Bank of Hawaii Corporation fourth quarter 2021 financial report January 24, 2022 Exhibit 99.2

this presentation, and other statements made by the Company in connection with it, may contain forward-looking statements concerning, among other things, forecasts of our financial results and condition, expectations for our operations and business prospects, and our assumptions used in those forecasts and expectations. we have not committed to update forward-looking statements to reflect later events or circumstances. disclosure 2 forward-looking statements

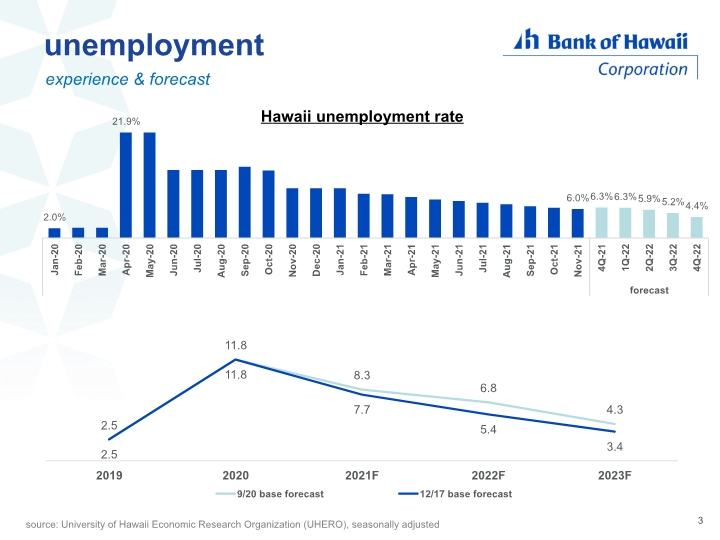

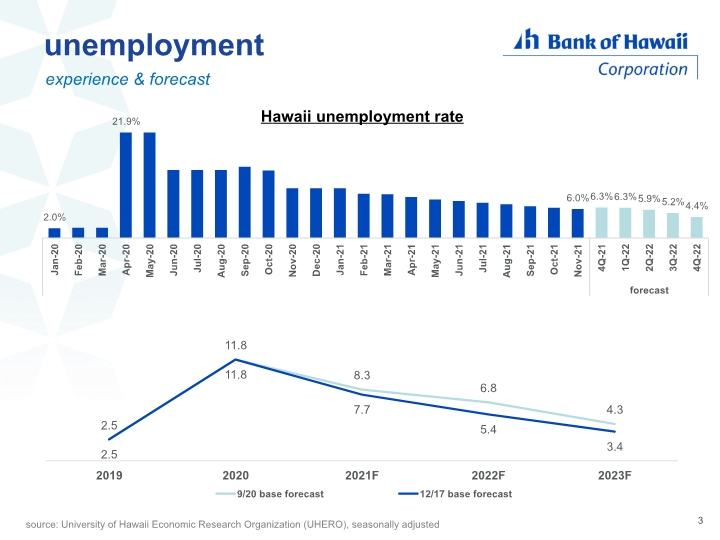

unemployment experience & forecast source: University of Hawaii Economic Research Organization (UHERO), seasonally adjusted Hawaii unemployment rate 3

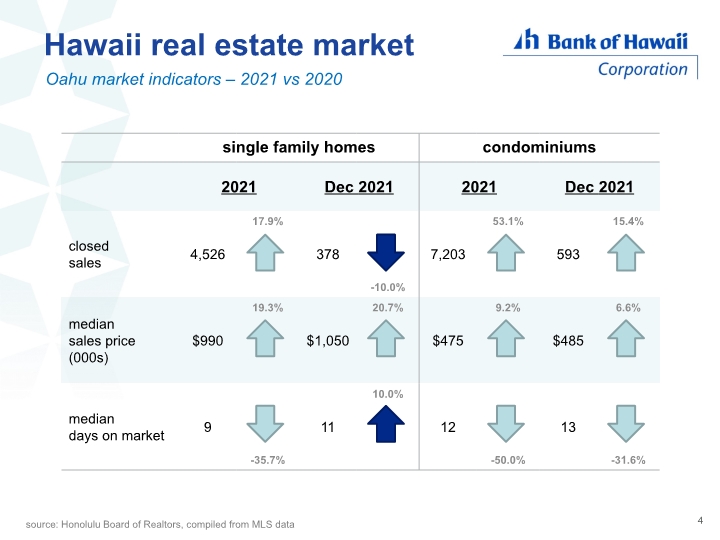

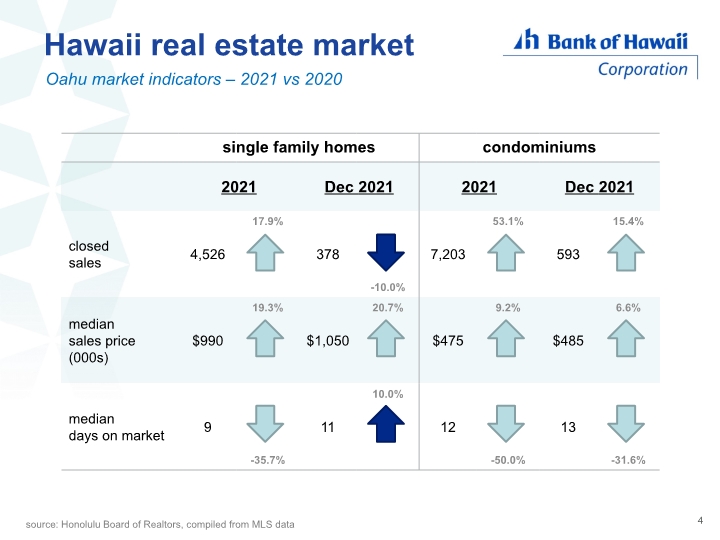

Hawaii real estate market Oahu market indicators – 2021 vs 2020 4 source: Honolulu Board of Realtors, compiled from MLS data

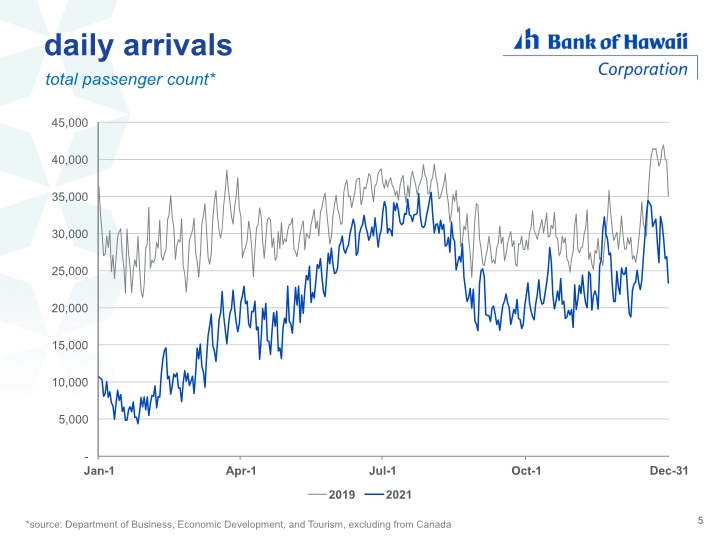

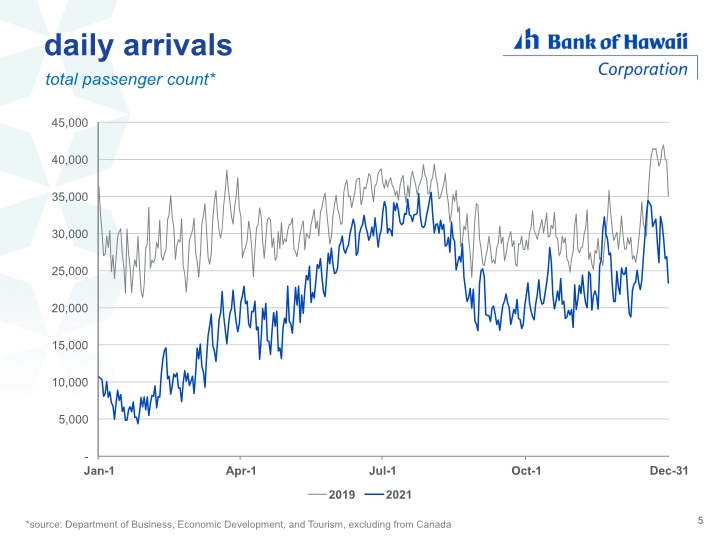

daily arrivals total passenger count* 5 *source: Department of Business, Economic Development, and Tourism, excluding from Canada Dec-31

4Q financial update

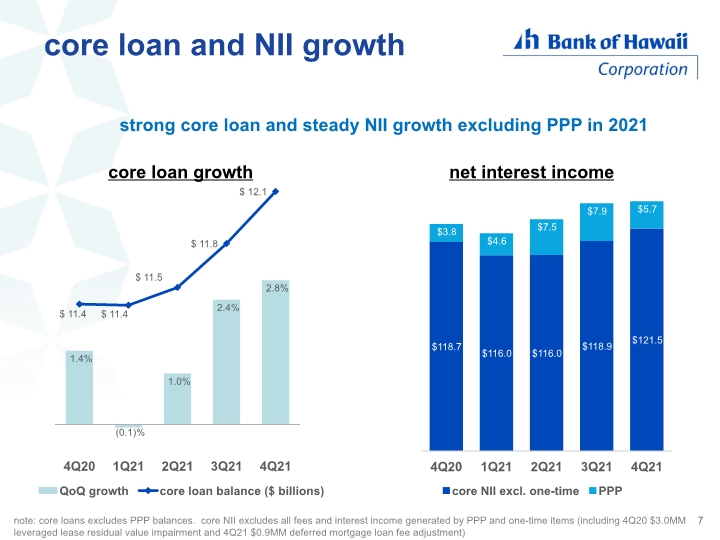

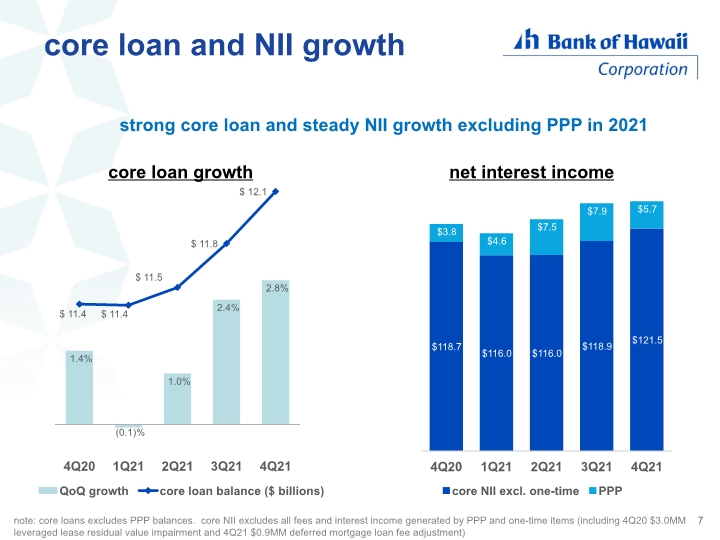

7 core loan and NII growth note: core loans excludes PPP balances. core NII excludes all fees and interest income generated by PPP and one-time items (including 4Q20 $3.0MM leveraged lease residual value impairment and 4Q21 $0.9MM deferred mortgage loan fee adjustment) strong core loan and steady NII growth excluding PPP in 2021

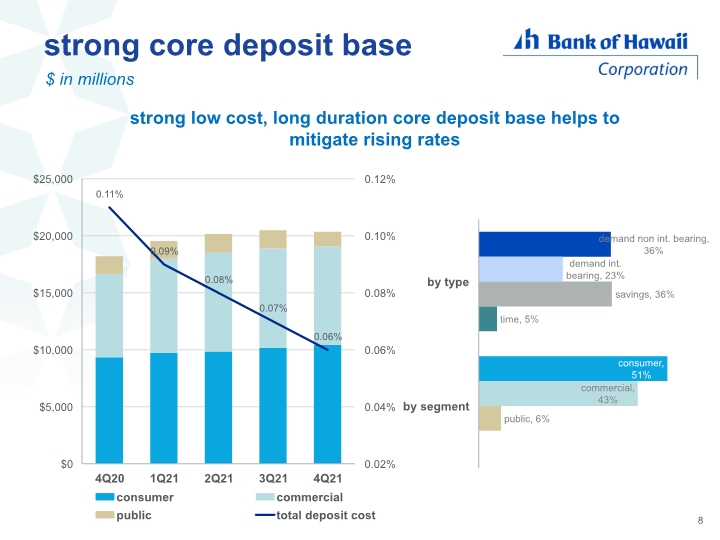

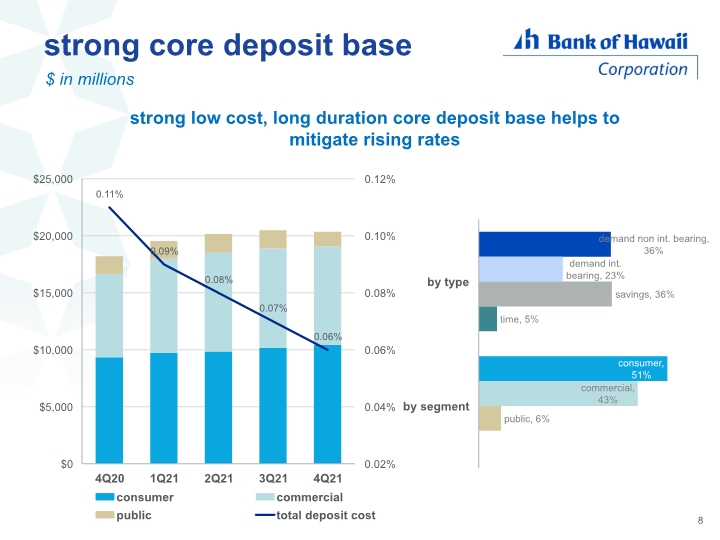

strong core deposit base 8 strong low cost, long duration core deposit base helps to mitigate rising rates $ in millions

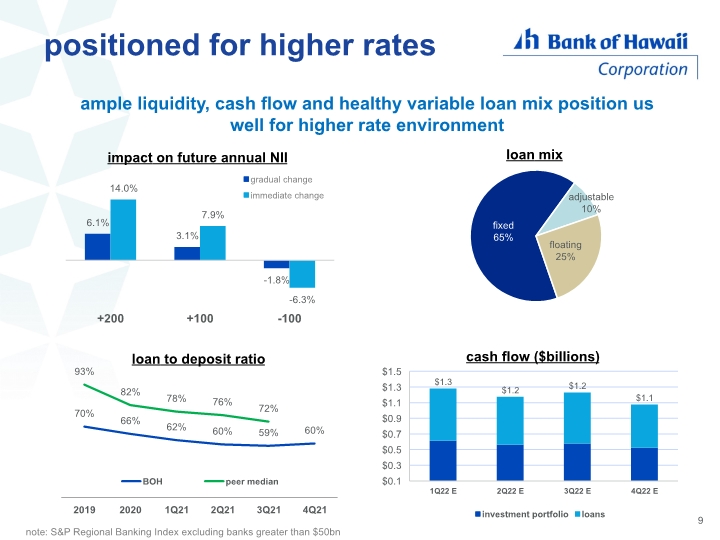

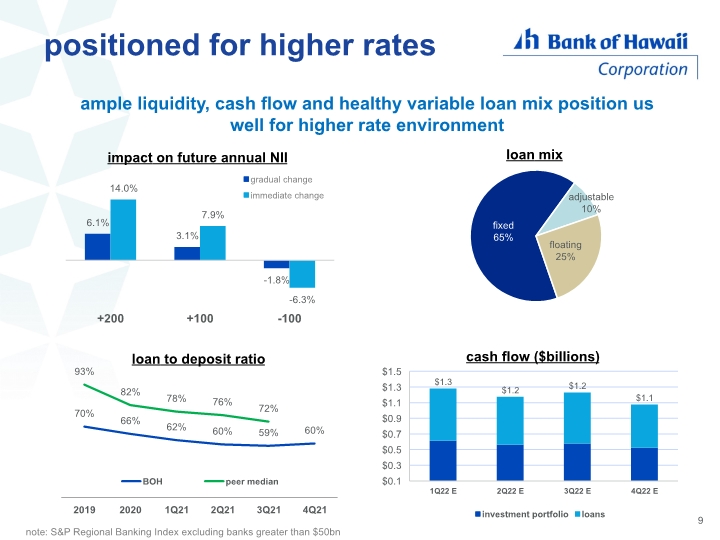

9 positioned for higher rates ample liquidity, cash flow and healthy variable loan mix position us well for higher rate environment note: S&P Regional Banking Index excluding banks greater than $50bn

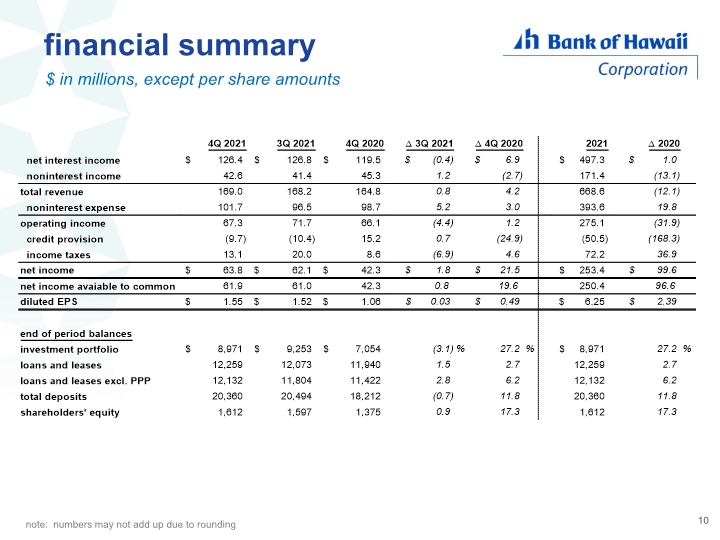

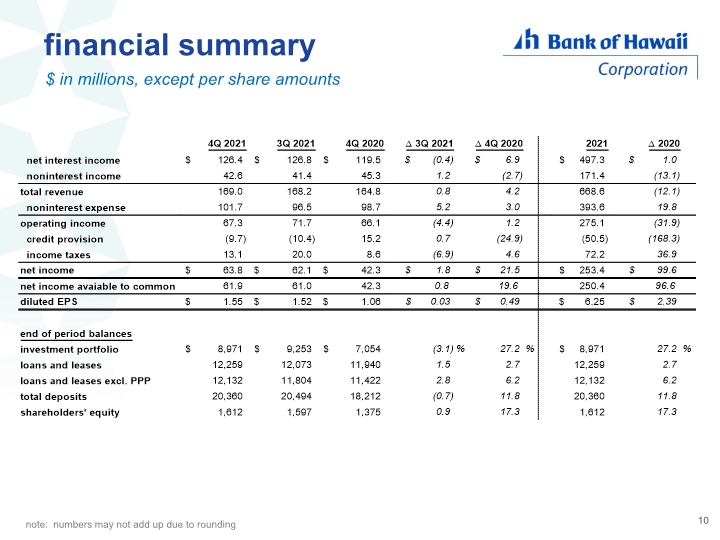

financial summary $ in millions, except per share amounts 10 note: numbers may not add up due to rounding

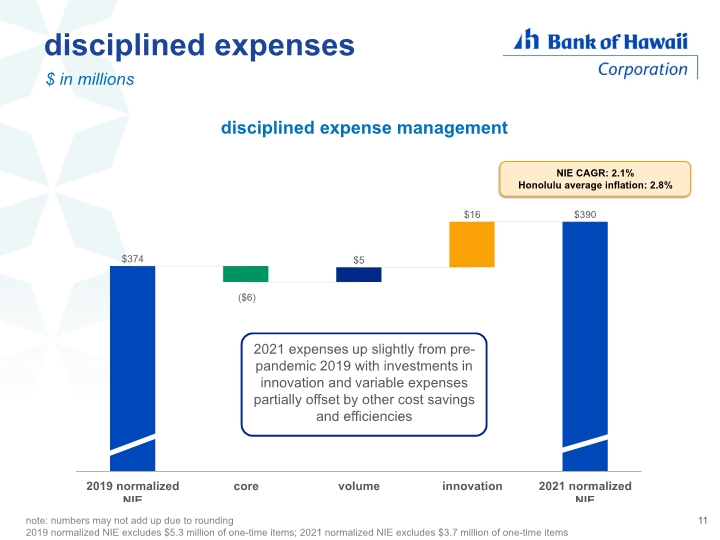

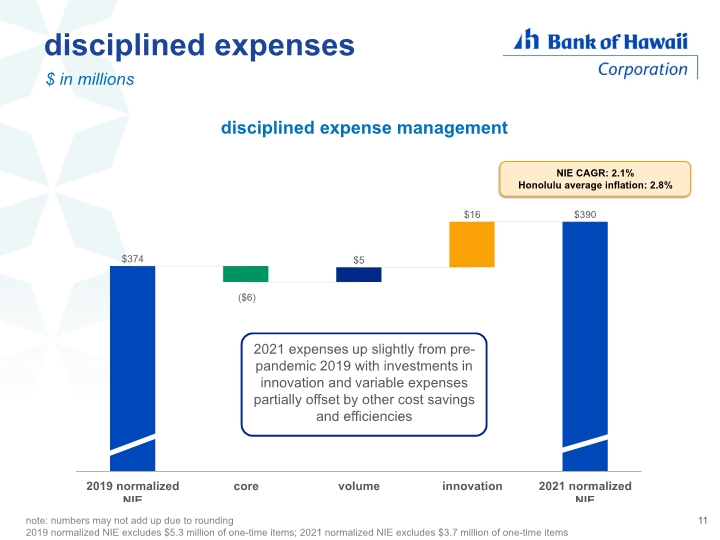

disciplined expenses $ in millions 11 disciplined expense management note: numbers may not add up due to rounding 2019 normalized NIE excludes $5.3 million of one-time items; 2021 normalized NIE excludes $3.7 million of one-time items 2021 expenses up slightly from pre-pandemic 2019 with investments in innovation and variable expenses partially offset by other cost savings and efficiencies NIE CAGR: 2.1% Honolulu average inflation: 2.8%

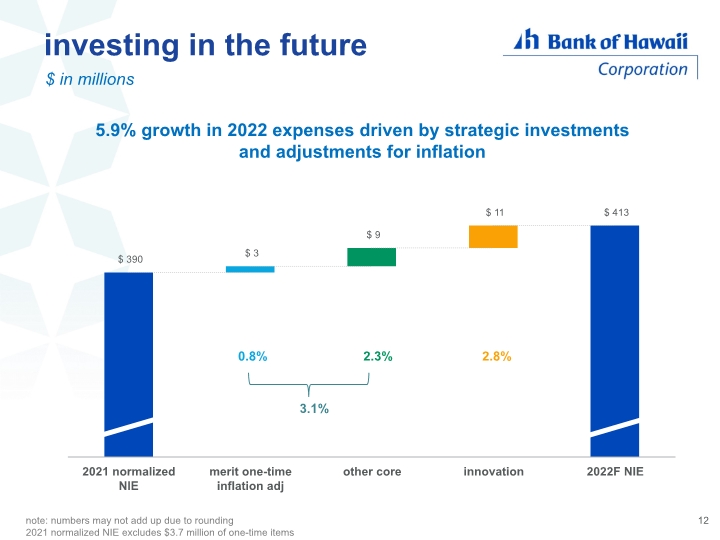

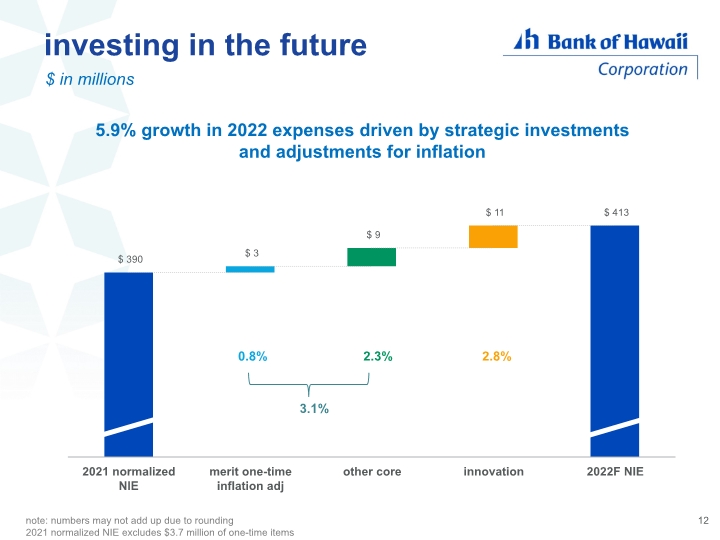

investing in the future $ in millions 12 note: numbers may not add up due to rounding 2021 normalized NIE excludes $3.7 million of one-time items 5.9% growth in 2022 expenses driven by strategic investments and adjustments for inflation

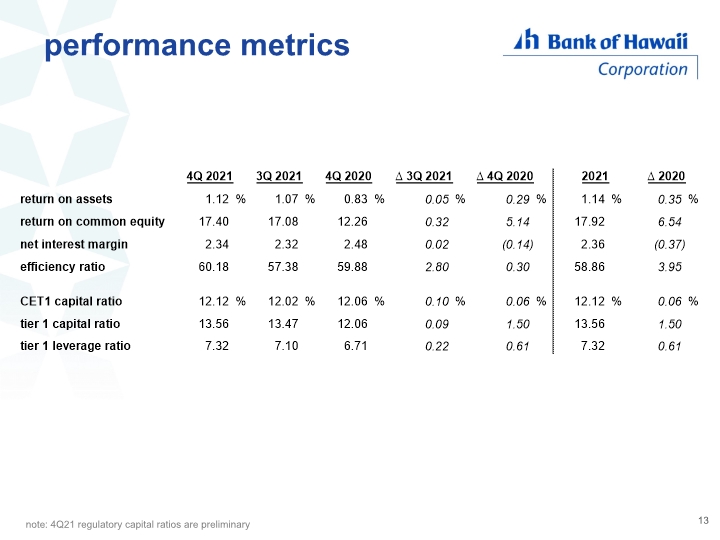

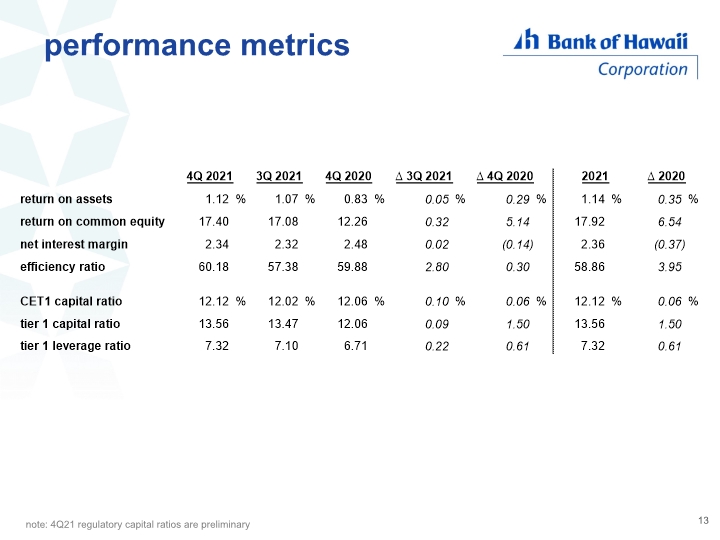

performance metrics 13 note: 4Q21 regulatory capital ratios are preliminary

14 strong risk-based capital fortress capital position note: 4Q21 regulatory capital ratios are preliminary

4Q credit update

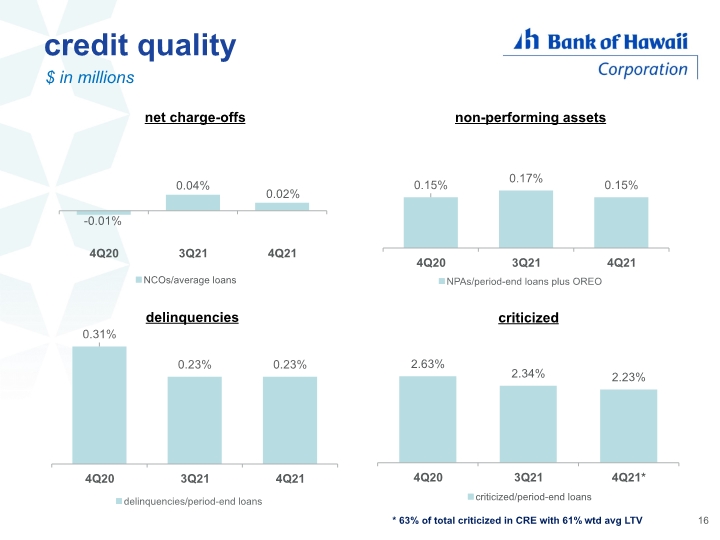

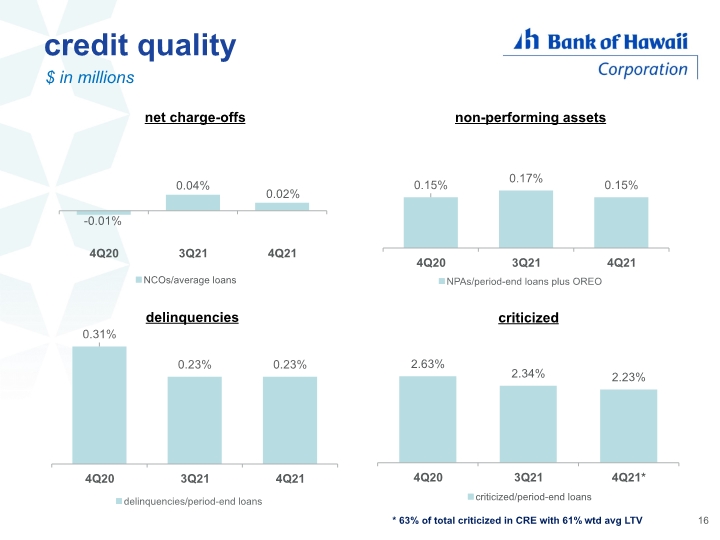

credit quality $ in millions 16 * 63% of total criticized in CRE with 61% wtd avg LTV

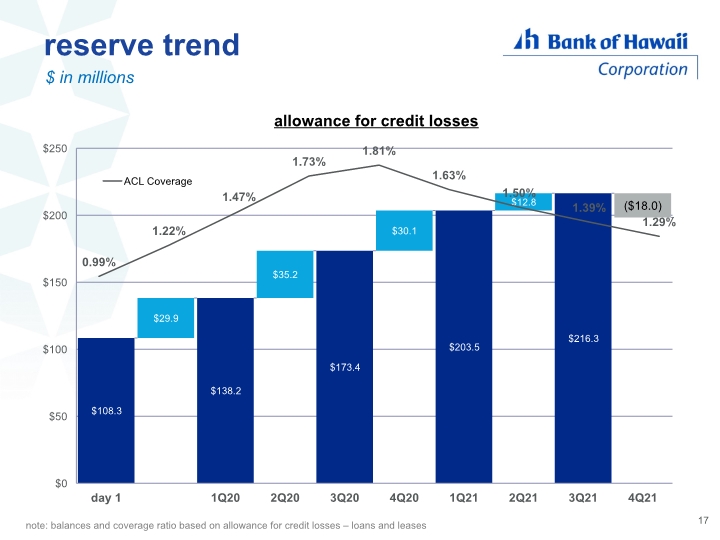

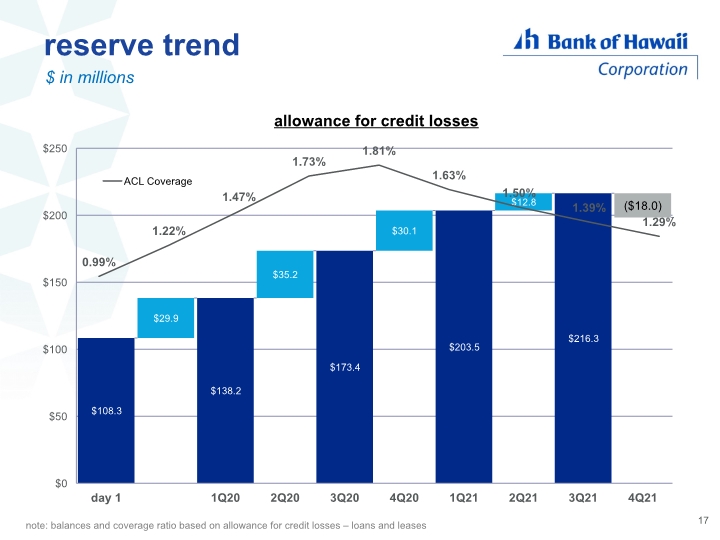

reserve trend 17 $ in millions allowance for credit losses note: balances and coverage ratio based on allowance for credit losses – loans and leases

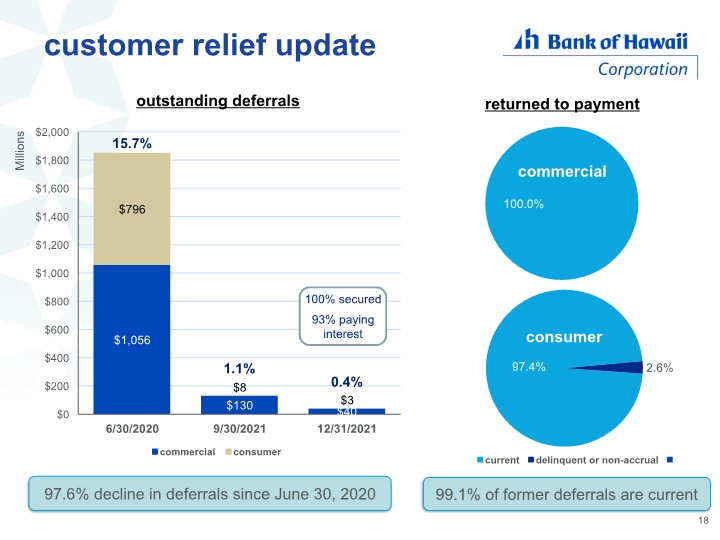

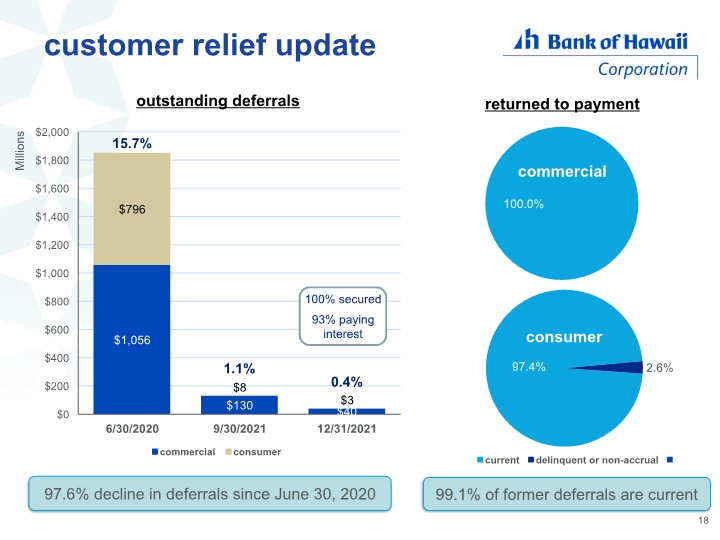

customer relief update 18 100% secured 93% paying interest commercial consumer 99.1% of former deferrals are current 97.6% decline in deferrals since June 30, 2020

Q & A

appendix

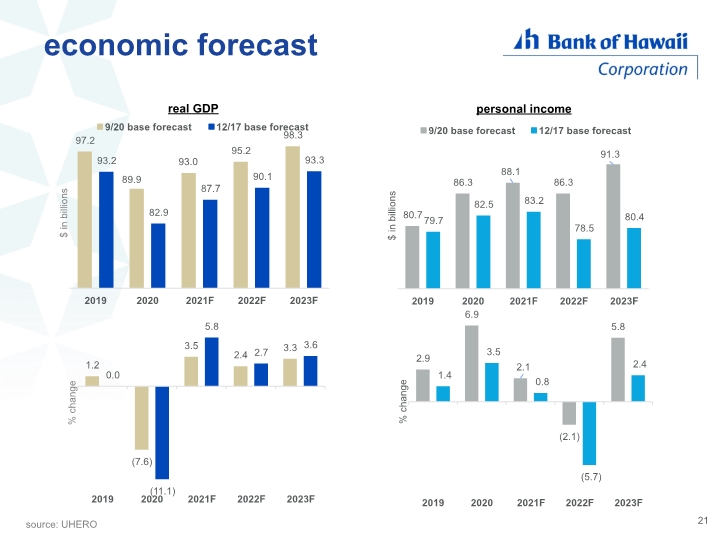

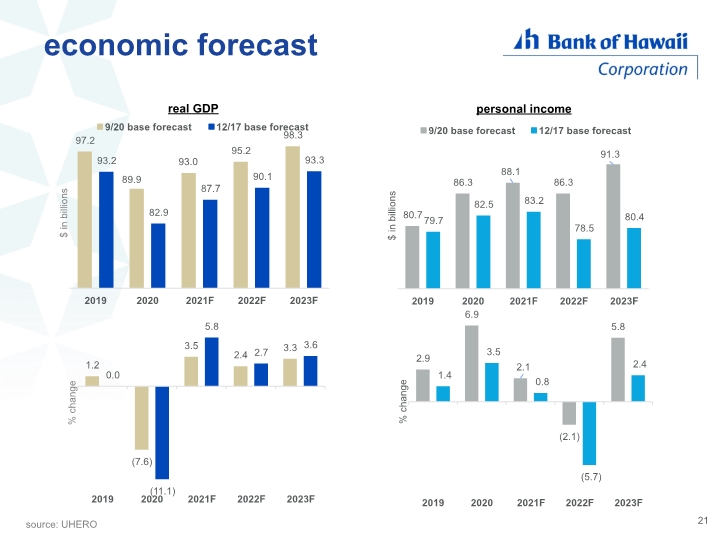

economic forecast source: UHERO 21

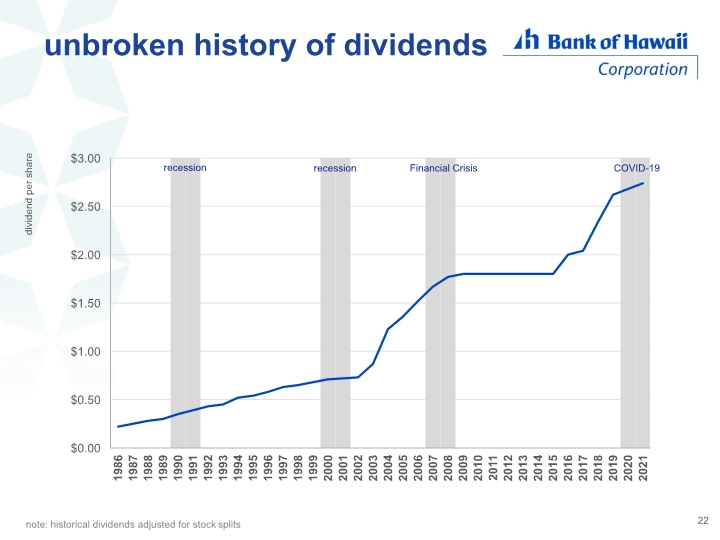

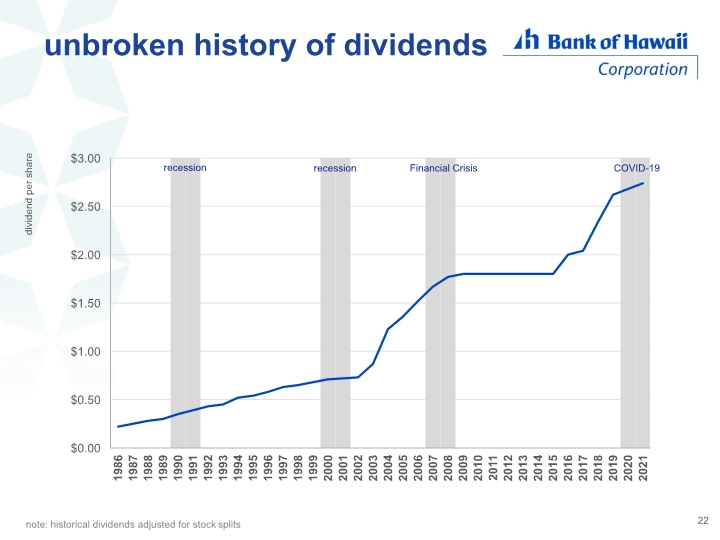

22 note: historical dividends adjusted for stock splits unbroken history of dividends recession COVID-19

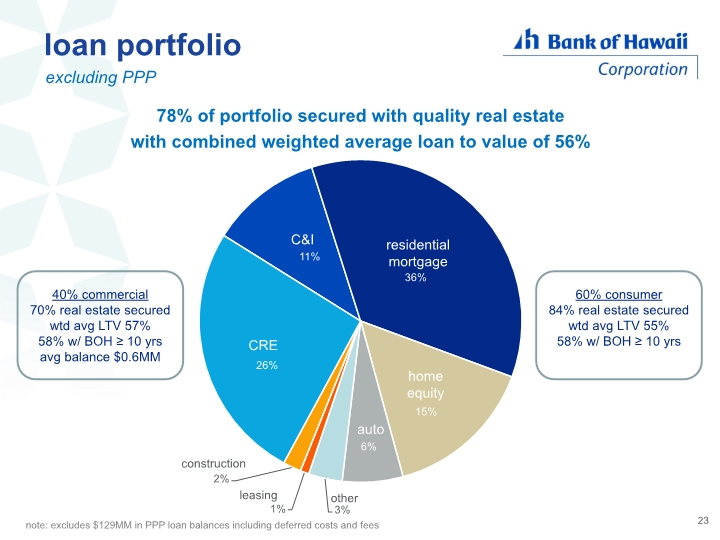

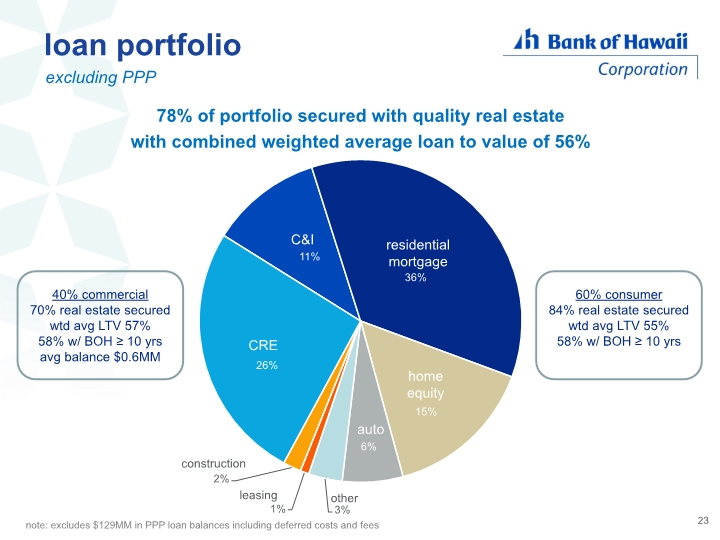

loan portfolio excluding PPP 23 40% commercial 70% real estate secured wtd avg LTV 57% 58% w/ BOH ≥ 10 yrs avg balance $0.6MM CRE C&I residential mortgage home equity auto leasing other construction 60% consumer 84% real estate secured wtd avg LTV 55% 58% w/ BOH ≥ 10 yrs 78% of portfolio secured with quality real estate with combined weighted average loan to value of 56% note: excludes $129MM in PPP loan balances including deferred costs and fees

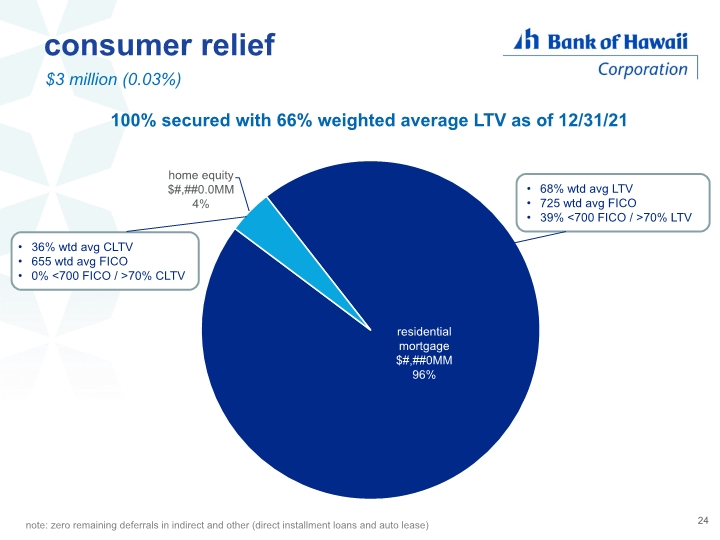

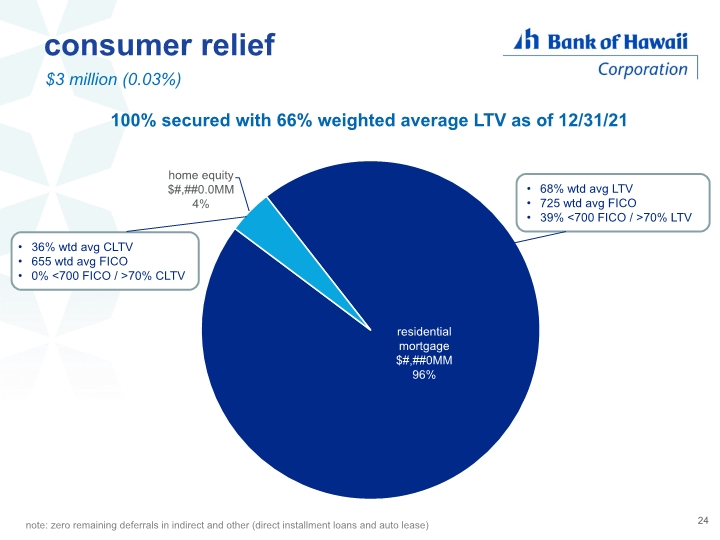

24 100% secured with 66% weighted average LTV as of 12/31/21 consumer relief $3 million (0.03%) 36% wtd avg CLTV 655 wtd avg FICO 0% <700 FICO / >70% CLTV 68% wtd avg LTV 725 wtd avg FICO 39% <700 FICO / >70% LTV note: zero remaining deferrals in indirect and other (direct installment loans and auto lease)

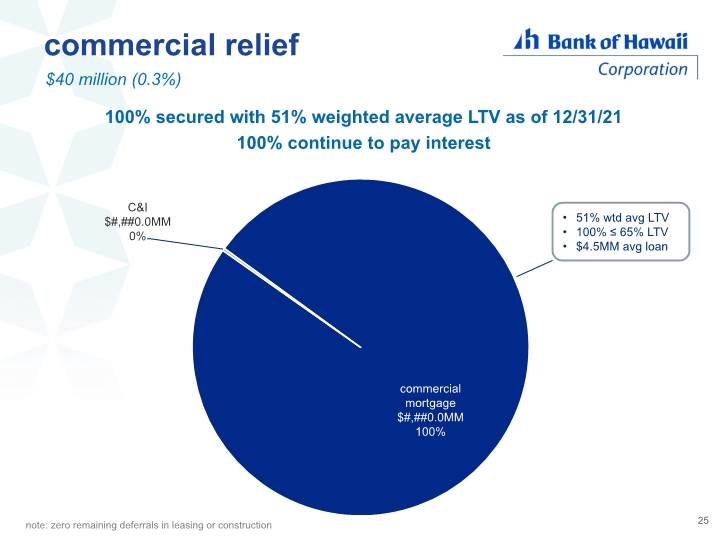

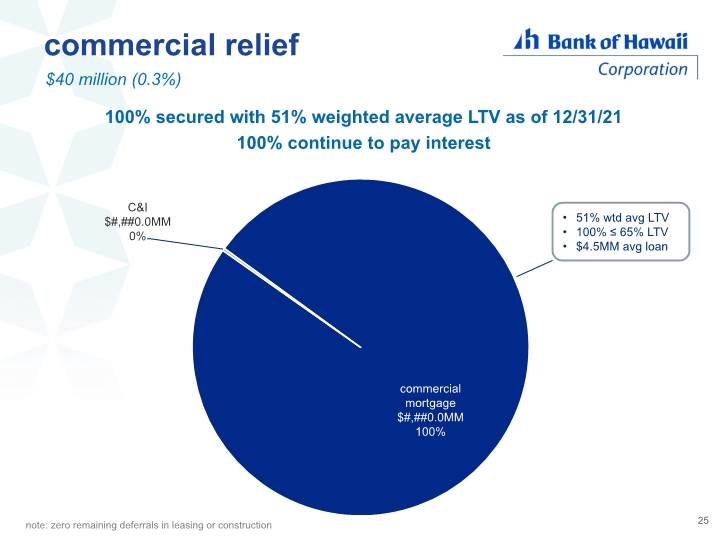

25 100% secured with 51% weighted average LTV as of 12/31/21 100% continue to pay interest commercial relief $40 million (0.3%) 51% wtd avg LTV 100% ≤ 65% LTV $4.5MM avg loan note: zero remaining deferrals in leasing or construction

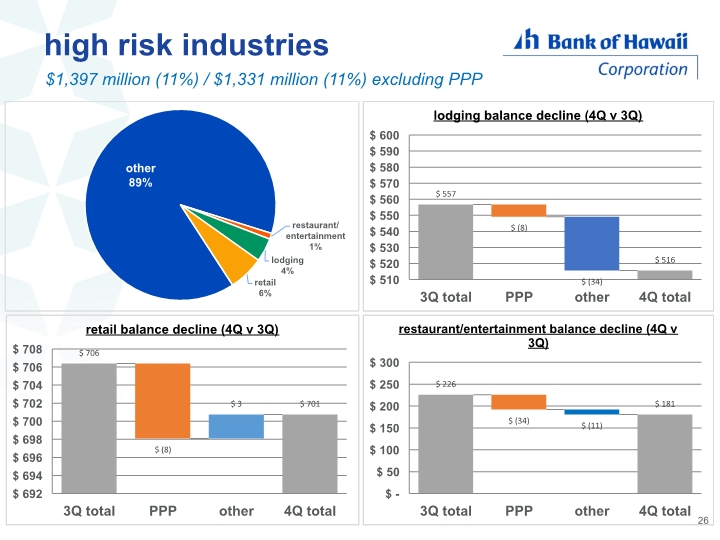

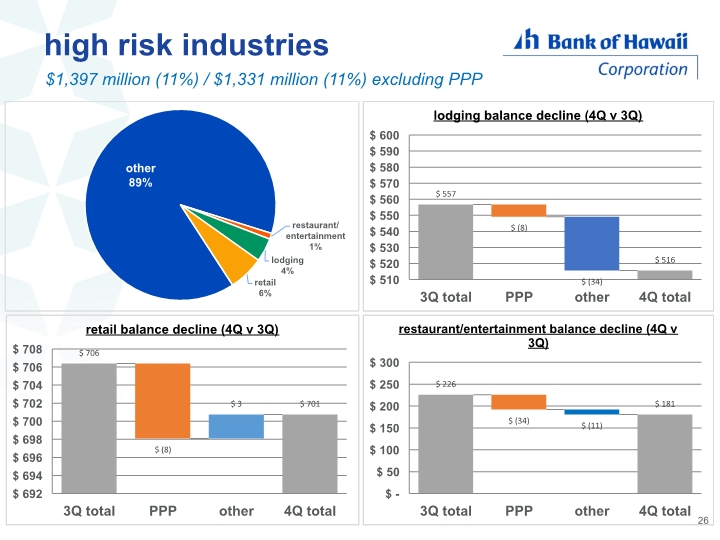

high risk industries $1,397 million (11%) / $1,331 million (11%) excluding PPP 26

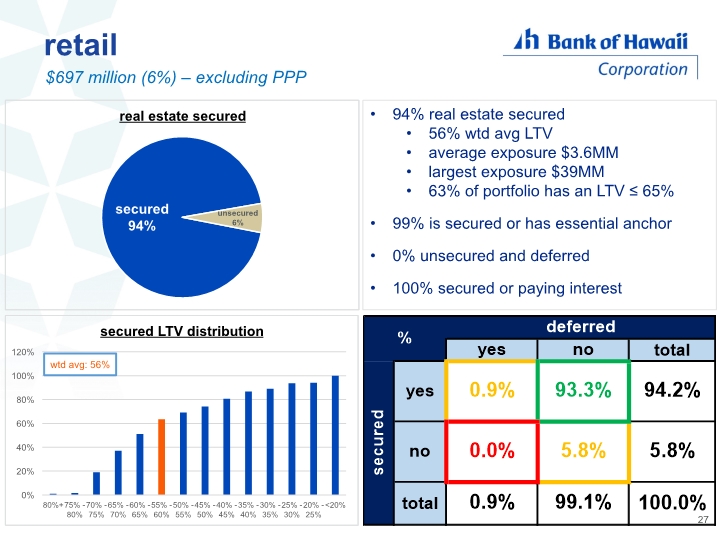

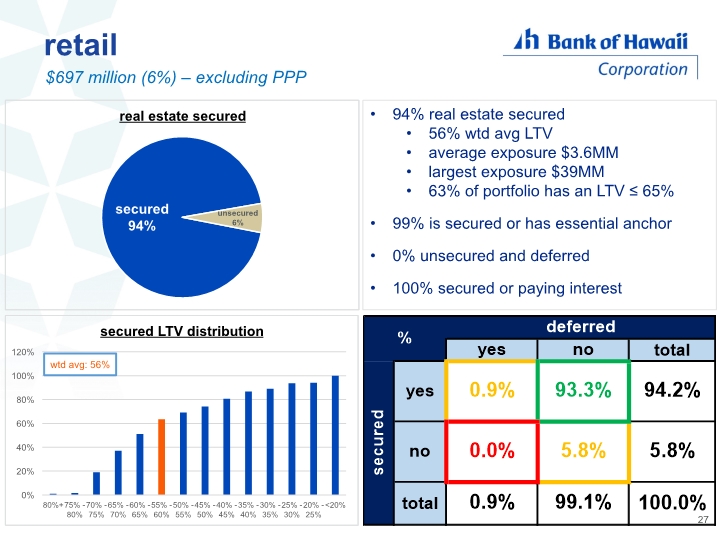

retail $697 million (6%) – excluding PPP 27 94% real estate secured 56% wtd avg LTV average exposure $3.6MM largest exposure $39MM 63% of portfolio has an LTV ≤ 65% 99% is secured or has essential anchor 0% unsecured and deferred 100% secured or paying interest

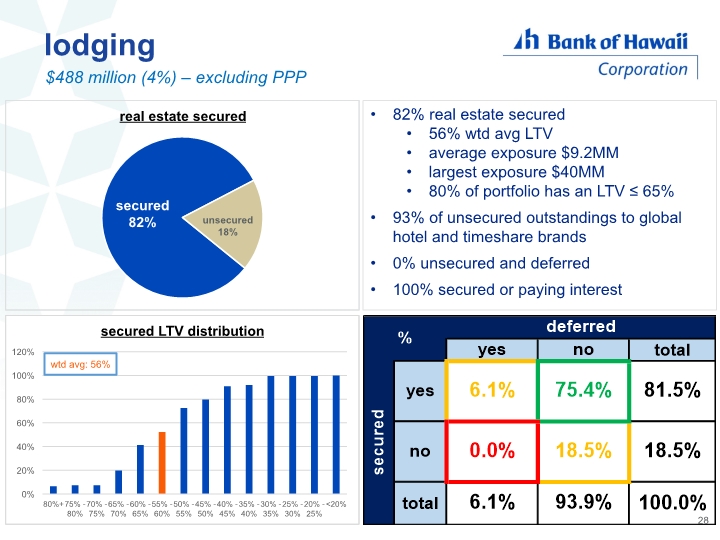

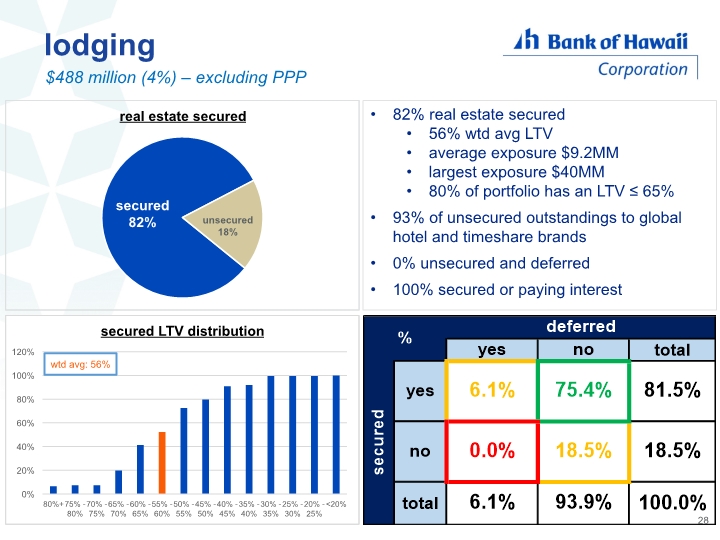

lodging $488 million (4%) – excluding PPP 28 82% real estate secured 56% wtd avg LTV average exposure $9.2MM largest exposure $40MM 80% of portfolio has an LTV ≤ 65% 93% of unsecured outstandings to global hotel and timeshare brands 0% unsecured and deferred 100% secured or paying interest

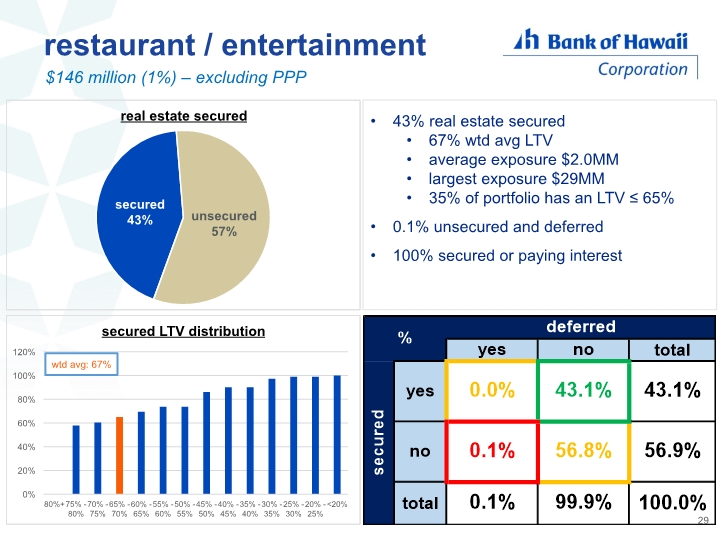

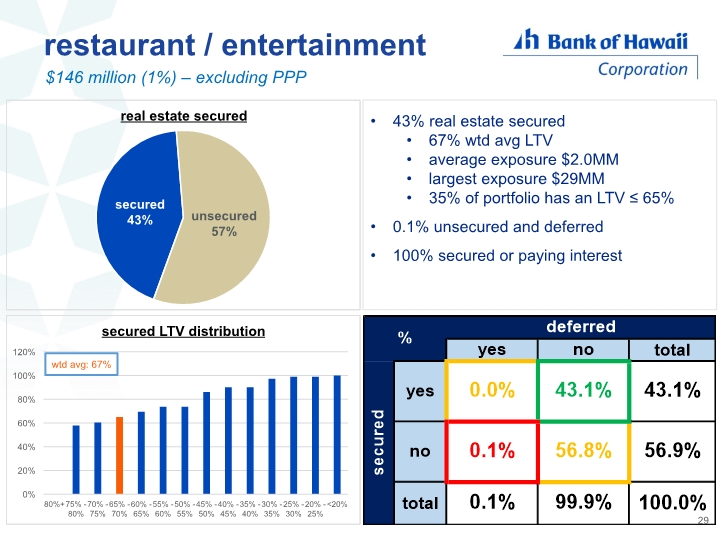

restaurant / entertainment $146 million (1%) – excluding PPP 29 43% real estate secured 67% wtd avg LTV average exposure $2.0MM largest exposure $29MM 35% of portfolio has an LTV ≤ 65% 0.1% unsecured and deferred 100% secured or paying interest