Bank of Hawaii Corporation fourth quarter 2020 financial report january 25, 2021 Exhibit 99.2

this presentation, and other statements made by the Company in connection with it, may contain forward-looking statements concerning, among other things, forecasts of our financial results and condition, expectations for our operations and business prospects, and our assumptions used in those forecasts and expectations. we have not committed to update forward-looking statements to reflect later events or circumstances. disclosure 2 forward-looking statements

3

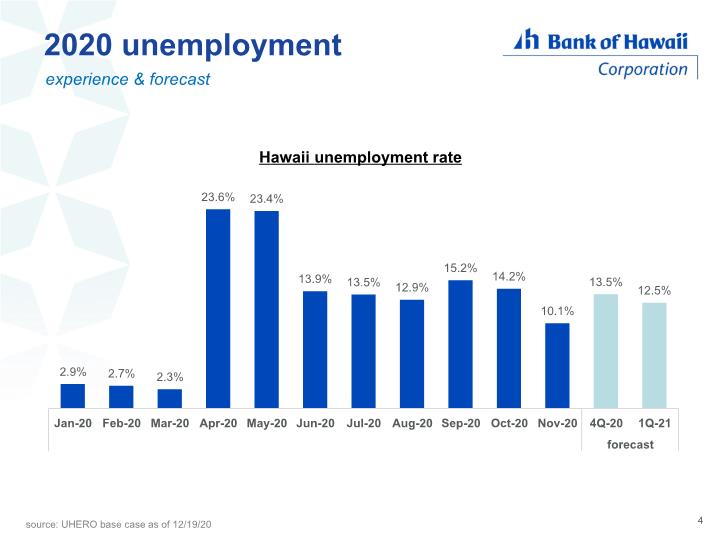

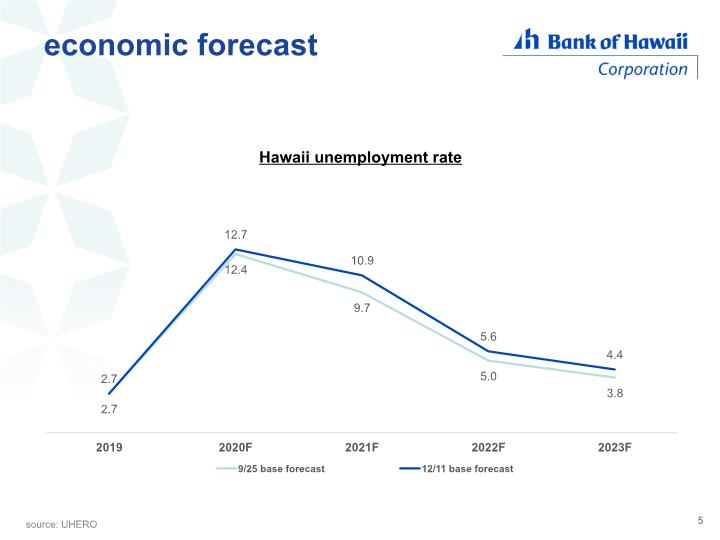

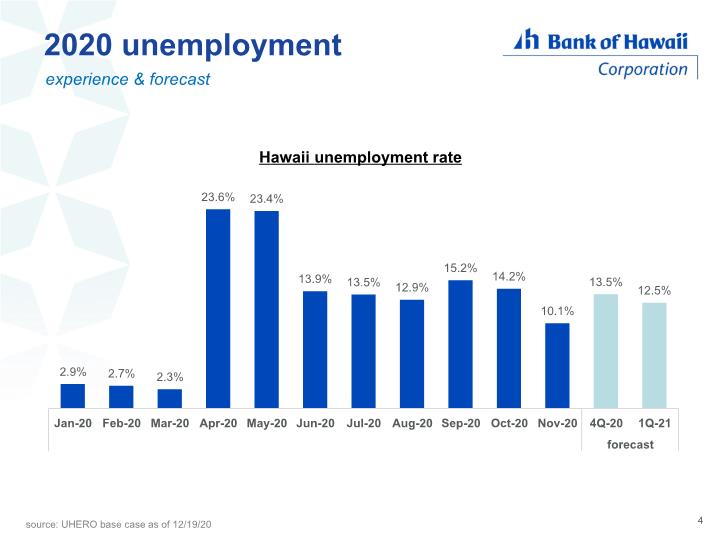

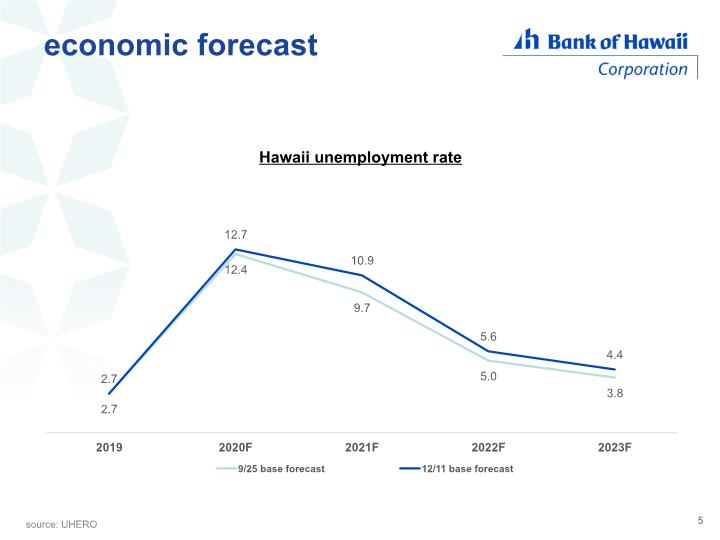

2020 unemployment experience & forecast 4 source: UHERO base case as of 12/19/20 Hawaii unemployment rate

economic forecast source: UHERO Hawaii unemployment rate 5

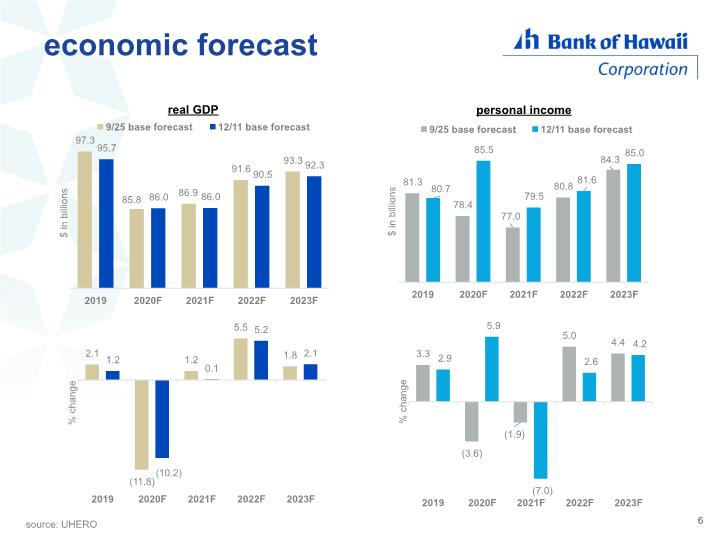

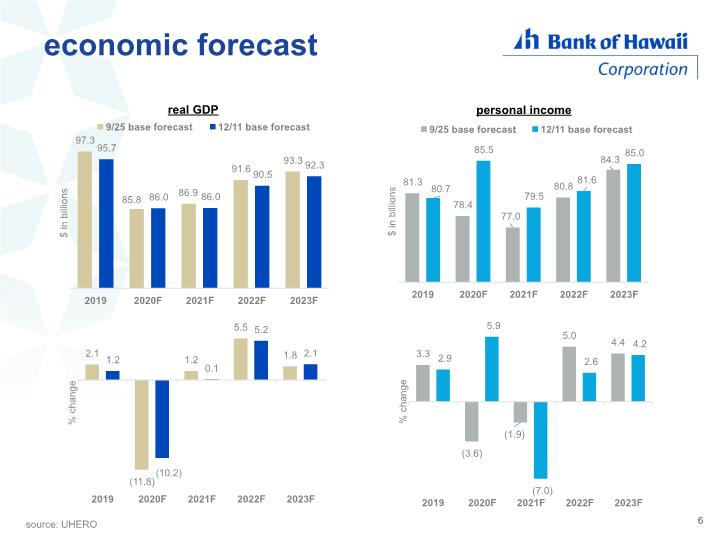

economic forecast source: UHERO 6

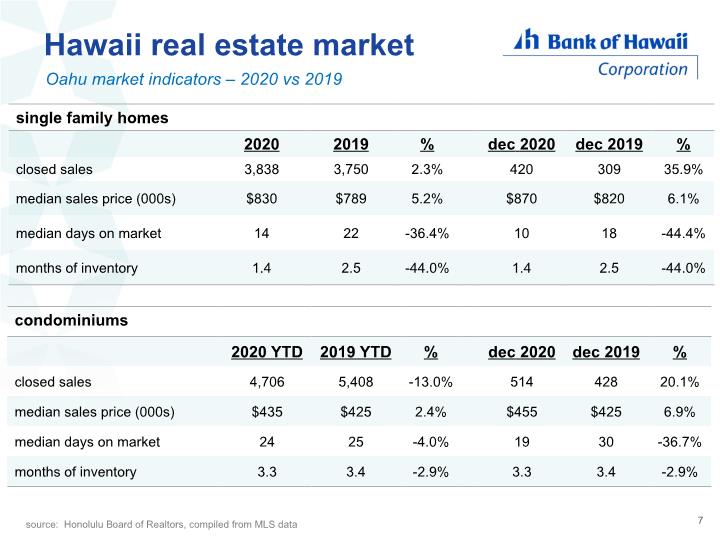

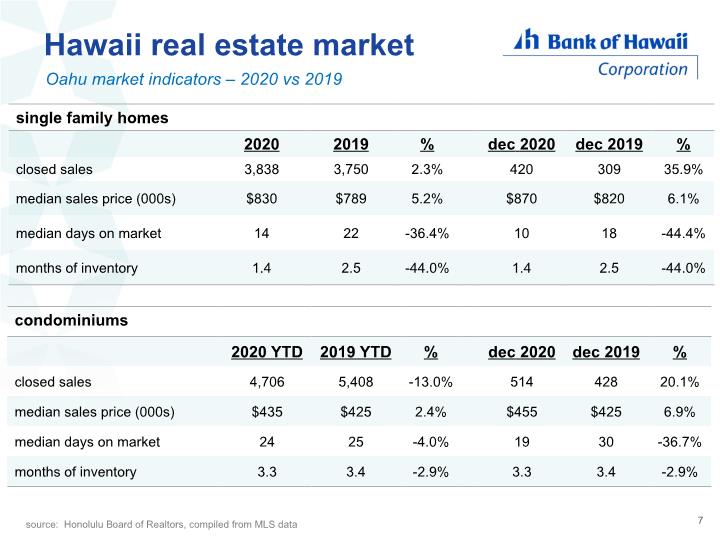

Hawaii real estate market Oahu market indicators – 2020 vs 2019 7 source: Honolulu Board of Realtors, compiled from MLS data

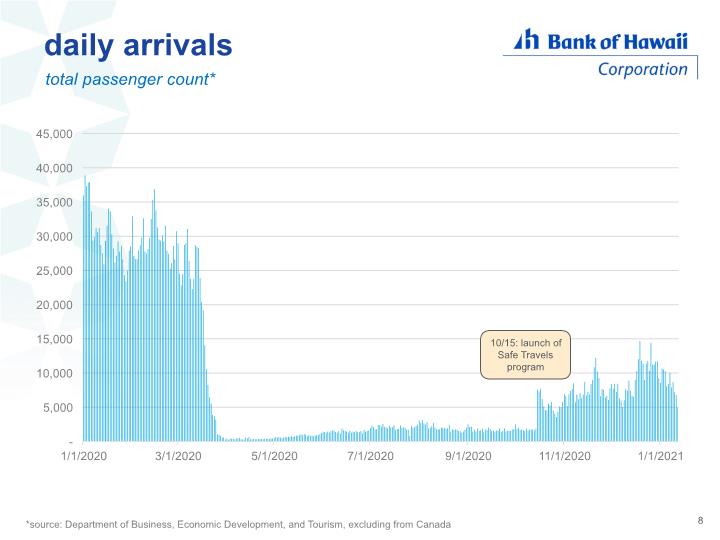

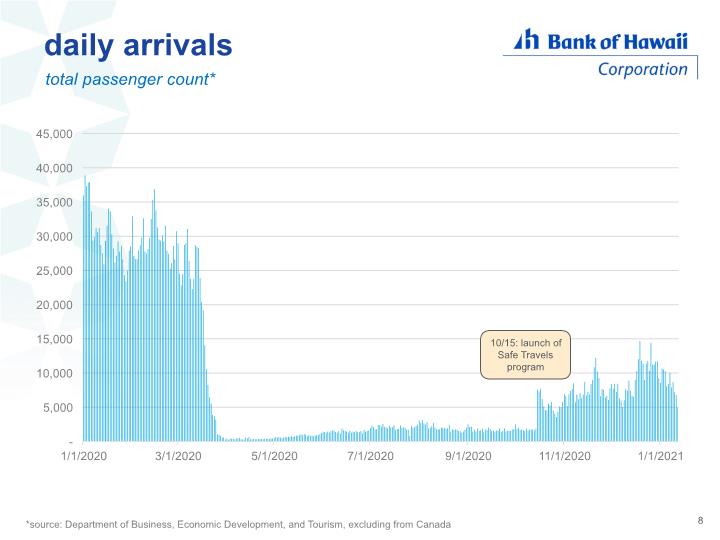

daily arrivals total passenger count* 8 *source: Department of Business, Economic Development, and Tourism, excluding from Canada 10/15: launch of Safe Travels program

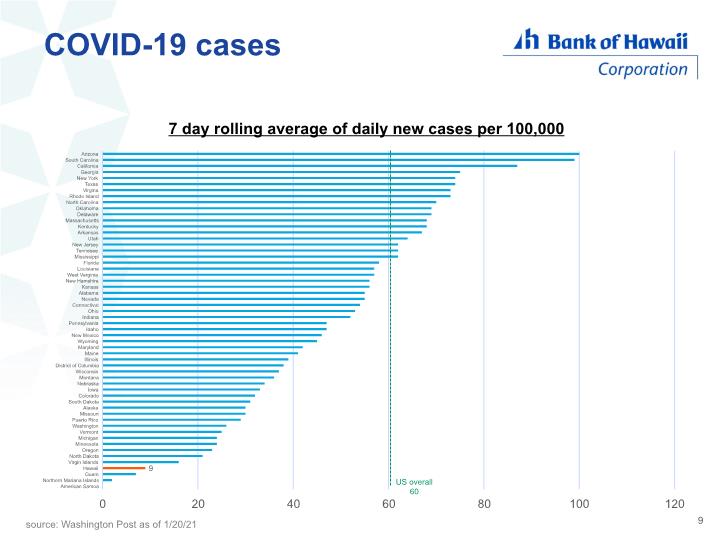

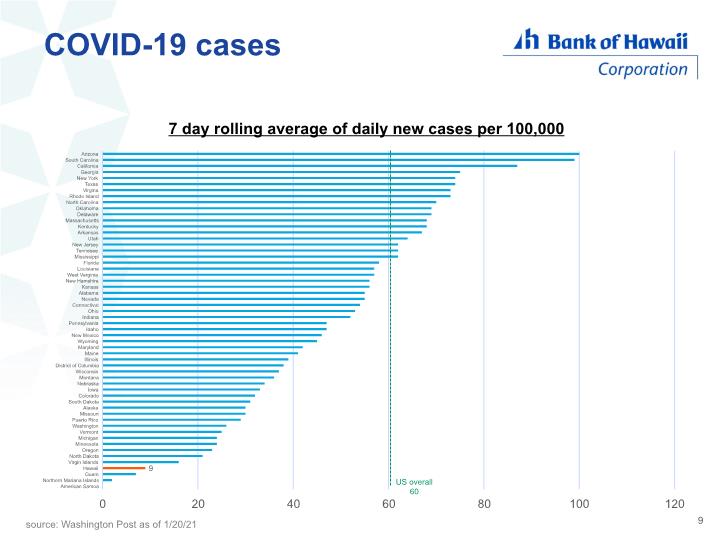

COVID-19 cases 9 source: Washington Post as of 1/20/21 US overall 60

Q4 financial update

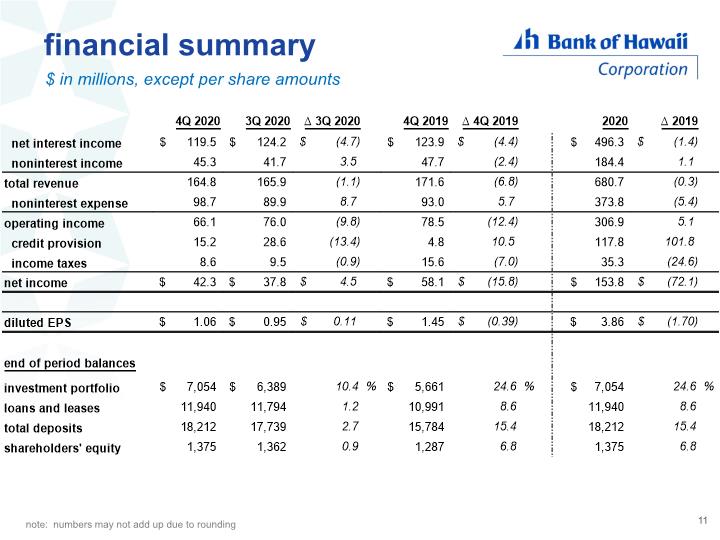

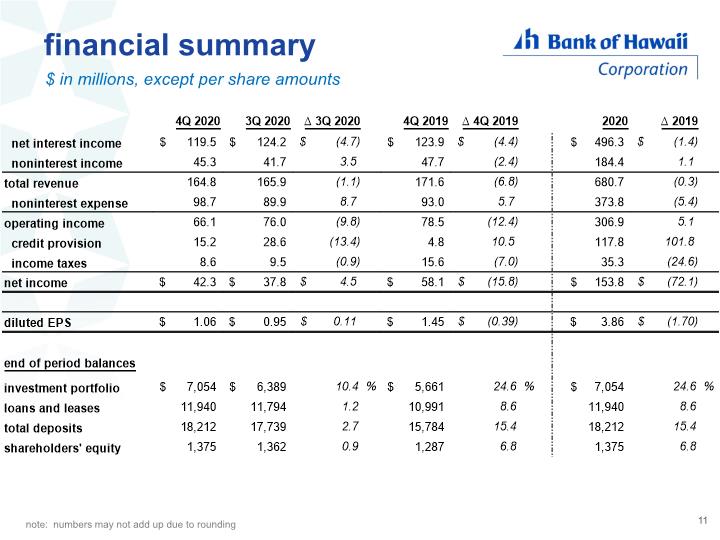

financial summary $ in millions, except per share amounts 11 note: numbers may not add up due to rounding

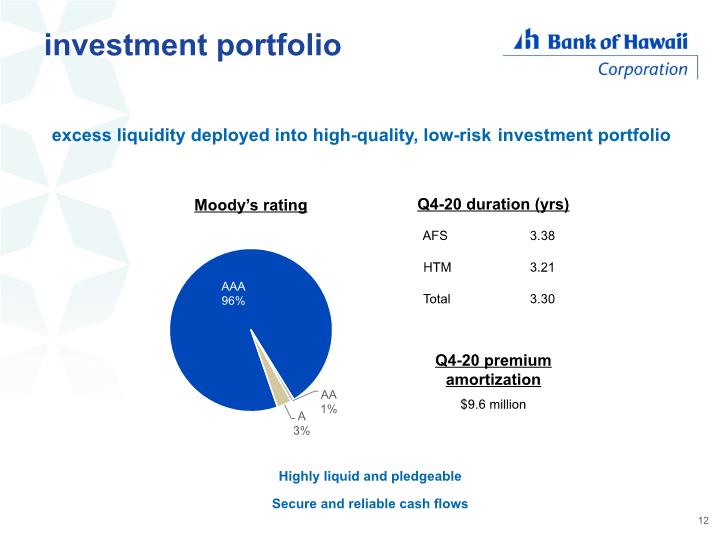

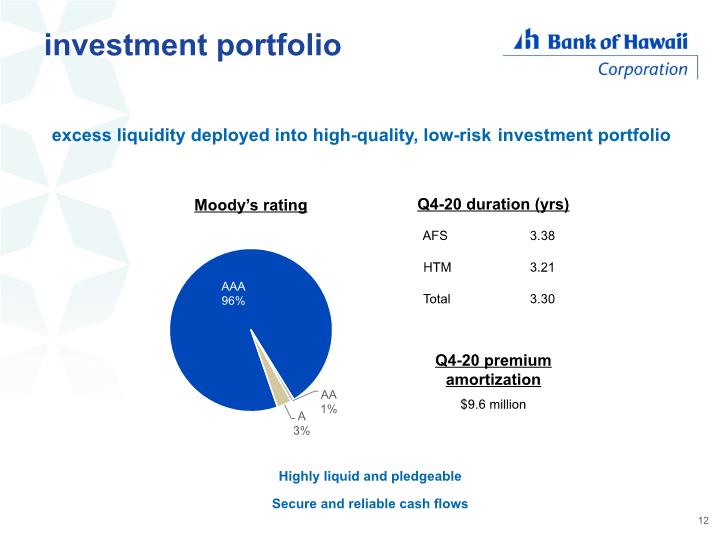

12 excess liquidity deployed into high-quality, low-risk investment portfolio investment portfolio Highly liquid and pledgeable Secure and reliable cash flows

performance metrics 13

Q4 credit update

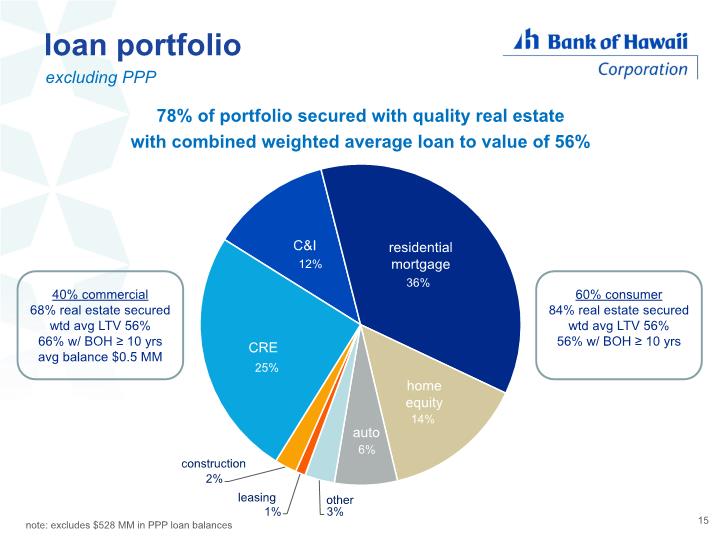

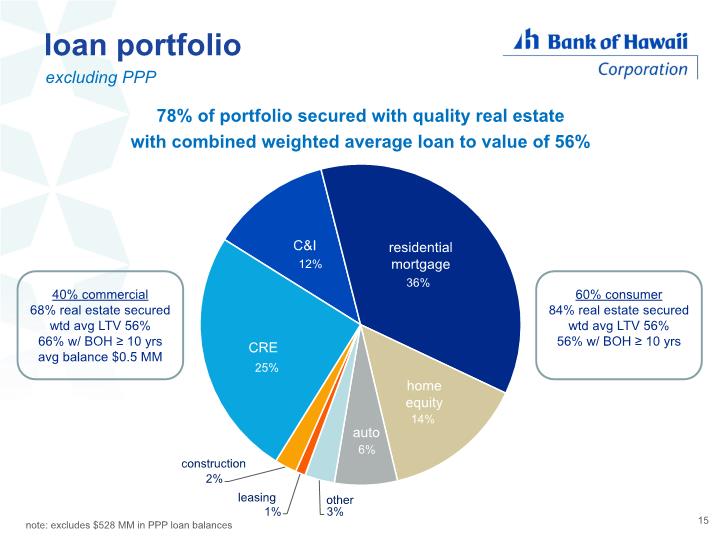

loan portfolio excluding PPP 15 40% commercial 68% real estate secured wtd avg LTV 56% 66% w/ BOH ≥ 10 yrs avg balance $0.5 MM CRE C&I residential mortgage home equity auto leasing other construction 60% consumer 84% real estate secured wtd avg LTV 56% 56% w/ BOH ≥ 10 yrs 78% of portfolio secured with quality real estate with combined weighted average loan to value of 56% note: excludes $528 MM in PPP loan balances

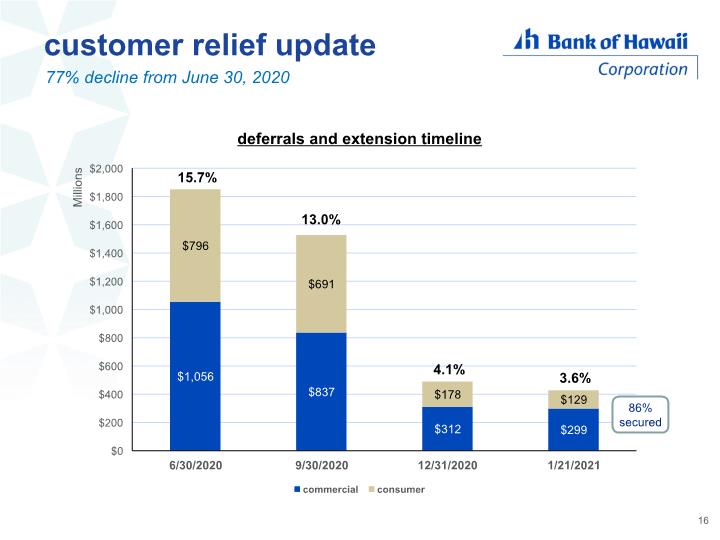

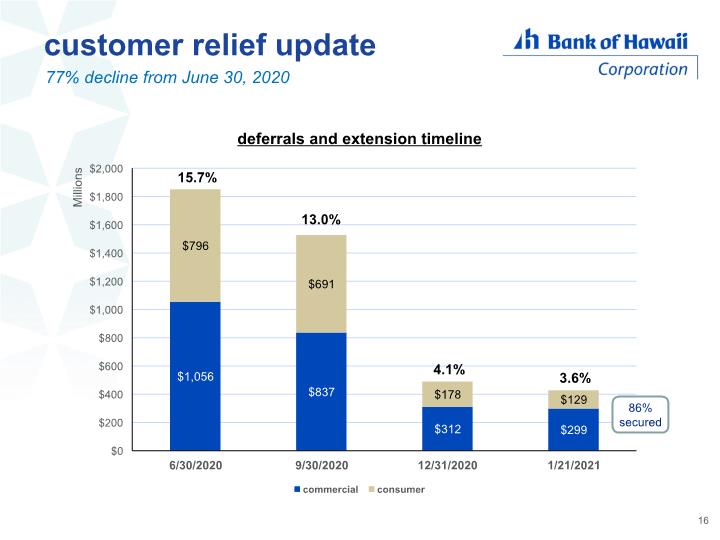

customer relief update 77% decline from June 30, 2020 16 15.7% 13.0% 4.1% 3.6% 86% secured

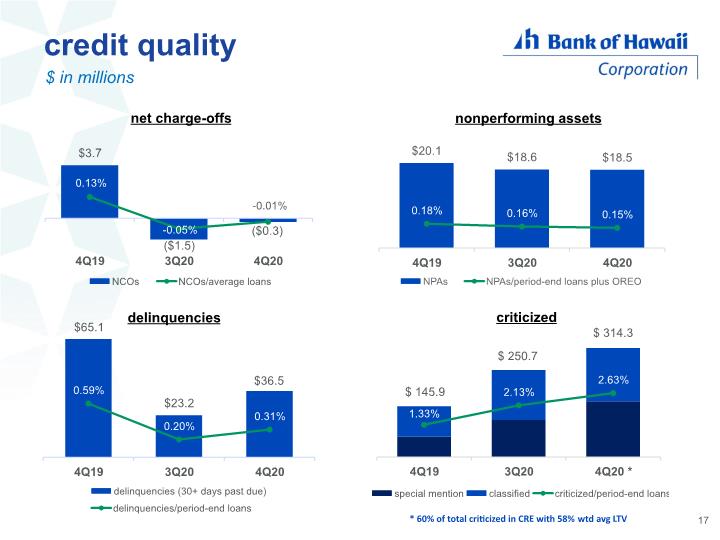

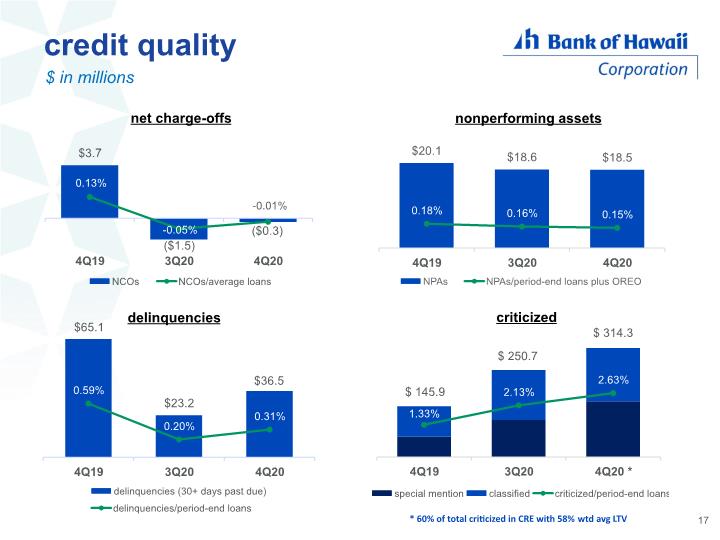

credit quality $ in millions 17 * 60% of total criticized in CRE with 58% wtd avg LTV

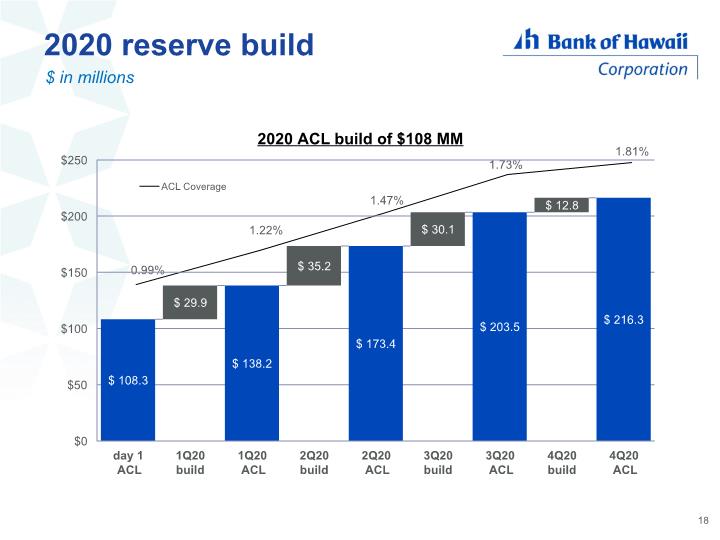

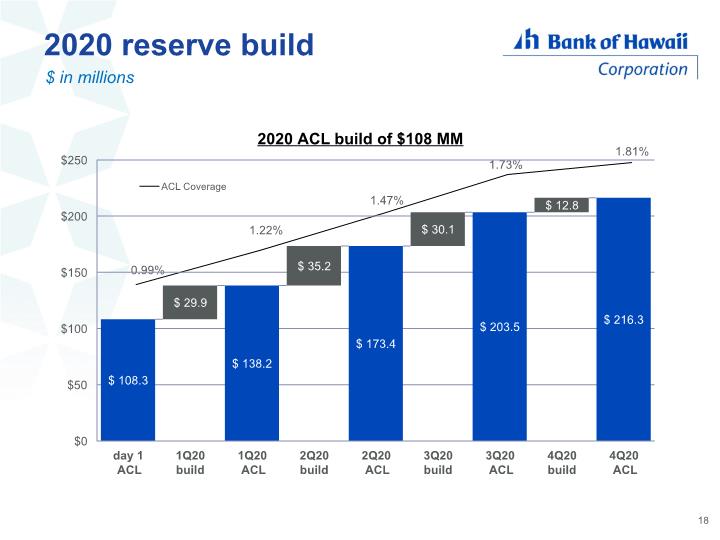

2020 reserve build $ in millions 18

looking forward

2021 macro environment 20 economic growth conditioned on COVID-19 conditions and trajectory accommodative monetary environment changed consumer preference

2021 priorities 21 continued risk vigilance support the recovery lean into evolving consumer preference self fund growth

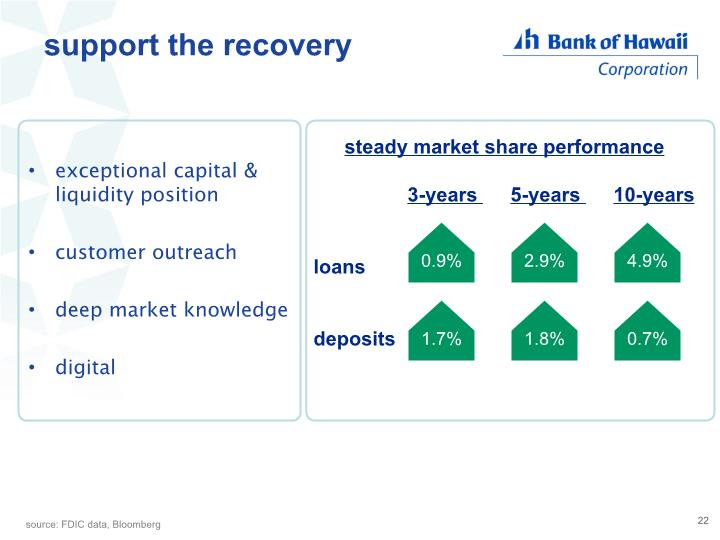

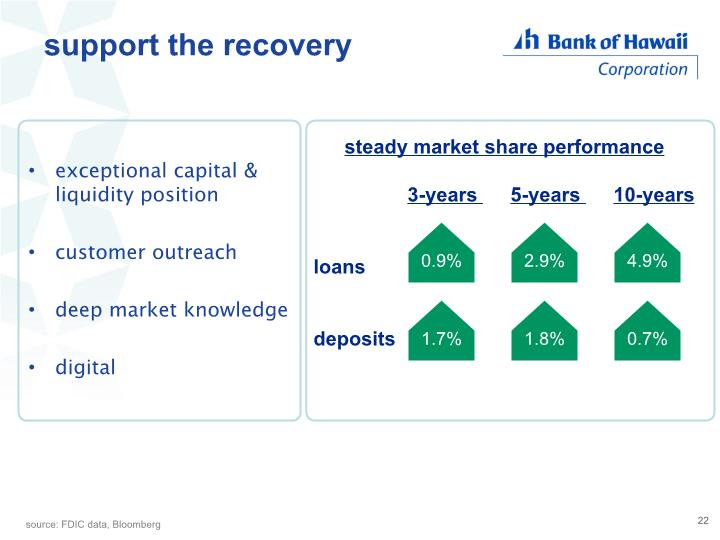

steady market share performance 3-years 5-years 10-years loans deposits source: FDIC data, Bloomberg exceptional capital & liquidity position customer outreach deep market knowledge digital support the recovery 22 0.9% 1.7% 1.8% 2.9% 4.9% 0.7%

evolving consumer preference 23 rapid change in certain consumer preferences span of change likely to extend to 18 to 24 months in total from March 2020 degree of snap back dependent on perception – enhancement or inconvenience? “new” normal

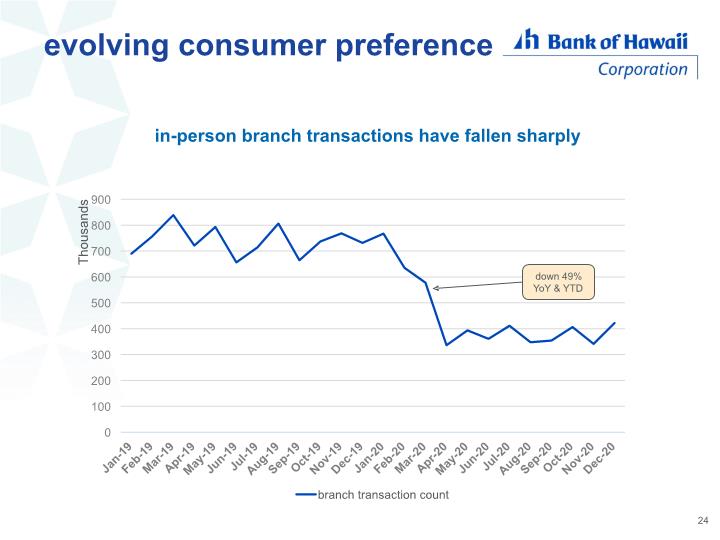

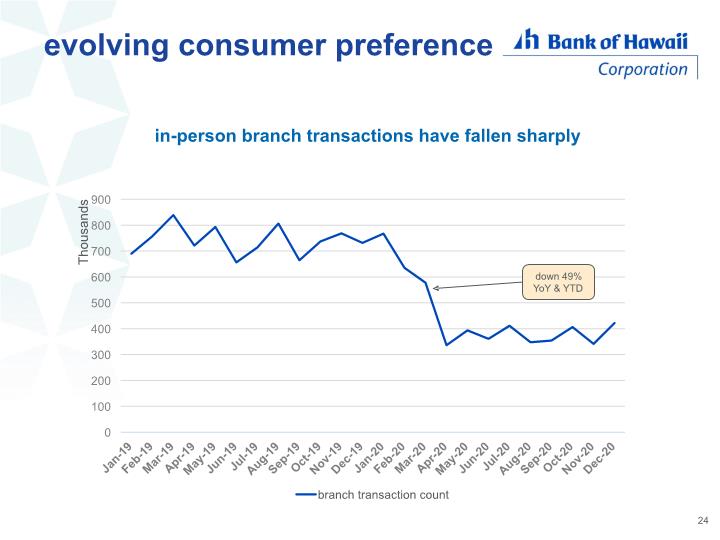

evolving consumer preference 24 down 49% YoY & YTD in-person branch transactions have fallen sharply

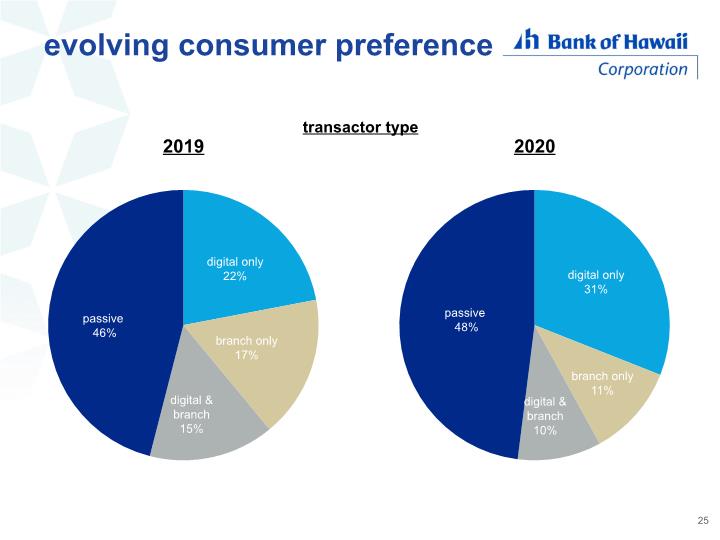

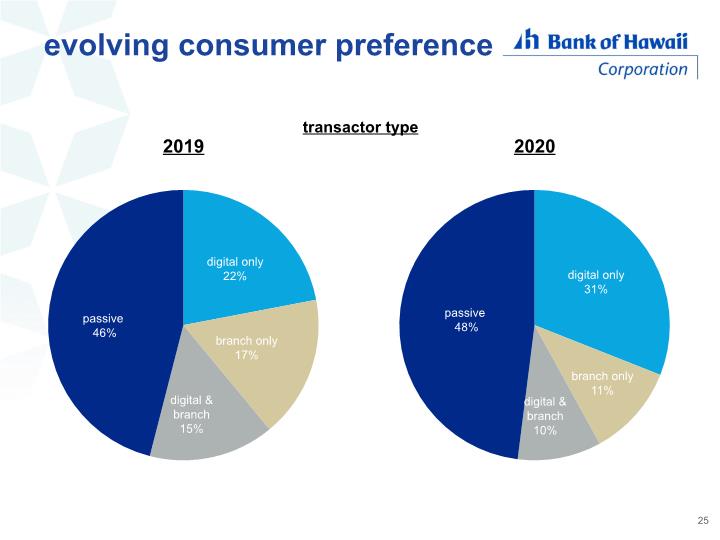

evolving consumer preference 25 transactor type

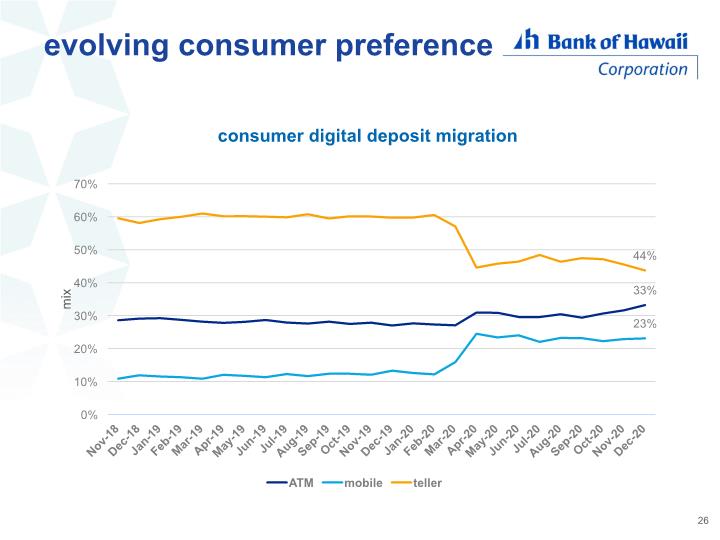

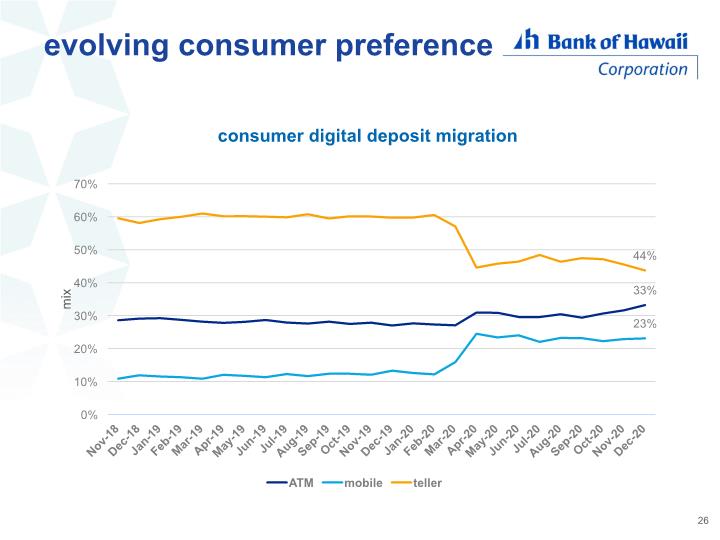

evolving consumer preference 26 consumer digital deposit migration

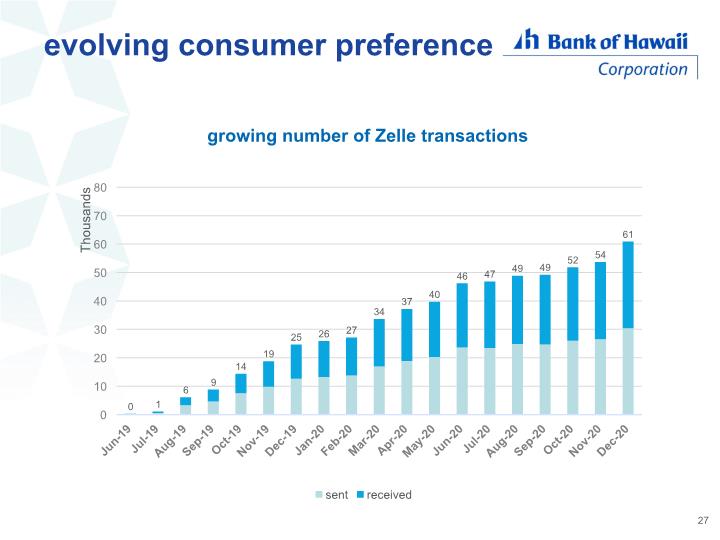

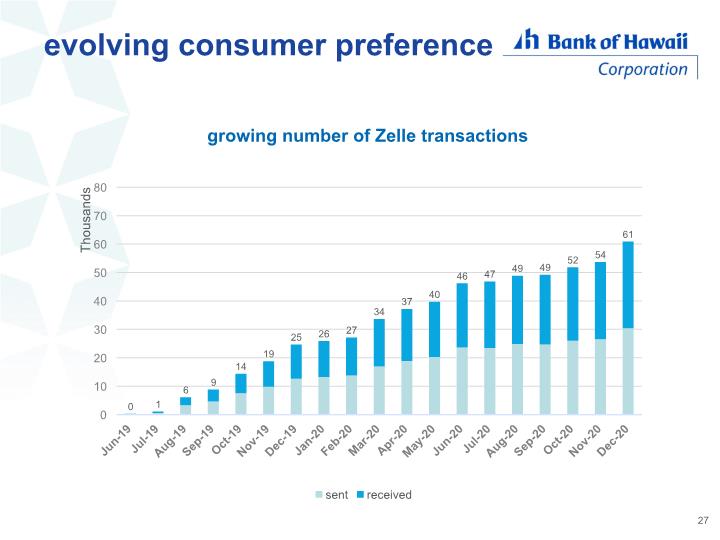

evolving consumer preference 27 growing number of Zelle transactions

core competency strategic & long-term oriented internally driven never ending self fund growth 28

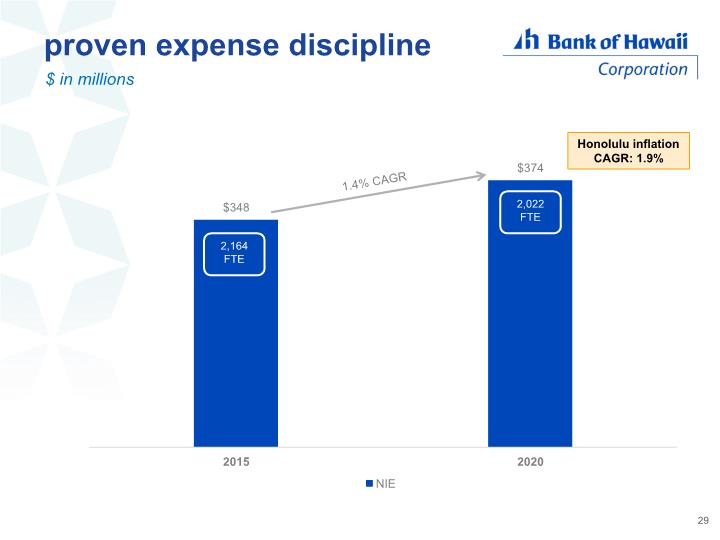

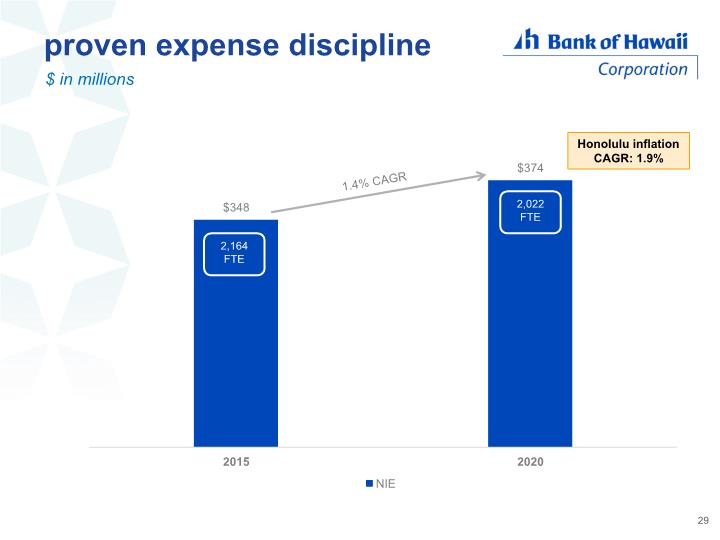

proven expense discipline 29 Honolulu inflation CAGR: 1.9% 1.4% CAGR 2,022 FTE $ in millions

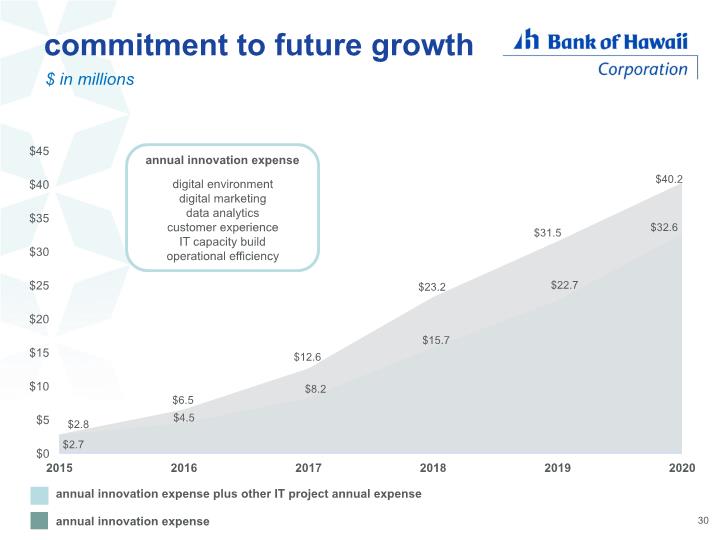

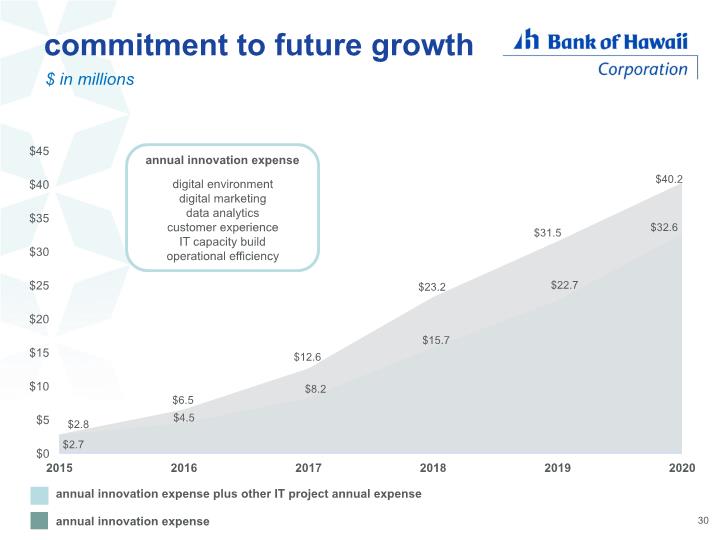

commitment to future growth 30 2,022 FTE annual innovation expense digital environment digital marketing data analytics customer experience IT capacity build operational efficiency annual innovation expense plus other IT project annual expense annual innovation expense $ in millions

digital sub-brand launch in 2017 10-year naming agreement with University of Hawaii main and most prominent arena sports venue in the state SimpliFi Arena 31

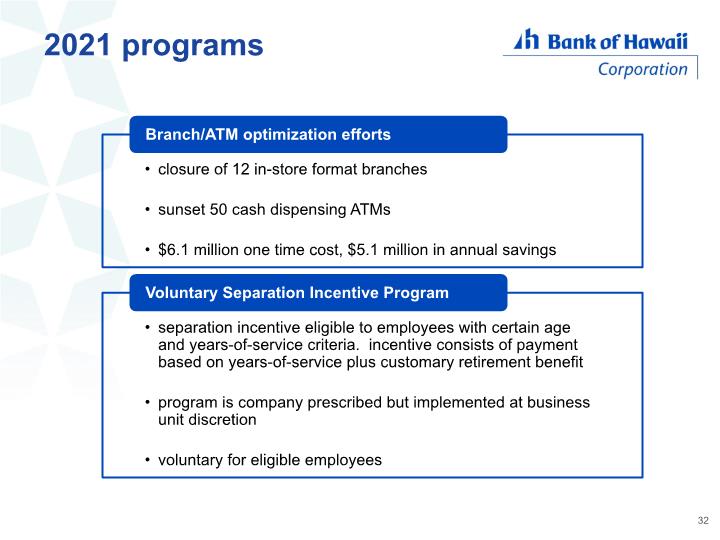

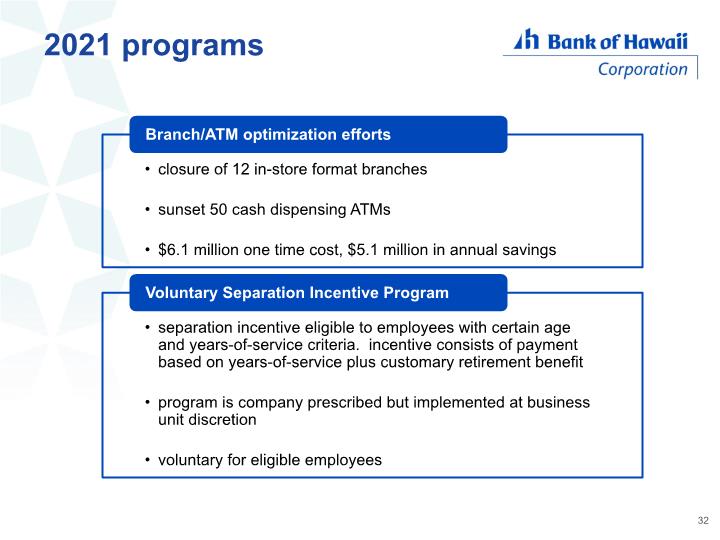

2021 programs 32

competitive innovation edge 33

Q & A

Bank of Hawaii Corporation fourth quarter 2020 financial report january 25, 2021

appendix

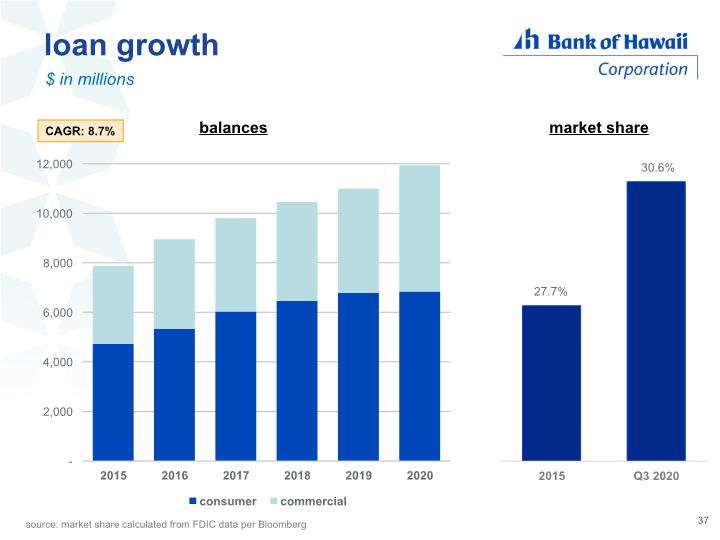

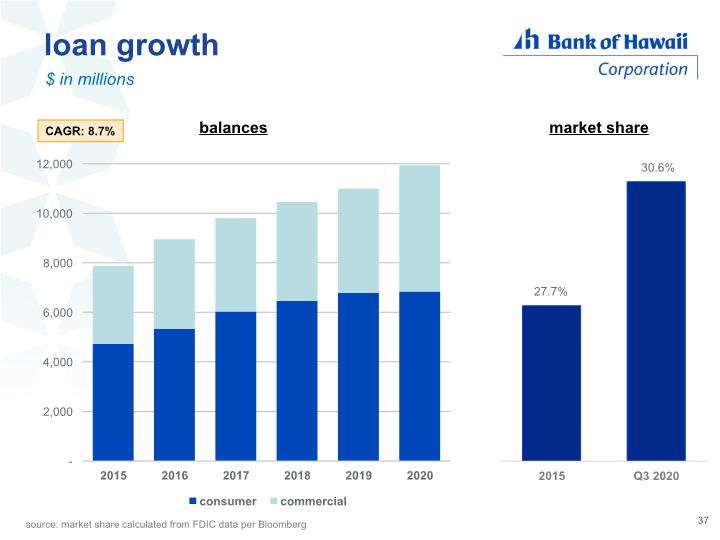

37 CAGR: 8.7% loan growth source: market share calculated from FDIC data per Bloomberg $ in millions

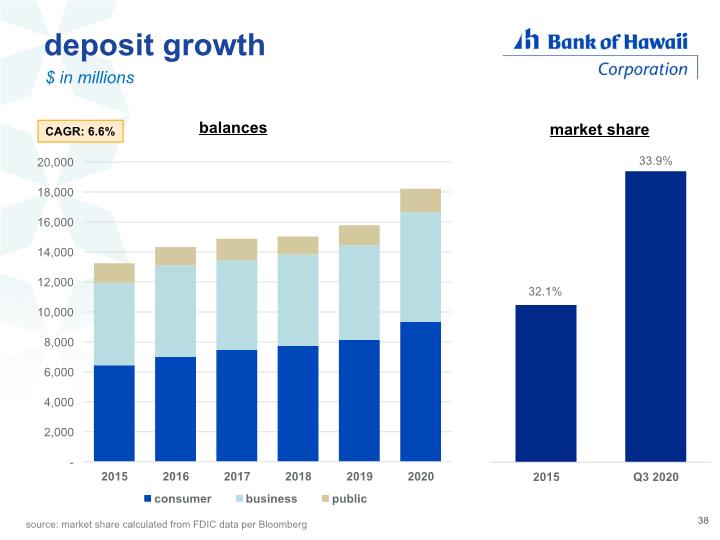

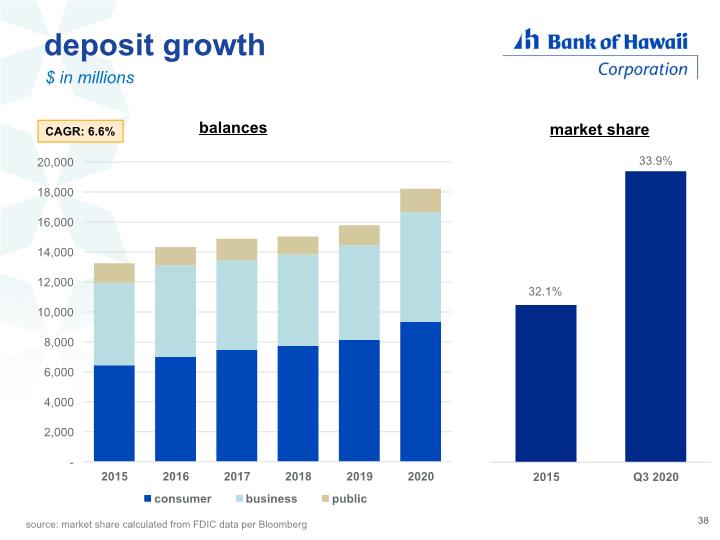

38 CAGR: 6.6% deposit growth $ in millions source: market share calculated from FDIC data per Bloomberg

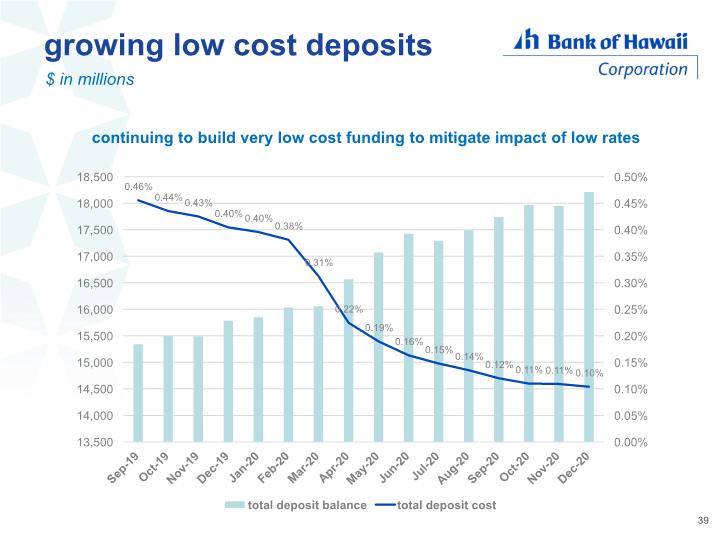

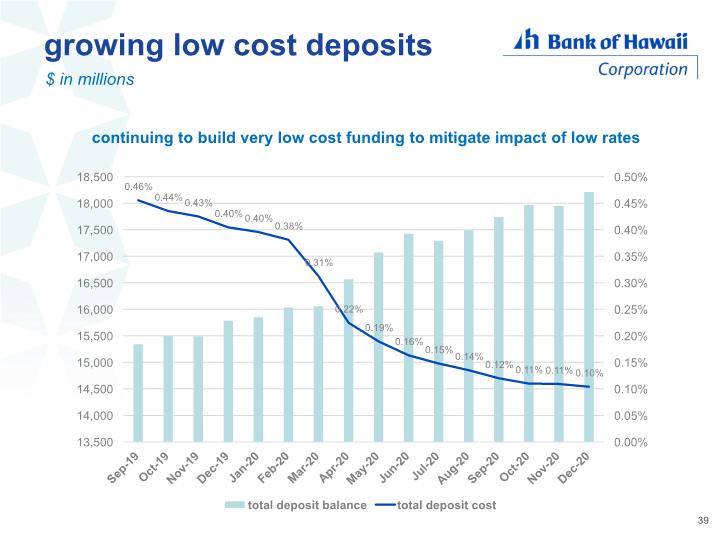

growing low cost deposits 39 continuing to build very low cost funding to mitigate impact of low rates $ in millions

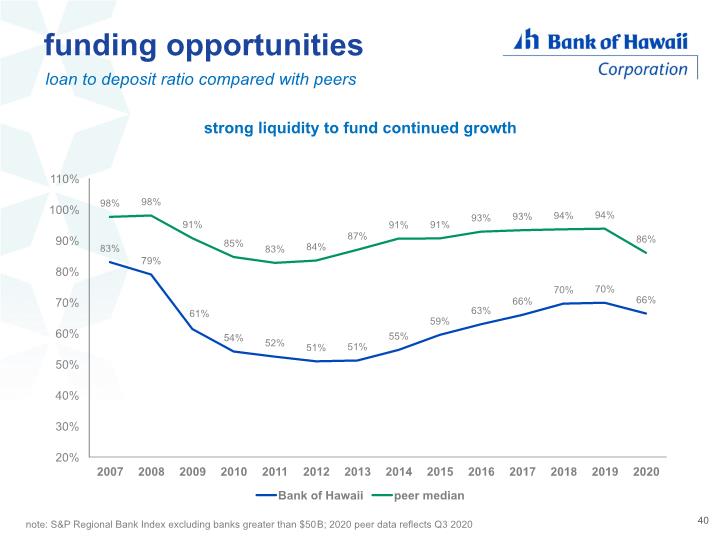

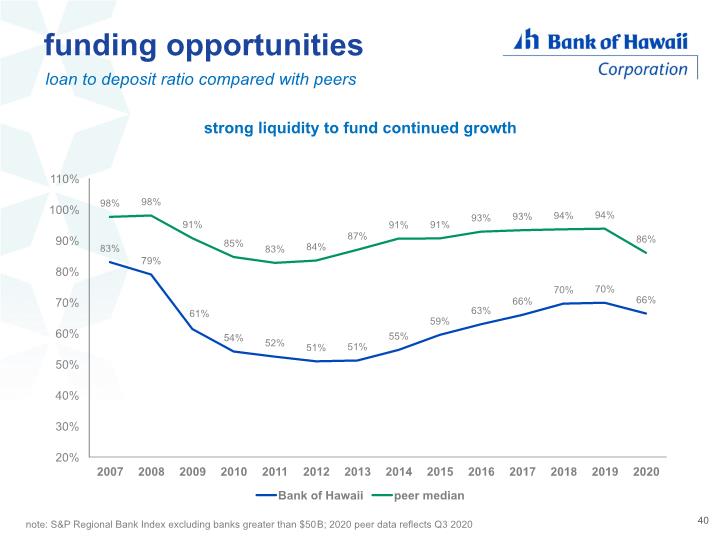

funding opportunities loan to deposit ratio compared with peers 40 note: S&P Regional Bank Index excluding banks greater than $50 B; 2020 peer data reflects Q3 2020 strong liquidity to fund continued growth

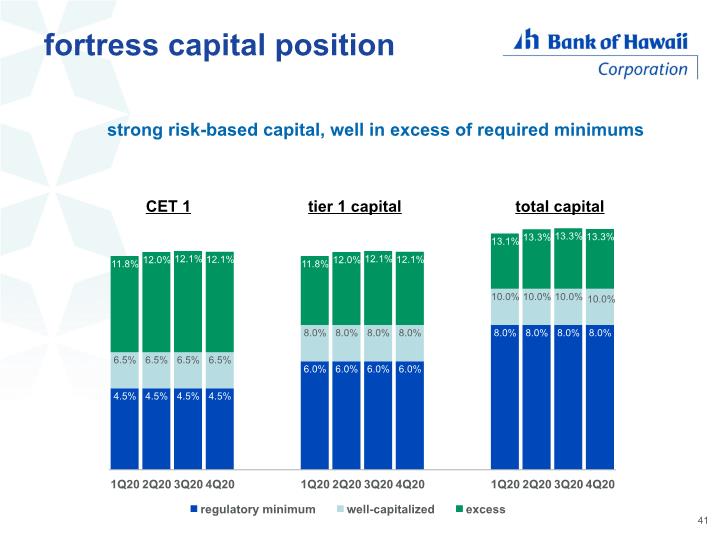

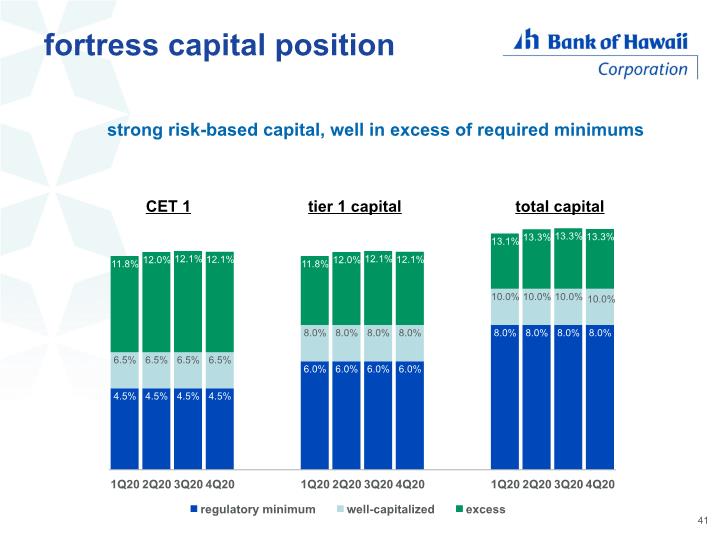

41 strong risk-based capital, well in excess of required minimums tier 1 capital CET 1 total capital fortress capital position

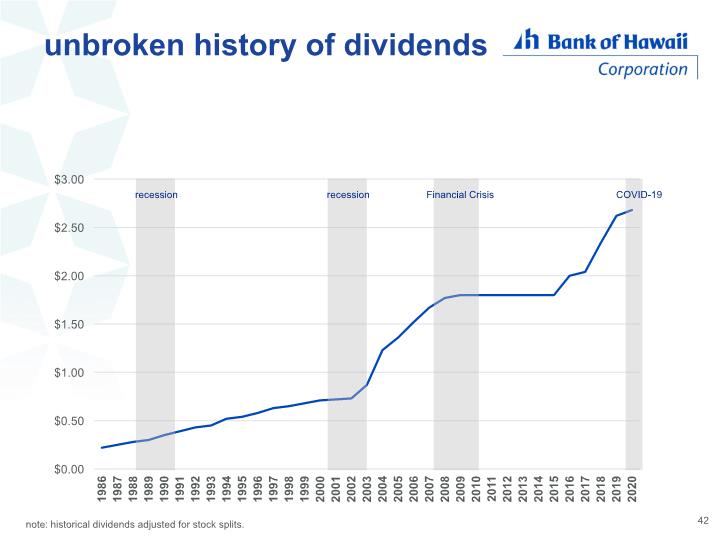

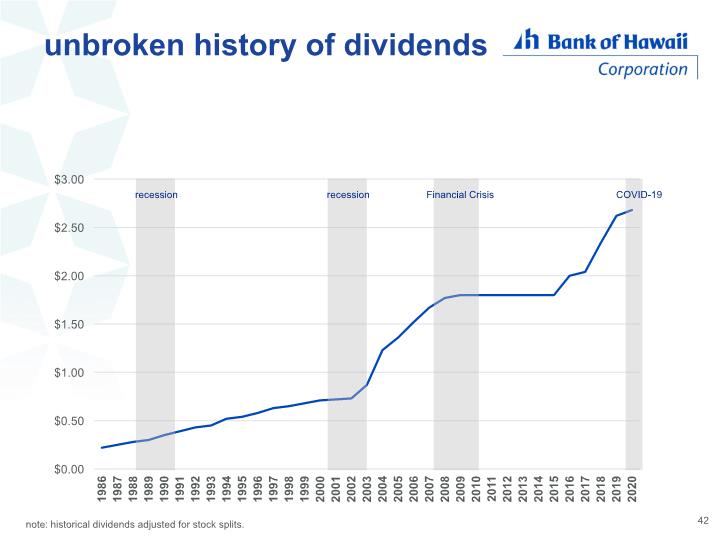

42 note: historical dividends adjusted for stock splits. Financial Crisis recession recession COVID-19 unbroken history of dividends

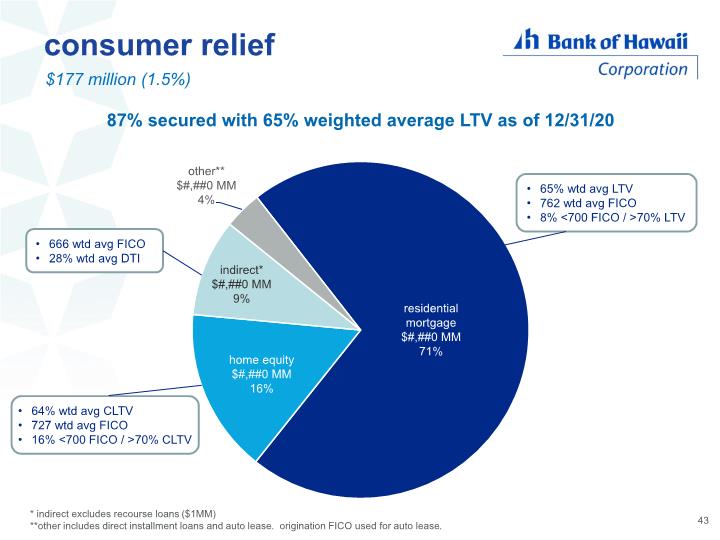

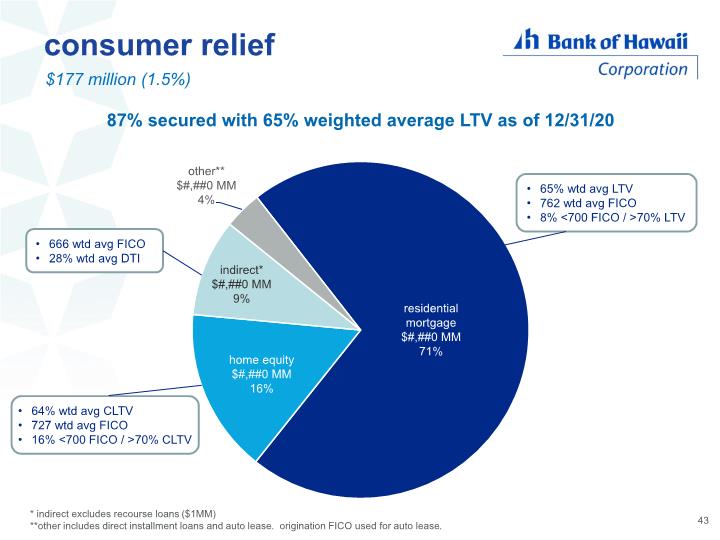

43 87% secured with 65% weighted average LTV as of 12/31/20 consumer relief $177 million (1.5%) 666 wtd avg FICO 28% wtd avg DTI 64% wtd avg CLTV 727 wtd avg FICO 16% <700 FICO / >70% CLTV 65% wtd avg LTV 762 wtd avg FICO 8% <700 FICO / >70% LTV * indirect excludes recourse loans ($1MM) **other includes direct installment loans and auto lease. origination FICO used for auto lease.

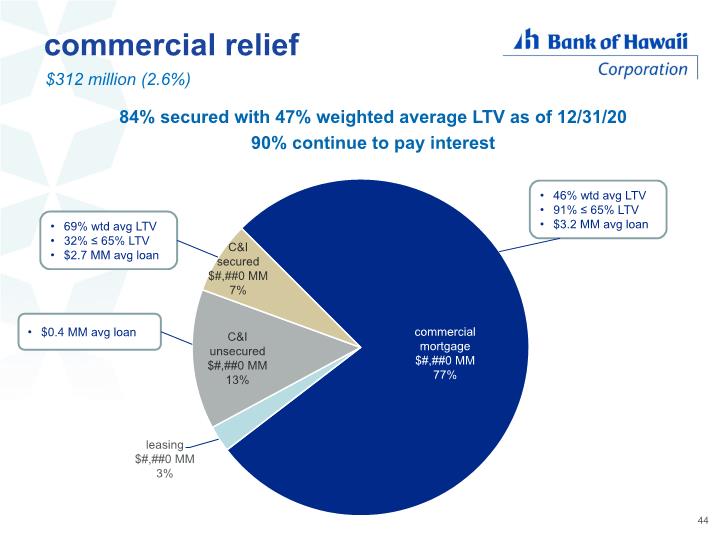

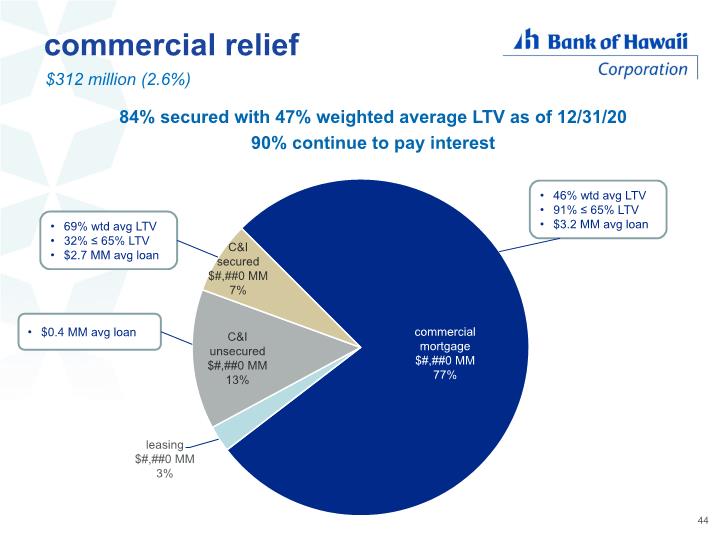

44 84% secured with 47% weighted average LTV as of 12/31/20 90% continue to pay interest commercial relief $312 million (2.6%) 69% wtd avg LTV 32% ≤ 65% LTV $2.7 MM avg loan $0.4 MM avg loan 46% wtd avg LTV 91% ≤ 65% LTV $3.2 MM avg loan

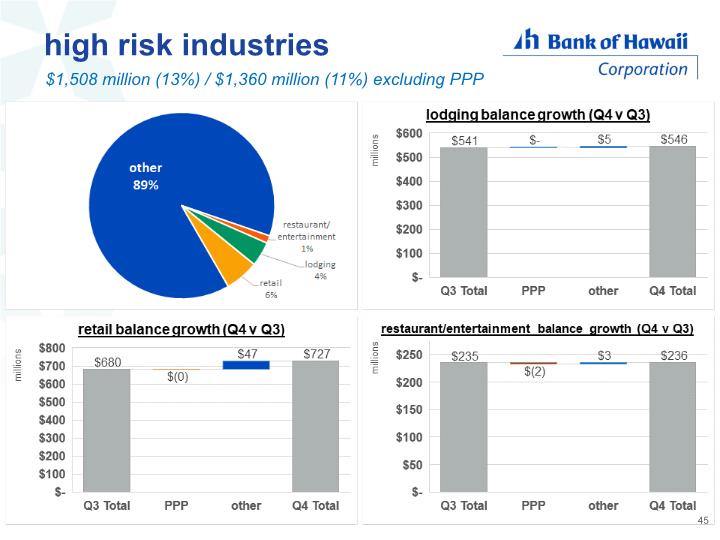

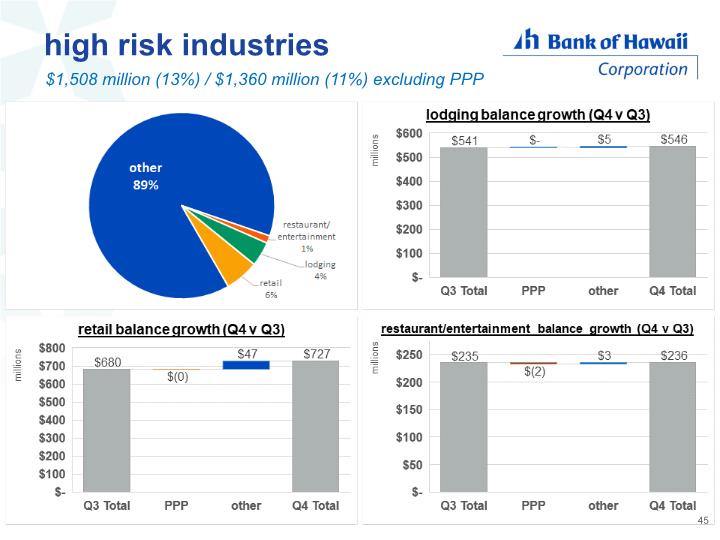

45 high risk industries $1,508 million (13%) / $1,360 million (11%) excluding PPP

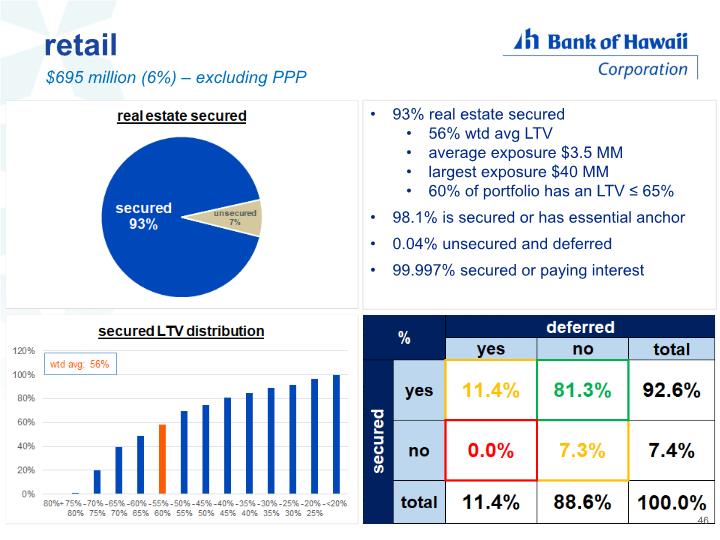

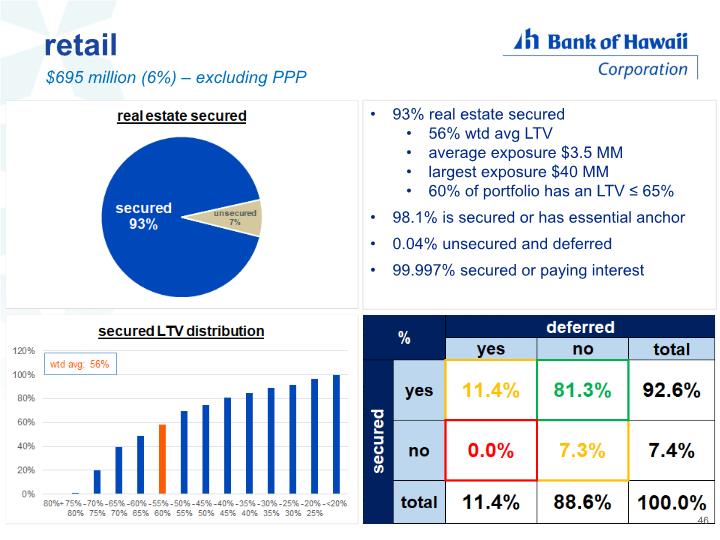

46 retail $695 million (6%) – excluding PPP 93% real estate secured 56% wtd avg LTV average exposure $3.5 MM largest exposure $40 MM 60% of portfolio has an LTV ≤ 65% 98.1% is secured or has essential anchor 0.04% unsecured and deferred 99.997% secured or paying interest

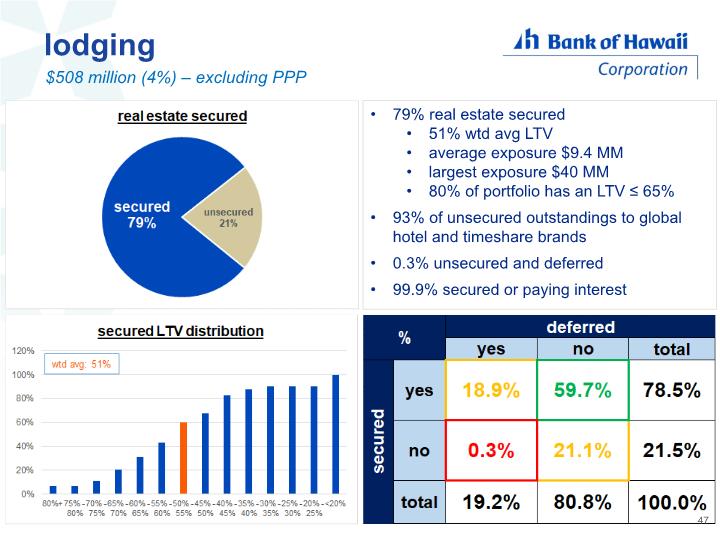

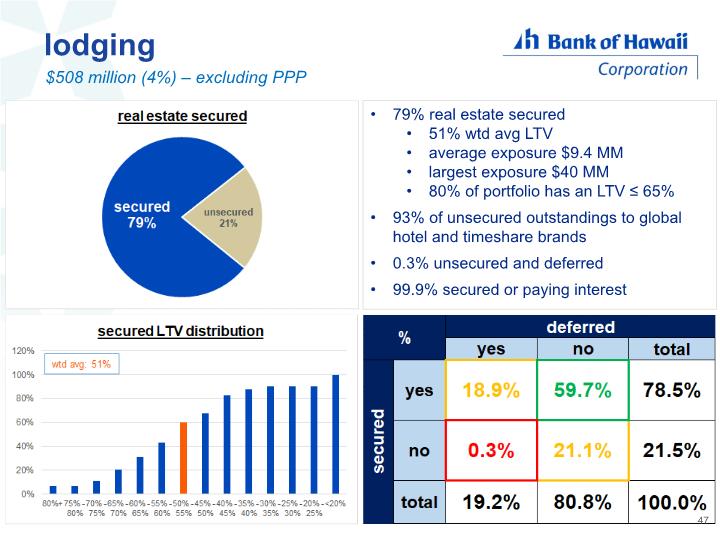

47 lodging $508 million (4%) – excluding PPP 79% real estate secured 51% wtd avg LTV average exposure $9.4 MM largest exposure $40 MM 80% of portfolio has an LTV ≤ 65% 93% of unsecured outstandings to global hotel and timeshare brands 0.3% unsecured and deferred 99.9% secured or paying interest

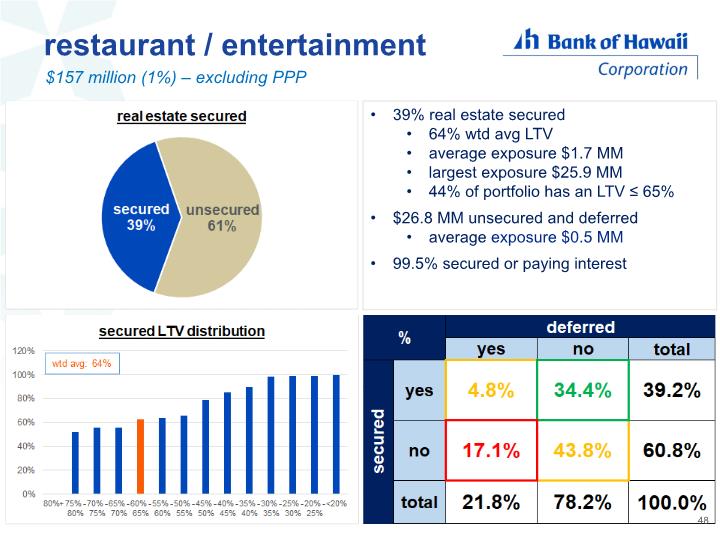

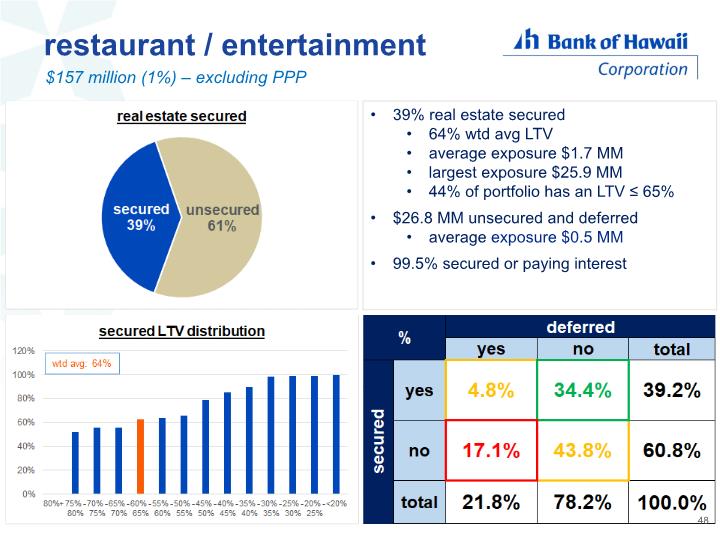

48 restaurant / entertainment $157 million (1%) – excluding PPP 39% real estate secured 64% wtd avg LTV average exposure $1.7 MM largest exposure $25.9 MM 44% of portfolio has an LTV ≤ 65% $26.8 MM unsecured and deferred average exposure $0.5 MM 99.5% secured or paying interest