Bank of Hawai‘i Corporation�first quarter 2024 �financial report April 22, 2024 Exhibit 99.2

this presentation, and other statements made by the Company in connection with it, may contain forward-looking statements concerning, among other things, forecasts of our financial results and condition, expectations for our operations and business prospects, and our assumptions used in those forecasts and expectations. we have not committed to update forward-looking statements to reflect later events or circumstances disclosure 2 forward-looking statements

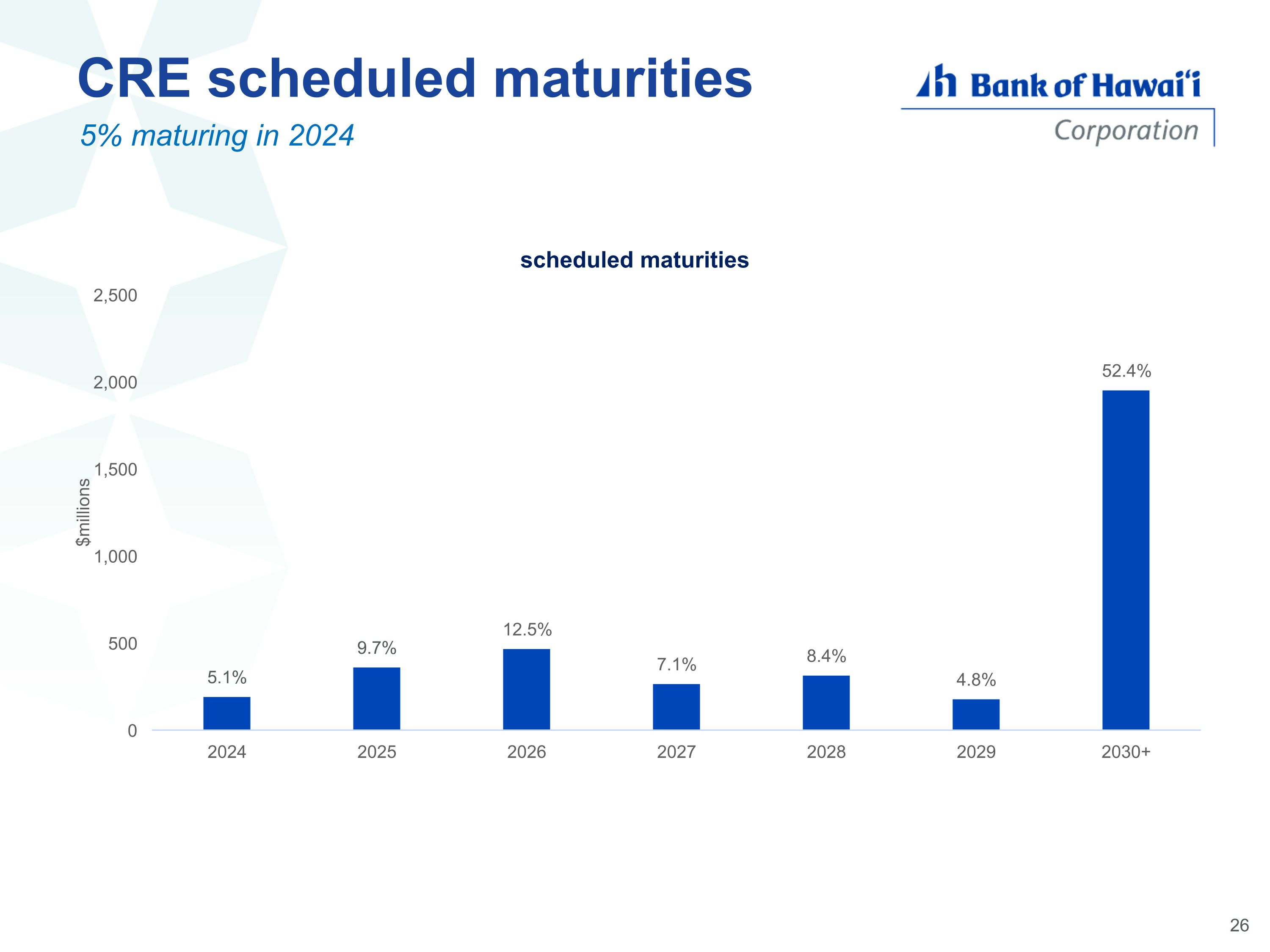

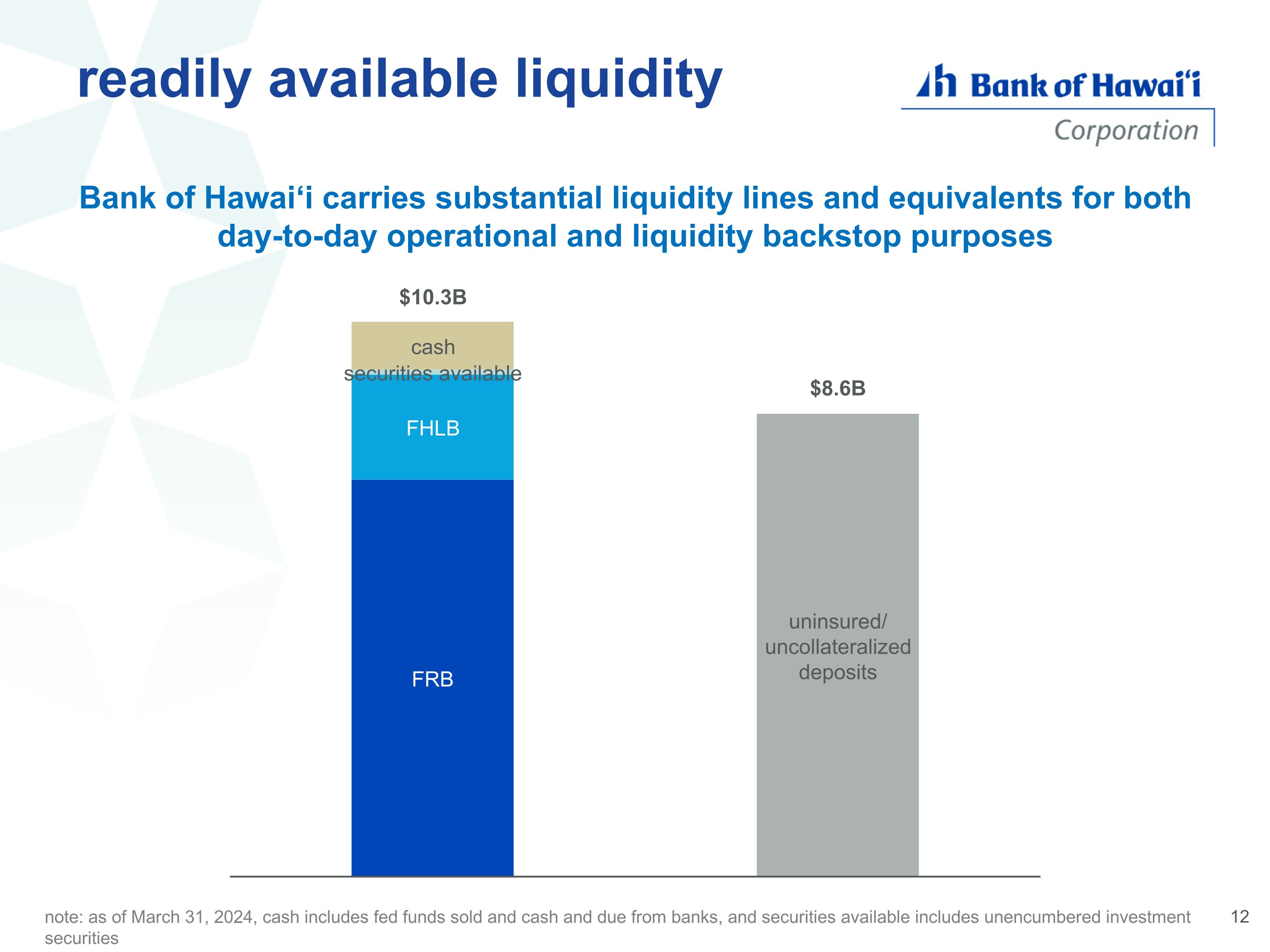

diversified, lower risk loan assets highlights broad & deep market penetration stable balance sheet performance earnings highlights strong credit average total deposits decreased 0.8% average total loans and leases decreased 0.3% $10.3 billion in readily available liquidity $0.87 diluted earnings per common share 1.74% average cost of total deposits 11.20% return on average common equity 0.07% net charge-off rate 0.09% non-performing assets level 79% of loan portfolio real-estate secured with combined wtd avg LTV of 52% CRE portfolio comprises 27% of total loans wtd avg LTV of 55%; only 5% maturing in 2024; CRE office exposure only 3% of total loans

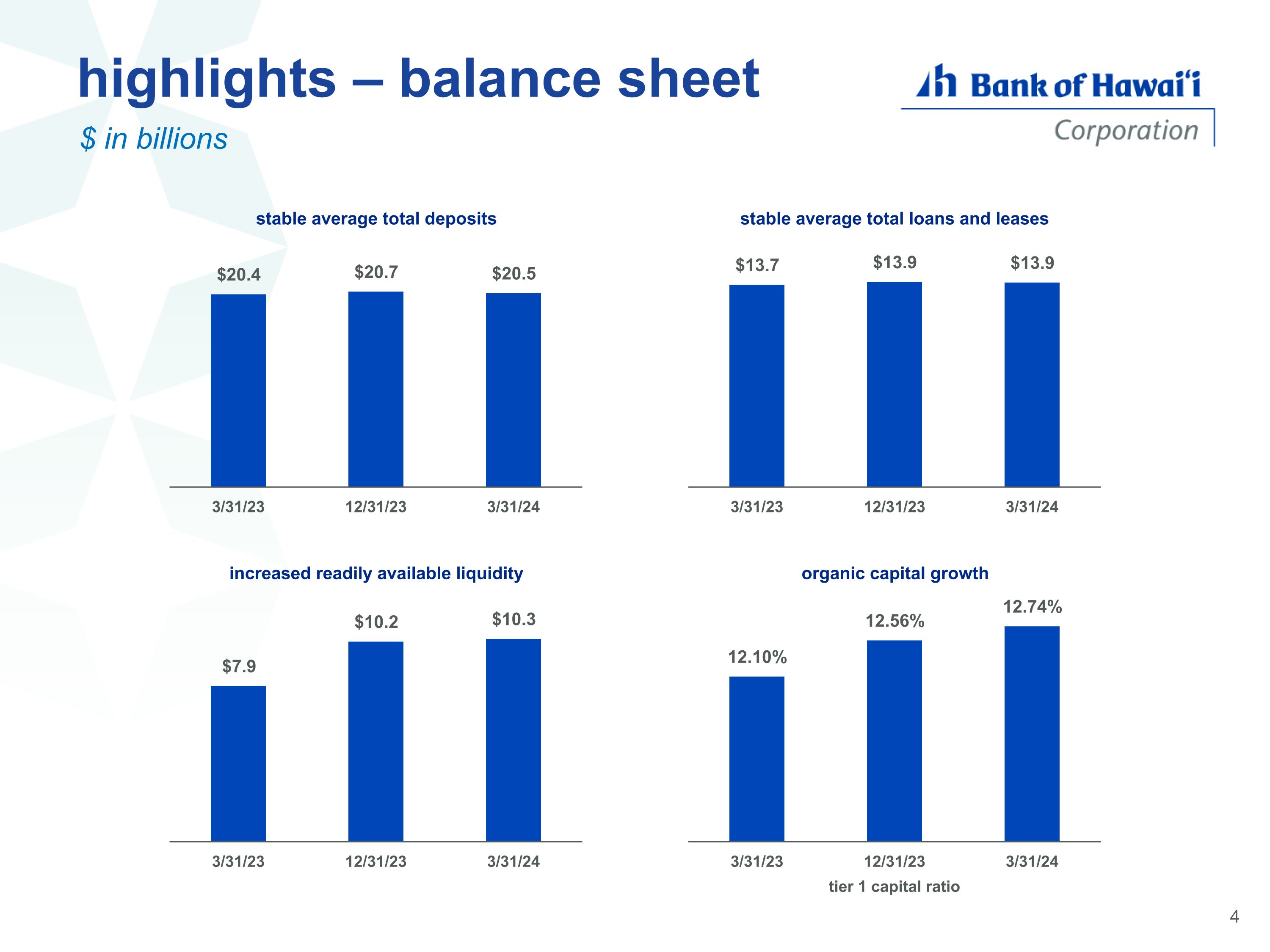

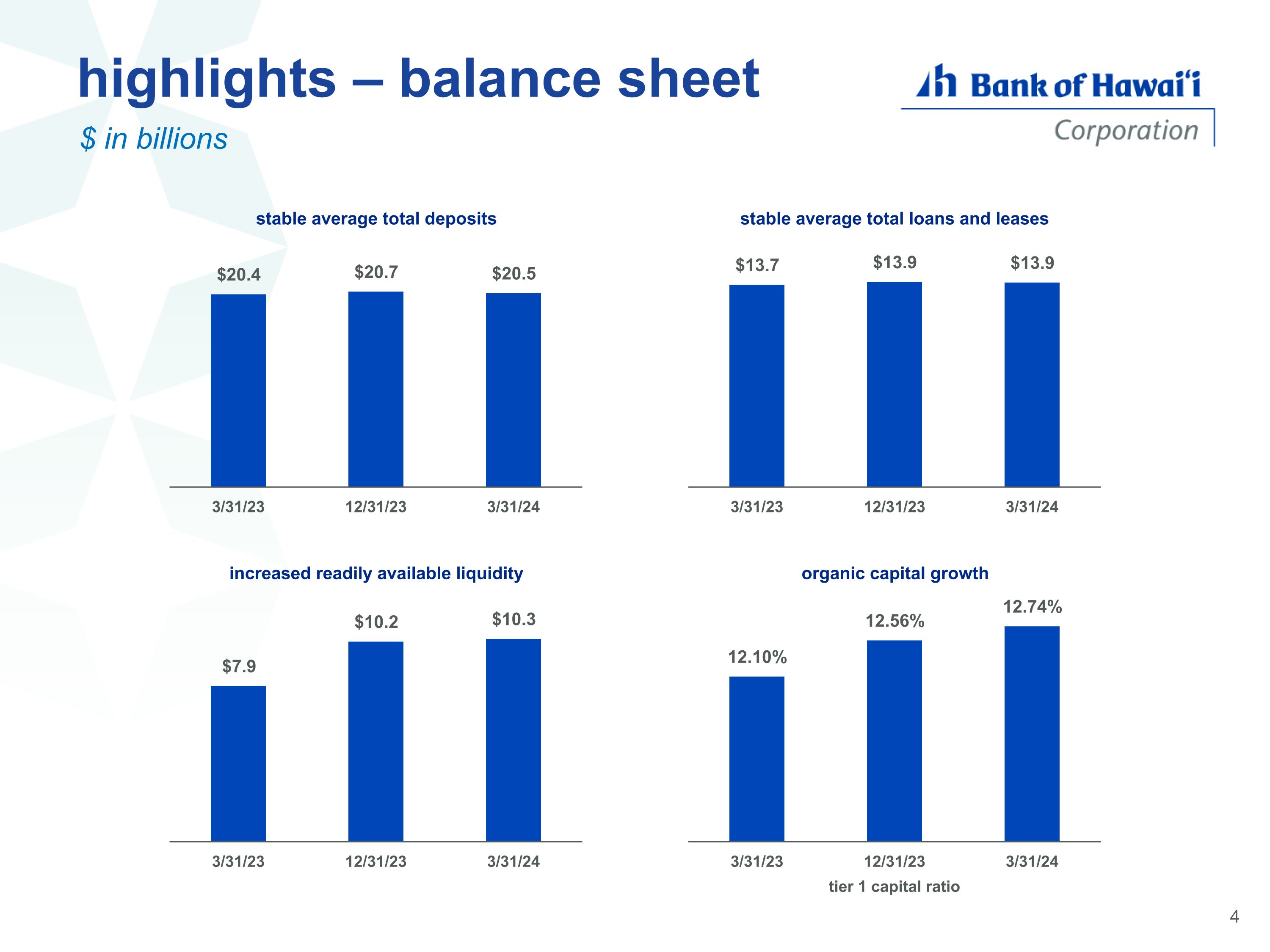

highlights – balance sheet $ in billions tier 1 capital ratio

our deposits through our 127 year history in the islands, Bank of Hawai‘i has developed an exceptionally seasoned deposit base, built one relationship at a time, over many years, and in neighborhoods and communities we understand unique marketplace diversified long tenured ✔ ✔ ✔

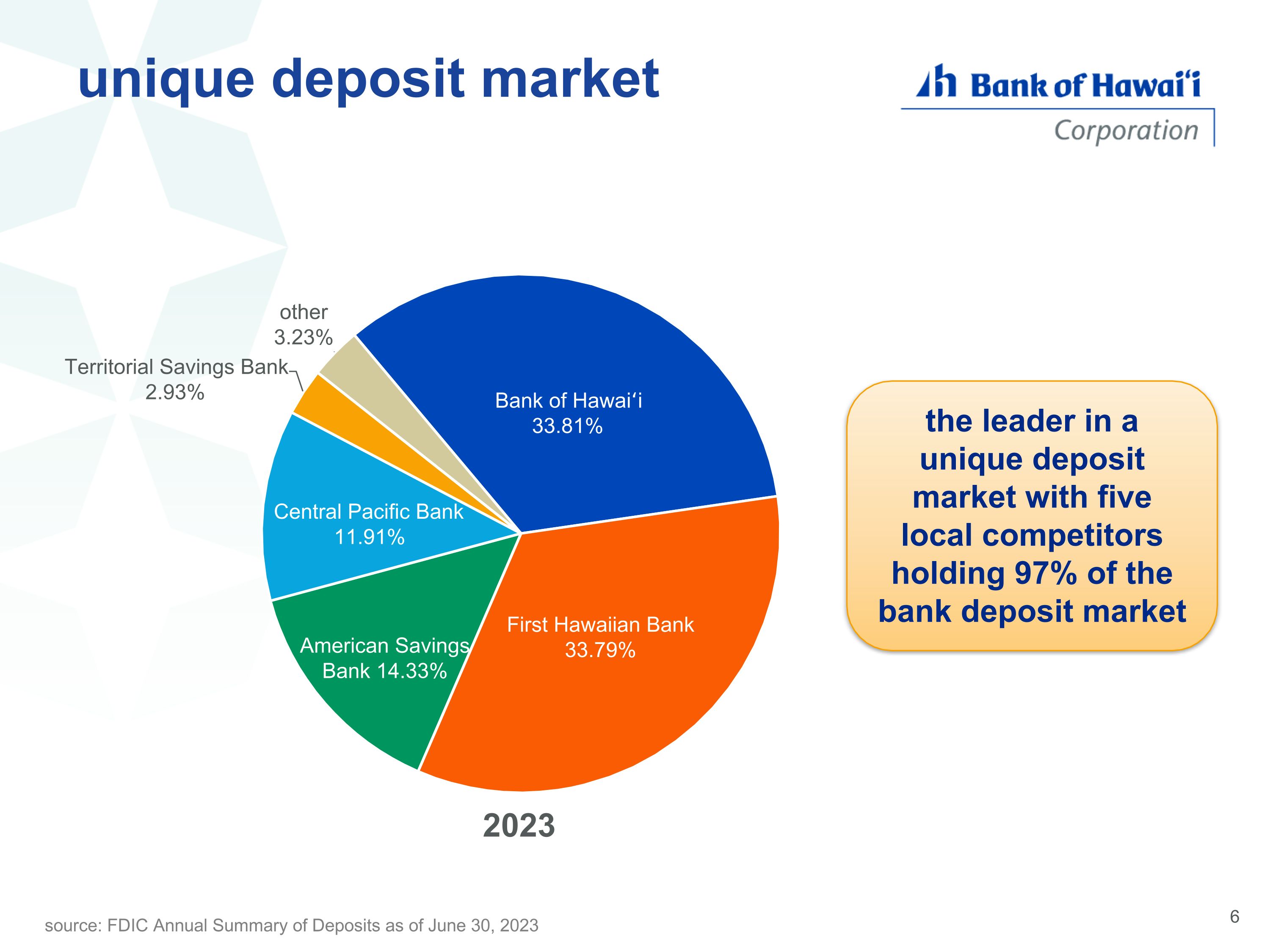

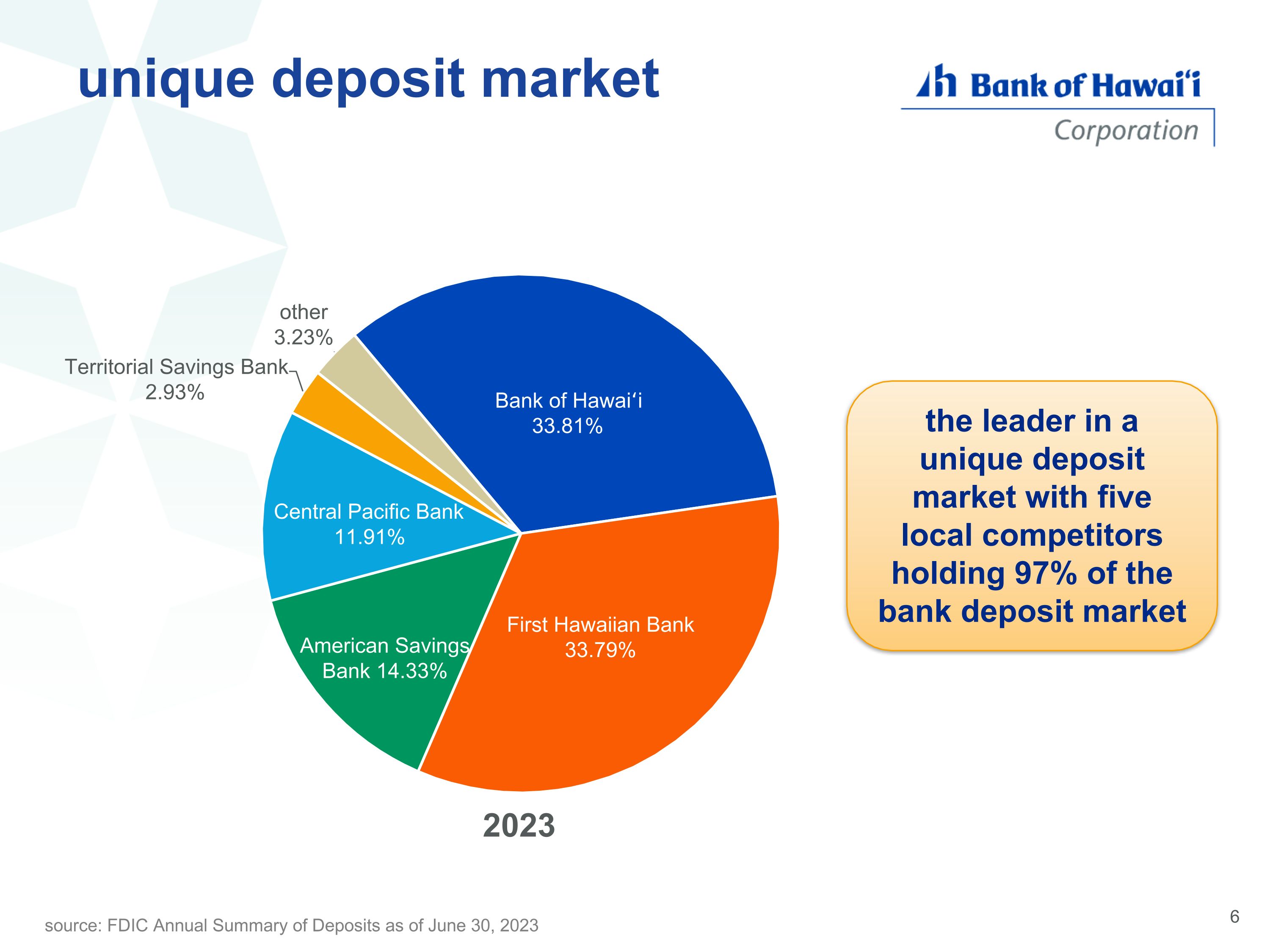

unique deposit market source: FDIC Annual Summary of Deposits as of June 30, 2023 the leader in a unique deposit market with five local competitors holding 97% of the bank deposit market

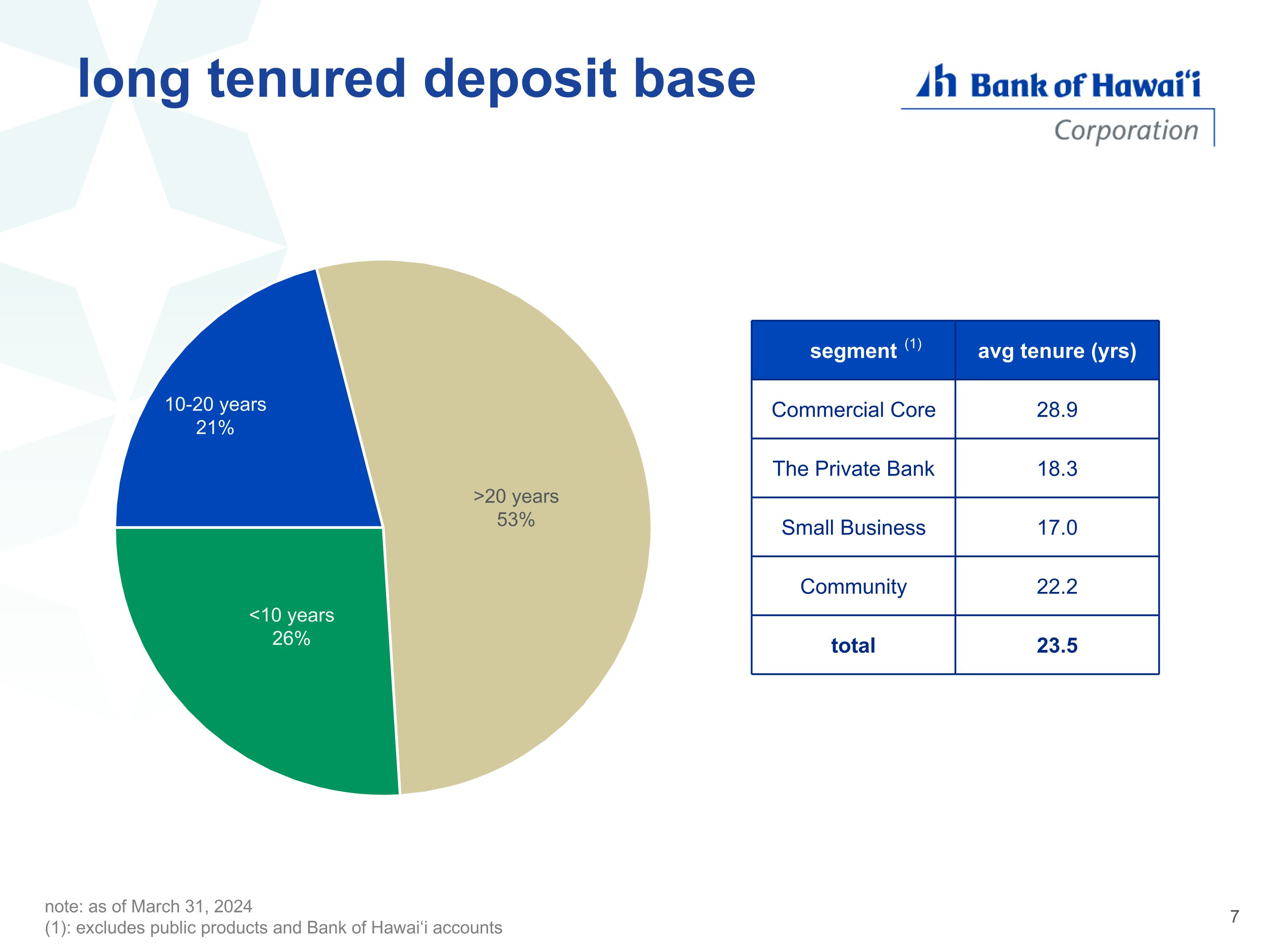

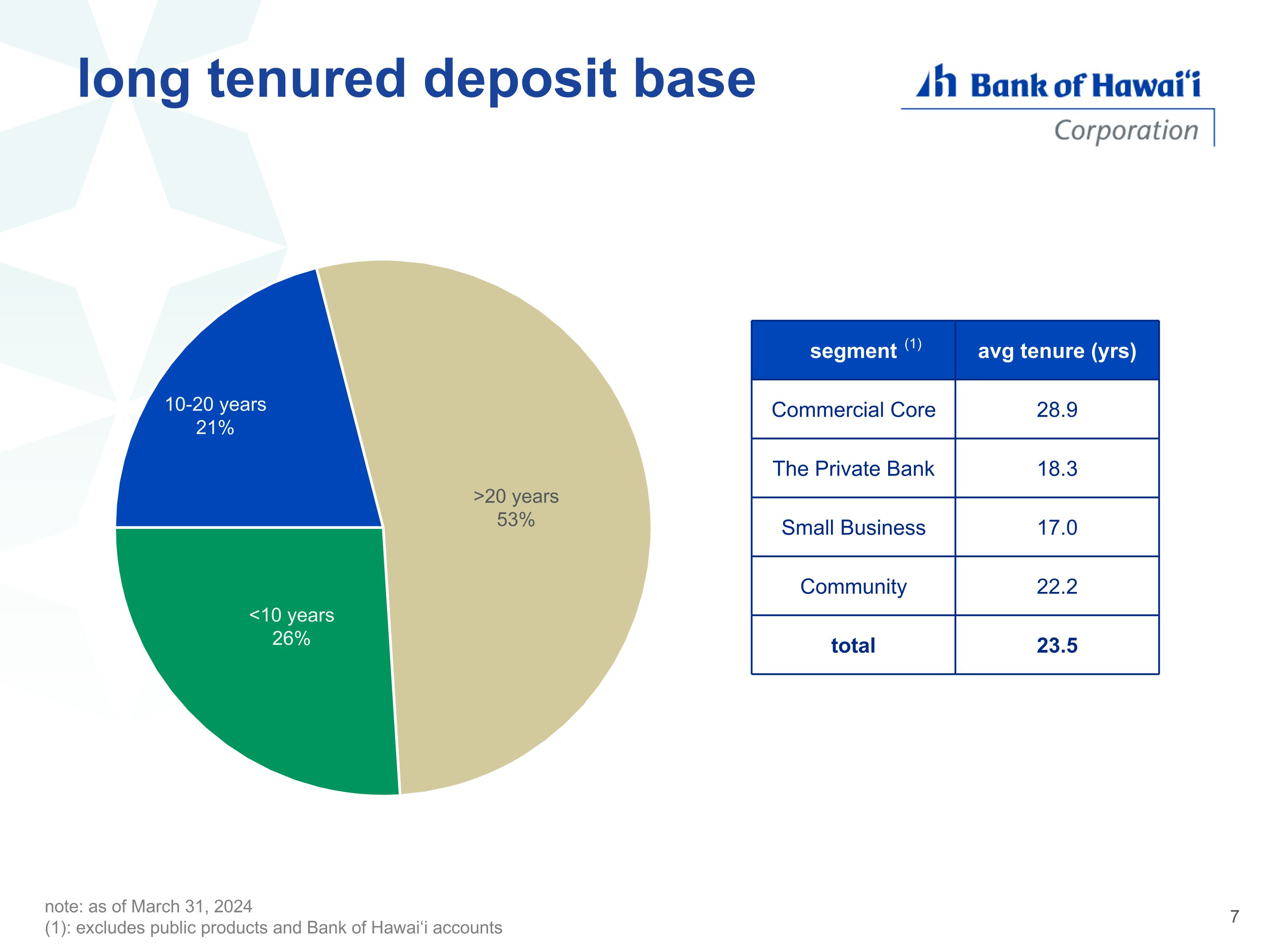

long tenured deposit base note: as of March 31, 2024 (1): excludes public products and Bank of Hawai‘i accounts segment avg tenure (yrs) Commercial Core 28.9 The Private Bank 18.3 Small Business 17.0 Community 22.2 total 23.5 (1)

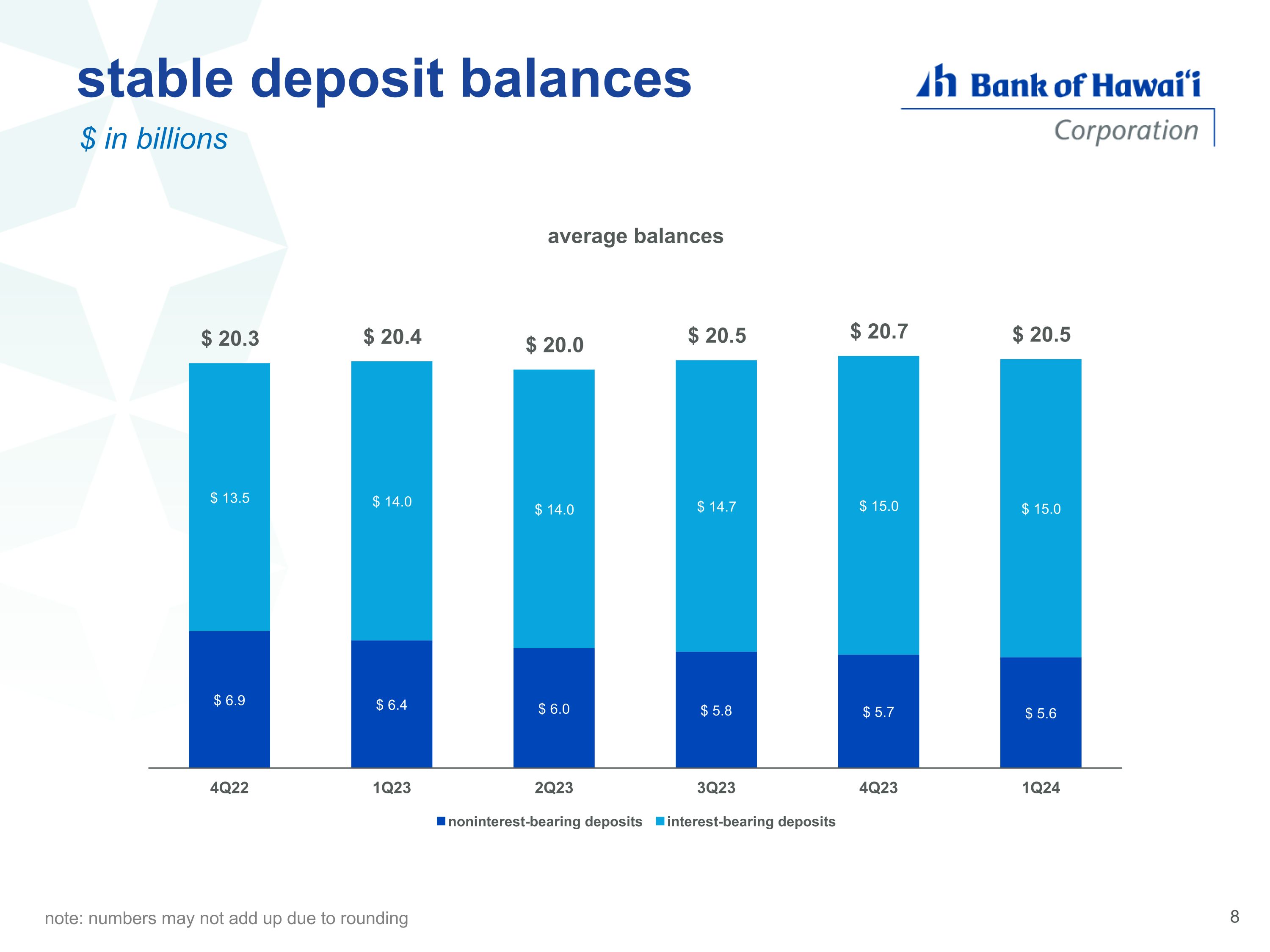

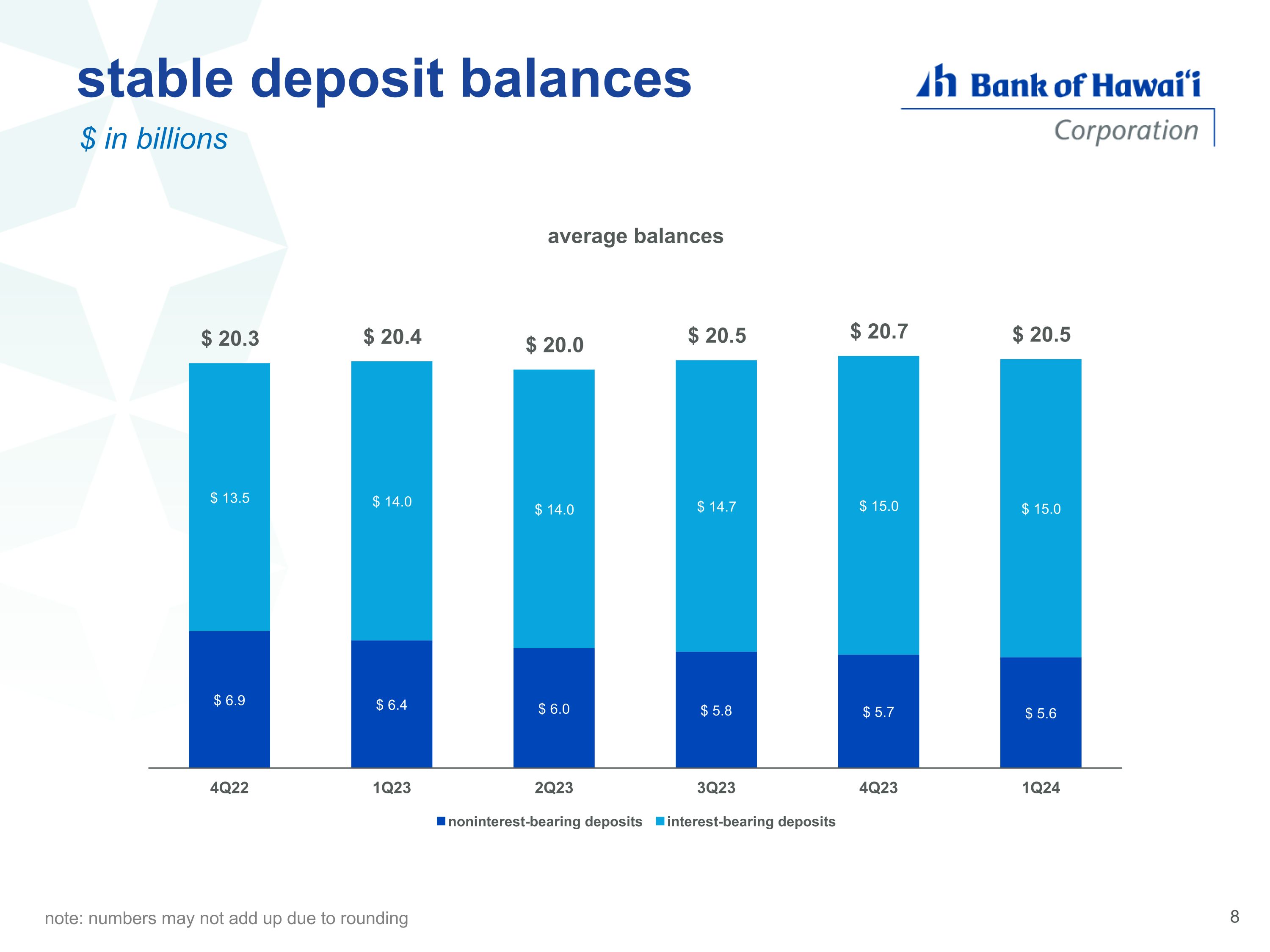

stable deposit balances $ in billions note: numbers may not add up due to rounding

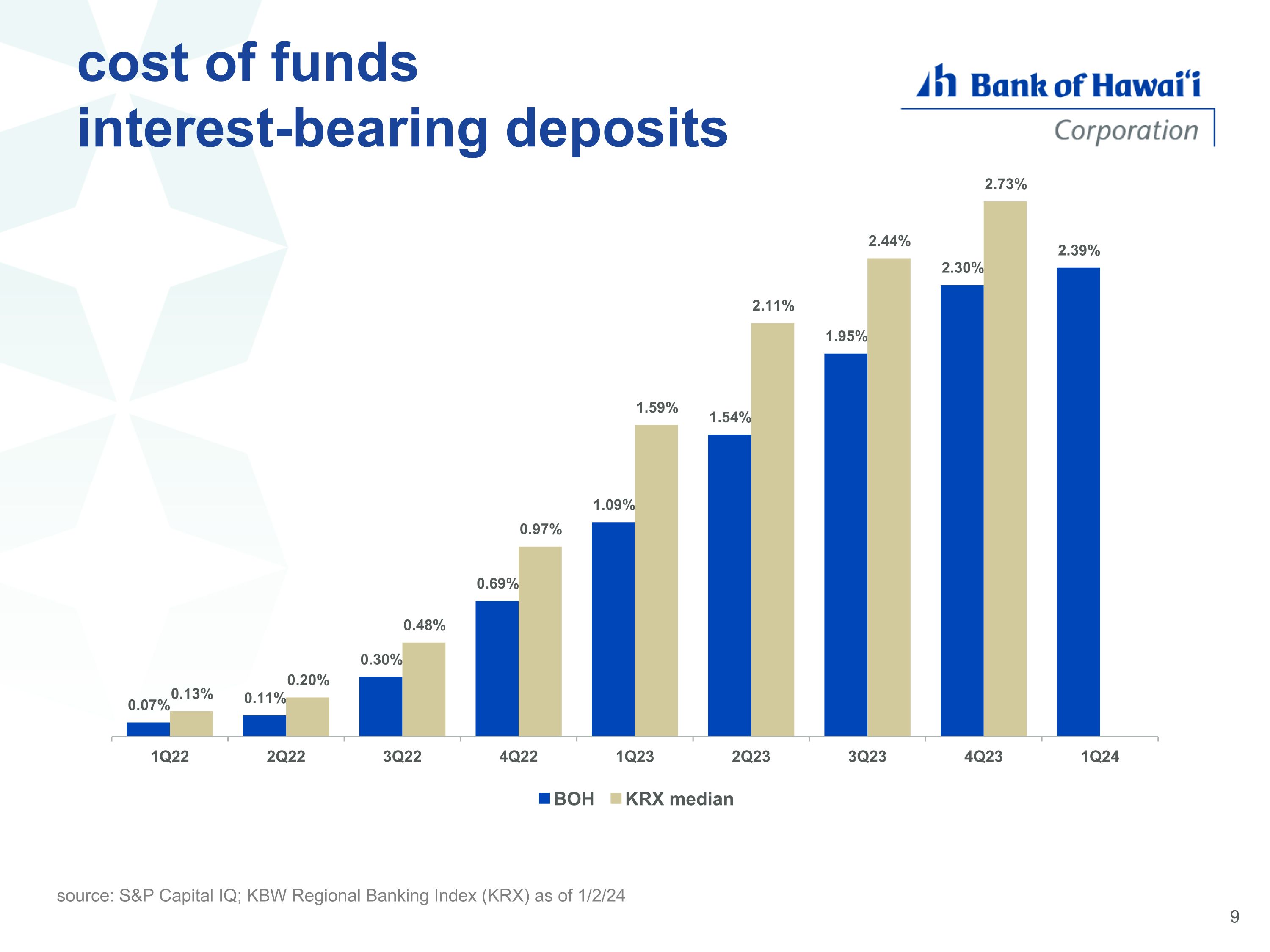

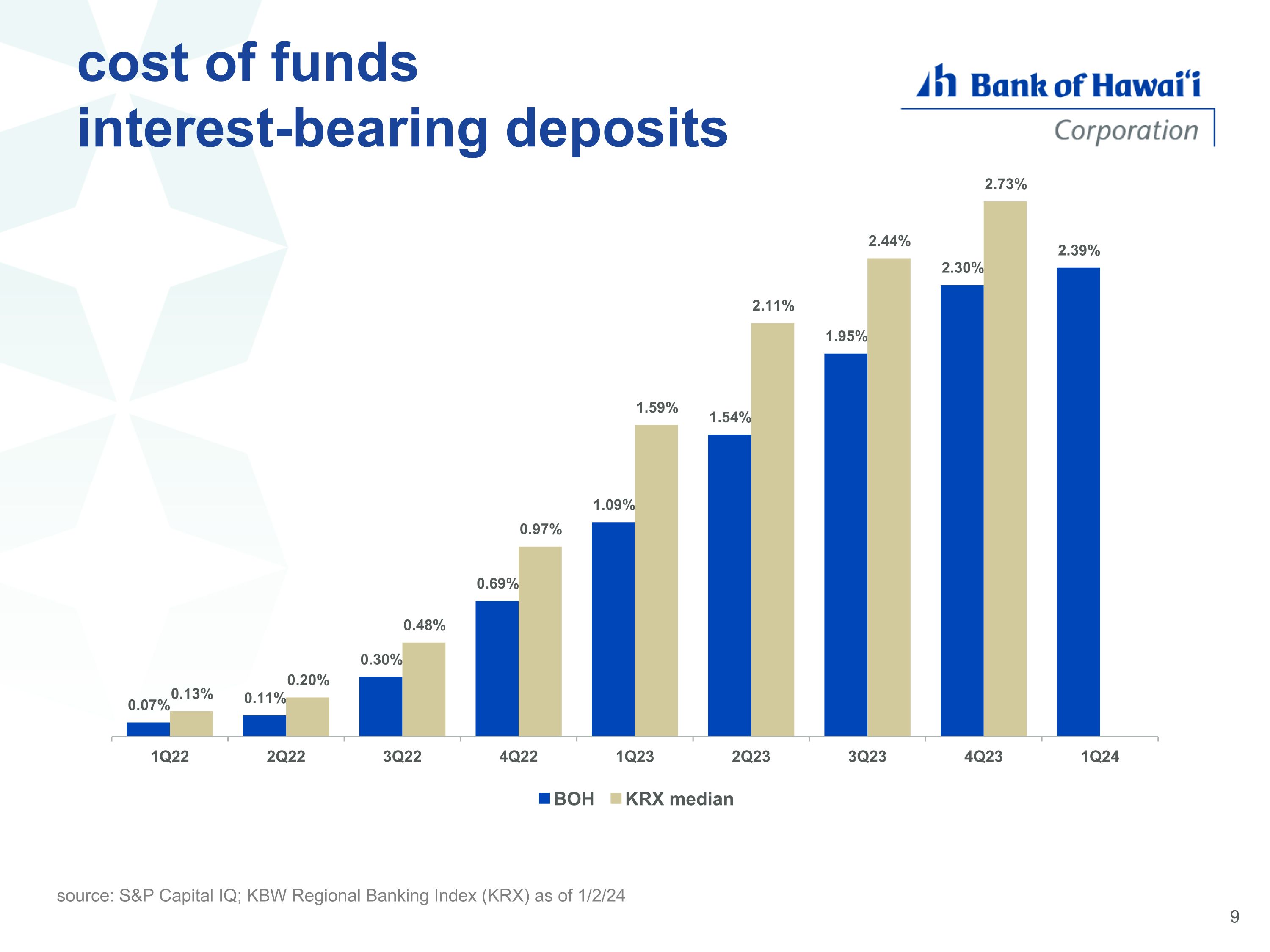

cost of funds�interest-bearing deposits source: S&P Capital IQ; KBW Regional Banking Index (KRX) as of 1/2/24

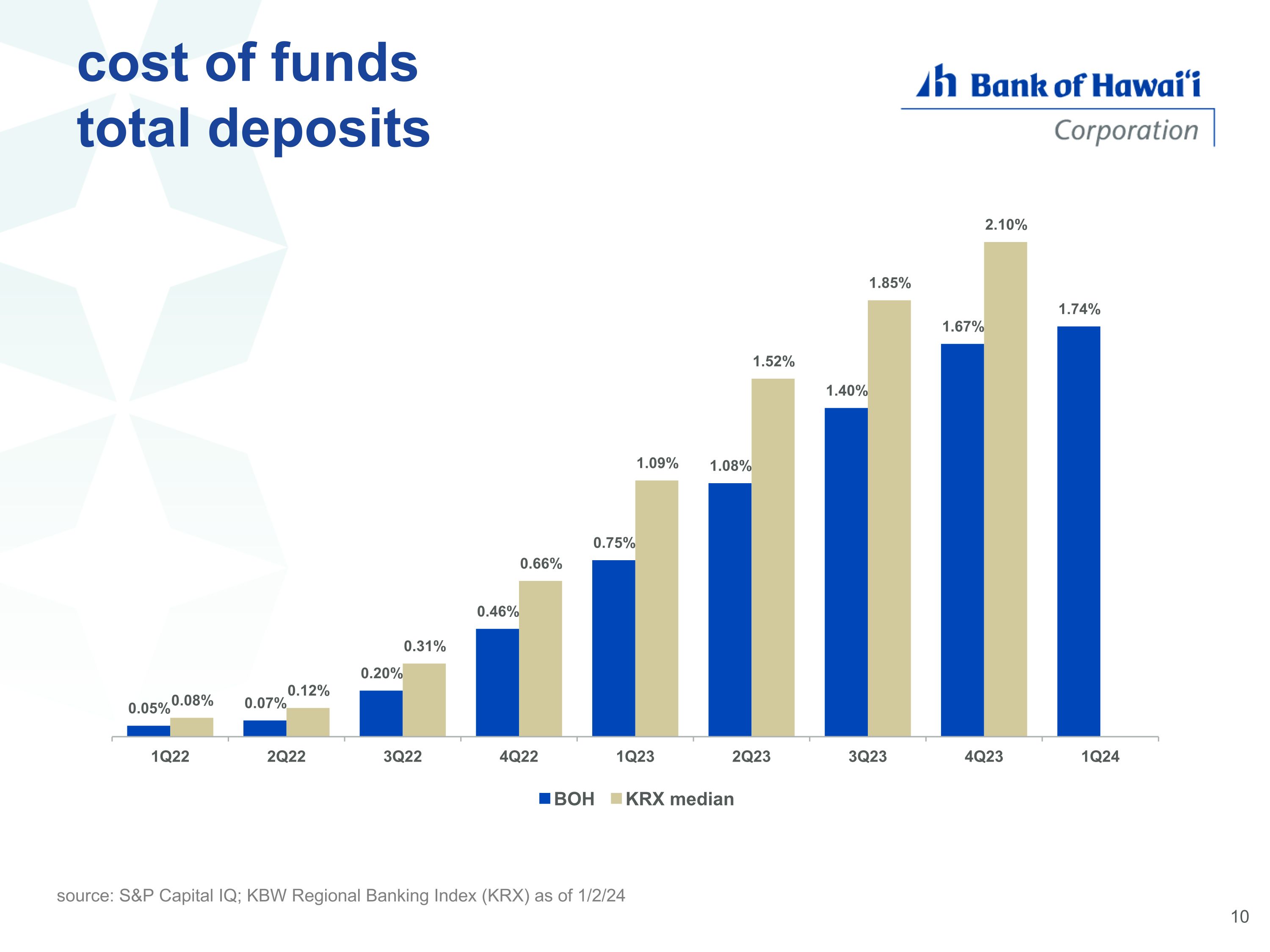

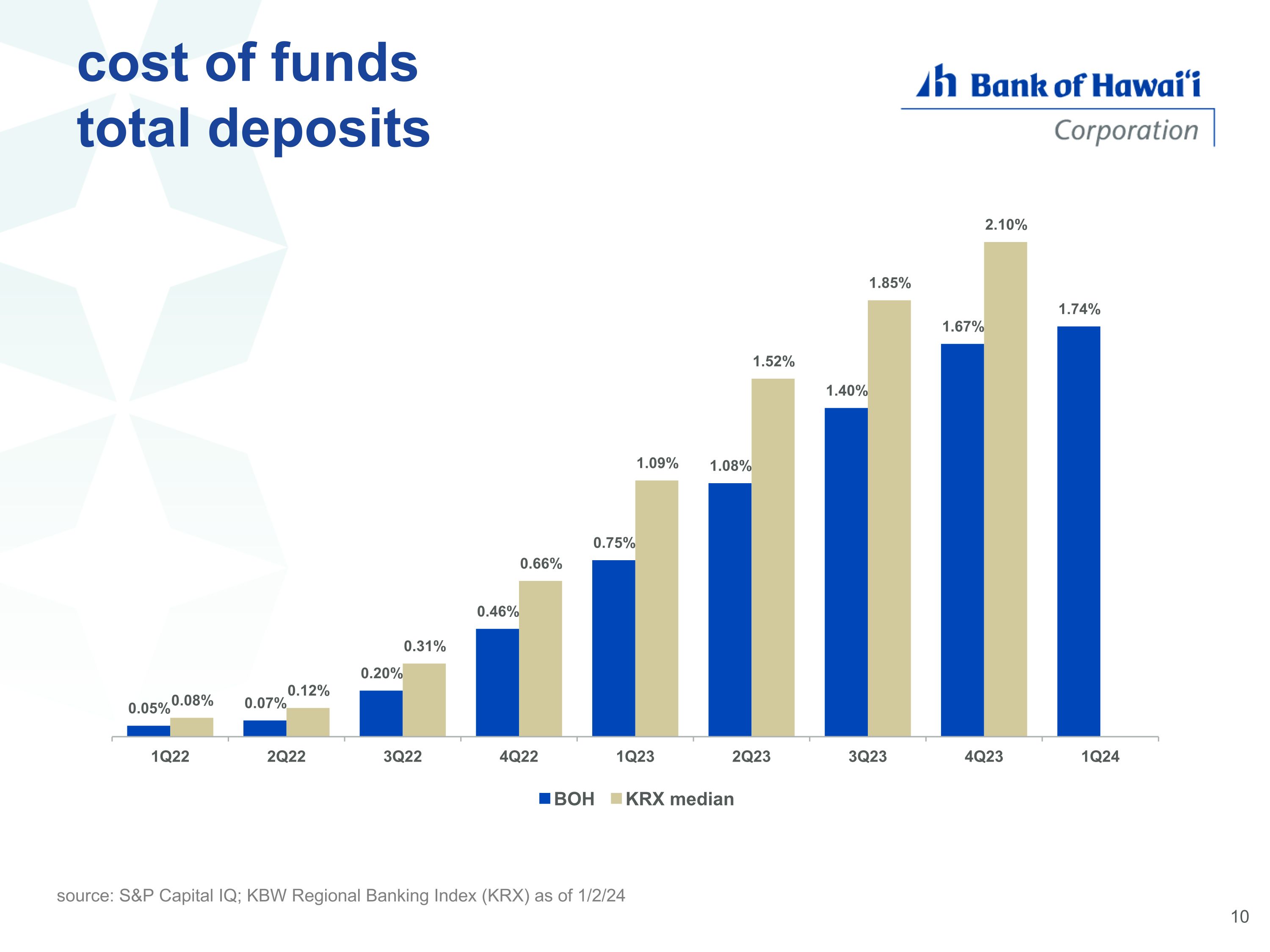

cost of funds�total deposits source: S&P Capital IQ; KBW Regional Banking Index (KRX) as of 1/2/24

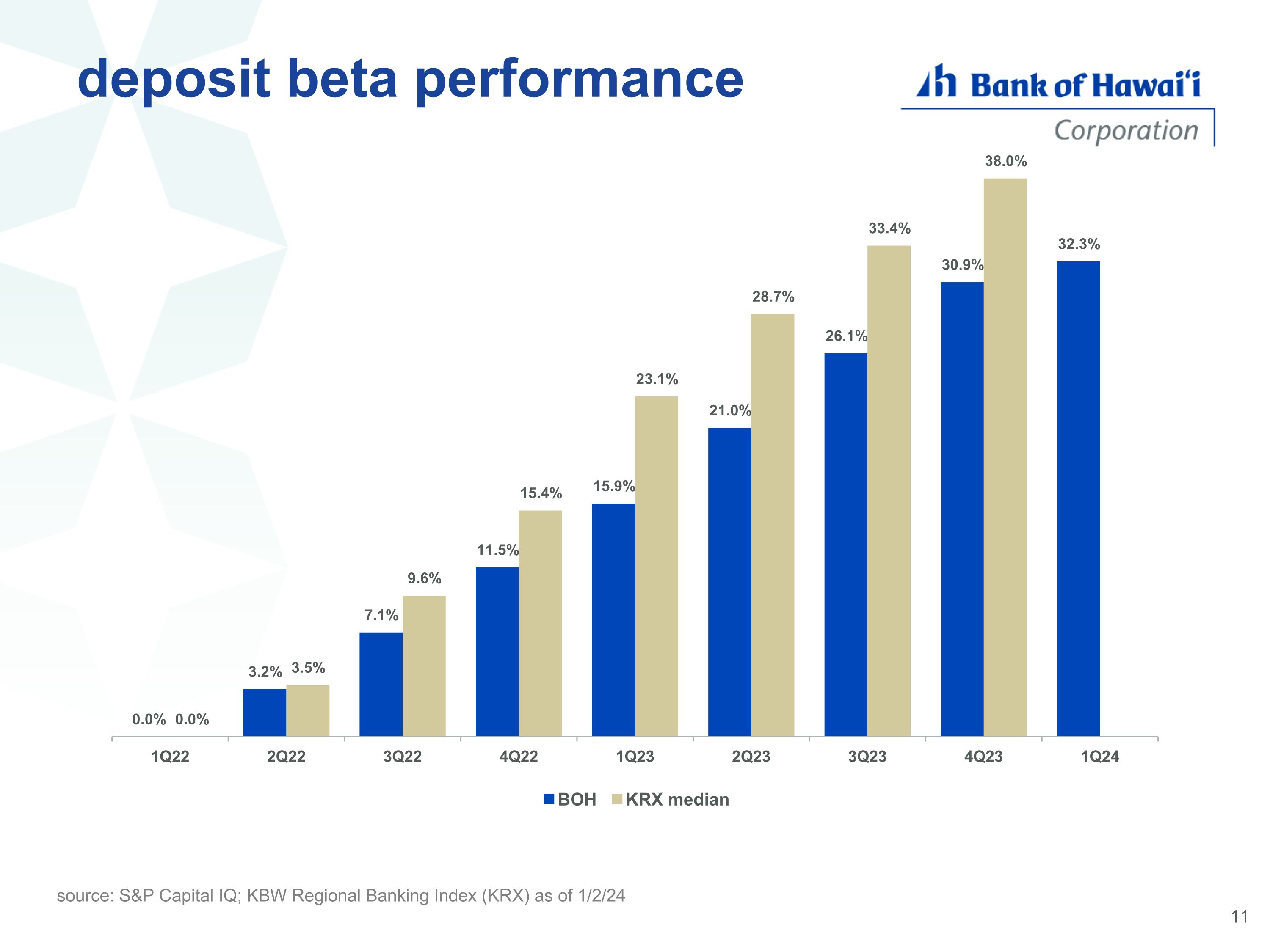

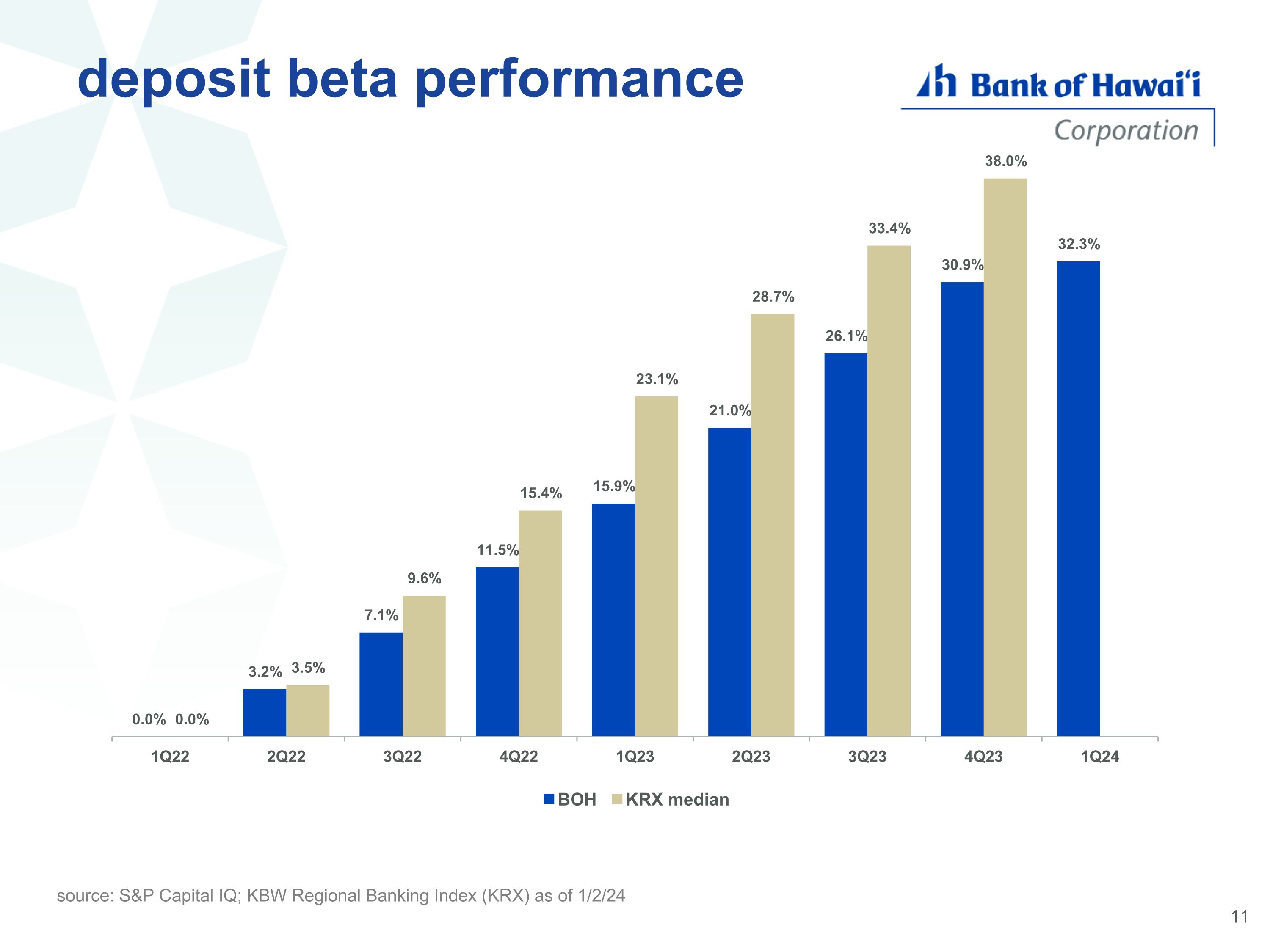

deposit beta performance source: S&P Capital IQ; KBW Regional Banking Index (KRX) as of 1/2/24

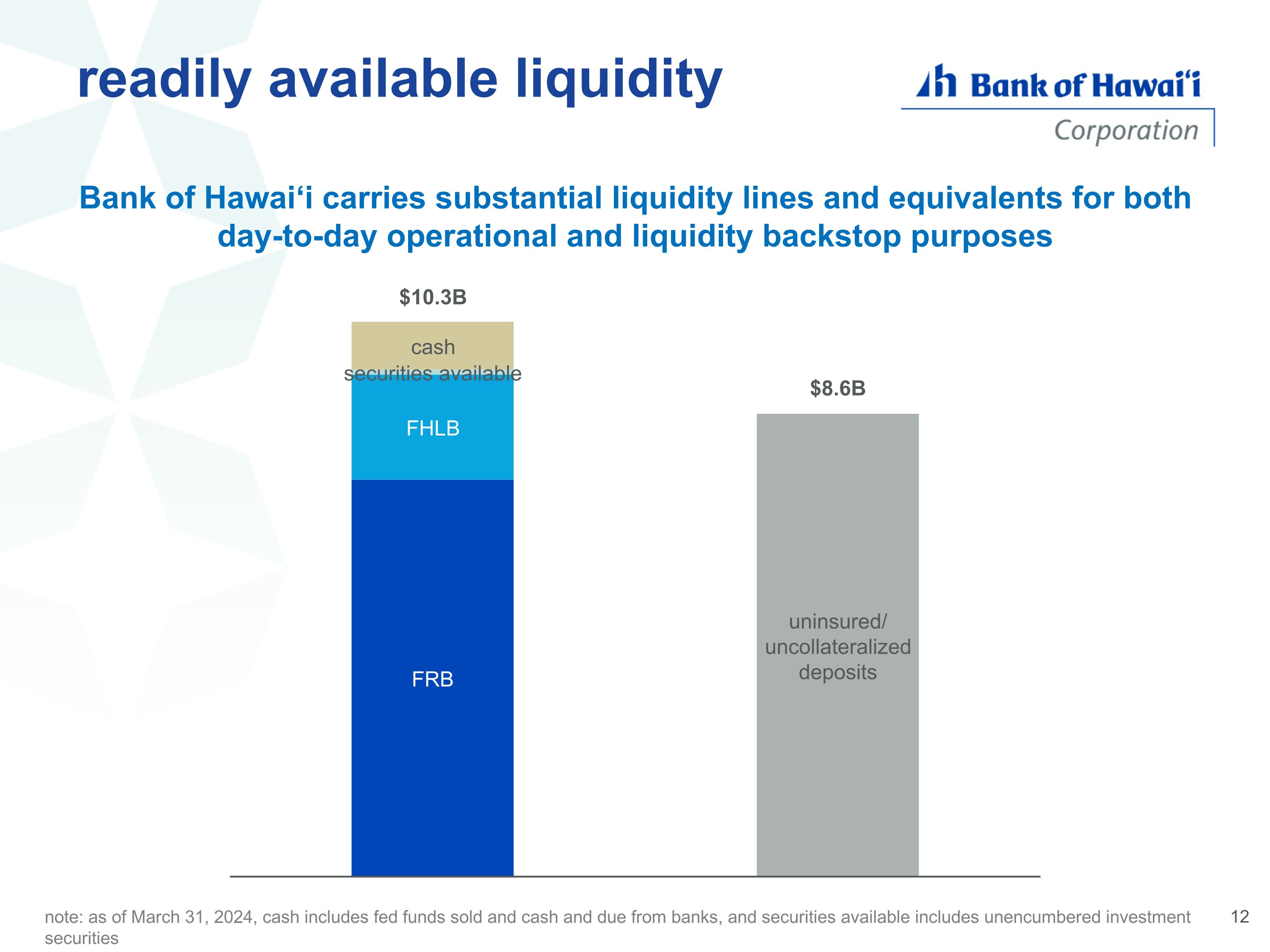

note: as of March 31, 2024, cash includes fed funds sold and cash and due from banks, and securities available includes unencumbered investment securities Bank of Hawai‘i carries substantial liquidity lines and equivalents for both day-to-day operational and liquidity backstop purposes readily available liquidity

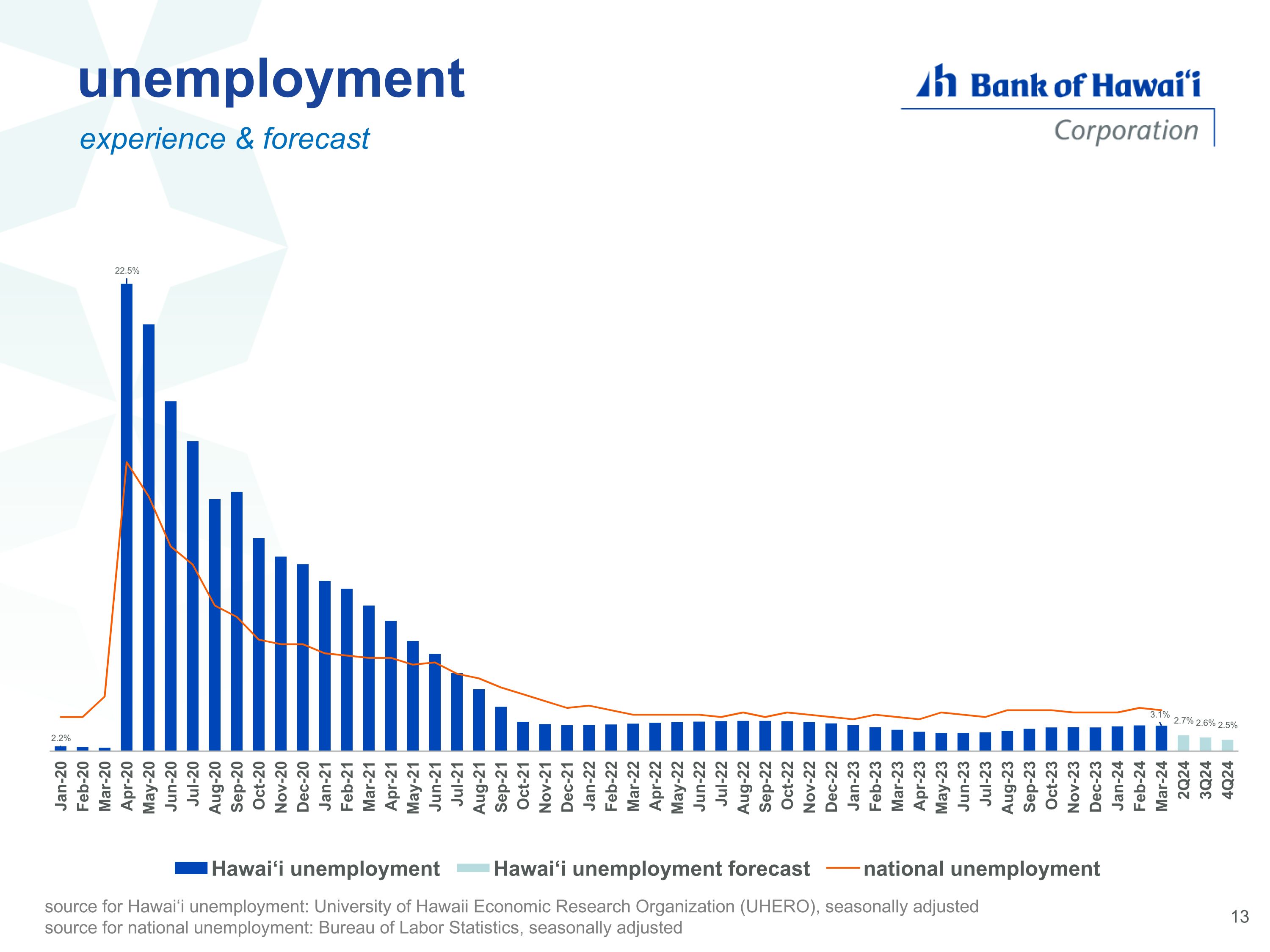

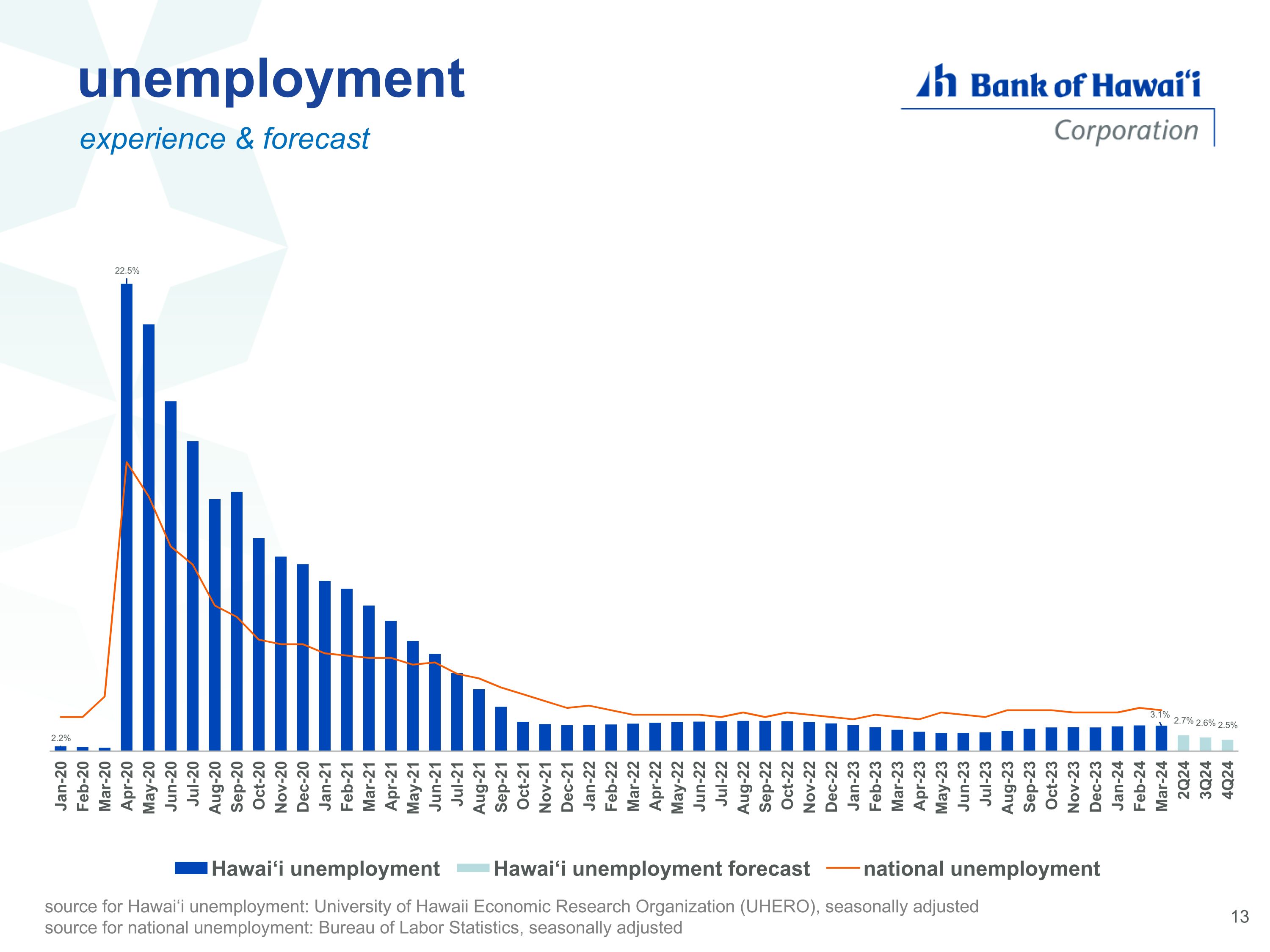

unemployment experience & forecast source for Hawai‘i unemployment: University of Hawaii Economic Research Organization (UHERO), seasonally adjusted source for national unemployment: Bureau of Labor Statistics, seasonally adjusted 13

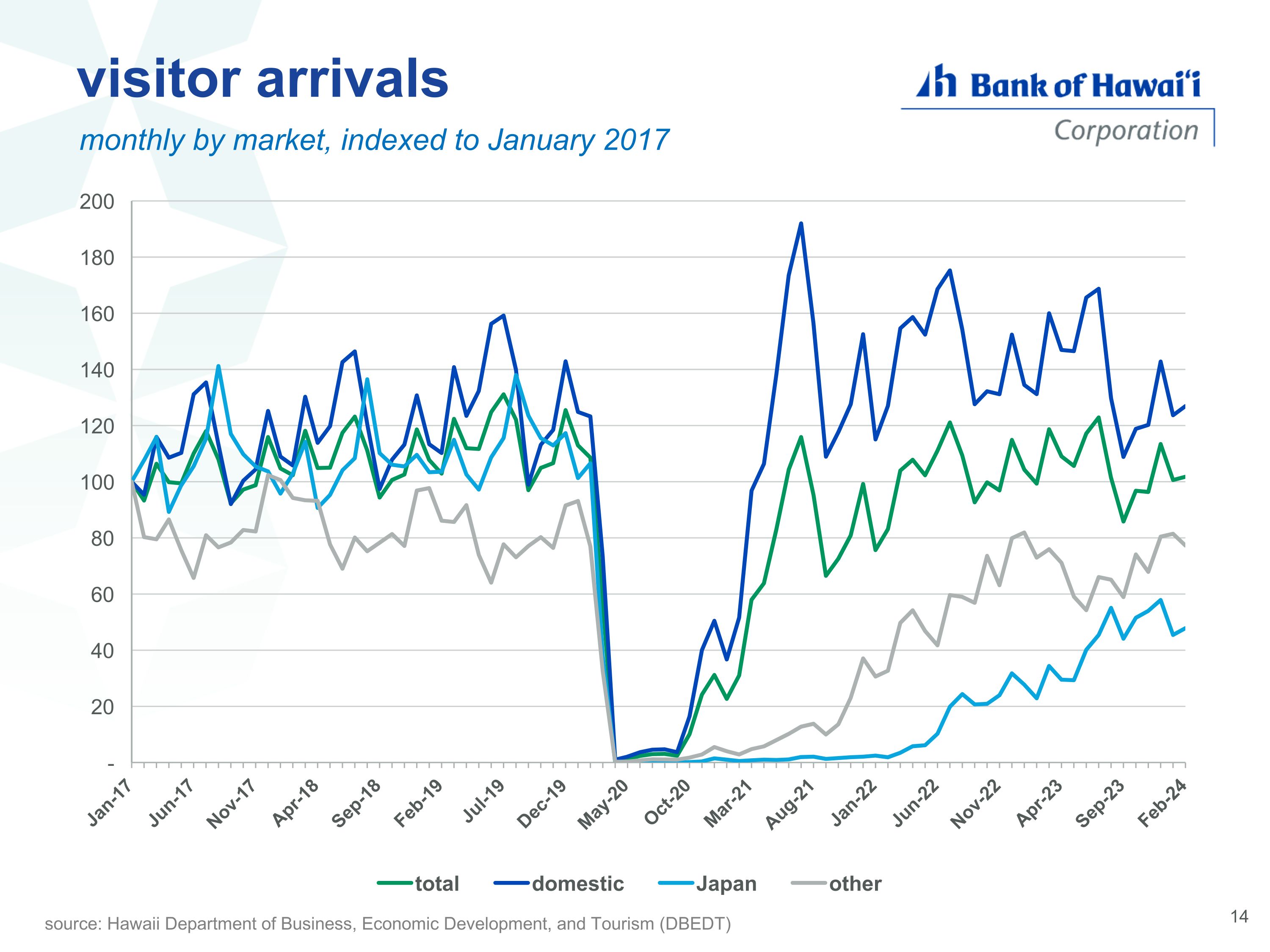

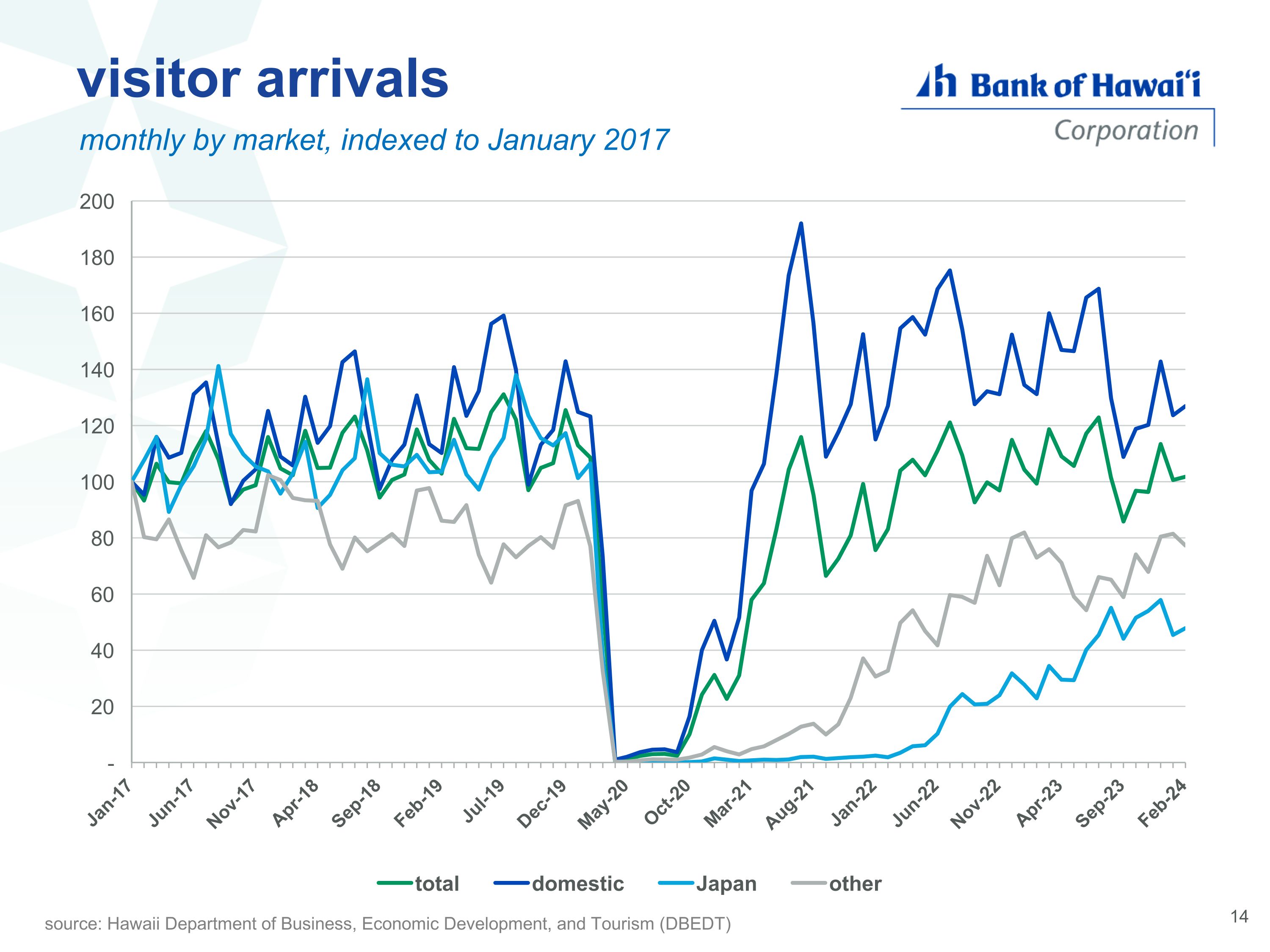

14 visitor arrivals monthly by market, indexed to January 2017 source: Hawaii Department of Business, Economic Development, and Tourism (DBEDT)

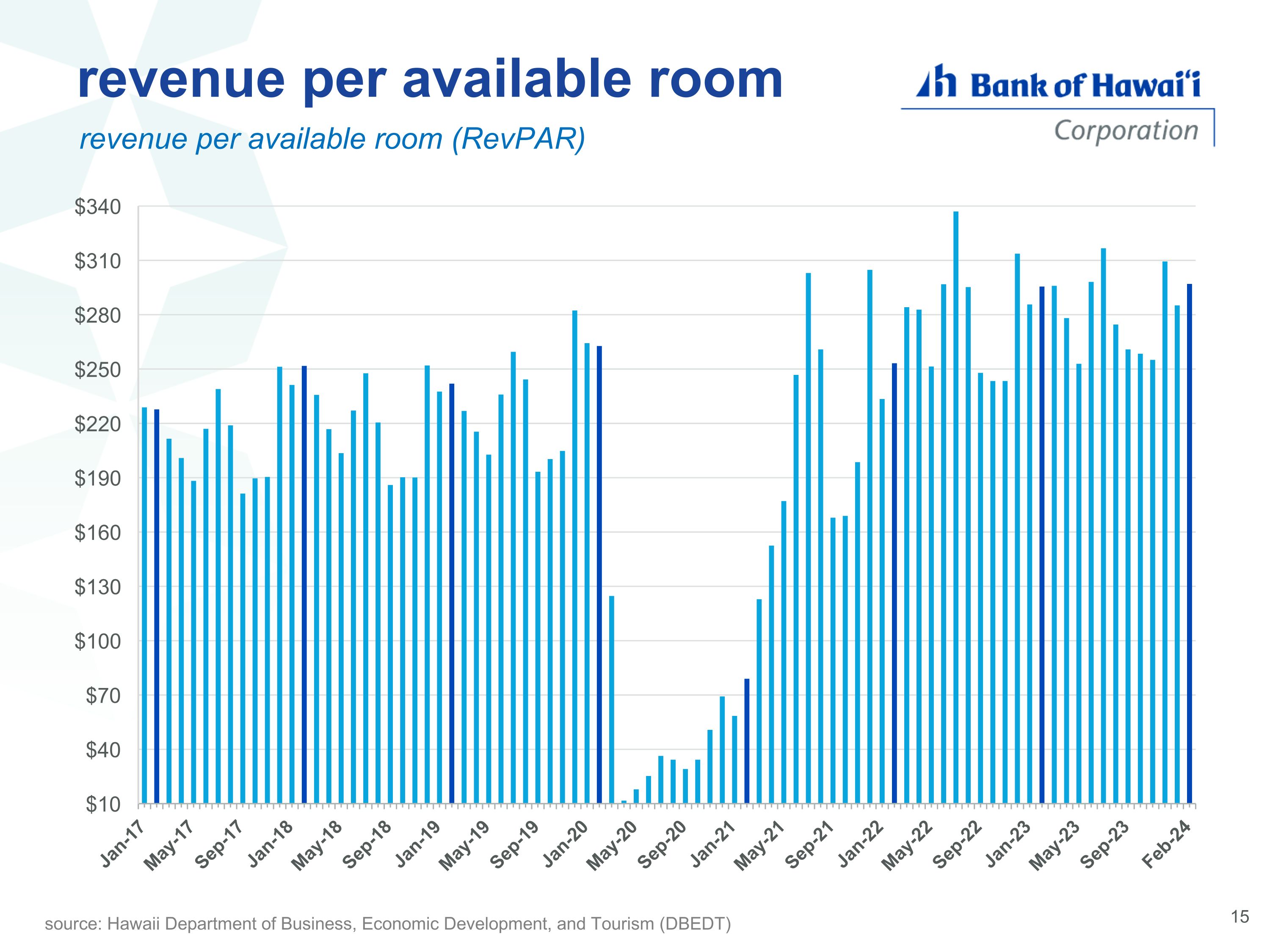

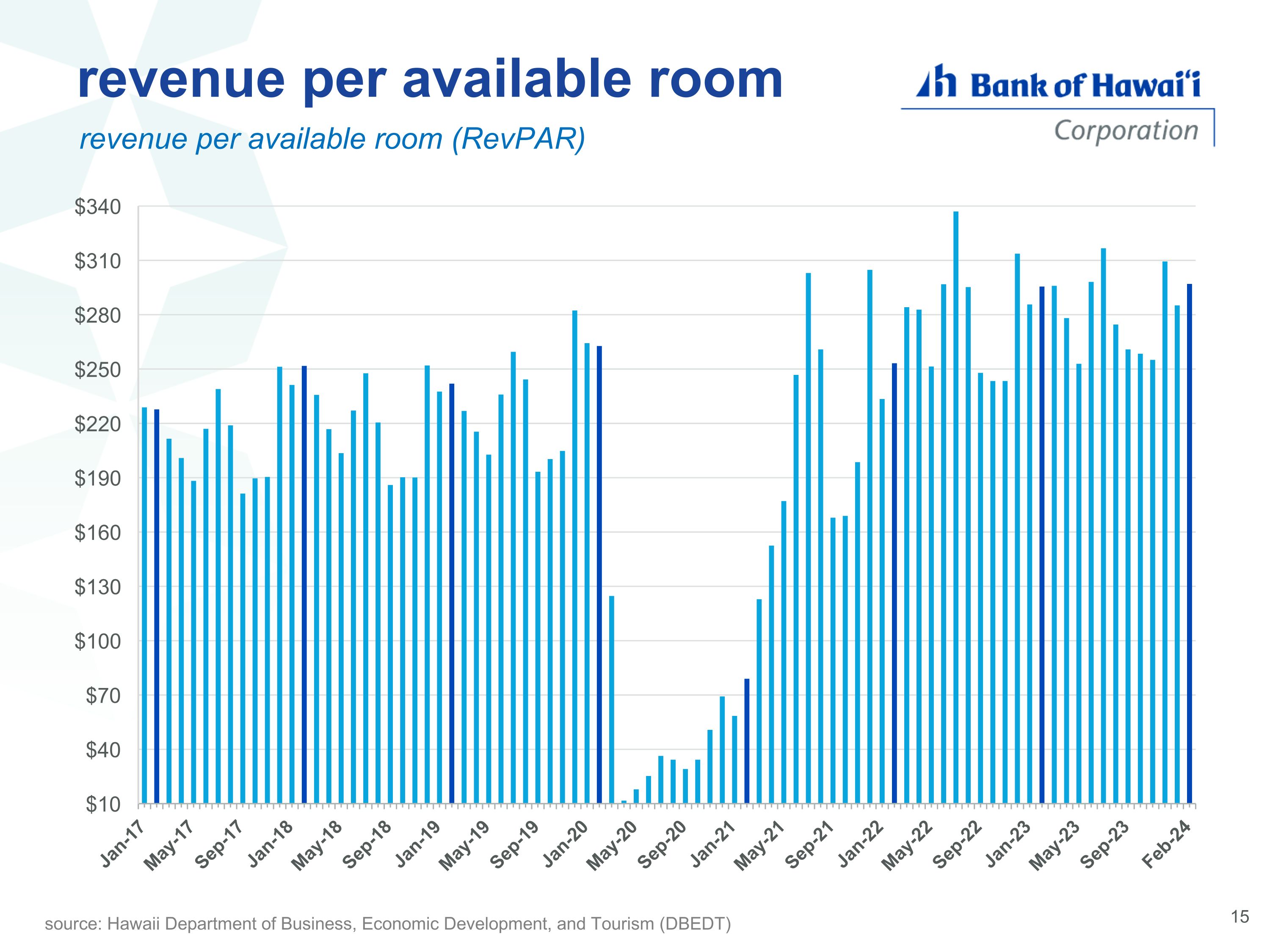

revenue per available room revenue per available room (RevPAR) source: Hawaii Department of Business, Economic Development, and Tourism (DBEDT)

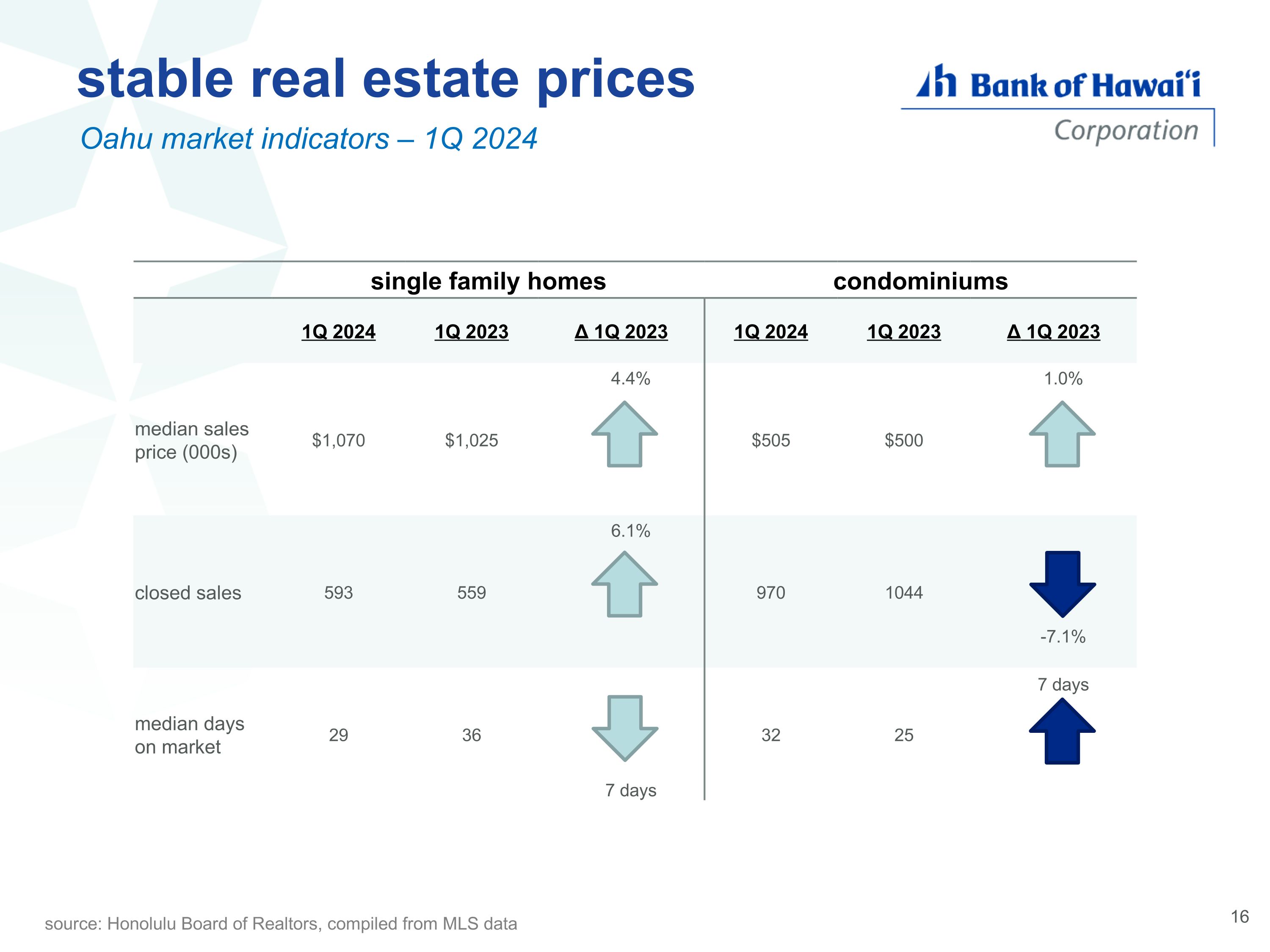

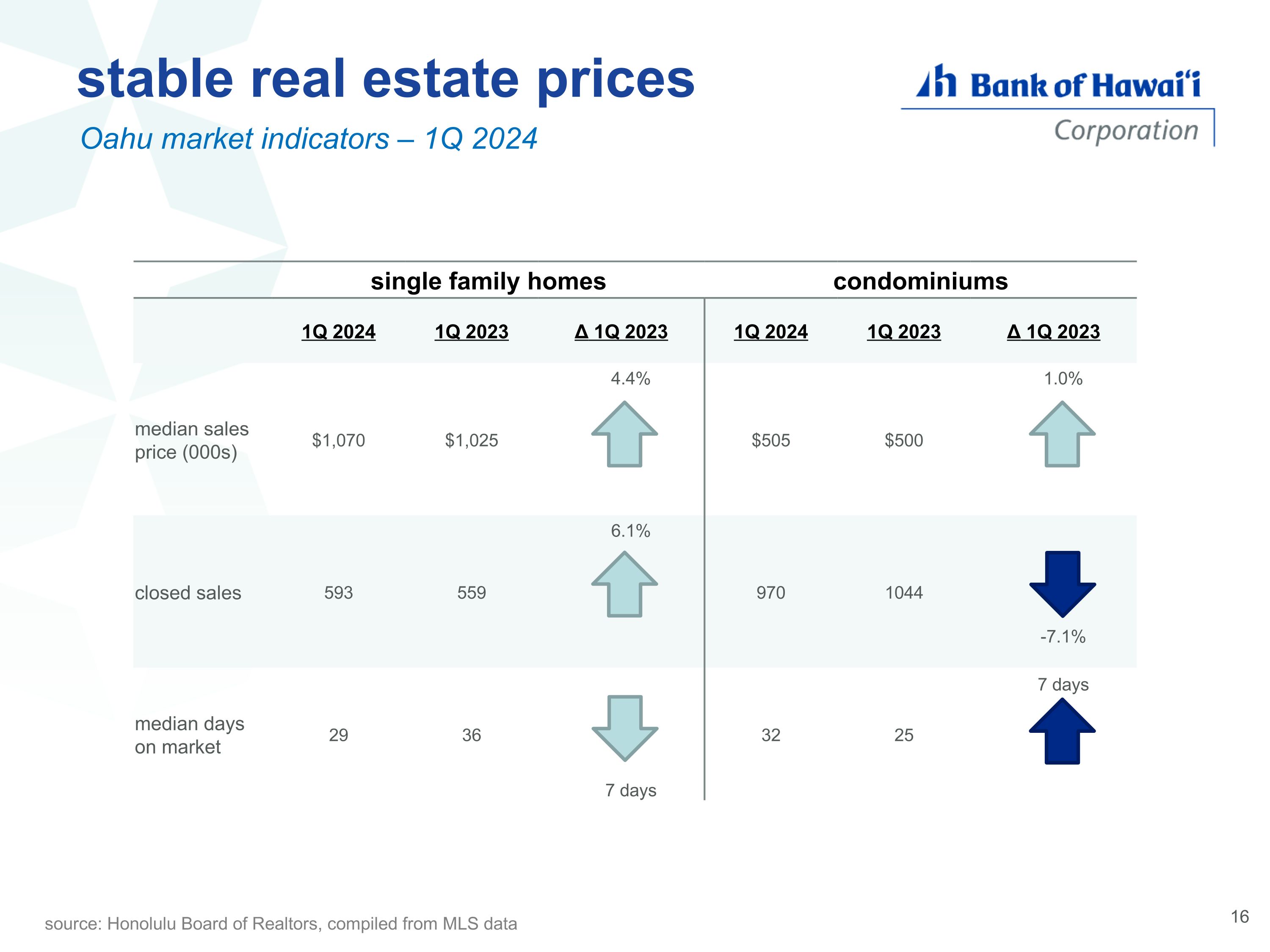

single family homes condominiums 1Q 2024 1Q 2023 Δ 1Q 2023 1Q 2024 1Q 2023 Δ 1Q 2023 median sales price (000s) $1,070 $1,025 4.4% $505 $500 1.0% closed sales 593 559 6.1% 970 1044 -7.1% median days on market 29 36 7 days 32 25 7 days stable real estate prices Oahu market indicators – 1Q 2024 source: Honolulu Board of Realtors, compiled from MLS data

credit performance

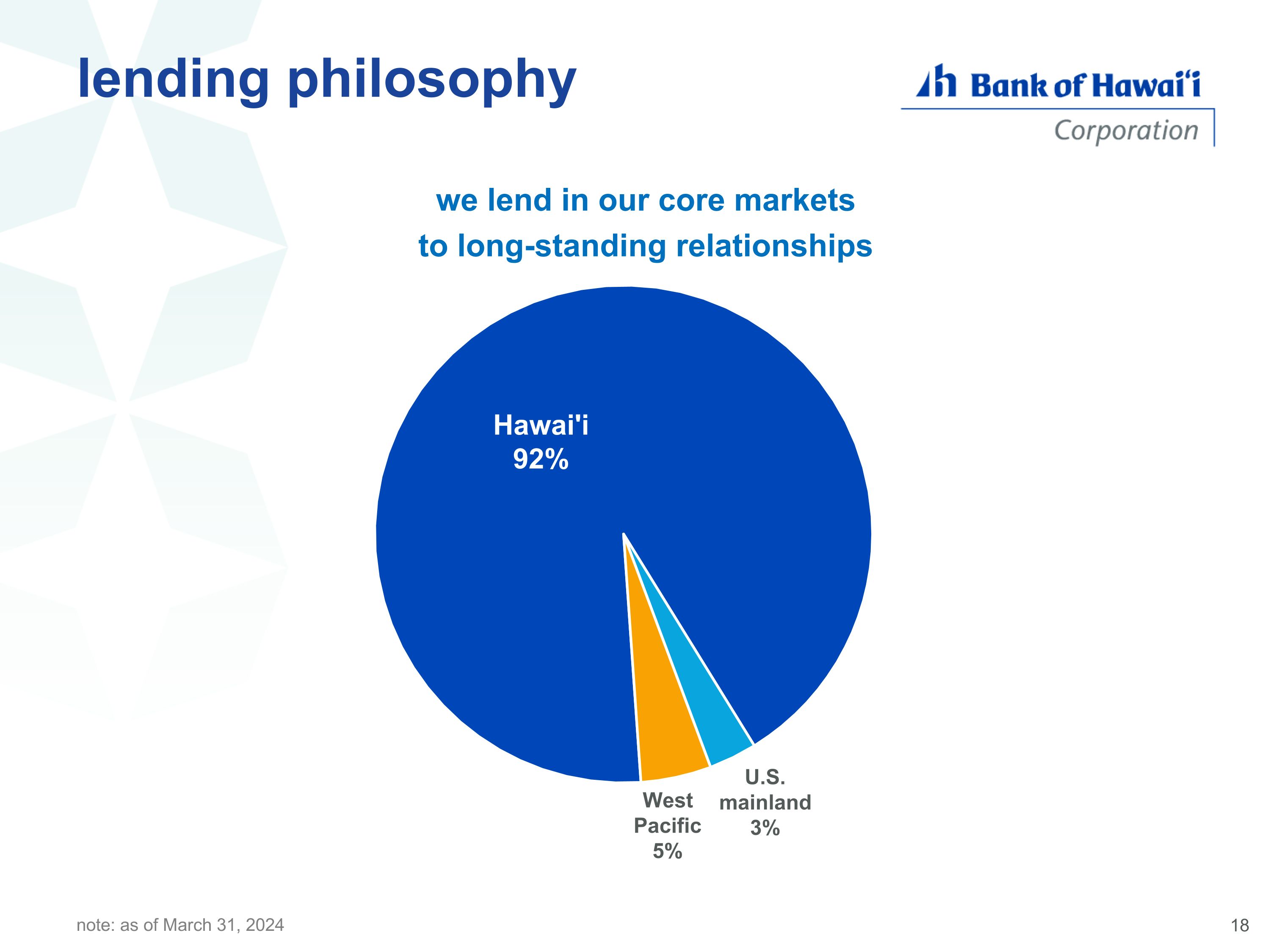

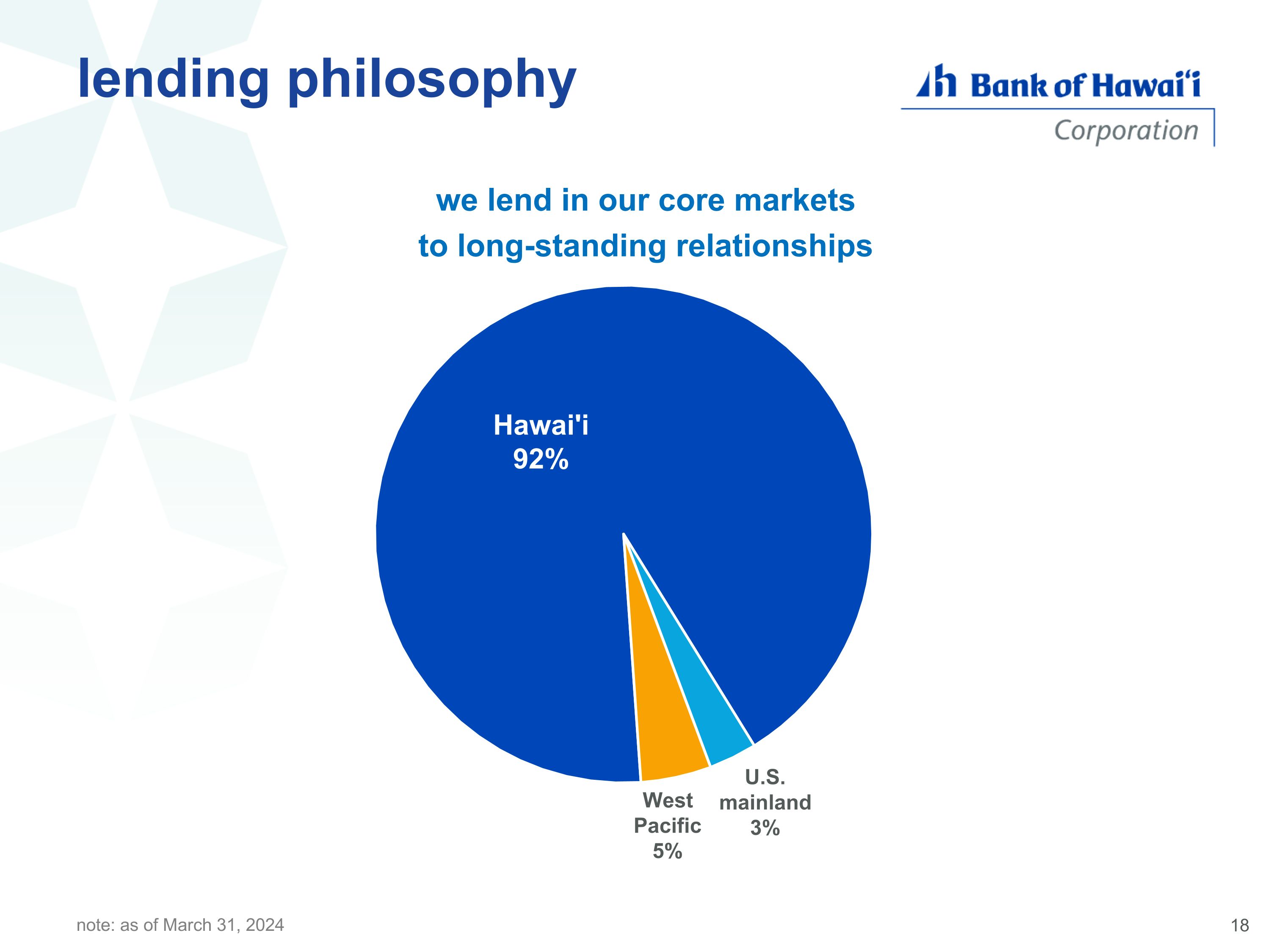

lending philosophy note: as of March 31, 2024 we lend in our core markets to long-standing relationships

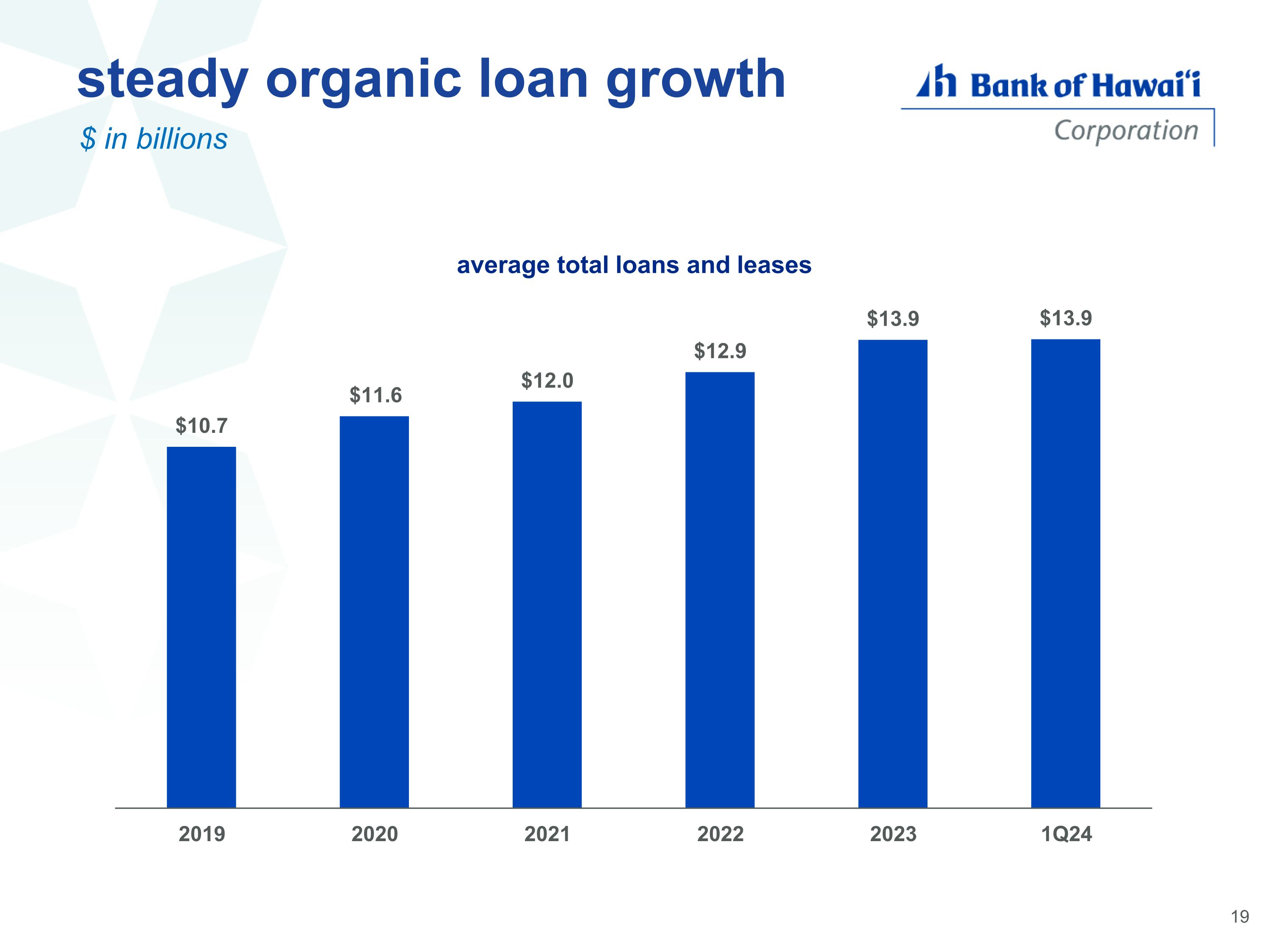

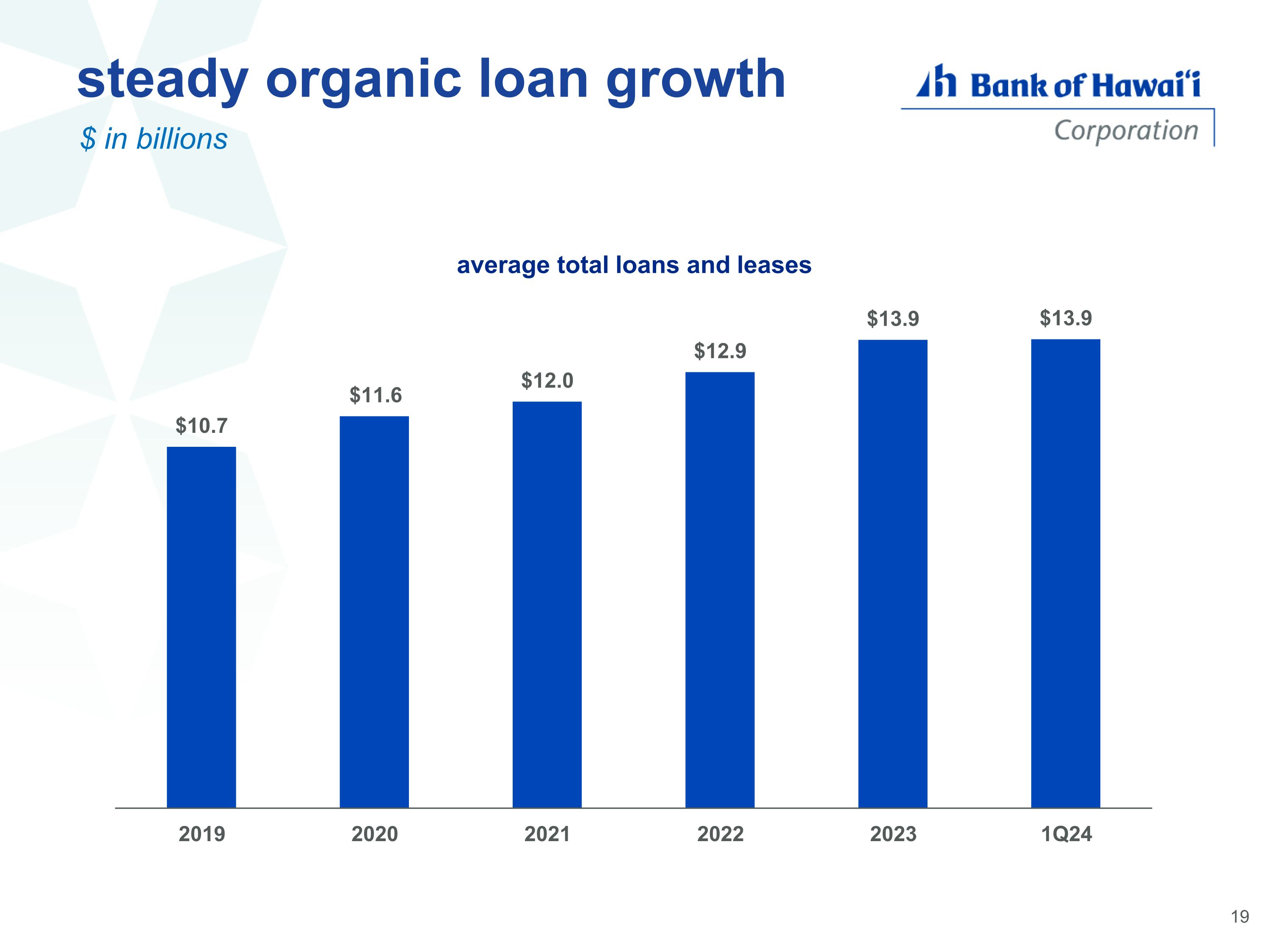

steady organic loan growth $ in billions

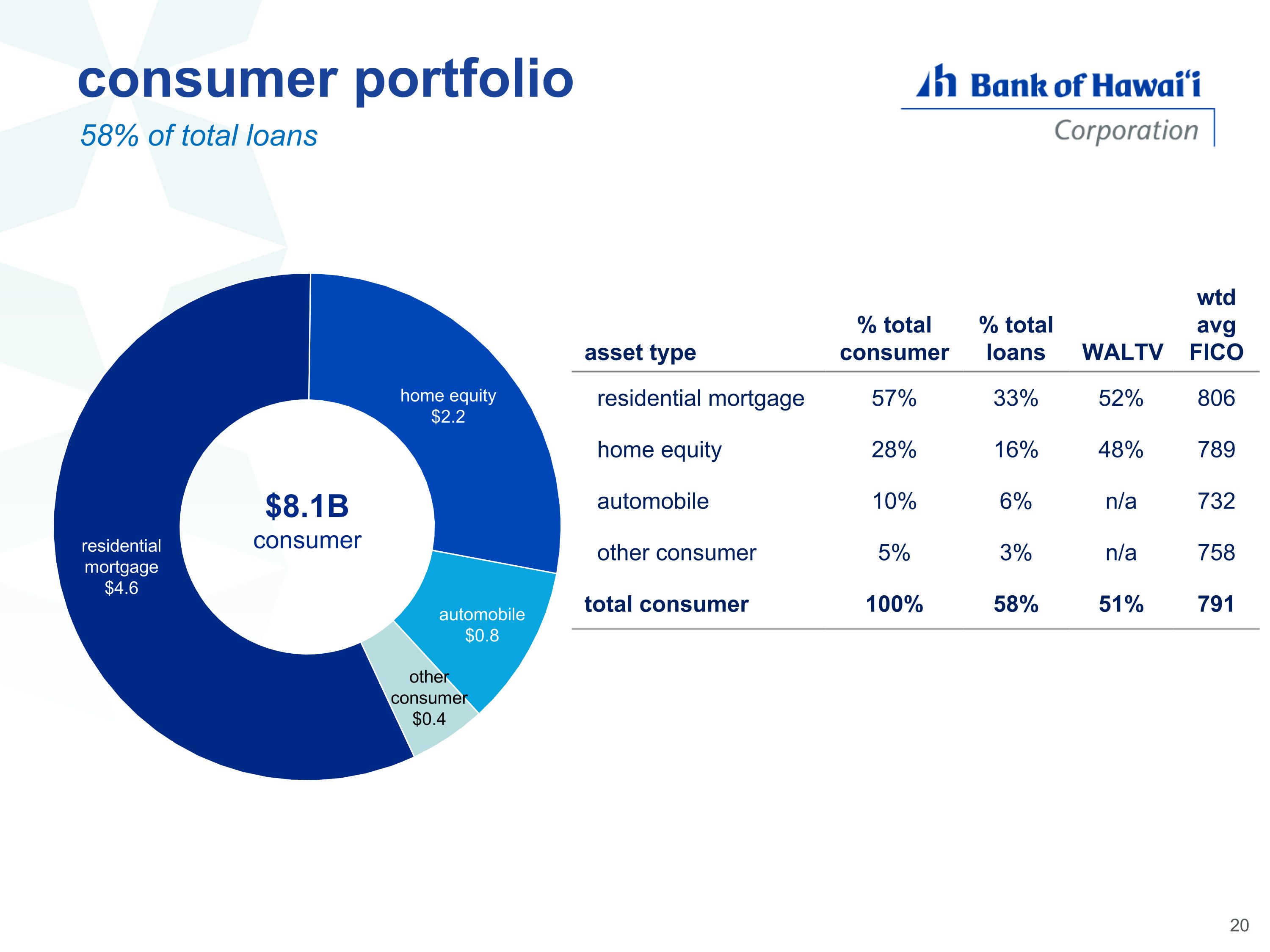

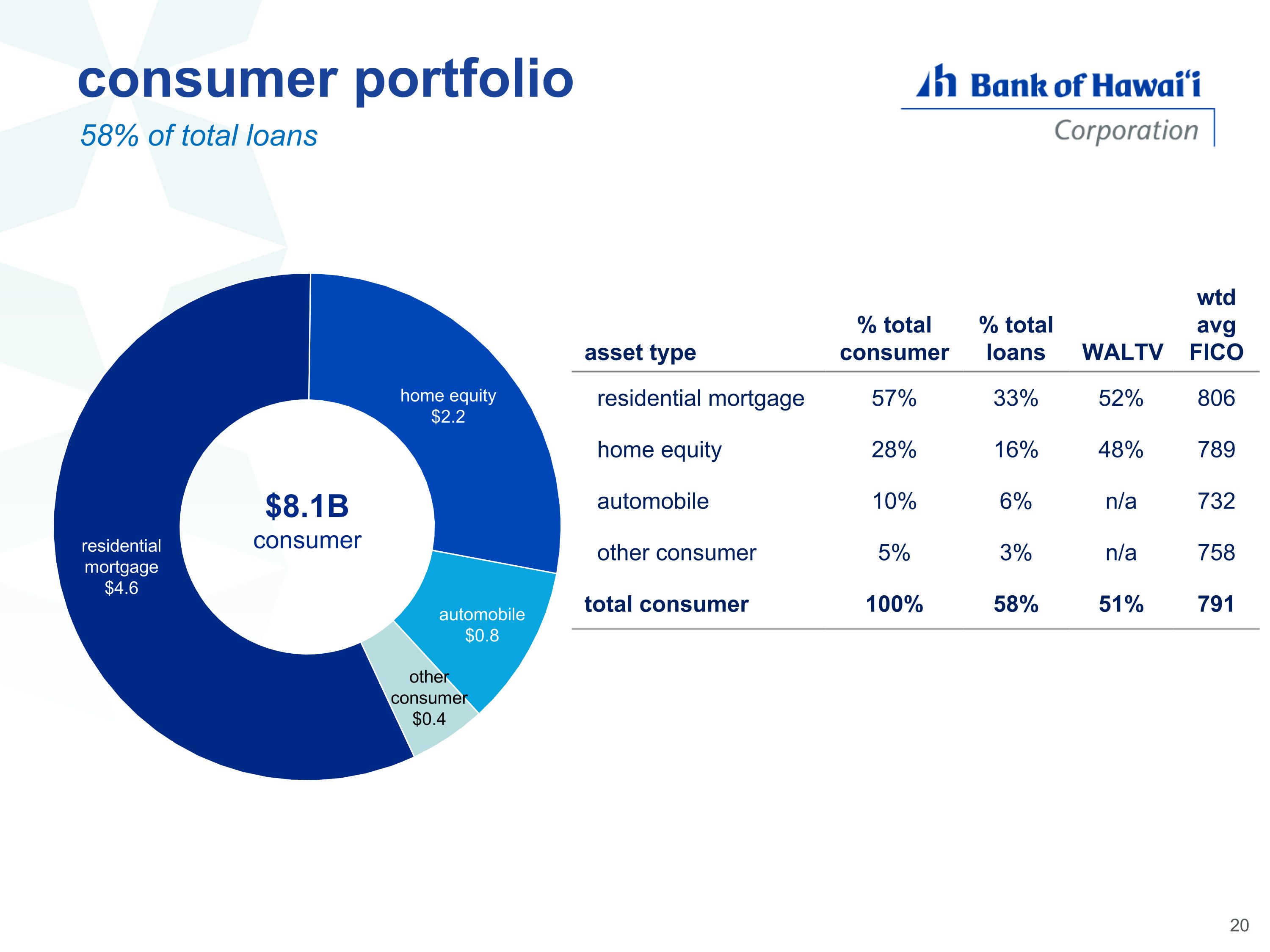

consumer portfolio 58% of total loans asset type % total consumer % total loans WALTV wtd avg FICO residential mortgage 57% 33% 52% 806 home equity 28% 16% 48% 789 automobile 10% 6% n/a 732 other consumer 5% 3% n/a 758 total consumer 100% 58% 51% 791 $8.1B consumer

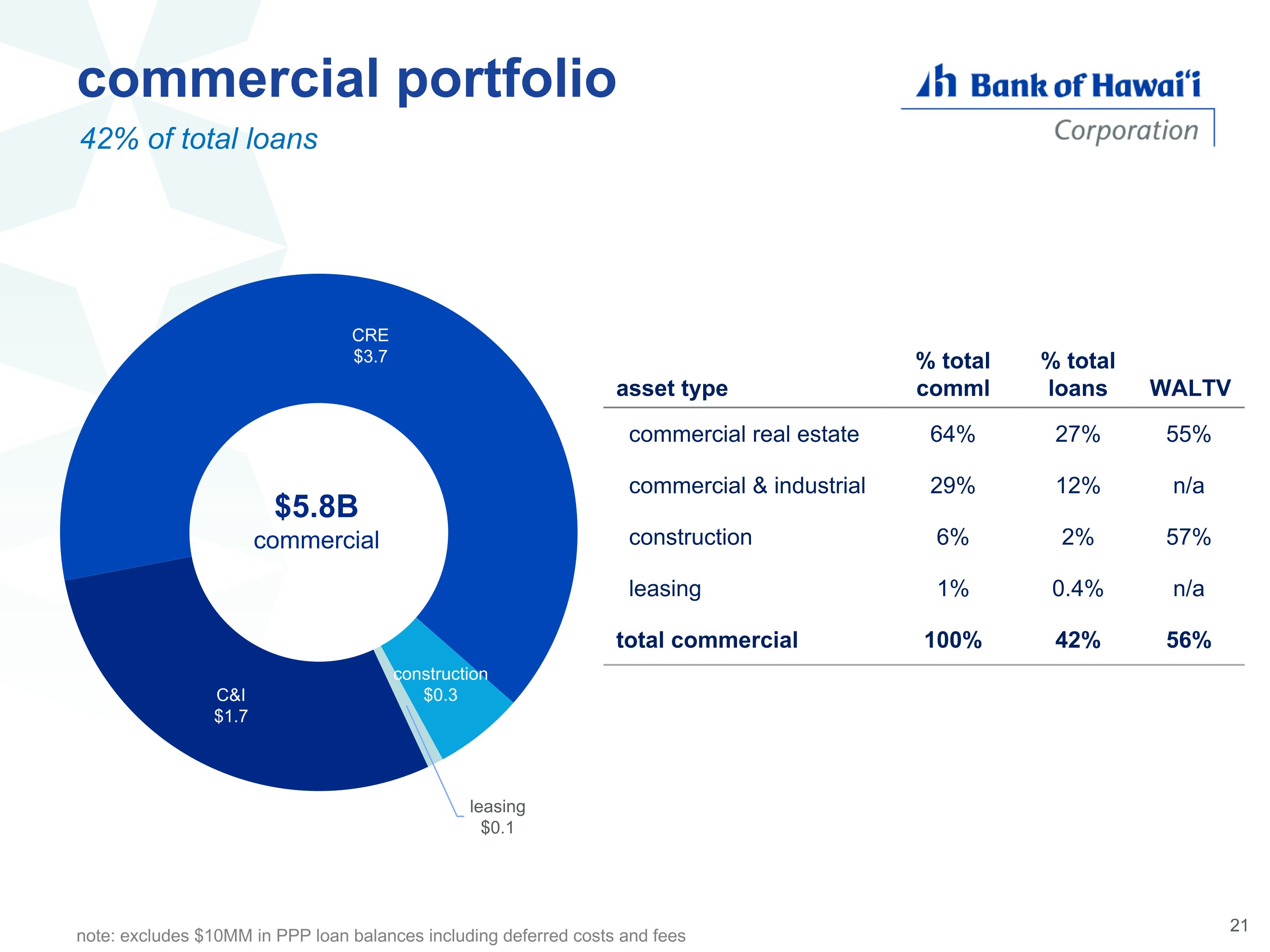

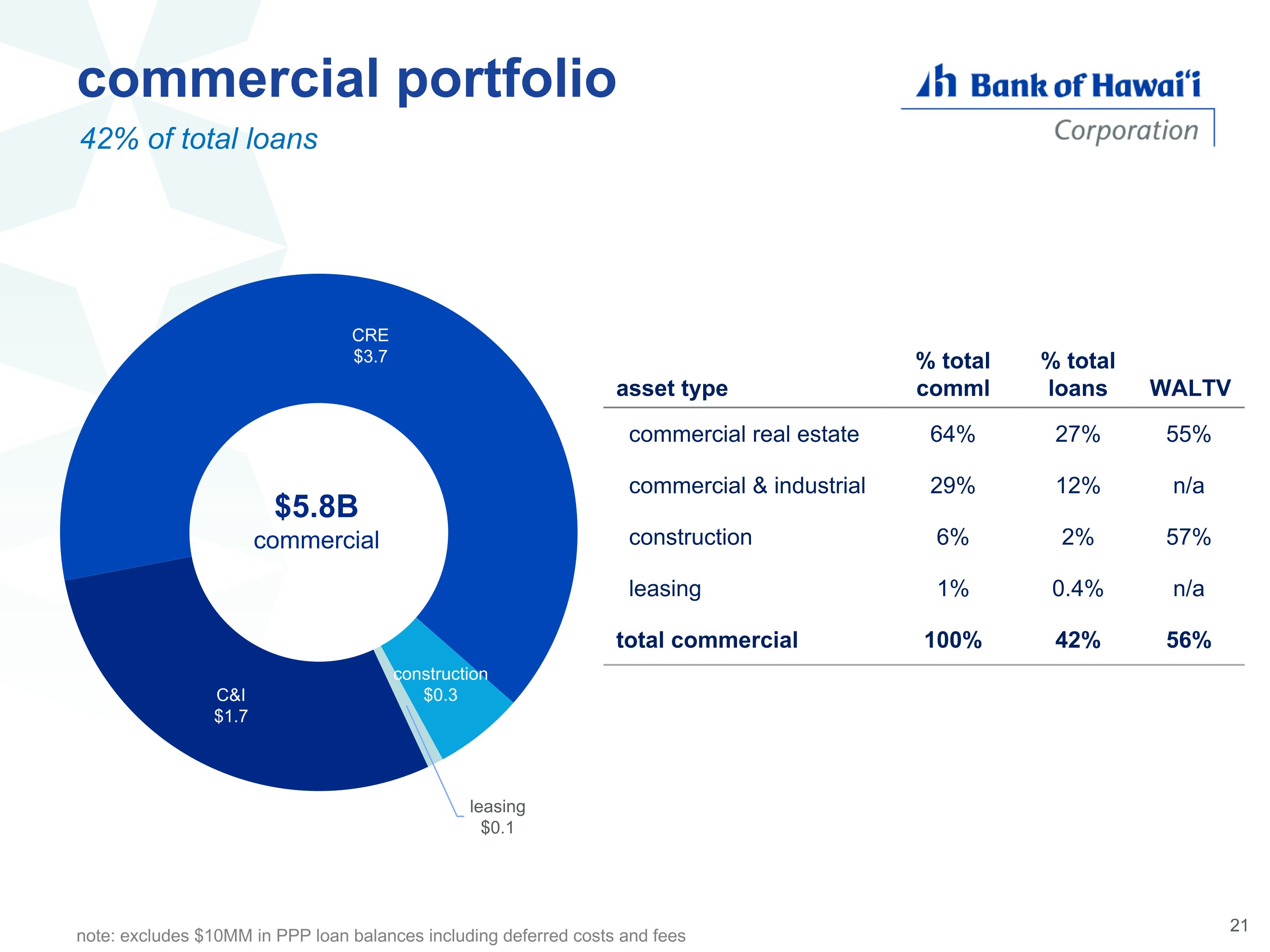

commercial portfolio CRE C&I residential mortgage home equity auto 42% of total loans $5.8B commercial asset type % total comml % total loans WALTV commercial real estate 64% 27% 55% commercial & industrial 29% 12% n/a construction 6% 2% 57% leasing 1% 0.4% n/a total commercial 100% 42% 56% note: excludes $10MM in PPP loan balances including deferred costs and fees

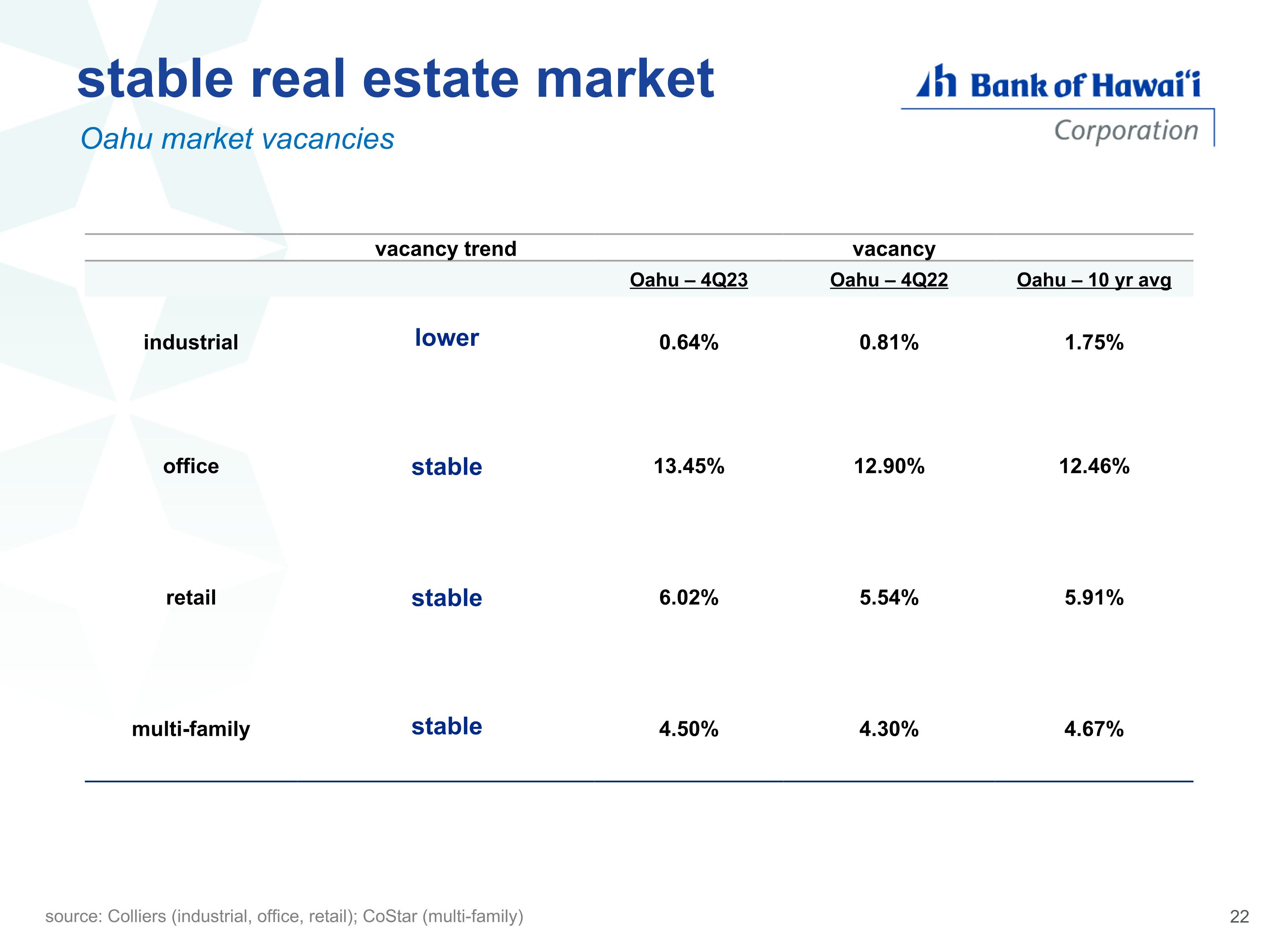

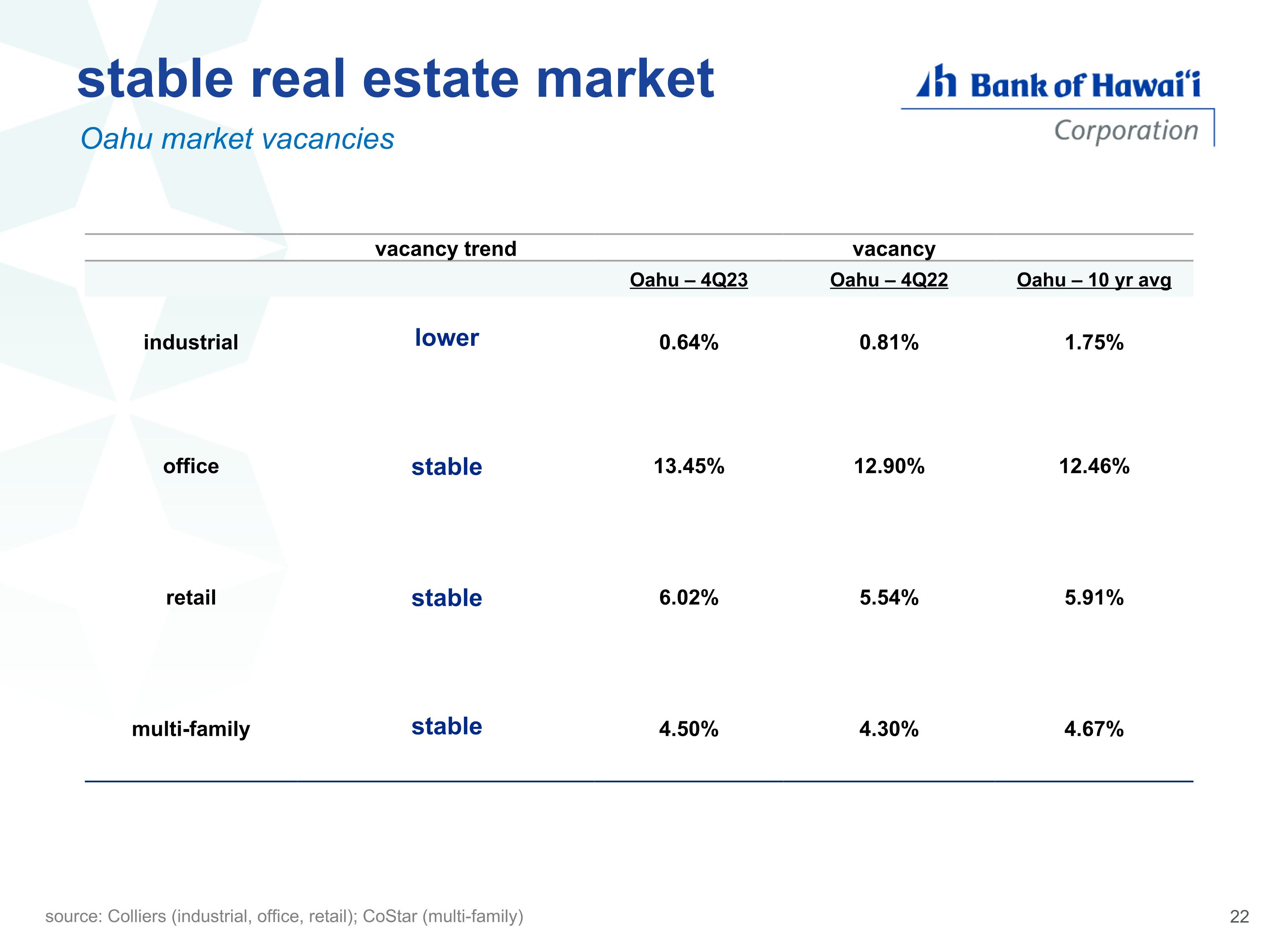

vacancy trend vacancy Oahu – 4Q23 Oahu – 4Q22 Oahu – 10 yr avg industrial 0.64% 0.81% 1.75% office 13.45% 12.90% 12.46% retail 6.02% 5.54% 5.91% multi-family 4.50% 4.30% 4.67% Oahu market vacancies source: Colliers (industrial, office, retail); CoStar (multi-family) stable real estate market lower stable stable stable

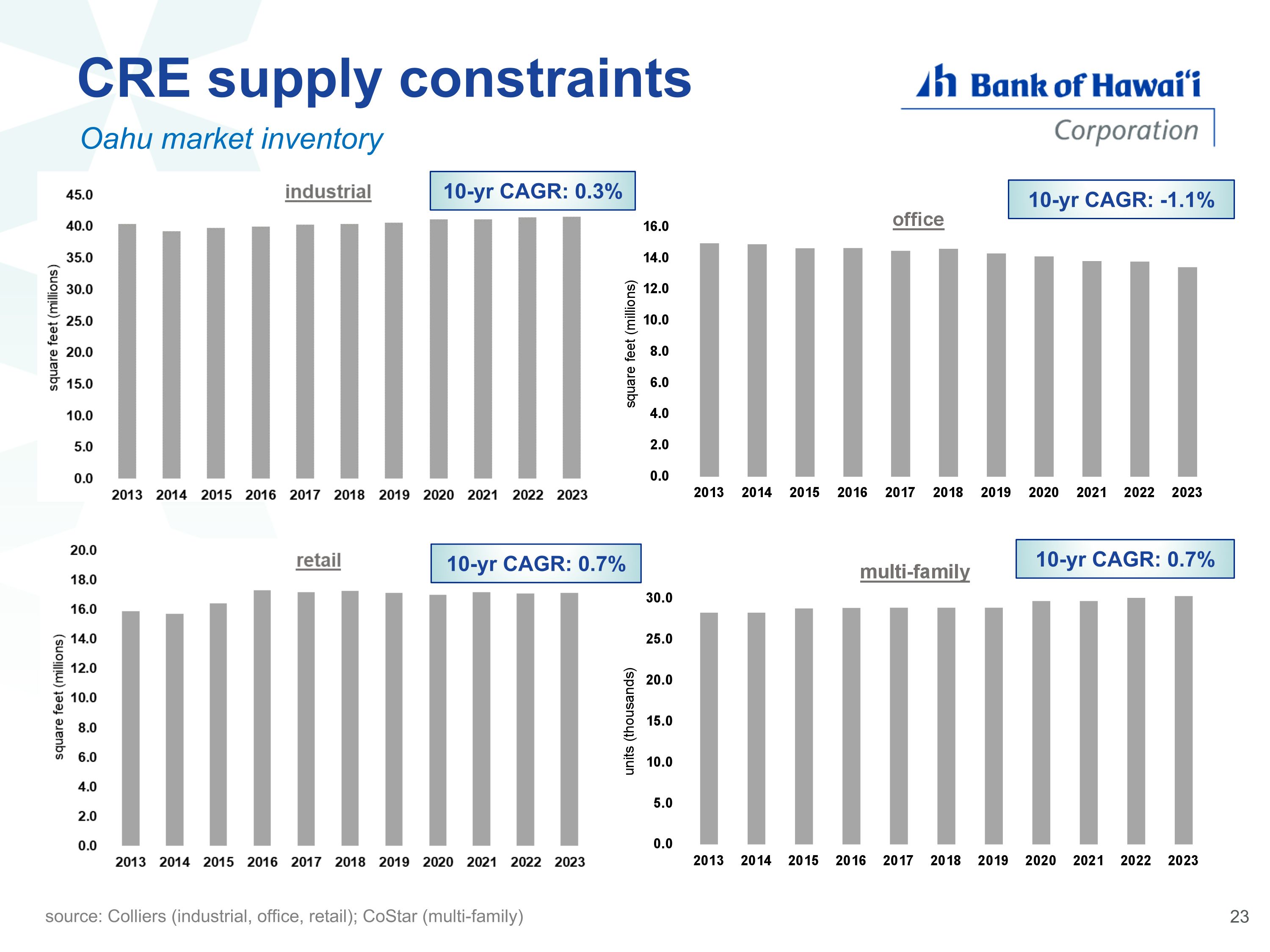

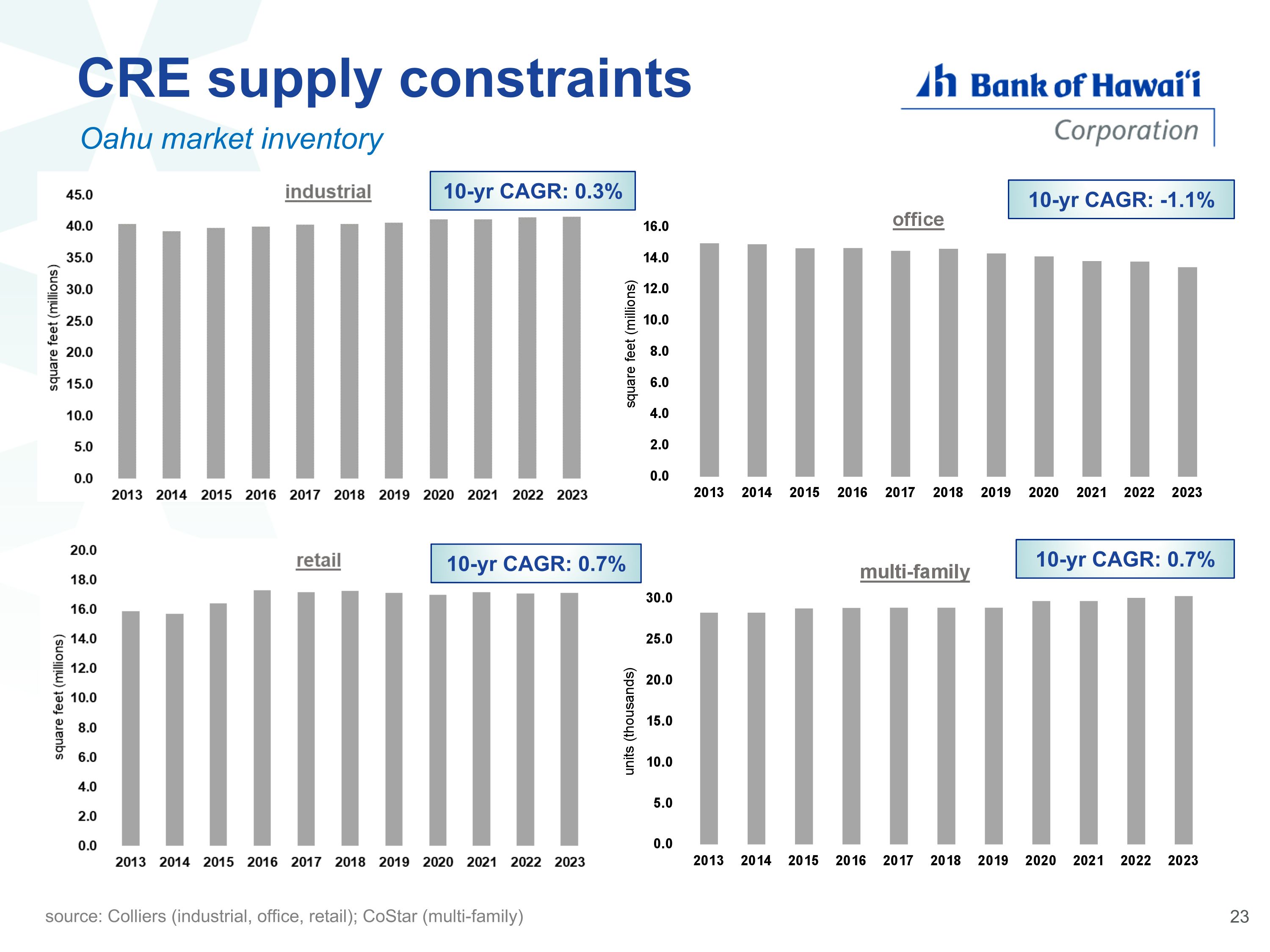

Oahu market inventory source: Colliers (industrial, office, retail); CoStar (multi-family) CRE supply constraints 10-yr CAGR: 0.3% 10-yr CAGR: -1.1% 10-yr CAGR: 0.7% 10-yr CAGR: 0.7%

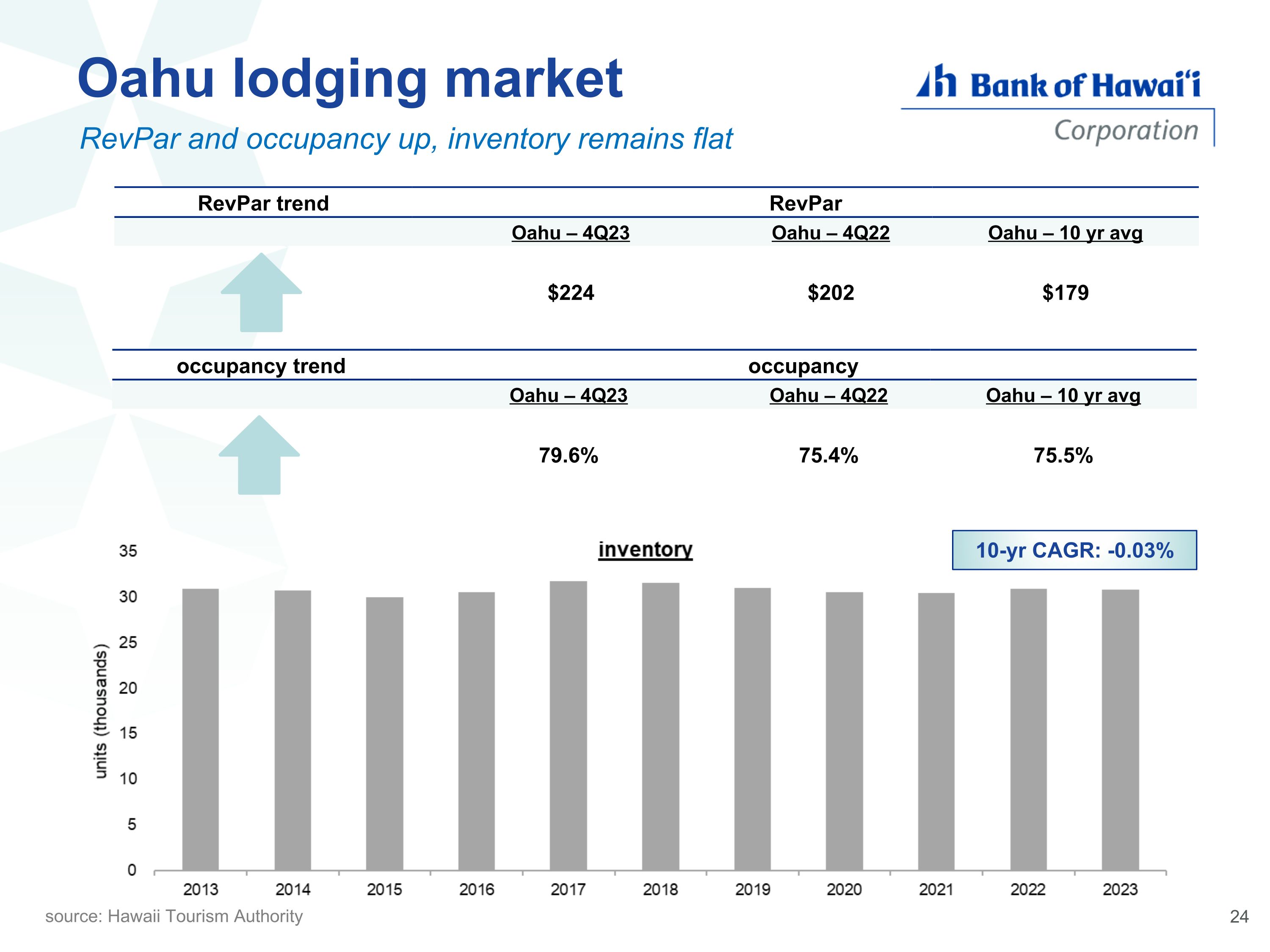

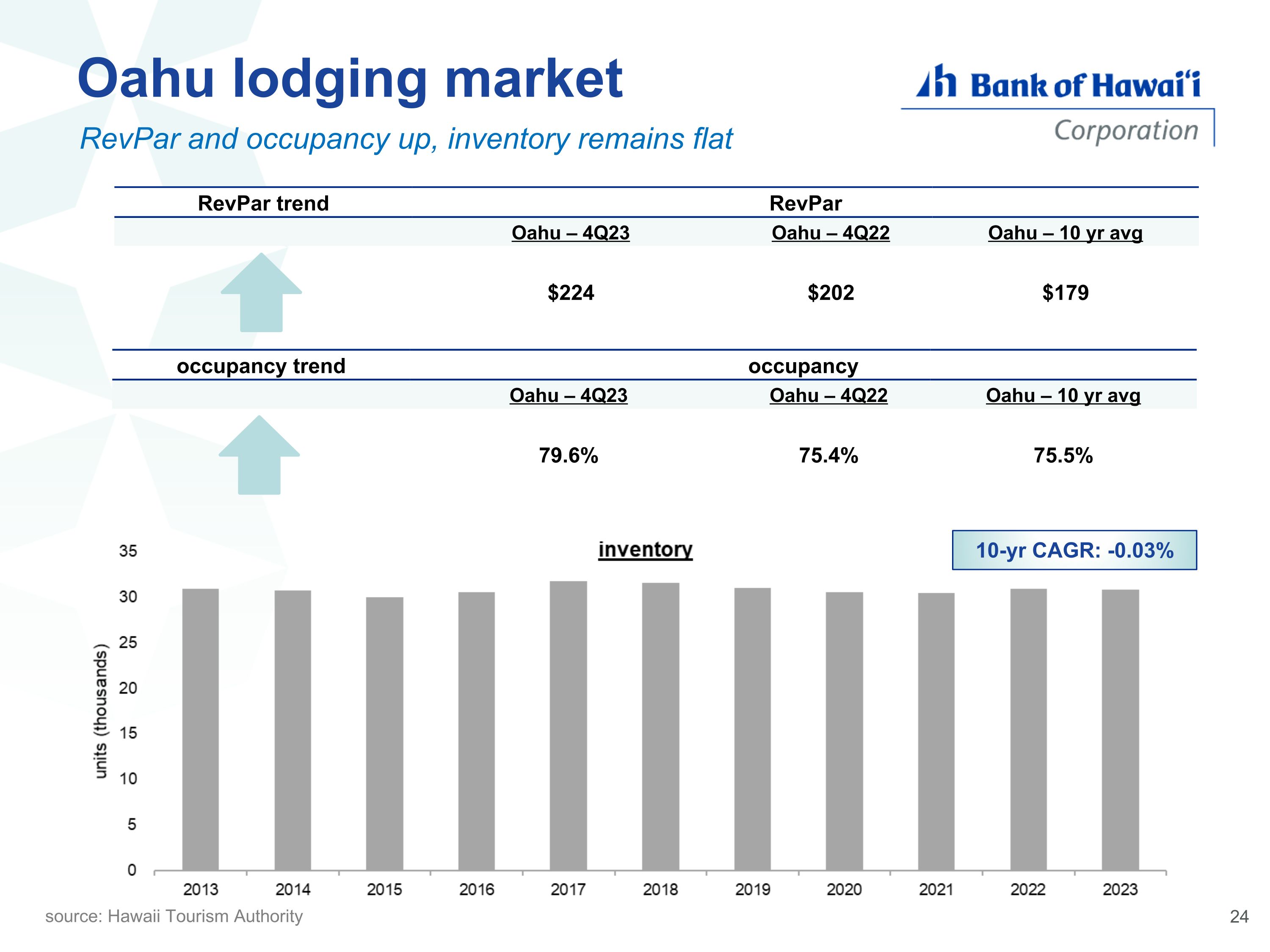

RevPar trend RevPar Oahu – 4Q23 Oahu – 4Q22 Oahu – 10 yr avg $224 $202 $179 source: Hawaii Tourism Authority Oahu lodging market RevPar and occupancy up, inventory remains flat 10-yr CAGR: -0.03% occupancy trend occupancy Oahu – 4Q23 Oahu – 4Q22 Oahu – 10 yr avg 79.6% 75.4% 75.5%

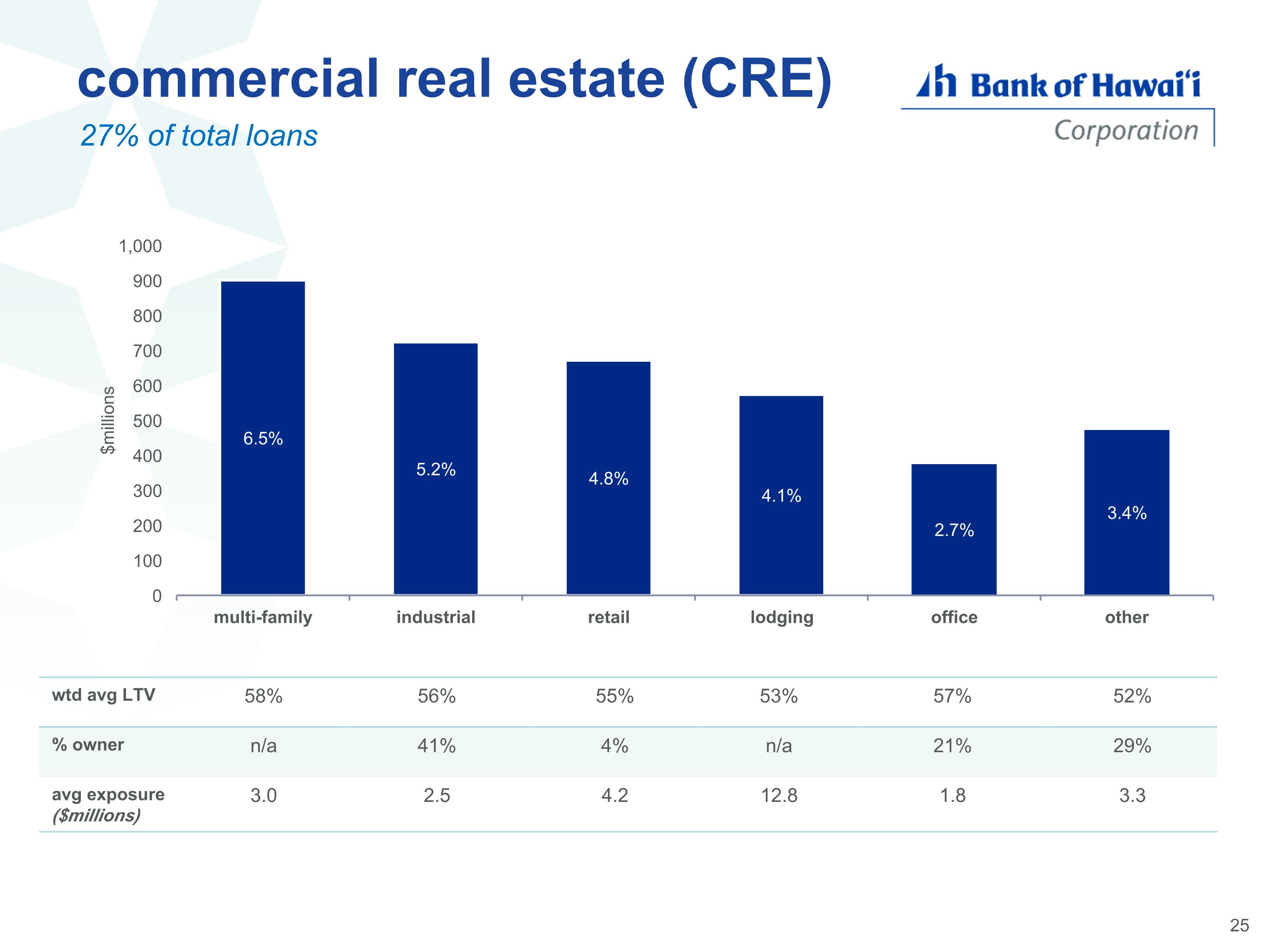

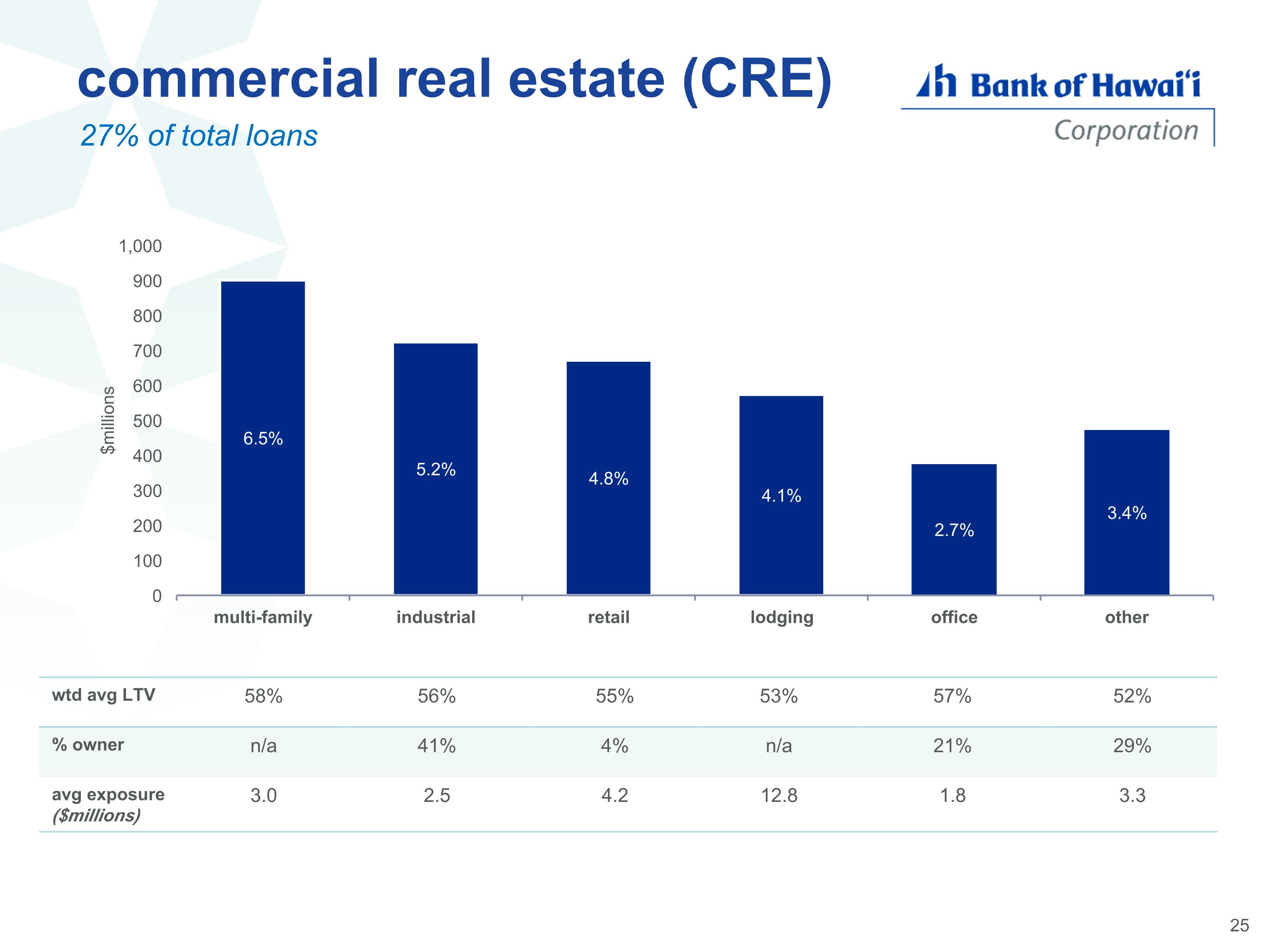

commercial real estate (CRE) 27% of total loans wtd avg LTV 58% 56% 55% 53% 57% 52% % owner n/a 41% 4% n/a 21% 29% avg exposure ($millions) 3.0 2.5 4.2 12.8 1.8 3.3

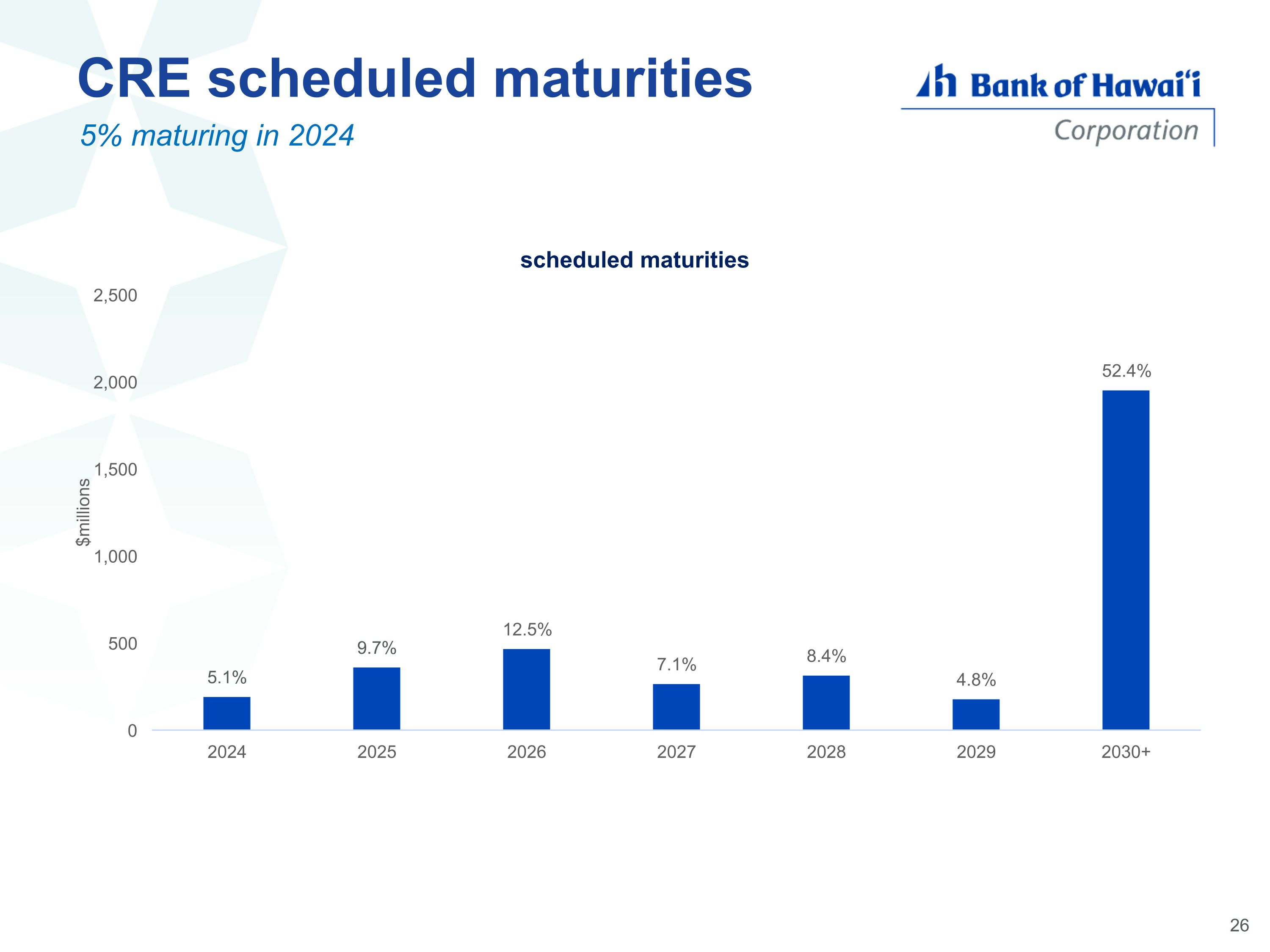

CRE scheduled maturities 5% maturing in 2024

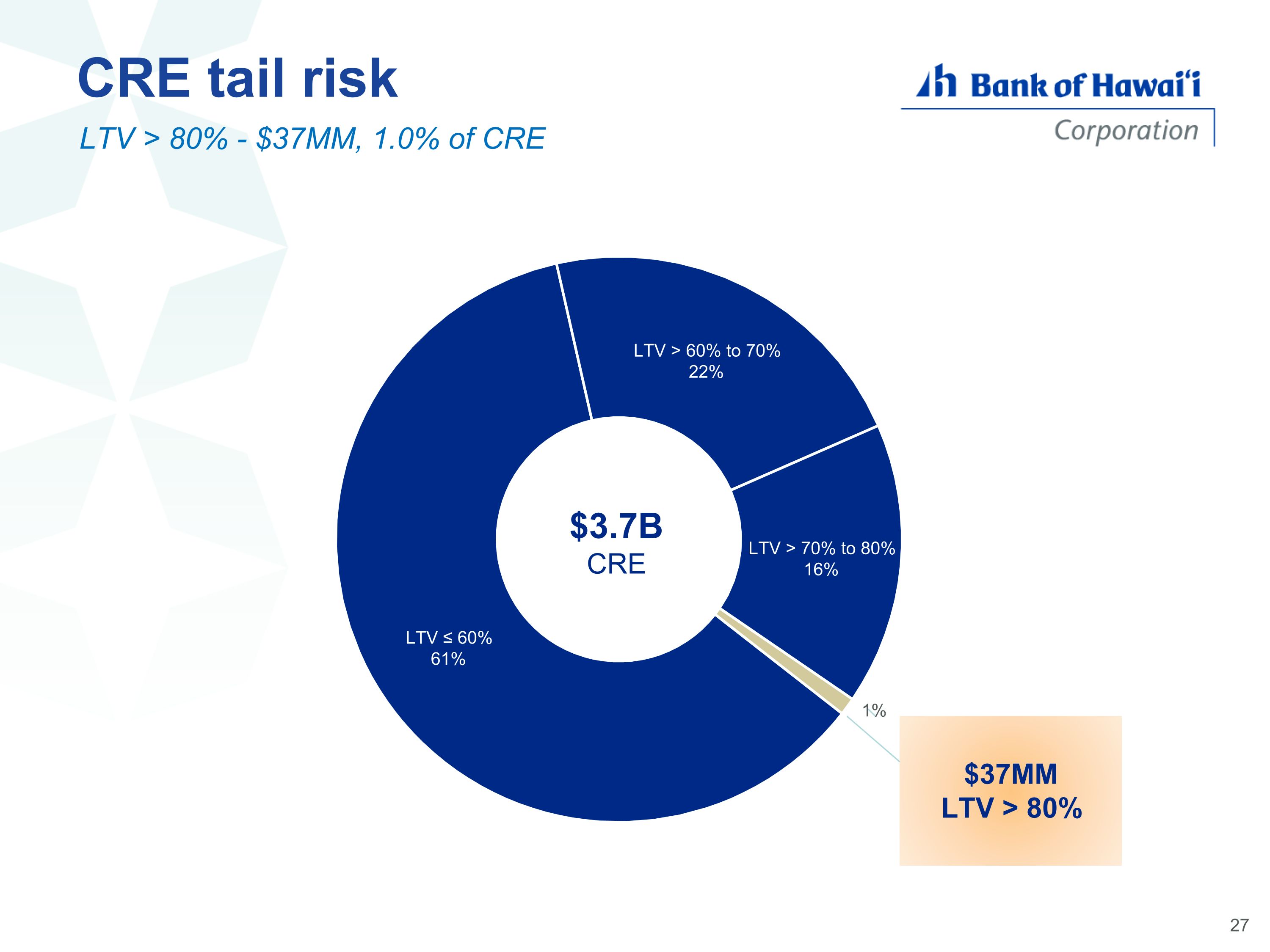

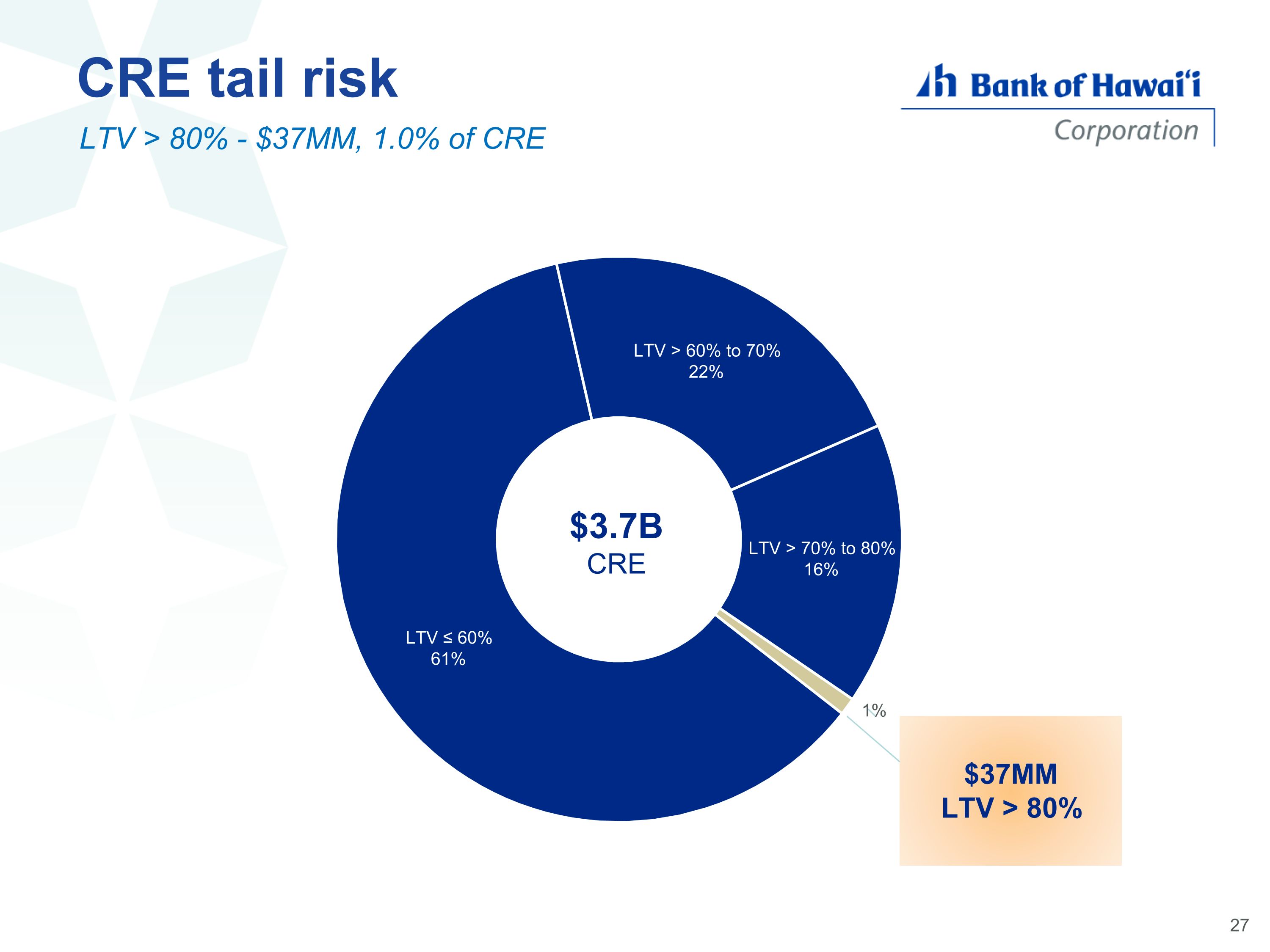

CRE tail risk $3.7B CRE LTV > 80% - $37MM, 1.0% of CRE $37MM LTV > 80% 1%

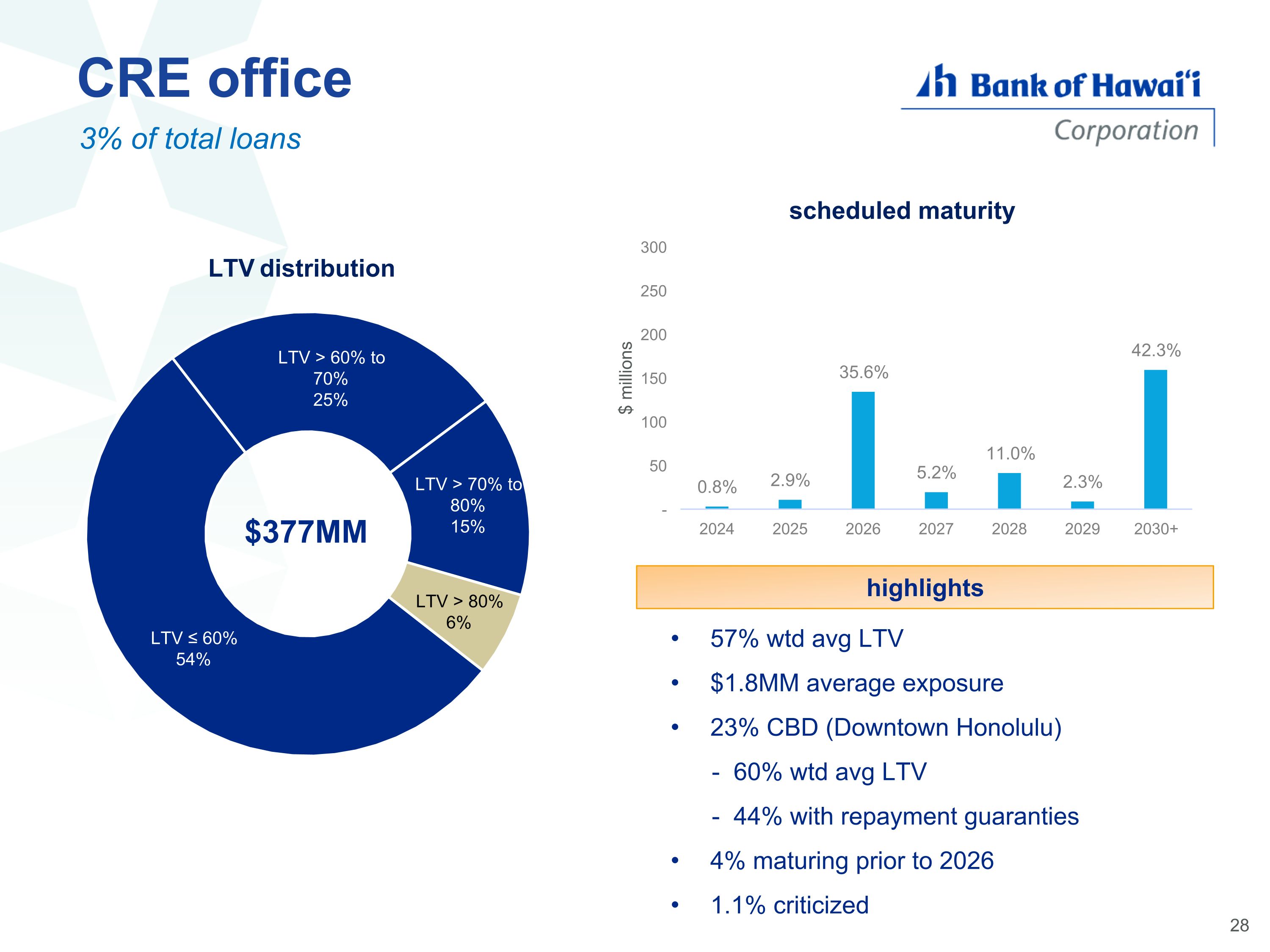

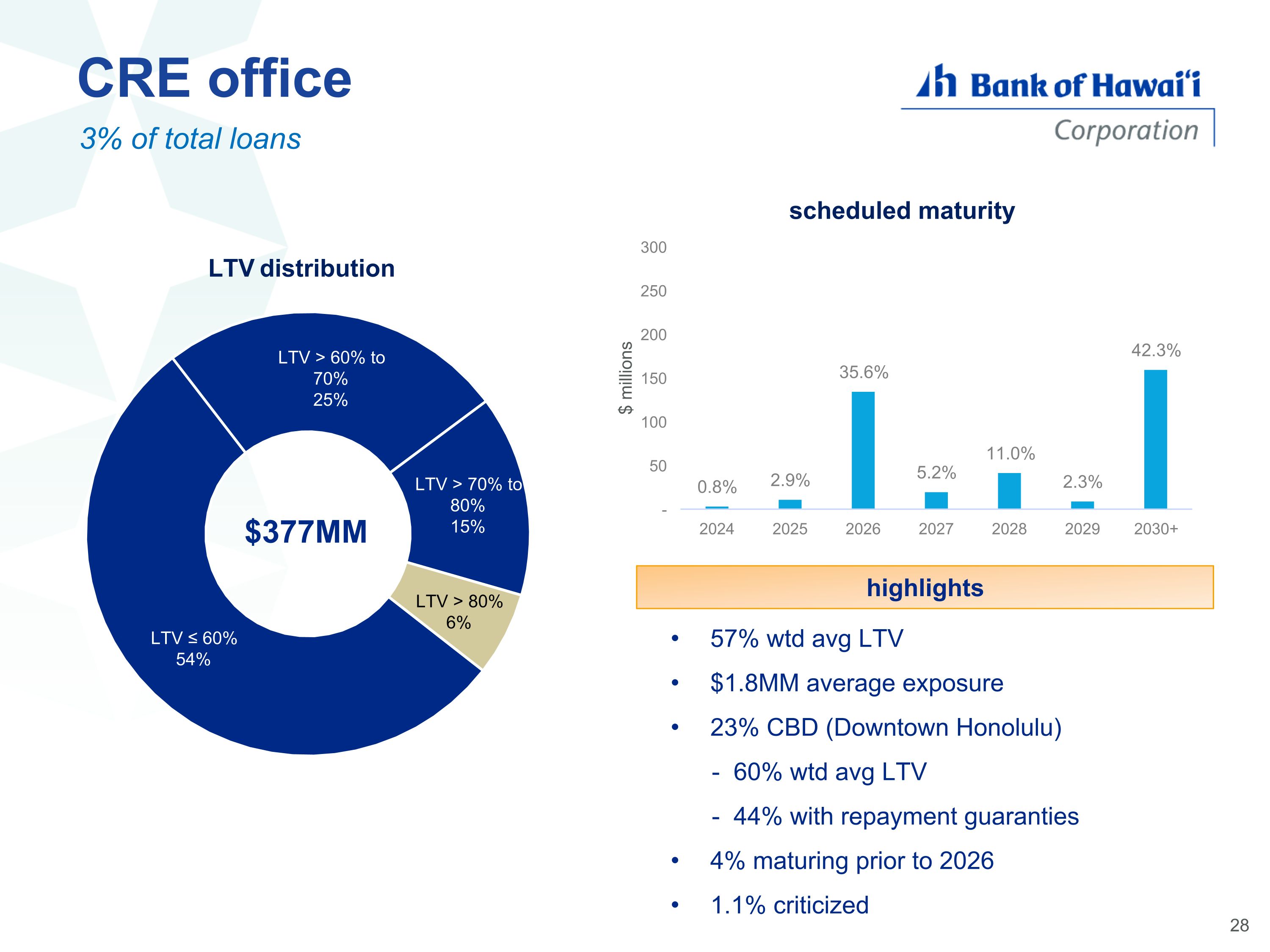

CRE office 3% of total loans 57% wtd avg LTV $1.8MM average exposure 23% CBD (Downtown Honolulu) - 60% wtd avg LTV - 44% with repayment guaranties 4% maturing prior to 2026 1.1% criticized highlights $377MM

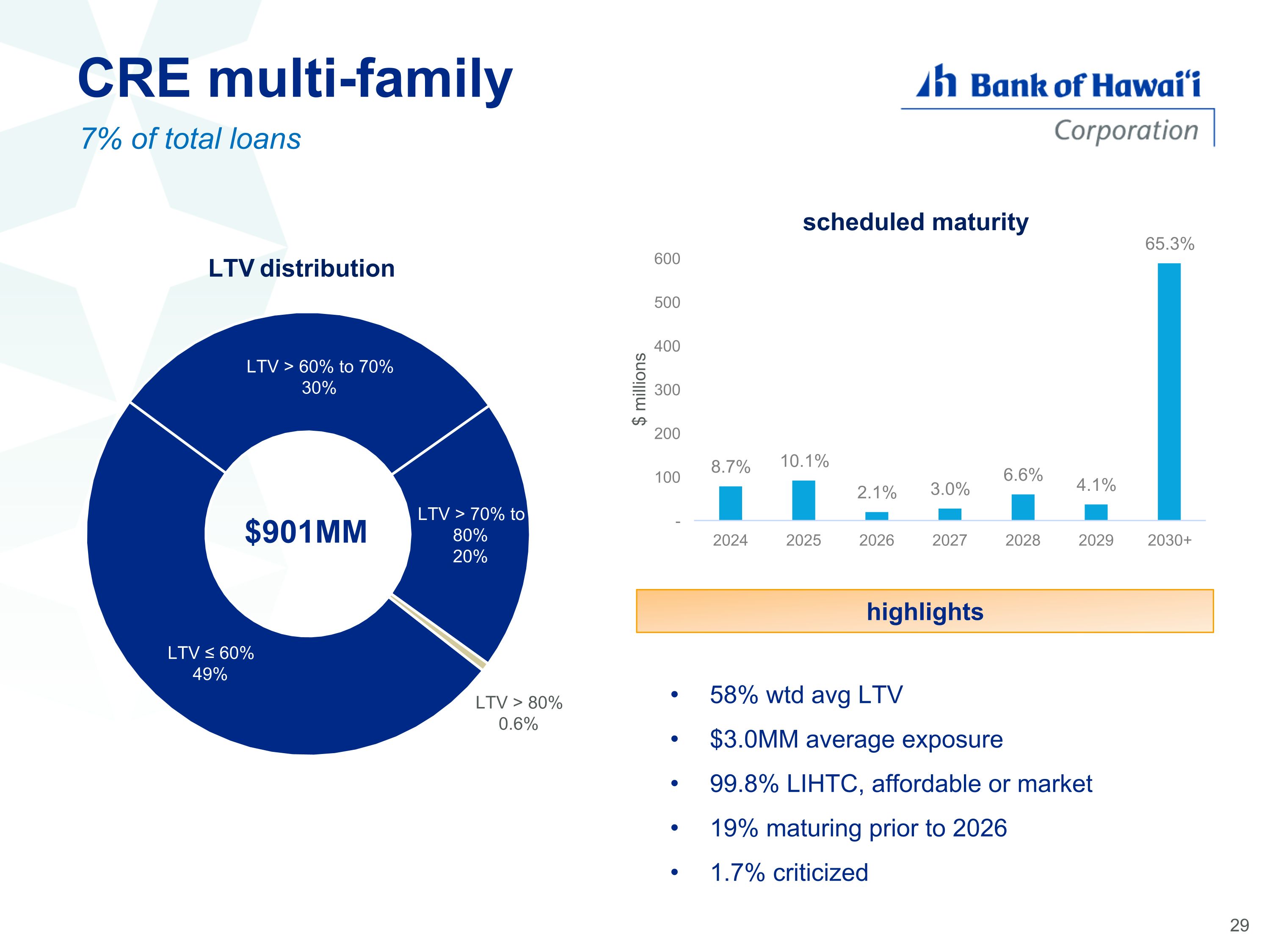

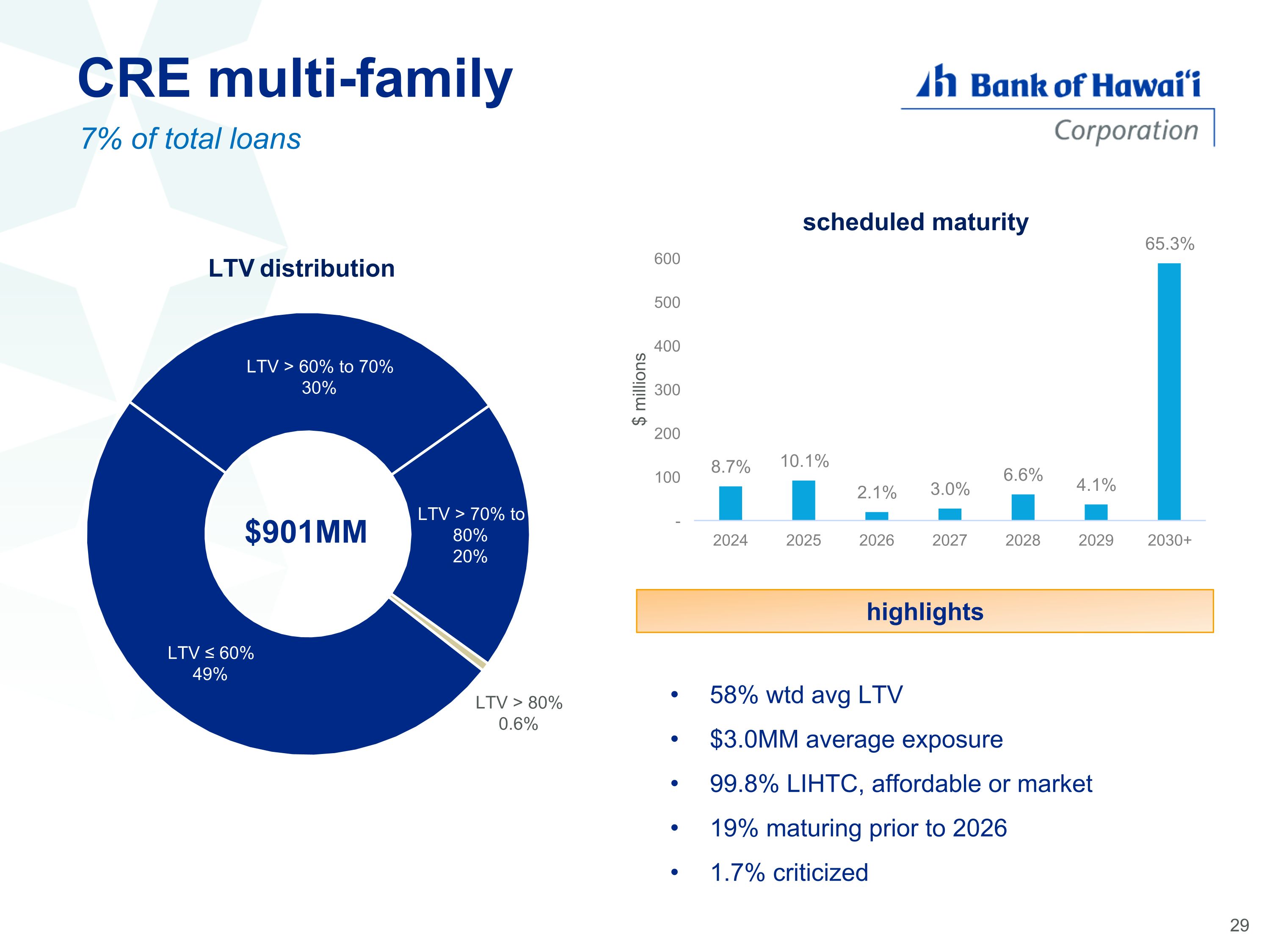

CRE multi-family 7% of total loans 58% wtd avg LTV $3.0MM average exposure 99.8% LIHTC, affordable or market 19% maturing prior to 2026 1.7% criticized highlights $901MM

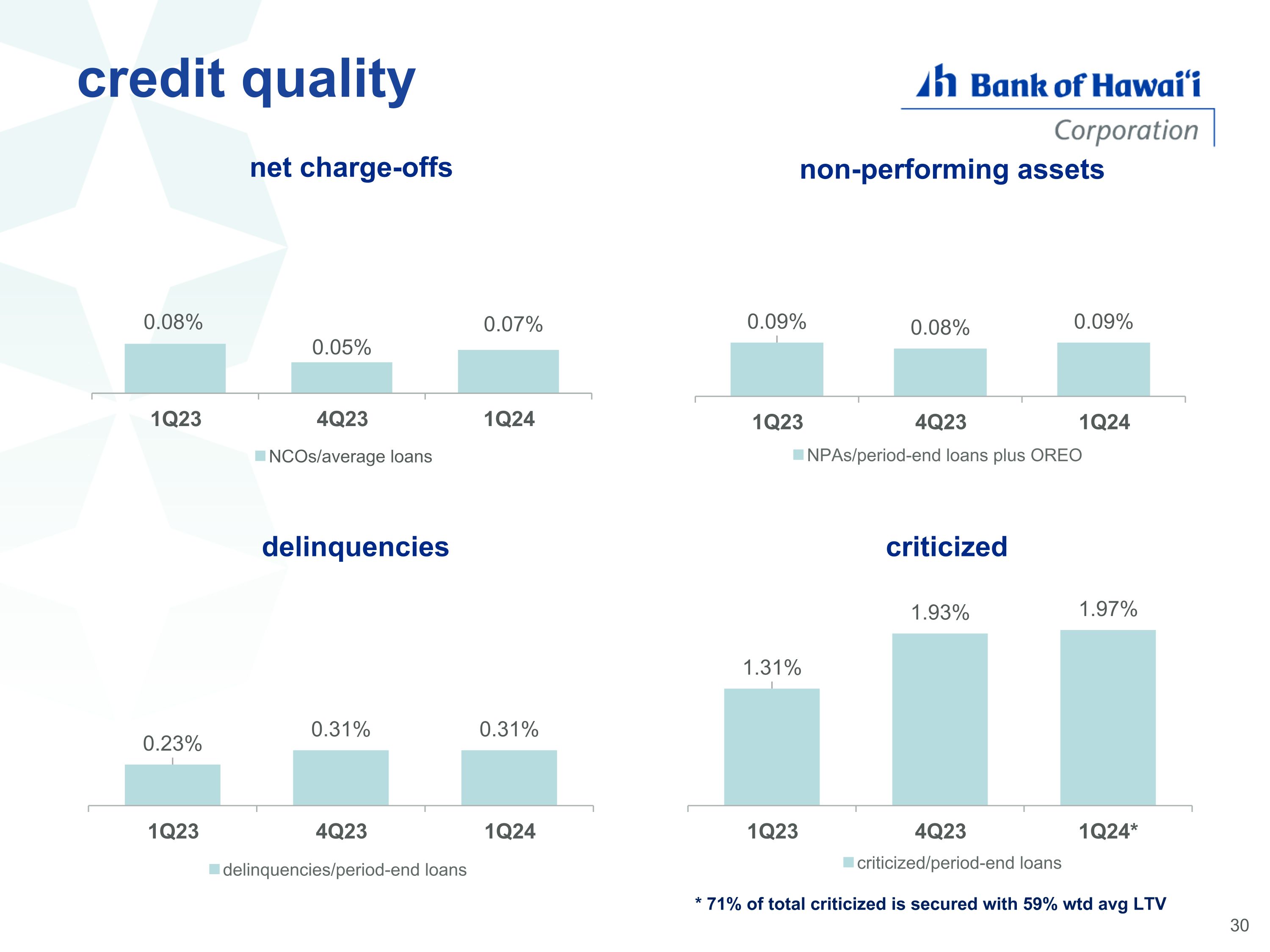

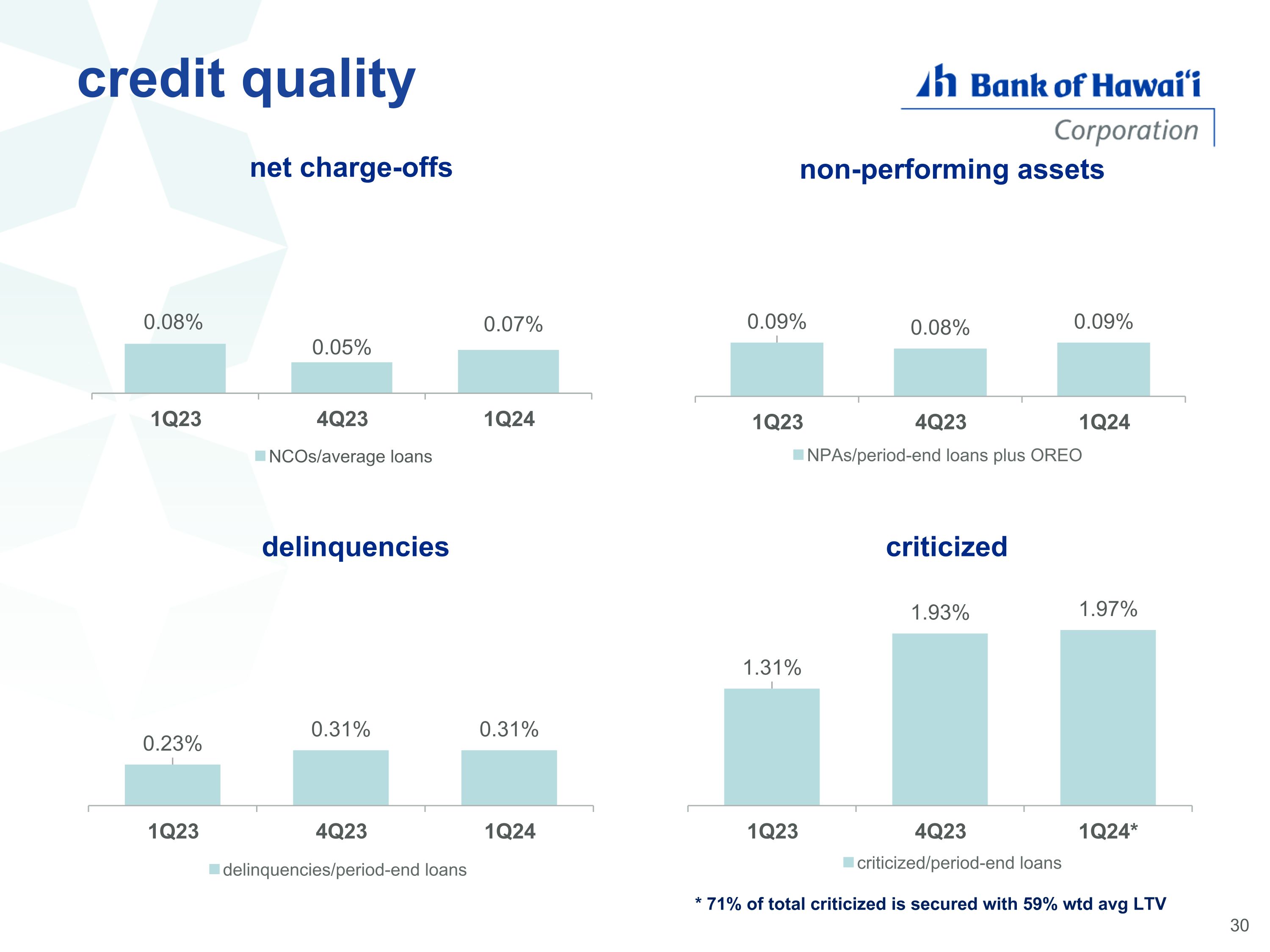

credit quality * 71% of total criticized is secured with 59% wtd avg LTV

financial update

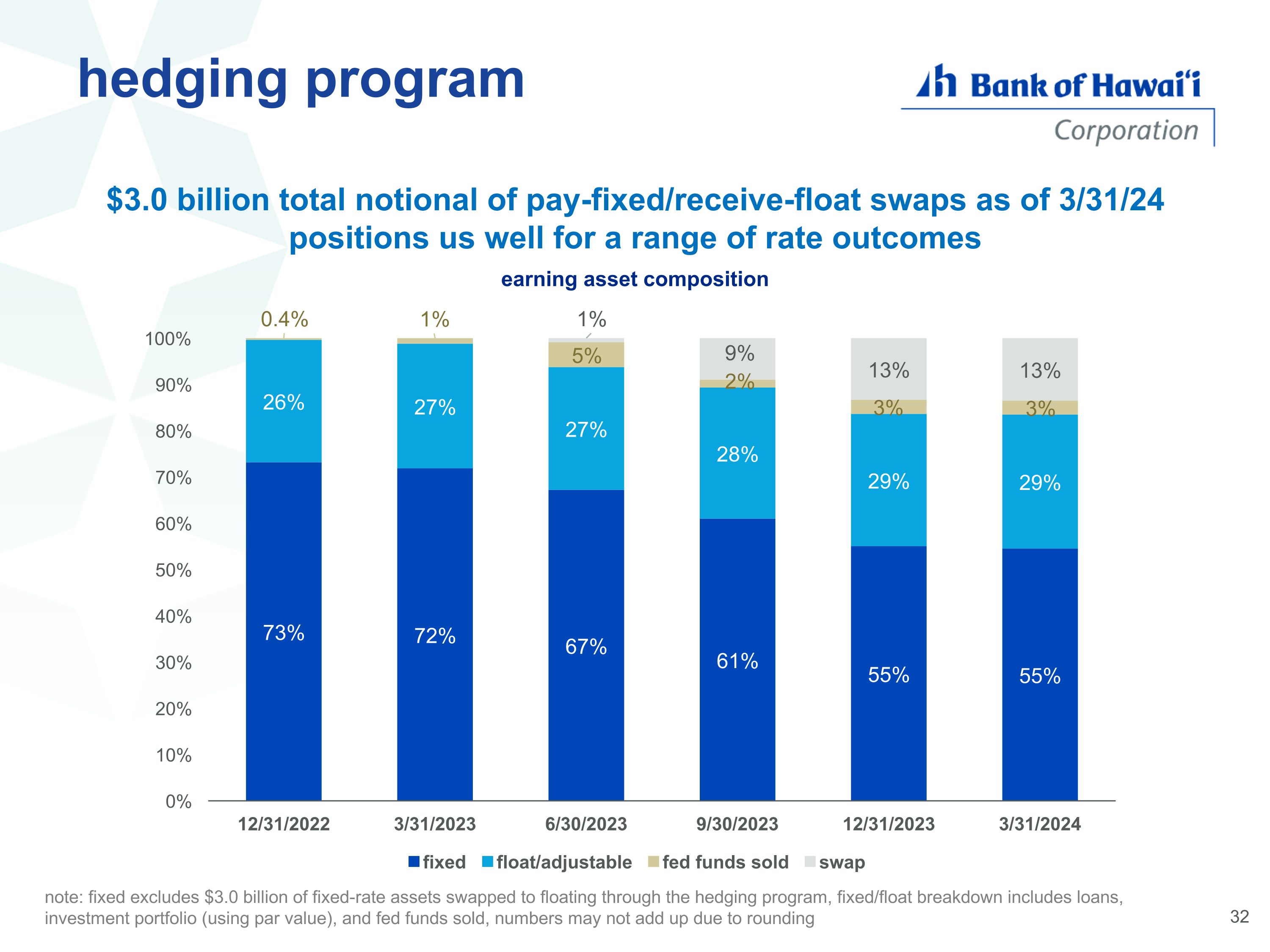

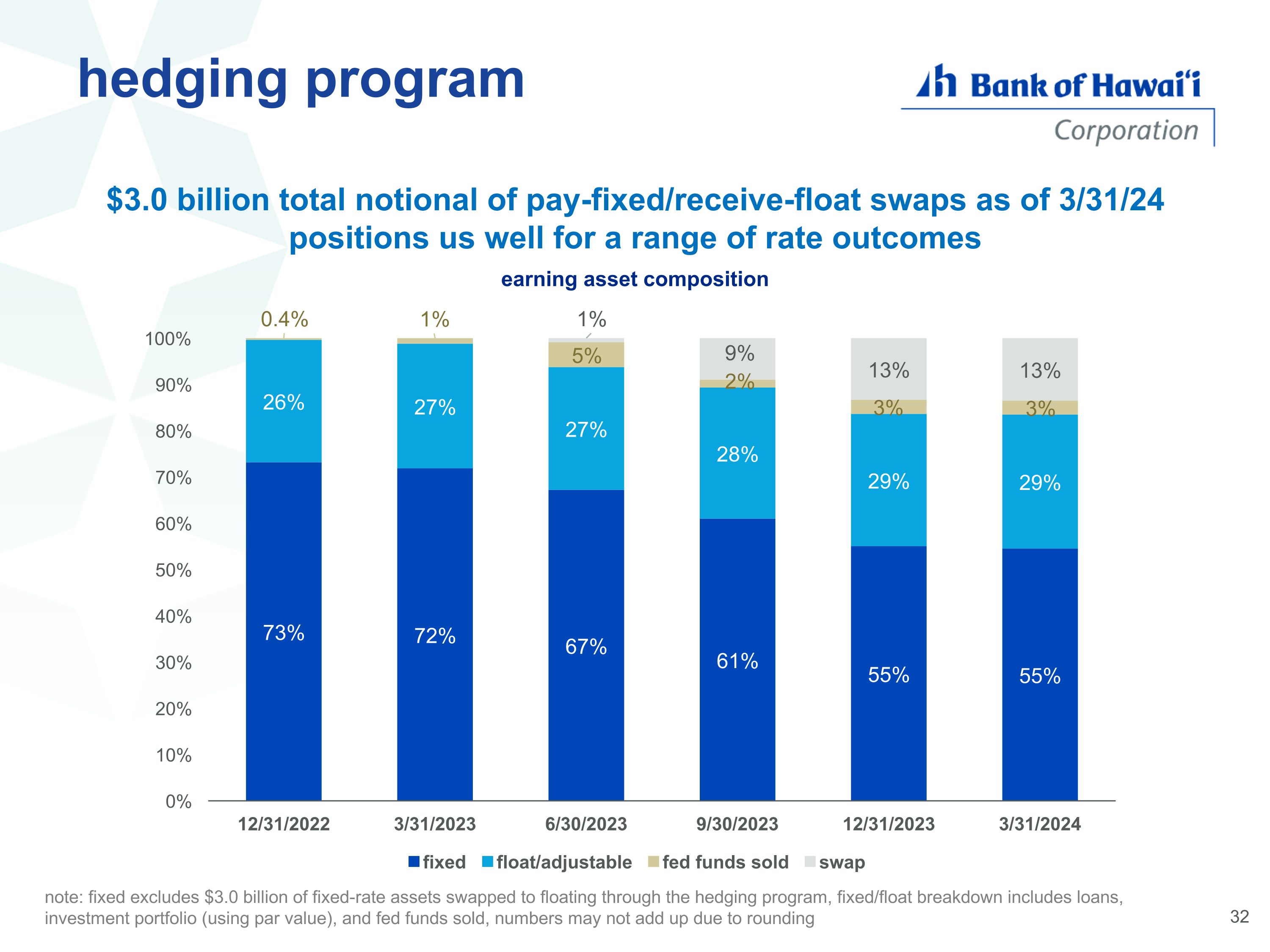

hedging program $3.0 billion total notional of pay-fixed/receive-float swaps as of 3/31/24 positions us well for a range of rate outcomes note: fixed excludes $3.0 billion of fixed-rate assets swapped to floating through the hedging program, fixed/float breakdown includes loans, investment portfolio (using par value), and fed funds sold, numbers may not add up due to rounding

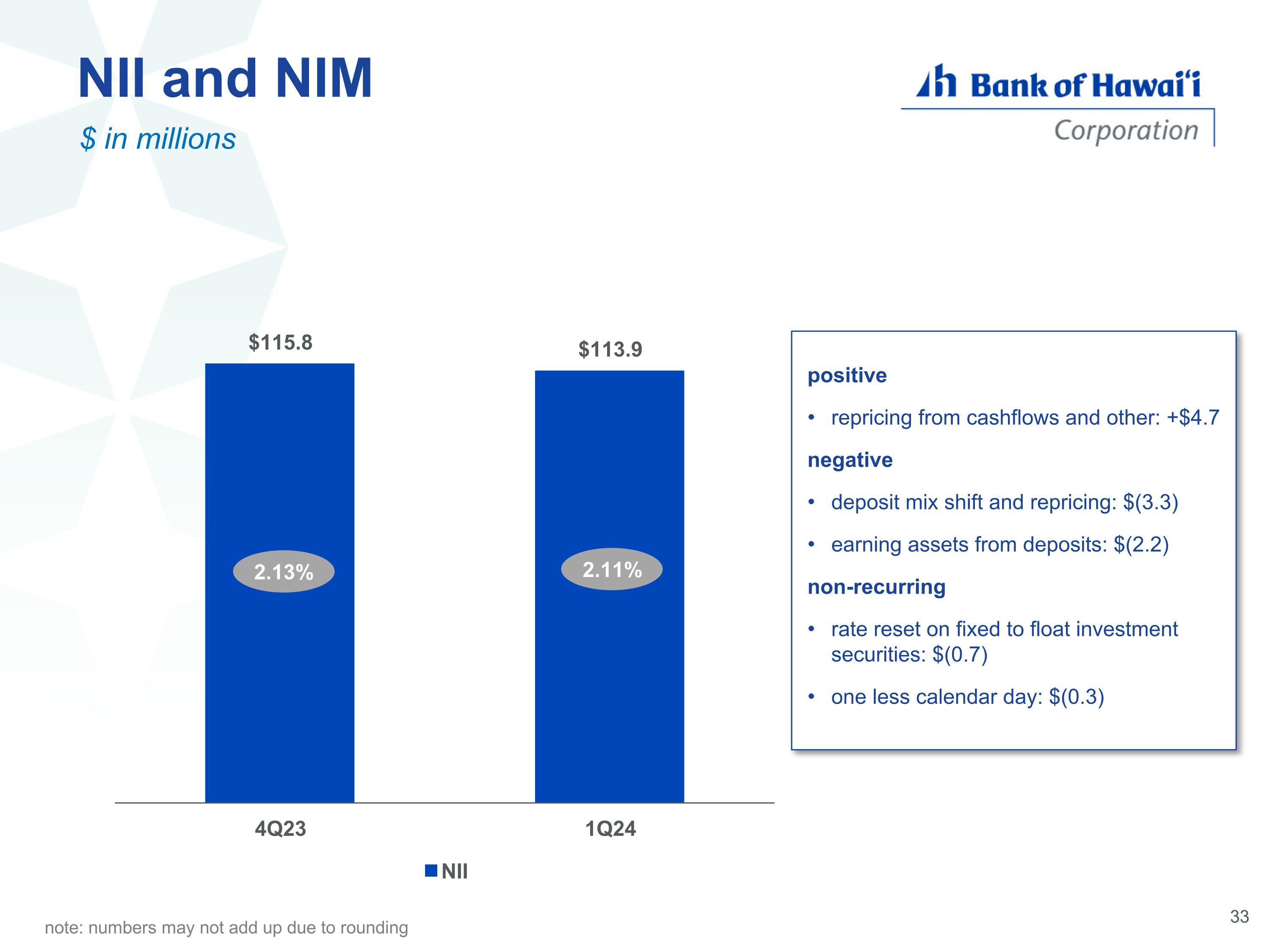

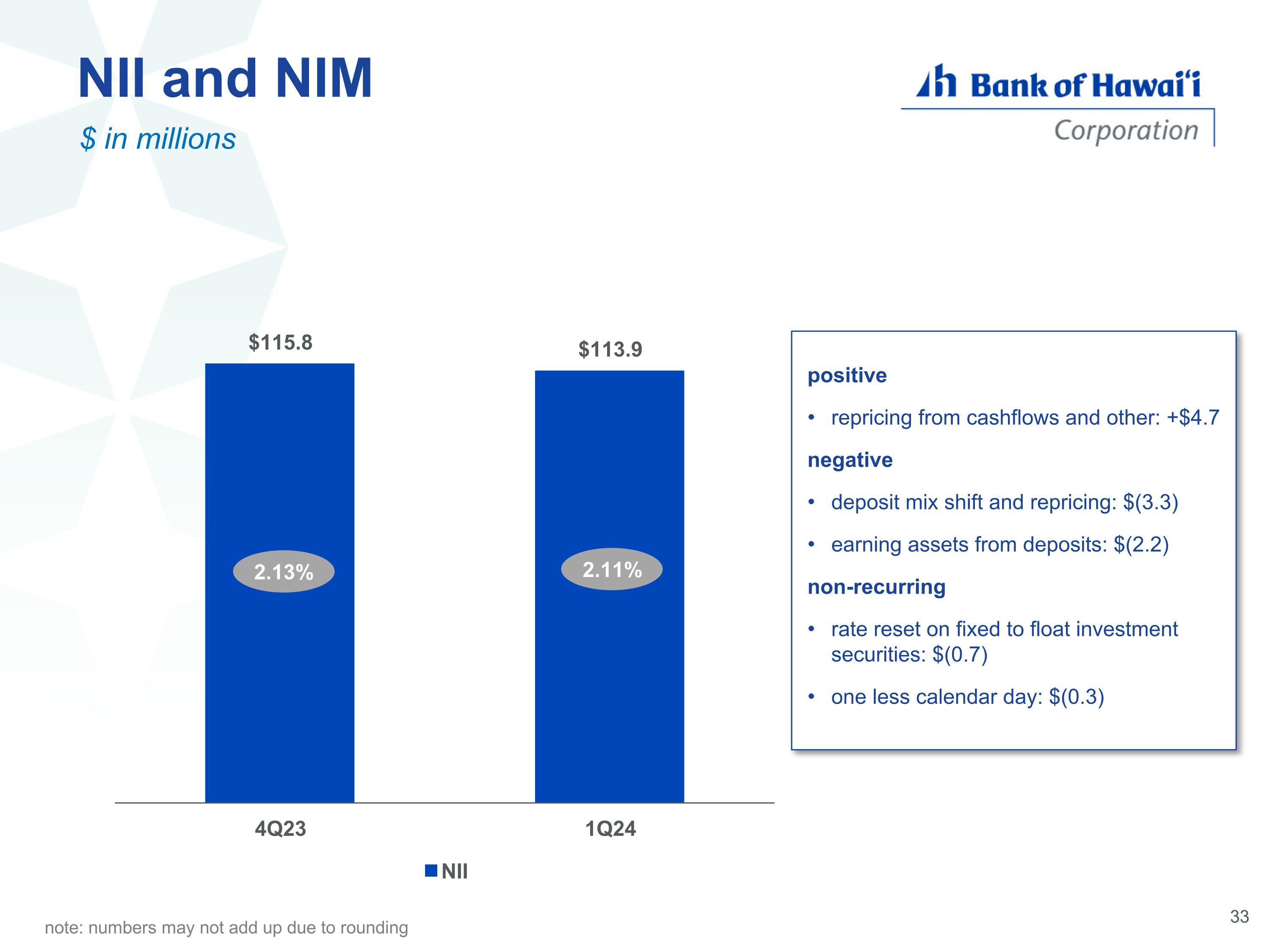

$ in millions NII and NIM positive repricing from cashflows and other: +$4.7 negative deposit mix shift and repricing: $(3.3) earning assets from deposits: $(2.2) non-recurring rate reset on fixed to float investment securities: $(0.7) one less calendar day: $(0.3) note: numbers may not add up due to rounding 2.13% 2.11%

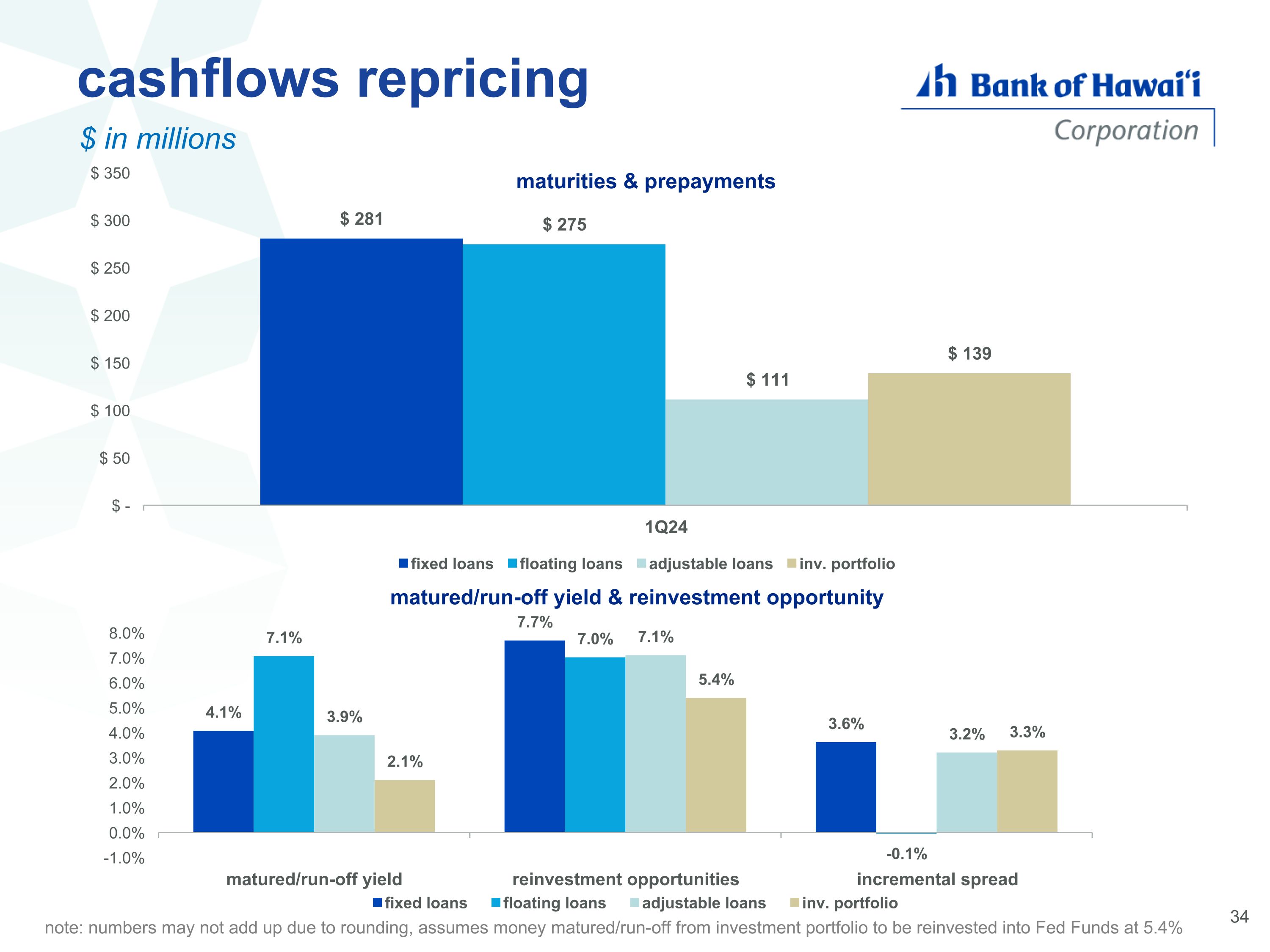

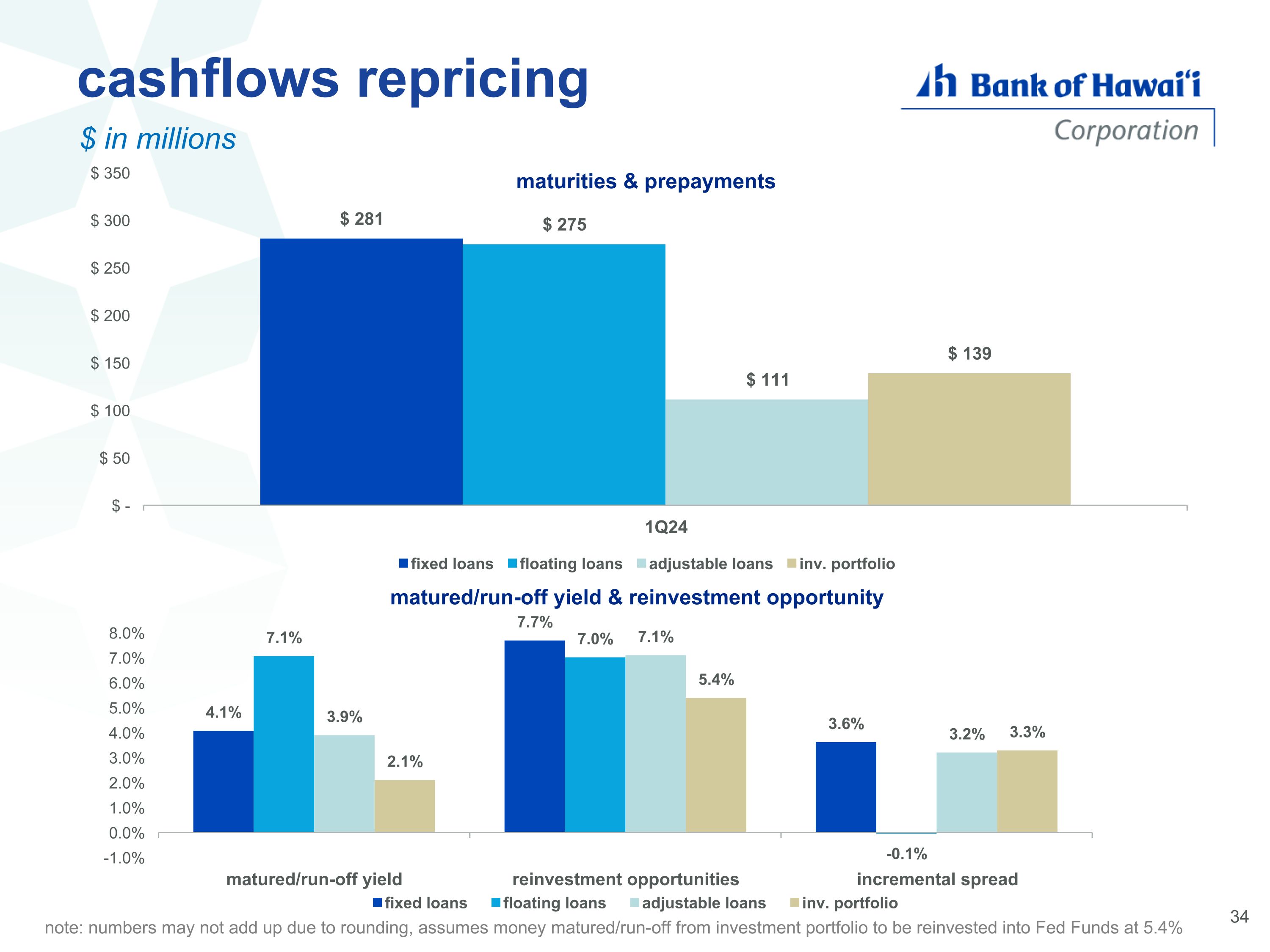

cashflows repricing note: numbers may not add up due to rounding, assumes money matured/run-off from investment portfolio to be reinvested into Fed Funds at 5.4% $ in millions

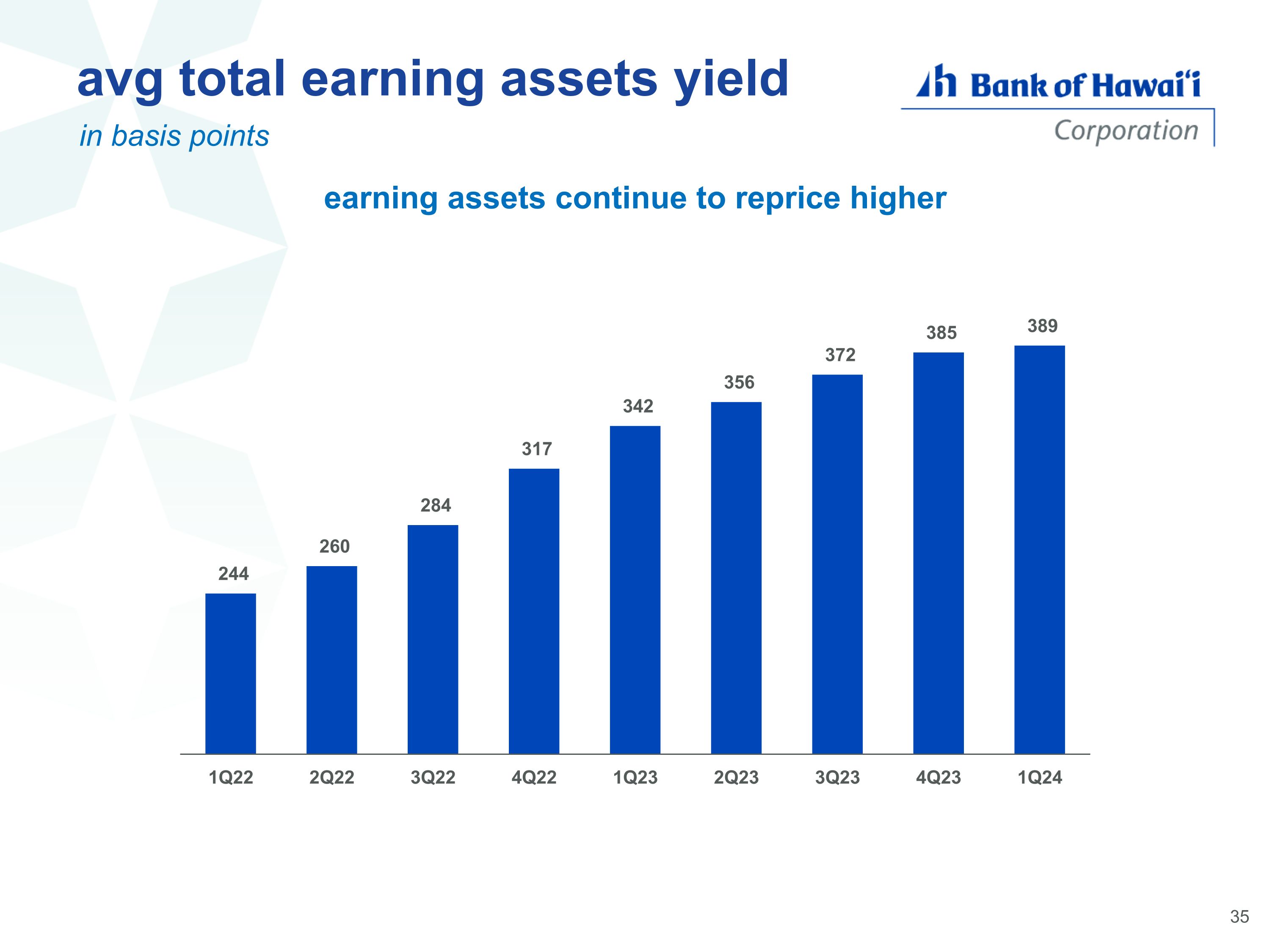

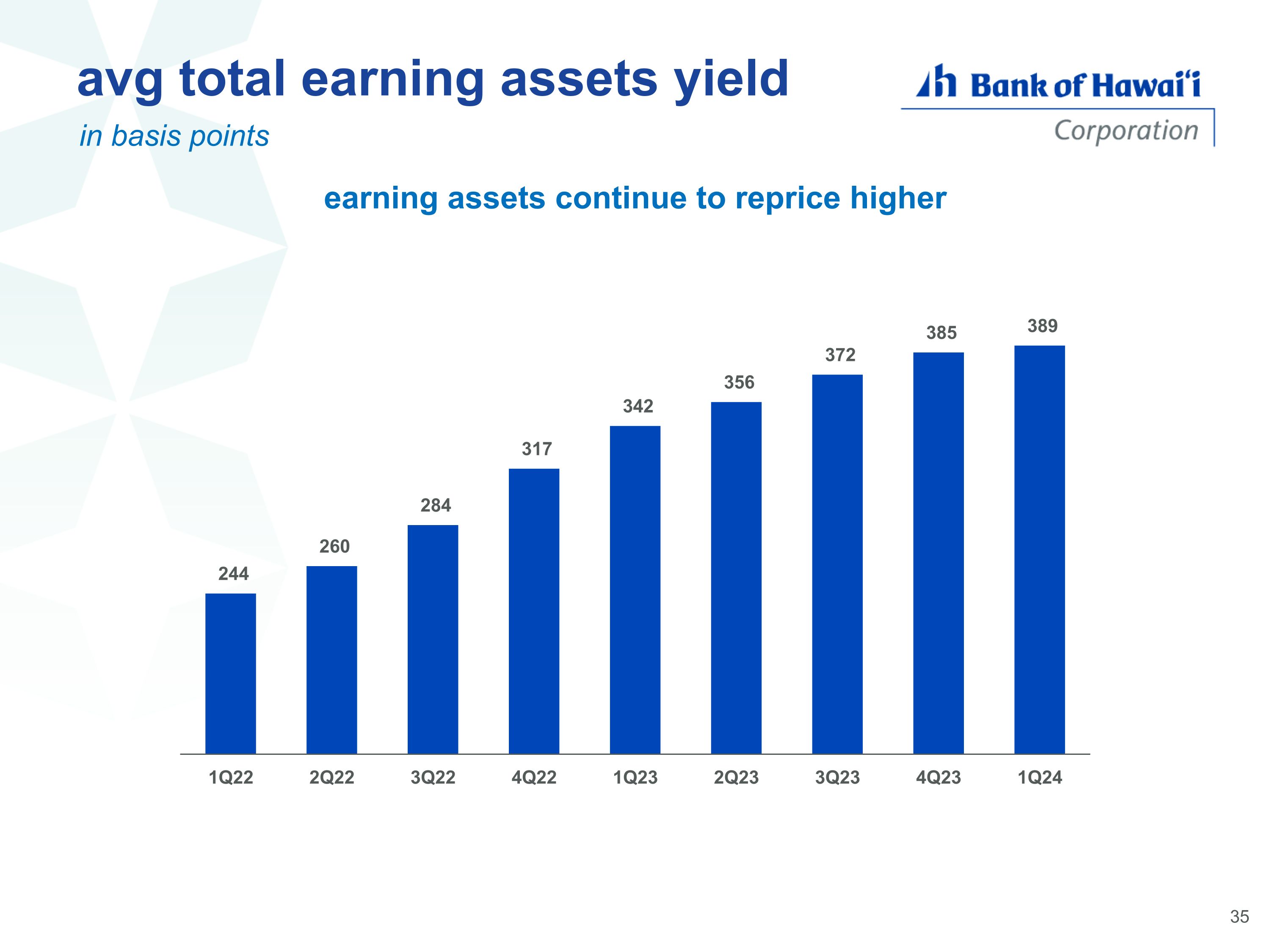

avg total earning assets yield in basis points earning assets continue to reprice higher

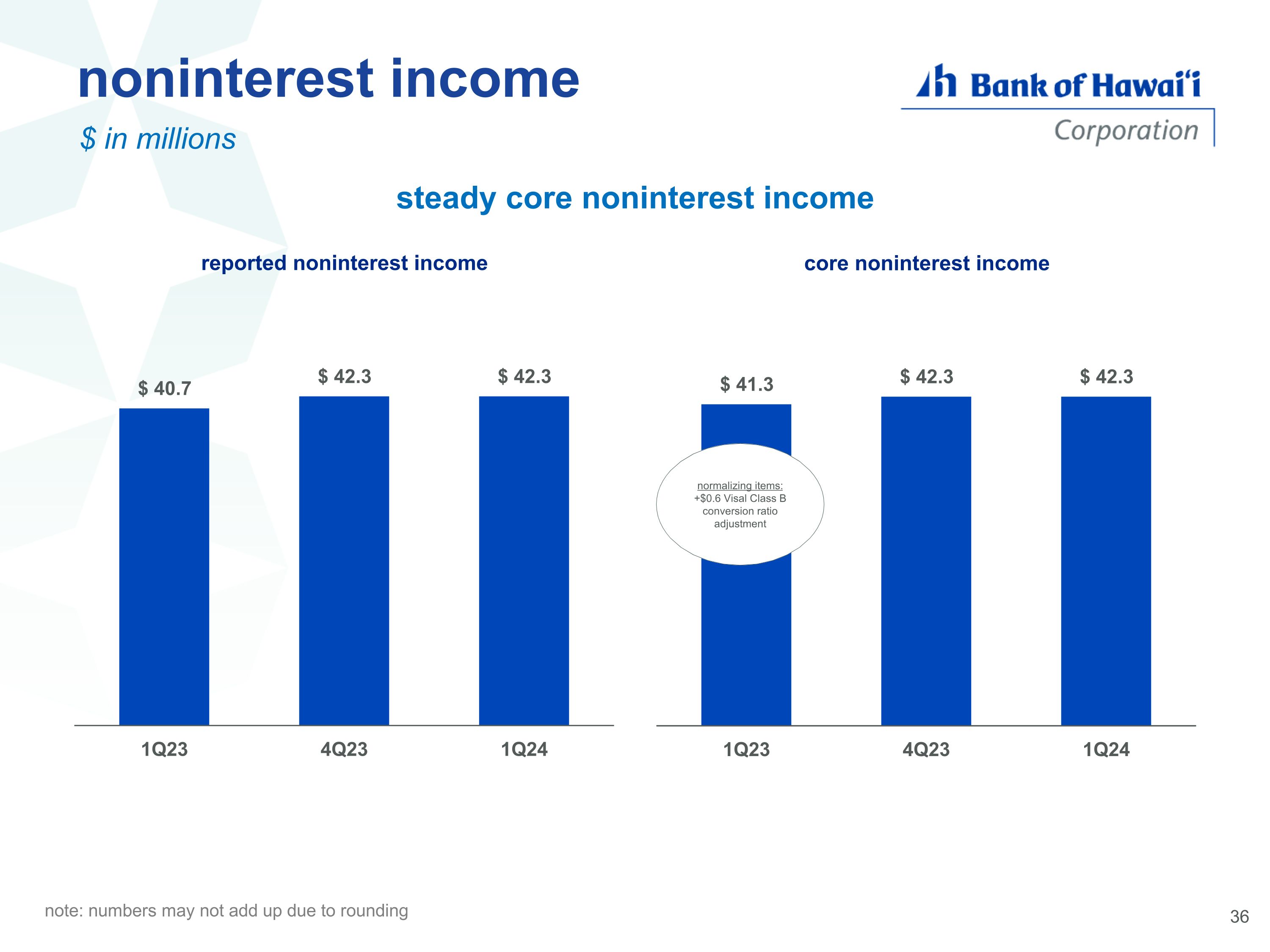

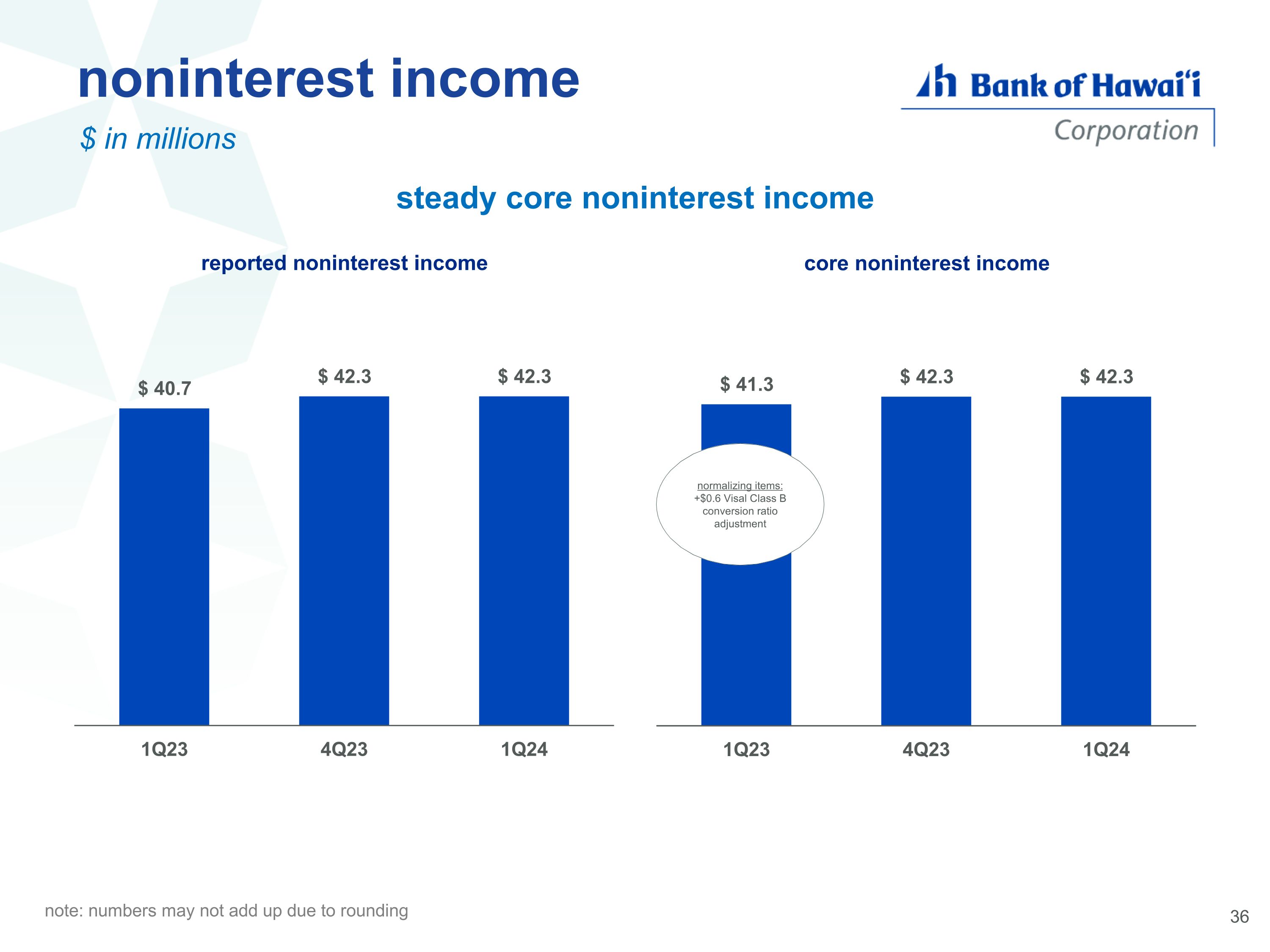

noninterest income $ in millions steady core noninterest income note: numbers may not add up due to rounding normalizing items: +$0.6 Visal Class B conversion ratio adjustment

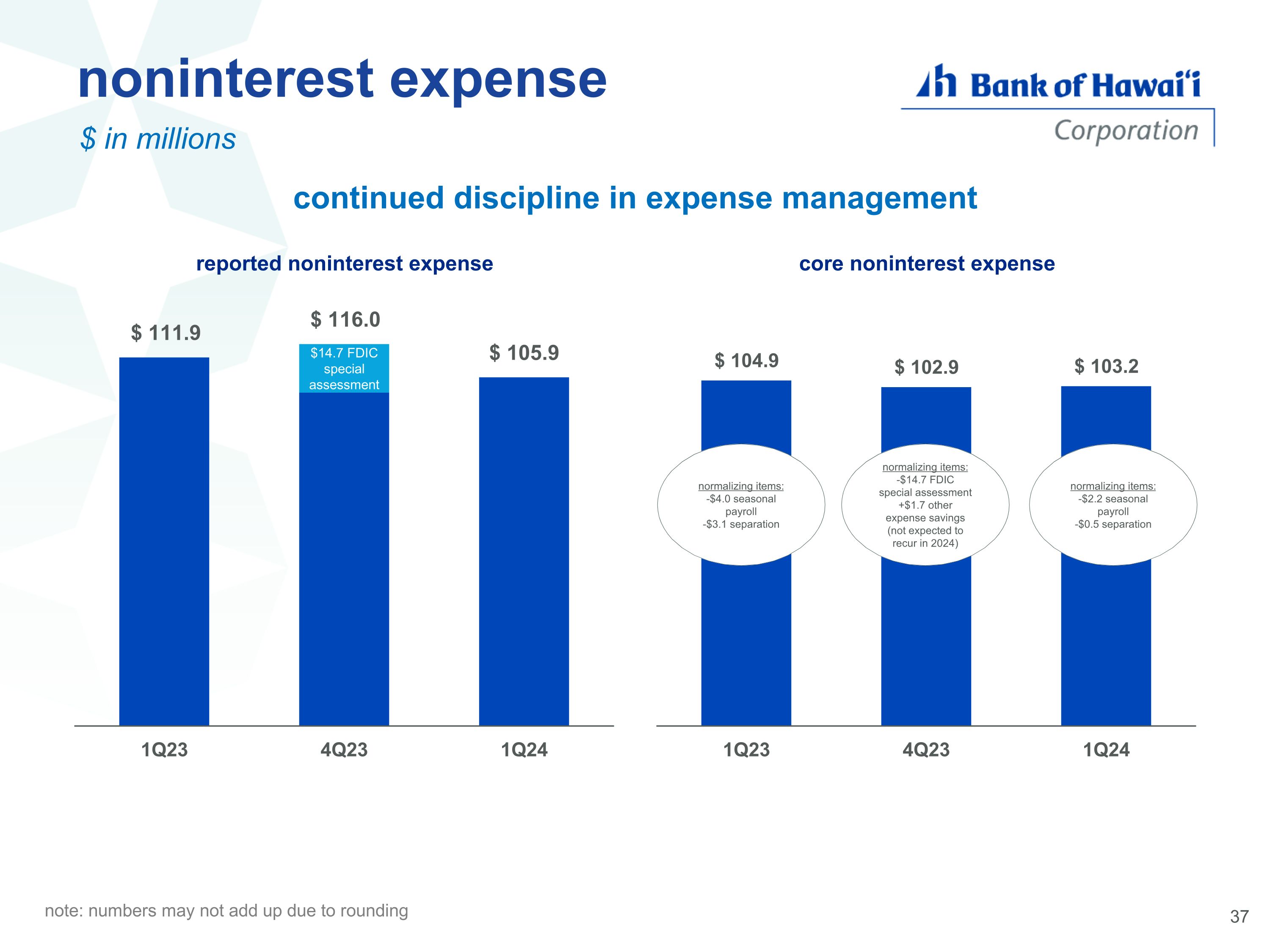

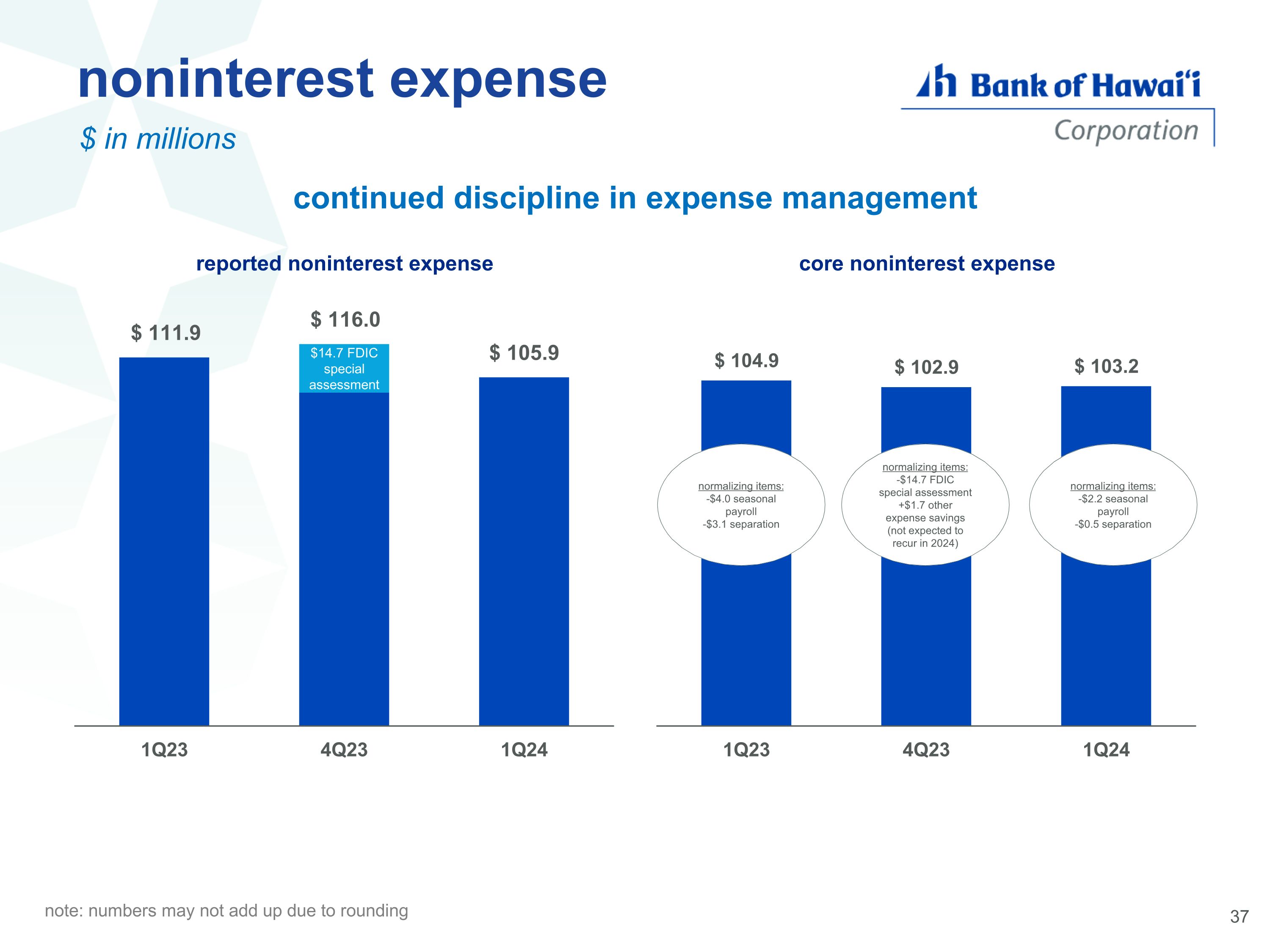

noninterest expense $ in millions continued discipline in expense management note: numbers may not add up due to rounding normalizing items: -$14.7 FDIC special assessment +$1.7 other expense savings (not expected to recur in 2024) normalizing items: -$4.0 seasonal payroll -$3.1 separation normalizing items: -$2.2 seasonal payroll -$0.5 separation

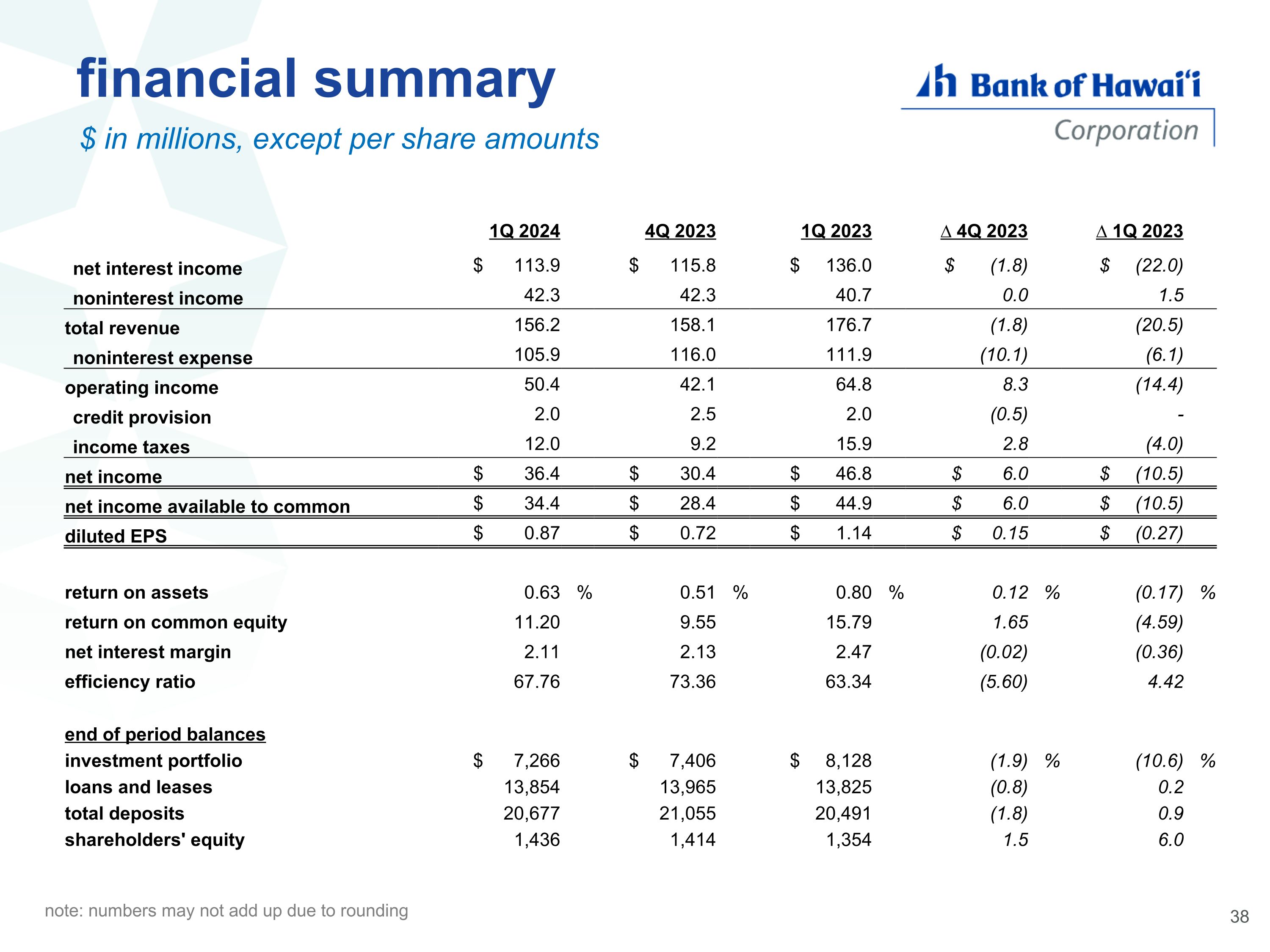

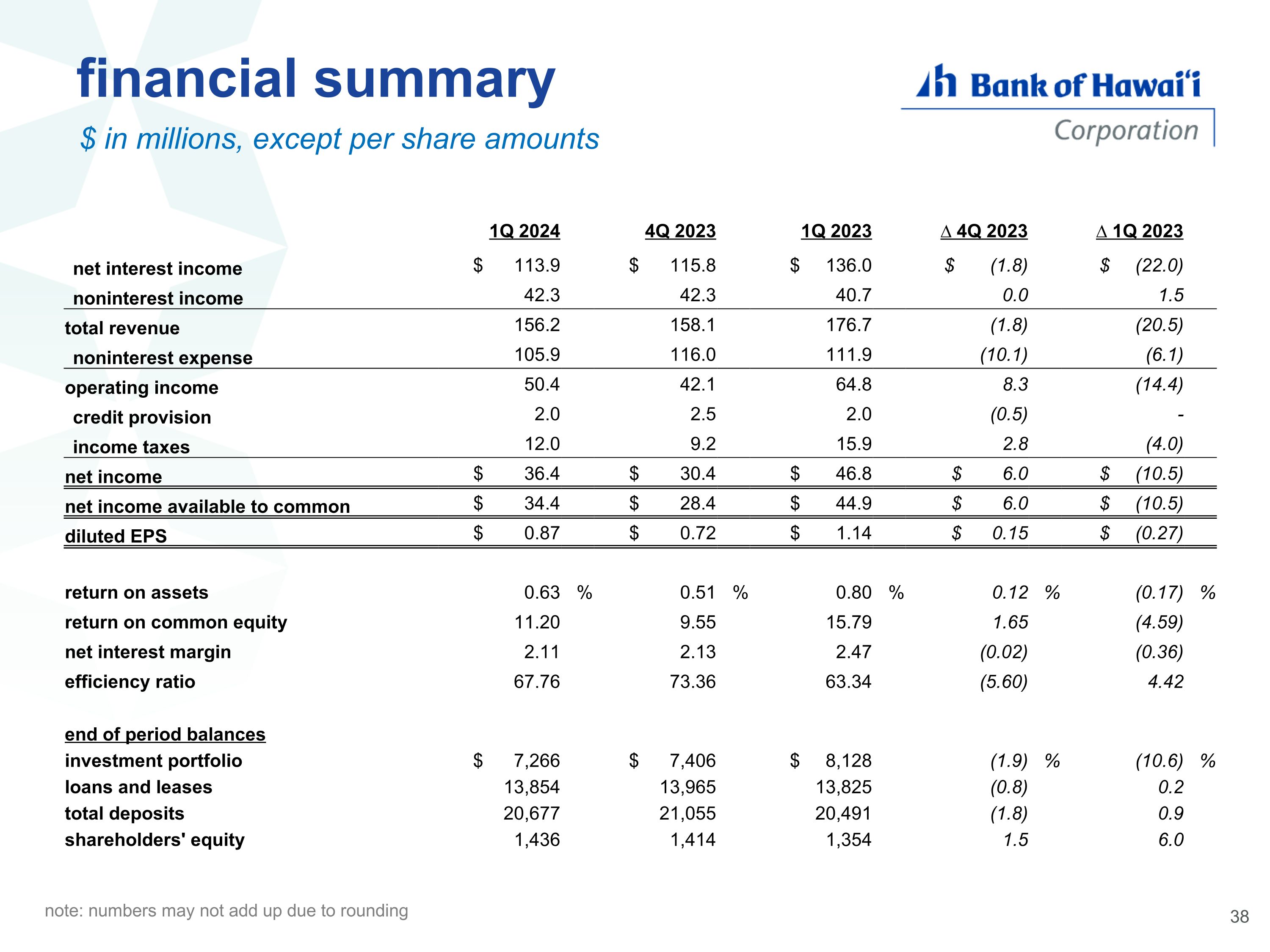

financial summary $ in millions, except per share amounts 1Q 2024 4Q 2023 1Q 2023 ∆ 4Q 2023 ∆ 1Q 2023 net interest income $ 113.9 $ 115.8 $ 136.0 $ (1.8) $ (22.0) noninterest income 42.3 42.3 40.7 0.0 1.5 total revenue 156.2 158.1 176.7 (1.8) (20.5) noninterest expense 105.9 116.0 111.9 (10.1) (6.1) operating income 50.4 42.1 64.8 8.3 (14.4) credit provision 2.0 2.5 2.0 (0.5) - income taxes 12.0 9.2 15.9 2.8 (4.0) net income $ 36.4 $ 30.4 $ 46.8 $ 6.0 $ (10.5) net income available to common $ 34.4 $ 28.4 $ 44.9 $ 6.0 $ (10.5) diluted EPS $ 0.87 $ 0.72 $ 1.14 $ 0.15 $ (0.27) return on assets 0.63 % 0.51 % 0.80 % 0.12 % (0.17) % return on common equity 11.20 9.55 15.79 1.65 (4.59) net interest margin 2.11 2.13 2.47 (0.02) (0.36) efficiency ratio 67.76 73.36 63.34 (5.60) 4.42 end of period balances investment portfolio $ 7,266 $ 7,406 $ 8,128 (1.9) % (10.6) % loans and leases 13,854 13,965 13,825 (0.8) 0.2 total deposits 20,677 21,055 20,491 (1.8) 0.9 shareholders' equity 1,436 1,414 1,354 1.5 6.0 note: numbers may not add up due to rounding

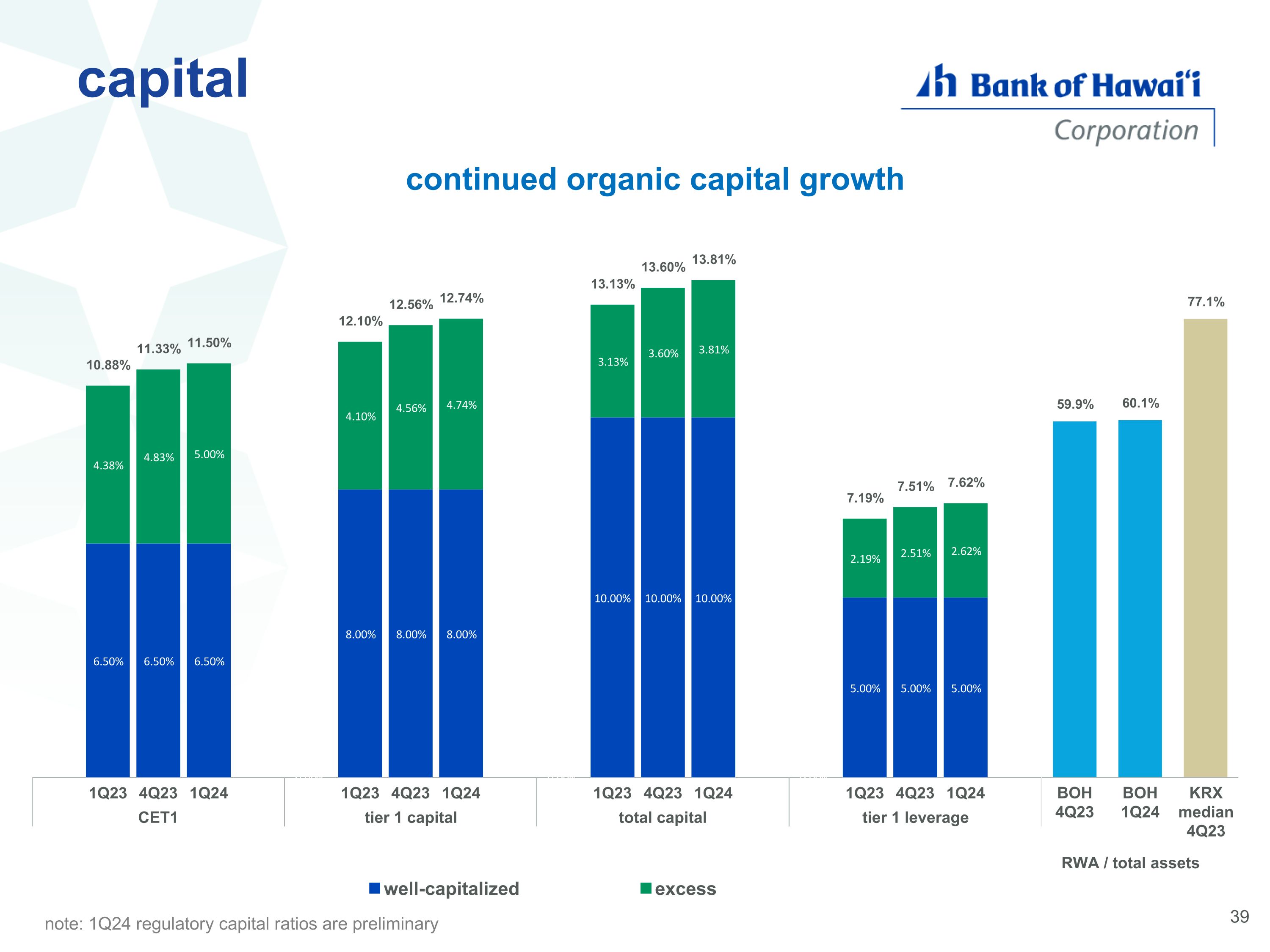

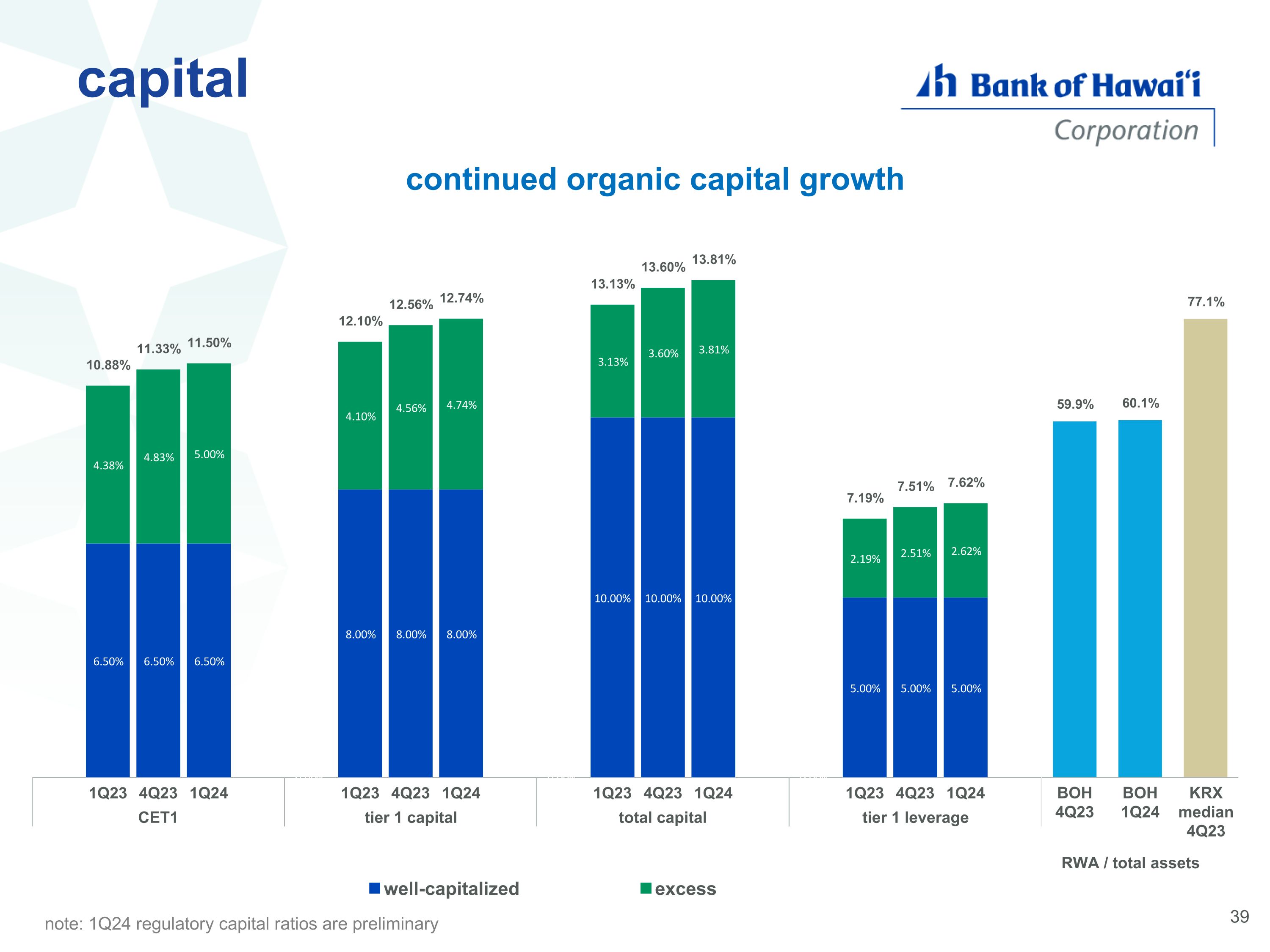

capital note: 1Q24 regulatory capital ratios are preliminary 13.6% continued organic capital growth 13.6% RWA / total assets

high quality deposit base in unique and competitively advantageous deposit market flattening deposit cost and continuing cashflow repricing exceptional credit quality strong liquidity takeaways

Q & A

appendix

insured/collateralized deposits note: as of March 31, 2024