UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______to_______

Commission File Number 001-03492

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 75-2677995 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 3000 North Sam Houston Parkway East, | Houston, | Texas | 77032 |

| (Address of principal executive offices) | (Zip Code) |

(281) 871-2699

(Registrant's telephone number, including area code)

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $2.50 per share | HAL | New York Stock Exchange |

| | |

| Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☒ Yes ☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| | Large Accelerated Filer | ☒ | Accelerated Filer | ☐ |

| | Non-accelerated Filer | ☐ | Smaller Reporting Company | ☐ |

| | | Emerging Growth Company | ☐ |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

The aggregate market value of Halliburton Company Common Stock held by non-affiliates on June 30, 2024, determined using the per share closing price on the New York Stock Exchange Composite tape of $33.78 on that date, was approximately $22.2 billion.

As of February 5, 2025, there were 868,091,623 shares of Halliburton Company Common Stock, $2.50 par value per share, outstanding.

Portions of the Halliburton Company Proxy Statement for our 2025 Annual Meeting of Shareholders (File No. 001-03492) are incorporated by reference into Part III of this report.

HALLIBURTON COMPANY

Index to Form 10-K

For the Year Ended December 31, 2024 | | | | | | | | |

| PART I | | PAGE |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| PART II | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| |

| |

| |

| | |

| PART III | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| PART IV | | |

| | |

| | |

| | |

| | |

PART I

Item 1. Business.

Description of business and strategy

Halliburton Company is one of the world’s largest providers of products and services to the energy industry. Its predecessor was established in 1919 and incorporated under the laws of the State of Delaware in 1924. Inspired by the past and leading into the future, what started with a single product from a single location is now a global enterprise. Our value proposition is to collaborate and engineer solutions to maximize asset value for our customers. We strive to achieve strong cash flows and returns for our shareholders by delivering technology and services that improve efficiency, increase recovery, and maximize production for our customers. Halliburton has fostered a culture of unparalleled service to the world’s major, national, and independent oil and natural gas producers. With over 48,000 employees, representing 145 nationalities in more than 70 countries, we help our customers maximize asset value throughout the lifecycle of the reservoir - from locating hydrocarbons and managing geological data, to drilling and formation evaluation, well construction and completion, and optimizing production throughout the life of the asset.

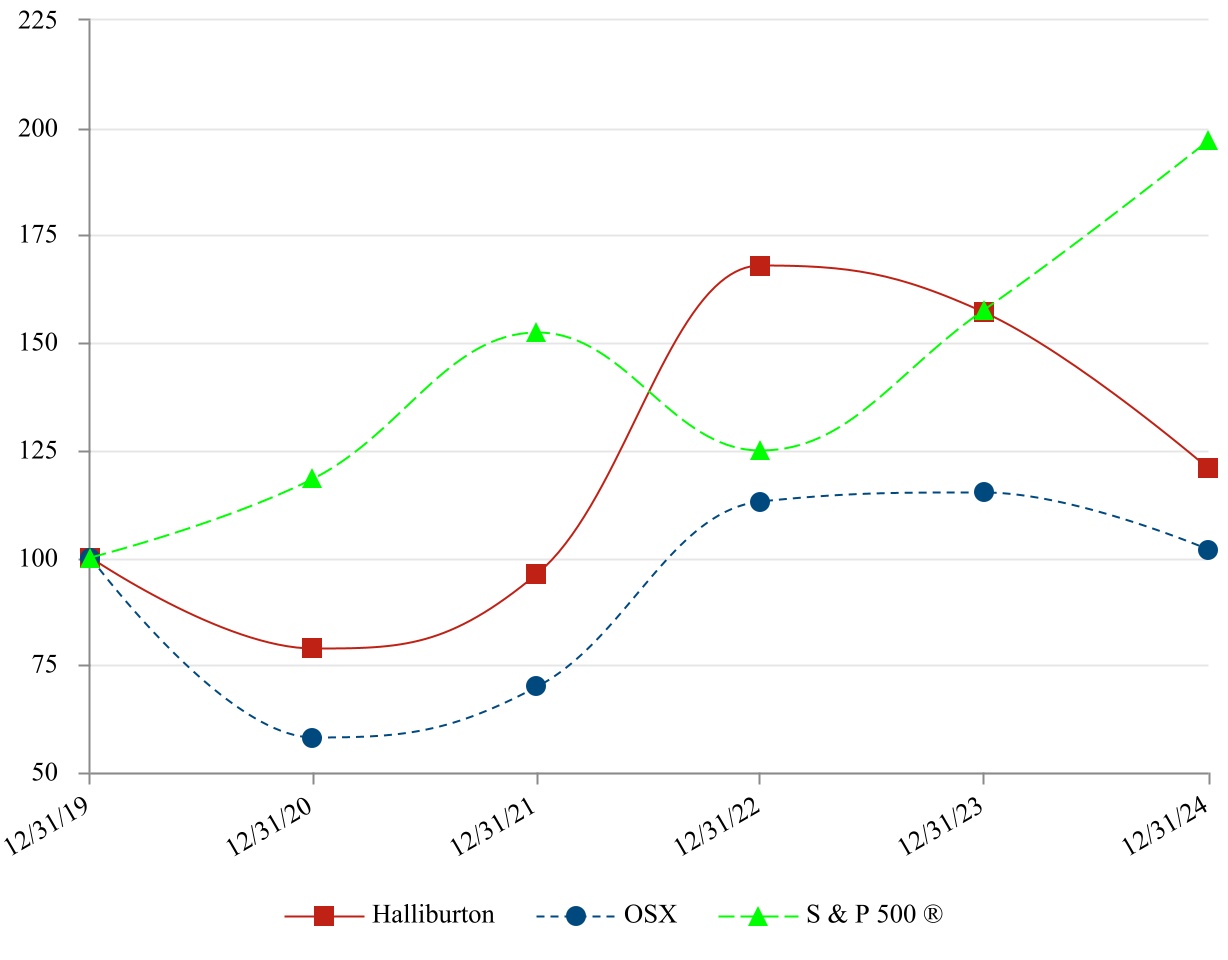

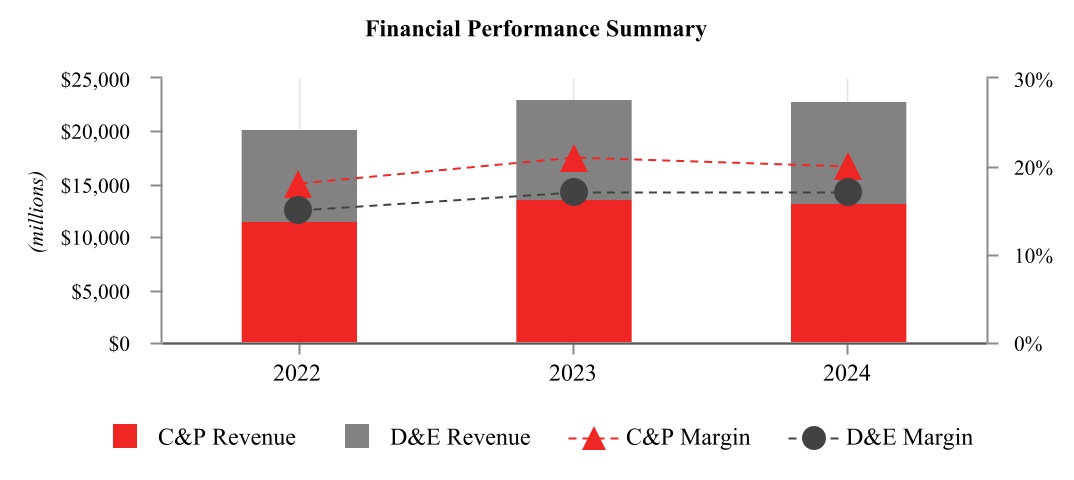

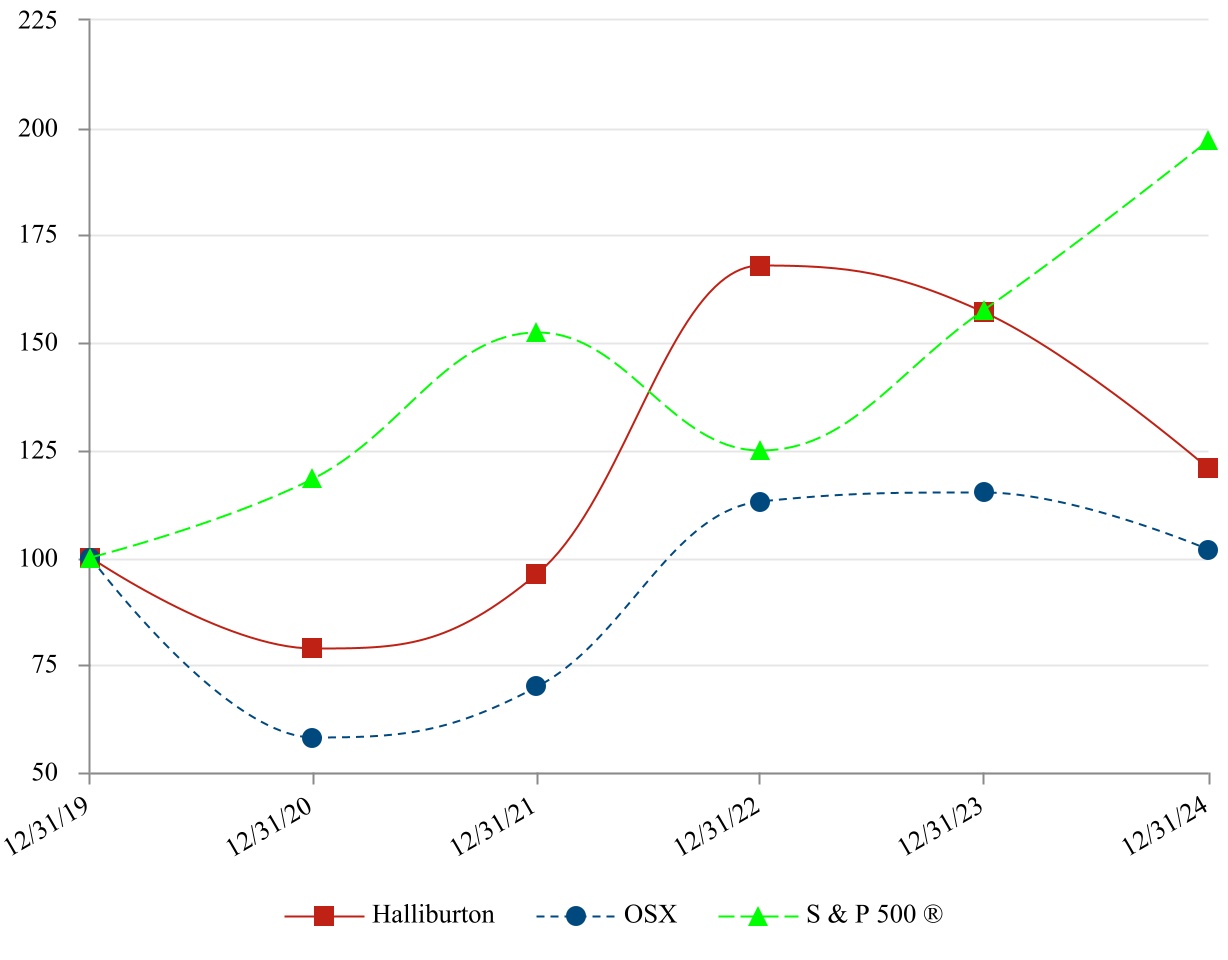

2024 Highlights

- Financial: Our total revenue was flat in 2024 as compared to 2023. Our International revenue increased 6% and our North America revenue decreased 8% in 2024 compared to 2023. Overall, our Completion and Production and Drilling and Evaluation operating segments finished the year with 20% and 16% operating margins, respectively. We generated strong cash flows from operations and repurchased $100 million of debt.

- Digital: We incorporated next-generation digital and automation technologies in certain of our processes to maximize value and improve efficiency.

- Capital efficiency: We advanced technologies and made strategic choices that kept our capital expenditures at 6% of revenue, which matched our target of 5% - 6%.

- Shareholder returns: We returned $1.6 billion of capital to shareholders through buybacks and dividends, which is consistent with our capital returns framework.

- Sustainability and energy mix transition: We expanded Halliburton Labs, our early-stage company accelerator, to a total of 38 participant and alumni organizations as we work to reach the future of energy, faster.

2025 Focus

- International: Increase international growth in directional drilling, unconventionals, well intervention, and artificial lift businesses.

- North America: Maximize value by, among other things, utilizing our Zeus electric fracturing platform and our iCruise rotary steerable systems.

- Digital: Continue to drive differentiation and efficiencies through the deployment of digital and automation technologies, both internally and for our customers.

- Capital efficiency: Maintain our capital expenditures at approximately 6% of revenue while utilizing technology and targeted process improvements to enhance utilization of existing capital.

- Shareholder returns: Return over 50% of annual free cash flow to shareholders through dividends and share repurchases.

- Advance a Sustainable Energy Future: Continue to develop technologies and solutions to help lower our customers’ and our emissions intensity, participate in carbon capture, utilization, and storage, and geothermal projects globally, and support Halliburton Labs early–stage company participants.

For further discussion on our business strategies, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Business Environment and Results of Operations–Business Outlook.”

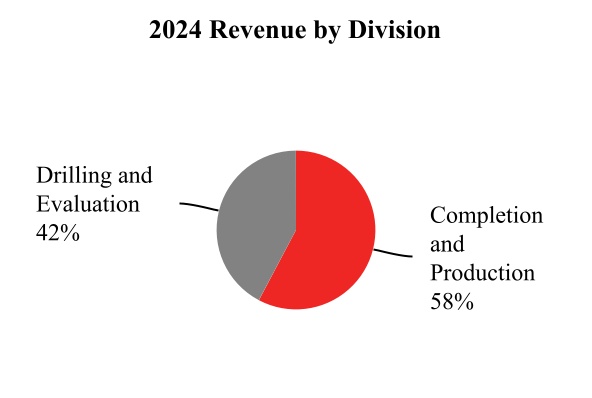

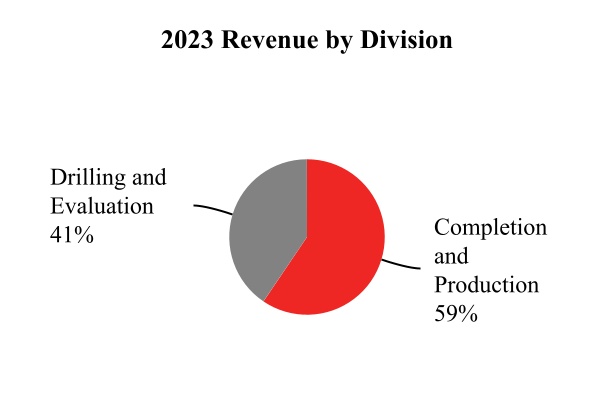

Operating segments

We operate under two divisions, which form the basis for the two operating segments we report, the Completion and Production segment and the Drilling and Evaluation segment.

Completion and Production delivers cementing, stimulation, specialty chemicals, intervention, pressure control, artificial lift, and completion products and services. The segment consists of the following product service lines:

- Artificial Lift: provides services to maximize reservoir and wellbore recovery by applying lifting technology, intelligent field management solutions, and related services throughout the life of the well, including electrical submersible pumps.

- Cementing: involves bonding the well and well casing while isolating fluid zones and maximizing wellbore stability. Our cementing product service line also provides casing equipment.

- Completion Tools: provides downhole solutions and services to our customers to complete their wells, including well completion products and services, intelligent well completions, liner hanger systems, sand control systems, multilateral systems, and service tools.

- Multi-Chem: provides customized specialty chemicals and services for completion, production, midstream, and downstream to optimize flow assurance and integrity. During the third quarter of 2024, we made a strategic decision to market for sale a portion of our chemical business.

- Pipeline & Process Services: provides a complete range of pre-commissioning, commissioning, maintenance, and decommissioning services to the onshore and offshore pipeline and process plant construction commissioning and maintenance industries.

- Production Enhancement: includes stimulation services and sand control services. Stimulation services optimize reservoir production through a variety of pressure pumping services and chemical processes, commonly known as hydraulic fracturing and acidizing. Sand control services include fluids and chemicals for the prevention of sand production of unconsolidated reservoirs.

- Production Solutions: provides customized well intervention solutions to increase well performance, which includes coiled tubing, hydraulic workover units, downhole tools, pumping services, and nitrogen services.

Drilling and Evaluation provides field and reservoir modeling, drilling, fluids, evaluation and precise wellbore placement solutions that enable customers to model, measure, drill, and optimize their well construction activities. The segment consists of the following product service lines:

- Baroid: provides drilling fluid systems, performance additives, completion fluids, solids control, specialized testing equipment, and waste management services for drilling wells, completion, and workover operations.

- Drill Bits and Services: provides roller cone bits, fixed cutter bits, hole enlargement and related downhole tools and services used in drilling wells. In addition, coring equipment and services are provided to extract formation cores for rock properties evaluation.

- Halliburton Project Management: provides integrated solutions by leveraging the full line of our well construction, well completion, and well intervention services to solve customer challenges throughout the entire well lifecycle, including project management and integrated asset management.

- Landmark Software and Services: provides cloud based digital services and artificial intelligence solutions on an open architecture for subsurface insights, integrated well construction, and reservoir and production management.

- Sperry Drilling: provides drilling systems and services that offer directional control for precise wellbore placement while providing important measurements about the characteristics of the drill string and geological formations while drilling wells. These services include directional and horizontal drilling, measurement-while-drilling, logging-while-drilling, surface data logging, and rig site information systems.

- Testing and Subsea: provides acquisition and analysis of dynamic reservoir information and reservoir optimization solutions through a broad portfolio of well testing tools, data acquisition services, fluid sampling, surface well testing, subsea safety systems, and underbalanced applications.

- Wireline and Perforating: provides open-hole logging services that supply information on formation evaluation and reservoir fluid analysis, including formation lithology, rock properties, and reservoir fluid properties. Also offered are cased-hole and slickline services, including perforating, pipe recovery services, through-casing formation evaluation and reservoir monitoring, casing and cement integrity measurements, and well intervention services.

The following charts depict our revenue split between our two operating segments for the years ended December 31, 2024 and 2023.

See Notes to Consolidated Financial Statements, Note 3 for further financial information related to each of our business segments.

Markets and competition

We are one of the world’s largest diversified energy services companies. Our services and products are sold in highly competitive markets throughout the world. Competitive factors impacting sales of our services and products include: price; service delivery; health, safety, and environmental standards and practices; service quality; global talent retention; understanding the geological characteristics of the reservoir; product quality; and technical proficiency.

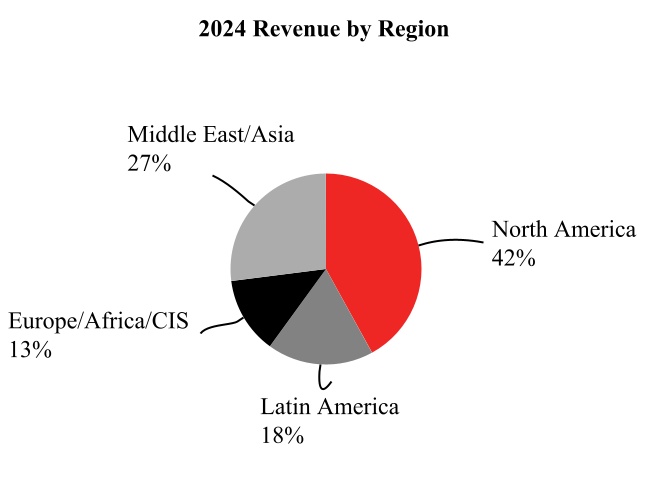

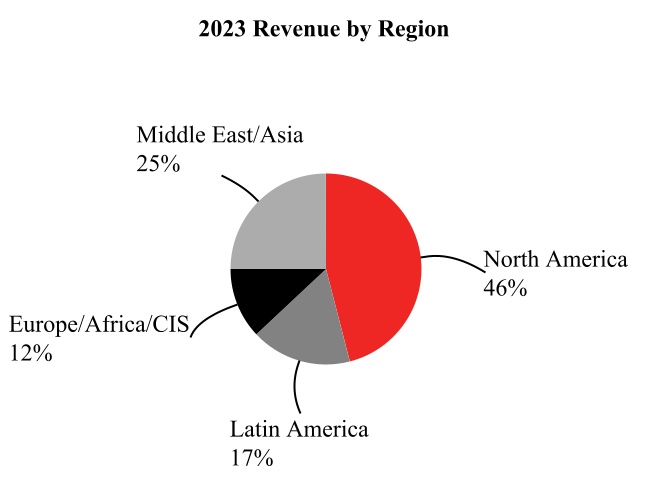

We conduct business worldwide in more than 70 countries. The business operations of our divisions are organized around four primary geographic regions: North America, Latin America, Europe/Africa/CIS, and Middle East/Asia. In 2024, 2023, and 2022, based on the location of services provided and products sold, 40%, 44%, and 45%, respectively, of our consolidated revenue was from the United States. No other country accounted for more than 10% of our consolidated revenue during these periods. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional information about our geographic operations. Because the markets for our services and products are vast and cross numerous geographic lines, it is not practicable to provide a meaningful estimate of the total number of our competitors. The industries we serve are highly competitive, and we have many substantial competitors. Most of our services and products are marketed through our service and sales organizations.

The following charts depict our revenue split between our four primary geographic regions for the years ended December 31, 2024 and 2023.

Our operations in some countries and regions may be adversely affected by unsettled political conditions, acts of terrorism, civil unrest, force majeure, war or other armed conflict, health or similar issues, sanctions, trade barriers and tariffs, expropriation or other governmental actions, inflation, changes in foreign currency exchange rates, foreign currency exchange restrictions and highly inflationary currencies, as well as other geopolitical factors. We believe the geographic diversification of our business activities reduces the risk that an interruption of operations in any single country, other than the United States, would be materially adverse to our business, consolidated results of operations, or consolidated financial condition.

Information regarding our exposure to foreign currency fluctuations, risk concentration, and financial instruments used to minimize risk is included in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Financial Instrument Market Risk” and Notes to Consolidated Financial Statements, Note 16.

Customers

Our revenue during the past three years was derived from the sale of services and products to the energy industry. No single customer represented more than 10% of our consolidated revenue in any period presented.

Raw materials

Raw materials essential to our business are normally readily available. However, market conditions can trigger constraints in the supply of certain raw materials, such as proppants (primarily sand), chemicals, metals, gels, and electronic components (circuit boards). We are always striving to ensure the availability of resources and manage raw material costs. Our procurement department uses our relationships and buying power to enhance our access to key materials at competitive prices.

Patents

We own a large number of patents and have pending a substantial number of patent applications covering various products and processes. We are also licensed to utilize technology covered by patents owned by others, and we license others to utilize technology covered by our patents. We do not consider any particular patent to be material to our business operations.

Seasonality

Weather and natural phenomena can temporarily affect the performance of our services, but the widespread geographical locations of our operations mitigate those effects. Examples of how weather can impact our business include:

- the severity and duration of the winter in North America can have a significant impact on drilling activity and on natural gas storage levels;

- the timing and duration of the spring thaw in Canada directly affects activity levels due to road restrictions;

- typhoons and hurricanes can disrupt coastal and offshore operations; and

- severe weather during the winter normally results in reduced activity levels in the North Sea.

Additionally, customer spending patterns for completion tools typically result in higher activity in the fourth quarter of the year. We recognize revenue on customer software contract sales predominantly in the first and fourth quarters of the year.

Our workforce

Our workforce is our top asset in enabling us to accomplish innovative, high-quality work for our customers and to address the world’s energy challenges. To attract and retain talent, we promote a safe and inclusive work environment along with competitive benefits. As of December 31, 2024, we employed over 48,000 people worldwide representing 145 nationalities and operated in more than 70 countries, with approximately 19% of our employees subject to collective bargaining agreements. Based upon the geographic diversification of our employees, we do not believe any risk of loss from employee strikes or other collective actions are material to the continuation of our operations as a whole.

With our large employee base and global breadth, our workforce is diverse. Halliburton invests in local workforce development with the aim of a positive impact on communities where we work. In 2024, 91% of our workforce and 84% of management, who were full-time employees, and not classified as expatriates or commuters, were local to the countries where they work.

Recruiting and Turnover

Given the size and geographic scope of our workforce, we have a robust global recruiting organization, which includes personnel focused on recruiting and retention, online job postings, and recruiting programs at academic institutions for internships and entry-level roles. In 2024, we hired about 6,800 new employees and experienced relatively low voluntary turnover of 8% despite a tight labor market.

Leadership

The ongoing identification and development of leadership talent ensures business continuity and strengthens our competitive advantage, both of which are critical for our short-term and long-term success. One of our most significant investments in developing future leaders is our executive education programs.

As part of our commitment to employee engagement, we invite employees to share anonymous feedback about different topics including their performance, development, and work-life balance. Notably, according to a survey we conducted in February 2024, 95% of responding employees feel the work they do everyday matters. This is especially meaningful since 86% of our employees responded to the survey.

Benefits and well-being

Halliburton is committed to providing competitive benefit programs. Our benefit packages include comprehensive medical coverage, retirement plans, paid time off, emergency childcare, and third-party discounts. Our Global Employee Assistance Program (EAP) provides mental health and wellness related training and education for employees. In 2024, our monthly Lessons for Life Web series covered topics such as parenting in the digital age and combating burnout. We also conducted mental health awareness campaigns tailored to address employee needs in different geographies.

Safety

Safety is a Halliburton core value. Our long-term safety programs and processes, including our Journey to ZERO initiative, are tried, tested, and well-established to maintain our strong performance and improve proactive identification and management of safety risks. In 2024, the operational discipline of our Halliburton Management System (HMS) and our focus on execution enabled us to outperform our industry group HSE indicators. As a result of our focus on safety, for the years ended December 31, 2024 and December 31, 2023, our total recordable incident rates were 0.24 and 0.25 (incidents per 200,000 hours worked), non-productive times were 0.23% and 0.24% (percentage of total operating hours), lost-time incident rates were 0.06 and 0.07 (incidents per 200,000 hours worked), and preventable recordable vehicle incident rates were 0.06 and 0.10 (incidents per million miles traveled), respectively.

Government regulation

We are subject to numerous environmental, legal, and regulatory requirements related to our operations worldwide. For further information related to environmental matters and regulation, see Notes to Consolidated Financial Statements, Note 11 and “Item 1(a). Risk Factors.”

Hydraulic fracturing

Hydraulic fracturing is a process that creates fractures extending from the well bore into the rock formation to enable natural gas or oil to move more easily from the rock pores to a production conduit. A significant portion of our Completion and Production segment provides hydraulic fracturing services to customers developing shale natural gas and shale oil. From time to time, questions arise about the scope of our operations in the shale natural gas and shale oil sectors, and the extent to which these operations may affect human health and the environment.

At the direction of our customer, we design and generally implement a hydraulic fracturing operation to stimulate the well’s production after the well has been drilled, cased, and cemented. Our customer is generally responsible for providing the base fluid (usually water) used in the hydraulic fracturing of a well. We frequently supply the proppant (primarily sand) and at least a portion of the additives used in the overall fracturing fluid mixture. In addition, we mix the additives and proppant with the base fluid and pump the mixture down the wellbore to create the desired fractures in the target formation. The customer is responsible for disposing or recycling for further use any materials that are subsequently produced or pumped out of the well, including flowback fluids and produced water.

As part of the process of constructing the well, the customer will take a number of steps designed to protect aquifers. In particular, the casing and cementing of the well are designed to provide ‘zonal isolation’ so that the fluids pumped down the wellbore and the oil and natural gas and other materials that are subsequently pumped out of the well will not come into contact with shallow aquifers or other shallow formations through which those materials could potentially migrate to freshwater aquifers or the surface.

The potential environmental impacts of hydraulic fracturing have been studied by numerous government entities and others. In 2004, the United States Environmental Protection Agency (EPA) conducted an extensive study of hydraulic fracturing practices, focusing on coalbed methane wells, and their potential effect on underground sources of drinking water. The EPA’s study concluded that hydraulic fracturing of coalbed methane wells poses little or no threat to underground sources of drinking water. In December 2016, the EPA released a final report, “Hydraulic Fracturing for Oil and Gas: Impacts from the Hydraulic Fracturing Water Cycle on Drinking Water Resources in the United States” representing the culmination of a six-year study requested by Congress. While the EPA report noted a potential for some impact to drinking water sources caused by hydraulic fracturing, the agency confirmed the overall incidence of impacts is low. Moreover, a number of the areas of potential impact identified in the report involve activities for which we are not generally responsible, such as potential impacts associated with withdrawals of surface water for use as a base fluid and management of wastewater.

We have proactively developed processes to provide our customers with the chemical constituents of our hydraulic fracturing fluids to enable our customers to comply with state laws as well as voluntary standards established by the Chemical Disclosure Registry, www.fracfocus.org. We have invested considerable resources in developing hydraulic fracturing technologies, in both the equipment and chemistry portions of our business, which offer our customers a variety of environment-friendly options related to the use of hydraulic fracturing fluid additives and other aspects of our hydraulic fracturing operations. We created a hydraulic fracturing fluid system comprised of materials sourced entirely from the food industry. We are committed to the continued development of innovative chemical and mechanical technologies that allow for more economical and environment-friendly development of the world’s oil and natural gas reserves, and that reduce noise while complying with Tier 4 lower emission legislation.

In evaluating any environmental risks that may be associated with our hydraulic fracturing services, it is helpful to understand the role that we play in the development of shale natural gas and shale oil. Our principal task generally is to manage the process of injecting fracturing fluids into the borehole to stimulate the well. Thus, based on the provisions in our contracts and applicable law, the primary environmental risks we face are potential pre-injection spills or releases of stored fracturing fluids and potential spills or releases of fuel or other fluids associated with pumps, blenders, conveyors, or other above-ground equipment used in the hydraulic fracturing process.

Although possible concerns have been raised about hydraulic fracturing, the circumstances described above have helped to mitigate those concerns. To date, we have not been obligated to compensate any indemnified party for any environmental liability arising directly from hydraulic fracturing, although there can be no assurance that such obligations or liabilities will not arise in the future. For further information on risks related to hydraulic fracturing, see “Item 1(a). Risk Factors.”

Working capital

We fund our business operations through a combination of available cash and equivalents, short-term investments, and cash flow generated from operations. In addition, our revolving credit facility is available for additional working capital needs.

Web site access - www.halliburton.com

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished to the Securities and Exchange Commission (SEC) pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available at www.halliburton.com soon thereafter. The SEC website www.sec.gov contains our reports, proxy and information statements and our other SEC filings. Our Code of Business Conduct, which applies to all our employees and Directors and serves as a code of ethics for our principal executive officer, principal financial officer, principal accounting officer, and other persons performing similar functions, can be found at www.halliburton.com. Any amendments to our Code of Business Conduct or any waivers from provisions of our Code of Business Conduct granted to the specified officers above are also disclosed on our web site within four business days after the date of any amendment or waiver pertaining to these officers. There have been no waivers from provisions of our Code of Business Conduct for the years 2024, 2023, or 2022. Except to the extent expressly stated otherwise, information contained on or accessible from our web site or any other web site is not incorporated by reference into this annual report on Form 10-K and should not be considered part of this report.

Executive Officers of the Registrant

The following table indicates the names and ages of the executive officers of Halliburton Company as of February 12, 2025, including all offices and positions held by each in the past five years: | | | | | | | | |

| Name and Age | Offices Held and Term of Office |

| | |

| Van H. Beckwith

(Age 59) | Executive Vice President, Secretary and Chief Legal Officer of Halliburton Company, since December 2020 |

| Senior Vice President and General Counsel, January 2020 to December 2020 |

| |

| | |

| Eric J. Carre

(Age 58) | Executive Vice President and Chief Financial Officer of Halliburton Company, since May 2022 |

| Executive Vice President, Global Business Lines of Halliburton Company, May 2016 to April 2022 |

| | |

| Charles E. Geer, Jr.

(Age 54) | Senior Vice President and Chief Accounting Officer of Halliburton Company, since December 2019 |

| |

| | |

| | |

| |

| |

| | |

| Timothy M. McKeon

(Age 52) | Senior Vice President and Treasurer of Halliburton Company, since January 2022 |

| Vice President and Treasurer of Halliburton Company, January 2014 to December 2021 |

| | |

| Jeffrey A. Miller

(Age 61) | Chairman of the Board, President, and Chief Executive Officer of Halliburton Company, since January 2019 |

| |

| | |

| Lawrence J. Pope

(Age 56) | Executive Vice President of Administration and Chief Human Resources Officer of Halliburton Company, since January 2008 |

| | |

| | |

| | |

| Mark J. Richard

(Age 63) | President, Western Hemisphere of Halliburton Company, since February 2019 |

| |

| |

| | |

| Jill D. Sharp

(Age 54) | Senior Vice President, Internal Assurance Services of Halliburton Company, since January 2022 |

| Vice President, Internal Assurance Services of Halliburton Company, September 2021 to December 2021 |

| Vice President, Finance - Western Hemisphere of Halliburton Company, October 2016 to August 2021 |

| | |

| Shannon Slocum

(Age 52) | President, Eastern Hemisphere of Halliburton Company, since March 2023 |

| Senior Vice President, Global Business Development and Marketing of Halliburton Company, January 2020 to February 2023 |

| |

There are no family relationships between the executive officers of the registrant or between any director and any executive officer of the registrant.

Directors of the Registrant

| | | | | | | | | | | |

| Name | Title and company |

| | | |

| Abdulaziz F. Al Khayyal | Former Director and Senior Vice President of Industrial Relations of Saudi Aramco |

| | | |

| William E. Albrecht | President of Moncrief Energy, LLC |

| | | |

| M. Katherine Banks | Former President of Texas A&M University |

| | | |

| Alan M. Bennett | Former President and Chief Executive Officer of H&R Block, Inc. |

| | | |

| | |

| | | |

| Earl M. Cummings | Managing Partner of MCM Houston Properties, LLC |

| | | |

| Murry S. Gerber | Former Executive Chairman of the Board of EQT Corporation |

| | | |

| | |

| | | |

| Robert A. Malone | Executive Chairman, President, and Chief Executive Officer of First Sonora Bancshares, Inc. and the First National Bank of Sonora |

| | | |

| Jefferey A. Miller | Chairman of the Board, President, and Chief Executive Officer of Halliburton Company |

| | | |

| Bhavesh V. Patel (a) | Former President of Standard Industries |

| | | |

| Maurice S. Smith | President, Chief Executive Officer, and Vice Chair of Health Care Service Corporation |

| | | |

| Janet L. Weiss | Former President of BP Alaska |

| | | |

| Tobi M. Edwards Young | Senior Vice President of Legal and Chief Corporate Affairs Officer of Cognizant Technology Solutions |

| | | |

| (a) | Mr. Patel will retire early from the Halliburton Board of Directors immediately prior to the 2025 Annual Meeting of Shareholders. |

Item 1(a). Risk Factors.

When considering an investment in Halliburton Company, all of the risk factors described below and other information included and incorporated by reference in this annual report should be carefully considered. Any of these risk factors could have a significant or material adverse effect on our business, results of operations, financial condition, or cash flows. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also adversely affect our business, financial condition, results of operations, or cash flows.

Industry Environment Related

Trends in oil and natural gas prices affect the level of exploration, development, and production activity of our customers and the demand for our services and products, which could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition.

Demand for our services and products is particularly sensitive to the level of exploration, development, and production activity of, and the corresponding capital spending by, oil and natural gas companies. The level of exploration, development, and production activity is directly affected by trends in oil and natural gas prices, which historically have been volatile and are likely to continue to be volatile. Prices for oil and natural gas are subject to large fluctuations in response to relatively minor changes in the supply of and demand for oil and natural gas, market uncertainty, and a variety of other economic factors that are beyond our control. Given the long-term nature of many large-scale development projects, even the perception of longer-term lower oil and natural gas prices by oil and natural gas companies can cause them to reduce or defer major expenditures. Any prolonged reductions of commodity prices or expectations of such reductions could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition.

Factors affecting the prices of oil and natural gas include:

- the level of supply and demand for oil and natural gas;

- the ability or willingness of the Organization of Petroleum Exporting Countries and the expanded alliance collectively known as OPEC+ to set and maintain oil production levels;

- the level of oil production in the U.S. and by other non-OPEC+ countries;

- oil refining capacity and shifts in end-customer preferences toward fuel efficiency and the use of natural gas;

- the cost of, and constraints associated with, producing and delivering oil and natural gas;

- governmental regulations and other actions, or proposed changes in respect thereof, including tariffs, economic sanctions and policies of governments regarding the exploration for and production and development of their oil and natural gas reserves;

- weather conditions, natural disasters, and health or similar issues, such as COVID-19 and other pandemics or epidemics;

- worldwide political and military actions, and economic conditions, including potential recessions; and

- increased demand for alternative energy and use of electric vehicles, increased emphasis on decarbonization (including government initiatives, such as tax credits and government subsidies to promote the use of renewable energy sources), and public sentiment around alternatives to oil and natural gas.

Our business is dependent on capital spending by our customers, and reductions in capital spending could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition.

Our business is directly affected by changes in capital expenditures by our customers, and reductions in their capital spending could reduce demand for our services and products and have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition. Some of the items that may impact our customers’ capital spending include:

- oil and natural gas prices, which are impacted by the factors described in the preceding risk factor;

- the inability of our customers to access capital on economically advantageous terms, which may be impacted by, among other things, a decrease of investors’ interest in hydrocarbon producers because of environmental and sustainability initiatives;

- changes in customers’ capital allocation, including an increased allocation to the production of renewable energy or other sustainability efforts, leading to less focus on oil and natural gas production growth;

- restrictions on our customers’ ability to get their produced oil and natural gas to market due to infrastructure limitations or other governmental limitations on transportation of produced oil and natural gas;

- consolidation of our customers;

- customer personnel changes; and

- adverse developments in the business or operations of our customers, including write-downs of oil and natural gas reserves and borrowing base reductions under customers’ credit facilities.

Liabilities arising out of our products and services could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition.

Events can occur at sites where our products and equipment are produced, stored, transported, or installed, or where we conduct our operations or provide our services, or at chemical blending or manufacturing facilities, including well blowouts and equipment or materials failures, which could result in explosions, fires, personal injuries, property damage (including surface and subsurface damage), pollution, and potential legal responsibility. Generally, we rely on contractual indemnities, releases, and limitations of liability with our customers and on liability insurance coverage to mitigate our potential liability related to such occurrences. However, we do not have these contractual provisions in all contracts, and even where we do, it is possible that the respective customer or insurer could seek to avoid or be financially unable to meet its obligations, or a court may decline to enforce such provisions. Damages that are not indemnified or released could greatly exceed available insurance coverage and could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition.

Our business could be materially and adversely affected by severe or unseasonable weather where we have operations.

Our business could be materially and adversely affected by severe weather, particularly in Canada, the Gulf of Mexico, and the North Sea. Many experts believe global climate change could increase the frequency and severity of extreme weather conditions. Repercussions of severe or unseasonable weather conditions may include:

- evacuation of personnel and inoperability of equipment resulting in curtailment of services;

- damage to offshore drilling rigs resulting in suspension of operations;

- damage to our facilities and project work sites;

- inability to deliver materials to job sites in accordance with contract schedules;

- fluctuations in demand for oil and natural gas, including possible decreases during unseasonably warm winters; and

- loss of productivity.

Our failure to protect our proprietary information and any successful intellectual property challenges or infringement proceedings against us could materially and adversely affect our competitive position.

We rely on a variety of intellectual property rights that we use in our services and products. We may not be able to successfully preserve these intellectual property rights in the future, and these rights could be invalidated, circumvented, or challenged. In addition, the laws of some foreign countries in which our services and products may be sold do not protect intellectual property rights to the same extent as the laws of the United States. Courts could find that others infringe our patent or other intellectual property rights or that our products and services may infringe the intellectual property rights of others. Our failure to protect our proprietary information and any successful intellectual property challenges or infringement proceedings against us could materially and adversely affect us.

If we are not able to design, develop and produce commercially competitive products and to implement commercially competitive services in a timely manner in response to changes in the market, customer requirements, competitive pressures, developments associated with climate change concerns and energy mix transition, and technology trends, our business and consolidated results of operations could be materially and adversely affected, and the value of our intellectual property may be reduced.

The market for our services and products is characterized by continual technological developments to provide better and more reliable performance and services. If we are not able to design, develop, and produce commercially competitive products and to implement commercially competitive services in a timely manner in response to changes in the market, customer requirements, competitive pressures, developments associated with climate change concerns and energy mix transition, and technology trends, including artificial intelligence and machine learning, our business and consolidated results of operations could be materially and adversely affected, and the value of our intellectual property may be reduced. Likewise, if our proprietary technologies, equipment, facilities, or work processes become obsolete, we may no longer be competitive, and our business and consolidated results of operations could be materially and adversely affected.

We sometimes provide integrated project management services in the form of long-term, fixed price contracts that may require us to assume additional risks associated with cost over-runs, operating cost inflation, labor availability and productivity, supplier and contractor pricing and performance, and potential claims for liquidated damages.

We sometimes provide integrated project management services outside our normal discrete business in the form of long-term, fixed price contracts. Some of these contracts are required by our customers, primarily national oil companies. These services include acting as project managers as well as service providers and may require us to assume additional risks associated with cost over-runs. These customers may provide us with inaccurate or limited information, that may result in cost over-runs, delays, and project losses. In addition, our customers often operate in countries with unsettled political conditions, war, civil unrest, or other types of community issues. These issues may also result in cost over-runs, delays, and project losses.

Providing services on an integrated basis may also require us to assume additional risks associated with operating cost inflation, labor availability and productivity, supplier pricing and performance, and potential claims for liquidated damages. We rely on third-party subcontractors and equipment providers to help us complete these contracts. To the extent that we cannot engage subcontractors or acquire equipment or materials in a timely manner and on reasonable terms, our ability to complete a project in accordance with stated deadlines or at a profit may be impaired. If the amount we are required to pay for these goods and services exceeds the amount we have estimated in bidding for fixed-price work, we could experience losses in the performance of these contracts. These delays and additional costs may be substantial, and we may be required to compensate our customers for these delays. This may reduce the profit to be realized or result in a loss on a project.

Constraints in the supply of, prices for, and availability of transportation of raw materials and electric power could have a material adverse effect on our business and consolidated results of operations.

Our business depends on the supply and availability of raw and essential materials. Raw materials essential to our operations and manufacturing, such as sand, chemicals, metals, gels, and electronic components (circuit boards), are normally readily available. Shortage of raw materials because of high levels of demand or loss of suppliers during market challenges can trigger constraints in the supply chain of those raw materials, particularly where we have a relationship with a single supplier for a particular resource. Many of the raw materials essential to our business require the use of rail, storage, and trucking services to transport the materials to our job sites. These services, particularly during times of high demand, may cause delays in the arrival of or otherwise constrain our supply of raw materials. In addition, as we increase the roll-out of our Zeus electric fracturing systems, we might face challenges to source sufficient electric power or there might not be adequate infrastructure to support the operation of our systems.

These constraints on raw materials and electric power could have a material adverse effect on our business and consolidated results of operations. In addition, price increases imposed by our vendors for raw materials and transportation providers used in our business could have a material adverse effect on our business and consolidated results of operations if we are unable pass these increases through to our customers.

Our ability to operate and our growth potential could be materially and adversely affected if we cannot attract, employ, and retain technical personnel at a competitive cost.

Many of the services that we provide and the products that we sell are complex and highly engineered and often must perform or be performed in harsh conditions. We believe that our success depends upon our ability to attract, employ, and retain technical personnel with the ability to design, utilize, and enhance these services and products. A significant increase in the wages paid by competing employers could result in a reduction of our skilled labor force, increases in the wage rates that we must pay, or both. If either of these events were to occur, our cost structure could increase, our margins could decrease, and any growth potential could be impaired.

Laws and Regulations Related

Our operations outside the United States require us to comply with a number of United States and international regulations, violations of which could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition.

Our operations outside the United States require us to comply with a number of United States and international regulations. For example, our operations in countries outside the United States are subject to the United States Foreign Corrupt Practices Act (FCPA), which prohibits United States companies and their agents and employees from providing anything of value to a foreign official for the purposes of influencing any act or decision of these individuals in their official capacity to help obtain or retain business, direct business to any person or corporate entity, or obtain any unfair advantage. Our activities create the risk of unauthorized payments or offers of payments by our employees, agents, or joint venture partners that could be in violation of anti-corruption laws, even though some of these parties are not subject to our control. We have internal control policies and procedures and have implemented training and compliance programs for our employees and agents with respect to the FCPA. However, we cannot assure that our policies, procedures, and programs will always protect us from reckless or criminal acts committed by our employees or agents. We are also subject to the risks that our employees, joint venture partners, and agents outside of the United States may fail to comply with other applicable laws. Allegations of violations of applicable anti-corruption laws have resulted and may in the future result in internal, independent, or government investigations. Violations of anti-corruption laws may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could have a material adverse effect on our business, consolidated results of operations and consolidated financial condition.

In addition, the shipment of goods, services, and technology across international borders subjects us to extensive trade laws and regulations. Our import activities are governed by the unique customs laws and regulations in each of the countries where we operate. Moreover, many countries, including the United States, control the export, re-export, and in-country transfer of certain goods, services, and technology, impose related export recordkeeping and reporting obligations, and impose trade barriers or tariffs. Governments may also impose economic sanctions against certain countries, persons, and entities that may restrict or prohibit transactions involving such countries, persons, and entities, which may limit or prevent our conduct of business in certain jurisdictions. The imposition of such sanctions on Russia in connection with Russia’s invasion of Ukraine led to our decision to dispose of our Russian operations during the third quarter of 2022.

Changes in U.S. foreign trade policies, including as a result of the new presidential administration, could lead to the imposition of additional trade barriers and tariffs on us in foreign jurisdictions. We cannot predict the full extent of new, extended, or changed trade policies, including tariffs, that may be made by the current or a future presidential administration or Congress, including whether existing tariff policies will be maintained or modified or if changes in the U.S. trade policy result in reactions from the U.S. trading partners, including adopting responsive trade policies making it more difficult or costly for us to export or import our products from countries where we currently purchase or sell products. Such changes in U.S. trade policy or in laws and policies governing foreign trade, and any resulting negative sentiments towards the United States as a result of such changes, could materially and adversely affect our business, financial condition, results of operations and liquidity.

The laws and regulations concerning import activity, export recordkeeping and reporting, export control and economic sanctions are complex and constantly changing. These laws and regulations can cause delays in shipments and unscheduled operational downtime. Moreover, any failure to comply with applicable legal and regulatory trading obligations could result in government investigations of our activities, as well as criminal and civil penalties and sanctions, such as fines, imprisonment, debarment from governmental contracts, seizure of shipments, and loss of import and export privileges.

Our activities outside of the United States expose us to various legal, social, economic, and political issues that could have a material adverse effect on our business, consolidated results of operations and consolidated financial condition.

Changes in, compliance with, or our failure to comply with laws in the countries in which we conduct business may negatively impact our ability to provide services in, make sales to, and transfer personnel or equipment among some of those countries and could have a material adverse effect on our business and consolidated results of operations.

In the countries in which we conduct business, we are subject to multiple and, at times, inconsistent regulatory regimes, including those that govern our use of radioactive materials, explosives, and chemicals in our operations. Various national and international regulatory regimes govern the shipment of these items. Many countries, but not all, impose special controls upon the export and import of radioactive materials, explosives, and chemicals. Our ability to do business is subject to maintaining required licenses and complying with these multiple regulatory requirements applicable to these special products. In addition, the various laws governing import and export of both products and technology apply to a wide range of services and products we offer. In turn, this can affect our employment practices of hiring people of different nationalities because these laws may prohibit or limit access to some products or technology by employees of various nationalities. Changes in, compliance with, or our failure to comply with these laws may negatively impact our ability to provide services in, make sales to, and transfer personnel or equipment among some of the countries in which we operate and could have a material adverse effect on our business and consolidated results of operations.

The adoption of any future federal, state, or local laws or implementing regulations imposing reporting obligations on, or limiting or banning, the hydraulic fracturing process could make it more difficult to complete natural gas and oil wells and could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition.

Various federal and state legislative and regulatory initiatives, as well as actions in other countries, have been or could be undertaken that could result in additional requirements or restrictions being imposed on hydraulic fracturing operations. For example, the United States may seek to adopt federal regulations or enact federal laws that would impose additional regulatory requirements on or even prohibit hydraulic fracturing in some areas. Legislation and/or regulations have been adopted by many states in the U.S. that require additional disclosure regarding chemicals used in the hydraulic fracturing process but that generally include protections for proprietary information. Legislation, regulations, and/or policies have also been adopted at the state level that impose other types of requirements on hydraulic fracturing operations (such as limits on operations in the event of certain levels of seismic activity). Additional legislation and/or regulations have been adopted or are being considered at the state and local level that could impose further chemical disclosure or other regulatory requirements (such as prohibitions on hydraulic fracturing operations in certain areas) that could affect our operations. Some states and some local jurisdictions have adopted ordinances that restrict or in certain cases prohibit the use of hydraulic fracturing. In addition, governmental authorities in various foreign countries where we have provided or may provide hydraulic fracturing services have imposed or are considering imposing various restrictions or conditions that may affect hydraulic fracturing operations. The adoption of any future federal, state, local, or foreign laws or regulations imposing reporting obligations on, or limiting or banning, the hydraulic fracturing process could make it more difficult to complete natural gas and oil wells and could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition.

Liability for cleanup costs, natural resource damages and other damages arising as a result of environmental laws and regulations could be substantial and could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition.

We are subject to numerous environmental laws and regulations in the United States and the other countries where we do business. We evaluate and address the environmental impact of our operations by assessing and remediating contaminated properties to avoid future liabilities and comply with legal and regulatory requirements. From time to time, claims have been made against us under environmental laws and regulations. In the United States, environmental laws and regulations typically impose strict liability. Strict liability means that in some situations we could be exposed to liability for cleanup costs, natural resource damages, and other damages as a result of our conduct that was lawful at the time it occurred or the conduct of prior operators or other third parties. We are periodically notified of potential liabilities at federal and state superfund sites. These potential liabilities may arise from both historical Halliburton operations and the historical operations of companies that we have acquired. Our exposure at these sites may be materially impacted by unforeseen adverse developments both in the final remediation costs and with respect to the final allocation among the various parties involved at the sites. The relevant regulatory agency may bring suit against us for amounts in excess of what we have accrued and what we believe is our proportionate share of remediation costs at any superfund site. We also could be subject to third-party claims, including punitive damages, with respect to environmental matters for which we have been named as a potentially responsible party. Liability for damages arising as a result of environmental laws or related third-party claims could be substantial and could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition.

Failure on our part to comply with, and the costs of compliance with, applicable health, safety, and environmental requirements could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition.

In addition to the numerous environmental laws and regulations that apply to our operations, we are subject to a variety of laws and regulations in the United States and other countries relating to health and safety. Among those laws and regulations are those covering hazardous materials and requiring emission performance standards for facilities. For example, our well service operations routinely involve the handling of significant amounts of waste materials, some of which are classified as hazardous substances. We also store, transport, and use radioactive and explosive materials in certain of our operations. Applicable regulatory requirements include those concerning:

- the containment and disposal of hazardous substances, oilfield waste, and other waste materials;

- the production, storage, transportation and use of chemicals;

- the production, storage, transportation and use of explosive materials;

- the importation and use of radioactive materials;

- the use of underground storage tanks;

- the use of underground injection wells; and

- the protection of worker safety both onshore and offshore.

These and other requirements generally are becoming increasingly strict. The failure to comply with the requirements, many of which may be applied retroactively, may result in:

- administrative, civil, and criminal penalties;

- revocation of permits to conduct business; and

- corrective action orders, including orders to investigate and/or clean up contamination.

Failure on our part to comply with applicable health, safety, and environmental laws and regulations or costs arising from regulatory compliance, including compliance with changes in or expansion of applicable regulatory requirements, could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition.

Existing or future laws, regulations, treaties, or international agreements related to greenhouse gases, climate change, or alternative energy sources could have a negative impact on our business and may result in additional compliance obligations that could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition.

Changes in or the adoption or enactment of laws, regulations, treaties or international agreements related to greenhouse gases, climate change, or alternative energy sources, including changes that may make it more expensive to explore for and produce oil and natural gas, may negatively impact demand for our services and products. International, national, state, and local governments and agencies in areas in which we conduct business continue to evaluate, and in some instances adopt, climate-related legislation and other regulatory initiatives that would restrict emissions of greenhouse gases.

We closely follow developments in this area, including changes in the regulatory landscape in the United States at both the federal and state levels and in the international markets in which we operate. We cannot predict, however, how or when such changes may be effected or ultimately impact our business. For example, in the United States, presidents have certain powers to issue executive orders that can have the effect of the enactment of new laws. In January 2025, President Biden issued a Memorandum of Withdrawal that could have had the effect of preventing future leasing by the federal government (and therefore oil and gas exploration) of the lands underlying federal waters offshore the U.S. East Coast, the eastern Gulf of Mexico, the Pacific Ocean off the coasts of Washington, Oregon, and California, and additional portions of the Northern Bering Sea in Alaska. Also in January 2025, President Trump in turn overturned President Biden’s Memorandum of Withdrawal and issued a series of executive orders that signal a shift in the United States’ energy and climate change policies. Future administrations may, however, pursue executive orders similar to, or more restrictive than, those put in place by predecessor administrations.

Because our business depends on the level of activity in the oil and natural gas industry, existing or future laws, orders, regulations, treaties, or international agreements related to greenhouse gases or climate change, including incentives to conserve energy or use alternative energy sources, may reduce demand for oil and natural gas and could have a negative impact on our business. The efforts we have taken, and may undertake in the future, to respond to these evolving or new regulations and to environmental initiatives of customers, investors, and others may increase our costs. These and other environmental requirements could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition.

We could be subject to changes in our tax rates, the adoption of new tax legislation, tax audits, or exposure to additional tax liabilities that could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition.

We are subject to taxes in the U.S. and numerous jurisdictions where we operate and our subsidiaries are organized. Due to economic and political conditions, tax rates in the U.S. and other jurisdictions may be subject to significant change. Our tax returns are subject to examination by the U.S. Internal Revenue Service (IRS) and other tax authorities and governmental bodies. We regularly assess the likelihood of an adverse outcome resulting from these examinations to determine the adequacy of our provision for taxes.

Our U.S. federal income tax filings for tax years 2016 through 2023 are currently under review or remain open for review by the IRS. As of December 31, 2024, the primary unresolved issue for the IRS audit for 2016 relates to the classification of the $3.5 billion ordinary deduction that we claimed for the termination fee we paid to Baker Hughes in the second quarter of 2016 for which we received a Notice of Proposed Adjustment (NOPA) from the IRS on September 28, 2023. In 2023, we initiated the IRS administrative appeals process, which is ongoing. There can be no assurance as to the outcome of the NOPA or other tax examinations and audits.

Adverse outcomes resulting from examinations of our tax returns, including the NOPA, an increase in tax rates in a jurisdiction where we generate substantial income, particularly in the U.S., or changes in our ability to realize our deferred tax assets could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition.

Our operations are subject to political and economic instability and risk of government actions that could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition.

We are exposed to risks inherent in doing business in each of the countries and regions in which we operate. Our operations are subject to various risks unique to each country and region that could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition. With respect to any particular country or region, these risks may include:

- political and economic instability, including:

•civil unrest, acts of terrorism, war, and other armed conflict, such as the ongoing actions in Ukraine, Israel, and the broader Middle East;

•inflation; and

•currency fluctuations, devaluations, and conversion restrictions; and

- governmental actions that may:

•result in expropriation and nationalization of our assets in that country;

•result in confiscatory taxation or other adverse tax policies;

•limit or disrupt markets or our customers and our operations, restrict payments, or limit the movement of funds;

•impose sanctions on our ability to conduct business with certain customers or persons;

•result in the deprivation of contract rights;

•impose tariffs or otherwise limit the transport of goods and equipment into or out of that country; and

•result in the inability to obtain or retain licenses required for operation.

For example, due to the unsettled political conditions in many oil-producing countries and regions, our operations, revenue, and profits are subject to the adverse consequences of war, terrorism, civil unrest, strikes, currency controls, and governmental actions. These, and other risks described above, could result in the loss of our personnel or assets, cause us to evacuate our personnel from certain countries, cause us to increase spending on security worldwide, cause us to cease operating in certain countries, cause disruption of shipping and supply chain operations, disrupt financial and commercial markets, including the supply of and pricing for oil and natural gas, and generate greater political and economic instability in some of the geographic areas in which we operate. Areas where we operate that have significant risk include, but are not limited to: the Middle East, North Africa, Angola, Argentina, Azerbaijan, Brazil, Indonesia, Kazakhstan, Mexico, Mozambique, Nigeria, Papua New Guinea, and Ukraine. In addition, any possible reprisals as a consequence of military or other action, such as acts of terrorism in the United States or elsewhere, could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition.

General Risk Factors

Our operations are subject to cyberattacks that could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition.

We are increasingly dependent on digital technologies and services to conduct our business. We use these technologies for internal and operational purposes, including data storage, processing, and transmissions, as well as in our interactions with customers and suppliers. Examples of these digital technologies include analytics, automation, and cloud services. Our digital technologies and services, and those of our customers and suppliers, are subject to the risk of cybersecurity incidents and, given the nature of such incidents, some can remain undetected for a period of time despite efforts to detect and respond to them in a timely manner. We routinely monitor our systems for cybersecurity threats and have processes in place aimed at detecting and remediating vulnerabilities and incidents. Nevertheless, we have experienced cybersecurity incidents and attempted breaches in the past, one of which resulted in an unauthorized third party gaining access to certain of our systems and exfiltrating information from those systems, which we previously disclosed in Form 8-Ks we filed with the SEC on August 23, 2024 and September 3, 2024. The incident caused disruptions and limitation of access to portions of our business applications supporting aspects of our operations and corporate functions, required us to incur significant costs, and required a significant amount of attention from management and our work force. Related to this incident, we face risks of unknown impacts or new events, regulatory actions, or potential litigation, which could affect our business, reputation, consolidated results of operations, or consolidated financial condition.

Even if we successfully defend our own digital technologies and services, we also rely on our customers and suppliers, with whom we may share data and services, to protect their digital technologies and services from cybersecurity incidents.

If our systems, or our customers’ or suppliers’ systems, for protecting against cybersecurity incidents prove not to be sufficient, we could be adversely affected by, among other things: loss of or damage to intellectual property, proprietary or confidential information, or customer, supplier, or employee data; interruption of our business operations; diversion of management or work force attention; and increased costs required to prevent, respond to, or mitigate cybersecurity incidents. These risks could harm our reputation and our relationships with our customers, employees, suppliers and other third parties, and may result in claims against us. In addition, laws and regulations governing cybersecurity resiliency, governance, and incidents; data privacy; and the unauthorized disclosure of confidential or protected information pose increasingly complex compliance challenges, and failure to comply with these laws could result in penalties and legal liability. These risks could have a material adverse effect on our business, consolidated results of operations and consolidated financial condition.

Our ability to declare and pay dividends and repurchase shares is subject to certain considerations and we may be unable to meet our capital return framework goal of returning at least 50% of annual free cash flow to shareholders through dividends and share repurchases, which could decrease expected returns on an investment in our stock.

Our capital return framework includes a goal of returning at least 50% of annual free cash flow (cash flow from operations less capital expenditures plus proceeds from sales of property, plant, and equipment) to our shareholders through dividends and share repurchases. Dividends and share repurchases are authorized and determined by our Board of Directors at its sole discretion and depend upon a number of factors, including our financial results, cash requirements, and future prospects, as well as such other factors deemed relevant by our Board of Directors. We can provide no assurance that we will pay dividends or make share repurchases in accordance with our capital return framework goal or at all. Any elimination of, or downward revision in, our dividend payout or share repurchase program could have an adverse effect on the market price of our common stock.

Meeting our capital return framework goal requires us to generate consistent free cash flow and have available capital in the years ahead in an amount sufficient to enable us to continue investing in organic and inorganic growth as well as to return a significant portion of the cash generated to shareholders in the form of dividends and share repurchases. Also, our cash flow fluctuates over the course of the year, so, although our goal is to return at least 50% of annual free cash flow to shareholders, that is an average over a year and the dividends paid, the number of shares repurchased, and the amount of free cash flow returned in any quarter during the year will vary and may be more or less than 50%. We may not meet this goal if we use our available cash to satisfy other priorities, if we have insufficient funds available to pay dividends and to repurchase shares, if we pause our repurchases due to unforeseen events, or if our Board of Directors determines to change or discontinue dividend payments or share repurchases.

We are subject to foreign currency exchange risks and limitations on our ability to reinvest earnings from operations in one country to fund the capital needs of our operations in other countries or to repatriate assets from some countries.

A sizable portion of our consolidated revenue and consolidated operating expenses is in foreign currencies. As a result, we are subject to significant risks, including:

- foreign currency exchange risks resulting from changes in foreign currency exchange rates and the implementation of exchange controls; and

- limitations on our ability to reinvest earnings from operations in one country to fund the capital needs of our operations in other countries.

As an example, we conduct business in countries that have restricted or limited trading markets for their local currencies and restrict or limit cash repatriation. We may accumulate cash in those geographies, but we may be limited in our ability to convert our profits into U.S. dollars or to repatriate the profits from those countries. For example, we have experienced these conditions in Argentina and other countries and though we have utilized processes to repatriate cash when we believe it is appropriate to do so, we have incurred losses from devaluation of the local currency and from repatriating cash. We expect restrictions on currency repatriation to continue in certain countries during 2025.

If we lose one or more of our significant customers or if our customers delay paying or fail to pay a significant amount of our outstanding receivables, it could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition.

We have a number of significant customers. While no single customer represented more than 10% of consolidated revenue in any period presented, the loss of one or more significant customers could have a material adverse effect on our business and our consolidated results of operations.

In most cases, we bill our customers for our services in arrears and are, therefore, subject to our customers delaying or failing to pay our invoices. We may experience increased delays and failures due to, among other reasons, a reduction in our customers’ cash flow from operations and their access to the credit markets, particularly in weak economic or commodity price environments. If our customers delay paying or fail to pay us a significant amount of our outstanding receivables, it could have a material adverse effect on our business, consolidated results of operations and consolidated financial condition.

Our acquisitions, dispositions and investments may not result in anticipated benefits and may present risks not originally contemplated, which may have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition.

We continually seek opportunities to maximize efficiency and value through various transactions, including purchases or sales of assets, businesses, investments, or joint venture interests. These transactions are intended to (but may not) result in the realization of savings, the creation of efficiencies, the offering of new products or services, the generation of cash or income, or the reduction of risk. Acquisition transactions may use cash on hand or be financed by additional borrowings or by the issuance of our common stock. These transactions may also adversely affect our business, consolidated results of operations, and consolidated financial condition.

These transactions also involve risks, and we cannot ensure that:

- any acquisitions we attempt would be completed on the terms announced, or at all;

- any acquisitions would result in an increase in income or provide an adequate return of capital or other anticipated benefits;

- any acquisitions would be successfully integrated into our operations and internal controls;

- the due diligence conducted prior to an acquisition would uncover situations that could result in financial or legal exposure, including under the FCPA, or that we will appropriately quantify the exposure from known risks;

- any disposition would not result in decreased earnings, revenue, or cash flow;

- use of cash for acquisitions would not adversely affect our cash available for capital expenditures and other uses; or