Bank of Hawaii Corporation second quarter 2021 financial report July 26, 2021 Exhibit 99.2

this presentation, and other statements made by the Company in connection with it, may contain forward-looking statements concerning, among other things, forecasts of our financial results and condition, expectations for our operations and business prospects, and our assumptions used in those forecasts and expectations. we have not committed to update forward-looking statements to reflect later events or circumstances. disclosure 2 forward-looking statements

3

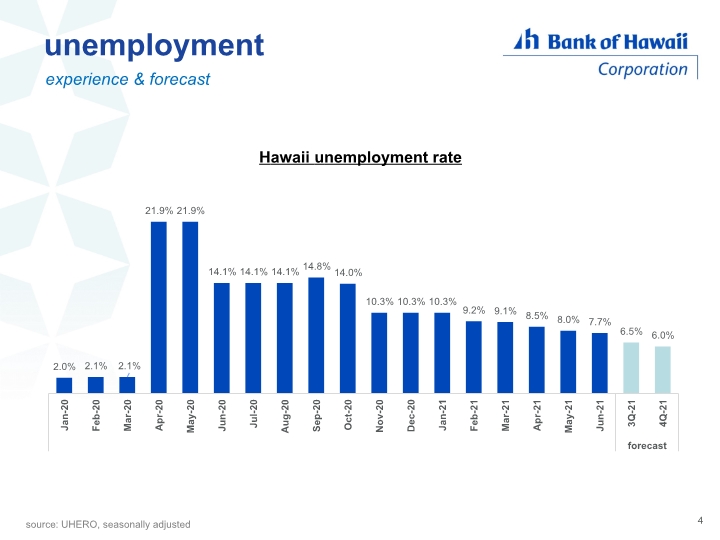

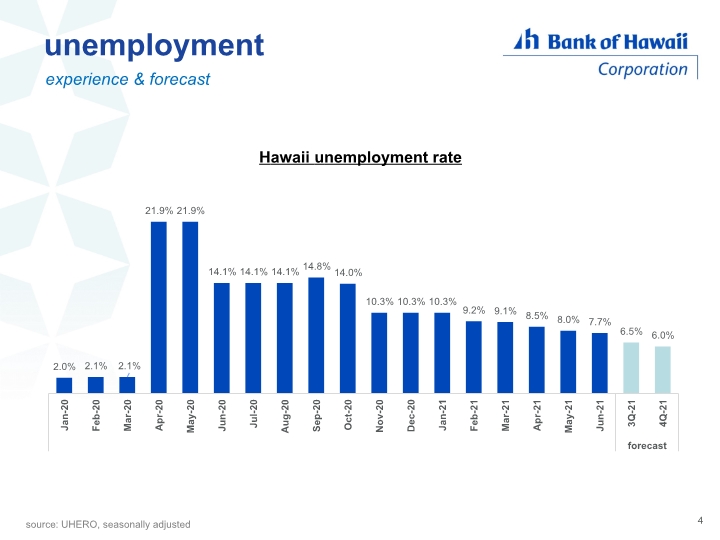

unemployment experience & forecast 4 source: UHERO, seasonally adjusted Hawaii unemployment rate

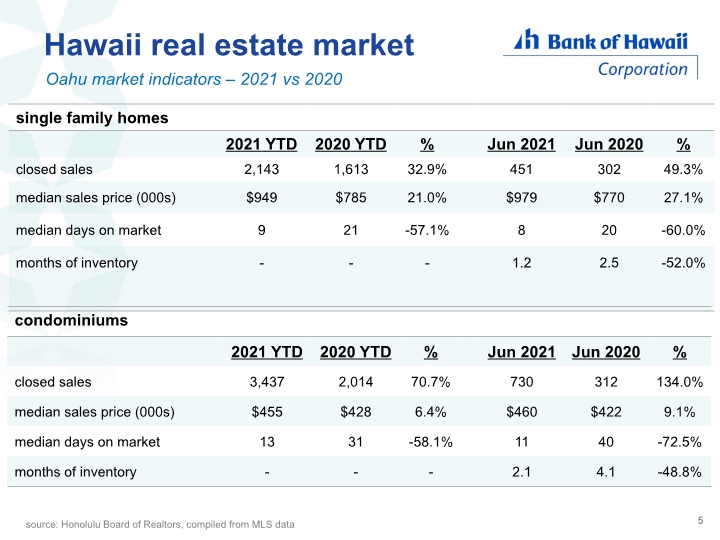

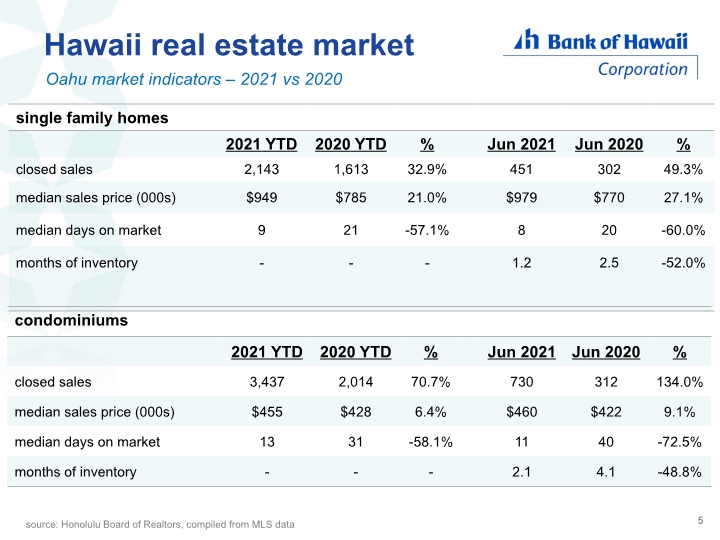

Hawaii real estate market Oahu market indicators – 2021 vs 2020 5 source: Honolulu Board of Realtors, compiled from MLS data

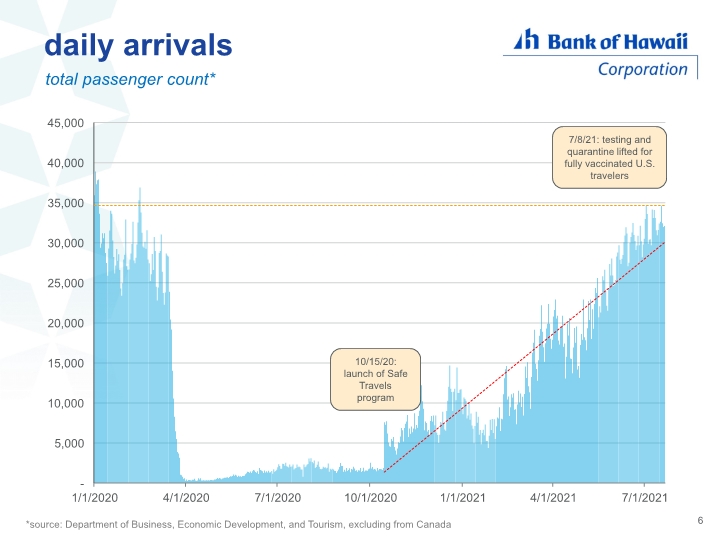

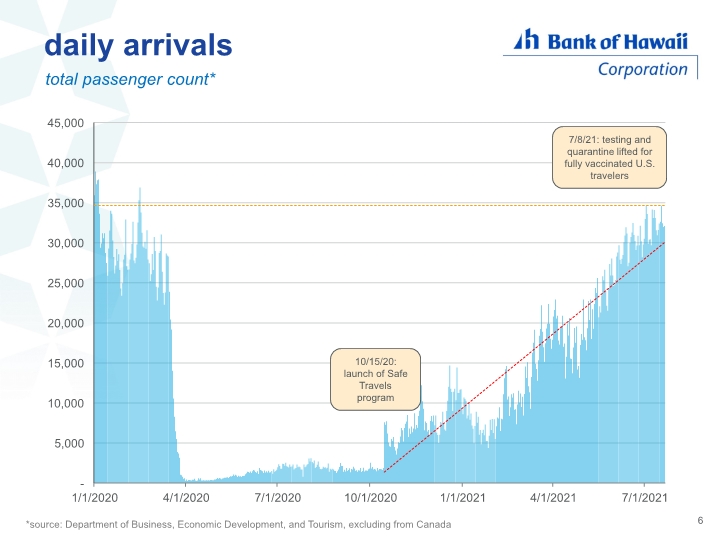

daily arrivals total passenger count* 6 *source: Department of Business, Economic Development, and Tourism, excluding from Canada 7/8/21: testing and quarantine lifted for fully vaccinated U.S. travelers 10/15/20: launch of Safe Travels program

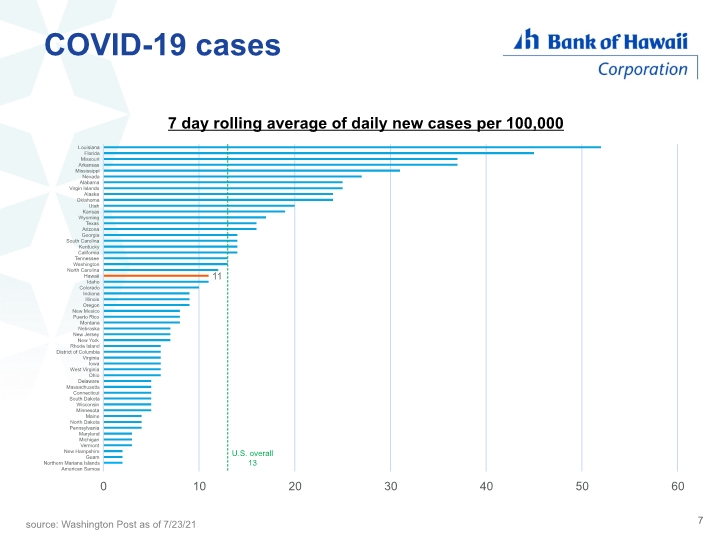

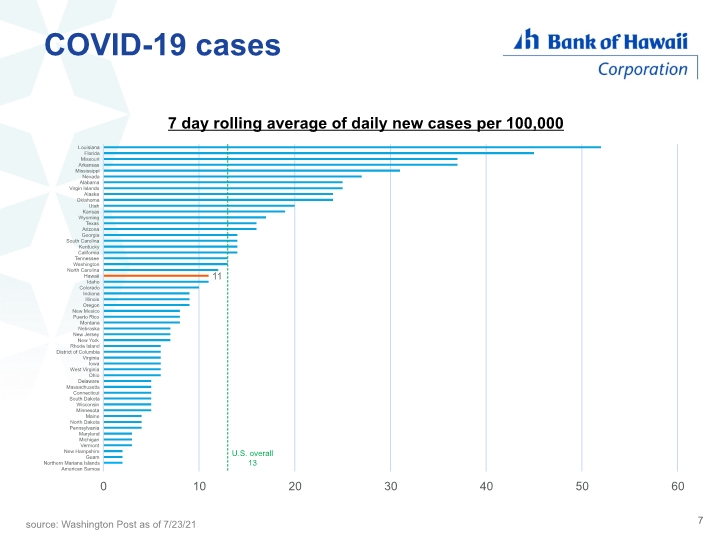

COVID-19 cases 7 source: Washington Post as of 7/23/21

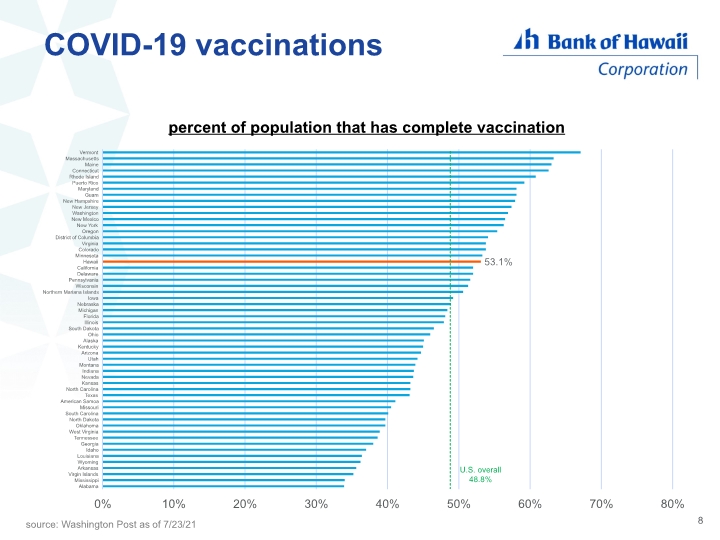

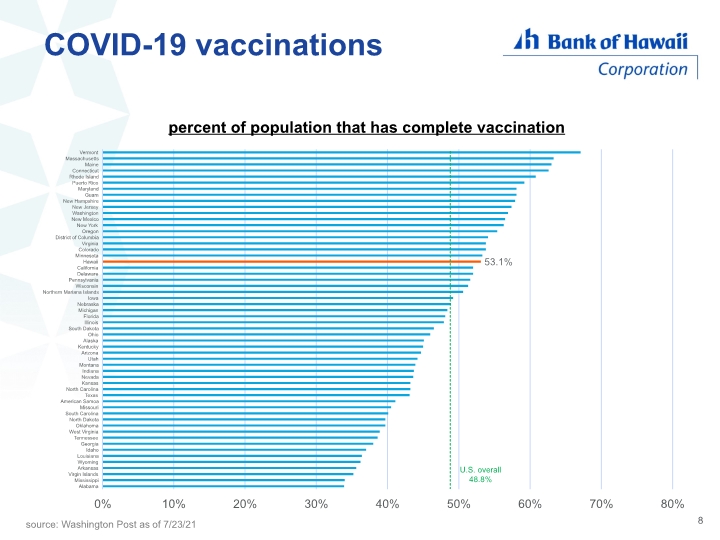

COVID-19 vaccinations 8 source: Washington Post as of 7/23/21 U.S. overall 48.8%

2Q financial update

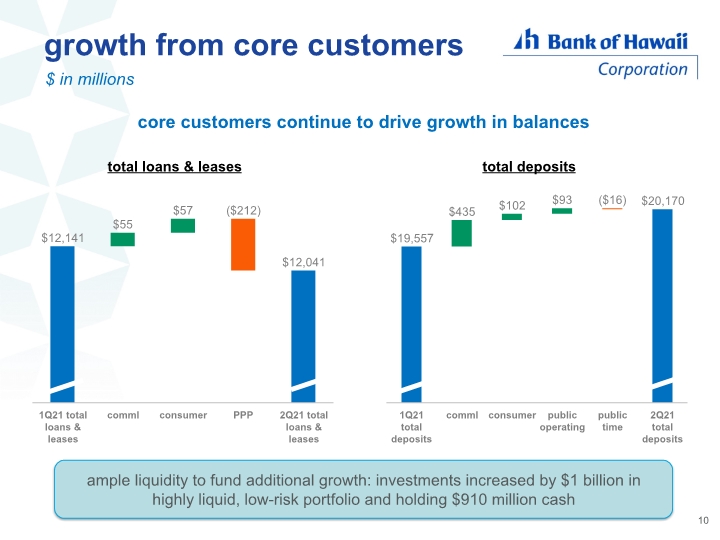

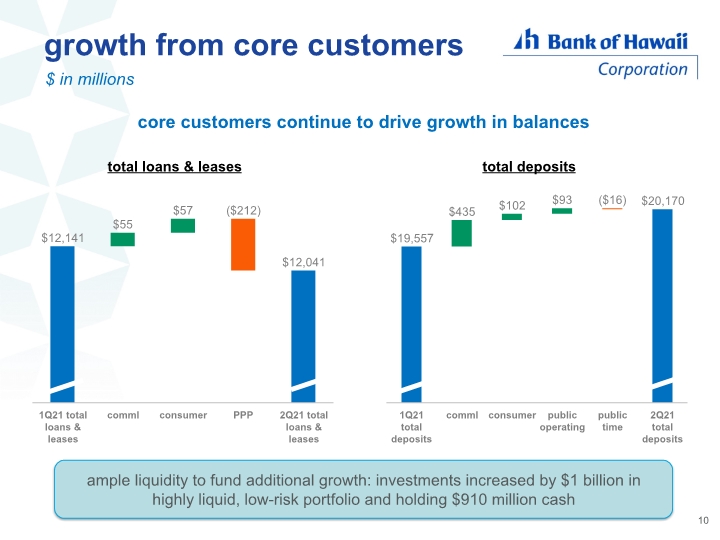

10 core customers continue to drive growth in balances growth from core customers $ in millions ample liquidity to fund additional growth: investments increased by $1 billion in highly liquid, low-risk portfolio and holding $910 million cash

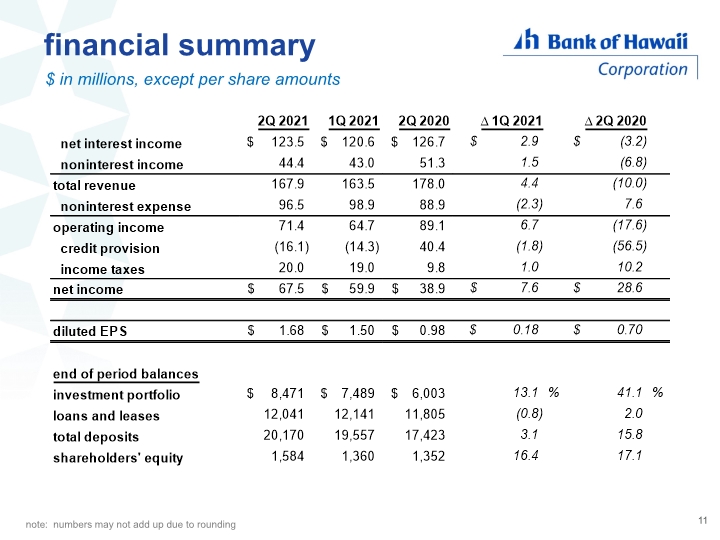

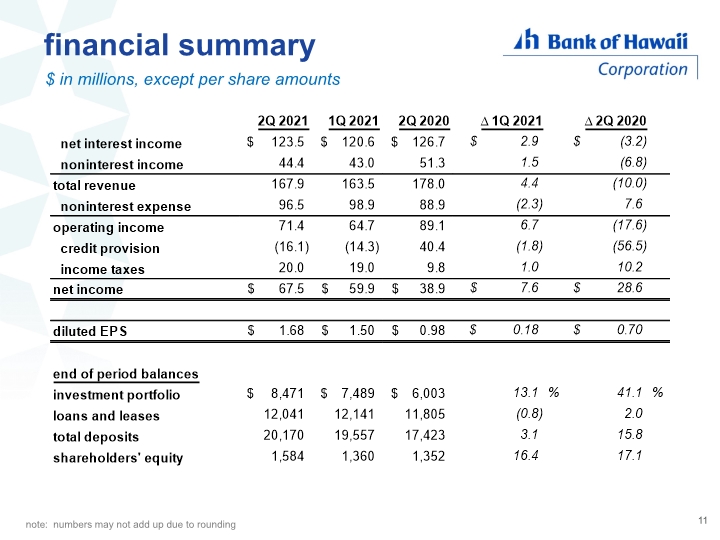

financial summary $ in millions, except per share amounts 11 note: numbers may not add up due to rounding

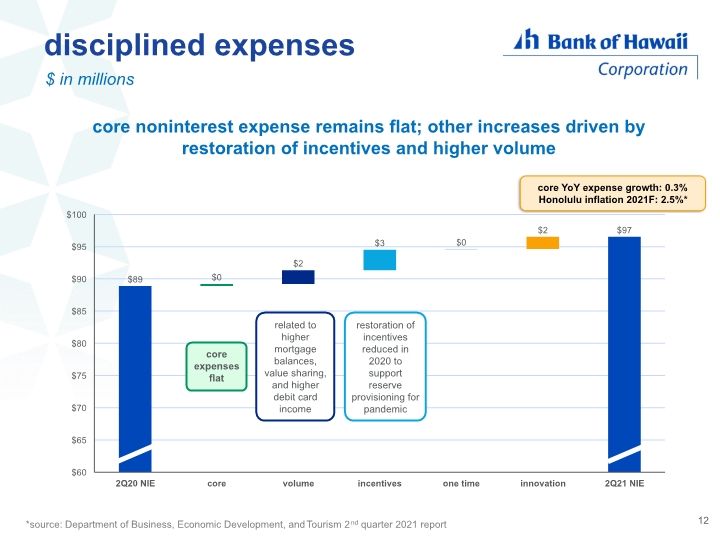

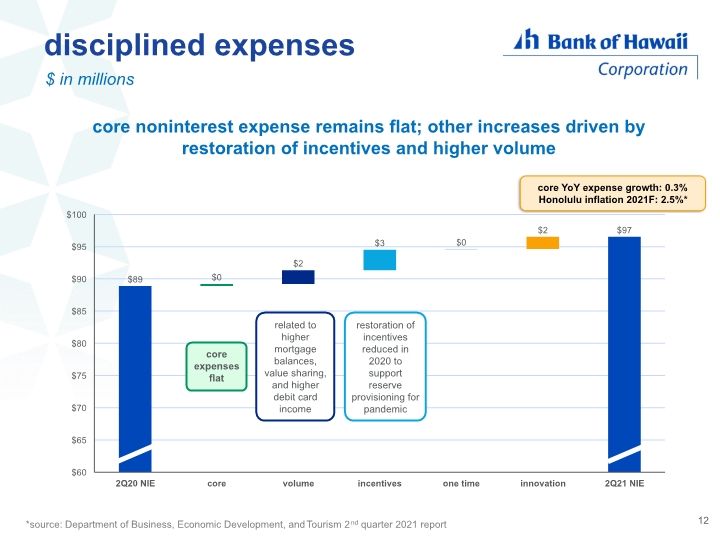

disciplined expenses $ in millions 12 core noninterest expense remains flat; other increases driven by restoration of incentives and higher volume restoration of incentives reduced in 2020 to support reserve provisioning for pandemic core expenses flat related to higher mortgage balances, value sharing, and higher debit card income core YoY expense growth: 0.3% Honolulu inflation 2021F: 2.5%* *source: Department of Business, Economic Development, and Tourism 2nd quarter 2021 report

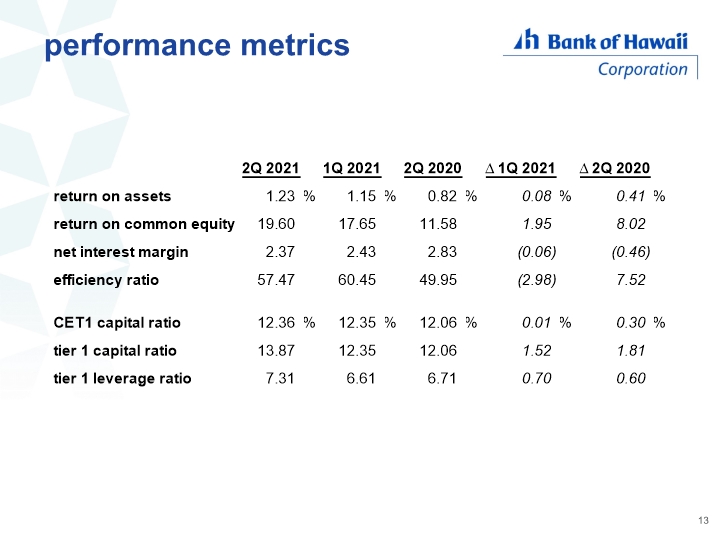

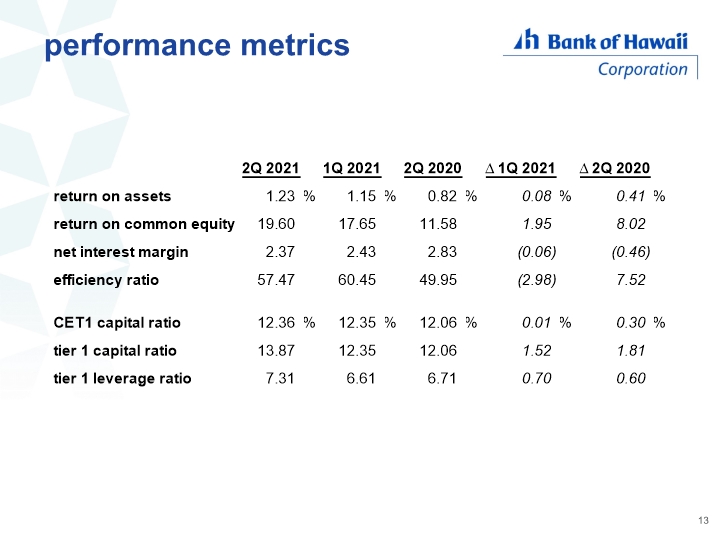

performance metrics 13

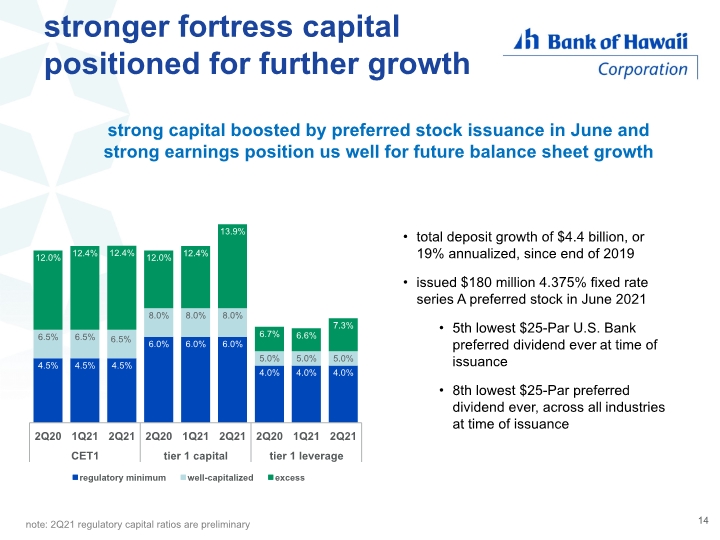

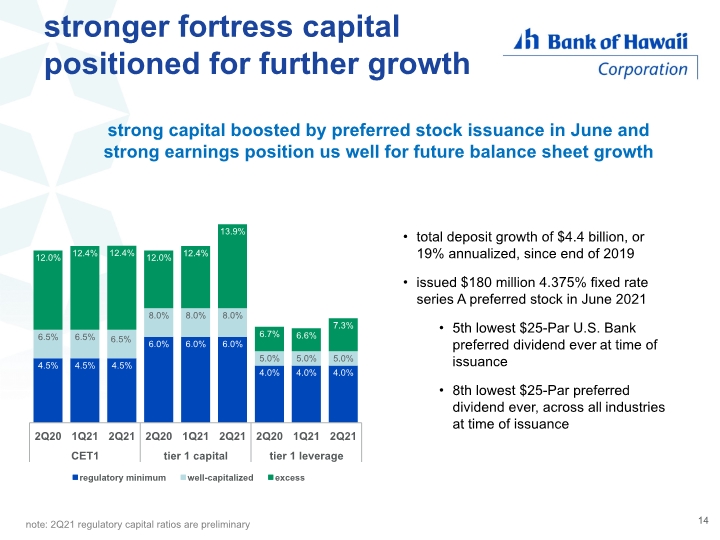

14 strong capital boosted by preferred stock issuance in June and strong earnings position us well for future balance sheet growth stronger fortress capital positioned for further growth note: 2Q21 regulatory capital ratios are preliminary total deposit growth of $4.4 billion, or 19% annualized, since end of 2019 issued $180 million 4.375% fixed rate series A preferred stock in June 2021 5th lowest $25-Par U.S. Bank preferred dividend ever at time of issuance 8th lowest $25-Par preferred dividend ever, across all industries at time of issuance

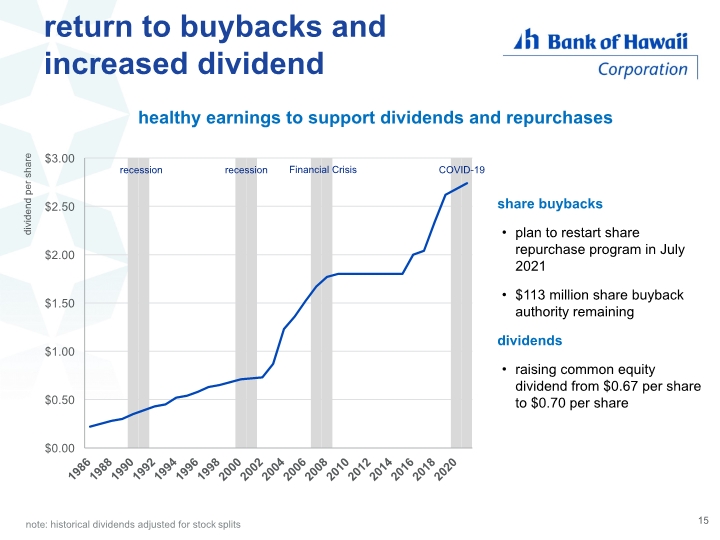

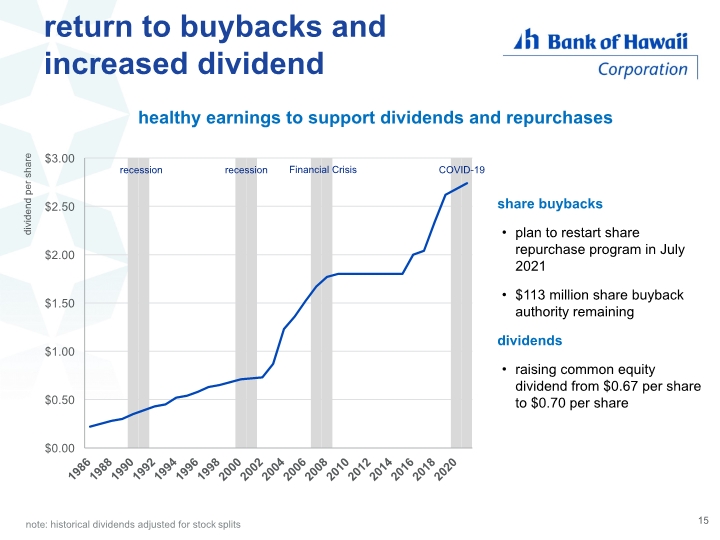

15 note: historical dividends adjusted for stock splits return to buybacks and increased dividend healthy earnings to support dividends and repurchases share buybacks plan to restart share repurchase program in July 2021 $113 million share buyback authority remaining dividends raising common equity dividend from $0.67 per share to $0.70 per share recession COVID-19

2Q credit update

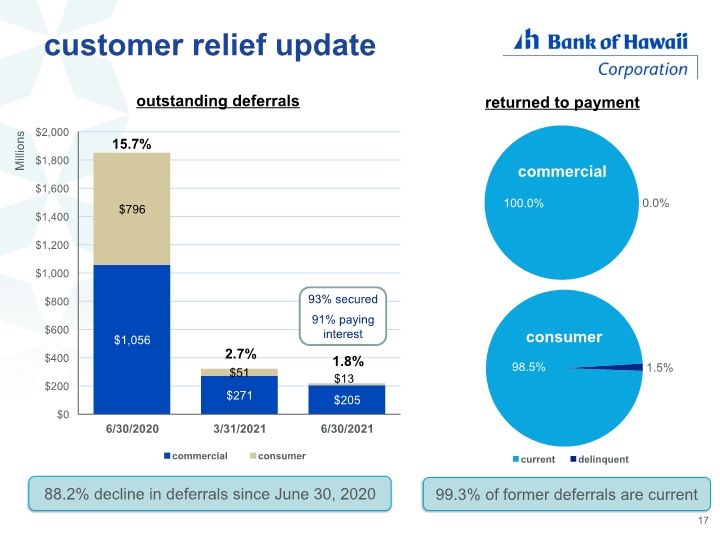

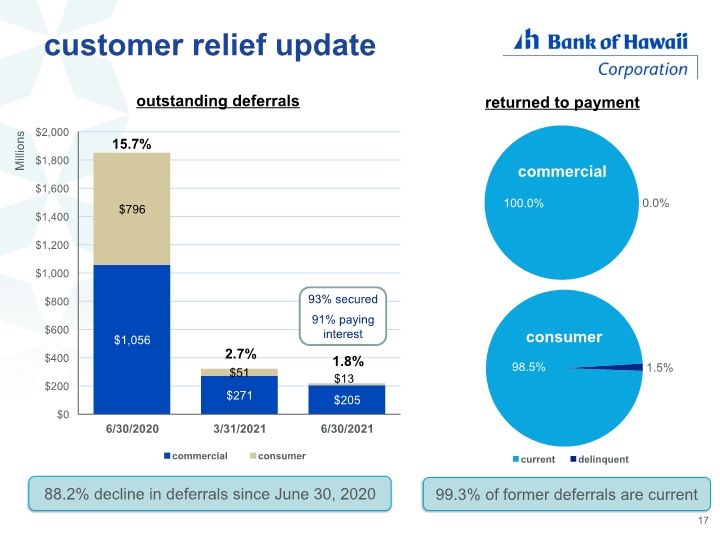

customer relief update 17 15.7% 2.7% 93% secured 91% paying interest commercial consumer 99.3% of former deferrals are current 88.2% decline in deferrals since June 30, 2020

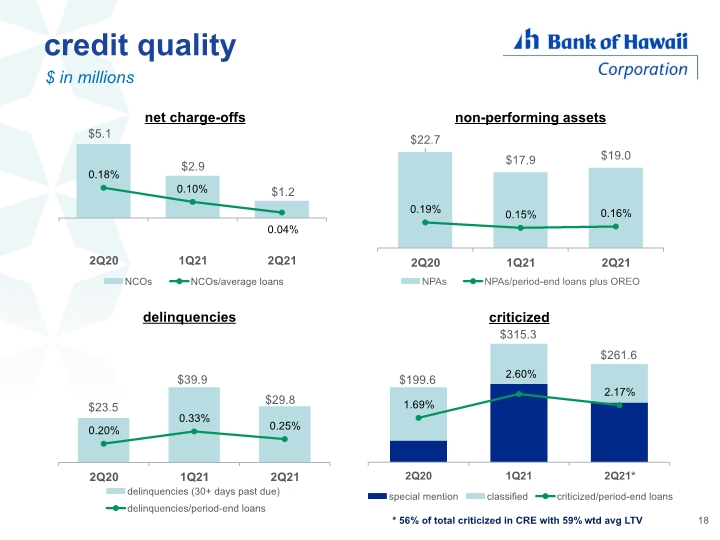

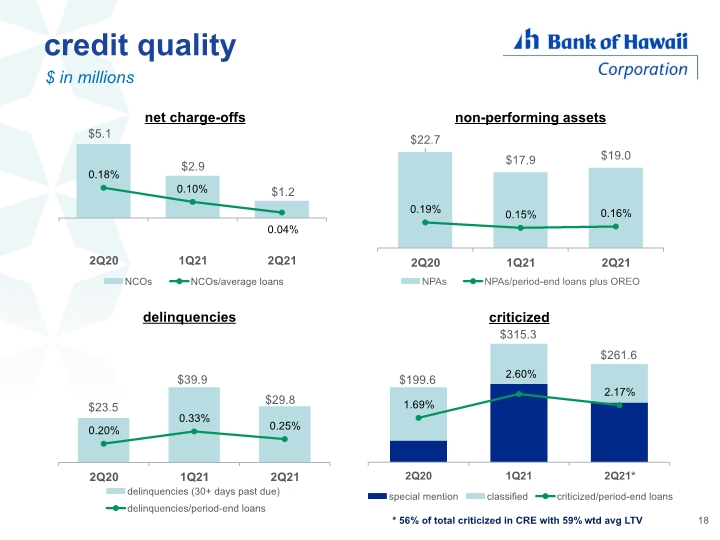

credit quality $ in millions 18 * 56% of total criticized in CRE with 59% wtd avg LTV

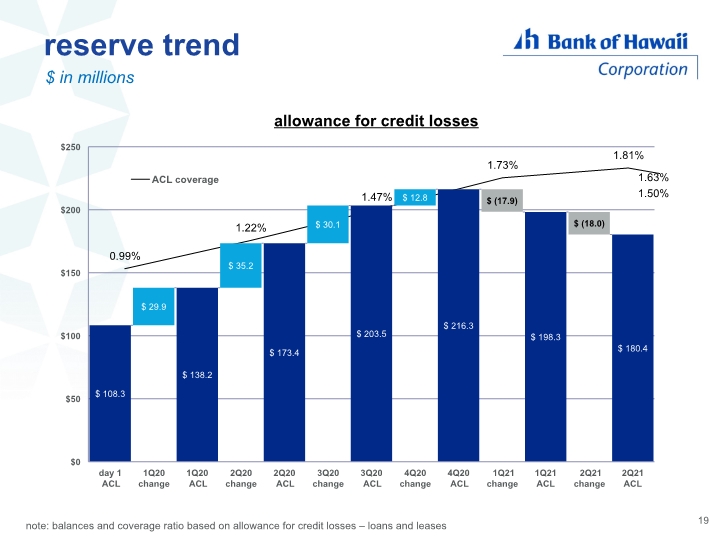

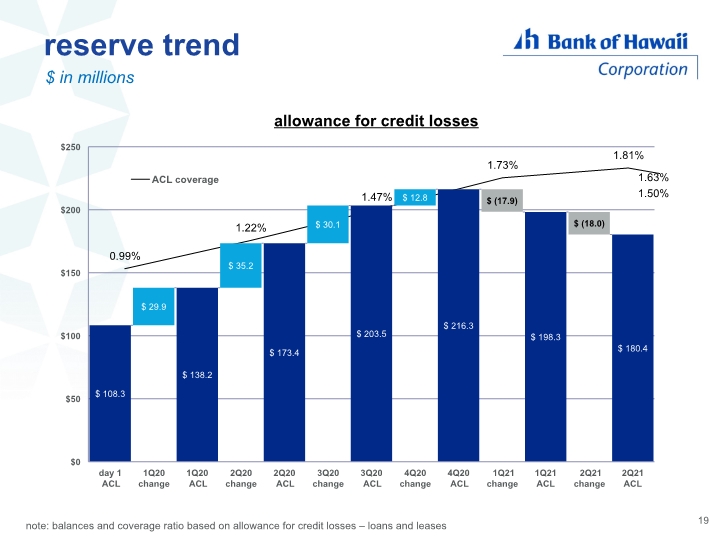

reserve trend $ in millions 19 allowance for credit losses note: balances and coverage ratio based on allowance for credit losses – loans and leases

Q & A

Bank of Hawaii Corporation second quarter 2021 financial report July 26, 2021

appendix

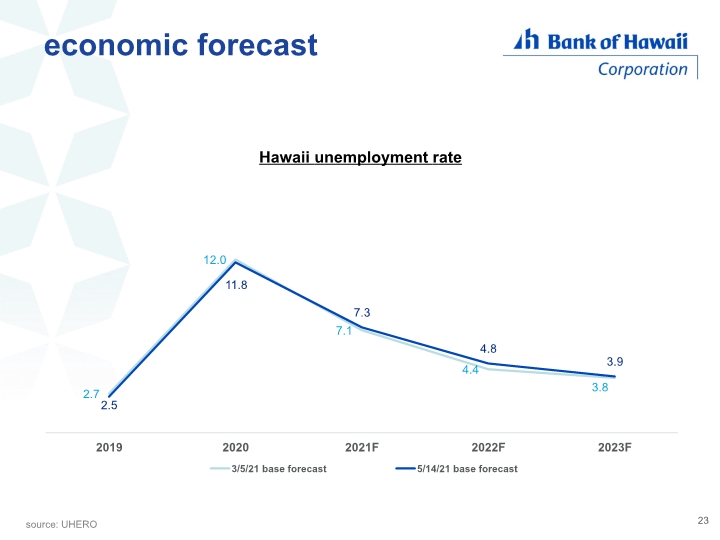

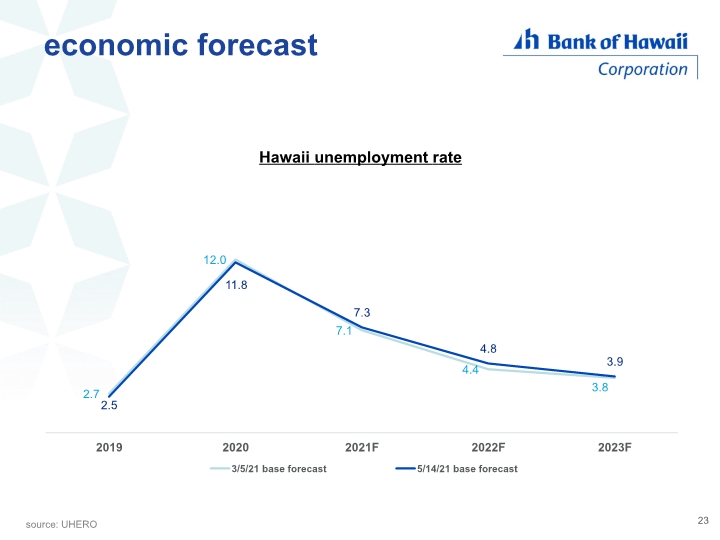

economic forecast source: UHERO Hawaii unemployment rate 23

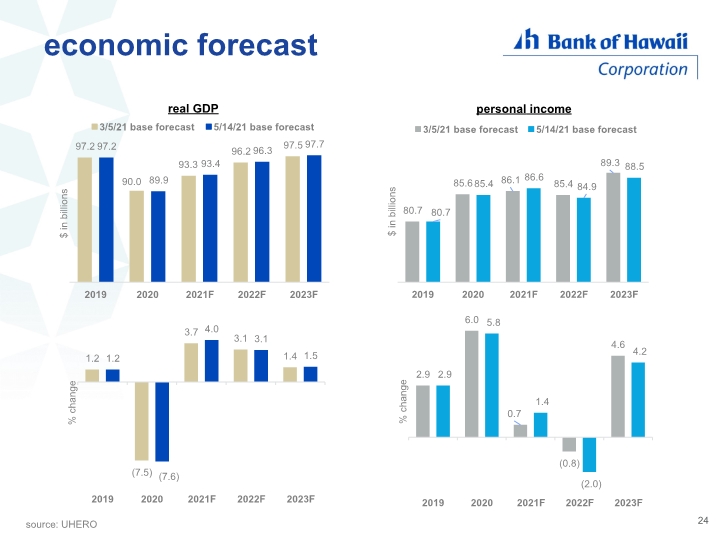

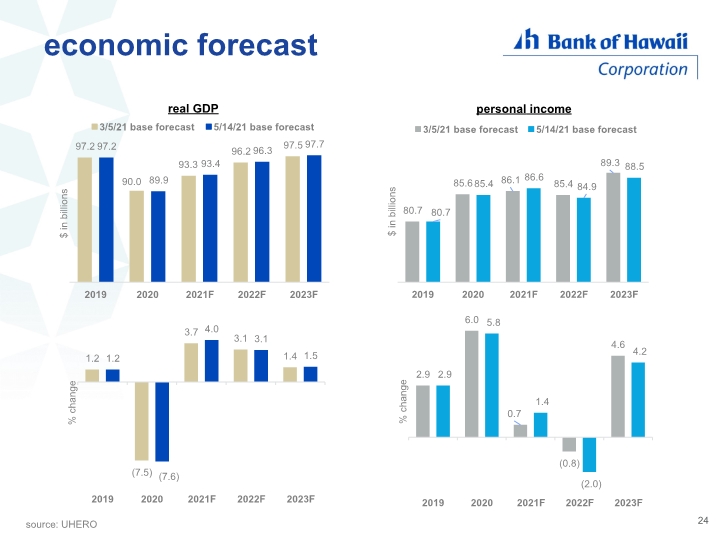

economic forecast source: UHERO 24

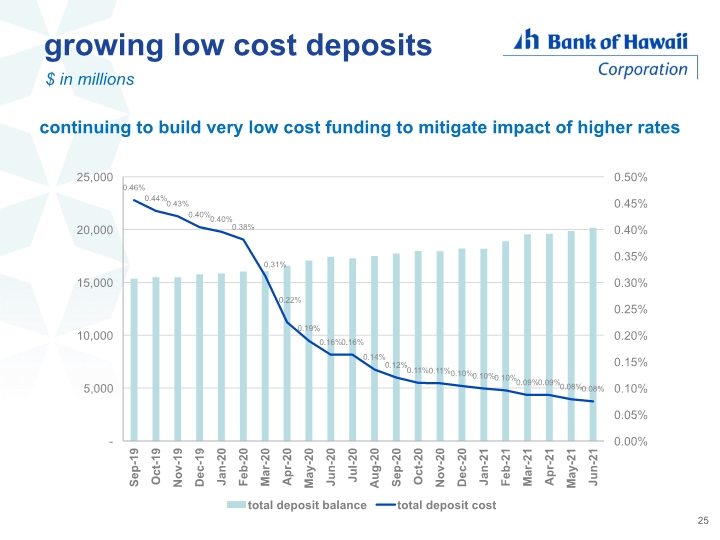

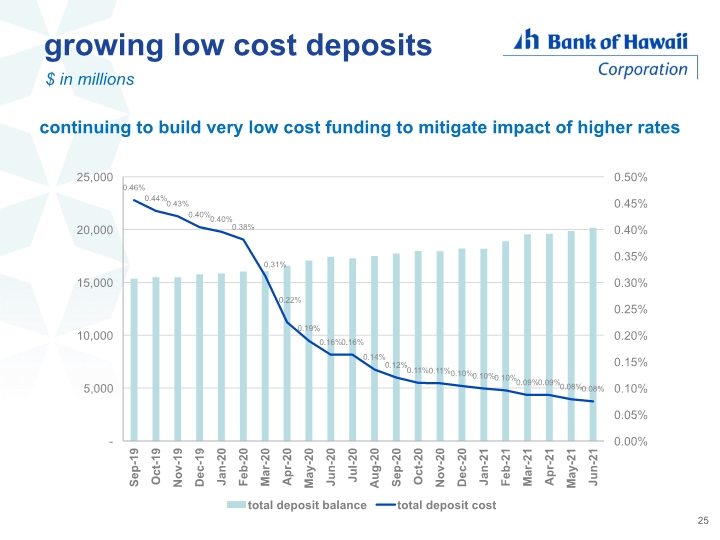

growing low cost deposits 25 continuing to build very low cost funding to mitigate impact of higher rates $ in millions

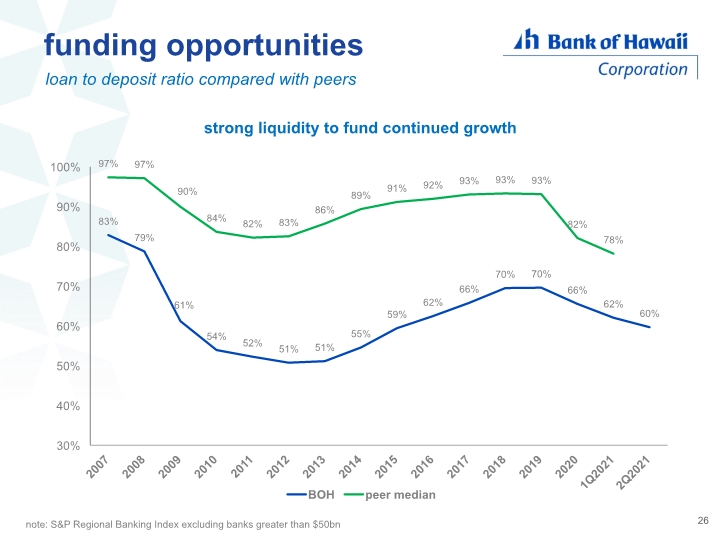

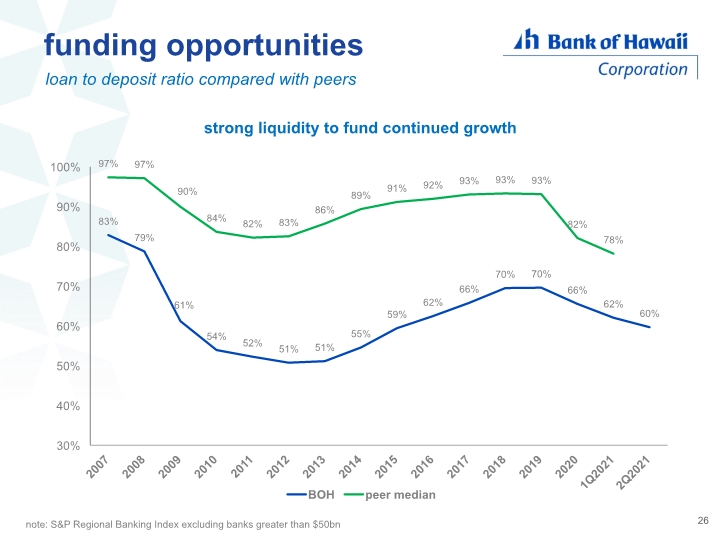

funding opportunities loan to deposit ratio compared with peers strong liquidity to fund continued growth 26 note: S&P Regional Banking Index excluding banks greater than $50bn

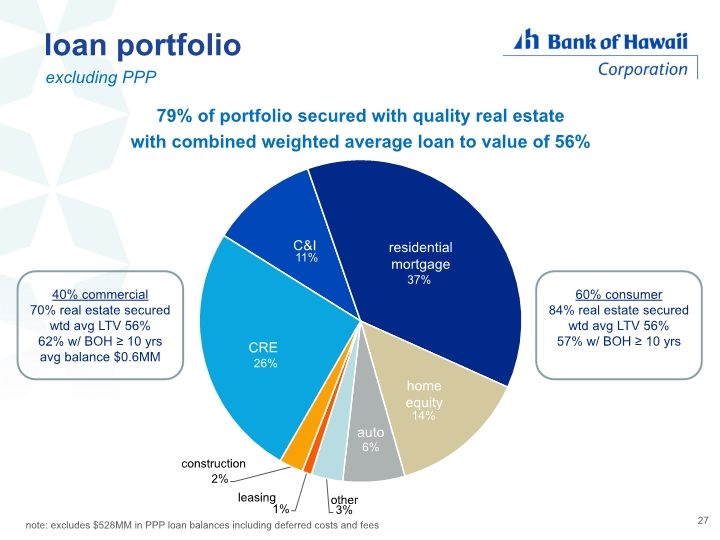

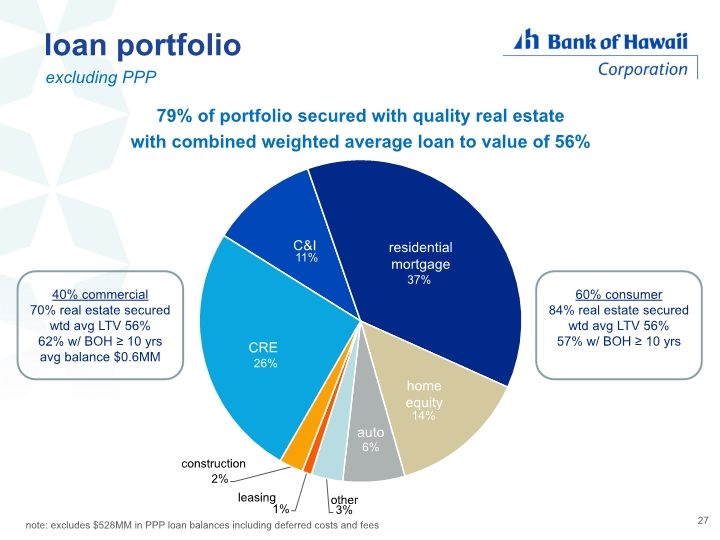

loan portfolio excluding PPP 27 40% commercial 70% real estate secured wtd avg LTV 56% 62% w/ BOH ≥ 10 yrs avg balance $0.6MM CRE C&I residential mortgage home equity auto leasing other construction 60% consumer 84% real estate secured wtd avg LTV 56% 57% w/ BOH ≥ 10 yrs 79% of portfolio secured with quality real estate with combined weighted average loan to value of 56% note: excludes $528MM in PPP loan balances including deferred costs and fees

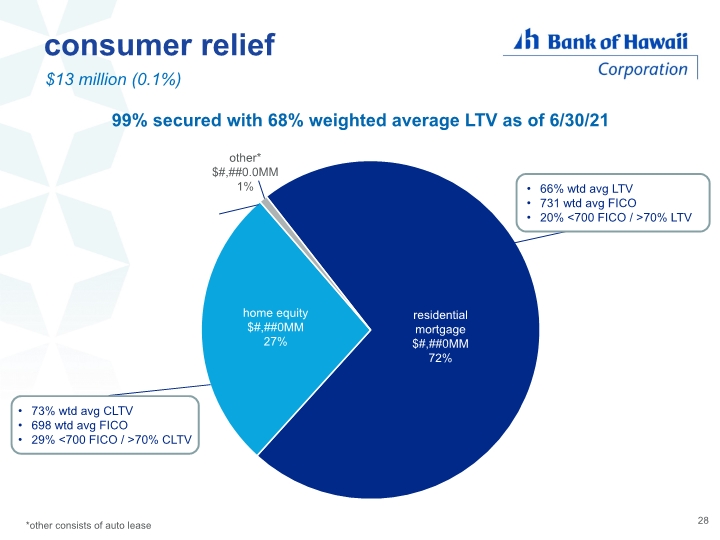

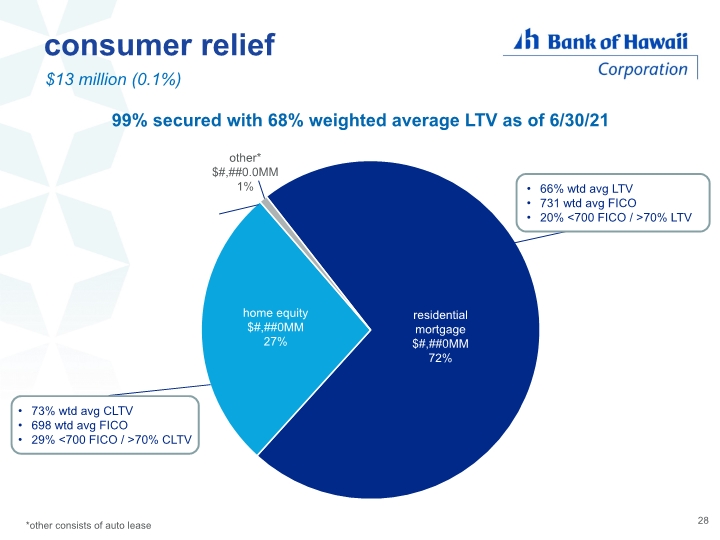

28 99% secured with 68% weighted average LTV as of 6/30/21 consumer relief $13 million (0.1%) 73% wtd avg CLTV 698 wtd avg FICO 29% <700 FICO / >70% CLTV 66% wtd avg LTV 731 wtd avg FICO 20% <700 FICO / >70% LTV *other consists of auto lease

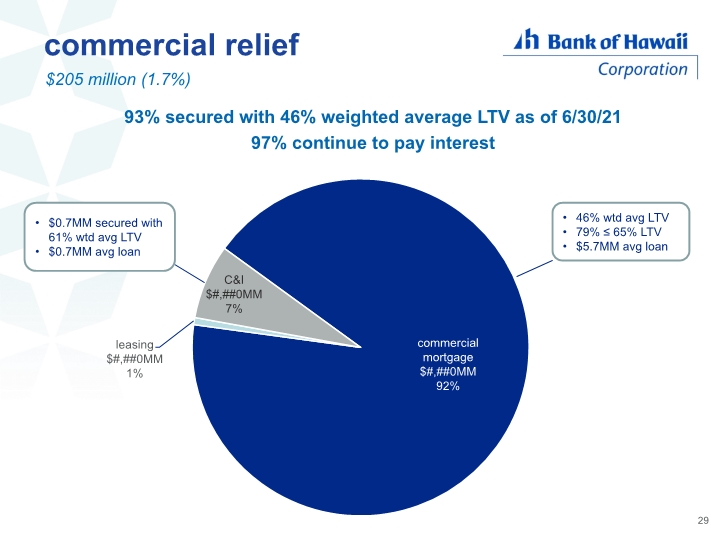

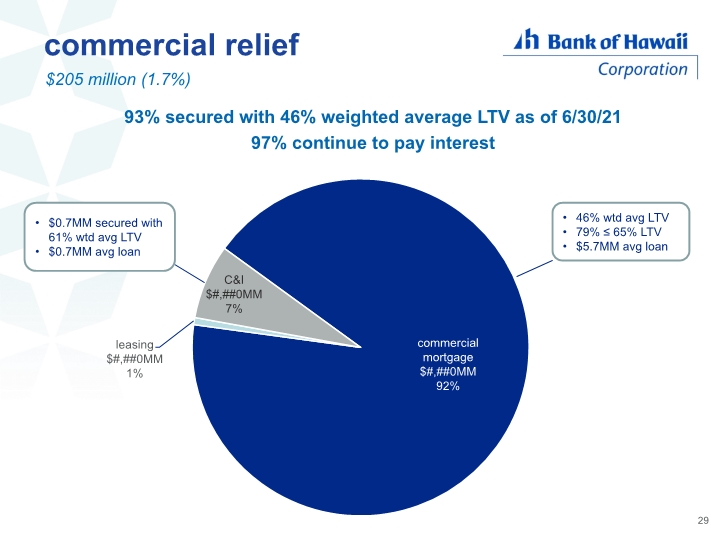

29 93% secured with 46% weighted average LTV as of 6/30/21 97% continue to pay interest commercial relief $205 million (1.7%) $0.7MM secured with 61% wtd avg LTV $0.7MM avg loan 46% wtd avg LTV 79% ≤ 65% LTV $5.7MM avg loan

high risk industries $1,577 million (13%) / $1,379 million (11%) excluding PPP 30

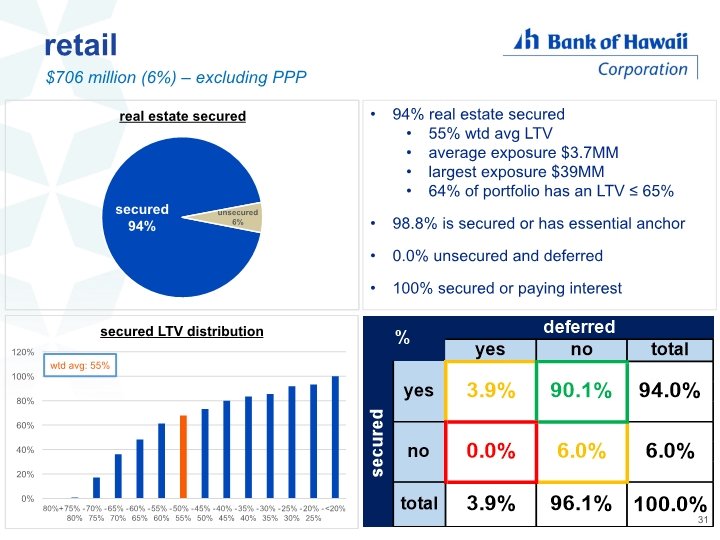

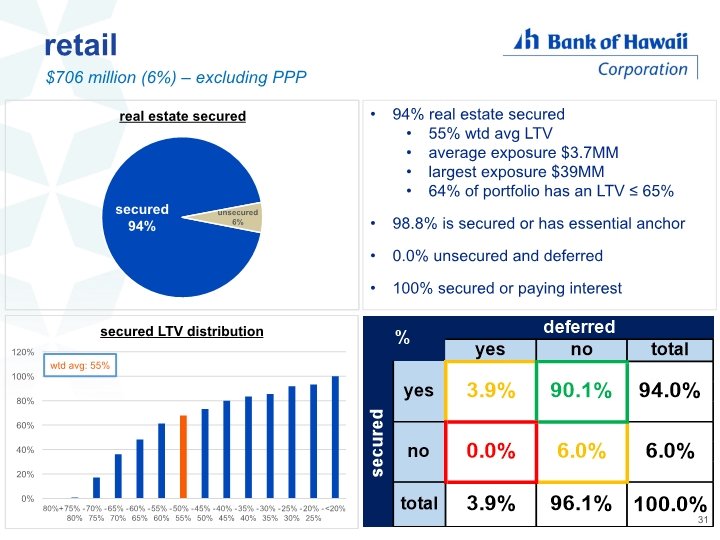

retail $706 million (6%) – excluding PPP 31 94% real estate secured 55% wtd avg LTV average exposure $3.7MM largest exposure $39MM 64% of portfolio has an LTV ≤ 65% 98.8% is secured or has essential anchor 0.0% unsecured and deferred 100% secured or paying interest

lodging $521 million (4%) – excluding PPP 32 81% real estate secured 52% wtd avg LTV average exposure $9.5MM largest exposure $40MM 81% of portfolio has an LTV ≤ 65% 92% of unsecured outstandings to global hotel and timeshare brands 0.1% unsecured and deferred 100% secured or paying interest

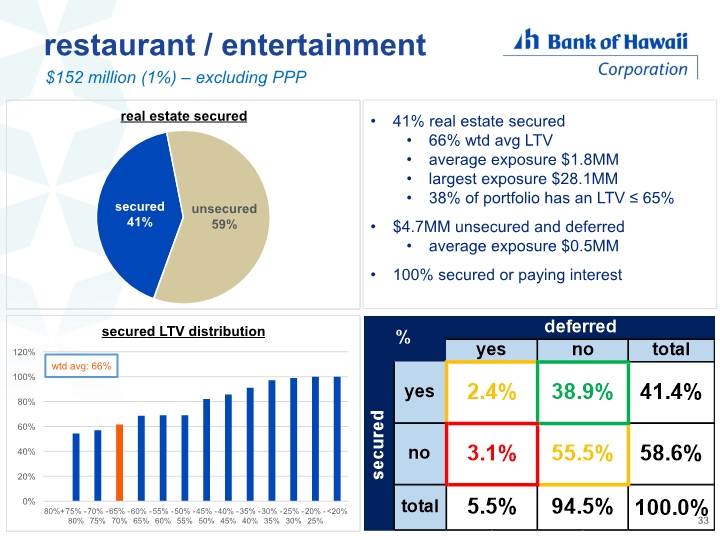

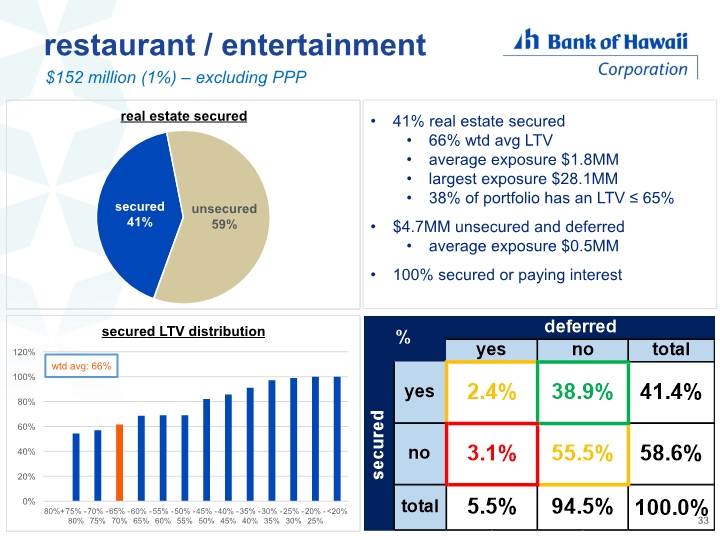

restaurant / entertainment $152 million (1%) – excluding PPP 33 41% real estate secured 66% wtd avg LTV average exposure $1.8MM largest exposure $28.1MM 38% of portfolio has an LTV ≤ 65% $4.7MM unsecured and deferred average exposure $0.5MM 100% secured or paying interest