 | ) | |||

Net Debt to Total Capital |

| 46.3 | % |

| 49.7 | % |

| (3.4 | )% | |||

Net Debt Including Off-balance Sheet Liabilities |

| 48.9 | % |

| 52.5 | % |

| (3.6 | )% | |||

Operational metrics are non-GAAP measures as they are calculated using operational net income, which excludes the impact of special items. As reported metrics are computed in accordance with GAAP as they include all components of net income, including special items. A reconciliation of operational earnings per share to as reported earnings per share and details on special items can be found on pages 4 - 5.

See page 44 for definitions of certain measures.

15

[17380.TX]16

Entergy Corporation has five wholly-owned domestic retail electric utility subsidiaries: Entergy Arkansas, Entergy Gulf States, Entergy Louisiana, Entergy Mississippi, and Entergy New Orleans. These utility companies provided retail electric service to approximately 2.6 million customers, in portions of Arkansas, Louisiana, Mississippi, and Texas. In addition, Entergy Gulf States furnishes natural gas utility service in and around Baton Rouge, Louisiana, and Entergy New Orleans furnishes natural gas utility service in New Orleans, Louisiana.

2002 | 2001 | YTD % Change | ||||||||||||||||||||||||||

1Q | 2Q | 3Q | 4Q | YTD | 1Q | 2Q | 3Q | 4Q | YTD | |||||||||||||||||||

UTILITY OPERATIONAL METRICS | ||||||||||||||||||||||||||||

Generation in GWh | 21,032 | 22,698 | 26,635 |

| 19,687 | 90,019 |

| 21,470 | 23,814 | 28,081 |

| 21,245 |

| 94,610 |

| (5 | )% | |||||||||||

Billed Retail | ||||||||||||||||||||||||||||

Electric Sales (GWh) | 23,079 | 24,309 | 29,906 |

| 24,338 | 101,631 |

| 24,037 | 23,981 | 29,032 |

| 22,906 |

| 99,956 |

| 2 | % | |||||||||||

O&M Expense per MWh ($) | 16.79 | 23.87 | 14.01 |

| 23.84 | 19.29 |

| 14.86 | 14.33 | 14.17 |

| 19.44 |

| 15.55 |

| 24 | % | |||||||||||

Reliability | ||||||||||||||||||||||||||||

SAIFI | 2.0 | 2.0 | 2.1 |

| 2.0 | 2.0 |

| 2.3 | 2.2 | 2.1 |

| 2.1 |

| 2.1 |

| (7 | )% | |||||||||||

SAIDI | 151.0 | 150.7 | 161.2 |

| 164.0 | 164.0 |

| 174.0 | 169.5 | 164.1 |

| 162.0 |

| 162.0 |

| 1 | % | |||||||||||

UTILITY FINANCIAL METRICS | ||||||||||||||||||||||||||||

Quarterly Metrics | ||||||||||||||||||||||||||||

EPS—As Reported ($) | 0.45 | 0.85 | 1.07 |

| 0.19 | 2.57 |

| 0.51 | 0.74 | 0.99 |

| 0.20 |

| 2.45 |

| 5 | % | |||||||||||

EPS—Operational ($) | 0.52 | 0.74 | 0.99 |

| 0.20 | 2.57 |

| 0.52 | 0.74 | 0.99 |

| 0.20 |

| 2.46 |

| 4 | % | |||||||||||

Weather EPS Effect ($) | 0.03 | 0.00 | (0.04 | ) | 0.00 | (0.01 | ) | 0.05 | 0.00 | (0.04 | ) | (0.02 | ) | (0.01 | ) | 0 | % | |||||||||||

Capital Expenditures ($M) | 221 | 309 | 235 |

| 367 | 1,132 |

| 215 | 264 | 293 |

| 339 |

| 1,110 |

| 2 | % | |||||||||||

Trailing Twelve Months | ||||||||||||||||||||||||||||

ROIC—As Reported (%) | 7.0 | 7.1 | 7.0 |

| 6.9 | 6.9 |

| 7.7 | 7.6 | 7.2 |

| 7.2 |

| 7.2 |

| (5 | )% | |||||||||||

ROIC—Operational (%) | 7.0 | 7.1 | 7.0 |

| 6.9 | 6.9 |

| 7.8 | 7.6 | 7.3 |

| 7.2 |

| 7.2 |

| (5 | )% | |||||||||||

ROE—As Reported (%) | 8.7 | 8.9 | 9.2 |

| 9.5 | 9.5 |

| 10.3 | 10.0 | 8.9 |

| 8.9 |

| 8.9 |

| 6 | % | |||||||||||

ROE—Operational (%) | 8.7 | 8.9 | 9.2 |

| 9.5 | 9.5 |

| 10.5 | 10.0 | 9.0 |

| 9.0 |

| 9.0 |

| 6 | % | |||||||||||

Net Debt to Net Capital (%) | 50.2 | 50.0 | 49.2 |

| 49.6 | — |

| 51.6 | 50.6 | 51.2 |

| 51.4 |

| — |

| (4 | )% | |||||||||||

Operational metrics are non-GAAP measures as they are calculated using operational net income, which excludes the impact of special items. As reported metrics are computed in accordance with GAAP as they include all components of net income, including special items. A reconciliation of operational earnings per share to as reported earnings per share and details on special items can be found on pages 4 - 5.

See page 44 for definitions of certain measures.

2002 | 2001 | 2000 | 1999 | 1998 | |||||||||||

Billed Retail Electric Sales (GWh) | 101,631 |

| 99,956 |

| 103,216 |

| 100,519 |

| 100,224 |

| |||||

Retail Electric Sales Growth Rates | 1.7 | % | (3.2 | )% | 2.7 | % | 0.3 | % | 3.2 | % | |||||

Regional Gross Domestic Product Rate | 2.1 | % | (0.2 | )% | (0.8 | )% | 3.1 | % | 1.5 | % | |||||

Retail Electric Customers (thousands) | 2,597 |

| 2,574 |

| 2,556 |

| 2,522 |

| 2,495 |

| |||||

Sources of Generation(a) | |||||||||||||||

Natural Gas | 39 | % | 34 | % | 42 | % | 45 | % | 40 | % | |||||

Nuclear Fuel | 46 | % | 43 | % | 39 | % | 35 | % | 40 | % | |||||

Coal | 15 | % | 15 | % | 15 | % | 16 | % | 14 | % | |||||

Fuel Oil | — |

| 8 | % | 4 | % | 4 | % | 6 | % | |||||

Average Fuel Cost (¢/KWh) | �� | ||||||||||||||

Natural Gas | 3.88 |

| 4.62 |

| 4.90 |

| 2.75 |

| 2.50 |

| |||||

Nuclear Fuel | 0.47 |

| 0.50 |

| 0.56 |

| 0.54 |

| 0.53 |

| |||||

Coal | 1.37 |

| 1.58 |

| 1.51 |

| 1.59 |

| 1.67 |

| |||||

Fuel Oil | 15.78 |

| 4.33 |

| 3.90 |

| 2.06 |

| 2.37 |

| |||||

Peak Demand (MW) | 20,419 |

| 20,257 |

| 22,052 |

| 20,664 |

| 20,591 |

| |||||

Operational Summer Capacity at Peak (MW) | 22,373 |

| 22,080 |

| 22,235 |

| 22,230 |

| 21,544 |

| |||||

Annual System Load Factor | 62 | % | 61 | % | 59 | % | 61 | % | 62 | % | |||||

| (a) | Immaterial amounts of generation were provided by hydroelectric power. |

16

[17380.TX]17

UTILITY REGULATORY KEY EVENTS/PENDING CASES

Company | Allowed ROE | Pending Cases/Events | Fuel Recovery Mechanism | |||

Entergy Arkansas | 11.0% | No cases are pending. Transition cost account mechanism expired on December 31, 2001. | Annual reset based on prior year’s cost. | |||

Entergy Gulf States—TX | 10.95% | Base rates have been frozen since settlement order issued in June 1999. Freeze will likely extend to the start of retail open access, which is currently not expected to occur until at least the first quarter of 2004. | Fuel Factor with semi-annual reset based on gas prices. Surcharge and refund material under-and over-recoveries semi-annually based on actual cost. | |||

Entergy Gulf States—LA | 11.1% | The LPSC approved a settlement in December 2002 resolving the 4th – 8th post-merger earnings reviews resulting in a $22.1 million prospective rate reduction effective January 2003 and a refund of $16.3 million. Also, the 9th earnings analysis (2002), the last required post-merger earnings analysis, and prospective revenue study are currently pending before the LPSC with hearings set for October 2003. In conjunction with the LPSC staff, Entergy Gulf States is currently pursuing a formula rate plan proposal. | Monthly reset with 60 day lag based on prior two months actual fuel and purchased power costs plus 1/12 of unrecovered fuel balance. | |||