UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-00066

American Balanced Fund

(Exact Name of Registrant as Specified in Charter)

P.O. Box 7650, One Market, Steuart Tower

San Francisco, California 94120

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (415) 421-9360

Date of fiscal year end: December 31

Date of reporting period: December 31, 2012

Patrick F. Quan

American Balanced Fund

P.O. Box 7650, One Market, Steuart Tower

San Francisco, California 94120

(Name and Address of Agent for Service)

Copies to:

Michael Glazer

Bingham McCutchen LLP

355 South Grand Avenue, Suite 4400

Los Angeles, California 90071

(Counsel for the Registrant)

ITEM 1 – Reports to Stockholders

The right choice for the long term ®

American Balanced Fund®

Special feature

How balanced fund

investing works as a

key strategy in volatile

markets

See page 7

Annual report for the year ended December 31, 2012

American Balanced Fund seeks conservation of capital, current income and long-term growth of both capital and income by investing in common stocks and fixed-income securities. The fund invests primarily in blue chip equities and investment-grade fixed-income securities, using a balanced approach and a U.S. emphasis.

This fund is one of more than 40 offered by American Funds, which is one of the nation’s largest mutual fund families. For more than 80 years, Capital Research and Management Company,SM the American Funds adviser, has invested with a long-term focus based on thorough research and attention to risk.

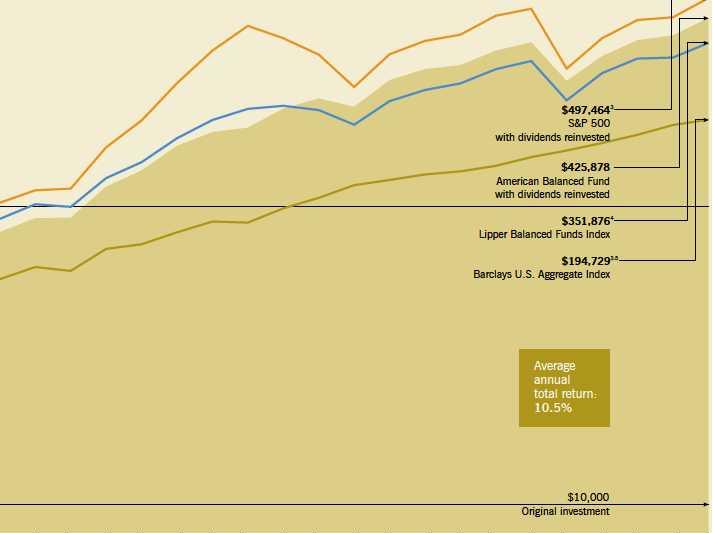

Fund results shown in this report, unless otherwise indicated, are for Class A shares at net asset value. If a sales charge (maximum 5.75%) had been deducted, the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value. For current information and month-end results, visit americanfunds.com.

See page 4 for Class A share results with relevant sales charges deducted. Results for other share classes can be found on page 30.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information.

The fund’s 30-day yield for Class A shares as of January 31, 2013, calculated in accordance with the U.S. Securities and Exchange Commission (SEC) formula, was 1.37%. The fund’s 12-month distribution rate for Class A shares as of that date was 1.69%. Both reflect the 5.75% maximum sales charge. The SEC yield reflects the rate at which the fund is earning income on its current portfolio of securities while the distribution rate reflects the fund’s past dividends paid to shareholders. Accordingly, the fund’s SEC yield and distribution rate may differ.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Refer to the fund prospectus and the Risk Factors section of this report for more information on these and other risks associated with investing in the fund.

| American Balanced Fund results* | | | | | | | | | |

| (yearly returns through December 31) | | | | | | | | | |

| | | Value of

principal | | Income

return | | Total

return† |

| 1975 (from July 26) | | | 2.4 | % | | | 3.2 | % | | | 5.6 | % |

| 1976 | | | 20.0 | | | | 6.0 | | | | 26.0 | |

| 1977 | | | –4.5 | | | | 5.2 | | | | 0.7 | |

| 1978 | | | 0.6 | | | | 5.6 | | | | 6.2 | |

| 1979 | | | 1.6 | | | | 6.0 | | | | 7.6 | |

| 1980 | | | 7.1 | | | | 7.3 | | | | 14.4 | |

| 1981 | | | –3.5 | | | | 7.9 | | | | 4.4 | |

| 1982 | | | 20.8 | | | | 8.6 | | | | 29.4 | |

| 1983 | | | 8.4 | | | | 7.7 | | | | 16.1 | |

| 1984 | | | 2.2 | | | | 7.2 | | | | 9.4 | |

| 1985 | | | 22.3 | | | | 6.8 | | | | 29.1 | |

| 1986 | | | 10.9 | | | | 6.0 | | | | 16.9 | |

| 1987 | | | –2.3 | | | | 6.3 | | | | 4.0 | |

| 1988 | | | 6.6 | | | | 6.3 | | | | 12.9 | |

| 1989 | | | 14.9 | | | | 6.6 | | | | 21.5 | |

| 1990 | | | –7.3 | | | | 5.7 | | | | –1.6 | |

| 1991 | | | 18.6 | | | | 6.1 | | | | 24.7 | |

| 1992 | | | 4.4 | | | | 5.1 | | | | 9.5 | |

| 1993 | | | 6.3 | | | | 5.0 | | | | 11.3 | |

| 1994 | | | –4.2 | | | | 4.5 | | | | 0.3 | |

| 1995 | | | 22.4 | | | | 4.7 | | | | 27.1 | |

| 1996 | | | 9.2 | | | | 4.0 | | | | 13.2 | |

| 1997 | | | 17.1 | | | | 3.9 | | | | 21.0 | |

| 1998 | | | 7.5 | | | | 3.6 | | | | 11.1 | |

| 1999 | | | –0.1 | | | | 3.6 | | | | 3.5 | |

| 2000 | | | 12.0 | | | | 3.9 | | | | 15.9 | |

| 2001 | | | 4.5 | | | | 3.7 | | | | 8.2 | |

| 2002 | | | –9.0 | | | | 2.7 | | | | –6.3 | |

| 2003 | | | 20.2 | | | | 2.6 | | | | 22.8 | |

| 2004 | | | 6.8 | | | | 2.1 | | | | 8.9 | |

| 2005 | | | 0.9 | | | | 2.2 | | | | 3.1 | |

| 2006 | | | 9.1 | | | | 2.7 | | | | 11.8 | |

| 2007 | | | 3.8 | | | | 2.8 | | | | 6.6 | |

| 2008 | | | –28.5 | | | | 2.8 | | | | –25.7 | |

| 2009 | | | 18.1 | | | | 3.0 | | | | 21.1 | |

| 2010 | | | 10.8 | | | | 2.2 | | | | 13.0 | |

| 2011 | | | 1.6 | | | | 2.2 | | | | 3.8 | |

| 2012 | | | 12.1 | | | | 2.1 | | | | 14.2 | |

| Average annual total return: | | | | | | | | | | | 10.7 | % |

| * | Capital Research and Management Company became the fund’s investment adviser on July 26, 1975. |

| † | Total return measures capital appreciation and income return, assuming reinvestment of dividends and capital gain distributions. |

Fellow investors:

U.S. equities generated solid gains in 2012, overcoming concerns about the rising debt of the federal government, a possible breakup of the euro zone and a slowdown of the Chinese economy. Equities, as measured by Standard & Poor’s 500 Composite Index, rose 16.0% for the 12 months ended December 31, 2012.

U.S. investment-grade fixed-income securities, as measured by Barclays U.S. Aggregate Index, gained 4.2%.

American Balanced Fund (AMBAL) gained 14.2%, exceeding the 11.9% return of the Lipper Balanced Funds Index, a measure of the fund’s peer group. The market indexes are unmanaged.

Over longer term periods, AMBAL has also outpaced its peers. For the three years ended December 31, 2012, the fund posted an average annual total return of 10.2%, exceeding the 8.1% return of the Lipper Balanced Funds Index. For the 10-year period, AMBAL had an average annual total return of 7.1%, compared with the 6.5% return of the Lipper index. Over the fund’s 37-year lifetime with Capital Research and Management Company, AMBAL had an average annual total return of 10.7%, compared with 10.0% for the Lipper Balanced Funds Index.

While the U.S. economy grew at a slow pace during 2012, the unemployment rate did decline modestly and in September fell below 8% for the first time in nearly four years. The long-awaited recovery in the housing market also appeared to take hold as home price increases took place in most major cities amid falling inventories. A confluence of positive factors should continue to drive house appreciation in 2013.

In September, the Federal Reserve announced it expected to keep interest rates at historically low levels until unemployment fell below 6.5% as long as inflation remained in check — the first time the central bank has explicitly tied interest rates to an economic milestone.

As a result of these factors and other potential positives such as rising auto sales and a significantly improving U.S. energy situation, we are cautiously optimistic that the rate of economic growth will accelerate in the U.S. in 2013.

In this report

| | Special feature |

| | |

| 7 | How balanced fund investing works as a key strategy in volatile markets |

| | |

| | Balanced funds offer investors the opportunity to balance the growth potential of equities with the income and stability of fixed-income securities. |

| | Contents |

| | |

| 2 | Letter to investors |

| | |

| 4 | The value of a long-term perspective |

| | |

| 12 | Summary investment portfolio |

| | |

| 17 | Financial statements |

| | |

| 35 | Board of trustees and other officers |

Financial companies had strong returns. Improved earnings and subsiding worries about the European financial system helped the share prices of a number of the fund’s significant financial investments — Wells Fargo (+24.0%), American Express (+21.9%) and Goldman Sachs (+41.1%).

Consumer discretionary stocks in the portfolio, such as do-it-yourself retailer Home Depot (+47.1%), Internet retailer Amazon (+45.1%) and cable TV company Comcast (+57.7%) also made major contributions to the AMBAL portfolio.

Energy stocks detracted from results as the outlook for global growth was a concern. Royal Dutch Shell reported a negative return of 6.7%. Chevron, the fund’s second-largest holding, rose only 1.6%. However, we continue to have a positive outlook on these energy companies for the long term.

During the year, AMBAL’s bond investments made a solid contribution to the results of the fund and helped to significantly reduce its volatility.

The year 2012 marked the 80th anniversary of the fund and the 37th anniversary of American Balanced Fund’s management by Capital Research and Management Company. For our feature story on how the fund began and why it is never more important than in today’s challenging markets, see page 7. As for the future, we assure you that we will continue to take the prudent, research-driven approach to investing that has characterized the fund through its long history. We thank all of our new and long-time shareholders for their support.

Cordially,

Gregory D. Johnson

Vice Chairman of the Board and Principal Executive Officer

February 11, 2013

For current information about the fund, visit americanfunds.com.

History of American Balanced Fund

A historical view of the comparative total returns of stocks, bonds, the 60%/40% S&P/BC Index, the Lipper Balanced Funds Index and AMBAL.

Stocks, bonds and balance (July 26, 1975, to December 31, 2012)

| | | | | Lipper | American |

| Total | U.S. | U.S. | 60%/40% | Balanced | Balanced |

| returns (through December 31) | stocks | bonds | S&P/BC Index | Funds Index | Fund |

| | | | | | | | | | | | | | | | |

| 1975 (from July 26) | | 3.1 | % | | 5.6 | % | | 4.2 | % | | 3.4 | % | | 5.6 | % |

| 1976 | | 23.9 | | | 15.6 | | | 20.7 | | | 26.0 | | | 26.0 | |

| 1977 | | –7.2 | | | 3.0 | | | –3.1 | | | –0.7 | | | 0.7 | |

| 1978 | | 6.6 | | | 1.4 | | | 4.7 | | | 4.8 | | | 6.2 | |

| 1979 | | 18.6 | | | 1.9 | | | 11.8 | | | 14.7 | | | 7.6 | |

| 1980 | | 32.5 | | | 2.7 | | | 20.4 | | | 19.7 | | | 14.4 | |

| 1981 | | –4.9 | | | 6.2 | | | –0.5 | | | 1.9 | | | 4.4 | |

| 1982 | | 21.5 | | | 32.6 | | | 26.2 | | | 30.6 | | | 29.4 | |

| 1983 | | 22.6 | | | 8.4 | | | 16.8 | | | 17.4 | | | 16.1 | |

| 1984 | | 6.3 | | | 15.1 | | | 10.0 | | | 7.5 | | | 9.4 | |

| 1985 | | 31.7 | | | 22.1 | | | 27.9 | | | 29.8 | | | 29.1 | |

| 1986 | | 18.7 | | | 15.3 | | | 17.6 | | | 18.4 | | | 16.9 | |

| 1987 | | 5.3 | | | 2.8 | | | 5.6 | | | 4.1 | | | 4.0 | |

| 1988 | | 16.6 | | | 7.9 | | | 13.1 | | | 11.2 | | | 12.9 | |

| 1989 | | 31.6 | | | 14.5 | | | 24.7 | | | 19.7 | | | 21.5 | |

| 1990 | | –3.1 | | | 9.0 | | | 1.8 | | | 0.7 | | | –1.6 | |

| 1991 | | 30.4 | | | 16.0 | | | 24.7 | | | 25.8 | | | 24.7 | |

| 1992 | | 7.6 | | | 7.4 | | | 7.6 | | | 7.5 | | | 9.5 | |

| 1993 | | 10.1 | | | 9.7 | | | 10.0 | | | 12.0 | | | 11.3 | |

| 1994 | | 1.3 | | | –2.9 | | | –0.3 | | | –2.0 | | | 0.3 | |

| 1995 | | 37.5 | | | 18.5 | | | 29.6 | | | 24.9 | | | 27.1 | |

| 1996 | | 22.9 | | | 3.6 | | | 15.0 | | | 13.1 | | | 13.2 | |

| 1997 | | 33.4 | | | 9.7 | | | 23.6 | | | 20.3 | | | 21.0 | |

| 1998 | | 28.6 | | | 8.7 | | | 21.0 | | | 15.1 | | | 11.1 | |

| 1999 | | 21.0 | | | –0.8 | | | 12.0 | | | 9.0 | | | 3.5 | |

| 2000 | | –9.1 | | | 11.6 | | | –1.0 | | | 2.4 | | | 15.9 | |

| 2001 | | –11.9 | | | 8.4 | | | –3.7 | | | –3.2 | | | 8.2 | |

| 2002 | | –22.1 | | | 10.3 | | | –9.8 | | | –10.7 | | | –6.3 | |

| 2003 | | 28.7 | | | 4.1 | | | 18.5 | | | 19.9 | | | 22.8 | |

| 2004 | | 10.9 | | | 4.3 | | | 8.3 | | | 9.0 | | | 8.9 | |

| 2005 | | 4.9 | | | 2.4 | | | 4.0 | | | 5.2 | | | 3.1 | |

| 2006 | | 15.8 | | | 4.3 | | | 11.1 | | | 11.6 | | | 11.8 | |

| 2007 | | 5.5 | | | 7.0 | | | 6.2 | | | 6.5 | | | 6.6 | |

| 2008 | | –37.0 | | | 5.2 | | | –22.1 | | | –26.2 | | | –25.7 | |

| 2009 | | 26.5 | | | 5.9 | | | 18.4 | | | 23.4 | | | 21.1 | |

| 2010 | | 15.1 | | | 6.5 | | | 12.1 | | | 11.9 | | | 13.0 | |

| 2011 | | 2.1 | | | 7.8 | | | 4.7 | | | 0.7 | | | 3.8 | |

| 2012 | | 16.0 | | | 4.2 | | | 11.3 | | | 11.9 | | | 14.2 | |

| Average annual total returns | | 11.0 | % | | 8.3 | % | | 10.2 | % | | 10.0 | % | | 10.7 | % |

| Volatility | | 15.2 | | | 5.6 | | | 9.9 | | | 10.3 | | | 9.8 | |

Figures assume reinvestment of all distributions.

Sources: Stocks — S&P 500; Bonds — Barclays U.S. Aggregate Index. Barclays U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. For the period July 31, 1975, to December 31, 1975, Barclays Government/Credit Bond Index was used.

The 60%/40% S&P/BC Index blends the S&P 500 with the Barclays U.S. Aggregate Index by weighting their total returns at 60% and 40%, respectively. The portfolio is rebalanced monthly.

The market indexes are unmanaged and, therefore, have no expenses.

The Lipper Balanced Funds Index is an equally weighted index of the 30 largest U.S. balanced funds.

Capital Research and Management Company became the fund’s investment adviser on July 26, 1975.

Volatility is calculated using annualized standard deviation (based on monthly returns), a measure of how returns over time have varied from the mean; a lower number signifies lower volatility.

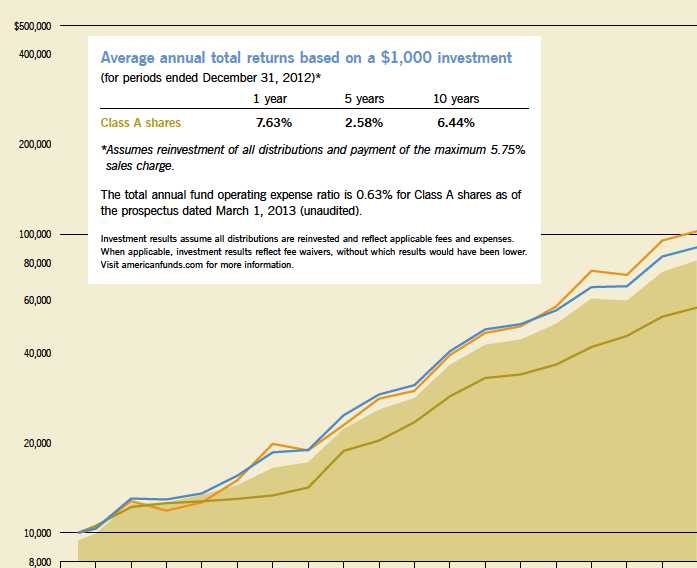

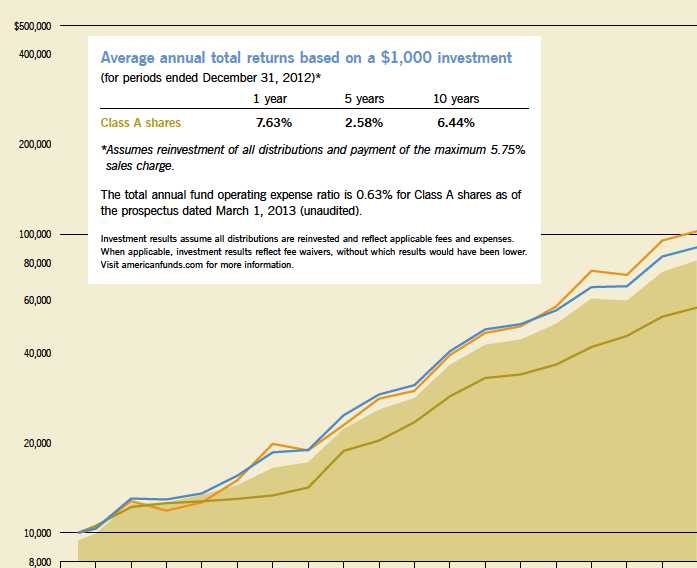

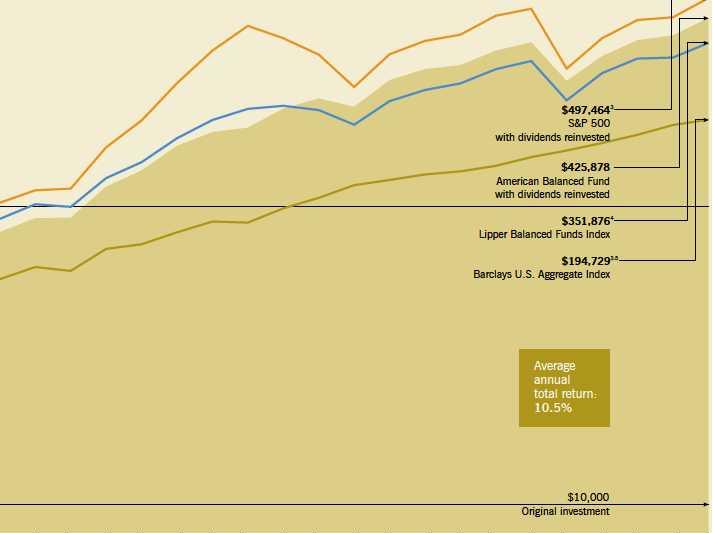

The value of a long-term perspective

How a $10,000 investment has grown

Fund results shown are for Class A shares and reflect deduction of the maximum sales charge of 5.75% on the $10,000 investment.1 Thus, the net amount invested was $9,425.2 Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com.

| Year ended Dec. 31 | | 19756 | | | 1976 | | 1977 | | 1978 | | 1979 | | 1980 | | 1981 | | 1982 | | 1983 | | 1984 | | 1985 | | 1986 | | 1987 | | 1988 | | 1989 | | 1990 | | 1991 | | 1992 |

| Total value (dollars in thousands) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends reinvested | | $ | .3 | | | | .6 | | | .7 | | | .7 | | | .8 | | | 1.1 | | | 1.3 | | | 1.5 | | | 1.7 | | | 1.9 | | | 1.9 | | | 2.2 | | | 2.7 | | | 2.8 | | | 3.3 | | | 3.5 | | | 3.7 | | | 3.8 |

| Value at year-end | | $ | 9.9 | | | | 12.5 | | | 12.6 | | | 13.4 | | | 14.4 | | | 16.5 | | | 17.2 | | | 22.3 | | | 25.9 | | | 28.3 | | | 36.5 | | | 42.7 | | | 44.4 | | | 50.1 | | | 60.9 | | | 60.0 | | | 74.8 | | | 81.9 |

| AMBAL total return | | | (0.5 | )% | | | 26.0 | | | 0.7 | | | 6.2 | | | 7.6 | | | 14.4 | | | 4.4 | | | 29.4 | | | 16.1 | | | 9.4 | | | 29.1 | | | 16.9 | | | 4.0 | | | 12.9 | | | 21.5 | | | (1.6 | ) | | 24.7 | | | 9.5 |

| 1 | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $25,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| 2 | The maximum initial sales charge was 8.5% prior to July 1, 1988. |

| 3 | The market indexes are unmanaged and, therefore, have no expenses. |

| 4 | Results of the Lipper Balanced Funds Index do not reflect any sales charges. |

This chart shows how a hypothetical $10,000 investment in American Balanced Fund grew from July 26, 1975 — when Capital Research and Management Company became the fund’s investment adviser — to December 31, 2012.

As you can see, the investment grew to $425,878 with all distributions reinvested. The fund’s year-by-year results appear under the chart. You can use this table to estimate how the value of your own holdings has grown.

| 1993 | | | 1994 | | | 1995 | | | 1996 | | | 1997 | | | 1998 | | | 1999 | | | 2000 | | | 2001 | | | 2002 | | | | 2003 | | | 2004 | | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | | 2009 | | | 2010 | | | 2011 | | | 2012 | |

| 4.1 | | | 4.1 | | | 4.3 | | | 4.7 | | | 5.2 | | | 5.8 | | | 6.4 | | | 7.2 | | | 7.8 | | | 6.3 | | | | 5.6 | | | 5.5 | | | 6.4 | | | 7.9 | | | 9.2 | | | 10.1 | | | | 7.9 | | | 7.1 | | | 8.1 | | | 7.8 | |

| 91.1 | | | 91.4 | | | 116.2 | | | 131.5 | | | 159.1 | | | 176.8 | | | 183.0 | | | 212.0 | | | 229.3 | | | 215.0 | | | | 264.0 | | | 287.6 | | | 296.5 | | | 331.6 | | | 353.4 | | | 262.5 | | | | 317.8 | | | 359.2 | | | 372.9 | | | 425.9 | |

| 11.3 | | | 0.3 | | | 27.1 | | | 13.2 | | | 21.0 | | | 11.1 | | | 3.5 | | | 15.9 | | | 8.2 | | | (6.3 | ) | | | 22.8 | | | 8.9 | | | 3.1 | | | 11.8 | | | 6.6 | | | (25.7 | ) | | | 21.1 | | | 13.0 | | | 3.8 | | | 14.2 | |

| 5 | Barclays U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. For the period July 31, 1975, to December 31, 1975, Barclays Government/Credit Bond Index was used. |

| 6 | For the period July 26, 1975 (when Capital Research and Management Company became the fund’s investment adviser) through December 31, 1975. |

| | |

| The results shown are before taxes on fund distributions and sale of fund shares. |

How balanced fund investing works as a key strategy in volatile markets

In these days of uncertain markets and cautious investors, it’s worth looking at why American Balanced Fund (AMBAL) was founded, how it operates today and how investors can benefit from balanced investing.

The basic concept of a balanced fund is to provide the investor with a diversified portfolio of equities and fixed-income securities. If executed properly, this investment strategy combines the long-term growth potential of equities with the income and stability of fixed-income securities. “American Balanced Fund has proven over time to be an investment vehicle for all seasons,” says Greg Johnson, vice chairman of the fund.

How balanced funds were born

The balanced fund concept dates back to 1928, a year before the great stock market crash. At the time, the idea of adding fixed-income securities to an equity portfolio seemed unthinkable as equity returns were vastly superior to bonds.

However, it didn’t take long for investors to see the benefits of a balanced investment approach. The stock market crash of 1929 to 1932 wiped out 89% of stock market value, as measured by the Dow Jones Industrial Average excluding dividends. Diversified portfolios with some assets in fixed-income securities and cash fared better in those gloomy days than equities. In 1932, the Commonwealth Fund was established as a balanced fund.

During the early 1930s, even though equity returns suffered, fixed-income securities generally provided steady income. Funds that balanced equity holdings with bonds and cash proved to be less volatile and had higher total returns than funds holding only stocks. In 1975, Capital Research and Management Company, the investment adviser for the American Funds, purchased what was once the Commonwealth Fund, then owned by American Express. It was renamed American Balanced Fund.

A closer look at AMBAL’s overall investment strategy

“AMBAL has three goals: conservation of capital, current income and long-term growth of capital,” says portfolio counselor Jeff Lager, who has 18 years of investment experience. “Many investors want to own a diversified mix of stocks and bonds but may not know how to allocate their investment dollars. For these investors, as well as others, AMBAL can be a good choice.”

The fund’s portfolio counselors manage an asset mix with a defined range of 50% to 75% in equities. The remainder is

invested in investment-grade bonds and cash. “The percentage will vary based on our judgment of the relative attractiveness of equities, bonds and cash,” Greg says. “We generally invest in attractively valued stocks of blue chip companies and in investment-grade bonds. The bond investments have played an important role in dampening the fund’s volatility and have provided a sizable amount of current income for AMBAL.”

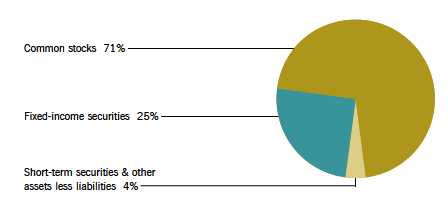

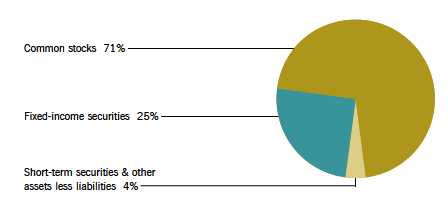

On December 31, 2012, the fund had an investment mix of 71% in equities, 25% in high-quality bonds and 4% in short-term securities including cash.

AMBAL’s equity investment strategy

The fund has six portfolio counselors who invest in equities. They pay close attention to a company’s underlying fundamentals but also give consideration to a stock’s valuation. “We are trying to deliver the highest possible return with a low to moderate level of risk,” explains Alan Berro, a veteran portfolio counselor with 27 years of investment experience.

“I like to invest in well-established companies when they become available at attractive prices.” Alan’s major holdings include do-it-yourself retailer Home Depot and Comcast, a broadcast and cable TV company.

Portfolio counselor Gene Stein, with 41 years of investment experience, describes himself as a value investor. Gene says he likes to invest in companies that have strategies that offer good growth potential for internally generated earnings at a reasonable valuation. One example is the fund’s investment in automobile components maker Johnson Controls. Gene says he avoids companies that depend on outside developments — such as acquisitions — for improved profits.

Greg, who is also a portfolio counselor, has 19 years of investment experience. He says he is a growth-oriented investor who likes to invest in large-capitalization companies that have solid balance sheets and cash flow and are well-positioned competitively. “I pay a lot of attention to the quality of their management teams and how they allocate their capital,” he says. Greg began at Capital as an investment analyst who covered retail companies and restaurant chains.

The fund’s research portfolio is another asset that few, if any, competitors have. While the portfolio counselors each manage a share of the fund’s portfolio, another share is designated for a group of 21 investment analysts, who cover specific industries ranging from information technology to energy.

“The investment analysts play a key role in helping to construct and closely monitor the fund’s balanced and diversified portfolio,” says investment analyst Rich Wolf, coordinator of the group. “They are an essential part of the fund’s strategy since they study individual industries and companies in depth. The investment analysts add diversity and balance to the portfolio.”

“AMBAL has three goals: conservation of capital, current income and long-term growth of capital.”

Jeff Lager

How the fund is managed

American Balanced Fund’s eight portfolio counselors have a median 29 years of investment experience.* The knowledge and wisdom they have accumulated over the years have helped them manage your fund through many stock market cycles.

| | | | |

| Eugene P. Stein | James R. Mulally | Dina N. Perry | John H. Smet |

| 41 years | 37 years | 35 years | 31 years |

| | | | |

| Alan N. Berro | Hilda L. Applbaum | Greg D. Johnson | Jeffrey T. Lager |

| 27 years | 26 years | 19 years | 18 years |

*Years of experience as of December 31, 2012.

Rich Wolf

The investment analyst’s role

The portfolio counselors invest broadly in several industries and tap the knowledge of the investment analyst when making an investment decision in a company. “Investment analysts are the field researchers who visit companies in person and meet with company executives and employees, suppliers, customers and competitors,” says Rich Wolf, coordinator of the group.

Fund results shown are for Class A shares at net asset value. If a sales charge (maximum 5.75%) had been deducted, the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com.

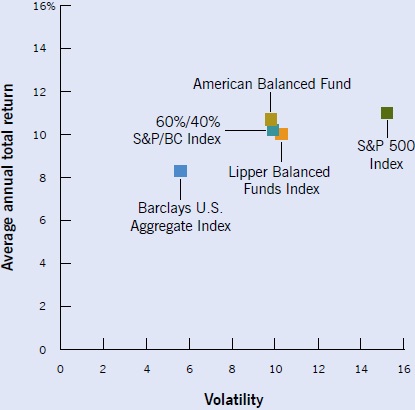

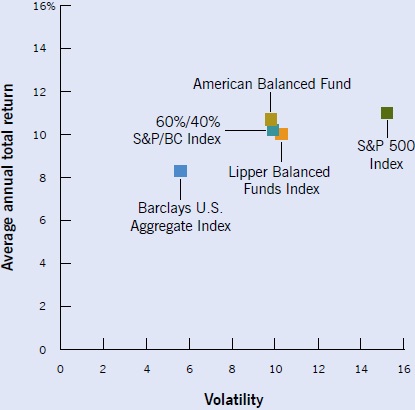

Above-average returns with less volatility

The chart below recaps AMBAL’s history since 1975 under CRMC’s management. As you can see, the fund has had a slightly higher average annual total return than both the 60%/40% S&P/BC Index and the Lipper Balanced Funds Index with lower volatility. Further, its annualized return was within 0.3% of the S&P 500 with only about two-thirds of the market’s volatility. The detail of all these data points may be found on page 3.

For the period July 26, 1975, to December 31, 2012

Sources: Stocks — S&P 500; Bonds — Barclays U.S. Aggregate Index. Barclays U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. For the period July 31, 1975, to December 31, 1975, Barclays Government/Credit Bond Index was used.

The market indexes are unmanaged and, therefore, have no expenses.

The Lipper Balanced Funds Index is an equally weighted index of the 30 largest U.S. balanced funds.

Capital Research and Management Company became the fund’s investment adviser on July 26, 1975.

Volatility is calculated using annualized standard deviation (based on monthly returns), a measure of how returns over time have varied from the mean; a lower number signifies lower volatility.

“AMBAL’s fixed-income investments are designed to act as an anchor to protect against volatile equity markets.”

John Smet

AMBAL’s fixed-income strategy

Two of AMBAL’s eight portfolio counselors invest in fixed-income securities.

“AMBAL’s fixed-income investments are designed to act as an anchor to protect against volatile equity markets,” says John Smet, veteran fixed-income portfolio counselor with 31 years of experience. “We never invest in high-yield bonds because they can behave like equities during bad economic times and periods of credit distress like we had in 2008. We also want to provide a certain amount of income because some investors live on the dividends that they are paid from the fund. We invest in government bonds, federal agency bonds, high-quality mortgage- and asset-backed bonds, and corporate bonds. We are providing our shareholders an opportunity to participate in fixed income in a diversified and convenient manner.”

How has an investment in AMBAL worked out for American Funds investors?

The balanced approach has worked well for AMBAL’s long-term investors. Since 1975, the fund has experienced a decline in value during only three calendar years of the 37 under American Funds management. In comparison, U.S. equities, as measured by Standard & Poor’s 500 Composite Index, lost money during seven years. (See table on page 3.) AMBAL’s average annual total return over that 37-year period was within 0.3% of the S&P 500 return with only about two-thirds of the stock market’s volatility, as defined by sharp fluctuations in price. (See chart on page 10.) Over the 37-year period, the fund produced a return of 10.7% compared with 10.0% for the Lipper Balanced Funds Index.

In addition, the fund produced a better return than the S&P 500 during all of the eight major equity market declines since 1975. (Major declines are defined as price declines of 15% or more, without dividends reinvested, in the unmanaged S&P 500.)

AMBAL has also fared well against its competition — equities, fixed-income securities and other balanced funds — over the last 10 years, which included one of the worst equity markets since the 1930s. AMBAL compiled an average annual total return of 7.08%, just about even with the 7.10% return of U.S. equities, as represented by the S&P 500. Investment-grade fixed-income securities returned 5.2%, and the Lipper Balanced Funds Index had a 6.5% return.

Since the inception of balanced funds in the 1920s, their approach to investing has stood the test of time. They offer investors the opportunity to balance the growth potential of equities with the income and stability of fixed-income securities. They also provide broad diversification and, therefore, have tended to be less volatile than other equity-focused mutual funds. “American Balanced Fund strives to take you where you want to go from an investing perspective without having to experience a roller-coaster ride,” says Greg. ¾

Summary investment portfolio December 31, 2012

The following summary investment portfolio is designed to streamline the report and help investors better focus on the fund’s principal holdings. See the inside back cover for details on how to obtain a complete schedule of portfolio holdings.

Investment mix by security type (percent of net assets)

| Common stocks — 70.57% | | Shares | | | Value (000) | | | Percent of

net assets | |

| Financials — 13.28% | | | | | | | | | | | | |

| Wells Fargo & Co. | | | 43,272,500 | | | $ | 1,479,054 | | | | 2.65 | % |

| Berkshire Hathaway Inc., Class A1 | | | 8,777 | | | | 1,176,645 | | | | 2.11 | |

| American Express Co. | | | 16,224,000 | | | | 932,556 | | | | 1.67 | |

| Goldman Sachs Group, Inc. | | | 6,686,700 | | | | 852,955 | | | | 1.53 | |

| ACE Ltd. | | | 5,150,000 | | | | 410,970 | | | | .73 | |

| Citigroup Inc. | | | 9,500,000 | | | | 375,820 | | | | .67 | |

| JPMorgan Chase & Co. | | | 8,295,215 | | | | 364,741 | | | | .65 | |

| Weyerhaeuser Co. | | | 12,315,242 | | | | 342,610 | | | | .61 | |

| Other securities | | | | | | | 1,486,469 | | | | 2.66 | |

| | | | | | | | 7,421,820 | | | | 13.28 | |

| | | | | | | | | | | | | |

| Consumer discretionary — 9.54% | | | | | | | | | | | | |

| Home Depot, Inc. | | | 28,925,000 | | | | 1,789,011 | | | | 3.20 | |

| Amazon.com, Inc.1 | | | 4,278,000 | | | | 1,074,377 | | | | 1.92 | |

| Comcast Corp., Class A | | | 20,310,000 | | | | 759,188 | | | | 1.36 | |

| Other securities | | | | | | | 1,710,490 | | | | 3.06 | |

| | | | | | | | 5,333,066 | | | | 9.54 | |

| | | | | | | | | | | | | |

| Industrials — 9.43% | | | | | | | | | | | | |

| Boeing Co. | | | 15,425,000 | | | | 1,162,428 | | | | 2.08 | |

| Union Pacific Corp. | | | 7,793,187 | | | | 979,759 | | | | 1.75 | |

| Lockheed Martin Corp. | | | 6,913,956 | | | | 638,089 | | | | 1.14 | |

| General Electric Co. | | | 26,600,000 | | | | 558,334 | | | | 1.00 | |

| Deere & Co. | | | 5,640,000 | | | | 487,409 | | | | .87 | |

| Parker-Hannifin Corp. | | | 4,100,000 | | | | 348,746 | | | | .63 | |

| Cummins Inc. | | | 2,695,000 | | | | 292,003 | | | | .52 | |

| Other securities | | | | | | | 800,977 | | | | 1.44 | |

| | | | | | | | 5,267,745 | | | | 9.43 | |

| Common stocks | | Shares | | | Value (000) | | | Percent of

net assets | |

| Information technology — 8.12% | | | | | | | | | | | | |

| Texas Instruments Inc. | | | 24,760,000 | | | $ | 766,074 | | | | 1.37 | % |

| Taiwan Semiconductor Manufacturing Co. Ltd. (ADR) | | | 44,400,000 | | | | 761,904 | | | | 1.36 | |

| Oracle Corp. | | | 20,542,591 | | | | 684,479 | | | | 1.23 | |

| Microsoft Corp. | | | 24,280,000 | | | | 649,004 | | | | 1.16 | |

| TE Connectivity Ltd. | | | 8,880,000 | | | | 329,626 | | | | .59 | |

| Google Inc., Class A1 | | | 440,000 | | | | 312,123 | | | | .56 | |

| Other securities | | | | | | | 1,032,505 | | | | 1.85 | |

| | | | | | | | 4,535,715 | | | | 8.12 | |

| | | | | | | | | | | | | |

| Health care — 7.37% | | | | | | | | | | | | |

| Merck & Co., Inc. | | | 23,174,575 | | | | 948,767 | | | | 1.70 | |

| Bristol-Myers Squibb Co. | | | 16,830,000 | | | | 548,490 | | | | .98 | |

| Gilead Sciences, Inc.1 | | | 7,100,000 | | | | 521,495 | | | | .93 | |

| UnitedHealth Group Inc. | | | 9,295,000 | | | | 504,161 | | | | .90 | |

| Baxter International Inc. | | | 6,225,000 | | | | 414,959 | | | | .74 | |

| Pfizer Inc | | | 12,750,000 | | | | 319,770 | | | | .57 | |

| Johnson & Johnson | | | 4,100,000 | | | | 287,410 | | | | .52 | |

| Other securities | | | | | | | 573,305 | | | | 1.03 | |

| | | | | | | | 4,118,357 | | | | 7.37 | |

| | | | | | | | | | | | | |

| Energy — 7.32% | | | | | | | | | | | | |

| Chevron Corp. | | | 13,937,000 | | | | 1,507,147 | | | | 2.70 | |

| Royal Dutch Shell PLC, Class B (ADR) | | | 15,504,700 | | | | 1,099,128 | | | | 1.97 | |

| Other securities | | | | | | | 1,483,445 | | | | 2.65 | |

| | | | | | | | 4,089,720 | | | | 7.32 | |

| | | | | | | | | | | | | |

| Consumer staples — 5.35% | | | | | | | | | | | | |

| Costco Wholesale Corp. | | | 6,337,326 | | | | 625,938 | | | | 1.12 | |

| Nestlé SA2 | | | 7,970,000 | | | | 519,437 | | | | | |

| Nestlé SA (ADR) | | | 1,500,000 | | | | 97,755 | | | | 1.11 | |

| Procter & Gamble Co. | | | 8,230,000 | | | | 558,735 | | | | 1.00 | |

| Philip Morris International Inc. | | | 5,920,000 | | | | 495,149 | | | | .89 | |

| PepsiCo, Inc. | | | 4,770,000 | | | | 326,411 | | | | .58 | |

| Other securities | | | | | | | 364,504 | | | | .65 | |

| | | | | | | | 2,987,929 | | | | 5.35 | |

| | | | | | | | | | | | | |

| Materials — 3.64% | | | | | | | | | | | | |

| Potash Corp. of Saskatchewan Inc. | | | 13,671,860 | | | | 556,308 | | | | 1.00 | |

| E.I. du Pont de Nemours and Co. | | | 6,750,000 | | | | 303,547 | | | | .54 | |

| Dow Chemical Co. | | | 9,330,000 | | | | 301,546 | | | | .54 | |

| Other securities | | | | | | | 870,993 | | | | 1.56 | |

| | | | | | | | 2,032,394 | | | | 3.64 | |

| | | | | | | | | | | | | |

| Utilities — 1.87% | | | | | | | | | | | | |

| PG&E Corp. | | | 7,660,000 | | | | 307,779 | | | | .55 | |

| Other securities | | | | | | | 735,754 | | | | 1.32 | |

| | | | | | | | 1,043,533 | | | | 1.87 | |

| Common stocks | | Value (000) | | | Percent of

net assets | |

| Telecommunication services — 0.67% | | | | | | |

| Other securities | | $ | 376,567 | | | | .67 | % |

| | | | | | | | | |

| Miscellaneous — 3.98% | | | | | | | | |

| Other common stocks in initial period of acquisition | | | 2,226,408 | | | | 3.98 | |

| Total common stocks (cost: $28,786,758,000) | | | 39,433,254 | | | | 70.57 | |

| Bonds & notes — 25.47% | | Principal amount

(000) | | | | | | | |

| Corporate bonds & notes — 9.21% | | | | | | | | | | | | |

| Financials — 2.63% | | | | | | | | | | | | |

| Murray Street Investment Trust I 4.647% 2017 | | $ | 20,000 | | | | 21,647 | | | | | |

| Goldman Sachs Group, Inc. 3.625%–5.75% 2016–2022 | | | 86,650 | | | | 95,885 | | | | .21 | |

| Wells Fargo & Co. 3.676%–4.60% 2016–2021 | | | 44,000 | | | | 49,330 | | | | .09 | |

| American Express Co. 6.15% 2017 | | | 22,800 | | | | 27,493 | | | | .05 | |

| Berkshire Hathaway Inc. 2.20% 2016 | | | 23,000 | | | | 24,012 | | | | .04 | |

| Other securities | | | | | | | 1,253,336 | | | | 2.24 | |

| | | | | | | | 1,471,703 | | | | 2.63 | |

| | | | | | | | | | | | | |

| Health care — 1.03% | | | | | | | | | | | | |

| UnitedHealth Group Inc. 6.00% 2017–2018 | | | 57,170 | | | | 69,243 | | | | .13 | |

| Merck & Co., Inc. 2.40% 2022 | | | 18,000 | | | | 18,023 | | | | .03 | |

| Other securities | | | | | | | 487,287 | | | | .87 | |

| | | | | | | | 574,553 | | | | 1.03 | |

| | | | | | | | | | | | | |

| Industrials — 0.97% | | | | | | | | | | | | |

| General Electric Capital Corp. 0.981%–6.00% 2014–20223 | | | 179,105 | | | | 185,456 | | | | | |

| General Electric Co. 0.85%–4.125% 2015–2042 | | | 39,500 | | | | 40,175 | | | | .40 | |

| Union Pacific Corp. 5.70%–5.75% 2017–2018 | | | 33,475 | | | | 40,596 | | | | .07 | |

| Other securities | | | | | | | 276,295 | | | | .50 | |

| | | | | | | | 542,522 | | | | .97 | |

| | | | | | | | | | | | | |

| Consumer staples — 0.95% | | | | | | | | | | | | |

| Procter & Gamble Co. 1.45% 2016 | | | 13,460 | | | | 13,723 | | | | .03 | |

| Other securities | | | | | | | 514,624 | | | | .92 | |

| | | | | | | | 528,347 | | | | .95 | |

| | | | | | | | | | | | | |

| Energy — 0.93% | | | | | | | | | | | | |

| Shell International Finance BV 1.125%–1.875% 2013–2017 | | | 37,500 | | | | 37,675 | | | | .07 | |

| Other securities | | | | | | | 483,090 | | | | .86 | |

| | | | | | | | 520,765 | | | | .93 | |

| | | | | | | | | | | | | |

| Consumer discretionary — 0.84% | | | | | | | | | | | | |

| Comcast Corp. 5.30%–6.95% 2014–2037 | | | 71,000 | | | | 88,480 | | | | .16 | |

| Home Depot, Inc. 4.40%–5.95% 2021–2041 | | | 30,000 | | | | 37,978 | | | | .07 | |

| Other securities | | | | | | | 340,619 | | | | .61 | |

| | | | | | | | 467,077 | | | | .84 | |

| | | Principal amount | | | Value | | | Percent of | |

| | | (000) | | | (000) | | | net assets | |

| Information technology — 0.20% | | | | | | | | | | | | |

| Microsoft Corp. 0.875% 2017 | | $ | 15,000 | | | $ | 14,933 | | | | .03 | % |

| Oracle Corp. 1.20% 2017 | | | 13,420 | | | | 13,470 | | | | .02 | |

| Other securities | | | | | | | 82,610 | | | | .15 | |

| | | | | | | | 111,013 | | | | .20 | |

| | | | | | | | | | | | | |

| Other corporate bonds & notes — 1.66% | | | | | | | | | | | | |

| Other securities | | | | | | | 926,723 | | | | 1.66 | |

| Total corporate bonds & notes | | | | | | | 5,142,703 | | | | 9.21 | |

U.S. Treasury bonds & notes — 7.99%

| U.S. Treasury — 6.79% | | | | | | | | | | | | |

| 2.75% 2013 | | | 291,500 | | | | 297,694 | | | | | |

| 1.125% 2019 | | | 428,500 | | | | 430,780 | | | | | |

| 1.625% 2022 | | | 337,750 | | | | 333,697 | | | | 6.79 | |

| 6.25% 2023 | | | 295,500 | | | | 423,280 | | | | | |

| 1.125%–6.375% 2013–2041 | | | 2,029,787 | | | | 2,311,978 | | | | | |

| | | | | | | | 3,797,429 | | | | 6.79 | |

| U.S. Treasury inflation-protected securities4 — 1.20% | | | | | | | | | | | | |

| 0.125%–2.375% 2013–2042 | | | 597,607 | | | | 668,916 | | | | 1.20 | |

| Total U.S. Treasury bonds & notes | | | | | | | 4,466,345 | | | | 7.99 | |

| | | | | | | | | | | | | |

| Mortgage-backed obligations5 — 7.62% | | | | | | | | | | | | |

| Fannie Mae 0%–11.187% 2018–20473 | | | 2,768,025 | | | | 2,963,531 | | | | 5.30 | |

| Freddie Mac 0%–6.801% 2019–20413 | | | 423,169 | | | | 449,993 | | | | .81 | |

| Other securities | | | | | | | 845,531 | | | | 1.51 | |

| | | | | | | | 4,259,055 | | | | 7.62 | |

| | | | | | | | | | | | | |

| Federal agency bonds & notes — 0.33% | | | | | | | | | | | | |

| Freddie Mac 0.75%–2.50% 2016–2018 | | | 147,000 | | | | 152,199 | | | | .27 | |

| Fannie Mae 6.25% 2029 | | | 8,000 | | | | 11,478 | | | | .02 | |

| Other securities | | | | | | | 19,262 | | | | .04 | |

| | | | | | | | 182,939 | | | | .33 | |

| | | | | | | | | | | | | |

| Other — 0.29% | | | | | | | | | | | | |

| Other securities | | | | | | | 162,783 | | | | .29 | |

| | | | | | | | | | | | | |

| Miscellaneous — 0.03% | | | | | | | | | | | | |

| Other bonds & notes in initial period of acquisition | | | | | | | 14,825 | | | | .03 | |

| Total bonds & notes (cost: $13,368,118,000) | | | | | | | 14,228,650 | | | | 25.47 | |

| Short-term securities — 5.64% | | Principal amount

(000) | | | Value

(000) | | | Percent of

net assets | |

| Fannie Mae 0.12%–0.185% due 1/2–7/1/2013 | | $ | 1,044,000 | | | $ | 1,043,869 | | | | 1.87 | % |

| Federal Home Loan Bank 0.115%–0.165% due 1/9–6/19/2013 | | | 594,300 | | | | 594,215 | | | | 1.06 | |

| U.S. Treasury Bills 0.109%–0.171% due 1/10–11/14/2013 | | | 562,600 | | | | 562,300 | | | | 1.01 | |

| Freddie Mac 0.11%–0.18% due 1/7–8/13/2013 | | | 482,753 | | | | 482,660 | | | | .86 | |

| Variable Funding Capital Company LLC 0.18% due 1/14/20136 | | | 27,000 | | | | 26,998 | | | | .05 | |

| Other securities | | | | | | | 440,239 | | | | .79 | |

| | | | | | | | | | | | | |

| Total short-term securities (cost: $3,149,801,000) | | | | | | | 3,150,281 | | | | 5.64 | |

| | | | | | | | | | | | | |

| Total investment securities (cost: $45,304,677,000) | | | | | | | 56,812,185 | | | | 101.68 | |

| Other assets less liabilities | | | | | | | (938,405 | ) | | | (1.68 | ) |

| | | | | | | | | | | | | |

| Net assets | | | | | | $ | 55,873,780 | | | | 100.00 | % |

As permitted by U.S. Securities and Exchange Commission regulations, “Miscellaneous” securities include holdings in their first year of acquisition that have not previously been publicly disclosed.

“Other securities” includes all issues that are not disclosed separately in the summary investment portfolio.

The following footnotes apply to either the individual securities noted or one or more of the securities aggregated and listed as a single line item.

| 1 | Security did not produce income during the last 12 months. |

| 2 | Valued under fair value procedures adopted by authority of the board of trustees. The total value of all such securities, including those in “Other securities,” was $910,898,000, which represented 1.63% of the net assets of the fund. This entire amount relates to certain securities trading outside the U.S. whose values were adjusted as a result of significant market movements following the close of local trading. |

| 3 | Coupon rate may change periodically. |

| 4 | Index-linked bond whose principal amount moves with a government price index. |

| 5 | Principal payments may be made periodically. Therefore, the effective maturity date may be earlier than the stated maturity date. |

| 6 | Acquired in a transaction exempt from registration under Rule 144A or section 4(2) of the Securities Act of 1933. May be resold in the U.S. in transactions exempt from registration, normally to qualified institutional buyers. The total value of all such securities, including those in “Other securities,” was $1,460,087,000, which represented 2.61% of the net assets of the fund. |

Key to abbreviation

ADR = American Depositary Receipts

See Notes to Financial Statements

Financial statements

Statement of assets and liabilities

at December 31, 2012 | | | (dollars in thousands) | |

| | | | | | | | | |

| Assets: | | | | | | | | |

| Investment securities, at value (cost: $45,304,677) | | | | | | $ | 56,812,185 | |

| Cash | | | | | | | 2,502 | |

| Receivables for: | | | | | | | | |

| Sales of investments | | $ | 545,498 | | | | | |

| Sales of fund’s shares | | | 138,939 | | | | | |

| Dividends and interest | | | 146,235 | | | | 830,672 | |

| | | | | | | | 57,645,359 | |

| Liabilities: | | | | | | | | |

| Payables for: | | | | | | | | |

| Purchases of investments | | | 1,546,060 | | | | | |

| Repurchases of fund’s shares | | | 187,359 | | | | | |

| Investment advisory services | | | 11,274 | | | | | |

| Services provided by related parties | | | 22,835 | | | | | |

| Trustees’ deferred compensation | | | 3,257 | | | | | |

| Other | | | 794 | | | | 1,771,579 | |

| Net assets at December 31, 2012 | | | | | | $ | 55,873,780 | |

| | | | | | | | | |

| Net assets consist of: | | | | | | | | |

| Capital paid in on shares of beneficial interest | | | | | | $ | 46,203,196 | |

| Undistributed net investment income | | | | | | | 79,783 | |

| Accumulated net realized loss | | | | | | | (1,916,745 | ) |

| Net unrealized appreciation | | | | | | | 11,507,546 | |

| Net assets at December 31, 2012 | | | | | | $ | 55,873,780 | |

| | | (dollars and shares in thousands, except per-share amounts) |

| | | |

| Shares of beneficial interest issued and outstanding (no stated par value) — | |

| unlimited shares authorized (2,741,071 total shares outstanding) | |

| | | | |

| | | | Net assets | | | | Shares

outstanding | | | | Net asset value

per share | |

| | | | | | | | | | | | | |

| Class A | | $ | 34,271,573 | | | | 1,679,893 | | | $ | 20.40 | |

| Class B | | | 1,123,057 | | | | 55,195 | | | | 20.35 | |

| Class C | | | 4,334,174 | | | | 213,416 | | | | 20.31 | |

| Class F-1 | | | 1,499,969 | | | | 73,550 | | | | 20.39 | |

| Class F-2 | | | 418,815 | | | | 20,536 | | | | 20.39 | |

| Class 529-A | | | 2,101,108 | | | | 103,120 | | | | 20.38 | |

| Class 529-B | | | 134,449 | | | | 6,595 | | | | 20.39 | |

| Class 529-C | | | 694,312 | | | | 34,090 | | | | 20.37 | |

| Class 529-E | | | 112,203 | | | | 5,509 | | | | 20.37 | |

| Class 529-F-1 | | | 81,845 | | | | 4,019 | | | | 20.36 | |

| Class R-1 | | | 120,923 | | | | 5,959 | | | | 20.29 | |

| Class R-2 | | | 1,157,599 | | | | 57,021 | | | | 20.30 | |

| Class R-3 | | | 2,617,530 | | | | 128,814 | | | | 20.32 | |

| Class R-4 | | | 3,005,761 | | | | 147,531 | | | | 20.37 | |

| Class R-5 | | | 2,049,911 | | | | 100,422 | | | | 20.41 | |

| Class R-6 | | | 2,150,551 | | | | 105,401 | | | | 20.40 | |

See Notes to Financial Statements

| Statement of operations | | | | | | | | |

| for the year ended December 31, 2012 | | | (dollars in thousands) | |

| | | | | | | | | |

| Investment income: | | | | | | | | |

| Income: | | | | | | | | |

| Dividends (net of non-U.S. taxes of $8,949) | | $ | 947,212 | | | | | |

| Interest | | | 429,060 | | | $ | 1,376,272 | |

| | | | | | | | | |

| Fees and expenses*: | | | | | | | | |

| Investment advisory services | | | 128,211 | | | | | |

| Distribution services | | | 182,494 | | | | | |

| Transfer agent services | | | 66,762 | | | | | |

| Administrative services | | | 12,803 | | | | | |

| Reports to shareholders | | | 2,135 | | | | | |

| Registration statement and prospectus | | | 876 | | | | | |

| Trustees’ compensation | | | 833 | | | | | |

| Auditing and legal | | | 128 | | | | | |

| Custodian | | | 454 | | | | | |

| Other | | | 3,154 | | | | 397,850 | |

| Net investment income | | | | | | | 978,422 | |

| | | | | | | | | |

| Net realized gain and unrealized appreciation on investments and currency: | | | | | | | | |

| Net realized gain on: | | | | | | | | |

| Investments | | | 2,100,942 | | | | | |

| Currency transactions | | | 970 | | | | 2,101,912 | |

| Net unrealized appreciation on: | | | | | | | | |

| Investments | | | 3,852,544 | | | | | |

| Currency translations | | | 122 | | | | 3,852,666 | |

| Net realized gain and unrealized appreciation on investments and currency | | | | | | | 5,954,578 | |

| Net increase in net assets resulting from operations | | | | | | $ | 6,933,000 | |

*Additional information related to class-specific fees and expenses is included in the Notes to Financial Statements.

| Statements of changes in net assets | | | | | | |

| | | (dollars in thousands) | |

| | | | |

| | | Year ended December 31 | |

| | | 2012 | | | 2011 | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 978,422 | | | $ | 923,374 | |

| Net realized gain on investments and currency transactions | | | 2,101,912 | | | | 1,067,689 | |

| Net unrealized appreciation (depreciation) on investments and currency translations | | | 3,852,666 | | | | (150,489 | ) |

| Net increase in net assets resulting from operations | | | 6,933,000 | | | | 1,840,574 | |

| | | | | | | | | |

| Dividends paid to shareholders from net investment income | | | (977,344 | ) | | | (1,032,748 | ) |

| | | | | | | | | |

| Net capital share transactions | | | 503,635 | | | | (1,924,854 | ) |

| | | | | | | | | |

| Total increase (decrease) in net assets | | | 6,459,291 | | | | (1,117,028 | ) |

| | | | | | | | | |

| Net assets: | | | | | | | | |

| Beginning of year | | | 49,414,489 | | | | 50,531,517 | |

| End of year (including undistributed net investment income: | | | | | | | | |

| $79,783 and $54,645, respectively) | | $ | 55,873,780 | | | $ | 49,414,489 | |

See Notes to Financial Statements

Notes to financial statements

1. Organization

American Balanced Fund (the “fund”) is registered under the Investment Company Act of 1940 as an open-end, diversified management investment company. The fund seeks conservation of capital, current income and long-term growth of both capital and income by investing in common stocks and fixed-income securities.

The fund has 16 share classes consisting of five retail share classes (Classes A, B and C, as well as two F share classes, F-1 and F-2), five 529 college savings plan share classes (Classes 529-A, 529-B, 529-C, 529-E and 529-F-1) and six retirement plan share classes (Classes R-1, R-2, R-3, R-4, R-5 and R-6). The 529 college savings plan share classes can be used to save for college education. The retirement plan share classes are generally offered only through eligible employer-sponsored retirement plans. The fund’s share classes are further described below:

| Share class | | Initial sales charge | | Contingent deferred sales

charge upon redemption | | Conversion feature |

| | | | | | | |

| Classes A and 529-A | | Up to 5.75% | | None (except 1% for certain redemptions

within one year of purchase without an

initial sales charge) | | None |

| Classes B and 529-B* | | None | | Declines from 5% to 0% for redemptions

within six years of purchase | | Classes B and 529-B convert to

Classes A and 529-A, respectively,

after eight years |

| Class C | | None | | 1% for redemptions

within one year of purchase | | Class C converts to Class F-1

after 10 years |

| Class 529-C | | None | | 1% for redemptions

within one year of purchase | | None |

| Class 529-E | | None | | None | | None |

| Classes F-1, F-2 and 529-F-1 | | None | | None | | None |

Classes R-1, R-2, R-3, R-4,

R-5 and R-6 | | None | | None | | None |

* Class B and 529-B shares of the fund are not available for purchase.

Holders of all share classes have equal pro rata rights to assets, dividends and liquidation proceeds. Each share class has identical voting rights, except for the exclusive right to vote on matters affecting only its class. Share classes have different fees and expenses (“class-specific fees and expenses”), primarily due to different arrangements for distribution, administrative and shareholder services. Differences in class-specific fees and expenses will result in differences in net investment income and, therefore, the payment of different per-share dividends by each class.

2. Significant accounting policies

The financial statements have been prepared to comply with accounting principles generally accepted in the United States of America. These principles require management to make estimates and assumptions that affect reported amounts and disclosures. Actual results could differ from those estimates. The fund follows the significant accounting policies described below, as well as the valuation policies described in the next section on valuation.

Security transactions and related investment income — Security transactions are recorded by the fund as of the date the trades are executed with brokers. Realized gains and losses from security transactions are determined based on the specific identified cost of the securities. In the event a security is purchased with a delayed payment date, the fund will segregate liquid assets sufficient to meet its payment obligations. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis. Market discounts, premiums and original issue discounts on fixed-income securities are amortized daily over the expected life of the security.

Class allocations — Income, fees and expenses (other than class-specific fees and expenses) and realized and unrealized gains and losses are allocated daily among the various share classes based on their relative net assets. Class-specific fees and expenses, such as distribution, administrative and shareholder services, are charged directly to the respective share class.

Dividends and distributions to shareholders — Dividends and distributions paid to shareholders are recorded on the ex-dividend date.

Currency translation — Assets and liabilities, including investment securities, denominated in currencies other than U.S. dollars are translated into U.S. dollars at the exchange rates supplied by one or more pricing vendors on the valuation date. Purchases and sales of investment

securities and income and expenses are translated into U.S. dollars at the exchange rates on the dates of such transactions. On the accompanying financial statements, the effects of changes in exchange rates on investment securities are included with the net realized gain or loss and net unrealized appreciation or depreciation on investments. The realized gain or loss and unrealized appreciation or depreciation resulting from all other transactions denominated in currencies other than U.S. dollars are disclosed separately.

3. Valuation

Capital Research and Management Company (“CRMC”), the fund’s investment adviser, values the fund’s investments at fair value as defined by accounting principles generally accepted in the United States of America. The net asset value of each share class of the fund is generally determined as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open.

Methods and inputs — The fund’s investment adviser uses the following methods and inputs to establish the fair value of the fund’s assets and liabilities. Use of particular methods and inputs may vary over time based on availability and relevance as market and economic conditions evolve.

Equity securities are generally valued at the official closing price of, or the last reported sale price on, the exchange or market on which such securities are traded, as of the close of business on the day the securities are being valued or, lacking any sales, at the last available bid price. Prices for each security are taken from the principal exchange or market on which the security trades.

Fixed-income securities, including short-term securities purchased with more than 60 days left to maturity, are generally valued at prices obtained from one or more pricing vendors. Vendors value such securities based on one or more of the inputs described in the following table. The table provides examples of inputs that are commonly relevant for valuing particular classes of fixed-income securities in which the fund is authorized to invest. However, these classifications are not exclusive, and any of the inputs may be used to value any other class of fixed-income security.

| Fixed-income class | Examples of standard inputs |

| | |

| All | Benchmark yields, transactions, bids, offers, quotations from dealers and trading systems, new issues, spreads and other relationships observed in the markets among comparable securities; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data (collectively referred to as “standard inputs”) |

| Corporate bonds & notes; convertible securities | Standard inputs and underlying equity of the issuer |

| Bonds & notes of governments & government agencies | Standard inputs and interest rate volatilities |

| Mortgage-backed; asset-backed obligations | Standard inputs and cash flows, prepayment information, default rates, delinquency and loss assumptions, collateral characteristics, credit enhancements and specific deal information |

| Municipal securities | Standard inputs and, for certain distressed securities, cash flows or liquidation values using a net present value calculation based on inputs that include, but are not limited to, financial statements and debt contracts |

When the fund’s investment adviser deems it appropriate to do so (such as when vendor prices are unavailable or not deemed to be representative), fixed-income securities will be valued in good faith at the mean quoted bid and ask prices that are reasonably and timely available (or bid prices, if ask prices are not available) or at prices for securities of comparable maturity, quality and type.

Securities with both fixed-income and equity characteristics, or equity securities traded principally among fixed-income dealers, are generally valued in the manner described above for either equity or fixed-income securities, depending on which method is deemed most appropriate by the fund’s investment adviser. Short-term securities purchased within 60 days to maturity are valued at amortized cost, which approximates fair value. The value of short-term securities originally purchased with maturities greater than 60 days is determined based on an amortized value to par when they reach 60 days.

Securities and other assets for which representative market quotations are not readily available or are considered unreliable by the fund’s investment adviser are fair valued as determined in good faith under fair value guidelines adopted by authority of the fund’s board of trustees as further described below. The investment adviser follows fair valuation guidelines, consistent with U.S. Securities and Exchange Commission rules and guidance, to consider relevant principles and factors when making fair value determinations. The investment adviser considers relevant indications of value that are reasonably and timely available to it in determining the fair value to be assigned to a particular security, such as the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer;

actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions. In addition, the closing prices of equity securities that trade in markets outside U.S. time zones may be adjusted to reflect significant events that occur after the close of local trading but before the net asset value of each share class of the fund is determined. Fair valuations and valuations of investments that are not actively trading involve judgment and may differ materially from valuations that would have been used had greater market activity occurred.

Processes and structure — The fund’s board of trustees has delegated authority to the fund’s investment adviser to make fair value determinations, subject to board oversight. The investment adviser has established a Joint Fair Valuation Committee (the “Fair Valuation Committee”) to administer, implement and oversee the fair valuation process, and to make fair value decisions. The Fair Valuation Committee regularly reviews its own fair value decisions, as well as decisions made under its standing instructions to the investment adviser’s valuation teams. The Fair Valuation Committee reviews changes in fair value measurements from period to period and may, as deemed appropriate, update the fair valuation guidelines to better reflect the results of back testing and address new or evolving issues. The Fair Valuation Committee reports any changes to the fair valuation guidelines to the board of trustees with supplemental information to support the changes. The fund’s board and audit committee also regularly review reports that describe fair value determinations and methods.

The fund’s investment adviser has also established a Fixed-Income Pricing Review Group to administer and oversee the fixed-income valuation process, including the use of fixed-income pricing vendors. This group regularly reviews pricing vendor information and market data. Pricing decisions, processes and controls over security valuation are also subject to additional internal reviews, including an annual control self-evaluation program facilitated by the investment adviser’s compliance group.

Classifications — The fund’s investment adviser classifies the fund’s assets and liabilities into three levels based on the inputs used to value the assets or liabilities. Level 1 values are based on quoted prices in active markets for identical securities. Level 2 values are based on significant observable market inputs, such as quoted prices for similar securities and quoted prices in inactive markets. Certain securities trading outside the U.S. may transfer between Level 1 and Level 2 due to valuation adjustments resulting from significant market movements following the close of local trading. Level 3 values are based on significant unobservable inputs that reflect the investment adviser’s determination of assumptions that market participants might reasonably use in valuing the securities. The valuation levels are not necessarily an indication of the risk or liquidity associated with the underlying investment. For example, U.S. government securities are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market. The following table presents the fund’s valuation levels as of December 31, 2012 (dollars in thousands):

| | | Investment securities | |

| | | Level 1 | | | Level 2* | | | Level 3 | | | Total | |

| | | | | | | | | | | | | |

| Assets: | | | | | | | | | | | | | | | | |

| Common stocks: | | | | | | | | | | | | | | | | |

| Financials | | $ | 7,421,820 | | | $ | — | | | $ | — | | | $ | 7,421,820 | |

| Consumer discretionary | | | 5,333,066 | | | | — | | | | — | | | | 5,333,066 | |

| Industrials | | | 5,267,745 | | | | — | | | | — | | | | 5,267,745 | |

| Information technology | | | 4,524,485 | | | | 11,230 | | | | — | | | | 4,535,715 | |

| Health care | | | 3,955,377 | | | | 162,980 | | | | — | | | | 4,118,357 | |

| Energy | | | 4,003,373 | | | | 86,347 | | | | — | | | | 4,089,720 | |

| Consumer staples | | | 2,468,492 | | | | 519,437 | | | | — | | | | 2,987,929 | |

| Materials | | | 2,032,394 | | | | — | | | | — | | | | 2,032,394 | |

| Utilities | | | 912,629 | | | | 130,904 | | | | — | | | | 1,043,533 | |

| Telecommunication services | | | 376,567 | | | | — | | | | — | | | | 376,567 | |

| Miscellaneous | | | 2,226,408 | | | | — | | | | — | | | | 2,226,408 | |

| Bonds & notes: | | | | | | | | | | | | | | | | |

| Corporate bonds & notes | | | — | | | | 5,142,703 | | | | — | | | | 5,142,703 | |

| U.S. Treasury bonds & notes | | | — | | | | 4,466,345 | | | | — | | | | 4,466,345 | |

| Mortgage-backed obligations | | | — | | | | 4,259,055 | | | | — | | | | 4,259,055 | |

| Federal agency bonds & notes | | | — | | | | 182,939 | | | | — | | | | 182,939 | |

| Other | | | — | | | | 162,783 | | | | — | | | | 162,783 | |

| Miscellaneous | | | — | | | | 14,825 | | | | — | | | | 14,825 | |

| Short-term securities | | | — | | | | 3,150,281 | | | | — | | | | 3,150,281 | |

| Total | | $ | 38,522,356 | | | $ | 18,289,829 | | | $ | — | | | $ | 56,812,185 | |

| * | Securities with a market value of $899,668,000, which represented 1.61% of the net assets of the fund, transferred from Level 1 to Level 2 since the prior fiscal year-end, primarily due to significant market movements following the close of local trading. |

Investing in the fund may involve certain risks including, but not limited to, those described below.

Market conditions — The prices of, and the income generated by, the common stocks, bonds and other securities held by the fund may decline due to market conditions and other factors, including those directly involving the issuers of securities held by the fund.

Investing in growth-oriented stocks — Growth-oriented stocks may involve larger price swings and greater potential for loss than other types of investments.

Investing in income-oriented stocks — Income provided by the fund may be reduced by changes in the dividend policies of, and the capital resources available at, the companies in which the fund invests.

Investing in bonds — Rising interest rates will generally cause the prices of bonds and other debt securities to fall. Longer maturity debt securities may be subject to greater price fluctuations than shorter maturity debt securities. In addition, falling interest rates may cause an issuer to redeem, call or refinance a security before its stated maturity, which may result in the fund having to reinvest the proceeds in lower yielding securities.

Bonds and other debt securities are subject to credit risk, which is the possibility that the credit strength of an issuer will weaken and/or an issuer of a debt security will fail to make timely payments of principal or interest and the security will go into default. Lower quality debt securities generally have higher rates of interest and may be subject to greater price fluctuations than higher quality debt securities. Credit risk is gauged, in part, by the credit ratings of the securities in which the fund invests. However, ratings are only the opinions of the rating agencies issuing them and are not guarantees as to credit quality or an evaluation of market risk.

Investing in securities backed by the U.S. government — Securities backed by the U.S. Treasury or the full faith and credit of the U.S. government are guaranteed only as to the timely payment of interest and principal when held to maturity. Accordingly, the current market values for these securities will fluctuate with changes in interest rates. Securities issued by government-sponsored entities and federal agencies and instrumentalities that are not backed by the full faith and credit of the U.S. government are neither issued nor guaranteed by the U.S. government.

Investing in mortgage-backed and asset-backed securities — Many types of bonds and other debt securities, including mortgage-backed securities, are subject to prepayment risk as well as the risks associated with investing in debt securities in general. If interest rates fall and the loans underlying these securities are prepaid faster than expected, the fund may have to reinvest the prepaid principal in lower yielding securities, thus reducing the fund’s income. Conversely, if interest rates increase and the loans underlying the securities are prepaid more slowly than expected, the expected duration of the securities may be extended, reducing the cash flow for potential reinvestment in higher yielding securities.

Thinly traded securities — There may be little trading in the secondary market for particular bonds or other debt securities, which may make them more difficult to value, acquire or sell.

Investing outside the U.S. — Securities of issuers domiciled outside the U.S., or with significant operations outside the U.S., may lose value because of adverse political, social, economic or market developments in the countries or regions in which the issuer operates. These securities may also lose value due to changes in foreign currency exchange rates against the U.S. dollar and/or currencies of other countries. Securities markets in certain countries may be more volatile and/or less liquid than those in the U.S. Investments outside the U.S. may also be subject to different settlement and accounting practices and different regulatory, legal and reporting standards, and may be more difficult to value, than those in the U.S. The risks of investing outside the U.S. may be heightened in connection with investments in emerging markets.

Management — The investment adviser to the fund actively manages the fund’s investments. Consequently, the fund is subject to the risk that the methods and analyses employed by the investment adviser in this process may not produce the desired results. This could cause the fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

| 5. Taxation and distributions |

Federal income taxation — The fund complies with the requirements under Subchapter M of the Internal Revenue Code applicable to mutual funds and intends to distribute substantially all of its net taxable income and net capital gains each year. The fund is not subject to income taxes to the extent such distributions are made. Therefore, no federal income tax provision is required.

As of and during the period ended December 31, 2012, the fund did not have a liability for any unrecognized tax benefits. The fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statement of operations. During the period, the fund did not incur any interest or penalties.

The fund is not subject to examination by U.S. federal tax authorities for tax years before 2009 and by state tax authorities for tax years before 2008.

Non-U.S. taxation — Dividend and interest income are recorded net of non-U.S. taxes paid.

Distributions — Distributions paid to shareholders are based on net investment income and net realized gains determined on a tax basis, which may differ from net investment income and net realized gains for financial reporting purposes. These differences are due primarily to different treatment for items such as currency gains and losses; short-term capital gains and losses; capital losses related to sales of certain securities within 30 days of purchase; deferred expenses; paydowns on fixed-income securities; and net capital losses. The fiscal year in which amounts are distributed may differ from the year in which the net investment income and net realized gains are recorded by the fund for financial reporting purposes.

During the year ended December 31, 2012, the fund reclassified $24,129,000 from accumulated net realized loss to undistributed net investment income and $69,000 from undistributed net investment income to capital paid in on shares of beneficial interest to align financial reporting with tax reporting.

Under the Regulated Investment Company Modernization Act of 2010 (the “Act”), net capital losses recognized after December 31, 2010, may be carried forward indefinitely, and their character is retained as short-term and/or long-term losses. Previously, net capital losses were carried forward for eight years and treated as short-term losses. As a transition rule, the Act requires that post-enactment net capital losses be used before pre-enactment net capital losses.

As of December 31, 2012, the tax basis components of distributable earnings, unrealized appreciation (depreciation) and cost of investment securities were as follows (dollars in thousands):

| | | | | |

| | | | | |

| Undistributed ordinary income | | $ | 83,372 | |

| Capital loss carryforward expiring 2017* | | | (1,810,298 | ) |

| Gross unrealized appreciation on investment securities | | | 12,062,929 | |

| Gross unrealized depreciation on investment securities | | | (662,219 | ) |

| Net unrealized appreciation on investment securities | | | 11,400,710 | |

| Cost of investment securities | | | 45,411,475 | |

| * | Reflects the utilization of capital loss carryforward of $2,057,317,000. The capital loss carryforward will be used to offset any capital gains realized by the fund in future years through the expiration date. The fund will not make distributions from capital gains while a capital loss carryforward remains. |

Tax-basis distributions paid to shareholders from ordinary income were as follows (dollars in thousands):

| | | Year ended December 31 | |

| Share class | | 2012 | | | 2011 | |

| | | | | | | |

| Class A | | $ | 641,065 | | | $ | 683,562 | |

| Class B | | | 15,571 | | | | 29,810 | |

| Class C | | | 49,332 | | | | 62,169 | |

| Class F-1 | | | 25,793 | | | | 20,555 | |

| Class F-2 | | | 7,506 | | | | 6,282 | |

| Class 529-A | | | 36,800 | | | | 35,963 | |

| Class 529-B | | | 1,576 | | | | 2,703 | |

| Class 529-C | | | 7,193 | | | | 8,089 | |

| Class 529-E | | | 1,725 | | | | 1,794 | |

| Class 529-F-1 | | | 1,528 | | | | 1,370 | |

| Class R-1 | | | 1,506 | | | | 1,858 | |

| Class R-2 | | | 13,722 | | | | 16,070 | |

| Class R-3 | | | 41,191 | | | | 44,622 | |

| Class R-4 | | | 50,016 | | | | 46,169 | |

| Class R-5 | | | 40,820 | | | | 36,957 | |

| Class R-6 | | | 42,000 | | | | 34,775 | |

| Total | | $ | 977,344 | | | $ | 1,032,748 | |

6. Fees and transactions with related parties

CRMC, the fund’s investment adviser, is the parent company of American Funds Distributors,® Inc. (“AFD”), the principal underwriter of the fund’s shares, and American Funds Service Company® (“AFS”), the fund’s transfer agent.

Investment advisory services — The fund has an investment advisory and service agreement with CRMC that provides for monthly fees accrued daily. These fees are based on a series of decreasing annual rates beginning with 0.420% on the first $500 million of daily net assets and decreasing to 0.210% on such assets in excess of $71 billion. For the year ended December 31, 2012, the investment advisory services fee was $128,211,000, which was equivalent to an annualized rate of 0.239% of average daily net assets.

Class-specific fees and expenses — Expenses that are specific to individual share classes are accrued directly to the respective share class. The principal class-specific fees and expenses are described below:

Distribution services — The fund has plans of distribution for all share classes, except Class F-2, R-5 and R-6 shares. Under the plans, the board of trustees approves certain categories of expenses that are used to finance activities primarily intended to sell fund shares and service existing accounts. The plans provide for payments, based on an annualized percentage of average daily net assets, ranging from 0.25% to 1.00% as noted below. In some cases, the board of trustees has limited the amounts that may be paid to less than the maximum allowed by the plans. All share classes with a plan may use up to 0.25% of average daily net assets to pay service fees, or to compensate AFD for paying service fees, to firms that have entered into agreements with AFD to provide certain shareholder services. The remaining amounts available to be paid under each plan are paid to dealers to compensate them for their sales activities.

For Class A and 529-A shares, distribution-related expenses include the reimbursement of dealer and wholesaler commissions paid by AFD for certain shares sold without a sales charge. These share classes reimburse AFD for amounts billed within the prior 15 months but only to the extent that the overall annual expense limit of 0.25% is not exceeded. As of December 31, 2012, there were no unreimbursed expenses subject to reimbursement for Class A or 529-A shares.

| Share class | | Currently approved limits | | Plan limits |

| | | | | |

| Class A | | | 0.25 | % | | | 0.25 | % |

| Class 529-A | | | 0.25 | | | | 0.50 | |

| Classes B and 529-B | | | 1.00 | | | | 1.00 | |

| Classes C, 529-C and R-1 | | | 1.00 | | | | 1.00 | |

| Class R-2 | | | 0.75 | | | | 1.00 | |

| Classes 529-E and R-3 | | | 0.50 | | | | 0.75 | |

| Classes F-1, 529-F-1 and R-4 | | | 0.25 | | | | 0.50 | |

Transfer agent services — The fund has a shareholder services agreement with AFS under which the fund compensates AFS for providing transfer agent services to each of the fund’s share classes. These services include recordkeeping, shareholder communications and transaction processing. In addition, the fund reimburses AFS for amounts paid to third parties for performing transfer agent services on behalf of fund shareholders.

Administrative services — The board of trustees approved an amended administrative services agreement with CRMC effective January 1, 2012. Under this agreement, Class A shares pay an annual fee of 0.01% and Class C, F, 529 and R shares pay an annual fee of 0.05% of their respective average daily net assets to compensate CRMC for providing administrative services. These services include, but are not limited to, coordinating, monitoring, assisting and overseeing third parties that provide services to fund shareholders.