UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| x | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to Section 240.14a-12. |

Harsco Corporation

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

|

WE HELP BUILD THE WORLD Camp Hill, Pennsylvania April 16, 2013 Additional Information to Inform 2013 Advisory Vote on Named Executive Officer Compensation Security holders of Harsco Corporation (the “Company”) should read the Company’s definitive proxy statement for its 2013 Annual Meeting of Stockholders because it contains important information. Security holders may obtain the Company’s 2013 definitive proxy statement and 2012 Annual Report for free at www.harsco.com. This document may be deemed “soliciting material” within the meaning of the rules and regulations of the Securities and Exchange Commission promulgated under the Securities Exchange Act of 1934, as amended. |

|

2 WE HELP BUILD THE WORLD Compensation Highlights Our compensation programs reflect our pay-for-performance (“P4P”) philosophy: Our annual incentive program (“AIP”) ties annual cash incentives to the achievement of pre-established Economic Value Added (“EVA”®) performance goals, thereby linking pay directly to the creation of stockholder value In 2012, we increased the percentage of performance-based equity awards under our long-term incentive program (“LTIP”) from 50% to approximately 70% through the use of stock appreciation rights (“SARs”). SARs are inherently performance-based awards as their value is directly tied to the performance of the Company’s stock price ISS, Glass Lewis & Co. and Egan-Jones ALL report that, for 2012, the Company’s pay was aligned with corporate performance Under our new CEO, our management team continues to focus our path toward improved performance and stockholder returns While we have taken reasonable steps to recruit and retain those executives who we believe will be key to the improved success of our Company, the average level of total direct compensation for 2012 remained below market medians, further reflecting the link between pay and performance |

|

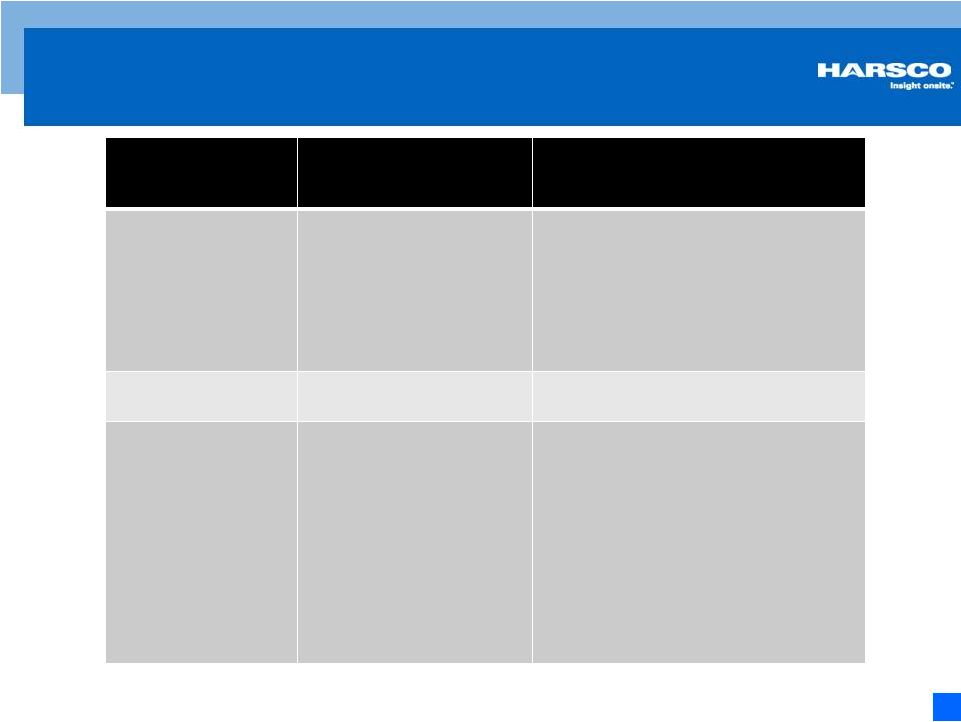

3 WE HELP BUILD THE WORLD ISS and Egan-Jones Recommend a Vote “FOR” Say-on-Pay Advisory Firm Recommendation on Proposal 3 P4P Comments ISS Yes • P4P quantitative screen resulted in a “low” level of concern • Overall, ISS found “no significant issues of concern” regarding our executive compensation programs and practices Egan-Jones Yes • No significant comments Glass Lewis No • Report notes improved P4P score and states “the Company has adequately aligned executive pay and corporate performance” • Specific issues raised with regard to the change in control provisions for certain equity awards,* certain one-time payments to a departing executive and changes made to the Company’s LTIP * See Slide 6 for a summary of the changes being made to the Company’s equity awards in 2013 |

|

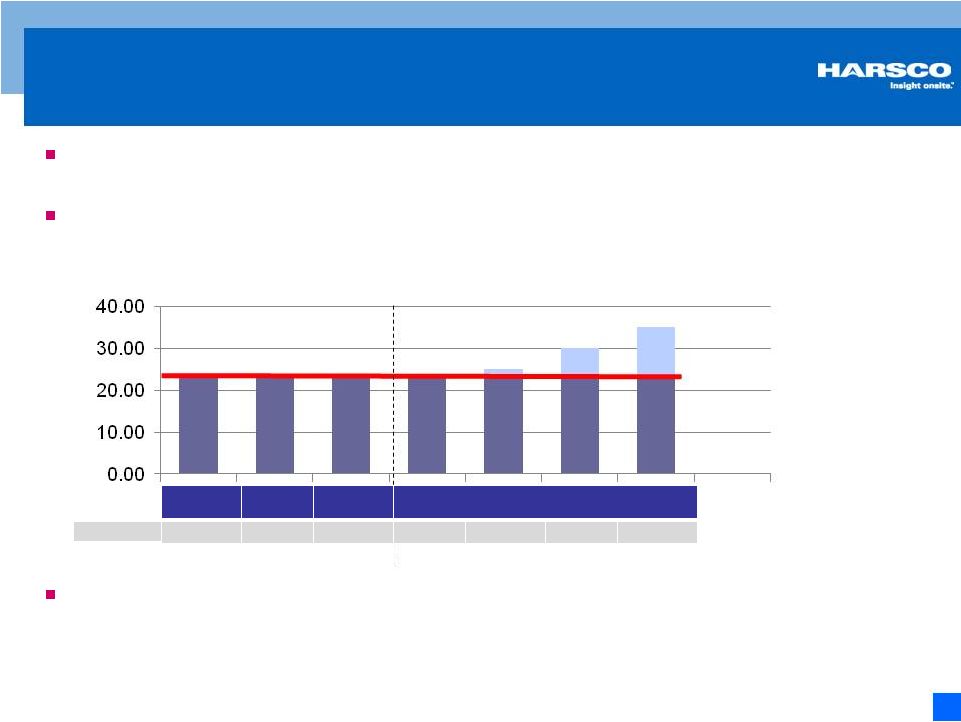

Harsco Pay and Performance are Aligned We have taken significant steps to ensure that compensation is commensurate with performance, which ALL THREE proxy advisors acknowledge Realizable compensation in 2012 was below target levels, consistent with our 2012 corporate-level performance 4 WE HELP BUILD THE WORLD |

|

5 WE HELP BUILD THE WORLD We Continue to Strengthen Our Executive Leadership Team As part of our renewed focus on optimizing financial and operational performance, we have sought talented new executive officers to lead the Company’s transformation We experienced several executive officer transitions during 2012: Sal Fazzolari departed from his position as Chairman, President and CEO in February 2012 after serving the Company for more than 30 years Patrick Decker commenced serving as our new President and CEO in September 2012 Steve Schnoor departed from his position as SVP, CFO and Treasurer in November 2012 after serving the Company for more than 24 years Separation pay packages for Messrs. Fazzolari and Schnoor reflect market practices: We do not maintain employment agreements with our executives Separation pay packages were developed with the assistance of the Management Development and Compensation Committee’s independent compensation consultant (Pearl Meyer & Partners) to ensure alignment with current market practices Cash severance amounts were established at or below market levels while still recognizing each executive’s significant tenure with the Company No payout for performance-based LTIP awards that were not earned |

|

6 WE HELP BUILD THE WORLD New CIC Acceleration Approach Under 2013 Equity and Incentive Compensation Plan Based on a strong recommendation from our new CEO, the Management Development and Compensation Committee has determined that all executive equity awards going forward will contain “double-trigger” change in control (“CIC”) accelerated vesting provisions, as permitted under the Company’s new 2013 Equity and Incentive Compensation Plan and in-line with current market practice This new approach to equity awards aligns with the “double-trigger” provisions already contained in CIC severance agreements in place with each of our executive officers A double-trigger provision generally functions so that, if equity awards are continued, assumed or replaced after a CIC, a participant must experience a qualifying termination of employment within a certain period of time after the CIC to vest in those awards on an accelerated basis The use of double-trigger CIC provisions helps ensure that if a CIC were to be contemplated, our executive officers involved in deliberations or negotiations would be positioned to consider as objectively as possible whether the CIC transaction would be in our and our stockholders’ best interests, rather than being motivated solely by compensation interests |

|

2012 SAR Grants Link Executive Pay With Performance (Namely, Stock Price Appreciation) Prior to 2012, only 50% of LTIP awards were performance-based, and those awards most often utilized the same performance metric as the AIP (EVA achievement) For 2012, approximately 70% of the LTIP award opportunity was granted in the form of SARs, which are designed to deliver value to our executives only to the extent value is being created for stockholders, as hypothetically illustrated in the following table: This focus on sustained stock price improvement aligns well with our stockholders’ interests and complements the AIP’s focus on EVA achievement Base Price = $23.73 Stock Price Realized Value Grant Date (3/16/12) 12/31/12 4/03/13 Hypothetical Stock Price Point $23.73 $23.50 $23.41 $23.73 $25.00 $30.00 $35.00 $0.00 $0.00 $0.00 $0.00 $1.27 $6.27 $11.27 7 WE HELP BUILD THE WORLD |