UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02402

John Hancock Sovereign Bond Fund

(Exact name of registrant as specified in charter)

Berkeley Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Salvatore Schiavone

Treasurer

200 Berkeley Street

Boston, Massachusetts 02116

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-663-4497

| Date of fiscal year end: | | May 31 |

| | | |

| | | |

| Date of reporting period: | | May 31, 2020 |

ITEM 1. REPORTS TO STOCKHOLDERS.

Annual report 5/31/2020

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the fund's shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change, and you do not need to take any action. You may elect to receive shareholder reports and other communications electronically by calling John Hancock Investment Management at 800-225-5291 (Class A, Class B and Class C shares) or 888-972-8696 (Class I, Class R2, Class R4 and Class R6 shares) or by contacting your financial intermediary.

You may elect to receive all reports in paper, free of charge, at any time. You can inform John Hancock Investment Management or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by following the instructions listed above. Your election to receive reports in paper will apply to all funds held with John Hancock Investment Management or your financial intermediary.

A message to shareholders

Dear shareholder,

Global financial markets delivered strong returns during first half of the 12-month period ended May 31, 2020; however, heightened fears over the coronavirus (COVID-19) sent markets tumbling during the latter half of February and early March. Investors reacted by exiting higher-risk assets and moving into cash, leading to a liquidity crunch in the fixed-income markets.

In response to the sell-off, the U.S. Federal Reserve acted quickly, lowering interest rates to near zero and reinstating quantitative easing, as well as announcing its plans to shore up short-term debt. These steps, along with the passage of a $2 trillion federal economic stimulus bill, helped lift the markets during the last two months of the period, while credit spreads rebounded off their highs as liquidity concerns eased.

The continued spread of COVID-19, trade disputes, rising unemployment, and other geopolitical tensions may continue to create uncertainty among businesses and investors. Your financial professional can help position your portfolio so that it's sufficiently diversified to seek to meet your long-term objectives and to withstand the inevitable bouts of market volatility along the way.

On behalf of everyone at John Hancock Investment Management, I'd like to take this opportunity to welcome new shareholders and thank existing shareholders for the continued trust you've placed in us.

Sincerely,

Andrew G. Arnott

President and CEO,

John Hancock Investment Management

Head of Wealth and Asset Management,

United States and Europe

This commentary reflects the CEO's views as of this report's period end and are subject to change at any time. Diversification does not guarantee investment returns and does not eliminate risk of loss. All investments entail risks, including the possible loss of principal. For more up-to-date information, you can visit our website at jhinvestments.com.

Table of contents

| | | |

| 2 | | Your fund at a glance |

| 5 | | Manager's discussion of fund performance |

| 7 | | A look at performance |

| 9 | | Your expenses |

| 11 | | Fund's investments |

| 41 | | Financial statements |

| 45 | | Financial highlights |

| 53 | | Notes to financial statements |

| 64 | | Report of independent registered public accounting firm |

| 65 | | Tax information |

| 66 | | Statement regarding liquidity risk management |

| 69 | | Trustees and Officers |

| 73 | | More information |

ANNUAL REPORT | JOHN HANCOCK BOND FUND 1

INVESTMENT OBJECTIVE

The fund seeks a high level of current income consistent with prudent investment risk.

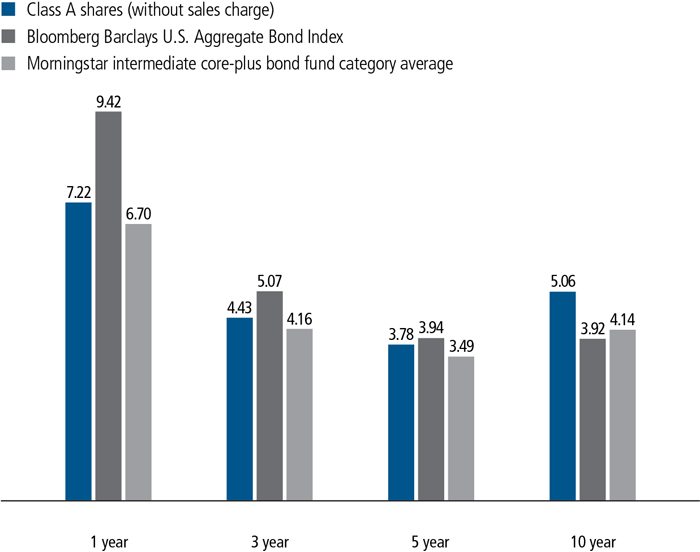

AVERAGE ANNUAL TOTAL RETURNS AS OF 5/31/2020 (%)

The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index of dollar-denominated and non-convertible investment-grade debt issues.

It is not possible to invest directly in an index. Index figures do not reflect expenses or sales charges, which would result in lower returns.

The fund's Morningstar category average is a group of funds with similar investment objectives and strategies and is the equal-weighted return of all funds per category. Morningstar places funds in certain categories based on their historical portfolio holdings. Figures from Morningstar, Inc. include reinvested distributions and do not take into account sales charges. Actual load-adjusted performance is lower.

The past performance shown here reflects reinvested distributions and the beneficial effect of any expense reductions, and does not guarantee future results. Performance of the other share classes will vary based on the difference in the fees and expenses of those classes. Shares will fluctuate in value and, when redeemed, may be worth more or less than their original cost. Current month-end performance may be lower or higher than the performance cited, and can be found at jhinvestments.com or by calling 800-225-5291. For further information on the fund's objectives, risks, and strategy, see the fund's prospectus.

ANNUAL REPORT | JOHN HANCOCK BOND FUND 2

PERFORMANCE HIGHLIGHTS OVER THE LAST TWELVE MONTHS

The spread of COVID-19 was the key driver of market performance

A long period of positive growth and healthy investor risk appetites ended with the emergence of coronavirus in early 2020, sparking a flight into lower-risk asset classes.

Investment-grade bonds posted strong gains during the 12-month period

Although the bond market was affected by volatility in February and March, the backdrop of slowing growth, accommodative U.S. Federal Reserve policy, and investor demand for higher-quality assets fueled positive returns.

The fund underperformed its benchmark

Asset allocation and security selection both played a role in the shortfall.

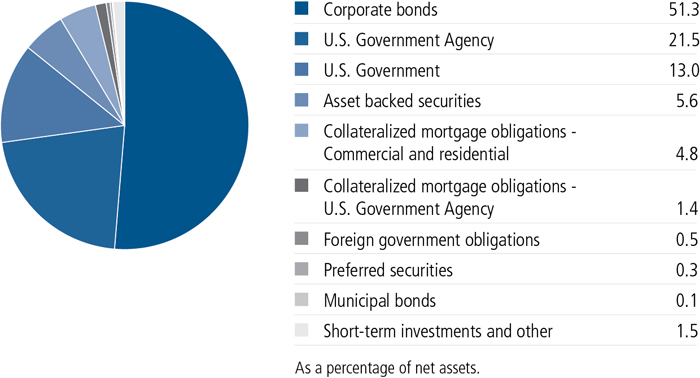

PORTFOLIO COMPOSITION AS OF 5/31/2020 (%)

ANNUAL REPORT | JOHN HANCOCK BOND FUND 3

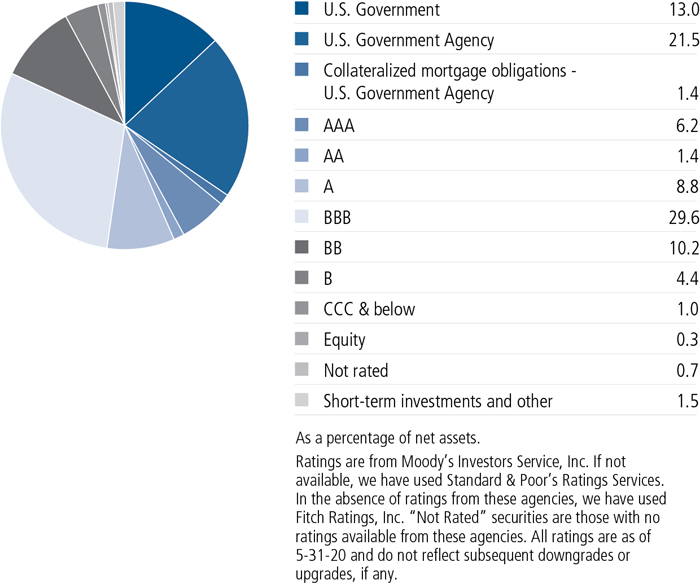

QUALITY COMPOSITION AS OF 5/31/2020 (%)

A note about risks

The fund may be subject to various risks as described in the fund's prospectus. A widespread health crisis such as a global pandemic could cause substantial market volatility, exchange trading suspensions and closures, impact the ability to complete redemptions, and affect fund performance. For example, the novel coronavirus disease (COVID-19) has resulted in significant disruptions to global business activity. The impact of a health crisis and other epidemics and pandemics that may arise in the future, could affect the global economy in ways that cannot necessarily be foreseen at the present time. A health crisis may exacerbate other pre-existing political, social, and economic risks. Any such impact could adversely affect the fund's performance, resulting in losses to your investment. For more information, please refer to the "Principal risks" section of the prospectus.

ANNUAL REPORT | JOHN HANCOCK BOND FUND 4

Manager's discussion of fund performance

How would you describe the investment backdrop during the 12 months ended May 31, 2020?

Investment-grade bonds delivered strong total returns, led by corporates and U.S. Treasuries. Yields fell dramatically as uncertainty about the economic impact of COVID-19 prompted a rotation from higher-risk assets toward those perceived to have a greater degree of safety. (Prices and yields move in opposite directions.) Bonds were also boosted by the U.S. Federal Reserve's decision to cut short-term interest rates to near zero. Corporate issues, while falling sharply in late February and most of March, posted a sizable gain thanks to their rally during the final two months of the period. High-yield (below investment-grade) bonds finished with a flat return and lagged the index by a wide margin due to their substantial underperformance in the first quarter of 2020.

What elements of the fund's positioning helped and hurt results?

Although the fund produced a strong absolute return, it underperformed its benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index. The fund's allocation to high-yield bonds, which aren't represented in the benchmark, was the largest source of underperformance, due to the relative weakness in lower-quality issues. An underweight in U.S. Treasuries also detracted from relative performance, as did an overweight in commercial mortgage-backed securities.

An overweight in investment-grade corporates contributed. Security selection further detracted from results, with the fund's holding in investment-grade corporates, asset-backed securities (ABS), and mortgage-backed securities (MBS) producing returns below those of the corresponding index components. Duration and yield curve positioning was a small net positive.

COUNTRY COMPOSITION AS OF 5/31/2020 (%)

| | |

| United States | 89.2 |

| United Kingdom | 2.5 |

| Netherlands | 1.4 |

| Canada | 1.3 |

| Other countries | 5.6 |

| TOTAL | 100.0 |

| As a percentage of net assets. | |

ANNUAL REPORT | JOHN HANCOCK BOND FUND 5

What were some key aspects of your portfolio activity?

We steadily reduced risk in the portfolio in the second half of 2019 and early 2020 on the belief that valuations had become rich compared to historical levels. As part of this process, we lowered the fund's allocations to investment-grade and high-yield corporate bonds and increased its weighting in agency MBS. Additionally, we repositioned the portfolio toward the intermediate portion of the yield curve, which led to a reduction in ABS due to their shorter average maturities.

As valuations became attractive in the sell-off, we began to increase the fund's weighting in corporates and reduce its position in agency MBS. We achieved this largely though additions in high-quality issuers in the new issue market, which has seen a record level issuance so far in 2020.

Given our cautious optimism on the prospects for a gradual economic recovery, we believe corporates and high-yield bonds remain the most attractive areas of the market. At the same time, we think a cautious approach is warranted due to the unprecedented nature of market conditions in recent months. We therefore remain focused on bottom-up security selection and by robust fundamental analysis. Our primary emphasis is identifying opportunities among stable, high-quality issuers in the best position to weather economic uncertainty, while avoiding those facing above-average risks.

MANAGED BY

| |

| Howard C. Greene, CFA, Manulife IM (US) |

| Jeffrey N. Given, CFA, Manulife IM (US) |

The views expressed in this report are exclusively those of Howard C. Greene, CFA, and Jeffrey N. Given, CFA, Manulife Investment Management (US) LLC, and are subject to change. They are not meant as investment advice. Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund's investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

ANNUAL REPORT | JOHN HANCOCK BOND FUND 6

TOTAL RETURNS FOR THE PERIOD ENDED MAY 31, 2020

| | | | | | | | | | | | |

Average annual

total returns (%)

with maximum sales charge | | Cumulative total

returns (%)

with maximum sales charge | | SEC 30-day

yield (%)

subsidized | | SEC 30-day

yield (%)

unsubsidized1 |

| | 1-year | 5-year | 10-year | | | 5-year | 10-year | | as of

5-31-20 | | as of

5-31-20 |

| Class A | 2.93 | 2.94 | 4.63 | | | 15.58 | 57.24 | | 2.52 | | 2.52 |

| Class B | 1.41 | 2.69 | 4.47 | | | 14.20 | 54.86 | | 1.94 | | 1.93 |

| Class C | 5.41 | 3.06 | 4.33 | | | 16.27 | 52.79 | | 1.94 | | 1.93 |

| Class I2 | 7.47 | 4.09 | 5.42 | | | 22.22 | 69.51 | | 2.92 | | 2.92 |

| Class R22,3 | 7.12 | 3.69 | 5.03 | | | 19.89 | 63.41 | | 2.55 | | 2.55 |

| Class R42,3 | 7.32 | 3.97 | 5.16 | | | 21.48 | 65.33 | | 2.81 | | 2.71 |

| Class R62,3 | 7.65 | 4.22 | 5.47 | | | 22.97 | 70.36 | | 3.05 | | 3.04 |

| Class NAV2,3 | 7.60 | 4.20 | 5.27 | | | 22.83 | 67.15 | | 3.06 | | 3.06 |

| Index† | 9.42 | 3.94 | 3.92 | | | 21.34 | 46.91 | | — | | — |

Performance figures assume all distributions have been reinvested. Figures reflect maximum sales charges on Class A shares of 4.0% and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The returns for Class A shares have been adjusted to reflect the reduction in the maximum sales charge from 4.5% to 4.0%, effective 2-3-14. The Class B shares' CDSC declines annually between years 1 to 6 according to the following schedule: 5%, 4%, 3%, 3%, 2%, 1%. No sales charge will be assessed after the sixth year. Class C shares sold within one year of purchase are subject to a 1% CDSC. Sales charges are not applicable to Class I, Class R2, Class R4, Class R6, and Class NAV shares.

The expense ratios of the fund, both net (including any fee waivers and/or expense limitations) and gross (excluding any fee waivers and/or expense limitations), are set forth according to the most recent publicly available prospectuses for the fund and may differ from those disclosed in the Financial highlights tables in this report. Net expenses reflect contractual expense limitations in effect until September 30, 2021 and are subject to change. Had the contractual fee waivers and expense limitations not been in place, gross expenses would apply. The expense ratios are as follows:

| | | | | | | | | |

| | Class A | Class B | Class C | Class I | Class R2 | Class R4 | Class R6 | Class NAV |

| Gross (%) | 0.79 | 1.49 | 1.49 | 0.49 | 0.89 | 0.74 | 0.39 | 0.37 |

| Net (%) | 0.78 | 1.48 | 1.48 | 0.48 | 0.88 | 0.63 | 0.38 | 0.36 |

Please refer to the most recent prospectus and annual or semiannual report for more information on expenses and any expense limitation arrangements for each class.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility and other factors, the fund's current performance may be higher or lower than the performance shown. For current to the most recent month-end performance data, please call 800-225-5291 or visit the fund's website at jhinvestments.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The fund's performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

| † | Index is the Bloomberg Barclays U.S. Aggregate Bond Index. |

See the following page for footnotes.

ANNUAL REPORT | JOHN HANCOCK BOND FUND 7

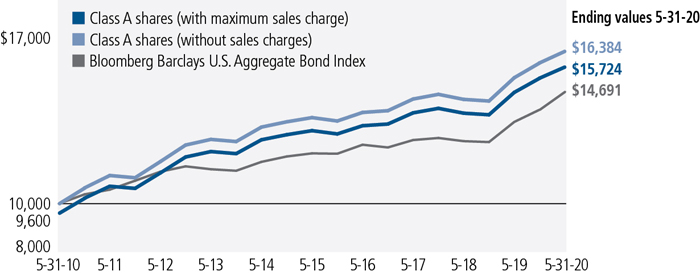

This chart and table show what happened to a hypothetical $10,000 investment in John Hancock Bond Fund for the share classes and periods indicated, assuming all distributions were reinvested. For comparison, we've shown the same investment in the Bloomberg Barclays U.S. Aggregate Bond Index.

| | | | | |

| | Start date | With maximum

sales charge ($) | Without

sales charge ($) | Index ($) |

| Class B4 | 5-31-10 | 15,486 | 15,486 | 14,691 |

| Class C4 | 5-31-10 | 15,279 | 15,279 | 14,691 |

| Class I2,3 | 5-31-10 | 16,951 | 16,951 | 14,691 |

| Class R22,3 | 5-31-10 | 16,341 | 16,341 | 14,691 |

| Class R42,3 | 5-31-10 | 16,533 | 16,533 | 14,691 |

| Class R62,3 | 5-31-10 | 17,036 | 17,036 | 14,691 |

| Class NAV2,3 | 5-31-10 | 16,715 | 16,715 | 14,691 |

The values shown in the chart for Class A shares with maximum sales charge have been adjusted to reflect the reduction in the Class A shares' maximum sales charge from 4.5% to 4.0%, which became effective on 2-3-14.

The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index of dollar-denominated and non-convertible investment-grade debt issues.

It is not possible to invest directly in an index. Index figures do not reflect expenses or sales charges, which would result in lower returns.

Footnotes related to performance pages

| 1 | Unsubsidized yield reflects what the yield would have been without the effect of reimbursements and waivers. |

| 2 | For certain types of investors, as described in the fund's prospectuses. |

| 3 | Class R2 shares were first offered 3-1-12; Class R4 shares were first offered 3-27-15; Class R6 shares were first offered 9-1-11; Class NAV shares were first offered 8-31-15. Returns prior to these dates are those of Class A shares that have not been adjusted for class-specific expenses; otherwise, returns would vary. |

| 4 | The contingent deferred sales charge is not applicable. |

ANNUAL REPORT | JOHN HANCOCK BOND FUND 8

These examples are intended to help you understand your ongoing operating expenses of investing in the fund so you can compare these costs with the ongoing costs of investing in other mutual funds.

Understanding fund expenses

As a shareholder of the fund, you incur two types of costs:

■Transaction costs, which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

■Ongoing operating expenses, including management fees, distribution and service fees (if applicable), and other fund expenses.

We are presenting only your ongoing operating expenses here.

Actual expenses/actual returns

The first line of each share class in the table on the following page is intended to provide information about the fund’s actual ongoing operating expenses, and is based on the fund’s actual return. It assumes an account value of $1,000.00 on December 1, 2019, with the same investment held until May 31, 2020.

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at May 31, 2020, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

Hypothetical example for comparison purposes

The second line of each share class in the table on the following page allows you to compare the fund’s ongoing operating expenses with those of any other fund. It provides an example of the fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not the class’s actual return). It assumes an account value of $1,000.00 on December 1, 2019, with the same investment held until May 31, 2020. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses. Please remember that these hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

| | ANNUAL REPORT | JOHN HANCOCK BOND FUND | 9 |

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectuses for details regarding transaction costs.

SHAREHOLDER EXPENSE EXAMPLE CHART

| | | Account

value on

12-1-2019 | Ending

value on

5-31-2020 | Expenses

paid during

period ended

5-31-20201 | Annualized

expense

ratio |

| Class A | Actual expenses/actual returns | $1,000.00 | $1,030.60 | $3.96 | 0.78% |

| | Hypothetical example | 1,000.00 | 1,021.10 | 3.94 | 0.78% |

| Class B | Actual expenses/actual returns | 1,000.00 | 1,026.30 | 7.50 | 1.48% |

| | Hypothetical example | 1,000.00 | 1,017.60 | 7.47 | 1.48% |

| Class C | Actual expenses/actual returns | 1,000.00 | 1,027.00 | 7.50 | 1.48% |

| | Hypothetical example | 1,000.00 | 1,017.60 | 7.47 | 1.48% |

| Class I | Actual expenses/actual returns | 1,000.00 | 1,031.50 | 2.44 | 0.48% |

| | Hypothetical example | 1,000.00 | 1,022.60 | 2.43 | 0.48% |

| Class R2 | Actual expenses/actual returns | 1,000.00 | 1,030.10 | 4.42 | 0.87% |

| | Hypothetical example | 1,000.00 | 1,020.70 | 4.40 | 0.87% |

| Class R4 | Actual expenses/actual returns | 1,000.00 | 1,030.80 | 3.10 | 0.61% |

| | Hypothetical example | 1,000.00 | 1,022.00 | 3.08 | 0.61% |

| Class R6 | Actual expenses/actual returns | 1,000.00 | 1,032.70 | 1.83 | 0.36% |

| | Hypothetical example | 1,000.00 | 1,023.20 | 1.82 | 0.36% |

| Class NAV | Actual expenses/actual returns | 1,000.00 | 1,032.10 | 1.78 | 0.35% |

| | Hypothetical example | 1,000.00 | 1,023.30 | 1.77 | 0.35% |

| 1 | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period). |

| 10 | JOHN HANCOCK BOND FUND | ANNUAL REPORT | |

AS OF 5-31-20

| | Rate (%) | Maturity date | | Par value^ | Value |

| U.S. Government and Agency obligations 34.5% | | | | $6,303,155,425 |

| (Cost $5,880,466,395) | | | | | |

| U.S. Government 13.0% | | | | 2,371,815,973 |

| U.S. Treasury | | | | | |

| Bond | 2.000 | 02-15-50 | | 238,412,000 | 272,544,030 |

| Bond | 2.250 | 08-15-49 | | 344,407,000 | 413,126,959 |

| Bond | 2.750 | 11-15-42 | | 345,125,000 | 440,317,484 |

| Bond | 3.125 | 11-15-41 | | 319,495,000 | 431,230,887 |

| Note | 0.375 | 04-30-25 | | 213,248,000 | 213,972,711 |

| Note (A) | 0.625 | 05-15-30 | | 399,517,000 | 398,393,358 |

| Note | 1.625 | 09-30-26 | | 96,650,000 | 103,728,858 |

| Treasury Inflation Protected Security | 0.250 | 07-15-29 | | 91,767,055 | 98,501,686 |

| U.S. Government Agency 21.5% | | | | 3,931,339,452 |

| Federal Home Loan Mortgage Corp. | | | | | |

| 30 Yr Pass Thru | 3.000 | 03-01-43 | | 5,338,354 | 5,824,441 |

| 30 Yr Pass Thru | 3.000 | 12-01-45 | | 21,736,868 | 23,362,907 |

| 30 Yr Pass Thru | 3.000 | 05-01-46 | | 4,012,095 | 4,329,776 |

| 30 Yr Pass Thru | 3.000 | 10-01-46 | | 7,556,287 | 8,107,371 |

| 30 Yr Pass Thru | 3.000 | 10-01-46 | | 7,446,956 | 7,968,192 |

| 30 Yr Pass Thru | 3.000 | 10-01-46 | | 13,062,066 | 13,937,134 |

| 30 Yr Pass Thru | 3.000 | 10-01-46 | | 90,228,233 | 96,865,025 |

| 30 Yr Pass Thru | 3.000 | 12-01-46 | | 76,309,832 | 81,016,668 |

| 30 Yr Pass Thru | 3.000 | 12-01-46 | | 15,786,339 | 17,026,444 |

| 30 Yr Pass Thru | 3.000 | 04-01-47 | | 45,480,583 | 48,527,468 |

| 30 Yr Pass Thru | 3.000 | 09-01-49 | | 30,870,654 | 32,600,461 |

| 30 Yr Pass Thru | 3.000 | 10-01-49 | | 36,145,288 | 38,100,621 |

| 30 Yr Pass Thru | 3.000 | 12-01-49 | | 49,198,959 | 51,817,402 |

| 30 Yr Pass Thru | 3.000 | 02-01-50 | | 105,694,365 | 111,352,607 |

| 30 Yr Pass Thru | 3.500 | 06-01-42 | | 5,137,690 | 5,602,740 |

| 30 Yr Pass Thru | 3.500 | 04-01-44 | | 6,131,224 | 6,760,930 |

| 30 Yr Pass Thru | 3.500 | 05-01-45 | | 13,595,309 | 14,753,694 |

| 30 Yr Pass Thru | 3.500 | 08-01-46 | | 71,617,351 | 78,189,482 |

| 30 Yr Pass Thru | 3.500 | 09-01-46 | | 18,735,788 | 20,215,068 |

| 30 Yr Pass Thru | 3.500 | 10-01-46 | | 4,011,867 | 4,314,833 |

| 30 Yr Pass Thru | 3.500 | 10-01-46 | | 27,319,836 | 29,842,910 |

| 30 Yr Pass Thru | 3.500 | 11-01-46 | | 9,025,342 | 9,737,936 |

| 30 Yr Pass Thru | 3.500 | 11-01-46 | | 8,916,503 | 9,653,940 |

| 30 Yr Pass Thru | 3.500 | 12-01-46 | | 14,596,431 | 15,812,749 |

| 30 Yr Pass Thru | 3.500 | 01-01-47 | | 8,612,802 | 9,397,793 |

| 30 Yr Pass Thru | 3.500 | 02-01-47 | | 14,258,086 | 15,332,590 |

| 30 Yr Pass Thru | 3.500 | 04-01-47 | | 15,825,831 | 17,268,233 |

| 30 Yr Pass Thru | 3.500 | 09-01-47 | | 49,192,228 | 53,199,171 |

| 30 Yr Pass Thru | 3.500 | 11-01-47 | | 38,815,369 | 41,625,302 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK BOND FUND | 11 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| U.S. Government Agency (continued) | | | | |

| 30 Yr Pass Thru | 3.500 | 11-01-47 | | 13,539,712 | $14,555,848 |

| 30 Yr Pass Thru | 4.000 | 01-01-41 | | 13,405,573 | 14,739,224 |

| 30 Yr Pass Thru | 4.000 | 03-01-42 | | 6,728,072 | 7,380,592 |

| 30 Yr Pass Thru | 4.000 | 11-01-43 | | 4,277,085 | 4,698,580 |

| 30 Yr Pass Thru | 4.000 | 01-01-47 | | 12,622,950 | 13,930,023 |

| 30 Yr Pass Thru | 4.000 | 03-01-47 | | 49,440,811 | 53,600,424 |

| 30 Yr Pass Thru | 4.000 | 04-01-47 | | 20,532,465 | 22,253,671 |

| 30 Yr Pass Thru | 4.000 | 05-01-47 | | 15,110,671 | 16,377,376 |

| 30 Yr Pass Thru | 4.000 | 10-01-47 | | 26,554,980 | 28,639,143 |

| 30 Yr Pass Thru | 4.000 | 03-01-48 | | 9,912,775 | 10,619,219 |

| 30 Yr Pass Thru | 4.000 | 07-01-48 | | 49,127,670 | 53,214,880 |

| 30 Yr Pass Thru | 4.000 | 08-01-48 | | 29,346,356 | 31,696,139 |

| 30 Yr Pass Thru | 5.500 | 11-01-39 | | 3,976,423 | 4,638,754 |

| Federal National Mortgage Association | | | | | |

| 30 Yr Pass Thru | 3.000 | 07-01-42 | | 4,009,041 | 4,310,106 |

| 30 Yr Pass Thru | 3.000 | 10-01-42 | | 7,754,760 | 8,298,342 |

| 30 Yr Pass Thru | 3.000 | 10-01-42 | | 4,006,521 | 4,287,364 |

| 30 Yr Pass Thru | 3.000 | 04-01-43 | | 2,469,811 | 2,642,936 |

| 30 Yr Pass Thru | 3.000 | 12-01-45 | | 46,287,530 | 49,083,714 |

| 30 Yr Pass Thru | 3.000 | 08-01-46 | | 51,295,724 | 54,715,045 |

| 30 Yr Pass Thru | 3.000 | 08-01-46 | | 38,065,305 | 40,626,491 |

| 30 Yr Pass Thru | 3.000 | 09-01-46 | | 4,945,846 | 5,290,369 |

| 30 Yr Pass Thru | 3.000 | 10-01-46 | | 3,844,873 | 4,112,703 |

| 30 Yr Pass Thru | 3.000 | 10-01-46 | | 32,939,527 | 34,785,260 |

| 30 Yr Pass Thru | 3.000 | 01-01-47 | | 30,437,826 | 32,466,781 |

| 30 Yr Pass Thru | 3.000 | 02-01-47 | | 16,320,234 | 17,596,827 |

| 30 Yr Pass Thru | 3.000 | 04-01-47 | | 78,695,534 | 83,105,160 |

| 30 Yr Pass Thru | 3.000 | 10-01-47 | | 35,706,455 | 38,086,612 |

| 30 Yr Pass Thru | 3.000 | 11-01-47 | | 41,857,333 | 44,647,500 |

| 30 Yr Pass Thru | 3.000 | 11-01-48 | | 96,607,762 | 102,021,081 |

| 30 Yr Pass Thru | 3.000 | 11-01-48 | | 34,572,312 | 36,617,576 |

| 30 Yr Pass Thru | 3.000 | 07-01-49 | | 44,799,174 | 47,113,455 |

| 30 Yr Pass Thru | 3.000 | 09-01-49 | | 42,639,779 | 45,029,057 |

| 30 Yr Pass Thru | 3.000 | 09-01-49 | | 49,599,653 | 53,184,915 |

| 30 Yr Pass Thru | 3.000 | 10-01-49 | | 31,660,962 | 33,338,585 |

| 30 Yr Pass Thru | 3.000 | 10-01-49 | | 60,417,849 | 63,633,378 |

| 30 Yr Pass Thru | 3.000 | 10-01-49 | | 61,263,591 | 65,213,347 |

| 30 Yr Pass Thru | 3.000 | 11-01-49 | | 34,425,959 | 36,957,437 |

| 30 Yr Pass Thru | 3.000 | 11-01-49 | | 42,432,536 | 44,969,322 |

| 30 Yr Pass Thru | 3.000 | 11-01-49 | | 37,121,582 | 39,224,854 |

| 30 Yr Pass Thru | 3.000 | 11-01-49 | | 59,845,127 | 63,030,175 |

| 30 Yr Pass Thru | 3.000 | 12-01-49 | | 46,950,441 | 49,610,606 |

| 30 Yr Pass Thru | 3.000 | 01-01-50 | | 36,921,229 | 39,003,919 |

| 30 Yr Pass Thru | 3.000 | 02-01-50 | | 54,821,255 | 57,735,498 |

| 12 | JOHN HANCOCK BOND FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| U.S. Government Agency (continued) | | | | |

| 30 Yr Pass Thru | 3.500 | 11-01-40 | | 2,928,485 | $3,198,076 |

| 30 Yr Pass Thru | 3.500 | 06-01-42 | | 2,803,387 | 3,056,205 |

| 30 Yr Pass Thru | 3.500 | 08-01-42 | | 4,998,872 | 5,446,562 |

| 30 Yr Pass Thru | 3.500 | 06-01-43 | | 17,765,107 | 19,467,150 |

| 30 Yr Pass Thru | 3.500 | 07-01-43 | | 5,123,506 | 5,614,379 |

| 30 Yr Pass Thru | 3.500 | 07-01-43 | | 5,320,920 | 5,835,696 |

| 30 Yr Pass Thru | 3.500 | 01-01-45 | | 4,230,964 | 4,644,258 |

| 30 Yr Pass Thru | 3.500 | 04-01-45 | | 13,726,309 | 14,891,270 |

| 30 Yr Pass Thru | 3.500 | 04-01-45 | | 3,635,628 | 3,944,187 |

| 30 Yr Pass Thru | 3.500 | 04-01-45 | | 14,812,115 | 16,069,229 |

| 30 Yr Pass Thru | 3.500 | 01-01-46 | | 35,722,712 | 39,167,567 |

| 30 Yr Pass Thru | 3.500 | 02-01-46 | | 25,705,521 | 27,509,616 |

| 30 Yr Pass Thru | 3.500 | 07-01-46 | | 29,796,395 | 31,738,620 |

| 30 Yr Pass Thru | 3.500 | 07-01-46 | | 9,664,702 | 10,430,588 |

| 30 Yr Pass Thru | 3.500 | 08-01-46 | | 36,650,146 | 39,691,950 |

| 30 Yr Pass Thru | 3.500 | 02-01-47 | | 41,528,633 | 44,949,375 |

| 30 Yr Pass Thru | 3.500 | 03-01-47 | | 46,227,763 | 50,425,623 |

| 30 Yr Pass Thru | 3.500 | 05-01-47 | | 31,152,388 | 34,020,221 |

| 30 Yr Pass Thru | 3.500 | 07-01-47 | | 58,519,683 | 63,833,750 |

| 30 Yr Pass Thru | 3.500 | 08-01-47 | | 44,484,792 | 48,204,642 |

| 30 Yr Pass Thru | 3.500 | 09-01-47 | | 10,416,773 | 11,056,708 |

| 30 Yr Pass Thru | 3.500 | 11-01-47 | | 55,269,919 | 59,753,454 |

| 30 Yr Pass Thru | 3.500 | 11-01-47 | | 7,310,783 | 7,759,907 |

| 30 Yr Pass Thru | 3.500 | 12-01-47 | | 27,763,238 | 29,893,947 |

| 30 Yr Pass Thru | 3.500 | 01-01-48 | | 47,189,355 | 50,810,935 |

| 30 Yr Pass Thru | 3.500 | 03-01-48 | | 9,471,738 | 10,370,328 |

| 30 Yr Pass Thru | 3.500 | 03-01-48 | | 36,489,599 | 38,662,853 |

| 30 Yr Pass Thru | 3.500 | 06-01-48 | | 23,193,408 | 25,060,378 |

| 30 Yr Pass Thru | 3.500 | 03-01-49 | | 7,361,947 | 7,926,945 |

| 30 Yr Pass Thru | 3.500 | 06-01-49 | | 49,990,416 | 53,670,745 |

| 30 Yr Pass Thru | 3.500 | 06-01-49 | | 22,170,159 | 23,414,364 |

| 30 Yr Pass Thru | 3.500 | 06-01-49 | | 39,540,845 | 42,167,670 |

| 30 Yr Pass Thru | 3.500 | 07-01-49 | | 23,144,582 | 24,557,024 |

| 30 Yr Pass Thru | 3.500 | 07-01-49 | | 87,497,476 | 92,900,069 |

| 30 Yr Pass Thru | 3.500 | 09-01-49 | | 18,466,027 | 19,473,500 |

| 30 Yr Pass Thru | 3.500 | 12-01-49 | | 108,543,480 | 115,338,856 |

| 30 Yr Pass Thru | 3.500 | 02-01-50 | | 71,298,357 | 75,204,980 |

| 30 Yr Pass Thru (6 month LIBOR + 2.122%) (B) | 3.997 | 07-01-33 | | 375 | 393 |

| 30 Yr Pass Thru | 4.000 | 09-01-40 | | 6,413,515 | 7,049,690 |

| 30 Yr Pass Thru | 4.000 | 09-01-40 | | 9,563,622 | 10,512,265 |

| 30 Yr Pass Thru | 4.000 | 11-01-40 | | 2,355,541 | 2,589,193 |

| 30 Yr Pass Thru | 4.000 | 12-01-40 | | 3,841,707 | 4,222,777 |

| 30 Yr Pass Thru | 4.000 | 01-01-41 | | 4,222,117 | 4,640,921 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK BOND FUND | 13 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| U.S. Government Agency (continued) | | | | |

| 30 Yr Pass Thru | 4.000 | 09-01-41 | | 7,726,044 | $8,487,584 |

| 30 Yr Pass Thru | 4.000 | 09-01-41 | | 3,491,722 | 3,871,902 |

| 30 Yr Pass Thru | 4.000 | 10-01-41 | | 2,361,385 | 2,592,666 |

| 30 Yr Pass Thru | 4.000 | 01-01-42 | | 3,096,173 | 3,414,902 |

| 30 Yr Pass Thru | 4.000 | 05-01-42 | | 5,554,412 | 6,091,484 |

| 30 Yr Pass Thru | 4.000 | 09-01-43 | | 7,388,487 | 8,306,085 |

| 30 Yr Pass Thru | 4.000 | 10-01-43 | | 7,946,385 | 8,836,423 |

| 30 Yr Pass Thru | 4.000 | 10-01-43 | | 3,308,250 | 3,657,081 |

| 30 Yr Pass Thru | 4.000 | 01-01-44 | | 5,715,332 | 6,355,480 |

| 30 Yr Pass Thru | 4.000 | 12-01-45 | | 18,171,519 | 19,877,469 |

| 30 Yr Pass Thru | 4.000 | 02-01-46 | | 11,347,898 | 12,321,042 |

| 30 Yr Pass Thru | 4.000 | 04-01-46 | | 11,607,982 | 12,567,154 |

| 30 Yr Pass Thru | 4.000 | 06-01-46 | | 7,858,977 | 8,508,368 |

| 30 Yr Pass Thru | 4.000 | 07-01-46 | | 19,050,397 | 20,624,539 |

| 30 Yr Pass Thru | 4.000 | 10-01-46 | | 4,540,195 | 4,908,259 |

| 30 Yr Pass Thru | 4.000 | 01-01-47 | | 15,777,839 | 17,129,147 |

| 30 Yr Pass Thru | 4.000 | 03-01-47 | | 24,437,691 | 26,487,534 |

| 30 Yr Pass Thru | 4.000 | 04-01-47 | | 20,737,521 | 22,513,607 |

| 30 Yr Pass Thru | 4.000 | 08-01-47 | | 28,377,800 | 30,403,418 |

| 30 Yr Pass Thru | 4.000 | 11-01-47 | | 7,153,107 | 7,660,792 |

| 30 Yr Pass Thru | 4.000 | 12-01-47 | | 13,491,148 | 14,694,463 |

| 30 Yr Pass Thru | 4.000 | 12-01-47 | | 11,065,439 | 11,855,295 |

| 30 Yr Pass Thru | 4.000 | 07-01-48 | | 21,366,246 | 22,764,516 |

| 30 Yr Pass Thru | 4.000 | 10-01-48 | | 24,829,341 | 26,795,648 |

| 30 Yr Pass Thru | 4.000 | 10-01-48 | | 29,886,820 | 32,468,455 |

| 30 Yr Pass Thru | 4.000 | 01-01-49 | | 19,267,128 | 20,979,598 |

| 30 Yr Pass Thru | 4.000 | 02-01-49 | | 26,001,663 | 28,345,204 |

| 30 Yr Pass Thru | 7.000 | 09-01-31 | | 126 | 148 |

| 30 Yr Pass Thru | 7.000 | 09-01-31 | | 125 | 146 |

| 30 Yr Pass Thru | 7.000 | 09-01-31 | | 1,962 | 2,300 |

| 30 Yr Pass Thru | 7.000 | 01-01-32 | | 81 | 95 |

| 30 Yr Pass Thru | 7.000 | 05-01-32 | | 115 | 137 |

| 30 Yr Pass Thru | 7.000 | 06-01-32 | | 98 | 115 |

| 30 Yr Pass Thru | 7.500 | 09-01-29 | | 53 | 62 |

| 30 Yr Pass Thru | 7.500 | 12-01-29 | | 63 | 73 |

| 30 Yr Pass Thru | 7.500 | 12-01-30 | | 14 | 17 |

| 30 Yr Pass Thru | 7.500 | 01-01-31 | | 27 | 31 |

| 30 Yr Pass Thru | 7.500 | 05-01-31 | | 302 | 357 |

| 30 Yr Pass Thru | 7.500 | 08-01-31 | | 113 | 128 |

| Government National Mortgage Association | | | | | |

| 30 Yr Pass Thru | 5.000 | 04-15-35 | | 3,167 | 3,558 |

| 30 Yr Pass Thru | 5.000 | 04-15-35 | | 1,519 | 1,703 |

| 30 Yr Pass Thru | 5.500 | 03-15-35 | | 3,398 | 3,922 |

| 30 Yr Pass Thru | 6.000 | 03-15-33 | | 2,296 | 2,668 |

| 14 | JOHN HANCOCK BOND FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| U.S. Government Agency (continued) | | | | |

| 30 Yr Pass Thru | 6.000 | 06-15-33 | | 846 | $978 |

| 30 Yr Pass Thru | 6.500 | 09-15-28 | | 305 | 343 |

| 30 Yr Pass Thru | 6.500 | 09-15-29 | | 149 | 168 |

| 30 Yr Pass Thru | 6.500 | 08-15-31 | | 214 | 245 |

| 30 Yr Pass Thru | 7.000 | 04-15-29 | | 636 | 728 |

|

| 30 Yr Pass Thru | 8.000 | 10-15-26 | | 333 | 373 |

| Foreign government obligations 0.5% | | | | $90,730,932 |

| (Cost $82,133,789) | | | | | |

| Qatar 0.3% | | | | | 48,694,395 |

| State of Qatar | | | | | |

| Bond (C) | 3.375 | 03-14-24 | | 24,739,000 | 26,226,160 |

| Bond (C) | 5.103 | 04-23-48 | | 17,235,000 | 22,468,235 |

| Saudi Arabia 0.2% | | | | | 42,036,537 |

Kingdom of Saudi Arabia

Bond (C) | 4.375 | 04-16-29 | | 36,950,000 | 42,036,537 |

|

| Corporate bonds 51.3% | | | $9,383,457,540 |

| (Cost $9,252,693,219) | | | | | |

| Communication services 6.5% | | | 1,181,055,340 |

| Diversified telecommunication services 1.9% | | | |

| AT&T, Inc. | 2.300 | 06-01-27 | | 16,319,000 | 16,506,382 |

| AT&T, Inc. | 3.400 | 05-15-25 | | 37,878,000 | 40,841,218 |

| AT&T, Inc. | 3.800 | 02-15-27 | | 17,626,000 | 19,258,234 |

| C&W Senior Financing DAC (C) | 6.875 | 09-15-27 | | 15,850,000 | 15,639,037 |

| CenturyLink, Inc. (C) | 4.000 | 02-15-27 | | 7,709,000 | 7,687,415 |

| Cincinnati Bell, Inc. (C) | 7.000 | 07-15-24 | | 22,599,000 | 23,276,970 |

| GCI LLC (C) | 6.625 | 06-15-24 | | 7,997,000 | 8,386,854 |

| GCI LLC | 6.875 | 04-15-25 | | 10,770,000 | 11,187,338 |

| Level 3 Financing, Inc. (C) | 3.400 | 03-01-27 | | 24,679,000 | 24,956,639 |

| Liquid Telecommunications Financing PLC (C) | 8.500 | 07-13-22 | | 12,325,000 | 11,111,287 |

| Radiate Holdco LLC (C) | 6.625 | 02-15-25 | | 16,207,000 | 16,603,909 |

| Telecom Argentina SA (A)(C) | 6.500 | 06-15-21 | | 13,645,000 | 11,925,730 |

| Telecom Argentina SA (A)(C) | 8.000 | 07-18-26 | | 12,621,000 | 10,187,545 |

| Telecom Italia Capital SA | 7.200 | 07-18-36 | | 19,715,000 | 22,573,675 |

| Telecom Italia SpA (C) | 5.303 | 05-30-24 | | 14,935,000 | 15,641,874 |

| Verizon Communications, Inc. | 3.000 | 03-22-27 | | 5,157,000 | 5,616,586 |

| Verizon Communications, Inc. | 4.400 | 11-01-34 | | 16,224,000 | 19,906,654 |

| Verizon Communications, Inc. | 4.862 | 08-21-46 | | 43,995,000 | 59,025,578 |

| Entertainment 0.6% | | | |

| Activision Blizzard, Inc. | 3.400 | 09-15-26 | | 10,623,000 | 11,846,923 |

| Lions Gate Capital Holdings LLC (C) | 5.875 | 11-01-24 | | 14,513,000 | 14,077,610 |

| Lions Gate Capital Holdings LLC (C) | 6.375 | 02-01-24 | | 955,000 | 963,375 |

| Netflix, Inc. | 4.875 | 04-15-28 | | 37,762,000 | 40,310,935 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK BOND FUND | 15 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Communication services (continued) | | | |

| Entertainment (continued) | | | |

| Netflix, Inc. (C) | 4.875 | 06-15-30 | | 13,997,000 | $15,111,161 |

| Netflix, Inc. (C) | 5.375 | 11-15-29 | | 5,283,000 | 5,864,658 |

| Netflix, Inc. | 5.875 | 11-15-28 | | 25,458,000 | 28,967,894 |

| Interactive media and services 0.1% | | | |

| Match Group, Inc. (C) | 4.125 | 08-01-30 | | 12,092,000 | 11,850,160 |

| National CineMedia LLC (C) | 5.875 | 04-15-28 | | 8,680,000 | 6,944,000 |

| Twitter, Inc. (C) | 3.875 | 12-15-27 | | 4,401,000 | 4,384,496 |

| Media 2.7% | | | |

| Altice Financing SA (C) | 5.000 | 01-15-28 | | 6,979,000 | 7,037,885 |

| Altice France Holding SA (C) | 10.500 | 05-15-27 | | 4,417,000 | 4,891,828 |

| Charter Communications Operating LLC | 4.200 | 03-15-28 | | 35,014,000 | 38,981,049 |

| Charter Communications Operating LLC | 4.800 | 03-01-50 | | 35,191,000 | 39,186,265 |

| Charter Communications Operating LLC | 5.750 | 04-01-48 | | 41,171,000 | 50,698,084 |

| Charter Communications Operating LLC | 6.484 | 10-23-45 | | 34,584,000 | 44,669,358 |

| Comcast Corp. | 3.100 | 04-01-25 | | 16,117,000 | 17,614,474 |

| Comcast Corp. | 3.999 | 11-01-49 | | 5,054,000 | 5,998,431 |

| Comcast Corp. | 4.049 | 11-01-52 | | 26,296,000 | 31,406,761 |

| Comcast Corp. | 4.150 | 10-15-28 | | 59,960,000 | 70,930,978 |

| CSC Holdings LLC (C) | 5.375 | 02-01-28 | | 7,610,000 | 8,090,381 |

| CSC Holdings LLC (C) | 5.750 | 01-15-30 | | 20,238,000 | 21,351,090 |

| CSC Holdings LLC | 5.875 | 09-15-22 | | 11,420,000 | 12,040,106 |

| CSC Holdings LLC (C) | 7.500 | 04-01-28 | | 11,630,000 | 12,880,225 |

| Diamond Sports Group LLC (C) | 6.625 | 08-15-27 | | 18,960,000 | 11,408,232 |

| LCPR Senior Secured Financing DAC (C) | 6.750 | 10-15-27 | | 9,115,000 | 9,482,973 |

| MDC Partners, Inc. (C) | 6.500 | 05-01-24 | | 25,380,000 | 19,796,400 |

| Meredith Corp. | 6.875 | 02-01-26 | | 2,283,000 | 2,114,629 |

| Sirius XM Radio, Inc. (C) | 5.000 | 08-01-27 | | 22,791,000 | 23,816,595 |

| Sirius XM Radio, Inc. (C) | 5.375 | 07-15-26 | | 11,714,000 | 12,145,954 |

| ViacomCBS, Inc. | 4.750 | 05-15-25 | | 25,902,000 | 28,497,215 |

| WMG Acquisition Corp. (C) | 4.875 | 11-01-24 | | 6,551,000 | 6,632,888 |

| WMG Acquisition Corp. (C) | 5.500 | 04-15-26 | | 9,627,000 | 9,915,810 |

| Wireless telecommunication services 1.2% | | | |

| CC Holdings GS V LLC | 3.849 | 04-15-23 | | 18,984,000 | 20,338,886 |

| Comunicaciones Celulares SA (C) | 6.875 | 02-06-24 | | 8,530,000 | 8,658,035 |

| Millicom International Cellular SA (C) | 5.125 | 01-15-28 | | 4,100,000 | 4,079,500 |

| MTN Mauritius Investments, Ltd. (C) | 4.755 | 11-11-24 | | 12,421,000 | 12,174,486 |

| Oztel Holdings SPC, Ltd. (C) | 6.625 | 04-24-28 | | 12,515,000 | 11,332,937 |

| SoftBank Group Corp. (6.875% to 7-19-27, then 5 Year ICE Swap Rate + 4.854%) (D) | 6.875 | 07-19-27 | | 28,364,000 | 26,865,814 |

| Sprint Corp. | 7.875 | 09-15-23 | | 15,206,000 | 17,258,810 |

| Telefonica Celular del Paraguay SA (C) | 5.875 | 04-15-27 | | 13,556,000 | 13,711,894 |

| T-Mobile USA, Inc. (C) | 3.875 | 04-15-30 | | 34,229,000 | 37,106,974 |

| 16 | JOHN HANCOCK BOND FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Communication services (continued) | | | |

| Wireless telecommunication services (continued) | | | |

| T-Mobile USA, Inc. (C) | 4.500 | 04-15-50 | | 19,195,000 | $21,581,514 |

| Vodafone Group PLC (7.000% to 1-4-29, then 5 Year U.S. Swap Rate + 4.873%) | 7.000 | 04-04-79 | | 32,561,000 | 37,704,742 |

| Consumer discretionary 4.9% | | | 889,345,702 |

| Auto components 0.0% | | | |

| Dealer Tire LLC (C) | 8.000 | 02-01-28 | | 6,281,000 | 5,430,553 |

| Automobiles 1.7% | | | |

| BMW US Capital LLC (C) | 2.950 | 04-14-22 | | 8,315,000 | 8,471,335 |

| Daimler Finance North America LLC (C) | 2.700 | 06-14-24 | | 13,695,000 | 13,711,783 |

| Daimler Finance North America LLC (C) | 3.500 | 08-03-25 | | 12,585,000 | 12,976,754 |

| Ford Motor Credit Company LLC | 4.134 | 08-04-25 | | 64,206,000 | 60,046,093 |

| Ford Motor Credit Company LLC | 5.113 | 05-03-29 | | 34,269,000 | 32,000,392 |

| Ford Motor Credit Company LLC | 5.875 | 08-02-21 | | 32,380,000 | 32,460,950 |

| General Motors Financial Company, Inc. | 4.000 | 01-15-25 | | 51,920,000 | 52,326,658 |

| General Motors Financial Company, Inc. | 4.300 | 07-13-25 | | 24,535,000 | 25,051,201 |

| General Motors Financial Company, Inc. | 5.200 | 03-20-23 | | 18,766,000 | 19,535,916 |

| JB Poindexter & Company, Inc. (C) | 7.125 | 04-15-26 | | 5,212,000 | 5,187,921 |

| Mclaren Finance PLC (C) | 5.750 | 08-01-22 | | 5,425,000 | 3,146,500 |

| Nissan Motor Acceptance Corp. (C) | 3.450 | 03-15-23 | | 13,440,000 | 12,379,071 |

| Volkswagen Group of America Finance LLC (C) | 2.900 | 05-13-22 | | 28,242,000 | 28,737,874 |

| Diversified consumer services 0.2% | | | |

| GEMS MENASA Cayman, Ltd. (C) | 7.125 | 07-31-26 | | 6,680,000 | 6,089,889 |

| Laureate Education, Inc. (C) | 8.250 | 05-01-25 | | 8,575,000 | 9,057,344 |

| Sotheby's (A)(C) | 7.375 | 10-15-27 | | 15,799,000 | 14,377,090 |

| Hotels, restaurants and leisure 0.9% | | | |

| CCM Merger, Inc. (A)(C) | 6.000 | 03-15-22 | | 10,775,000 | 10,074,625 |

| Connect Finco SARL (C) | 6.750 | 10-01-26 | | 23,202,000 | 22,505,940 |

| Eldorado Resorts, Inc. | 6.000 | 09-15-26 | | 6,670,000 | 6,970,150 |

| Eldorado Resorts, Inc. | 7.000 | 08-01-23 | | 4,535,000 | 4,569,965 |

| Hilton Domestic Operating Company, Inc. | 4.875 | 01-15-30 | | 10,028,000 | 9,977,860 |

| Hilton Domestic Operating Company, Inc. (C) | 5.750 | 05-01-28 | | 4,667,000 | 4,818,678 |

| International Game Technology PLC (C) | 6.500 | 02-15-25 | | 11,430,000 | 11,777,243 |

| Jacobs Entertainment, Inc. (C) | 7.875 | 02-01-24 | | 11,775,000 | 8,949,000 |

| Resorts World Las Vegas LLC (C) | 4.625 | 04-16-29 | | 16,090,000 | 15,167,454 |

| Starbucks Corp. | 2.250 | 03-12-30 | | 26,460,000 | 26,343,160 |

| Twin River Worldwide Holdings, Inc. (C) | 6.750 | 06-01-27 | | 17,764,000 | 16,564,930 |

| Waterford Gaming LLC (C)(E)(F) | 8.625 | 09-15-14 | | 422,977 | 0 |

| Wyndham Destinations, Inc. (C) | 4.625 | 03-01-30 | | 9,653,000 | 8,349,845 |

| Yum! Brands, Inc. (C) | 4.750 | 01-15-30 | | 12,072,000 | 12,514,077 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK BOND FUND | 17 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Consumer discretionary (continued) | | | |

| Internet and direct marketing retail 1.2% | | | |

| Amazon.com, Inc. | 3.150 | 08-22-27 | | 40,614,000 | $46,136,682 |

| Amazon.com, Inc. | 4.050 | 08-22-47 | | 22,762,000 | 29,923,155 |

| Expedia Group, Inc. | 3.250 | 02-15-30 | | 23,593,000 | 21,096,108 |

| Expedia Group, Inc. | 3.800 | 02-15-28 | | 38,185,000 | 35,246,321 |

| Expedia Group, Inc. | 5.000 | 02-15-26 | | 33,757,000 | 34,519,151 |

| Prosus NV (C) | 4.850 | 07-06-27 | | 4,575,000 | 5,069,809 |

| Prosus NV (C) | 5.500 | 07-21-25 | | 19,530,000 | 21,835,674 |

| QVC, Inc. | 4.375 | 03-15-23 | | 19,408,000 | 18,922,800 |

| QVC, Inc. | 5.125 | 07-02-22 | | 8,874,000 | 8,862,908 |

| QVC, Inc. | 5.450 | 08-15-34 | | 10,129,000 | 8,533,683 |

| Multiline retail 0.4% | | | |

| Dollar Tree, Inc. | 4.200 | 05-15-28 | | 45,224,000 | 51,121,685 |

| Macy's, Inc. (C) | 8.375 | 06-15-25 | | 6,259,000 | 6,345,061 |

| Nordstrom, Inc. (C) | 8.750 | 05-15-25 | | 2,499,000 | 2,683,587 |

| Target Corp. | 2.250 | 04-15-25 | | 12,632,000 | 13,463,706 |

| Specialty retail 0.4% | | | |

| Asbury Automotive Group, Inc. (C) | 4.750 | 03-01-30 | | 1,014,000 | 973,440 |

| AutoNation, Inc. | 4.750 | 06-01-30 | | 12,415,000 | 12,925,430 |

| The TJX Companies, Inc. | 3.500 | 04-15-25 | | 21,198,000 | 23,683,401 |

| The TJX Companies, Inc. | 3.875 | 04-15-30 | | 25,962,000 | 30,490,740 |

| Textiles, apparel and luxury goods 0.1% | | | |

| Hanesbrands, Inc. (C) | 5.375 | 05-15-25 | | 6,182,000 | 6,336,550 |

| Levi Strauss & Company (C) | 5.000 | 05-01-25 | | 11,378,000 | 11,605,560 |

| Consumer staples 1.5% | | | 271,938,266 |

| Beverages 0.4% | | | |

| Anheuser-Busch InBev Worldwide, Inc. | 4.600 | 04-15-48 | | 22,485,000 | 24,998,587 |

| Constellation Brands, Inc. | 2.875 | 05-01-30 | | 8,258,000 | 8,557,744 |

| Keurig Dr Pepper, Inc. | 3.200 | 05-01-30 | | 7,793,000 | 8,458,255 |

| The Coca-Cola Company | 4.200 | 03-25-50 | | 17,528,000 | 22,650,961 |

| Food and staples retailing 0.4% | | | |

| Albertsons Companies, Inc. (C) | 4.875 | 02-15-30 | | 7,584,000 | 7,858,920 |

| Alimentation Couche-Tard, Inc. (C) | 2.700 | 07-26-22 | | 15,724,000 | 16,060,676 |

| Dollar General Corp. | 3.500 | 04-03-30 | | 16,383,000 | 18,321,138 |

| Sysco Corp. | 5.950 | 04-01-30 | | 7,575,000 | 9,109,021 |

| The Kroger Company | 2.200 | 05-01-30 | | 13,549,000 | 13,877,500 |

| Food products 0.6% | | | |

| Cargill, Inc. (C) | 1.375 | 07-23-23 | | 10,816,000 | 10,999,890 |

| Cargill, Inc. (C) | 2.125 | 04-23-30 | | 10,774,000 | 10,942,479 |

| JBS Investments II GmbH (C) | 5.750 | 01-15-28 | | 27,194,000 | 27,261,985 |

| Kraft Heinz Foods Company (C) | 3.875 | 05-15-27 | | 1,601,000 | 1,672,648 |

| Kraft Heinz Foods Company (C) | 4.875 | 02-15-25 | | 13,957,000 | 14,296,843 |

| 18 | JOHN HANCOCK BOND FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Consumer staples (continued) | | | |

| Food products (continued) | | | |

| Kraft Heinz Foods Company (C) | 5.500 | 06-01-50 | | 11,274,000 | $11,733,344 |

| Lamb Weston Holdings, Inc. (C) | 4.875 | 05-15-28 | | 1,130,000 | 1,183,336 |

| NBM US Holdings, Inc. (A)(C) | 6.625 | 08-06-29 | | 8,240,000 | 8,260,600 |

| Post Holdings, Inc. (C) | 5.500 | 12-15-29 | | 9,872,000 | 10,316,240 |

| Simmons Foods, Inc. (C) | 5.750 | 11-01-24 | | 11,320,000 | 10,584,200 |

| Household products 0.0% | | | |

| Edgewell Personal Care Company (C) | 5.500 | 06-01-28 | | 8,227,000 | 8,525,229 |

| Personal products 0.1% | | | |

| Natura Cosmeticos SA (A)(C) | 5.375 | 02-01-23 | | 19,995,000 | 19,915,020 |

| Walnut Bidco PLC (C) | 9.125 | 08-01-24 | | 6,925,000 | 6,353,650 |

| Energy 4.2% | | | 774,247,458 |

| Energy equipment and services 0.2% | | | |

| CSI Compressco LP | 7.250 | 08-15-22 | | 22,264,000 | 8,432,490 |

| CSI Compressco LP (C) | 7.500 | 04-01-25 | | 20,041,000 | 14,429,520 |

| Inkia Energy, Ltd. (C) | 5.875 | 11-09-27 | | 4,600,000 | 4,462,000 |

| Tervita Corp. (C) | 7.625 | 12-01-21 | | 13,901,000 | 10,738,523 |

| Oil, gas and consumable fuels 4.0% | | | |

| Aker BP ASA (C) | 3.000 | 01-15-25 | | 13,687,000 | 13,218,303 |

| Antero Resources Corp. (A) | 5.000 | 03-01-25 | | 11,643,000 | 6,636,510 |

| Cheniere Energy Partners LP (C) | 4.500 | 10-01-29 | | 26,578,000 | 25,979,995 |

| Cimarex Energy Company | 4.375 | 06-01-24 | | 12,404,000 | 12,569,119 |

| Colorado Interstate Gas Company LLC (C) | 4.150 | 08-15-26 | | 9,460,000 | 10,188,013 |

| DCP Midstream Operating LP | 5.125 | 05-15-29 | | 5,850,000 | 5,323,500 |

| DCP Midstream Operating LP (5.850% to 5-21-23, then 3 month LIBOR + 3.850%) (C) | 5.850 | 05-21-43 | | 13,527,000 | 8,488,193 |

| Enbridge, Inc. (5.500% to 7-15-27, then 3 month LIBOR + 3.418%) | 5.500 | 07-15-77 | | 20,627,000 | 19,014,175 |

| Enbridge, Inc. (6.250% to 3-1-28, then 3 month LIBOR + 3.641%) | 6.250 | 03-01-78 | | 19,207,000 | 18,438,720 |

| Energy Transfer Operating LP | 4.200 | 04-15-27 | | 8,447,000 | 8,644,649 |

| Energy Transfer Operating LP | 4.250 | 03-15-23 | | 27,143,000 | 28,147,175 |

| Energy Transfer Operating LP | 5.150 | 03-15-45 | | 22,139,000 | 21,288,690 |

| Energy Transfer Operating LP | 5.875 | 01-15-24 | | 17,707,000 | 19,332,114 |

| Enterprise Products Operating LLC (5.250% to 8-16-27, then 3 month LIBOR + 3.033%) | 5.250 | 08-16-77 | | 38,773,000 | 34,934,861 |

| Husky Energy, Inc. | 3.950 | 04-15-22 | | 17,036,000 | 17,162,095 |

| Kinder Morgan Energy Partners LP | 7.750 | 03-15-32 | | 14,860,000 | 20,051,783 |

| MPLX LP | 4.000 | 03-15-28 | | 20,580,000 | 21,179,322 |

| MPLX LP | 4.250 | 12-01-27 | | 7,928,000 | 8,304,427 |

| MPLX LP | 5.250 | 01-15-25 | | 11,827,000 | 12,261,872 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK BOND FUND | 19 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Energy (continued) | | | |

| Oil, gas and consumable fuels (continued) | | | |

| MPLX LP (6.875% to 2-15-23, then 3 month LIBOR + 4.652%) (A)(D) | 6.875 | 02-15-23 | | 48,906,000 | $41,766,702 |

| Murphy Oil Corp. (A) | 5.750 | 08-15-25 | | 9,531,000 | 8,923,399 |

| ONEOK Partners LP | 4.900 | 03-15-25 | | 8,673,000 | 9,083,758 |

| Petrobras Global Finance BV (C) | 5.093 | 01-15-30 | | 45,050,000 | 42,932,650 |

| Petrobras Global Finance BV | 6.900 | 03-19-49 | | 12,360,000 | 12,311,178 |

| Petroleos Mexicanos | 5.350 | 02-12-28 | | 20,866,000 | 16,998,487 |

| Phillips 66 | 3.700 | 04-06-23 | | 6,205,000 | 6,630,104 |

| Sabine Pass Liquefaction LLC | 4.200 | 03-15-28 | | 15,585,000 | 16,582,297 |

| Sabine Pass Liquefaction LLC | 5.000 | 03-15-27 | | 15,534,000 | 17,238,249 |

| Sabine Pass Liquefaction LLC | 5.875 | 06-30-26 | | 30,826,000 | 35,422,395 |

| Sunoco Logistics Partners Operations LP | 3.900 | 07-15-26 | | 24,214,000 | 24,409,464 |

| Sunoco Logistics Partners Operations LP | 5.400 | 10-01-47 | | 16,846,000 | 16,733,622 |

| Targa Resources Partners LP | 5.875 | 04-15-26 | | 27,952,000 | 28,441,160 |

| Teekay Offshore Partners LP (A)(C) | 8.500 | 07-15-23 | | 17,682,000 | 15,779,240 |

| The Williams Companies, Inc. | 3.750 | 06-15-27 | | 22,804,000 | 24,254,262 |

| The Williams Companies, Inc. | 4.550 | 06-24-24 | | 45,771,000 | 49,619,672 |

| The Williams Companies, Inc. | 5.750 | 06-24-44 | | 7,401,000 | 8,634,816 |

| TransCanada PipeLines, Ltd. | 4.250 | 05-15-28 | | 13,565,000 | 15,383,802 |

| WPX Energy, Inc. | 4.500 | 01-15-30 | | 13,044,000 | 11,959,652 |

| WPX Energy, Inc. | 5.250 | 09-15-24 | | 5,040,000 | 5,002,200 |

| WPX Energy, Inc. | 5.250 | 10-15-27 | | 17,348,000 | 16,914,300 |

| Financials 14.5% | | | 2,657,782,010 |

| Banks 9.0% | | | |

| Australia & New Zealand Banking Group, Ltd. (6.750% to 6-15-26, then 5 Year ICE Swap Rate + 5.168%) (A)(C)(D) | 6.750 | 06-15-26 | | 12,365,000 | 13,686,571 |

| Banco Santander SA | 4.379 | 04-12-28 | | 18,430,000 | 20,149,211 |

| Bank of America Corp. (2.592% to 4-29-30, then SOFR + 2.150%) | 2.592 | 04-29-31 | | 30,889,000 | 31,749,019 |

| Bank of America Corp. | 3.950 | 04-21-25 | | 29,823,000 | 32,584,570 |

| Bank of America Corp. | 4.200 | 08-26-24 | | 13,422,000 | 14,802,123 |

| Bank of America Corp. | 4.450 | 03-03-26 | | 33,850,000 | 38,121,252 |

| Bank of America Corp. (6.300% to 3-10-26, then 3 month LIBOR + 4.553%) (D) | 6.300 | 03-10-26 | | 36,217,000 | 39,657,615 |

| Barclays Bank PLC (C) | 10.179 | 06-12-21 | | 8,040,000 | 8,699,201 |

| Barclays PLC | 4.375 | 01-12-26 | | 15,935,000 | 17,535,081 |

| BPCE SA (C) | 4.500 | 03-15-25 | | 20,836,000 | 22,419,166 |

| BPCE SA (C) | 5.700 | 10-22-23 | | 23,245,000 | 25,502,037 |

| Citigroup, Inc. | 3.200 | 10-21-26 | | 33,754,000 | 36,117,280 |

| Citigroup, Inc. | 4.600 | 03-09-26 | | 40,223,000 | 45,044,520 |

| Citigroup, Inc. (4.700% to 1-30-25, then SOFR + 3.234%) (D) | 4.700 | 01-30-25 | | 29,338,000 | 25,524,060 |

| 20 | JOHN HANCOCK BOND FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Financials (continued) | | | |

| Banks (continued) | | | |

| Citigroup, Inc. | 5.500 | 09-13-25 | | 10,901,000 | $12,750,789 |

| Citigroup, Inc. (6.250% to 8-15-26, then 3 month LIBOR + 4.517%) (D) | 6.250 | 08-15-26 | | 25,873,000 | 27,554,745 |

| Citizens Bank NA | 2.250 | 04-28-25 | | 21,654,000 | 22,094,240 |

| Citizens Financial Group, Inc. | 3.250 | 04-30-30 | | 30,743,000 | 31,590,478 |

| Credit Agricole SA (C) | 3.250 | 01-14-30 | | 34,359,000 | 35,612,243 |

| Credit Agricole SA (7.875% to 1-23-24, then 5 Year U.S. Swap Rate + 4.898%) (C)(D) | 7.875 | 01-23-24 | | 18,085,000 | 19,717,699 |

| Danske Bank A/S (C) | 5.000 | 01-12-22 | | 19,629,000 | 20,565,835 |

| Discover Bank | 2.450 | 09-12-24 | | 24,190,000 | 24,232,729 |

| Fifth Third Bancorp | 1.625 | 05-05-23 | | 8,107,000 | 8,254,752 |

| Fifth Third Bancorp (5.100% to 6-30-23, then 3 month LIBOR + 3.033%) (D) | 5.100 | 06-30-23 | | 18,634,000 | 16,630,845 |

| Freedom Mortgage Corp. (C) | 8.125 | 11-15-24 | | 16,277,000 | 15,056,225 |

| Freedom Mortgage Corp. (C) | 8.250 | 04-15-25 | | 5,630,000 | 5,207,750 |

| HSBC Holdings PLC (3.950% to 5-18-23, then 3 month LIBOR + 0.987%) | 3.950 | 05-18-24 | | 37,829,000 | 40,397,603 |

| HSBC Holdings PLC (6.375% to 3-30-25, then 5 Year ICE Swap Rate + 4.368%) (D) | 6.375 | 03-30-25 | | 7,004,000 | 7,069,698 |

| HSBC Holdings PLC (6.875% to 6-1-21, then 5 Year ICE Swap Rate + 5.514%) (A)(D) | 6.875 | 06-01-21 | | 22,840,000 | 23,404,833 |

| ING Bank NV (C) | 5.800 | 09-25-23 | | 1,952,000 | 2,155,837 |

| ING Groep NV | 3.550 | 04-09-24 | | 20,292,000 | 21,750,361 |

| ING Groep NV (6.500% to 4-16-25, then 5 Year U.S. Swap Rate + 4.446%) (D) | 6.500 | 04-16-25 | | 7,245,000 | 7,363,818 |

| JPMorgan Chase & Co. (2.522% to 4-22-30, then SOFR + 2.040%) | 2.522 | 04-22-31 | | 31,844,000 | 32,519,929 |

| JPMorgan Chase & Co. | 2.950 | 10-01-26 | | 37,457,000 | 40,381,685 |

| JPMorgan Chase & Co. (2.956% to 5-13-30, then SOFR + 2.515%) | 2.956 | 05-13-31 | | 30,008,000 | 30,893,119 |

| JPMorgan Chase & Co. (3.960% to 1-29-26, then 3 month LIBOR + 1.245%) | 3.960 | 01-29-27 | | 30,465,000 | 33,963,675 |

| JPMorgan Chase & Co. (4.600% to 2-1-25, then SOFR + 3.125%) (D) | 4.600 | 02-01-25 | | 29,100,000 | 25,805,880 |

| JPMorgan Chase & Co. (6.750% to 2-1-24, then 3 month LIBOR + 3.780%) (D) | 6.750 | 02-01-24 | | 30,309,000 | 32,279,085 |

| Lloyds Banking Group PLC | 4.450 | 05-08-25 | | 50,365,000 | 56,087,239 |

| Lloyds Banking Group PLC (7.500% to 6-27-24, then 5 Year U.S. Swap Rate + 4.760%) (D) | 7.500 | 06-27-24 | | 18,250,000 | 18,637,813 |

| M&T Bank Corp. (5.125% to 11-1-26, then 3 month LIBOR + 3.520%) (D) | 5.125 | 11-01-26 | | 14,920,000 | 14,920,000 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK BOND FUND | 21 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Financials (continued) | | | |

| Banks (continued) | | | |

| Manufacturers & Traders Trust Company (3 month LIBOR + 0.640%) (B) | 2.220 | 12-01-21 | | 9,230,000 | $9,137,700 |

| Regions Financial Corp. | 2.250 | 05-18-25 | | 54,364,000 | 55,383,927 |

| Santander Holdings USA, Inc. | 3.244 | 10-05-26 | | 43,601,000 | 43,907,918 |

| Santander Holdings USA, Inc. | 3.400 | 01-18-23 | | 20,887,000 | 21,568,966 |

| Santander Holdings USA, Inc. | 3.450 | 06-02-25 | | 37,428,000 | 37,792,327 |

| Santander Holdings USA, Inc. | 3.500 | 06-07-24 | | 41,420,000 | 43,071,542 |

| Santander Holdings USA, Inc. | 4.400 | 07-13-27 | | 9,667,000 | 10,173,234 |

| Santander UK Group Holdings PLC (C) | 4.750 | 09-15-25 | | 18,879,000 | 19,949,977 |

| Societe Generale SA (7.375% to 9-13-21, then 5 Year U.S. Swap Rate + 6.238%) (C)(D) | 7.375 | 09-13-21 | | 17,145,000 | 17,261,757 |

| The PNC Financial Services Group, Inc. | 2.200 | 11-01-24 | | 33,630,000 | 35,256,593 |

| The PNC Financial Services Group, Inc. | 3.150 | 05-19-27 | | 5,223,000 | 5,758,716 |

| The PNC Financial Services Group, Inc. | 3.500 | 01-23-24 | | 14,588,000 | 15,875,958 |

| The PNC Financial Services Group, Inc. (4.850% to 6-1-23, then 3 month LIBOR + 3.040%) (D) | 4.850 | 06-01-23 | | 15,854,000 | 15,085,398 |

| The PNC Financial Services Group, Inc. (6.750% to 8-1-21, then 3 month LIBOR + 3.678%) (D) | 6.750 | 08-01-21 | | 29,319,000 | 29,412,528 |

| The Royal Bank of Scotland Group PLC (3.754% to 11-1-24, then 5 Year CMT + 2.100%) | 3.754 | 11-01-29 | | 9,658,000 | 9,769,972 |

| The Royal Bank of Scotland Group PLC | 3.875 | 09-12-23 | | 26,092,000 | 27,628,680 |

| The Royal Bank of Scotland Group PLC (8.625% to 8-15-21, then 5 Year U.S. Swap Rate + 7.598%) (D) | 8.625 | 08-15-21 | | 37,157,000 | 38,582,343 |

| The Toronto-Dominion Bank | 3.250 | 03-11-24 | | 28,876,000 | 31,367,908 |

| Wells Fargo & Company (2.188% to 4-30-25, then SOFR + 2.000%) | 2.188 | 04-30-26 | | 52,396,000 | 53,089,665 |

| Wells Fargo & Company (2.393% to 6-2-27, then SOFR + 2.100%) | 2.393 | 06-02-28 | | 34,716,000 | 35,051,199 |

| Wells Fargo & Company (3.068% to 4-30-40, then SOFR + 2.530%) | 3.068 | 04-30-41 | | 24,469,000 | 24,492,814 |

| Wells Fargo & Company (5.875% to 6-15-25, then 3 month LIBOR + 3.990%) (D) | 5.875 | 06-15-25 | | 58,933,000 | 62,699,408 |

| Capital markets 1.8% | | | |

| Ares Capital Corp. | 4.200 | 06-10-24 | | 19,978,000 | 19,113,975 |

| Cantor Fitzgerald LP (C) | 4.875 | 05-01-24 | | 27,559,000 | 28,066,449 |

| Credit Suisse Group AG (C) | 3.574 | 01-09-23 | | 8,054,000 | 8,303,732 |

| Credit Suisse Group AG (7.500% to 7-17-23, then 5 Year U.S. Swap Rate + 4.600%) (C)(D) | 7.500 | 07-17-23 | | 19,450,000 | 19,998,490 |

| 22 | JOHN HANCOCK BOND FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Financials (continued) | | | |

| Capital markets (continued) | | | |

| Credit Suisse Group AG (7.500% to 12-11-23, then 5 Year U.S. Swap Rate + 4.598%) (C)(D) | 7.500 | 12-11-23 | | 10,205,000 | $10,957,619 |

| Lazard Group LLC | 4.375 | 03-11-29 | | 14,025,000 | 14,991,086 |

| Macquarie Bank, Ltd. (C) | 3.624 | 06-03-30 | | 16,604,000 | 16,907,335 |

| Macquarie Bank, Ltd. (C) | 4.875 | 06-10-25 | | 21,805,000 | 23,642,069 |

| Morgan Stanley (2.188% to 4-28-25, then SOFR + 1.990%) | 2.188 | 04-28-26 | | 54,083,000 | 55,561,040 |

| Morgan Stanley | 3.875 | 01-27-26 | | 19,085,000 | 21,473,195 |

| Raymond James Financial, Inc. | 4.650 | 04-01-30 | | 8,111,000 | 9,329,433 |

| Stearns Holdings LLC (C) | 5.000 | 11-05-24 | | 63,888 | 38,333 |

| Stifel Financial Corp. | 4.250 | 07-18-24 | | 14,959,000 | 15,718,148 |

| The Bank of New York Mellon Corp. | 1.600 | 04-24-25 | | 20,479,000 | 21,194,156 |

| The Goldman Sachs Group, Inc. | 3.850 | 01-26-27 | | 51,756,000 | 57,021,670 |

| UBS Group AG (7.000% to 1-31-24, then 5 Year U.S. Swap Rate + 4.344%) (C)(D) | 7.000 | 01-31-24 | | 16,288,000 | 16,771,754 |

| Consumer finance 0.9% | | | |

| Ally Financial, Inc. | 5.125 | 09-30-24 | | 33,892,000 | 35,269,032 |

| Ally Financial, Inc. | 5.800 | 05-01-25 | | 16,524,000 | 18,064,367 |

| Capital One Financial Corp. | 2.600 | 05-11-23 | | 12,943,000 | 13,290,472 |

| Capital One Financial Corp. | 3.900 | 01-29-24 | | 15,290,000 | 16,235,701 |

| Credito Real SAB de CV (9.125% to 11-29-22, then 5 Year CMT + 7.026%) (C)(D) | 9.125 | 11-29-22 | | 9,375,000 | 7,218,844 |

| Discover Financial Services | 3.950 | 11-06-24 | | 31,439,000 | 33,302,431 |

| Discover Financial Services | 4.100 | 02-09-27 | | 8,552,000 | 8,964,927 |

| Enova International, Inc. (C) | 8.500 | 09-01-24 | | 3,051,000 | 2,585,723 |

| Enova International, Inc. (C) | 8.500 | 09-15-25 | | 15,597,000 | 13,296,443 |

| Springleaf Finance Corp. | 6.875 | 03-15-25 | | 5,750,000 | 5,676,400 |

| Springleaf Finance Corp. | 8.875 | 06-01-25 | | 7,187,000 | 7,474,480 |

| Diversified financial services 1.0% | | | |

| Allied Universal Holdco LLC (C) | 6.625 | 07-15-26 | | 7,548,000 | 7,925,400 |

| GE Capital International Funding Company Unlimited Company | 4.418 | 11-15-35 | | 36,402,000 | 36,344,965 |

| Gogo Intermediate Holdings LLC (C) | 9.875 | 05-01-24 | | 10,941,000 | 10,145,480 |

| Jefferies Financial Group, Inc. | 5.500 | 10-18-23 | | 18,076,000 | 19,455,246 |

| Jefferies Group LLC | 4.150 | 01-23-30 | | 23,760,000 | 23,867,925 |

| Jefferies Group LLC | 4.850 | 01-15-27 | | 25,592,000 | 27,415,803 |

| Operadora de Servicios Mega SA de CV (C) | 8.250 | 02-11-25 | | 10,104,000 | 8,676,810 |

| Refinitiv US Holdings, Inc. (C) | 6.250 | 05-15-26 | | 2,370,000 | 2,529,975 |

| Refinitiv US Holdings, Inc. (C) | 8.250 | 11-15-26 | | 3,750,000 | 4,096,875 |

| Trident TPI Holdings, Inc. (C) | 6.625 | 11-01-25 | | 4,032,000 | 3,588,480 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK BOND FUND | 23 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Financials (continued) | | | |

| Diversified financial services (continued) | | | |

| Voya Financial, Inc. (5.650% to 5-15-23, then 3 month LIBOR + 3.580%) | 5.650 | 05-15-53 | | 31,340,000 | $31,073,923 |

| Insurance 1.4% | | | |

| AXA SA | 8.600 | 12-15-30 | | 9,222,000 | 13,062,179 |

| Brighthouse Financial, Inc. | 3.700 | 06-22-27 | | 37,858,000 | 37,160,943 |

| CNO Financial Group, Inc. | 5.250 | 05-30-25 | | 10,445,000 | 11,403,168 |

| CNO Financial Group, Inc. | 5.250 | 05-30-29 | | 25,844,000 | 26,890,349 |

| Liberty Mutual Group, Inc. (C) | 3.951 | 10-15-50 | | 25,053,000 | 25,544,891 |

| MetLife, Inc. (6.400% to 12-15-36, then 3 month LIBOR + 2.205%) | 6.400 | 12-15-36 | | 21,462,000 | 24,873,170 |

| MetLife, Inc. (9.250% to 4-8-38, then 3 month LIBOR + 5.540%) (C) | 9.250 | 04-08-38 | | 6,634,000 | 9,188,090 |

| New York Life Insurance Company (C) | 3.750 | 05-15-50 | | 13,283,000 | 14,915,540 |

| Nippon Life Insurance Company (5.100% to 10-16-24, then 5 Year ICE Swap Rate + 3.650%) (C) | 5.100 | 10-16-44 | | 20,670,000 | 22,737,000 |

| Prudential Financial, Inc. (5.875% to 9-15-22, then 3 month LIBOR + 4.175%) | 5.875 | 09-15-42 | | 44,481,000 | 47,296,647 |

| Teachers Insurance & Annuity Association of America (C) | 4.270 | 05-15-47 | | 23,451,000 | 27,571,026 |

| Thrifts and mortgage finance 0.4% | | | |

| Ladder Capital Finance Holdings LLLP (C) | 5.250 | 03-15-22 | | 3,415,000 | 3,193,025 |

| Ladder Capital Finance Holdings LLLP (C) | 5.250 | 10-01-25 | | 7,705,000 | 6,549,250 |

| MGIC Investment Corp. | 5.750 | 08-15-23 | | 7,286,000 | 7,395,290 |

| Nationstar Mortgage Holdings, Inc. (C) | 6.000 | 01-15-27 | | 5,041,000 | 4,536,900 |

| Nationstar Mortgage Holdings, Inc. (C) | 8.125 | 07-15-23 | | 8,821,000 | 8,997,420 |

| Nationstar Mortgage Holdings, Inc. (C) | 9.125 | 07-15-26 | | 7,037,000 | 7,212,925 |

| Nationwide Building Society (3.622% to 4-26-22, then 3 month LIBOR + 1.181%) (C) | 3.622 | 04-26-23 | | 18,230,000 | 18,768,480 |

| Quicken Loans LLC (C) | 5.750 | 05-01-25 | | 15,960,000 | 16,279,200 |

| Radian Group, Inc. | 4.500 | 10-01-24 | | 7,901,000 | 7,809,190 |

| Health care 3.1% | | | 560,961,029 |

| Biotechnology 0.6% | | | |

| AbbVie, Inc. (C) | 3.200 | 11-21-29 | | 47,261,000 | 50,638,160 |

| AbbVie, Inc. (C) | 4.250 | 11-21-49 | | 13,743,000 | 15,744,857 |

| Shire Acquisitions Investments Ireland DAC | 3.200 | 09-23-26 | | 33,459,000 | 36,937,398 |

| Health care equipment and supplies 0.0% | | | |

| Baxter International, Inc. (C) | 3.950 | 04-01-30 | | 3,594,000 | 4,235,097 |

| Health care providers and services 2.0% | | | |

| AmerisourceBergen Corp. | 2.800 | 05-15-30 | | 23,074,000 | 23,624,626 |

| Anthem, Inc. | 2.375 | 01-15-25 | | 6,513,000 | 6,845,246 |

| 24 | JOHN HANCOCK BOND FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Health care (continued) | | | |

| Health care providers and services (continued) | | | |

| Centene Corp. | 3.375 | 02-15-30 | | 8,535,000 | $8,594,745 |

| Centene Corp. | 4.250 | 12-15-27 | | 6,147,000 | 6,421,279 |

| Centene Corp. | 4.625 | 12-15-29 | | 6,865,000 | 7,390,173 |

| Centene Corp. (C) | 5.375 | 06-01-26 | | 16,963,000 | 17,938,373 |

| CVS Health Corp. | 3.000 | 08-15-26 | | 5,073,000 | 5,540,989 |

| CVS Health Corp. | 3.750 | 04-01-30 | | 19,223,000 | 21,514,091 |

| CVS Health Corp. | 4.300 | 03-25-28 | | 25,350,000 | 28,904,936 |

| CVS Health Corp. | 5.050 | 03-25-48 | | 26,664,000 | 34,232,642 |

| DaVita, Inc. (C) | 4.625 | 06-01-30 | | 18,547,000 | 18,500,633 |

| DaVita, Inc. | 5.000 | 05-01-25 | | 29,189,000 | 29,955,211 |

| Encompass Health Corp. | 4.500 | 02-01-28 | | 8,919,000 | 9,052,785 |

| HCA, Inc. | 4.125 | 06-15-29 | | 12,534,000 | 13,614,316 |

| HCA, Inc. | 5.250 | 04-15-25 | | 20,376,000 | 23,114,471 |

| HCA, Inc. | 5.250 | 06-15-26 | | 18,243,000 | 20,766,320 |

| MEDNAX, Inc. (A)(C) | 5.250 | 12-01-23 | | 13,806,000 | 13,529,880 |

| MEDNAX, Inc. (C) | 6.250 | 01-15-27 | | 12,515,000 | 11,701,525 |

| Rede D'or Finance Sarl (C) | 4.500 | 01-22-30 | | 16,474,000 | 13,796,975 |

| Select Medical Corp. (C) | 6.250 | 08-15-26 | | 15,024,000 | 15,793,980 |

| Team Health Holdings, Inc. (A)(C) | 6.375 | 02-01-25 | | 3,197,000 | 1,774,015 |

| Universal Health Services, Inc. (C) | 4.750 | 08-01-22 | | 17,830,000 | 17,830,000 |

| Universal Health Services, Inc. (C) | 5.000 | 06-01-26 | | 15,554,000 | 15,942,850 |

| Life sciences tools and services 0.0% | | | |

| Charles River Laboratories International, Inc. (C) | 4.250 | 05-01-28 | | 3,981,000 | 4,014,600 |

| Pharmaceuticals 0.5% | | | |

| Bausch Health Companies, Inc. (C) | 5.250 | 01-30-30 | | 9,478,000 | 9,312,135 |

| Bausch Health Companies, Inc. (C) | 6.125 | 04-15-25 | | 21,930,000 | 22,254,345 |

| Bausch Health Companies, Inc. (C) | 6.250 | 02-15-29 | | 19,740,000 | 20,233,500 |

| Catalent Pharma Solutions, Inc. (C) | 5.000 | 07-15-27 | | 3,705,000 | 3,797,625 |

| GlaxoSmithKline Capital PLC | 3.000 | 06-01-24 | | 25,294,000 | 27,413,251 |

| Industrials 5.7% | | | 1,049,278,688 |

| Aerospace and defense 1.1% | | | |

| Howmet Aerospace, Inc. | 5.125 | 10-01-24 | | 18,793,000 | 19,073,059 |

| Huntington Ingalls Industries, Inc. (C) | 3.844 | 05-01-25 | | 5,163,000 | 5,552,425 |

| Huntington Ingalls Industries, Inc. (C) | 4.200 | 05-01-30 | | 12,968,000 | 14,039,007 |

| Huntington Ingalls Industries, Inc. (C) | 5.000 | 11-15-25 | | 21,100,000 | 21,735,474 |

| Kratos Defense & Security Solutions, Inc. (C) | 6.500 | 11-30-25 | | 11,995,000 | 12,324,863 |

| The Boeing Company | 3.200 | 03-01-29 | | 38,178,000 | 36,103,614 |

| The Boeing Company | 4.875 | 05-01-25 | | 27,593,000 | 29,286,448 |

| The Boeing Company | 5.805 | 05-01-50 | | 27,011,000 | 30,574,278 |

| TransDigm, Inc. (C) | 5.500 | 11-15-27 | | 35,928,000 | 32,604,660 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK BOND FUND | 25 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Industrials (continued) | | | |

| Air freight and logistics 0.2% | | | |

| United Parcel Service, Inc. | 3.900 | 04-01-25 | | 17,934,000 | $20,382,421 |

| XPO Logistics, Inc. (C) | 6.250 | 05-01-25 | | 2,025,000 | 2,113,290 |

| XPO Logistics, Inc. (C) | 6.500 | 06-15-22 | | 11,266,000 | 11,280,083 |

| Airlines 1.7% | | | |

| Air Canada 2013-1 Class A Pass Through Trust (C) | 4.125 | 05-15-25 | | 10,353,252 | 9,421,460 |

| Air Canada 2017-1 Class B Pass Through Trust (C) | 3.700 | 01-15-26 | | 12,861,607 | 8,366,249 |

| America West Airlines 2000-1 Pass Through Trust | 8.057 | 07-02-20 | | 441,869 | 434,410 |

| American Airlines 2001-1 Pass Through Trust | 6.977 | 05-23-21 | | 994,675 | 968,493 |

| American Airlines 2013-2 Class A Pass Through Trust | 4.950 | 01-15-23 | | 17,725,642 | 13,826,000 |

| American Airlines 2015-1 Class A Pass Through Trust | 3.375 | 05-01-27 | | 19,563,331 | 15,164,835 |

| American Airlines 2015-1 Class B Pass Through Trust | 3.700 | 05-01-23 | | 6,236,092 | 3,585,753 |

| American Airlines 2016-1 Class A Pass Through Trust | 4.100 | 01-15-28 | | 23,834,498 | 16,088,286 |

| American Airlines 2017-1 Class A Pass Through Trust | 4.000 | 02-15-29 | | 7,600,038 | 5,244,026 |

| American Airlines 2017-1 Class AA Pass Through Trust | 3.650 | 02-15-29 | | 17,599,863 | 16,279,873 |

| American Airlines 2017-2 Class A Pass Through Trust | 3.600 | 10-15-29 | | 8,788,244 | 6,151,771 |

| American Airlines 2019-1 Class A Pass Through Trust | 3.500 | 02-15-32 | | 10,224,121 | 6,747,920 |

| American Airlines 2019-1 Class AA Pass Through Trust | 3.150 | 02-15-32 | | 17,170,497 | 15,024,185 |

| British Airways 2013-1 Class A Pass Through Trust (C) | 4.625 | 06-20-24 | | 13,319,973 | 12,121,176 |

| British Airways 2013-1 Class B Pass Through Trust (C) | 5.625 | 06-20-20 | | 191,905 | 191,687 |

| British Airways 2018-1 Class A Pass Through Trust (C) | 4.125 | 09-20-31 | | 8,784,231 | 7,011,330 |

| Continental Airlines 2007-1 Class A Pass Through Trust | 5.983 | 04-19-22 | | 7,473,270 | 6,501,745 |

| Delta Air Lines 2002-1 Class G-1 Pass Through Trust | 6.718 | 01-02-23 | | 4,482,111 | 4,258,573 |

| Delta Air Lines, Inc. | 2.900 | 10-28-24 | | 33,754,000 | 27,364,844 |

| Delta Air Lines, Inc. | 3.800 | 04-19-23 | | 20,679,000 | 18,365,400 |

| Delta Air Lines, Inc. (A) | 4.375 | 04-19-28 | | 25,250,000 | 20,515,759 |

| JetBlue 2019-1 Class AA Pass Through Trust | 2.750 | 05-15-32 | | 18,434,457 | 16,712,669 |

| United Airlines 2014-2 Class A Pass Through Trust | 3.750 | 09-03-26 | | 22,402,174 | 19,603,141 |

| 26 | JOHN HANCOCK BOND FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Industrials (continued) | | | |

| Airlines (continued) | | | |

| United Airlines 2014-2 Class B Pass Through Trust | 4.625 | 09-03-22 | | 9,185,983 | $7,682,031 |

| United Airlines 2016-1 Class A Pass Through Trust | 3.450 | 07-07-28 | | 19,044,974 | 13,905,472 |

| United Airlines 2016-1 Class B Pass Through Trust | 3.650 | 01-07-26 | | 25,275,463 | 16,517,965 |

| United Airlines 2018-1 Class B Pass Through Trust | 4.600 | 03-01-26 | | 6,720,951 | 4,452,196 |

| United Airlines 2019-1 Class A Pass Through Trust | 4.550 | 08-25-31 | | 15,276,477 | 11,346,525 |

| US Airways 2010-1 Class A Pass Through Trust | 6.250 | 04-22-23 | | 3,898,493 | 3,177,272 |

| US Airways 2012-1 Class A Pass Through Trust | 5.900 | 10-01-24 | | 5,988,509 | 4,970,462 |

| Building products 0.4% | | | |

| Builders FirstSource, Inc. (C) | 5.000 | 03-01-30 | | 2,354,000 | 2,206,875 |

| Builders FirstSource, Inc. (C) | 6.750 | 06-01-27 | | 3,811,000 | 4,011,078 |

| Carrier Global Corp. (C) | 2.242 | 02-15-25 | | 27,457,000 | 27,499,144 |

| Carrier Global Corp. (C) | 2.493 | 02-15-27 | | 11,038,000 | 10,705,912 |

| Carrier Global Corp. (C) | 2.722 | 02-15-30 | | 11,008,000 | 10,495,845 |

| Owens Corning (A) | 3.950 | 08-15-29 | | 19,555,000 | 20,604,202 |

| Commercial services and supplies 0.3% | | | |

| APX Group, Inc. (A) | 7.625 | 09-01-23 | | 19,027,000 | 17,314,570 |

| Cimpress PLC (C) | 7.000 | 06-15-26 | | 6,781,000 | 6,543,665 |

| Clean Harbors, Inc. (C) | 4.875 | 07-15-27 | | 2,960,000 | 3,063,600 |

| Harsco Corp. (C) | 5.750 | 07-31-27 | | 5,035,000 | 4,927,704 |

| IAA, Inc. (C) | 5.500 | 06-15-27 | | 835,000 | 847,525 |

| LSC Communications, Inc. (C)(E) | 8.750 | 10-15-23 | | 19,591,000 | 1,371,370 |

| Prime Security Services Borrower LLC (C) | 6.250 | 01-15-28 | | 11,195,000 | 10,607,263 |

| Construction and engineering 0.2% | | | |

| AECOM | 5.125 | 03-15-27 | | 22,537,000 | 23,913,109 |

| Tutor Perini Corp. (A)(C) | 6.875 | 05-01-25 | | 3,182,000 | 2,800,160 |

| Industrial conglomerates 0.6% | | | |

| 3M Company | 3.250 | 02-14-24 | | 27,037,000 | 29,384,754 |

| DuPont de Nemours, Inc. | 2.169 | 05-01-23 | | 20,832,000 | 21,251,705 |

| General Electric Company | 4.350 | 05-01-50 | | 26,915,000 | 26,148,019 |

| General Electric Company | 5.550 | 01-05-26 | | 33,170,000 | 36,817,020 |

| Machinery 0.1% | | | |

| Clark Equipment Company (C) | 5.875 | 06-01-25 | | 2,336,000 | 2,409,000 |

| Otis Worldwide Corp. (C) | 2.056 | 04-05-25 | | 21,531,000 | 22,215,670 |

| Professional services 0.2% | | | |

| IHS Markit, Ltd. (C) | 4.000 | 03-01-26 | | 18,580,000 | 19,850,872 |

| IHS Markit, Ltd. (C) | 4.750 | 02-15-25 | | 8,486,000 | 9,242,527 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK BOND FUND | 27 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Industrials (continued) | | | |

| Professional services (continued) | | | |

| IHS Markit, Ltd. | 4.750 | 08-01-28 | | 12,135,000 | $13,910,472 |

| Road and rail 0.2% | | | |

| Uber Technologies, Inc. (C) | 7.500 | 05-15-25 | | 15,524,000 | 15,407,570 |

| Uber Technologies, Inc. (C) | 7.500 | 09-15-27 | | 26,411,000 | 26,807,165 |

| Trading companies and distributors 0.7% | | | |

| AerCap Ireland Capital DAC | 2.875 | 08-14-24 | | 26,469,000 | 22,333,595 |

| Ahern Rentals, Inc. (C) | 7.375 | 05-15-23 | | 19,991,000 | 8,696,085 |

| Air Lease Corp. | 3.625 | 12-01-27 | | 10,511,000 | 9,319,610 |

| Aircastle, Ltd. | 5.500 | 02-15-22 | | 13,545,000 | 12,731,780 |

| Ashtead Capital, Inc. (C) | 4.250 | 11-01-29 | | 8,614,000 | 8,527,860 |

| Ashtead Capital, Inc. (C) | 4.375 | 08-15-27 | | 15,640,000 | 15,796,400 |

| Avolon Holdings Funding, Ltd. (C) | 5.125 | 10-01-23 | | 15,195,000 | 12,841,770 |

| H&E Equipment Services, Inc. | 5.625 | 09-01-25 | | 7,015,000 | 6,855,689 |

| United Rentals North America, Inc. (A) | 3.875 | 11-15-27 | | 11,931,000 | 11,960,828 |

| United Rentals North America, Inc. | 4.875 | 01-15-28 | | 22,117,000 | 22,787,145 |

| Information technology 6.1% | | | 1,109,007,493 |

| Communications equipment 0.6% | | | |

| CommScope, Inc. (A)(C) | 8.250 | 03-01-27 | | 22,177,000 | 23,119,523 |

| Motorola Solutions, Inc. | 4.600 | 02-23-28 | | 36,543,000 | 40,279,373 |

| Motorola Solutions, Inc. | 4.600 | 05-23-29 | | 6,509,000 | 7,266,755 |

| Telefonaktiebolaget LM Ericsson | 4.125 | 05-15-22 | | 29,836,000 | 31,104,030 |

| Electronic equipment, instruments and components 0.1% | | | |

| Tech Data Corp. | 3.700 | 02-15-22 | | 12,352,000 | 12,384,988 |

| IT services 0.4% | | | |

| PayPal Holdings, Inc. | 2.850 | 10-01-29 | | 35,754,000 | 38,560,364 |

| Tempo Acquisition LLC (C) | 6.750 | 06-01-25 | | 6,270,000 | 6,238,650 |

| VeriSign, Inc. | 4.750 | 07-15-27 | | 8,417,000 | 8,790,546 |

| VeriSign, Inc. | 5.250 | 04-01-25 | | 9,850,000 | 10,820,619 |

| Visa, Inc. | 2.700 | 04-15-40 | | 10,595,000 | 11,233,903 |

| Semiconductors and semiconductor equipment 3.4% | | | |

| Applied Materials, Inc. | 1.750 | 06-01-30 | | 12,819,000 | 12,809,206 |

| Applied Materials, Inc. | 2.750 | 06-01-50 | | 14,855,000 | 14,802,101 |

| Broadcom Corp. | 3.125 | 01-15-25 | | 15,770,000 | 16,302,761 |

| Broadcom Corp. | 3.875 | 01-15-27 | | 54,160,000 | 56,984,748 |