UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811- 2402

John Hancock Sovereign Bond Fund

(Exact name of registrant as specified in charter)

601 Congress Street, Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Salvatore Schiavone

Treasurer

601 Congress Street

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-663-4497

| Date of fiscal year end: | May 31 |

| Date of reporting period: | May 31, 2017 |

ITEM 1. REPORT TO STOCKHOLDERS.

A message to shareholders

Dear shareholder,

Bond markets were a study in contrasts over the past 12 months, with credit-sensitive segments enjoying solid gains while rate-sensitive areas posted much more muted returns. Generally, the global macroeconomic picture continued to improve, with corporate earnings in both the United States and abroad showing signs of strength.

In the United States, the steady drumbeat of economic growth convinced the U.S. Federal Reserve (Fed) to raise short-term interest rates by a quarter of a percentage point twice during your fund's fiscal year and once more shortly after the period ended, and continued to hint at one more rate hike in the back half of this year. The Fed also began laying out plans for shrinking its $4.5 trillion balance sheet, a potentially delicate operation that investors will be watching closely.

There are a number of potential headwinds and uncertainties facing bond investors today. At John Hancock Investments, we believe one of the best ways to navigate these challenges is by talking with your financial advisor, who can make sure that your fixed-income allocations are suitable for your investment goals and that they appropriately balance the need for income with market risks.

On behalf of everyone at John Hancock Investments, I'd like to take this opportunity to thank you for the continued trust you've placed in us.

Sincerely,

Andrew G. Arnott

President and Chief Executive Officer

John Hancock Investments

This commentary reflects the CEO's views, which are subject to change at any time. Investing involves risks, including the potential loss of principal. Diversification does not guarantee a profit or eliminate the risk of a loss. For more up-to-date information, please visit our website at jhinvestments.com.

John Hancock

Bond Fund

INVESTMENT OBJECTIVE

The fund seeks a high level of current income consistent with prudent investment risk.

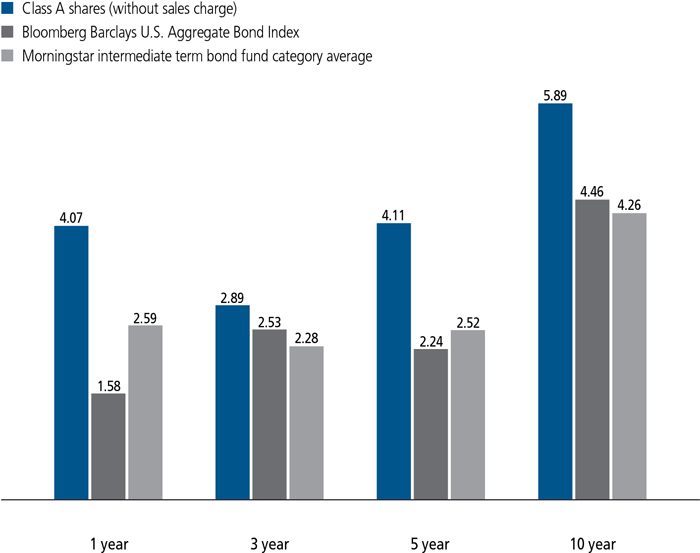

AVERAGE ANNUAL TOTAL RETURNS AS OF 5/31/17 (%)

The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index of dollar-denominated and non-convertible investment-grade debt issues.

It is not possible to invest directly in an index. Index figures do not reflect expenses or sales charges, which would result in lower returns.

Figures from Morningstar, Inc. include reinvested distributions and do not take into account sales charges. Actual load-adjusted performance is lower.

The past performance shown here reflects reinvested distributions and the beneficial effect of any expense reductions, and does not guarantee future results. Performance of the other share classes will vary based on the difference in the fees and expenses of those classes. Shares will fluctuate in value and, when redeemed, may be worth more or less than their original cost. Current month-end performance may be lower or higher than the performance cited, and can be found at jhinvestments.com or by calling 800-225-5291. For further information on the fund's objectives, risks, and strategy, see the fund's prospectus.

PERFORMANCE HIGHLIGHTS OVER THE LAST TWELVE MONTHS

The U.S. election caused a rise in yields

Yields spiked in the final months of 2016 following the November U.S. presidential election.

Risk assets led the bond market's advance

Investors' outlook for improved economic conditions in the United States fueled strong gains in risk assets.

The fund generated a positive return

The fund significantly outperformed its benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index.

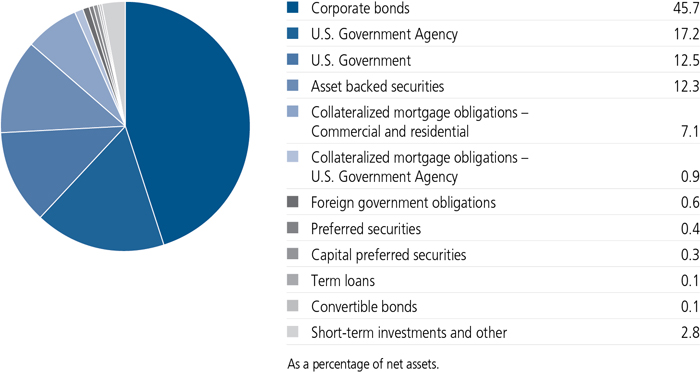

PORTFOLIO COMPOSITION AS OF 5/31/17 (%)

A note about risks

Fixed-income investments are subject to interest-rate and credit risk; their value will normally decline as interest rates rise or if a creditor, grantor, or counterparty is unable or unwilling to make principal, interest, or settlement payments. Investments in higher-yielding, lower-rated securities are subject to a higher risk of default. A fund concentrated in one sector or that holds a limited number of securities may fluctuate more than a fund that invests in a wider variety of sectors. Foreign investing has additional risks, such as currency and market volatility and political and social instability. Mortgage- and asset-backed securities may be sensitive to changes in interest rates, and may be subject to early repayment and the market's perception of issuer creditworthiness. Liquidity—the extent to which a security may be sold or a derivative position closed without negatively affecting its market value—may be impaired by reduced trading volume, heightened volatility, rising interest rates, and other market conditions. Hedging, derivatives, and other strategic transactions may increase a fund's volatility and could produce disproportionate losses, potentially more than the fund's principal investment. Fund distributions generally depend on income from underlying investments and may vary or cease altogether in the future. Please see the fund's prospectus for additional risks.

An interview with Portfolio Managers Howard C. Greene, CFA, and Jeffrey N. Given, CFA, John Hancock Asset Management a division of Manulife Asset Management (US) LLC

Howard C. Greene, CFA

Portfolio Manager

John Hancock Asset Management

Jeffrey N. Given, CFA

Portfolio Manager

John Hancock Asset Management

The 12 months ended May 31, 2017, represented a challenging period for fixed-income investors. What were some of the major issues moving markets?

It was really a tale of two markets during the fund's fiscal year. Yields in the U.S. Treasury market were fairly stable in the months leading up to the November U.S. presidential election. After the election, however, yields spiked, reflecting a sell-off in U.S. Treasuries and corresponding rally in so-called risk assets (generally those rated BB and lower), including equities, high-yield bonds, and emerging-market debt. Since late December, yields in the 10-year U.S. Treasury market have been choppy but rangebound, generally trading between 2.2% and 2.6%. While risk assets have, for the most part, continued to notch gains, there are growing concerns about some of the macroeconomic factors facing markets. Much of the rally in late 2016 was driven by the belief that the Trump administration would usher in some pro-growth policy changes, including tax reform and potential deregulation. While changes to economic policy are still certainly possible, investors have lately begun to grapple with the fact that they may have overestimated the speed with which any reforms could be implemented. Nonetheless, all told, it was a very strong 12 months for risk assets and credit-sensitive securities, while rate-sensitive debt was essentially flat.

What's your outlook for interest rates over the near term?

The U.S. Federal Reserve (Fed) hiked short-term interest rates twice during the fund's fiscal year and once more shortly after the end of the period. The Fed has been suggesting it intends to hike rates once more in 2017, potentially in September. We think that's a likely outcome, barring any unforeseen shock to the economy.

The bigger question, however, has to do with the Fed's plans regarding the size of its balance sheet. After multiple iterations of bond-buying programs in the wake of the financial crisis, the Fed now holds approximately $4.5 trillion worth of debt on its books, including $1.8 trillion in agency

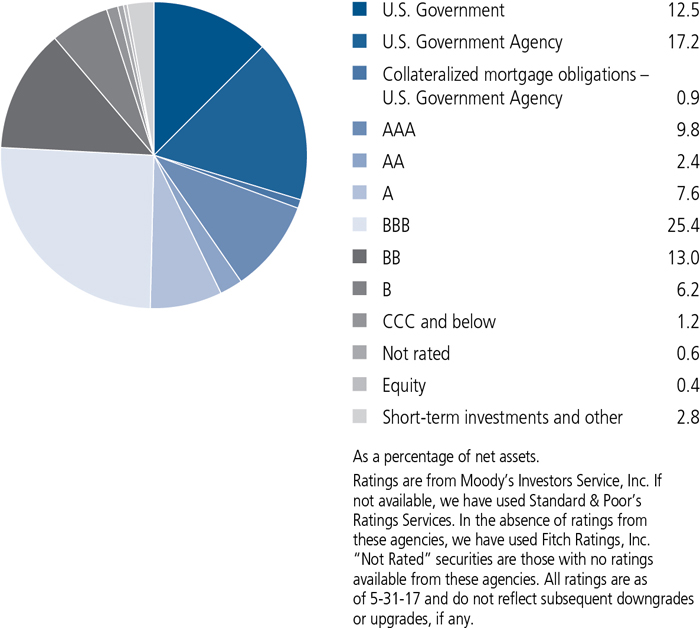

QUALITY COMPOSITION AS OF 5/31/17 (%)

What positions helped the fund's performance versus its benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index?

One of the biggest positive contributions to performance came from the fund's limited exposure to U.S. Treasuries and its slightly below-benchmark exposure to duration, which measures a portfolio's sensitivity to interest rates. The fund's duration at period end was 5.72, compared with 5.95 for the benchmark. Treasuries sold off throughout the period and the fund's underweight position contributed positively to relative returns. Likewise, the fund's lower duration profile meant it was less susceptible to price declines as interest rates rose.

Another big contributor was the fund's modest position in high-yield debt, which gained during the period. Investment-grade corporate debt also had a positive effect on returns, and strong security selection in the corporate bond space was beneficial to relative results.

Finally, the fund's overweight exposure to commercial mortgage-backed securities (CMBS) boosted relative returns. Fundamentals in commercial real estate, which tend to be correlated with the health of the overall economy, continued to strengthen during the period and CMBS benefited.

What positions detracted from relative performance?

The fund's small positions in high-grade U.S. utilities and foreign industrials were a slight drag on returns, as were the fund's allocations to certain asset-backed securities, including securities backed by auto loans and credit card receivables. Altogether, these were relatively small positions for the fund and were only a minor factor in the fund's relative results versus the benchmark.

COUNTRY COMPOSITION AS OF 5/31/17 (%)

| United States | 89.6 |

| United Kingdom | 1.7 |

| Netherlands | 1.5 |

| France | 1.1 |

| Other countries | 6.1 |

| TOTAL | 100.0 |

| As a percentage of net assets. |

Given the level of uncertainty in the markets, how have you positioned the fund?

We're continuing to take a fairly conservative stance in general as we head into the second half of 2017. We don't believe now is the time to be making big bets on either interest rates or credit. To that end, we held a modestly defensive stance with respect to the fund's duration; however, sector weighting and individual security selection remain our primary strategic emphasis.

With that said, the fund holds some floating-rate securities, primarily mortgage-backed securities that hold adjustable rate loans. These investments can benefit should interest rates continue to move higher, and we believe they provide an element of diversification to the fund. With regard to credit, we have been focused on high-quality securities within both the investment-grade space and the high-yield area.

While our primary goal is to offer investors a well-diversified portfolio, in general we prefer credit-driven holdings over rate-sensitive securities, given the incremental yields offered and the potential opportunity for some spread tightening. The reality for investors, however, is that for the foreseeable future, we are likely to remain in an environment of coupon-driven returns. There are not a lot of opportunities in the market for meaningful price appreciation, and given the headwinds of rising interest rates and sluggish global economic growth, we prefer a more conservative tilt to the portfolio. As the Fed continues to navigate normalizing monetary policy, individual security selection will become increasingly important. While the markets seem to have already priced in stronger economic growth under a Trump administration, we believe our slightly more conservative stance is warranted until potential policy changes become realities and that growth begins to manifest itself in real economic data.

MANAGED BY

| Howard C. Greene, CFA On the fund since 2002 Investing since 1979 |

| Jeffrey N. Given, CFA On the fund since 2006 Investing since 1993 |

TOTAL RETURNS FOR THE PERIOD ENDED MAY 31, 2017

| Average annual total returns (%) with maximum sales charge | Cumulative total returns (%) with maximum sales charge | SEC 30-day yield (%) subsidized | SEC 30-day yield (%) unsubsidized1 | ||||||||

| 1-year | 5-year | 10-year | 5-year | 10-year | as of 5-31-17 | as of 5-31-17 | |||||

| Class A | -0.10 | 3.27 | 5.46 | 17.45 | 70.17 | 2.53 | 2.48 | ||||

| Class B | -1.65 | 3.04 | 5.30 | 16.15 | 67.58 | 1.95 | 1.89 | ||||

| Class C | 2.35 | 3.38 | 5.15 | 18.06 | 65.27 | 1.94 | 1.89 | ||||

| Class I2 | 4.33 | 4.44 | 6.29 | 24.27 | 84.03 | 2.96 | 2.90 | ||||

| Class R22,3 | 3.97 | 4.10 | 5.88 | 22.23 | 77.05 | 2.54 | 2.48 | ||||

| Class R42,3 | 4.25 | 4.26 | 6.05 | 23.19 | 79.90 | 2.78 | 2.63 | ||||

| Class R62,3 | 4.58 | 4.59 | 6.39 | 25.15 | 85.77 | 3.05 | 2.97 | ||||

| Class NAV2,3 | 4.51 | 4.58 | 6.41 | 25.08 | 86.06 | 3.05 | 2.99 | ||||

| Index† | 1.58 | 2.24 | 4.46 | 11.72 | 54.66 | — | — | ||||

Performance figures assume all distributions have been reinvested. Figures reflect maximum sales charges on Class A shares of 4.0% and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The returns for Class A shares have been adjusted to reflect the reduction in the maximum sales charge from 4.5% to 4.0%, effective 2-3-14. The Class B shares' CDSC declines annually between years 1 to 6 according to the following schedule: 5%, 4%, 3%, 3%, 2%, 1%. No sales charge will be assessed after the sixth year. Class C shares sold within one year of purchase are subject to a 1% CDSC. Sales charges are not applicable to Class I, Class R2, Class R4, Class R6, and Class NAV shares.

The expense ratios of the fund, both net (including any fee waivers and/or expense limitations) and gross (excluding any fee waivers and/or expense limitations), are set forth according to the most recent publicly available prospectuses for the fund and may differ from those disclosed in the Financial highlights tables in this report. Had the fee waivers and expense limitations not been in place, gross expenses would apply. The expense ratios are as follows:

| Class A | Class B | Class C | Class I | Class R2 | Class R4 | Class R6 | Class NAV | |

| Gross (%) | 0.93 | 1.63 | 1.63 | 0.61 | 1.02 | 0.87 | 0.52 | 0.50 |

| Net (%) | 0.88 | 1.58 | 1.58 | 0.56 | 0.97 | 0.72 | 0.45 | 0.45 |

Please refer to the most recent prospectus and annual or semiannual report for more information on expenses and any expense limitation arrangements for each class.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility and other factors, the fund's current performance may be higher or lower than the performance shown. For current to the most recent month-end performance data, please call 800-225-5291 or visit the fund's website at jhinvestments.com.

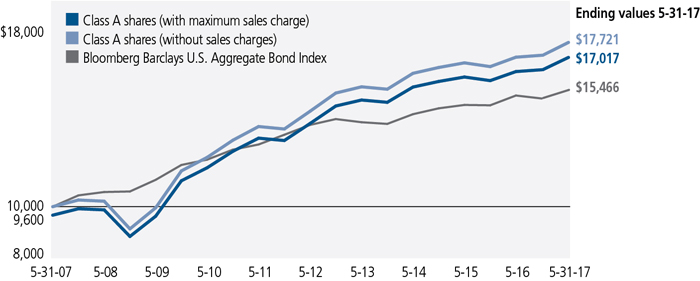

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The fund's performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

| † | Index is the Bloomberg Barclays U.S. Aggregate Bond Index. |

See the following page for footnotes.

This chart and table show what happened to a hypothetical $10,000 investment in John Hancock Bond Fund for the share classes and periods indicated, assuming all distributions were reinvested. For comparison, we've shown the same investment in the Bloomberg Barclays U.S. Aggregate Bond Index.

| Start date | With maximum sales charge ($) | Without sales charge ($) | Index ($) | |

| Class B4 | 5-31-07 | 16,758 | 16,758 | 15,466 |

| Class C4 | 5-31-07 | 16,527 | 16,527 | 15,466 |

| Class I2,3 | 5-31-07 | 18,403 | 18,403 | 15,466 |

| Class R22,3 | 5-31-07 | 17,705 | 17,705 | 15,466 |

| Class R42,3 | 5-31-07 | 17,990 | 17,990 | 15,466 |

| Class R62,3 | 5-31-07 | 18,577 | 18,577 | 15,466 |

| Class NAV2,3 | 5-31-07 | 18,606 | 18,606 | 15,466 |

The values shown in the chart for Class A shares with maximum sales charge have been adjusted to reflect the reduction in the Class A shares' maximum sales charge from 4.5% to 4.0%, which became effective on 2-3-14.

The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index of dollar-denominated and non-convertible investment-grade debt issues.

It is not possible to invest directly in an index. Index figures do not reflect expenses or sales charges, which would result in lower returns.

Footnotes related to performance pages

| 1 | Unsubsidized yield reflects what the yield would have been without the effect of reimbursements and waivers. |

| 2 | For certain types of investors, as described in the fund's prospectuses. |

| 3 | Class R2 shares were first offered 3-1-12; Class R4 shares were first offered 3-27-15; Class R6 shares were first offered 9-1-11; Class NAV shares were first offered 8-31-15. Returns prior to these dates are those of Class A shares that have been recalculated to apply the gross fees and expenses of Class R2, Class R4, Class R6, and Class NAV shares, as applicable. |

| 4 | The contingent deferred sales charge is not applicable. |

These examples are intended to help you understand your ongoing operating expenses of investing in the fund so you can compare these costs with the ongoing costs of investing in other mutual funds.

Understanding fund expenses

As a shareholder of the fund, you incur two types of costs:

| • | Transaction costs, which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc. |

| • | Ongoing operating expenses, including management fees, distribution and service fees (if applicable), and other fund expenses. |

We are presenting only your ongoing operating expenses here.

Actual expenses/actual returns

The first line of each share class in the table on the following page is intended to provide information about the fund's actual ongoing operating expenses, and is based on the fund's actual return. It assumes an account value of $1,000.00 on December 1, 2016, with the same investment held until May 31, 2017.

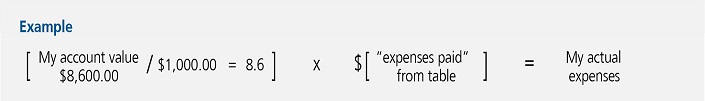

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at May 31, 2017, by $1,000.00, then multiply it by the "expenses paid" for your share class from the table. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

Hypothetical example for comparison purposes

The second line of each share class in the table on the following page allows you to compare the fund's ongoing operating expenses with those of any other fund. It provides an example of the fund's hypothetical account values and hypothetical expenses based on each class's actual expense ratio and an assumed 5% annualized return before expenses (which is not the fund's actual return). It assumes an account value of $1,000.00 on December 1, 2016, with the same investment held until May 31, 2017. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses. Please remember that these hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectuses for details regarding transaction costs.

SHAREHOLDER EXPENSE EXAMPLE CHART

| Account value on 12-1-2016 | Ending value on 5-31-2017 | Expenses paid during period ended 5-31-20171 | Annualized expense ratio | ||

| Class A | Actual expenses/actual returns | $1,000.00 | $1,035.20 | $4.16 | 0.82% |

| Hypothetical example for comparison purposes | 1,000.00 | 1,020.80 | 4.13 | 0.82% | |

| Class B | Actual expenses/actual returns | 1,000.00 | 1,031.70 | 7.70 | 1.52% |

| Hypothetical example for comparison purposes | 1,000.00 | 1,017.40 | 7.65 | 1.52% | |

| Class C | Actual expenses/actual returns | 1,000.00 | 1,031.70 | 7.70 | 1.52% |

| Hypothetical example for comparison purposes | 1,000.00 | 1,017.40 | 7.65 | 1.52% | |

| Class I | Actual expenses/actual returns | 1,000.00 | 1,036.90 | 2.54 | 0.50% |

| Hypothetical example for comparison purposes | 1,000.00 | 1,022.40 | 2.52 | 0.50% | |

| Class R2 | Actual expenses/actual returns | 1,000.00 | 1,034.70 | 4.67 | 0.92% |

| Hypothetical example for comparison purposes | 1,000.00 | 1,020.30 | 4.63 | 0.92% | |

| Class R4 | Actual expenses/actual returns | 1,000.00 | 1,036.00 | 3.35 | 0.66% |

| Hypothetical example for comparison purposes | 1,000.00 | 1,021.60 | 3.33 | 0.66% | |

| Class R6 | Actual expenses/actual returns | 1,000.00 | 1,038.00 | 2.03 | 0.40% |

| Hypothetical example for comparison purposes | 1,000.00 | 1,022.90 | 2.02 | 0.40% | |

| Class NAV | Actual expenses/actual returns | 1,000.00 | 1,037.40 | 2.08 | 0.41% |

| Hypothetical example for comparison purposes | 1,000.00 | 1,022.90 | 2.07 | 0.41% | |

| 1 | Expenses are equal to the fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

Fund's investments

| As of 5-31-17 | |||||||||||||||||||||||||||||

| Rate (%) | Maturity date | Par value^ | Value | ||||||||||||||||||||||||||

| Corporate bonds 45.7% | $4,421,982,378 | ||||||||||||||||||||||||||||

| (Cost $4,315,315,795) | |||||||||||||||||||||||||||||

| Consumer discretionary 5.1% | 494,758,572 | ||||||||||||||||||||||||||||

| Auto components 0.2% | |||||||||||||||||||||||||||||

| Lear Corp. | 5.250 | 01-15-25 | 10,154,000 | 10,819,371 | |||||||||||||||||||||||||

| Nemak SAB de CV (S) | 5.500 | 02-28-23 | 6,941,000 | 7,175,259 | |||||||||||||||||||||||||

| ZF North America Capital, Inc. (S) | 4.750 | 04-29-25 | 5,650,000 | 5,937,868 | |||||||||||||||||||||||||

| Automobiles 1.7% | |||||||||||||||||||||||||||||

| American Honda Finance Corp. | 1.700 | 02-22-19 | 12,703,000 | 12,708,145 | |||||||||||||||||||||||||

| American Honda Finance Corp. | 2.000 | 02-14-20 | 20,100,000 | 20,179,214 | |||||||||||||||||||||||||

| BMW US Capital LLC (S) | 2.150 | 04-06-20 | 13,760,000 | 13,845,670 | |||||||||||||||||||||||||

| Daimler Finance North America LLC (S) | 2.200 | 05-05-20 | 8,250,000 | 8,258,745 | |||||||||||||||||||||||||

| Ford Motor Company | 4.750 | 01-15-43 | 7,330,000 | 6,894,188 | |||||||||||||||||||||||||

| Ford Motor Credit Company LLC | 2.375 | 03-12-19 | 7,838,000 | 7,867,087 | |||||||||||||||||||||||||

| Ford Motor Credit Company LLC | 2.551 | 10-05-18 | 4,810,000 | 4,841,145 | |||||||||||||||||||||||||

| Ford Motor Credit Company LLC | 5.875 | 08-02-21 | 22,875,000 | 25,518,961 | |||||||||||||||||||||||||

| General Motors Company | 4.875 | 10-02-23 | 17,244,000 | 18,425,197 | |||||||||||||||||||||||||

| General Motors Company | 6.250 | 10-02-43 | 10,085,000 | 11,027,423 | |||||||||||||||||||||||||

| General Motors Financial Company, Inc. | 4.000 | 01-15-25 | 15,329,000 | 15,417,617 | |||||||||||||||||||||||||

| General Motors Financial Company, Inc. | 4.300 | 07-13-25 | 15,131,000 | 15,318,640 | |||||||||||||||||||||||||

| Diversified consumer services 0.1% | |||||||||||||||||||||||||||||

| Laureate Education, Inc. (S) | 8.250 | 05-01-25 | 5,175,000 | 5,446,688 | |||||||||||||||||||||||||

| Service Corp. International | 5.375 | 05-15-24 | 6,765,000 | 7,127,942 | |||||||||||||||||||||||||

| Hotels, restaurants and leisure 0.5% | |||||||||||||||||||||||||||||

| CCM Merger, Inc. (S) | 6.000 | 03-15-22 | 5,595,000 | 5,776,838 | |||||||||||||||||||||||||

| Chester Downs & Marina LLC (S) | 9.250 | 02-01-20 | 9,575,000 | 9,838,313 | |||||||||||||||||||||||||

| Eldorado Resorts, Inc. | 7.000 | 08-01-23 | 3,770,000 | 4,090,450 | |||||||||||||||||||||||||

| GLP Capital LP | 5.375 | 04-15-26 | 5,705,000 | 6,175,663 | |||||||||||||||||||||||||

| Hilton Grand Vacations Borrower LLC (S) | 6.125 | 12-01-24 | 3,245,000 | 3,488,375 | |||||||||||||||||||||||||

| International Game Technology PLC (S) | 6.500 | 02-15-25 | 5,175,000 | 5,650,479 | |||||||||||||||||||||||||

| Jacobs Entertainment, Inc. (S) | 7.875 | 02-01-24 | 2,798,000 | 2,951,890 | |||||||||||||||||||||||||

| Mohegan Tribal Gaming Authority (S) | 7.875 | 10-15-24 | 6,820,000 | 7,041,650 | |||||||||||||||||||||||||

| Seminole Tribe of Florida, Inc. (S) | 6.535 | 10-01-20 | 2,354,000 | 2,389,310 | |||||||||||||||||||||||||

| Waterford Gaming LLC (H)(S) | 8.625 | 09-15-14 | 440,015 | 0 | |||||||||||||||||||||||||

| Household durables 0.0% | |||||||||||||||||||||||||||||

| Newell Brands, Inc. | 2.150 | 10-15-18 | 2,995,000 | 3,010,721 | |||||||||||||||||||||||||

| Internet and direct marketing retail 0.5% | |||||||||||||||||||||||||||||

| Expedia, Inc. | 5.000 | 02-15-26 | 24,642,000 | 26,750,197 | |||||||||||||||||||||||||

| QVC, Inc. | 4.375 | 03-15-23 | 9,652,000 | 9,775,314 | |||||||||||||||||||||||||

| QVC, Inc. | 5.125 | 07-02-22 | 6,244,000 | 6,614,063 | |||||||||||||||||||||||||

| QVC, Inc. | 5.450 | 08-15-34 | 7,169,000 | 6,711,948 | |||||||||||||||||||||||||

| Rate (%) | Maturity date | Par value^ | Value | ||||||||||||||||||||||||||

| Consumer discretionary (continued) | |||||||||||||||||||||||||||||

| Leisure products 0.1% | |||||||||||||||||||||||||||||

| Vista Outdoor, Inc. | 5.875 | 10-01-23 | 9,817,000 | $9,927,441 | |||||||||||||||||||||||||

| Media 1.8% | |||||||||||||||||||||||||||||

| Altice Financing SA (S) | 6.625 | 02-15-23 | 7,765,000 | 8,261,960 | |||||||||||||||||||||||||

| Cengage Learning, Inc. (S) | 9.500 | 06-15-24 | 9,160,000 | 7,923,400 | |||||||||||||||||||||||||

| Charter Communications Operating LLC | 6.484 | 10-23-45 | 18,975,000 | 22,673,190 | |||||||||||||||||||||||||

| Clear Channel Worldwide Holdings, Inc. | 6.500 | 11-15-22 | 9,097,000 | 9,369,910 | |||||||||||||||||||||||||

| Lions Gate Entertainment Corp. (S) | 5.875 | 11-01-24 | 6,620,000 | 6,901,350 | |||||||||||||||||||||||||

| McGraw-Hill Global Education Holdings LLC (S) | 7.875 | 05-15-24 | 4,150,000 | 4,046,250 | |||||||||||||||||||||||||

| MDC Partners, Inc. (S) | 6.500 | 05-01-24 | 6,155,000 | 6,201,163 | |||||||||||||||||||||||||

| Midcontinent Communications (S) | 6.875 | 08-15-23 | 7,670,000 | 8,274,013 | |||||||||||||||||||||||||

| Myriad International Holdings BV (S) | 5.500 | 07-21-25 | 15,025,000 | 16,144,363 | |||||||||||||||||||||||||

| Omnicom Group, Inc. | 3.600 | 04-15-26 | 8,550,000 | 8,698,001 | |||||||||||||||||||||||||

| Sinclair Television Group, Inc. (S) | 5.625 | 08-01-24 | 6,495,000 | 6,681,731 | |||||||||||||||||||||||||

| Sirius XM Radio, Inc. (S) | 5.250 | 08-15-22 | 6,419,000 | 6,635,641 | |||||||||||||||||||||||||

| Sirius XM Radio, Inc. (S) | 5.375 | 04-15-25 | 8,895,000 | 9,139,613 | |||||||||||||||||||||||||

| Sirius XM Radio, Inc. (S) | 5.375 | 07-15-26 | 11,385,000 | 11,669,625 | |||||||||||||||||||||||||

| Time Warner Cable LLC | 8.250 | 04-01-19 | 8,190,000 | 9,075,208 | |||||||||||||||||||||||||

| Time Warner, Inc. | 3.800 | 02-15-27 | 13,465,000 | 13,430,678 | |||||||||||||||||||||||||

| WMG Acquisition Corp. (S) | 4.875 | 11-01-24 | 5,311,000 | 5,364,110 | |||||||||||||||||||||||||

| WMG Acquisition Corp. (S) | 6.750 | 04-15-22 | 8,037,000 | 8,464,970 | |||||||||||||||||||||||||

| Specialty retail 0.2% | |||||||||||||||||||||||||||||

| L Brands, Inc. | 6.625 | 04-01-21 | 11,935,000 | 13,218,013 | |||||||||||||||||||||||||

| L Brands, Inc. | 6.875 | 11-01-35 | 5,760,000 | 5,583,571 | |||||||||||||||||||||||||

| Consumer staples 2.1% | 208,646,948 | ||||||||||||||||||||||||||||

| Beverages 0.6% | |||||||||||||||||||||||||||||

| Anheuser-Busch InBev Finance, Inc. | 4.900 | 02-01-46 | 29,535,000 | 32,742,826 | |||||||||||||||||||||||||

| Molson Coors Brewing Company | 1.450 | 07-15-19 | 12,820,000 | 12,709,492 | |||||||||||||||||||||||||

| Molson Coors Brewing Company | 3.000 | 07-15-26 | 11,267,000 | 10,942,353 | |||||||||||||||||||||||||

| PepsiCo, Inc. | 1.500 | 02-22-19 | 6,570,000 | 6,567,792 | |||||||||||||||||||||||||

| Food and staples retailing 0.6% | |||||||||||||||||||||||||||||

| CVS Health Corp. | 2.875 | 06-01-26 | 10,415,000 | 10,120,474 | |||||||||||||||||||||||||

| CVS Health Corp. | 5.125 | 07-20-45 | 16,344,000 | 18,507,848 | |||||||||||||||||||||||||

| SUPERVALU, Inc. | 7.750 | 11-15-22 | 5,043,000 | 5,181,683 | |||||||||||||||||||||||||

| Walgreens Boots Alliance, Inc. | 1.750 | 05-30-18 | 10,115,000 | 10,198,752 | |||||||||||||||||||||||||

| Whole Foods Market, Inc. | 5.200 | 12-03-25 | 12,328,000 | 13,182,639 | |||||||||||||||||||||||||

| Food products 0.6% | |||||||||||||||||||||||||||||

| Bunge, Ltd. Finance Corp. | 8.500 | 06-15-19 | 6,016,000 | 6,745,957 | |||||||||||||||||||||||||

| Kraft Heinz Foods Company | 2.000 | 07-02-18 | 13,669,000 | 13,708,230 | |||||||||||||||||||||||||

| Kraft Heinz Foods Company (S) | 4.875 | 02-15-25 | 8,527,000 | 9,128,733 | |||||||||||||||||||||||||

| Kraft Heinz Foods Company | 5.200 | 07-15-45 | 13,702,000 | 14,663,456 | |||||||||||||||||||||||||

| Mondelez International Holdings Netherlands BV (S) | 1.625 | 10-28-19 | 10,935,000 | 10,795,994 | |||||||||||||||||||||||||

| Rate (%) | Maturity date | Par value^ | Value | ||||||||||||||||||||||||||

| Consumer staples (continued) | |||||||||||||||||||||||||||||

| Food products (continued) | |||||||||||||||||||||||||||||

| Post Holdings, Inc. (S) | 5.750 | 03-01-27 | 7,496,000 | $7,842,690 | |||||||||||||||||||||||||

| Household products 0.1% | |||||||||||||||||||||||||||||

| Kronos Acquisition Holdings, Inc. (S) | 9.000 | 08-15-23 | 7,165,000 | 7,047,494 | |||||||||||||||||||||||||

| Personal products 0.2% | |||||||||||||||||||||||||||||

| Revlon Consumer Products Corp. | 5.750 | 02-15-21 | 7,905,000 | 7,395,997 | |||||||||||||||||||||||||

| Revlon Consumer Products Corp. | 6.250 | 08-01-24 | 8,285,000 | 7,352,938 | |||||||||||||||||||||||||

| Tobacco 0.0% | |||||||||||||||||||||||||||||

| Vector Group, Ltd. (S) | 6.125 | 02-01-25 | 3,665,000 | 3,811,600 | |||||||||||||||||||||||||

| Energy 5.6% | 543,181,183 | ||||||||||||||||||||||||||||

| Energy equipment and services 0.1% | |||||||||||||||||||||||||||||

| Antero Midstream Partners LP (S) | 5.375 | 09-15-24 | 9,687,000 | 9,917,066 | |||||||||||||||||||||||||

| Oil, gas and consumable fuels 5.5% | |||||||||||||||||||||||||||||

| Boardwalk Pipelines LP | 4.450 | 07-15-27 | 6,252,000 | 6,443,555 | |||||||||||||||||||||||||

| Cenovus Energy, Inc. | 4.450 | 09-15-42 | 13,939,000 | 12,137,900 | |||||||||||||||||||||||||

| Cheniere Corpus Christi Holdings LLC (S) | 5.125 | 06-30-27 | 3,580,000 | 3,629,225 | |||||||||||||||||||||||||

| Cheniere Corpus Christi Holdings LLC | 5.875 | 03-31-25 | 5,295,000 | 5,685,506 | |||||||||||||||||||||||||

| Cimarex Energy Company | 4.375 | 06-01-24 | 7,159,000 | 7,542,572 | |||||||||||||||||||||||||

| Colorado Interstate Gas Company LLC (S) | 4.150 | 08-15-26 | 5,300,000 | 5,304,203 | |||||||||||||||||||||||||

| Columbia Pipeline Group, Inc. | 4.500 | 06-01-25 | 17,100,000 | 18,348,454 | |||||||||||||||||||||||||

| Continental Resources, Inc. | 5.000 | 09-15-22 | 18,230,000 | 18,252,788 | |||||||||||||||||||||||||

| DCP Midstream Operating LP | 2.700 | 04-01-19 | 7,399,000 | 7,362,005 | |||||||||||||||||||||||||

| DCP Midstream Operating LP (S) | 9.750 | 03-15-19 | 6,855,000 | 7,711,875 | |||||||||||||||||||||||||

| DCP Midstream Operating LP (5.850% to 5-21-23, then 3 month LIBOR + 3.850%) (S) | 5.850 | 05-21-43 | 6,615,000 | 6,185,025 | |||||||||||||||||||||||||

| Enbridge Energy Partners LP | 4.375 | 10-15-20 | 6,223,000 | 6,579,329 | |||||||||||||||||||||||||

| Enbridge Energy Partners LP (8.050% to 10-1-17, then 3 month LIBOR + 3.797%) | 8.050 | 10-01-77 | 8,873,000 | 8,739,905 | |||||||||||||||||||||||||

| Enbridge, Inc. | 4.250 | 12-01-26 | 11,315,000 | 11,927,334 | |||||||||||||||||||||||||

| Energy Transfer LP | 4.200 | 04-15-27 | 4,282,000 | 4,360,583 | |||||||||||||||||||||||||

| Energy Transfer LP | 5.150 | 03-15-45 | 10,490,000 | 10,334,192 | |||||||||||||||||||||||||

| Energy Transfer LP | 9.700 | 03-15-19 | 4,468,000 | 5,047,794 | |||||||||||||||||||||||||

| EnLink Midstream Partners LP | 4.850 | 07-15-26 | 10,194,000 | 10,751,795 | |||||||||||||||||||||||||

| Enterprise Products Operating LLC (P) | 4.877 | 08-01-66 | 9,655,000 | 9,655,000 | |||||||||||||||||||||||||

| Gulfport Energy Corp. (S) | 6.000 | 10-15-24 | 2,040,000 | 1,999,200 | |||||||||||||||||||||||||

| KCA Deutag UK Finance PLC (S) | 9.875 | 04-01-22 | 1,455,000 | 1,496,831 | |||||||||||||||||||||||||

| Kerr-McGee Corp. | 6.950 | 07-01-24 | 10,309,000 | 12,267,700 | |||||||||||||||||||||||||

| Kinder Morgan Energy Partners LP | 7.750 | 03-15-32 | 4,605,000 | 5,835,336 | |||||||||||||||||||||||||

| Kinder Morgan, Inc. | 4.300 | 06-01-25 | 8,751,000 | 9,173,148 | |||||||||||||||||||||||||

| Kinder Morgan, Inc. | 5.550 | 06-01-45 | 14,656,000 | 15,621,405 | |||||||||||||||||||||||||

| Lukoil International Finance BV (S) | 3.416 | 04-24-18 | 7,095,000 | 7,176,067 | |||||||||||||||||||||||||

| Newfield Exploration Company | 5.625 | 07-01-24 | 3,752,000 | 3,977,120 | |||||||||||||||||||||||||

| Newfield Exploration Company | 5.750 | 01-30-22 | 3,575,000 | 3,807,375 | |||||||||||||||||||||||||

| Rate (%) | Maturity date | Par value^ | Value | ||||||||||||||||||||||||||

| Energy (continued) | |||||||||||||||||||||||||||||

| Oil, gas and consumable fuels (continued) | |||||||||||||||||||||||||||||

| Occidental Petroleum Corp. | 3.400 | 04-15-26 | 11,715,000 | $11,937,819 | |||||||||||||||||||||||||

| ONEOK Partners LP | 5.000 | 09-15-23 | 5,258,000 | 5,729,516 | |||||||||||||||||||||||||

| Petrobras Global Finance BV | 5.625 | 05-20-43 | 16,668,000 | 13,917,780 | |||||||||||||||||||||||||

| Petrobras Global Finance BV | 7.375 | 01-17-27 | 19,063,000 | 20,435,536 | |||||||||||||||||||||||||

| Petroleos Mexicanos | 4.875 | 01-24-22 | 12,118,000 | 12,637,862 | |||||||||||||||||||||||||

| Petroleos Mexicanos (S) | 5.375 | 03-13-22 | 3,420,000 | 3,635,460 | |||||||||||||||||||||||||

| Regency Energy Partners LP | 5.000 | 10-01-22 | 1,834,000 | 1,999,750 | |||||||||||||||||||||||||

| Regency Energy Partners LP | 5.500 | 04-15-23 | 15,455,000 | 16,057,745 | |||||||||||||||||||||||||

| Regency Energy Partners LP | 5.875 | 03-01-22 | 1,250,000 | 1,399,619 | |||||||||||||||||||||||||

| Resolute Energy Corp. (S) | 8.500 | 05-01-20 | 1,604,000 | 1,632,070 | |||||||||||||||||||||||||

| Resolute Energy Corp. | 8.500 | 05-01-20 | 6,925,000 | 7,046,188 | |||||||||||||||||||||||||

| Sabine Pass Liquefaction LLC (S) | 4.200 | 03-15-28 | 8,965,000 | 9,077,412 | |||||||||||||||||||||||||

| Sabine Pass Liquefaction LLC | 5.000 | 03-15-27 | 8,466,000 | 9,049,333 | |||||||||||||||||||||||||

| Sabine Pass Liquefaction LLC | 5.750 | 05-15-24 | 6,205,000 | 6,931,419 | |||||||||||||||||||||||||

| Shell International Finance BV | 4.375 | 05-11-45 | 19,067,000 | 19,913,251 | |||||||||||||||||||||||||

| Summit Midstream Holdings LLC | 5.750 | 04-15-25 | 9,700,000 | 9,942,500 | |||||||||||||||||||||||||

| Sunoco Logistics Partners Operations LP | 3.900 | 07-15-26 | 14,609,000 | 14,620,892 | |||||||||||||||||||||||||

| Sunoco Logistics Partners Operations LP | 4.400 | 04-01-21 | 11,169,000 | 11,838,358 | |||||||||||||||||||||||||

| Tallgrass Energy Partners LP (S) | 5.500 | 09-15-24 | 5,985,000 | 6,074,775 | |||||||||||||||||||||||||

| Tapstone Energy LLC (S) | 9.750 | 06-01-22 | 3,710,000 | 3,672,900 | |||||||||||||||||||||||||

| Teekay Offshore Partners LP | 6.000 | 07-30-19 | 11,238,000 | 9,945,630 | |||||||||||||||||||||||||

| Tesoro Logistics LP | 5.250 | 01-15-25 | 3,922,000 | 4,147,515 | |||||||||||||||||||||||||

| Tesoro Logistics LP | 6.125 | 10-15-21 | 11,685,000 | 12,225,431 | |||||||||||||||||||||||||

| Tesoro Logistics LP | 6.375 | 05-01-24 | 10,439,000 | 11,352,413 | |||||||||||||||||||||||||

| The Williams Companies, Inc. | 4.550 | 06-24-24 | 10,935,000 | 11,235,713 | |||||||||||||||||||||||||

| The Williams Companies, Inc. | 5.750 | 06-24-44 | 9,585,000 | 9,998,305 | |||||||||||||||||||||||||

| Williams Partners LP | 3.750 | 06-15-27 | 12,370,000 | 12,363,691 | |||||||||||||||||||||||||

| Williams Partners LP | 4.875 | 05-15-23 | 9,660,000 | 9,949,800 | |||||||||||||||||||||||||

| Williams Partners LP | 4.875 | 03-15-24 | 20,438,000 | 21,178,878 | |||||||||||||||||||||||||

| YPF SA (S) | 8.500 | 07-28-25 | 14,030,000 | 15,963,334 | |||||||||||||||||||||||||

| Financials 14.2% | 1,370,142,074 | ||||||||||||||||||||||||||||

| Banks 7.9% | |||||||||||||||||||||||||||||

| ABN AMRO Bank NV (S) | 2.100 | 01-18-19 | 6,060,000 | 6,071,617 | |||||||||||||||||||||||||

| Australia & New Zealand Banking Group, Ltd. | 2.125 | 08-19-20 | 16,630,000 | 16,636,486 | |||||||||||||||||||||||||

| Australia & New Zealand Banking Group, Ltd. (6.750% to 6-15-26, then 5 Year U.S. ISDAFIX + 5.168%) (Q)(S) | 6.750 | 06-15-26 | 5,975,000 | 6,623,718 | |||||||||||||||||||||||||

| Bank of America Corp. | 3.950 | 04-21-25 | 13,411,000 | 13,635,701 | |||||||||||||||||||||||||

| Bank of America Corp. | 4.200 | 08-26-24 | 4,282,000 | 4,453,378 | |||||||||||||||||||||||||

| Bank of America Corp. | 4.250 | 10-22-26 | 9,036,000 | 9,339,989 | |||||||||||||||||||||||||

| Bank of America Corp. | 4.450 | 03-03-26 | 17,663,000 | 18,445,824 | |||||||||||||||||||||||||

| Bank of America Corp. | 6.875 | 04-25-18 | 11,975,000 | 12,511,827 | |||||||||||||||||||||||||

| Rate (%) | Maturity date | Par value^ | Value | ||||||||||||||||||||||||||

| Financials (continued) | |||||||||||||||||||||||||||||

| Banks (continued) | |||||||||||||||||||||||||||||

| Bank of America Corp. (6.300% to 3-10-26, then 3 month LIBOR + 4.553%) (Q) | 6.300 | 03-10-26 | 20,765,000 | $22,906,391 | |||||||||||||||||||||||||

| BankUnited, Inc. | 4.875 | 11-17-25 | 7,515,000 | 7,859,285 | |||||||||||||||||||||||||

| Barclays Bank PLC (S) | 10.179 | 06-12-21 | 6,375,000 | 8,074,887 | |||||||||||||||||||||||||

| Barclays PLC | 4.375 | 01-12-26 | 9,515,000 | 9,924,221 | |||||||||||||||||||||||||

| BPCE SA (S) | 4.500 | 03-15-25 | 12,800,000 | 13,132,122 | |||||||||||||||||||||||||

| BPCE SA (S) | 5.700 | 10-22-23 | 13,670,000 | 15,169,435 | |||||||||||||||||||||||||

| Branch Banking & Trust Company | 2.100 | 01-15-20 | 17,860,000 | 17,945,621 | |||||||||||||||||||||||||

| Citigroup, Inc. | 2.350 | 08-02-21 | 16,670,000 | 16,569,963 | |||||||||||||||||||||||||

| Citigroup, Inc. | 4.600 | 03-09-26 | 15,935,000 | 16,779,443 | |||||||||||||||||||||||||

| Citigroup, Inc. (5.875% to 3-27-20, then 3 month LIBOR + 4.059%) (Q) | 5.875 | 03-27-20 | 21,995,000 | 22,929,788 | |||||||||||||||||||||||||

| Citigroup, Inc. (6.250% to 8-15-26, then 3 month LIBOR + 4.517%) (Q) | 6.250 | 08-15-26 | 15,060,000 | 16,434,225 | |||||||||||||||||||||||||

| Citizens Bank NA | 2.200 | 05-26-20 | 14,890,000 | 14,892,770 | |||||||||||||||||||||||||

| Commerzbank AG (S) | 8.125 | 09-19-23 | 9,780,000 | 11,728,264 | |||||||||||||||||||||||||

| Cooperatieve Rabobank UA (11.000% to 6-30-19, then 3 month LIBOR + 10.868%) (Q)(S) | 11.000 | 06-30-19 | 9,084,000 | 10,594,215 | |||||||||||||||||||||||||

| Credit Agricole SA (7.875% to 1-23-24, then 5 Year U.S. Swap Rate + 4.898%) (Q)(S) | 7.875 | 01-23-24 | 9,405,000 | 10,340,083 | |||||||||||||||||||||||||

| Credit Agricole SA (8.125% to 9-19-18, then 5 Year U.S. Swap Rate + 6.283%) (S) | 8.125 | 09-19-33 | 9,690,000 | 10,367,137 | |||||||||||||||||||||||||

| Fifth Third Bancorp (5.100% to 6-30-23, then 3 month LIBOR + 3.033%) (Q) | 5.100 | 06-30-23 | 6,988,000 | 7,005,470 | |||||||||||||||||||||||||

| HBOS PLC (S) | 6.750 | 05-21-18 | 12,070,000 | 12,583,579 | |||||||||||||||||||||||||

| HSBC Holdings PLC (6.375% to 9-17-24, then 5 Year U.S. ISDAFIX + 3.705%) (Q) | 6.375 | 09-17-24 | 5,770,000 | 6,023,880 | |||||||||||||||||||||||||

| HSBC Holdings PLC (6.875% to 6-1-21, then 5 Year U.S. ISDAFIX + 5.514%) (Q) | 6.875 | 06-01-21 | 10,010,000 | 10,848,338 | |||||||||||||||||||||||||

| ING Bank NV (S) | 5.800 | 09-25-23 | 12,274,000 | 13,891,664 | |||||||||||||||||||||||||

| ING Groep NV (6.500% to 4-16-25, then 5 Year U.S. Swap Rate + 4.446%) (Q) | 6.500 | 04-16-25 | 5,855,000 | 6,137,797 | |||||||||||||||||||||||||

| JPMorgan Chase & Co. | 3.200 | 06-15-26 | 12,992,000 | 12,830,834 | |||||||||||||||||||||||||

| JPMorgan Chase & Co. | 4.625 | 05-10-21 | 16,379,000 | 17,767,890 | |||||||||||||||||||||||||

| JPMorgan Chase & Co. (5.300% to 5-1-20, then 3 month LIBOR + 3.800%) (Q) | 5.300 | 05-01-20 | 13,798,000 | 14,358,889 | |||||||||||||||||||||||||

| JPMorgan Chase & Co. (6.750% to 2-1-24, then 3 month LIBOR + 3.780%) (Q) | 6.750 | 02-01-24 | 12,993,000 | 14,617,125 | |||||||||||||||||||||||||

| Lloyds Banking Group PLC | 4.650 | 03-24-26 | 27,640,000 | 29,017,467 | |||||||||||||||||||||||||

| Lloyds Banking Group PLC (7.500% to 6-27-24, then 5 Year U.S. Swap Rate + 4.760%) (Q) | 7.500 | 06-27-24 | 6,825,000 | 7,507,500 | |||||||||||||||||||||||||

| M&T Bank Corp. (5.125% to 11-1-26, then 3 month LIBOR + 3.520%) (Q) | 5.125 | 11-01-26 | 9,087,000 | 9,314,175 | |||||||||||||||||||||||||

| Manufacturers & Traders Trust Company (P) | 1.695 | 12-01-21 | 7,160,000 | 7,034,700 | |||||||||||||||||||||||||

| Popular, Inc. | 7.000 | 07-01-19 | 8,935,000 | 9,359,413 | |||||||||||||||||||||||||

| Rate (%) | Maturity date | Par value^ | Value | ||||||||||||||||||||||||||

| Financials (continued) | |||||||||||||||||||||||||||||

| Banks (continued) | |||||||||||||||||||||||||||||

| Royal Bank of Scotland Group PLC | 3.875 | 09-12-23 | 11,120,000 | $11,271,043 | |||||||||||||||||||||||||

| Royal Bank of Scotland Group PLC (8.000% to 8-10-25, then 5 Year U.S. Swap Rate + 5.720%) (Q) | 8.000 | 08-10-25 | 6,630,000 | 7,251,775 | |||||||||||||||||||||||||

| Royal Bank of Scotland Group PLC (8.625% to 8-15-21, then 5 Year U.S. Swap Rate + 7.598%) (Q) | 8.625 | 08-15-21 | 6,245,000 | 6,838,275 | |||||||||||||||||||||||||

| Santander Holdings USA, Inc. | 2.700 | 05-24-19 | 19,683,000 | 19,856,998 | |||||||||||||||||||||||||

| Santander UK Group Holdings PLC (S) | 4.750 | 09-15-25 | 11,670,000 | 12,059,078 | |||||||||||||||||||||||||

| Societe Generale SA (7.375% to 9-13-21, then 5 Year U.S. Swap Rate + 6.238%) (Q)(S) | 7.375 | 09-13-21 | 12,430,000 | 13,362,648 | |||||||||||||||||||||||||

| Societe Generale SA (8.000% to 9-29-25, then 5 Year U.S. ISDAFIX + 5.873%) (Q)(S) | 8.000 | 09-29-25 | 12,050,000 | 13,679,160 | |||||||||||||||||||||||||

| Societe Generale SA (8.250% to 11-29-18, then 5 Year U.S. Swap Rate + 6.394%) (Q) | 8.250 | 11-29-18 | 9,140,000 | 9,739,108 | |||||||||||||||||||||||||

| Standard Chartered PLC (S) | 2.100 | 08-19-19 | 16,345,000 | 16,286,452 | |||||||||||||||||||||||||

| Sumitomo Mitsui Banking Corp. | 2.450 | 01-10-19 | 13,871,000 | 13,988,224 | |||||||||||||||||||||||||

| Sumitomo Mitsui Trust Bank, Ltd. (S) | 2.050 | 03-06-19 | 19,930,000 | 19,947,419 | |||||||||||||||||||||||||

| Synovus Financial Corp. | 7.875 | 02-15-19 | 7,804,000 | 8,496,995 | |||||||||||||||||||||||||

| The PNC Financial Services Group, Inc. (4.850% to 6-1-23, then 3 month LIBOR + 3.040%) (Q) | 4.850 | 06-01-23 | 10,034,000 | 10,146,983 | |||||||||||||||||||||||||

| The PNC Financial Services Group, Inc. (6.750% to 8-1-21, then 3 month LIBOR + 3.678%) (Q) | 6.750 | 08-01-21 | 9,323,000 | 10,511,683 | |||||||||||||||||||||||||

| US Bank NA | 2.000 | 01-24-20 | 15,265,000 | 15,354,453 | |||||||||||||||||||||||||

| Wells Fargo & Company | 4.650 | 11-04-44 | 9,650,000 | 9,986,698 | |||||||||||||||||||||||||

| Wells Fargo & Company (5.875% to 6-15-25, then 3 month LIBOR + 3.990%) (Q) | 5.875 | 06-15-25 | 30,976,000 | 33,996,160 | |||||||||||||||||||||||||

| Wells Fargo & Company, Series K (7.980% to 3-15-18, then 3 month LIBOR + 3.770%) (Q) | 7.980 | 03-15-18 | 11,207,000 | 11,627,263 | |||||||||||||||||||||||||

| Westpac Banking Corp. | 2.150 | 03-06-20 | 24,398,000 | 24,476,610 | |||||||||||||||||||||||||

| Capital markets 2.2% | |||||||||||||||||||||||||||||

| Ares Capital Corp. | 3.875 | 01-15-20 | 6,900,000 | 7,048,205 | |||||||||||||||||||||||||

| Credit Suisse Group AG (7.500% to 12-11-23, then 5 Year U.S. Swap Rate + 4.598%) (Q)(S) | 7.500 | 12-11-23 | 6,595,000 | 7,369,913 | |||||||||||||||||||||||||

| FS Investment Corp. | 4.000 | 07-15-19 | 6,555,000 | 6,605,932 | |||||||||||||||||||||||||

| FS Investment Corp. | 4.250 | 01-15-20 | 6,800,000 | 6,954,673 | |||||||||||||||||||||||||

| Jefferies Group LLC | 4.850 | 01-15-27 | 15,010,000 | 15,770,512 | |||||||||||||||||||||||||

| Jefferies Group LLC | 8.500 | 07-15-19 | 4,720,000 | 5,319,478 | |||||||||||||||||||||||||

| Macquarie Bank, Ltd. (S) | 4.875 | 06-10-25 | 13,835,000 | 14,701,915 | |||||||||||||||||||||||||

| Morgan Stanley | 2.450 | 02-01-19 | 5,986,000 | 6,030,769 | |||||||||||||||||||||||||

| Morgan Stanley | 3.875 | 01-27-26 | 8,763,000 | 9,031,227 | |||||||||||||||||||||||||

| Morgan Stanley | 5.500 | 01-26-20 | 10,397,000 | 11,276,711 | |||||||||||||||||||||||||

| Morgan Stanley | 7.300 | 05-13-19 | 18,201,000 | 19,995,200 | |||||||||||||||||||||||||

| S&P Global, Inc. | 4.000 | 06-15-25 | 13,725,000 | 14,435,859 | |||||||||||||||||||||||||

| S&P Global, Inc. | 4.400 | 02-15-26 | 8,420,000 | 9,059,827 | |||||||||||||||||||||||||

| Stifel Financial Corp. | 4.250 | 07-18-24 | 13,165,000 | 13,498,904 | |||||||||||||||||||||||||

| Rate (%) | Maturity date | Par value^ | Value | ||||||||||||||||||||||||||

| Financials (continued) | |||||||||||||||||||||||||||||

| Capital markets (continued) | |||||||||||||||||||||||||||||

| The Bear Stearns Companies LLC | 7.250 | 02-01-18 | 5,445,000 | $5,643,960 | |||||||||||||||||||||||||

| The Goldman Sachs Group, Inc. | 2.000 | 04-25-19 | 8,124,000 | 8,130,743 | |||||||||||||||||||||||||

| The Goldman Sachs Group, Inc. | 2.300 | 12-13-19 | 25,518,000 | 25,611,141 | |||||||||||||||||||||||||

| The Goldman Sachs Group, Inc. | 3.850 | 01-26-27 | 24,200,000 | 24,645,812 | |||||||||||||||||||||||||

| Consumer finance 1.5% | |||||||||||||||||||||||||||||

| Ally Financial, Inc. | 3.250 | 11-05-18 | 8,410,000 | 8,540,523 | |||||||||||||||||||||||||

| Ally Financial, Inc. | 5.125 | 09-30-24 | 17,928,000 | 18,611,595 | |||||||||||||||||||||||||

| Capital One Financial Corp. | 2.450 | 04-24-19 | 8,905,000 | 8,958,118 | |||||||||||||||||||||||||

| Capital One Financial Corp. | 3.750 | 07-28-26 | 21,708,000 | 21,312,980 | |||||||||||||||||||||||||

| Capital One Financial Corp. | 4.200 | 10-29-25 | 11,334,000 | 11,553,075 | |||||||||||||||||||||||||

| Capital One Financial Corp. (5.550% to 6-1-20, then 3 month LIBOR + 3.800%) (Q) | 5.550 | 06-01-20 | 10,355,000 | 10,717,425 | |||||||||||||||||||||||||

| Capital One NA | 2.350 | 08-17-18 | 7,895,000 | 7,938,991 | |||||||||||||||||||||||||

| Credit Acceptance Corp. | 6.125 | 02-15-21 | 7,539,000 | 7,595,543 | |||||||||||||||||||||||||

| Credito Real SAB de CV (S) | 7.250 | 07-20-23 | 5,700,000 | 5,970,750 | |||||||||||||||||||||||||

| Discover Bank | 2.600 | 11-13-18 | 10,125,000 | 10,210,860 | |||||||||||||||||||||||||

| Discover Financial Services | 3.950 | 11-06-24 | 22,310,000 | 22,674,590 | |||||||||||||||||||||||||

| Discover Financial Services | 5.200 | 04-27-22 | 2,350,000 | 2,553,064 | |||||||||||||||||||||||||

| Enova International, Inc. | 9.750 | 06-01-21 | 10,689,000 | 10,956,225 | |||||||||||||||||||||||||

| Diversified financial services 0.6% | |||||||||||||||||||||||||||||

| ASP AMC Merger Sub, Inc. (S) | 8.000 | 05-15-25 | 7,156,000 | 7,012,880 | |||||||||||||||||||||||||

| Doric Nimrod Air Alpha 2013-1 Class B Pass Through Trust (S) | 6.125 | 11-30-21 | 1,232,408 | 1,272,461 | |||||||||||||||||||||||||

| Flagstar Bancorp, Inc. | 6.125 | 07-15-21 | 6,340,000 | 6,855,879 | |||||||||||||||||||||||||

| Ladder Capital Finance Holdings LLLP (S) | 5.250 | 03-15-22 | 2,850,000 | 2,924,813 | |||||||||||||||||||||||||

| Leucadia National Corp. | 5.500 | 10-18-23 | 13,041,000 | 14,072,504 | |||||||||||||||||||||||||

| NewStar Financial, Inc. | 7.250 | 05-01-20 | 8,690,000 | 8,907,250 | |||||||||||||||||||||||||

| Voya Financial, Inc. (5.650% to 5-15-23, then 3 month LIBOR + 3.580%) | 5.650 | 05-15-53 | 12,257,000 | 12,869,850 | |||||||||||||||||||||||||

| Insurance 1.4% | |||||||||||||||||||||||||||||

| Aquarius & Investments PLC (6.375% to 9-1-19, then 5 Year U.S. Swap Rate + 5.210%) | 6.375 | 09-01-24 | 11,450,000 | 12,211,268 | |||||||||||||||||||||||||

| AXA SA | 8.600 | 12-15-30 | 6,219,000 | 8,737,695 | |||||||||||||||||||||||||

| AXA SA (6.379% to 12-14-36, then 3 month LIBOR + 2.256%) (Q)(S) | 6.379 | 12-14-36 | 2,670,000 | 2,959,214 | |||||||||||||||||||||||||

| CNO Financial Group, Inc. | 5.250 | 05-30-25 | 11,318,000 | 11,869,753 | |||||||||||||||||||||||||

| Liberty Mutual Group, Inc. (7.800% to 3-15-37, then 3 month LIBOR +3.576%) (S) | 7.800 | 03-07-87 | 14,721,000 | 17,812,410 | |||||||||||||||||||||||||

| MetLife, Inc. | 6.400 | 12-15-66 | 9,668,000 | 11,030,028 | |||||||||||||||||||||||||

| MetLife, Inc. (S) | 9.250 | 04-08-68 | 5,290,000 | 7,710,175 | |||||||||||||||||||||||||

| Nippon Life Insurance Company (5.100% to 10-16-24, then 5 Year U.S. ISDAFIX + 3.650%) (S) | 5.100 | 10-16-44 | 11,580,000 | 12,462,975 | |||||||||||||||||||||||||

| Rate (%) | Maturity date | Par value^ | Value | ||||||||||||||||||||||||||

| Financials (continued) | |||||||||||||||||||||||||||||

| Insurance (continued) | |||||||||||||||||||||||||||||

| Prudential Financial, Inc. (5.200% to 3-15-24, then 3 month LIBOR + 3.040%) | 5.200 | 03-15-44 | 9,550,000 | $10,087,188 | |||||||||||||||||||||||||

| Prudential Financial, Inc. (5.875% to 9-15-22, then 3 month LIBOR + 4.175%) | 5.875 | 09-15-42 | 7,423,000 | 8,230,251 | |||||||||||||||||||||||||

| Teachers Insurance & Annuity Association of America (S) | 4.270 | 05-15-47 | 14,535,000 | 14,817,037 | |||||||||||||||||||||||||

| Teachers Insurance & Annuity Association of America (S) | 6.850 | 12-16-39 | 818,000 | 1,135,697 | |||||||||||||||||||||||||

| The Hartford Financial Services Group, Inc. (8.125% to 6-15-18, then 3 month LIBOR + 4.603%) | 8.125 | 06-15-68 | 20,019,000 | 21,170,093 | |||||||||||||||||||||||||

| Thrifts and mortgage finance 0.6% | |||||||||||||||||||||||||||||

| MGIC Investment Corp. | 5.750 | 08-15-23 | 2,676,000 | 2,876,700 | |||||||||||||||||||||||||

| Nationstar Mortgage LLC | 6.500 | 07-01-21 | 7,424,000 | 7,581,760 | |||||||||||||||||||||||||

| Nationstar Mortgage LLC | 7.875 | 10-01-20 | 5,568,000 | 5,748,960 | |||||||||||||||||||||||||

| Nationstar Mortgage LLC | 9.625 | 05-01-19 | 4,555,000 | 4,680,263 | |||||||||||||||||||||||||

| Quicken Loans, Inc. (S) | 5.750 | 05-01-25 | 13,695,000 | 13,712,119 | |||||||||||||||||||||||||

| Radian Group, Inc. | 5.250 | 06-15-20 | 7,395,000 | 7,838,700 | |||||||||||||||||||||||||

| Radian Group, Inc. | 7.000 | 03-15-21 | 10,502,000 | 11,788,495 | |||||||||||||||||||||||||

| Stearns Holdings LLC (S) | 9.375 | 08-15-20 | 2,450,000 | 2,499,000 | |||||||||||||||||||||||||

| Health care 3.1% | 297,831,527 | ||||||||||||||||||||||||||||

| Biotechnology 0.8% | |||||||||||||||||||||||||||||

| AbbVie, Inc. | 3.600 | 05-14-25 | 14,343,000 | 14,664,943 | |||||||||||||||||||||||||

| Amgen, Inc. | 1.900 | 05-10-19 | 21,110,000 | 21,134,530 | |||||||||||||||||||||||||

| Amgen, Inc. | 4.400 | 05-01-45 | 6,682,000 | 6,745,813 | |||||||||||||||||||||||||

| Shire Acquisitions Investments Ireland DAC | 1.900 | 09-23-19 | 17,170,000 | 17,106,145 | |||||||||||||||||||||||||

| Shire Acquisitions Investments Ireland DAC | 3.200 | 09-23-26 | 18,825,000 | 18,382,274 | |||||||||||||||||||||||||

| Health care equipment and supplies 0.4% | |||||||||||||||||||||||||||||

| Becton, Dickinson and Company (C) | 2.133 | 06-06-19 | 14,885,000 | 14,893,738 | |||||||||||||||||||||||||

| Medtronic, Inc. | 4.625 | 03-15-45 | 9,208,000 | 10,226,792 | |||||||||||||||||||||||||

| Team Health Holdings, Inc. (S) | 6.375 | 02-01-25 | 1,505,000 | 1,461,731 | |||||||||||||||||||||||||

| Zimmer Biomet Holdings, Inc. | 3.550 | 04-01-25 | 13,477,000 | 13,543,408 | |||||||||||||||||||||||||

| Health care providers and services 1.2% | |||||||||||||||||||||||||||||

| Community Health Systems, Inc. | 5.125 | 08-01-21 | 9,844,000 | 9,991,660 | |||||||||||||||||||||||||

| Community Health Systems, Inc. | 8.000 | 11-15-19 | 6,431,000 | 6,463,155 | |||||||||||||||||||||||||

| Covenant Surgical Partners, Inc. (S) | 8.750 | 08-01-19 | 2,272,000 | 2,203,840 | |||||||||||||||||||||||||

| DaVita, Inc. | 5.000 | 05-01-25 | 10,636,000 | 10,569,525 | |||||||||||||||||||||||||

| Fresenius US Finance II, Inc. (S) | 4.500 | 01-15-23 | 4,880,000 | 5,099,600 | |||||||||||||||||||||||||

| HCA, Inc. | 5.250 | 04-15-25 | 11,189,000 | 12,217,045 | |||||||||||||||||||||||||

| HCA, Inc. | 5.250 | 06-15-26 | 10,238,000 | 11,108,230 | |||||||||||||||||||||||||

| HCA, Inc. | 7.500 | 02-15-22 | 8,740,000 | 10,072,850 | |||||||||||||||||||||||||

| LifePoint Health, Inc. (S) | 5.375 | 05-01-24 | 10,690,000 | 10,816,944 | |||||||||||||||||||||||||

| Medco Health Solutions, Inc. | 7.125 | 03-15-18 | 3,760,000 | 3,917,717 | |||||||||||||||||||||||||

| Rate (%) | Maturity date | Par value^ | Value | ||||||||||||||||||||||||||

| Health care (continued) | |||||||||||||||||||||||||||||

| Health care providers and services (continued) | |||||||||||||||||||||||||||||

| MEDNAX, Inc. (S) | 5.250 | 12-01-23 | 5,175,000 | $5,252,625 | |||||||||||||||||||||||||

| Select Medical Corp. | 6.375 | 06-01-21 | 11,493,000 | 11,751,593 | |||||||||||||||||||||||||

| Universal Health Services, Inc. (S) | 4.750 | 08-01-22 | 9,490,000 | 9,727,250 | |||||||||||||||||||||||||

| Universal Health Services, Inc. (S) | 5.000 | 06-01-26 | 10,906,000 | 11,205,915 | |||||||||||||||||||||||||

| Life sciences tools and services 0.1% | |||||||||||||||||||||||||||||

| Quintiles IMS, Inc. (S) | 4.875 | 05-15-23 | 5,275,000 | 5,420,063 | |||||||||||||||||||||||||

| Pharmaceuticals 0.6% | |||||||||||||||||||||||||||||

| Allergan Funding SCS | 3.800 | 03-15-25 | 11,000,000 | 11,352,638 | |||||||||||||||||||||||||

| Mylan NV | 2.500 | 06-07-19 | 8,513,000 | 8,564,027 | |||||||||||||||||||||||||

| Mylan NV | 3.950 | 06-15-26 | 23,148,000 | 23,211,101 | |||||||||||||||||||||||||

| Valeant Pharmaceuticals International, Inc. (S) | 6.125 | 04-15-25 | 13,450,000 | 10,726,375 | |||||||||||||||||||||||||

| Industrials 4.8% | 465,585,677 | ||||||||||||||||||||||||||||

| Aerospace and defense 0.6% | |||||||||||||||||||||||||||||

| Arconic, Inc. | 5.125 | 10-01-24 | 11,478,000 | 12,201,114 | |||||||||||||||||||||||||

| Engility Corp. | 8.875 | 09-01-24 | 1,862,000 | 2,001,650 | |||||||||||||||||||||||||

| Huntington Ingalls Industries, Inc. (S) | 5.000 | 12-15-21 | 10,070,000 | 10,422,450 | |||||||||||||||||||||||||

| Huntington Ingalls Industries, Inc. (S) | 5.000 | 11-15-25 | 5,600,000 | 5,985,000 | |||||||||||||||||||||||||

| Lockheed Martin Corp. | 2.900 | 03-01-25 | 12,976,000 | 12,957,626 | |||||||||||||||||||||||||

| Lockheed Martin Corp. | 4.700 | 05-15-46 | 11,583,000 | 12,925,064 | |||||||||||||||||||||||||

| Textron, Inc. | 7.250 | 10-01-19 | 2,950,000 | 3,283,775 | |||||||||||||||||||||||||

| Air freight and logistics 0.1% | |||||||||||||||||||||||||||||

| XPO Logistics, Inc. (S) | 6.500 | 06-15-22 | 14,175,000 | 15,049,598 | |||||||||||||||||||||||||

| Airlines 1.5% | |||||||||||||||||||||||||||||

| Air Canada 2013-1 Class C Pass Through Trust (S) | 6.625 | 05-15-18 | 5,790,000 | 5,985,413 | |||||||||||||||||||||||||

| America West Airlines 2000-1 Pass Through Trust | 8.057 | 01-02-22 | 500,149 | 562,668 | |||||||||||||||||||||||||

| American Airlines 2011-1 Class B Pass Through Trust (S) | 7.000 | 07-31-19 | 7,385,240 | 7,588,334 | |||||||||||||||||||||||||

| American Airlines 2013-2 Class A Pass Through Trust | 4.950 | 07-15-24 | 12,871,495 | 13,756,411 | |||||||||||||||||||||||||

| American Airlines 2015-1 Class B Pass Through Trust | 3.700 | 11-01-24 | 6,941,892 | 6,803,054 | |||||||||||||||||||||||||

| American Airlines 2016-1 Class A Pass Through Trust | 4.100 | 07-15-29 | 4,198,789 | 4,293,262 | |||||||||||||||||||||||||

| American Airlines 2017-1 Class A Pass Through Trust | 4.000 | 08-15-30 | 3,615,000 | 3,714,413 | |||||||||||||||||||||||||

| American Airlines 2017-1 Class AA Pass Through Trust | 3.650 | 08-15-30 | 5,570,000 | 5,664,690 | |||||||||||||||||||||||||

| British Airways 2013-1 Class A Pass Through Trust (S) | 4.625 | 12-20-25 | 10,880,858 | 11,533,709 | |||||||||||||||||||||||||

| British Airways 2013-1 Class B Pass Through Trust (S) | 5.625 | 12-20-21 | 2,494,767 | 2,588,321 | |||||||||||||||||||||||||

| Continental Airlines 1997-4 Class A Pass Through Trust | 6.900 | 07-02-19 | 150,897 | 152,951 | |||||||||||||||||||||||||

| Continental Airlines 1998-1 Class A Pass Through Trust | 6.648 | 03-15-19 | 49,722 | 50,343 | |||||||||||||||||||||||||

| Continental Airlines 1999-1 Class A Pass Through Trust | 6.545 | 08-02-20 | 731,291 | 769,684 | |||||||||||||||||||||||||

| Continental Airlines 2000-2 Class B Pass Through Trust | 8.307 | 10-02-19 | 93,037 | 97,107 | |||||||||||||||||||||||||

| Continental Airlines 2007-1 Class A Pass Through Trust | 5.983 | 10-19-23 | 6,003,643 | 6,604,008 | |||||||||||||||||||||||||

| Continental Airlines 2012-1 Class B Pass Through Trust | 6.250 | 10-11-21 | 1,287,285 | 1,361,304 | |||||||||||||||||||||||||

| Delta Air Lines 2002-1 Class G-1 Pass Through Trust | 6.718 | 07-02-24 | 5,038,729 | 5,693,764 | |||||||||||||||||||||||||

| Delta Air Lines 2010-1 Class A Pass Through Trust | 6.200 | 01-02-20 | 3,033,562 | 3,151,113 | |||||||||||||||||||||||||

| Rate (%) | Maturity date | Par value^ | Value | ||||||||||||||||||||||||||

| Industrials (continued) | |||||||||||||||||||||||||||||

| Airlines (continued) | |||||||||||||||||||||||||||||

| Delta Air Lines 2011-1 Class A Pass Through Trust | 5.300 | 10-15-20 | 909,823 | $957,589 | |||||||||||||||||||||||||

| Delta Air Lines, Inc. | 3.625 | 03-15-22 | 17,355,000 | 17,894,637 | |||||||||||||||||||||||||

| Northwest Airlines 2007-1 Class A Pass Through Trust | 7.027 | 05-01-21 | 2,972,507 | 3,297,075 | |||||||||||||||||||||||||

| United Airlines 2014-2 Class A Pass Through Trust | 3.750 | 03-03-28 | 14,823,449 | 15,212,565 | |||||||||||||||||||||||||

| United Airlines 2014-2 Class B Pass Through Trust | 4.625 | 03-03-24 | 6,157,758 | 6,311,702 | |||||||||||||||||||||||||

| United Airlines 2016-1 Class A Pass Through Trust | 3.450 | 01-07-30 | 9,169,000 | 9,214,845 | |||||||||||||||||||||||||

| US Airways 2010-1 Class A Pass Through Trust | 6.250 | 10-22-24 | 3,914,807 | 4,365,010 | |||||||||||||||||||||||||

| US Airways 2012-1 Class A Pass Through Trust | 5.900 | 04-01-26 | 4,645,963 | 5,197,671 | |||||||||||||||||||||||||

| Building products 0.3% | |||||||||||||||||||||||||||||

| Builders FirstSource, Inc. (S) | 10.750 | 08-15-23 | 4,355,000 | 5,051,800 | |||||||||||||||||||||||||

| Masco Corp. | 4.375 | 04-01-26 | 6,930,000 | 7,392,924 | |||||||||||||||||||||||||

| Masco Corp. | 4.450 | 04-01-25 | 6,280,000 | 6,722,740 | |||||||||||||||||||||||||

| Owens Corning | 4.200 | 12-15-22 | 8,168,000 | 8,672,709 | |||||||||||||||||||||||||

| Commercial services and supplies 0.2% | |||||||||||||||||||||||||||||

| LSC Communications, Inc. (S) | 8.750 | 10-15-23 | 10,993,000 | 11,377,755 | |||||||||||||||||||||||||

| Prime Security Services Borrower LLC (S) | 9.250 | 05-15-23 | 5,135,000 | 5,614,301 | |||||||||||||||||||||||||

| Tervita Escrow Corp. (S) | 7.625 | 12-01-21 | 1,415,000 | 1,441,531 | |||||||||||||||||||||||||

| Construction and engineering 0.2% | |||||||||||||||||||||||||||||

| AECOM (S) | 5.125 | 03-15-27 | 15,000,000 | 14,943,750 | |||||||||||||||||||||||||

| Tutor Perini Corp. (S) | 6.875 | 05-01-25 | 2,682,000 | 2,806,043 | |||||||||||||||||||||||||

| Electrical equipment 0.0% | |||||||||||||||||||||||||||||

| EnerSys (S) | 5.000 | 04-30-23 | 3,313,000 | 3,416,531 | |||||||||||||||||||||||||

| Industrial conglomerates 0.3% | |||||||||||||||||||||||||||||

| General Electric Company (P) | 1.662 | 08-15-36 | 4,270,000 | 3,821,650 | |||||||||||||||||||||||||

| General Electric Company (5.000% to 1-21-21, then 3 month LIBOR + 3.330%) (Q) | 5.000 | 01-21-21 | 22,268,000 | 23,499,420 | |||||||||||||||||||||||||

| Machinery 0.0% | |||||||||||||||||||||||||||||

| Neovia Logistics Services LLC (S) | 8.875 | 08-01-20 | 2,565,000 | 2,052,000 | |||||||||||||||||||||||||

| Professional services 0.3% | |||||||||||||||||||||||||||||

| IHS Markit, Ltd. (S) | 4.750 | 02-15-25 | 3,107,000 | 3,262,350 | |||||||||||||||||||||||||

| IHS Markit, Ltd. (S) | 5.000 | 11-01-22 | 4,011,000 | 4,297,385 | |||||||||||||||||||||||||

| Verisk Analytics, Inc. | 4.000 | 06-15-25 | 22,125,000 | 22,891,653 | |||||||||||||||||||||||||

| Road and rail 0.0% | |||||||||||||||||||||||||||||

| The Hertz Corp. (S) | 7.625 | 06-01-22 | 3,270,000 | 3,270,000 | |||||||||||||||||||||||||

| Trading companies and distributors 1.2% | |||||||||||||||||||||||||||||

| AerCap Global Aviation Trust (6.500% to 6-15-25, then 3 month LIBOR + 4.300%) (S) | 6.500 | 06-15-45 | 9,410,000 | 9,939,313 | |||||||||||||||||||||||||

| AerCap Ireland Capital DAC | 4.625 | 10-30-20 | 9,220,000 | 9,812,947 | |||||||||||||||||||||||||

| AerCap Ireland Capital DAC | 5.000 | 10-01-21 | 12,950,000 | 14,060,463 | |||||||||||||||||||||||||

| Ahern Rentals, Inc. (S) | 7.375 | 05-15-23 | 9,460,000 | 7,922,750 | |||||||||||||||||||||||||

| Air Lease Corp. | 3.000 | 09-15-23 | 9,314,000 | 9,257,473 | |||||||||||||||||||||||||

| Rate (%) | Maturity date | Par value^ | Value | ||||||||||||||||||||||||||

| Industrials (continued) | |||||||||||||||||||||||||||||

| Trading companies and distributors (continued) | |||||||||||||||||||||||||||||

| Air Lease Corp. | 3.375 | 01-15-19 | 3,994,000 | $4,074,599 | |||||||||||||||||||||||||

| Air Lease Corp. | 3.625 | 04-01-27 | 10,890,000 | 10,938,156 | |||||||||||||||||||||||||

| Aircastle, Ltd. | 5.500 | 02-15-22 | 6,757,000 | 7,331,345 | |||||||||||||||||||||||||

| Aircastle, Ltd. | 6.250 | 12-01-19 | 3,625,000 | 3,933,125 | |||||||||||||||||||||||||

| Aircastle, Ltd. | 7.625 | 04-15-20 | 1,950,000 | 2,208,375 | |||||||||||||||||||||||||

| Ashtead Capital, Inc. (S) | 5.625 | 10-01-24 | 2,840,000 | 3,031,700 | |||||||||||||||||||||||||

| International Lease Finance Corp. | 5.875 | 04-01-19 | 5,285,000 | 5,628,710 | |||||||||||||||||||||||||

| International Lease Finance Corp. (S) | 7.125 | 09-01-18 | 4,470,000 | 4,748,785 | |||||||||||||||||||||||||

| Park Aerospace Holdings, Ltd. (S) | 5.500 | 02-15-24 | 2,838,000 | 2,988,769 | |||||||||||||||||||||||||

| United Rentals North America, Inc. | 5.500 | 07-15-25 | 10,880,000 | 11,467,520 | |||||||||||||||||||||||||

| United Rentals North America, Inc. | 5.750 | 11-15-24 | 4,725,000 | 4,996,735 | |||||||||||||||||||||||||

| Transportation infrastructure 0.1% | |||||||||||||||||||||||||||||

| Florida East Coast Holdings Corp. (S) | 6.750 | 05-01-19 | 4,915,000 | 5,062,450 | |||||||||||||||||||||||||

| Information technology 3.0% | 291,345,573 | ||||||||||||||||||||||||||||

| Electronic equipment, instruments and components 0.8% | |||||||||||||||||||||||||||||

| CDW LLC | 5.000 | 09-01-25 | 1,242,000 | 1,279,260 | |||||||||||||||||||||||||

| Dell International LLC (S) | 7.125 | 06-15-24 | 4,080,000 | 4,546,034 | |||||||||||||||||||||||||

| Ingram Micro, Inc. | 5.450 | 12-15-24 | 13,889,000 | 14,090,988 | |||||||||||||||||||||||||

| Jabil Circuit, Inc. | 4.700 | 09-15-22 | 19,331,000 | 20,490,860 | |||||||||||||||||||||||||

| Keysight Technologies, Inc. | 4.600 | 04-06-27 | 9,770,000 | 10,273,634 | |||||||||||||||||||||||||

| Tech Data Corp. | 4.950 | 02-15-27 | 19,351,000 | 20,389,549 | |||||||||||||||||||||||||

| Zebra Technologies Corp. | 7.250 | 10-15-22 | 5,220,000 | 5,603,670 | |||||||||||||||||||||||||

| Internet software and services 0.3% | |||||||||||||||||||||||||||||

| eBay, Inc. | 2.150 | 06-05-20 | 8,485,000 | 8,483,812 | |||||||||||||||||||||||||

| Match Group, Inc. | 6.375 | 06-01-24 | 8,905,000 | 9,706,450 | |||||||||||||||||||||||||

| VeriSign, Inc. | 5.250 | 04-01-25 | 6,750,000 | 7,163,438 | |||||||||||||||||||||||||

| IT services 0.1% | |||||||||||||||||||||||||||||

| Gartner, Inc. (S) | 5.125 | 04-01-25 | 2,169,000 | 2,266,605 | |||||||||||||||||||||||||

| Sixsigma Networks Mexico SA de CV (S) | 8.250 | 11-07-21 | 4,775,000 | 4,747,783 | |||||||||||||||||||||||||

| Tempo Acquisition LLC (S) | 6.750 | 06-01-25 | 1,520,000 | 1,551,312 | |||||||||||||||||||||||||

| Semiconductors and semiconductor equipment 0.3% | |||||||||||||||||||||||||||||

| Micron Technology, Inc. | 5.875 | 02-15-22 | 5,615,000 | 5,867,675 | |||||||||||||||||||||||||

| Micron Technology, Inc. | 7.500 | 09-15-23 | 5,340,000 | 5,965,314 | |||||||||||||||||||||||||

| NXP BV (S) | 4.625 | 06-01-23 | 20,240,000 | 21,859,200 | |||||||||||||||||||||||||

| Software 1.0% | |||||||||||||||||||||||||||||

| Activision Blizzard, Inc. | 3.400 | 09-15-26 | 14,200,000 | 14,317,164 | |||||||||||||||||||||||||

| Activision Blizzard, Inc. (S) | 6.125 | 09-15-23 | 12,455,000 | 13,420,263 | |||||||||||||||||||||||||

| CA, Inc. | 3.600 | 08-15-22 | 12,780,000 | 13,226,776 | |||||||||||||||||||||||||

| CA, Inc. | 4.700 | 03-15-27 | 9,753,000 | 10,394,523 | |||||||||||||||||||||||||

| Electronic Arts, Inc. | 4.800 | 03-01-26 | 19,242,000 | 21,165,257 | |||||||||||||||||||||||||

| Microsoft Corp. | 4.450 | 11-03-45 | 19,354,000 | 21,113,317 | |||||||||||||||||||||||||

| Rate (%) | Maturity date | Par value^ | Value | ||||||||||||||||||||||||||

| Information technology (continued) | |||||||||||||||||||||||||||||

| Software (continued) | |||||||||||||||||||||||||||||

| Open Text Corp. (S) | 5.875 | 06-01-26 | 5,245,000 | $5,615,454 | |||||||||||||||||||||||||

| Symantec Corp. (S) | 5.000 | 04-15-25 | 2,808,000 | 2,913,300 | |||||||||||||||||||||||||

| Technology hardware, storage and peripherals 0.5% | |||||||||||||||||||||||||||||

| Dell International LLC (S) | 6.020 | 06-15-26 | 27,285,000 | 30,095,519 | |||||||||||||||||||||||||

| Dell International LLC (S) | 8.350 | 07-15-46 | 9,188,000 | 11,858,566 | |||||||||||||||||||||||||

| NCR Corp. | 5.875 | 12-15-21 | 2,820,000 | 2,939,850 | |||||||||||||||||||||||||

| Materials 1.5% | 146,667,995 | ||||||||||||||||||||||||||||

| Chemicals 0.7% | |||||||||||||||||||||||||||||

| Braskem Finance, Ltd. (S) | 7.000 | 05-07-20 | 7,445,000 | 8,077,825 | |||||||||||||||||||||||||

| NOVA Chemicals Corp. (S) | 5.000 | 05-01-25 | 13,335,000 | 13,368,338 | |||||||||||||||||||||||||

| Platform Specialty Products Corp. (S) | 6.500 | 02-01-22 | 15,155,000 | 15,609,650 | |||||||||||||||||||||||||

| Rain CII Carbon LLC (S) | 8.250 | 01-15-21 | 4,082,000 | 4,242,749 | |||||||||||||||||||||||||

| The Chemours Company | 5.375 | 05-15-27 | 2,285,000 | 2,387,825 | |||||||||||||||||||||||||

| The Chemours Company | 6.625 | 05-15-23 | 16,166,000 | 17,255,427 | |||||||||||||||||||||||||

| The Sherwin-Williams Company | 2.250 | 05-15-20 | 10,350,000 | 10,390,199 | |||||||||||||||||||||||||

| Construction materials 0.2% | |||||||||||||||||||||||||||||

| Cemex SAB de CV (S) | 6.125 | 05-05-25 | 10,035,000 | 10,787,625 | |||||||||||||||||||||||||

| U.S. Concrete, Inc. (S) | 6.375 | 06-01-24 | 3,860,000 | 4,033,700 | |||||||||||||||||||||||||

| Containers and packaging 0.2% | |||||||||||||||||||||||||||||

| Ardagh Packaging Finance PLC (S) | 4.250 | 09-15-22 | 4,400,000 | 4,496,800 | |||||||||||||||||||||||||

| Ardagh Packaging Finance PLC (S) | 6.000 | 02-15-25 | 5,795,000 | 6,041,288 | |||||||||||||||||||||||||

| Cascades, Inc. (S) | 5.500 | 07-15-22 | 8,987,000 | 9,144,273 | |||||||||||||||||||||||||

| Metals and mining 0.3% | |||||||||||||||||||||||||||||

| Anglo American Capital PLC (S) | 4.750 | 04-10-27 | 6,295,000 | 6,499,588 | |||||||||||||||||||||||||

| Commercial Metals Company | 7.350 | 08-15-18 | 3,850,000 | 4,061,750 | |||||||||||||||||||||||||

| First Quantum Minerals, Ltd. (S) | 7.500 | 04-01-25 | 4,200,000 | 4,228,875 | |||||||||||||||||||||||||

| Novelis Corp. (S) | 5.875 | 09-30-26 | 2,302,000 | 2,382,570 | |||||||||||||||||||||||||

| Vale Overseas, Ltd. | 6.250 | 08-10-26 | 7,675,000 | 8,289,000 | |||||||||||||||||||||||||

| Vedanta Resources PLC (S) | 6.375 | 07-30-22 | 6,990,000 | 6,990,000 | |||||||||||||||||||||||||

| Paper and forest products 0.1% | |||||||||||||||||||||||||||||

| Boise Cascade Company (S) | 5.625 | 09-01-24 | 2,129,000 | 2,208,838 | |||||||||||||||||||||||||

| Norbord, Inc. (S) | 6.250 | 04-15-23 | 5,795,000 | 6,171,675 | |||||||||||||||||||||||||

| Real estate 1.4% | 133,482,063 | ||||||||||||||||||||||||||||

| Equity real estate investment trusts 1.4% | |||||||||||||||||||||||||||||

| American Tower Corp. | 3.400 | 02-15-19 | 5,985,000 | 6,124,486 | |||||||||||||||||||||||||

| American Tower Corp. | 4.700 | 03-15-22 | 8,529,000 | 9,260,950 | |||||||||||||||||||||||||

| Crown Castle Towers LLC (S) | 4.883 | 08-15-40 | 8,056,000 | 8,592,339 | |||||||||||||||||||||||||

| Crown Castle Towers LLC (S) | 6.113 | 01-15-40 | 10,185,000 | 11,025,630 | |||||||||||||||||||||||||

| Equinix, Inc. | 5.375 | 05-15-27 | 5,676,000 | 5,972,230 | |||||||||||||||||||||||||

| Iron Mountain, Inc. | 5.750 | 08-15-24 | 13,252,000 | 13,599,865 | |||||||||||||||||||||||||

| Iron Mountain, Inc. | 6.000 | 08-15-23 | 13,957,000 | 14,794,420 | |||||||||||||||||||||||||

| Rate (%) | Maturity date | Par value^ | Value | ||||||||||||||||||||||||||

| Real estate (continued) | |||||||||||||||||||||||||||||

| Equity real estate investment trusts (continued) | |||||||||||||||||||||||||||||

| MPT Operating Partnership LP | 6.375 | 02-15-22 | 4,735,000 | $4,894,806 | |||||||||||||||||||||||||

| Omega Healthcare Investors, Inc. | 4.500 | 01-15-25 | 7,415,000 | 7,545,118 | |||||||||||||||||||||||||

| Omega Healthcare Investors, Inc. | 4.950 | 04-01-24 | 8,758,000 | 9,159,327 | |||||||||||||||||||||||||

| Omega Healthcare Investors, Inc. | 5.250 | 01-15-26 | 5,064,000 | 5,363,688 | |||||||||||||||||||||||||

| Ventas Realty LP | 3.500 | 02-01-25 | 17,352,000 | 17,318,077 | |||||||||||||||||||||||||

| Ventas Realty LP | 3.750 | 05-01-24 | 2,845,000 | 2,910,893 | |||||||||||||||||||||||||

| VEREIT Operating Partnership LP | 4.600 | 02-06-24 | 12,117,000 | 12,681,410 | |||||||||||||||||||||||||

| Welltower, Inc. | 3.750 | 03-15-23 | 4,091,000 | 4,238,824 | |||||||||||||||||||||||||

| Telecommunication services 2.6% | 251,867,826 | ||||||||||||||||||||||||||||

| Diversified telecommunication services 1.8% | |||||||||||||||||||||||||||||

| AT&T, Inc. | 4.750 | 05-15-46 | 11,392,000 | 10,948,008 | |||||||||||||||||||||||||

| AT&T, Inc. | 5.450 | 03-01-47 | 27,160,000 | 28,679,548 | |||||||||||||||||||||||||

| Cincinnati Bell, Inc. (S) | 7.000 | 07-15-24 | 8,764,000 | 9,180,290 | |||||||||||||||||||||||||

| Columbus Cable Barbados, Ltd. (S) | 7.375 | 03-30-21 | 5,275,000 | 5,620,513 | |||||||||||||||||||||||||

| CSC Holdings LLC (S) | 5.500 | 04-15-27 | 6,695,000 | 7,011,807 | |||||||||||||||||||||||||

| Frontier Communications Corp. | 8.875 | 09-15-20 | 12,308,000 | 13,092,635 | |||||||||||||||||||||||||

| GCI, Inc. | 6.875 | 04-15-25 | 7,853,000 | 8,520,505 | |||||||||||||||||||||||||

| Radiate Holdco LLC (S) | 6.625 | 02-15-25 | 9,200,000 | 9,407,000 | |||||||||||||||||||||||||

| Sprint Spectrum Company LLC (S) | 3.360 | 03-20-23 | 9,890,000 | 10,038,350 | |||||||||||||||||||||||||

| Telecom Italia Capital SA | 7.200 | 07-18-36 | 9,850,000 | 11,327,500 | |||||||||||||||||||||||||

| Verizon Communications, Inc. | 4.400 | 11-01-34 | 10,284,000 | 10,060,416 | |||||||||||||||||||||||||

| Verizon Communications, Inc. | 4.672 | 03-15-55 | 7,830,000 | 7,317,448 | |||||||||||||||||||||||||

| Verizon Communications, Inc. | 4.862 | 08-21-46 | 25,104,000 | 24,744,511 | |||||||||||||||||||||||||

| Verizon Communications, Inc. | 5.012 | 08-21-54 | 8,461,000 | 8,268,199 | |||||||||||||||||||||||||

| Wind Acquisition Finance SA (S) | 7.375 | 04-23-21 | 4,065,000 | 4,235,730 | |||||||||||||||||||||||||

| Zayo Group LLC (S) | 5.750 | 01-15-27 | 3,700,000 | 3,903,093 | |||||||||||||||||||||||||

| Wireless telecommunication services 0.8% | |||||||||||||||||||||||||||||

| CC Holdings GS V LLC | 3.849 | 04-15-23 | 7,811,000 | 8,208,556 | |||||||||||||||||||||||||

| Comcel Trust (S) | 6.875 | 02-06-24 | 4,490,000 | 4,781,401 | |||||||||||||||||||||||||

| Digicel Group, Ltd. (S) | 8.250 | 09-30-20 | 5,550,000 | 5,265,563 | |||||||||||||||||||||||||

| Digicel, Ltd. (S) | 6.750 | 03-01-23 | 9,615,000 | 9,206,363 | |||||||||||||||||||||||||

| Millicom International Cellular SA (S) | 4.750 | 05-22-20 | 5,375,000 | 5,476,373 | |||||||||||||||||||||||||

| Millicom International Cellular SA (S) | 6.625 | 10-15-21 | 10,550,000 | 11,011,563 | |||||||||||||||||||||||||

| MTN Mauritius Investments, Ltd. (S) | 4.755 | 11-11-24 | 8,465,000 | 8,170,418 | |||||||||||||||||||||||||

| SBA Tower Trust (S) | 3.598 | 04-15-43 | 5,435,000 | 5,436,380 | |||||||||||||||||||||||||

| Sprint Capital Corp. | 6.875 | 11-15-28 | 10,955,000 | 12,146,356 | |||||||||||||||||||||||||

| T-Mobile USA, Inc. | 6.125 | 01-15-22 | 9,320,000 | 9,809,300 | |||||||||||||||||||||||||

| Utilities 2.3% | 218,472,940 | ||||||||||||||||||||||||||||

| Electric utilities 1.6% | |||||||||||||||||||||||||||||

| Abengoa Transmision Sur SA (S) | 6.875 | 04-30-43 | 9,573,482 | 10,423,129 | |||||||||||||||||||||||||

| Beaver Valley II Funding Corp. | 9.000 | 06-01-17 | 50,000 | 50,000 | |||||||||||||||||||||||||

| Rate (%) | Maturity date | Par value^ | Value | ||||||||||||||||||||||||||

| Utilities (continued) | |||||||||||||||||||||||||||||

| Electric utilities (continued) | |||||||||||||||||||||||||||||

| Broadcom Corp. (S) | 2.375 | 01-15-20 | 18,186,000 | $18,219,499 | |||||||||||||||||||||||||

| Broadcom Corp. (S) | 3.875 | 01-15-27 | 20,626,000 | 20,931,203 | |||||||||||||||||||||||||

| BVPS II Funding Corp. | 8.890 | 06-01-17 | 68,000 | 67,986 | |||||||||||||||||||||||||

| Electricite de France SA (S) | 3.625 | 10-13-25 | 4,925,000 | 5,048,253 | |||||||||||||||||||||||||

| Electricite de France SA (5.250% to 1-29-23, then 10 Year U.S. Swap Rate + 3.709%) (Q)(S) | 5.250 | 01-29-23 | 6,095,000 | 6,140,713 | |||||||||||||||||||||||||

| Emera US Finance LP | 3.550 | 06-15-26 | 7,285,000 | 7,279,981 | |||||||||||||||||||||||||

| Empresa Electrica Angamos SA (S) | 4.875 | 05-25-29 | 8,100,000 | 8,283,757 | |||||||||||||||||||||||||

| Great Plains Energy, Inc. | 3.900 | 04-01-27 | 9,940,000 | 10,076,327 | |||||||||||||||||||||||||

| Israel Electric Corp., Ltd. (S) | 5.625 | 06-21-18 | 8,070,000 | 8,345,187 | |||||||||||||||||||||||||

| Israel Electric Corp., Ltd. (S) | 6.875 | 06-21-23 | 5,430,000 | 6,446,257 | |||||||||||||||||||||||||

| Israel Electric Corp., Ltd. (S) | 7.250 | 01-15-19 | 6,960,000 | 7,499,122 | |||||||||||||||||||||||||

| NextEra Energy Capital Holdings, Inc. | 1.649 | 09-01-18 | 3,690,000 | 3,683,199 | |||||||||||||||||||||||||

| NextEra Energy Capital Holdings, Inc. | 2.300 | 04-01-19 | 6,546,000 | 6,581,355 | |||||||||||||||||||||||||

| NextEra Energy Capital Holdings, Inc. | 3.550 | 05-01-27 | 16,530,000 | 16,807,803 | |||||||||||||||||||||||||